The #1 Question To Ask Yourself Before Selling A Stock

When is the right time to sell an investment? It's a tough decision that individuals have a difficult time making but it's one of the most important decisions that you will have to make as an investor. Often time the decision to "buy" an investment is much easier. You gather information on a given investment, look at the trends in the market acting on

When is the right time to sell an investment? It's a tough decision that individuals have a difficult time making but it's one of the most important decisions that you will have to make as an investor. Often time the decision to "buy" an investment is much easier. You gather information on a given investment, look at the trends in the market acting on that investment, assess the risk versus reward trade off, and you put your strategy to work. Deciding to sell has a lot more emotions involved which frequently causes investors to make the wrong decision.

When do I sell a big winner?

First scenario is "the rocket ship". You purchased a stock and the stock price has gone through the roof. It's made you a ton of money on paper, you proudly boast to your friends and co-workers about the price that you bought it at, and in certain instances it has been a life changing financial event. The mistake investors make here is they get into what we call "the teddy bear syndrome".

Teddy bear syndrome.....

Have you ever tried to take a teddy bear away from a five year old......good luck. As adults, we often fall into the same behavioral pattern with very successful investments. Individuals typically have a strong emotional attachment to their most successful investments. But you will frequently hear many legendary investment managers make comments like: "Investment decisions are not emotional decisions. You have to remove your emotions from the decision-making process." Let's say you bought $10,000 of XYZ stock at $10 per share and five years later it's now selling at $890 per share turning your $10,000 into $890,000. Do you sell some of it, maybe all of it?

Here is the key question........

"If you had that $890,000 in cash in your hand today, would you invest all of it back into XYZ stock at $890 per share?"

Most people would say "No!! That's crazy. I would diversify that $890,000 across a number of holdings and the stock has already gone up so much". Continuing to hold a stock is the same decision as buying a stock. But doing nothing is easier because we feel like we are not making a decision, we are just "continuing to hold". Remember, it's easy to sell a stock that has lost money. It's much more difficult to sell a stock that produced a gain. Of course, this brings up the question of how do you find the right stocks to invest in?

"If I sell the stock, I'll have to pay tax on the gain."

Question: Would you rather pay taxes on a gain or lose money? Usually if you are paying taxes it means that you are making money. If I sold the stock holding in the example above, I would have an $880,000 long term capital gain at a minimum would pay around $132,000 in long term capital gains tax at 15%. This would leave me with $758,000 cash in hand from a $748,000 gain plus $10,000 original investment. What if instead of selling I continue to hold the stock and to no fault of company XYZ the economy goes into a recession? The stock goes from $890 a share to $500 a share. Now my total investment is worth $500,000 instead of $890,000. It's still a good investment because I bought it at $10,000 and it's still worth $500,000 but if I sold it at $500 per share I would still pay tax on the gain, now a smaller amount of gain, and be left with around $425,000. That poor decision cost me $333,000 after tax.

The fallen star

Most investors have been here at one point or another. You purchased a stock that rose in value dramatically but for whatever reason the stock lost all of its early investment gains and your investment is now underwater. Many investors will say “It’s a good long term holding so I’m just going to wait for it to come back.” While we are all familiar with the buy and hold strategy, there is a risk and opportunity cost with this strategy. The risk being that it may never come back to its original value. The opportunity cost is the money invested in that underperforming company could be growing somewhere else instead of just “waiting for it to come back”.

You must ask yourself the same key question that was listed above: “If I had that money in my hand today, would I invest all of it in that stock?” If the answer is “no”, you should probably sell some or all of it. Do not hold a stock solely based on a target share price. I will hear people say, “Well I bought it at $55 per share so I’m going to wait until it at least gets back to that price.” That is not an investment strategy. You must look at the fundamentals of the company, their competitors, global market conditions, company management, the company’s strategy, and their financials to really come up with a price target for the stock.

The inherited gem

It's a common occurrence that individuals will inherit stock from a family member and they know that family member had a strong emotional attachment to the stock because they either work for the company or they never sold a single share during their lifetime. It's easy to feel that selling the stock is in some way selling the memory of that family member. I will often hear comments like: "My dad worked for the company and held that stock for 40 years. He would be rolling in his grave right now if he knew I was thinking about selling his stock." This frequently happens because the generation before us had pension plans to support them in retirement and did not have to sell stock to supplement their income or they came from a generation that was very frugal about spending money. Your needs and circumstances are probably very different from the person that you inherited the stock from so you need to look at that investment holding from your financial standpoint.

I work for the company........

If you work for a publicly traded company then there is a good chance that you own shares of that company in an employee stock purchase plan, retirement plan, options plan, or brokerage account. Since you work for the company it usually means that you have "drank the kool-aide" and believe in the company's mission, vision, and you feel like you have more control over the fate of your investment. Remember, even though you work for that company it's still one company and attaching too much for your net worth to one investment is very risky. It's even more risky for employees because if something negatively impacts the company not only is your employment at risk but so is your total net worth if a large portion of your investment portfolio is tied to the company that you work for. Make sure you periodically calculate a total of all your investment holdings and compare that to the amount invested in your company's stocks to make sure you stay balanced in your overall investment approach.

Ask yourself the easy question.......

While making the decision to buy, sell, or hold an investment is not always an easy one. Finding the right answer may be as easy as asking yourself: "If the amount invested in that stock was in cash and in my hand today, would I invest 100% of it back into that stock holding?"

