Beware of the 5 Year Rule for Your Roth Assets

Being able to save money in a Roth account, whether in a company retirement plan or an IRA, has great benefits. You invest money and when you use it during retirement you don't pay taxes on your distributions. But is that always the case? The answer is no. There is an IRS rule that you must take note of known as the "5 Year Rule". There are a number

Beware of the 5 Year Rule for Your Roth Assets

Being able to save money in a Roth account, whether in a company retirement plan or an IRA, has great benefits. You invest money and when you use it during retirement you don't pay taxes on your distributions. But is that always the case? The answer is no. There is an IRS rule that you must take note of known as the "5 Year Rule". There are a number of scenarios where this rule could impact you and rather than getting too much into the weeds, this post is meant to serve as a public service announcement so you are aware it exists.

Advantages of a Roth

As previously mentioned, the benefit of Roth assets is that the account grows tax deferred and if the distributions are "qualified" you don't have to pay taxes. This is compared to a Traditional IRA/401(k) where the full distribution is taxed at ordinary income tax rates and regular investment accounts where you pay taxes on dividends/interest each year and capital gains taxes when you sell holdings. A quick example of Roth vs. Traditional below:

Roth Traditional

Original Investment $ 10,000.00 $ 10,000.00

Earnings $ 10,000.00 $ 10,000.00

Total Account Balance $ 20,000.00 $ 20,000.00

Taxes (Assume 25%) $ - $ 5,000.00

Account Value at Distribution $ 20,000.00 $ 15,000.00

This all seems great, and it is, but there are benefits of both Roth and Traditional (Pre-Tax) accounts so don’t think you have to start moving everything to Roth now. This article gives more detail on the two different types of accounts and may help you decide which is best for you Traditional vs. Roth IRA’s: Differences, Pros, and Cons.

Qualified Disbursements

Note the “occurs at least five years after the year of the employee’s first designated Roth contribution”. This is the “5 Year Rule”. The other qualifications are the same for Traditional IRA’s, but the “5 Year Rule” is special for Roth money. Not always good to be special.

It seems pretty straight forward and in most cases it is. Open a Roth IRA, let it grow at least 5 years, and as long as I’m 59.5 my distributions are qualified. Someone who has Roth money in a 401(k) or other employer sponsored plan may think it is just as easy. That isn’t always the case. Typically, an employee retires, and they roll their retirement savings into a Traditional or a Roth IRA. Say I worked at the company for 10 years, and I now retire and want to use all the savings I’ve created for myself throughout the years. I can start taking qualified distributions from my Roth IRA because I started contributing 10 years ago, correct? Wrong! The time you we’re contributing to the Roth 401(k) is not transferred to the new Roth IRA. If you took distributions directly from the 401(k) and we’re at least 59.5 they would be qualified. In most cases however, people don’t start using their 401(k) money until retirement and most plans only allow for lump sum distributions once you are no longer with the company.

So what do you do?

Open a Roth IRA outside of the plan with a small balance well before you plan to use the money. If I fund a Roth IRA with $100, 10 years from now I retire and roll my Roth 401(k) into that Roth IRA, I have satisfied the 5 year rule because I opened that Roth IRA account 10 years ago. The clock starts on the date the Roth IRA was opened, not the date the assets are transferred in.

About Rob.........

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Does "Sell In May And Go Away" Really Work?

There is a well-known trading strategy that goes by the name of "Sell In May And Go Away". The strategy involves liquidating all of your stock holdings in May and then re-establishing your stock positions in November. The basic premise of this strategy is when you reference performance data from the stock market for the past 100 years, two of

There is a well-known trading strategy that goes by the name of "Sell In May And Go Away". The strategy involves liquidating all of your stock holdings in May and then re-establishing your stock positions in November. The basic premise of this strategy is when you reference performance data from the stock market for the past 100 years, two of the three worse months typically occur between May and October. But does it really work?

Losing Strategy

While there are years that we can point to that the "Sell In May" strategy would have worked, it would have been a losing strategy for the past 4 out of 5 years.

The only year that strategy would have worked within the last five years was in 2015 and you avoid a minuscule 1% loss. On the flip side, you missed a huge 11.6% gain in 2017. If you implemented this strategy every year for the past 5 years, it would have cost you 22.4% in investment returns. Not good.

Looking Back Further

Instead of looking back just 5 years, let’s look back 10 years from 2008 to 2017. The “Sell In May” strategy would have only worked 4 out of 10 times. So it would have been the losing strategy 60% of the time. Again, not good.

So why do you hear so much about it? Looking at the market data, even though it has not been a reliable source as to whether or not the stock market will be up or down during the May to October months, the return data of the Dow Jones Industrial Average suggests historically that the largest returns are found during the November through April months.

A perfect example is 2010. In 2010, the Dow Jones Industrial Average produced a return of 1% between May – October. However, the Dow Jones produced a 15.2% rate of return in 2010 between November and April. Implementing the “Sell In May” strategy would have cost you 1% in return since you were not invested during the summer months but you still captured the lion share of the return from the stock market for the year.

Also, when the economy is in a recession, May through October typically contains the months that produce the largest losses for the Dow. During the 2008 recession, the Dow was down 27.3% between May and October but it was only down 12.4% between November and April. Likewise, during the 2001 recession, the Dow was down 15.5% between May and October but it was actually positive 9.6% between November and April.

Measure of Magnitude Not Direction

The further you dig into the data, the more it seems that the "Sell In May" strategy is a more accurate measure of "magnitude" instead of direction. Let's compare the May to October vs. the November to April return data of the Dow Jones Industrial Average 2008 – 2015 from Stock Almanac.

Looking at this time period, the losses were either less severe or the gains were greater between the November and April time frame 6 out of 8 years or 75% of the time. Compared with only 3 out of the 8 years where the direction of the returns were different when comparing those two time frames or 37.5% of the time.

Recession vs. Expansion

I think there are a number of takeaways from looking at this data. One might conclude that when U.S. economy is in a period of expansion, the "Sell In May" strategy has less than a coin flip chance of creating a more favorable investment return. However, when the economy is in a recession, the historical data may also suggest that more weight be given to the strategy since May through October in the past two recessions has contained the largest drops in the stock market.With all of that said, timing the market is very difficult and many investment professionals even label it as foolish. In general, long term investors are often better served by selecting an asset allocation that is appropriate for their risk tolerance and time horizon and staying the course.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

College Students: The Top 2 Action Items To Get Ahead

The job market for college students is more competitive than it has ever been in the past. Why? Because companies continue to leverage technology to do more with less people. So what separates the college students that have multiple job offers prior to graduation from the college grads that struggle to find their first career?As an investment advisor,

The job market for college students is more competitive than it has ever been in the past. Why? Because companies continue to leverage technology to do more with less people. So what separates the college students that have multiple job offers prior to graduation from the college grads that struggle to find their first career?As an investment advisor, most of our clients are business owners or executives. They are the folks that hold the keys to the positions that are available at their respective companies. Throughout our daily interaction with these clients we receive continuous feedback about:

Their young rockstar employee that is rising quickly through the ranks

The troubles that they are having finding the right people

The skills and personality traits that they are looking for in their next round of hires

If your child is either in college or about to enter college, what advice can you give them to put them at the top of the most wanted list of these high growth companies?

