Trump Tariffs 2025 versus Trump Tariffs 2017 to 2020: The Stock Market Reaction

President Trump just announced tariffs against Canada, Mexico, and China that will go into effect this week, which has sent the stock market sharply lower. I have received multiple emails from clients over the past 24 hours, all asking the same question:

“With the Trump tariffs that were just announced, should we be going to cash?”

President Trump just announced tariffs against Canada, Mexico, and China that will go into effect this week, which has sent the stock market sharply lower. I have received multiple emails from clients over the past 24 hours, many asking the same question:

“With the Trump tariffs that were just announced, should we be going to cash?”

Investors have to remember that we have seen Trump’s tariff playbook during his first term as president between 2017 and 2020, but investors' memories are short, and they forget how the stock market reacted to tariffs during his first term. While history does not always repeat itself, today we are going to look back on how the stock market reacted to the Trump tariffs during his first term, how those tariffs compare in magnitude to new tariffs that were just announced, and what changes investors should be making to their investment portfolio.

Trump Tariffs 2017 – 2020

During Trump’s first term as president, he introduced multiple rounds of tariffs, including the tariffs in 2018 on solar panels, washing machines, steel, and aluminum. The tariffs were levied against Canada, Mexico, and the European Union. Throughout his first term, he also escalated tariffs against China, which led to the news headlines of the trade war during his first four years in office.

How did the U.S. stock market react to these tariff announcements? Similar to today, not good. There were sharp selloffs in the stock market in the days following each tariff announcement, but here were the returns for the S&P 500 Index during Trump’s first term in office:

2017: 21.9%

2018: -4.41%

2019: 31.74%

2020: 18.38%

If we are looking to history as a guide, the first round of Trump tariffs created heightened levels of volatility in the markets, financially harmed specific industries in the U.S., and raised prices on various goods and services throughout the US economy. In the end, despite all of the negative press about the tariffs and trade wars, the U.S. stock market posted solid gains in 3 of the 4 years during Trumps first term as president.

The Trump Tariffs Are Larger This Time

However, we also have to acknowledge the difference between the tariffs that were announced in Trump’s first term and the tariffs that were just announced on February 2, 2025. The tariffs that Trump just announced are dramatically larger than the tariffs that we imposed during his first term, which could translate to a larger impact on the U.S. economy and higher prices. During his first term, Trump was very strategic as to which types of goods would be hit with the tariffs, but the latest round of tariffs is a 25% tariff on ALL goods from Canada and Mexico (with the exception of oil) and a 10% tariff on goods coming from China.

Negotiating Tool

Trump historically has used tariffs as a negotiating tool. During his first term, there were multiple rounds of delays in the tariffs being implemented as trade terms were negotiated; that could happen again. Even if the tariff is implemented this week, it’s tough to estimate how long those tariffs will stay in place, if they will be reduced or increased in coming months, and since they are so widespread this time, which industries in the US will get hit the hardest in this new round of tariffs.

U.S. Unfair Advantage in the Tariff Game

While the trade war / tariff game hurts all countries involved because it ultimately drives prices higher on specific goods and services, investors have to acknowledge the advantage that the United States has over other countries when tariffs are imposed. The U.S……by FAR…..is the largest consumer economy in the WORLD, so when we put tariffs on goods coming into our country, the US consumer historically will begin to shift their buying habits to lower-cost goods or buy less of those higher-cost items.

While the US consumer feels some pain from the impact of higher costs on the imported goods being tariffed, the pain is 3x or 5x for the country that tariffs are being imposed on because it’s immediately impacting their sales in the largest consumer economy in the world. This is why Trump has identified tariffs as such a powerful negotiating tool, even if the action that the president is trying to resolve has nothing to do with trade.

Investor Action

While the knee-jerk reaction to the tariff announcement may be to run for the hills, in our opinion, it’s too soon to make a dramatic shift in investment strategy given the opposing forces of the possible outcomes to the stock market beyond the initial reaction from the stock market. On the positive side of the argument, the stock market reacted similarly to the tariff announcements during his first term but still produced sizable gains throughout that four-year period. We don’t know how long these tariffs may be in place, they may not be permanent, or they may be reduced as negotiations progress. Third, the U.S. economy is healthy right now and may be able to absorb some of the negative impact of short-term price increases from the tariffs.

On the other side of the argument, the tariffs are much larger this time compared to Trump’s first term so it could have a larger negative impact. Also, the tariffs this round are broader versus the more surgical approach that he took during his first term, which could negatively impact more businesses in the US than it did the first time. Third, the retaliatory tariffs by Canada, Mexico, and China could be larger this time, which again, could have a larger negative impact on the U.S. economy compared to the 2017 – 2020 time frame.

The word “could” is used a lot in this article because the tariffs were just announced, and there are so many outcomes that could unfold in the coming months. When counseling clients on asset allocation, we find it prudent to hold off on making dramatic changes to the investment strategy until the path forward becomes clearer, even though it’s very tempting to want to react immediately to the events that trigger market sell-offs.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Surrendering an Annuity: Beware of Taxes and Surrender Fees

There are many reasons why individuals decide to surrender their annuities. Unfortunately, one of the most common reasons that we see is when individuals realize that they were sold the annuity by a broker and that annuity investment was either not in their best interest or they discover that there are other investment solutions that will better meet the investment objectives. This situation can often lead to individuals making the tough decision to cut their losses and surrender the annuity. But before surrendering their annuity, it’s important for investors to understand the questions to ask the annuity company about the surrender fees and potential tax liability before making e the final decision to end their annuity contract.

There are many reasons why individuals decide to surrender their annuities. Unfortunately, one of the most common reasons that we see is that individuals realize they were sold the annuity by a broker that was either not in their best interest, or they discover that there are other investment solutions that will better meet their investment objectives. This situation can often lead to individuals making the tough decision to cut their losses and surrender the annuity. But before surrendering their annuity, it’s important for investors to understand the questions to ask the annuity company about the surrender fees and potential tax liability before making the final decision to end their annuity contract.

Surrender Fee Schedule

Most annuities have what are called “surrender fees,” which are fees that are charged against the account balance in the annuity if the contract is terminated within a specific number of years. The surrender fee schedule varies greatly from annuity to annuity. Some have a 5-year surrender schedule, others have a 7-year surrender schedule, and some have 8+ year surrender fees. Typically, the amount of the surrender fees decreases over time, but the fees can be very high within the first few years of obtaining the annuity contract.

For example, an annuity may have a 7-year surrender fee schedule that is as follows:

Year 1: 8%

Year 2: 7%

Year 3: 6%

Year 4: 5%

Year 5: 4%

Year 6: 3%

Year 7: 3%

Year 8+: 0%

If you purchased an annuity with this surrender fee schedule and two years after purchasing the annuity you realize it was not the optimal investment solution for you, you would incur a 7% surrender fee. If your annuity had a $100,000 value, the annuity company would assess a $7,000 surrender fee when you cancel your contract and move your account.

When It Makes Sense To Pay The Surrender Fee

In some cases, it may make financial sense to pay the surrender fee to get rid of the annuity and just move your money into a more optimal investment solution. If a client has had an annuity for 6 years and they would only incur a 3% surrender fee to cancel the annuity, it may make sense to pay the 3% surrender fee as opposed to waiting 2 more years to surrender the annuity contract without a surrender fee. For example, if the annuity contract is only expected to produce a 4% rate of return over the next year, but they have another investment solution that is expected to produce an 8%+ rate of return over that same one-year period, it may make sense to just surrender the annuity and pay the 3% surrender fee, so they can start earning those higher rates of return sooner, which essentially more than covers the surrender fee that they paid to the annuity company.

Potential Tax Liability Associated with Annuity Surrender

An investor may or may not incur a tax liability when they surrender their annuity contract. Assuming the annuity is a non-qualified annuity, if the cash surrender value is not more than an investor's original investment, then there would not be a tax liability associated with the surrender process because the annuity contract did not create any “gain” in value for the investor. However, if the cash surrender value is greater than the initial investment in the contract, then the investors would trigger a realized gain when they surrender the contract, which is taxed at an ordinary income tax rate. Annuity investments do not receive long-term capital gain preferential tax treatment for contacts held for more than 12 months like stocks and other investments held in brokerage accounts. The gains are always taxed as ordinary income rates because it’s technically an insurance contract.

Not all annuity companies list your total “cost basis” on your statement. Often, we advise clients to call the annuity company to obtain their cost basis in the policy and have the annuity company tell them whether or not there would be a tax liability if they surrendered the annuity contract. You can call the annuity company directly; you do not need to call the broker that sold you the annuity.

If there is no tax liability associated with surrendering the contract, surrendering the contract can be an easy decision for an investor. However, if there is a large tax liability associated with surrendering an annuity, some tax planning may be required. There are tax strategies associated with surrendering annuities that have unrealized gains, such as if you are close to retirement, you could wait to surrender the annuity until the year that you are fully retired, making the taxable gain potentially subject to a lower tax rate. We have had clients that have surrendered an annuity, incurred a $15,000 taxable gain, and then turned around and contributed $15,000 more, pre-tax, to their 401(k) account at work, which offset the additional taxable income from the annuity surrender in that tax year.

Is Paying The Surrender Fee and Taxes Worth It?

