Should I Refinance My Mortgage Now?

With all the volatility going on in the market, it seems there is one certainty and that is the word “historical” will continue to be in the headlines. Over the past few months, we’ve seen the Dow Jones Average hit historical highs, the 10-year treasury hit historical lows, and historical daily point movements in the market.

Should I Refinance My Mortgage Now?

With all the volatility going on in the market, it seems there is one certainty and that is the word “historical” will continue to be in the headlines. Over the past few months, we’ve seen the Dow Jones Average hit historical highs, the 10-year treasury hit historical lows, and historical daily point movements in the market. Market volatility will always lead the headlines as it does impact anyone with an investment account. With that in mind, it is important to use these times to reassess your overall financial plan and take advantage of parts of the plan that are in your control.

For a lot of people, their home is their most significant asset and is held for a longer period than any stock or bond they may have. This brings us back to “historical” as mortgage rates continue to drop. Whenever this happens, our clients will call and ask if it makes sense to refinance. In this article, we will help you in making this decision.

3 Important Questions

How much will I be saving annually in interest with a lower rate?

What are the closing costs of refinancing?

How long do I plan on being in the home and how many more years do I have on the mortgage?

If you can answer these questions, then you should have a pretty good idea if it makes sense for you to refinance.

How Much Will I be Saving Annually in Interest with a Lower Rate?

With most financial decisions, dollars matter. So how do you determine how much you will be saving each year with a lower interest rate? Below, I walk through a very basic example, but it will show the possible advantage of the refinance.

One important note with this example is the fact that most loan payments you make will decrease the principal which should decrease the cost of interest. To make this simple, I assume a consistent mortgage balance throughout the year.

Higher Interest Lower Interest

Mortgage Balance: $300,000 Mortgage Balance: $300,000

Interest Rate: 4.5% Interest Rate: 3.5%

Annual Interest: $13,500 Annual Interest: $10,500

By refinancing at the lower rate, the dollar savings in one year was $3,000 in the example when the mortgage balance was $300,000.

Savings over the life of a mortgage at 3.5% compared to 4.5% on a $300,000, 30-year mortgage, should be over $60,000 in interest over that time period if you are making consistent monthly payments.

What are the Closing Costs of Refinancing?

After walking through the exercise above, most people will say “Of course it makes sense to refinance”. Before making the decision, you must consider the cost of refinancing which can vary from person to person and bank to bank. There are several closing costs to consider which could include title insurance, tax stamps, appraisal fee, application fees, etc.

If the cost of closing is $5,000, you will have to determine how long it will take you to make that back based on the annual interest savings. Using the example from before, if you save $3,000 in interest each year, it should take you 2 years to breakeven.

One tip we give clients is to start at your current lender. Banks are in competition with other banks and they usually do not want to lose business to a competitor. Knowing the current interest rate environment, a lot of institutions will offer a type of “rapid refinance” for existing customers which may make the process easier but also give you a break on the closing costs if you are staying with them. This should be taken into consideration along with the possibility of getting an even lower interest rate from a different institution which could save you more in the long run even if closing costs are higher.

How Long do I Plan on Being in the Home and How Many More Years do I have on the Mortgage?

This is important since there is a cost to refinancing your mortgage. If it will take you 10 years to “breakeven” between the closing costs and interest you are saving but only plan on being in the house for 5 more years, refinancing may not be the right choice. Also, if you only have a few years left to pay the mortgage you would have to weigh your options.

In summary, taking advantage of these historical low mortgage rates could save you a lot of dollars over the long term but you should consider all the costs associated with it. Taking the time to answer these questions and shop around to make sure you are getting a good deal should be worth the effort.

Public Service Announcement: Like the stock market, it is hard to say anyone has the capability of knowing for sure when interest rates will hit their lows. Make sure you are comfortable with the decision you are making and if you do refinance try not to have buyer’s remorse if the historical lows today turn into new historical lows next year.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Coronavirus vs. SARS: Buying Opportunity?

As fears of the Coronavirus continue to spread, this week was the largest drop in the stock market since the 2008 / 2009 financial crisis. On Thursday, February 27, 2020, the Dow Jones Index dropped by 1,191 points, making it the

As fears of the Coronavirus continue to spread, this week was the largest drop in the stock market since the 2008 / 2009 financial crisis. On Thursday, February 27, 2020, the Dow Jones Index dropped by 1,191 points, making it the largest single day point drop in the history of the index. As the selling has intensified into the week, clients are asking us what we expect in the upcoming weeks. Should they be buying the dip? Do we expect a further selloff from here?

Like most major market events, we have to look back in history to find similar events that allow us to model how the markets might behave from here. This week, we have conducted extensive research into virus outbreaks that have happened in the past such as SARS, MERS, Zika, and Swine Flu, in an effort to better understand possible outcomes to the Coronavirus epidemic. In this article, I’m going to share with you:

Coronavirus vs SARS / Zika / other epidemics

What makes the Coronavirus different than other epidemics in the past

Why has this selloff been so fast & fierce

Disruptions to the global supply chain

Performance of the stock market following the end of epidemics in the past

Will the Fed lower rates to help the market

When does this become a buying opportunity for investors

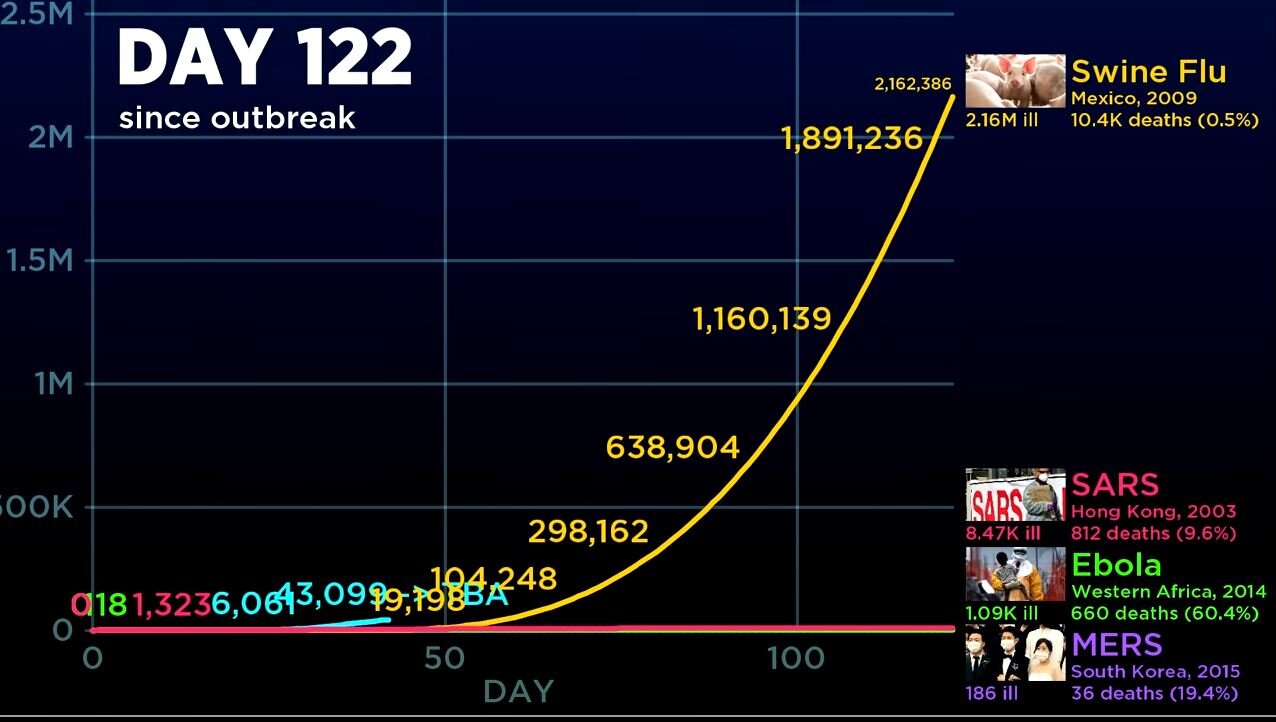

Coronavirus vs SARS

We spent an extensive amount of time comparing Coronvavirus to SARS, and other epidemics in the past. Without a doubt, the Coronavirus is very different than many of the epidemics that we have seen in the past which is making financial modeling very difficult. When we compare the Coronavirus to SARS and other outbreaks, the rate at which the Coronavirus has spread in the first 30 days is unprecedented. Here are a few time lapse charts that compares the infection rate of the Coronavirus to SARS, Ebola, MERS, and Swine Flu.

