No Deduction For Entertainment Expenses In 2019. Ouch!!

There is a little known change that was included in tax reform that will potentially have a big impact on business owners. The new tax laws that went into effect on January 1, 2018 placed stricter limits on the ability to deduct expenses associated with entertainment and business meals. Many of the entertainment expenses that businesses

There is a little known change that was included in tax reform that will potentially have a big impact on business owners. The new tax laws that went into effect on January 1, 2018 placed stricter limits on the ability to deduct expenses associated with entertainment and business meals. Many of the entertainment expenses that businesses were able to deduct in 2017 will no longer we allowed in 2018 and beyond. A big ouch for business owners that spend a lot of money entertaining clients and prospects.

A Quick Breakdown Of The Changes

No Deduction in 2019

Prior to 2018, if the business spent money to take a client out to a baseball game, meet a client for 18 holes of golf, or to host a client event, the business would be able to take a deduction equal to 50% of the total cost associated with the entertainment expense. Starting in 2018, you get ZERO. There is no deduction for those expenses.

The new law specifically states that there is no deduction for:

Any activity generally considered to be entertainment, amusement, or recreation

Membership dues to any club organization for recreation or social purpose

A facility, or portion thereof, used in connection with the above items

This will inevitably cause business owners to ask their accountant: “If I spend the same amount on entertainment expenses in 2018 as I did in 2017, how much are the new tax rules going to cost me tax wise?”

Impact On Sales Professionals

If you are in sales and big part of your job is entertaining prospects in hopes of winning their business, if your company can no longer deduct those expenses, are you going to find out at some point this year that the company is going to dramatic limit the resources available to entertain clients? If they end up limiting these resources, how are you supposed to hit your sales numbers and how does that change the landscape of how you solicit clients?

Impact On The Entertainment Industry

This has to be bad news for golf courses, casinos, theaters, and sports arena. As the business owner, if you were paying $15,000 per year for your membership to the local country club and you justified spending that amount because you knew that you could take a tax deduction for $7,500, now what? Now that you can’t deduct any of it, you may decide to cancel your membership or seek out a cheaper alternative.

Impact On Charitable Organizations

How do most charities raise money? Events. As you may have noticed in the chart, in 2017 tickets to a qualified charitable event were 100% deductible. In 2018, it goes from 100% deductible to Zero!! It’s bad enough that the regular entertainment expenses went from 50% to zero but going from 100% to zero hurts so much more. Also charitable events usually have high price tags because they have to cover the cost of event and raise money for the charity. In 2018, it will be interesting to see how charitable organizations get over this hurdle. It may have to disclose right on the registration form for the event that the ticket cost is $500 but $200 of that amount is the cost of the event (non-deductible) and $300 is the charitable contribution.

Exceptions To The New Rules

There are some unique exceptions to the new rules. Many business owners will not find any help within these exceptions but here they are:

Entertainment, amusement, and recreation expenses you treat as compensation to your employees in their wages (In other words, the cost ends up in your employee’s W2)

Expenses for recreation, social, or similar activities, including facilities, primarily for employees, and it can’t be highly compensation employees (“HCE”). In 2018 an HCE employee is an employee that makes more than $120,000 or is a 5%+ owners of the company.

Expenses for entertainment goods, services, and facilities that you sell to customers

What’s The Deal With Meals?

Prior to 2018, employers could deduct 50% of expenses for business-related meals while traveling. Also meals provided to an employee for the convenience of the employer on the employer’s business premises were 100% deductible by the employer and tax-free to the recipient employee.

Starting in 2018, meal expenses incurred while traveling on business remain 50% deductible to the business. However, meals provided via an on-premises cafeteria or otherwise on the employers premise for the convenience of the employer will now be limited to a 50% deduction.

There is also a large debate going on between tax professional as to which meals or drinks may fall into the “entertainment” category and will lose their deduction entirely.

Impact On Business

This is just one of the many “small changes” that was made to the new tax laws that will have a big impact on many businesses. It may very well change the way that businesses spend money to attract new clients. This in turn will most likely lead to unintended negative consequences for organizations that operate in the entertainment, catering, and charitable sectors of the U.S. economy.

