Attention Middle Class: The End Is Near

I'm not a fan of conspiracy theories and I'm not a fan of "doom and gloom" articles. However, I feel compelled to write this article because I want people to be aware of a trend that is unfolding right now in our economy. This trend will strengthen over time, we will cheer for it as it's happening, but like many great things in history, it may have an

I'm not a fan of conspiracy theories and I'm not a fan of "doom and gloom" articles. However, I feel compelled to write this article because I want people to be aware of a trend that is unfolding right now in our economy. This trend will strengthen over time, we will cheer for it as it's happening, but like many great things in history, it may have an unintended consequence. I fear that the unintended consequence of this new trend will be the elimination of the U.S. middle class.

More Profits

I’m an investment advisor so I naturally love a strong bull market that results in large investment gains for our clients. The stock market generally goes up when companies are more profitable than the consensus expects. Higher profits equal higher stock prices which equal more wealth for investors. Corporations have become laser-focused on findings new ways to increase profits. This is important because businesses that struggle to make profits and have constant losses are not so successful and will probably end up shutting down in the near future, according to websites like https://www.laraedo.com/signs-that-my-business-is-ripe-for-a-shutdown/. The equation for net profit is easy:

Revenue – Expenses = Net Profit

Let me ask you this question: What is typically a company’s largest expense?

Answer: Payroll. Said another way, the employees. Salaries, benefits, the building to house the employees, training, workers comp, payroll taxes, and the list goes on and on. If you are the owner of a company that makes cell phones and I told you that I have a way that you can make TWICE as many cell phones with HALF the number of employees, what do you think is going to happen to profits? Up!!! In a big way.

The scenario that I just described is not something that might happen in the future, it’s something that is happening right now. Here is the data to support it.

The chart below compares the 10 largest companies in the S&P 500 Index in 1990 to the 10 largest companies in the S&P 500 in 2016. First, you may notice that none of the companies that were the largest in 1990 remained on the list in 2016. But here is the trend that I want to point out. When you look at the 10 largest companies in 1990, they produced $368 Billion dollars of revenue and employed 1.4 Million workers. Fast forward to 2016, the top 10 largest companies produced $1.2 Trillion dollars in revenue and employed about 1.6 Million workers. Now let’s do some quick math, between 1990 and 2016 the gross revenue of the largest 10 companies in the S&P 500 increased by 239% but the number of workers employed by those companies only increased by 14%. Companies are already doing more with less people.

Just when you thought things were going good for the company, I now come to you, the owner of the company, and tell you I have a way to make profits double within the next 3 years. Are you interested? Of course you are. All we have to do is buy these three machines that will replace another 50% of the employees. These machines work 24 hours a day, don’t need health insurance, don’t get sick, and we can move to a smaller building which will reduce rent by 60%. How is that possible? Welcome to the party…..artificial intelligence.

Not A Terminator Movie

What do we think of when we hear the words “artificial intelligence”? Terminators!! Fortunately for us that’s not the artificial intelligence that I’m referring too. But a machine that thinks and learns from its mistakes? The human mind is not as unique as we would like to think it is. Just take a Myers Briggs personality test. You answer 100 questions and then it tells you how you react to things, what annoys you, what your strengths are, how you communicate, and what you have difficulties with. It’s kind of scary as you read the results and realize “Yup. That’s me”

Think about it. Google may know more about you than your spouse. What do you want for Christmas? Your spouse may not know but Google knows all of the items that you looked at over the past 3 months, what items you spent the most time looking at, did you click on the description to read more, and what other items did you look at after you click on the initial item. It tells Google how you search for information. Also Google acknowledges that we all search for things differently and what we are searching for tells Google more about us. Essentially Google learns at little bit more about you every time you search for something via their website.

What about a machine that can respond to questions and it sounds just like a person when it speaks? Oh and it speaks perfect English. No more overseas call centers with people you can’t understand. With most call centers, there are probably 20 questions that represent 80% of all the questions asked. If the machine is unable to answer the question, it automatically routes that call to a living, breathing person. The programmers of the machines are notified when a question triggers a transfer to a live person, they listen to the call, and then update the software to be able to answer the question the next time it is asked. The easy math, this could reduce the number of customer service representatives that the company needs to employ by 80%. Oh and the number of employees will continue to decrease as the machines learn to answer more questions and the software gets more sophisticated.

While a company may go this direction to reduce expenses, we as the consumer will also champion this change. Think about how painful it is to call the cable company. What if I told you that when you call you won’t have to wait on hold, the “person” that you are speaking to will know how to resolve your problem, and you will be off the phone in less than 2 minutes. Time is a valuable commodity to us. Fix my problem and fix it quickly. If a machine can do that better than a real person, be my guest. If companies want it and we as the consumer want it, how fast do you think it’s going to happen?

I Can't Be Replaced By A Machine.....Wrong

While we will cheer how the new A.I. technology saves us time and makes life easier, many of us will have the hubris that “a machine can’t do what I do?”. While a machine may not be able to replace 100% of what you do, could it replace 50%? It’s going to be presented like this, “you know all of those daily tasks that you don’t like to do: paperwork, scanning forms, payroll, and preparing financial reports for the weekly managers meeting. Well you don’t have to do those anymore.” Yes!!!! Oh and more good news you don’t have to train a new employee to complete those tasks and wonder if they are going to leave a year from now and have to train someone else.

Programming a machine to complete a task is not too different from training a new employee. When you hire a new employee many of them may know very little about your industry, they have no idea how your company operates, how to answer tough questions from prospects, etc. You have to train them or “program” them. Then they learn on the job from there. The value of having 20 years of experience is you have seen many difficult situations throughout your career and you learned from your past experiences. The next time the same or similar problem surfaces you know how to react. Normally what you do is you teach those lessons to each new manager and employee over and over again. That takes time. What if you only had to teach that lesson one more time and every new employee already knew how to react in the same tough situation? That’s artificial intelligence.

My point, this trend will not be limited to just manufacturing or customer services. This new technology will eventually impact each of our careers in some way, shape, or form.

3 Stages

I expect this to happen in three stages.

Stage 1: Companies do MORE with only a FEW MORE employees

Stage 2: Companies do MORE with the SAME number of employees

Stage 3: Companies do MORE with LESS employees

We are already through Stage 1 and we are entering Stage 2. How long will it be before we reach stage 3? That’s anyone’s guess. But with most evolution, Stage 1 takes the longest and the following stages evolve more rapidly. If Stage 1 took 16 years, my guess would be that stage 3 will be here a lot sooner than we think.

