How Much Should I Contribute to Retirement?

A question I’m sure to address during employee retirement presentations is, “How Much Should I be Contributing?”. In this article, I will address some of the variables at play when coming up with your number and provide detail as to why two answers you will find searching the internet are so common.

A question I’m sure to address during employee retirement presentations is, “How Much Should I be Contributing?”. Quick internet search led me to two popular answers.

Whatever you need to contribute to get the match from the employer,

10-15% of your compensation.

As with most questions around financial planning, the answer should really be, “it depends”. We all know it is important to save for retirement, but knowing how much is enough is the real issue and typically there is more work involved than saying 10-15% of your pay.

In this article, I will address some of the variables at play when coming up with your number and provide detail as to why the two answers previously mentioned are so common.

Expenses and Income Replacement

Creating a budget and tracking expenses is usually the best way to estimate what your spending needs will be in retirement. Unfortunately, this is time-consuming and is becoming more difficult considering how easy it is to spend money these days. Automatic payments, subscriptions, payment apps, and credit cards make it easy to purchase but also more difficult to track how much is leaving your bank accounts.

Most financial plans we create start with the client putting together an itemized list of what they believe they spend on certain items like clothes, groceries, vacations, etc. A copy of our expense planner template can be found here. These are usually estimates as most people don’t track expenses in that much detail. Since these are estimates, we will use household income, taxes, and bank/investment accounts as a check to see if expenses appear reasonable.

What do expenses have to do with contributions to your retirement account now? Throughout your career, you receive a paycheck and use those funds to pay for the expenses you have. At some point, you no longer have the paycheck but still have the expenses. Most retirees will have access to social security and others may have a pension, but rarely does that income cover all your expenses. This means that the shortfall often comes from retirement accounts and other savings.

Not taking taxes, inflation, or investment gains into account, if your expenses are $50,000 per year and Social Security income is $25,000 a year, that is a $25,000 shortfall. 20 years of retirement times a $25,000 shortfall means $500,000 you’d need saved to fund retirement. Once we have an estimate of the coveted “What’s My Number?” question, we can create a savings plan to try and achieve that goal.

Cash Flow

As we age, some of the larger expenses we have in life go away. Student loan debt, mortgages, and children are among those expenses that stop at some point in most people’s lives. At the same time, your income is usually higher due to experience and raises throughout your career. As expenses potentially go down and income is higher, there may be cash flow that frees up allowing people to save more for retirement. The ability to save more as we get older means the contribution target amount may also change over time.

Timing of Contributions

Over time, the interest that compounds in retirement accounts often makes up most of the overall balance.

For example, if you contribute $2,000 a year for 30 years into a retirement account, you will end up saving $60,000. If you were able to earn an annual return of 6%, the ending balance after 30 years would be approximately $158,000. $60,000 of contributions and $98,000 of earnings.

The sooner the contributions are in an account, the sooner interest can start compounding. This means, that even though retirement saving is more cash flow friendly as we age, it is still important to start saving early.

Contribute Enough to Receive the Full Employer Match

Knowing the details of your company’s retirement plan is important. Most employers that sponsor a retirement plan make contributions to eligible employees on their behalf. These contributions often come in the form of “Non-Elective” or “Matching”.

Non-Elective – Contributions that will be made to eligible employees whether employees are contributing to the plan or not. These types of contributions are beneficial because if a participant is not able to save for retirement from their own paycheck, the company will still contribute. That being said, the contribution amount made by the employer, on its own, is usually not enough to achieve the level of savings needed for retirement. Adding some personal savings in addition to the employer contribution is recommended.

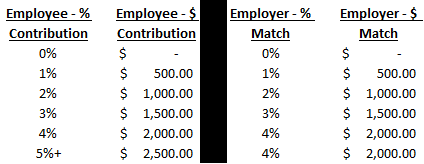

Matching – Employers will contribute on behalf of the employee if the employee is contributing to the plan as well. This means if the employee is contributing $0 to the retirement plan, the company will not contribute. The amount of matching varies by company, so knowing “Match Formula” is important to determine how much to contribute. For example, if the matching formula is “100% of compensation up to 4% of pay”, that means the employer will contribute a dollar-for-dollar match until they contribute 4% of your compensation. Below is an example of an employee making $50,000 with the 4% matching contribution at different contribution rates.

As you can see, this employee could be eligible for a $2,000 contribution from the employer, if they were to save at least 4% of their pay. That is a 100% return on your money that the company is providing.

Any contribution less than 4%, the employee would not be taking advantage of the employer contribution available to them. I’m not a fan of the term “free money”, but that is often the reasoning behind the “Contribute Enough to Receive the Full Employer Match” response.

10%-15% of Your Compensation

As said previously, how much you should be contributing to your retirement depends on several factors and can be different for everyone. 10%-15% over a long-term period is often a contribution rate that can provide sufficient retirement savings. Math below…

Assumptions

Age: 25

Retirement Age: 65

Current Income: $30,000

Annual Raises: 2%

Social Security @ 65: $25,000

Annualized Return: 6%

Step 1: Estimate the Target Balance to Accumulate by 65

On average, people will need an estimated 90% of their income for early retirement spending. As we age, spending typically decreases because people are unable to do a lot of the activities we typically spend money on (i.e. travel). For this exercise, we will assume a 65-year-old will need 80% of their income throughout retirement.

Present Salary - $30,000

Future Value After 40 Years of 2% Raises - $65,000

80% of Future Compensation - $52,000

$52,000 – income needed to replace

$25,000 – social security @ 65

$27,000 – amount needed from savings

X 20 – years of retirement (Age 85 - life expectancy)

$540,000 – target balance for retirement account

Step 2: Savings Rate Needed to Achieve $540,000 Target Balance

40 years of a 10% annual savings rate earning 6% interest per year, this person could have an estimated balance of $605,000. $181,000 of contributions and $424,000 of compounded interest.

I hope this has helped provide a basic understanding of how you can determine an appropriate savings rate for yourself. We recommend reaching out to an advisor who can customize your plan based on your personal needs and goals.

About Rob……...

Hi, I’m Rob Mangold, Partner at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

How Pension Income and Retirement Account Withdrawals Can Impact Unemployment Benefits

How Pension Income and Retirement Account Withdrawals Can Impact Unemployment Benefits As the economy continues to slow, unemployment claims continue to rise at historic rates.

How Pension Income and Retirement Account Withdrawals Can Impact Unemployment Benefits

As the economy continues to slow, unemployment claims continue to rise at historic rates. Due to this expected increase in unemployment, the CARES Act included provisions for Coronavirus related distributions which give people access to retirement dollars with more favorable tax treatment. Details on these distributions can be found here. With retirement dollars becoming more accessible with the CARES Act, a common question we are receiving is “Will a retirement distribution impact my Unemployment Benefits?”.

Unemployment Benefits vary from state to state and therefore the answer to this question can be different depending on the state you reside in. This article will focus on New York State Unemployment Benefits, but a lot of the items discussed may be applied similarly in other states.

The answer to this question also depends on the type of retirement account you are receiving money from so we will touch on the most common.

Note: Typically, to qualify for unemployment insurance benefits, you must have been paid minimum wage during the “base period”. Base period is defined as the first four quarters of the last five calendar quarters prior to the calendar quarter which the claim is effective. “Base period employer” is any employer that paid the claimant during the base period.