When you compare SARS to the Coronavirus at Day 19, SARS was much worse out of the gates. By Day 19, SARS had infected 1,490 people and 53 people had died, making the death rate 3.6%. By comparison, at Day 19, Coronavirus had only infected 123 people in China, and resulted in 2 deaths. Making the death rate 1.6%.

However, only 7 days later, at Day 26, the story completely changed:

By Day 26, the number of confirmed cases of Coronavirus rocketed higher, outpacing that of SARS in the early 2000’s. In addition, the death toll for the Coronavirus jumped to 79 people.

But then it continued to get worse. By Day 43, the chart says it all:

By day 43, the number of confirmed cases of the Coronavirus jumped to 43,099 compared to just 3,860 confirmed cases of the SARS virus during that same time period. The death toll for the Coronavirus had risen to over 1,000 people compared to 217 from SARS during that same time period. This chart highlights the main issue with the Coronavirus. It’s spreading faster than government’s are able to control compared to most epidemics in the past.

Now, I say “most” because when we started gathering the data, there is a chart that looks similar to the Coronravirus outbreak. If I move these charts forward to Day 122, this is what happened with the Swine Flu in Mexico in 2009.

The Swine Flu was relatively mute for the first 50 days, but after day 50, the chart looks very similar to the fast spread of the Coronavirus. By Day 122, 2.1M people had been infected with the Swine Flu and over 10,000 people had died.

So why didn’t you hear more about the Swine flu when it was happening? The death rate of the Swing Flu was only 0.5%. Compare this to the current 2.1% estimated death rate of the Coronavirus, which is not as high as the SARS death rate of 4.9%, but it is significantly higher than the Swine Flu. Here is a chart comparing the death rate of SARS, Coronavirus, and MERS:

Another important note, the Swine Flu was fairly wide spread as well. See the chart below from the World Health Organization on the Swine Flu:

However, given how fast the Coronavirus is spreading in it’s early stage, it could end up having a larger global footprint than the Swine Flu if they are unable to contain it soon.

Key Takeaway From The Comparison

Our key takeaway from this comparison is that Coronavirus has spread more quickly in the early stages compared to past epidemics which represents a larger risk to the markets than in the past. Due to the pace of the spread, it’s difficult to put an estimated timeline together for containment. When we look at the comparison of Coronavirus to the Swine Flu, it shows that there could be further downside risks to the markets if the spread of the virus follows a similar glide path.

Coronavirus Disruption To The Market

We issued an article earlier this week explaining the business impact of the Coronavirus.

Article: Coronavirus & The Market Selloff

I just want to quickly summarize again what’s causing the market selloff from a business standpoint. As the Coronavirus continues to spread to other regions, it forces governments to restrict the movements of its people in an effort to contain the spread of the virus. This means transportation is shut down, events are canceled where there would have been large gatherings of people, and employees are not going to work. Also, when people are afraid, they don’t go out to eat, and they don’t go shopping. All of these things have a direct impact on the revenue of the companies that make up the stock market. When these companies entered 2020, there was no expectation that their manufacturing operations could be completely shut down due to a global health epidemic. The stock market right now is trying to determine how much it needs to discount the prices of these companies based on the revenue that’s being lost.

The longer the epidemic continues, the longer it takes people to get back to work, the longer it takes people to resume their normal spending habits, and the more damage it does to the markets.

The China Impact

When comparing SARS to the Coronavirus it’s also important to acknowledge the growth in the size of China’s economy between 2003 and 2020. When the SARS outbreak happened in 2003, China’s economy only represented 8.7% of global GDP. As of 2019, China’s economy now equals 19% of total global GDP. Since the Coronavirus has been the most wide spread in China, It will have a much larger impact on the markets around the globe compared to the SARS outbreak when China was a much smaller player in the global economy.

Valuations in the U.S. Stock Market

In our opinion, one of the other big factors that has fueled the magnitude of the selloff here in the U.S., is the simple fact that going into 2020, the stock market was overvalued already by historic terms. As of December 31, 2019, the P/E ratio of the S&P 500 was 18. The 25 year historical average P/E for the S&P 500 Index is 16. This essentially means that stocks were expensive going into the beginning of the year. When stocks are already arguably overvalued, and a negative event happens, the prices have to drop by more realizing that those companies are not going to produce the earnings growth for the upcoming year that was already baked into the stock price.

Fed Lowering Rates

There is talk now of the Fed coming to the markets aid and lowering interest rates throughout the year. Going into 2020, it was the market’s expectation that the Fed was going to remain on hold for 2020. In my opinion, the rate cuts are probably warranted at this point, given the unexpected slowdown to the global economy as a result of the Coronavirus. But I would also warn that the Fed lowering interest rates is not in itself going to heal the markets. Giving companies access to cheaper capital is not going to make people feel safer about traveling around the globe and it’s not going to help manufacturers resume operations if their employees can’t get to the factory due to travel restrictions.

However, giving companies access to cheaper capital will allow them to better weather the storm while the governments around the world work on a containment plan. Without that access to cheap capital, you could see companies going under because it took revenue too long to ramp back up.

Global Supply Chain

Investors should not underestimate the damage that has been done to the global supply change and how long it takes to get the supply chain back up and running again. A good example are car manufacturers. They do not typically keep large inventories of parts, and if those parts are not being made, they’re not being shipped, meaning they can’t build the cars, so they can’t sell the cars, and revenue drops.

Within the electronics industry, a lot of the products are made up of hundreds if not thousands of components, and the product does not work without all of those components. If there is one computer chip that is made in Korea, and the manufacturing of those chips has been halted, then the end product cannot be built and shipped. The examples go on and on but when you think of manufacturing around the globe being brought offline, it’s not like a light switch where you can go and simply turn it back on. It takes a while for it to get back up and running again. So while investors might think the Coronavirus could just impact Q1 revenue, it’s more likely that it will impact revenue beyond just the first quarter.

When Do You Buy The Dip?

I have received a lot of calls from clients asking if they should begin buying stocks at these lower levels with the anticipation of a bounce back. When we look at other epidemics in the past, there has been a sizable rally in the stock market 6 to 12 months after the epidemic has ended. The chart below shows each epidemic and the subsequent 6 month and 12 month return of the S&P 500 after the epidemic ended. On average, the stock market rose 20% a year following the end of the epidemic which is why investors are eager to buy into the selloff.

In my personal opinion, at some point, the Coronavirus will be contained and it will create an opportunity for investors. There is pent up demand being accumulated now that will need to be filled after the virus is contained. Individuals will most likely reschedule vacations and travel plans once they feel it’s safe to travel around the globe, and the Fed, via lower rates, will have given companies access to even cheaper capital to grow. But as I write this article on February 28th, I caution investors. When you look at the data that we’ve collected, there could definitely be more downside to the selloff if they are unable to contain the spread of the Coronavirus within the next few weeks. The market right now is just trying to guess how much damage has been done with no real solid guidance as to whether it’s guessing right or wrong.