Intern, Intern, Intern

The college degree gets you the interview. Your work experience is what lands you the job. If it comes down to two candidates for a position, both interview well, both have the right personality for the job, good GPA’s, etc, if one candidate has completed an internship and other has not, the candidate with the work experience is going to be highly favored. There are a number of reasons for this.

First, the goal of the company is to get you up and running as soon as possible. If you have real life work experience, the employer will most likely assume that you will be up and running more quickly than a new employee that has no work experience. You probably already know the lingo of the industry, you may be familiar with the software that the company uses, you know who the competitors are in the industry, etc.

Second, there is more to talk about in the interview. While it’s pleasant to talk about your personal interests, the research that you have completed on the company, general knowledge of the industry, and your college experience. Instead, if you are able to talk about a project that you worked on during a college internship that is relevant to the positon that you are applying for, the conversation and the lasting impression that you will have during your interview will be elevated to a level that is head and shoulders above most of the other job candidates that will follow the typically question and answer session.

College students should get involved with as many internships and work studies as they can while they are attending college. Also, don’t’ wait until your senior year in college to obtain an internship. Internships serve another purpose besides giving you the advantage in a job interview. They can also tell you what you don’t want to do. You put yourself in a tough spot if you spend four years in college to obtain an accounting degree, only to find out after obtaining your first job that you don’t like being an accountant. It happens more often than you would think. We all have to do all we can in order to reach our career goal. It’s better to find that out in your freshman or sophomore year of college so you have the opportunity to change majors if needed.

Internships also help to narrow down your options. You may be interested in obtaining a degree in business but business is a very broad industry with a lot of different paths. Are you interested in marketing, finance, sales, accounting, management, operations, data analytics, manufacturing, or investment banking? Even if you are not 100% certain which path is the right one for you, make a choice. It will either reinforce your decision or it will allow you to scratch it off the list. Both are equally important.

Read These Books

There is common trait among business owners and executives. They typically have a thirst for knowledge which usually means that they are avid readers. One of the greatest challenges that young employees have is being able to relate to how the owner of the business thinks, what motivates them, and how they view the world. In general, business owners tend to admire or at least acknowledge the risk taking behaviors and achievements of some of the standout CEO’s of their time. Steve Jobs, Elon Musk, Bill Gates, Warren Buffet, Jeff Bezos, and the list goes on.

It’s not uncommon for a business owner to borrow personality traits or business strategies from some of these highly regarded CEO’s and incorporated them into their own business. If during an interview you happen to bring up that you admire how Elon Musk has the ability to identify solutions to problems in industries where it was previously deemed impossible like PayPal and SpaceX. There is a good chance that the business owner or executive that is interviewing you has either read Elon’s book or is aware of his achievements and it brings that conversation to next level.

In addition, the person interviewing you will most likely assume that if you are interested in reading those types of books than you probably have that entrepreneur mindset which is rare and valuable. It’s very difficult to teach someone how to think like an entrepreneur. Showing that you possess that trait can easily excite a potential employer.

Here are the top three books that I would recommend reading:

Delivering Happiness by Tony Hsieh (CEO of Zappos)

Elon Musk by Ashlee Vance (CEO of Tesla)

The Virgin Way by Richard Branson (CEO of Virgin Group)

Each of these CEO's have different leadership styles, come from different industries, have different backgrounds, and provide different takeaways for the reader. There is a tremendous amount of knowledge to be gain from reading these books and all of these books are written in a way that makes it difficult to put them down once you have started reading them.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Don't Let Taxes Dictate Your Investment Decisions

Everyone hates to pay more in taxes. But this is something that has to be done. Sometimes taxes can often lead investors to make foolish investment decisions. The stock market bottomed in March 2009 and since then we have experienced the second-longest bull market rally of all time. This type of market environment typically creates a

Everyone hates to pay more in taxes. But this is something that has to be done. Sometimes taxes can often lead investors to make foolish investment decisions. The stock market bottomed in March 2009 and since then we have experienced the second-longest bull market rally of all time. This type of market environment typically creates a stockpile of unrealized gains in the equity portion of your portfolio. When you go to sell one of your investment holdings that has appreciated in value over the past few years there may be a big tax bill waiting for you. But when is it the right time to ignore the tax hit and execute the trade?

Do The Math

What sounds worse? Writing a check to the government for $10,000 in taxes or experiencing a 3% loss in your investment accounts? Most people would answer paying taxes. After all, who wants to write a check to the government for $10,000 after you have already paid your fair share of taxes throughout the year. It’s this exact situation that gets investors in a lot of trouble when the stock market turns or when that concentrated stock position takes a nosedive.

Before making this decision make sure you do the math. If you have $500,000 in your taxable investment account and the account value drops by 3%, your account just lost $15,000. It would have been better to sell the holding, pay the $10,000 in taxes, and you would still be ahead by $5,000. Before making the decision not to sell for tax reasons, make sure you run this calculation.

Gains Are Good

While most of us run from paying taxes like the plague, remember gains are good. It means that you made money on the investment. At some point you are going to have to pay tax on that gain unless your purposefully waiting for the investment to lose value or if you plan to die with that holding in your estate.

If you put $100,000 in an aggressive investment a year ago and it’s now worth $200,000, if you sell it all today, you will have to pay long term cap gains tax and possibly state tax on the $100,000 realized gain. But remember, what goes up by 100% can also go down by 100%. To avoid the tax bill, you make the decision to just sit on the investment and 3 months from now the economy goes into a recession. The value of that investment drops to $125,000 and you sell it before things get worse. While you successfully decreased your tax liability, the tax hit would have been a lot better than saying goodbye to $75,000.

As financial planners we are always looking for ways to reduce the tax bill for our clients but sometimes paying taxes is unavoidable. The more you make, the more you pay in taxes. In most tax years, investors try to use investment losses to help offset some of the realized taxable gains. However, since most assets classes have appreciated in value over the last few years, investors may be challenges to find investment losses in their accounts.

Capital Gains Tax

A quick recap of capital gains tax rates. There are long-term and short-term capital gains. They apply to investments that are held in non-retirement account. IRA’s, 401(k), and 403(b) plans are all tax deferred vehicles so you do not have worry about realizing capital gains tax when you sell a holding within those types of accounts.

