How Much Should I Contribute to Retirement?

A question I’m sure to address during employee retirement presentations is, “How Much Should I be Contributing?”. In this article, I will address some of the variables at play when coming up with your number and provide detail as to why two answers you will find searching the internet are so common.

A question I’m sure to address during employee retirement presentations is, “How Much Should I be Contributing?”. Quick internet search led me to two popular answers.

Whatever you need to contribute to get the match from the employer,

10-15% of your compensation.

As with most questions around financial planning, the answer should really be, “it depends”. We all know it is important to save for retirement, but knowing how much is enough is the real issue and typically there is more work involved than saying 10-15% of your pay.

In this article, I will address some of the variables at play when coming up with your number and provide detail as to why the two answers previously mentioned are so common.

Expenses and Income Replacement

Creating a budget and tracking expenses is usually the best way to estimate what your spending needs will be in retirement. Unfortunately, this is time-consuming and is becoming more difficult considering how easy it is to spend money these days. Automatic payments, subscriptions, payment apps, and credit cards make it easy to purchase but also more difficult to track how much is leaving your bank accounts.

Most financial plans we create start with the client putting together an itemized list of what they believe they spend on certain items like clothes, groceries, vacations, etc. A copy of our expense planner template can be found here. These are usually estimates as most people don’t track expenses in that much detail. Since these are estimates, we will use household income, taxes, and bank/investment accounts as a check to see if expenses appear reasonable.

What do expenses have to do with contributions to your retirement account now? Throughout your career, you receive a paycheck and use those funds to pay for the expenses you have. At some point, you no longer have the paycheck but still have the expenses. Most retirees will have access to social security and others may have a pension, but rarely does that income cover all your expenses. This means that the shortfall often comes from retirement accounts and other savings.

Not taking taxes, inflation, or investment gains into account, if your expenses are $50,000 per year and Social Security income is $25,000 a year, that is a $25,000 shortfall. 20 years of retirement times a $25,000 shortfall means $500,000 you’d need saved to fund retirement. Once we have an estimate of the coveted “What’s My Number?” question, we can create a savings plan to try and achieve that goal.

Cash Flow

As we age, some of the larger expenses we have in life go away. Student loan debt, mortgages, and children are among those expenses that stop at some point in most people’s lives. At the same time, your income is usually higher due to experience and raises throughout your career. As expenses potentially go down and income is higher, there may be cash flow that frees up allowing people to save more for retirement. The ability to save more as we get older means the contribution target amount may also change over time.

Timing of Contributions

Over time, the interest that compounds in retirement accounts often makes up most of the overall balance.

For example, if you contribute $2,000 a year for 30 years into a retirement account, you will end up saving $60,000. If you were able to earn an annual return of 6%, the ending balance after 30 years would be approximately $158,000. $60,000 of contributions and $98,000 of earnings.

The sooner the contributions are in an account, the sooner interest can start compounding. This means, that even though retirement saving is more cash flow friendly as we age, it is still important to start saving early.

Contribute Enough to Receive the Full Employer Match

Knowing the details of your company’s retirement plan is important. Most employers that sponsor a retirement plan make contributions to eligible employees on their behalf. These contributions often come in the form of “Non-Elective” or “Matching”.

Non-Elective – Contributions that will be made to eligible employees whether employees are contributing to the plan or not. These types of contributions are beneficial because if a participant is not able to save for retirement from their own paycheck, the company will still contribute. That being said, the contribution amount made by the employer, on its own, is usually not enough to achieve the level of savings needed for retirement. Adding some personal savings in addition to the employer contribution is recommended.

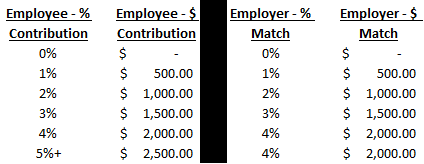

Matching – Employers will contribute on behalf of the employee if the employee is contributing to the plan as well. This means if the employee is contributing $0 to the retirement plan, the company will not contribute. The amount of matching varies by company, so knowing “Match Formula” is important to determine how much to contribute. For example, if the matching formula is “100% of compensation up to 4% of pay”, that means the employer will contribute a dollar-for-dollar match until they contribute 4% of your compensation. Below is an example of an employee making $50,000 with the 4% matching contribution at different contribution rates.

As you can see, this employee could be eligible for a $2,000 contribution from the employer, if they were to save at least 4% of their pay. That is a 100% return on your money that the company is providing.

Any contribution less than 4%, the employee would not be taking advantage of the employer contribution available to them. I’m not a fan of the term “free money”, but that is often the reasoning behind the “Contribute Enough to Receive the Full Employer Match” response.

10%-15% of Your Compensation

As said previously, how much you should be contributing to your retirement depends on several factors and can be different for everyone. 10%-15% over a long-term period is often a contribution rate that can provide sufficient retirement savings. Math below…

Assumptions

Age: 25

Retirement Age: 65

Current Income: $30,000

Annual Raises: 2%

Social Security @ 65: $25,000

Annualized Return: 6%

Step 1: Estimate the Target Balance to Accumulate by 65

On average, people will need an estimated 90% of their income for early retirement spending. As we age, spending typically decreases because people are unable to do a lot of the activities we typically spend money on (i.e. travel). For this exercise, we will assume a 65-year-old will need 80% of their income throughout retirement.

Present Salary - $30,000

Future Value After 40 Years of 2% Raises - $65,000

80% of Future Compensation - $52,000

$52,000 – income needed to replace

$25,000 – social security @ 65

$27,000 – amount needed from savings

X 20 – years of retirement (Age 85 - life expectancy)

$540,000 – target balance for retirement account

Step 2: Savings Rate Needed to Achieve $540,000 Target Balance

40 years of a 10% annual savings rate earning 6% interest per year, this person could have an estimated balance of $605,000. $181,000 of contributions and $424,000 of compounded interest.

I hope this has helped provide a basic understanding of how you can determine an appropriate savings rate for yourself. We recommend reaching out to an advisor who can customize your plan based on your personal needs and goals.

About Rob……...

Hi, I’m Rob Mangold, Partner at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

How Pension Income and Retirement Account Withdrawals Can Impact Unemployment Benefits

How Pension Income and Retirement Account Withdrawals Can Impact Unemployment Benefits As the economy continues to slow, unemployment claims continue to rise at historic rates.

How Pension Income and Retirement Account Withdrawals Can Impact Unemployment Benefits

As the economy continues to slow, unemployment claims continue to rise at historic rates. Due to this expected increase in unemployment, the CARES Act included provisions for Coronavirus related distributions which give people access to retirement dollars with more favorable tax treatment. Details on these distributions can be found here. With retirement dollars becoming more accessible with the CARES Act, a common question we are receiving is “Will a retirement distribution impact my Unemployment Benefits?”.

Unemployment Benefits vary from state to state and therefore the answer to this question can be different depending on the state you reside in. This article will focus on New York State Unemployment Benefits, but a lot of the items discussed may be applied similarly in other states.

The answer to this question also depends on the type of retirement account you are receiving money from so we will touch on the most common.