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Tax Deductions For College Savings

Did you know that if you are resident of New York State there are tax deductions waiting for you in the form of a college savings account? As a resident of NYS you are allowed to take a NYS tax deduction for contributions to a NYS 529 Plan up to $5,000 for a single filer or $10,000 for married filing joint. These limits are hard dollar thresholds so it

Did you know that if you are resident of New York State there are tax deductions waiting for you in the form of a college savings account? As a resident of NYS you are allowed to take a NYS tax deduction for contributions to a NYS 529 Plan up to $5,000 for a single filer or $10,000 for married filing joint. These limits are hard dollar thresholds so it does not matter how many kids or grandchildren you have.

529 Accounts

529 accounts are one of the most tax efficient ways to save for college. You receive a state income tax deduction for contributions and all of the earnings are withdrawn tax free if used for a qualified education expense. These accounts can only be used for a college degree but they can be used toward an associate’s degree, bachelor’s degree, masters, or doctorate. You can name whoever you want as a beneficiary including yourself. More commonly, we see parents set these accounts up for their children or grandparents for the grandchildren.

Can they go to college in any state?

If you setup a NYS 529 account, the beneficiary can go to college anywhere in the United States. It’s not limited to just colleges in New York. As the owner of the account you can change the beneficiary on the account whenever you choose or close the account at your discretion.

What if they don't go to college?

The question we usually get is “what if they don’t go to college?” If you have a 529 account for a beneficiary that does not end up going to college you have a few choices. You can change the beneficiary listed on the account to another child or even yourself. You can also decide to just liquidate the account and receive a check. If the account is closed and the balance is not used for a qualified college expense then you as the owner receive your contributions back tax and penalty free. However, you will pay ordinary income tax and a 10% penalty on just the earnings portion of the account.

What if my child receives a scholarship?

There is a special withdrawal exception for scholarship awards. They do not want to penalize you because the beneficiary did well in high school or is a star athlete so they allow you to make a withdrawal from the 529 account equal to the amount of the scholarship. You receive your contributions tax free, you pay ordinary income tax on the earnings, but you avoid the 10% penalty for not using the account toward a qualified college expense.

Don't make this mistake.............

We often see individuals making the mistake of setting up a 529 account in another state because “their advisor told them to do so”. You are completely missing out on a good size NYS tax deduction because you only get credit for NYS 529 contributions. A little-known fact is that you can rollover a 529 with another state into a NYS 529 account and that rollover amount will count toward your $5,000 / $10,000 deduction limit for the year. If a client has $30,000 in a 529 account outside of NYS we typically advise them to roll it over in $10,000 pieces over a three year period to maximize the $10,000 per year NYS tax deduction.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Fiduciary Rule: Exposing Your 401(K) Advisor’s Secrets

It’s here. On June 9, 2017, the long awaited Fiduciary Rule for 401(k) plans will arrive. What secrets does your 401(k) advisor have?

It’s here. On June 9, 2017, the long awaited Fiduciary Rule for 401(k) plans will arrive. The wirehouse and broker-dealer community within the investment industry has fought this new rule every step of the way. Why? Because their secrets are about to be exposed. Fee gouging in these 401(k) plans has spiraled out of control and it has gone on for way too long. While the Fiduciary Rule was designed to better protect plan participants within these employer sponsored retirement plans, the response from the broker-dealer community, in an effort to protect themselves, may actually drive the fees in 401(k) plans higher than they are now.

If your company sponsors an employer sponsored retirement plan and your investment advisor is a broker with one of the main stream wirehouse or broker dealers then they may be approaching you within the next few months regarding a “platform change” for your 401(k) plan. Best advice, start asking questions before you sign anything!! The brokerage community is going to try to gift wrap this change and present this as a value added service to their current 401(k) clients when the reality is this change is being forced onto the brokerage community and they are at great risk at losing their 401(k) clients to independent registered investment advisory firms that have served as co-fiduciaries to their plans along.

The Fiduciary Rule requires all investment advisors that handle 401(k) plans to act in the best interest of their clients. Up until now may brokers were not held to this standard. As long as they delivered the appropriate disclosure documents to the client, the regulations did not require them to act in their client’s best interest. Crazy right? Well that’s all about to change and the response of the brokerage community will shock you.

I will preface this article by stating that there have been a variety of responses by the broker-dealer community to this new regulation. While we cannot reasonably gather information on every broker-dealers response to the Fiduciary Rule, this article will provide information on how many of the brokerage firms are responding to the new legislation given our independent research.

SECRET #1:

Many of the brokerage dealers are restricting what 401(k) platforms their brokers can use. If the broker currently has 401(k) clients that maintain a plan with a 401(k) platform outside of their new “approved list”, they are forcing them to move the plan to a pre-approved platform or the broker will be required to resign as the advisor to the plan. Even though your current 401(k) platform may be better than the new proposed platform, the broker may attempt to move your plan so they can keep the plan assets. How is this remotely in your employee’s best interest? But it’s happening. We have been told that some of these 401(k) providers end up on the “pre-approve list” because they are willing to share fees with the broker dealer. If you don’t share fees, you don’t make the list. Really ugly stuff!!

SECRET #2:

Because these wirehouses and broker-dealers know that their brokers are not “experts” in 401(k) plans, many of the brokerage firms are requiring their 401(k) plans to add a third-party fiduciary service which usually results in higher plan fees. The question to ask is “if you were so concerned about our fiduciary liability why did you wait until now to present this third party fiduciary service?” They are doing this to protect themselves, not the client. Also, many of these third party fiduciary services could standardize the investment menu and take the control of the investment menu away from the broker. Which begs the question, what are you paying the broker for?

SECRET #3:

Some broker-dealers are responding to the Fiduciary Rule by forcing their brokers to move all their 401(k) plans to a “fee based platform” versus a commission based platform. The plan participants may have paid commissions on investments when they were purchased within their 401(k) account and now could be forced out of those investments and locked into a fee based fee structure after they already paid a commission on their balance. This situation will be common for 401(k) plans that are comprised primarily of self-directed brokerage accounts. Make sure you ask the advisor about the impact of the fee structure change and any deferred sales charges that may be imposed due to the platform change.