So What Happens To All Of The Employees?

The million dollar question and I don't know the answer. If I had to guess, the current middle class is going to be divided into two. Half of the middle class is going move up into the "upper class" and the other half will be "unemployed". The level of education will be the dividing line. Companies will continue to do more with less people. The only way to stop it is to tell companies that need to stop trying to be more profitable. Good luck. Our entire economy is built on the premise that you should accumulate as much as you can as fast as you can.

War and Conflict

When I look back in history, major conflicts arise when there is a large deviation between the “Have’s” and the “Have Not’s”. The fancy name that is used today is “income inequality”. When you have a robust middle class, everyone has something to lose if a conflict arises because that conflict generally disrupts the current system, uncertainty prevails, the economy goes into a recession, people lose their job, and they in turn cannot make their mortgage payment.

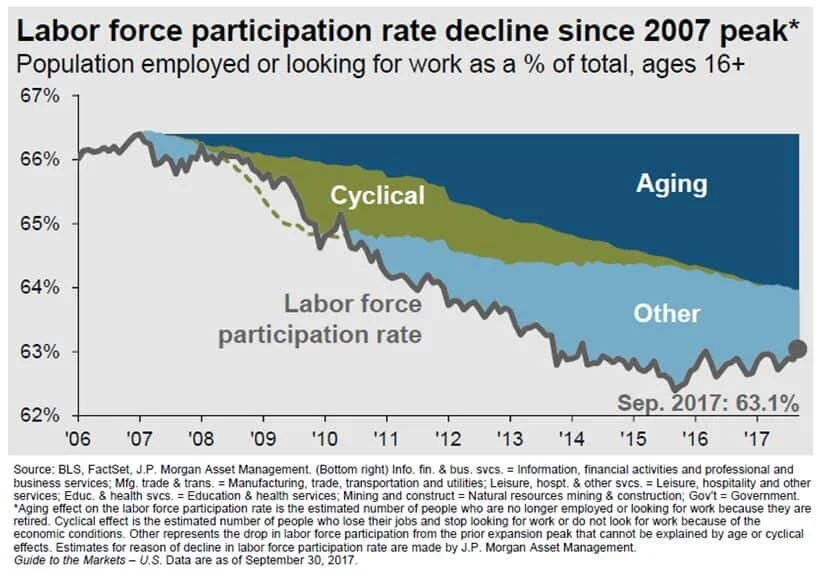

If instead, a majority of the population is unemployed and they can’t find a job because the jobs don’t exist anymore, that group of individuals has nothing to lose by burning the current system to the ground and rebuilding a new one from the ashes. I know that sounds dark but there is no arguing the gap between the Have’s and the Have Not’s is getting larger. Just look at the labor participation rate:

The Labor Participation Rate answers the question, how many people in the U.S. that could be working either are working or are looking for work? If there are individuals who could work, don’t have a job, and stop looking for work, they drop out of the labor force which decrease the labor participation rate because there are less citizens participating on the work force. As you can see in the chart above, in 2006 the labor participation rate was around 66%, and while we continue to experience one of the longest economic expansions of all time, the labor participation rate is still lower now than it was prior to the beginning of the economic recovery. Remember we are in an expansion and it has dropped by about 3%. What do you think will happen when we hit the next recession? While the baby boomer generation has had an impact on these numbers as you can see based on the large percentage of that decrease attributed to an “aging population”. Traditionally when someone retires, the company will promote the person below them and then hire another person to fill there spot. As many of us know, that’s not how it works anymore. Now that key employee retires, the company promotes one person into their role, but instead of hiring a new employee they just redistribute the work to the current staff. If anything, the baby boomer generation moving into retirement has made this transition to “do more with less people” easier on companies because they don’t have to fire anyone.

Tax Reform Will Accelerate The Trend

If you combine tax reform with the current 4.1% employment rate, I would expect this to accelerate the development of artificial intelligence. Companies are going to have cash from the tax savings to reinvest into new technologies which includes artificial intelligence. If the economy continues to grow at its current 2% pace or accelerates, one would expect consumption to increase which increases the demand for products and services. With the unemployment rate at 4.1%, we are already at "full employment". There are not enough qualified workers for companies to hire to meet the increase in demand for their product or service. The answer, let's accelerate the development of artificial intelligence that will allow the company to enter Phase 2 which is "Do MORE with the SAME number of workers".

People Will Cheer

These advances in technology are potentially setting the stage for levels of profitability that companies have only dreamed of. Higher profits traditionally equal higher stock prices. Investors will cheer this!! It may even lead us to the longest economic expansion of all time. In the short term, investors may have a lot to be excited about but we may look back years from now and realize that we were unintentionally cheering for the end of the middle class as we know it.

Again, this article is not meant to be a “dark cloud” or a new conspiracy theory but rather to keep our readers aware of the world that is changing rapidly around us. Like many of the economic challenges that the U.S. economy has experienced in the past, the hazard was in plain view, but investors failed to see it because they got caught up in the moment. When investing, it’s ok to take advantage of short term gains but never lose sight of the big picture.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

A Lesson From Bitcoin

I'm not writing this article to predict whether Bitcoin is going to $0 or $50,000. I have no idea whether it's going to go up or down from here. But I have had countless conversations with clients and friends over the past few weeks which starts like this "What do you think about Bitcoin?"My response is, before you make any type of investment, you should

I'm not writing this article to predict whether Bitcoin is going to $0 or $50,000. I have no idea whether it's going to go up or down from here. But I have had countless conversations with clients and friends over the past few weeks which starts like this "What do you think about Bitcoin?"

My response is, before you make any type of investment, you should be able to answer the following questions. If you can't answer these questions with confidence, you probably should not be investing in it.

"Explain It To Me In 30 Seconds"

Investing is as much of an art as it is a science which is why you can ask three different investment advisors about the same investment and get three different answers. While the full analysis of an investment can be complex and require a thorough understanding of markets, equity analysis, and financial reports, seasoned veterans have mastered their craft and have a way of simplifying the process. One of the lessons that I learned from my mentor and that I continue to apply to selecting investments today is "If you can't explain it to me in less than 30 seconds, I don't want to have anything to do with it."Before investing in anything, you should:

Develop an investment thesis

Identify the risks

Identify competitors

Know at what price to sell at

Let's look at each of these items and how they apply to the Bitcoin situation.

