The Hidden Tax Traps in Retirement Most People Miss

Many retirees are caught off guard by unexpected tax hits from required minimum distributions (RMDs), Social Security, and even Medicare premiums. In this article, we break down the most common retirement tax traps — and how smart planning can help you avoid them.

Most people think retirement is the end of tax planning. But nothing could be further from the truth. There are several tax traps that retirees encounter, which range from:

How RMDs create tax surprises

How Social Security is taxed

How Medicare Premiums (IRMAA) are affected by income

A lack of tax-specific distribution planning

We will be covering each of these tax traps in this article to assist retirees in avoiding these costly mistakes in the retirement years.

RMD Tax Surprises

Once you reach a specific age, the IRS requires individuals to begin taking mandatory distributions from their pre-tax retirement accounts, called RMDs (required minimum distributions). Distributions from pre-tax retirement accounts represent taxable income to the retiree, which requires advanced planning to ensure that that income is not realized at an unnecessarily high tax rate.

All too often, Retirees will make the mistake of putting off distributions from their pre-tax retirement accounts until RMDs are required to begin, which allows the pretax accounts to accumulate and become larger during retirement, which in turn requires larger distributions once the RMD start age is reached.

Here is a common example: Tim and Sue retire from New York State at age 55 and both have pensions that are more than enough to meet their current expenses. Both of them also have retirement accounts through NYS, totaling $500,000. Assuming Tim and Sue start taking their required minimum distributions (RMDs) at age 75, and since Tim and Sue do not need to take withdrawals from their retirement account to supplement their income, those retirement accounts could grow to over $1,000,000. This sounds like a good thing, but it creates a potential tax problem. By age 75, they’ll both be receiving their pensions and have turned on Social Security, which under current tax law is 85% taxable at the federal level. On top of that, they’ll need to take a required minimum distribution of $37,735 which stacks up on top of all their other income sources.

This additional income from age 75 and beyond could:

Be subject to higher tax rates

Trigger higher Medicare Premiums

Cause them to phase out of certain tax deductions or credits

In hindsight, it may have been more prudent for Tim & Sue to begin taking distributions from their retirement accounts each year beginning the year after they retired, to avoid many of these unforeseen tax consequences 20 years after they retired.

How Is Social Security Taxed?

I start this section by saying, based on current law, because the Trump administration has on its agenda to make social security tax-free at the Federal level. At the time of this article, social security is potentially subject to taxation at the federal level for individuals based on their income. A handful of states also tax social security benefits.

Here is a quick summary of the proportion of social security benefits subject to taxation at the Federal level in 2025:

0% Taxable: Combined income for single filers below $25,000 and joint filers below $32,000.

50% Taxable: Combined income for single filers between $25,000 - $34,000 and joint filers between $32,000 - $44,000

85% Taxable: Combined income for single filers above $34,000 and joint filers above $44,000.

One-time events that occur in retirement could dramatically impact the amount of a retiree's social security benefit, subject to taxation. For example, a retiree might sell a stock at a gain in a brokerage account, surrender an insurance policy, earn part-time income, or take a distribution from a pre-tax retirement account. Any one of these events could inadvertently trigger a larger tax liability associated with the amount of an individual’s social security that is subject to taxation at the Federal level.

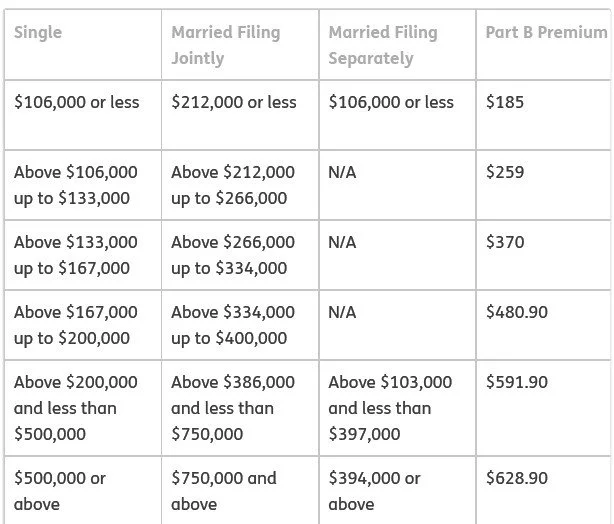

Medicare Premiums Are Income-Based

When you turn age 65, many retirees discover for the first time that there is a cost associated with enrolling in Medicare, primarily in the form of the Medicare Part B premiums that are deducted directly from a retiree's monthly social security benefit. The tax trap is that if a retiree shows too much income in a given year, it can cause their Medicare premium to increase for 2 years in the future.

Medicare looks back at your income from two years prior to determine the amount of your Medicare Part B premium in the current year. Here is the Medicare Part B premium table for 2025:

As you can see from the table, as income rises, so does the monthly premium charged by Medicare. There are no additional benefits, the retiree just has to pay more for their Medicare coverage.

This is where those higher RMDs can come back to haunt retirees once they reach the RMD start age. They might be ok between ages 65 – 75, but once they hit age 75 and must start taking RMDs from their pre-tax retirement accounts, those pre-tax RMD’s can sometimes push retirees over the Medicare based premium income threshold, and then they end up paying higher premiums to Medicare for the rest of their lives that could have been avoided.

Lack of Retirement Distribution Planning

All these tax traps surface due to a lack of proper distribution planning as an individual enters retirement. It’s incredibly important for retirees to look at their entire asset picture leading up to retirement, determine the income level that is needed to cover expenses in their retirement year, and then construct a long-term distribution plan that allows them to minimize their tax liability over the remainder of their life expectancy. This may include:

Processing sizable distributions from pre-tax accounts early in the retirement years

Processing Roth conversions

Delaying to file for social security

Developing a tax plan for surrendering permanent life insurance policies

Evaluating pension and annuity elections

A tax plan for realizing gains in taxable investment accounts

Forecasting RMDs at age 73 or 75

Developing a robust distribution plan leading up to retirement can potentially save retirees thousands of dollars in taxes over the long run and avoid many of the pitfalls and tax traps that we reviewed in the article today.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Do You Have Enough To Retire? The 60 Second Calculation

Do you have enough to retire? Believe it or not, as financial planners, we can often answer that question in LESS THAN 60 SECONDS just by asking a handful of questions. In this video, I’m going to walk you through the 60-second calculation.

Do you have enough to retire? Believe it or not, as financial planners, we can often answer that question in LESS THAN 60 SECONDS just by asking a handful of questions. In this video, I’m going to walk you through the 60-second calculation.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Should You Surrender Your Life Insurance Policies When You Retire?

Squarespace Excerpt: As individuals approach retirement, they often begin reviewing their annual expenses, looking for ways to trim unnecessary expenses so their retirement savings last as long as possible now that their paychecks are about to stop for their working years. A common question that comes up during these client meetings is “Should I get rid of my life insurance policy now that I will be retiring?”

As individuals approach retirement, they often begin reviewing their annual expenses, looking for ways to trim unnecessary expenses so their retirement savings last as long as possible now that their paychecks are about to stop for their working years. A common question that comes up during these client meetings is “Should I get rid of my life insurance policy now that I will be retiring?”