SECRET #4:

The plan fees are often times buried. The 401(k) industry has gotten very good at hiding fees. They talk in percentages and basis points but rarely talk in hard dollars. One percent does not sound like a lot but if you have a $2 million dollar 401(k) plan that equals $20,000 in fees coming out of the plans assets every year. Most of the fees are buried in the mutual fund expense ratios and you basically have to be an investment expert to figure out how much you are paying. This has continued to go on because very rarely do companies write a check for their 401(k) fees. Most plans debit plan assets for their plan fees but the fees are real.

With all of these changes taking place, now is the perfect time to take a good hard look at your company’s employer sponsored retirement plan. If your current investment advisor approaches you with a recommended “platform change” that is a red flag. Start asking a lot of questions and it may be a good time to put your plan out to bid to see if you can negotiate a better overall solution for you and your employees.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Should I Gift A Stock To My Kids Or Just Let Them Inherit It?

Many of our clients own individual stocks that they either bought a long time ago or inherited from a family member. If they do not need to liquidate the stock in retirement to supplement their income, the question comes up “should I just gift the stock to my kids while I’m still alive or should I just let them inherit it after I pass away?” The right answer is

Many of our clients own individual stocks that they either bought a long time ago or inherited from a family member. If they do not need to liquidate the stock in retirement to supplement their income, the question comes up “should I just gift the stock to my kids while I’m still alive or should I just let them inherit it after I pass away?” The right answer is largely influenced by the amount of appreciation or depreciation in the stock.

Gifting Stock

When you make a non-cash gift such as a stock, house, or even a business, the person receiving the gift assumes your cost basis in the assets. They do not receive a “step-up” in basis at the time the gift is made. Example, I buy XYZ Corp stock in 1995 for $10,000. In 2017, those shares of XYZ are now worth $100,000. If I gift them to my kids, no one owes tax on the gift at the time that the gift is made but my kids carry over my cost basis in the stock. If my kids hold the stock for 10 more years and sell it for $150,000, their basis in the stock is $10,000, and they owe capital gains tax on the $140,000 gain. Thus, creating an adverse tax consequence for my kids.

Inheriting Stock

Instead, let’s say I continue to hold XYZ stock and when I pass away my kids inherited the stock. If I pass away in 10 years and the stock is worth $150,000 then my kids receive a “step-up” in basis which means that their cost basis in the stock is the value of the stock as of the date of my death. They inherit the stock at $150,000 value, sell it the next day, and they owe $0 in taxes due to the step-up in basis upon my death.

In general, if you have assets that have low cost basis it is usually better for your heirs to inherit the assets as opposed to gifting it to them.

The concept is often times reversed for assets that have depreciated in value…..with an important twist. If I purchase XYZ Corp stock in 1995 for $10,000 but in 2017 it’s only worth $5,000, if I sold the stock myself I would capture the realized investment loss and could use it to offset investment gains or reduce my income by $3,000 for the IRS realized loss allowance.

Here is a very important rule......

In most cases, do not gift a depreciated asset to someone else. Why? When you gift an asset that has depreciated in value the carry over basis rules change. For an asset that has depreciated in value, the carry over basis for the person receiving the gift is the higher of the fair market value of the asset or the cost basis of the person making the gift. In other words, the loss evaporates when I gift the asset to someone else and no one gets the tax advantage of using the realized loss for tax purposes. It would be better if I sold the stock, captured the investment loss, and then gifted the cash.

If they inherit the stock that has lost value there is no value to the step-up in basis because the stock has not appreciated in value.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Do Phantom Stock Plans Work?

In the world of executive compensation, there are a number of ways that a company can reward key employees. Although most companies are familiar with traditional deferred compensation plans, one of the lesser known options which is growing in popularity is called a “phantom stock plan”. Especially in small to mid-size companies.

In the world of executive compensation, there are a number of ways that a company can reward key employees. Although most companies are familiar with traditional deferred compensation plans, one of the lesser known options which is growing in popularity is called a “phantom stock plan”. Especially in small to mid-size companies.

Here is the most common situation, a closely held business or family business has a key employee that they would like to reward but also further tie that employee to the company. The current owners of the company do not want to give up equity but they want to tie this reward system to the actual performance of the company as if that key employee was an owner or shareholder. This can be accomplished via a phantom stock plan.

These plans provide select employees with additional compensation equal to the appreciation of a percent of the company for a partnership, LLC, or PLLC, or in the case of an S-corp or C-corp a given number of shares in the company even though the ownership only exists in theory. For example, I own a company that is incorporated as a partnership and I would like to reward a key employee by providing them with an annual cash reward equal to a 5% ownership stake in the company without formally making them a partner. Once the books are closed at the end of year I will issue a cash bonus to that employee equal to 5% of the net profits for the year. From the employee’s standpoint, they are receiving the monetary reward mimicking a 5% ownership share of the company so they have an incentive to continue to grow the company. From the employer’s standpoint, they have taken further steps to retain a key employee, they can deduct the additional comp pay to the employee, and the current owners have retained full control of the company.

The features of these plans and how they are design are limitless because they are just another flavor of nonqualified executive compensation plan. A few plan design features are listed below:

Companies have full discretion as to who is covered and not covered by the plan

Instead of paying out the benefit each year as compensation, the company can attach a vesting schedule to essentially put “golden handcuffs” on the key employee. If they leave the company prior to a stated date they lose the benefit.

