Spouse Inherited IRA Options

If your spouse passes away and they had either an IRA, 401(k), 403(b), or some other type of employer sponsored retirement account, you will have to determine which distribution option is the right one for you. There are deadlines that you will need to be aware of, different tax implications based on the option that you choose, forms that need to be

If your spouse passes away and they had either an IRA, 401(k), 403(b), or some other type of employer sponsored retirement account, you will have to determine which distribution option is the right one for you. There are deadlines that you will need to be aware of, different tax implications based on the option that you choose, forms that need to be completed, and accounts that may need to be established.

Spouse Distribution Options

As the spouse, if you are listed as primary beneficiary on a retirement account or IRA, you have more options available to you than a non-spouse beneficiary. Non-spouse beneficiaries that inherited retirement accounts after December 31, 2019 are required to fully distribution the account 10 years following the year that the decedent passed away. But as the spouse of the decedent, you have the following options:

Fulling distribute the retirement account with 10 years

Rollover the balance to an inherited IRA

Rollover the balance to your own IRA

To determine which option is the right choice, you will need to take the following factors into consideration:

Your age

The age of your spouse

Will you need to take money from the IRA to supplement your income?

Taxes

Cash Distributions

We will start with the most basic option which is to take a cash distribution directly from your spouse’s retirement account. Be very careful with this option. When you take a cash distribution from a pre-tax retirement account, you will have to pay income tax on the amount that is distributed to you. For example, if your spouse had $50,000 in a 401(k), and you decide to take the full amount out in the form of a lump sum distribution, the full $50,000 will be counted as taxable income to you in the year that the distribution takes place. It’s like receiving a paycheck from your employer for $50,000 with no taxes taken out. When you go to file your taxes the following year, a big tax bill will probably be waiting for you.

In most cases, if you need some or all of the cash from a 401(k) account or an IRA, it usually makes more sense to first rollover the entire balance into an inherited IRA, and then take the cash that you need from there. This strategy gives you more control over the timing of the distributions which may help you to save some money in taxes. If as the spouse, you need the $50,000, but you really need $30,000 now and $20,000 in 6 months, you can rollover the full $50,000 balance to the inherited IRA, take $30,000 from the IRA this year, and take the additional $20,000 on January 2nd the following year so it spreads the tax liability between two tax years.

10% Early Withdrawal Penalty

Typically, if you are under the age of 59½, and you take a distribution from a retirement account, you incur not only taxes but also a 10% early withdrawal penalty on the amount this is distributed from the account. This is not the case when you take a cash distribution, as a beneficiary, directly from the decedents retirement account. You have to report the distribution as taxable income but you do not incur the 10% early withdrawal penalty, regardless of your age.

IRA Options

Let's move onto the two IRA options that are available to spouse beneficiaries. The spouse has the decide whether to:

Rollover the balance into their own IRA

Rollover the balance into an inherited IRA

By processing a direct rollover to an IRA in either case, the beneficiary is able to avoid immediate taxation on the balance in the account. However, it’s very important to understand the difference between these two options because all too often this is where the surviving spouse makes the wrong decision. In most cases, once this decision is made, it cannot be reversed.

Spouse IRA vs Inherited IRA

There are some big differences comparing the spouse IRA and inherited IRA option.

There is common misunderstanding of the RMD rules when it comes to inherited IRA’s. The spouse often assumes that if they select the inherited IRA option, they will be forced to take a required minimum distribution from the account just like non-spouse beneficiaries had to under the old inherited IRA rules prior to the passing of the SECURE Act in 2019. That is not necessarily true. When the spouses establishes an inherited IRA, a RMD is only required when the deceases spouse would have reached age 70½. This determination is based on the age that your spouse would have been if they were still alive. If they are under that “would be” age, the surviving spouse is not required to take an RMD from the inherited IRA for that tax year.

For example, if you are 39 and your spouse passed away last year at the age of 41, if you establish an inherited IRA, you would not be required to take an RMD from your inherited IRA for 29 years which is when your spouse would have turned age 70½. In the next section, I will explain why this matters.

Surviving Spouse Under The Age of 59½

As the surviving spouse, if you are under that age of 59½, the decision between either establishing an inherited IRA or rolling over the balance into your own IRA is extremely important. Here’s why .