Very often, the answer is “Yes, you should surrender your life insurance policy”, because by the time individuals reach retirement, their mortgage is paid off, kids are through college and out of the house, they have no debt outside of maybe a car loan, and they have accumulated large sums in their retirement accounts. So, what is the need for life insurance?

However, for some individuals, the answer is “No, you should keep your life insurance policies in force,” and we will review several of those scenarios in this article as well.

Retirees That Should Surrender Their Life Insurance Policies

Since this is the more common scenario, we will start with the situations where it may make sense to surrender your life insurance policies when you retire.

Remember Why You Have Life Insurance In The First Place

Let’s start off with the most basic reason why individuals have life insurance to begin with. Life insurance is a financial safety net that protects you and your family against the risk if you unexpectedly pass away before you're able to accumulate enough assets to support you and your family for the rest of their lives, there is a big insurance policy that pays out to provide your family with the financial support that they need to sustain their standard of living.

Once you have paid off mortgages, the kids are out of the house, and you have accumulated enough wealth in investment accounts to support you, your spouse, and any dependents for the rest of their lives, there is very little need for life insurance.

For example, if we have a married couple, both age 67, who want to retire this year and they have accumulated $800,000 in their 401(K) accounts, we can show them via retirement projections that, based on their estimated expenses in retirement, the $800,000 in their 401(K) accounts in addition to their social security benefits is more than enough to sustain their expenses until age 95. So, why would they need to keep paying into their life insurance policies when they are essentially self-insured. If something happens to one of the spouses, there may be enough assets to provide support for the surviving spouse for the rest of their life. So again, instead of paying $3,000 per year for a life insurance policy that they no longer need, why not surrender the policy, and spend the money on more travel, gifts for the kids, or just maintain a larger retirement nest egg to better hedge against inflation over time?

It's simple. If there is no longer a financial need for life insurance protection, why are you continuing to pay for financial protection that you don’t need? There are a lot of retirees that fall into this category.

Individuals That Should KEEP Their Life Insurance Policies in Retirement

So, who are the individuals who should keep their life insurance policies after they retire? They fall into a few categories.

#1: Still Have A Mortgage or Debt

If a married couple is about to retire and they still have a mortgage or debt, it may make sense to continue to sustain their life insurance policies until the mortgage and/or debt have been satisfied, because if something happens to one of the spouses and they lose one of the social security benefits or part-time retirement income, it could put the surviving spouse in a difficult financial situation without a life insurance policy to pay off the mortgage.

#2: Single Life Pension Election

If an individual has a pension, when they retire, they have to elect a survivor benefit for their pension. If they elect a single life with no survivor benefit and that pension is a large portion of the household income and that spouse passes away, that pension would just stop, so a life insurance policy may be needed to protect against that pension spouse passing away unexpectedly.

#3: Estate Tax Liability

Uber wealthy individuals who pass away with over $13 Million in assets may have to pay estate tax at the federal level. Knowing they are going to have an estate tax liability, oftentimes these individuals will purchase a whole life insurance policy and place it in an ILIT (Irrevocable Life Insurance Trust) to remove it from their estate, but the policy will pay the estate tax liability on behalf of the beneficiaries of the estate.

#4: Tax-Free Inheritance

Some individuals will buy a whole life insurance policy so they have an inheritance asset earmarked for their children or heirs. The plan is to maintain that policy forever, and after the second spouse passes, the kids receive their inheritance in the form of a tax-free life insurance payout. This one can be a wishy-washy reason to maintain an insurance policy in retirement, because you have to pay into the insurance policy for a long time, and if you run an apple-to-apple comparison of accumulating the inheritance in a life insurance policy versus accumulating all of the life insurance premium dollars in another type of account, like a brokerage account, sometimes the latter is the more advantageous way to go.

#5: Illiquid Asset Within the Estate

An individual may have ownership in a privately held business or investment real estate which, if they were to pass away, the estate may have expenses that need to be paid. Or, if a business owner has two kids, and one child inherits the business, they may want a life insurance policy to be the inheritance asset for the child not receiving ownership in the family business. In these illiquid estate situations, the individual may maintain a life insurance policy to provide liquidity to the estate for any number of reasons.

#6: Poor Health Status

The final reason to potentially keep your life insurance in retirement is for individuals who are in poor health. Sometimes an individual is forced into retirement due to a health issue. Until that health issue is resolved, it probably makes sense to keep the life insurance policy in force. Even though they may no longer “need” that insurance policy to support a spouse or dependents, it may be a prudent investment decision to keep that policy in force if the individual has a shortened life expectancy and the policy may pay out within the next 10 years.

While “keeping” the life insurance policy in retirement is less commonly the optimal solution, there are situations like the ones listed above, where keeping the policy makes sense.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Should You Lease or Buy A Car: Interview with a CFP® and Owner of a Car Dealership

When clients are looking to purchase a new car one of the most common questions that we receive is “Should I Buy or Lease?” To get the answer, we interviewed a Certified Financial Planner and the owner of Rensselaer Honda to educate our audience on the pros and cons of buying vs leasing.

When clients are looking to purchase a new car one of the most common questions that we receive is “Should I Buy or Lease?” To get the answer, we interviewed a Certified Financial Planner and the owner of Rensselaer Honda to educate our audience on the pros and cons of buying vs leasing.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Should You Buy or Lease A Car?

The most common questions that I receive when clients are about to purchase their next car is “should I buy it or lease it?” The answer depends on a number of factors including how long do you typically keep cars for, how many miles do you drive each year, the amount of the down payment, maintenance considerations, or do you have any teenagers in the family that will be driving soon?

The most common questions that I receive when clients are about to purchase their next car is, “Should I buy it or lease it?” The answer depends on the following items:

How long do you typically keep cars for?

How many miles do you drive each year?

Amount of the down payment

Maintenance considerations

Do you have any teenagers in the family that will be driving soon?

When Should You Lease A Car?

Let’s start with the lease scenario. The leasing approach tends to favor individuals that keep their cars for less than 5 years and don’t drive a lot of miles each year. The duration of ownership matters because most cars are considered depreciating assets, meaning they decrease in value over time, and the lion share of depreciation on a new car typically happens within the first few years.

Example: If you buy a brand-new car for $40,000 and a year or two from now if you wanted to sell that car, you would receive less than $40,000. You may only receive $35,000 or $30,000 depending on how well the type of car you purchased holds its value which varies from car to car.

If you are the type of person that likes driving a new car every 3 years and you were to buy the car instead of lease it, you are incurring the lion share of the depreciation in value every time you buy a new car and then trade it in or sell it every few years. When you lease a car, you technically do not own it, you are borrowing it from the dealer, and you are entering a contract with the dealer that specifies how long you are allowed to borrow the car, the mileage allowance, and the buyout price at the end of the lease.

When the car lease is over, you drive the car back to the dealer, hand them the keys, and you don’t have to worry about what the trade in value will be. If you decide you want to buy the car at the end of your lease, the lease contract typically has a set purchase amount that you are allowed to buy the car from at the end of the 3-year lease term.

