Traditional vs. Roth IRA’s: Differences, Pros, and Cons

Individual Retirement Accounts (IRA’s) are one of the most popular retirement vehicles available for savers and the purpose of this article is to give a general idea of how IRA’s work, explain the differences between Traditional and Roth IRA’s, and provide some pros and cons of each. In January 2015, The Investment Company Institute put out a research report with some interesting statistics regarding IRA’s which can be found at the following link, ICI Research Perspective. The article states, “In mid-2014, 41.5 million, or 33.7 percent of U.S. households owned at least one type of IRA”. At first I was slightly shocked and asked myself the following question: “If IRA’s are the most important investment vehicle and source of income for most retirees, how do only one third of U.S. households own one?” Then when I took a step back and considered how money gets deposited into these retirement vehicles this figure begins making more sense.

Yes, a lot of American’s will contribute to IRA’s throughout their lifetime whether it is to save for retirement throughout one’s lifetime or each year when the CPA gives you the tax bill and you ask “What can I do to pay less?” When thinking about IRA’s in this way, one third of American’s owning IRA’s is a scary figure and leads one to believe more than half the country is not saving for retirement. This is not necessarily the case. 401(k) plans and other employer sponsored defined contribution plans have become very popular over the last 20 years and rather than individuals opening their own personal IRA’s, they are saving for retirement through their employer sponsored plan.

Employees with access to these employer plans save throughout their working years and then, when they retire, the money in the company retirement account will be rolled into IRA’s. If the money is rolled directly from the company sponsored plan into an IRA, there is likely no tax or penalty as it is going from one retirement account to another. People roll the balance into IRA’s for a number of reasons. These reasons include the point that there is likely more flexibility with IRA’s regarding distributions compared to the company plan, more investment options available, and the retiree would like the money to be managed by an advisor. The IRA’s allow people to draw on their savings to pay for expenses throughout retirement in a way to supplement income that they are no longer receiving through a paycheck.

The process may seem simple but there are important strategies and decisions involved with IRA’s. One of those items is deciding whether a Traditional, Roth or both types of IRA’s are best for you. In this article we will breakdown Traditional and Roth IRA’s which should illustrate why deciding the appropriate vehicle to use can be a very important piece of retirement planning.

Why are they used?

Both Traditional and Roth IRA’s have multiple uses but the most common for each is retirement savings. People will save throughout their lifetime with the goal of having enough money to last in retirement. These savings are what people are referring to when they ask questions like “What is my number?” Savers will contribute to retirement accounts with the intent to earn money through investing. Tax benefits and potential growth is why people will use retirement accounts over regular savings accounts. Retirees have to cover expenses in retirement which are likely greater than the social security checks they receive. Money is pulled from retirement accounts to cover the expenses above what is covered by social security. People are living longer than they have in the past which means the answer to “What is my number?” is becoming larger since the money must last over a greater period.

How much can I contribute?

For both Traditional and Roth IRA’s, the limit in 2021 for individuals under 50 is the lesser of $6,000 or 100% of MAGI and those 50 or older is the lesser of $7,000 or 100% of MAGI. More limit information can be found on the IRS website Retirement Topics - IRA Contribution Limits

What are the important differences between Traditional and Roth?

Taxation

Traditional (Pre-Tax) IRA: Typically people are more familiar with Traditional IRA’s as they’ve been around longer and allow individuals to take income off the table and lower their tax bill while saving. Each year a person contributes to a Pre-Tax IRA, they deduct the contribution amount from the income they received in that tax year. The IRS allows this because they want to encourage people to save for retirement. Not only are people decreasing their tax bill in the year they make the contribution, the earnings of Pre-Tax IRA’s are not taxed until the money is withdrawn from the account. This allows the account to earn more as money is not being taken out for taxes during the accumulation phase. For example, if I have $100 in my account and the account earns 10% this year, I will have $10 of earnings. Since that money is not taxed, my account value will be $110. That $110 will increase more in the following year if the account grows another 10% compared to if taxes were taken out of the gain. When the money is used during retirement, the individual will be taxed on the amount distributed at ordinary income tax rates because the money was never taxed before. A person’s tax rate during retirement is likely to be lower than while they are working because total income for the year will most likely be less. If the account owner takes a distribution prior to 59 ½ (normal retirement age), there will be penalties assessed.

