Planning for Long Term Care

The number of conversations that we are having with our clients about planning for long term care is increasing exponentially. Whether it’s planning for their parents, planning for themselves, or planning for a relative, our clients are largely initiating these conversations as a result of their own personal experiences.

The number of conversations that we are having with our clients about planning for long term care is increasing exponentially. Whether it’s planning for their parents, planning for themselves, or planning for a relative, our clients are largely initiating these conversations as a result of their own personal experiences.

The baby-boomer generation is the first generation that on a large scale is seeing the ugly aftermath of not having a plan in place to address a long term care event because they are now caring for their aging parents that are in their 80’s and 90’s. Advances in healthcare have allowed us to live longer but the longer we live the more frail we become later in life.

Our clients typically present the following scenario to us: “I have been taking care of my parents for the past three years and we just had to move my dad into the nursing home. What an awful process. How can I make sure that my kids don’t have to go through that same awful experience when I’m my parents age?”

“Planning for long term care is not just about money…….it’s about having a plan”

If there are no plans, your kids or family members are now responsible for trying to figure out “what mom or dad would have wanted”. Now tough decisions need to be made that can poison a relationship between siblings or family members.

Some individuals never create a plan because it involves tough personal decisions. We have to face the reality that at some point in our lives we are going to get older and later in life we may reach a threshold that we may need help from someone else to care for ourselves or our spouse. It’s a tough reality to face but not facing this reality will most likely result in the worst possible outcome if it happens.

Ask yourself this question: “You worked hard all of your life to buy a house, accumulate assets in retirement accounts, etc. If there are assets left over upon your death, would you prefer that those assets go to your kids or to the nursing home?” With some advance planning, you can make sure that your assets are preserved for your heirs.

The most common reason that causes individuals to avoid putting a plan in place is: “I have heard that long term care insurance is too expensive.” I have good news. First, there are other ways to plan for the cost of a long term care event besides using long term care insurance. Second, there are ways to significantly reduce the cost of these policies if designed correctly.

The most common solution is to buy a long term care insurance policy. The way these policies work is if you can no longer perform certain daily functions, the policy pays a set daily benefit. Now a big mistake many people make is when they hear “long term care” they think “nursing home”. In reality, about 80% of long term care is provided right in the home via home health aids and nurses. Most LTC policies cover both types of care. Buying a LTC policy is one of the most effective ways to address this risk but it’s not the only one.

Why does long term care insurance cost more than term life insurance or disability insurance? The answer, most insurance policies insure you against risks that have a low probability of happening but has a high financial impact. Similar to a life insurance policy. There is a very low probability that a 25 year old will die before the age of 60. However, the risk of long term care has a high probability of happening and a high financial impact. According to a study conducted by the U.S Department of Human Health and Services, “more than 70% of Americans over the age of 65 will need long-term care services at some point in their lives”. Meaning, there is a high probability that at some point that insurance policy is going to pay out and the dollars are large. The average daily rate of a nursing home in upstate New York is around $325 per day ($118,625 per year). The cost of home health care ranges greatly but is probably around half that amount.

So what are some of the alternatives besides using long term care insurance? The strategy here is to protect your assets from Medicaid. If you have a long term care event you will be required to spend down all of your assets until you reach the Medicaid asset allowance threshold (approx. $13,000 in assets) before Medicaid will start picking up the tab for your care. Often times we will advise clients to use trusts or gifting strategies to assist them in protecting their assets but this has to be done well in advance of the long term care event. Medicaid has a 5 year look back period which looks at your full 5 year financial history which includes tax returns, bank statements, retirement accounts, etc, to determine if any assets were “given away” within the last 5 years that would need to come back on the table before Medicaid will begin picking up the cost of an individuals long term care costs. A big myth is that Medicare covers the cost of long term care. False, Medicare only covers 100 days following a hospitalization. There are a lot of ins and outs associated with buildings a plan to address the risk of long term care outside of using insurance so it is strongly advised that individuals work with professionals that are well versed in this subject matter when drafting a plan.

An option that is rising in popularity is “semi self-insuring”. Instead of buying a long term care policy that has a $325 per day benefit, an individual can obtain a policy that covers $200 per day. This can dramatically reduce the cost of the LTC policy because it represents less financial risk to the insurance company. You have essentially self insured for a portion of that future risk. The policy will still payout $73,000 per year and the individual will be on the line for $45,625 out of pocket. Versus not having a policy at all and the individual is out of pocket $118,000 in a single year to cover that $325 per day cost.