Mileage Matters

When you enter into a car lease, there is usually a mileage allowance listed in your contract that states the number of miles you are allowed to log on the odometer during the duration of the lease agreement. Most 3-year lease agreements provide a 10,000 to 15,000 mileage allowance each year, so your 3-year lease agreement may be limited to 30,000 miles during the duration of the lease. If you go over that mileage allowance, there are usually fairly steep mileage penalties that you have to pay at the end of the lease agreement. Typically, those milage fees can be $0.10 to $0.30 per mile.

Example: If your 3-year lease has a 30,000-mileage allowance, but you drive more miles than expected and turn in the car with 40,000 miles at the end of the 3 year period with a mileage penalty of $0.25 per mile in your lease agreement, you would owe the dealer $2,500 when you go to turn in your car.

When individuals go way over their mileage allowance, instead of just handing the dealer a big chunk of cash, and then not having a car, you may have the option to take out car loan at the end of the lease and buy the car from the dealer at the set price listed in your lease agreement.

Leasing Risks for Young Professionals

I think mileage is one of the bigger risks when leasing a car, especially for young individuals that are just entering the work force. Why? Because life and careers tend to change at a rapid pace between the ages of 20 and 40. These young professionals may be working for an employer now that allows them to work fully remote, so they put minimal mileage on their car and decide that leasing the car is the way to go. However, what happens when that individual is offered a much better job that requires them to go into an office setting and the office is 30 miles from their apartment? Now, they are going to start logging more miles on their car which could put them over the mileage allowance in the lease.

Lease: No Down Payment

The first two questions that the car salesman asks you when you enter a dealership is:

What were thinking about for a monthly payment?

How much were you planning on putting down on the car as a down payment?

If you want to buy a new car, in most cases, buying the car versus leasing the car is going to be more expensive out of the gates because remember, when you buy the car you own it and when you lease the car you don’t own it, you are just borrowing it. With a lease, since you don’t own the car, they may offer a new car with no down payment, and the payments may be lower than buying the car outright…..again…..because you don’t own it. Your monthly payments just go directly to the financing company without you ever owning anything. It’s a similar concept as renting an apartment vs buying a house.

However, if you typically trade in your cars every three years for the newer model, as long as you can stay within the mileage allowance, leasing could make sense because unlike a house that’s an appreciating asset (which means it gains value over time), a car is a depreciating asset which loses value over time. So, if you are trading in cars every three years with the benefit of realizing a loss in value every three years, it may be better to borrow the car and use your additional cash to meet other financial goals.

Maintenance Costs

When you lease a car, often times it removes the risk of incurring big costs associated with fixing the vehicle if something major goes wrong. It’s common for the lessee to be responsible for routine maintenance like oil changes, but leased cars are typically new and covered under warrantee for most major issues that could arise.

When Should You Buy A Car Instead of Leasing?

Now onto the buy section. When should you buy a car instead of lease it? The first question I always ask is how long do you drive your cars for? If someone says 5 years or more, it almost always favors buying the car instead of leasing it. While you will have a little more cost up front, because purchasing a car usually requires a downpayment, you open the opportunity to visit the land of “No Car Payments”.

For anyone that has been to the “Land of No Car Payments” it’s wonderful. If you enter into a 5-year car loan and you drive that car for 8 years, you have 3 years of no car payments. It’s like driving a car for free. With a lease you will technically always have a car payment, even if you front all the money at the beginning of the lease, because you never own the car. At the end of the 3rd year, you still have to buy it at a price that may be above what the market value of that car is at the end of the lease.

The car still depreciates in value but if you own a car for 6 years and have 120,000 miles on the car, as long as you have taken care of it over that 6 year period, you car will typically still have value, so when you go to trade it in to buy your next car, you down payment may already be covered by the trade in value.

You Drive A Lot

If you drive a lot, whether for work, pleasure, or both, it tends to favor buying a car because it’s unlikely you would be able to stay within the mileage allowance of a lease, and big mileage penalties would be waiting for you at the end of the lease agreement.

Buying A Car: Bigger Down Payment & Higher Monthly Payments

We covered this topic in the leasing section but it’s worth repeating. It can be very tempting to enter into a lease since there may be no downpayment, a low monthly lease payment, which may get you into a newer or nicer car, and all too often people underestimate how much they drive each year mileage wise. While you may work for home, how many miles do you drive taking the kids back and forth to school, practices, dinners, friends houses, family vacations, grocery store runs, meeting friends for dinner, etc. Unless you have owned cars for a number of years, and life is relatively unchanged compared to past years, it often tough to judge how many miles you will log on that car over the next 3 years outside of the life surprises like moving or changing careers.

Buying a car and not having to worry about staying within a mileage allowance takes that financial risk off the table.

Car Maintenance

When you own a car, you have the option of buying extended warranties which adds to your monthly payments on the vehicle. These become a personal preference of whether or not these extended warranties are worth the money, but if you opt not to go with robust extended warranties, you have to make sure that you have enough cash reserved in case your vehicle requires an expensive repair that’s not covered by warranty after the first number of years, that you will have the cash to pay for it. It just takes some extra planning on the part of the car owner.

Teenage Driving Soon

When I'm consulting with clients that are about to buy a new car and have children between the ages of 12 and 16, I'll sometimes ask the question, “What's the plan for when their child turns 16 and begins driving?”. Depending on the type of car they're buying, would it potentially be a long term financial planning move for the parent to buy the car, drive it for four to six years, and then when their child gets their driver’s license, they have a used car that has been paid off, taken care of, ready to go, and then the parent can go out an get a new car at the time of the hand off. It’s a plan that has worked well for several clients which favors buying the car versus leasing.

Avoid 6 to 8 Year Car Loans

We have seen a rapid rise and the number of consumers that are taking car loans with a duration of six to eight years. The conventional auto loan used to be five years, and nothing beyond that was offered, but now we see car dealerships starting the conversation at a seven-year car loan in an effort to make the monthly payments lower. However, this created a new problem called the negative equity trap. Since, again, a car is a depreciating asset, it loses value over time, and if at the time you go to trade it in the loan outstanding on the car is higher than the value of the car itself, you get stuck in what’s called a negative equity event, where the outstanding car loan is higher than the value of the car.

Auto dealers will often address this by allowing you to roll over your negative equity to your next car. Meaning if you're upside down by $3000 when you go to trade in your car and you buy the new car for $40,000, the car loan will be for $43,000. The problem is, your negative equity problem just got larger with the next car because you're already starting at a higher loan amount than what the car is worth. If you do this a few times people will sometimes reach a situation where the negative equity amount has become so large that banks will no longer allow them to roll that into the next car loan and they get stuck.

When buying a car, I often encourage individuals to avoid the temptation of the six to eight-year car loan and stick with the five year conventional auto loan to avoid these negative equity events.

What Does The Investment Advisor Do?

