Should I Rollover My Pension To An IRA?

Whether you are about to retire or if you were just notified that your company is terminating their pension plan, making the right decision with regard to your pension plan payout is extremely important. It's important to get this decision right because you only get one shot at it. There are a lot of variables that factor into choosing the right option.

Whether you are about to retire or if you were just notified that your company is terminating their pension plan, making the right decision with regard to your pension plan payout is extremely important. It's important to get this decision right because you only get one shot at it. There are a lot of variables that factor into choosing the right option. While selecting the monthly payment option may be the right choice for your fellow co-worker, it could be the wrong choice for you. Here is a quick list of the items that you should consider before making the decision.

Financial health of the plan sponsor

Your age

Your health

Flexibility

Monthly benefit vs lump sum amount

Inflation

Your overall retirement picture

Financial Health Of The Plan Sponsor

The plan sponsor is the company, organization, union, municipality, state agency, or government entity that is in charge of the pension plan. The financial health of the plan sponsor should weigh heavily on your decision in many cases. After all what good is a monthly pension payment if five years from now the company or entity that sponsors the plan goes bankrupt?

Pension Benefit Guarantee Corporation

But wait……..isn’t there some type of organization that guarantees the pension payments? The answer, there may or may not be. The Pension Benefit Guarantee Corporation (PBGC) is an organization that was established to protect your pension benefit. But PBGC protection only applies if your company participates in the PBGC. Not all pension plans have this protection.

Large companies will typically have PBGC protection. The pension plan is required to pay premiums to the PBGC each year. Those premiums are used to subsidize the cost of bankrupt pension plans if the PBGC has to step in to pay benefits. But it’s very important to understand that even through a pension plan may have PBGC protection that does not mean that 100% of the employee’s pension benefits are protected if the company goes bankrupt.

There is a dollar limited placed on the monthly pension benefit that the PBGC will pay if it has to step in. It’s a sliding scale based on your age and the type of pension benefit that you elected. If your pension payment is greater that the cap, the excess amount is not insured. Here is the PBGC 2021 Maximum Monthly Guarantee Table:

Another important note, if you have not reached age 65, your full pension benefit may not be insured even if it is less than the cap listed in the table.

Again, not all pension plans are afforded this protection by the PBGC. Pension plans offered by states and local government agencies typically do not have PBGC protection.

If you are worried about the financial health of the plan sponsor, that scenario may favor electing the lump sum payment option and then rolling over the funds into your rollover IRA. Once the money is in your IRA, the plan sponsor insolvency risk is eliminated.

Your Age

Your age definitely factors into the decision. If you have 10+ years to retirement and your company decides to terminate their pension plan, it may make sense to rollover your balance in the pension plan into an IRA or your current employer’s 401(k) plan. Primarily because you have the benefit of time on your side and you have full control over the asset allocation of the account.

Pension plans typically maintain a conservative to moderate growth investment object. You will rarely ever find a pension plan that has 80%+ in equity exposure. Why? It’s a pooled account for all of the employees of all ages. Since the assets are required to meet current pension payments, pension plans cannot be subject to high levels of volatility.

If your personal balance in the pension plan is moved into our own IRA, you have the option of selecting an investment objective that matches your personal time horizon to retirement. If you have a long time horizon to retirement, it allows you the freedom to be more aggressive with the investment allocation of the account.

If you are within 5 years to retirement, it does not necessarily mean that selecting the monthly pension payment is the right choice but the decision is less cut and dry. You really have to compare the monthly pension payment versus the return that you would have to achieve in your IRA to replicate that income stream in retirement.

Your Health

Your health is a big factor as well. If you are in poor health, it may favor electing the lump sum option and rolling over the balance into an IRA. Whatever amount is left in your IRA account will be distributed to your beneficiaries. With a straight life pension option, the benefit just stops when you pass away. However, if you are worried about your spouse's spending habits and your spouse is either in good health or is much younger than you, you may want to consider the pension option with a 100% survivor benefit.

Flexibility

While some retirees like the security of a monthly pension payment that will not change for the rest of their life, other retirees prefer to have more flexibility. If you rollover you balance to an IRA, you can decide how much you want to take or not take out of the account in a given year.

Some retirees prefer to spend more in their early years in retirement because that is when their health is the best. Walking around Europe when you are 65 is usually not the same experience as walking around Europe when you are 80. If you want to take $10,000 out of your IRA to take that big trip to Europe or to spend a few months in Florida, it provides you with the flexibility to do so. By making sure that you have sufficient funds in your savings at the time of retirement can help to make things like this possible.

Working Because I Want To

The other category of retirees that tend to favor the IRA rollover option is the "I'm working because I want to" category. It has becoming more common for individuals to retire from their primary career and want to still work doing something else for two or three days a week just to keep their mind fresh. If the income from your part-time employment and your social security are enough to meet your expenses, having a fixed pension payment may just create more taxable income for you when you don't necessarily need it. Rolling over your pension plan to an IRA allows you to defer the receipt of that income until at least age 70½. That is the age that distributions are required from IRA accounts.