As you can see there are a number of different options when it come to planning for long term care. It’s about understanding your options and determining which solution is right for your personal financial situation.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Strategies to Save for Retirement with No Company Retirement Plan

The question, “How much do I need to retire?” has become a concern across generations rather than something that only those approaching retirement focus on. We wrote the article, How Much Money Do I Need To Save To Retire?, to help individuals answer this question. This article is meant to help create a strategy to reach that number. More

The question, “How much do I need to retire?” has become a concern across generations rather than something that only those approaching retirement focus on. We wrote the article, How Much Money Do I Need To Save To Retire?, to help individuals answer this question. This article is meant to help create a strategy to reach that number. More specifically, for those who work at a company that does not offer a company sponsored plan.

Over the past 20 years, 401(k) plans have become the most well-known investment vehicle for individuals saving for retirement. This type of plan, along with other company sponsored plans, are excellent ways to save for people who are offered them. Company sponsored plans are set up by the company and money comes directly from the employees paycheck to fund their retirement. This means less effort on the side of the individual. It is up to the employee to be educated on how the plan operates and use the resources available to them to help in their savings strategy and goals but the vehicle is there for them to take advantage of.

We also wrote the article, Comparing Different Types of Employer Sponsored Retirement Plans, to help business owners choose a retirement plan that is most beneficial to them in their retirement savings.

Now back to our main focus on savings strategies for people that do not have access to an employer sponsored plan. We will discuss options based on a few different scenarios because matters such as marital status and how much you’d like to save may impact which strategy makes the most sense for you.

Married Filing Jointly - One Spouse Covered by Employer Sponsored Plan and is Not Maxing Out

A common strategy we use for clients when a covered spouse is not maxing out their deferrals is to increase the deferrals in the retirement plan and supplement income with the non-covered spouse’s salary. The limits for 401(k) deferrals in 2021 is $19,500 for individuals under 50 and $26,000 for individuals 50+. For example, if I am covered and only contribute $8,000 per year to my account and my spouse is not covered but has additional money to save for retirement, I could increase my deferrals up to the plan limits using the amount of additional money we have to save. This strategy is helpful as it allows for easier tracking of retirement accounts and the money is automatically deducted from payroll. Also, if you are contributing pre-tax dollars, this will decrease your tax liability.

Note: Payroll deferrals must be withheld from payroll by 12/31. If you owe money when you file your taxes in April, you would not be able to go back and increase your deferrals in your company plan for that tax year.

Married Filing Jointly - One Spouse Covered by Employer Sponsored Plan and is Maxing Out

If the covered spouse is maxing out at the high limits already, you may be able to save additional pre-tax dollars depending on your Adjusted Gross Income (AGI).

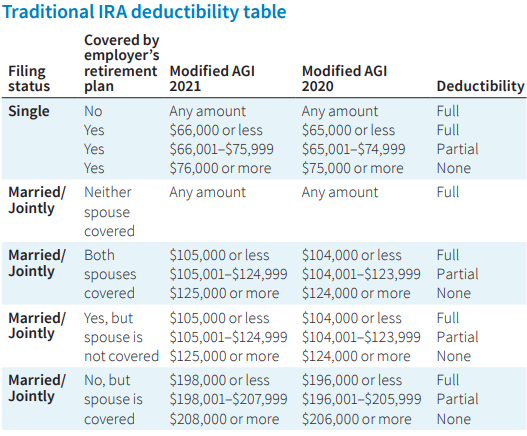

Below is the Traditional IRA Deductibility Table for 2021. This table shows how much individuals or married couples can earn and still deduct IRA contributions from their taxable income.

As shown in the chart, if you are married filing jointly and one spouse is covered, the couple can fully deduct IRA contributions to an account in the covered spouses name if AGI is less than $99,000 and can fully deduct IRA contributions to an account in the non-covered spouses name if AGI is less than $184,000. The Traditional IRA limits for 2017 are $5,500 if under 50 and $6,500 if 50+. These lower limits and income thresholds make contributing to company sponsor plans more attractive in most cases.

Single or Married Filing Jointly and Neither Spouse is Covered

If you (and your spouse if married filing joint) are not covered by an employer sponsored plan, you do not have an income threshold for contributing pre-tax dollars to a Traditional IRA. The only limitations you have relate to the amount you can contribute. These contribution limits for both Traditional and Roth IRA’s are $5,500 if under 50 and $6,500 if 50+. If married filing joint, each spouse can contribute up to these limits.

Unlike employer sponsored plans, your contributions to IRA’s can be made after 12/31 of that tax year as long as the contributions are in before you file your tax return.

Please feel free to e-mail or call with any questions on this article or any other financial planning questions you may have.

Below are related articles that may help answer additional questions you have after reading this.

Traditional vs. Roth IRA’s: Differences, Pros, and Cons

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.

A New Year: Should I Make Changes To My Retirement Account?