When awarding the shares or ownership the company can limit the award to just the appreciation of their shares or ownership percentage and not award the full current value of the ownership percentage. These are called “appreciation only” plans. Appreciation only phantom stock plans can be viewed as a favorable option to key employees because it does not require them to make a cash outlay to purchase their ownership interest as would normally be required by an actual equity or share purchase.

How do these plans work from an operation standpoint? The ownership percentage or shares are issued to the employee as hypothetical units or “phantom units” that are just tracked internally by the company. The employee is taxed on the benefit and the company can take the deduction for the compensation paid when there is no longer a “risk of forfeiture”. In other words, when the employee vests in the benefit whether they decide to “sell their phantom shares” or not. As soon as the employee has the ability to “sell” their phantom interest in exchange for compensation that triggers the taxable event.

When designed correctly, these plans can be a valuable tool for small to mid-size companies in their efforts to retain key employees.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How To Teach Your Kids About Investing

As kids enter their teenage years, as a parent, you begin to teach them more advanced life lessons that they will hopefully carry with them into adulthood. One of the life lessons that many parents teach their children early on is the value of saving money. By their teenage years many children have built up a small savings account from birthday gifts,

As kids enter their teenage years, as a parent, you begin to teach them more advanced life lessons that they will hopefully carry with them into adulthood. One of the life lessons that many parents teach their children early on is the value of saving money. By their teenage years many children have built up a small savings account from birthday gifts, holidays, and their part-time jobs. As parents you have most likely realized the benefit of compounding interest through working with a financial advisor, contributing to a 401(k) plan, or depositing money to a college savings account. As financial planners, we often get the question: “What is the best way to teach your children about the value of investing and compounding interest? "

The #1 rule.......

We have been down this road many times with our clients and their children. Here is the number one rule: Make it an engaging experience for your kids. Investments can be a very dull topic to talk about and it can be painfully dull from a child’s point of view. All they know is the $1,000 that was in their savings account is now with their parent’s investment guy.

Ignoring the life lessons for a moment, the primary investment vehicle for brokerage accounts with balances under $50,000 is typically a mutual fund. But let’s pause for a moment. We have a dual objective here. We of course want our children to make as much money as possible in their investment account but we also want to simultaneously teach them life long lessons about investing.

The issue with young investors

Explaining how a mutual fund operates can be a complex concept for a first time investor because you have all of these companies in one investment, expense ratios, different types of funds, and different fund families. It’s not exciting, it’s intimidating.

Consider this approach. Ask the child what their hobbies are? Do they have a cell phone? Have them take their cell phone out during the meeting and ask them how often they use it during the day and how many of their friends have cell phones. Then ask them, if you received $20 every time someone in this area bought a cell phone would you have a lot of money? Then explain that this scenario is very similar to owning stock in a cell phone company. The more they sell the more money the company makes. As a “shareholder” you own a piece of that company and you receive a piece of the profits if the company grows. If your child plays sports, do they wear a lot of Nike or Under Armour? Explain investing to them in a way that they can relate it to their everyday life. Now you have their attention because you attached the investment idea to something they love.

A word of caution....

If they are investing in stocks it is also important for them to understand the concept of risk. Not every investment goes up and you could start with $1,000 and end the year with $500, so they need to understand risk and time horizon.

While it’s not prudent in most scenarios to invest 100% of a portfolio in one stock, there may be some middle ground. Instead of investing their entire $1,000 in a mutual fund, consider investing $500 – $700 in a mutual fund but let them pick one to three stocks to hold in the account. It may make sense to have them review those stock picks with your investment advisor for two reasons. One, you want them to have a good experience out of the gates and that investment advisor can provide them with their option of their stock picks. Second, the investment advisor can tell them more about the companies that they have selected to further engage them.

Don't forget the last step......

Download an app on their smartphone so they can track the investments that they selected. You may be surprise how often they check the performance of their stock holdings and how they begin to pay attention to news and articles applicable to the companies that they own.At that point you have engaged them and as they hopefully see their investment holdings appreciate in value they will become even more excited about saving money in their investment account and making their next stock pick. In addition, they also learn valuable investment lessons early on like when one of their stocks loses value. How do they decide whether to sell it or continue to hold it? It’s a great system that teaches them about investing, decision making, risk, and the value of compounding investment returns.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

A New Year: Should I Make Changes To My Retirement Account?

A simple and easy answer to this question would be…..Maybe? Not only would that answer make this article extremely short, it wouldn’t explain some important items that participants should take into consideration when making decisions about their retirement plan.Every time the calendar adds a year we get a sense of reset. A lot of the same tasks on the

A simple and easy answer to this question would be…..Maybe? Not only would that answer make this article extremely short, it wouldn’t explain some important items that participants should take into consideration when making decisions about their retirement plan.Every time the calendar adds a year we get a sense of reset. A lot of the same tasks on the to do list get added each January and hopefully this article helps you focus on matters to consider regarding your retirement plan.

Should I Consult With The Advisor On My Plan?

At our firm we make an effort to meet with participants at least annually. Saving in company retirement plans is about longevity so many times the individual meetings are brief and no allocation changes are made. Even if this is the result, an overview of your account, at least annually, is a good way to keep retirement savings fresh in your mind and add a sense of comfort that you’re investing appropriately based on your time horizon and risk tolerance.

These individual meetings are also a good time to discuss other financial questions you may have. Your retirement plan is only a piece of your financial plan and we encourage participants to use the resources available to them. Often times these meetings start off as a simple account overview but turn into lengthy conversations about various financial decisions the participant has been weighing.

How Much Should I Be Contributing This Year?