Monthly Pension vs Lump Sum

It’s important to determine the rate of return that you would need to achieve in your IRA account to replicate the pension benefit based on your life expectancy. With the monthly pension payment option, you do not have to worry about market fluctuations because the onus is on the plan sponsor to produce the returns necessary to make the pension payments. With the IRA, you or your investment advisor are responsible for producing the investment return in the account.

Example 1: You are 65 and you have the option of either taking a monthly pension payment of $3,000 per month or taking a lump sum in the amount of $500,000. If your life expectancy is age 85, what is the rate of return that you would need to achieve in your IRA to replicate the pension payment?

The answer: 4%

If your IRA account performs better than 4% per year, you are ahead of the game. If your IRA produces a return below 4%, you run the risk of running out of money prior to reaching age 85.

Part of this analysis is to determining whether or not the rate of return threshold is a reasonable rate of return to replicate. If the required rate of return calculation results in a return of 6% or higher, outside of any special circumstances, you may be inclined to select the pension payments and put the responsibility of producing that 6% rate of return each year on the plan sponsor.

Low Interest Rate Environment

A low interest rate environment tends to favor the lump sum option because it lowers the “discount rate” that actuaries can use when they are running the present value calculation. Wait……what?

The actuaries are the mathletes that produce the numbers that you see on your pension statement. They have to determine how much they would have to hand you today in a lump sum payment to equal the amount that you would have received if you elected the monthly pension option.

This is called a “present value” calculation. This amount is not the exact amount that you would have received if you elected the monthly pension payments because they get to assume that they money in the pension plan will earn interest over your life expectancy. For example, if the pension plan is supposed to pay you $10,000 per year for the next 30 years, that would equal $300,000 paid out over that 30 year period. But the present value may only be $140,000 because they get to assume that you will earn interest off of that money over the next 30 years for the amount that is not distributed until a later date.

In lower interest rate environments, the actuaries have to use a lower assume rate of return or a lower “discount rate”. Since they have to assume that you will make less interest on the money in your IRA, they have to provide you with a larger lump sum payment to replicate the monthly pension payments over your life expectancy.

Inflation

Inflation can be one of the largest enemies to a monthly pension payment. Inflation, in its simplest form is “the price of everything that you buy today goes up in price over time”. It’s why your grandparents have told you that they remember when a gallon of milk cost a nickel. If you are 65 today and your lock into receiving $2,000 per month for the rest of your life, inflation will erode the spending power of that $2,000 over time.

Historically, inflation increases by about 3% per year. As an example, if your monthly car payment is $400 today, the payment for that same exact car 20 years from now will be $722 per month. Now use this multiplier against everything that you buy each month and it begins to add up quickly.

If you have the money in an IRA, higher inflation typically leads to higher interest rate, which can lead to higher interest rates on bonds. Again, having control over the investment allocation of your IRA account may help you to mitigate the negative impact of inflation compared to a fixed pension payment.

A special note, some pension plans have a cost of living adjustment (“COLA”) built into the pension payment. Having this feature available in your pension plan will help to manage the inflation risk associated with selecting the monthly pension payment option. The plan basically has an inflation measuring stick built into your pension payment. If inflation increases, the plan is allowed to increase the amount of your monthly pension payment to help protect the benefit.

Your Overall Financial Picture

While I have highlighted a number of key variables that you will need to consider before selecting the payout option for your pension benefit, at the end of the day, you have to determine how each option factors into your own personal financial situation. It’s usually wise to run financial projections that identify both the opportunities and risks associated with each payment option.

Don’t be afraid to seek professional help with this decision. They will help you consider what you might need to pay for in the future. Are you going to need money spare for holidays, transportation, even funeral costs should be considered. Where people get into trouble is when they guess or they choose an option based on what most of their co-workers selected. Remember, those co-workers are not going to be there to help you financially if you make the wrong decision.

As an investment advisor, I will also say this, if you meet with a financial planner or investment advisor to assist you with this decision, make sure they are providing you with a non-bias analysis of your options. Depending on how they are compensation, they may have a vested interest in getting you to rollover you pension benefit to an IRA. Even though electing the lump sum payment and rolling the balance over to an IRA may very well be the right decision, they should walk you through a thorough analysis of the month pension payments versus the lump sum rollover option to assist you with your decision.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Much Should I Budget For Health Care Costs In Retirement?

The number is higher than you think. When you total up the deductibles and premiums for Medicare part A, B, and D, that alone can cost a married couple $7,000 per year. We look at that figure as the baseline number. That $7,000 does not account for the additional costs associated with co-insurance, co-pays, dental costs, or Medigap insurance

The number is higher than you think. When you total up the deductibles and premiums for Medicare part A, B, and D, that alone can cost a married couple $7,000 per year. We look at that figure as the baseline number. That $7,000 does not account for the additional costs associated with co-insurance, co-pays, dental costs, or Medigap insurance premiums which can quickly increase the overall cost to $10,000+ per year.