A simple and easy answer to this question would be…..Maybe? Not only would that answer make this article extremely short, it wouldn’t explain some important items that participants should take into consideration when making decisions about their retirement plan.Every time the calendar adds a year we get a sense of reset. A lot of the same tasks on the

A simple and easy answer to this question would be…..Maybe? Not only would that answer make this article extremely short, it wouldn’t explain some important items that participants should take into consideration when making decisions about their retirement plan.Every time the calendar adds a year we get a sense of reset. A lot of the same tasks on the to do list get added each January and hopefully this article helps you focus on matters to consider regarding your retirement plan.

Should I Consult With The Advisor On My Plan?

At our firm we make an effort to meet with participants at least annually. Saving in company retirement plans is about longevity so many times the individual meetings are brief and no allocation changes are made. Even if this is the result, an overview of your account, at least annually, is a good way to keep retirement savings fresh in your mind and add a sense of comfort that you’re investing appropriately based on your time horizon and risk tolerance.

These individual meetings are also a good time to discuss other financial questions you may have. Your retirement plan is only a piece of your financial plan and we encourage participants to use the resources available to them. Often times these meetings start off as a simple account overview but turn into lengthy conversations about various financial decisions the participant has been weighing.

How Much Should I Be Contributing This Year?

This answer is not the same for everyone because, among other things, people have different retirement goals, financial situations, and time horizon. That being said, if the company has a match component in their plan, the first milestone would be to contribute enough to receive the most the company is willing to give you. For example, if the company will match 100% of your contributions up to 3% of pay, any amount you contribute less than 3% will leave you missing out on retirement savings the company is willing to provide you.

Again, the amount that should be saved is dependent on the individual but saving anywhere from 10% to 15% of your compensation is a good benchmark. In the previous example, if the company will match 3%, that means you would have to contribute 7% to achieve the lower end of that benchmark. This may seem like a difficult task so starting at an amount you are comfortable with and working your way to your ultimate goal is important.

Should You Be Making Allocation Changes?

The initial allocation you choose for your retirement account is important. Selecting the appropriate portfolio from the start based on your risk tolerance and time until retirement can satisfy your investment needs for a number of years. The chart below shows that over longer periods of time historical annual returns tend to be less volatile.

When you have over 10 years until retirement, reviewing the account at least annually is important as there are a number of reasons you would want to change your allocation. Lifestyle changes, different retirement goals, or specific investment performance to name a few. Participants tend to lose out on investment return when they try to time the market and are forced to sell low and buy high. This chart shows that even though there may be volatility in the short term, as long as you have time and an appropriate allocation from the start, you should see returns that will help you achieve your retirement goals.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.

Traditional vs. Roth IRA’s: Differences, Pros, and Cons

Individual Retirement Accounts (IRA’s) are one of the most popular retirement vehicles available for savers and the purpose of this article is to give a general idea of how IRA’s work, explain the differences between Traditional and Roth IRA’s, and provide some pros and cons of each. In January 2015, The Investment Company Institute put out a research

Individual Retirement Accounts (IRA’s) are one of the most popular retirement vehicles available for savers and the purpose of this article is to give a general idea of how IRA’s work, explain the differences between Traditional and Roth IRA’s, and provide some pros and cons of each. In January 2015, The Investment Company Institute put out a research report with some interesting statistics regarding IRA’s which can be found at the following link, ICI Research Perspective. The article states, “In mid-2014, 41.5 million, or 33.7 percent of U.S. households owned at least one type of IRA”. At first I was slightly shocked and asked myself the following question: “If IRA’s are the most important investment vehicle and source of income for most retirees, how do only one third of U.S. households own one?” Then when I took a step back and considered how money gets deposited into these retirement vehicles this figure begins making more sense.

Yes, a lot of American’s will contribute to IRA’s throughout their lifetime whether it is to save for retirement throughout one’s lifetime or each year when the CPA gives you the tax bill and you ask “What can I do to pay less?” When thinking about IRA’s in this way, one third of American’s owning IRA’s is a scary figure and leads one to believe more than half the country is not saving for retirement. This is not necessarily the case. 401(k) plans and other employer sponsored defined contribution plans have become very popular over the last 20 years and rather than individuals opening their own personal IRA’s, they are saving for retirement through their employer sponsored plan.

Employees with access to these employer plans save throughout their working years and then, when they retire, the money in the company retirement account will be rolled into IRA’s. If the money is rolled directly from the company sponsored plan into an IRA, there is likely no tax or penalty as it is going from one retirement account to another. People roll the balance into IRA’s for a number of reasons. These reasons include the point that there is likely more flexibility with IRA’s regarding distributions compared to the company plan, more investment options available, and the retiree would like the money to be managed by an advisor. The IRA’s allow people to draw on their savings to pay for expenses throughout retirement in a way to supplement income that they are no longer receiving through a paycheck.