This answer is not the same for everyone because, among other things, people have different retirement goals, financial situations, and time horizon. That being said, if the company has a match component in their plan, the first milestone would be to contribute enough to receive the most the company is willing to give you. For example, if the company will match 100% of your contributions up to 3% of pay, any amount you contribute less than 3% will leave you missing out on retirement savings the company is willing to provide you.

Again, the amount that should be saved is dependent on the individual but saving anywhere from 10% to 15% of your compensation is a good benchmark. In the previous example, if the company will match 3%, that means you would have to contribute 7% to achieve the lower end of that benchmark. This may seem like a difficult task so starting at an amount you are comfortable with and working your way to your ultimate goal is important.

Should You Be Making Allocation Changes?

The initial allocation you choose for your retirement account is important. Selecting the appropriate portfolio from the start based on your risk tolerance and time until retirement can satisfy your investment needs for a number of years. The chart below shows that over longer periods of time historical annual returns tend to be less volatile.

When you have over 10 years until retirement, reviewing the account at least annually is important as there are a number of reasons you would want to change your allocation. Lifestyle changes, different retirement goals, or specific investment performance to name a few. Participants tend to lose out on investment return when they try to time the market and are forced to sell low and buy high. This chart shows that even though there may be volatility in the short term, as long as you have time and an appropriate allocation from the start, you should see returns that will help you achieve your retirement goals.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.

Where Are We In The Market Cycle?

Before you can determine where you are going, you first have to know where you are now. Seems like a simple concept. A similar approach is taken when we are developing the investment strategy for our client portfolios. The question more specifically that we are trying to answer is “where are we at in the market cycle?” Is there more upside

Before you can determine where you are going, you first have to know where you are now. Seems like a simple concept. A similar approach is taken when we are developing the investment strategy for our client portfolios. The question more specifically that we are trying to answer is “where are we at in the market cycle?” Is there more upside to the market? Is there a downturn coming? No one knows for sure and there is no single market indicator that has proven to be an accurate predicator of future market trends. Instead, we have to collect data on multiple macroeconomic indicators and attempt to plot where we are in the current market cycle. Here is a snapshot of where we are at now:

The length of the current bull market is starting to worry some investors. Living through the tech bubble and the 2008 recession, those were healthy reminders that markets do not always go up. We are currently in the 87th month of the expansion which is the 4th longest on record. Since 1900, the average economic expansion has lasted 46 months. This leaves many investors questioning, “is the bull market rally about to end?” We are actually less concerned about the “duration” of the expansion. We prefer to look at the “magnitude” of the expansion. This recovery has been different. In most economic recoveries the market grows rapidly following a recession. If you look at the magnitude of this expansion that started in the 4th quarter of 2007 versus previous expansions, it has been lackluster at best. See the chart on the next page. This may lead investors to conclude that there is more to the current economic expansion.

Next up, employment. Over the past 50 years, the unemployment rate has averaged 6.2%. We are currently sitting at an unemployment rate of 5.0%. Based on that number it may be reasonable to conclude that we are close to full employment. Once you get close to full employment you begin to lose that surge in growth that the economy receives from adding 250,000+ jobs per month. It may also imply that we are getting closer to the end of this market cycle.

Now let’s look at the valuation levels in the stock market. In other words, in general are the stocks in the S&P 500 Index cheap to buy, fairly valued, or expensive to buy at this point? We measure this by the forward price to earning ratio (P/E) of the S&P 500 index. The average P/E of the S&P 500 over the last 25 years is 15.9. Back in 2008, the P/E of the S&P 500 was around 9.0. From a valuation standpoint, back in 2008, stocks were very cheap to buy. When stocks are cheap, investors tend to hold them regardless of what’s happening in the global economy with the hopes that they will at least become “fairly valued” at some point in the future. Right now the P/E Ratio of the S&P 500 Index is about 16.8 which is above the 15.9 historic average. This may indicate that stock are starting to become “expensive” from a valuation standpoint and investors may be tempted to sell positions during periods of volatility.

Even though stocks may be perceived as “overvalued” that does not necessarily mean they are not going to become more overvalued from here. In fact, often times after long bull rallies “the plane will overshoot the runway”. However, it does typically mean that big gains are harder to come by since a large amount of the future earnings expectations of the S&P 500 companies are already baked into the stock price. It leaves the door open for more quarterly earning disappointments which could rise to higher levels of volatility in the markets.

The most popular question of the year goes to: “Trump or Hillary? And how will the outcome impact the stock market?” I try not to get too deep in the weeds of politics mainly because history has shown us that there is no clear evidence whether the economy fares better under a Republican president or a Democratic president. However, here is the key point. Markets do not like uncertainty and one of the candidates that is running (I will let you guess which one) represents a tremendous amount of uncertainty regarding the actions that they may take if elected president of the United States. Still, under these circumstances, it is very difficult to develop a sound investment strategy centered around political outcomes that may or may not happen. We really have to “wait and see” in this case.

Let’s travel over the Atlantic. Brexit was a shock to the stock market over the summer but the long term ramifications of the United Kingdom’s exit from the European Union is yet to be known. The exit process will most likely take a number of years as the EU and the UK negotiate terms. In our view, this does not pose an immediate threat to the global economy but it will represent an ongoing element of uncertainty as the EU continues to restart sustainable economic growth in the region.

The chart below is one of the most important illustrations that allows us to gauge the overall level of risk that exists in the global economy. When a country wants to jump start its economy it will often lower the reserve rate (similar to our Fed Funds Rate) in an effort to encourage lending. An increase in borrowing hopefully leads to an increase in consumer spending and economic growth. Unfortunately, countries around the globed have taken this concept to an extreme level and have implemented “negative rates”. If you buy a 10 year government bond in Germany or Japan, you are guaranteed to lose money over that 10 year period. If you have a checking account at a bank in Japan, instead of receiving interest from the bank, the bank may charge you a fee to hold onto your own money. Crazy right? It’s happening. In fact, 33% of the countries around the world have a negative yield on their 10 year government bond. See the chart below. When you look around the globe 71% of the countries have a 10 year government bond yield below 1%. The U.S. 10 Year Treasury sits just above that at 1.7%.

