Tax Filing Requirements For Minor Children with Investment Income

When parents gift money to their kids, instead of having the money sit in a savings account, often parents will set up UTMA accounts at an investment firm to generate investment returns in the account that can be used by the child at a future date. Depending on the amount of the investment income, the child may be required to file a tax return.

When parents gift money to their kids, instead of having the money sit in a savings account, often parents will set up a UTMA Account at an investment firm to generate investment returns that can be used by the child at a future date. But if the child is a minor, which is often the case, we have to educate our clients on the following topics:

How UTMA accounts work for minor children

Since the child will have investment income, do they need to file a tax return?

The special standard deduction for dependents

How kiddie tax works (taxed investment income at the parent’s tax rate)

Completed gifts for estate planning

How UTMA Accounts Work

When a parent sets up an investment account for their child, if the child is a minor, they typically set up the accounts as UTMA accounts, which stands for Uniform Transfer to Minors Act. UTMA accounts are established in the social security number of the child, and the parent is typically listed on the account as the “custodian”. As the custodian, the parent has full control over the account until the child reaches the “age of majority”. Once the child reaches the age of majority, the UTMA designation is removed, the account is re-registered into the name of the adult child, and the child now has full control over the account.

Age of Majority Varies State by State for UTMA

While the age of majority varies state by state, the age of majority for UTMA purposes and the age of majority for all other reasons often varies. For most states, the “age of majority” is 18 but the “UTMA age of majority” is 21. That is true for our state: New York. If a parent establishes an UTMA account in New York, the parent has control over the account until the child reaches age 21, then the control of the account must be turned over to their child.

$18,000 Gifting Exclusion Amount

When a parent deposits money to a UTMA account, in the eyes of the IRS, the parent has completed a gift. Even though the parent has control of the minor child’s UTMA account, from that point forward, the assets in the account belong to the child. Parents with larger estates will sometimes include gifting to the kids each year in their estate planning strategy. Each parent can make a gift of $18,000 (2024 Limit) each year ($36K combined) into the child’s UTMA account, and that gift will not count against the parent’s lifetime Federal and State lifetime estate tax exclusion amount.

A parent can contribute more than $18,000 per year to the child’s UTMA account, but a gift tax return may need to be filed in that year. For more information on this topic, see our video:

Video: When You Make Cash Gifts To Your Children, Who Pays The Tax?

When Does The Minor Child Need To File A Tax Return?

For minor children that have investment income from a UTMA account, if they are claimed as a dependent on their parent’s tax return, they will need to file a tax return if their investment income is above $1,250, which is the standard deduction amount for dependents with unearned income in 2024.

For dependent children with investment income over the $1,250 threshold, the investment is taxed at different rates. Here is a quick breakdown of how it works:

$0 - $1,250: Covered by standard deduction. No tax due

1,250 - $2,500: Taxed at the CHILD’s marginal tax rate

$2,500+: Taxed at the PARENT’s marginal tax rate (“Kiddie tax”)

How Does Kiddie Tax Work?

Kiddie tax is a way for the IRS to prevent parents in high-income tax brackets from gifting assets to their kids in an effort to shift the investment income into their child’s lower tax bracket. For children that have unearned income above $2,500, that income is now taxed as if it was earned by the parent, not the child. This applies to dependent children under the age of 18 at the end of the tax year or full-time students younger than 24.

IRS Form 8615 needs to be filed with the child’s tax return, which calculates tax liability on the unearned income above $2,500 based on the parent's tax rate. A tax note here: in these cases, the parent’s tax return has to be completed before the child can file their tax return since the parent’s taxable income is included in the Kiddie tax calculation. In other words, if the parents put their tax return on extension, the child’s tax return will also need to be put on extension.

Unearned vs Earned Income

This article has focused on the unearned income of a child; if the child also has earned income from employment, there are different tax filing rules. The earned income portion of the child’s income can potentially be sheltered by the $14,600 (2024) standard deduction awarded to individual tax filers.

This topic is fully covered in our article: At What Age Does A Child Have To File A Tax Return?

Investment Strategy for Minor Child’s UTMA

Knowing the potential tax implications associated with the UTMA account for your child, there is usually a desire to avoid the Kiddie tax as much as possible. This can often drive the investment strategy within the UTMA account to focus on investment holdings that do not produce a lot of dividends or interest income. It’s also common to try to avoid short-term capital gains within a child’s UTMA account since a large short-term capital gain could be taxed as ordinary income at the parent’s tax rate.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Why Do Wealthy Families Set Up Foundations and How Do They Work?

When a business owner sells their business and is looking for a large tax deduction and has charitable intent, a common solution is setting up a private foundation to capture a large tax deduction. In this video, we will cover how foundations work, what is the minimum funding amount, the tax benefits, how the foundation is funded, and more…….

When a business owner sells their business or a corporate executive receives a windfall in W2 compensation, some of these individuals will set up and fund a private foundation to capture a significant tax deduction, and potentially pre-fund their charitable giving for the rest of their lives and beyond. In this video, David Wojeski of the Wojeski Company CPA firm and Michael Ruger of Greenbush Financial Group will be covering the following topics regarding setting up a private foundation:

What is a private foundation

Why do wealthy individuals set up private foundations

What are the tax benefits associated with contributing to a private foundation

Minimum funding amount to start a private foundation

Private foundation vs. Donor Advised Fund vs. Direct Charitable Contributions

Putting family members on the payroll of the foundation

What is the process of setting up a foundation, tax filings, and daily operations

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Huge NYS Tax Credit Available For Donations To The SUNY Impact Foundation

There is a little-known, very lucrative New York State Tax Credit that came into existence within the past few years for individuals who wish to make charitable donations to their SUNY college of choice through the SUNY Impact Foundation. The tax credit is so large that individuals who make a $10,000 donation to the SUNY Impact Foundation can receive a dollar-for-dollar tax credit of $8,500 whether they take the standard deduction or itemize on their tax return. This results in a windfall of cash to pre-selected athletic programs and academic programs by the donor at their SUNY college of choice, with very little true out-of-pocket cost to the donors themselves once the tax credit is factored in.

There is a little-known, very lucrative New York State Tax Credit that came into existence within the past few years for individuals who wish to make charitable donations to their SUNY college of choice through the SUNY Impact Foundation. The tax credit is so large, that individuals who make a $10,000 donation to the SUNY Impact Foundation can receive a dollar-for-dollar tax credit of $8,500 whether they take the standard deduction or itemize on their tax return. This results in a windfall of cash to pre-selected athletic programs and academic programs by the donor at their SUNY college of choice, with very little true out-of-pocket cost to the donors themselves once the tax credit is factored in.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Trump Tax Plan for 2025: Social Security, Tips, Overtime, SALT Cap, and more….

It seems as though the likely outcome of the 2024 presidential elections will be a Trump win, and potentially full control of the Senate and House by the Republicans to complete the “full sweep”. As I write this article at 6am the day after election day, it looks like Trump will be president, the Senate will be controlled by the Republicans, and the House is too close to call. If the Republicans complete the full sweep, there is a higher probability that the tax law changes that Trump proposed on his campaign trail will be passed by Congress and signed into law as early as 2025.