If you rollover the balance to your own IRA and you need to take a distribution from that account prior to reaching age 59½, you will incur both taxes and the 10% early withdrawal penalty on the amount of the distribution.

But wait…….I thought you said the 10% early withdrawal penalty does not apply?

The 10% early withdrawal penalty does not apply for distributions from an “inherited IRA” or for distributions to a beneficiary directly from the decedents retirement account. However, since you moved the balance into your own IRA, you have essentially forfeited the ability to avoid the 10% early withdrawal penalty for distributions taken before age 59½.

The Switch Strategy

There is also a little know “switch strategy” for the surviving spouse. Even if you initially elect to rollover the balance to an inherited IRA to maintain the ability to take penalty free withdrawals prior to age 59½, at any time, you can elect to rollover that inherited IRA balance into your own IRA.

Why would you do this? If there is a big age gap between you and your spouse, you may decide to transition your inherited IRA to your own IRA prior to age 59½. Example, let’s assume the age gap between you and your spouse was 15 years. In the year that you turn age 55, your spouse would have turned age 70½. If the balance remains in the inherited IRA, as the spouse, you would have to take an RMD for that tax year. If you do not need the additional income, you can choose to rollover the balance from your inherited IRA to your own IRA and you will avoid the RMD requirement. However, in doing so, you also lose the ability to take withdrawals from the IRA without the 10% early withdrawal penalty between ages 55 to 59½. Based on your financial situation, you will have to determine whether or not the “switch strategy” makes sense for you.

The Spousal IRA

So when does it make sense to rollover your spouse’s IRA or retirement account into your own IRA? There are two scenarios where this may be the right solution:

The surviving spouse is already age 59½ or older

The surviving spouse is under the age of 59½ but they know with 100% certainty that they will not have to access the IRA assets prior to reaching age 59½

If the surviving spouse is already 59½ or older, they do not have to worry about the 10% early withdrawal penalty.

For the second scenarios, even though this may be a valid reason, it begs the question: “If you are under the age of 59½ and you have the option of changing the inherited IRA to your own IRA at any time, why take the risk?”

As the spouse you can switch from inherited IRA to your own IRA but you are not allowed to switch from your own IRA to an inherited IRA down the road.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Big Changes For 401(k) Hardship Distributions

While it probably seems odd that there is a connection between the government passing a budget and your 401(k) plan, this year there was. On February 9, 2018, the Bipartisan Budget Act of 2018 was passed into law which ended the government shutdown by raising the debt ceiling for the next two years. However, also buried in the new law were

While it probably seems odd that there is a connection between the government passing a budget and your 401(k) plan, this year there was. On February 9, 2018, the Bipartisan Budget Act of 2018 was passed into law which ended the government shutdown by raising the debt ceiling for the next two years. However, also buried in the new law were changes to rules that govern hardship distributions in 401(k) plans.

What Is A Hardship Distribution?

A hardship distribution is an optional distribution feature within a 401(k) plan. In other words, your 401(k) plan may or may not allow them. To answer that question, you will have to reference the plan’s Summary Plan Description (SPD) which should be readily available to plan participants.

If your plan allows hardship distributions, they are one of the few in-service distribution options available to employees that are still working for the company. There are traditional in-service distributions which allow employees to take all or a portion of their account balance after reaching the age 59½. By contrast, hardship distributions are for employees that have experienced a “financial hardship”, are still employed by the company, and they are typically under the age of 59½.

Meeting The "Hardship" Requirement

First, you have to determine if your financial need qualifies as a "hardship". They typically include:

Unreimbursed medical expenses for you, your spouse, or dependents

Purchase of an employee's principal residence

Payment of college tuition and relative education costs such as room and board for the next 12 months for you, your spouse, dependents, or children who are no longer dependents.

Payment necessary to prevent eviction of you from your home, or foreclosure on the mortgage of your primary residence

For funeral expenses

Certain expenses for the repair of damage to the employee's principal residence

Second, there are rules that govern how much you can take out of the plan in the form of a hardship distribution and restrictions that are put in place after the hardship distribution is taken. Below is a list of the rules under the current law:

The withdrawal must not exceed the amount needed by you

You must first obtain all other distribution and loan options available in the plan

You cannot contribute to the 401(k) plan for six months following the withdrawal

Growth and investment gains are not eligible for distribution from specific sources

Changes To The Rules Starting In 2019

Plan sponsors need to be aware that starting in 2019 some of the rules surrounding hardship distributions are going to change in conjunction with the passing of the Budget Act of 2018. The reasons for taking a hardship distribution did not change. However, there were changes made to the rules associated with taking a hardship distribution starting in 2019. More specifically, of the four rules listed above, only one will remain.