Note: Typically, to qualify for unemployment insurance benefits, you must have been paid minimum wage during the “base period”. Base period is defined as the first four quarters of the last five calendar quarters prior to the calendar quarter which the claim is effective. “Base period employer” is any employer that paid the claimant during the base period.

Pension Reduction

Money received from a pension that a base period employer contributed to will result in a dollar for dollar reduction in your unemployment benefit. Even if you partially contributed to the pension, 100% of the amount received will result in an unemployment benefit reduction.

If you were the sole contributor to the pension, then the unemployment benefit should not be impacted.

Even if you are retired from a job and receiving a pension, you may still qualify for unemployment benefits if you are actively seeking employment.

Qualified Retirement Plans (examples; 401(k), 403(b))

If the account you are accessing is from a base period employer, a withdrawal from a qualified retirement plan could result in a reduction in your unemployment benefit. It is common for retirement plans to include some type of match or profit-sharing element which would qualify as an employer contribution. Accounts which include employer contributions may result in a reduction of your unemployment benefit.

We recommend you contact the unemployment claims center to determine how these distributions would impact your benefit amount before taking them.

IRA

No unemployment benefit rate reduction will occur if the distribution is from a qualified IRA.Knowing there is no reduction caused by qualified IRA withdrawals, a common practice is rolling money from a qualified retirement plan into an IRA and then accessing it as needed. Once you are no longer at the employer, you are often able to take a distribution from the plan. Rolling it into an IRA and accessing the money from that account rather than directly from the retirement plan could result in a higher unemployment benefit.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Coronavirus Relief: $100K 401(k) Loans & Penalty Free Distributions

With the passing of the CARES Act, Congress made new distribution and loan options available within 401(k) plans, IRA’s, and other types of employer sponsored plans.

With the passing of the CARES Act, Congress made new distribution and loan options available within 401(k) plans, IRA’s, and other types of employer sponsored plans. These new distribution options will provide employees and business owners with access to their retirement accounts with the:

10% early withdrawal penalty waived

Option to spread the income tax liability over a 3-year period

Option to repay the distribution and avoid taxes altogether

401(k) loans up to $100,000 with loan payments deferred for 1 year

Many individuals and small businesses are in a cash crunch. Individuals are waiting for their IRS Stimulus Checks and many small business owners are in the process of applying for the new SBA Disaster Loans and SBA Paycheck Protection Loans. Since no one knows at this point how long it will take the IRS checks to arrive or how long it will take to process these new SBA loans, people are looking for access to cash now to help bridge the gap. The CARES Act opened up options within pre-tax retirement accounts to provide that bridge.

10% Early Withdrawal Penalty Waived

Under the CARES Act, “Coronavirus Related Distributions” up to $100,000 are not subject the 10% early withdrawal penalty for individuals under the age of 59½. The exception will apply to distributions from:

IRA’s

401(K)

403(b)

Simple IRA

SEP IRA

Other types of Employer Sponsored Plans

To qualify for the waiver of the 10% early withdrawal penalty, you must meet one of the following criteria:

You, your spouse, or a dependent was diagnosed with the COVID-19

You are unable to work due to lack of childcare resulting from COVID-19

You own a business that has closed or is operating under reduced hours due to COVID-19

You have experienced adverse financial consequences as a result of being quarantined, furloughed, laid off, or having work hours reduced because of COVID-19

They obviously made the definition very broad and it’s anticipated that a lot of taxpayers will qualify under one of the four criteria listed above. The IRS may also take a similar broad approach in the application of these new qualifying circumstances.

Tax Impact

While the 10% early withdrawal penalty can be waived, in most cases, when you take a distribution from a pre-tax retirement account, you still have to pay income tax on the distribution. That is still true of these Coronavirus Related Distributions but there are options to help either mitigate or completely eliminate the income tax liability associated with taking these distributions from your retirement accounts.

Tax Liability Spread Over 3 Years

Normally when you take a distribution from a pre-tax retirement account, you have to pay income tax on the full amount of the distribution in the year that the distribution takes place.

However, under these new rules, by default, if you take a Coronavirus-Related Distribution from your 401(k), IRA, or other type of employer sponsored plan, the income tax liability will be split evenly between 2020, 2021, and 2022 unless you make a different election. This will help individuals by potentially lowering the income tax liability on these distributions by spreading the income across three separate tax years. However, taxpayers do have the option to voluntarily elect to have the full distribution taxed in 2020. If your income has dropped significantly in 2020, this may be an attractive option instead of deferring that additional income into a tax year where your income has returned to it’s higher level.

1099R Issue

I admittedly have no idea how the tax reporting is going to work for these Coronavirus-Related Distributions. Normally when you take a distribution from a retirement account, the custodian issues you a 1099R Tax Form at the end of the year for the amount of the distribution which is how the IRS cross checks that you reported that income on your tax return. If the default option is to split the distribution evenly between three separate tax years, it would seem logical that the custodians would now have to issue three separate 1099R tax forms for 2020, 2021, and 2022. As of right now, we don’t have any guidance as to how this is going to work.

Repayment Option

There is also a repayment option associated with these Coronavirus Related Distributions, that will provide taxpayers with the option to repay these distributions back into their retirement accounts within a 3-year period and avoid having to pay income tax on these distributions. If individuals elect this option, not only did they avoid the 10% early withdrawal penalty, but they also avoided having to pay tax on the distribution. The distribution essentially becomes an “interest free loan” that you made to yourself using your retirement account.

The 3-year repayment period begins the day after the individual receives the Coronavirus Related Distribution. The repayment is technically treated as a “rollover” similar to the 60 day rollover rule but instead of having only 60 days to process the rollover, taxpayers will have 3 years.

The timing of the repayment is also flexible. You can either repay the distribution as a:

Single lump sum

Partial payments over the course of the 3 year period

Even if you do not repay the full amount of the distribution, any amount that you do repay will avoid income taxation. If you take a Coronavirus Related Distribution, whether you decide to have the distribution split into the three separate tax years or all in 2020, if you repay a portion or all of the distribution within that three year window, you can amend your tax return for the year that the taxes were paid on that distribution, and recoup the income taxes that you paid.

Example: I take a $100,000 distribution from my IRA in April 2020. Since my income is lower in 2020, I elect to have the full distribution taxed to me in 2020, and remit that taxes with my 2020 tax return. The business has a good year in 2021, so in January 2022 I return the full $100,000 to my IRA. I can now amend my 2020 tax return and recapture the income tax that I paid for that $100,000 distribution that qualified as a Coronavirus Related Distribution.

No 20% Withholding Requirement

Normally when you take cash distributions from employee sponsored retirement plans, they are subject to a mandatory 20% federal tax withholding; that requirement has been waived for these Coronavirus Related Distributions up to the $100,000 threshold, so plan participants have access to their full account balance.

Cash Bridge Strategy

Here are some examples as to how individuals and small business owners may be able to use these strategies.

For small business owners that intend to apply for the new SBA Disaster Loan (EIDL) and/or SBA Paycheck Protection Program (PPP), the underwriting process will most likely take a few weeks before the company actually receives the money for the loan. Some businesses need cash sooner than that just to keep the lights on while they are waiting for the SBA money to arrive. A business owner could take a $100,000 from the 401(K) plan, use that money to operate the business, and they have 3 years to return that money to 401(k) plan to avoid having to pay income tax on that distribution. The risk of course, is if the business goes under, then the business owner may not have the cash to repay the loan. In that case, if the owner was under the age of 59½, they avoided the 10% early withdrawal penalty, but would have to pay income tax on the distribution amount.