Pension Reduction

Money received from a pension that a base period employer contributed to will result in a dollar for dollar reduction in your unemployment benefit. Even if you partially contributed to the pension, 100% of the amount received will result in an unemployment benefit reduction.

If you were the sole contributor to the pension, then the unemployment benefit should not be impacted.

Even if you are retired from a job and receiving a pension, you may still qualify for unemployment benefits if you are actively seeking employment.

Qualified Retirement Plans (examples; 401(k), 403(b))

If the account you are accessing is from a base period employer, a withdrawal from a qualified retirement plan could result in a reduction in your unemployment benefit. It is common for retirement plans to include some type of match or profit-sharing element which would qualify as an employer contribution. Accounts which include employer contributions may result in a reduction of your unemployment benefit.

We recommend you contact the unemployment claims center to determine how these distributions would impact your benefit amount before taking them.

IRA

No unemployment benefit rate reduction will occur if the distribution is from a qualified IRA.Knowing there is no reduction caused by qualified IRA withdrawals, a common practice is rolling money from a qualified retirement plan into an IRA and then accessing it as needed. Once you are no longer at the employer, you are often able to take a distribution from the plan. Rolling it into an IRA and accessing the money from that account rather than directly from the retirement plan could result in a higher unemployment benefit.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Medicare Supplemental Plans ("Medigap") vs. Medicare Advantage Plans

As you approach age 65, there are a lot of very important decisions that you will have to make regarding your Medicare coverage. Since Medicare Parts A & B by itself have deductibles, coinsurance, and no maximum out of pocket

As you approach age 65, there are a lot of very important decisions that you will have to make regarding your Medicare coverage. Since Medicare Parts A & B by itself have deductibles, coinsurance, and no maximum out of pocket protection for retirees, individuals fill in those cost gaps by enrolling in either a Medicare Supplemental Plan or Medicare Advantage Plan. Most retirees have no idea what the differences are between the two options but I would argue that making the right choice is probably one of the most important decisions that you will make as you plan for retirement.

Making the wrong decision could cost you thousands upon thousands of dollars in unexpected medical and prescription drug costs in the form of:

Inadequate coverage

Paying too much for Medicare insurance that you are not using

Healthcare that is provided outside of the plan’s network of doctors and specialists

Expensive prescription drugs

Insurance claims that are denied by the insurance company

Original Medicare

Before we jump into the differences between the two Medicare insurance options, you first have to understand how Original Medicare operates. “Original Medicare” is a combination of your Medicare Part A & Part B benefits. Medicare is sponsored and administered by the Social Security Administration which means that the government is providing you with your healthcare benefits.

Medicare Part A provides you with your coverage for inpatient services. In other words, health care services that are provided to you when you are admitted to the hospital. If you worked for more than 10 years, there is no monthly premium for Part A but it’s not necessarily “free”. Medicare Part A has both deductibles and coinsurance that retirees are required to pay out of pocket prior to Medicare picking up the tab.

Medicare Part B provides you with your outpatient services. This would be your doctor’s visits, lab work, preventative care, medical equipment, etc. Unlike Medicare Part A, Part B has a monthly premium that individuals pay once they enroll in Medicare. For 2020, most individuals will pay $144.60 per month for their Part B coverage. However, in addition to the monthly premiums, Part B also has deductibles and coinsurance. More specifically, Part B has a 20% coinsurance, meaning anything that is paid by Medicare under Part B, you have to pay 20% of the cost out of pocket, and there are no out of pocket maximums associated with Original Medicare. Your financial exposure is unlimited.

Filling In The Gaps

Since in most cases, Original Medicare is inadequate to cover the total cost of your health care in retirement, individuals will purchase Medicare Insurance to fill in the gaps not covered by Original Medicare. Medicare insurance is provided by private health insurance companies and it comes in two flavors:

Medicare Supplemental Plans (Medigap)

Medicare Advantage Plans (Medicare Part C)

Medicare Supplemental Plans (“Medigap”)

We will start off by looking at Medicare Supplemental Plans, also known as Medigap Plans. If you enroll in a Medicare Supplemental Plan, you are keeping your Medicare Part A & B coverage, and then adding a Medicare Insurance Plan on top of it to fill in the costs not covered by Part A & B. Thus, the name “supplemental” because it’s supplementing your Original Medicare benefits.

There are a variety of Medigap plans that you can choose from and each plan has a corresponding letter such as Plan A, Plan D, Plan G, or Plan N. See the grid below:

When you see a line item in the chart that has “100%”, that means the Medigap plan covers 100% of that particular cost that is not otherwise covered by Original Medicare. For example, on the first line you see 100% across the board, that’s because all of the Medigap plans cover 100% of the Medicare Part A coinsurance and hospital costs. As you would expect, the more each plan covers, the higher the monthly premium for that particular plan.

Medigap Plans Are Standardized

It's very important to understand that Medical Supplemental Plans are “standardized” which means by law each plan is required to covers specific services. The only difference is the cost that each insurance company charges for the monthly premium.

For example, Insurance Company A and Insurance Company B both offer a Medigap Plan N. Regardless of which insurance company you purchased the policy through, they provide the exact same coverage and benefits. However, Insurance Company A might charge a monthly premium of $240 for their Plan N but Insurance Company B only charges a monthly premium of $160. The only difference is the cost that you pay. For this reason, it's prudent to get quotes from all of the insurance companies that offer each type of Medigap plan in your zip code.

Some zip codes have only a handful of insurance providers while other zip codes could have 15+ providers. Instead of spending hours of time running around to all the different insurance companies getting quotes, it’s usually helpful to work with an Independent Medicare Broker like Greenbush Financial Group to run all of the quotes for you and identify the lowest cost provider in your area. In addition, there is no additional cost to you for using an independent broker.

Freedom of Choice

By enrolling in a Medicare Supplemental Plan you're allowed to go to any provider that accepts Medicare. You do not have to ask your doctors or specialists if they accept the insurance from the company that is sponsoring your Medigap policy. All you have to ask them is if they accept Medicare. When you access the health care system, the doctor’s office bills Medicare. If Medicare does not cover the total cost of that service but it’s covered under your Medigap plan, Medicare instructs the insurance company to pay it. The insurance company is not allowed to deny the claim.

This provides individuals with flexibility as to how, when, and where their health care services are provided.

Part D – Prescription Drug Plan

If you enroll in a Medigap plan, you will also need to obtain a Part D Prescription Drug plan which is separate from your Medigap plan. Part D plans are sponsored by private insurance companies and carry an additional monthly premium. Based on the prescription drugs that you are currently taking, you can select the plan that best meets your needs and budget.

Medicare Advantage Plans

Now let's switch gears to Medicare Advantage Plans. I will start off by saying loud and clear:

“Medicare Supplemental Plans and Medicare Advantage Plans are NOT the same.”

All too often we ask individuals what type of Medicare plan they have and they reply “a Medigap Plan”, only to find out that they have a Medicare Advantage Plan. The differences are significant and it's important to understand how those differences will impact your health care options in retirement.

Medicare Advantage Plans REPLACE Your Medicare Coverage

Most people don’t realize that when you enroll in a Medicare Advantage Plan it DOES NOT “supplement” your Medicare Part A & B coverage. It actually REPLACES your Medicare coverage. Once enrolled in a Medicare Advantage Plan you are no longer covered by Medicare.

