5 Options For Money Left Over In College 529 Plans

If your child graduates from college and you are fortunate enough to still have a balance in their 529 college savings account, what are your options for the remaining balance? There are basically 5 options for the money left over in college 529 plans.

If your child graduates from college and you are fortunate enough to still have a balance in their 529 college savings account, what are your options for the remaining balance? There are basically 5 options for the money left over in college 529 plans.

Advanced degree for child

If after the completion of an undergraduate degree, your child plans to continue on to earn a master's degree, law school, or medical school, you can use the remaining balance toward their advanced degree.

Transfer the balance to another child

If you have another child that is currently in college or a younger child that will be attending college at some point, you can change the beneficiary on that account to one of your other children. There is no limit on the number of 529 accounts that can be assigned to a single beneficiary.

Take the cash

When you make withdrawals from 529 accounts for reasons that are not classified as a "qualified education expenses", the earnings portion of the distribution is subject to income taxation and a 10% penalty. Again, only the earnings are subject to taxation and the penalty, your cost basis in the account is not. For example, if my child finishes college and there is $5,000 remaining in their 529 account, I can call the 529 provider and ask them what my cost basis is in the account. If they tell me my cost basis is $4,000 that means that the income taxation and 10% penalty will only apply to $1,000. The rest of the account is withdrawn tax and penalty free.

Reserve the account for a future grandchild

Once your child graduates from college, you can change the beneficiary on the account to yourself. By doing so the account will continue to grow and once your first grandchild is born, you can change the beneficiary on that account over to the grandchild.

Reserve the account for yourself or spouse

If you think it's possible that at some point in the future you or your wife may go back to school for a different degree or advanced degree, you assign yourself as the beneficiary of the account and then use the account balance to pay for that future degree.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Social Security Filing Strategies

Making the right decision of when to turn on your social security benefit is critical. The wrong decision could cost you tens of thousands of dollars over the long run. Given all the variables surrounding this decision, what might be the right decision for one person may be the wrong decision for another. This article will cover some of the key factors to

Making the right decision of when to turn on your social security benefit is critical. The wrong decision could cost you tens of thousands of dollars over the long run. Given all the variables surrounding this decision, what might be the right decision for one person may be the wrong decision for another. This article will cover some of the key factors to consider:

Normal Retirement Age

First, you have to determine your "Normal Retirement Age" (NRA). This is listed on your social security statement in the "Your Estimated Benefits" section. If you were born between 1955 – 1960, your NRA is between age 66 – 67. If you were born 1960 or later, your NRA is age 67. You can obtain a copy of your statement via the social security website.

Before Normal Retirement Age

You have the option to turn on social security prior to your normal retirement age. The earliest you can turn on social security is age 62. However, they reduce your social security benefit by approximately 7% per year for each year prior to your normal retirement age. See the chart below from USA Today which illustrates an individual with a normal retirement age of 66. If they turn on their social security benefit at age 62, they would only receive 75% of their full benefit. This reduction is a permanent reduction. It does not increase at a later date, outside of the small cost of living increases.

The big questions is: “If I start taking it age 62, at what age is the breakeven point?” Remember, if I turn on social security at 62 and my normal retirement age is 66, I have received 4 years of payments from social security. So at what age would I be kicking myself wishing that I had waited until normal retirement age to turn on my benefit. There are a few different ways to calculate this accounting for taxes, the rates of return on other retirement assets, inflations, etc. but in general it’s sometime between the ages of 78 and 82.

Since the breakeven point may be in your early 80’s, depending on your health, and the longevity in your family history, it may or may not make sense to turn on your benefit early. If we have a client that is in ok health but not great health and both of their parents passed way prior to age 85, then it may make sense to for them to turn on their social security benefit early. We also have clients that have pensions and turning on their social security benefit early makes the different between retiring now or have to work for 5+ more years. As long as the long-term projections work out ok, we may recommend that they turn on their social security benefit early so they can retire sooner.

Are You Still Working?

This is a critical question for anyone that is considering turning on their social security benefits early. Why? If you turn on your social security benefit prior to reaching normal retirement age, there is an “earned income” penalty if you earn over the threshold set by the IRS for that year. See the table listed below:

In 2016, for every $2 that you earned over the $15,720 threshold, your social security was reduced by $1. For example, let’s say I’m entitled to $1,000 per month ($12,000 per year) from social security at age 62 and in 2016 I had $25,000 in W2 income. That is $9,280 over the $15,720 threshold for 2016 so they would reduce my annual benefit by $4,640. Not only did I reduce my social security benefit permanently by taking my social security benefit prior to normal retirement age but now my $12,000 in annual social security payments they are going to reduce that by another $4,640 due to the earned income penalty. Ouch!!!

Once you reach your normal retirement age, this earned income penalty no longer applies and you can make as much as you want and they will not reduce your social security benefit.