Tough to believe? Allow me to walk you through the numbers for a married couple.

Medicare Part A: $2,632 Per Year

Part A covers inpatient hospital stays, skilled nursing facility stays, some home health visits, and hospice care. While Part A does not have an annual premium, it does have an annual deductible for each spouse. That deductible for 2017 is $1,316 per person.

Medicare Part B: $3,582

Part B covers physician visits, outpatient services, preventive services, and some home health visits. The standard monthly premium is $134 per person but it could be higher depending on your income level in retirement. There is also a deductible of $183 per year for each spouse.

Medicare Part D: $816

Part D covers outpatient prescription drugs through private plans that contract with Medicare. Enrollment in Part D is voluntary. The benefit helps pay for enrollees’ drug costs after a deductible is met (where applicable), and offers catastrophic coverage for very high drug costs. Part D coverage is actually provided by private health insurance companies. The premium varies based on your income and the types of prescriptions that you are taking. The national average in 2017 for Part D premiums is $34 per person.

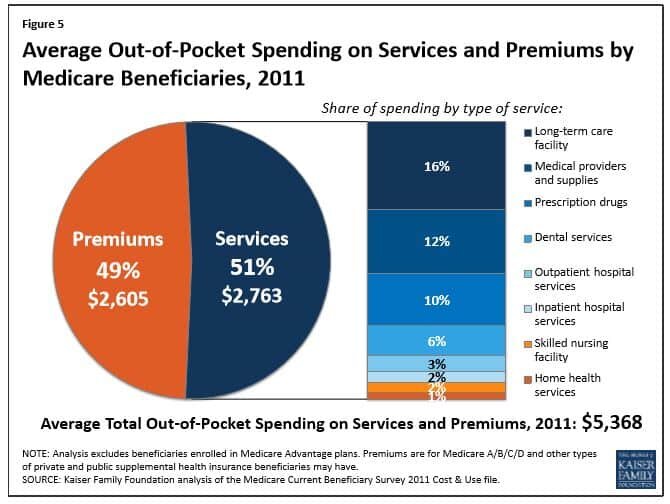

If you total up just these three items, you reach $7,030 in premiums and deductibles for the year. Then you start adding in dental cost, Medigap insurance premiums, co-insurance for Medicare benefits, and it quickly gets a married couple over that $10,000 threshold in health and dental cost each year. Medicare published a report that in 2011, Medicare beneficiaries spent $5,368 out of their own pockets for health care spending, on average. See the table below.

Start Planning Now

Fidelity Investments published a study that found that the average 65 year old will pay $240,000 in out-of-pocket costs for health care during retirement, not including potential long-term-care costs. While that seems like an extreme number, just take the $10,000 that we used above, multiply that by 20 year in retirement, and you get to $200,000 without taking into consideration inflation and other important variable that will add to the overall cost.

Bottom line, you have to make sure you are budgeting for these expenses in retirement. While most individuals focus on paying off the mortgage prior to retirement, very few are aware that the cost of health care in retirement may be equal to or greater than your mortgage payment. When we are create retirement projections for clients we typically included $10,000 to $15,000 in annual expenses to cover health care cost for a married couple and $5,000 – $7,500 for an individual.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Lower Your Tax Bill By Directing Your Mandatory IRA Distributions To Charity

When you turn 70 1/2, you will have the option to process Qualified Charitable Distributions (QCD) which are distirbution from your pre-tax IRA directly to a chiartable organizaiton. Even though the SECURE Act in 2019 changed the RMD start age from 70 1/2 to age 72, your are still eligible to make these QCDs beginning the calendar year that you

When you turn 70 1/2, you will have the option to process Qualified Charitable Distributions (QCD) which are distribution from your pre-tax IRA directly to a chartable organization. Even though the SECURE Act in 2019 changed the RMD start age from 70 1/2 to age 72, your are still eligible to make these QCDs beginning the calendar year that you turn age 70 1/2. At age 72, you must begin taking required minimum distributions (RMD) from your pre-tax IRA’s and unless you are still working, your employer sponsored retirement plans as well. The IRS forces you to take these distributions whether you need them or not. Why is that? They want to begin collecting income taxes on your tax deferred retirement assets.

Some retirees find themselves in the fortunate situation of not needing this additional income so the RMD’s just create additional tax liability. If you are charitably inclined and would prefer to avoid the additional tax liability, you can make a charitable contribution directly from your IRA and avoid all or a portion of the tax liability generated by the required minimum distribution requirement.

It Does Not Work For 401(k)’s

You can only make “qualified charitable contributions” from an IRA. This option is not available for 401(k), 403(b), and other qualified retirement plans. If you wish to execute this strategy, you would have to process a direct rollover of your FULL 401(k) balance to a rollover IRA and then process the distribution from your IRA to charity.