For investors who face either a surrender fee, taxes, or both when surrendering an annuity contract, the decision of whether or not to surrender the annuity contract comes down to whether or not paying those taxes and/or penalties is worth it, just to get out of that annuity that was not the right fit in the first place. Or maybe it was the right investment when you first purchased it, but now your investment needs have changed, or there is a better investment opportunity elsewhere. If there are no surrender fees and minimal tax liability, the decision can be very easy, but when large surrender fees and/or tax liability exists, additional analysis is often required to determine if delaying the surrender of the annuity contract makes sense.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Will The Fed’s 50bps Rate Cut Impact The Economy In Coming Months?

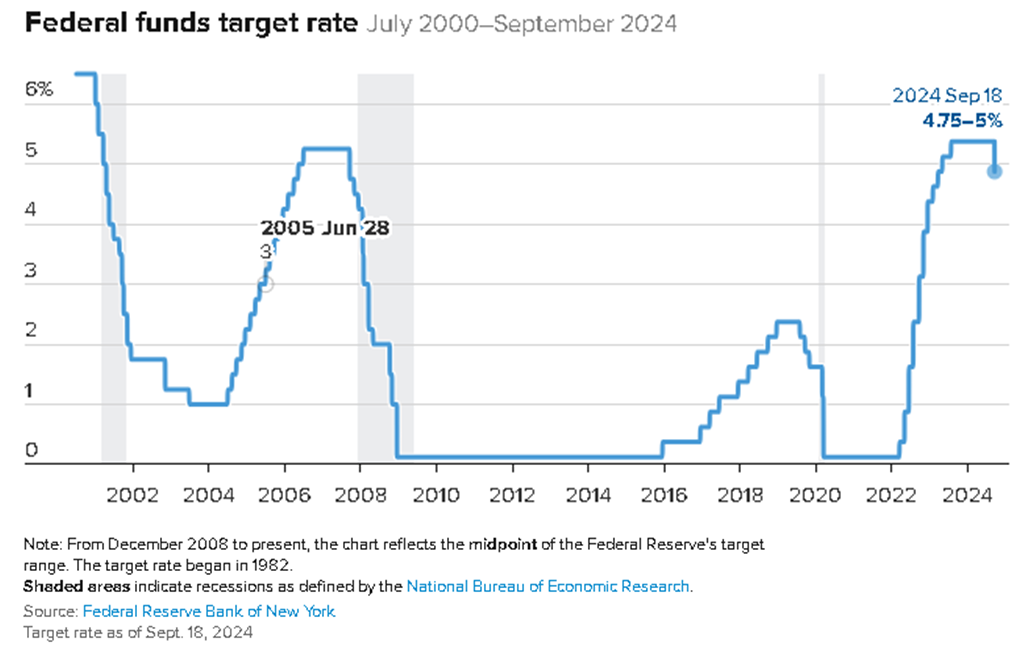

The Fed cut the Federal Funds Rate by 0.50% on September 18, 2024 which is not only the first rate cut since the Fed started raising rates in March 2022 but it was also a larger rate cut than the census expected. The consensus going into the Fed meeting was the Fed would cut rates by 0.25% and they doubled it. This is what the bigger Fed rate cut historically means for the economy

The Fed cut the Federal Funds Rate by 0.50% on September 18, 2024, which is not only the first rate cut since the Fed started raising rates in March 2022, but it’s also a larger rate cut than most economists predicted. The consensus going into the Fed meeting was that the Fed would cut rates by 0.25%, and they doubled it. In this article, we will cover:

How is the stock market likely to respond to this larger than anticipated rate cut?

How is this rate cut expected to impact the economy in the coming months?

Do we expect this rate cut trend to continue in the coming months?

Recession trends when the Fed begins cutting rates.

How Rate Cuts Impact The Economy

When the Fed decreases the Federal Funds Rate, it is essentially breathing oxygen back into the economy. Even the anticipation of the Fed lowering rates has an impact on the interest rate on car loans, mortgages, and commercial lending. As interest rates move lower, it usually stimulates the economy by making financing more attractive to the U.S. consumer. For example, a new homebuyer may not be able to afford a new house if it’s financed with a 30-year mortgage with a 7.5% interest rate, but as interest rates move lower, to say 6%, it lowers the monthly mortgage payments, putting the house in reach for that new homebuyer.

6 Month Delay

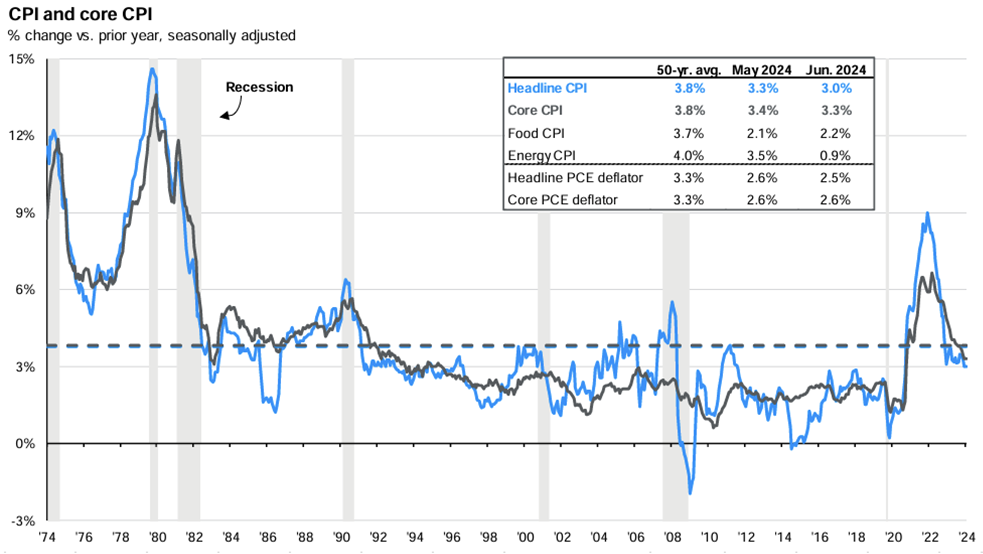

The reason why we support the Fed making a bigger rate cut now is the inflation rate has moved into the Feds 2% to 3% range, the job market has been cooling over the past few months, evident in the unemployment rate rising, and when the Fed cuts rates, it takes 6 to 9 months before that rate cut translates to more economic activity because it takes time for the impact of those lower interest rates to work their way through the economy.

Historically, The Fed Waits Too Long To Cut Rates

It’s reassuring to see the Fed cutting rates before we see significant pain in the U.S. economy because that is not the typical Fed pattern. Historically, the Fed waits too long to begin cutting rates, and only after a recession has arrived from rates being held high for too long does the Fed begin cutting rates. However, then there is a 6-month lag before the economy feels the benefits of those rate cuts and it’s usually an ugly 6 months for the equity market. The fact that the Fed is cutting rates now and by a larger amount than the consensus expects increases the chances that a soft landing will be delivered to the economy coming out of this rate hike cycle.

Not Out of The Woods Yet

While the Fed proactively cutting rates is a positive sign in the short term, if we look at a historic chart of the Fed Funds Rate going back to 2000, you will see a pattern from past cycles that only AFTER the Fed begins cutting rates does the economy enter a recession. So, while we applaud the Fed for being proactive with these bigger rate cuts, it still echoes the warning, “Will this rate cut and the future rate cuts be enough to avoid a recession?”. Only time will tell.

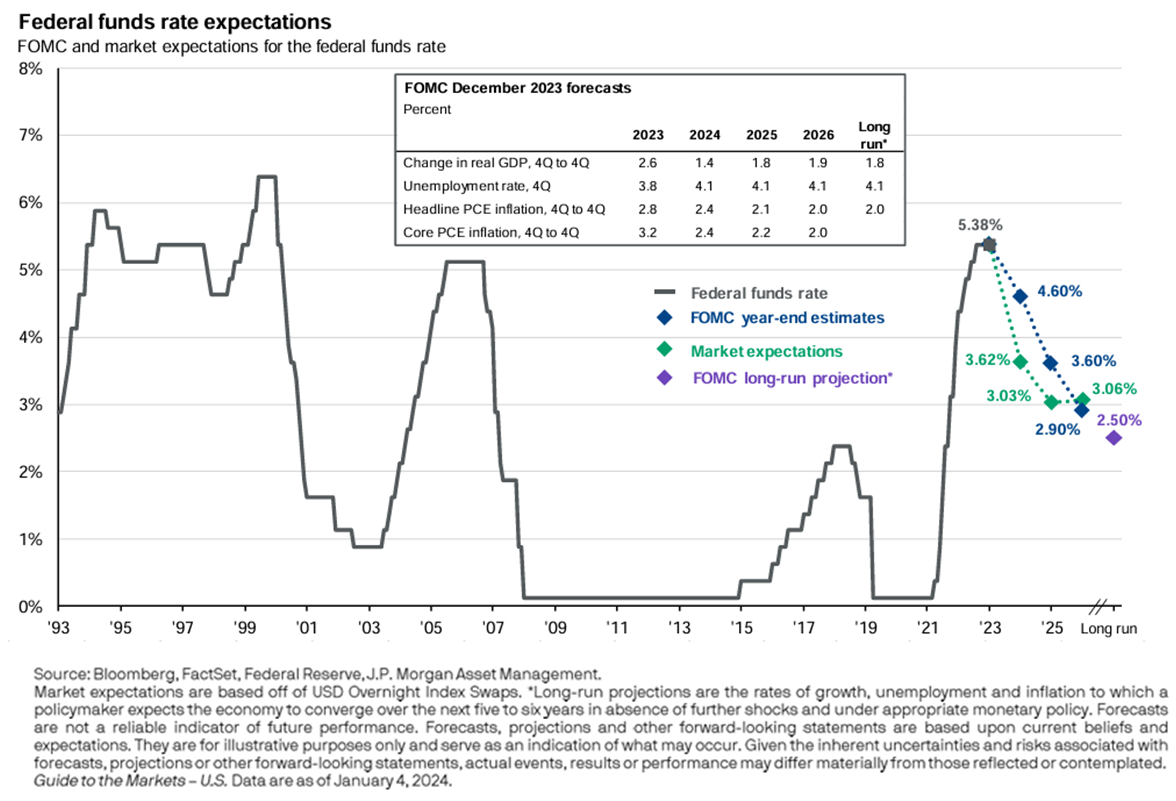

Do We Expect Additional Fed Rate Cuts

We do expect the Fed to implement additional rate cuts before the end of 2024, which if the economy hits a rough patch within the next few months, will hopefully provide some optimism that help is already on the way as these rates cuts that have already been made work their way through the economy.