For individuals and families that are struggling to make ends meet due to the virus containment efforts, they could take a distribution from their retirement account to help subsidize their income while they are waiting for the IRS Stimulus checks to arrive. When they receive the IRS stimulus checks or return to work full time, they can repay the money back into their retirement account prior to the end of the year to avoid the tax liability associated with the distribution for 2020.

401(k) Plan Sponsors

I wanted to issue a special note the plan sponsors of these employer sponsored plans, these Coronavirus Related Distributions are an “optional” feature within the retirement plan. If you want to provide your employees with the opportunity to take these distributions from the plan, you will need to contact your third party administrator, and authorize them to make these distributions. This change will eventually require a plan amendment but companies have until 2022 to amend their plan to allow these Coronavirus Related Distributions to happen now, and the amendment will apply retroactively.

$100,000 Loan Option

The CARES Act also opened up the option to take a $100,000 loan against your 401(k) or 403(b) balance. Normally, the 401(k) maximum loan amount is the lesser of:

50% of your vested balance OR $50,000

The CARES Act includes a provision that will allow plan sponsors to amend their loan program to allow “Coronavirus Related Loans” which increases the maximum loan amount to the lesser of:

100% of your vested balance OR $100,000

To gain access to these higher loan amounts, plan participants have to self attest to the same criteria as the waiver of the 10% early withdrawal penalty. But remember, loans are an optional plan provision within these retirement plans so your plan may or may not allow loans. If the plan sponsors want to allow these high threshold loans, similar to the Coronavirus Related Distributions, they will need to contact their plan administrator authorizing them to do so and process the plan amendment by 2022.

No Loan Payments For 1 Year

Normally when you take a 401(K) loan, the company begins the payroll deductions for your loan payment immediately after you receive the loan. The CARES act will allow plan participants that qualify for these Coronavirus loans to defer loan payments for up to one year. The loan just has to be taken prior to December 31, 2020.

Caution

While the CARES ACT provides some new distribution and loan options for individuals impacted by the Coronavirus, there are always downsides to using money in your retirement account for purposes other than retirement. The short list is:

The money is no longer invested

If the distribution is not returned to the account within 3 years, you will have a tax liability

If you use your retirement account to fund the business and the business fails, you could have to work a lot longer than you anticipated

If you take a big 401(k) loan, even though you don’t have to make loan payments now, a year from the issuance of the loan, you will have big deductions from your paycheck as those loan payments are required to begin.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

$5,000 Penalty Free Distribution From An IRA or 401(k) After The Birth Of A Child or Adoption

New parents have even more to be excited about in 2020. On December 19, 2019, Congress passed the SECURE Act, which now allows parents to withdraw up to $5,000 out of their IRA’s or 401(k) plans following the birth of their child

New parents have even more to be excited about in 2020. On December 19, 2019, Congress passed the SECURE Act, which now allows parents to withdraw up to $5,000 out of their IRA’s or 401(k) plans following the birth of their child without having to pay the 10% early withdrawal penalty. To take advantage of this new distribution option, parents will need to know:

Effective date of the change

Taxes on the distribution

Deadline to make the withdrawal

Is it $5,000 for each parent or a total per couple?

Do all 401(k) plans allow these types of distributions?

Is it a per child or is it a one-time event?

Can you repay the money to your retirement account at a future date?

How does it apply to adoptions?

This article will provide you with answers to these questions and also provide families with advanced tax strategies to reduce the tax impact of these distributions.

SECURE Act

The SECURE Act was passed in December 2019 and Section 113 of the Act added a new exception to the 10% early withdrawal penalty for taking distributions from retirement accounts called the “Qualified Birth or Adoption Distribution.”

Prior to the SECURE Act, if you were under the age of 59½ and you distributed pre-tax money from an IRA or 401(k) plan, in addition to having to pay ordinary income tax on the amount distributed, you were also hit with a 10% early withdrawal penalty from the IRS. The IRS prior to the SECURE Act did have a list of exceptions to the 10% penalty but having a child or adopting a child was not on that list. Now it is.

How It Works

After the birth of a child, a parent is allowed to distribute up to $5,000 out of either an IRA or a 401(k) plan. Notice the word “after”. You are not allowed to withdraw the money prior to the child being born. New parents have up to 12 months following the date of birth to process the distribution from their retirement accounts and avoid the 10% early withdrawal penalty.

Example: Jim and Sarah have their first child on May 5, 2020. To help with some of the additional costs of a larger family, Jim decides to withdraw $5,000 out of his rollover IRA. Jim’s window to process that distribution is between May 5, 2020 – May 4, 2021.

The Tax Hit

Assuming Jim is 30 years old, he would avoid having to pay the 10% early withdrawal penalty on the $5,000 but that $5,000 still represents taxable income to him in the year that the distribution takes place. If Jim and Sarah live in New York and make a combined income of $100,000, in 2020, that $5,000 would be subject to federal income tax of 22% and state income tax of 6.45%, resulting in a tax liability of $1,423.

Luckily under the current tax laws, there is a $2,000 federal tax credit for dependent children under the age of 17, which would more than offset the total 22% in fed tax liability ($1,100) created by the $5,000 distribution from the IRA. Essentially reducing the tax bill to $323 which is just the state tax portion.

TAX NOTE: While the $2,000 fed tax credit can be used to offset the federal tax liability in this example, if the IRA distribution was not taken, that $2,000 would have reduced Jim & Sarah’s existing tax liability dollar for dollar.

For more info on the “The Child Tax Credit” see our article: More Taxpayers Will Qualify For The Child Tax Credit

$5,000 Per Parent

But it gets better. The $5,000 limit is available to EACH parent meaning if both parents have a pre-tax IRA or 401(k) plan, they can each distribute up to $5,000 from their retirement accounts within 12 months following the birth of their child and avoid the 10% early withdrawal penalty.

ADVANCED TAX STRATEGY: If both parents are planning to distribute the full $5,000 out of their retirement accounts and they are in a medium to high tax bracket, it may make sense to split the two distributions between separate tax years.

Example: Scott and Linda have a child on October 3, 2020 and they both plan to take the full $5,000 out of their IRA accounts. If they are in a 24% federal tax bracket and they process both distributions prior to December 31, 2020, the full $10,000 would be taxable to them in 2020. This would create a $2,400 federal tax liability. Since this amount is over the $2,000 child tax credit, they will have to be prepared to pay the additional $400 federal income tax when they file their taxes since it was not fully offset by the $2,000 tax credit.

In addition, by taking the full $10,000 in the same tax year, Scott and Linda also run the risk of making that income subject to a higher tax rate. If instead, Linda processes her distribution in November 2020 and Scott waits until January 2021 to process his $5,000 IRA distribution, it could result in a lower tax liability and less out of pocket expense come tax time.

Remember, you have 12 months following the date of birth to process the distribution and qualify for the 10% early withdrawal exemption.

$5,000 For Each Child

This 10% early withdrawal exemption is available for each child that is born. It does not have a lifetime limit.