Sometimes my clients will ask me “Mike, what do you do?” I’m a buyer of cars mainly becuase I drive a lot miles each year and I typically keep cars for 7 to 8 years. But if I was an individual that drove under 12,000 mile each year and enjoyed trading in my cars every 3 years, then I could see how leasing would make sense. The decision to buy or lease truly depends on the travel habits, ownership duration, debt preferences, budget, and new or used car preference of each individual buyer.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Much Should I Contribute to Retirement?

A question I’m sure to address during employee retirement presentations is, “How Much Should I be Contributing?”. In this article, I will address some of the variables at play when coming up with your number and provide detail as to why two answers you will find searching the internet are so common.

A question I’m sure to address during employee retirement presentations is, “How Much Should I be Contributing?”. Quick internet search led me to two popular answers.

Whatever you need to contribute to get the match from the employer,

10-15% of your compensation.

As with most questions around financial planning, the answer should really be, “it depends”. We all know it is important to save for retirement, but knowing how much is enough is the real issue and typically there is more work involved than saying 10-15% of your pay.

In this article, I will address some of the variables at play when coming up with your number and provide detail as to why the two answers previously mentioned are so common.

Expenses and Income Replacement

Creating a budget and tracking expenses is usually the best way to estimate what your spending needs will be in retirement. Unfortunately, this is time-consuming and is becoming more difficult considering how easy it is to spend money these days. Automatic payments, subscriptions, payment apps, and credit cards make it easy to purchase but also more difficult to track how much is leaving your bank accounts.

Most financial plans we create start with the client putting together an itemized list of what they believe they spend on certain items like clothes, groceries, vacations, etc. A copy of our expense planner template can be found here. These are usually estimates as most people don’t track expenses in that much detail. Since these are estimates, we will use household income, taxes, and bank/investment accounts as a check to see if expenses appear reasonable.

What do expenses have to do with contributions to your retirement account now? Throughout your career, you receive a paycheck and use those funds to pay for the expenses you have. At some point, you no longer have the paycheck but still have the expenses. Most retirees will have access to social security and others may have a pension, but rarely does that income cover all your expenses. This means that the shortfall often comes from retirement accounts and other savings.

Not taking taxes, inflation, or investment gains into account, if your expenses are $50,000 per year and Social Security income is $25,000 a year, that is a $25,000 shortfall. 20 years of retirement times a $25,000 shortfall means $500,000 you’d need saved to fund retirement. Once we have an estimate of the coveted “What’s My Number?” question, we can create a savings plan to try and achieve that goal.

Cash Flow

As we age, some of the larger expenses we have in life go away. Student loan debt, mortgages, and children are among those expenses that stop at some point in most people’s lives. At the same time, your income is usually higher due to experience and raises throughout your career. As expenses potentially go down and income is higher, there may be cash flow that frees up allowing people to save more for retirement. The ability to save more as we get older means the contribution target amount may also change over time.

Timing of Contributions

Over time, the interest that compounds in retirement accounts often makes up most of the overall balance.

For example, if you contribute $2,000 a year for 30 years into a retirement account, you will end up saving $60,000. If you were able to earn an annual return of 6%, the ending balance after 30 years would be approximately $158,000. $60,000 of contributions and $98,000 of earnings.

The sooner the contributions are in an account, the sooner interest can start compounding. This means, that even though retirement saving is more cash flow friendly as we age, it is still important to start saving early.

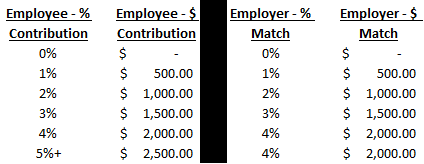

Contribute Enough to Receive the Full Employer Match

Knowing the details of your company’s retirement plan is important. Most employers that sponsor a retirement plan make contributions to eligible employees on their behalf. These contributions often come in the form of “Non-Elective” or “Matching”.

Non-Elective – Contributions that will be made to eligible employees whether employees are contributing to the plan or not. These types of contributions are beneficial because if a participant is not able to save for retirement from their own paycheck, the company will still contribute. That being said, the contribution amount made by the employer, on its own, is usually not enough to achieve the level of savings needed for retirement. Adding some personal savings in addition to the employer contribution is recommended.

Matching – Employers will contribute on behalf of the employee if the employee is contributing to the plan as well. This means if the employee is contributing $0 to the retirement plan, the company will not contribute. The amount of matching varies by company, so knowing “Match Formula” is important to determine how much to contribute. For example, if the matching formula is “100% of compensation up to 4% of pay”, that means the employer will contribute a dollar-for-dollar match until they contribute 4% of your compensation. Below is an example of an employee making $50,000 with the 4% matching contribution at different contribution rates.

As you can see, this employee could be eligible for a $2,000 contribution from the employer, if they were to save at least 4% of their pay. That is a 100% return on your money that the company is providing.

Any contribution less than 4%, the employee would not be taking advantage of the employer contribution available to them. I’m not a fan of the term “free money”, but that is often the reasoning behind the “Contribute Enough to Receive the Full Employer Match” response.

10%-15% of Your Compensation

As said previously, how much you should be contributing to your retirement depends on several factors and can be different for everyone. 10%-15% over a long-term period is often a contribution rate that can provide sufficient retirement savings. Math below…

Assumptions

Age: 25

Retirement Age: 65

Current Income: $30,000

Annual Raises: 2%

Social Security @ 65: $25,000

Annualized Return: 6%

Step 1: Estimate the Target Balance to Accumulate by 65

On average, people will need an estimated 90% of their income for early retirement spending. As we age, spending typically decreases because people are unable to do a lot of the activities we typically spend money on (i.e. travel). For this exercise, we will assume a 65-year-old will need 80% of their income throughout retirement.

Present Salary - $30,000

Future Value After 40 Years of 2% Raises - $65,000

80% of Future Compensation - $52,000

$52,000 – income needed to replace

$25,000 – social security @ 65

$27,000 – amount needed from savings

X 20 – years of retirement (Age 85 - life expectancy)

$540,000 – target balance for retirement account

Step 2: Savings Rate Needed to Achieve $540,000 Target Balance

40 years of a 10% annual savings rate earning 6% interest per year, this person could have an estimated balance of $605,000. $181,000 of contributions and $424,000 of compounded interest.

I hope this has helped provide a basic understanding of how you can determine an appropriate savings rate for yourself. We recommend reaching out to an advisor who can customize your plan based on your personal needs and goals.

About Rob……...

Hi, I’m Rob Mangold, Partner at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

$7,500 EV Tax Credit: Use It or Lose It

Claiming the $7,500 tax credit for buying an EV (electric vehicle) or hybrid vehicle may not be as easy as you think. First, it’s a “use it or lose it credit” meaning if you do not have a federal tax liability of at least $7,500 in the year that you buy your electric vehicle, you cannot claim the full $7,500 credit and it does not carryforward to future tax years.

Claiming the $7,500 tax credit for buying an EV (electric vehicle) or hybrid vehicle may not be as easy as you think. First, it’s a “use it or lose it credit” meaning if you do not have a federal tax liability of at least $7,500 in the year that you buy your electric vehicle, you cannot claim the full $7,500 credit and it does not carryforward to future tax years. Normally, most individuals and business owners adopt tax strategies to reduce their tax liability but this use it or lose it EV tax credit could cause some taxpayers to do the opposite, to intentionally create a larger federal tax liability, if they think their federal tax liability will be below the $7,500 credit threshold.