Because of this, the general rule of thumb is if you are still working and your income is above the IRS earned income threshold for the year, you should hold off on turning on your social security benefits until you either reach your normal retirement age or your income drops below the threshold.

Should I Delay May Benefit Past Normal Retirement Age

As was illustrated in first table, if you delay your social security benefit past your normal retirement age, your benefit will increase by approximately 8% per year until you reach age 70. At age 70, your social security benefit is capped and you should elect to turn on your benefits.

So when does it make sense to wait? The most common situation is the one where you plan to continue working past your normal retirement age. It’s becoming more common that people are working until age 70. Not because they necessarily have too but because they want something to keep them busy and to keep their mind fresh. If you have enough income from employment to cover you expenses, in many cases, is does make sense to wait. Based on the current formula, your social security benefit will increase by 8% per year for each year you delay your benefit past normal retirement age. It’s almost like having an investment that is guaranteed to go up by 8% per year which does not exist.

Also, for high-income earners, a majority of their social security benefit will be taxable income. Why would you want to add more income to the picture during your highest tax years? It may very well make sense to delay the benefit and allow the social security benefit to increase.

Death Benefit

The social security death benefit also comes into play as well when trying to determine which strategy is the right one for you. For a married couple, when their spouse passes away they do not continue to receive both benefits. Instead, when the first spouse passes away, the surviving spouse will receive the “higher of the two” social security benefits for the rest of their life. Here is an example:

Spouse 1 SS Benefit: $2,000

Spouse 2 SS Benefit: $1,000

If Spouse 1 passes away first, Spouse 2 would bump up to the $2,000 monthly benefit and their $1,000 monthly benefit would end. Now let’s switch that around, let’s say Spouse 2 passes away first, Spouse 1 will continue to receive their $2,000 per month and the $1,000 benefit will end.

If social security is a large percentage of the income picture for a married couple, losing one of the social security payments could be detrimental to the surviving spouse. Due to this situation, it may make sense to have the spouse with the higher benefit delay receiving social security past normal retirement to further increase their permanent monthly benefit which in turn increases the death benefit for the surviving spouse.

Spousal Benefit

The “spousal benefit” can be a powerful filing strategy. If you are married, you have the option of turning on your benefit based on your earnings history or you are entitled to half of your spouse’s benefit, whichever benefit is higher. This situation is common when one spouse has a much higher income than the other spouse.

Here is an important note. To be eligible for the spousal benefit, you personally must have earned 40 social security “credits”. You receive 1 credit for each calendar quarter that you earn a specific amount. In 2016, the figure was $1,260. You can earn up to 4 credits each calendar year.

Another important note, under the new rules, you cannot elect your spousal benefit until your spouse has started receiving social security payments.

Here is where the timing of the social security benefits come into play. You can turn on your spousal benefit as early as 62 but similar to the benefit based on your own earnings history it will be reduce by approximately 7% per year for each year you start the benefit prior to normal retirement age. At your normal retirement age, you are entitled to receive your full spousal benefit.

What happens if you delay your spousal benefit past normal retirement age? Here is where the benefit calculation deviates from the norm. Typically when you delay benefits, you receive that 8% annual increase in the benefits up until age 70. The spousal benefit is based exclusively on the benefit amount due to your spouse at their normal retirement age. Even if your spouse delays their social security benefit past their normal retirement age, it does not increase the 50% spousal benefit.

Here is the strategy. If it’s determine that the spousal benefit will be elected as part of a married couple’s filing strategy, since delaying the start date of the benefits past normal retirement age will only increase the social security benefit for the higher income earning spouse and not the spousal benefit, in many cases, it does not make sense to delay the start date of the benefits past normal retirement age.

Divorce

For divorced couples, if you were married for at least 10 years, you can still elect the spousal benefit even though you are no longer married. But you must wait until your ex-spouse begins receiving their benefits before you can elect the spousal benefit.

Also, if you were married for at least 10 years, you are also entitled to the death benefit as their ex-spouse. When your ex-spouse passes away, you can notify the social security office, elect the death benefit, and you will receive their full social security benefit amount for the rest of your life instead of just 50% of their benefit resulting from the “spousal benefit” calculation.

Whether or not your ex-spouse remarries has no impact on your ability to elect the spousal benefit or death benefit based on their earnings history.

Consult A Financial Planner

Given all of the variables in the mix and the importance of this decision, we strongly recommend that you consult with a Certified Financial Planner® before making your social security benefit elections. While the interaction with a fee-based CFP® may cost you a few hundred dollars, making the wrong decision regarding your social security benefits could cost you thousands of dollars over your lifetime. You can also download a Financial Planner Budget Worksheet to give you that extra help when sorting out your finances and monthly budgeting.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Does A SEP IRA Work?

SEP stands for “Simplified Employee Pension”. The SEP IRA is one of the most common employer sponsored retirement plans used by sole proprietors and small businesses.

What is a SEP?