It may be prudent to wait for evidence that progress is being made on the containment efforts of the virus before buying back into the market. For long term investors, it’s important to understand that while the Coronavirus will undoubtedly have an impact on the revenue of companies in 2020, in the past, epidemics have rarely changed the fate of solid companies over the long term.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Coronavirus & The Market Selloff

Today was a wild ride for the stock market. The Dow Jones posted a loss of 1,031 points on February 24, 2020 as fears of the continued spread of the Coronavirus sparked a selloff in the stock market. Over the past 24 hours, we've

Today was a wild ride for the stock market. The Dow Jones posted a loss of 1,031 points on February 24, 2020 as fears of the continued spread of the Coronavirus sparked a selloff in the stock market. Over the past 24 hours, we've received the following questions from clients that I want to address in this article:

Why is the market selling off on this news?

Do you think the selloff will continue?

Should you be moving money out of stocks into bonds?

Why Is Market Selling Off On This News?

You have to remember that the stock market is made up of individual companies. Each company’s stock price is just an educated guess by investors as to how much those companies are going to make in profits over the next 3 months, 1 year, 5 years, and beyond. Unexpected events like the Coronavirus create large deviations between those educated guesses and actual results.

In the case of the Coronavirus, it’s disrupting the revenue stream of many companies that produce and sell goods across the globe. For example, Nike receives 17% of its revenue from China, and the company has temporarily closed more than half of its stores in China. The stores that remain open are operating on abbreviated hours. If the stores are not open, then they can’t sell Nike shoes and apparel, which will most likely cause Nike’s Q1 revenue to be lower than expected. That in turn could cause the stock price to drop once the Q1 earnings report is released later this year.

But it’s not just Nike. The S&P 500 Index is made up of a lot of companies that sell goods in China and other locations around the world: Apple, Yum Brands, McDonalds, Proctor & Gamble, and the list goes on. Beyond just retail, you have airlines, hotels, and casinos that are being negatively impacted as people cancel travel plans and vacations. The point I’m trying to make is there are real business reasons why the stock market is reacting the way it is, it’s not just displaced fear.

All of these companies are trying to figure out right now what the impact will be to their revenue. The next question then becomes, how much are these companies going to miss by?

Do You Think the Selloff Will Continue?

That leads us into the next questions which is “do you think the selloff will continue?” Historically, contagious disease outbreaks have been quickly contained, such as the SARS outbreak in the early 2000’s. The amount of damage to the markets seems to be highly correlated to the amount of time it takes to contain the outbreak. The longer it takes to contain the outbreak, the longer it takes people to return to work and to return to their normal spending habits. The news broke this morning that there are new confirmed cases of the Coronavirus in Italy and South Korea which makes investors question whether or not the threat has been contained.

Unfortunately, there is no solid answer as to how long the current selloff might last. It could end tomorrow or it could continue off and on over the next few weeks. But it’s important to remember that even though market events like the Coronavirus do impact the short-term profitability of companies, it’s less common that these types of events impact the long-term performance. When you have a selloff sparked by a single market event versus a full blown recession, it’s not uncommon for long term investors to start stepping into the market and buying stocks at these lower levels.

Should You Be Moving Money Out Of Stocks Into Bonds?

This bring us to the final question, should you be making changes to your investment portfolio based on today’s market events? In my opinion, the answer to that is “no” but I think there is a lesson to be learned for investors that are still overweight stocks in their portfolio. Over the past year, the stock market has appreciated rapidly in value but the growth rate of corporate earnings has lagged behind. When this happens, stocks start to become overvalued, and the market becomes more vulnerable to selloffs.

This week the selloff was sparked by the Coronavirus, a few months from now it could be fears surrounding the elections in the U.S., trade, or some other geopolitical event. When you enter the later stages of an economic expansion, volatility, which has been largely absent from the U.S. stock market over the past few years, becomes a common place. Investors that have elected to stay overweight riskier asset classes in the later stages of this economic cycle, need to make sure they have the risk tolerance and discipline to weather these market selloffs.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

When To Enroll In Medicare

Medicare has important deadlines that you need to be aware of during your initial enrollment period. Missing those deadlines could mean gaps in coverage, penalties, and limited options when it comes to selecting a Medicare

Medicare has important deadlines that you need to be aware of during your initial enrollment period. Missing those deadlines could mean gaps in coverage, penalties, and limited options when it comes to selecting a Medicare Supplemental Plan.

Many people are aware of the age 65 start date for Medicare, however, it’s not uncommon for individuals to work past age 65 and have health insurance coverage through their employer or through their spouse’s employer. For many of these individuals working past age 65, they are often surprised to find out that even though they are still covered by an employer sponsored health plan, depending on the size of the employer, and the insurance carrier, they may still be required to enroll in Medicare at age 65.

In this article we will cover:

Enrollment deadlines for Medicare

When to start the enrollment process

Effective dates of coverage

Special rules for individuals working past age 65

Medicare vs. employer health coverage

Initial Enrollment Period

For many individuals, when they turn age 65, they are required to enroll in Medicare Part A and Part B which becomes their primary health insurance provider. The Medicare initial enrollment period lasts for seven months. This period begins 3 months prior to the month of your 65th birthday and ends 3 months after that month.

Example: If you turn age 65 on June 10th, your initial enrollment period begins on March 1 and ends on September 30.

Retired and Collecting Social Security

If you are retired and you are already receiving Social Security benefits prior to your 65th birthday, no action is needed to enroll in Medicare Part A & B. Your Medicare card should arrive in the mail one or two months prior to your 65th birthday.

However, even though you are automatically enrolled in Medicare Part A and Part B, if you are not covered by a retiree health plan through your former employer, you should begin the process of enrolling in either a Medicare Supplemental Plan or Medicare Advantage Plan at least two months prior to your 65th birthday. Medicare Part A and Part B by itself, does not cover all of your health costs which is why most retirees obtain a Supplemental Plan. If you wait until your 65th birthday, the effective date of that Supplemental coverage may not begin until the following month which creates a gap in coverage.

As soon as you receive your Medicare card, you can enroll in a Medicare Supplemental Plan or Medicare Advantage Plan to ensure that both your Medicare coverage and Supplemental Coverage will begin as soon as your employer health coverage ends.

Retired But Not Collecting Social Security Yet

If you are retired, about to turn age 65, but you have not turned on your Social Security benefits yet, action is required. Medicare is not going to proactively notify you that you need to enroll in Medicare Part A & B. The responsibility of enrolling at the right time within your initial enrollment period falls 100% on you.

Three months prior to your 65th birthday you can either enroll in Medicare online or schedule an appointment to enroll in Medicare at your local Social Security office.

Note: If you plan to enroll in Medicare via an in-person meeting at the Social Security office, it is strongly recommended that you call your local Social Security office two months prior to the beginning of your initial enrollment period because they may require you to make an appointment.

If you decide to enroll online, it’s a fairly easy process, and it should only take you 10 to 15 minutes. Here is the link to enroll online: https://www.ssa.gov/benefits/medicare/

If you are simultaneously applying for Medicare and Social Security to begin at age 65, there is a separate link where you can enroll in both online: https://www.ssa.gov/retire

Working Past Age 65

If you or your spouse plan to work past age 65 and will be covered by an employer sponsored health plan, you may or may not need to enroll in Medicare at age 65. Unfortunately, many people assume that because they are covered by a company health plan, they don’t have to do anything with Medicare until they officially retire. That assumption can lead to problems for many people when they go to enroll in Medicare after age 65.

The following factors need to be taken into consideration if you have employer sponsored health coverage past age 65:

How many employees work for the company

The insurance company providing the health benefit

Does the plan qualify as “credible coverage” in the eyes of Medicare

The terms of your company’s plan

At Age 64: TAKE ACTION

I’m going to review each of the variables listed above but before I do, I want to make a blanket recommendation. If you plan to work past age 65 and will be covered by your employer’s health insurance plan, right after your 64th birthday, go talk to the person at your company that handles the health insurance benefit and ask them how the company’s health plan coordinates with Medicare. Do not wait until a week before you turn 65 to ask questions. If you or your spouse are required to enroll in Medicare, the process takes time.