The process may seem simple but there are important strategies and decisions involved with IRA’s. One of those items is deciding whether a Traditional, Roth or both types of IRA’s are best for you. In this article we will breakdown Traditional and Roth IRA’s which should illustrate why deciding the appropriate vehicle to use can be a very important piece of retirement planning.

Why are they used?

Both Traditional and Roth IRA’s have multiple uses but the most common for each is retirement savings. People will save throughout their lifetime with the goal of having enough money to last in retirement. These savings are what people are referring to when they ask questions like “What is my number?” Savers will contribute to retirement accounts with the intent to earn money through investing. Tax benefits and potential growth is why people will use retirement accounts over regular savings accounts. Retirees have to cover expenses in retirement which are likely greater than the social security checks they receive. Money is pulled from retirement accounts to cover the expenses above what is covered by social security. People are living longer than they have in the past which means the answer to “What is my number?” is becoming larger since the money must last over a greater period.

How much can I contribute?

For both Traditional and Roth IRA’s, the limit in 2021 for individuals under 50 is the lesser of $6,000 or 100% of MAGI and those 50 or older is the lesser of $7,000 or 100% of MAGI. More limit information can be found on the IRS website Retirement Topics - IRA Contribution Limits

What are the important differences between Traditional and Roth?

Taxation

Traditional (Pre-Tax) IRA: Typically people are more familiar with Traditional IRA’s as they’ve been around longer and allow individuals to take income off the table and lower their tax bill while saving. Each year a person contributes to a Pre-Tax IRA, they deduct the contribution amount from the income they received in that tax year. The IRS allows this because they want to encourage people to save for retirement. Not only are people decreasing their tax bill in the year they make the contribution, the earnings of Pre-Tax IRA’s are not taxed until the money is withdrawn from the account. This allows the account to earn more as money is not being taken out for taxes during the accumulation phase. For example, if I have $100 in my account and the account earns 10% this year, I will have $10 of earnings. Since that money is not taxed, my account value will be $110. That $110 will increase more in the following year if the account grows another 10% compared to if taxes were taken out of the gain. When the money is used during retirement, the individual will be taxed on the amount distributed at ordinary income tax rates because the money was never taxed before. A person’s tax rate during retirement is likely to be lower than while they are working because total income for the year will most likely be less. If the account owner takes a distribution prior to 59 ½ (normal retirement age), there will be penalties assessed.

Roth (After-Tax) IRA: The Roth IRA was established by the Taxpayer Relief Act of 1997. Unlike the Traditional IRA, contributions to a Roth IRA are made with money that has already been subject to income tax. The money gets placed in these accounts with the intent of earning interest and then when the money is taken during retirement, there is no taxes due as long as the account has met certain requirements (i.e. has been established for at least 5 years). These accounts are very beneficial to people who are younger or will not need the money for a significant number of years because no tax is paid on all the earnings that the account generates. For example, if I contribute $100 to a Roth IRA and the account becomes $200 in 15 years, I will never pay taxes on the $100 gain the account generated. If the account owner takes a distribution prior to 59 ½ (normal retirement age), there will be penalties assessed on the earnings taken.

Eligibility

Traditional IRA: Due to the benefits the IRS allows with Traditional IRA’s, there are restrictions on who can contribute and receive the tax benefit for these accounts. Below is a chart that shows who is eligible to deduct contributions to a Traditional IRA:

There are also Required Minimum Distributions (RMD’s) associated with Pre-Tax dollars in IRA’s and therefore people cannot contribute to these accounts after the age of 70 ½. Once the account owner turns 70 ½, the IRS forces the individual to start taking distributions each year because the money has never been taxed and the government needs to start receiving revenue from the account. If RMD’s are not taken timely, there will be penalties assessed.

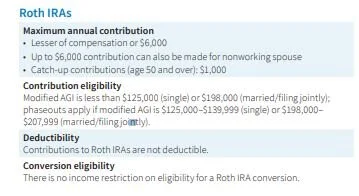

Roth IRA: As long as an individual has earned income, there are only income limitations on who can contribute to Roth IRA’s. The limitations for 2021 are as follows:

There are a number of strategies to get money into Roth IRA’s as a financial planning strategy. This method is explained in our article Backdoor Roth IRA Contribution Strategy.

Investment Strategies

Investment strategies are different for everyone as individuals have different risk tolerances, time horizons, and purposes for these accounts.

That being said, Roth IRA’s are often times invested more aggressively because they are likely the last investment someone touches during retirement or passes on to heirs. A longer time horizon allows one to be more aggressive if the circumstances permit. Accounts that are more aggressive will likely generate higher returns over longer periods. Remember, Roth accounts are meant to generate income that will never be taxed, so in most cases that account should be working for the saver as long as possible. If money is passed onto heirs, the Roth accounts are incredibly valuable as the individual who inherits the account can continue earning interest tax free.