So, what does that mean for the global economy? Basically, countries around the world are starving for economic growth and everyone is trying to jump start their economy at the same time. Possible outcomes? On the positive side, the stage is set for growth. There is “cheap money” and favorable interest rates at levels that we have never seen before in history. Meaning a little growth could go a long ways.

On the negative side, these central banks around the global are pretty much out of ammunition. They have fired every arrow that they have at this point to prevent their economy from contracting. If they cannot get their economy to grow and begin to normalize rates in the near future, when they get hit by the next recession they will have nothing to combat it with. It’s like the fire department showing up to a house fire with no water in the truck. The U.S. is not immune to this situation. Everyone wants the Fed to either not raise rates or raise rates slowly for the fear of the negative impact that it may have on the stock market or the value of the dollar. But would you rather take a little pain now or wait for the next recession to hit and have no way to stop the economy from contracting? It seems like a risky game.

When we look at all of these economic factors as a whole it suggests to us that the U.S. economy is continuing to grow but at a slower pace than a year ago. The data leads us to believe that we may be entering the later stages of the recent bull market rally and that now is a prudent time to revisit the level of exposure to risk assets in our client portfolios. At this point we are more concerned about entering a period of long term stagnation as opposed to a recession. With the rate of economic growth slowing here in the U.S. and the rich valuations already baked into the stock market, we could be entering a period of muted returns from both the stock and bond market. It is important that investors establish a realistic view of where we are in the economic cycle and adjust their return expectations accordingly.

As always, please feel free to contact me if you’d like to discuss your portfolio or our outlook for the economy.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Traditional vs. Roth IRA’s: Differences, Pros, and Cons

Individual Retirement Accounts (IRA’s) are one of the most popular retirement vehicles available for savers and the purpose of this article is to give a general idea of how IRA’s work, explain the differences between Traditional and Roth IRA’s, and provide some pros and cons of each. In January 2015, The Investment Company Institute put out a research

Individual Retirement Accounts (IRA’s) are one of the most popular retirement vehicles available for savers and the purpose of this article is to give a general idea of how IRA’s work, explain the differences between Traditional and Roth IRA’s, and provide some pros and cons of each. In January 2015, The Investment Company Institute put out a research report with some interesting statistics regarding IRA’s which can be found at the following link, ICI Research Perspective. The article states, “In mid-2014, 41.5 million, or 33.7 percent of U.S. households owned at least one type of IRA”. At first I was slightly shocked and asked myself the following question: “If IRA’s are the most important investment vehicle and source of income for most retirees, how do only one third of U.S. households own one?” Then when I took a step back and considered how money gets deposited into these retirement vehicles this figure begins making more sense.

Yes, a lot of American’s will contribute to IRA’s throughout their lifetime whether it is to save for retirement throughout one’s lifetime or each year when the CPA gives you the tax bill and you ask “What can I do to pay less?” When thinking about IRA’s in this way, one third of American’s owning IRA’s is a scary figure and leads one to believe more than half the country is not saving for retirement. This is not necessarily the case. 401(k) plans and other employer sponsored defined contribution plans have become very popular over the last 20 years and rather than individuals opening their own personal IRA’s, they are saving for retirement through their employer sponsored plan.

Employees with access to these employer plans save throughout their working years and then, when they retire, the money in the company retirement account will be rolled into IRA’s. If the money is rolled directly from the company sponsored plan into an IRA, there is likely no tax or penalty as it is going from one retirement account to another. People roll the balance into IRA’s for a number of reasons. These reasons include the point that there is likely more flexibility with IRA’s regarding distributions compared to the company plan, more investment options available, and the retiree would like the money to be managed by an advisor. The IRA’s allow people to draw on their savings to pay for expenses throughout retirement in a way to supplement income that they are no longer receiving through a paycheck.

The process may seem simple but there are important strategies and decisions involved with IRA’s. One of those items is deciding whether a Traditional, Roth or both types of IRA’s are best for you. In this article we will breakdown Traditional and Roth IRA’s which should illustrate why deciding the appropriate vehicle to use can be a very important piece of retirement planning.

Why are they used?

Both Traditional and Roth IRA’s have multiple uses but the most common for each is retirement savings. People will save throughout their lifetime with the goal of having enough money to last in retirement. These savings are what people are referring to when they ask questions like “What is my number?” Savers will contribute to retirement accounts with the intent to earn money through investing. Tax benefits and potential growth is why people will use retirement accounts over regular savings accounts. Retirees have to cover expenses in retirement which are likely greater than the social security checks they receive. Money is pulled from retirement accounts to cover the expenses above what is covered by social security. People are living longer than they have in the past which means the answer to “What is my number?” is becoming larger since the money must last over a greater period.

How much can I contribute?

For both Traditional and Roth IRA’s, the limit in 2021 for individuals under 50 is the lesser of $6,000 or 100% of MAGI and those 50 or older is the lesser of $7,000 or 100% of MAGI. More limit information can be found on the IRS website Retirement Topics - IRA Contribution Limits

What are the important differences between Traditional and Roth?