19 or Fewer Employees

Medicare has a general rule of thumb that if a company has 19 or fewer employees, at age 65, employees have to enroll in Medicare Part A and B. Medicare becomes your primary insurance coverage and the employer’s health plan becomes your secondary insurance coverage. Your open enrollment period is the same as if you were turning age 65 with no employer health coverage.

20 or More Employees

If your company has 20 or more employees and the health insurance plan is considered “credible coverage” in the eyes on Medicare, there may be no action needed at age 65. As mentioned above, you should go to your human resource representative at your company, after your 64th birthday, to verify that the health plan that they have is considered “credible coverage” for Medicare. If it is, then there is no need to sign up for Medicare at age 65, your employer health coverage will continue to serve as your primary coverage until you retire.

However, if your company’s health plan does not qualify as “creditable coverage” then you will have to enroll in Medicare Part A & B at age 65 to avoid having to pay a penalty and avoid gaps in coverage once you officially retire.

Action: 90 Days Before You Retire

If you work past age 65 and have credible employer health coverage, 90 days before you plan to retire, you will need to take action regarding your Medicare benefits. This will ensure that your Medicare Part A & B coverage as well as your Medicare Supplemental coverage will begin immediately after your employer health insurance coverage ends.

When you retire after age 65, Medicare provides you with a “Special Enrollment Period”. You have 8 months to enroll in Medicare Part A & B without a late penalty:

63 Day Enrollment Window: Medicare Supplemental, Advantage, & Part D Plans

Even though the Special Enrollment Period lasts for 8 months, you only have 63 days after your employer coverage ends to enroll in a Medicare Supplemental, Medicare Advantage Plan (Part C), or a Medicare Part D Prescription Drug Plan. But remember, you are not eligible to enroll in those plans until after you have already enrolled in Medicare Part A & B which is why you need to start the process 90 days in advance of your actual retirement date to make sure you meet the deadlines.

COBRA Coverage Does Not Count

Some individuals voluntarily elect COBRA coverage after they retire to extend the employer based health coverage. But be aware, COBRA coverage does not count as credible insurance coverage in the eyes of Medicare regardless of the plan that you are covered by. If you do not enroll in Medicare within the eight months after leaving employment, you may face gaps in coverage and permanent Medicare penalties once your COBRA coverage ends.

Spousal Coverage After Age 65

You have to be very careful if you plan to be covered by your spouse’s employer sponsored health insurance past age 65. Some plans with 20 or more employees will serve as primary insurance provider for the employee but not their spouse. In these plans, the non-working spouse is required to enroll in Medicare at age 65.

We have even seen plans where the health insurance for the non-working spouse ends on the first day of the calendar year that they are scheduled to turn age 65. This creates a whole other issue because there is a gap in coverage between January 1st and when the non-working spouse turns age 65. Again, as soon as you or your spouse turn age 64, you should start asking questions about your health coverage.

The Insurance Company Matters

There are a few insurance companies that voluntarily deviate from the 19 or less employees rule listed above. These insurance companies serve as the primary insurance coverage for employee that work past age 65 regardless of the size of the company. Medicare does not fight it because the government is more than happy to allow an insurance company to foot the bill for your health coverage. In these cases, even if your company employs less than 20 employees, you do not have to take any action with regard to Medicare at age 65.

You Cannot Enroll Online

If you work past age 65 and have employer based health coverage, you do not have the option to enroll in Medicare online. You have to prove to Medicare that you have maintained credible health insurance coverage through your employer since age 65, otherwise you face penalties and potential gaps in coverage. You will need to make an appointment at your local Social Security office to enroll. Your employer or the health insurance company will provide you with a letter which serves as your proof of insurance coverage.

Enrolling in Medicare Supplemental or Medicare Advantage Plans

Once enrolled in Medicare Part A and part B, individuals that do not have retiree health benefits, will enroll in either a Medicare Advantage Plan or Medicare Supplemental Plan. You have to be enrolled in Medicare Part A & B, before you can enroll in a Supplemental or Advantage Plan.

It’s extremely important to understand the differences between a Medicare Supplemental Plan and Medicare Advantage Plan which is why we dedicated an entire article to this topic:

Article: Medicare Supplemental Plan vs. Medicare Advantage Plan

Retiree Health Benefits Through Your Former Employer

For employees that have retiree health coverage, you still need to enroll in Medicare Part A & B which serves as the primary insurance coverage and the retiree health coverage serves as your secondary insurance coverage.

Some larger employers even give employees access to multiple retiree health plans. You have to do your homework because some of those plans are structured as Supplemental Plans while others are structured as Advantage Plans.

Medicare vs Employer Health Coverage

Once you turn age 65, if you plan to continue to work, and have access to an employer based health plan, you still need to evaluate your options. A lot of companies have high deductible plans where the employee is required to pay a lot of money out of pocket before the insurance coverage begins. In general, Medicare Part A & B, paired with a Supplemental Plan, can offer very comprehensive coverage at a reasonable cost to individuals 65 and old. You have to compare how much you are paying in your employer health plan and the benefits, versus if you decided to voluntarily enroll in Medicare and obtain a Supplemental policy.

The results vary on a case by case basis and each person’s health needs are different but it’s worth running a comparison. In some cases, it can save both the employer and the employee money while providing the employee with a higher level of health insurance coverage.

Contact Us For Help

If you have any questions about anything Medicare related, please feel free to contact us at 518-477-6686. We are independent Medicare brokers and we can make the Medicare enrollment process easy, help you select the right Medicare Supplemental or Advantage Plan, and provide you with ongoing support with your Medicare benefits in retirement.

Other Medicare Articles

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Do Social Security Survivor Benefits Work?

Social Security payments can sometimes be a significant portion of a couple’s retirement income. If your spouse passes away unexpectedly, it can have a dramatic impact on your financial wellbeing in retirement. This is especially

Social Security payments can sometimes be a significant portion of a couple’s retirement income. If your spouse passes away unexpectedly, it can have a dramatic impact on your financial wellbeing in retirement. This is especially true if there was a big income difference between you and your spouse. In this article we will review:

Who is eligible to receive the Social Security Survivor Benefit

How the benefit is calculated

Electing to take the benefit early vs. delaying the benefit

Filing strategies that allow the surviving spouse to receive more from Social Security

Social Security Earned Income Penalty

Social Security filing strategies that married couples should consider to preserve the Survivor Benefit

Divorce: 2 Ex-spouses & 1 Current Spouse: All receiving the same Survivor Benefit

How Much Social Security Does A Surviving Spouse Receive?

When your spouse passes away, as the surviving spouse, you are entitled to receive the higher of the two benefits. You do not continue to collect both benefits simultaneously.

Example: Jim is age 80 and he is collecting a Social Security benefit of $2,500 per month. His wife Sarah is 79 and is collecting $2,000 per month for her Social Security benefit.

If Jim passes away first, Sarah would begin to receive $2,500 per month, but her $2,000 per month benefit would end.

If Sarah passes away first, Jim would continue to receive his $2,500 per month because his benefit was the higher of the two, and Sarah’s Social Security payments would end.

Married For 9 Month

To be eligible for the Social Security Survivor Benefit as the spouse, you have to have been married for at least nine months prior to your spouse passing away. If the marriage was shorter than that, you are not entitled to the Social Security Survivor Benefit.

Increasing Your Spouse’s Survivor Benefit

Due to this higher of the two rule, as financial planners we work this into the Social Security filing strategy for our clients. Before we get into the strategy, let’s do a quick review of your filing options and how it impacts your Social Security benefit.

Normal Retirement Age

Each of us has a Normal Retirement Age for Social Security which is based on our date of birth. The Normal Retirement Age is the age that you are entitled to your full Social Security benefit:

Should You Turn On The Benefit Early?