It looks as though the likely outcome of the 2024 presidential election will be a Trump win, and potentially full control of the Senate and House by the Republicans to complete the “full sweep”. As I write this article at 6am the day after election day, it looks like Trump will be president, the Senate will be controlled by the Republicans, and the House is too close to call. If the Republicans complete the full sweep, there is a higher probability that the tax law changes that Trump proposed on his campaign trail will be passed by Congress and signed into law as early as 2025. Here are the main changes that Trump has proposed to the current tax laws:

Making Social Security Completely Exempt from Taxation

Exempting tips from income taxes

Exempting overtime pay from taxation

A new itemized deduction for auto loan interest

Dropping the corporate tax rate from the current 21% down to 15%

Eliminating the $10,000 SALT Cap

Extension of the Tax Cut & Jobs Act beyond 2025

Even if the Democrats end up hanging on to the House by a narrow margin, there is still a chance that some of these tax law changes could be passed in 2025.

Social Security Exempt From Taxation

This one is big for retirees. Under current tax law, 85% of Social Security retirement benefits are typically taxed at the federal level. Trump has proposed that all Social Security Benefits would be exempt from taxation, which would put a lot more money into the pocket of many retirees. For example, if a retiree receives $40,000 in social security benefits each year and they are in the 22% Fed bracket, 85% of their $40,000 is currently taxed at the Federal level ($34,000), not paying tax on their social security benefit would put $7,480 per year back in their pocket.

Note: Most states do not tax social security benefits. This would be a tax change at the federal level.

Exempting Tips from Taxation

For anyone who works in a career that receives tips, such as waiters, bartenders, hair stylists, and the list goes on, under current tax law, you are supposed to claim those tips and pay taxes on those tips. Trump has proposed making tips exempt from taxation, which for industries that receive 50% or more of their income in tips could be a huge windfall. The Trump proposed legislation would create an above-the-line deduction for all tip income, including both cash and credit card tips.

Overtime Pay Exempt From Taxation

For hourly employees who work over 40 hours per week and receive overtime pay, Trump has proposed making all overtime wages exempt from taxation, which could be a huge windfall for hourly workers. The Tax Foundation estimates that 34 million Americans receive some form of overtime pay during the year.

Auto Loan Interest Deduction

Trump has also proposed a new itemized deduction for auto loan interest. However, since it’s likely that high standard deductions will be extended beyond 2026, if there is a full Republican sweep, only about 10% of Americans would elect to itemize on their tax return as opposed to taking the standard deduction. A taxpayer would need to itemize to take advantage of this new proposed tax deduction.

Reducing The Corporate Tax Rate from 21% to 15%

Trump proposed reducing the corporate tax rate from the current 21% to 15%, but only for companies that produce goods within the United States. For these big corporations, a 6% reduction in their federal tax rates could bring a lot more money to their bottom line.

Eliminating the $10,000 SALT Cap

This would be a huge win for states like New York and California, which have both high property taxes and state income taxes. When the Tax Cut and Jobs Act was passed, it was perhaps one of the largest deductions for individuals who resided in states that had both state income tax and property taxes referred to as the SALT Cap (State and Local Taxes). Trump has proposed extending the Tax Cut and Jobs Act but eliminating the $10,000 SALT cap.

For example, if you currently live in New York and have property taxes of $10,000 and you pay state income tax of $20,000, prior to the passing of the Tax Cut and Jobs Act, you were able to itemize your tax deductions and take a $30,000 tax deduction at the federal level. When TCJA passed, it capped those deductions at $10,000, so most individuals defaulted into just taking the standard deduction and lost some of that tax benefit. Under these proposed tax law changes, taxpayers will once again be able to capture the full deduction for their state income taxes and property taxes making itemizing more appealing.

No Sunset For The Tax Cut and Jobs Act

The Tax Cut and Jobs Act was passed by Trump and the Republican Congress during his first term. That major taxation legislation was scheduled to expire on December 31, 2025, which would have automatically reverted everything back to the old tax brackets, standard deductions, loss of the QBI deduction, etc., prior to the passing of TCJA. If the Republicans gain control of the House, there is a very high probability that the tax laws associated with TCJA will be extended beyond 2025.

Summary of Proposed 2025 Tax Law Changes

There could be a tremendous number of tax law changes starting in 2025, depending on the ultimate outcome of the election results within the House of Representatives. If a full sweep takes place, a large number of the reforms that were covered in this article could be passed into the law in 2025. However, if there is a divided Congress, only a few changes may make it through Congress. We should know the outcome within the next 24 to 48 hours.

It’s also important to acknowledge that these are all proposed tax law changes. Before passing them into law, Congress could place income limitations on any number of these new tax benefits, and/or new tax law changes could be introduced. It should be a very interesting 2025 from a tax standpoint.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

What Is A Donor Advised Fund and How Do They Work for Charitable Contributions?

Due to changes in the tax laws, fewer individuals are now able to capture a tax deduction for their charitable contributions. In an effort to recapture the tax deduction, more individuals are setting up Donor Advised Funds at Fidelity and Vanguard to take full advantage of the tax deduction associated with giving to a charity, church, college, or other not-for-profit organizations.

Due to changes in the tax laws, fewer individuals are now able to capture a tax deduction for their charitable contributions. In an effort to recapture the tax deduction, more individuals are setting up Donor Advised Funds at Fidelity and Vanguard to take full advantage of the tax deduction associated with giving to charity, church, college, or other not-for-profit organizations.

In this article, we will review:

The reason why most taxpayers can no longer deduct charitable contributions

What is a Donor Advised Fund?

How do Donor Advised Funds operate?

Gifting appreciated securities to Donor Advised Funds

How are Donor Advised Funds invested?

How to set up a self-directed Donor Advised Fund

The Problem: No Tax Deductions For Charitable Contributions

When the Tax Cut and Jobs Act was passed in 2017, it greatly limited the number of taxpayers that were able to claim a tax deduction for their charitable contributions. Primarily because in order to claim a tax deduction for charitable contributions, you have to itemize when you file your taxes because charitable contributions are an itemized deduction.

When you file your taxes, you have to choose whether to elect the standard deduction or to itemize. The Tax Cut & Jobs Act greatly increased the amount of the standard deduction, while at the same time it capped two of the largest itemized tax deductions for taxpayers - which is state income tax paid and property taxes. SALT (state and local taxes) are now capped at $10,000 per year if you itemize.

In 2024, the standard deduction for single filers is $14,600 and $29,200 for married filing joint, which means if you are a married filer, and you want to deduct your charitable contributions, assuming you reach the SALT cap at $10,000 for state income and property taxes, you would need another $19,200 in tax deductions before your reached that amount of the standard deduction. That’s a big number to hurdle for most taxpayers.

Example: Joe and Sarah file a joint tax return. They pay state income tax of $8,000 and property taxes of $6,000. They donate $5,000 to their church and a variety of charities throughout the year. They can elect to take the standard deduction of $29,200, or they could itemize. However, if they itemize while their state income tax and property taxes total $14,000, they are capped at $10,000 and the only other tax deduction that they could itemize is their $5,000 to church and charity which brings them to a total of $15,000. Since the standard deduction is $14,000 higher than if they itemized, they would forgo being able to deduct those charitable contributions, and just elect that standard deduction.