The reason why I emphases the word “full” for your 401(k) rollover is due to the IRS “aggregation rule”. Assuming that you no longer work for the company that sponsors your 401(k) account, you are age 72 or older, and you have both a 401(k) account and a separate IRA account, you will need to take an RMD from both the 401(k) account and the IRA separately. The IRS allows you to aggregate your IRA’s together for purposes of taking RMD’s. If you have 10 separate IRA’s, you can total up the required distribution amounts for each IRA, and then take that amount from a single IRA account. The IRS does not allow you to aggregate 401(k) accounts for purposes of satisfying your RMD requirement. Thus, if it’s your intention to completely avoid taxes on your RMD requirement, you will have to make sure all of your retirement accounts have been moved into an IRA.

Contributions Must Be Made Directly To Charity

Another important rule. At no point can the IRA distribution ever hit your checking account. To complete the qualified charitable contribution, the money must go directly from your IRA to the charity or not-for-profit organization. Typically this is completed by issuing a “third party check” from your IRA. You provide your IRA provider with payment instructions for the check and the mailing address of the charitable organization. If at any point during this process you take receipt of the distribution from your IRA, the full amount will be taxable to you and the qualified charitable contribution will be void.

Tax Lesson

For many retirees, their income is lower in the retirement years and they have less itemized deductions since the kids are out of the house and the mortgage is paid off. Given this set of circumstances, it may make sense to change from itemizing to taking the standard deduction when preparing your taxes. Charitable contributions are an itemized deduction. Thus, if you take the standard deduction for your taxes, you no longer receive the tax benefit of your contributions to charity. By making IRA distributions directly to a charity, you are able to take the standard deduction but still capture the tax benefit of making a charitable contribution because you avoid tax on an IRA distribution that otherwise would have been taxable income to you.

Example: Church Offering

Instead of putting cash or personal checks in the offering each Sunday, you may consider directing all or a portion of your required minimum distribution from your IRA directly to the church or religious organization. Usually having a conversation with your church or religious organization about your new “offering structure” helps to ease the awkward feeling of passing the offering basket without making a contribution each week.

Example: Annual Contributions To Charity

In this example, let’s assume that each year I typically issue a personal check of $2,000 to my favorite charity, Big Brother Big Sisters, a not-for-profit organization. I’m turning 70½ this year and my accountant tells me that it would be more beneficial to take the standard deduction instead of itemizing. My RMD for the year is $5,000. I can contact my IRA provider, have them issuing a check directly to the charity for $2,000 and issue me a check for the remaining $3,000. I will only have to pay taxes on the $3,000 that I received as opposed to the full $5,000. I win, the charity wins, and the IRS kind of loses. I’m ok with that situation.

Don’t Accept Anything From The Charity In Return

This is a very important rule. Sometimes when you make a charitable contribution, as a sign of gratitude, the charity will send you a coffee mug, gift basket, etc. When this happens, you will typically get a letter from the charity confirming your contribution but the amount listed in the letter will be slightly lower than the actual dollar amount contributed. The charity will often reduce the contribution by the amount of the gift that was given. If this happens, the total amount of the charitable contribution fails the “qualified charitable contribution” requirement and you will be taxed on the full amount. Plus, you already gave the money to charity so you have spend the funds that you could use to pay the taxes. Not good

Limits

While this will not be an issue for many of us, there is a $100,000 per person limit for these qualified charitable contributions from IRA’s.

Summary

While there are a number of rules to follow when making these qualified charitable contributions from IRA’s, it can be a great strategy that allows retirees to continue contributing to their favorite charities, religious organizations, and/or not-for-profit organizations, while reducing their overall tax liability.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Do Inherited IRA's Work For Non-Spouse Beneficiaries?

The SECURE Act was signed into law on December 19, 2019 which completely changed the distribution options that are available to non-spouse beneficiaries. One of the major changes was the elimination of the “stretch provision” which previously allowed non-spouse beneficiaries to rollover the balance into their own inherited IRA and then take small

The SECURE Act was signed into law on December 19, 2019 which completely changed the distribution options that are available to non-spouse beneficiaries. One of the major changes was the elimination of the “stretch provision” which previously allowed non-spouse beneficiaries to rollover the balance into their own inherited IRA and then take small required minimum distributions over their lifetime.

That popular option was replaced with the new 10 Year Rule which will apply to most non-spouse beneficiaries that inherit IRA’s and other types of retirements account after December 31, 2019.

New Rules For Non-Spouse Beneficiaries Years 2020+

The article and Youtube video listed below will provide you with information on:

New distribution options available to non-spouse beneficiaries

The new 10 Year Rule

Beneficiaries that are grandfathered in under the old rules

SECURE Act changes

Old rules vs New rules

New tax strategies for non-spouse beneficiaries

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Social Security Filing Strategies

Making the right decision of when to turn on your social security benefit is critical. The wrong decision could cost you tens of thousands of dollars over the long run. Given all the variables surrounding this decision, what might be the right decision for one person may be the wrong decision for another. This article will cover some of the key factors to

Making the right decision of when to turn on your social security benefit is critical. The wrong decision could cost you tens of thousands of dollars over the long run. Given all the variables surrounding this decision, what might be the right decision for one person may be the wrong decision for another. This article will cover some of the key factors to consider:

Normal Retirement Age

First, you have to determine your "Normal Retirement Age" (NRA). This is listed on your social security statement in the "Your Estimated Benefits" section. If you were born between 1955 – 1960, your NRA is between age 66 – 67. If you were born 1960 or later, your NRA is age 67. You can obtain a copy of your statement via the social security website.