Choosing the correct IRA is an important decision and is often times more complex than people think. Even if you are 30 years from retiring, it is important to consider the benefits of each and consult with a professional for advice.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.

Do I Have To Pay Taxes On My Inheritance?

Whenever people come into large sums of money, such as inheritance, the first question is “how much will I be taxed on this money”? Believe it or not, money you receive from an inheritance is likely not taxable income to you.

Whenever people come into large sums of money, such as inheritance, the first question is “how much will I be taxed on this money”? Believe it or not, money you receive from an inheritance is likely not taxable income to you.

Of course there are some caveats to this. If the inherited money is from an estate, there is a chance the money received was already taxed at the estate level. The current federal estate exclusion is $5,430,000 (estate taxes and the exclusion amount varies for states). Therefore, if the estate was large enough, a portion of the inheritance may have been subject to estate tax which is 40% in most cases. That being said, whether the money was or was not taxed at the estate level, you as an individual do not have to pay income taxes on the money.

Although the inheritance itself is not taxable, you may end up paying taxes if there is appreciation after the money is inherited. The type of account and distribution will dictate how the income will be taxed.

Basis Of Inherited Property

Typically, the basis of inherited property is the fair market value of the property on the date of the decedent’s death or the fair market value of the property on the alternate valuation date if the estate uses the alternate valuation date for valuing assets. An estate will choose to value assets on an alternate date subsequent to the date of death if certain assets, such as stocks, have depreciated since the date of death and the estate would pay less tax using the alternate date.

What the fair market value basis means is that if you inherit stock that was originally purchased for $500 and at the date of death has appreciated to $10,000, you will have a “step-up” basis of $10,000. If you turn around and sell the stock for $11,000, you will have a $1,000 gain and if you sell the stock for $9,000, you will have a $1,000 loss.

Inheriting a personal residence also provides for a step-up in basis but the gain or loss may be treated differently. If no one lives in the inherited home after the date of death, it will be treated similar to the stock example above. If you move into the home after death, any subsequent sale at a loss will not be deductible as it will be treated as your personal asset but a gain would have to be recognized and possibly taxed. If you rent the property subsequent to inheritance, it could be treated as a trade or business which would be treated differently for tax purposes.

Inheriting An IRA or Retirement Plan Account

Please read our article “Inherited IRA’s: How Do They Work” for a more detailed explanation of the three different types of distribution options.

When you inherit a retirement account, and you are not the spouse of the decedent, in most cases you will only have one option, fully distribute the account balance 10 years following the year of the decedents death. The SECURE Act that was passed in December 2019 dramatically change the distribution options available to non-spouse beneficiaries. See the article below:

If you are the spouse of the of the decedent, you are able to treat the retirement account as if it was yours and not be forced to take one of the options above. You will have to pay taxes on distributions but you do not have to start withdrawing funds immediately unless there are required minimum distributions needed.

Note: If the inherited account was an after tax account (i.e. Roth), the inheritor must choose one of the options presented above but no tax will be paid on distributions.

Non-Qualified Annuities

Non-qualified annuities are an exception to the step-up in basis rule. The non-spousal inheritor of a non-qualified annuity will have to take either a lump sum or receive payments over a specified time period. If the inheritor chooses a lump sum, the portion that represents the gain (lump sum balance minus decedent’s contributions) will be taxed as ordinary income. If the inheritor chooses a series of payments, distributions will be treated as last in, first out. Last in, first out means that the appreciation will be distributed first and fully taxable until there is only basis left.

If the spouse inherits the annuity, they most likely have the option to treat the annuity contract as if they were the original owner.

This article concentrated on inheritance at a federal level. There is no inheritance tax at a federal level but some states do have an inheritance tax and therefore meeting with a professional is recommended. New York currently does not have an inheritance tax.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.

How Much Money Do I Need To Save To Retire?

This is by far the most popular question that we come across as financial planners. You may have heard some of the "rules of thumb" like “80% of your current take-home pay” or “1 million dollars”. In reality, the answer varies greatly on an individual by individual basis. This article will outline the procedures that we follow as financial planners to help

This is by far the most popular question that we come across as financial planners. You may have heard some of the "rules of thumb" like “80% of your current take-home pay” or “1 million dollars”. In reality, the answer varies greatly on an individual by individual basis. This article will outline the procedures that we follow as financial planners to help individuals answer this very important question.