Develop an investment thesis

An investment thesis answers the question, why are you committing money to that particular investment? When buying a stock, you try to identify companies that have strong management, good cash flow, a promising new product or service, expanding market share, and a competitive advantage with the expectation that the company will outperform a given benchmark.

“Because I think it will go up” is not an investment thesis. You have to include in your investment thesis items that can be measured. If for example, I decide to invest in a cell phone company because they are expected to expand into China, India, and increase their market share over the next 3 years by 50%. I have identified a clear and measurable reason why I have chosen to invest in that company.

Bitcoin poses a challenge in this sense. When you invest in a company, you are essentially investing in the future cash flow that is expected to be produced by that company. Which is why the price to earnings ratio is often used to determine if a company is “reasonably priced”. Bitcoin is a currency that does not produce future cash flow so what metrics can you build into an investment thesis that will allow you to measure your expected outcome? I have yet to hear a good answer to that question. An “expert” making a prediction that Bitcoin is going to $30,000 is not a great metric to use. Remember, price appreciation is a by product of the improvement of the underlying financial drivers of an investment. If you can’t identify what those financial drivers are, price is irrelevant.

Identify the risks

Before making any investment, you should be able to take out a sheet of paper and list of the risks to your investment thesis. If you don’t know the risks, how do you know when to get out of that investment? In my cell phone company example, I bought that stock because I expected that company to gain 50% of the cell phone market share in China & India over the next 3 years. What are the risks to that investment thesis?

Currency risk: The value of the U.S. dollar increases versus the local currency decreasing profits

Execution risk: They do not successfully execute their strategy. It takes 5 years instead of 3.

Political risk: The Chinese government assumes ownership of the company

Market risk: The global economy goes into a recession

Competitor risk: Another reputable cell phone company enters that market

Management risk: The current CEO leaves the company and the new CEO takes the company in a different direction

Cash flow risk: The company takes on too much debt trying to expand and has to scale back

While everyone goes into a new investment with the hopes and dreams that it is the next Apple, you have to be able to identify what could send your great investment tumbling to the ground.

Can you list all of the risks associated with Bitcoin? It could go to zero but that’s true of any investment. With many new technologies, services, currencies, and medical devices, you have too unfortunately accept the fact that all of the risks associated with that investment are probably not known. It does not necessarily mean it’s a bad investment since most breakthrough technology and products are met with resistance and then uniformly accepted by the masses down the road. But it does imply that the investment comes with a much higher level of risk because a greater number of unknowns exists and you have to be able to live with the fact that it has just as much of a chance of going up by 100% as it does going to zero. While this line of thinking may not completely deter you from making a particular investment, it will hopefully influence the amount that you decide to commit to riskier investments.

Identify Competitors

When identifying competitors, my first question is usually "how large are the barriers to entry into are particular product or market?" The larger the barriers to entry, the longer it takes competitors to catch up to the market leaders. It would seem in the case of Bitcoin, that the barriers to entry for cryptocurrencies are fairly low. I'm already starting to hear the buzz at holiday parties about "ICO's" which stands for Initial Coin Offering. If I were looking to invest in Bitcoin, I would be asking the questions:

Who are the other main stream cryptocurrencies?

Do they have a competitive advantage over Bitcoin?

What would entice someone to switch from Bitcoin to another cryptocurrency?

How large is the cyptocurrency market?

Will regulations eventually come into play and create barriers to entry?

How many people that invested in Bitcoin do you think can answer these questions? My guess is not many. That in itself is risky.

Knowing At What Price To Sell

Of all the investment criteria that I have listed so far, I think this one is the most problematic when it comes to Bitcoin. When making any investment, you have to be able to answer the question: “Based on all of the information that I have today, at what price should I sell it at?” If I own a rental property and it’s fair market value is $250,000 and I collect $15,000 per year in rent, if someone offered me $300,000 to buy my rental property should I sell it? To answer that question, I would map out all of the income that I expect to receive from that property over my lifetime and apply a reasonable appreciation rate of the property value itself. It’s a similar process in evaluating a stock. You are looking at the annual earnings of the company and what you expect those earnings to be in the future. Both of these examples, like most investments, generate future cash flow and have reasonable appreciation rates that can be applied. With Bitcoin, as I mentioned earlier, there is no future cash flow. It’s value right now is being set based on what the next person is willing to buy it for. If one day people wake up and decide I don’t want to buy your Bitcoin or provide you with any good or services in exchange for your Bitcoin, there is nothing there. There are no earnings, there are no products, there are no services, there are no brick and mortar buildings, it’s vapor. With traditional currency, like the U.S. dollar, you have the taxing power and the assets of the United States government confirming that the dollar bill in your hand is worth something

So if I decide to buy Bitcoin today at $14,000 per coin, at what dollar amount should I sell it because it has become overvalued? I have no idea how anyone answers that question at this point. That’s problematic because if I start to make money, the difficult decision is “when do I get out?” When investing, it’s very easy to sell investments that have lost money. It’s emotionally much more difficult to sell your winners. So again, if I buy Bitcoin today and it goes to $30,000, do I sell it? Does it keep going to $50,000? I have absolutely nothing to based that on and that’s a problem.

Remember The Tulips

The single most important take away from this articles is "make sure you understand what you are investing in". If you can't explain it in less than 30 seconds, you probably should not be investing in it. Specific to Bitcoin, I use the saying, history does not repeat itself but it does rhyme. Some of the rhyming took place in the 1600's in the form of the Tulip bubble. In the Netherlands, during the Tulip mania, the cost of a tulip equaled to the cost of a house. Don't believe it? Just take a stroll down history lane. Here's the article: Tulip Mania

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Do I Make Too Much To Qualify For Financial Aid?

If you have children that are college-bound at some point you will begin the painful process of calculating how much college will cost for both you and them. However, you might be less worried about the financial aspects of your child going to college after viewing some of the Bloomsburg student apartments for rent on the market at the moment.

If you have children that are college-bound at some point you will begin the painful process of calculating how much college will cost for both you and them. However, you might be less worried about the financial aspects of your child going to college after viewing some of the Bloomsburg student apartments for rent on the market at the moment. Anyway, I have heard the statement, "well they will just have to take loans" but what parents don't realize is loans are a form of financial aid. Loans are not a given. Whether your children plan to attend a public college or private college, both have formulas to determine how much a family is expected to pay out of pocket before you even reach any "financial aid" which includes loans.

College Costs Are Increasing By 6.5% Per Year

The rise in the cost of college has outpaced the inflation rate of most other household costs over the past three decades.