For your own personal Social Security benefit, once you reach age 62, you have the option to turn on your Social Security benefit early. However, if you elect to turn on your Social Security benefit prior to Normal Retirement Age, your monthly benefit is permanently reduced by approximately 6% per year for each year you take it early. So, if your normal retirement age is 67 and you file for Social Security at age 62, you only receive 70% of your full benefit and that is a permanent reduction.

On the flip side, if you delay filing for Social Security past your normal retirement age, your Social Security benefit increases by about 8% per year until you reach age 70.

There is no benefit to delaying Social Security past age 70.

How This Factors Into The Survivor Benefit

The decision of when you turn on your Social Security benefit will ultimately impact the Social Security Survivor Benefit that is available to your spouse should you pass away first. Remember, it’s the higher of the two. When there is a large gap between the amount that you and your spouse will receive from Social Security, it’s not uncommon for us to recommend that the higher income earner should delay filing for Social Security as long as possible. By delaying the start date, it increases the monthly amount that higher income earning spouse receives, which in turn preserves a higher monthly survivor benefit regardless of which spouse passes away first.

Example: Matt and Sarah are married, they are both 62, they retired last year, and they are trying to decide if they should turn on their Social Security benefit now, waiting until Normal Retirement Age, or delay it until age 70. Matt’s Social Security benefit at age 67 would be $2,700 per month. Sarah Social Security benefit at age 67 would be $2,000 per month.

They need $7,000 per month to meet their expenses. If Matt and Sarah both took their Social Security benefits at age 62, Matt’s benefit would be reduced to $1,890 per month and Sarah’s benefit would be reduced to $1,400 per month. At age 75, Matt passes away from a heart attack. Sarah’s Social Security benefit would increase to the amount that Matt was receiving, $1,890, and Sarah’s benefit of $1,400 per month would end. Since Sarah’s monthly expenses are still close to $7,000 per month, with the loss of the second Social Security benefit, she would have to withdraw $5,110 per month from another source to meet the $7,000 in monthly expenses. That’s $61,320 per year!!

Let’s compare that scenario to Matt waiting to file for his Social Security benefit until age 70 and Sarah turning on her Social Security benefit at age 62. By turning on Sarah’s benefit at age 62, it provides them with some additional income to meet expense, but when Matt turns 70, he will now receive $3,348 per month from Social Security. If Matt passes away at age 75, Sarah now receives Matt’s $3,348 per month from Social Security and her lower benefit ends. However, since the Social Security payments are higher than the previous example, now Sarah only needs to withdraw $3,652 per month from her personal savings to meet her expenses. That equals $43,824 per year.

If Sarah lives to age 90, by Matt making the decision to delay his Social Security Benefit to age 70, that saved Sarah an additional $262,400 that she otherwise would have had to withdraw from her personal savings over that 15 year period.

Age 60 - Surviving Spouse Benefit

As mentioned above, with your personal Social Security retirement benefits, you have the option to turn on your Social Security payments as early as age 62 at a reduced amount. In contrast, if your spouse predeceases you, you are allowed to turn on the Social Security Survivor Benefit as early as age 60.

Similar to turning on your personal Social Security benefit at age 62, if you elect to receive the Social Security Survivor Benefit prior to reaching your normal retirement age, Social Security reduces the benefit by approximately 6% per year, for each year that you start receiving the benefit prior to your normal retirement age.

Advance Filing Strategy

There is an advanced filing strategy associated with the Survivor Benefit. Social Security allows you to turn on the Survivor Benefit which is based on your spouse’s earnings history and defer your personal benefit until a future date. This allows your benefit to continue to grow even though you are currently receiving payments from Social Security. When you turn age 70, you can switch over to your own benefit which is at its maximum dollar threshold. But you would only do this, if your benefit was higher than the survivor benefit.

Example: Mike and Lisa are married and are both entitled to receive $2,000 per month from Social Security at age 67. Mike passes away unexpectedly at age 50. When Lisa turns 60, she will have to option to turn on the Social Security Survivor Benefit based on Mike’s earnings history at a reduced amount of $1,160 per month. In the meantime, Lisa can allow her personal Social Security benefit to continue to grow, and at age 70, Sarah can switch from the Surviving Spouse Benefit of $1,160 over to her personal benefit of $2,480 per month.

Beware of the Social Security Earned Income Penalty

If you are considering turning on your Social Security benefits prior to your normal retirement age, you must be aware of the Social Security earned income penalty. This is true for both your own personal Social Security benefits and the benefits you may receive as the surviving spouse. In 2020, if you are receiving Social Security benefits prior to your normal retirement age and you have earned income over $18,240 for that calendar year, not only are you receiving the benefit at a permanently reduced amount but Social Security assesses a penalty at the end of the year which is equal to $1 for every $2 of income over that threshold.

Example: Jackie decides to turn on her Social Security Survivor Benefits at age 60 in the amount of $1,000 per month. She is still working and will receive $40,000 in W-2 income. Based on the formula, of the $12,000 in Social Security payments that Jackie received, Social Security would assess a $10,880 penalty against that amount. So she basically loses it all to the penalty.

For clarification purposes, when Social Security levies the earned income penalty, they do not require you to issue them a check for the dollar amount of the penalty; instead, they deduct the amount that is due to them from your future Social Security payments. This usually happens shortly after you file your tax return for the previous year because the IRS uses your tax return to determine if the earned income penalty applies.

For this reason, there is a general rule of thumb that if you have not reached your normal retirement age for Social Security and you anticipate receiving income during the year well above the $18,240 threshold, it typically does not make sense to turn on the Social Security benefits early. It just ends up creating more taxable income for you, and you end up losing most or all of the money the next year when Social Security assesses the earned income penalty against your future benefits.

Once you reach normal retirement age, this earned income penalty no longer applies. You can turn on Social Security benefits and make as much as you want without a penalty.

Divorce

We find that many ex-spouses are not aware that they are also entitled to the Social Security Survivor Benefit if they were married to the decedent for more than 10 years prior to the divorce. Meaning if your ex-spouse passes away and you were married more than 10 years, if the monthly benefit that they were receiving from Social Security is higher than yours, you go back to Social Security, file under the Survivor Benefit, and your benefit will increase to their amount.

The only way you lose this option is if you remarry prior to age 60. However, if you get remarried after age 60, it does not jeopardize your ability to claim the Survivor Benefit based on your ex-spouse’s earnings history.

If your ex-spouse was remarried at the time they passed away, you are still entitled to receive the Survivor Benefit. In addition, their current spouse will also be able to claim the Survivor Benefit simultaneously and it does not reduced the amount that you receive as the ex-spouse.

There was even a case where an individual was divorced twice, both marriages lasted more than 10 years, and he was remarried at the time he passed away. After his passing, the two ex-spouses and the current spouse were all eligible to receive the full Social Security Survivor Benefit based on his earnings history.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Medicare Supplemental Plans ("Medigap") vs. Medicare Advantage Plans

As you approach age 65, there are a lot of very important decisions that you will have to make regarding your Medicare coverage. Since Medicare Parts A & B by itself have deductibles, coinsurance, and no maximum out of pocket

As you approach age 65, there are a lot of very important decisions that you will have to make regarding your Medicare coverage. Since Medicare Parts A & B by itself have deductibles, coinsurance, and no maximum out of pocket protection for retirees, individuals fill in those cost gaps by enrolling in either a Medicare Supplemental Plan or Medicare Advantage Plan. Most retirees have no idea what the differences are between the two options but I would argue that making the right choice is probably one of the most important decisions that you will make as you plan for retirement.