There are pluses and minuses to Medicare Advantage Plans that we are going to cover in the following sections. Remember, your health care needs and budget are custom to your personal situation. Just because your coworker, friend, neighbor, or family member selected a specific type of Medicare Plan, it does not necessarily mean that it’s the right plan for you.

Lower Monthly Premiums

The primary reason why most individuals select a Medicare Advantage Plan over a Medicare Supplemental Plan is cost. In many cases, the monthly premiums for Advantage Plans are lower than Supplemental Plans.

For example, in 2020, in Albany, New York, a Medicare Supplemental Plan G can cost an individual anywhere between $189 to $432 per month depending on the insurance company that they select. Compared to a Medicare Advantage Plan that can cost $0, $34, all the way up to a few hundred dollars per month.

Time Out!! How Do $0 Premium Plans Work?

When I first started learning about Medicare Advantage Plan, when I found out about the $0 premium plans or plans that only cost $34 per month, my questions was “How does the insurance company make money if I’m not paying them a premium each month?”

Here is the answer. Remember that Medicare Part B monthly premium of $144.60 per month that I mentioned in the “Original Medicare” section? When you enroll in a Medicare Advantage Plan, even though you are technically not covered by Medicare any longer, you still have to pay the $144.60 Part B premium to Medicare. However, instead of Medicare keeping it, they collect it from you and then pass it on to the insurance company that is providing your Medicare Advantage Plan.

But wait…..there’s more. Honestly, I almost fell out of my seat what I discovered this little treat. For each person that enrolls in a Medicare Advantage Plan, the government issues a monthly payment to the insurance company over and above that Medicare Part B premium. These payments to the insurance companies from the U.S government vary by zip code but in our area it’s more than $700 per month per person. So the insurance company receives over $8,400 per year from the U.S. government for each person that they have enrolled in one of their Medicare Advantage Plans.

Plus, Advantage Plans typically have co-pays, deductibles, and coinsurance that they collect from the policyholder throughout the year.

Don’t worry about the insurance company, they are getting paid. For me, it just sounded like one of those too good to be true situations so I had to dig deeper.

Insurance Companies WANT To Sell You An Advantage Plan

Since the insurance companies are receiving all of these payments from the government for these Advantage Plans, they are usually very eager to sell you an Advantage Plan as opposed to a Medicare Supplemental Plan. If you go directly to an insurance company to discuss your options, they may not even present a Medicare Supplemental Plan as an option even though that might be the right plan for you. Also be aware, that not all insurance companies offer Medicare Supplemental Plan which is another reason why they may not present it as an option.

Now I’m not saying Medicare Advantage Plans are bad. Medicare Advantage Plans can often be the right fit for an individual. I’m just saying that it’s up to you and you alone to make sure that you fully understand the difference between the two types of plans because both options may not be presented to you in an unbiased fashion.

HMO & PPO Plans

Most Medicare Advantage Plans are structured as either an HMO or PPO plan. If your employer provided you with health insurance during your working years, you may be familiar with how HMO and PPO plans operate.

With HMO plans, the insurance company has a “network” of doctors, hospitals, and service providers that is usually limited to a geographic area that you are required to receive your health care from. If you go outside of that network, you typically have to pay the full cost of those medical bills. There is an exception in most HMO plans for medical emergencies that occur when you are traveling outside of your geographic region.

PPO plans offer individuals more flexibility because they provide coverage for both “in-network” and “out-of-network” providers. Even though the insurance plan provides you with coverage for out-to-network providers, there is typically a higher cost to the policy owner in the form of higher co-pays or coinsurance for utilizing doctors and hospitals that are outside of the plan’s network. Since PPO plans offer you more flexibility than HMO plans, the monthly premiums for PPO are typically higher.

Non-Standardize Plans

Unlike Medicare Supplemental Plans, Medicare Advantage plans are non-standardized plans. This means that the benefits and costs associated with each type of plan are different from insurance company to insurance company. Insurance companies also typically have multiple Medicare Advantage plans to choose from. Each plan has different monthly premiums, benefit structures, drug coverage, and additional benefits. You really have to do your homework with Medicare Advantage Plans to understand what's covered and what's not.

Medicare Advantage plans include prescription drug coverage

Unlike a Medicare Supplemental Plan which typically requires you to obtain a separate Part D plan to cover your prescription drugs, most Medicare Advantage plans include prescription drug coverage within the plan. However, there are some Medicare Advantage plans that don't have prescription drug coverage. Again, you just have to do your homework and make sure the prescription drugs that you are currently taking are covered by that particular Advantage Plan at a reasonable cost.

Changes To The Network

Since Medicare Advantage Plans incentivize individuals to obtain care from “in-network” service providers, it’s important to know that the doctors, hospitals, and prescription drug coverage can change each year. This is less common with Medigap Plans because the doctor or hospital would have to stop accepting Medicare. The coverage for Medicare plans runs from January 1st – December 31st. The insurance company is required to issue you an “Annual Notice of Change” which summarizes any changes to the plans cost or coverage for the upcoming calendar year.

The insurance company will typically send you these notices prior to September 30th and if you find that your doctors or prescription drugs are no longer covered by the plan or covered at a higher rate, you will have the opportunity to change the type of Advantage Plan that you have during the open enrollment period which lasts from October 15th – December 7th each year.

Thus, Medicare Advantage plans tend to require more ongoing monitoring compared to Medicare Supplemental Plans.

Additional Benefits

Medicare Advantage plans sometimes offer additional benefits that Medicare Supplemental Plans do not, such as reimbursement for gym memberships, vision coverage, and dental coverage. These benefits will vary based on the plan and the insurance company that you select.

Maximum Out of Pocket Limits

As mentioned earlier, one of the largest issues with Original Medicare without Medicare Insurance is there is no maximum out of the pocket limits. If you have a major health event, the cost to you can keep stacking up. Medicare Advantage Plans fix that problem because by law they are required to have maximum out of pocket limits. Once you hit that threshold in a given calendar year, you have no more out of pocket costs. The maximum out of pockets limits vary by provider and by plan but Medicare sets a maximum threshold for these amounts which is $6,700 for in-network services. Notice it only applies to in-network services. If you go outside of the carriers network, there may be no maximum out of pocket protection depending on the plan that you choose.

Most Medigap plans do not have maximum out of the pocket thresholds but given the level of protection that most Medigap plans provide, it’s rare that policy holders have large out of pocket expenses.

New York & Connecticut Residents

When it comes to selecting the right type of Medicare Plan for yourself, residents of New York and Connecticut have an added advantage. For most states, if you choose a Medicare Advantage plan you may not have the option to return to Medicare with a Medigap Plan if your health needs change down the road. Most states allow the insurance companies to conduct medical underwriting if you apply for Medicare Supplemental insurance after the initial enrollment period and they can deny you coverage or charge a ridiculously high premium.

In New York and Connecticut, the insurance laws allow you to change back and forth between Medicare Supplemental Plans and Medicare Advantage Plan as of the first of each calendar year. There are even special programs in New York, that if an individual qualifies for based on income, they are allowed to switch mid-year.

While this is a nice option to have, the ability to switch back and forth between the two types of Medicare plans, also makes Medicare Supplemental Plans more expensive in New York and Connecticut. Individuals in those states can elect the lower cost, lower coverage, Medicare Advantage plans, and if their health needs change they know they can automatically switch back to a Medicare Supplemental Plan that provides them with more comprehensive coverage with a lower overall out of pocket cost.