In a taxable brokerage account, if you buy an investment and sell it in less than 12 months, if it made money, you realize a short-term capital gain. Short-term gains do not receive preferential tax treatment. You pay tax at the ordinary income tax rates.

However, if you buy an investment and hold it for more than a year before selling it, the gain is taxed at the preferential long-term capital gain rates. At the federal level, there are three flat rates: 0%, 15%, and 20%. At the state level, it varies based on what state you live in. If you live in New York, where we are headquartered, long-term capital gains do not have preferential tax treatment for state income tax purposes. They are taxed as ordinary income. While other states like Alaska, Florida, and Texas assess no taxes at the state level on capital gains.

The tax rate that you pay on your long-term capital gains at the federal level depends on your AGI for that particular tax year. Here are the thresholds for 2021:

A special note for investors that fall in the 20% category, in addition to being taxed at the higher rate, there is also a 3.8% Medicare surtax that is tacked onto the 20% rate. So the top long-term capital gains rate for high income earners is really 23.8%, not 20%.

Don't Forget About The Flat Rate

Investors forget that long-term capital gains are taxed for the most part at a flat rate. If your AGI is $200,000 and you are considering selling an investment that would cause you to incur a $100,000 long-term capital gain, it may not matter from a tax standpoint whether you sell it all this year or if you split the gain between two different tax years. You are still taxed at that flat 15% federal tax rate on the full amount of the gain regardless of when you sell it.There are of course exceptions to this rule. Here is a list of some of the exceptions that you need to aware of:

Your AGI limit for the year

The impact of the long-term capital gain on your AGI

College financial aid

Social security taxation

Health insurance through the exchange

First exception is the one-time income event that pushes your income dramatically higher for the year. This could be a big bonus, a good year for the company that you own, or you sell an investment property. In these cases you have to mindful of the federal capital gains tax thresholds. If it’s toward the end of the year and you are thinking about selling an investment that has a good size unrealized gain built up into it, it may be prudent to sell enough to keep yourself out of the top long-term capital gains bracket and then sell the rest in January when you enter the new tax year. That move could save you 8.8% in taxes on the realized gains. The 23.8% to tax rate minus the 15% median rate. If you are at the beginning or in the middle of a tax year trying to make this decision, the decision is more difficult. You will have to weigh the risk of the investment losing value before you flip into a new tax year versus paying a slightly higher tax rate on the gain.

To piggyback on the first exception, you have to remember that long term capital gains increase your AGI. If you make $300,000 and you realize a $200,000 long term capital gain on an investment, it’s going to bump you up into the highest federal long term capital gains tax rate.

College financial aid can be a big exception. If you have a child in college or a child that will be going to college within the next two years, and you expect to receive some type of financial aid based on income, be very careful about when you realize capital gains in your investment portfolio. The parent’s investment income can count against a student’s financial aid package. Also, FASFA looks back two years for purposes of determining your financial aid package so conducing this tax versus risk analysis requires some advanced planning.

For those receiving social security benefit, capital gains can impact how much of your social security benefit is subject to taxation.

For individuals that receive their health insurance through a state exchange platform (Obamacare) and qualify for income subsidies, the capital gains income could decrease the amount of the subsidy that you are receive for that year. Be careful.

Don't Make The This Mistake

Bottom line, nothing is ever simple. I wish I could say that in all instances you should completely ignore the tax ramifications and make the right investment decision. In the real world, it’s about determining the balance between the two. It’s about doing the math to better under the tax hit versus the downside risk of continuing to hold a security to avoid paying taxes.

While the current economic expansion may still have further to go, we are probably closer to the end than we are the beginning of the current economic expansion. When the expansion ends, investors are going to be tempted to hold onto certain investments within their portfolio longer than they should because they don’t want to take the tax hit. Don’t make this mistake. If you have a stock holding within your portfolio and it drops significantly in value, you may not have the time horizon needed to wait for that investment to bounce back. Or you may have the opportunity to preserve principal during the next market downturn and buy back that same investment at lower level.

In general, it’s good time for investors to revisit their investment portfolios from a risk standpoint. You may be faced with some difficult investment decisions within the next few years. Remember, selling an investment that has lost money is ten times easier than selling one of your “big winners”. Do the math, don’t get emotionally attached to any particular investment, and be prepared to make investment changes to your investment portfolios as we enter the later stages of this economic cycle.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Can I Open A Roth IRA For My Child?

Parents always want their children to succeed financially so they do everything they can to set them up for a good future. One of the options for parents is to set up a Roth IRA and we have a lot of parents that ask us if they are allowed to establish one on behalf of their son or daughter. You can, as long as they have earned income. This can be a

Parents will often ask us: “What type of account can I setup for my kids that will help them to get a head start financially in life?" One of the most powerful wealth building tools that you can setup for your children is a Roth IRA because all of accumulation between now and when they withdrawal it in retirement will be all tax free. If your child has $10,000 in their Roth IRA today, assuming they never make another deposit to the account, and it earns 8% per year, 40 years from now the account balance would be $217,000.

Contribution Limits

The maximum contribution that an individual under the age of 50 can make to a Roth IRA in 2025 is the LESSER of:

$7,000

100% of earned income

For most children between the age of 15 and 21, their Roth IRA contributions tend to be capped by the amount of their earned income. The most common sources of earned income for young adults within this age range are:

• Part-time employment

• Summer jobs

• Paid internships

• Wages from parent-owned company

If they add up all of their W-2's at the end of the year and they total $3,000, the maximum contribution that you can make to their Roth IRA for that tax year is $3,000.

Roth IRA's for Minors

If your child is under the age of 18, you can still establish a Roth IRA for them. However, it will be considered a "custodial IRA". Since minors cannot enter into contracts, you as the parent serve as the custodian to their account. You will need to sign all of the forms to setup the account and select the investment allocation for the IRA. It's important to understand that even though you are listed as a custodian on the account, all contributions made to the account belong 100% to the child. Once the child turns age 18, they have full control over the account.

Age 18+

If the child is age 18 or older, they will be required to sign the forms to setup the Roth IRA and it's usually a good opportunity to introduce them to the investing world. We encourage our clients to bring their children to the meeting to establish the account so they can learn about investing, stocks, bonds, the benefits of compounded interest, and the stock market in general. It's a great learning experience.

Contribution Deadline & Tax Filing

The deadline to make a Roth IRA contribution is April 15th following the end of the calendar year. We often get the question: "Does my child need to file a tax return to make a Roth IRA contribution?" The answer is "no". If their taxable income is below the threshold that would otherwise require them to file a tax return, they are not required to file a tax return just because a Roth IRA was funded in their name.