Making the wrong decision could cost you thousands upon thousands of dollars in unexpected medical and prescription drug costs in the form of:

Inadequate coverage

Paying too much for Medicare insurance that you are not using

Healthcare that is provided outside of the plan’s network of doctors and specialists

Expensive prescription drugs

Insurance claims that are denied by the insurance company

Original Medicare

Before we jump into the differences between the two Medicare insurance options, you first have to understand how Original Medicare operates. “Original Medicare” is a combination of your Medicare Part A & Part B benefits. Medicare is sponsored and administered by the Social Security Administration which means that the government is providing you with your healthcare benefits.

Medicare Part A provides you with your coverage for inpatient services. In other words, health care services that are provided to you when you are admitted to the hospital. If you worked for more than 10 years, there is no monthly premium for Part A but it’s not necessarily “free”. Medicare Part A has both deductibles and coinsurance that retirees are required to pay out of pocket prior to Medicare picking up the tab.

Medicare Part B provides you with your outpatient services. This would be your doctor’s visits, lab work, preventative care, medical equipment, etc. Unlike Medicare Part A, Part B has a monthly premium that individuals pay once they enroll in Medicare. For 2020, most individuals will pay $144.60 per month for their Part B coverage. However, in addition to the monthly premiums, Part B also has deductibles and coinsurance. More specifically, Part B has a 20% coinsurance, meaning anything that is paid by Medicare under Part B, you have to pay 20% of the cost out of pocket, and there are no out of pocket maximums associated with Original Medicare. Your financial exposure is unlimited.

Filling In The Gaps

Since in most cases, Original Medicare is inadequate to cover the total cost of your health care in retirement, individuals will purchase Medicare Insurance to fill in the gaps not covered by Original Medicare. Medicare insurance is provided by private health insurance companies and it comes in two flavors:

Medicare Supplemental Plans (Medigap)

Medicare Advantage Plans (Medicare Part C)

Medicare Supplemental Plans (“Medigap”)

We will start off by looking at Medicare Supplemental Plans, also known as Medigap Plans. If you enroll in a Medicare Supplemental Plan, you are keeping your Medicare Part A & B coverage, and then adding a Medicare Insurance Plan on top of it to fill in the costs not covered by Part A & B. Thus, the name “supplemental” because it’s supplementing your Original Medicare benefits.

There are a variety of Medigap plans that you can choose from and each plan has a corresponding letter such as Plan A, Plan D, Plan G, or Plan N. See the grid below:

When you see a line item in the chart that has “100%”, that means the Medigap plan covers 100% of that particular cost that is not otherwise covered by Original Medicare. For example, on the first line you see 100% across the board, that’s because all of the Medigap plans cover 100% of the Medicare Part A coinsurance and hospital costs. As you would expect, the more each plan covers, the higher the monthly premium for that particular plan.

Medigap Plans Are Standardized

It's very important to understand that Medical Supplemental Plans are “standardized” which means by law each plan is required to covers specific services. The only difference is the cost that each insurance company charges for the monthly premium.

For example, Insurance Company A and Insurance Company B both offer a Medigap Plan N. Regardless of which insurance company you purchased the policy through, they provide the exact same coverage and benefits. However, Insurance Company A might charge a monthly premium of $240 for their Plan N but Insurance Company B only charges a monthly premium of $160. The only difference is the cost that you pay. For this reason, it's prudent to get quotes from all of the insurance companies that offer each type of Medigap plan in your zip code.

Some zip codes have only a handful of insurance providers while other zip codes could have 15+ providers. Instead of spending hours of time running around to all the different insurance companies getting quotes, it’s usually helpful to work with an Independent Medicare Broker like Greenbush Financial Group to run all of the quotes for you and identify the lowest cost provider in your area. In addition, there is no additional cost to you for using an independent broker.

Freedom of Choice

By enrolling in a Medicare Supplemental Plan you're allowed to go to any provider that accepts Medicare. You do not have to ask your doctors or specialists if they accept the insurance from the company that is sponsoring your Medigap policy. All you have to ask them is if they accept Medicare. When you access the health care system, the doctor’s office bills Medicare. If Medicare does not cover the total cost of that service but it’s covered under your Medigap plan, Medicare instructs the insurance company to pay it. The insurance company is not allowed to deny the claim.

This provides individuals with flexibility as to how, when, and where their health care services are provided.

Part D – Prescription Drug Plan

If you enroll in a Medigap plan, you will also need to obtain a Part D Prescription Drug plan which is separate from your Medigap plan. Part D plans are sponsored by private insurance companies and carry an additional monthly premium. Based on the prescription drugs that you are currently taking, you can select the plan that best meets your needs and budget.

Medicare Advantage Plans

Now let's switch gears to Medicare Advantage Plans. I will start off by saying loud and clear:

“Medicare Supplemental Plans and Medicare Advantage Plans are NOT the same.”

All too often we ask individuals what type of Medicare plan they have and they reply “a Medigap Plan”, only to find out that they have a Medicare Advantage Plan. The differences are significant and it's important to understand how those differences will impact your health care options in retirement.

Medicare Advantage Plans REPLACE Your Medicare Coverage

Most people don’t realize that when you enroll in a Medicare Advantage Plan it DOES NOT “supplement” your Medicare Part A & B coverage. It actually REPLACES your Medicare coverage. Once enrolled in a Medicare Advantage Plan you are no longer covered by Medicare.

There are pluses and minuses to Medicare Advantage Plans that we are going to cover in the following sections. Remember, your health care needs and budget are custom to your personal situation. Just because your coworker, friend, neighbor, or family member selected a specific type of Medicare Plan, it does not necessarily mean that it’s the right plan for you.

Lower Monthly Premiums

The primary reason why most individuals select a Medicare Advantage Plan over a Medicare Supplemental Plan is cost. In many cases, the monthly premiums for Advantage Plans are lower than Supplemental Plans.

For example, in 2020, in Albany, New York, a Medicare Supplemental Plan G can cost an individual anywhere between $189 to $432 per month depending on the insurance company that they select. Compared to a Medicare Advantage Plan that can cost $0, $34, all the way up to a few hundred dollars per month.

Time Out!! How Do $0 Premium Plans Work?

When I first started learning about Medicare Advantage Plan, when I found out about the $0 premium plans or plans that only cost $34 per month, my questions was “How does the insurance company make money if I’m not paying them a premium each month?”

Here is the answer. Remember that Medicare Part B monthly premium of $144.60 per month that I mentioned in the “Original Medicare” section? When you enroll in a Medicare Advantage Plan, even though you are technically not covered by Medicare any longer, you still have to pay the $144.60 Part B premium to Medicare. However, instead of Medicare keeping it, they collect it from you and then pass it on to the insurance company that is providing your Medicare Advantage Plan.

But wait…..there’s more. Honestly, I almost fell out of my seat what I discovered this little treat. For each person that enrolls in a Medicare Advantage Plan, the government issues a monthly payment to the insurance company over and above that Medicare Part B premium. These payments to the insurance companies from the U.S government vary by zip code but in our area it’s more than $700 per month per person. So the insurance company receives over $8,400 per year from the U.S. government for each person that they have enrolled in one of their Medicare Advantage Plans.

Plus, Advantage Plans typically have co-pays, deductibles, and coinsurance that they collect from the policyholder throughout the year.

Don’t worry about the insurance company, they are getting paid. For me, it just sounded like one of those too good to be true situations so I had to dig deeper.

Insurance Companies WANT To Sell You An Advantage Plan

Since the insurance companies are receiving all of these payments from the government for these Advantage Plans, they are usually very eager to sell you an Advantage Plan as opposed to a Medicare Supplemental Plan. If you go directly to an insurance company to discuss your options, they may not even present a Medicare Supplemental Plan as an option even though that might be the right plan for you. Also be aware, that not all insurance companies offer Medicare Supplemental Plan which is another reason why they may not present it as an option.

Now I’m not saying Medicare Advantage Plans are bad. Medicare Advantage Plans can often be the right fit for an individual. I’m just saying that it’s up to you and you alone to make sure that you fully understand the difference between the two types of plans because both options may not be presented to you in an unbiased fashion.