How many taxpayers fall into the standard deduction category? According to the Tax Policy Center, in 2020, about 90% of taxpayers claimed the standard deduction. Prior to the passing of the Tax Cut and Jobs Act, only about 70% of taxpayers claimed the standard deduction meaning that more taxpayers were able to itemize and capture the tax deduction for their charitable contributions.

What Is A Donor Advised Fund

For individuals that typically take the standard deduction, but would like to regain the tax deduction for their charitable contributions, establishing a Donor Advised Fund may be a solution.

A Donor Advised Fund looks a lot like a self-directed investment account. You can make contributions to your donor advisor fund, you can request distributions to be made to your charities of choice, and you can direct the investments within your account. But the account is maintained and operated by a not-for-profit organization, a 501(c)(3), that serves as the “sponsoring organization”. Two of the most recognized providers within the Donor Advised Fund space are Fidelity and Vanguard.

Both Fidelity and Vanguard have their own Donor Advised Fund program. These large investment providers have established a not-for-profit arm for the sole purpose of allowing investors to establish, operate, and invest their Donor Advised Account for their charitable giving.

Why Do People Contribute To A Donor Advised Fund?

We just answered the “What” question, now we will address the “Why” question. Why do people contribute to these special investment accounts at Fidelity and Vanguard and what is it about these accounts that allow taxpayers to capture the tax deduction for their charitable giving that was previously lost?

The short answer - it allows taxpayers that give to charity each year, to make a large lump sum contribution to an investment account designated for their charitable giving. That then allows them to itemize when they file their taxes and capture the deduction for their charitable contributions in future years.

Here’s How It Works

As an example, Tim and Linda typically give $5,000 per year to their church and charities throughout the year. Since they don’t have any other meaningful tax deductions outside of their property taxes and state income taxes that are capped at $10,000, they take the $29,200 standard deduction when they file their taxes, and do not receive any additional tax deductions for their $5,000 in charitable contributions, because they did not itemize.

Instead, Tim and Linda establish a Donor Advised Fund at Fidelity, and fund it with a one-time $50,000 contribution. Since they made that contribution to a Donor Advised Fund which qualifies as an IRS approved charitable organization, the year that they made the $50,000 contribution, they will elect to itemize when they file their taxes and they’ll be able to capture the full $50,000 tax deduction, since that amount is well over the $29,200 standard deductions.

But the $50,000 that was contributed to their Donor Advised Fund does not have to be distributed to charities all in that year. Each Donor Advised Program has different minimum annual charitable distribution requirements, but at the Fidelity program it’s just $50 per year. In other words, taxpayers that make these contributions to the Donor Advised Fund can capture the full tax benefit in the year they make the contributions, but that account can then be used to fund charitable contribution for many years into the future, they just have to distribute at least $50 per year to charity.

It gets better, Tim and Linda then get to choose how they want to invest their Donor Advised Fund, and they select a 60% stock / 40% bond portfolio. So not only are they able to give from the $50,000 that they contributed, but all of the investment returns continue to accumulate in that account that Tim and Linda will never pay tax on, that they can then use for additional charitable giving in the future.

How Do Donor Advised Funds Operate?

The example that I just walked you through laid the groundwork for how these Donor Advised Fund to operate, but I want to dive a little bit deeper into some features that are important with these types of accounts.

Funding Minimums

All Donor Advised Funds operate differently depending on the provider. One example is the minimum funding requirement to open a Donor Advised Fund. The Fidelity program does not have an investment minimum, so they can be opened with any amount. However, the Vanguard program currently has a $20,000 investment minimum.

Fees Charged By Donor Advised Sponsor

Both Vanguard and Fidelity assess an annual “administration fee” against the assets held within their Donor Advised Fund program. This is how the platform is compensated for maintaining the not-for-profit entity, processing contributions and distributions, investment services, issuing statements, trade confirmations, and other administrative responsibilities. At the time that I’m writing this article, both the Fidelity and Vanguard program charge an administrative fee of approximately 0.60% per year.

How Charitable Distributions Are Made From Donor Advised Funds

Once the Donor Advised Account is funded, owners are able to either login online to their account and request money to be sent directly to their charity of choice, or they can call the sponsor of the program and provide payment instructions over the phone.

For example, if you wanted to send $1,000 to the Red Cross, you would log in to your Donor Advised account and request that $1,000 be sent directly from your Donor Advised account to the charity. You never come into contact with the funds. The charitable distributions are made directly from your account to the charity.

When you login to their online portals, they have a long list of pre-approved not-for-profit organizations that have been already established on their platform, but you are able to give to charities that are not on that pre-approved list. A common example is a church or a local not-for-profit organization. You can still direct charitable contributions to those organizations, but you would need to provide the platform with the information that they need to issue the payment to the not-for-profit organization not on their pre-approved list.

Annual Grant Requirement

As I mentioned earlier, different donor advised programs have different requirements as to how much you are required to disperse from your account each year and some platforms only require a disbursement every couple of years. For example, the Vanguard program only requires that a $500 charitable distribution be made once every three years, but they do not require an annual distribution to be made.

Irrevocable Contributions

It’s important to understand that contributions made to Donor Advised Funds are irrevocable, meaning they cannot be reversed. Once the money is in your Donor Advised Account, you cannot ask for that money back. The platform just gives you “control” over the investment allocation, and how and to who the funds are disbursed to for your charitable giving.

What Happens To The Balance In The Donor Advised Fund After The Owner Passes Away?

Since some of our clients have substantial balances in these Donor Advised Funds, we had to ask the question, “What happens to the remaining balance in the account after the owner of the account passes away?”. Again, the answer can vary from platform to platform, but most platforms offer a few options.

Option 1: The owner of the account can designate any number of charities as final beneficiaries of the account balance after they pass away, and then the full account balance is distributed to those charities after they pass.

Option 2: The owner can name one or more successor owners for the account that will take over control of the account and the charitable giving after the original owner passes away. As planners, we then asked the additional question, “What if they have multiple children, and each child has different charitable preferences?”. The response from Vanguard was that the Donor Advisor Fund can be split into separate Donor Advised accounts controlled by each child, Then, each child can dictate how the funds in their account are distributed to charity.

Gifting Cash or Appreciated Securities

There are two main funding options when making contributions to a Donor Advised Fund. You can make a cash contribution or you can fund it by transferring securities from a brokerage account. Funding with cash is easy and straightforward. When you establish your Donor Advised Fund, you can set up bank instructions to attach your checking account to their Donor Advised Fund for purposes of making contributions to the account. There are limits on the tax deductions for cash contributions in a given year. For cash contributions, donors can receive a tax deduction up to 60% of their AGI for the year.

Funding the donor advised fund with appreciated securities from your taxable brokerage account has additional tax benefits. First, you receive the tax deduction for making the charitable contribution just like it was made in cash, but, if you transfer a stock or security directly from your taxable brokerage account to the Donor Advised Fund, the owner of the brokerage account avoids having to pay tax on the unrealized capital gains built up in that security.