Disclosure: For education purposes only. Please seek tax advice from your tax professional

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Tax Reform: Summary Of The Changes

The conference version of the tax bill was released on Friday. The House and the Senate will be voting to approve the updated tax bill this week with what seems to be wide spread support from the Republican party which is all they need to sign the bill into law before Christmas. Most of the changes will not take effect until 2018 with new tax rates for

The conference version of the tax bill was released on Friday. The House and the Senate will be voting to approve the updated tax bill this week with what seems to be wide spread support from the Republican party which is all they need to sign the bill into law before Christmas. Most of the changes will not take effect until 2018 with new tax rates for individuals set to expire in 2025. At which time the tax rates and brackets will return to their current state. Here is a run down of some of the main changes baked into the updated tax bill:

Individual Tax Rates

They are keeping 7 tax brackets with only minor changes to percentages in each bracket. The top tax bracket was reduced from 39.6% to 37%.

Capital Gains Rates

There were no changes to the capital gains rates and they threw out the controversial mandatory FIFO rule for calculating capital gains tax when selling securities.

Standard Deduction and Personal Exemptions

They did double the standard deduction limits. Single tax payers will receive a $12,000 standard deduction and married couples filing joint will receive a $24,000 standard deduction.The personal exemptions are eliminated.

Mortgage Interest Deduction

New mortgages would be capped at $750,000 for purposes of the home mortgage interest deduction.

State and Local Tax Deductions

State and local tax deduction will remain but will be capped at $10,000. An ouch for New York State. That $10,000 can be a combination of your property tax and either sales or income tax (whichever is larger or will get you to the cap of $10,000).Oh and you cannot prepay your 2018 state income taxes in 2017 to avoid the cap. They made it clear that if you prepay your 2018 state income taxes in 2017, you will not be able to deduct them in 2017.

Medical Expense Deductions

Medical expense deductions will remain for 2017 and 2018 and they lowered the AGI threshold to 7.5%. Beginning in 2019, the threshold will change back to the 10% threshold.

Miscellaneous Expense Deductions

Under the current rules, you are able to deduct miscellaneous expenses that exceed 2% of your AGI. That was eliminated. This includes unreimbursed business expenses and home office expenses.

A Few Quick Ones

Student Loan Interest: Still deductible

Teacher Out-of-Pocket Expenses: Still deductible

Tuition Waivers: Still not taxable

Fringe Benefits (including moving expenses): Will be taxable starting in 2018 (except for military)

Child Tax Credit: Doubled to $2,000 per child

Gain Exclusion On Sale Of Primary Residence: No Change

Obamacare Individual Mandate: Eliminated

Corporate AMT: Eliminated

Individual AMT: Remains but exemption is increased: Individuals: $70,300 Married: $109,400

Corporate Tax Rate: Drops to 21% in 2018

Federal Estate Tax: Remains but exemption limit doubles

Alimony

For divorce agreements signed after December 31, 2018, alimony will no longer be deducible. This only applies to divorce agreements executed or modified after December 31, 2018.

529 Plans

Under current tax law, you do not pay taxes on the earnings for distributions from 529 accounts for qualified college expenses. The new tax reform allows 529 account owners to distribute up to $10,000 per student for public, private and religious elementary and secondary schools, as well as home school students.

Pass-Through Income For Business

This is still a little cloudy but in general under the conference bill, owners of pass-through companies and sole proprietors will be taxed at their individual tax rates less a 20% deduction for business-related income, subject to certain wage limits and exceptions. The deduction would be disallowed for businesses offering "professional services" above a threshold amount; phase-ins begin at $157,500 for individual taxpayers and $315,000 for married taxpayers filing jointly.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Tax Reform: At What Cost?

The Republicans are in a tough situation. There is a tremendous amount of pressure on them to get tax reform done by the end of the year. This type of pressure can have ugly side effects. It’s similar to the Hail Mary play at the end of a football game. Everyone, including the quarterback, has their eyes fixed on the end zone but nobody realizes that no

The Republicans are in a tough situation. There is a tremendous amount of pressure on them to get tax reform done by the end of the year. This type of pressure can have ugly side effects. It’s similar to the Hail Mary play at the end of a football game. Everyone, including the quarterback, has their eyes fixed on the end zone but nobody realizes that no one is covering one of the defensive lineman and he’s just waiting for the ball to be hiked. The game ends without the ball leaving the quarterback’s hands.