SEP stands for “Simplified Employee Pension”. The SEP IRA is one of the most common employer sponsored retirement plans used by sole proprietors and small businesses.

Special Establishment Deadline

SEP are one of the few retirement plans that can be established after December 31st which make them a powerful tax tool. For example, it’s March, you are meeting with your accountant and they deliver the bad news that you have a big tax bill that is due. You can setup the SEP IRA any time to your tax filing date PLUS extension, fund it, and capture the tax deduction.

Easy to Setup & Low Plan Fees

The other advantage of SEP IRA’s is they are easy to setup and you do not have a third-party administrator to run the plan, so the costs are a lot lower than a traditional 401(k) plans. These plans can typically be setup with 24 hours.

Contributions limits

SEP IRA contributions are expressed as a percentage of compensation. The maximum contribution is either 20% of the owners “net earned income” or 25% of the owners W2 wages. It all depends on how your business is incorporated. You have the option to contribution any amount less than the maximum contribution.

100% Employer Funded

SEP IRA plans are 100% employer funded meaning there is no employee deferral piece. Which makes them expense plans to sponsor for a company that eligible employees because the employer contribution is uniform for all employees. Meaning if the owner contributes 20% of their compensation to the plan for themselves they must also make a contribution equal to 20% of compensation for each eligible employee. Typically, once employees begin becoming eligible for the plan, a company will terminate the SEP IRA and replace it with either a Simple IRA or 401(k) plans.

Employee Eligibility Requirements

An employee earns a “year of service” for each calendar year that they earn $500 in compensation. You can see how easy it is to earn a “year of service” in these types of plans. This is where a lot of companies make an error because they only look at their “full time employees” as eligible. The good news for business owners is you can keep employees out of the plan for 3 years and then they become eligible in the 4th year of employment. For example, I am a sole proprietor and I hire my first employee, if my plan document is written correctly, I can keep that employee out of the SEP IRA for 3 years and then they will not be eligible for the employer contribution until the 4th year of employment.

Read This……..Very Important…..

There is a plan document called a 5305 SEP form that is required to sponsor a SEP IRA plan. This form can be printed off the IRS website or is sometimes provide by the investment platform for your plan. Remember, SEP IRA plans are “self-administered” meaning that you as the business owner are responsible for keeping the plan in compliance. Do cannot always rely on your investment advisor or accountant to help you with your SEP IRA plan. You should have a 5305 SEP for in your employer files for each year you have sponsored the plan. This form does not get filed with the IRS or DOL but rather is just kept in your employer files in the case of an audit. You are required to give this form to all employees of the company each year. It’s a way of notifying your employees that the plan exists and it lists the eligibility requirements.

Compliance Issues

The main compliance issues to watch out for with these plan is not having that 5305 SEP Form for each year the plan has been sponsored, not accurately identifying eligible employees, and miscalculating your “net earned income” for the max SEP IRA contribution.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Can I Use My 401K or IRA To Buy A House?

The most difficult part of buying a house is coming up with the down payment. This leads to the question, "Can I access cash in my retirement accounts to help toward the down payment on my house?". The short answer is in most cases, "Yes". The next important questions is "Is it a good idea to take a withdrawal from my retirement account for the down

The most difficult part of buying a house is coming up with the down payment. This leads to the question, "Can I access cash in my retirement accounts to help toward the down payment on my house?". The short answer is in most cases, "Yes". The next important questions is "Is it a good idea to take a withdrawal from my retirement account for the down payment given all of the taxes and penalties that I would have to pay?" This article aims to answer both of those questions and provide you with withdrawal strategies to help you avoid big tax consequences and early withdrawal penalties.

401(k) Withdrawal Options Are Not The Same As IRA's

First you have to acknowledge that different types of retirement accounts have different withdrawal options available. The withdrawal options for a down payment on a house from a 401(k) plan are not the same a the withdrawal options from a Traditional IRA. There is also a difference between Traditional IRA's and Roth IRA's.

401(k) Withdrawal Options

There may be loan or withdrawal options available through your employer sponsored retirement plan. I specifically say "may" because each company's retirement plan is different. You may have all or none of the options available to you that will be presented in this article. It all depends on how your company's 401(k) plan is designed. You can obtain information on your withdrawal options from the plan's Summary Plan Description also referred to as the "SPD".

Taking a 401(k) loan.............

The first option is a 401(k) loan. Some plans allow you to borrow 50% of your vested balance in the plan up to a maximum of $50,000 in a 12 month period. Taking a loan from your 401(k) does not trigger a taxable event and you are not hit with the 10% early withdrawal penalty for being under the age of 59.5. 401(k) loans, like other loans, change interest but you are paying that interest to your own account so it is essentially an interest free loan. Typically 401(k) loans have a maximum duration of 5 years but if the loan is being used toward the purchase of a primary residence, the duration of the loan amortization schedule can be extended beyond 5 years if the plan's loan specifications allow this feature.