For example, Sue bought $10,000 of Apple stock 10 years ago and it’s now worth $50,000. If she sells the stock, she will have to pay long term capital gains taxes on the $40,000 gain in that holding. If instead, she sets up a Donor Advised Fund and transfers the $50,000 in Apple stock directly from her brokerage account to her Donor Advised account at Fidelity, she may receive a tax deduction for the full $50,000 fair market value of the stock and avoids having to pay tax on the unrealized capital gain.

An important note regarding the deduction limits for gifting appreciated securities - the tax deduction it limited to 30% of the taxpayers AGI for the year. Example, if Sue has an AGI of $100,000 for 2024 and wants to fund her Donor Advised Fund with her appreciated stock, the most she can take a deduction for in 2024 is $30,000. ($100,000 AGI x 30% limit).

As you can see, transferring appreciated stock to a Donor Advised Fund can be beneficial, but cash offers a higher threshold for the tax deduction in a single year.

Donor Advised Funds Do Not Make Sense For Everyone

While establishing and funding a Donor Advised Fund may be a viable solution for many taxpayers, it’s definitely not for everyone. In short, your annual charitable contributions have to be large enough for this strategy to make sense.

First example, if you are contributing approximately $2,000 per year to charity, and you don’t intend on making bigger contributions to charities in the future, it may not make sense to contribute $40,000 to a Donor Advised Fund. Remember, the whole idea is you have to make a large enough one-time contribution to hurdle the standard deduction limit for itemizing to make sense. You also have to itemize to capture the tax deduction for your charitable contributions.

If you are a single filer, you don’t have any tax deductions, and you make a $5,000 contribution to a Donor Advised Fund - that is still below the $14,600 standard deduction amount. In this case, you are not realizing the tax benefit of making that contribution to the Donor Advised Fund. If instead, you made a $30,000 contribution as a single filer, now it may make sense.

Second example, not enough taxable income. For our clients that are retired, many of them are showing very little income (on purpose). If we have a client that is only showing $50,000 for their AGI, the tax deduction for their cash contributions would be limited to $30,000 (60% of AGI) and gift appreciated securities would be limited to $15,000 (30% of AGI). Unless they have other itemized deductions, that may not warrant making a contribution to a Donor Advised Fund because they are right there at the Standard Deduction amount. PLUS, they are already in a really low tax bracket, so they don’t really need the deduction.

This Strategy is Frequently Used When A Client Sells Their Business

Our clients commonly use this Donor Advised Fund strategy during abnormally large income years. The most common is when a client sells their business. They may realize a few million dollars in income from the sale of their business in a single year, and if they have some form of charitable intent either now or in the future, they may be able to fund a Donor Advised Fund with $100,000+ in cash or appreciated securities. This takes income off the table at potentially the highest tax brackets and they now have an account that is invested and growing that will fund their charitable gifts for the rest of their life.

How to Set-up A Donor Advised Fund

Setting up a Donor Advised Fund is very easy. Here are the links to the Fidelity and Vanguard Platforms for their Donor Advised Fund solutions:

Fidelity Donor Advised Fund Link: Fidelity Charitable Fund Link

Vanguard Donor Advised Fund Link: Vanguard Charitable Fund Link

Disclosure: We want to provide the links as a convenience to our readers, but it does not represent an endorsement of either platform. Investors should seek guidance from their financial professionals.

These Donor Advised Funds for the most part are self-directed platforms which allow you to select the appropriate investment allocation from their investment menu when you set up your account.

Contact Us With Questions if you have any questions on the Donor Advised Fund tax strategy, please feel free to reach out to us.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

What Vehicle Expenses Can Self-Employed Individuals Deduct?

Self-employed individuals have a lot of options when it comes to deducting expenses for their vehicle to offset income from the business. In this video we are going to review:

1) What vehicle expenses can be deducted: Mileage, insurance, payments, registration, etc.

2) Business Use Percentage

3) Buying vs Leasing a Car Deduction Options

4) Mileage Deduction Calculation

5) How Depreciation and Bonus Depreciation Works

6) Depreciation recapture tax trap

7) Can you buy a Ferreri through the business and deduct it? (luxury cars)

8) Tax impact if you get into an accident and total the vehicle

Self-employed individuals have a lot of options when it comes to deducting expenses for their vehicle to offset income from the business. In this video we are going to review:

What vehicle expenses can be deducted: Mileage, insurance, payments, registration, etc.

Business Use Percentage

Buying vs Leasing a Car Deduction Options

Mileage Deduction Calculation

How Depreciation and Bonus Depreciation Works

Depreciation recapture tax trap

Can you buy a Ferreri through the business and deduct it? (luxury cars)

Tax impact if you get into an accident and total the vehicle

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Focusing On Buying Dividend Paying Stocks Is A Mistake

Picking the right stocks to invest in is not an easy process but all too often I see retail investors make the mistake of narrowing their investment research to just stocks that pay dividends. This is a common mistake that investors make and, in this article, we are going to cover the total return approach versus the dividend payor approach to investing.

Picking the right stocks to invest in is not an easy process, but all too often I see retail investors make the mistake of narrowing their investment research to just stocks that pay dividends. This is a common mistake that investors make, and in this article, we are going to cover the total return approach versus the dividend payor approach to investing.

Myth: Stocks That Pay Dividends Are Safer

Retail investors sometimes view dividend paying stocks as a “safer” investment because if the price of the stock does not appreciate, at least they receive the dividend. There are several flaws to this strategy. First, when times get tough in the economy, dividends can be cut, and they are often cut by companies to preserve cash. For example, prior to the 2008/2009 Great Recession, General Electric stock was paying a solid dividend, and some retirees were using those dividends to supplement their income. When the recession hit, GE dramatically cut it dividends, forcing some shareholders to sell the stock at lower levels just to create enough cash to supplement their income. Forcing a buy high, sell low scenario.

The Magnificent 7 Stocks Do Not Pay Dividends

In more recent years, when you look at the performance of the “Magnificent 7” tech stocks which have crushed the performance of the S&P 500 Index over the past 1 year, 5 years, and 10 years, there is one thing most of those Magnificent 7 stocks have in common. As I write this article today, Nvidia, Microsoft, Google, Amazon, and Meta either don’t pay a dividend or their dividend yield is under 1%. So, if you were an investor that had a bias toward dividend paying stocks, you may have missed out on the “Mag 7 rally” that has happened over the past 10 years.

Growth Companies = No Dividends

When a company issues a dividend, they are returning capital to the shareholders as opposed to reinvesting that capital into the company. Depending on the company and the economic environment, a company paying a dividend could be viewed as a negative action because maybe the company does not have a solid growth plan, so instead of reinvesting the money into the company, they default to just returning that excess capital to their investors. It’s may feel good to have some investment income coming back to you, but if you are trying to maximize investment returns over the long term, will that dividend paying stock be able to outperform a growth company that is plowing all of their cash back into more growth?

