Why Did Silicon Valley Bank Fail? The Contagion Risk

This week, Silicon Valley Bank (SVB), the 16th largest bank in the United States, became insolvent in a matter of 48 hours. The bank now sits in the hands of the FDIC which has sent ripples across the financial markets. In this article, I’m going to address:

What caused SVB to fail?

The contagion risk for the banking sector

The business fallout for start-ups

How this could impact Fed policy

FDIC insurance coverage

Silicon Valley Bank

SVB has been in business for 40 years and at the time of the failure, had about $209 Billion in total assets, ranking it as the 16th largest bank in the U.S., so not a small or new bank. But it’s important to acknowledge that this bank was unique when compared to its peers in the banking sector. This bank was known for its concentrated lending to start-up tech companies and venture capital firms.

SVB Isolated Event?

Before we discuss the contagion factors associated with the SVB failure, there are definitely catalysts for this insolvency that were probably specific just to Silicon Valley Bank. Since the bank had such a high concentration of lending practices to start-ups and venture capital firms, that in itself exposed the bank to higher risk when comparing it to traditional bank lending practices. While most major banks in some form or another, lend money to start-up companies, it’s typically not a high percentage of their overall loan portfolio. Over the years, Silicon Valley Bank has become known as the “go-to lender” for start-ups and venture capital firms.

What is a venture capital firm?

Venture capital firms, otherwise known as “VC’s”, are large investment companies that essentially raise money, and then invest that capital primarily and start-up companies. Venture capital firms will sometimes take loans from banks, like SVB, and then invest that money in start-up companies with the hopes of earning a superior rate of return. For example, a venture capital firm could requests a $50 million loan at a 5% interest rate and then invests that money into 5 different start-up companies, with the hopes of earning a return greater than 5% interest rate that they are paying to the bank.

Start-up lending is risky

Lending money to start-up companies generally carries a higher risk than lending money to long-term, cash-stable companies. It’s not uncommon for start-up companies to be producing little to no revenue because they have a promising business idea that has yet to see wide spread adoption. Then add into the mix, the reality that a lot of these start-up companies fail before reaching profitability.

For this reason, if you have a bank, like SVB that has a high concentration of lending activity to start-ups and venture capital firms, they are naturally going to have more risk than a bank that does not engage in concentrated lending activities to this sector of the market.

A Challenging Market Environment For Start-Ups

In 2020 in 2021, the start-up market was booming because there was so much capital injected into the US economy from the Covid stimulus packages issued by the US government. That favorable liquidity environment changed dramatically in 2022 when inflation got out of control, and then the Federal Reserve started quantitative tightening, essentially pulling that cash back out of the economy. This lack of liquidity and higher interest rates put stress on the start-up industry, who depends, mainly on loans and new capital investment to keep operations going. Given this adverse market environment for start-ups, there has been an increase in the number of start-up defaulting on their loans, running out of cash, and going bankrupt. Since SVB’s loan portfolio is heavily concentrated in that start-up sector of the market, they would naturally feel more pain than their peers that have less exposure.

This gives way to the argument that this could in fact just be an unfortunate isolated incident by a bank that overextended its level of risk to a sector of the market that due to monetary tightening by the Fed has gotten crushed over the past year.

However, in the midst of the failure of SVB, another risk has surfaced that could spell trouble for the rest of the banking industry in the coming weeks.

The Contagion Risk

There is some contagion risk associated with what has happened with the failure of SVB which is why I think you saw a rapid drop in the price of other bank stocks, especially small regional banks, over the past two days. The contagion risk centers around, not their loan portfolio, but rather the assets that SVB was holding as reserves that many other banks hold as well, which rendered them unable to meet the withdrawal request of their depositors, and ultimately created a run on the bank.

The Treasury Bond Issue

When banks take in money from depositors, one of the ways that a bank makes money is by taking those deposits that are sitting on the bank’s balance sheet and investing them in “safe” securities which allow the bank to earn interest on that money until their clients request withdrawals. It’s not uncommon for banks to invest that money in low-risk fixed-income investments like U.S. Treasury Bonds which principal and interest payments are backed by U.S. government.

SVB was holding many of these Treasuries and other fixed-income securities when these start-up companies began to default on their loans which then spooked the individuals and companies that still had money on deposit with SVB, worried that the bank might fail, and they started requesting large withdrawals, which then required SVB to begin selling their fixed income assets to raise cash to meet the redemption requests.

Herein lies the problem. While the value of a U.S. Treasury Bond is backed by the U.S. Government, meaning they promise to hand you back the face value of that bond when it matures, the value of that bond can fluctuate in value while it’s waiting to reach maturity. In other words, if you sell the bond before its maturity date, you could lose money.

The enemy of bond prices is rising interest rates because when interest rates go up, bond prices go down. Over the past 12 months, in an effort to fight inflation, the Fed has increased interest rates bigger and faster than it ever has within the past 50 years. So banks, like SVB, that were most likely buying bonds back in 2017, 2018, and 2019 before interest rates skyrocketed, if they were holding longer duration bonds hoping to hold them to maturity, the prices of those bonds are most likely underwater.