No More "6 Month Rule"

The Bipartisan Budget Act of 2018 eliminated the rule that prevents employees from making 401(k) contributions until 6 months after the date the hardship distribution was issued. The purpose of the 6 month wait was to deter employees from taking a hardship distribution. In addition, for employees that had to take a hardship it was a silent way of implying that “if things are bad enough financially that you have to take a distribution from your retirement account, you probably should not be making contributions to your 401(k) plan for the next few months.”

However, for employees that are covered by a 401(k) plan that offers an employer matching contribution, not being able to defer in the plan for 6 months also meant no employer matching contribution during that 6 month probationary period. Starting in 2019, employees will no longer have to worry about that limitation.

Loan First Rule Eliminated

Under the current 401(k) rules, if loans are available in the 401(k) plan, the plan participant was required to take the maximum loan amount before qualifying for a hardship distribution. That is no longer a requirement under the new law.

We are actually happy to see this requirement go away. It never really made sense to us. If you have an employee, who’s primary residence is going into foreclosure, why would you make them take a loan which then requires loan payments to be made via deductions from their paycheck? Doesn’t that put them in a worse financial position? Most of the time when a plan participant qualifies for a hardship, they need the money as soon as possible and having to go through the loan process first can delay the receipt of the money needed to remedy their financial hardship.

Earnings Are Now On The Table

Under the current 401(k) rules, if an employee requests a hardship distribution, the portion of their elective deferral source attributed to investment earnings was not eligible for withdrawal. Effective 2019, that rule has also changed. Both contributions and earnings will be eligible for a hardship withdrawal.

Still A Last Resort

We often refer to hardship distributions as the “option of last resort”. This is due to the taxes and penalties that are incurred in conjunction with hardship distributions. Unlike a 401(k) loan which does not trigger immediate taxation, hardship distributions are a taxable event. To make matters worse, if you are under the age of 59½, you are also subject to the 10% early withdrawal penalty.

For example, if you are under the age of 59½ and you take a $20,000 hardship distribution to make the down payment on a house, you will incur taxes and the 10% penalty on the $20,000 withdrawal. Let’s assume you are in the 24% federal tax bracket and 7% state tax bracket. That $20,000 distribution just cost you $8,200 in taxes.

Gross Distribution: $20,000

Fed Tax (24%): ($4,800)

State Tax (7%): ($1,400)

10% Penalty: ($2,000)

Net Amount: $11,800

There is also an opportunity cost for taking that money out of your retirement account. For example, let’s assume you are 30 years old and plan to retire at age 65. If you assume an 8% annual rate of return on your 401(K) investment that $20,000 really cost you $295,707. That’s what the $20,000 would have been worth, 35 years from now, compounded at 8% per year.

Plan Amendment Required

These changes to the hardship distribution rule will not be automatic. The plan sponsor of the 401(k) will need to amend the plan document to adopt these new rules otherwise the old hardship distribution rules will still apply. We recommend that companies reach out to their 401(k) providers to determine whether or not amending the plan to adopt the new hardship distribution rules makes sense for the company and your employees.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Procedures For Splitting Retirement Accounts In A Divorce

If you are going through a divorce and you or your spouse have retirement accounts, the processes for splitting the retirement accounts will vary depending on what type of retirement accounts are involved.

If you are going through a divorce and you or your spouse have retirement accounts, the processes for splitting the retirement accounts will vary depending on what type of retirement accounts are involved.

401(k) & 403(b) Plan

The first category of retirement plans are called ?employer sponsored qualified plans?. This category includes 401(k) plans, 403(b) plans, 457 plans, and profit sharing plans. Once you and your spouse have agreed upon the split amount of the retirement plans, one of the attorneys will draft Domestic Relations Order, otherwise known as a QDRO. This document provides instruction to the plans TPA (third party administrator) as to how and when to split the retirement assets between the ex-spouses. Here is the procedures from start to finish:

One attorney drafts the Domestic Relations Order (?DRO?)