The Big Play

Tax reform is the big play. If it works, it could lead to an extension of the current economic rally and more. I’m a supporter of tax reform for the purpose of accelerating job growth both now and in the future. It’s not just about U.S. companies keeping jobs in the U.S. That has been the game for the past two decades. The new game is about attracting foreign companies to set up shop in the U.S. and then hire U.S. workers to run their plants, companies, subsidiaries, etc. Right now we have the highest corporate tax rate in the world which has not only prevented foreign companies from coming here but it has also caused U.S. companies to move jobs outside of the United States. If everyone wants more pie, you have to focus on making the pie bigger, otherwise we are all just going to sit around and fight over who’s piece is bigger.

Easier Said Than Done

How do we make the pie bigger? We have to lower the corporate tax rate which will entice foreign companies to come here to produce the goods and services that they are already selling in the U.S. Which is easy to do if the government has a big piggy bank of money to help offset the tax revenue that will be lost in the short term from these tax cuts. But we don’t.

$1.5 Trillion In Debt Approved

Tax reform made some headway in mid-October when the Senate passed the budget. Within that budget was a provision that would allow the national debt to increase by approximately $1.5 trillion dollars to help offset the short-term revenue loss cause by tax reform. While $1.5 trillion sounds like a lot of money, and don’t get me wrong, it is, let’s put that number in context with some of the proposals that are baked into the proposed tax reform.

Pass-Through Entities

One of the provisions in the proposed tax reform is that income from “pass-through” businesses would be taxed at a flat rate of 25%.

A little background on pass-through business income: sole proprietorships, S corporations, limited liability companies (LLCs), and partnerships are known as pass-through businesses. These entities are called pass-throughs, because the profits of these firms are passed directly through the business to the owners and are taxed on the owners’ individual income tax returns.

How many businesses in the U.S. are pass-through entities? The Tax Foundation states on its website that pass-through entities “make up the vast majority of businesses and more than 60 percent of net business income in America. In addition, pass-through businesses account for more than half of the private sector workforce and 37 percent of total private sector payroll.”

At a conference in D.C., the American Society of Pension Professionals and Actuaries (ASPPA), estimated that the “pass through 25% flat tax rate” will cost the government $6 trillion - $7 trillion in tax revenue. That is a far cry from the $1.5 trillion that was approved in the budget and remember that is just one of the many proposed tax cuts in the tax reform package.

Are Democrats Needed To Pass Tax Reform?

Since $1.5 trillion was approved in the budget by the senate, if the proposed tax reform is able to prove that it will add $1.5 trillion or less to the national debt, the Republicans can get tax reform passed through a “reconciliation package” which does not require any Democrats to step across the aisle. If the tax reform forecasts exceed that $1.5 trillion threshold, then they would need support from a handful of Democrats to get the tax reformed passed which is unlikely.

Revenue Hunting

To stay below that $1.5 trillion threshold, the Republicans are “revenue hunting”. For example, if the proposed tax reform package is expected to cost $5 trillion, they would need to find $3.5 trillion in new sources of tax revenue to get the net cost below the $1.5 trillion debt limit.

State & Local Tax Deductions – Gone?

One for those new revenue sources that is included in the tax reform is taking away the ability to deduct state and local income taxes. This provision has created a divide among Republicans. Since many southern states do not have state income tax, many Republicans representing southern states support this provision. Visa versa, Republicans representing states from the northeast are generally opposed to this provision since many of their states have high state and local incomes taxes. There are other provisions within the proposed tax reform that create the same “it depends on where you live” battle ground within the Republican party.

Obamacare

One of the main reasons why the Trump administration pushed so hard for the Repeal and Replace of Obamacare was “revenue hunting”. They needed the tax savings from the repeal and replace of Obamacare to carrry over to fill the hole that will be created by the proposed tax reform. Since that did not happen, they are now looking high and low for other revenue sources.

Retirement Accounts At Risk?

If the Republicans fail to get tax reform through they run the risk of losing face with their supporters since they have yet to get any of the major reforms through that they campaigned on. Tax reform was supposed to be a layup, not a Hail Mary and this is where the hazard lies. Republicans, out of the desperation to get tax reform through, may start making cuts where they shouldn’t. There are rumors that the Republican Party may consider making cuts to the 401(k) contribution limits and employers sponsored retirement plan. Even though Trump tweeted on October 23, 2017 that he would not touch 401(k)’s as part of tax reform, they are running out of the options for other places that they can find new sources of tax revenue. If it comes down to the 1 yard line and they have the make the decision between making deep cuts to 401(k) plans or passing the tax reform, retirement plans may end up being the sacrificial lamb. There are other consequences that retirement plans may face if the proposed tax reform is passed but it’s too broad to get into in this article. We will write a separate article on that topic.