There are several other factors that you also have to consider to qualify for this EV tax credit which include:

New income limitations for claiming the credit

Limits on the purchase price of the car

The type of EV / hybrid vehicles that qualify for the credit

Inflation Reduction Act (August 2022) changes to the EV tax credit rules

Buying an EV in 2022 vs 2023+

Tax documents that you need to file with your tax return

State EV tax credits that may be available

Inflation Reduction Act Changes To EV Tax Credits

On August 16, 2022, the Inflation Reduction Act was signed into law, which changed the $7,500 EV Tax Credits that were previously available. The new law expanded and limited the EV tax credits depending on your income level, what type of EV car you want, and when you plan to buy the car. Most of the changes do not take place until 2023 and 2024, so depending on your financial situation it may be better to purchase an EV in 2022 or it may be beneficial to wait until 2023+.

$7,500 EV Tax Credit

If you purchase an electronic vehicle or hybrid that qualifies for the EV tax credit, you may be eligible to claim a tax credit of up to $7,500 in the tax year that you purchased the car. This is the government’s way of incentivizing consumers to buy electric vehicles. The Inflation Reduction Act also opened up a new $4,000 tax credit for used EVs.

New Income Limits for EV Tax Credits

Starting in 2023, your income (modified AGI) will need to be below the following thresholds to qualify for the federal EV tax credits on a new EV or hybrid:

Single Filers: $150,000

Married Filing Joint: $300,000

Single Head of Household: $225,000

There are lower income thresholds to be eligible for the used EV tax credit which is as follows:

Single Filers: $75,000

Married Filing Joint: $150,000

Single Head of Household: $112,500

Before the passage of the Income Reduction Act, there were no income limitations to claim the $7,500 Tax Credit. Taxpayers with incomes level above the new thresholds may have an incentive to purchase their new EV before December 31, 2022, before the income limitations take effect in 2023.

Restriction on EV Cars That Qualify

Not all EV or hybrid vehicles will qualify for the EV tax credit. The passage of the Inflation Reduction Act made several changes in this category.

Removal of the Manufacturers Cap

On the positive side, Tesla and GM cars will once again be eligible for the EV tax credit. Under the old EV tax credit rules, once a car manufacturer sold over 200,000 EVs, vehicles made by that manufacturer were no longer eligible for the $7,500 tax credit. The new legislation that just passed eliminated those caps making Tesla, GM, and Toyota vehicles once again eligible for the credit. The removal of the cap does not take place until January 1, 2023.

Purchase Price Limit

Adding restrictions, the Inflation Reduction Act introduced a cap on the purchase price of new EVs and hybrids that qualify for the $7,500 EV tax credit. The limit on the manufacturer’s suggested retail price is as follows:

Sedans: $55,000

SUV / Trucks / Vans: $80,000

If the MSRP is above those prices, the vehicle no longer qualified for the EV tax credit.

Assembly & Battery Requirements

Another change was made to the EV tax credit under the new legislation that will most likely limit the number of vehicles that are eligible for the credit. The new law introduced a final assembly and battery component requirement. First, to be eligible for the credit, the final assembly of the vehicle needs to take place in North America. Second, the battery used to power the vehicle must be made up of key materials and consist of components that are either manufactured or assembled in North America.

Leases Do Not Qualify

If you lease a car, that does not qualify toward the EV tax credit because you technically do not own the vehicle, the manufacturer does. You have to buy the vehicle to be eligible for the $7,500 EV tax credit.

Are You Eligible For The EV Tax Credit?

Bringing everything together, starting in 2023, to determine whether or not you will be eligible for the $7,500 EV Tax Credit, you will have to make sure that:

Your income is below the EV tax credit limits

The purchase price of the vehicle is below the EV tax credit limit

The vehicles assembly and battery components meet the new requirement

Once there is more clarification around the assembly and components piece of the new legislation there will undoubtedly be a website that lists all of the vehicles that are eligible for the $7,500 tax credit that you will be able to use to determine which vehicles qualify.

Timing of The Tax Credit

Under the current EV tax credit rule, you purchase the vehicle now, but you do not receive the tax credit until you file your taxes for that calendar year. Starting in 2024, the tax credit will be allowed to occur at the point of sale which is more favorable for consumers. Logistically, it would seem that an individual would assign the credit to the car dealer, and then the car dealer would receive an advance payment from the US Department of Treasury to apply the discount or potentially allow the car buyer to use the credit toward the down payment on the vehicle.

However, car buyers will have to be careful here. Since your eligibility for the tax credit is income based, if you apply for the credit in advance, but then your income for the year is over the MAGI threshold, you may owe that money back to the IRS when you file your taxes. It will be interesting to see how this is handled since the credits are being awarded in advance.

A Use It or Lose It Tax Credit

There are going to be some challenges with the new EV tax credit rule beyond limiting the number of people that qualify and the number of cars that qualify. The primary one is that the $7,500 EV federal tax credit is not a “refundable tax credit.” A refundable tax credit means if your total federal tax liability is less than the credit, the government gives you a refund of the remaining amount, so you receive the full amount as long as you qualify. The EV tax credit is still a “non-refundable tax credit” meaning if you do not have a federal tax liability of at least $7,500 in the year that you purchase the new EV vehicle, you may lose all or a portion of the $7,500 that you thought you were going to receive.

For example, let’s say you are a single tax filer, and you make $50,000 per year. If you just take the standard deduction, with no other tax deductions, your federal tax liability may be around $4,200 in 2023. You buy a new EV in 2023, you meet the income qualifications, and the vehicle meets all of the manufacturing qualifications, so you expect to receive $7,500 when you file your taxes for 2023. However, since your federal tax liability was only $4,200 and the EV tax credit is not refundable, you would only receive a tax credit of $4,200, not the full $7,500.

No EV Tax Credit Carryforward

With some tax deductions, there is something called tax carryforward, meaning if you do not use the tax deduction in the current tax year, you can “carry it forward” to be used in future tax years to offset future income. The EV tax credit does not allow carryforward, if you can’t use all of it in the year of the EV purchase, you lose it.

Intentionally Creating Federal Tax Liability

If you are in this scenario where you purchase an EV but you expect your federal tax liability to be below the full $7,500 credit threshold, you may have to do what I call “opposite tax planning”. Normally you are trying to find ways to reduce your tax bill, but in these cases, you are trying to find ways to increase your tax liability to get the maximum refund from the government. But how do you intentionally increase your tax liability? Here are a few ideas:

Stop or reduce the contributions being made to your pre-tax retirement accounts. When you make pretax contributions to retirement accounts it reduces your tax liability. But you have to be careful here, if your company offers an employer match, you could be leaving free money on the table, so you have to conduct some analysis here. In many cases, 401(k) / 403(b) allows either pre-tax or Roth contributions. If you are making pre-tax contributions, you may be able to just switch to Roth contributions, which are after-tax contributions, and still take advantage of the employer match.