Taxation

Traditional (Pre-Tax) IRA: Typically people are more familiar with Traditional IRA’s as they’ve been around longer and allow individuals to take income off the table and lower their tax bill while saving. Each year a person contributes to a Pre-Tax IRA, they deduct the contribution amount from the income they received in that tax year. The IRS allows this because they want to encourage people to save for retirement. Not only are people decreasing their tax bill in the year they make the contribution, the earnings of Pre-Tax IRA’s are not taxed until the money is withdrawn from the account. This allows the account to earn more as money is not being taken out for taxes during the accumulation phase. For example, if I have $100 in my account and the account earns 10% this year, I will have $10 of earnings. Since that money is not taxed, my account value will be $110. That $110 will increase more in the following year if the account grows another 10% compared to if taxes were taken out of the gain. When the money is used during retirement, the individual will be taxed on the amount distributed at ordinary income tax rates because the money was never taxed before. A person’s tax rate during retirement is likely to be lower than while they are working because total income for the year will most likely be less. If the account owner takes a distribution prior to 59 ½ (normal retirement age), there will be penalties assessed.

Roth (After-Tax) IRA: The Roth IRA was established by the Taxpayer Relief Act of 1997. Unlike the Traditional IRA, contributions to a Roth IRA are made with money that has already been subject to income tax. The money gets placed in these accounts with the intent of earning interest and then when the money is taken during retirement, there is no taxes due as long as the account has met certain requirements (i.e. has been established for at least 5 years). These accounts are very beneficial to people who are younger or will not need the money for a significant number of years because no tax is paid on all the earnings that the account generates. For example, if I contribute $100 to a Roth IRA and the account becomes $200 in 15 years, I will never pay taxes on the $100 gain the account generated. If the account owner takes a distribution prior to 59 ½ (normal retirement age), there will be penalties assessed on the earnings taken.

Eligibility

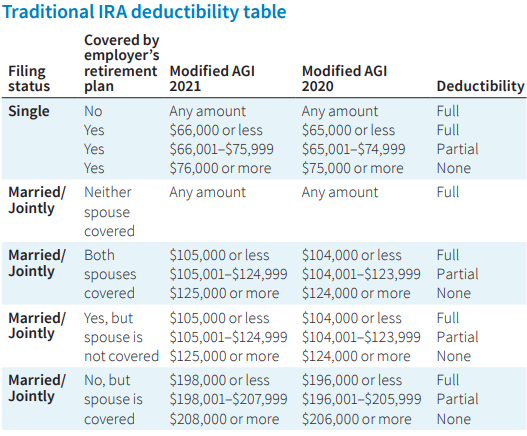

Traditional IRA: Due to the benefits the IRS allows with Traditional IRA’s, there are restrictions on who can contribute and receive the tax benefit for these accounts. Below is a chart that shows who is eligible to deduct contributions to a Traditional IRA:

There are also Required Minimum Distributions (RMD’s) associated with Pre-Tax dollars in IRA’s and therefore people cannot contribute to these accounts after the age of 70 ½. Once the account owner turns 70 ½, the IRS forces the individual to start taking distributions each year because the money has never been taxed and the government needs to start receiving revenue from the account. If RMD’s are not taken timely, there will be penalties assessed.

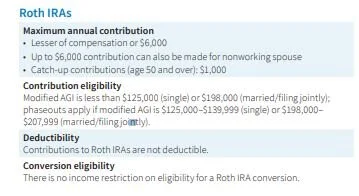

Roth IRA: As long as an individual has earned income, there are only income limitations on who can contribute to Roth IRA’s. The limitations for 2021 are as follows:

There are a number of strategies to get money into Roth IRA’s as a financial planning strategy. This method is explained in our article Backdoor Roth IRA Contribution Strategy.

Investment Strategies

Investment strategies are different for everyone as individuals have different risk tolerances, time horizons, and purposes for these accounts.

That being said, Roth IRA’s are often times invested more aggressively because they are likely the last investment someone touches during retirement or passes on to heirs. A longer time horizon allows one to be more aggressive if the circumstances permit. Accounts that are more aggressive will likely generate higher returns over longer periods. Remember, Roth accounts are meant to generate income that will never be taxed, so in most cases that account should be working for the saver as long as possible. If money is passed onto heirs, the Roth accounts are incredibly valuable as the individual who inherits the account can continue earning interest tax free.

Choosing the correct IRA is an important decision and is often times more complex than people think. Even if you are 30 years from retiring, it is important to consider the benefits of each and consult with a professional for advice.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.

What is a Bond?

A bond is a form of debt in which an investor serves as the lender. Think of a bond as a type of loan that a company or government would obtain from a bank but in this case the investor is serving as the bank. The issuer of the bond is typically looking to generate cash for a specific use such as general operations, a specific project, and staying current or

What is a Bond?

A bond is a form of debt in which an investor serves as the lender. Think of a bond as a type of loan that a company or government would obtain from a bank but in this case the investor is serving as the bank. The issuer of the bond is typically looking to generate cash for a specific use such as general operations, a specific project, and staying current or paying off other debt.

How do Investors Make Money on a Bond?

Your typical bonds will generate income for investors in one of two ways: periodic interest payments or purchasing the bond at a discount. There are also bonds where a combination of the two are applicable but we will explain each separately.

Interest Payments

There are interest rates associated with the bonds and interest payments are made periodically to the investor (i.e. semi-annual). When the bonds are issued, a promise to pay the interest over the life of the bond as well as the principal when the bond becomes due is made to the investor. For example, a $10,000 bond with a 5% interest rate would pay the investor $500 annually ($250 semi-annually). Typically tax would be due on the interest each year and when the bond comes due, the principal would be paid tax free as a return of cash basis.