Distribution Options

While many of parents establish Roth IRA’s for their children to give them a head start on saving for retirement, these accounts can be used to support other financial goals as well. Roth contributions are made with after-tax dollars. The main benefit of having a Roth IRA is if withdrawals are made after the account has been established for 5 years and the IRA owner has obtained age 59½, there is no tax paid on the investment earnings distributed from the account.

If you distribute the investment earnings from a Roth IRA before reaching age 59½, the account owner has to pay income tax and a 10% early withdrawal penalty on the amount distributed. However, income taxes and penalties only apply to the “earnings” portion of the account. The contributions, since they were made with after-tax dollars, can be withdrawn from the Roth IRA at any time without having to pay income taxes or penalties.

Example: I deposit $7,000 to my daughter’s Roth IRA and four years from now the account balance is $9,000. My daughter wants to buy a house but is having trouble coming up with the money for the down payment. She can withdraw $7,000 out of her Roth IRA without having to pay taxes or penalties since that amount represents the after-tax contributions that were made to the account. The $2,000 that represents the earnings portion of the account can remain in the account and continue to accumulate tax-free. Not only did I provide my daughter with a head start on her retirement savings but I was also able to help her with the purchase of her first house.

We have seen clients use this flexible withdrawal strategy to help their children pay for their wedding, pay for college, pay off student loans, and to purchase their first house.

Not Limited To Just Your Children

This wealth accumulate strategy is not limited to just your children. We have had grandparents fund Roth IRA's for their grandchildren and aunts fund Roth IRA's for their nephews. They do not have to be listed as a dependent on your tax return to establish a custodial IRA. If you are funding a Roth IRA for a minor or a college student that is not your child, you may have to obtain the total amount of wages on their W-2 form from their parents or the student because the contribution could be capped based on what they made for the year.

Business Owners

Sometimes we see business owners put their kids on payroll for the sole purpose of providing them with enough income to make the $7,000 contribution to their Roth IRA. Also, the child is usually in a lower tax bracket than their parents, so the wages earned by the child are typically taxed at a lower tax rate. A special note with this strategy: you have to be able to justify the wages being paid to your kids if the IRS or DOL comes knocking at your door.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Should I Rollover My Pension To An IRA?

Whether you are about to retire or if you were just notified that your company is terminating their pension plan, making the right decision with regard to your pension plan payout is extremely important. It's important to get this decision right because you only get one shot at it. There are a lot of variables that factor into choosing the right option.

Whether you are about to retire or if you were just notified that your company is terminating their pension plan, making the right decision with regard to your pension plan payout is extremely important. It's important to get this decision right because you only get one shot at it. There are a lot of variables that factor into choosing the right option. While selecting the monthly payment option may be the right choice for your fellow co-worker, it could be the wrong choice for you. Here is a quick list of the items that you should consider before making the decision.

Financial health of the plan sponsor

Your age

Your health

Flexibility

Monthly benefit vs lump sum amount

Inflation

Your overall retirement picture

Financial Health Of The Plan Sponsor

The plan sponsor is the company, organization, union, municipality, state agency, or government entity that is in charge of the pension plan. The financial health of the plan sponsor should weigh heavily on your decision in many cases. After all what good is a monthly pension payment if five years from now the company or entity that sponsors the plan goes bankrupt?

Pension Benefit Guarantee Corporation

But wait……..isn’t there some type of organization that guarantees the pension payments? The answer, there may or may not be. The Pension Benefit Guarantee Corporation (PBGC) is an organization that was established to protect your pension benefit. But PBGC protection only applies if your company participates in the PBGC. Not all pension plans have this protection.

Large companies will typically have PBGC protection. The pension plan is required to pay premiums to the PBGC each year. Those premiums are used to subsidize the cost of bankrupt pension plans if the PBGC has to step in to pay benefits. But it’s very important to understand that even through a pension plan may have PBGC protection that does not mean that 100% of the employee’s pension benefits are protected if the company goes bankrupt.

There is a dollar limited placed on the monthly pension benefit that the PBGC will pay if it has to step in. It’s a sliding scale based on your age and the type of pension benefit that you elected. If your pension payment is greater that the cap, the excess amount is not insured. Here is the PBGC 2021 Maximum Monthly Guarantee Table:

Another important note, if you have not reached age 65, your full pension benefit may not be insured even if it is less than the cap listed in the table.

Again, not all pension plans are afforded this protection by the PBGC. Pension plans offered by states and local government agencies typically do not have PBGC protection.

If you are worried about the financial health of the plan sponsor, that scenario may favor electing the lump sum payment option and then rolling over the funds into your rollover IRA. Once the money is in your IRA, the plan sponsor insolvency risk is eliminated.

Your Age

Your age definitely factors into the decision. If you have 10+ years to retirement and your company decides to terminate their pension plan, it may make sense to rollover your balance in the pension plan into an IRA or your current employer’s 401(k) plan. Primarily because you have the benefit of time on your side and you have full control over the asset allocation of the account.

Pension plans typically maintain a conservative to moderate growth investment object. You will rarely ever find a pension plan that has 80%+ in equity exposure. Why? It’s a pooled account for all of the employees of all ages. Since the assets are required to meet current pension payments, pension plans cannot be subject to high levels of volatility.

If your personal balance in the pension plan is moved into our own IRA, you have the option of selecting an investment objective that matches your personal time horizon to retirement. If you have a long time horizon to retirement, it allows you the freedom to be more aggressive with the investment allocation of the account.

If you are within 5 years to retirement, it does not necessarily mean that selecting the monthly pension payment is the right choice but the decision is less cut and dry. You really have to compare the monthly pension payment versus the return that you would have to achieve in your IRA to replicate that income stream in retirement.

Your Health

Your health is a big factor as well. If you are in poor health, it may favor electing the lump sum option and rolling over the balance into an IRA. Whatever amount is left in your IRA account will be distributed to your beneficiaries. With a straight life pension option, the benefit just stops when you pass away. However, if you are worried about your spouse's spending habits and your spouse is either in good health or is much younger than you, you may want to consider the pension option with a 100% survivor benefit.

Flexibility

While some retirees like the security of a monthly pension payment that will not change for the rest of their life, other retirees prefer to have more flexibility. If you rollover you balance to an IRA, you can decide how much you want to take or not take out of the account in a given year.

Some retirees prefer to spend more in their early years in retirement because that is when their health is the best. Walking around Europe when you are 65 is usually not the same experience as walking around Europe when you are 80. If you want to take $10,000 out of your IRA to take that big trip to Europe or to spend a few months in Florida, it provides you with the flexibility to do so. By making sure that you have sufficient funds in your savings at the time of retirement can help to make things like this possible.