Push more income into the current tax year. If you are a small business owner, you may want to push more income into the current tax year. If you are a W2 employee, you are expecting to receive a bonus payment, and you have a good working relationship with your employer, you may be able to request that they pay the bonus to you this year as opposed to the spring of next year.

Delay tax-deductible expenses into the following tax year. Again, if you are a small business owner and have control over when you realize expenses, you could push those into the following year. For W2 employees, if you have enough tax deductions to itemize, you may want to push some of the itemized deductions into the following tax year.

Delay getting married until the following tax year. Kidding but not kidding. Nothing says I love you like a full $7,500 tax credit. Use it toward the wedding. You may not qualify under the single file income limit but maybe you would qualify under the joint filer limit.

State EV Tax Credit

The $7,500 EV tax credit is a federal tax credit but some states also have EV tax credits in addition to the federal tax credit and those credits could have different criteria to qualify. It’s worth looking into before purchasing your new or used EV.

EV Tax Credit Tax Forms

In 2022, you apply for the federal EV tax credit when you file your tax return. You will have to file Form 8936 with your tax return.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Much Should You Have In An Emergency Fund?

Establishing an emergency fund is an important step in achieving financial stability and growth. Not only does it help protect you when big expenses arise or when a spouse loses a job but it also helps keep your other financial goals on track.

Establishing an emergency fund is an important step in achieving financial stability and growth. Not only does it help protect you when big expenses arise or when a spouse loses a job but it also helps keep your other financial goals on track. When we educate clients on emergency funds, the follow questions typically arise:

How much should you have in an emergency fund?

Does the amount vary if you are retired versus still working?

Should your emergency fund be held in a savings account or invested?

When is your emergency fund too large?

How do you coordinate this with your other financial goals?

Emergency Fund Amount

In general, your emergency fund should typically be 4 to 6 months of your total monthly expenses. To calculate this, you will have to complete a monthly budget listing all of your expenses. Here is a link to an excel spreadsheet that we provide to our clients to assist them with this budgeting exercise: GFG Expense Planner.

Big unforeseen expenses come in all shapes and sizes but frequently include:

You or your spouse lose a job

Medical expenses

Unexpected tax bill

Household expenses (storm, flooding, roof, furnace, fire)

Major car expenses

Increase in childcare expenses

Family member has an emergency and needs financial support

Without a cash reserve, surprise financial events like these can set you back a year, 5 years, 10 years, or worse, force you into bankruptcy, require you to move, or to sell your house. Having the discipline to establish an emergency fund will help to insulate you and your family from these unfortunate events.

Cash Is King

We usually advise clients to keep their emergency fund in a savings account that is liquid and readily available. That will usually prompt the question: “But my savings account is earning minimal interest, isn’t it a waste to have that much sitting in cash earning nothing?” The purpose of the emergency fund it to be able write a check on the spot in the event of a financial emergency. If your emergency fund is invested in the stock market and the stock market drops by 20%, it may be an inopportune time to liquidate that investment, or your emergency fund amount may no longer be the adequate amount.

Even though that cash is just sitting in your savings account earning little to no interest, it prevents you from having to go into debt, take a 401(k) loan, or liquidate investments at an inopportune time to meet the unforeseen expense.

Cash Reserve When You Retire

I will receive the question from retirees: “Should your cash reserve be larger once you are retired because you are no longer receiving a paycheck?” In general, my answer is “no”, as long as you have your 4 months of living expenses in cash, that should be sufficient. I will explain why in the next section.

Your Cash Reserve Is Too Large

There is such a thing as having too much cash. Cash can provide financial security but beyond that, holding cash does not provide a lot of financial benefits. If 4 months of your living expenses is $20,000 and you are holding $100,000 in cash in your savings account, whether you are retired or not, that additional $80,000 in cash over and above your emergency fund amount could probably be working harder for you doing something else. There is a long list of options, but it could include:

Paying down debt (including the mortgage)

Making contributions to retirement accounts to lower your income tax liability

Roth conversions

College savings accounts for your kids or grandchildren\

Gifting strategies

Investing the money in an effort to hedge inflation and receive a higher long-term return

Emergency Fund & Other Financial Goals

It’s not uncommon for individuals and families to find it difficult to accumulate 4 months worth of savings when they have so many other bills. If you are living paycheck to paycheck right now and you have debt such as credit cards or student loans, you may first have to focus on a plan for paying down your debt to increase the amount of extra money you have left over to begin working toward your emergency fund goal. If you find yourself in this situation, a great book to read is “The Total Money Makeover” by Dave Ramsey.

The probability of achieving your various financial goals in life increases dramatically once you have an emergency fund in place. If you plan to retire at a certain age, pay for your children to go college, be mortgage and debt free, purchase a second house, whatever the goal may be, large unexpected expenses can either derail those financial goals completely, or set you back years from achieving them.

Remember, life is full of surprises and usually those surprises end up costing you money. Having that emergency fund in place allows you to handle those surprise expenses without causing stress or jeopardizing your financial future.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Selecting The Best Pension Payout Option

When you retire and turn on your pension, you typically have to make a decision as to how you would like to receive your benefits which includes making a decision about the survivor benefits. Do you select….

When you retire and turn on your pension, you typically have to make a decision as to how you would like to receive your benefits which includes making a decision about the survivor benefits. Do you select….

Lump sum

Single Life Benefit

100% Survivor Benefit

50% Survivor Benefit

Survivor Benefit Plus Pop-up Election

The right option varies person by person but some of the primary considerations are:

Marital status

Your age

Your spouse’s age

Income needed in retirement

Retirement assets that you have outside of the pension

Health considerations

Life expectancy

Financial stability of the company sponsoring the plan

Tax Strategy

Risk Tolerance

There are a lot of factors because the decision is not an easy one. In this article, I’m going to walk you through how we evaluate these options for our clients so you can make an educated decision when selecting your pension payout option.

Understanding The Options

To give you a better understanding of the various payout options, I’m going to walk you through how each type of benefit works. Not all pension plans are the same, some plans may only offer some of these options, others after all of these options, and some plans have additional payout options available.

Lump Sum: Some pension plans will give you the option of receiving a lump sum dollar amount instead of receiving monthly payment for the rest of your life. Retirees will typically rollover these lump sum amounts into their IRA’s, which is a non-taxable event, and then take distributions as needed from their IRA.

Single Life Benefit: This is also referred to as the “straight life benefit”. This option usually offers the highest monthly pension payments because there are no survivor benefits attached to it. You receive a monthly payment for the rest of your life but when you pass away, all pension payments stop.

Survivor Benefits: There are usually multiple survivor benefit payout options. They are typically listed as:

100% Survivor Benefit

75% Survivor Benefit

50% Survivor Benefit

25% Survivor Benefit

The percentages represent the amount of the benefit that will continue to your spouse should you pass away first. The higher the survivor benefit, typically the lower your monthly pension payment will be because the pension plans realize they may have to make payments for longer because it’s based on two lives instead of one.