Example: Building on the Scott and Linda example above, they have their first child October 2020, and both of them process a $5,000 distribution from their IRA’s avoiding the 10% penalty. They then have their second child in November 2021. Both Scott and Linda would be eligible to withdraw another $5,000 each out of their IRA or 401(k) within 12 months after the birth of their second child and again avoid having to pay the 10% early withdrawal penalty.

IRS Audit

One question that we have received is “Do I need to keep track of what I spend the money on in case I’m ever audited by the IRS?” The short answer is “No”. The new law does not require you to keep track of what the money was spent on. The birth of your child is the “qualifying event” which makes you eligible to distribute the $5,000 penalty free.

Not All 401(k) Plans Will Allow These Distributions

Starting in 2020, this 10% early withdrawal exception will apply to all pre-tax IRA accounts but it does not automatically apply to all 401(k), 403(b), or other types of qualified employer sponsored retirement plans.

While the SECURE Act “allows” these penalty free distributions to be made, companies can decide whether or not they want to provide this special distribution option to their employees. For employers that have existing 401(k) or 403(b) plans, if they want to allow these penalty free distributions to employees after the birth of a child, they will need to contact their third-party administrator and request that the plan be amended.

For companies that intend to add this distribution option to their plan, they may need to be patient with the timeline for the change. 401(k) providers will most likely need to update their distribution forms, tax codes on their 1099R forms, and update their recordkeeping system to accommodate this new type of distribution.

Ability To Repay The Distribution

The new law also offers parents the option to repay the amounts to their retirement account that were distributed due to a qualified birth or adoption. The repayment of the amounts previously distributed from the IRA or 401(k) would be in addition to the annual contribution limits. There is not a lot of clarity at this point as to how these “repayments” will work so we will have to wait for future guidance from the IRS on this feature.

Adoptions

The 10% early withdrawal exception also applies to adoptions. An individual is allowed to take a distribution from their retirement account up to $5,000 for any children under the age of 18 that is adopted. Similar to the timing rules of the birth of a child, the distribution must take place AFTER the adoption is finalized, but within 12 months following that date. Any money distributed from retirement accounts prior to the adoption date will be subject to the 10% penalty for individuals under the age of 59½.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

IRA RMD Start Date Changed From Age 70 ½ to Age 72 Starting In 2020

The SECURE Act was passed into law on December 19, 2019 and with it came some big changes to the required minimum distribution (“RMD”) requirements from IRA’s and retirement plans. Prior to December 31, 2019, individuals

The SECURE Act was passed into law on December 19, 2019 and with it came some big changes to the required minimum distribution (“RMD”) requirements from IRA’s and retirement plans. Prior to December 31, 2019, individuals were required to begin taking mandatory distributions from their IRA’s, 401(k), 403(b), and other pre-tax retirement accounts starting in the year that they turned age 70 ½. The SECURE Act delayed the start date of the RMD’s to age 72. But like most new laws, it’s not just a simple and straightforward change. In this article we will review:

Old Rules vs New Rules surrounding RMD’s

New rules surrounding Qualified Charitable Distributions from IRA’s

Who is still subject to the 70 ½ RMD requirement?

The April 1st delay rule

Required Minimum Distributions

A quick background on required minimum distributions, also referred to as RMD’s. Prior to the SECURE Act, when you turned age 70 ½ the IRS required you to take small distributions from your pre-tax IRA’s and retirement accounts each year. For individuals that did not need the money, they did not have a choice. They were forced to withdraw the money out of their retirement accounts and pay tax on the distributions. Under the current life expectancy tables, in the year that you turned age 70 ½ you were required to take a distribution equaling 3.6% of the account balance as of the previous year end.

With the passing of the SECURE Act, the start age from these RMD’s is now delayed until the calendar year that an individual turns age 72.

OLD RULE: Age 70 ½ RMD Begin Date

NEW RULE: Age 72 RMD Begin Date

Still Subject To The Old 70 ½ Rule

If you turned age 70 ½ prior to December 31, 2019, you will still be required to take RMD’s from your retirement accounts under the old 70 ½ RMD rule. You are not able to delay the RMD’s until age 72.

Example: Sarah was born May 15, 1949. She turned 70 on May 15, 2019 making her age 70 ½ on November 15, 2019. Even though she technically could have delayed her first RMD to April 1, 2020, she will not be able to avoid taking the RMD’s for 2019 and 2020 even though she will be under that age of 72 during those tax years.

Here is a quick date of birth reference to determine if you will be subject to the old 70 ½ start date or the new age 72 start date:

Date of Birth Prior to July 1, 1949: Subject to Age 70 ½ start date for RMD

Date of Birth On or After July 1, 1949: Subject to Age 72 start date for RMD

April 1 Exception Retained

OLD RULE: In the the year that an individual turned age 70 ½, they had the option to delay their first RMD until April 1st of the following year. This is a tax strategy that individuals engaged in to push that additional taxable income associated with the RMD into the next tax year. However, in year 2, the individual was then required to take two RMD’s in that calendar year: One prior to April 1st for the previous tax year and the second prior to December 31st for the current tax year.

NEW RULE: Unchanged. The April 1st exception for the first RMD year was retained by the SECURE Act as well as the requirement that if the RMD was voluntarily delayed until the following year that two RMD’s would need be taken in the second year.

Qualified Charitable Distributions (QCD)

OLD RULES: Individuals that had reached the RMD age of 70 ½ had the option to distribute all or a portion of their RMD directly to a charitable organization to avoid having to pay tax on the distribution. This option was reserved only for individuals that had reached age 70 ½. In conjunction with tax reform that took place a few years ago, this has become a very popular option for individuals that make charitable contributions because most individual taxpayers are no longer able to deduct their charitable contributions under the new tax laws.

NEW RULES: With the delay of the RMD start date to age 72, do individuals now have to wait until age 72 to be eligible to make qualified charitable distributions? The answer is thankfully no. Even though the RMD start date is delayed until age 72, individuals will still be able to make tax free charitable distributions from their IRA’s in the calendar year that they turn age 70 ½. The limit on QCDs is still $100,000 for each calendar year.

NOTE: If you plan to process a qualified charitable distributions from your IRA after age 70 ½, you have to be well aware of the procedures for completing those special distributions otherwise it could cause those distributions to be taxable to the owner of the IRA. See the article below for more on this topic:

ANOTHER NEW RULE: There is a second new rule associated with the SECURE Act that will impact this Qualified Charitable Distribution strategy. Under the old tax law, individuals were unable to contribute to Traditional IRA’s past the age of 70 ½. The SECURE Act eliminated that rule so individuals that have earned income past age 70 ½ will be eligible to make contributions to Traditional IRAs and take a tax deduction for those contributions.

As an anti-abuse provision, any contributions made to a Traditional IRA past the age of 70 ½ will, in aggregate, dollar for dollar, reduce the amount of your qualified charitable distribution that is tax free.

Example: A 75 year old retiree was working part-time making $20,000 per year for the past 3 years. To reduce her tax bill, she contributed $7,000 per year to a traditional IRA which is allowed under the new tax laws. This year she is required to take a $30,000 required minimum distribution (RMD) from her retirement accounts and she wants to direct that all to charity to avoid having to pay tax on the $30,000. Because she contributed $21,000 to a traditional IRA past the age of 70 ½, $21,000 of the qualified charitable distribution would be taxable income to her, while the remaining $9,000 would be a tax free distribution to the charity.