The attorney for the other spouse reviews and approved the DRO

The spouse covered by the retirement plan submits it to the TPA for review

The TPA will review the document and respond with changes that need to be made (if any)

Attorneys submit the DRO to the judge for signing

Once the judge has signed the DRO, its now considered a Qualified Domestic Relations Order (QDRO)

The spouse covered by the retirement plan submits the QDRO to the plans TPA for processing

The TPA splits the retirement account and will often issues distribution forms to the ex-spouse not covered by the plan detailing the distribution options

Step number four is very important. Before the DRO is submitting to the judge for signing, make sure that the TPA, that oversees the plan being split, has had a chance to review the document. Each plan is different and some plans require unique language to be included in the DRO before the retirement account can be split. If the attorneys skip this step, we have seen cases where they go through the entire process, pay the court fees to have the judge sign the QDRO, they submit the QDRO for processing with the TPA, and then the TPA firm rejects the QDRO because it is missing information. The process has to start all over again, wasting time and money.

Pension Plans

Like employer sponsored retirement plans, pension plans are split through the drafting of a Qualified Domestic Relations Order (QDRO). However, unlike 401(k) and 403(b) plans that usually provide the ex-spouse with distribution options as soon as the QDRO is processed, with pension plans the benefit is typically delayed until the spouse covered by the plan is eligible to begin receiving pension payments. A word of caution, pension plans are tricky. There are a lot more issues to address in a QDRO document compared to a 401(k) plan. 401(k) plans are easy. With a 401(k) plan you have a current balance that can be split immediately. Pension plan are a promise to pay a future benefit and a lot can happen between now and the age that the covered spouse begins to collect pension payments. Pension plans can terminate, be frozen, employers can go bankrupt, or the spouse covered by the retirement plan can continue to work past the retirement date.

I would like to specifically address the final option in the paragraph above. In pension plans, typically the ex-spouse is not entitled to a benefit until the spouse covered by the pension plan is eligible to receive benefits. While the pension plan may state that the employee can retire at 65 and start collecting their pension, that does not mean that they will with 100% certainty. We have seen cases where the ex-husband could have retired at age 65 and started collecting his pension benefit but just to prevent his ex-wife from collecting on his benefit decided to delay retirement which in turn delayed the pension payments to his ex-wife. The ex-wife had included those pension payments in her retirement planning but had to keep working because the ex-husband delayed the benefit. Attorneys will often put language in a QDRO that state that whether the employee retires or not, at a given age, the ex-spouse is entitled to turn on her portion of the pension benefit. The attorneys have to work closely with the TPA of the pension plan to make sure the language in the QDRO is exactly what it need to be to reserve that benefit for the ex-spouse.

IRA (Individual Retirement Accounts)

IRA? are usually the easiest of the three categories to split because they do not require a Qualified Domestic Relations Order to separate the accounts. However, each IRA provider may have different documentation requirements to split the IRA accounts. The account owner should reach out to their investment advisor or the custodian of their IRA accounts to determine what documents are needed to split the account. Sometimes it is as easy as a letter of instruction signed by the owner of the IRA detailing the amount of the split and a copy of the signed divorce agreement. While these accounts are easier to split, make sure the procedures set forth by the IRA custodians are followed otherwise it could result in adverse tax consequences and/or early withdrawal penalties.

About Michael??...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Lower Your Tax Bill By Directing Your Mandatory IRA Distributions To Charity

When you turn 70 1/2, you will have the option to process Qualified Charitable Distributions (QCD) which are distirbution from your pre-tax IRA directly to a chiartable organizaiton. Even though the SECURE Act in 2019 changed the RMD start age from 70 1/2 to age 72, your are still eligible to make these QCDs beginning the calendar year that you

When you turn 70 1/2, you will have the option to process Qualified Charitable Distributions (QCD) which are distribution from your pre-tax IRA directly to a chartable organization. Even though the SECURE Act in 2019 changed the RMD start age from 70 1/2 to age 72, your are still eligible to make these QCDs beginning the calendar year that you turn age 70 1/2. At age 72, you must begin taking required minimum distributions (RMD) from your pre-tax IRA’s and unless you are still working, your employer sponsored retirement plans as well. The IRS forces you to take these distributions whether you need them or not. Why is that? They want to begin collecting income taxes on your tax deferred retirement assets.