Example: If the Single Life pension payment is $3,000, if instead you elect a 50% survivor benefit, your pension payment may only be $2,800, but if you elect the 100% survivor benefit it may only be $2,700. The monthly pension payments go down as the survivor benefits go up.

Here is an example of the survivor benefit, let’s say you elect the $2,800 pension payment with a 50% survivor benefit. Your pension will pay you $2,800 per month when you retire but if you were to pass away, the pension plan will continue to pay your spouse $1,400 per month (50% of the benefit) for the rest of their life.

Pop-Up Elections: Some pension plans, like the New York State Pension Plan, provide retirees with a “Pop-Up Election”. With the pop-up, if you select a survivor benefit which provides you with a lower monthly pension payment amount but your spouse passes away first, thus eliminating the need for a survivor benefit, your monthly pension payment “pops-up” to the amount that you would have received if you elected the Single Life Benefit.

Example: You are married, getting ready to retire, and you have the following pension payout options:

Single Life: $3,000 per month

50% Survivor Benefit: $2,800 per month

50% Survivor Benefit with Pop-Up: $2,700 per month

If you elect the Single Life option, you would receive $3,000 per month, but when you pass away the pension payments stop.

If you elect the 50% Survivor Benefit, you would receive $2,800 per month, but if you pass away before your spouse, they will continue to receive $1,400 for the rest of their life.

If you elect the 50% Survivor Benefit WITH the Pop-Up, you would receive $2,700 per month, if you were to pass away before your spouse, your spouse would continue to receive $1,350 per month. But if your spouse passes away before you, your pension payment pops-up to the $3,000 Single Life amount for the rest of your life.

Why do people select the pop-up? It’s more related to what happens to the social security benefits when a spouse passes away. If your spouse were to pass away, one of the social security benefits is going to stop, and you receive the higher of the two but some of that lost social security income could be made up by the higher pop-up pension amount.

Marital Status

The easiest variable to address is marital status. If you are not married or there are no domestic partners that depend on your pension payments to meet their expenses, then typically it makes sense to elect either the Lump Sum or Straight Life payment option. Whether or not the lump sum or straight life benefit makes sense will depend on your age, tax strategy, income need, if you want to preserve assets for your children, and other factors.

Income Need

If you are married or have someone that depends on your pension income, by far, the number one factors becomes your income need in retirement when making your pension election. If the primary source of your retirement income is your pension and you were to pass away, your spouse would need to continue to receive all or a portion of those pension payments to meet their expenses, you have to weigh very heavily the survivor benefit options. We have seen people make the mistake of electing the Single Life Option because it was the highest monthly payout and then the spouse with the pension unexpectedly passes away at an earlier age. It’s a devastating financial event for the surviving spouse because the pension payments just stop. If someone were to pass away 5 years after leaving their company, they worked all of those year to receive 5 years worth of pension payments, and then they just stopped.

We usually have to run projections for clients to answer this question, if the spouse with the pension passes away will their surviving spouse need 50%, 75%, or 100% of the pension payments to meet their income needs? In most cases it’s worth accepting a slightly lower monthly pension payment to reduce this survivor risk.

Retirement Assets Outside Of The Pension

If you have substantial retirement savings outside of your pension like 401(k) accounts, investment accounts, 457, IRA’s, 403(b) plans, this may give you more flexibility with your pension options. Having those outside assets almost creates a survivor benefit for your spouse that if the pension payments were to stop or be reduced, there are other retirement assets to draw from to meet their income needs.

Example: You have a retired couple, both have pensions, and they have also accumulated $1M in retirement accounts outside the pension, if one spouse were to pass away, even though the pension payments may stop or be reduced, there may be enough assets to draw from the outside retirement accounts to make up for that lost pension income. This may allow a couple to elect a 50% survivor benefit and receive a higher monthly pension payment compared to electing the 100% survivor benefit with the lower monthly pension payment.

Risk Management

This last example usually leads us into another discussion about long-term risk. Even though you may have the outside assets to accept a higher monthly pension payment with a lower survivor benefit, should you? When we create retirement plans for clients we have to make a lot of assumptions about assumed rates of return, life expectancy, expenses, etc. But what if your investment accounts take a big hit during the next recession or a spouse passes away much sooner than expected, accepting a lower survivor benefit may increase the impact of those risks on your plan. If you and your spouse are both able to elect the 100% survivor benefit on your pensions, you then know, that no matter what happens in the future, that pension income will always be there, so it’s one less variable in your long-term financial plan.

While this could be looked at as a less risky path, there is also the flip side to that. If you lock up the 100% survivor benefit on the pension, that may allow you to take more risk in your outside retirement accounts, because you are not as dependent on those accounts to supplement a survivor benefit depending on which spouse passes away first.

Age

The age of you and your spouse can also be a factor. If the spouse with the pension is quite a bit older than the spouse without pension, it may make sense for normal life expectancy reasons, to elect a larger survivor benefit. Visa versa, if the spouse with then pension is much younger, it may warrant a lower survivor benefit elect. But in the end, it all goes full circle back to the income need if the pension payments were to stop, are there enough other assets to supplement income for the surviving spouse?

Health Considerations / Life Expectancy

When conducting a pension analysis, we will typically use age 90 as a life expectancy for most clients. But there are factors that can alter the use of age 90 such as special health considerations and longevity. If the spouse that has the pension is forced to retire for health reasons, it gives greater weight to electing a pension benefit with a higher survivor benefit. When a client tells us that their father, mother, and grandmother, all lived past age 93, that can impact the pension decision. Since people are living longer, it increases the risk of spending through their traditional retirement savings, whereas the pension payments will be there for as long as they live.

Financial Stability Of The Company / Organization

You are seeing more and more stories about workers that were promised a pension but then their company, union, or not-for-profit goes bankrupt. This is a real risk that should factor into your pension decision. While there are government agencies like the PBGC that are there to help backstop these failed pension plans, there have been so many bankrupt pensions over the past two decades that the PBGC fund itself is at risk of running out of assets. If a retiree is worried about the financial solvency of their employer, it may give greater weight to electing the “Lump Sum Option”, taking your money out of the plan, getting it over to your IRA, and then taking monthly payments from the IRA. Since this is becoming a greater risk to employees, we created a video dedicated to this topic: What Happens To Your Pension If The Company Goes Bankrupt?

Tax Strategy

Tax strategy also comes into play when electing your pension benefit. If we have retirees that have both a pension and retirement accounts outside the pension plan, we have to map out the distribution / tax strategy for the next 10 to 20 years. Depending on who you worked for and what state you live in, the monthly pension payments may be taxed at the federal level, state level, or both. Also, many retirees don’t realize that social security will also be considered taxable income in retirement. Then, if you have pre-tax retirement accounts, at age 72, you have to begin taking Required Minimum Distributions which are taxable.

There are situations where we will have a retiree forego the monthly pension payment from the pension plan and elect the Lump Sum Benefit option, so they can rollover the full balance to an IRA, and then we have more flexibility as to what their taxable income will be each year to execute a long term tax strategy that can save them thousands and thousands of dollars in taxes over their lifetime. We may have them process Roth conversions, or realize long term capital gains at a 0% tax rate, neither of which may be available if the pension income is pushing them up into the higher tax brackets.