Tax Reform May Be Delayed

Given all the variables in the mix, passing tax reform before December 31st is starting to look like a tall order to fill. If the Republicans are looking for new sources of revenue, they should probably look for sources that are uniform across state lines otherwise they risk splintering the Republican Party like we saw during the attempt to Repeal and Replace Obamacare. We are encouraging everyone to pay attention to the details buried in the tax reform. While I support tax reform to secure the country’s place in the world both now and in the future, if provisions that make up the tax reform are rushed just to get something done, we run the risk of repeating the short lived glory that tax reform saw during the Reagan Era. They passed sweeping tax cuts, the deficits spiked, and they were forced to raise tax rates a few years later.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Traditional vs. Roth IRA’s: Differences, Pros, and Cons

Individual Retirement Accounts (IRA’s) are one of the most popular retirement vehicles available for savers and the purpose of this article is to give a general idea of how IRA’s work, explain the differences between Traditional and Roth IRA’s, and provide some pros and cons of each. In January 2015, The Investment Company Institute put out a research

Individual Retirement Accounts (IRA’s) are one of the most popular retirement vehicles available for savers and the purpose of this article is to give a general idea of how IRA’s work, explain the differences between Traditional and Roth IRA’s, and provide some pros and cons of each. In January 2015, The Investment Company Institute put out a research report with some interesting statistics regarding IRA’s which can be found at the following link, ICI Research Perspective. The article states, “In mid-2014, 41.5 million, or 33.7 percent of U.S. households owned at least one type of IRA”. At first I was slightly shocked and asked myself the following question: “If IRA’s are the most important investment vehicle and source of income for most retirees, how do only one third of U.S. households own one?” Then when I took a step back and considered how money gets deposited into these retirement vehicles this figure begins making more sense.

Yes, a lot of American’s will contribute to IRA’s throughout their lifetime whether it is to save for retirement throughout one’s lifetime or each year when the CPA gives you the tax bill and you ask “What can I do to pay less?” When thinking about IRA’s in this way, one third of American’s owning IRA’s is a scary figure and leads one to believe more than half the country is not saving for retirement. This is not necessarily the case. 401(k) plans and other employer sponsored defined contribution plans have become very popular over the last 20 years and rather than individuals opening their own personal IRA’s, they are saving for retirement through their employer sponsored plan.

Employees with access to these employer plans save throughout their working years and then, when they retire, the money in the company retirement account will be rolled into IRA’s. If the money is rolled directly from the company sponsored plan into an IRA, there is likely no tax or penalty as it is going from one retirement account to another. People roll the balance into IRA’s for a number of reasons. These reasons include the point that there is likely more flexibility with IRA’s regarding distributions compared to the company plan, more investment options available, and the retiree would like the money to be managed by an advisor. The IRA’s allow people to draw on their savings to pay for expenses throughout retirement in a way to supplement income that they are no longer receiving through a paycheck.

The process may seem simple but there are important strategies and decisions involved with IRA’s. One of those items is deciding whether a Traditional, Roth or both types of IRA’s are best for you. In this article we will breakdown Traditional and Roth IRA’s which should illustrate why deciding the appropriate vehicle to use can be a very important piece of retirement planning.

Why are they used?

Both Traditional and Roth IRA’s have multiple uses but the most common for each is retirement savings. People will save throughout their lifetime with the goal of having enough money to last in retirement. These savings are what people are referring to when they ask questions like “What is my number?” Savers will contribute to retirement accounts with the intent to earn money through investing. Tax benefits and potential growth is why people will use retirement accounts over regular savings accounts. Retirees have to cover expenses in retirement which are likely greater than the social security checks they receive. Money is pulled from retirement accounts to cover the expenses above what is covered by social security. People are living longer than they have in the past which means the answer to “What is my number?” is becoming larger since the money must last over a greater period.

How much can I contribute?

For both Traditional and Roth IRA’s, the limit in 2021 for individuals under 50 is the lesser of $6,000 or 100% of MAGI and those 50 or older is the lesser of $7,000 or 100% of MAGI. More limit information can be found on the IRS website Retirement Topics - IRA Contribution Limits

What are the important differences between Traditional and Roth?