Some retirees find themselves in the fortunate situation of not needing this additional income so the RMD’s just create additional tax liability. If you are charitably inclined and would prefer to avoid the additional tax liability, you can make a charitable contribution directly from your IRA and avoid all or a portion of the tax liability generated by the required minimum distribution requirement.

It Does Not Work For 401(k)’s

You can only make “qualified charitable contributions” from an IRA. This option is not available for 401(k), 403(b), and other qualified retirement plans. If you wish to execute this strategy, you would have to process a direct rollover of your FULL 401(k) balance to a rollover IRA and then process the distribution from your IRA to charity.

The reason why I emphases the word “full” for your 401(k) rollover is due to the IRS “aggregation rule”. Assuming that you no longer work for the company that sponsors your 401(k) account, you are age 72 or older, and you have both a 401(k) account and a separate IRA account, you will need to take an RMD from both the 401(k) account and the IRA separately. The IRS allows you to aggregate your IRA’s together for purposes of taking RMD’s. If you have 10 separate IRA’s, you can total up the required distribution amounts for each IRA, and then take that amount from a single IRA account. The IRS does not allow you to aggregate 401(k) accounts for purposes of satisfying your RMD requirement. Thus, if it’s your intention to completely avoid taxes on your RMD requirement, you will have to make sure all of your retirement accounts have been moved into an IRA.

Contributions Must Be Made Directly To Charity

Another important rule. At no point can the IRA distribution ever hit your checking account. To complete the qualified charitable contribution, the money must go directly from your IRA to the charity or not-for-profit organization. Typically this is completed by issuing a “third party check” from your IRA. You provide your IRA provider with payment instructions for the check and the mailing address of the charitable organization. If at any point during this process you take receipt of the distribution from your IRA, the full amount will be taxable to you and the qualified charitable contribution will be void.

Tax Lesson

For many retirees, their income is lower in the retirement years and they have less itemized deductions since the kids are out of the house and the mortgage is paid off. Given this set of circumstances, it may make sense to change from itemizing to taking the standard deduction when preparing your taxes. Charitable contributions are an itemized deduction. Thus, if you take the standard deduction for your taxes, you no longer receive the tax benefit of your contributions to charity. By making IRA distributions directly to a charity, you are able to take the standard deduction but still capture the tax benefit of making a charitable contribution because you avoid tax on an IRA distribution that otherwise would have been taxable income to you.

Example: Church Offering

Instead of putting cash or personal checks in the offering each Sunday, you may consider directing all or a portion of your required minimum distribution from your IRA directly to the church or religious organization. Usually having a conversation with your church or religious organization about your new “offering structure” helps to ease the awkward feeling of passing the offering basket without making a contribution each week.

Example: Annual Contributions To Charity

In this example, let’s assume that each year I typically issue a personal check of $2,000 to my favorite charity, Big Brother Big Sisters, a not-for-profit organization. I’m turning 70½ this year and my accountant tells me that it would be more beneficial to take the standard deduction instead of itemizing. My RMD for the year is $5,000. I can contact my IRA provider, have them issuing a check directly to the charity for $2,000 and issue me a check for the remaining $3,000. I will only have to pay taxes on the $3,000 that I received as opposed to the full $5,000. I win, the charity wins, and the IRS kind of loses. I’m ok with that situation.

Don’t Accept Anything From The Charity In Return

This is a very important rule. Sometimes when you make a charitable contribution, as a sign of gratitude, the charity will send you a coffee mug, gift basket, etc. When this happens, you will typically get a letter from the charity confirming your contribution but the amount listed in the letter will be slightly lower than the actual dollar amount contributed. The charity will often reduce the contribution by the amount of the gift that was given. If this happens, the total amount of the charitable contribution fails the “qualified charitable contribution” requirement and you will be taxed on the full amount. Plus, you already gave the money to charity so you have spend the funds that you could use to pay the taxes. Not good

Limits

While this will not be an issue for many of us, there is a $100,000 per person limit for these qualified charitable contributions from IRA’s.

Summary

While there are a number of rules to follow when making these qualified charitable contributions from IRA’s, it can be a great strategy that allows retirees to continue contributing to their favorite charities, religious organizations, and/or not-for-profit organizations, while reducing their overall tax liability.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

5 Options For Money Left Over In College 529 Plans

If your child graduates from college and you are fortunate enough to still have a balance in their 529 college savings account, what are your options for the remaining balance? There are basically 5 options for the money left over in college 529 plans.