Step 1: Estimate Your Annual Expenses In Retirement

The first step is to get a ballpark idea of what your annual expenses might look like in retirement. The best place to start is to list your current monthly and annual expenses. Then create a separate column labeled “expenses in retirement”. Whether you are 2 years, 10 years, or 20 years away from retirement the idea is to pretend as if you were retiring tomorrow and determining what your annual expenses might look like. Some of your expenses in retirement will be lower, others may be higher, but most people find that a lot of their current expenses will carry over at the same level into the retirement years. This is because most people have become accustom to a certain standards of living and they intend to maintain that standard of living in retirement. Here are a few important questions that you should ask yourself when forecasting your retirement expenses:

How much should I budget for health insurance?

Will I have a mortgage or debt when I retire?

Do I plan to move when I retire?

Since I will not be working, should I budget additional expenses for vacations and hobbies?

Will I need to keep my life insurance policies after I retire?

Step 2: Adjust Your Retirement Expenses For Inflation

Now that you have a ballpark number of your annual expenses in retirement, you will need to adjust those expenses for inflation. Inflation is just a fancy word for “the price of everything that we buy today will gradually go up in price over time”. If the price of a gallon of milk today is $2 then most likely 20 years from now that same gallon of milk will cost $3.51. A 75% increase!! Historically inflation has grown at a rate of about 3% per year. There are periods of time when the rate of inflation grows faster or slower but on average it grows at 3% per year.

Another way to look at inflation is $20,000 in today’s dollars will not buy the same amount of goods and services 10 years from now because inflation erodes the purchasing power of your $20,000. If I did my annual expense planner and it tells me that I need $50,000 per year in retirement to meet all of my estimated expenses, let’s look at what adjusting that $50,000 for inflation does over different periods of time assuming a 3% rate of inflation:

Today’s Dollars 5 Years From Now 10 Years From Now 20 Years From Now

$50,000 $56,275 $65,238 $87,675

In the above example, if I am retiring in 10 years, and my estimated annual expenses in retirement will be $50,000 in today’s dollars, by the time I retire 10 years from now my annual expenses will increase to $65,238 per year just to stay in the same place that I am in today. Also, inflation does not stop when you retire, it continues into the retirement years. If I am 50 today and plan to live until 90, I have to apply this inflation adjustment for 40 years. It’s clear to see how inflation can have a significant impact on the amount that you may need to withdrawal for your account to meet you estimated expenses at a future date.

Step 3: Gather The Information On Your Current Assets

Once you know your expenses, you now need to gather all of the information on your retirement accounts and pension plans. You should collect the most recent statement for all of your investment accounts (401K, 403B, IRA’s, brokerage accounts, stocks, etc.), pension statements (if applicable), obtain your most recent social security statement, and gather information on the other sources of income and/or assets that may be available when you retire. Such as:

Sale of a business

Downsizing the primary residence

Rental income

Part-time employment

Step 4: Project The Growth Of Your Retirement Assets

There are three main categories to consider when calculating the growth rate of your retirement assets:

Annual contributions

Withdrawals

Investment rate of return

For annual contributions, it’s determining which accounts you plan on making deposits too each year and how much? For most individuals, their employer sponsored retirement plan is the main source of new contributions to their retirement nest egg. If your employer makes regular employer contributions to your retirement plan, you should factor those in as well. For example, if I am contributing 8% of my pay into the plan and my employer is providing me with a 4% matching contributions, I would reasonably assume that I’m adding 12% of my pay to my 401(k) plan each year.

The most popular question that we get in this category is “how much should I be contributing each year to my retirement account with my employer?” We advise employees that they should have a goal of contributing 10% of their pay each year to their retirement accounts. This is an aggregate total between your personal contributions and the employer contributions. Even if you cannot reach that level right now, 10%+ is the target.

Let’s move onto the next category…….withdrawals. Pre-retirement withdrawals from retirement accounts have become much more common in recent years due largely to the rising cost of college education. Parents will take loans from their 401K/403B plans or take early withdrawals from IRA accounts to fulfill the need for additional income during the years that their children are in college. If part of your overall financial plan is to use your retirement accounts to pay for one-time expenses such as college, you will need to factor that into your projections.

The third variable to consider when determining the growth of your assets is the assumed annual rate of return on your investments. There are many items to consider when determining a reasonable annual rate of return for your accounts. Some of those considerations include:

Time horizon to retirement

Allocation of your portfolio (stocks vs bonds)

Concentrated holdings (10%+ of your portfolio allocated to a single investment)

Accumulation phase versus distribution phase

The answer to the question: “what rate of return should I expect from my retirement accounts?”, can really only be determine on a case by case basis. Using an unreasonable rate of return assumption can create a significant disconnect between your retirement projections versus what is likely to actually occur within your investment accounts. Be careful with this step.

Step 5: Factor In Taxes

Don’t forget about the lovely IRS. All assets are not treated equally from a tax standpoint. For most individuals, the majority of their retirement savings will be in pre-tax retirement vehicles such as 401(k), 403(b), and Traditional IRA’s. That means when you take distributions from those accounts, you will realize earned income, and have to pay tax. For example, if you have $400,000 in your 401K account and you are in the 25% tax bracket, $100,000 of that $400,000 will be lost to taxes as withdrawals are made from the account.