To put this in perspective, if you have a 3 year old child and the cost of tuition / room & board for a state school is currently $25,000 by the time that child turns 17, the cost for one year of tuition / room & board will be $60,372. Multiply that by 4 years for a bachelor's degree: $241,488. Ouch!!! Which leads you to the next question, how much of that $60,372 per year will I have to pay out of pocket?

FAFSA vs CSS Profile Form

Public schools and private school have a different calculation for how much “aid” you qualify for. Public or state schools go by the FAFSA standards. Private schools use the “CSS Profile” form. The FAFSA form is fairly straight forward and is applied universally for state colleges. However, private schools are not required to follow the FAFSA financial aid guidelines which is why they have the separate CSS Profile form. By comparison the CSS profile form requests more financial information.

For example, for couples that are divorced, the FAFSA form only takes into consideration the income and assets of the parent that the child lives with for more than six months out of the year. This excludes the income and assets of the parent that the child does not live with for the majority of the year which could have a positive impact on the financial aid calculation. However, the CSS profile form, for children with divorced parents, requests and takes into consideration the income and assets of both parents regardless of their marital status.

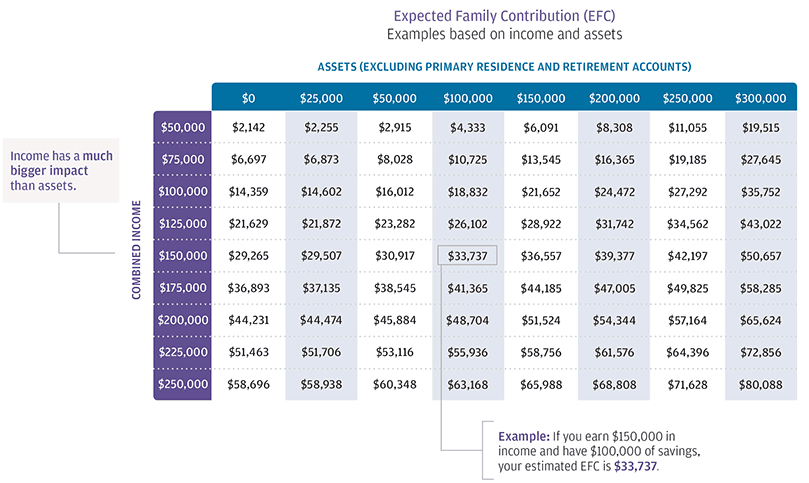

Expected Family Contribution

Both the FAFSA and CSS Profile form result in an "Expected Family Contribution" (EFC). That is the amount the family is expected to pay out of pocket for their child's college expense before the financial aid package begins. Below is a EFC award chart based on the following criteria:

FAFSA Criteria

2 Parent Household

1 Child Attending College

1 Child At Home

State of Residence: NY

Oldest Parent: 49 year old

As you can see in the chart, income has the largest impact on the amount of financial aid. If a married couple has $150,000 in AGI but has no assets, their EFC is already $29,265. For example, if tuition / room and board is $25,000 for SUNY Albany that means they would receive no financial aid.

Student Loans Are A Form Of Financial Aid

Most parents don't realize the federal student loans are considered "financial aid". While "grant" money is truly "free money" from the government to pay for college, federal loans make up about 32% of the financial aid packages for the 2016 – 2017 school year. See the chart below:

Start Planning Now

The cost of college is increasing and the amount of financial aid is declining. According to The College Board, between 2010 – 2016, federal financial aid declined by 25% while tuition and fees increased by 13% at four-year public colleges and 12% at private colleges. This unfortunate trend now requires parents to start running estimated EFC calculation when their children are still in elementary school so there is a plan for paying for the college costs not covered by financial aid.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Much Should I Budget For Health Care Costs In Retirement?

The number is higher than you think. When you total up the deductibles and premiums for Medicare part A, B, and D, that alone can cost a married couple $7,000 per year. We look at that figure as the baseline number. That $7,000 does not account for the additional costs associated with co-insurance, co-pays, dental costs, or Medigap insurance

The number is higher than you think. When you total up the deductibles and premiums for Medicare part A, B, and D, that alone can cost a married couple $7,000 per year. We look at that figure as the baseline number. That $7,000 does not account for the additional costs associated with co-insurance, co-pays, dental costs, or Medigap insurance premiums which can quickly increase the overall cost to $10,000+ per year.

Tough to believe? Allow me to walk you through the numbers for a married couple.

Medicare Part A: $2,632 Per Year

Part A covers inpatient hospital stays, skilled nursing facility stays, some home health visits, and hospice care. While Part A does not have an annual premium, it does have an annual deductible for each spouse. That deductible for 2017 is $1,316 per person.

Medicare Part B: $3,582

Part B covers physician visits, outpatient services, preventive services, and some home health visits. The standard monthly premium is $134 per person but it could be higher depending on your income level in retirement. There is also a deductible of $183 per year for each spouse.

Medicare Part D: $816

Part D covers outpatient prescription drugs through private plans that contract with Medicare. Enrollment in Part D is voluntary. The benefit helps pay for enrollees’ drug costs after a deductible is met (where applicable), and offers catastrophic coverage for very high drug costs. Part D coverage is actually provided by private health insurance companies. The premium varies based on your income and the types of prescriptions that you are taking. The national average in 2017 for Part D premiums is $34 per person.

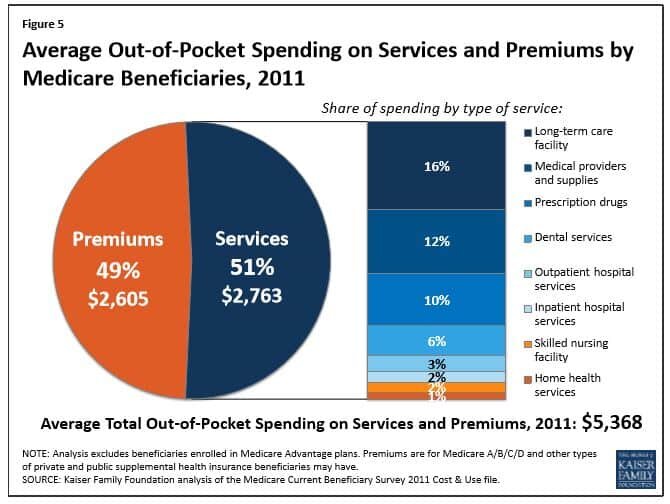

If you total up just these three items, you reach $7,030 in premiums and deductibles for the year. Then you start adding in dental cost, Medigap insurance premiums, co-insurance for Medicare benefits, and it quickly gets a married couple over that $10,000 threshold in health and dental cost each year. Medicare published a report that in 2011, Medicare beneficiaries spent $5,368 out of their own pockets for health care spending, on average. See the table below.