Companies Taking Loans to Pay Their Dividend

For companies that pay a solid dividend, they are probably very aware that there are subsets of shareholders that are holding their stock for the dividend payments, and if they were to significantly cut their dividend or stop it all together, it may cause investors to sell their stock. When these companies are faced with tough financial conditions, they may resist cutting the dividends long after they really should have, putting the company in a potentially worse financial position knowing that shareholders may sell their stock as soon as the dividend cut is announced.

Some companies may even go to the extreme that since they don’t have the cash on hand to pay the dividend, they will issue bonds (go into debt) to raise enough cash for the sole purpose of being able to continue to pay their dividends, which goes completely against the reason why most companies issue dividends.

If a company generates a profit, they can decide to reinvest that profit back into the company, return that capital to investors by paying a dividend, or some combination of two. However, if a company goes into debt just to avoid having to cut the dividend payments to investors, I would be very worried about the growth prospects for that company.

Focus on Total Return

I’m a huge fan on focusing on total return. The total return of a stock equals both how much the value of the stock has appreciated AND any dividends that the stock pays while the investor holds the stock. If I gave someone the option of owning Stock ABC that does not pay a dividend and Stock XYZ that pays a 5% dividend, a lot of individuals will automatically start to build a strong bias toward buying XYZ over ABC without digging much deeper into the analysis. However, if Stock ABC does not pay a dividend due to its significant growth prospects and rises 30% in a year, while Stock XYZ pays a 5% dividend but only appreciates 8%, the total return for Stock XYZ is just 13%. This means the investor missed out on an additional 17% return by choosing the lower-performing stock.

Diversification Is Still Prudent

The purpose of this article is not to encourage investors to completely abandon dividend paying stocks for growth stocks that don’t pay dividends. Having a diversified portfolio is still a prudent approach, especially since growth stocks tend to be more volatile over time. Instead, the purpose of this article is to help investors understand that just because a stock pays a dividend does not mean it’s a “safer investment” or that it’s a “better” long-term investment from a total return standpoint.

Accumulation Phase vs Distribution Phase

We categorize investors into two phases: the Accumulation Phase and the Distribution Phase. The Accumulation Phase involves building your nest egg, during which you either make contributions to your investment accounts or refrain from taking distributions. In contrast, the Distribution Phase refers to individuals who are drawing down from their investment accounts to supplement their income.

During the Accumulation Phase, a total return approach can be prudent, as most investors have a longer time horizon and can better weather market volatility without needing to sell investments to supplement their income. These investors are typically less concerned about whether their returns come primarily from appreciation or dividends.

As you enter the Distribution Phase, often in retirement, the strategy shifts. Reducing portfolio volatility becomes crucial because you are making regular withdrawals. For instance, if you need to withdraw $50,000 annually from your Traditional IRA and the market drops, you may be forced to liquidate investments at an inopportune time, negatively impacting long-term performance. In the Accumulation Phase, you can ride out market declines since you are not making withdrawals.

Times Are Changing

Traditionally, investors would buy and hold 10 to 30 individual dividend-paying stocks indefinitely. This is why inherited stock accounts often include companies like GE, AT&T, and Procter & Gamble, known for their consistent dividends.

However, the S&P 500 now features seven tech companies that make up over 30% of the index's total market cap, driving a significant portion of stock market returns over the past decade, with very few paying meaningful dividends. This article highlights the need for investors to adapt their stock selection methodologies as the economy evolves. It’s essential to understand the criteria used when selecting investments to maximize long-term returns.

Special Disclosure: This article does not constitute a recommendation to buy or sell any of the securities mentioned and is for educational purposes only.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

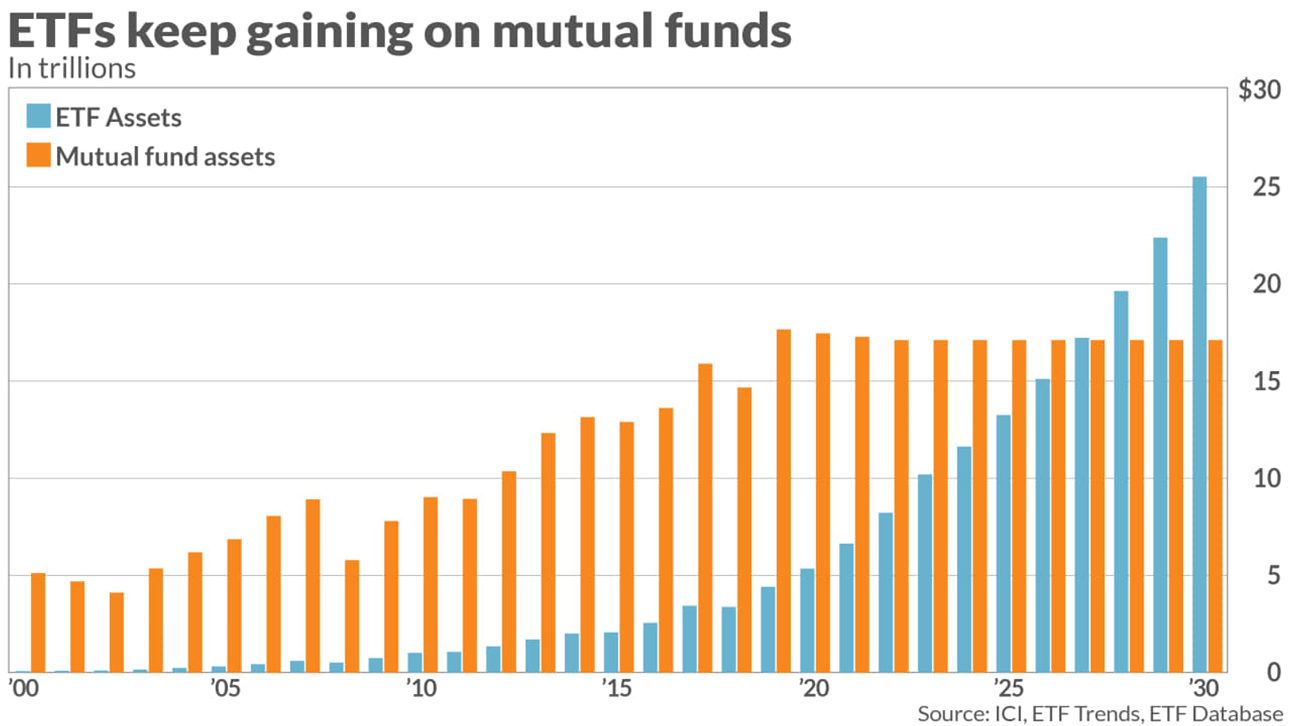

What Is an ETF & Why Have They Surpassed Mutual Funds in Popularity?

There is a sea change happening in the investment industry where the inflows into ETF’s are rapidly outpacing the inflows into mutual funds. When comparing ETFs to mutual funds, ETFs sometimes offer more tax efficiency, trade flexibility, a wider array of investment strategies, and in certain cases lower trading costs and expense ratios which has led to their rise in popularity among investors. But there are also some risks associated with ETFs that not all investors are aware of……..