Note of caution, when you take a 401(k) loan, loan payments begin immediately after the loan check is received. As a result, your take home pay will be reduced by the amount of the loan payments. Make sure you are able to afford both the 401(k) loan payment and the new mortgage payment before considering this option.

The other withdrawal option within a 401(k) plan, if the plan allows, is a hardship distribution. As financial planners, we strongly recommend against hardship distributions for purposes of accumulating the cash needed for a down payment on your new house. Even though a hardship distribution gives you access to your 401(k) balance while you are still working, you will get hit with taxes and penalties on the amount withdrawn from the plan. Unlike IRA's which waive the 10% early withdrawal penalty for first time homebuyers, this exception is not available in 401(k) plans. When you total up the tax bill and the 10% early withdrawal penalty, the cost of this withdrawal option far outweighs the benefits.

If You Have A Roth IRA.......Read This.....

Roth IRA's can be one of the most advantageous retirement accounts to access for the down payment on a new house. With Roth IRA's, you make after tax contributions to the account, and as long as the account has been in existence for 5 years and you are over the age of 59� all of the earnings are withdrawn from the account 100% tax free. If you withdraw the investment earnings out of the Roth IRA before meeting this criteria, the earnings are taxed as ordinary income and a 10% early withdrawal penalty is assessed on the earnings portion of the account.

What very few people know is if you are under the age of 59� you have the option to withdraw just your after-tax contributions and leave the earnings in your Roth IRA. By doing so, you are able to access cash without taxation or penalty and the earnings portion of your Roth IRA will continue to grow and can be distributed tax free in retirement.

The $10,000 Exclusion From Traditional IRA's.......

Typically if you withdraw money out of your Traditional IRA prior to age 59� you have to pay ordinary income tax and a 10% early withdrawal penalty on the distribution. There are a few exceptions and one of them is the "first time homebuyer" exception. If you are purchasing your first house, you are allowed to withdrawal up to $10,000 from your Traditional IRA and avoid the 10% early withdrawal penalty. You will still have to pay ordinary income tax on the withdrawal but you will avoid the early withdrawal penalty. The $10,000 limit is an individual limit so if you and your spouse both have a traditional IRA, you could potentially withdrawal up to $20,000 penalty free.

Helping your child to buy a house..........

Here is a little known fact. You do not have to be the homebuyer. You can qualify for the early withdrawal exemption if you are helping your spouse, child, grandchild, or parent to buy their first house.

Be careful of the timing rules..........

There is a very important timing rule associated with this exception. The closing must take place within 120 day of the date that the withdrawal is taken from the IRA. If the closing happens after that 120 day window, the full 10% early withdrawal penalty will be assessed. There is also a special rollover rule for the first time homebuyer exemption which provides you with additional time to undo the withdrawal if need be. Typically with IRA's you are only allowed 60 days to put the money back into the IRA to avoid taxation and penalty on the IRA withdrawal. This is called a "60 Day Rollover". However, if you can prove that the money was distributed from the IRA with the intent to be used for a first time home purchase but a delay or cancellation of the closing brought you beyond the 60 day rollover window, the IRS provides first time homebuyers with a 120 window to complete the rollover to avoid tax and penalties on the withdrawal.

Don't Forget About The 60 Day Rollover Option

Another IRA withdrawal strategy that is used as a “bridge solution” is a “60 Day Rollover”. The 60 Day Rollover option is available to anyone with an IRA that has not completed a 60 day rollover within the past 12 months. If you are under the age of 59.5 and take a withdrawal from your IRA but you put the money back into the IRA within 60 days, it’s like the withdrawal never happened. We call it a “bridge solution” because you have to have the cash to put the money back into your IRA within 60 days to avoid the taxes and penalty. We frequently see this solution used when a client is simultaneously buying and selling a house. It’s often the intent that the seller plans to use the proceeds from the sale of their current house for the down payment on their new house. Unfortunately due to the complexity of the closing process, sometimes the closing on the new house will happen prior to the closing on the current house. This puts the homeowner in a cash strapped position because they don’t have the cash to close on the new house.

As long as the closing date on the house that you are selling happens within the 60 day window, you would be able to take a withdrawal from your IRA, use the cash from the IRA withdrawal for the closing on their new house, and then return the money to your IRA within the 60 day period from the house you sold. Unlike the “first time homebuyer” exemption which carries a $10,000 limit, the 60 day rollover does not have a dollar limit.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Changes to 2016 Tax Filing Deadlines

In 2015, a bill was passed that changed tax filing deadlines for certain IRS forms that will impact a lot of filers. Not only is it important to know the changes so you can prepare and file your return timely but to understand why the changes were made.

In 2015, a bill was passed that changed tax filing deadlines for certain IRS forms that will impact a lot of filers. Not only is it important to know the changes so you can prepare and file your return timely but to understand why the changes were made.