Before Normal Retirement Age

You have the option to turn on social security prior to your normal retirement age. The earliest you can turn on social security is age 62. However, they reduce your social security benefit by approximately 7% per year for each year prior to your normal retirement age. See the chart below from USA Today which illustrates an individual with a normal retirement age of 66. If they turn on their social security benefit at age 62, they would only receive 75% of their full benefit. This reduction is a permanent reduction. It does not increase at a later date, outside of the small cost of living increases.

The big questions is: “If I start taking it age 62, at what age is the breakeven point?” Remember, if I turn on social security at 62 and my normal retirement age is 66, I have received 4 years of payments from social security. So at what age would I be kicking myself wishing that I had waited until normal retirement age to turn on my benefit. There are a few different ways to calculate this accounting for taxes, the rates of return on other retirement assets, inflations, etc. but in general it’s sometime between the ages of 78 and 82.

Since the breakeven point may be in your early 80’s, depending on your health, and the longevity in your family history, it may or may not make sense to turn on your benefit early. If we have a client that is in ok health but not great health and both of their parents passed way prior to age 85, then it may make sense to for them to turn on their social security benefit early. We also have clients that have pensions and turning on their social security benefit early makes the different between retiring now or have to work for 5+ more years. As long as the long-term projections work out ok, we may recommend that they turn on their social security benefit early so they can retire sooner.

Are You Still Working?

This is a critical question for anyone that is considering turning on their social security benefits early. Why? If you turn on your social security benefit prior to reaching normal retirement age, there is an “earned income” penalty if you earn over the threshold set by the IRS for that year. See the table listed below:

In 2016, for every $2 that you earned over the $15,720 threshold, your social security was reduced by $1. For example, let’s say I’m entitled to $1,000 per month ($12,000 per year) from social security at age 62 and in 2016 I had $25,000 in W2 income. That is $9,280 over the $15,720 threshold for 2016 so they would reduce my annual benefit by $4,640. Not only did I reduce my social security benefit permanently by taking my social security benefit prior to normal retirement age but now my $12,000 in annual social security payments they are going to reduce that by another $4,640 due to the earned income penalty. Ouch!!!

Once you reach your normal retirement age, this earned income penalty no longer applies and you can make as much as you want and they will not reduce your social security benefit.

Because of this, the general rule of thumb is if you are still working and your income is above the IRS earned income threshold for the year, you should hold off on turning on your social security benefits until you either reach your normal retirement age or your income drops below the threshold.

Should I Delay May Benefit Past Normal Retirement Age

As was illustrated in first table, if you delay your social security benefit past your normal retirement age, your benefit will increase by approximately 8% per year until you reach age 70. At age 70, your social security benefit is capped and you should elect to turn on your benefits.

So when does it make sense to wait? The most common situation is the one where you plan to continue working past your normal retirement age. It’s becoming more common that people are working until age 70. Not because they necessarily have too but because they want something to keep them busy and to keep their mind fresh. If you have enough income from employment to cover you expenses, in many cases, is does make sense to wait. Based on the current formula, your social security benefit will increase by 8% per year for each year you delay your benefit past normal retirement age. It’s almost like having an investment that is guaranteed to go up by 8% per year which does not exist.

Also, for high-income earners, a majority of their social security benefit will be taxable income. Why would you want to add more income to the picture during your highest tax years? It may very well make sense to delay the benefit and allow the social security benefit to increase.

Death Benefit

The social security death benefit also comes into play as well when trying to determine which strategy is the right one for you. For a married couple, when their spouse passes away they do not continue to receive both benefits. Instead, when the first spouse passes away, the surviving spouse will receive the “higher of the two” social security benefits for the rest of their life. Here is an example:

Spouse 1 SS Benefit: $2,000

Spouse 2 SS Benefit: $1,000

If Spouse 1 passes away first, Spouse 2 would bump up to the $2,000 monthly benefit and their $1,000 monthly benefit would end. Now let’s switch that around, let’s say Spouse 2 passes away first, Spouse 1 will continue to receive their $2,000 per month and the $1,000 benefit will end.

If social security is a large percentage of the income picture for a married couple, losing one of the social security payments could be detrimental to the surviving spouse. Due to this situation, it may make sense to have the spouse with the higher benefit delay receiving social security past normal retirement to further increase their permanent monthly benefit which in turn increases the death benefit for the surviving spouse.