$30,000 QCD – $21,000 IRA Contribution After Age 70 ½ = $9,000 tax free QCD

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How To Use Your Retirement Accounts To Start A Business

One of the most challenging aspects of starting a new business is finding the capital that is needed to support your expenses as you begin to build up a revenue stream since it’s not always easy to ask friends and family for money to invest in a startup business. Luckily, for new entrepreneurs, there are some little-known ways on how you can use

One of the most challenging aspects of starting a new business is finding the capital that is needed to support your expenses as you begin to build up a revenue stream since it’s not always easy to ask friends and family for money to invest in a startup business. Luckily, for new entrepreneurs, there are some little-known ways on how you can use retirement accounts as a funding source for your new business. However, before you cash out your 401(k) account to start a business, you have to fully understand the pros and cons of each option.

ROBS Plans

ROBS stands for “Rollover for Business Startups”. ROBS is a special program that allows you to use the balance in your 401(k) or IRA account to fund your new business while avoiding having to pay taxes and the 10% early withdrawal penalty for business owners under age 59.5. Unlike a 401(k) loan that has limits, loan payments, and interest, ROBS plans allow you to use your full retirement account balance without having to enter into a repayment plan.

Why do business owners use ROBS plans?

The benefits are fairly obvious. First off, by using your own retirement assets to fund your new business, you don’t have to ask friends and family for money. Secondly, if you were to embark on the traditional lending route from a bank for your start-up, most would require you to pledge personal assets, such as your house, as collateral for the loan. Doing this puts an added pressure on the new entrepreneur because if the business fails you not only lose the business, but potentially your house as well. By using the ROBS plan, you are only risking your own assets, you have quick and easy access to those funds, and if the business fails, worst case scenario, you just have to work longer than you expected.

Is this too good to be true?

When I explain this funding strategy to new business owners, the question I usually get is, “Why haven’t I heard of these plans before?”, and here are a few reasons why. To begin, you are using retirement plan dollars and accessing the tax benefits, and in doing so there are a lot of complex rules surrounding these types of plans. It’s not uncommon for accountants, third-party administrators, and financial advisors to not know what a ROBS plan is, let alone understand the compliance rules surrounding these plans; thus, it’s rarely presented as a viable option. Over the course of this article we will cover the pros and cons of this funding mechanism.

How do ROBS plans work?

The concept is fairly simple, your retirement account essentially buys shares of stock in your new business which provides the business with the cash needed to grow. You do not have to be a publicly traded company for your retirement account to buy shares, however, you are required to establish your new company as a C-Corp in order for this plan to work.

This process entails incorporating your new business, as well as establishing a new 401(k) plan within that business, that contains the special ROBS features. Then, you can transfer assets from your various retirement accounts into the new 401(k) plan allowing the 401(k) plan to then buy shares in your new company. While this sounds easy, I cannot stress enough that you must work with a firm that fully understands these types of plans and the funding strategy. These plans are perfectly legal, but there are a lot of rules to follow. Since this funding strategy allows you to access retirement account dollars without having to pay tax to the IRS, the IRS will sometimes audit these plans hoping that you did not fully understand or comply with the rules surrounding the establishment and operations of these ROBS plans.

The steps to set up a ROBS plan

Here are the steps for setting up the plan:

1) Establish your new business as a C-Corp.

2) Establish a new 401(k) plan for your new business

3) Process direct rollovers from your 401(k) accounts and IRA accounts into your new 401(k) plan

4) Use the balance in your 401(k) account to purchase shares of the corporation

5) Now you have cash in your business checking account to pay expenses

You must be a C-Corp

The only type of corporate structure that works for a ROBS plan is a C-Corp because only a C-Corp can sell shares of the business to a retirement account legally. That means that LLCs, sole proprietorships, partnerships or even S-Corps will not work for this funding option.

Establishing the new 401(k) plan

ROBS plans have all the same features and benefits of a traditional 401(k) plan, profit-sharing plan, or defined benefit plan, except they also have special features that allow the plan to invest plan assets in the privately held C-Corp.

You need to work with a firm that knows these plans well because not all custodians will allow you to hold shares of a privately held corporation in a qualified retirement account. For many investment firms and custodians, this is considered either a “private placement” or an “alternative investment”. There is typically a special approval process that you must go through with the custodian before they allow your 401(k) account to purchase the shares of stock in your new company. Be ready, there are a lot of mainstream 401(k) providers that will not only not know what a ROBS plan is, but they often times limit the plan investment options to mutual funds; to avoid this, make sure you are aligning yourself with the right provider.

Transferring funds from your retirement accounts to your new 401(k) plan

Your new investment provider should assist you with coordinating the rollovers into your 401(k) account to avoid paying taxes and penalties. Also, if you have 401(K) Roth or after-tax money in your retirement accounts, special preparations need to be made prior to the rollover occurring for those sources.

Purchasing stock in the business

It’s not as easy as simply transferring money into the business checking account since you have to go through the process of issuing shares to the 401(k) account. In most cases, the percentage of ownership attributed to the 401(k) plan is based upon your total funding picture to start up the company. If your retirement accounts are the sole resource to fund the business, then technically your 401(k) plan owns 100% of the company. It’s not uncommon for new business owners to use multiple funding sources including personal savings, funding from friends and family, or a home-equity loan. In these instances, a ROBS plan is still allowed but the plan will own less than 100% of the business.

I don’t want to get too deep in the weeds with this point, but it’s usually advisable not to issue 100% of the shares of the business to your 401(k) plan. This could limit your ability to raise additional capital down the road because you don’t have any additional shares to issue to new investors or to share equity with a new partner.

Using the capital to grow your business

Once the share purchase is complete, the cash will be transferred from your retirement account into the business checking account allowing use those funds to start growing the business.

There is a very important rule when it comes to what you can use these funds for within the new business. First and foremost, you cannot use these funds to pay yourself compensation as the business owner. This is probably the biggest ‘no-no’ associated with these types of plans. The IRS does not want you circumnavigating income taxes and penalties just to pay yourself under a ROBS plan. In order to pay yourself as the business owner, you have to be able to generate revenue from the business. The assets from the stock purchase can be used to pay all of your expenses but before you’re able to take any money out of the business to pay yourself compensation you have to be showing revenue.

Once new business owners hear this, it’s often disheartening. It’s great that they have access to capital to build their business, but how do they pay their bills while they’re building up the revenue stream? Luckily, I have good news on this front. We have additional strategies that we can implement using your retirement accounts outside of the ROBS plan that will allow you to pay yourself compensation as the owner and it can work out better tax wise than paying yourself as a W2 income through the C-corp.

Requirements for ROBS plans

There are a few requirements you have to meet for this funding strategy to work.

1) The funds have to be held in a pre-tax retirement account. This means that money in Roth IRA’s and Roth 401(k)’s are not eligible for this funding strategy.