HMO & PPO Plans

Most Medicare Advantage Plans are structured as either an HMO or PPO plan. If your employer provided you with health insurance during your working years, you may be familiar with how HMO and PPO plans operate.

With HMO plans, the insurance company has a “network” of doctors, hospitals, and service providers that is usually limited to a geographic area that you are required to receive your health care from. If you go outside of that network, you typically have to pay the full cost of those medical bills. There is an exception in most HMO plans for medical emergencies that occur when you are traveling outside of your geographic region.

PPO plans offer individuals more flexibility because they provide coverage for both “in-network” and “out-of-network” providers. Even though the insurance plan provides you with coverage for out-to-network providers, there is typically a higher cost to the policy owner in the form of higher co-pays or coinsurance for utilizing doctors and hospitals that are outside of the plan’s network. Since PPO plans offer you more flexibility than HMO plans, the monthly premiums for PPO are typically higher.

Non-Standardize Plans

Unlike Medicare Supplemental Plans, Medicare Advantage plans are non-standardized plans. This means that the benefits and costs associated with each type of plan are different from insurance company to insurance company. Insurance companies also typically have multiple Medicare Advantage plans to choose from. Each plan has different monthly premiums, benefit structures, drug coverage, and additional benefits. You really have to do your homework with Medicare Advantage Plans to understand what's covered and what's not.

Medicare Advantage plans include prescription drug coverage

Unlike a Medicare Supplemental Plan which typically requires you to obtain a separate Part D plan to cover your prescription drugs, most Medicare Advantage plans include prescription drug coverage within the plan. However, there are some Medicare Advantage plans that don't have prescription drug coverage. Again, you just have to do your homework and make sure the prescription drugs that you are currently taking are covered by that particular Advantage Plan at a reasonable cost.

Changes To The Network

Since Medicare Advantage Plans incentivize individuals to obtain care from “in-network” service providers, it’s important to know that the doctors, hospitals, and prescription drug coverage can change each year. This is less common with Medigap Plans because the doctor or hospital would have to stop accepting Medicare. The coverage for Medicare plans runs from January 1st – December 31st. The insurance company is required to issue you an “Annual Notice of Change” which summarizes any changes to the plans cost or coverage for the upcoming calendar year.

The insurance company will typically send you these notices prior to September 30th and if you find that your doctors or prescription drugs are no longer covered by the plan or covered at a higher rate, you will have the opportunity to change the type of Advantage Plan that you have during the open enrollment period which lasts from October 15th – December 7th each year.

Thus, Medicare Advantage plans tend to require more ongoing monitoring compared to Medicare Supplemental Plans.

Additional Benefits

Medicare Advantage plans sometimes offer additional benefits that Medicare Supplemental Plans do not, such as reimbursement for gym memberships, vision coverage, and dental coverage. These benefits will vary based on the plan and the insurance company that you select.

Maximum Out of Pocket Limits

As mentioned earlier, one of the largest issues with Original Medicare without Medicare Insurance is there is no maximum out of the pocket limits. If you have a major health event, the cost to you can keep stacking up. Medicare Advantage Plans fix that problem because by law they are required to have maximum out of pocket limits. Once you hit that threshold in a given calendar year, you have no more out of pocket costs. The maximum out of pockets limits vary by provider and by plan but Medicare sets a maximum threshold for these amounts which is $6,700 for in-network services. Notice it only applies to in-network services. If you go outside of the carriers network, there may be no maximum out of pocket protection depending on the plan that you choose.

Most Medigap plans do not have maximum out of the pocket thresholds but given the level of protection that most Medigap plans provide, it’s rare that policy holders have large out of pocket expenses.

New York & Connecticut Residents

When it comes to selecting the right type of Medicare Plan for yourself, residents of New York and Connecticut have an added advantage. For most states, if you choose a Medicare Advantage plan you may not have the option to return to Medicare with a Medigap Plan if your health needs change down the road. Most states allow the insurance companies to conduct medical underwriting if you apply for Medicare Supplemental insurance after the initial enrollment period and they can deny you coverage or charge a ridiculously high premium.

In New York and Connecticut, the insurance laws allow you to change back and forth between Medicare Supplemental Plans and Medicare Advantage Plan as of the first of each calendar year. There are even special programs in New York, that if an individual qualifies for based on income, they are allowed to switch mid-year.

While this is a nice option to have, the ability to switch back and forth between the two types of Medicare plans, also makes Medicare Supplemental Plans more expensive in New York and Connecticut. Individuals in those states can elect the lower cost, lower coverage, Medicare Advantage plans, and if their health needs change they know they can automatically switch back to a Medicare Supplemental Plan that provides them with more comprehensive coverage with a lower overall out of pocket cost.

The Plan That Is Right For You

As you can clearly see there are a lot of variables that come into play when trying to determine whether to select a Medicare Supplemental Plan or Medicare Advantage Plan in retirement; it’s a case by case decision. For clients that live in New York, that are in good health, taking very few prescription drugs, a Medicare Advantage plan maybe the right fit for them. For clients that plan to travel in retirement, have two houses, like the flexibility of seeing any specialist that they want, or clients that are in fair to poor health, a Medicare Supplemental Plan may be a better fit.

Undoubtedly if you live outside of New York or Connecticut the decision is even more difficult knowing that people are living longer, as you age your health care needs become greater, and you may only have one shot at obtaining a Medicare Supplemental Plan

No Cost To Work With Us

As independent Medicare brokers we are here to help you navigate the Medicare enrollment process and to obtain the Medicare insurance plan that is right for you. Our goal is to make the process easy, make sure all of your doctors and prescription drugs are covered by your plan, select a plan that meets your budget, and provides you with ongoing support.

The best part is it costs you nothing to work with us. If Insurance Company ABC is offering a Medicare Advantage that cost $0 per month, it’s going to be $0 per month whether you go directly to the insurance company or work with us as your independent broker. As a Medicare broker, we are compensated by the insurance company that issues you the insurance policy and that cost is not passed on to you.

Feel free to contact us at 518-477-6686 for a free consult or we would be more than happy to run quotes for you.

Other Medicare Articles

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

$5,000 Penalty Free Distribution From An IRA or 401(k) After The Birth Of A Child or Adoption

New parents have even more to be excited about in 2020. On December 19, 2019, Congress passed the SECURE Act, which now allows parents to withdraw up to $5,000 out of their IRA’s or 401(k) plans following the birth of their child

New parents have even more to be excited about in 2020. On December 19, 2019, Congress passed the SECURE Act, which now allows parents to withdraw up to $5,000 out of their IRA’s or 401(k) plans following the birth of their child without having to pay the 10% early withdrawal penalty. To take advantage of this new distribution option, parents will need to know:

Effective date of the change

Taxes on the distribution

Deadline to make the withdrawal

Is it $5,000 for each parent or a total per couple?

Do all 401(k) plans allow these types of distributions?

Is it a per child or is it a one-time event?

Can you repay the money to your retirement account at a future date?

How does it apply to adoptions?

This article will provide you with answers to these questions and also provide families with advanced tax strategies to reduce the tax impact of these distributions.

SECURE Act

The SECURE Act was passed in December 2019 and Section 113 of the Act added a new exception to the 10% early withdrawal penalty for taking distributions from retirement accounts called the “Qualified Birth or Adoption Distribution.”

Prior to the SECURE Act, if you were under the age of 59½ and you distributed pre-tax money from an IRA or 401(k) plan, in addition to having to pay ordinary income tax on the amount distributed, you were also hit with a 10% early withdrawal penalty from the IRS. The IRS prior to the SECURE Act did have a list of exceptions to the 10% penalty but having a child or adopting a child was not on that list. Now it is.

How It Works

After the birth of a child, a parent is allowed to distribute up to $5,000 out of either an IRA or a 401(k) plan. Notice the word “after”. You are not allowed to withdraw the money prior to the child being born. New parents have up to 12 months following the date of birth to process the distribution from their retirement accounts and avoid the 10% early withdrawal penalty.