Spousal Benefit

The “spousal benefit” can be a powerful filing strategy. If you are married, you have the option of turning on your benefit based on your earnings history or you are entitled to half of your spouse’s benefit, whichever benefit is higher. This situation is common when one spouse has a much higher income than the other spouse.

Here is an important note. To be eligible for the spousal benefit, you personally must have earned 40 social security “credits”. You receive 1 credit for each calendar quarter that you earn a specific amount. In 2016, the figure was $1,260. You can earn up to 4 credits each calendar year.

Another important note, under the new rules, you cannot elect your spousal benefit until your spouse has started receiving social security payments.

Here is where the timing of the social security benefits come into play. You can turn on your spousal benefit as early as 62 but similar to the benefit based on your own earnings history it will be reduce by approximately 7% per year for each year you start the benefit prior to normal retirement age. At your normal retirement age, you are entitled to receive your full spousal benefit.

What happens if you delay your spousal benefit past normal retirement age? Here is where the benefit calculation deviates from the norm. Typically when you delay benefits, you receive that 8% annual increase in the benefits up until age 70. The spousal benefit is based exclusively on the benefit amount due to your spouse at their normal retirement age. Even if your spouse delays their social security benefit past their normal retirement age, it does not increase the 50% spousal benefit.

Here is the strategy. If it’s determine that the spousal benefit will be elected as part of a married couple’s filing strategy, since delaying the start date of the benefits past normal retirement age will only increase the social security benefit for the higher income earning spouse and not the spousal benefit, in many cases, it does not make sense to delay the start date of the benefits past normal retirement age.

Divorce

For divorced couples, if you were married for at least 10 years, you can still elect the spousal benefit even though you are no longer married. But you must wait until your ex-spouse begins receiving their benefits before you can elect the spousal benefit.

Also, if you were married for at least 10 years, you are also entitled to the death benefit as their ex-spouse. When your ex-spouse passes away, you can notify the social security office, elect the death benefit, and you will receive their full social security benefit amount for the rest of your life instead of just 50% of their benefit resulting from the “spousal benefit” calculation.

Whether or not your ex-spouse remarries has no impact on your ability to elect the spousal benefit or death benefit based on their earnings history.

Consult A Financial Planner

Given all of the variables in the mix and the importance of this decision, we strongly recommend that you consult with a Certified Financial Planner® before making your social security benefit elections. While the interaction with a fee-based CFP® may cost you a few hundred dollars, making the wrong decision regarding your social security benefits could cost you thousands of dollars over your lifetime. You can also download a Financial Planner Budget Worksheet to give you that extra help when sorting out your finances and monthly budgeting.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Required Minimum Distribution Tax Strategies

If you are turning age 72 this year, this article is for you. You will most likely have to start taking required minimum distributions from your retirement accounts. This article will outline:

If you are turning age 72 this year, this article is for you. You will most likely have to start taking required minimum distributions from your retirement accounts. This article will outline:

Deadlines to take your RMD

Tax implications

Strategies to reduce your tax bill

How is my RMD calculated?

The IRS has a tax table that determines the amount that you have to take out of your retirement accounts each year. To determine your RMD amount you will need to obtain the December 31st balance in your retirement accounts, find your age on the IRS RMD tax table, and divide your 12/31 balance by the number listed next to your age in the tax table.

Exceptions to the RMD requirement........

There are two exceptions. First, Roth IRA’s do not require RMD’s. Second, if you are still working, you maintain a balance in your current employer’s retirement plan, and you are not a 5%+ owner of the company, you do not need to take an RMD from that particular retirement account until you terminate employment with the company. Which leads us to the first tax strategy. If you are age 72 or older and you are still working, you can typically rollover your traditional IRA’s and former employer 401(k)/403(b) accounts into your current employers retirement plan. By doing so, you avoid the requirement to take RMD’s from those retirement accounts outside of your current employers retirement plan and you avoid having to pay taxes on those required minimum distributions. If you are 5%+ owner of the company, you are out of luck. The IRS will still require you to take the RMD from your retirement account even though you are still “employed” by the company.

Deadlines

In the year that you turn 72, if you do not meet one of the exceptions listed above, you will have a very important decision to make. You have the option to take the RMD by 12/31 of that year or wait until the beginning of the following tax year. For your first RMD, the deadline to take the RMD is April 1st of the year following the year that you turn age 72. For example, if you turn 72 on June 2017, you will not be required to take your first RMD until April 1, 2018. If you worked full time from January 2017 – June 2017, it may make sense for you to delay your first RMD until January 2018 because your income will most likely be higher in 2017 because you worked for half of the year. When you take a RMD, like any other distribution from a pre-tax retirement account, it increases the amount of your taxable income for the year. From a pure tax standpoint it usually makes snese to realize income from retirement accounts in years that you are in a lower tax bracket.

SPECIAL NOTE: If you decided to delay your first RMD until after December 31st, you will be required to take two RMD’s in that year. One prior to April 1st and the second before Decemeber 31st. The April 1st rule only applies to your first RMD. You should consult with your accountant to determine the best RMD strategy given your personal income tax situation. For all tax years following the year that you turn age 72, the RMD deadline is December 31st.