2) You typically need at least $50,000 in your new 401(k) account for the ROBS plan to make sense since there are special costs associated with establishing and maintaining a ROBS 401(k) plan. If your balance is less than $50,000, the cost to establish and maintain the plan begins to outweigh the benefit of executing this funding strategy.

3) If you’re rolling over a 401(k) plan to fund your ROBS 401(k) plan, it cannot be from a current employer. In other words, if you are still working for a company and you’re running this new business on the side, you are not able to rollover your 401(k) balance into your newly established 401(k) plan and implement this ROBS strategy. The 401(k) account must be coming from a former employer that you no longer work for.

4) You have to be an active employee in the business

There are special IRS rules that define if an employee is actively or materially participating in a business. Since ROBS plans do not work for passive business owners, it is difficult to use these plans for real estate investments unless you can prove that you are an active employee of that real estate corporation. If your new business is your only employer, you work over 1000 hours per year, and it’s your primary source of revenue, then you should not have a problem qualifying as an active employee. If you have multiple businesses however, you really need to consult your accountant and ROBS provider to make sure you satisfy the IRS definition of materially participating.

A ROBS plan can be used for more than just start-ups

While we have talked a lot about using ROBS plans to start up a business, they can also be used for other purposes. These plans can be a funding source to:

1) Buy an existing business

2) Recapitalize a business

3) Build a franchise

These plans can offer fast access to large amounts of capital without having to go through the traditional lending channels.

Cost of setting up and maintaining a ROBS plan

It typically costs $4,000 – $5,000 to set up a ROBS plan and you cannot use the balance in your retirement account to pay this fee. It must be paid with outside funds.

As for ongoing fees, you will have the regular administrative, recordkeeping, and investment advisory fees associated with sponsoring a 401(k) plan which vary from provider to provider. You may also have additional fees charged each year by the custodian for holding the privately held C-Corp shares in your retirement account. Make sure you clearly understand what the custodian will require from you each year to value those shares. If you wind up with a custodian that requires audited financial statements, this could easily run you an additional $8,000+ per year to obtain those audited financial statements from an accounting firm. If you are sponsoring one of these plans, you probably want to try to avoid this large additional cost.

Complications if you have employees

For start-up companies or established companies that have employees that would otherwise be eligible for the 401(k) plan, there are special issues that need to be addressed. The rules within the 401(k) world state that all investment options available within the plan must be made available to all eligible employees. That means if the business owner is able to purchase shares of the company within the retirement plan, the other eligible employees must also be given the same investment opportunity. You can see immediately where this would pose a challenge to the ROBS plan if you have eligible employees.

However, investment options can be changed which is why ROBS plans are the most common in start-ups where there are no employees yet, allowing the 401(k) plan to setup the only eligible plan participant, the business owner, allowing them to buy shares of the company. Once the share purchases are complete, the business owner can then remove those shares as an investment option in the plan going forward.

The Cons of a ROBS plan

Up until now we have presented the advantages of the ROBS plan but there are some disadvantages.

1) The first one is pretty obvious. You are risking your retirement account dollars in a start-up business. If the business fails, not only will you be looking for a new job, but you’ve depleted your retirement assets.

2) You are required to sponsor a C-Corp which may not be the most advantageous corporate structure.

3) You are required to sponsor a 401(k) plan. When running a start-up business, it’s sometimes more advantageous to sponsor a Simple IRA or SEP IRA which requires less cost and time to maintain, but you don’t have that option using this funding strategy.

4) The business owners can’t pay themselves compensation from the stock purchase

5) The cost to setup and maintain the plan. Paying $5,000 just to establish the plan isn’t exactly cheap. Plus, you’re looking at $2,000+ in annual maintenance costs for the plan. Other options like taking a home-equity loan or establishing a Solo 401(K) plan and taking a $50,000 401(k) loan from the plan may be the better funding option.

6) Audit risk. While it’s not the case that all these plans are audited, they do present an audit opportunity for the IRS given the compliance rules surrounding the operation of these plans. However, this risk can be managed with knowledgeable providers.

7) Asset sale of the business becomes complex. If 10 years from now you sell your company, there are two ways to sell it. An asset sale or a stock sale. While a stock sale jives very easily with this ROBS funding strategy, an asset sale becomes more complex.

Summary

Finding the capital to start up a business is never easy. Each funding option comes with its own set of pros and cons. The ROBS plan is just another option for consideration. While I have greatly simplified how these plans work and how they operate, if you are strongly considering using this plan as a funding vehicle for your new business, please reach out to us so we can have an open discussion about what you are trying to accomplish, and how the ROBS plan stacks up against other funding options that you may have available.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Accountant Put The Owner’s Kids On Payroll And Bomb Shelled The 401(k) Plan

The higher $12,000 standard deduction for single filers has produced an incentive in some cases for business owners to put their kids on the payroll in an effort to shift income out of the owner’s high tax bracket into the children’s lower tax bracket. However, there was a non-Wojeski accountant that advised his clients not only to put his kids on the

Big Issue

The higher $12,000 standard deduction for single filers has produced an incentive in some cases for business owners to put their kids on the payroll in an effort to shift income out of the owner’s high tax bracket into the children’s lower tax bracket. However, there was a non-Wojeski accountant that advised his clients not only to put his kids on the payroll but also to have their children put all of that W2 compensation in the company’s 401(k) plan as a Roth deferral.

At first look it would seem to be a dynamite tax strategy but this strategy blew up when the company got their year end discrimination testing back for the 401(k) plan and all of the executives, including the owner, were forced to distribute their pre-tax deferrals from the plan due to failed discrimination testing. It created a huge unexpected tax liability for the owners and all of the executives completely defeating the tax benefit of putting the kids on payroll. Not good!!

Why This Happened

If your client sponsors a 401(k) plan and they are not a “safe harbor plan”, then each year the plan is subject to “discrimination testing”. This discrimination testing is to ensure that the owners and “highly compensated employees” are not getting an unfair level of benefits in the 401(k) plan compared to the rest of the employees. They look at what each employee contributes to the plan as a percent of their total compensation for the year. For example, if you make $3,000 in employee deferrals and your W2 comp for the year is $60,000, your deferral percentage is 5%.

They run this calculation for each employee and then they separate the employees into two groups: “Highly Compensated Employees” (HCE) and “Non-Highly Compensation Employees” (NHCE). A highly compensated employee is any employee that in 2019:

is a 5% or more owner, or

Makes $125,000 or more in compensation

They put the employees in their two groups and take an average of each group. In most cases, the HCE’s average cannot be more than 2% higher than the NHCE average. If it is, then the HCE’s get pre-tax money kicked back to them out of the 401(k) plan that they have to pay tax on. It really ticks off the HCE’s when this happens because it’s an unexpected tax bill.

Little Known Attribution Rule

ATTRIBUTION RULE: Event though a child of an owner may not be a 5%+ owner or make more than $125,000 in compensation, they are automatically considered an HCE because they are related to the owner of the business. So in the case that I referred above, the accountant had the client pay the child $12,000 and defer $12,000 into the 401(k) plan as a Roth deferral making their deferral percentage 100% of compensation. That brought the average for the HCE way way up and caused the plan fail testing.