If your child graduates from college and you are fortunate enough to still have a balance in their 529 college savings account, what are your options for the remaining balance? There are basically 5 options for the money left over in college 529 plans.

Advanced degree for child

If after the completion of an undergraduate degree, your child plans to continue on to earn a master's degree, law school, or medical school, you can use the remaining balance toward their advanced degree.

Transfer the balance to another child

If you have another child that is currently in college or a younger child that will be attending college at some point, you can change the beneficiary on that account to one of your other children. There is no limit on the number of 529 accounts that can be assigned to a single beneficiary.

Take the cash

When you make withdrawals from 529 accounts for reasons that are not classified as a "qualified education expenses", the earnings portion of the distribution is subject to income taxation and a 10% penalty. Again, only the earnings are subject to taxation and the penalty, your cost basis in the account is not. For example, if my child finishes college and there is $5,000 remaining in their 529 account, I can call the 529 provider and ask them what my cost basis is in the account. If they tell me my cost basis is $4,000 that means that the income taxation and 10% penalty will only apply to $1,000. The rest of the account is withdrawn tax and penalty free.

Reserve the account for a future grandchild

Once your child graduates from college, you can change the beneficiary on the account to yourself. By doing so the account will continue to grow and once your first grandchild is born, you can change the beneficiary on that account over to the grandchild.

Reserve the account for yourself or spouse

If you think it's possible that at some point in the future you or your wife may go back to school for a different degree or advanced degree, you assign yourself as the beneficiary of the account and then use the account balance to pay for that future degree.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Required Minimum Distribution Tax Strategies

If you are turning age 72 this year, this article is for you. You will most likely have to start taking required minimum distributions from your retirement accounts. This article will outline:

If you are turning age 72 this year, this article is for you. You will most likely have to start taking required minimum distributions from your retirement accounts. This article will outline:

Deadlines to take your RMD

Tax implications

Strategies to reduce your tax bill

How is my RMD calculated?

The IRS has a tax table that determines the amount that you have to take out of your retirement accounts each year. To determine your RMD amount you will need to obtain the December 31st balance in your retirement accounts, find your age on the IRS RMD tax table, and divide your 12/31 balance by the number listed next to your age in the tax table.

Exceptions to the RMD requirement........

There are two exceptions. First, Roth IRA’s do not require RMD’s. Second, if you are still working, you maintain a balance in your current employer’s retirement plan, and you are not a 5%+ owner of the company, you do not need to take an RMD from that particular retirement account until you terminate employment with the company. Which leads us to the first tax strategy. If you are age 72 or older and you are still working, you can typically rollover your traditional IRA’s and former employer 401(k)/403(b) accounts into your current employers retirement plan. By doing so, you avoid the requirement to take RMD’s from those retirement accounts outside of your current employers retirement plan and you avoid having to pay taxes on those required minimum distributions. If you are 5%+ owner of the company, you are out of luck. The IRS will still require you to take the RMD from your retirement account even though you are still “employed” by the company.

Deadlines

In the year that you turn 72, if you do not meet one of the exceptions listed above, you will have a very important decision to make. You have the option to take the RMD by 12/31 of that year or wait until the beginning of the following tax year. For your first RMD, the deadline to take the RMD is April 1st of the year following the year that you turn age 72. For example, if you turn 72 on June 2017, you will not be required to take your first RMD until April 1, 2018. If you worked full time from January 2017 – June 2017, it may make sense for you to delay your first RMD until January 2018 because your income will most likely be higher in 2017 because you worked for half of the year. When you take a RMD, like any other distribution from a pre-tax retirement account, it increases the amount of your taxable income for the year. From a pure tax standpoint it usually makes snese to realize income from retirement accounts in years that you are in a lower tax bracket.

SPECIAL NOTE: If you decided to delay your first RMD until after December 31st, you will be required to take two RMD’s in that year. One prior to April 1st and the second before Decemeber 31st. The April 1st rule only applies to your first RMD. You should consult with your accountant to determine the best RMD strategy given your personal income tax situation. For all tax years following the year that you turn age 72, the RMD deadline is December 31st.

VERY IMPORTANT: Do not miss your RMD deadline. The IRS hits you with a lovely 50% excise tax if you fail to take your RMD by the deadline. If you were due a $4,000 RMD and you miss the deadline, the IRS is going to levy a $2,000 excise tax against you.