The good news is they have room to cut rates by more. We were concerned at the beginning of the rate hike cycle that if they were not able to raise rates by enough, they would not have enough room to cut rates if the economy ran into a soft patch; but given the magnitude of the rate hikes between March 2022 and now, there is plenty of room to cut and restore confidence if it is needed in coming months.

COVID Stimulus Money Still In The Economy

In general, I think individuals underestimate the power of the amount of cash that was pumped into the system during COVID that was never taken out. In the 2008/2009 recession, the Federal Reserve expanded its balance sheet by about $1 trillion. During COVID they expanded the Fed balance sheet by about $4.5 Trillion, and to date they have only taken back about $1T of the initial $4.5T, so the U.S. economy has an additional $3.5T in liquidity that was not in the economy before 2020. That’s a lot of money to build a bridge to a possible soft-landing scenario.

Multiple Forces Acting On The Markets

We do expect escalated levels of volatility in the stock market in the fourth quarter. Not only do we have the market volatility surrounding the change in Fed policy, but we also have the elections in November that will inevitably inject additional volatility into the markets. As we get past the elections and enter 2025, we may return to more normal levels of volatility, because at that point the economy will know the political agenda for the next 4 years and some of the Fed rate cuts will have worked their way into the economy, potentially leading to stronger economic data in Q1 and Q2 of 2025.

All eyes will be on the race between the Fed rate cuts and the health of the economy.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

A Market Selloff Triggered By A Fed Policy Error

The Fed made a significant policy error last week by deciding not to cut the Fed Funds rate and the stock market is now responding to that error via the selloff we have seen over the past week. Unfortunately, this policy error is nothing new. Throughout history, the Fed typically waits too long to begin reducing interest rates after inflation has already abated and they seem to be on that path again.

The Fed made a significant policy error last week by deciding not to cut the Fed Funds rate and the stock market is now responding to that error via the selloff we have seen over the past week. Unfortunately, this policy error is nothing new. Throughout history, the Fed typically waits too long to begin reducing interest rates after inflation has already abated and they seem to be on that path again.

The Fed’s primary objective is to create an economic environment with full employment and inflation in a range of 2% to 3%. The Fed's primary tool to achieve these objectives is the use of the Fed Funds rate, which has a dramatic impact on interest rates within the economy. When the economy runs too hot, the Fed raises interest rates to slow it down. When the economy begins to contract, the Fed lowers interest rates and makes lending more attractive to get the economy going again.

Think of the economy like a campfire; the Fed is the campfire attendant, and they have three tools at their disposal:

Logs

Gasoline

Garden hose

When the economy is growing rapidly, the fire can get too big and risks getting out of control. When that happens, the Fed can use the garden hose (raising interest rates) to dampen the blaze. Over the past 18 months, the Fed has raised rates to reduce inflation from the peak rate of 9% to the current rate of 3%.

Their use of the hose has also caused the labor market to soften which can be seen in the reduction in the rate of non-farm payroll gains:

It can also be seen in the recent rise in the unemployment rate (grey line) and the steady decline in wage growth (blue line):

While the Fed has successfully tamed the inflation blaze, it now runs a new risk: the fire going out completely, which results in the economy slipping into a recession.

As the fire dies down, the Fed's job is to add logs to the fire via interest rate cuts to keep the fire from going out completely.

Last Wednesday (July 31, 2024), the fire was at a level that it needed a log, but the Fed decided not to add one, and the stock market responded accordingly. The Fed does not meet again until September 17th, which is almost seven weeks away. They now run the risk that the fire gets too low before reaching that September meeting.

But there is also another risk that the market is digesting: if the fire does get too low or goes out before the September 17th meeting; for anyone that has ever used too much water on a fire, it can take a while to rebuild the fire. Meaning, if the Fed does wait until the September meeting to reduce interest rates by 0.25% - 0.50%, it historically takes 4 to 6 months before that decrease in interest rates has a positive impact on the economy, and that 4 to 6 month wait is usually ugly for the equity markets knowing that help is on the way but it’s not here yet.

If the recent market selloff escalates, I think there is a good chance that the Fed may need to step in before the September 17th meeting and announce a rate cut to calm the markets. While it may be viewed as an act of desperation to keep the economy from slipping into a recession, in my opinion, it’s something that should have already happened. It’s only logical that if inflation is in a safe range and trending downward, and labor markets are showing the same trend line of softening which they are, a 0.25% rate cut, at a minimum, is warranted given the fact that the rate cut will not have its positive impact for another 4 – 6 months.

Unfortunately, throughout history, the Fed has been late to both sides of the game. They typically wait too long to raise rates, which gave us the 9% inflation in 2022, and they historically wait too long to cut rates, which is why there has historically been turbulence from the equity market on the backside of Fed rate hike cycles.

If the Fed either steps in before the September 17th meeting to lower rates or if the economy can stabilize between now and the September meeting for a potentially larger rate cut from the Fed, markets may stabilize in the coming week, however, investors also have to be ready for an escalation of the current selloff and increased levels of volatility as the markets try to maneuver through the late-innings of the Fed’s tightening cycle. Otherwise, the economy could slip into a mild recession that so many economists were predicting in 2023 that never happened, and then the Fed will be forced to use gasoline on the fire via a series of rapid large rate cuts and/or direct injection of liquidity (bond buying).

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

2024 Market Outlook: Investors Are In For A Few Surprises

Investors have to be ready for many surprises in 2024. While the US economy was able to escape a recession in 2023, if anything, it has increased the chances of either a recession or a market pullback in the first half of 2024.

Investors have to be ready for many surprises in 2024. While the US economy was able to escape a recession in 2023, if anything, it has increased the chances of either a recession or a market pullback in the first half of 2024. While many investors remember how bad the Great Recession was back in 2008 and 2009, very few remember what the market conditions were like prior to the recession beginning. As an investment firm, we archive a lot of that data, so we reference it at any time to determine where the market may be headed today, and the historical data is alarming.

Rewind the clock to January 2008

In January 2008, the US economy was already in a recession, but it had not officially been declared yet that's because a recession, by textbook definition, is two consecutive quarters of negative GDP, but you don't get the quarterly GDP readings until after each calendar quarter end, so while the recession in the US officially began December 2007, investors didn't realize recession had been declared until mid-way through 2008. So what were the forecasts for the S&P 500 in January 2008?

The broker-dealer that we were with at the time was forecasting in January 2008 that the S&P 500 Index would be up 16% in 2008. We now know that 2008 was the first year of the Great Recession, and the S&P 500 ended up posting a loss of 36% for the year. Many investors don't realize that historically, the consensus is very bad at predicting a coming recession because they failed to recognize the patterns in the economy and monetary policy that tend to be very good predictors of recessions. Investors are often more worried about missing out on the next 20% rally in the markets, which is why they get caught when the market begins its steep sell-off.

What were some of these economists looking at in January 2008 that made them so wrong? Towards the end of 2007, we had already begun to see the cracks within the US housing market, the economy had already started to slow, but in September 2007, the Federal Reserve began to lower interest rates which stock forecasters saw as a bullish signal that the monetary stimulus of lower interest rates would mean growth for the stock market in 2008. This echoes much of the same rhetoric that I heard in the fourth quarter of 2023 as the Fed decided to go on pause and then built in rate cuts to their 2024 forecast.

If you look back at history, there's a pattern between the US economy and the Fed funds rate, and it's fairly consistent over time. Here is a chart of the Fed funds rate going back to 1993. You will see the same pattern in the chart, The Fed raises rates to fight inflation, they pause (which is the tabletop portion at each of the mountain peaks), and then rates drop rapidly when the economy slows by too much, and the economy enters a recession. The Fed is historically very bad at delivering soft landings, which is a reduction in inflation without a recession.

Why is that? I think largely it's because we have the largest economy in the world, so picture a battleship in a bathtub, it takes a long time to turn, and because it's so large, once you've begun the turn you can't just stop the turn on a dime, so our turns tend to overshoot their mark, creating prolonged bull market rallies past what the consensus expects, but also an inability to stop the economy from slowing too much in an effort to fight inflation before it dips into a recession.