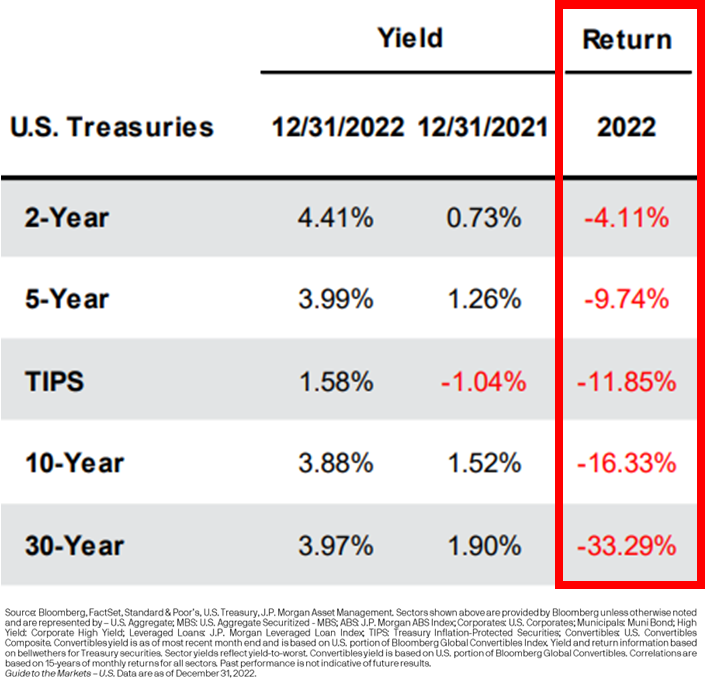

Below is a chart that shows price decline of U.S. Treasury Bonds in 2022 based on the duration of the bonds:

As you can see on the chart, in 2022, the price of a 5 Year US Treasury Bond declined by 9.74% but if you owned a 30 Year U.S. Treasury Bond, the price of that bond declines by 33.29% in 2022. Ouch!!

SVB Forced To Sell Assets At A Bad Time

When a bank needs to raise capital to either make up for loan defaults or because depositors are requesting their cash back, if they do not have enough liquid cash on hand, then they have to begin selling their reserve investments to raise cash. Again, if SVB was buying longer duration bonds back in 2018 and 2019, the intent might have been to hold those bonds until maturity, but the run on their bank forced them to sell those bonds at a loss, so they no longer had the cash to meet the redemption requests.

Will This Problem Spread To Other Banks?

While other banks may not lend as heavily to start-up companies, it is not uncommon at all for banks to purchase Treasuries and other fixed-income securities with their cash reserves. With the economy facing a potential recession in 2023, this has investors asking, what if defaults begin to rise on auto loans, mortgages, and lines of credit during a recession, and then these other banks are forced to liquidate their fixed-income assets at a loss, rendering them unable to meet redemption requests?

Over the next few weeks, this is the exact type of analysis that is probably going to take place at banks across the U.S. banking sector. It’s no longer just a question of “how much does a bank have in reserve assets?” but “What type of assets are being held by the bank and if redemptions increased dramatically would they have the cash to meet those redemption requests?”

The answer may very well be “Yes, there is no reason to panic.” SVB may end up being an isolated incident, not only because they had overexposure to high-risk start-up companies but also because they made poor choices with the fixed-income securities that they purchased with longer durations which compounded the issues when redemptions flooded in and they were forced to sell them at a loss. It’s too early to know for sure so we will have to wait and see.

Change In Fed Policy

This SVB failure could absolutely have an impact on Fed policy. If the Fed realizes that by continuing to push interest rates higher, it could create larger losses in these Treasury cash reserve portfolios at banks across the U.S., a recession shows up, redemptions at banks increase, and then more banks face the same fate as SVB due to the forced selling of those bonds at a loss, it may prompt the Fed to only raise rates by 25bps at the next Fed meeting instead of 50bps.

The reality is we have not seen interest rates rise this fast or by this magnitude within the last 50 years, so the Fed has to be aware that things can begin to break within the U.S. economy that were not intended to break. While getting inflation back down to the 2% - 3% level is the Fed’s primary focus right now, it will be interesting to see if they acknowledge some of these outlier events like SVB failure at the next Fed meeting.

FDIC Insurance

The FDIC has stepped in and taken control of Silicon Valley Bank. Banks have something called FDIC insurance which basically protects an individual’s deposits at a bank up to $250,000 if the bank were to be rendered insolvent. The FDIC saw the run on the bank and basically stepped in to make sure the remainder of the bank’s assets were being preserved as much as possible to meet their $250,000 protection obligation. But there is no protection for individuals and companies that had balances over $250,000 and considering this was a big bank, there are probably a lot of clients of the bank that fall into that category. Not just small companies either. For example, Roku came out on Friday and announced they had approximately $487 Million on deposit with Silicon Valley Bank (Source: CNBC).

The FDIC has issued preliminary guidance that the $250,000 protected amount should be available to depositors for withdrawal but Monday, March 13th, but there has been little to no guidance on what is going to happen to clients of SVB that had balances over $250,000. How much are they going to be able to recoup? When will they have access to that money?

The Business Fallout

Investors are probably going to see a lot of headlines over the next few weeks about businesses not being able to meet payroll or businesses going bankrupt due to SVB failure. Since SVB had a large concentration of start-up companies as clients, this may be more pronounced because many start-ups are not producing enough cash yet to sustain operations. If a company had their business checking account at SVB, depending on the answers from the FDIC as to how much money over the $250,000 they will be able to recoup, and when will they have access to the cash, some of these companies could fold just because they lost access to their cash which is very sad and unfortunate collateral damage from this banking fallout.

Isolated Incident or Contagion?

On the surface, the failure of Silicon Valley Bank may end up being an isolated event that does not spread to the rest of the banking industry but sitting here today, it’s too early to know that for sure. If there are other banks out there that have made similar mistakes by taking on too much duration in their bond portfolio prior to the rapid rise in interest rates, they could potentially face similar redemption problems if the U.S. economy sinks into a recession and defaults and redemption requests start piling up. A lot will depend on the results of these bank asset stress tests, Fed policy, and the direction of the economy over the next 12 months.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.