Taxation

Traditional (Pre-Tax) IRA: Typically people are more familiar with Traditional IRA’s as they’ve been around longer and allow individuals to take income off the table and lower their tax bill while saving. Each year a person contributes to a Pre-Tax IRA, they deduct the contribution amount from the income they received in that tax year. The IRS allows this because they want to encourage people to save for retirement. Not only are people decreasing their tax bill in the year they make the contribution, the earnings of Pre-Tax IRA’s are not taxed until the money is withdrawn from the account. This allows the account to earn more as money is not being taken out for taxes during the accumulation phase. For example, if I have $100 in my account and the account earns 10% this year, I will have $10 of earnings. Since that money is not taxed, my account value will be $110. That $110 will increase more in the following year if the account grows another 10% compared to if taxes were taken out of the gain. When the money is used during retirement, the individual will be taxed on the amount distributed at ordinary income tax rates because the money was never taxed before. A person’s tax rate during retirement is likely to be lower than while they are working because total income for the year will most likely be less. If the account owner takes a distribution prior to 59 ½ (normal retirement age), there will be penalties assessed.

Roth (After-Tax) IRA: The Roth IRA was established by the Taxpayer Relief Act of 1997. Unlike the Traditional IRA, contributions to a Roth IRA are made with money that has already been subject to income tax. The money gets placed in these accounts with the intent of earning interest and then when the money is taken during retirement, there is no taxes due as long as the account has met certain requirements (i.e. has been established for at least 5 years). These accounts are very beneficial to people who are younger or will not need the money for a significant number of years because no tax is paid on all the earnings that the account generates. For example, if I contribute $100 to a Roth IRA and the account becomes $200 in 15 years, I will never pay taxes on the $100 gain the account generated. If the account owner takes a distribution prior to 59 ½ (normal retirement age), there will be penalties assessed on the earnings taken.

Eligibility

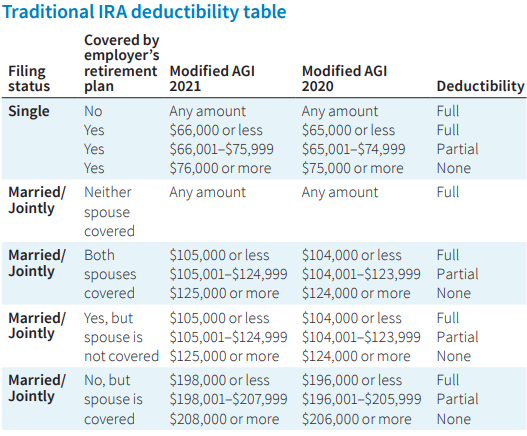

Traditional IRA: Due to the benefits the IRS allows with Traditional IRA’s, there are restrictions on who can contribute and receive the tax benefit for these accounts. Below is a chart that shows who is eligible to deduct contributions to a Traditional IRA:

There are also Required Minimum Distributions (RMD’s) associated with Pre-Tax dollars in IRA’s and therefore people cannot contribute to these accounts after the age of 70 ½. Once the account owner turns 70 ½, the IRS forces the individual to start taking distributions each year because the money has never been taxed and the government needs to start receiving revenue from the account. If RMD’s are not taken timely, there will be penalties assessed.

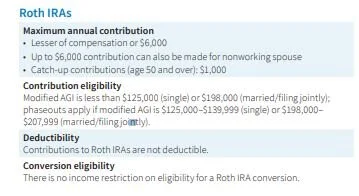

Roth IRA: As long as an individual has earned income, there are only income limitations on who can contribute to Roth IRA’s. The limitations for 2021 are as follows:

There are a number of strategies to get money into Roth IRA’s as a financial planning strategy. This method is explained in our article Backdoor Roth IRA Contribution Strategy.

Investment Strategies

Investment strategies are different for everyone as individuals have different risk tolerances, time horizons, and purposes for these accounts.

That being said, Roth IRA’s are often times invested more aggressively because they are likely the last investment someone touches during retirement or passes on to heirs. A longer time horizon allows one to be more aggressive if the circumstances permit. Accounts that are more aggressive will likely generate higher returns over longer periods. Remember, Roth accounts are meant to generate income that will never be taxed, so in most cases that account should be working for the saver as long as possible. If money is passed onto heirs, the Roth accounts are incredibly valuable as the individual who inherits the account can continue earning interest tax free.

Choosing the correct IRA is an important decision and is often times more complex than people think. Even if you are 30 years from retiring, it is important to consider the benefits of each and consult with a professional for advice.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.