Here is the pattern

This chart shows our current rate hike cycle as well as the five rate hike cycles before us. For the five rate hike cycles preceding our current cycle, four of the five resulted in a recession. But that means one of the five created a soft landing, which one was it?

The 1994/1995 rate hike cycle was one of the very few soft landings that the Fed has engineered in history, so could that be done again? What was different about the mid-90s compared to the other four rate hike cycles that led us into a recession?

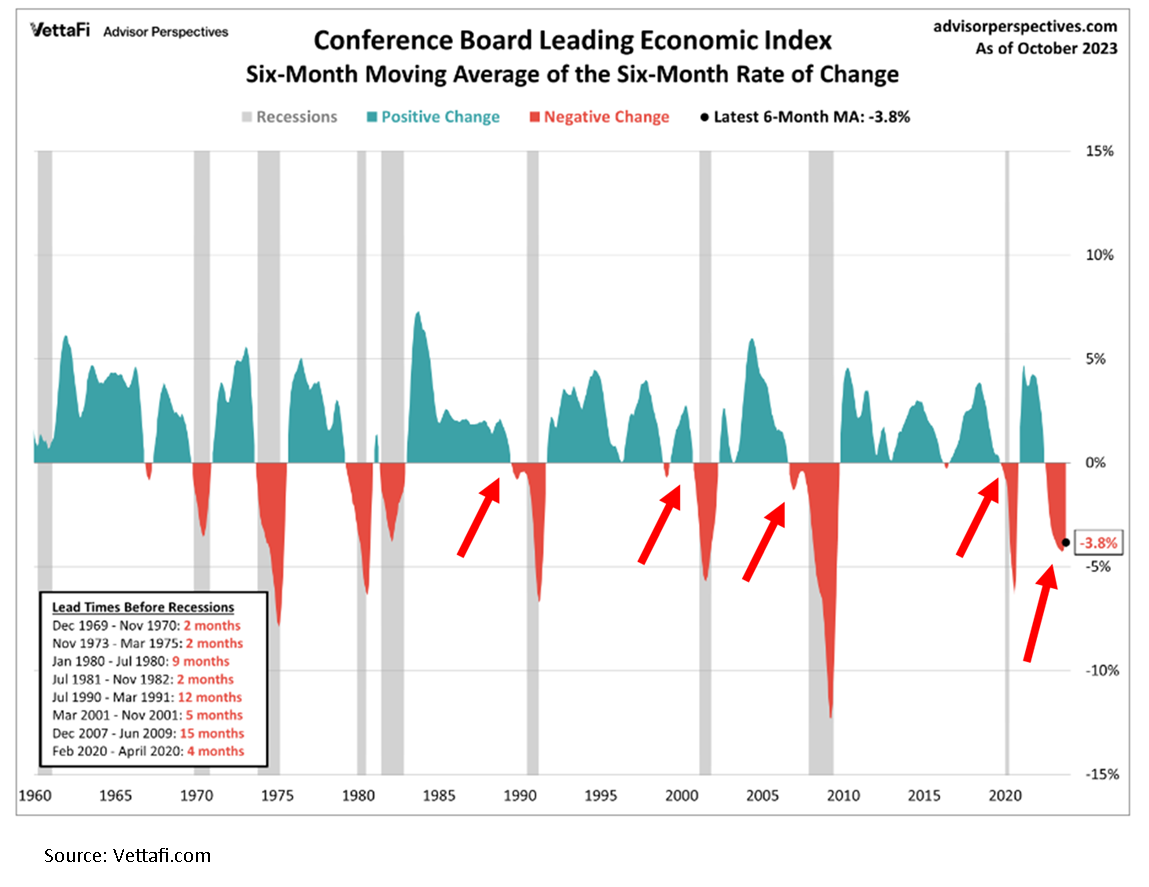

Leading Economic Index

The leading economic index is comprised of multiple economic indicators such as manufacturing hours worked, consumer sediment, building permits, and more. Its parts are considered by many to be forward-looking measurements of economic activity, which is why it's called the leading index. Below is a historical chart of the LEI index going back to 1960. The way you read the chart, when it's blue the leading indicators in aggregate are positive, when it's red, the leading indicators in aggregate are contracting.

If you look at the four rate hike cycles that led to a recession, the leading indicators index was contracting in all four prior to the recession beginning, serving as a warning sign. But if you look at 1995 in the chart, the leading indicators index never contracted, which means the Fed was able to bring down inflation without slowing the economy.

But on the far right-hand side of the chart, look at where we are now. Not only has the leading indicators index contracted similar to the four rate hike cycles that caused the recession, but it's contracted at a level so deep that we've never been at this level without already being in a recession. If we avoid a recession over the next 12 months, it will be the first time that the LEI index has been this low without a recession preceding it.

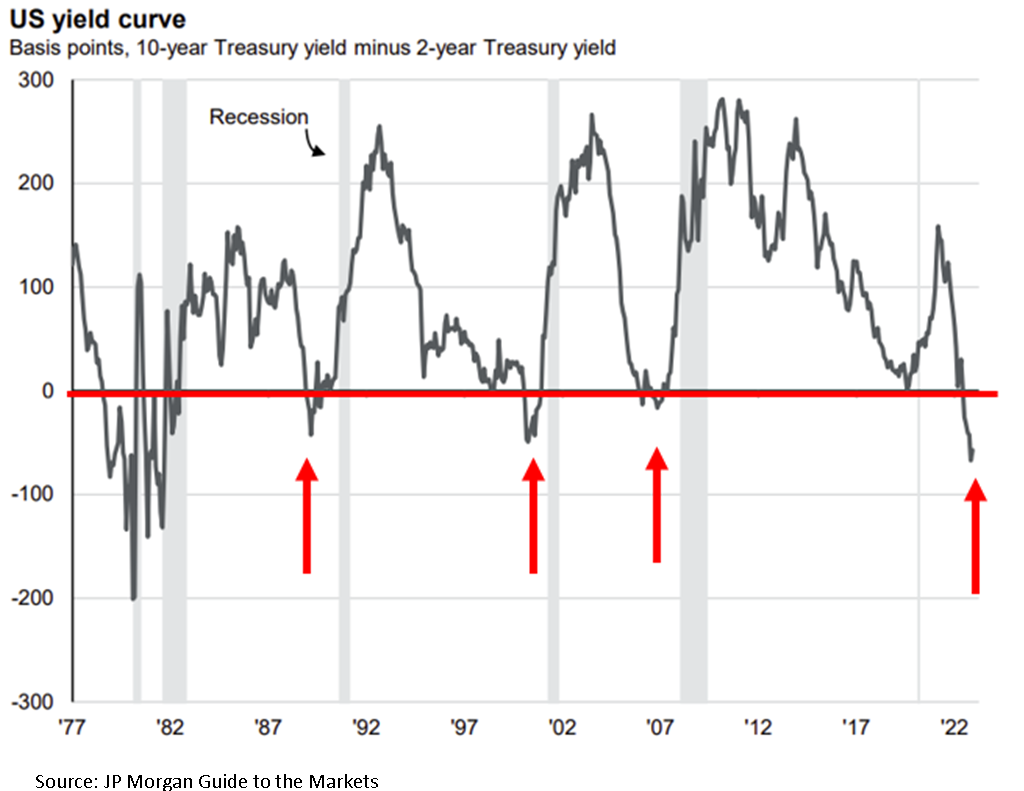

Inverted yield curve

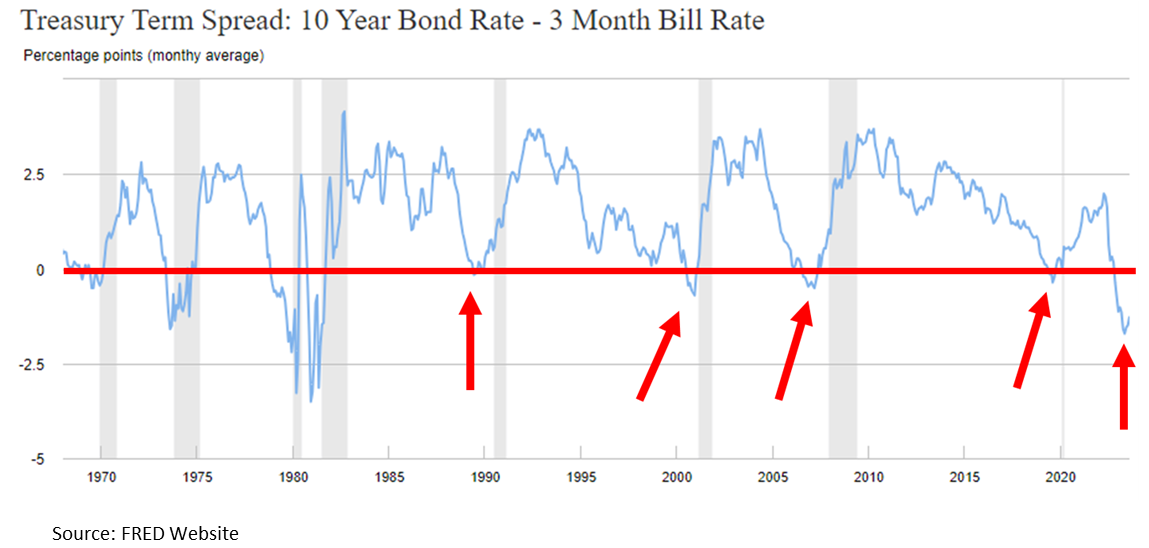

There is a technical indicator in the bond market called the yield curve, which tracks both short-term and long-term interest rates. Without getting into the technical details of how it works, when the yield curve inverts, which means short-term interest rates are higher than long-term interest rates, historically, it's a bearish signal, and it increases the likelihood of a recession occurring. In the past, an inverted yield curve has been a very good predictor of a coming recession. See the chart below.