There is a sea change happening in the investment industry where the inflows into ETF’s are rapidly outpacing the inflows into mutual funds. See the chart below, showing the total asset investments in ETFs vs Mutual Funds going back to 2000, as well as the Investment Company Institute’s projected trends going out to 2030.

Why is this happening? While mutual funds and ETFs may look similar on the surface, there are several dramatic differences that are driving this new trend.

What is an ETF?

ETF stands for Exchange Traded Fund. On the surface, an ETF looks very similar to an index mutual fund. It’s a basket of securities often used to track an index or an investment theme. For example, Vanguard has the Vanguard S&P 500 Index EFT (Ticker: VOO), but they also have the Vanguard S&P 500 Index Fund (Ticker: VFIAX); both aim to track the performance of the S&P 500 Index, but there are a few differences.

ETFs Trade Intraday

Unlike a mutual fund that only trades at 4pm each day, an ETF can be traded like a stock intraday, so if you want to see $10,000 of the Vanguard S&P 500 ETF at 10am, you can do that, versus if you are invested in the Vanguard S&P 500 Index Fund, it will only trade at 4pm which may be at a better or worse price depending where the S&P 500 index finished the trading day compared to the price at 10am.

How ETFs Are Traded

When it comes to comparing ETFs to Mutual Funds, a big difference is not only WHEN they trade, but also HOW they trade. When you sell a mutual fund, your shares are sold back to the mutual fund company at 4pm and settled in cash. An exchange traded fund trades like a stock where shares are “exchanged” between a buyer and a seller in the open market, which is where ETF’s get their name from. They are “exchanged”, not redeemed like mutual fund shares.

ETF Tax Advantage Over Mutual Funds

One of the biggest advantages of ETFs over mutual funds is their tax efficiency, which relates back to what we just covered about how ETFs are traded. When you redeem mutual fund shares, if the fund company does not have enough in its cash reserve within the mutual fund itself, it has to go on the open market and sell securities to raise cash to meet the redemptions. Like any other type of investment account, if the security that they sell has an unrealized gain, selling the security to raise cash creates a taxable realized gain, and then the mutual fund distributes those gains to the existing shareholders, typically at the end of the calendar year as “capital gains distributions” which are then taxed to the current holders of the mutual funds.

If the current shareholders are holding that mutual fund in a taxable account when the capital gains distribution is issued, the shareholder needs to report that capital gains distribution as taxable income. This never seemed fair because that shareholder didn't redeem any shares, however since the mutual fund had to redeem securities to meet redemptions, the shareholders that remain unfortunately bear the tax burden.

Example: Jim and Sarah both own ABC Growth Fund in their brokerage accounts. ABC has performed well for the past few years, so Sarah decides to sell her shares. The mutual fund company then has to sell shares of stock within its portfolio to meet the redemption request, generating a taxable gain within the mutual fund portfolio. At the end of the year, ABC Growth Fund issues a capital gain distribution to Jim, which he must pay tax on, even though Jim did not sell his shares, Sarah did.

ETFs do not trigger capital gains distributions to shareholders because the shares are exchanged between a buyer and a seller, an ETF company does not have to redeem securities within its portfolio to meet redemptions. So, you could technically have an ABC Growth Mutual Fund and an ABC Growth ETF, same holdings, but the investor that owns the mutual fund could be getting hit with taxed on capital gains distribution each year while the holder of the ETF has no tax impact until they sell their shares.

Holding ETFs In A Taxable Account vs Retirement Account

Tax efficiency matters the most in taxable accounts, like brokerage accounts. If you are holding an ETF or mutual fund within an IRA or 401(k) account, since retirement accounts by nature are tax deferred, the capital gains distributions being issued by the mutual fund companies do not have an immediate tax impact on the shareholders because of the tax deferred nature of retirement accounts. For this reason, there has been less urgency to transition from mutual funds to ETFs in retirement accounts.

Many ETFs Don’t Trade In Fractional Shares

The second reason why ETFs have been slower to be adopted into employer sponsored retirement plans, like 401(k) plans, is most ETFs, like stocks, only trade in whole shares. Example: If you want to buy 1 share of Google, and Google is trading for $163 per share, you have to have $163 in cash to buy one whole share. You can’t buy $53 of Google because it’s not enough to purchase a whole share. Most ETF’s work the same way. They have a share price like a stock, and you have to purchase them in whole shares. Mutual funds by comparison trade in fractional shares, meaning while the “share price” or “NAV” of a mutual fund may be $80, you can buy $25.30 of that mutual fund because they can be bought and sold in fractional shares.

This is why from an operational standpoint, mutual funds can work better in 401(k) accounts because you have employees making all different levels of contributions each pay period to their 401(K) accounts - Jim is contributing $250 per pay period, Sharon $423 per pay period, Scott $30 per pay period. Since mutual funds can trade in fractional shares, the full amount of those contributions can be invested each pay period, whereas if it was a menu of ETFs that only traded in full shares, there would most likely be uninvested cash left over each pay period because only whole shares can be purchased.

ETF’s Do Not Have Minimum Initial Investments

Another advantage that ETF’s have over mutual funds is they do not have “minimum initial investments” like many mutual funds do. For example, if you look up the Vanguard S&P 500 Index Mutual Fund (Ticker VFIAX), there is a minimum initial investment of $3,000, meaning you must have at least $3,000 to buy a position in that mutual fund. Whereas the Vanguard S&P 500 Index ETF (Ticker: VOO) does not have a minimum initial investment, the current share price is $525.17, so you just need $525,17 to purchase 1 share.

NOTE: I’m not picking on Vanguard, they are in a lot of my example because we use Vanguard in our client portfolios, so we are very familiar with how their mutual funds and ETFs operate.

ETFs Do Not CLOSE To New Investors

Every now and then a mutual fund will declare either a “soft close” or “hard close”. A soft close means the mutual fund is closed to “new investors” meaning if you currently have a position in the mutual fund, you are allowed to continue to make deposits, but if you don’t already own the mutual fund, you can no longer buy it. A “hard close” is when both current and new investors are no longer allowed to purchase shares of the mutual fund, existing shareholders are only allowed to sell their holdings.

Mutual Funds will sometimes do this to protect performance or their investment strategy. If you are managing a Small Cap Value Mutual Fund and you receive buy orders for $100 billion, it may be difficult, if not impossible to buy enough of the publicly traded small cap stock to put that cash to work. Then, the fund manager might have to expand the stock holding to “B team” selections, or begin buying mid-cap stock which creates style drift out of the core small cap value strategy. To prevent this, the mutual fund will announce either a soft or hard close to prevent these big drifts from happening.

Arguably a good thing, but if you love the fund, and they tell you that you can’t put any more money into it, it can be a headache for current shareholders.

Since ETFs trade in the open market between buyers and sellers, they cannot implement hard or soft closes, it just becomes, ‘how much are the current holders of the ETF willing to sell their shares for in the open market to the buyers’.

ETFs Can Offer A Wider Selection of Investment Strategies

With ETFs, there are also a wider variety of investment strategies to choose from and the number of ETFs available in the open market are growing rapidly.