Summary of Changes

IRS Form Business Type Previous Deadline New Deadline

1065 Partnership April 15 March 15

1120C Corporation March 15 April 15

NOTE: The dates in the chart above are for companies with years ending 12/31. If a company has a different fiscal year, Partnerships will now file by the 15th day of the third month following year end and C Corporations will now file by the 15th day of the fourth month following year end.

Why the Changes?

The most practical reason for the change to filing deadlines is that individuals with partnership interests will now have a better opportunity to file their individual returns (Form 1040) without extending. Form K-1 provides information related to the activity of a Partnership at the level of each individual partner. For example, if I own 50% of a Partnership, my K-1 would show 50% of the income (or loss) generated, certain deductions, and any other activity needed for me to file my Form 1040. The issue with the previous Partnership return deadline of April 15th is that it coincided with the individual deadline. This resulted in partners of the company not receiving their K-1’s with sufficient time to file their personal return by April 15th. With Partnerships now having a deadline of March 15th, this will give individuals a month to receive their K-1 and file their personal return without having to extend.

The deadline for Form 1120, which is filed by C Corporations, was also changed with this bill. Where the Form 1065 deadline was cut back by a month, the Form 1120 was extended a month. C Corporations, for tax purposes, are treated similar to individuals whereas they pay taxes directly when they file their return. Partnerships are not taxed directly, rather the income or loss is passed through to each individual partner who recognizes the tax ramifications on their personal return. For this reason, the deadline for Form 1120 being extended a month has little impact, if any, on individuals. The change gives C Corporations more time to file without having to extend the return.

S Corporations are another common business type. The deadlines for S Corporation returns (Form 1120S) were not changed with this bill. S Corporations are similar to Partnerships in that K-1’s are distributed to owners and the income or loss generated is passed through to the individuals return. That being said, Form 1120S already has a due date of March 15th, the same as the new Partnership deadline.

Extension Deadlines

IRS Form Business Type Deadline

1040 Individual October 15

1065 Partnership September 15

1120 C Corporation September 15

1120S S Corporation September 15

Extension deadlines were not immediately changed with the passing of the bill. Although Partnerships previously had the same filing deadline as individuals, the deadline with the filing of an extension was a month before. This was necessary because if a Partnership did not have to file an extended return until October 15th, individuals with partnership interests wouldn’t have a choice but to file delinquent.

The one change to the extension chart above set to take place in 2026 is the C Corporation extension being changed to October 15th.

Summary

Overall, the changes appear to have improved the filing calendar. This may be a big adjustment for Partnerships that are used to the April 15th deadline as they will have one less month to get organized and file. For this reason, you may see an increase in 2016 Partnership extensions.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.

Traditional vs. Roth IRA’s: Differences, Pros, and Cons

Individual Retirement Accounts (IRA’s) are one of the most popular retirement vehicles available for savers and the purpose of this article is to give a general idea of how IRA’s work, explain the differences between Traditional and Roth IRA’s, and provide some pros and cons of each. In January 2015, The Investment Company Institute put out a research

Individual Retirement Accounts (IRA’s) are one of the most popular retirement vehicles available for savers and the purpose of this article is to give a general idea of how IRA’s work, explain the differences between Traditional and Roth IRA’s, and provide some pros and cons of each. In January 2015, The Investment Company Institute put out a research report with some interesting statistics regarding IRA’s which can be found at the following link, ICI Research Perspective. The article states, “In mid-2014, 41.5 million, or 33.7 percent of U.S. households owned at least one type of IRA”. At first I was slightly shocked and asked myself the following question: “If IRA’s are the most important investment vehicle and source of income for most retirees, how do only one third of U.S. households own one?” Then when I took a step back and considered how money gets deposited into these retirement vehicles this figure begins making more sense.

Yes, a lot of American’s will contribute to IRA’s throughout their lifetime whether it is to save for retirement throughout one’s lifetime or each year when the CPA gives you the tax bill and you ask “What can I do to pay less?” When thinking about IRA’s in this way, one third of American’s owning IRA’s is a scary figure and leads one to believe more than half the country is not saving for retirement. This is not necessarily the case. 401(k) plans and other employer sponsored defined contribution plans have become very popular over the last 20 years and rather than individuals opening their own personal IRA’s, they are saving for retirement through their employer sponsored plan.

Employees with access to these employer plans save throughout their working years and then, when they retire, the money in the company retirement account will be rolled into IRA’s. If the money is rolled directly from the company sponsored plan into an IRA, there is likely no tax or penalty as it is going from one retirement account to another. People roll the balance into IRA’s for a number of reasons. These reasons include the point that there is likely more flexibility with IRA’s regarding distributions compared to the company plan, more investment options available, and the retiree would like the money to be managed by an advisor. The IRA’s allow people to draw on their savings to pay for expenses throughout retirement in a way to supplement income that they are no longer receiving through a paycheck.