Anytime The blue line drops below the red line the yield curve is inverted, the gray bars on the chart are the recessions, so when all of the previous 5 recessions the yield curve gave us an advance warning before the recession actually occurred. On the far right-hand side of the chart, that is where we are now, not just slightly inverted, but far more heavily inverted than the previous four recessions. Similar to the leading indicators index historical behavior, if we were to avoid a recession in the next 12 months, that would be the exception to the rule.

Returning to our original question of why was the 1994/1995 soft landing different, notice on the inverted yield curve chart during 1995, the yield curve never inverted, making it much different than the situation we're in now.

Magnitude and pace of rate hikes

After going through this exercise and understanding the patterns of the leading indicators index as well as the yield curve, let's return to our first chart, which showed the six rate hike cycles, including the one we're in now.

The gold line is the rate hike cycle that we're in now, the others are the five previous rate hike cycles. Again four of those five caused the recession, and the reason why the gold line on the chart is higher than the rest the Fed raised rates higher and faster than they had in the previous five rate hike cycles which begs the question, if the catalyst that caused the recessions is stronger, wouldn't the occurance of a recession be more likely?

Said another way, think of the Fed as a bully that likes to push kids at school, the kids represent the US economy, and the force that the bully uses to push the kids is measured by the magnitude of the interest rate increase. There are six kids standing in the hallway as the bully approaches, the first four he pushes with half of his strength, and the kids fall over on the floor, the fifth child gets nudged but does not fall over, but the bully is now running full speed at the sixth child and we're trying to figure out how it's going to end.

With history as a guide, I have a difficult time envisioning a situation where that sixth student remains on their feet.

No Recession

So what if we're wrong? What if, by some miracle, in the face of all these historic trends, the US economy avoids a recession? I would then add that while it is, of course, possible that we could avoid a recession because it's happened before, that does not necessarily mean we are going avoid a 10% plus market correction at some point in 2024 because the stock market looks to be priced for perfection. You can see this in the future earnings expectations for the S&P 500. Blue bars on the chart are the earnings expectations going into 2024 that are already baked into the S&P 500 stock prices.

It seems that not only is the consensus expecting no recession, but they are also expecting significant earnings growth. Again, with the leading economic indicators being so negative right now and the Fed not expected to lower rates until mid-2024, how do the companies in the S&P 500 meet those aggressive earnings expectations when it seems like the consumer is softening? I completely understand that the stock market is a forward-looking animal, but it seems more likely that we're repeating the mistakes of the past because the stock market can only go so far without the economy and the stock market is already way ahead even as we head into 2024. That was the most puzzling aspect of 2023, the stock market continued to rally throughout all of 2023, while the U.S. economy continued to slow throughout 2023.

The Consumer Is Not As Strong As They Seem

I continue to hear the phrase, “consumer spending remains strong”, and I agree that the consumer has been more resilient that even I expected in 2023. However, much of that spending is being done on credit. Take a look at how much credit card debt has risen in the U.S. post COVID, quickly breaking through over $1 Trillon dollars.

Not only has the level of credit card debt risen to record levels but the interest rates being charged on that debt is significantly higher than it was just a year ago, resulting in less discretionary income for consumers with credit card debt.

Buffet & Munger

Many people know the famous investor Warren Buffet and his famous quote: “Be fearful when others are greedy, and be greedy when others are fearful.” But many people don’t know that Warren had a fellow billionaire partner in Berkshire Hathaway named Charlie Munger. Charlie just passed away in 2023 at the age of 99, and Charlie had a famous quote of his own:

“The world is full of foolish gamblers, and they will not do as well as the patient investors.”

Living in a world of FOMO (Fear Of Missing Out), patience is probably the most difficult investment discipline to master, but I personally have found it to be the most rewarding discipline during my 20+ year career in the investment industry. The year 2024 may be lining up to be another history lesson as FOMO investors fail to recognize the historical pattern between interest rates and the economy dating back 50 years but time will tell.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

So Where Is The Recession?

Toward the end of 2022 and for the first half of this year, many economics and market analysts were warning investors of a recession starting within the first 6 months of 2023. Despite those widespread warnings, the S&P 500 Index is up 16% YTD as of July 3, 2023, notching one of the strongest 6-month starts to a year in history. So why have so many people been wrong about their prediction and off by so much?

Toward the end of 2022 and for the first half of this year, many economists and market analysts were warning investors of a recession starting within the first 6 months of 2023. Despite those widespread warnings, the S&P 500 Index is up 16% YTD as of July 3, 2023, notching one of the strongest 6-month starts to a year in history. So why have so many people been wrong about their prediction and off by so much?

The primary reason is that the U.S. economy and the U.S. stock market are telling us two different stories. The U.S. stock market seems to be telling the story that the worst is behind us, inflation is coming down, and we are at the beginning of a renewed economic growth cycle fueled by the new A.I. technology. But the U.S. economy is telling a very different story. The economic data suggests that the economy is slowing down quickly, higher interest rates are taking their toll on bank lending, the consumer, commercial real estate, and many of the economic indicators that have successfully forecasted a recession in the past are not only flashing red but have become progressively more negative over the past 6 months despite the rally in the stock market.

So are the economists that predicted a recession this year wrong or just early? In this article, we will review both sides of the argument to determine where the stock market may be heading in the second half of 2023.

The Bull Case

Let’s start off by looking at the bull case making the argument that the worst is behind us and the stock market will continue to rally from here.

Strong Labor Markets

The bulls will point to the strength of the U.S. labor market. Due to the shortage of workers in the labor market, companies are still desperate to find employees to hire, and even companies that have experienced a slowdown within the last 6 months are reluctant to layoff employees for fear that they will not be able to hire them back if either a recession is avoided or if it’s just a mild recession.

I agree that the labor market environment is different than previous market cycles, as a business owner myself, I cannot remember the last time it was this difficult to find qualified employees to hire. From the research that we have completed, the main catalyst of this issue stems from a demographic issue within the U.S. labor force. It’s the simple fact that there are a lot more people in the U.S. ages 50 to 70 than there are people ages 20 – 40. You have people retiring in droves, dropping out of the workforce, and there are just not enough people to replace them.

The bulls are making the case that because of this labor shortage, the unemployment rate will remain low, the consumer will retain their spending power, and a recession will be avoided.

Inflation is Dropping Fast

The main risk to the economy over the past 18 months has been the rapid rise in inflation. The bulls will highlight that not only has the inflation dropped but it has dropped quickly. Inflation peaked in June 2022 at around 9% and as of May 2023, the inflation rate has dropped all of the way down to 4% with the Fed’s target at 2% - 3%. The inflation battle is close to being won. As a result of the rapid drop in inflation, the Fed made the decision to pause as opposed to raising the Fed Fund Rate at their last meeting, which is also welcomed news for bullish investors since avoiding additional interest rate hikes and shifting the discussion to Fed Fund rate cuts could eliminate some of the risks of a Fed-induced recession.

The Market Has Already Priced In The Recession

Some bulls will argue that the stock market has already priced in a mild recession which is the reason why the S&P 500 Index was down 19% in 2022, so even if we end up in a recession, the October 2022 market lows will not be retested. Also, since the market was down in 2022, historically it’s a rare occurrence that the market is down two years in a row.

The Bear Case

Now let’s shift gears over to the bear case that would argue that while a recession has not surfaced yet, there are numerous economic indicators that would suggest that there is a very high probability that the U.S. economy will enter a recession within the next 12 months. Full disclosure, we are in this camp and we have been in this camp since December 2021. Admittedly, I am surprised at the “magnitude” of the rally this year but not necessarily surprised at the rally itself.

Bear Market Rallies Are Common

Rarely does the stock market fire a warning shot and then proceed to enter a recession. Historically, it is more common that the stock market experiences what we call a “false rally”, right before the stock market wakes up to the fact that the economy is headed for a recession, followed by a steep selloff but there is always a bull market case that exists that investors want to believe.

The last real recession that we had was the 2008 housing crisis and while investors remember how painful that recession was for their investment accounts, they typically don’t remember what was happening prior to the recession beginning. Leading into the 2008/2009 recession, the S&P 500 Index had rallied 12%, the housing market issues were beginning to surface, but there was still a strong case for a soft landing as the Fed paused interest rate hikes, and began decreasing the Fed Funds Rate at the beginning of 2008, but as we know today the Great Recession occurred anyways.

The Fed Has Never Delivered A Soft Landing

While there is talk of a soft landing with no recession, if you look back in history, anytime the Fed has had to reduce the inflation rate by more than 2%, the Fed rate hike cycle has been followed by a recession every single time. As I mentioned above, the inflation rate peaked at 9% and their target is 2% - 3% so they have to bring down the inflation rate by much more than 2%. If they pull off a soft landing with no recession, it would be the first time that has ever happened.