To make matters worse, when 401(k) refunds happen to the HCE’s they do not go back to the person that deferred the highest PERCENTAGE of pay, they go to the person that deferred the largest DOLLAR AMOUNT which was the owner and the other HCE’s that deferred over $18,000 in the plan each.

How To Avoid This Mistake

Before advising a client to put their children on payroll and having them defer that money into the 401(k) plan, ask them these questions:

Does your company sponsor a 401(k) plan?

If yes, is your plan a “safe harbor 401(k) plan?

If the company sponsors a 401(k) plan AND it’s a safe harbor plan, you are in the clear with using this strategy because there is no discrimination testing for the employee deferrals.

If the company sponsors a 401(k) plan AND it’s NOT a safe harbor plan, STOP!! The client should either consult with the TPA (third party administrator) of their 401(k) plan to determine how their kids deferring into the plan will impact testing or put the kids on payroll but make sure they don’t contribute to the plan.

Side note, if the company sponsors a Simple IRA, you don’t have to worry about this issue because Simple IRA’s do not have discrimination testing. The children can defer into the retirement plan without causing any issues for the rest of the HCE’s.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Percentage of Pay vs Flat Dollar Amount

Enrolling in a company retirement plan is usually the first step employees take to join the plan and it is important that the enrollment process be straight forward. There should also be a contact, i.e. an advisor (wink wink), who can guide the employees through the process if needed. Even with the most efficient enrollment process, there is a lot of

Retirement Contributions - Percentage of Pay vs Flat Dollar Amount

Enrolling in a company retirement plan is usually the first step employees take to join the plan and it is important that the enrollment process be straight forward. There should also be a contact, i.e. an advisor (wink wink), who can guide the employees through the process if needed. Even with the most efficient enrollment process, there is a lot of information employees must provide. Along with basic personal information, employees will typically select investments, determine how much they’d like to contribute, and document who their beneficiaries will be. This post will focus on one part of the contribution decision and hopefully make it easier when you are determining the appropriate way for you to save.

A common question you see on the investment commercials is “What’s Your Number”? Essentially asking how much do you need to save to meet your retirement goals. This post isn’t going to try and answer that. The purpose of this post is to help you decide whether contributing a flat dollar amount or a percentage of your compensation is the better way for you to save.

As we look at each method, it may seem like I favor the percentage of compensation because that is what I use for my personal retirement account but that doesn’t mean it is the answer for everyone. Using either method can get you to “Your Number” but there are some important considerations when making the choice for yourself.

Will You Increase Your Contribution As Your Salary Increases?

For most employees, as you start to earn more throughout your working career, you should probably save more as well. Not only will you have more money coming in to save but people typically start spending more as their income rises. It is difficult to change spending habits during retirement even if you do not have a paycheck anymore. Therefore, to have a similar quality of life during retirement as when you were working, the amount you are saving should increase.

By contributing a flat dollar, the only way to increase the amount you are saving is if you make the effort to change your deferral amount. If you do a percentage of compensation, the amount you save should automatically go up as you start to earn more without you having to do anything.

Below is an example of two people earning the same amount of money throughout their working career but one person keeps the same percentage of pay contribution and the other keeps the same flat dollar contribution. The percentage of pay person contributes 5% per year and starts at $1,500 at 25. The flat dollar person saves $2,000 per year starting at 25.

The percentage of pay person has almost $50,000 more in their account which may result in them being able to retire a full year or two earlier.

A lot of participants, especially those new to retirement plans, will choose the flat dollar amount because they know how much they are going to be contributing each pay period and how that will impact them financially. That may be useful in the beginning but may harm someone over the long term if changes aren’t made to the amount they are contributing. If you take the gross amount of your paycheck and multiply that amount by the percent you are thinking about contributing, that will give you close to, if not the exact, amount you will be contributing to the plan. You may also be able to request your payroll department to run a quick projection to show the net impact on your paycheck.

There are a lot of factors to take into consideration to determine how much you need to be saving to meet your retirement goals. Simply setting a percentage of pay and keeping it the same your entire working career may not get you all the way to your goal but it can at least help you save more.

Are You Maxing Out?

The IRS sets limits on how much you can contribute to retirement accounts each year and for most people who max out it is based on a dollar limit. For 2024, the most a person under the age of 50 can defer into a 401(k) plan is $23,000. If you plan to max out, the fixed dollar contribution may be easier to determine what you should contribute. If you are paid weekly, you would contribute approximately $442.31 per pay period throughout the year. If the IRS increases the limit in future years, you would increase the dollar amount each pay period accordingly.

Company Match

A company match as it relates to retirement plans is when the company will contribute an amount to your retirement account as long as you are eligible and are contributing. The formula on how the match is calculated can be very different from plan to plan but it is typically calculated based on a dollar amount or a percentage of pay. The first “hurdle” to get over with a company match involved is to put in at least enough money out of your paycheck to receive the full match from the company. Below is an example of a dollar match and a percent of pay match to show how it relates to calculating how much you should contribute.

Dollar for Dollar Match Example

The company will match 100% of the first $1,000 you contribute to your plan. This means you will want to contribute at least $1,000 in the year to receive the full match from the company. Whether you prefer contributing a flat dollar amount or percentage of compensation, below is how you calculate what you should contribute per pay period.

Flat Dollar – if you are paid weekly, you will want to contribute at least $19.23 ($1,000 / 52 weeks = $19.23). Double that amount to $38.46 if you are paid bi-weekly.

Percentage of Pay – if you make $30,000 a year, you will want to contribute at least 3.33% ($1,000 / $30,000).

Percentage of Compensation Match Example

The company will match 100% of every dollar up to 3% of your compensation.

Flat Dollar – if you make $30,000 a year and are paid weekly, you will want to contribute at least $17.31 ($30,000 x 3% = $900 / 52 weeks = $17.31). Double that amount to $34.62 if you are paid bi-weekly.

Percentage of Pay – no matter how much you make, you will want to contribute at least 3%.

If the match is based on a percentage of pay, not only is it easier to determine what you should contribute by doing a percent of pay yourself, you also do not have to make changes to your contribution amount if your salary increases. If the match is up to 3% and you are contributing at least 3% as a percentage of pay, you know you should receive the full match no matter what your salary is.

If you do a flat dollar amount to get the 3% the first year, when your salary increases you will no longer be contributing 3%. For example, if I set up my contributions to contribute $900 a year, at a salary of $30,000 I am contributing 3% of my compensation (900 / 30,000) but at a salary of $35,000 I am only contributing 2.6% (900 / 35,000) and therefore not receiving the full match.

Note: Even though in these examples you are receiving the full match, it doesn’t mean it is always enough to meet your retirement goals, it is just a start.

In summary, either the flat dollar or percentage of pay can be effective in getting you to your retirement goal but knowing what that goal is and what you should be saving to get there is key.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Target Date Funds: A Public Service Announcement

Before getting into the main objective of this article, let me briefly explain a Target Date Fund. Investopedia defines a target date fund as “a fund offered by an investment company that seeks to grow assets over a specified period of time for a targeted goal”. The specified period of time is typically the period until the date you “target” for retirement

Target Date Funds: A Public Service Announcement

Before getting into the main objective of this article, let me briefly explain a Target Date Fund. Investopedia defines a target date fund as “a fund offered by an investment company that seeks to grow assets over a specified period of time for a targeted goal”. The specified period of time is typically the period until the date you “target” for retirement or to start withdrawing assets. For this article, I will refer to the target date as the “retirement date” because that is how Target Date Funds are typically used.