The process may seem simple but there are important strategies and decisions involved with IRA’s. One of those items is deciding whether a Traditional, Roth or both types of IRA’s are best for you. In this article we will breakdown Traditional and Roth IRA’s which should illustrate why deciding the appropriate vehicle to use can be a very important piece of retirement planning.

Why are they used?

Both Traditional and Roth IRA’s have multiple uses but the most common for each is retirement savings. People will save throughout their lifetime with the goal of having enough money to last in retirement. These savings are what people are referring to when they ask questions like “What is my number?” Savers will contribute to retirement accounts with the intent to earn money through investing. Tax benefits and potential growth is why people will use retirement accounts over regular savings accounts. Retirees have to cover expenses in retirement which are likely greater than the social security checks they receive. Money is pulled from retirement accounts to cover the expenses above what is covered by social security. People are living longer than they have in the past which means the answer to “What is my number?” is becoming larger since the money must last over a greater period.

How much can I contribute?

For both Traditional and Roth IRA’s, the limit in 2021 for individuals under 50 is the lesser of $6,000 or 100% of MAGI and those 50 or older is the lesser of $7,000 or 100% of MAGI. More limit information can be found on the IRS website Retirement Topics - IRA Contribution Limits

What are the important differences between Traditional and Roth?

Taxation

Traditional (Pre-Tax) IRA: Typically people are more familiar with Traditional IRA’s as they’ve been around longer and allow individuals to take income off the table and lower their tax bill while saving. Each year a person contributes to a Pre-Tax IRA, they deduct the contribution amount from the income they received in that tax year. The IRS allows this because they want to encourage people to save for retirement. Not only are people decreasing their tax bill in the year they make the contribution, the earnings of Pre-Tax IRA’s are not taxed until the money is withdrawn from the account. This allows the account to earn more as money is not being taken out for taxes during the accumulation phase. For example, if I have $100 in my account and the account earns 10% this year, I will have $10 of earnings. Since that money is not taxed, my account value will be $110. That $110 will increase more in the following year if the account grows another 10% compared to if taxes were taken out of the gain. When the money is used during retirement, the individual will be taxed on the amount distributed at ordinary income tax rates because the money was never taxed before. A person’s tax rate during retirement is likely to be lower than while they are working because total income for the year will most likely be less. If the account owner takes a distribution prior to 59 ½ (normal retirement age), there will be penalties assessed.

Roth (After-Tax) IRA: The Roth IRA was established by the Taxpayer Relief Act of 1997. Unlike the Traditional IRA, contributions to a Roth IRA are made with money that has already been subject to income tax. The money gets placed in these accounts with the intent of earning interest and then when the money is taken during retirement, there is no taxes due as long as the account has met certain requirements (i.e. has been established for at least 5 years). These accounts are very beneficial to people who are younger or will not need the money for a significant number of years because no tax is paid on all the earnings that the account generates. For example, if I contribute $100 to a Roth IRA and the account becomes $200 in 15 years, I will never pay taxes on the $100 gain the account generated. If the account owner takes a distribution prior to 59 ½ (normal retirement age), there will be penalties assessed on the earnings taken.

Eligibility

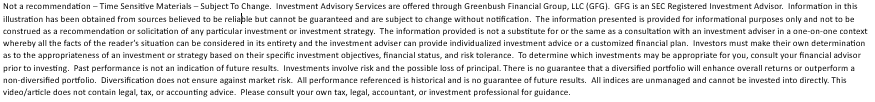

Traditional IRA: Due to the benefits the IRS allows with Traditional IRA’s, there are restrictions on who can contribute and receive the tax benefit for these accounts. Below is a chart that shows who is eligible to deduct contributions to a Traditional IRA:

There are also Required Minimum Distributions (RMD’s) associated with Pre-Tax dollars in IRA’s and therefore people cannot contribute to these accounts after the age of 70 ½. Once the account owner turns 70 ½, the IRS forces the individual to start taking distributions each year because the money has never been taxed and the government needs to start receiving revenue from the account. If RMD’s are not taken timely, there will be penalties assessed.

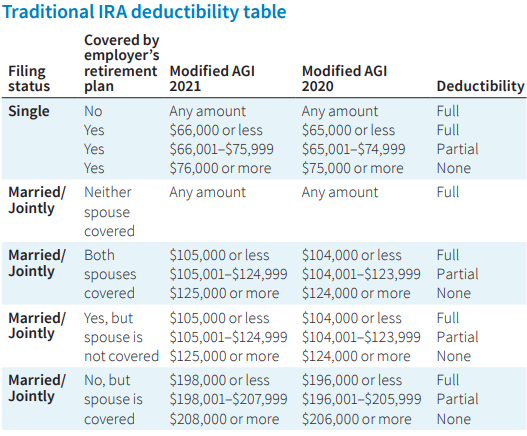

Roth IRA: As long as an individual has earned income, there are only income limitations on who can contribute to Roth IRA’s. The limitations for 2021 are as follows:

There are a number of strategies to get money into Roth IRA’s as a financial planning strategy. This method is explained in our article Backdoor Roth IRA Contribution Strategy.