Start Planning Now

Fidelity Investments published a study that found that the average 65 year old will pay $240,000 in out-of-pocket costs for health care during retirement, not including potential long-term-care costs. While that seems like an extreme number, just take the $10,000 that we used above, multiply that by 20 year in retirement, and you get to $200,000 without taking into consideration inflation and other important variable that will add to the overall cost.

Bottom line, you have to make sure you are budgeting for these expenses in retirement. While most individuals focus on paying off the mortgage prior to retirement, very few are aware that the cost of health care in retirement may be equal to or greater than your mortgage payment. When we are create retirement projections for clients we typically included $10,000 to $15,000 in annual expenses to cover health care cost for a married couple and $5,000 – $7,500 for an individual.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Tax Reform: Your Company May Voluntarily Terminate Your Retirement Plan

Make no mistake, your company retirement plan is at risk if the proposed tax reform is passed. But wait…..didn’t Trump tweet on October 23, 2017 that “there will be NO change to your 401(k)”? He did tweet that, however, while the tax reform might not directly alter the contribution limits to employer sponsored retirement plans, the new tax rates

Make no mistake, your company retirement plan is at risk if the proposed tax reform is passed. But wait…..didn’t Trump tweet on October 23, 2017 that “there will be NO change to your 401(k)”? He did tweet that, however, while the tax reform might not directly alter the contribution limits to employer sponsored retirement plans, the new tax rates will produce a “disincentive” for companies to sponsor and make employer contributions to their plans.

What Are Pre-Tax Contributions Worth?

Remember, the main incentive of making contributions to employer sponsored retirement plans is moving income that would have been taxed now at a higher tax rate into the retirement years, when for most individuals, their income will be lower and that income will be taxed at a lower rate. If you have a business owner or executive that is paying 45% in taxes on the upper end of the income, there is a large incentive for that business owner to sponsor a retirement plan. They can take that income off of the table now and then realize that income in retirement at a lower rate.

This situation also benefits the employees of these companies. Due to non-discrimination rules, if the owner or executives are receiving contributions from the company to their retirement accounts, the company is required to make employer contributions to the rest of the employees to pass testing. This is why safe harbor plans have become so popular in the 401(k) market.

But what happens if the tax reform is passed and the business owners tax rate drops from 45% to 25%? You would have to make the case that when the business owner retires 5+ years from now that their tax rate will be below 25%. That is a very difficult case to make.

An Incentive NOT To Contribute To Retirement Plans

This creates an incentive for business owners NOT to contribution to employer sponsored retirement plans. Just doing the simple math, it would make sense for the business owner to stop contributing to their company sponsored retirement plan, pay tax on the income at a lower rate, and then accumulate those assets in a taxable account. When they withdraw the money from that taxable account in retirement, they will realize most of that income as long term capital gains which are more favorable than ordinary income tax rates.

If the owner is not contributing to the plan, here are the questions they are going to ask themselves:

Why am I paying to sponsor this plan for the company if I’m not using it?

Why make an employer contribution to the plan if I don’t have to?

This does not just impact 401(k) plans. This impacts all employer sponsored retirement plans: Simple IRA’s, SEP IRA’s, Solo(k) Plans, Pension Plans, 457 Plans, etc.

Where Does That Leave Employees?

For these reasons, as soon as tax reform is passed, in a very short time period, you will most likely see companies terminate their retirement plans or at a minimum, lower or stop the employer contributions to the plan. That leaves the employees in a boat, in the middle of the ocean, without a paddle. Without a 401(k) plan, how are employees expected to save enough to retire? They would be forced to use IRA’s which have much lower contribution limits and IRA’s don’t have employer contributions.

Employees all over the United States will become the unintended victim of tax reform. While the tax reform may not specifically place limitations on 401(k) plans, I’m sure they are aware that just by lowering the corporate tax rate from 35% to 20% and allowing all pass through business income to be taxes at a flat 25% tax rate, the pre-tax contributions to retirement plans will automatically go down dramatically by creating an environment that deters high income earners from deferring income into retirement plans. This is a complete bomb in the making for the middle class.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Lower Your Tax Bill By Directing Your Mandatory IRA Distributions To Charity

When you turn 70 1/2, you will have the option to process Qualified Charitable Distributions (QCD) which are distirbution from your pre-tax IRA directly to a chiartable organizaiton. Even though the SECURE Act in 2019 changed the RMD start age from 70 1/2 to age 72, your are still eligible to make these QCDs beginning the calendar year that you

When you turn 70 1/2, you will have the option to process Qualified Charitable Distributions (QCD) which are distribution from your pre-tax IRA directly to a chartable organization. Even though the SECURE Act in 2019 changed the RMD start age from 70 1/2 to age 72, your are still eligible to make these QCDs beginning the calendar year that you turn age 70 1/2. At age 72, you must begin taking required minimum distributions (RMD) from your pre-tax IRA’s and unless you are still working, your employer sponsored retirement plans as well. The IRS forces you to take these distributions whether you need them or not. Why is that? They want to begin collecting income taxes on your tax deferred retirement assets.

Some retirees find themselves in the fortunate situation of not needing this additional income so the RMD’s just create additional tax liability. If you are charitably inclined and would prefer to avoid the additional tax liability, you can make a charitable contribution directly from your IRA and avoid all or a portion of the tax liability generated by the required minimum distribution requirement.

It Does Not Work For 401(k)’s

You can only make “qualified charitable contributions” from an IRA. This option is not available for 401(k), 403(b), and other qualified retirement plans. If you wish to execute this strategy, you would have to process a direct rollover of your FULL 401(k) balance to a rollover IRA and then process the distribution from your IRA to charity.

The reason why I emphases the word “full” for your 401(k) rollover is due to the IRS “aggregation rule”. Assuming that you no longer work for the company that sponsors your 401(k) account, you are age 72 or older, and you have both a 401(k) account and a separate IRA account, you will need to take an RMD from both the 401(k) account and the IRA separately. The IRS allows you to aggregate your IRA’s together for purposes of taking RMD’s. If you have 10 separate IRA’s, you can total up the required distribution amounts for each IRA, and then take that amount from a single IRA account. The IRS does not allow you to aggregate 401(k) accounts for purposes of satisfying your RMD requirement. Thus, if it’s your intention to completely avoid taxes on your RMD requirement, you will have to make sure all of your retirement accounts have been moved into an IRA.