Example: Jim and Sarah have their first child on May 5, 2020. To help with some of the additional costs of a larger family, Jim decides to withdraw $5,000 out of his rollover IRA. Jim’s window to process that distribution is between May 5, 2020 – May 4, 2021.

The Tax Hit

Assuming Jim is 30 years old, he would avoid having to pay the 10% early withdrawal penalty on the $5,000 but that $5,000 still represents taxable income to him in the year that the distribution takes place. If Jim and Sarah live in New York and make a combined income of $100,000, in 2020, that $5,000 would be subject to federal income tax of 22% and state income tax of 6.45%, resulting in a tax liability of $1,423.

Luckily under the current tax laws, there is a $2,000 federal tax credit for dependent children under the age of 17, which would more than offset the total 22% in fed tax liability ($1,100) created by the $5,000 distribution from the IRA. Essentially reducing the tax bill to $323 which is just the state tax portion.

TAX NOTE: While the $2,000 fed tax credit can be used to offset the federal tax liability in this example, if the IRA distribution was not taken, that $2,000 would have reduced Jim & Sarah’s existing tax liability dollar for dollar.

For more info on the “The Child Tax Credit” see our article: More Taxpayers Will Qualify For The Child Tax Credit

$5,000 Per Parent

But it gets better. The $5,000 limit is available to EACH parent meaning if both parents have a pre-tax IRA or 401(k) plan, they can each distribute up to $5,000 from their retirement accounts within 12 months following the birth of their child and avoid the 10% early withdrawal penalty.

ADVANCED TAX STRATEGY: If both parents are planning to distribute the full $5,000 out of their retirement accounts and they are in a medium to high tax bracket, it may make sense to split the two distributions between separate tax years.

Example: Scott and Linda have a child on October 3, 2020 and they both plan to take the full $5,000 out of their IRA accounts. If they are in a 24% federal tax bracket and they process both distributions prior to December 31, 2020, the full $10,000 would be taxable to them in 2020. This would create a $2,400 federal tax liability. Since this amount is over the $2,000 child tax credit, they will have to be prepared to pay the additional $400 federal income tax when they file their taxes since it was not fully offset by the $2,000 tax credit.

In addition, by taking the full $10,000 in the same tax year, Scott and Linda also run the risk of making that income subject to a higher tax rate. If instead, Linda processes her distribution in November 2020 and Scott waits until January 2021 to process his $5,000 IRA distribution, it could result in a lower tax liability and less out of pocket expense come tax time.

Remember, you have 12 months following the date of birth to process the distribution and qualify for the 10% early withdrawal exemption.

$5,000 For Each Child

This 10% early withdrawal exemption is available for each child that is born. It does not have a lifetime limit.

Example: Building on the Scott and Linda example above, they have their first child October 2020, and both of them process a $5,000 distribution from their IRA’s avoiding the 10% penalty. They then have their second child in November 2021. Both Scott and Linda would be eligible to withdraw another $5,000 each out of their IRA or 401(k) within 12 months after the birth of their second child and again avoid having to pay the 10% early withdrawal penalty.

IRS Audit

One question that we have received is “Do I need to keep track of what I spend the money on in case I’m ever audited by the IRS?” The short answer is “No”. The new law does not require you to keep track of what the money was spent on. The birth of your child is the “qualifying event” which makes you eligible to distribute the $5,000 penalty free.

Not All 401(k) Plans Will Allow These Distributions

Starting in 2020, this 10% early withdrawal exception will apply to all pre-tax IRA accounts but it does not automatically apply to all 401(k), 403(b), or other types of qualified employer sponsored retirement plans.

While the SECURE Act “allows” these penalty free distributions to be made, companies can decide whether or not they want to provide this special distribution option to their employees. For employers that have existing 401(k) or 403(b) plans, if they want to allow these penalty free distributions to employees after the birth of a child, they will need to contact their third-party administrator and request that the plan be amended.

For companies that intend to add this distribution option to their plan, they may need to be patient with the timeline for the change. 401(k) providers will most likely need to update their distribution forms, tax codes on their 1099R forms, and update their recordkeeping system to accommodate this new type of distribution.

Ability To Repay The Distribution

The new law also offers parents the option to repay the amounts to their retirement account that were distributed due to a qualified birth or adoption. The repayment of the amounts previously distributed from the IRA or 401(k) would be in addition to the annual contribution limits. There is not a lot of clarity at this point as to how these “repayments” will work so we will have to wait for future guidance from the IRS on this feature.

Adoptions

The 10% early withdrawal exception also applies to adoptions. An individual is allowed to take a distribution from their retirement account up to $5,000 for any children under the age of 18 that is adopted. Similar to the timing rules of the birth of a child, the distribution must take place AFTER the adoption is finalized, but within 12 months following that date. Any money distributed from retirement accounts prior to the adoption date will be subject to the 10% penalty for individuals under the age of 59½.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

IRA RMD Start Date Changed From Age 70 ½ to Age 72 Starting In 2020

The SECURE Act was passed into law on December 19, 2019 and with it came some big changes to the required minimum distribution (“RMD”) requirements from IRA’s and retirement plans. Prior to December 31, 2019, individuals

The SECURE Act was passed into law on December 19, 2019 and with it came some big changes to the required minimum distribution (“RMD”) requirements from IRA’s and retirement plans. Prior to December 31, 2019, individuals were required to begin taking mandatory distributions from their IRA’s, 401(k), 403(b), and other pre-tax retirement accounts starting in the year that they turned age 70 ½. The SECURE Act delayed the start date of the RMD’s to age 72. But like most new laws, it’s not just a simple and straightforward change. In this article we will review:

Old Rules vs New Rules surrounding RMD’s

New rules surrounding Qualified Charitable Distributions from IRA’s

Who is still subject to the 70 ½ RMD requirement?

The April 1st delay rule

Required Minimum Distributions

A quick background on required minimum distributions, also referred to as RMD’s. Prior to the SECURE Act, when you turned age 70 ½ the IRS required you to take small distributions from your pre-tax IRA’s and retirement accounts each year. For individuals that did not need the money, they did not have a choice. They were forced to withdraw the money out of their retirement accounts and pay tax on the distributions. Under the current life expectancy tables, in the year that you turned age 70 ½ you were required to take a distribution equaling 3.6% of the account balance as of the previous year end.

With the passing of the SECURE Act, the start age from these RMD’s is now delayed until the calendar year that an individual turns age 72.

OLD RULE: Age 70 ½ RMD Begin Date

NEW RULE: Age 72 RMD Begin Date

Still Subject To The Old 70 ½ Rule

If you turned age 70 ½ prior to December 31, 2019, you will still be required to take RMD’s from your retirement accounts under the old 70 ½ RMD rule. You are not able to delay the RMD’s until age 72.

Example: Sarah was born May 15, 1949. She turned 70 on May 15, 2019 making her age 70 ½ on November 15, 2019. Even though she technically could have delayed her first RMD to April 1, 2020, she will not be able to avoid taking the RMD’s for 2019 and 2020 even though she will be under that age of 72 during those tax years.

Here is a quick date of birth reference to determine if you will be subject to the old 70 ½ start date or the new age 72 start date:

Date of Birth Prior to July 1, 1949: Subject to Age 70 ½ start date for RMD

Date of Birth On or After July 1, 1949: Subject to Age 72 start date for RMD

April 1 Exception Retained

OLD RULE: In the the year that an individual turned age 70 ½, they had the option to delay their first RMD until April 1st of the following year. This is a tax strategy that individuals engaged in to push that additional taxable income associated with the RMD into the next tax year. However, in year 2, the individual was then required to take two RMD’s in that calendar year: One prior to April 1st for the previous tax year and the second prior to December 31st for the current tax year.