The Plan That Is Right For You

As you can clearly see there are a lot of variables that come into play when trying to determine whether to select a Medicare Supplemental Plan or Medicare Advantage Plan in retirement; it’s a case by case decision. For clients that live in New York, that are in good health, taking very few prescription drugs, a Medicare Advantage plan maybe the right fit for them. For clients that plan to travel in retirement, have two houses, like the flexibility of seeing any specialist that they want, or clients that are in fair to poor health, a Medicare Supplemental Plan may be a better fit.

Undoubtedly if you live outside of New York or Connecticut the decision is even more difficult knowing that people are living longer, as you age your health care needs become greater, and you may only have one shot at obtaining a Medicare Supplemental Plan

No Cost To Work With Us

As independent Medicare brokers we are here to help you navigate the Medicare enrollment process and to obtain the Medicare insurance plan that is right for you. Our goal is to make the process easy, make sure all of your doctors and prescription drugs are covered by your plan, select a plan that meets your budget, and provides you with ongoing support.

The best part is it costs you nothing to work with us. If Insurance Company ABC is offering a Medicare Advantage that cost $0 per month, it’s going to be $0 per month whether you go directly to the insurance company or work with us as your independent broker. As a Medicare broker, we are compensated by the insurance company that issues you the insurance policy and that cost is not passed on to you.

Feel free to contact us at 518-477-6686 for a free consult or we would be more than happy to run quotes for you.

Other Medicare Articles

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Potential Consequences of Taking IRA Distributions to Pay Off Debt

Once there is no longer a paycheck, retirees will typically meet expenses with a combination of social security, withdrawals from retirement accounts, annuities, and pensions. Social security, pensions, and annuities are usually fixed amounts, while withdrawals from retirement accounts could fluctuate based on need. This flexibility presents

Potential Consequences of Taking IRA Distributions to Pay Off Debt

Once there is no longer a paycheck, retirees will typically meet expenses with a combination of social security, withdrawals from retirement accounts, annuities, and pensions. Social security, pensions, and annuities are usually fixed amounts, while withdrawals from retirement accounts could fluctuate based on need. This flexibility presents opportunities to use retirement savings to pay off debt; but before doing so, it is important to consider the possible consequences.

Clients often come to us saying they have some amount left on a mortgage and they would feel great if they could just pay it off. Lower monthly bills and less debt when living on a fixed income is certainly good, both from a financial and psychological point of view, but taking large distributions from retirement accounts just to pay off debt may lead to tax consequences that can make you worse off financially.

Below are three items I typically consider before making a recommendation for clients. Every retiree is different so consulting with a professional such as a financial planner or accountant is recommended if you’d like further guidance.

Impact on State Income and Property Taxes

Depending on what state you are in, withdrawals from IRA’s could be taxed very differently. It is important to know how they are taxed in your state before making any big decision like this. For example, New York State allows for tax free withdrawals of IRA accounts up to a maximum of $20,000 per recipient receiving the funds. Once the $20,000 limit is met in a certain year, any distribution you take above that will be taxed.

If someone normally pulls $15,000 a year from a retirement account to meet expenses and then wanted to pull another $50,000 to pay off a mortgage, they have created $45,000 of additional taxable income to New York State. This is typically not a good thing, especially if in the future you never have to pull more than $20,000 in a year, as you would have never paid New York State taxes on the distributions.

Note: Another item to consider regarding states is the impact on property taxes. For example, New York State offers an “Enhanced STAR” credit if you are over the age of 65, but it is dependent on income. Here is an article that discusses this in more detail STAR Property Tax Credit: Make Sure You Know The New Income Limits.

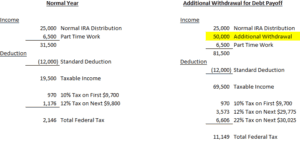

What Tax Bracket Are You in at the Federal Level?

Federal income taxes are determined using a “Progressive Tax” calculation. For example, if you are filing single, the first $9,700 of taxable income you have is taxed at a lower rate than any income you earn above that. Below are charts of the 2019 tax tables so you can review the different tax rates at certain income levels for single and married filing joint ( Source: Nerd Wallet ).

There isn’t much of a difference between the first two brackets of 10% and 12%, but the next jump is to 22%. This means that, if you are filing single, you are paying the government 10% more on any additional taxable income from $39,475 – $84,200. Below is a basic example of how taking a large distribution from the IRA could impact your federal tax liability.

How Will it Impact the Amount of Social Security You Pay Tax on?

This is usually the most complicated to calculate. Here is a link to the 2018 instructions and worksheets for calculating how much of your Social Security benefit will be taxed ( IRS Publication 915 ). Basically, by showing more income, you may have to pay tax on more of your Social Security benefit. Below is a chart put together with information from the IRS to show how much of your benefit may be taxed.

To calculate “Combined Income”, you take your Adjusted Gross Income + Nontaxable Interest + Half of your Social Security benefit. For the purpose of this discussion, remember that any amount you withdraw from your IRA is counted in your Combined Income and therefore could make more of your social security benefit subject to tax.

Peace of mind is key and usually having less bills or debt can provide that, but it is important to look at the cost you are paying for it. There are times that this strategy could make sense, but if you have questions about a personal situation please consult with a professional to put together the correct strategy.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

How To Change Your Residency To Another State For Tax Purposes

If you live in an unfriendly tax state such as New York or California, it’s not uncommon for your retirement plans to include a move to a more tax friendly state once your working years are over. Many southern states offer nicer weather, no income taxes, and lower property taxes. According to data from the US Census Bureau, more residents

If you live in an unfriendly tax state such as New York or California, it’s not uncommon for your retirement plans to include a move to a more tax friendly state once your working years are over. Many southern states offer nicer weather, no income taxes, and lower property taxes. According to data from the US Census Bureau, more residents left New York than any other state in the U.S. Between July 2017 and July 2018, New York lost 180,360 residents and gained only 131,726, resulting in a net loss of 48,560 residents. With 10,000 Baby Boomers turning 65 per day over the next few years, those numbers are expected to escalate as retirees continue to leave the state.

When we meet with clients to build their retirement projections, the one thing anchoring many people to their current state despite higher taxes is family. It’s not uncommon for retirees to have children and grandchildren living close by so they greatly favor the “snow bird” routine. They will often downsize their primary residence in New York and then purchase a condo or small house down in Florida so they can head south when the snow starts to fly.

The inevitable question that comes up during those meetings is “Since I have a house in Florida, how do I become a resident of Florida so I can pay less in taxes?” It’s not as easy as most people think. There are very strict rules that define where your state of domicile is for tax purposes. It’s not uncommon for states to initiate tax audit of residents that leave their state to claim domicile in another state and they split time travelling back and forth between the two states. Be aware, the state on the losing end of that equation will often do whatever it can to recoup that lost tax revenue. It’s one of those guilty until proven innocent type scenarios so taxpayers fleeing to more tax favorable states need to be well aware of the rules.

Residency vs Domicile

First, you have to understand the difference between “residency” and “domicile”. It may sound weird but you can actually be considered a “resident” of more than one state in a single tax year without an actual move taking place but for tax purposes each person only has one state of “domicile”.

Domicile is the most important. Think of domicile as your roots. If you owned 50 houses all around the world, for tax purposes, you have to identify via facts and circumstances which house is your home base. Domicile is important because regardless of where you work or earn income around the world, your state of domicile always has the right to tax all of your income regardless of where it was earned.