Contributions Must Be Made Directly To Charity

Another important rule. At no point can the IRA distribution ever hit your checking account. To complete the qualified charitable contribution, the money must go directly from your IRA to the charity or not-for-profit organization. Typically this is completed by issuing a “third party check” from your IRA. You provide your IRA provider with payment instructions for the check and the mailing address of the charitable organization. If at any point during this process you take receipt of the distribution from your IRA, the full amount will be taxable to you and the qualified charitable contribution will be void.

Tax Lesson

For many retirees, their income is lower in the retirement years and they have less itemized deductions since the kids are out of the house and the mortgage is paid off. Given this set of circumstances, it may make sense to change from itemizing to taking the standard deduction when preparing your taxes. Charitable contributions are an itemized deduction. Thus, if you take the standard deduction for your taxes, you no longer receive the tax benefit of your contributions to charity. By making IRA distributions directly to a charity, you are able to take the standard deduction but still capture the tax benefit of making a charitable contribution because you avoid tax on an IRA distribution that otherwise would have been taxable income to you.

Example: Church Offering

Instead of putting cash or personal checks in the offering each Sunday, you may consider directing all or a portion of your required minimum distribution from your IRA directly to the church or religious organization. Usually having a conversation with your church or religious organization about your new “offering structure” helps to ease the awkward feeling of passing the offering basket without making a contribution each week.

Example: Annual Contributions To Charity

In this example, let’s assume that each year I typically issue a personal check of $2,000 to my favorite charity, Big Brother Big Sisters, a not-for-profit organization. I’m turning 70½ this year and my accountant tells me that it would be more beneficial to take the standard deduction instead of itemizing. My RMD for the year is $5,000. I can contact my IRA provider, have them issuing a check directly to the charity for $2,000 and issue me a check for the remaining $3,000. I will only have to pay taxes on the $3,000 that I received as opposed to the full $5,000. I win, the charity wins, and the IRS kind of loses. I’m ok with that situation.

Don’t Accept Anything From The Charity In Return

This is a very important rule. Sometimes when you make a charitable contribution, as a sign of gratitude, the charity will send you a coffee mug, gift basket, etc. When this happens, you will typically get a letter from the charity confirming your contribution but the amount listed in the letter will be slightly lower than the actual dollar amount contributed. The charity will often reduce the contribution by the amount of the gift that was given. If this happens, the total amount of the charitable contribution fails the “qualified charitable contribution” requirement and you will be taxed on the full amount. Plus, you already gave the money to charity so you have spend the funds that you could use to pay the taxes. Not good

Limits

While this will not be an issue for many of us, there is a $100,000 per person limit for these qualified charitable contributions from IRA’s.

Summary

While there are a number of rules to follow when making these qualified charitable contributions from IRA’s, it can be a great strategy that allows retirees to continue contributing to their favorite charities, religious organizations, and/or not-for-profit organizations, while reducing their overall tax liability.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Do Inherited IRA's Work For Non-Spouse Beneficiaries?

The SECURE Act was signed into law on December 19, 2019 which completely changed the distribution options that are available to non-spouse beneficiaries. One of the major changes was the elimination of the “stretch provision” which previously allowed non-spouse beneficiaries to rollover the balance into their own inherited IRA and then take small

The SECURE Act was signed into law on December 19, 2019 which completely changed the distribution options that are available to non-spouse beneficiaries. One of the major changes was the elimination of the “stretch provision” which previously allowed non-spouse beneficiaries to rollover the balance into their own inherited IRA and then take small required minimum distributions over their lifetime.

That popular option was replaced with the new 10 Year Rule which will apply to most non-spouse beneficiaries that inherit IRA’s and other types of retirements account after December 31, 2019.

New Rules For Non-Spouse Beneficiaries Years 2020+

The article and Youtube video listed below will provide you with information on:

New distribution options available to non-spouse beneficiaries

The new 10 Year Rule

Beneficiaries that are grandfathered in under the old rules

SECURE Act changes

Old rules vs New rules

New tax strategies for non-spouse beneficiaries

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Social Security Filing Strategies

Making the right decision of when to turn on your social security benefit is critical. The wrong decision could cost you tens of thousands of dollars over the long run. Given all the variables surrounding this decision, what might be the right decision for one person may be the wrong decision for another. This article will cover some of the key factors to

Making the right decision of when to turn on your social security benefit is critical. The wrong decision could cost you tens of thousands of dollars over the long run. Given all the variables surrounding this decision, what might be the right decision for one person may be the wrong decision for another. This article will cover some of the key factors to consider:

Normal Retirement Age

First, you have to determine your "Normal Retirement Age" (NRA). This is listed on your social security statement in the "Your Estimated Benefits" section. If you were born between 1955 – 1960, your NRA is between age 66 – 67. If you were born 1960 or later, your NRA is age 67. You can obtain a copy of your statement via the social security website.

Before Normal Retirement Age

You have the option to turn on social security prior to your normal retirement age. The earliest you can turn on social security is age 62. However, they reduce your social security benefit by approximately 7% per year for each year prior to your normal retirement age. See the chart below from USA Today which illustrates an individual with a normal retirement age of 66. If they turn on their social security benefit at age 62, they would only receive 75% of their full benefit. This reduction is a permanent reduction. It does not increase at a later date, outside of the small cost of living increases.

The big questions is: “If I start taking it age 62, at what age is the breakeven point?” Remember, if I turn on social security at 62 and my normal retirement age is 66, I have received 4 years of payments from social security. So at what age would I be kicking myself wishing that I had waited until normal retirement age to turn on my benefit. There are a few different ways to calculate this accounting for taxes, the rates of return on other retirement assets, inflations, etc. but in general it’s sometime between the ages of 78 and 82.

Since the breakeven point may be in your early 80’s, depending on your health, and the longevity in your family history, it may or may not make sense to turn on your benefit early. If we have a client that is in ok health but not great health and both of their parents passed way prior to age 85, then it may make sense to for them to turn on their social security benefit early. We also have clients that have pensions and turning on their social security benefit early makes the different between retiring now or have to work for 5+ more years. As long as the long-term projections work out ok, we may recommend that they turn on their social security benefit early so they can retire sooner.

Are You Still Working?