VERY IMPORTANT: Do not miss your RMD deadline. The IRS hits you with a lovely 50% excise tax if you fail to take your RMD by the deadline. If you were due a $4,000 RMD and you miss the deadline, the IRS is going to levy a $2,000 excise tax against you.

Contributions to charity to avoid taxes

Another helpful tax strategy, if you make contributions to a charity, a church, or not-for-profit organization, you have the option with IRA’s to direct all or a portion of your RMD directly to these organization. In doing so, you satisfy your RMD but avoid having to pay income tax on the distribution from the IRA. The number one rule here, the distribution must go directly from your IRA account to the not-for-profit organization. At no point during this transaction can the owner of the IRA take possession of cash from the RMD otherwise the full amount will be taxable to the owner of the IRA. Typically the custodian of your IRA will have to issue and mail a third party check directly to the not-for-profit organization.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Social Security Loophole: Age 62+ With Kids In High School

There is a little known loophole in the social security system for parents that are age 62 or older with children still in high school or younger. Since couples are having children later in life this situation is becoming more common and it could equal big dollars for families that are aware of this social security filing strategy.

There is a little known loophole in the social security system for parents that are age 62 or older with children still in high school or younger. Since couples are having children later in life this situation is becoming more common and it could equal big dollars for families that are aware of this social security filing strategy.

Here is how it works. If you are age 62 or older and you have children under that age of 18, they can collect a social security benefit based on your earnings history equal to half of the parents social security benefit at normal retirement age. This amount could equal as much as $16,122 per year for one child for higher income earners. If you have multiple children the total annual amount paid to your family members could equal between 150% to $180% of your normal retirement benefit which could be in excess of $40,000 per year depending on your earnings history.

There are some key considerations. First, your children cannot collect on this “family benefit” until you have begun to collect your social security benefit. You can turn on your social security benefit as early as age 62 but they reduce the monthly amount that you receive if you turn on the benefit prior to your normal retirement age. However, it may make sense to do so depending on the amount of the family benefit paid and the duration of the benefit. If you wait until normal retirement age, you will receive a slightly higher social security benefit for yourself, but all of the social security dollars that could have been paid to your children is lost.

Second, if you are still working and your earned income exceeds certain thresholds this filing strategy may not be advantageous due to the earned income penalty. They reduce your social security benefit by $1 for every $2 earned over a given threshold ($16,920 in 2017). Not only is your social security benefit reduce but also the benefit to your dependents.

Due to these restrictions, this filing strategy yields that greatest benefit to parents that are either fully or partially retired, age 62 or older, with a child or children below the age of 18.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Should I Establish A Power of Attorney?

There are three key estate documents that everyone should have: Will, Health Proxy, Power of Attorney, If you have dependents, such as a spouse or children, the statement above graduates from “should have” to “need to

There are three key estate documents that everyone should have:

Will

Health Proxy

Power of Attorney

If you have dependents, such as a spouse or children, the statement above graduates from “should have” to “need to have in place.” The power of attorney document allows someone that you designate to act on your behalf if you are rendered incapacitated such as a car accident, illness, or as you become become more frail later in life.

What happens if I'm in a car accident?

If I have a wife and kids and one day I end up in a car accident and end up in a coma, without a power of attorney in place, not even my wife would be able to access accounts that are solely in my name such as bank accounts, retirement accounts, or creditors. It could put my family in a very difficult situation if my wife is unable to access certain accounts to pay bills or withdraw money to pay for my medical bills while I am recovering. If I establish a Power of Attorney with my wife listed as the POA (Power of Attorney), if I become incapacitated, she can use that document to access all of my accounts as if she were me.

Protecting Against Long Term Care Event

While this a valid example, the Power of Attorney document is more frequently used when elderly individuals experience a long term care event and they are no longer able to manage their finances. The POA gives the designated person the power to make gifts, setup trusts, or implement other wealth preservation strategies to prevent the total depletion of your assets due to the expenses associated with the long term care event.

What happens if you don’t have a power of attorney?

From working with individuals that have been in these situations, it’s ugly. Very ugly. Instead of a trusted person being able to step in and act on your behalf, without a POA your family or friends would need to initiate a guardianship proceeding, wherein the individual is declared incapacitated and a guardian is appointed by the court to manage their financial affairs. The largest drawback of a guardianship proceeding is time and money. It can often times cost more that $15,000 to complete a guardianship processing when taking into account court fees, attorney fees, court evaluations, and bonding fees. In addition and arguably more importantly, you have no control over who the court will decide to appoint as your guardian and that individual will have full control over your finances. You know your family and friends best. Ask yourself this, wouldn’t you prefer to appoint the individual that you trust to carry out your wishes? If the answer is “yes”, then you should strongly consider putting a power of attorney in place.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Who Pays The Tax On A Cash Gift?