For example, if you want to replicate the performance of Brazil’s stock market within your portfolio, iShares has an ETF called MSCI Brazil (Ticker: EWZ) which seeks to track the investment results of an index composed of Brazilian equities. While traditional indexes exist within the ETF world like tracking the total bond market or S&P 500 Index, EFTs can provide access to more limited scope investment strategies.

ETF Liquidity Risk

But this brings me to one of the risks that shareholders need to be aware of when buying thinly traded ETFs. Since they are exchange traded funds, if you want to sell your position, you need a buyer that wants to buy your shares, otherwise there is no way to sell your position. One of the metrics we advise individuals to look at before buying an ETF is the daily trade volume of that security to determine how easily or difficult it would be to find a buyer for your shares if you wanted to sell them.

For example, VOO, the Vanguard S&P 500 Index ETF has an average trading volume right now about 5 million shares and as the current share price is about $2.6 Billion in activity each day, there is a high probability that if you wanted to sell $500,000 of your VOO, that order could be easily filled. If instead, you are holding a very thinly traded ETF that only has an average trading volume of 100,000 share per day and you are holding 300,000 shares, it may take you a few days or weeks to sell your position and your activity could negatively impact the price as you try to sell because it could move the market with your trade given the light trading volume. Or worse, there is no one interested in buying your shares, so you are stuck with them. You just have to do your homework when investing the more thinly traded ETFs.

Passive & Active ETFs

Similar to mutual funds, there are both passive and active ETF’s. Passive ETFs aim to replicate the performance of an existing index like the S&P 500 Index or a bond index, while active strategy ETFs are trying to outperform a specific index through the implementation of their investment strategy within the ETF.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

When Should High-Income Earners Max Out Their Roth 401(k) Instead of Pre-tax 401(k)?

While pre-tax contributions are typically the 401(k) contribution of choice for most high-income earners, there are a few situations where individuals with big incomes should make their deferrals contribution all in Roth dollars and forgo the immediate tax deduction.

While pre-tax contributions are typically the 401(k) contribution of choice for most high-income earners, there are a few situations where individuals with big incomes should make their deferral contributions all in Roth dollars and forgo the immediate tax deduction.

No Income Limits for Roth 401(k)

It’s common for high income earners to think they are not eligible to make Roth deferrals to their 401(k) because their income is too high. However, unlike Roth IRAs that have income limitations for making contributions, Roth 401(k) contributions have no income limitation.

401(k) Deferral Aggregation Limits

In 2024, the employee deferral limits are $23,000 for individuals under the age of 50, and $30,500 for individuals aged 50 or older. If your 401(k) plan allows Roth deferrals, the annual limit is the aggregate between both pre-tax and Roth deferrals, meaning you are not allowed to contribute $23,000 pre-tax and then turn around and contribute $23,000 Roth in the same year. It’s a combined limit between the pre-tax and Roth employee deferral sources in the plan.

Scenario 1: Business Owner Has Abnormally Low-Income Year

Business owners from time to time will have a tough year for their business. They may have been making $300,000 or more per year for the past year but then something unexpected happens or they make a big investment in their business that dramatically reduces their income from the business for the year. We counsel these clients to “never waste a bad year for the business”.

Normally, a business owner making over $300,000 per year would be trying to max out their pre-tax deferral to their 401(K) plans in an effort to reduce their tax liability. But, if they are only showing $80,000 this year, placing a married filing joint tax filer in the 12% federal tax bracket, I’ll ask, “When are you ever going to be in a tax bracket below 12%?”. If the answer is “probably never”, then it an opportunity to change the tax plan, max out their Roth deferrals to the 401(k) plan, and realize that income at their abnormally lower rate. Plus, as the Roth source grows, after age 59 ½ they will be able to withdrawal the Roth source ALL tax free including the earnings.

Scenario 2: Change In Employment Status

Whenever there is a change in employment status such as:

Retirement

High income spouse loses a job

Reduction from full-time to part-time employment

Leaving a high paying W2 job to start a business which shows very little income

All these events may present an abnormally low tax year, similar to the business owner that experienced a bad year for the business, that could justify the switch from pre-tax deferrals to Roth deferrals.

The Value of Roth Compounding

I’ll pause for a second to remind readers of the big value of Roth. With pre-tax deferrals, you realize a tax benefit now by avoiding paying federal or state income taxes on those employee deferrals made to your 401(k) plan. However, you must pay tax on those contributions AND the earnings when you take distributions from that account in retirement. The tax liability is not eliminated, just deferred.

For example, if you are 40 years old, and you defer $23,000 into your 401K plan, if you get an 8% annual rate of return on that $23,000, it will grow to $157,515 when you turn age 65. As you withdraw that $157,515 in retirement, you’ll pay income tax on all of it.

Now instead let’s assume you made the $23,000 employee deferral all Roth, with the same 8% rate of return per year, reaching the same $157,515 balance at age 65, now you can withdrawal the full $157,515 all tax free.

Scenario 3: Too Much In Pre-Tax Retirement Accounts Already

When high income earners have been diligently saving in their 401(k) plan for 30 plus years, sometimes they amass huge pre-tax balances in their retirement plans. While that sounds like a good thing, sometimes it can come back to haunt high-income earnings in retirement when they hit their RMD start date. RMD stands for required minimum distribution, and when you reach a specific age, the IRS forces you to begin taking distributions from your pre-tax retirement account whether you need to our not. The IRS wants their income tax on that deferred tax asset.

The RMD start age varies depending on your date of birth but right now the RMD start age ranges from age 73 to age 75. If for example, you have $3,000,000 in a Traditional IRA or pre-tax 401(k) and you turn age 73 in 2024, your RMD for the 2024 would be $113,207. That is the amount that you would be forced to withdrawal out of your pre-tax retirement account and pay tax on. In addition to that income, you may also be showing income from social security, investment income, pension, or rental income depending on your financial picture at age 73.

If you are making pre-tax contributions to your retirement now, normally the goal is to take that income off that table now and push it into retirement when you will hopefully be in a lower tax bracket. However, if your pre-tax balances become too large, you may not be in a lower tax bracket in retirement, and if you’re not going to be in a lower tax bracket in retirement, why not switch your contributions to Roth, pay tax on the contributions now, and then you will receive all of the earning tax free since you will now have money in a Roth source.

Scenario 4: Multi-generational Wealth

It’s not uncommon for individuals to engage a financial planner as they approach retirement to map out their distribution plan and verify that they do in fact have enough to retire. Sometimes when we conduct these meetings, the clients find out that not only do they have enough to retire, but they will not need a large portion of their retirement plan assets to live off and will most likely pass it to their kids as inheritance.

Due to the change in the inheritance rules for non-spouse beneficiaries that inherit a pre-tax retirement account, the non-spouse beneficiary now is forced to deplete the entire account balance 10 years after the decedent has passed AND potentially take RMDs during the 10- year period. Not a favorable tax situation for a child or grandchild inheriting a large pre-tax retirement account.