This is a critical question for anyone that is considering turning on their social security benefits early. Why? If you turn on your social security benefit prior to reaching normal retirement age, there is an “earned income” penalty if you earn over the threshold set by the IRS for that year. See the table listed below:

In 2016, for every $2 that you earned over the $15,720 threshold, your social security was reduced by $1. For example, let’s say I’m entitled to $1,000 per month ($12,000 per year) from social security at age 62 and in 2016 I had $25,000 in W2 income. That is $9,280 over the $15,720 threshold for 2016 so they would reduce my annual benefit by $4,640. Not only did I reduce my social security benefit permanently by taking my social security benefit prior to normal retirement age but now my $12,000 in annual social security payments they are going to reduce that by another $4,640 due to the earned income penalty. Ouch!!!

Once you reach your normal retirement age, this earned income penalty no longer applies and you can make as much as you want and they will not reduce your social security benefit.

Because of this, the general rule of thumb is if you are still working and your income is above the IRS earned income threshold for the year, you should hold off on turning on your social security benefits until you either reach your normal retirement age or your income drops below the threshold.

Should I Delay May Benefit Past Normal Retirement Age

As was illustrated in first table, if you delay your social security benefit past your normal retirement age, your benefit will increase by approximately 8% per year until you reach age 70. At age 70, your social security benefit is capped and you should elect to turn on your benefits.

So when does it make sense to wait? The most common situation is the one where you plan to continue working past your normal retirement age. It’s becoming more common that people are working until age 70. Not because they necessarily have too but because they want something to keep them busy and to keep their mind fresh. If you have enough income from employment to cover you expenses, in many cases, is does make sense to wait. Based on the current formula, your social security benefit will increase by 8% per year for each year you delay your benefit past normal retirement age. It’s almost like having an investment that is guaranteed to go up by 8% per year which does not exist.

Also, for high-income earners, a majority of their social security benefit will be taxable income. Why would you want to add more income to the picture during your highest tax years? It may very well make sense to delay the benefit and allow the social security benefit to increase.

Death Benefit

The social security death benefit also comes into play as well when trying to determine which strategy is the right one for you. For a married couple, when their spouse passes away they do not continue to receive both benefits. Instead, when the first spouse passes away, the surviving spouse will receive the “higher of the two” social security benefits for the rest of their life. Here is an example:

Spouse 1 SS Benefit: $2,000

Spouse 2 SS Benefit: $1,000

If Spouse 1 passes away first, Spouse 2 would bump up to the $2,000 monthly benefit and their $1,000 monthly benefit would end. Now let’s switch that around, let’s say Spouse 2 passes away first, Spouse 1 will continue to receive their $2,000 per month and the $1,000 benefit will end.

If social security is a large percentage of the income picture for a married couple, losing one of the social security payments could be detrimental to the surviving spouse. Due to this situation, it may make sense to have the spouse with the higher benefit delay receiving social security past normal retirement to further increase their permanent monthly benefit which in turn increases the death benefit for the surviving spouse.

Spousal Benefit

The “spousal benefit” can be a powerful filing strategy. If you are married, you have the option of turning on your benefit based on your earnings history or you are entitled to half of your spouse’s benefit, whichever benefit is higher. This situation is common when one spouse has a much higher income than the other spouse.

Here is an important note. To be eligible for the spousal benefit, you personally must have earned 40 social security “credits”. You receive 1 credit for each calendar quarter that you earn a specific amount. In 2016, the figure was $1,260. You can earn up to 4 credits each calendar year.

Another important note, under the new rules, you cannot elect your spousal benefit until your spouse has started receiving social security payments.

Here is where the timing of the social security benefits come into play. You can turn on your spousal benefit as early as 62 but similar to the benefit based on your own earnings history it will be reduce by approximately 7% per year for each year you start the benefit prior to normal retirement age. At your normal retirement age, you are entitled to receive your full spousal benefit.

What happens if you delay your spousal benefit past normal retirement age? Here is where the benefit calculation deviates from the norm. Typically when you delay benefits, you receive that 8% annual increase in the benefits up until age 70. The spousal benefit is based exclusively on the benefit amount due to your spouse at their normal retirement age. Even if your spouse delays their social security benefit past their normal retirement age, it does not increase the 50% spousal benefit.

Here is the strategy. If it’s determine that the spousal benefit will be elected as part of a married couple’s filing strategy, since delaying the start date of the benefits past normal retirement age will only increase the social security benefit for the higher income earning spouse and not the spousal benefit, in many cases, it does not make sense to delay the start date of the benefits past normal retirement age.

Divorce

For divorced couples, if you were married for at least 10 years, you can still elect the spousal benefit even though you are no longer married. But you must wait until your ex-spouse begins receiving their benefits before you can elect the spousal benefit.

Also, if you were married for at least 10 years, you are also entitled to the death benefit as their ex-spouse. When your ex-spouse passes away, you can notify the social security office, elect the death benefit, and you will receive their full social security benefit amount for the rest of your life instead of just 50% of their benefit resulting from the “spousal benefit” calculation.

Whether or not your ex-spouse remarries has no impact on your ability to elect the spousal benefit or death benefit based on their earnings history.

Consult A Financial Planner

Given all of the variables in the mix and the importance of this decision, we strongly recommend that you consult with a Certified Financial Planner® before making your social security benefit elections. While the interaction with a fee-based CFP® may cost you a few hundred dollars, making the wrong decision regarding your social security benefits could cost you thousands of dollars over your lifetime. You can also download a Financial Planner Budget Worksheet to give you that extra help when sorting out your finances and monthly budgeting.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Equifax Data Breach: How To Protect Yourself

Equifax, a credit agency, had a data breach that resulted in an estimated 143 million people having their personal information compromised. Surprisingly enough, the greatest risk is right not now but rather a few months down the road. After your data is stolen, your information is sold on the black market, and then the bad guys figure out how they

Equifax, a credit agency, had a data breach that resulted in an estimated 143 million people having their personal information compromised. Surprisingly enough, the greatest risk is right not now but rather a few months down the road. After your data is stolen, your information is sold on the black market, and then the bad guys figure out how they are going to use your personal information to maximize their financial gain. So there is delay between the time that your information is stolen and when the fraudulent activity using your data begins.

In this article we are going to discuss the top ways to protect your credit from fraudulent activity. Here are the main steps

Monitor your financial activity closely

Run a free credit report

Consider "Freezing" your credit

Step 1: Monitor Your Financial Activity Closely

Make sure you keep a close eye on each transaction running through your checking account and credit card. This is often the first place that signs of fraudulent activity surfaces. If for some reason you cannot identify a charge to your card or bank account, make sure you contact your financial institution immediately.