If you have after tax investment accounts, it’s possible that you may owe little to no taxes on withdrawals. However, if there are unrealized investment gains built up in your after tax investment accounts then you may owe capital gains tax when liquidating positons.

Also note, you may have to pay taxes on a portion of your social security benefit. The amount of your social security benefit that is taxable varies based on your level of income.

Step 6: Spend Down Your Assets

In the final step, you should run long term projections to illustrate the spend down of your assets in retirement. Here are the steps:Example

Start with your annual after tax expense number $60,000

Subtract social security less taxes: ($20,000)

Subtract pension payments less taxes (if applicable): ($10,000)

Annual Expenses Net SS and Pensions: $30,000

In the example above, this individual would need an additional $30,000 after-tax to meet their anticipated annual expenses in Year 1 of retirement. I stress “after-tax” because if all of the retirement assets are in a pre-tax retirement account then they would need to gross up their distributions for taxes to get to the $30,000 after tax. If it is assumed that $40,000 has to be withdrawn from an IRA each year, the 3% inflation rate is applied to the annual expenses, and the life expectancy of this individual is 20 years from the date that they retire, this individual would need to withdrawal $1,074,814 out of their retirement accounts over the next 20 years to meet their income needs.

Step 7: Identify Multiple Solutions

There are often times multiple roads to reach a destination and the same is true when planning for retirement. If you find that you assets are falling short of the amount that is needed to sustain your expenses in retirement, you should work with a knowledgeable financial planner to identify alternative solutions. It may help you to answer questions like:

If I decided to work part-time in retirement how much would I have to earn?

If I downsize my primary residence in retirement how does this impact the overall picture?

If I can’t retire at age 63, what age can I comfortably retire at?

What are the pros and cons of taking social security benefits prior to normal retirement age

I also encourage clients to spend time looking at their annual expenses. If you find that your are cutting it close on income versus expenses in retirement, it's usually easier to cut expenses than it is to create more income in the retirement year.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How is my Social Security Benefit Calculated?

The top two questions that we receive from individuals approaching retirement are:

What amount will I received from social security?

When should I turn on my social security benefits?

The top two questions that we receive from individuals approaching retirement are:

What amount will I received from social security?

When should I turn on my social security benefits?

Are you eligible to receive benefits?

As you work and pay taxes, you earn Social Security “credits.” In 2015, you earn one credit for each $1,220 in earnings—up to a maximum of four credits a year. The amount of money needed to earn one credit usually goes up every year. Most people need 40 credits (10 years of work) to qualify for benefits.

When will I begin receiving my social security benefit?

You are entitled to your full social security benefit at your “Normal Retirement Age” (NRA). Your NRA varies based on your date of birth. Below is the chart that social security uses to determine your “normal retirement age” or “full retirement age”:

For example, if you were born in 1965, your NRA would be 67. At 67, you would be eligible for your full retirement benefit.

Delayed Retirement or Early Retirement

You can claim benefits as early as age 62, but your monthly check will be cut by 25% for the rest of your life. The way the math works out, for each year you take your social security benefit prior to your normal retirement age, you benefit is permanently reduce by 6% for each year you take it prior to your NRA.

On the opposite end of that scenario, if you delay claiming past your NRA, you will get a delayed credit of approximately 8% per year plus cost of living adjustments.

There are a number of variables that factor into this decision as to when to turn on your benefit. Some of the main factors are:

Your health

Do you plan to keep working?

What is your current tax bracket?

The amount of retirement savings that you have

Income difference between spouses

What amount will I receive from social security?

Social security uses a fairly complex formula for calculating social security retirement benefits but the short version is the formula uses your highest 35 years of income. If you have less than 35 years are income, zeros are entered into the average for the number of years you are short of 35 years of income. They also apply an inflation adjustment to your annual earnings in the calculation.

You can obtain your Social Security statement by creating an account at www.ssa.gov. Your statement contains lots of valuable information, such as:

Your estimated benefit amount at full retirement age

Eligibility for benefits

A detailed history of how much you've earned each year

Keep in mind that the figures in your statement are just estimates, and your eventual benefit amount could be quite different, especially if you're relatively young now.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Do I Have to Pay Taxes on my Social Security Benefit?

If your “combined income” exceeds specific annual limits, you may owe federal income taxes on up to 50% or 85% of your Social Security benefits. The limits for federal income tax purposes are listed in the chart below.

If your “combined income” exceeds specific annual limits, you may owe federal income taxes on up to 50% or 85% of your Social Security benefits. The limits for federal income tax purposes are listed in the chart below.