Contributions to charity to avoid taxes

Another helpful tax strategy, if you make contributions to a charity, a church, or not-for-profit organization, you have the option with IRA’s to direct all or a portion of your RMD directly to these organization. In doing so, you satisfy your RMD but avoid having to pay income tax on the distribution from the IRA. The number one rule here, the distribution must go directly from your IRA account to the not-for-profit organization. At no point during this transaction can the owner of the IRA take possession of cash from the RMD otherwise the full amount will be taxable to the owner of the IRA. Typically the custodian of your IRA will have to issue and mail a third party check directly to the not-for-profit organization.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Traditional vs. Roth IRA’s: Differences, Pros, and Cons

Individual Retirement Accounts (IRA’s) are one of the most popular retirement vehicles available for savers and the purpose of this article is to give a general idea of how IRA’s work, explain the differences between Traditional and Roth IRA’s, and provide some pros and cons of each. In January 2015, The Investment Company Institute put out a research

Individual Retirement Accounts (IRA’s) are one of the most popular retirement vehicles available for savers and the purpose of this article is to give a general idea of how IRA’s work, explain the differences between Traditional and Roth IRA’s, and provide some pros and cons of each. In January 2015, The Investment Company Institute put out a research report with some interesting statistics regarding IRA’s which can be found at the following link, ICI Research Perspective. The article states, “In mid-2014, 41.5 million, or 33.7 percent of U.S. households owned at least one type of IRA”. At first I was slightly shocked and asked myself the following question: “If IRA’s are the most important investment vehicle and source of income for most retirees, how do only one third of U.S. households own one?” Then when I took a step back and considered how money gets deposited into these retirement vehicles this figure begins making more sense.

Yes, a lot of American’s will contribute to IRA’s throughout their lifetime whether it is to save for retirement throughout one’s lifetime or each year when the CPA gives you the tax bill and you ask “What can I do to pay less?” When thinking about IRA’s in this way, one third of American’s owning IRA’s is a scary figure and leads one to believe more than half the country is not saving for retirement. This is not necessarily the case. 401(k) plans and other employer sponsored defined contribution plans have become very popular over the last 20 years and rather than individuals opening their own personal IRA’s, they are saving for retirement through their employer sponsored plan.

Employees with access to these employer plans save throughout their working years and then, when they retire, the money in the company retirement account will be rolled into IRA’s. If the money is rolled directly from the company sponsored plan into an IRA, there is likely no tax or penalty as it is going from one retirement account to another. People roll the balance into IRA’s for a number of reasons. These reasons include the point that there is likely more flexibility with IRA’s regarding distributions compared to the company plan, more investment options available, and the retiree would like the money to be managed by an advisor. The IRA’s allow people to draw on their savings to pay for expenses throughout retirement in a way to supplement income that they are no longer receiving through a paycheck.

The process may seem simple but there are important strategies and decisions involved with IRA’s. One of those items is deciding whether a Traditional, Roth or both types of IRA’s are best for you. In this article we will breakdown Traditional and Roth IRA’s which should illustrate why deciding the appropriate vehicle to use can be a very important piece of retirement planning.

Why are they used?

Both Traditional and Roth IRA’s have multiple uses but the most common for each is retirement savings. People will save throughout their lifetime with the goal of having enough money to last in retirement. These savings are what people are referring to when they ask questions like “What is my number?” Savers will contribute to retirement accounts with the intent to earn money through investing. Tax benefits and potential growth is why people will use retirement accounts over regular savings accounts. Retirees have to cover expenses in retirement which are likely greater than the social security checks they receive. Money is pulled from retirement accounts to cover the expenses above what is covered by social security. People are living longer than they have in the past which means the answer to “What is my number?” is becoming larger since the money must last over a greater period.

How much can I contribute?

For both Traditional and Roth IRA’s, the limit in 2021 for individuals under 50 is the lesser of $6,000 or 100% of MAGI and those 50 or older is the lesser of $7,000 or 100% of MAGI. More limit information can be found on the IRS website Retirement Topics - IRA Contribution Limits

What are the important differences between Traditional and Roth?