While each state recognizes that a taxpayer only has one state of domicile, each state has its own definition of who they considered to be a “resident” for tax purposes. If you are considered a resident of a particular state then that state has the right to tax you on any income that was earned in that state. But they are not allowed to tax income earned or received outside of their state like your state of domicile does.

States Set Their Own Residency Rules

To make the process even more fun, each state has their own criteria that defines who they considered to be a resident of their state. For example, in New York and New Jersey, they consider someone to be a resident if they maintain a home in that state for all or most of the year, and they spend at least half the year within the state (184 days). Other states use a 200 day threshold. If you happen to meet the residency requirement of more than one state in a single year, then two different states could consider you a resident and you would have to file a tax return for each state.

Domicile Is The Most Important

Your state of domicile impacts more that just your taxes. Your state of domicile dictates your asset protection rules, family law, estate laws, property tax breaks, etc. From an income tax standpoint, it’s the most powerful classification because they have right to tax your income no matter where it was earned. For example, your domicile state is New York but you worked for a multinational company and you spent a few months working in Ireland, a few months in New Jersey, and most of the year renting a house and working in Florida. You also have a rental property in Virginia and are co-owners of a business based out of Texas. Even though you did not spend a single day physically in New York during the year, they still have the right to tax all of your income that you earned throughout the year.

What Prevents Double Taxation?

So what prevents double taxation where they tax you in the state where the money is earned and then tax you again in your state of domicile? Fortunately, most states provide you with a credit for taxes paid to other states. For example, if my state of domicile is Colorado which has a 4% state income tax and I earned some wages in New York which has a 7% state income tax rate, when I file my state tax return in Colorado, I will not own any additional state taxes on those wages because Colorado provides me with a credit for the 7% tax that I already paid to New York.

It only hurts when you go the other way. Your state of domicile is New York and you earned wage in Colorado during the year. New York will credit you with the 4% in state tax that you paid to Colorado but you will still owe another 3% to New York State since they have the right to tax all of your income as your state of domicile.

Count The Number Of Days

Most people think that if they own two houses, one in New York and one in Florida, as long as they keep a log showing that they lived in Florida for more than half the year that they are free to claim Florida, the more tax favorable state, as their state of domicile. I have some bad news. It’s not that easy. The key in all of this is to take enough steps to prove that your new house is your home base. While the number of days that you spend living in the new house is a key factor, by itself, it’s usually not enough to win an audit.

That notebook or excel spreadsheet that you used to keep a paper trail of the number of days that you spent at each location, while it may be helpful, the state conducting the audit may just use the extra paper in your notebook to provide you with the long list of information that they are going to need to construct their own timeline. I’m not exaggerating when I say that they will request your credit card statement to see when and where you were spending money, freeway charges, cell phone records with GPS time and date stamps, dentist appointments, and other items that give them a clear picture of where you spent most of your time throughout the year. If you supposedly live in Florida but your dentist, doctors, country club, and newspaper subscriptions are all in New York, it’s going to be very difficult to win that audit. Remember the number of days that you spend in the state is just one factor.

Proving Your State of Domicile

There are a number of action items that you should take if it’s your intent to travel back and forth between two states during the year, and it’s your intent to claim domicile in the more favorable tax state. Here is the list of the action items that you should consider to prove domicile in your state of choice:

Register to vote and physically vote in that state

Register your car and/or boat

Establish gym memberships

Newspapers and magazine subscriptions

Update your estate document to comply with the domicile state laws

Use local doctors and dentists

File your taxes as a resident

Have mail forwarded from your “old house” to your “new house”

Part-time employment in that state

Join country clubs, social clubs, etc.

Host family gatherings in your state of domicile

Change your car insurance

Attend a house of worship in that state

Where your pets are located

Dog Saves Owner $400,000 In Taxes

Probably the most famous court case in this area of the law was the Petition of Gregory Blatt. New York was challenging Mr Blatt’s change of domicile from New York to Texas. While he had taken numerous steps to prove domicile in Texas at the end of the day it was his dog that saved him. The State of New York Division of Tax Appeals in February 2017 ruled that “his change in domicile to Dallas was complete once his dog was moved there”. Mans best friends saved him more than $400,000 in income tax that New York was after him for.

Audit Risk

When we discuss this topic people frequently ask “what are my chances of getting audited?” While some audits are completely random, from the conversations that we have had with accountants in this subject area, it would seem that the more you make, the higher the chances are of getting audited if you change your state of domicile. I guess that makes sense. If your Mr Blatt and you are paying New York State $100,000 per year in income taxes, they are probably going to miss that money when you leave enough to press you on the issue. But if all you have is a NYS pension, social security, and a few small distributions from an IRA, you might have been paying little to no income tax to New York State as it is, so the state has very little to gain by auditing you.

But one of the biggest “no no’s” is changing your state of domicile on January 1st. Yes, it makes your taxes easier because you file your taxes in your old state of domicile for last year and then you get to start fresh with your new state of domicile in the current year without having to file two state tax returns in a single year. However, it’s a beaming red audit flag. Who actually moves on New Year’s Eve? Not many people, so don’t celebrate your move by inviting a state tax audit from your old state of domicile

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Percentage of Pay vs Flat Dollar Amount

Enrolling in a company retirement plan is usually the first step employees take to join the plan and it is important that the enrollment process be straight forward. There should also be a contact, i.e. an advisor (wink wink), who can guide the employees through the process if needed. Even with the most efficient enrollment process, there is a lot of

Retirement Contributions - Percentage of Pay vs Flat Dollar Amount

Enrolling in a company retirement plan is usually the first step employees take to join the plan and it is important that the enrollment process be straight forward. There should also be a contact, i.e. an advisor (wink wink), who can guide the employees through the process if needed. Even with the most efficient enrollment process, there is a lot of information employees must provide. Along with basic personal information, employees will typically select investments, determine how much they’d like to contribute, and document who their beneficiaries will be. This post will focus on one part of the contribution decision and hopefully make it easier when you are determining the appropriate way for you to save.

A common question you see on the investment commercials is “What’s Your Number”? Essentially asking how much do you need to save to meet your retirement goals. This post isn’t going to try and answer that. The purpose of this post is to help you decide whether contributing a flat dollar amount or a percentage of your compensation is the better way for you to save.

As we look at each method, it may seem like I favor the percentage of compensation because that is what I use for my personal retirement account but that doesn’t mean it is the answer for everyone. Using either method can get you to “Your Number” but there are some important considerations when making the choice for yourself.

Will You Increase Your Contribution As Your Salary Increases?

For most employees, as you start to earn more throughout your working career, you should probably save more as well. Not only will you have more money coming in to save but people typically start spending more as their income rises. It is difficult to change spending habits during retirement even if you do not have a paycheck anymore. Therefore, to have a similar quality of life during retirement as when you were working, the amount you are saving should increase.

By contributing a flat dollar, the only way to increase the amount you are saving is if you make the effort to change your deferral amount. If you do a percentage of compensation, the amount you save should automatically go up as you start to earn more without you having to do anything.

Below is an example of two people earning the same amount of money throughout their working career but one person keeps the same percentage of pay contribution and the other keeps the same flat dollar contribution. The percentage of pay person contributes 5% per year and starts at $1,500 at 25. The flat dollar person saves $2,000 per year starting at 25.

The percentage of pay person has almost $50,000 more in their account which may result in them being able to retire a full year or two earlier.