Roth (After-Tax) IRA: The Roth IRA was established by the Taxpayer Relief Act of 1997. Unlike the Traditional IRA, contributions to a Roth IRA are made with money that has already been subject to income tax. The money gets placed in these accounts with the intent of earning interest and then when the money is taken during retirement, there is no taxes due as long as the account has met certain requirements (i.e. has been established for at least 5 years). These accounts are very beneficial to people who are younger or will not need the money for a significant number of years because no tax is paid on all the earnings that the account generates. For example, if I contribute $100 to a Roth IRA and the account becomes $200 in 15 years, I will never pay taxes on the $100 gain the account generated. If the account owner takes a distribution prior to 59 ½ (normal retirement age), there will be penalties assessed on the earnings taken.

Eligibility

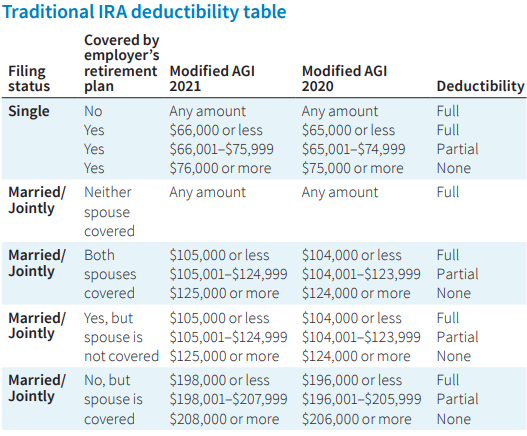

Traditional IRA: Due to the benefits the IRS allows with Traditional IRA’s, there are restrictions on who can contribute and receive the tax benefit for these accounts. Below is a chart that shows who is eligible to deduct contributions to a Traditional IRA:

There are also Required Minimum Distributions (RMD’s) associated with Pre-Tax dollars in IRA’s and therefore people cannot contribute to these accounts after the age of 70 ½. Once the account owner turns 70 ½, the IRS forces the individual to start taking distributions each year because the money has never been taxed and the government needs to start receiving revenue from the account. If RMD’s are not taken timely, there will be penalties assessed.

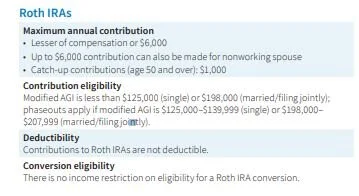

Roth IRA: As long as an individual has earned income, there are only income limitations on who can contribute to Roth IRA’s. The limitations for 2021 are as follows:

There are a number of strategies to get money into Roth IRA’s as a financial planning strategy. This method is explained in our article Backdoor Roth IRA Contribution Strategy.

Investment Strategies

Investment strategies are different for everyone as individuals have different risk tolerances, time horizons, and purposes for these accounts.

That being said, Roth IRA’s are often times invested more aggressively because they are likely the last investment someone touches during retirement or passes on to heirs. A longer time horizon allows one to be more aggressive if the circumstances permit. Accounts that are more aggressive will likely generate higher returns over longer periods. Remember, Roth accounts are meant to generate income that will never be taxed, so in most cases that account should be working for the saver as long as possible. If money is passed onto heirs, the Roth accounts are incredibly valuable as the individual who inherits the account can continue earning interest tax free.

Choosing the correct IRA is an important decision and is often times more complex than people think. Even if you are 30 years from retiring, it is important to consider the benefits of each and consult with a professional for advice.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.