Investment Strategies

Investment strategies are different for everyone as individuals have different risk tolerances, time horizons, and purposes for these accounts.

That being said, Roth IRA’s are often times invested more aggressively because they are likely the last investment someone touches during retirement or passes on to heirs. A longer time horizon allows one to be more aggressive if the circumstances permit. Accounts that are more aggressive will likely generate higher returns over longer periods. Remember, Roth accounts are meant to generate income that will never be taxed, so in most cases that account should be working for the saver as long as possible. If money is passed onto heirs, the Roth accounts are incredibly valuable as the individual who inherits the account can continue earning interest tax free.

Choosing the correct IRA is an important decision and is often times more complex than people think. Even if you are 30 years from retiring, it is important to consider the benefits of each and consult with a professional for advice.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.

Do I Have To Pay Taxes On My Inheritance?

Whenever people come into large sums of money, such as inheritance, the first question is “how much will I be taxed on this money”? Believe it or not, money you receive from an inheritance is likely not taxable income to you.

Whenever people come into large sums of money, such as inheritance, the first question is “how much will I be taxed on this money”? Believe it or not, money you receive from an inheritance is likely not taxable income to you.

Of course there are some caveats to this. If the inherited money is from an estate, there is a chance the money received was already taxed at the estate level. The current federal estate exclusion is $5,430,000 (estate taxes and the exclusion amount varies for states). Therefore, if the estate was large enough, a portion of the inheritance may have been subject to estate tax which is 40% in most cases. That being said, whether the money was or was not taxed at the estate level, you as an individual do not have to pay income taxes on the money.

Although the inheritance itself is not taxable, you may end up paying taxes if there is appreciation after the money is inherited. The type of account and distribution will dictate how the income will be taxed.

Basis Of Inherited Property

Typically, the basis of inherited property is the fair market value of the property on the date of the decedent’s death or the fair market value of the property on the alternate valuation date if the estate uses the alternate valuation date for valuing assets. An estate will choose to value assets on an alternate date subsequent to the date of death if certain assets, such as stocks, have depreciated since the date of death and the estate would pay less tax using the alternate date.

What the fair market value basis means is that if you inherit stock that was originally purchased for $500 and at the date of death has appreciated to $10,000, you will have a “step-up” basis of $10,000. If you turn around and sell the stock for $11,000, you will have a $1,000 gain and if you sell the stock for $9,000, you will have a $1,000 loss.

Inheriting a personal residence also provides for a step-up in basis but the gain or loss may be treated differently. If no one lives in the inherited home after the date of death, it will be treated similar to the stock example above. If you move into the home after death, any subsequent sale at a loss will not be deductible as it will be treated as your personal asset but a gain would have to be recognized and possibly taxed. If you rent the property subsequent to inheritance, it could be treated as a trade or business which would be treated differently for tax purposes.

Inheriting An IRA or Retirement Plan Account

Please read our article “Inherited IRA’s: How Do They Work” for a more detailed explanation of the three different types of distribution options.

When you inherit a retirement account, and you are not the spouse of the decedent, in most cases you will only have one option, fully distribute the account balance 10 years following the year of the decedents death. The SECURE Act that was passed in December 2019 dramatically change the distribution options available to non-spouse beneficiaries. See the article below:

If you are the spouse of the of the decedent, you are able to treat the retirement account as if it was yours and not be forced to take one of the options above. You will have to pay taxes on distributions but you do not have to start withdrawing funds immediately unless there are required minimum distributions needed.

Note: If the inherited account was an after tax account (i.e. Roth), the inheritor must choose one of the options presented above but no tax will be paid on distributions.

Non-Qualified Annuities

Non-qualified annuities are an exception to the step-up in basis rule. The non-spousal inheritor of a non-qualified annuity will have to take either a lump sum or receive payments over a specified time period. If the inheritor chooses a lump sum, the portion that represents the gain (lump sum balance minus decedent’s contributions) will be taxed as ordinary income. If the inheritor chooses a series of payments, distributions will be treated as last in, first out. Last in, first out means that the appreciation will be distributed first and fully taxable until there is only basis left.

If the spouse inherits the annuity, they most likely have the option to treat the annuity contract as if they were the original owner.

This article concentrated on inheritance at a federal level. There is no inheritance tax at a federal level but some states do have an inheritance tax and therefore meeting with a professional is recommended. New York currently does not have an inheritance tax.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.

How Is Child Support & Alimony Calculated In New York?

For purposes of child support, either parent can be named the custodial parent by a Court. For the purposes of this article we will assume that the mother is the custodial parent and will be receiving the child support and alimony payments. However, fathers who have custody can also use this as a guide.

