The Hidden Tax Traps in Retirement Most People Miss

Most people think retirement is the end of tax planning. But nothing could be further from the truth. There are several tax traps that retirees encounter, which range from:

How RMDs create tax surprises

How Social Security is taxed

How Medicare Premiums (IRMAA) are affected by income

A lack of tax-specific distribution planning

We will be covering each of these tax traps in this article to assist retirees in avoiding these costly mistakes in the retirement years.

RMD Tax Surprises

Once you reach a specific age, the IRS requires individuals to begin taking mandatory distributions from their pre-tax retirement accounts, called RMDs (required minimum distributions). Distributions from pre-tax retirement accounts represent taxable income to the retiree, which requires advanced planning to ensure that that income is not realized at an unnecessarily high tax rate.

All too often, Retirees will make the mistake of putting off distributions from their pre-tax retirement accounts until RMDs are required to begin, which allows the pretax accounts to accumulate and become larger during retirement, which in turn requires larger distributions once the RMD start age is reached.

Here is a common example: Tim and Sue retire from New York State at age 55 and both have pensions that are more than enough to meet their current expenses. Both of them also have retirement accounts through NYS, totaling $500,000. Assuming Tim and Sue start taking their required minimum distributions (RMDs) at age 75, and since Tim and Sue do not need to take withdrawals from their retirement account to supplement their income, those retirement accounts could grow to over $1,000,000. This sounds like a good thing, but it creates a potential tax problem. By age 75, they’ll both be receiving their pensions and have turned on Social Security, which under current tax law is 85% taxable at the federal level. On top of that, they’ll need to take a required minimum distribution of $37,735 which stacks up on top of all their other income sources.

This additional income from age 75 and beyond could:

Be subject to higher tax rates

Trigger higher Medicare Premiums

Cause them to phase out of certain tax deductions or credits

In hindsight, it may have been more prudent for Tim & Sue to begin taking distributions from their retirement accounts each year beginning the year after they retired, to avoid many of these unforeseen tax consequences 20 years after they retired.

How Is Social Security Taxed?

I start this section by saying, based on current law, because the Trump administration has on its agenda to make social security tax-free at the Federal level. At the time of this article, social security is potentially subject to taxation at the federal level for individuals based on their income. A handful of states also tax social security benefits.

Here is a quick summary of the proportion of social security benefits subject to taxation at the Federal level in 2025:

0% Taxable: Combined income for single filers below $25,000 and joint filers below $32,000.

50% Taxable: Combined income for single filers between $25,000 - $34,000 and joint filers between $32,000 - $44,000

85% Taxable: Combined income for single filers above $34,000 and joint filers above $44,000.

One-time events that occur in retirement could dramatically impact the amount of a retiree's social security benefit, subject to taxation. For example, a retiree might sell a stock at a gain in a brokerage account, surrender an insurance policy, earn part-time income, or take a distribution from a pre-tax retirement account. Any one of these events could inadvertently trigger a larger tax liability associated with the amount of an individual’s social security that is subject to taxation at the Federal level.

Medicare Premiums Are Income-Based

When you turn age 65, many retirees discover for the first time that there is a cost associated with enrolling in Medicare, primarily in the form of the Medicare Part B premiums that are deducted directly from a retiree's monthly social security benefit. The tax trap is that if a retiree shows too much income in a given year, it can cause their Medicare premium to increase for 2 years in the future.

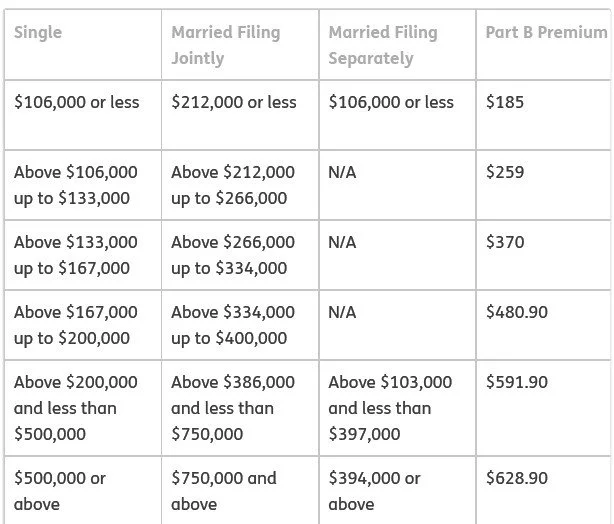

Medicare looks back at your income from two years prior to determine the amount of your Medicare Part B premium in the current year. Here is the Medicare Part B premium table for 2025:

As you can see from the table, as income rises, so does the monthly premium charged by Medicare. There are no additional benefits, the retiree just has to pay more for their Medicare coverage.

This is where those higher RMDs can come back to haunt retirees once they reach the RMD start age. They might be ok between ages 65 – 75, but once they hit age 75 and must start taking RMDs from their pre-tax retirement accounts, those pre-tax RMD’s can sometimes push retirees over the Medicare based premium income threshold, and then they end up paying higher premiums to Medicare for the rest of their lives that could have been avoided.

Lack of Retirement Distribution Planning

All these tax traps surface due to a lack of proper distribution planning as an individual enters retirement. It’s incredibly important for retirees to look at their entire asset picture leading up to retirement, determine the income level that is needed to cover expenses in their retirement year, and then construct a long-term distribution plan that allows them to minimize their tax liability over the remainder of their life expectancy. This may include:

Processing sizable distributions from pre-tax accounts early in the retirement years

Processing Roth conversions

Delaying to file for social security

Developing a tax plan for surrendering permanent life insurance policies

Evaluating pension and annuity elections

A tax plan for realizing gains in taxable investment accounts

Forecasting RMDs at age 73 or 75

Developing a robust distribution plan leading up to retirement can potentially save retirees thousands of dollars in taxes over the long run and avoid many of the pitfalls and tax traps that we reviewed in the article today.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.