Working Because I Want To

The other category of retirees that tend to favor the IRA rollover option is the "I'm working because I want to" category. It has becoming more common for individuals to retire from their primary career and want to still work doing something else for two or three days a week just to keep their mind fresh. If the income from your part-time employment and your social security are enough to meet your expenses, having a fixed pension payment may just create more taxable income for you when you don't necessarily need it. Rolling over your pension plan to an IRA allows you to defer the receipt of that income until at least age 70½. That is the age that distributions are required from IRA accounts.

Monthly Pension vs Lump Sum

It’s important to determine the rate of return that you would need to achieve in your IRA account to replicate the pension benefit based on your life expectancy. With the monthly pension payment option, you do not have to worry about market fluctuations because the onus is on the plan sponsor to produce the returns necessary to make the pension payments. With the IRA, you or your investment advisor are responsible for producing the investment return in the account.

Example 1: You are 65 and you have the option of either taking a monthly pension payment of $3,000 per month or taking a lump sum in the amount of $500,000. If your life expectancy is age 85, what is the rate of return that you would need to achieve in your IRA to replicate the pension payment?

The answer: 4%

If your IRA account performs better than 4% per year, you are ahead of the game. If your IRA produces a return below 4%, you run the risk of running out of money prior to reaching age 85.

Part of this analysis is to determining whether or not the rate of return threshold is a reasonable rate of return to replicate. If the required rate of return calculation results in a return of 6% or higher, outside of any special circumstances, you may be inclined to select the pension payments and put the responsibility of producing that 6% rate of return each year on the plan sponsor.

Low Interest Rate Environment

A low interest rate environment tends to favor the lump sum option because it lowers the “discount rate” that actuaries can use when they are running the present value calculation. Wait……what?

The actuaries are the mathletes that produce the numbers that you see on your pension statement. They have to determine how much they would have to hand you today in a lump sum payment to equal the amount that you would have received if you elected the monthly pension option.

This is called a “present value” calculation. This amount is not the exact amount that you would have received if you elected the monthly pension payments because they get to assume that they money in the pension plan will earn interest over your life expectancy. For example, if the pension plan is supposed to pay you $10,000 per year for the next 30 years, that would equal $300,000 paid out over that 30 year period. But the present value may only be $140,000 because they get to assume that you will earn interest off of that money over the next 30 years for the amount that is not distributed until a later date.

In lower interest rate environments, the actuaries have to use a lower assume rate of return or a lower “discount rate”. Since they have to assume that you will make less interest on the money in your IRA, they have to provide you with a larger lump sum payment to replicate the monthly pension payments over your life expectancy.

Inflation

Inflation can be one of the largest enemies to a monthly pension payment. Inflation, in its simplest form is “the price of everything that you buy today goes up in price over time”. It’s why your grandparents have told you that they remember when a gallon of milk cost a nickel. If you are 65 today and your lock into receiving $2,000 per month for the rest of your life, inflation will erode the spending power of that $2,000 over time.

Historically, inflation increases by about 3% per year. As an example, if your monthly car payment is $400 today, the payment for that same exact car 20 years from now will be $722 per month. Now use this multiplier against everything that you buy each month and it begins to add up quickly.

If you have the money in an IRA, higher inflation typically leads to higher interest rate, which can lead to higher interest rates on bonds. Again, having control over the investment allocation of your IRA account may help you to mitigate the negative impact of inflation compared to a fixed pension payment.

A special note, some pension plans have a cost of living adjustment (“COLA”) built into the pension payment. Having this feature available in your pension plan will help to manage the inflation risk associated with selecting the monthly pension payment option. The plan basically has an inflation measuring stick built into your pension payment. If inflation increases, the plan is allowed to increase the amount of your monthly pension payment to help protect the benefit.

Your Overall Financial Picture

While I have highlighted a number of key variables that you will need to consider before selecting the payout option for your pension benefit, at the end of the day, you have to determine how each option factors into your own personal financial situation. It’s usually wise to run financial projections that identify both the opportunities and risks associated with each payment option.

Don’t be afraid to seek professional help with this decision. They will help you consider what you might need to pay for in the future. Are you going to need money spare for holidays, transportation, even funeral costs should be considered. Where people get into trouble is when they guess or they choose an option based on what most of their co-workers selected. Remember, those co-workers are not going to be there to help you financially if you make the wrong decision.

As an investment advisor, I will also say this, if you meet with a financial planner or investment advisor to assist you with this decision, make sure they are providing you with a non-bias analysis of your options. Depending on how they are compensation, they may have a vested interest in getting you to rollover you pension benefit to an IRA. Even though electing the lump sum payment and rolling the balance over to an IRA may very well be the right decision, they should walk you through a thorough analysis of the month pension payments versus the lump sum rollover option to assist you with your decision.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Moving Expenses Are No Longer Deductible

If you were planning on moving this year to take a new position with a new company or even a new position within your current employer, the moving process just got a little more expensive. Not only is it expensive, but it can put you under an intense amount of stress as there will be lots of things that you need to have in place before packing up and

If you were planning on moving this year to take a new position with a new company or even a new position within your current employer, the moving process just got a little more expensive. Not only is it expensive, but it can put you under an intense amount of stress as there will be lots of things that you need to have in place before packing up and moving. Even things like how you are going to transport your car over to your new home, can take up a lot of your time, and on top of that, you have to think about how much it's going to cost. Prior to the tax law changes that took effect January 1, 2018, companies would often offer new employees a "relocation package" or "moving expense reimbursements" to help subsidize the cost of making the move. From a tax standpoint, it was great benefit because those reimbursements were not taxable to the employee. Unfortunately that tax benefit has disappeared in 2018 as a result of tax reform.

Taxable To The Employee

Starting in 2018, moving expense reimbursements paid to employee will now represent taxable income. Due to the change in the tax treatment, employees may need to negotiate a higher expense reimbursement rate knowing that any amount paid to them from the company will represent taxable income.

For example, let’s say you plan to move from New York to California and you estimate that your moving expense will be around $5,000. In 2017, your new employer would have had to pay you $5,000 to fully reimburse you for the moving expense. In 2018, assuming you are in the 35% tax bracket, that same employer would need to provide you with $6,750 to fully reimburse you for your moving expenses because you are going to have to pay income tax on the reimbursement amount.

Increased Expense To The Employer

For companies that attract new talent from all over the United States, this will be an added expense for them in 2018. Many companies limit full moving expense reimbursement to executives. Coincidentally, employees at the executive level are usually that highest paid. Higher pay equals higher tax brackets. If you total up the company's moving expense reimbursements paid to key employees in 2017 and then add another 40% to that number to compensate your employees for the tax hit, it could be a good size number.