For purposes of child support, either parent can be named the custodial parent by a Court. For the purposes of this article we will assume that the mother is the custodial parent and will be receiving the child support and alimony payments. However, fathers who have custody can also use this as a guide.

How do I apply for child support?

Usually, you ask for child support in Family Court in the county where you and the child live. You can also go for child support in the county where the father lives. You are not required to have a lawyer to apply for child support but it is recommended that you consult with a divorce attorney prior to filing for support.

How is the dollar amount of child support calculated?

The Child Support Standard Act (CSSA) is the law in NYS and tells the amount of child support the father must pay. The CSSA applies to parental income up to a maximum of $181,000 (2021 limit) and the Court can apply it to income in excess of $148,000 based on certain factors. Examples of these factors are: the financial ability of the father, the lifestyle the child would have enjoyed if the parents stayed living together, and any special needs the child may have. The maximum can be adjusted periodically by the New York State legislature. The amount you get depends on what the father’s income is, what your income is, how many children you have together, and what your children’s basic needs are

The Support Magistrate will look at the information in your financial disclosure affidavit and the father’s financial disclosure affidavit, if he supplies one. The Support Magistrate might also ask you and the father to answer questions. And you and he might be asked to give the Support Magistrate other evidence of your income and expenses, such as a paystub or a W-2 statement.

Both parents’ incomes are used to figure out how much child support the father has to pay because both parents have to support their children.

This is how it is calculated:

Deduct (subtract) these things from each parent’s income:

spousal maintenance paid to a former husband or wife by court order

child support paid to other children by court order

public assistance and supplemental security income (SSI)

city taxes

social security and Medicare taxes (FICA)

Combine (add) the incomes of both parents after making those deductions, and multiply the total you get by the correct percentage:

17% for one child

25% for two children

29% for three children

31% for four children

Not less than 35% for five children or more

Divide the figure you get between both parents according to both your incomes (on a “pro rata” basis). This means that if the father earns twice as much as you, he must pay twice as much child support.

The father may also have to pay additional amounts for:

child care, if you are working or going to school.

medical care not covered by insurance

the child’s educational expenses

The parent who has health insurance must also (if reasonable) continue providing health insurance for your children. The cost of providing health insurance will be shared between yourself and the father, in proportion to your respective incomes. If neither of you has health insurance, the court will order the custodial parent (the parent with the greatest amount of custody) to apply for the state’s child health insurance plan.

When do child support payments stop?

Child support payments typically end when the child reaches age 21 or becomes emancipated. Emancipation means a child is living separately and independently from a parent, or is self –supporting. Some things that show that a child is emancipated are:

Child has completed 4 years of college education

Child has gotten married

Child is living away from home (except for living at school or college)

Child has gone into the military

Child is 17 years old and working full-time (except for summer vacation jobs)

Child willingly and fro no good reason has ended the relationship with both parents

In New York, alimony is referred to in three different ways: as alimony, spousal support, and maintenance. “Temporary maintenance” is an order that one spouse must financially support the other while the divorce is being finalized. Once the divorce is finalized, the temporary maintenance stops and the judge decides whether permanent alimony is appropriate.

How is the amount of alimony payments determined?

Unlike child support payments there really are no set guidelines for the amount and duration of alimony payments. To decide whether spousal support is appropriate, the judge will look at the needs of the spouse asking for support and whether the other spouse has the financial ability to provide financial help. For example, if your income is lower than your spouse’s but you are able to support yourself, you may not be entitled to alimony. The court will also look at other factors when making a decision about support:

the length of the marriage

each spouse’s age and health status

each spouse’s present and future earning capacity

the need of one spouse to incur education or training expenses

whether the spouse seeking maintenance is able to become self-supporting

whether caring for children inhibited one spouse’s earning capacity

equitable distribution of marital property, and

the contributions that one spouse has made as a homemaker in order to help enhance the other spouse’s earning capacity.

The court will also look to see whether the acts of one spouse have inhibited or continue to inhibit the other spouse’s earning capacity or ability to obtain employment. The most common example of this would be domestic violence. If one spouse’s abuse of the other affected that abused spouse’s ability to maintain or to get a job, the court might consider those actions in making its order. Disclosure: The information listed above is for educational purposes only. Greenbush Financial Group, LLC does not provide legal advice. For legal advice, please consult your attorney.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Do I Have to Pay Taxes on my Social Security Benefit?

If your “combined income” exceeds specific annual limits, you may owe federal income taxes on up to 50% or 85% of your Social Security benefits. The limits for federal income tax purposes are listed in the chart below.

If your “combined income” exceeds specific annual limits, you may owe federal income taxes on up to 50% or 85% of your Social Security benefits. The limits for federal income tax purposes are listed in the chart below.

The federal income thresholds are not indexed for inflation, so they are the same every year. “Combined income” is defined as adjusted gross income plus any tax-exempt interest plus 50% of your Social Security Benefit. Some states tax Social Security Benefits, whereas others do not tax them. See the chart below:

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.