A lot of participants, especially those new to retirement plans, will choose the flat dollar amount because they know how much they are going to be contributing each pay period and how that will impact them financially. That may be useful in the beginning but may harm someone over the long term if changes aren’t made to the amount they are contributing. If you take the gross amount of your paycheck and multiply that amount by the percent you are thinking about contributing, that will give you close to, if not the exact, amount you will be contributing to the plan. You may also be able to request your payroll department to run a quick projection to show the net impact on your paycheck.

There are a lot of factors to take into consideration to determine how much you need to be saving to meet your retirement goals. Simply setting a percentage of pay and keeping it the same your entire working career may not get you all the way to your goal but it can at least help you save more.

Are You Maxing Out?

The IRS sets limits on how much you can contribute to retirement accounts each year and for most people who max out it is based on a dollar limit. For 2024, the most a person under the age of 50 can defer into a 401(k) plan is $23,000. If you plan to max out, the fixed dollar contribution may be easier to determine what you should contribute. If you are paid weekly, you would contribute approximately $442.31 per pay period throughout the year. If the IRS increases the limit in future years, you would increase the dollar amount each pay period accordingly.

Company Match

A company match as it relates to retirement plans is when the company will contribute an amount to your retirement account as long as you are eligible and are contributing. The formula on how the match is calculated can be very different from plan to plan but it is typically calculated based on a dollar amount or a percentage of pay. The first “hurdle” to get over with a company match involved is to put in at least enough money out of your paycheck to receive the full match from the company. Below is an example of a dollar match and a percent of pay match to show how it relates to calculating how much you should contribute.

Dollar for Dollar Match Example

The company will match 100% of the first $1,000 you contribute to your plan. This means you will want to contribute at least $1,000 in the year to receive the full match from the company. Whether you prefer contributing a flat dollar amount or percentage of compensation, below is how you calculate what you should contribute per pay period.

Flat Dollar – if you are paid weekly, you will want to contribute at least $19.23 ($1,000 / 52 weeks = $19.23). Double that amount to $38.46 if you are paid bi-weekly.

Percentage of Pay – if you make $30,000 a year, you will want to contribute at least 3.33% ($1,000 / $30,000).

Percentage of Compensation Match Example

The company will match 100% of every dollar up to 3% of your compensation.

Flat Dollar – if you make $30,000 a year and are paid weekly, you will want to contribute at least $17.31 ($30,000 x 3% = $900 / 52 weeks = $17.31). Double that amount to $34.62 if you are paid bi-weekly.

Percentage of Pay – no matter how much you make, you will want to contribute at least 3%.

If the match is based on a percentage of pay, not only is it easier to determine what you should contribute by doing a percent of pay yourself, you also do not have to make changes to your contribution amount if your salary increases. If the match is up to 3% and you are contributing at least 3% as a percentage of pay, you know you should receive the full match no matter what your salary is.

If you do a flat dollar amount to get the 3% the first year, when your salary increases you will no longer be contributing 3%. For example, if I set up my contributions to contribute $900 a year, at a salary of $30,000 I am contributing 3% of my compensation (900 / 30,000) but at a salary of $35,000 I am only contributing 2.6% (900 / 35,000) and therefore not receiving the full match.

Note: Even though in these examples you are receiving the full match, it doesn’t mean it is always enough to meet your retirement goals, it is just a start.

In summary, either the flat dollar or percentage of pay can be effective in getting you to your retirement goal but knowing what that goal is and what you should be saving to get there is key.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

What Happens To My Pension If The Company Goes Bankrupt?

Given the downward spiral that GE has been in over the past year, we have received the same question over and over again from a number of GE employees and retirees: “If GE goes bankrupt, what happens to my pension?” While it's anyone’s guess what the future holds for GE, this is an important question that any employee with a pension should

Given the downward spiral that GE has been in over the past year, we have received the same question over and over again from a number of GE employees and retirees: “If GE goes bankrupt, what happens to my pension?” While it's anyone’s guess what the future holds for GE, this is an important question that any employee with a pension should know the answer to. While some employees are aware of the PBGC (Pension Benefit Guarantee Corporation) which is an organization that exists to step in and provide pension benefits to employees if the employer becomes insolvent, very few are aware that the PBGC itself may face insolvency within the next ten years. So if the company can’t make the pension payments and the PBGC is out of money, are employees left out in the cold?

Pension shortfall

When a company sponsors a pension plan, they are supposed to make contributions to the plan each year to properly fund the plan to meet the future pension payments that are due to the employees. However, if the company is unable to make those contributions or the underlying investments that the pension plan is invested in underperform, it can lead to shortfalls in the funding.

We have seen instances where a company files for bankruptcy and the total dollar amount owed to the pension plan is larger than the total assets of the company. When this happens, the bankruptcy courts may allow the company to terminate the plan and the PBGC is then forced to step in and continue the pension payments to the employees. While this seems like a great system since up until now that system has worked as an effective safety net for these failed pension plans, the PBGC in its most recent annual report is waiving a red flag that it faces insolvency if Congress does not make changes to the laws that govern the premium payments to the PBGC.

What is the PBGC?

The PBGC is a federal agency that was established in 1974 to protect the pension benefits of employees in the private sector should their employer become insolvent. The PBGC does not cover state or government sponsored pension plans. The number of employees that were plan participants in an insolvent pension plan that now receive their pension payments from the PBGC is daunting. According to the 2017 PBGC annual report, the PBGC “currently provides pension payments to 840,000 participants in 4,845 failed single-employer plans and an additional 63,000 participants across 72 multi-employer plans.”

Wait until you hear the dollar amounts associate with those numbers. The PBGC paid out $5.7 Billion dollars in pension payments to the 840,000 participants in the single-employer plans and $141 Million to the 63,000 participants in the multi-employer plans in 2017.

Where Does The PBGC Get The Money To Pay Benefits?

So where does the PBGC get all of the money needed to make billions of dollars in pension payments to these plan participants? You might have guessed “the taxpayers” but for once that’s incorrect. The PBGC’s operations are financed by premiums payments made by companies in the private sector that sponsor pension plans. The PBGC receive no taxpayer dollars. The corporations that sponsor these pension plans pay premiums to the PBGC each year and the premium amounts are set by Congress.

Single-Employer vs Multi-Employer Plans

The PBGC runs two separate insurance programs: “Single-Employer Program” and “Multi-Employer Program”. It’s important to understand the difference between the two. While both programs are designed to protect the pension benefits of the employees, they differ greatly in the level of benefits guaranteed. The assets of the two programs are also kept separate. If one programs starts to fail, the PBGC is not allowed to shift assets over from the other program to save it.

The single-employer program protects plans that are sponsored by single employers. The PBGC steps in when the employer goes bankrupt or can no longer afford to sponsor the plan. The Single-Employer Program is the larger of the two programs. About 75% of the annual pension payments from the PBGC come from this program. Some examples of single-employer companies that the PBGC has had to step into to make pension payments are United Airlines, Lehman Brothers, and Circuit City.

The Multi-Employer program covers pension plans created and funded through collective bargaining agreements between groups of employers, usually in related industries, and a union. These pension plans are most commonly found in construction, transportation, retail food, manufacturing, and services industries. When a plan runs out of money, the PBGC does not step in and takeover the plan like it does for single-employer plans. Instead, it provides “financial assistance” and the guaranteed amounts of that financial assistants are much lower than the guaranteed amounts offered under the single-employer program. For example, in 2017, the PBGC began providing financial assistance to the United Furniture Workers Pension Fund A (UFW Plan), which covers 10,000 participants.