Taxation

Traditional (Pre-Tax) IRA: Typically people are more familiar with Traditional IRA’s as they’ve been around longer and allow individuals to take income off the table and lower their tax bill while saving. Each year a person contributes to a Pre-Tax IRA, they deduct the contribution amount from the income they received in that tax year. The IRS allows this because they want to encourage people to save for retirement. Not only are people decreasing their tax bill in the year they make the contribution, the earnings of Pre-Tax IRA’s are not taxed until the money is withdrawn from the account. This allows the account to earn more as money is not being taken out for taxes during the accumulation phase. For example, if I have $100 in my account and the account earns 10% this year, I will have $10 of earnings. Since that money is not taxed, my account value will be $110. That $110 will increase more in the following year if the account grows another 10% compared to if taxes were taken out of the gain. When the money is used during retirement, the individual will be taxed on the amount distributed at ordinary income tax rates because the money was never taxed before. A person’s tax rate during retirement is likely to be lower than while they are working because total income for the year will most likely be less. If the account owner takes a distribution prior to 59 ½ (normal retirement age), there will be penalties assessed.

Roth (After-Tax) IRA: The Roth IRA was established by the Taxpayer Relief Act of 1997. Unlike the Traditional IRA, contributions to a Roth IRA are made with money that has already been subject to income tax. The money gets placed in these accounts with the intent of earning interest and then when the money is taken during retirement, there is no taxes due as long as the account has met certain requirements (i.e. has been established for at least 5 years). These accounts are very beneficial to people who are younger or will not need the money for a significant number of years because no tax is paid on all the earnings that the account generates. For example, if I contribute $100 to a Roth IRA and the account becomes $200 in 15 years, I will never pay taxes on the $100 gain the account generated. If the account owner takes a distribution prior to 59 ½ (normal retirement age), there will be penalties assessed on the earnings taken.

Eligibility

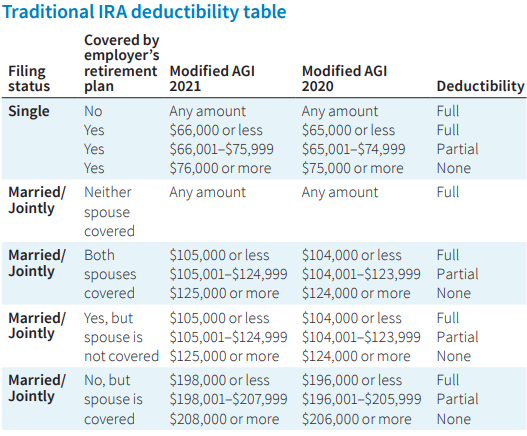

Traditional IRA: Due to the benefits the IRS allows with Traditional IRA’s, there are restrictions on who can contribute and receive the tax benefit for these accounts. Below is a chart that shows who is eligible to deduct contributions to a Traditional IRA:

There are also Required Minimum Distributions (RMD’s) associated with Pre-Tax dollars in IRA’s and therefore people cannot contribute to these accounts after the age of 70 ½. Once the account owner turns 70 ½, the IRS forces the individual to start taking distributions each year because the money has never been taxed and the government needs to start receiving revenue from the account. If RMD’s are not taken timely, there will be penalties assessed.

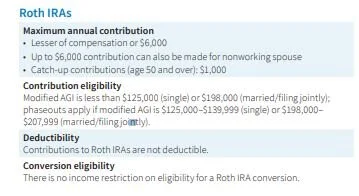

Roth IRA: As long as an individual has earned income, there are only income limitations on who can contribute to Roth IRA’s. The limitations for 2021 are as follows:

There are a number of strategies to get money into Roth IRA’s as a financial planning strategy. This method is explained in our article Backdoor Roth IRA Contribution Strategy.

Investment Strategies

Investment strategies are different for everyone as individuals have different risk tolerances, time horizons, and purposes for these accounts.

That being said, Roth IRA’s are often times invested more aggressively because they are likely the last investment someone touches during retirement or passes on to heirs. A longer time horizon allows one to be more aggressive if the circumstances permit. Accounts that are more aggressive will likely generate higher returns over longer periods. Remember, Roth accounts are meant to generate income that will never be taxed, so in most cases that account should be working for the saver as long as possible. If money is passed onto heirs, the Roth accounts are incredibly valuable as the individual who inherits the account can continue earning interest tax free.

Choosing the correct IRA is an important decision and is often times more complex than people think. Even if you are 30 years from retiring, it is important to consider the benefits of each and consult with a professional for advice.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.