The Market Bottom

For the bulls that argue that the market is expecting a mild recession and has already priced that in, that would also be the first time that has ever happened. If you look back at the past 9 recessions, how many times in the past 9 recessions did the market bottom PRIOR to the recession beginning? Answer: Zero. In each of the past 9 recessions, the market bottomed at some point during the recession but not before it.

Also, the historical P/E ratio of the S&P 500 Index is a 17. P/E ratios are a wildly used metric to determine whether an investment or index is undervalued, fairly valued, or overvalued. As I write this article on July 3, 2023, the forward P/E of the S&P 500 Index is 22 so the stock market is already arguably overvalued or as others might describe it as “priced to perfection”. So not only is the stock market priced for no recession, it’s priced for significant earnings growth from the companies that are represented within the S&P 500 Index.

A Rally Fueled by 6 Tech Companies

The S&P 500 Index, the stock market, is comprised of 500 of the largest publicly traded companies in the U.S. The S&P Index is a “cap-weighted index” which means the larger the company, the larger the impact on the direction of the index. Why does this matter? In 2023, many of the big tech companies in the U.S. have rallied substantially on the back of the artificial intelligence boom.

As of June 2, 2023, the S&P 500 Index was up 11.4% YTD, and at that time Nvidia one of the top ten largest companies in the S&P 500 was up 171%, Amazon up 49%, Google up 41%. If instead you ignored the size of the companies in the S&P 500 Index and gave equal weight to each of the 500 companies that make up the stock index, the S&P 500 Index would have only been up 1.2% YTD as of June 2, 2023. So this has not been what we consider a broad rally where most of the companies are moving higher. (Data Source for this section: Reuters)

Why is this important? In a truly sustainable growth environment, we tend to see a broad market rally where a large number of companies within the index see a meaningful amount of appreciation and just doesn’t seem to be the case with the stock market rally this year.

2 Predictors of Coming Recessions

There are two economic indicators that have historically been very good at predicting recessions; the yield curve and the Leading Economic Indicators Index. Both started the year flashing red warning signals and despite the stock market rally so far this year, both indicators have moved even more negative within the first 6 months of 2023.

Inverted Yield Curve

The yield curve right now is inverted which historically is a very accurate predictor of a coming recession. Below is a chart of the yield curve going back to 1977, anytime the grey line moved below the red line in the chart, the yield curve is inverted. As you can see, each time the yield curve inverts it’s followed by a recession which are the grey shaded areas within the graph. On the far right side of the chart is where we are now, heavily inverted. If we don’t get a recession within the next 12 months, it would be the first time ever that the yield curve was this inverted and a recession did not occur.

The duration of the inversion is also something to take note of. As of July 2, 2023 the yield curve has been inverted for 159 trading days, since 1962 the longest streak that the yield curve was inverted was 209 trading days ending May 2008 (the beginning of the Great Recession). If the current yield curve stays inverted until mid-September, which is likely, it will break that record.

Leading Economic Indicators Index (LEI Index)

The Leading Economic Indicators index is the second very accurate predictor of a coming recession because as the name suggests the index is comprised of forward-looking economic data including but not limited to manufacturing hours works, building permits, yield curve, consumer confidence, and weekly unemployment claims. The yield curve is a warning from the bond market and the LEI index is a warning from the U.S. economy.

In the chart below, when the blue drops below the red line (where the red arrows are) the LEI index has turned negative, indicating that the forward-looking economic indicators in the U.S. economy are slowing down. The light grey areas are the recessions. As you can see in the chart, shortly after the LEI index goes negative, historically a recession appears shortly after. If you look at where are now on the righthand side of the chart, not only are we negative on the LEI, but we have never been this negative without already being in a recession. Again, if we don’t get a recession within the next 12 months, it would be the first time ever that this indicator did not accurately predict a recession at its current level.

“Well…..This Time It’s Different”

A common phrase that you will hear from the bulls right now is “well…..this time is different” followed by a list of all the reasons why the yield curve, LEI index, and other indicators that are flashing red are no longer a creditable predictor of a coming recession. After being in the investment industry for over 20 years and experiencing the tech bubble bust, housing crisis, Eurozone crisis, and Covid, from my experience, it’s rarely different which is why these predictors of recessions have been so accurate over time. Yes, the market environment is not exactly the same in each time period, sometimes there is a house crisis, other times an energy crisis, or maybe a pandemic, but the impact that monetary policy and fiscal policy have on the economy tend to remain constant over longer periods of time.

Market Timing

It’s very difficult to time the market. I would love to be able to know exactly when the market was peaking and bottoming in each market cycle but the stock market itself throws off so many false readings that become traps for investors. While we rely more heavily on the economic indicators because they have a better track record of predicting market outcomes over the long term, the timing is never spot on but what I have learned over time is that if you are able to sidestep the recessions, and avoid the big 25%+ downturns in an investment portfolio, it often leads to greater outperformance over the long term. Remember, mathematically, if your portfolio drops by 50%, you have to earn a 100% rate of return to get back to breakeven. But it takes discipline to watch these market rallies happen and not feel like you are missing out.

The Consumer’s Uphill Battle

Consumer spending is the number one driver of the U.S. economy and the consumer is going to face multiple headwinds in the second half of 2023. First, student loan payments are set to restart in October. Due to the Covid relief, many individuals with student loans have not been required to make a payment for the past three years and the $10,000 student loan debt cancellation that many people were banking on was recently struck down by the Supreme Court.

Second, while inflation has dropped, the interest rates on mortgages, car loans, and credit cards have not. The inflation rate dropped from 9% in June 2022 to 4% in May 2023 but the 30-year fixed mortgage rate peaked in November at around 7% and as of July 2023 still remains around 6.8%, virtually unchanged, so not a lot of relief for individuals that are trying to buy a house.

This is largely attributed to the third headwind for consumers which is that banks are tightening their lending practices. The banks see the same charts of the economy that we do and when the economy begins slowing down banks begin to tighten their lending standards making it more difficult for consumers and businesses to obtain loans. Even though the stock market has rallied in 2023, banks have continued to tighten their lending standards over the past 6 months and with more limited access to credit, that could put pressure on the economy in the second half of 2023.

Consumer spending has been stronger than expected in 2023 which has helped fuel the stock market rally this year but we can see in the data that a lot of this spending has been done using credit cards and default rates on credit cards and auto loans are rising quickly. So now many consumers have not only spent through their savings but by the end of the year they could have large credit card payments, car payments, higher mortgage/rent payments, and student loan payments.

Reasons for Recession Delay

With all of these clear headwinds for the market, why has the recession not begun yet as so many economists had forecasted at the beginning of 2023? In my opinion, the primary reason for the delay is that it typically takes 9 to 12 months for each Fed rate hike to impact the economy. When the Fed is raising rates, they are intentionally trying to slow down the economy to curb inflation. The Fed just paused for the first time in June 2023 but all of the rate hikes that were implemented in the first half of 2023 have yet to work their way into the economy. This is why you see yet another very consist historically pattern with the Fed Funds Rate. A pattern that I call the “Fed Table Top”. Here is a chart showing the last three Fed rate hike cycles going back to 2000:

You will see the same pattern over time, the Fed raises interest rates to fight inflation which are the moves higher in the chart, they pause at the top of their rate hike cycle which is the “Table Top”, and then a recession appears as a result of their tightening cycle, and they begin dropping interest rates. Once the Fed has reached its pause status or “table top”, some of those pauses last over a year, while other pauses only last a few months. The pause makes sense because again it takes time for all of those rate hikes to impact the economy so it’s never just a straight up and then a straight down in interest rates.

So then that raises the question, how long will this pause be? Honestly, I have no idea, and this is the tricky part again about timing but the pattern has repeated itself time and time again. However, as you can also see in the Fed chart above when you compare the current Fed rate hike cycle to those of the previous 3 cycles, the Fed just raised rates by more than the previous three cycles in a much shorter period of time, that would lead me to believe that this Fed Table Top could be shorter because the 9-month lag of the interest rate hikes on the economy will happen at a greater magnitude compared to the Fed rating rates at 0.25% - 0.50% per meeting as they did in the previous two Fed rate hike cycles.

Bulls or the Bears?

Only time will tell if the economic patterns of the past will remain true and a recession will emerge within the next 12 months or if this time it is truly different, and a recession will be avoided. For investors that have chosen the path of the bull, they will have to remain on their toes, because historically when the turn comes, it comes fast, and with very little warning.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Why Did Silicon Valley Bank Fail? The Contagion Risk

This week, Silicon Valley Bank (SVB), the 16th largest bank in the United States, became insolvent in a matter of 48 hours. The bank now sits in the hands of the FDIC which has sent ripples across the financial markets.

This week, Silicon Valley Bank (SVB), the 16th largest bank in the United States, became insolvent in a matter of 48 hours. The bank now sits in the hands of the FDIC which has sent ripples across the financial markets. In this article, I’m going to address:

What caused SVB to fail?

The contagion risk for the banking sector

The business fallout for start-ups

How this could impact Fed policy

FDIC insurance coverage

Silicon Valley Bank

SVB has been in business for 40 years and at the time of the failure, had about $209 Billion in total assets, ranking it as the 16th largest bank in the U.S., so not a small or new bank. But it’s important to acknowledge that this bank was unique when compared to its peers in the banking sector. This bank was known for its concentrated lending to start-up tech companies and venture capital firms.