Eliminated From Miscellaneous Deductions

As an employee, if your employer did not reimburse you for your moving expenses and you had to move at least 50 miles to obtain that position, prior to 2018, you were allowed to deduct those expenses when you filed your taxes and you were not required to itemize to capture the deduction. However, this expense will no longer be deductible even for employees that are not reimbursed by their employer for the move starting in 2018.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Spouse Inherited IRA Options

If your spouse passes away and they had either an IRA, 401(k), 403(b), or some other type of employer sponsored retirement account, you will have to determine which distribution option is the right one for you. There are deadlines that you will need to be aware of, different tax implications based on the option that you choose, forms that need to be

If your spouse passes away and they had either an IRA, 401(k), 403(b), or some other type of employer sponsored retirement account, you will have to determine which distribution option is the right one for you. There are deadlines that you will need to be aware of, different tax implications based on the option that you choose, forms that need to be completed, and accounts that may need to be established.

Spouse Distribution Options

As the spouse, if you are listed as primary beneficiary on a retirement account or IRA, you have more options available to you than a non-spouse beneficiary. Non-spouse beneficiaries that inherited retirement accounts after December 31, 2019 are required to fully distribution the account 10 years following the year that the decedent passed away. But as the spouse of the decedent, you have the following options:

Fulling distribute the retirement account with 10 years

Rollover the balance to an inherited IRA

Rollover the balance to your own IRA

To determine which option is the right choice, you will need to take the following factors into consideration:

Your age

The age of your spouse

Will you need to take money from the IRA to supplement your income?

Taxes

Cash Distributions

We will start with the most basic option which is to take a cash distribution directly from your spouse’s retirement account. Be very careful with this option. When you take a cash distribution from a pre-tax retirement account, you will have to pay income tax on the amount that is distributed to you. For example, if your spouse had $50,000 in a 401(k), and you decide to take the full amount out in the form of a lump sum distribution, the full $50,000 will be counted as taxable income to you in the year that the distribution takes place. It’s like receiving a paycheck from your employer for $50,000 with no taxes taken out. When you go to file your taxes the following year, a big tax bill will probably be waiting for you.

In most cases, if you need some or all of the cash from a 401(k) account or an IRA, it usually makes more sense to first rollover the entire balance into an inherited IRA, and then take the cash that you need from there. This strategy gives you more control over the timing of the distributions which may help you to save some money in taxes. If as the spouse, you need the $50,000, but you really need $30,000 now and $20,000 in 6 months, you can rollover the full $50,000 balance to the inherited IRA, take $30,000 from the IRA this year, and take the additional $20,000 on January 2nd the following year so it spreads the tax liability between two tax years.

10% Early Withdrawal Penalty

Typically, if you are under the age of 59½, and you take a distribution from a retirement account, you incur not only taxes but also a 10% early withdrawal penalty on the amount this is distributed from the account. This is not the case when you take a cash distribution, as a beneficiary, directly from the decedents retirement account. You have to report the distribution as taxable income but you do not incur the 10% early withdrawal penalty, regardless of your age.

IRA Options

Let's move onto the two IRA options that are available to spouse beneficiaries. The spouse has the decide whether to:

Rollover the balance into their own IRA

Rollover the balance into an inherited IRA

By processing a direct rollover to an IRA in either case, the beneficiary is able to avoid immediate taxation on the balance in the account. However, it’s very important to understand the difference between these two options because all too often this is where the surviving spouse makes the wrong decision. In most cases, once this decision is made, it cannot be reversed.

Spouse IRA vs Inherited IRA

There are some big differences comparing the spouse IRA and inherited IRA option.

There is common misunderstanding of the RMD rules when it comes to inherited IRA’s. The spouse often assumes that if they select the inherited IRA option, they will be forced to take a required minimum distribution from the account just like non-spouse beneficiaries had to under the old inherited IRA rules prior to the passing of the SECURE Act in 2019. That is not necessarily true. When the spouses establishes an inherited IRA, a RMD is only required when the deceases spouse would have reached age 70½. This determination is based on the age that your spouse would have been if they were still alive. If they are under that “would be” age, the surviving spouse is not required to take an RMD from the inherited IRA for that tax year.

For example, if you are 39 and your spouse passed away last year at the age of 41, if you establish an inherited IRA, you would not be required to take an RMD from your inherited IRA for 29 years which is when your spouse would have turned age 70½. In the next section, I will explain why this matters.

Surviving Spouse Under The Age of 59½

As the surviving spouse, if you are under that age of 59½, the decision between either establishing an inherited IRA or rolling over the balance into your own IRA is extremely important. Here’s why .

If you rollover the balance to your own IRA and you need to take a distribution from that account prior to reaching age 59½, you will incur both taxes and the 10% early withdrawal penalty on the amount of the distribution.

But wait…….I thought you said the 10% early withdrawal penalty does not apply?

The 10% early withdrawal penalty does not apply for distributions from an “inherited IRA” or for distributions to a beneficiary directly from the decedents retirement account. However, since you moved the balance into your own IRA, you have essentially forfeited the ability to avoid the 10% early withdrawal penalty for distributions taken before age 59½.

The Switch Strategy

There is also a little know “switch strategy” for the surviving spouse. Even if you initially elect to rollover the balance to an inherited IRA to maintain the ability to take penalty free withdrawals prior to age 59½, at any time, you can elect to rollover that inherited IRA balance into your own IRA.

Why would you do this? If there is a big age gap between you and your spouse, you may decide to transition your inherited IRA to your own IRA prior to age 59½. Example, let’s assume the age gap between you and your spouse was 15 years. In the year that you turn age 55, your spouse would have turned age 70½. If the balance remains in the inherited IRA, as the spouse, you would have to take an RMD for that tax year. If you do not need the additional income, you can choose to rollover the balance from your inherited IRA to your own IRA and you will avoid the RMD requirement. However, in doing so, you also lose the ability to take withdrawals from the IRA without the 10% early withdrawal penalty between ages 55 to 59½. Based on your financial situation, you will have to determine whether or not the “switch strategy” makes sense for you.

The Spousal IRA

So when does it make sense to rollover your spouse’s IRA or retirement account into your own IRA? There are two scenarios where this may be the right solution:

The surviving spouse is already age 59½ or older

The surviving spouse is under the age of 59½ but they know with 100% certainty that they will not have to access the IRA assets prior to reaching age 59½

If the surviving spouse is already 59½ or older, they do not have to worry about the 10% early withdrawal penalty.

For the second scenarios, even though this may be a valid reason, it begs the question: “If you are under the age of 59½ and you have the option of changing the inherited IRA to your own IRA at any time, why take the risk?”