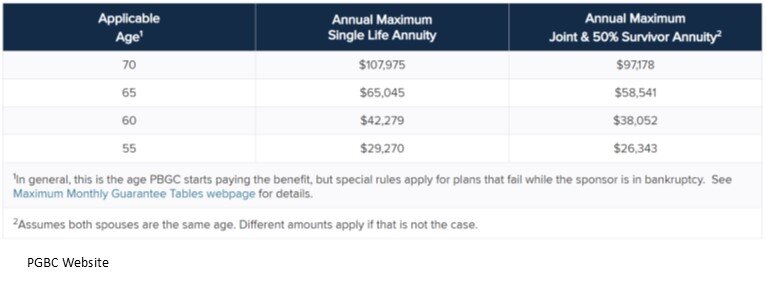

Maximum Guaranteed Amounts

The million dollar question. What is the maximum monthly pension amount that the PBGC will guarantee if the company or organization goes bankrupt? There are maximum dollar amounts for both the single-employer and multi-employer program. The maximum amounts are indexed for inflation each year and are listed on the PBGC website. To illustrate the dramatic difference between the guarantees associated with the pension pensions in a single-employer plan versus a multi-employer plan; here is an example from the PBGC website based on the 2018 rates.

“PBGC’s guarantee for a 65-year-old in a failed single-employer plan can be up to $60,136 annually, while a participant with 30 years of service in a failed multi-employer plan caps out at $12,870 per year. The multi-employer program guarantee for a participant with only 10 years of service caps out at $4,290 per year.”

It’s a dramatic difference.

For the single-employer program the PBGC provides participants with a nice straight forward benefits table based on your age. Below is a sample of the 2018 chart. However, the full chart with all ages can be found on the PBGC website.

Unfortunately, the lower guaranteed amounts for the multi-employer plans are not provided by the PBGC in a nice easy to read table. Instead they provide participant with a formula that is a headache for even a financial planner to sort through. Here is a link to the formula for 2018 on the PBGC website.

PBGC Facing Insolvency In 2025

If the organization guaranteeing your pension plan runs out of money, how much is that guarantee really worth? Not much. If you read the 138 page 2017 annual report issued by the PBGC (which was painful), at least 20 times throughout the report you will read the phase:

“The Multi-employer Program faces very serious challenges and is likely to run out of money by the end of fiscal year 2025.”

They have placed a 50% probability that the multi-employer program runs out of money by 2025 and a 99% probability that it runs out of money by 2036. Not good. The PBGC has urged Congress to take action to fix the problem by raising the premiums charged to sponsors of these multi-employer pension plans. While it seems like a logical move, it’s a double edged sword. While raising the premiums may fix some of the insolvency issues for the PBGC in the short term, the premium increase could push more of the companies that sponsor these plans into bankruptcy.

There is better news for the Single-Employer Program. As of 2017, even though the Single-Employer Program ran a cumulative deficit of $10.9 billion dollars, over the next 10 years, the PBGC is expected to erase that deficit and run a surplus. By comparison the multi-employer program had accumulated a deficit of $65.1 billion dollars by the end of 2017..

Difficult Decision For Employees

While participants in Single-Employer plans may be breathing a little easier after reading this article, if the next recession results in a number of large companies defaulting on their pension obligations, the financial health of the PBGC could change quickly without help from Congress. Employees are faced with a one-time difficult decision when they retire. Option one, take the pension payments and hope that the company and PBGC are still around long enough to honor the pension payments. Or option two, elect the lump sum, and rollover then present value of your pension benefit to your IRA while the company still has the money. The right answer will vary on a case by case basis but the projected insolvency of the PBGC’s Multi-employer Program makes that decision even more difficult for employees.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Volatility, Market Timing, and Long-Term Investing

For many savers, the objective of a retirement account is to accumulate assets while you are working and use those assets to pay for your expenses during retirement. While you are in the accumulation phase, assets are usually invested and hopefully earn a sufficient rate of return to meet your retirement goal. For the majority,

Volatility, Market Timing, and Long-Term Investing

For many savers, the objective of a retirement account is to accumulate assets while you are working and use those assets to pay for your expenses during retirement. While you are in the accumulation phase, assets are usually invested and hopefully earn a sufficient rate of return to meet your retirement goal. For the majority, these accounts are long-term investments and there are certain investing ideas that should be taken into consideration when managing portfolios. This article will discuss volatility, market timing and their role in long-term retirement accounts.

“Market timing is the act of moving in and out of the market or switching between asset classes based on using predictive methods such as technical indicators or economic data” (Investopedia). In other words, trying to sell investments when they are near their highest and buy investments when they are near their lowest. It is difficult, some argue impossible, to time the market successfully enough to generate higher returns. Especially over longer periods. That being said, by reallocating portfolios and not experiencing the full loss during market downturns, investors could see higher returns. When managing portfolios over longer periods, this should be done without the emotion of day to day volatility but by analyzing greater economic trends.

So far, the stock market in 2018 has been volatile; particularly when compared to 2017. Below are charts of the S&P 500 from 1/1/2018 – 10/21/2018 and the same period for 2017.

Source: Yahoo Finance. Information has been obtained from sources believed to be reliable and are subject to change without notification.

Based on the two charts above, one could conclude the majority of investors would prefer 2017 100% of the time. In reality, the market averages a correction of over 10% each year and there are years the market goes up and there are years the market goes down. Currently, the volatility in the market has a lot of investors on edge, but when comparing 2018 to the market historically, one could argue this year is more typical than a year like 2017 where the market had very little to no volatility.

Another note from the charts above are the red and green bars on the bottom of each year. The red represent down days in the market and the green represent up days. You can see that even though there is more volatility in 2018 compared to 2017 when the market just kept climbing, both years have a mixture of down days and up days.

A lot of investors become emotional when the market is volatile but even in the midst of volatility and downturns, there are days the market is up. The chart below shows what happens to long-term portfolio performance if investors miss the best days in the market during that period.

Source: JP Morgan. Information has been obtained from sources believed to be reliable and are subject to change without notification.

Two main takeaways from the illustration above are; 1) missing the best days over a period in the market could have a significant impact on a portfolios performance, and 2) some of the best days in the market over the period analyzed came shortly after the worst days. This means that if people reacted on the worst days and took their money from the market then they likely missed some of the best days.

Market timing is difficult over long periods of time and making drastic moves in asset allocation because of emotional reactions to volatility isn’t always the best strategy for long-term investing. Investors should align their portfolios taking both risk tolerance and time horizon into consideration and make sure the portfolio is updated as each of these change multiple times over longer periods.

When risk tolerance or time horizon do not change, most investors should focus on macro-economic trends rather than daily/weekly/monthly volatility of the market. Not experiencing the full weight of stock market declines could generate higher returns and if data shows the economy may be slowing, it could be a good time to take some “chips off the table”. That being said, looking at past down markets, some of the best days occur shortly after the worst days and staying invested enough to keep in line with your risk tolerance and time horizon could be the best strategy.