Target Date Funds are continuing to grow in popularity as Defined Contribution Plans (i.e. 401(k)’s) become the primary savings vehicle for retirement. Per the Investment Company Institute, as of March 31, 2018, there was $1.1 trillion invested in Target Date Mutual Funds. Defined Contribution Plans made up 67 percent of that total.

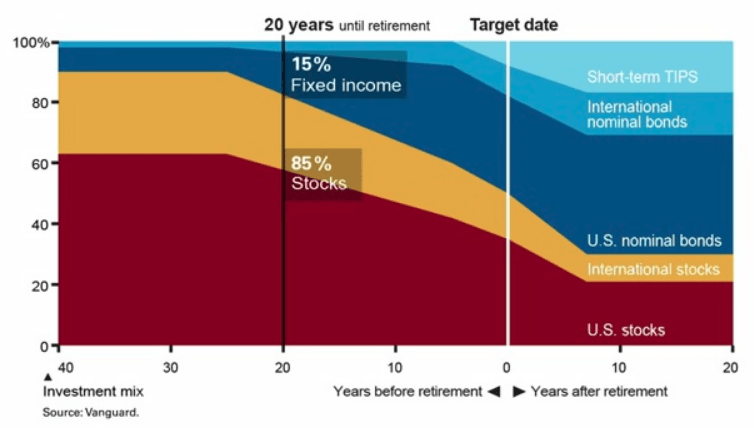

Target Date Funds are often coined as the “set it and forget it” of investments for participants in retirement plans. Target Date Funds that are farther from the retirement date will be invested more aggressively than target date funds closer to the retirement date. Below is a chart showing the “Glide Path” of the Vanguard Target Date Funds. The horizontal access shows how far someone is from retirement and the vertical access shows the percentage of stocks in the investment. In general, more stock means more aggressive. The “40” in the bottom left indicates someone that is 40 years from their retirement date. A common investment strategy in retirement accounts is to be more aggressive when you’re younger and become more conservative as you approach your retirement age. Following this strategy, someone with 40 years until retirement is more aggressive which is why at this point the Glide Path shows an allocation of approximately 90% stocks and 10% fixed income. When the fund is at “0”, this is the retirement date and the fund is more conservative with an allocation of approximately 50% stocks and 50% fixed income. Using a Target Date Fund, a person can become more conservative over time without manually making any changes.

Note: Not every fund family (i.e. Vanguard, American Funds, T. Rowe Price, etc.) has the same strategy on how they manage the investments inside the Target Date Funds, but each of them follows a Glide Path like the one shown below.

The Public Service Announcement

The public service announcement is to remind investors they should take both time horizon and risk tolerance into consideration when creating a portfolio for themselves. The Target Date Fund solution focuses on time horizon but how does it factor in risk tolerance?Target Date Funds combine time horizon and risk tolerance as if they are the same for each investor with the same amount of time before retirement. In other words, each person 30 years from retirement that is using the Target Date strategy as it was intended will have the same stock to bond allocation.This is one of the ways the Target Date Fund solution can fall short as it is likely not possible to truly know somebody’s risk tolerance without knowing them. In my experience, not every investor 30 years from retirement is comfortable with their biggest retirement asset being allocated to 90% stock. For various reasons, some people are more conservative, and the Target Date Fund solution may not be appropriate for their risk tolerance.The “set it and forget it” phrase is often used because Target Date Funds automatically become more conservative for investors as they approach their Target Date. This is a strategy that does work and is appropriate for a lot of investors which is why the strategy is continuing to increase in popularity. The takeaway from this article is to think about your risk tolerance and to be educated on the way Target Date Funds work as it is important to make sure both are in line with each other.For a more information on Target Date Funds please visit https://www.greenbushfinancial.com/target-date-funds-and-their-role-in-the-401k-space/

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Beware of the 5 Year Rule for Your Roth Assets

Being able to save money in a Roth account, whether in a company retirement plan or an IRA, has great benefits. You invest money and when you use it during retirement you don't pay taxes on your distributions. But is that always the case? The answer is no. There is an IRS rule that you must take note of known as the "5 Year Rule". There are a number

Beware of the 5 Year Rule for Your Roth Assets

Being able to save money in a Roth account, whether in a company retirement plan or an IRA, has great benefits. You invest money and when you use it during retirement you don't pay taxes on your distributions. But is that always the case? The answer is no. There is an IRS rule that you must take note of known as the "5 Year Rule". There are a number of scenarios where this rule could impact you and rather than getting too much into the weeds, this post is meant to serve as a public service announcement so you are aware it exists.

Advantages of a Roth

As previously mentioned, the benefit of Roth assets is that the account grows tax deferred and if the distributions are "qualified" you don't have to pay taxes. This is compared to a Traditional IRA/401(k) where the full distribution is taxed at ordinary income tax rates and regular investment accounts where you pay taxes on dividends/interest each year and capital gains taxes when you sell holdings. A quick example of Roth vs. Traditional below:

Roth Traditional

Original Investment $ 10,000.00 $ 10,000.00

Earnings $ 10,000.00 $ 10,000.00

Total Account Balance $ 20,000.00 $ 20,000.00

Taxes (Assume 25%) $ - $ 5,000.00

Account Value at Distribution $ 20,000.00 $ 15,000.00

This all seems great, and it is, but there are benefits of both Roth and Traditional (Pre-Tax) accounts so don’t think you have to start moving everything to Roth now. This article gives more detail on the two different types of accounts and may help you decide which is best for you Traditional vs. Roth IRA’s: Differences, Pros, and Cons.

Qualified Disbursements

Note the “occurs at least five years after the year of the employee’s first designated Roth contribution”. This is the “5 Year Rule”. The other qualifications are the same for Traditional IRA’s, but the “5 Year Rule” is special for Roth money. Not always good to be special.

It seems pretty straight forward and in most cases it is. Open a Roth IRA, let it grow at least 5 years, and as long as I’m 59.5 my distributions are qualified. Someone who has Roth money in a 401(k) or other employer sponsored plan may think it is just as easy. That isn’t always the case. Typically, an employee retires, and they roll their retirement savings into a Traditional or a Roth IRA. Say I worked at the company for 10 years, and I now retire and want to use all the savings I’ve created for myself throughout the years. I can start taking qualified distributions from my Roth IRA because I started contributing 10 years ago, correct? Wrong! The time you we’re contributing to the Roth 401(k) is not transferred to the new Roth IRA. If you took distributions directly from the 401(k) and we’re at least 59.5 they would be qualified. In most cases however, people don’t start using their 401(k) money until retirement and most plans only allow for lump sum distributions once you are no longer with the company.

So what do you do?

Open a Roth IRA outside of the plan with a small balance well before you plan to use the money. If I fund a Roth IRA with $100, 10 years from now I retire and roll my Roth 401(k) into that Roth IRA, I have satisfied the 5 year rule because I opened that Roth IRA account 10 years ago. The clock starts on the date the Roth IRA was opened, not the date the assets are transferred in.

About Rob.........

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.