There are so many other tax strategies, long term care strategies, and wealth accumulation strategies that come into the mix when deciding whether to take the monthly pension payments or the lump sum payment of your pension benefit.

Pension Option Analysis

These pension decisions are very important because you only get one shot at them. Once the decision is made you are not allowed to go back and change your mind to a different option. We run this pension analysis for clients all of the time, so before you make the decision, feel free to reach out to us and we can help you to determine which pension benefit is the right one for you.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Buying A Second House In Retirement

More and more retires are making the decision to keep their primary residence in retirement but also own a second residence, whether that be a lake house, ski lodge, or a condo down south. Maintaining two houses in retirement requires a lot of additional planning because you need to be able to answer the following questions:

More and more retirees are making the decision to keep their primary residence in retirement but also own a second residence, whether that be a lake house, ski lodge, or a condo down south. Maintaining two houses in retirement requires a lot of additional planning because you need to be able to answer the following questions:

Do you have enough retirement savings to maintain two houses in retirement?

Should you purchase the house before you officially retire or after?

Are you planning on paying for the house in cash or taking a mortgage?

If you are taking mortgage, where will the down payment come from?

Will you have the option to claim domicile in another state for tax purposes?

Should you setup a trust to own your real estate in retirement?

Adequate Retirement Savings

The most important question is do you have enough retirement income and assets to support the carrying cost of two houses in retirement? This requires you to run detailed retirement projection to determine what your total expense will be in retirement including the expenses associates with the second house, and the spending down of your assets over your life expectancy to make sure you do not run out of money. Here are some of the most common mistakes that we see retirees make:

They underestimated the impact of inflation. The ongoing costs associated with maintaining a house such as property taxes, utilities, association dues, maintenance, homeowners insurance, water bills, etc, tend to go up each year. While it may look like you can afford both houses now, if those expenses go up by 3% per year, will you have enough income and assets to pay those higher cost in the future?

They forget about taxes. If you will have to take larger distributions out of your pre-tax retirement accounts to maintain the second house, those larger distributions could push you into a higher tax bracket, cause your Medicare premiums to increase, lose property tax credits, or change the amount of your social security benefits that are taxable income.

A house is an illiquid asset. When you look at your total net worth, you have to be careful how much of your net worth is tied up in real estate. Remember, you are retired, you are no longer receiving a paycheck, if the economy hits a big recession, and your retirement accounts take a big hit, you may be forced to sell that second house when everyone else is also trying to sell their house. It could put you a in a difficult situation if you do not have adequate retirement assets outside of your real estate holdings.

Should You Purchase A Second House Before You Retire?

Many retirees wrestle with the decision as to whether to purchase their second house before they retire or after they have retired. There are two primary advantages to purchasing the second house prior to retirement:

If you plan on taking a mortgage to buy the second house, it is usually easier to get a mortgage while you are still working. Banks typically care more about your income than they do about your level of assets. We have seen clients retire, have over $2M in retirement assets, and have difficulties getting a mortgage, due to a lack of income.

There can be large expenses associated with acquiring a new piece of real estate. You move into your second house and you learn that it needs new appliances, a new roof, or you have to buy furniture to fill the house. We typically encourage our clients to get these big expenses out of the way before their paychecks stop in case they incur larger expenses than anticipated.

Mortgage or No Mortgage?

The decision of whether or not to take a mortgage on the second house is an important one. Sometimes it makes sense to take a mortgage and sometimes is doesn’t. Many retirees are hesitant to take a mortgage because they realize having a mortgage in retirement means higher annual expenses. While we generally encourage our client to reduce their debt by as much as possible leading up to retirement, there are situations where taking out a mortgage to buy that second house makes sense.

But it’s not for the reason that you may think. It’s not because you may be able to get a mortgage rate of 3% and keep your retirement assets invested with hopes of achieving a return of over 3%. While many retirees are willing to take on that risk, we remind our clients that you will be retired, therefore there is no more money going into your retirement accounts. If you are wrong and the value of your retirement accounts drop, now you have less in assets, no more contributions going in, and you have a new mortgage payment.

In certain situations, it makes sense to take a mortgage for tax purposes. If most of your retirement saving are in pre-tax sources like Traditional IRA’s or 401(k)’s, you withdrawal a large amount from those accounts in a single year to buy your second house, you may avoid having to take a mortgage, but it may also trigger a huge tax bill. For example, if you want to purchase a second house in Florida and the purchase price is $300,000. You take a distribution out of your traditional IRA to purchase the house in full, you will have federal and state income tax on the full $300,000, meaning if you are married filer you may have to withdrawal over $400,000 to get to the $300,000 that you need after tax to purchase the house.

If you are pre-tax heavy, it may be better to take out a mortgage, withdrawal just the down payment out of your IRA or preferably from an after tax source, and then you can make the mortgage payments with monthly withdrawals out of your IRA account. This spreads the tax liability of the house purchase over multiple years potentially keeping you out of those higher tax brackets.

But outside of optimizing a tax strategy, if you have adequate after-tax resources to purchase the second house in full, more times than not, we will encourage retirees to go that route because we are big fans of lowering your fixed expenses by as much as possible in retirement.

Planning For The Down Payment

If we meet with someone who plans to purchase a second house in retirement and we know they are going to have to take a mortgage, we have to start planning for the down payment on that house. Depending on what their retirement picture looks like we may:

Determine what amount of their cash reserves they could safely commit to the down payment

Reduce contributions to retirement accounts to accumulate more cash

If their tax situation allows, take distributions from certain types of accounts prior to retirement

Weigh the pros and cons of using equity in their primary residence for the down payment

If they have permanent life insurance policies, discuss pros and cons of taking a loan against the policy

Becoming A Resident of Another State

If you maintain two separate houses in different states, you may have the opportunity to have your retirement income taxed in the more tax favorable state. This topic could be an article all in itself, but it’s a tax strategy that should not be overlook because it can have a sizable impact on your retirement projections. If your primary residence is in New York, which is a very tax heavy state, and you buy a condo in Florida and you are splitting your time between the two houses in retirement, knowing what it requires to claim domicile in Florida could save you a lot of money in state taxes. To learn more about this I would recommend watching the following two videos that we created specifically on this topic:

Video 1: Will Moving From New York to Florida In Retirement Save You Taxes?

Video 2: How Do I Change My State Residency For Tax Purposes?

Should A Trust Own Your Second House

The final topic that we are going to cover are the pros and cons of a trust owning your house in retirement. For any house that you plan to own during the retirement years, it often makes sense to have the house owned by either a Revocable Trust or Irrevocable Trust. Trust are not just for the ultra wealthy. Trust have practical uses for everyday families just as protecting the house from the spend down process triggered by a long term care event or to avoid the house having to go through probate when you or your spouse pass away. Again, this is a relate topic but one that requires its own video to understand the difference between Revocable Trust and Irrevocable Trusts:

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.