It is difficult to take the emotion out of investing when the money is meant to fund your future needs so speaking with your financial consultant to review your situation may be beneficial.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Target Date Funds: A Public Service Announcement

Before getting into the main objective of this article, let me briefly explain a Target Date Fund. Investopedia defines a target date fund as “a fund offered by an investment company that seeks to grow assets over a specified period of time for a targeted goal”. The specified period of time is typically the period until the date you “target” for retirement

Target Date Funds: A Public Service Announcement

Before getting into the main objective of this article, let me briefly explain a Target Date Fund. Investopedia defines a target date fund as “a fund offered by an investment company that seeks to grow assets over a specified period of time for a targeted goal”. The specified period of time is typically the period until the date you “target” for retirement or to start withdrawing assets. For this article, I will refer to the target date as the “retirement date” because that is how Target Date Funds are typically used.

Target Date Funds are continuing to grow in popularity as Defined Contribution Plans (i.e. 401(k)’s) become the primary savings vehicle for retirement. Per the Investment Company Institute, as of March 31, 2018, there was $1.1 trillion invested in Target Date Mutual Funds. Defined Contribution Plans made up 67 percent of that total.

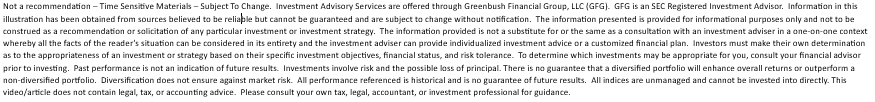

Target Date Funds are often coined as the “set it and forget it” of investments for participants in retirement plans. Target Date Funds that are farther from the retirement date will be invested more aggressively than target date funds closer to the retirement date. Below is a chart showing the “Glide Path” of the Vanguard Target Date Funds. The horizontal access shows how far someone is from retirement and the vertical access shows the percentage of stocks in the investment. In general, more stock means more aggressive. The “40” in the bottom left indicates someone that is 40 years from their retirement date. A common investment strategy in retirement accounts is to be more aggressive when you’re younger and become more conservative as you approach your retirement age. Following this strategy, someone with 40 years until retirement is more aggressive which is why at this point the Glide Path shows an allocation of approximately 90% stocks and 10% fixed income. When the fund is at “0”, this is the retirement date and the fund is more conservative with an allocation of approximately 50% stocks and 50% fixed income. Using a Target Date Fund, a person can become more conservative over time without manually making any changes.

Note: Not every fund family (i.e. Vanguard, American Funds, T. Rowe Price, etc.) has the same strategy on how they manage the investments inside the Target Date Funds, but each of them follows a Glide Path like the one shown below.

The Public Service Announcement

The public service announcement is to remind investors they should take both time horizon and risk tolerance into consideration when creating a portfolio for themselves. The Target Date Fund solution focuses on time horizon but how does it factor in risk tolerance?Target Date Funds combine time horizon and risk tolerance as if they are the same for each investor with the same amount of time before retirement. In other words, each person 30 years from retirement that is using the Target Date strategy as it was intended will have the same stock to bond allocation.This is one of the ways the Target Date Fund solution can fall short as it is likely not possible to truly know somebody’s risk tolerance without knowing them. In my experience, not every investor 30 years from retirement is comfortable with their biggest retirement asset being allocated to 90% stock. For various reasons, some people are more conservative, and the Target Date Fund solution may not be appropriate for their risk tolerance.The “set it and forget it” phrase is often used because Target Date Funds automatically become more conservative for investors as they approach their Target Date. This is a strategy that does work and is appropriate for a lot of investors which is why the strategy is continuing to increase in popularity. The takeaway from this article is to think about your risk tolerance and to be educated on the way Target Date Funds work as it is important to make sure both are in line with each other.For a more information on Target Date Funds please visit https://www.greenbushfinancial.com/target-date-funds-and-their-role-in-the-401k-space/

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

How Much Should I Budget For Health Care Costs In Retirement?

The number is higher than you think. When you total up the deductibles and premiums for Medicare part A, B, and D, that alone can cost a married couple $7,000 per year. We look at that figure as the baseline number. That $7,000 does not account for the additional costs associated with co-insurance, co-pays, dental costs, or Medigap insurance

The number is higher than you think. When you total up the deductibles and premiums for Medicare part A, B, and D, that alone can cost a married couple $7,000 per year. We look at that figure as the baseline number. That $7,000 does not account for the additional costs associated with co-insurance, co-pays, dental costs, or Medigap insurance premiums which can quickly increase the overall cost to $10,000+ per year.

Tough to believe? Allow me to walk you through the numbers for a married couple.

Medicare Part A: $2,632 Per Year

Part A covers inpatient hospital stays, skilled nursing facility stays, some home health visits, and hospice care. While Part A does not have an annual premium, it does have an annual deductible for each spouse. That deductible for 2017 is $1,316 per person.

Medicare Part B: $3,582

Part B covers physician visits, outpatient services, preventive services, and some home health visits. The standard monthly premium is $134 per person but it could be higher depending on your income level in retirement. There is also a deductible of $183 per year for each spouse.

Medicare Part D: $816

Part D covers outpatient prescription drugs through private plans that contract with Medicare. Enrollment in Part D is voluntary. The benefit helps pay for enrollees’ drug costs after a deductible is met (where applicable), and offers catastrophic coverage for very high drug costs. Part D coverage is actually provided by private health insurance companies. The premium varies based on your income and the types of prescriptions that you are taking. The national average in 2017 for Part D premiums is $34 per person.

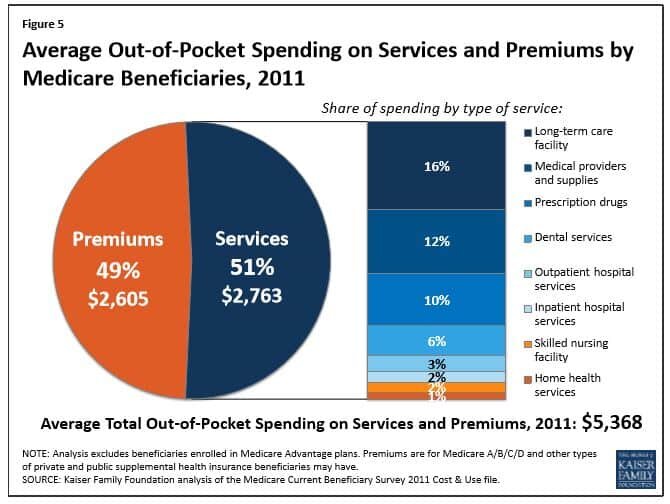

If you total up just these three items, you reach $7,030 in premiums and deductibles for the year. Then you start adding in dental cost, Medigap insurance premiums, co-insurance for Medicare benefits, and it quickly gets a married couple over that $10,000 threshold in health and dental cost each year. Medicare published a report that in 2011, Medicare beneficiaries spent $5,368 out of their own pockets for health care spending, on average. See the table below.

Start Planning Now

Fidelity Investments published a study that found that the average 65 year old will pay $240,000 in out-of-pocket costs for health care during retirement, not including potential long-term-care costs. While that seems like an extreme number, just take the $10,000 that we used above, multiply that by 20 year in retirement, and you get to $200,000 without taking into consideration inflation and other important variable that will add to the overall cost.

Bottom line, you have to make sure you are budgeting for these expenses in retirement. While most individuals focus on paying off the mortgage prior to retirement, very few are aware that the cost of health care in retirement may be equal to or greater than your mortgage payment. When we are create retirement projections for clients we typically included $10,000 to $15,000 in annual expenses to cover health care cost for a married couple and $5,000 – $7,500 for an individual.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.