Purchasing at a Discount

Another way to earn money on a bond would be to purchase the bond at a discount and at some time in the future get paid the face value of the bond. A simple example would be the purchase of a 10 year, $10,000 bond for a discounted price of $9,000. 10 years from the date of the purchase the investor would receive $10,000 (a $1,000 gain). Typically, the investor would be required to recognize $100 of income per year as “Original Issue Discount” (OID). At the end of the 10 year period, the gain will be recognized and the $10,000 would be paid but only $100, not $1,000, will have to be recognized as income in the final year.

Is There Risk in Bonds?

Investment grade bonds are often used to make a portfolio more conservative and less volatile. If an investor is less risk oriented or approaching retirement/in retirement they would be more likely to have a portfolio with a higher allocation to bonds than a young investor willing to take risk. This is due to the volatility in the stock market and impact a down market has on an account close to or in the distribution phase.

That being said, there are risks associated with bonds.

Interest Rate Risk – in an environment of rising interest rates, the value of a bond held by an investor will decline. If I purchased a 10 year bond two years ago with a 5% interest rate, that bond will lose value if an investor can purchase a bond with the same level of risk at a higher interest rate today. This will make the bond you hold less valuable and therefore will earn less if the bond is sold prior to maturity. If the bond is held to maturity it will earn the stated interest rate and will pay the investor face value but there is an opportunity cost with holding that bond if there are similar bonds available at higher interest rates.

Default Risk – most relevant with high risk bonds, default risk is the risk that the issuer will not be able to pay the face value of the bond. This is the same as someone defaulting on a loan. A bond held by an investor is only as good as the ability of the issuer to pay back the amount promised.

Call Risk – often times there are call features with a bond that will allow the issuer to pay off the bond earlier than the maturity date. In a declining interest rate environment, an issuer may issue new bonds at a lower interest rate and use the profits to pay off other outstanding bonds at higher interest rates. This would negatively impact the investor because if they were receiving 5% from a bond that gets called, they would likely use the proceeds to reinvest in a bond paying a lower rate or accept more risk to earn the same interest rate as the called bond.

Inflation Risk – a high inflation rate environment will negatively impact a bond because it is likely a time of rising interest rates and the purchasing power of the revenue earned on the bond will decline. For example, if an investor purchases a bond with a 3% interest rate but inflation is increasing at 5% the purchasing power of the return on that bond is eroded.

Below is a chart showing the risk spectrum of investing between asset classes and gives a visual on the different classes of bonds and their most susceptible risks.

Types of Bonds

Federal Government

Bonds issued by the federal government are backed by the full faith and credit of the U.S. Government and therefore are often referred to as “risk-free”. There are always risks associated with investing but in this case “risk-free” is referring to the idea that the U.S. Government is not likely to default on a bond and therefore the investor has a high likelihood of being paid the face value of the bond if held to maturity but like any investment there is risk.

There are a number of different federal bonds known as Treasuries and below we will touch on the more common:

Treasuries – Sold via auction in $1,000 increments. An investor will purchase the bond at a price below the face value and be paid the face value when the bond matures. You can bid on these bonds directly through www.treasurydirect.gov, or you can purchase the bonds through a broker or bank.

Treasury Bills – Short term investments sold in $1,000 increments. T-Bills are purchased at a discount with the promise to be paid the face value at maturity. These bonds have a period of less than a year and therefore, in a normal market environment, rates will be less than those of longer term bonds.

Treasury Notes – Sold in $1,000 increments and have terms of 2, 5, and 10 years. Treasury notes are often purchased at a discount and pay interest semi-annually. The 10 year Treasury note is most often used to discuss the U.S. government bond market and analyze the markets take on longer term macroeconomic trends.

Treasury Bonds – Similar to Treasury Notes but have periods of 30 years.

Treasury Inflation-Protected Securities (TIPS) – Sold in 5, 10, and 20 year terms. Not only will TIPS pay periodic interest, the face value of the bond will also increase with inflation each year. The increase in face value will be taxable income each year even though the principal is not paid until maturity. Interest rates on TIPS are usually lower than bonds with like terms because of the inflation protection.

Savings Bonds – There are two types of savings bonds still being issued, Series EE and Series I. The biggest difference between the two is that Series EE bonds have a fixed interest rate while Series I bonds have a fixed interest rate as well as a variable interest rate component. Savings bonds are purchased at a discount and accrue interest monthly. Typically these bonds mature in 20 years but can be cashed early and the cash basis plus accrued interest at the time of sale will be paid to the investor.

Municipal Bonds (Munis) – Bonds issued by states, cities, and local governments to fund specific projects. These bonds are exempt from federal tax and depending on where you live and where the bond was issued they may be tax free at the state level as well. There are two categories of Munis: Government Obligation Bonds and Revenue Bonds. Government Obligation Bonds are secured by the full faith and credit of the issuer’s taxing power (property/income/other). These bonds must be approved by voters. Revenue Bonds are secured by the revenues derived from specific activities the bonds were used to finance. These can be revenues from activities such as tolls, parking garages, or sports arenas.

Agency Bonds – These bonds are issued by government sponsored enterprises such as the Federal Home Loan Mortgage Association (Freddie Mac), the Federal Home Loan Mortgage Association (Fannie Mae), and the Federal Agricultural Mortgage Corporation (Farmer Mac). Agency bonds are used to stimulate activity such as increasing home ownership or agriculture production. Although they are not backed by the full faith and credit of the U.S. Government, they are viewed as less risky than corporate bonds.

Corporate Bonds – These bonds are issued by companies and although viewed as more risky than government bonds, the level of risk depends on the company issuing the bond. Bonds issued by a company like GE or Cisco may be viewed by investors as less of a default risk than a start-up company or company that operates in a volatile industry. The level of risk with the bond is directly related to the interest rate of the bond. Generally, the riskier the bond the higher the interest rate.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.