This question comes up a lot when a parent makes a cash gift to a child or when a grandparent gifts to a grandchild. When you make a cash gift to someone else, who pays the tax on that gift? The short answer is “typically no one does”. Each individual has a federal “lifetime gift tax exclusion” of $5,400,000 which means that I would have to give

This question comes up a lot when a parent makes a cash gift to a child or when a grandparent gifts to a grandchild. When you make a cash gift to someone else, who pays the tax on that gift? The short answer is “typically no one does”. Each individual has a federal “lifetime gift tax exclusion” of $5,400,000 which means that I would have to give away $5.4 million dollars before I would owe “gift tax” on a gift. For married couples, they each have a $5.4 million dollar exclusion so they would have to gift away $10.8M before they would owe any gift tax. When a gift is made, the person making the gift does not pay tax and the person receiving the gift does not pay tax below those lifetime thresholds.

“But I thought you could only gift $15,000 per year per person?” The $15,000 per year amount is the IRS “gift exclusion amount” not the “limit”. You can gift $15,000 per year to any number of people and it will not count toward your $5.4M lifetime exclusion amount. A married couple can gift $30,000 per year to any one person and it will not count toward their $10.8M lifetime exclusion. If you do not plan on making gifts above your lifetime threshold amount you do not have to worry about anyone paying taxes on your cash gifts.

Let’s look at an example. I’m married and I decide to gift $20,000 to each of my three children. When I make that gift of $60,000 ($20K x 3) I do not owe tax on that gift and my kids do not owe tax on the gift. Also, that $60,000 does not count toward my lifetime exclusion amount because it’s under the $28K annual exclusion for a married couple to each child.

In the next example, I’m single and I gift $1,000,000 my neighbor. I do not owe tax on that gift and my neighbor does not owe any tax on the gift because it is below my $5.4M threshold. However, since I made a gift to one person in excess of my $15,000 annual exclusion, I do have to file a gift tax return when I file my taxes that year acknowledging that I made a gift $985,000 in excess of my annual exclusion. This is how the IRS tracks the gift amounts that count against my $5.4M lifetime exclusion.

Important note: This article speaks to the federal tax liability on gifts. If you live in a state that has state income tax, your state’s gift tax exclusion limits may vary from the federal limits.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Should I Gift A Stock To My Kids Or Just Let Them Inherit It?

Many of our clients own individual stocks that they either bought a long time ago or inherited from a family member. If they do not need to liquidate the stock in retirement to supplement their income, the question comes up “should I just gift the stock to my kids while I’m still alive or should I just let them inherit it after I pass away?” The right answer is

Many of our clients own individual stocks that they either bought a long time ago or inherited from a family member. If they do not need to liquidate the stock in retirement to supplement their income, the question comes up “should I just gift the stock to my kids while I’m still alive or should I just let them inherit it after I pass away?” The right answer is largely influenced by the amount of appreciation or depreciation in the stock.

Gifting Stock

When you make a non-cash gift such as a stock, house, or even a business, the person receiving the gift assumes your cost basis in the assets. They do not receive a “step-up” in basis at the time the gift is made. Example, I buy XYZ Corp stock in 1995 for $10,000. In 2017, those shares of XYZ are now worth $100,000. If I gift them to my kids, no one owes tax on the gift at the time that the gift is made but my kids carry over my cost basis in the stock. If my kids hold the stock for 10 more years and sell it for $150,000, their basis in the stock is $10,000, and they owe capital gains tax on the $140,000 gain. Thus, creating an adverse tax consequence for my kids.

Inheriting Stock

Instead, let’s say I continue to hold XYZ stock and when I pass away my kids inherited the stock. If I pass away in 10 years and the stock is worth $150,000 then my kids receive a “step-up” in basis which means that their cost basis in the stock is the value of the stock as of the date of my death. They inherit the stock at $150,000 value, sell it the next day, and they owe $0 in taxes due to the step-up in basis upon my death.

In general, if you have assets that have low cost basis it is usually better for your heirs to inherit the assets as opposed to gifting it to them.

The concept is often times reversed for assets that have depreciated in value…..with an important twist. If I purchase XYZ Corp stock in 1995 for $10,000 but in 2017 it’s only worth $5,000, if I sold the stock myself I would capture the realized investment loss and could use it to offset investment gains or reduce my income by $3,000 for the IRS realized loss allowance.

Here is a very important rule......

In most cases, do not gift a depreciated asset to someone else. Why? When you gift an asset that has depreciated in value the carry over basis rules change. For an asset that has depreciated in value, the carry over basis for the person receiving the gift is the higher of the fair market value of the asset or the cost basis of the person making the gift. In other words, the loss evaporates when I gift the asset to someone else and no one gets the tax advantage of using the realized loss for tax purposes. It would be better if I sold the stock, captured the investment loss, and then gifted the cash.

If they inherit the stock that has lost value there is no value to the step-up in basis because the stock has not appreciated in value.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.