As the spouse you can switch from inherited IRA to your own IRA but you are not allowed to switch from your own IRA to an inherited IRA down the road.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Are The New Trade Tariffs Good Or Bad For The Stock Market?

US businesses often imports their manufactured goods from China. This is because the cost of manufacturing products is much lower than in other places so they want to take advantage of this. The government makes money off this relationship by imposing tariffs on certain products coming into the US. President Trump announced on March 8, 2018

US businesses often imports their manufactured goods from China. This is because the cost of manufacturing products is much lower than in other places so they want to take advantage of this. The government makes money off this relationship by imposing tariffs on certain products coming into the US. President Trump announced on March 8, 2018 that the United States will begin imposing a tariff on steel and aluminum imported into the U.S. from countries other than Mexico and Canada. The tariff on steel will be 25% and 10% on aluminum. There are two main questions that we will seek to answer in this article:

What happened the last time the U.S. implemented trade tariffs?

How will the stock market react to the new trade barriers?

What Is A Tariff?

First, let's do a quick recap on what a tariff is. A tariff is a special tax on goods that come into the United States. Tariffs are imposed to make select foreign goods more expensive in an effort to encourage the U.S. consumer to buy more American made goods. For example, if the government puts a 25% tariff on cars that are imported into the U.S., that BMW that was manufactured in Germany and shipped over to the U.S. and sold to you for $70,000 will now cost $87,500 for that same exact car due to the 25% tariff. As a consumer this may cause you not to buy that BMW and instead buy a Corvette that was manufactured in the U.S. and carries a lower price tag.

What Does History Tell Us?

It’s very clear from this chart that the U.S. has not imposed meaningful tariffs since the early 1900’s. Conclusion, it’s going to be very difficult to predict how these tariffs are going to impact the U.S. economy and global trade. Even though we have some historical references, the world is very different today compared to 1930. The “global economy” did not even really exist back then.

As you can see in the chart, the average import trade tariff in 1930 was about 20%. Since 1975, the average trade tariff on imports has been below 5%. More recently, between 2000 and 2016 the average tariff on imports was below 2%.

History Will Not Be A Useful Guide

As an investment manager, when a big financial event takes place, we start to scour through historical data to determine what happened in the past when a similar event took place. While we have had tariffs implemented in the past, many of those tariffs were implemented for reasons other than the ones that are driving the U.S. trade policy today.

Prior to 1914, tariffs were used primarily to generate revenue for the U.S. government. In 1850, tariffs represented 91% of the government’s total revenue mainly because there was no income tax back then. By 1900 that percentage had dropped to 41%. As many of us are well aware, over time, the main source of revenue for the government has shifted to the receipt of income and payroll taxes with tariff revenue only representing about 2% of the government’s total receipts.

During the Industrial Revolution (1760 – 1840), tariffs were used to protect the new U.S. industries that were in their infancy. Without tariffs it would have been very difficult for these new industries that were just starting in the U.S. colonies to compete with the price of goods coming from Europe. Tariffs were used to boost the domestic demand for steel, wool, and other goods that were being produced in the U.S. colonies. These trade policies helped the new industries get off the ground, expand the workforce, and led to a prosperous century of economic growth.

Today, tariffs are being used for a different reason. To protect our mature industries from the risk of extinction as a result of foreign competition. Since the 1950’s, the global economy has evolved and the trade policies of the U.S. have been largely in support of free trade. While this sounds like a positive approach, free trade policies have taken their toll on a number of industries here in the U.S. such as steel, automobiles, and electronics. Foreign countries like China have access to cheap labor and they are able to produce select goods and services at a much lower cost than here in the United States.

While this a good thing for the U.S. consumer because you can purchase a big screen TV made in China for a lot less than that same TV made in the U.S., there are negative side effects. First and foremost are the U.S. jobs that are lost when a company decides that it can produce the same product for a lot less over in China. We have seen this trend play out over the past 20 or 30 years. Tariffs can help protect some of those U.S. jobs because it makes products purchased from foreign manufactures more expensive and it increases the demand for U.S. goods. The downside to that is the consumer may be asked to pay more for those same products since at the end of the day it costs more to produce those products in the U.S.

In the announcement of the steel and aluminum tariffs yesterday, the White House also acknowledged the national security risk of certain industries facing extinction in the United States. Below is a chart of production of steel in the U.S. from 1970 – 2016.

As you can see in the chart, our economy has grown dramatically over this time period but we are producing half the amount of steel in the U.S. that we were 47 years ago. If everything stayed the same, this reduction in the U.S. production of steel would probably continue. It begs the question, what happens 50 years from now if there is a global conflict and we are unable to build tanks, jets, and ships because we import 100% of our steel from China and they decide to shut off the supply? There are definitely certain industries that we will always need to protect here in the U.S. even though they may be “cheaper” to buy somewhere else.

There is also monopoly risk. Once we have to import 100% of a particular good or service, those producers have 100% pricing power over us. While I would be less concerned over TV’s and electronics, I would be more concerned over items like cars, foods, building materials, and other items that many of us consider a necessity to our everyday lives.

Free or Fair?

While we have had “free” trade policies over the past few decades, have they been “fair”? Elon Musk, the CEO of Tesla, recently highlighted that “China isn’t playing fair in the car trade with the U.S.” He goes on to point out that China puts a 25% import tariff on American cars sold to China but the U.S. only has a 2.5% import tariff on cars that are manufactured in China and sold in the U.S.

In response to this, Trump mentioned in his speech that the U.S. will be pursuing “reciprocal” or “mirror” trade policies. Meaning, if a country puts a 25% tariff on U.S. goods imported into their country, the U.S. would put a 25% tariff on those same goods that are imported from their country into the U.S.

Trade Wars

While the reciprocal trade policies seem fair on the surface and it also makes sense to protect industries that are vital to our national security, the greatest risk of transitioning from a “free trade” policy to “protectionism” policy is trade wars. We just put a 25% tariff on all of the steel that is imported from China, how is China going to respond to that? Remember, the U.S. is part of a global economy and trade is important. How important? When you look at the gross revenue of all of the companies that make up the S&P 500 Index, over 50% of their revenue now comes from outside the U.S. If all of a sudden, foreign countries start putting tariffs on U.S. goods sold aboard, that could have a big negative impact on the corporate earnings of our big multinational corporations in the United States. In addition, when you listen to the quarterly earnings calls from companies like Apple, Nike, Pepsi, and Ford, the future growth of those companies are relying heavily on their ability to sell their products to the growing consumer base in the emerging market. Countries like China, India, Russia, and Brazil.