SVB Isolated Event?

Before we discuss the contagion factors associated with the SVB failure, there are definitely catalysts for this insolvency that were probably specific just to Silicon Valley Bank. Since the bank had such a high concentration of lending practices to start-ups and venture capital firms, that in itself exposed the bank to higher risk when comparing it to traditional bank lending practices. While most major banks in some form or another, lend money to start-up companies, it’s typically not a high percentage of their overall loan portfolio. Over the years, Silicon Valley Bank has become known as the “go-to lender” for start-ups and venture capital firms.

What is a venture capital firm?

Venture capital firms, otherwise known as “VC’s”, are large investment companies that essentially raise money, and then invest that capital primarily and start-up companies. Venture capital firms will sometimes take loans from banks, like SVB, and then invest that money in start-up companies with the hopes of earning a superior rate of return. For example, a venture capital firm could requests a $50 million loan at a 5% interest rate and then invests that money into 5 different start-up companies, with the hopes of earning a return greater than 5% interest rate that they are paying to the bank.

Start-up lending is risky

Lending money to start-up companies generally carries a higher risk than lending money to long-term, cash-stable companies. It’s not uncommon for start-up companies to be producing little to no revenue because they have a promising business idea that has yet to see wide spread adoption. Then add into the mix, the reality that a lot of these start-up companies fail before reaching profitability.

For this reason, if you have a bank, like SVB that has a high concentration of lending activity to start-ups and venture capital firms, they are naturally going to have more risk than a bank that does not engage in concentrated lending activities to this sector of the market.

A Challenging Market Environment For Start-Ups

In 2020 in 2021, the start-up market was booming because there was so much capital injected into the US economy from the Covid stimulus packages issued by the US government. That favorable liquidity environment changed dramatically in 2022 when inflation got out of control, and then the Federal Reserve started quantitative tightening, essentially pulling that cash back out of the economy. This lack of liquidity and higher interest rates put stress on the start-up industry, who depends, mainly on loans and new capital investment to keep operations going. Given this adverse market environment for start-ups, there has been an increase in the number of start-up defaulting on their loans, running out of cash, and going bankrupt. Since SVB’s loan portfolio is heavily concentrated in that start-up sector of the market, they would naturally feel more pain than their peers that have less exposure.

This gives way to the argument that this could in fact just be an unfortunate isolated incident by a bank that overextended its level of risk to a sector of the market that due to monetary tightening by the Fed has gotten crushed over the past year.

However, in the midst of the failure of SVB, another risk has surfaced that could spell trouble for the rest of the banking industry in the coming weeks.

The Contagion Risk

There is some contagion risk associated with what has happened with the failure of SVB which is why I think you saw a rapid drop in the price of other bank stocks, especially small regional banks, over the past two days. The contagion risk centers around, not their loan portfolio, but rather the assets that SVB was holding as reserves that many other banks hold as well, which rendered them unable to meet the withdrawal request of their depositors, and ultimately created a run on the bank.

The Treasury Bond Issue

When banks take in money from depositors, one of the ways that a bank makes money is by taking those deposits that are sitting on the bank’s balance sheet and investing them in “safe” securities which allow the bank to earn interest on that money until their clients request withdrawals. It’s not uncommon for banks to invest that money in low-risk fixed-income investments like U.S. Treasury Bonds which principal and interest payments are backed by U.S. government.

SVB was holding many of these Treasuries and other fixed-income securities when these start-up companies began to default on their loans which then spooked the individuals and companies that still had money on deposit with SVB, worried that the bank might fail, and they started requesting large withdrawals, which then required SVB to begin selling their fixed income assets to raise cash to meet the redemption requests.

Herein lies the problem. While the value of a U.S. Treasury Bond is backed by the U.S. Government, meaning they promise to hand you back the face value of that bond when it matures, the value of that bond can fluctuate in value while it’s waiting to reach maturity. In other words, if you sell the bond before its maturity date, you could lose money.

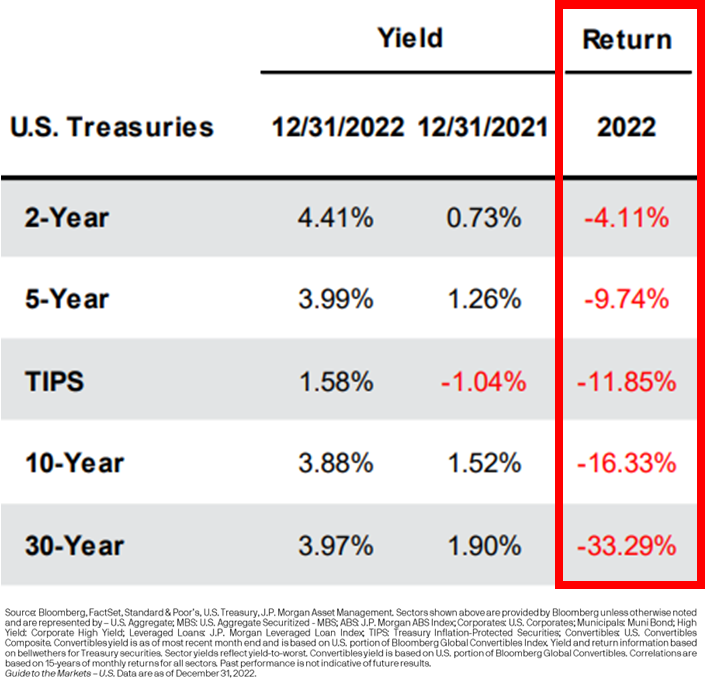

The enemy of bond prices is rising interest rates because when interest rates go up, bond prices go down. Over the past 12 months, in an effort to fight inflation, the Fed has increased interest rates bigger and faster than it ever has within the past 50 years. So banks, like SVB, that were most likely buying bonds back in 2017, 2018, and 2019 before interest rates skyrocketed, if they were holding longer duration bonds hoping to hold them to maturity, the prices of those bonds are most likely underwater.

Below is a chart that shows price decline of U.S. Treasury Bonds in 2022 based on the duration of the bonds:

As you can see on the chart, in 2022, the price of a 5 Year US Treasury Bond declined by 9.74% but if you owned a 30 Year U.S. Treasury Bond, the price of that bond declines by 33.29% in 2022. Ouch!!

SVB Forced To Sell Assets At A Bad Time

When a bank needs to raise capital to either make up for loan defaults or because depositors are requesting their cash back, if they do not have enough liquid cash on hand, then they have to begin selling their reserve investments to raise cash. Again, if SVB was buying longer duration bonds back in 2018 and 2019, the intent might have been to hold those bonds until maturity, but the run on their bank forced them to sell those bonds at a loss, so they no longer had the cash to meet the redemption requests.

Will This Problem Spread To Other Banks?

While other banks may not lend as heavily to start-up companies, it is not uncommon at all for banks to purchase Treasuries and other fixed-income securities with their cash reserves. With the economy facing a potential recession in 2023, this has investors asking, what if defaults begin to rise on auto loans, mortgages, and lines of credit during a recession, and then these other banks are forced to liquidate their fixed-income assets at a loss, rendering them unable to meet redemption requests?

Over the next few weeks, this is the exact type of analysis that is probably going to take place at banks across the U.S. banking sector. It’s no longer just a question of “how much does a bank have in reserve assets?” but “What type of assets are being held by the bank and if redemptions increased dramatically would they have the cash to meet those redemption requests?”

The answer may very well be “Yes, there is no reason to panic.” SVB may end up being an isolated incident, not only because they had overexposure to high-risk start-up companies but also because they made poor choices with the fixed-income securities that they purchased with longer durations which compounded the issues when redemptions flooded in and they were forced to sell them at a loss. It’s too early to know for sure so we will have to wait and see.

Change In Fed Policy

This SVB failure could absolutely have an impact on Fed policy. If the Fed realizes that by continuing to push interest rates higher, it could create larger losses in these Treasury cash reserve portfolios at banks across the U.S., a recession shows up, redemptions at banks increase, and then more banks face the same fate as SVB due to the forced selling of those bonds at a loss, it may prompt the Fed to only raise rates by 25bps at the next Fed meeting instead of 50bps.

The reality is we have not seen interest rates rise this fast or by this magnitude within the last 50 years, so the Fed has to be aware that things can begin to break within the U.S. economy that were not intended to break. While getting inflation back down to the 2% - 3% level is the Fed’s primary focus right now, it will be interesting to see if they acknowledge some of these outlier events like SVB failure at the next Fed meeting.

FDIC Insurance

The FDIC has stepped in and taken control of Silicon Valley Bank. Banks have something called FDIC insurance which basically protects an individual’s deposits at a bank up to $250,000 if the bank were to be rendered insolvent. The FDIC saw the run on the bank and basically stepped in to make sure the remainder of the bank’s assets were being preserved as much as possible to meet their $250,000 protection obligation. But there is no protection for individuals and companies that had balances over $250,000 and considering this was a big bank, there are probably a lot of clients of the bank that fall into that category. Not just small companies either. For example, Roku came out on Friday and announced they had approximately $487 Million on deposit with Silicon Valley Bank (Source: CNBC).

The FDIC has issued preliminary guidance that the $250,000 protected amount should be available to depositors for withdrawal but Monday, March 13th, but there has been little to no guidance on what is going to happen to clients of SVB that had balances over $250,000. How much are they going to be able to recoup? When will they have access to that money?