If instead of continuing to amass a larger pre-tax balanced in the 401(k) plan, say that high income earner forgoes the tax deduction and begins maxing out their 401K contributions at $31,500 per year to the Roth source. If they retire at age 65, and their life expectancy is age 90, that Roth contribution could experience 25 years of compounding investment returns and when their child or grandchild inherits the account, because it’s a Roth IRA, they are still subject to the 10 year rule, but they can continue to accumulate returns in that Roth IRA for another 10 years after the decedent passes away and then distribute the full account balance ALL TAX FREE. That is super powerful from a tax free accumulate standpoint.

Very few strategies can come close to replicating the value of this multigenerational wealth accumulation strategy.

One more note about this strategy, Roth sources are not subject to RMDs. Unlike pre-tax retirement plans which force the account owner to begin taking distributions at a specific age, Roth accounts do not have an RMD requirement, so the money can stay in the Roth source and continue to compound investment returns.

Scenario 5: Tax Diversification Strategy

The pre-tax vs Roth deferrals strategy is not an all or nothing decision. You are allowed to allocate any combination of pre-tax and Roth deferrals up to the annual contribution limits each year. For example, a high-income earner under the age of 50 could contribute $13,000 pre-tax and $10,000 Roth in 2024 to reach the $23,000 deferral limit.

Remember, the pre-tax strategy assumes that you will be in lower tax bracket in retirement than you are now, but some individuals have the point of view that with the total U.S. government breaking new debt records every year, at some point they are probably going to have to raise the tax rates to begin to pay back our massive government deficit. If someone is making $300,000 and paying a top Fed tax rate of 24%, even if they expect their income to drop in retirement to $180,000, who’s to say the tax rate on $180,000 income in 20 years won’t be above the current 24% rate if the US government needs to generate more tax return to pay back our national debt?

To hedge against this risk, some high-income earnings will elect to make some Roth deferrals now and pay tax at the current tax rate, and if tax rates go up in the future, anything in that Roth source (unless the government changes the rules) will be all tax free.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

2023 RMDs Waived for Non-spouse Beneficiaries Subject To The 10-Year Rule

There has been a lot of confusion surrounding the required minimum distribution (RMD) rules for non-spouse, beneficiaries that inherited IRAs and 401(k) accounts subject to the new 10 Year Rule. This has left many non-spouse beneficiaries questioning whether or not they are required to take an RMD from their inherited retirement account prior to December 31, 2023. Here is the timeline of events leading up to that answer

There has been a lot of confusion surrounding the required minimum distribution (RMD) rules for non-spouse beneficiaries who inherited IRAs and 401(k) accounts subject to the new 10-Year Rule. This has left many non-spouse beneficiaries questioning whether or not they are required to take an RMD from their inherited retirement account prior to December 31, 2023. Here is the timeline of events leading up to that answer:

December 2019: Secure Act 1.0

In December 2019, Congress passed the Secure Act 1.0 into law, which contained a major shift in the distribution options for non-spouse beneficiaries of retirement accounts. Prior to the passing of Secure Act 1.0, non-spouse beneficiaries were allowed to move these inherited retirement accounts into an inherited IRA in their name, and then take small, annual distributions over their lifetime. This was referred to as the “stretch option” since beneficiaries could keep the retirement account intact and stretch those small required minimum distributions over their lifetime.

Secure Act 1.0 eliminated the stretch option for non-spouse beneficiaries who inherited retirement accounts for anyone who passed away after December 31, 2019. The stretch option was replaced with a much less favorable 10-year distribution rule. This new 10-year rule required non-spouse beneficiaries to fully deplete the inherited retirement account 10 years following the original account owner’s death. However, it was originally interpreted as an extension of the existing 5-year rule, which would not require the non-spouse beneficiary to take annual RMD, but rather, the account balance just had to be fully distributed by the end of that 10-year period.

2022: The IRS Adds RMDs to the 10-Year Rule

In February 2022, the Treasury Department issued proposed regulations changing the interpretation of the 10-year rule. In the proposed regulations the IRS clarified that RMDs would be required for select non-spouse beneficiaries subject to the 10-year rule, depending on the decedent’s age when they passed away. Making some non-spouse beneficiaries subject to the 10-year rule with no RMDs and others subject to the 10-year rule with annual RMDs.

Why the change? The IRS has a rule within the current tax law that states that once required minimum distributions have begun for an owner of a retirement account the account must be depleted, at least as rapidly as a decedent would have, if they were still alive. The 10-year rule with no RMD requirement would then violate that current tax law because an account owner could be 80 years old, subject to annual RMDs, then they pass away, their non-spouse beneficiary inherits the account, and the beneficiary could voluntarily decide not to take any RMDs, and fully deplete the account in year 10 in accordance with the new 10-year rule. So, technically, stopping the RMDs would be a violation of the current tax law despite the account having to be fully depleted within 10 years.

In the proposed guidance, the IRS clarified, that if the account owner had already reached their “Required Beginning Date” (RBD) for required minimum distributions (RMD) while they were still alive, if a non-spouse beneficiary, inherits that retirement account, they would be subject to both the 10-year rule and the annual RMD requirement.

However, if the original owner of the IRA or 401k passes away prior to their Required Beginning Date for RMDs since the RMDs never began if a non-spouse beneficiary inherits the account, they would still be required to deplete the account within 10 years but would not be required to take annual RMDs from the account.

Let’s look at some examples. Jim is age 80 and has $400,000 in a traditional IRA, and his son Jason is the 100% primary beneficiary of the account. Jim passed away in May 2023. Since Jason is a non-spouse beneficiary, he would be subject to the 10-year rule, meaning he would have to fully deplete the account by year 10 following the year of Jim’s death. Since Jim was age 80, he would have already reached his RMD start date, requiring him to take an RMD each year while he was still alive, this in turn would then require Jason to continue those annual RMDs during that 10-year period. Jason’s first RMD from the inherited IRA account would need to be taken in 2024 which is the year following Jim’s death.

Now, let’s keep everything the same except for Jim’s age when he passes away. In this example, Jim passes away at age 63, which is prior to his RMD required beginning date. Now Jason inherits the IRA, he is still subject to the 10-year rule, but he is no longer required to take RMDs during that 10-year period since Jim had not reached his RMD required beginning date at the time that he passed.

As you can see in these examples, the determination as to whether or not a non-spouse beneficiary is subject to the mandatory RMD requirement during the 10-year period is the age of the decedent when they pass away.

No Final IRS Regs Until 2024

The scenario that I just described is in the proposed regulations from the IRS but “proposed regulations” do not become law until the IRS issues final regulations. This is why we advised our clients to wait for the IRS to issue final regulations before applying this new RMD requirement to inherited retirement accounts subject to the 10-year rule.

The IRS initially said they anticipated issuing final regulations in the first half of 2023. Not only did that not happen, but they officially came out on July 14, 2023, and stated that they would not issue final regulations until at least 2024, which means non-spouse beneficiaries of retirement accounts subject to the 10-year rule will not face a penalty for not taking an RMD for 2023, regardless of when the decedent passed away.

Heading into 2024 we will once again have to wait and see if the IRS comes forward with the final regulations to implement the new RMDs rules outlined in their proposed regs.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.