I go back to my initial point, that history will not be a great guide for us here. We have not used tariffs in a very long period of time and the reason why we are using tariffs now is different than it was in the past. Plus the world has changed. There is no clear way to know at this point if these new tariffs are going to help or hurt the U.S. economy over the next year because a lot depends on how these foreign countries respond to the United States moving away from the long standing era of free trade.

Canada & Mexico Exempt

The White House announced yesterday that Canada and Mexico would be exempt from the new tariffs. Why? This is my guess and it's only guess, the U.S. is currently in the process of negotiating the NAFTA terms with Canada and Mexico. NAFTA stands for the North American Free Trade Agreement. Trump has made it clear that if we cannot obtain favorable trade terms, the U.S. will exit the NAFTA agreement. The U.S. may use the recent tariff announcement as a negotiation tool in the talks with Canada and Mexico on NAFTA. "Listen, we gave you an exemption but if you don't give us favorable trade terms, all deals are off."

Coin Flip

While tax reform seems like a clear win for U.S. corporations, only history will tell us whether or not these new trade policies will help or harm the U.S. economy. If we are able to protect more U.S. jobs, protect industries vital to the growth and protection of the U.S., and negotiate better trade deals with our trading partners, we may look back and realize this was the right move at the right time.On the flip side of the coin, if trade wars break out that could lead to a decrease in the demand for U.S. goods around the globe that may cause the U.S. to lose more jobs than it is trying to protect. As a result, that could put downward pressure on corporate earnings and in turn send stock prices lower in the U.S. Only time will tell.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Warning To All Employees: Review The Tax Withholding In Your Paycheck Otherwise A Big Tax Bill May Be Waiting For You

As a result of tax reform, the IRS released the new income tax withholding tables in January and your employer probably entered those new withholding amounts into the payroll system in February. It was estimated that about 90% of taxpayers would see an increase in their take home pay once the new withholding tables were implemented.

As a result of tax reform, the IRS released the new income tax withholding tables in January and your employer probably entered those new withholding amounts into the payroll system in February. It was estimated that about 90% of taxpayers would see an increase in their take home pay once the new withholding tables were implemented. While lower tax rates and more money in your paycheck sounds like a good thing, it may come back to bite you when you file your taxes.

The Tax Withholding Guessing Game

Knowing the correct amount to withhold for federal and state income taxes from your paycheck is a bit of a guessing game. Withhold too little throughout the year and when you file your taxes you have a tax bill waiting for you equal to the amount of the shortfall. Withhold too much and you will receive a big tax refund but that also means you gave the government an interest free loan for the year.

There are two items that tell your employer how much to withhold for federal income tax from your paycheck:

Income Tax Withholding Tables

Form W-4

The IRS provides your employer with the Income Tax Withholding Tables. On the other hand, you as the employee, complete the Form W-4 which tells your employer how much to withhold for taxes based on the “number of allowances” that you claim on the form.

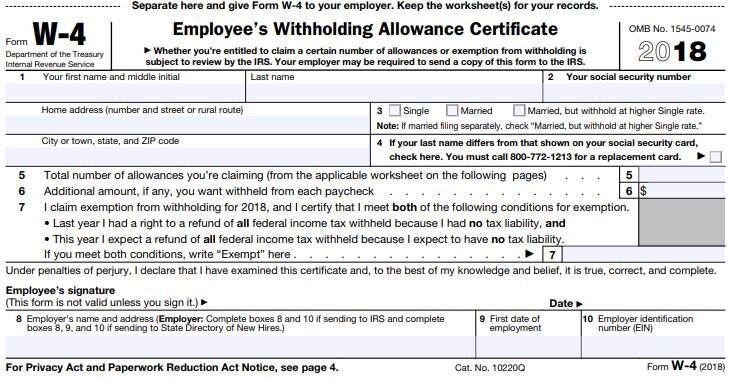

What Is A W-4 Form?

The W-4 form is one of the many forms that HR had you complete when you were first hired by the company. Here is what it looks like:

Section 3 of this form tells your employer which withholding table to use:

Single

Married

Married, but withhold at higher Single Rate

Section 5 tells your employer how many "allowances" you are claiming. Allowance is just another word for "dependents". The more allowances your claim, the lower the tax withholding in your paycheck because it assumes that you will have less "taxable income" because in the past you received a deduction for each dependent. This is where the main problem lies. Due to the changes in the tax laws, the tax deduction for personal exemptions was eliminated. This may adversely affect some taxpayers the were claiming a high number of allowances on their W-4 form because even though the number of their dependents did not change, their taxable income may be higher in 2018 because the deduction for personal exemptions no longer exists.

Even though everyone should review their Form W-4 form this year, employees that claimed allowances on their W-4 form are at the highest risk of either under withholding or over withholding taxes from their paychecks in 2018 due to the changes in the tax laws.

How Much Should I Withhold From My Paycheck For Taxes?

So how do you go about calculating that right amount to withhold from your paycheck for taxes to avoid an unfortunate tax surprise when you file your taxes for 2018? There are two methods:

Ask your accountant

Use the online IRS Withholding Calculator

The easiest and most accurate method is to ask your personal accountant when you meet with them to complete your 2017 tax return. Bring them your most recent pay stub and a blank Form W-4. Based on the changes in the tax laws, they can assist you in the proper completion of your W-4 Form based on your estimated tax liability for the year.If you complete your own taxes, I would highly recommend visiting the updated IRS Withholding Calculator. The IRS calculator will ask you a series of questions, such as:

How many dependents you plan to claim in 2018

Are you over the age of 65

The number of children that qualify for the dependent care credit

The number of children that will qualify for the new child tax credit

Estimated gross wages

How much fed income tax has already been withheld year to date

Payroll frequency

At the end of the process it will provide you with your personal results based on the data that you entered. It will provide you with guidance as to how to complete your Form W-4 including the number of allowances to claim and if applicable, the additional amount that you should instruct your employer to withhold from your paycheck for federal income taxes. Additional withholding requests are listed in Section 6 of the Form W-4.

Avoid Disaster

Having this conversation with your accountant and/or using the new IRS Withholding Calculator will help you to avoid a big tax disaster in 2018. Unfortunately, many employees may not learn about this until it's too late. Employees that are used to getting a tax refund may find out in the spring of next year that they owe thousands of dollars to the IRS because the combination of the new tax tables and the changes in the tax law that caused them to inadvertently under withhold federal income taxes throughout the year.

Action Item!!

Take action now. The longer you wait to run this calculation or to have this conversation with your accountant, the larger the adjustment may be to your paycheck. It's easier to make these adjustments now when you have nine months left in the year as opposed to waiting until November.I would strongly recommend that you share this article with your spouse, children in the work force, and co-workers to help them avoid this little known problem. The media will probably not catch wind of this issue until employees start filing their tax returns for 2018 and they find out that there is a tax bill waiting for them.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.