The Business Fallout

Investors are probably going to see a lot of headlines over the next few weeks about businesses not being able to meet payroll or businesses going bankrupt due to SVB failure. Since SVB had a large concentration of start-up companies as clients, this may be more pronounced because many start-ups are not producing enough cash yet to sustain operations. If a company had their business checking account at SVB, depending on the answers from the FDIC as to how much money over the $250,000 they will be able to recoup, and when will they have access to the cash, some of these companies could fold just because they lost access to their cash which is very sad and unfortunate collateral damage from this banking fallout.

Isolated Incident or Contagion?

On the surface, the failure of Silicon Valley Bank may end up being an isolated event that does not spread to the rest of the banking industry but sitting here today, it’s too early to know that for sure. If there are other banks out there that have made similar mistakes by taking on too much duration in their bond portfolio prior to the rapid rise in interest rates, they could potentially face similar redemption problems if the U.S. economy sinks into a recession and defaults and redemption requests start piling up. A lot will depend on the results of these bank asset stress tests, Fed policy, and the direction of the economy over the next 12 months.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

2023 Market Outlook: A New Problem Emerges

While the markets are still very focused on the battle with inflation, a new problem is going to emerge in 2023 that is going to take it’s place. The markets have experienced a relief rally in November and December but we expect the rally to fade quickly going into 2023.

While the markets are still very focused on the battle with inflation, a new problem is going to emerge in 2023 that is going to take its place. The markets have experienced a relief rally in November and December, but we expect the rally to fade quickly going into 2023.

Inflation Trend and Fed Policy

I’m writing this article on December 15, 2022, and this week, we received the inflation reading for November and the Fed’s 0.50% interest rate hike. Headline CPI, the primary measure of inflation, dropped from 7.7% in October to 7.1% in November which is a meaningful decline, most likely signaling that peak inflation is behind us. So why such a grim outlook for 2023? One word……History. If you look at the historical trends of meaningful economic indicators and compare them to what the data is telling us now, the message to us is it will be nothing short of a Christmas miracle for the U.S. economy to avoid a recession in 2023.

The Inflation Battle Will Begin at 5%

While it's encouraging to see the inflation rate dropping, the true battle will begin once the year-over-year inflation rate measured by headline CPI reaches the 5% - 6% range. Inflation most likely peaked in June 2022 at 9% and dropped to 7.1% in November, but remember, the Fed’s target range for inflation is 2% - 3%, so we still have at least another 4% to go.

RECESSION RISK #1: If you look back through U.S. history, the Fed has never successfully reduced the inflation rate by more than 2% WITHOUT causing a recession. We have already dropped by 2%, and we still have another 4% to go.

I expect the next 3 months to show meaningful drops in the inflation rate and would not be surprised if we are in a 5% - 6% range by March or April, largely because supply chains have healed, the economy is slowing, the price of oil has come down substantially, and the job market is beginning to soften. But once we get down to the 5% - 6% range, we could see slow progress, which could end the party for investors that are stilling in the bull rally camp.

The Wage Growth Battle

We expect progress to be halted because of the shortage of supply of workers in the labor force, which will keep wages persistently higher, allowing the US consumer to keep paying higher prices for goods and services, which will leave us with higher interest rates for longer. Every time Powell has spoken over the past few months (the head of the Federal Reserve), he expresses his concerns that wages remain far too high. The solution is simple but ugly. The Fed needs to continue to apply pressure on the economy until the unemployment rate begins to rise which will bring wage growth level down to a level that will allow them to reach their 2% - 3% target inflation range.

Companies Are Reluctant To Let Go of Employees

Since one of the major issues plaguing US businesses is trying to find employees, companies will be more reluctant to let go of employee with the fear that they will need them once the economy begins to recover. This situation could create an abrupt spike and the unemployment rate when companies are finally forced to give in all at once to the reality that they will need to shed employees due to the slowing economy.

Rising Unemployment

Another lesson from history, if you look back at the past 9 recessions, how many times did the stock market bottom BEFORE the recession began? Answer: ZERO. So, if you think the bottom is already in the stock market but you also believe that there is a high probability that the U.S. economy will enter a recession in 2023, you are on the wrong side of history.

When we look back at the past 9 recessions, there is a common trend. As you would expect, when the economy begins to contract, people lose their jobs, which causes the unemployment rate to rise. In all of the past 9 recessions, the stock market did not bottom until AFTER the unemployment rate began to rise. If you think there is a high probability that the unemployment rate will rise in 2023, which is what the Fed is targeting to bring down wage growth, then we most likely have not seen the market bottom in this bear market cycle.

JP Morgan has a great chart summarizing this point across the past 9 recessions. While it looks like a lot is going on in this illustration, each chart shows one of the past 9 recessions.

The Purple Line = Unemployment Rate

The Black Straight Line = Where the stock market bottomed

The Gray Area = The recession

In each of the charts below, observe how the purple line begin to rise and then the solid black line follows in each chart. That would support the trend that the bottom in the stock market historically happens after the unemployment rate begin it’s climb which has not happened yet.

A New Problem Will Emerge

While the markets have been super focused on inflation in 2022, a new problem is going to surface in 2023. The economy is going to trade its inflation problem for the reality of a weakening U.S. consumer.

The Fed will be successful at slowing down the economy via their rate hikes, which will eventually lead to job losses, weakness in the housing market, a slowdown in consumer spending on goods and travel, and less capital spending. Those forces should be enough to deliver the two quarters of negative GDP growth in 2023, which would coincide with a recession.

The Fed Will Have Its Hands Tied

Normally, when the economy begins to contract, the Fed will step in and begin lowering interest rates to restart economic growth. However, if the inflation rate, while moving lower, is still between 4% and 5% when the economic slowdown hits, the Fed will not be able to come to the economy’s aid with fear that premature reductions in the fed funds rate could reignite inflation which is exactly what happened in the 1970s.

The recession itself will eventually bring inflation down to the Feds 2% inflation target, but while it’s happening, it’s going to feel like you are watching a train wreck in slow motion, but you can’t do anything about it. Not a great environment for the stock market.

Length of the recession

The next question I receive is, do we expect a mild recession or severe recession? I’ll be completely honest, it’s impossible to know. A lot will depend on the timing of when the economy begins to contract and where the rate of inflation is. The longer it takes inflation to get down to the 2% range while the economy contracts, the longer and more severe the recession will be. This absolutely could end up being a mild recession but there’s no way to know that sitting here in December 2022, looking at all of the challenges that lie ahead for the markets in 2023.

An Opportunity For Bonds

Due to the rising interest rates in 2022, the bond market has had one of the worst years in history. Below is a chart showing the annual returns of the aggregate bond index going back to 1970.

We have never seen a year where bonds are down 11% in a single year. It’s our expectation that this trend will reverse course in 2023. When interest rates stop rising, the Fed pauses and eventually begins lowering rates, that should be a positive environment for fixed-income returns. Where bonds failed to give investors any type of safety net in 2022, I think that safety net will return in 2023. We are already beginning to see evidence of interest rates moving lower, with the 10-year US Treasury yields moving from 4.2% down to the current rate of 3.5% over the past 45 days.

Warnings From The Inverted Yield Curve

While a number of the economic indicators that we watching are flashing red going into 2023, there are very few that tell the story better than the inverted yield curve. Without getting into all the technical details about what an inverted yield curve is, the simple version of this explanation is, it's basically the bond market telling the stock market that trouble is on the horizon. Historically, when the yield curve inverts, The US economy enters a recession within the next 6 to 18 months. See below, a chart of the yield curve going back to 1970.

Each of the red arrows is where the yield curve inverts. The gray areas on the chart are the recessions. You can see very quickly how consistent the yield curve inversion has been at predicting recessions over time. If you look on the far right-hand side of the chart, that red arrow is where we are now, heavily inverted. So if you believe that we are not going to get a recession within the next 6 to 18 months, you are sitting heavily on the wrong side of history and have adopted a “this time it's different” mentality which can be dangerous. History tends to repeat itself more times than people like to admit.

Proactive investment decisions

Going into 2023, I think it's very important to be realistic about your expectations for the equity markets, given the headwinds that we face. This market environment is going to require very proactive investment decisions and constant monitoring of the economic data as we receive it throughout the year. A mild recession is entirely possible. If we end up in a mild recession, inflation drops down into the Feds comfort range due to the contracting economy, and the Fed can begin lowering rates before the end of 2023, that could put a bottom in the stock market, and the next bull market rally could emerge. But it's just too early to know that sitting here in December 2022 with a lot of headwinds facing the market.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Government Savings Bonds (I Bonds) Are Paying A 9.62% Interest Rate

U.S. Government Savings Bonds called I Bonds are currently paying an interest rate of 9.62%. There are certain restrictions associated with these bonds that you should be aware of……..

There are U.S. Government Savings Bonds, called “I Bonds”, that are currently paying a 9.62% interest rate as of August 2022, you can continue to buy the bonds at that interest rate until October 2022, and then the rate resets. Before you buy these bonds, you should know the 9.62% interest rate is only for the first 6 months that you own the bonds and there are restrictions as to when you can redeem the bonds. In this article I will cover:

How do I Bonds works?

Are they safe investments?

Purchase limits