The federal income thresholds are not indexed for inflation, so they are the same every year. “Combined income” is defined as adjusted gross income plus any tax-exempt interest plus 50% of your Social Security Benefit. Some states tax Social Security Benefits, whereas others do not tax them. See the chart below:

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Can I Receive Social Security Benefits While I'm Still Working?

The short answer is "Yes". But you may not want to depending on when you plan to turn on your social security benefits and how much you plan to earn each year from working.

The short answer is "Yes". But you may not want to depending on when you plan to turn on your social security benefits and how much you plan to earn each year from working.

Electing social security benefits AFTER your Normal Retirement Age

For social security, your Normal Retirement Age (NRA), is the age you are eligible to receive full retirement benefits. Your NRA is based on your date of birth and the table is listed below:

Once you reach your NRA, you are allowed to begin receiving social security benefits without having to worry about the social security "earnings test". Meaning that you can earn as much as you want working and they will not reduce your social security benefit. You are free and clear.

Electing social security benefits BEFORE your Normal Retirement Age

If you turn on your social security benefits prior to reaching your Normal Retirement Age, you will be subject to the "earnings test" each year. For social security recipients who will not reach full retirement age in the 2016 calendar year, the first $15,720 in earnings is exempt. Beyond that amount, every $2 in earnings will reduce your social security benefits by $1. It's a fairly steep penalty. The general rule is if you plan to earn over the $15,720 threshold and you will not hit your normal retirement age for social security in 2016, do not elect to begin taking social security early because you will lose most of it from the "earned income penalty".

Electing social security benefits in the year your reach "Normal Retirement Age"

For social security recipients who will attain full retirement age during 2016, the first $41,880 is exempt, and the reduction is just $1 for every $3 in earnings beyond that point. Plus, only the months before your birthday count toward the total.

We advise our clients in this situation to keep their pay stub from the payroll period prior to reaching Normal Retirement Age because the IRS may contact them the following year to prove the amount of income that they earned prior to receiving their first social security payment.

About Michael.........

Hi, I'm Michael Ruger. I'm the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Inherited IRA's: How Do They Work?

An Inherited IRA is a retirement account that is left to a beneficiary after the owner’s death. It is important to have a general knowledge of how Inherited IRA’s work because a minor error in how the account is set up could lead to major tax consequences.

An Inherited IRA is a retirement account that is left to a beneficiary after the owner’s death. It is important to have a general knowledge of how Inherited IRA’s work because a minor error in how the account is set up could lead to major tax consequences.

Before going into the different kinds of Inherited IRA’s, if you are the sole beneficiary of your spouse’s IRA, you are able to transfer the assets to your own existing IRA or to a new IRA through what is called a “Spousal Transfer”. This account is not treated as an Inherited IRA and therefore is subject to all the rules a Traditional IRA would be subject to as if it was always held in your name. If the spouse needs to have access to the money before age 59 ½, it would probably make sense to set up an Inherited IRA because this would give the spouse options to access the money without incurring a 10% early withdrawal penalty.

Withdrawal Rules for Spouse & Non-Spouse Beneficiaries

The SECURE Act that passed in December 2019 dramatically changed the distribution options that are available to non-spouse beneficiaries. If you are spousal beneficiary please reference the following article:

10 Year Method

All the assets must be distributed by the 10th year after the year in which the account holder died. This option may make sense compared to the Lump Sum option explained next to spread out the tax liability over a longer period.

Lump Sum Distribution

You may take a lump sum distribution when the account is inherited. It is recommended that you consult your tax preparer to discuss the tax consequences of this method since you may move up into a different tax bracket.

Additional Takeaways

If the decedent was required to take a distribution in the year of death, it is important to determine whether or not the decedent took the distribution. If the decedent was required to take a RMD but did not do so in the year they passed, the inheritor must take the distribution based on the life expectancy of the decedent or the distribution will be subject to a 50% penalty. Distributions going forward will be based on the life expectancy of the inheritor.

It is important to be sure a beneficiary form is completed for the Inherited IRA. If there is no beneficiary and the account goes to an estate then the inheritor will have limited choices on which distribution method to choose among other tax consequences.

You are only able to combine Inherited IRA’s if they were inherited from the same individual. If you have multiple Inherited IRA’s from different individuals, you cannot commingle the assets because of the distributions that must be taken.

There is no 60 day rule with Inherited IRA’s like there is with other Traditional IRA’s. The 60 day rule allows someone to withdraw money from an IRA and as long as it’s replenished within 60 days there is no tax consequence. This is not available with Inherited IRA’s, all non-Roth distributions are taxable.

The charts below are from insurancenewsnet.com publication titled “Extended IRA Quick Reference Guide” give another look at the details of Inherited IRA’s.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.