Use Credit Cards, Not Debit Cards

Along these lines we strongly recommend that you use a credit card instead of a debit card and just payoff the balance of the credit card each month. If your debit card information is compromised and the "bad guys" charge $1,000 to the card, the $1,000 is actually pulled out of your checking account. You now have to report the fraudulent activity and get your money back. Instead, if your credit card is compromised and they make the $1,000 fraudulent transaction, you notify the credit card company but you are not out the $1,000. They just remove the charge from the bill and the credit card tracks down the bad guys. You should only be using your debit card for ATM withdrawals.

Step 2: Run A Free Credit Report

You should get in the habit of running a credit report on yourself once a year. These credit reports list all of your current creditors: car loans, mortgage, credit cards, store charge accounts, credit lines, etc. If you see a creditor on the list that you cannot identify that is a big red flag. If your data is compromised, the bad guys may use your data to apply for a credit card without your knowledge. The only way that you would find out that the fraudulent account existed is by running a credit report on yourself. Running your credit report once a year does not hurt your credit score. It's only if you are running your credit report more frequently that it could impact your credit score. Frequent credit runs can give the impression that you are eagerly searching for more credit and it can lower your credit score.

You can run a free credit report at www.annualcreditreport.com or you can request one from your bank or credit union.

Step 3: Consider Freezing Your Credit

One of the best ways to protect yourself is to freeze your credit with the 3 credit bureaus. There 3 credit bureaus are:

Equifax

Experian

TransUnion

A credit freeze means if someone tries to access your credit to establish a credit card, car loan, whatever it is, the request for the credit report will reject. When you set up the credit freeze each of the bureaus will you with a login or a pin number that allows you to "unfreeze" your credit for a selected period of time. If you have implemented a credit freeze and you apply for a car loan, you would follow the steps below:

Ask the dealership which credit bureau they run their reports through

Login to your account at that credit bureau

Unfreeze your credit report for a selected period of time

Notify the dealership of the limited time window to request the credit report

The window will automatically close and your credit will "re-freeze"

The credit freeze is simple to implement and it can be implemented by visiting the website of each credit bureau. You can also implement the freeze by calling the credit bureau but the on hold wait time is so long that we recommend to our clients implement the freeze via the web.Below is great video that walks you though what the online freezing process looks like:

Don't Use Public Wifi

One last tip to protect your information, do not use public wifi networks. It's tempting if you are at a coffee shop, hotel, or airport to access their free wifi network but it's the wrong move. There are individuals that have special programs that hack into the wireless network and see everything that you are looking at on your laptop or mobile device. If you are going to use a wireless network, make sure it is secure.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Watch These Two Market Indicators

While a roaring economy typically rewards equity investors, the GDP growth rate in the U.S. has continued to grow at that same 2.2% pace that we have seen since the recovery began in March 2009. When you compare that to the GDP growth rates of past economic expansions, some may classify the current growth rate as “sub par”. As in the tale of the

While a roaring economy typically rewards equity investors, the GDP growth rate in the U.S. has continued to grow at that same 2.2% pace that we have seen since the recovery began in March 2009. When you compare that to the GDP growth rates of past economic expansions, some may classify the current growth rate as “sub par”. As in the tale of the tortoise and the hare, sometimes slow and steady wins the race.

The number one questions on investor’s minds: “It’s been a great rally but are we close to the end?” Referencing the chart below, if you look at the length of the current economic expansion, going back to 1900 we are now witnessing the 3rd longest economic expansion on record which is making investors nervous because as we all know that markets work in cycles.

However, if you ignore the “length” of the rally for a moment and look at the “magnitude” of the rally it would seem that total GDP growth of the current economic expansion has been relatively tame compared to some of the economic recoveries in the past. See the chart below. The chart shows evidence that there have been economic rallies in the past that were shorter in duration but greater in magnitude. This may indicate that we still have further to go in the current economic expansion.

What causes big rallies to end?

Looking back at strong economic rallies in the past, the rallies did not die of old age but rather there was an event that triggered the next recession. So we have to be able identify trends within the economic data that would suggest that the economic expansion has ended and it will lead to the next recession.

Watch these two indicators

Two of the main indicators that we monitor to determine where we are in the current economic cycle are the Leading Indicators Index and the Yield Curve. History rarely repeats itself but it does rhyme. Look at the chart of the leading indicators index below. The leading indicators index is comprised of multiple economic indicators that are considered “forward looking”, like housing permits. If there are a lot of housing permits being issues, then demand for housing must be strong, and a strong housing market could lead to further economic growth. Look specifically at 2006. The leading indicators went negative in 2006, over a year before the stock market peaked in 2007. This indicator was telling us there was a problem before a majority of investors realized that we were on the doorstep of the recession.

Let’s look at the second key indicator, the yield curve. You will hear a lot about the “slope of the yield curve” in the media. In a healthy economy, long term interest rates are typically higher than short term rates which results in a “positively slopped” yield curve. In other words, when you go to the bank and you have the choice of buying a 2 year CD or a 10 year CD, you would expect to receive a higher interest rate on the 10 year CD because they are locking up your money for 10 years instead of 2.

There are periods of time where the interest rate on a 10 year government bond will drop below the interest rate on a 2 year government bond which is considered an “inverted yield curve”. Why does this happen and why would investors by that 10 year bond that is yielding less than the 2 year bond? This happens because bond investors are predicting an economic slowdown in the foreseeable future. They want to lock in the current 10 year interest rate knowing that if the economy goes into a recession that the Fed may begin to lower the Fed Funds Rate which has a more rapid impact on short term rates. It’s a bet that the 2 year bond rate will drop below the 10 year bond rate within the next few years.

If you look at the historical chart of the yield curve above, the yield curve inverted prior to the recession in the early 2000’s and prior to the 2008 recession.

Looking at where we sit today, within the last 6 months the leading indicators index has not only been positive but it’s accelerating and the yield curve is still positively sloped. While we realize that there is not a single indicator that accurately predicts the end of a market cycle, these particular economic indicators have historically been helpful in predicting danger ahead.

There will always be uncertainty in the world. Currently it has taken the form of U.S, politics, tax reforms, geopolitical events, and global monetary policy but it would seem that based on the hard economic data here in the U.S. that our economic expansion that began in March 2009 may still have further to go.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.