Do I Make Too Much To Qualify For Financial Aid?

If you have children that are college-bound at some point you will begin the painful process of calculating how much college will cost for both you and them. However, you might be less worried about the financial aspects of your child going to college after viewing some of the Bloomsburg student apartments for rent on the market at the moment.

If you have children that are college-bound at some point you will begin the painful process of calculating how much college will cost for both you and them. However, you might be less worried about the financial aspects of your child going to college after viewing some of the Bloomsburg student apartments for rent on the market at the moment. Anyway, I have heard the statement, "well they will just have to take loans" but what parents don't realize is loans are a form of financial aid. Loans are not a given. Whether your children plan to attend a public college or private college, both have formulas to determine how much a family is expected to pay out of pocket before you even reach any "financial aid" which includes loans.

College Costs Are Increasing By 6.5% Per Year

The rise in the cost of college has outpaced the inflation rate of most other household costs over the past three decades.

To put this in perspective, if you have a 3 year old child and the cost of tuition / room & board for a state school is currently $25,000 by the time that child turns 17, the cost for one year of tuition / room & board will be $60,372. Multiply that by 4 years for a bachelor's degree: $241,488. Ouch!!! Which leads you to the next question, how much of that $60,372 per year will I have to pay out of pocket?

FAFSA vs CSS Profile Form

Public schools and private school have a different calculation for how much “aid” you qualify for. Public or state schools go by the FAFSA standards. Private schools use the “CSS Profile” form. The FAFSA form is fairly straight forward and is applied universally for state colleges. However, private schools are not required to follow the FAFSA financial aid guidelines which is why they have the separate CSS Profile form. By comparison the CSS profile form requests more financial information.

For example, for couples that are divorced, the FAFSA form only takes into consideration the income and assets of the parent that the child lives with for more than six months out of the year. This excludes the income and assets of the parent that the child does not live with for the majority of the year which could have a positive impact on the financial aid calculation. However, the CSS profile form, for children with divorced parents, requests and takes into consideration the income and assets of both parents regardless of their marital status.

Expected Family Contribution

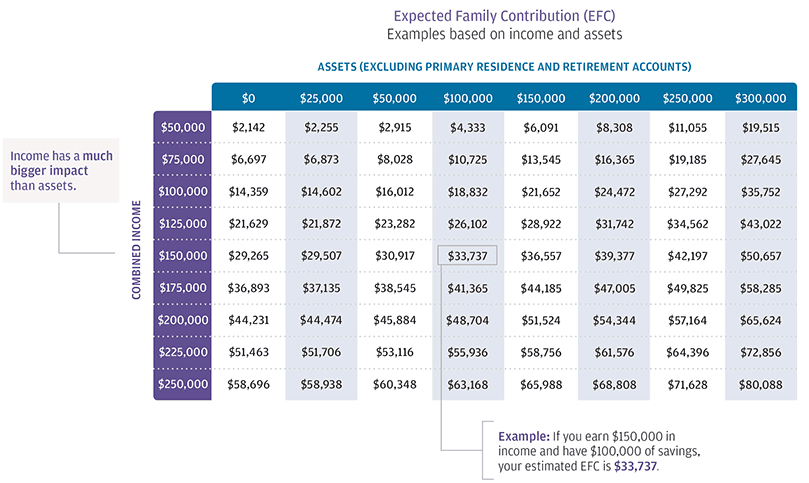

Both the FAFSA and CSS Profile form result in an "Expected Family Contribution" (EFC). That is the amount the family is expected to pay out of pocket for their child's college expense before the financial aid package begins. Below is a EFC award chart based on the following criteria:

FAFSA Criteria

2 Parent Household

1 Child Attending College

1 Child At Home

State of Residence: NY

Oldest Parent: 49 year old

As you can see in the chart, income has the largest impact on the amount of financial aid. If a married couple has $150,000 in AGI but has no assets, their EFC is already $29,265. For example, if tuition / room and board is $25,000 for SUNY Albany that means they would receive no financial aid.

Student Loans Are A Form Of Financial Aid

Most parents don't realize the federal student loans are considered "financial aid". While "grant" money is truly "free money" from the government to pay for college, federal loans make up about 32% of the financial aid packages for the 2016 – 2017 school year. See the chart below:

Start Planning Now

The cost of college is increasing and the amount of financial aid is declining. According to The College Board, between 2010 – 2016, federal financial aid declined by 25% while tuition and fees increased by 13% at four-year public colleges and 12% at private colleges. This unfortunate trend now requires parents to start running estimated EFC calculation when their children are still in elementary school so there is a plan for paying for the college costs not covered by financial aid.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Procedures For Splitting Retirement Accounts In A Divorce

If you are going through a divorce and you or your spouse have retirement accounts, the processes for splitting the retirement accounts will vary depending on what type of retirement accounts are involved.

If you are going through a divorce and you or your spouse have retirement accounts, the processes for splitting the retirement accounts will vary depending on what type of retirement accounts are involved.

401(k) & 403(b) Plan

The first category of retirement plans are called ?employer sponsored qualified plans?. This category includes 401(k) plans, 403(b) plans, 457 plans, and profit sharing plans. Once you and your spouse have agreed upon the split amount of the retirement plans, one of the attorneys will draft Domestic Relations Order, otherwise known as a QDRO. This document provides instruction to the plans TPA (third party administrator) as to how and when to split the retirement assets between the ex-spouses. Here is the procedures from start to finish:

One attorney drafts the Domestic Relations Order (?DRO?)

The attorney for the other spouse reviews and approved the DRO

The spouse covered by the retirement plan submits it to the TPA for review

The TPA will review the document and respond with changes that need to be made (if any)

Attorneys submit the DRO to the judge for signing

Once the judge has signed the DRO, its now considered a Qualified Domestic Relations Order (QDRO)

The spouse covered by the retirement plan submits the QDRO to the plans TPA for processing

The TPA splits the retirement account and will often issues distribution forms to the ex-spouse not covered by the plan detailing the distribution options

Step number four is very important. Before the DRO is submitting to the judge for signing, make sure that the TPA, that oversees the plan being split, has had a chance to review the document. Each plan is different and some plans require unique language to be included in the DRO before the retirement account can be split. If the attorneys skip this step, we have seen cases where they go through the entire process, pay the court fees to have the judge sign the QDRO, they submit the QDRO for processing with the TPA, and then the TPA firm rejects the QDRO because it is missing information. The process has to start all over again, wasting time and money.

Pension Plans

Like employer sponsored retirement plans, pension plans are split through the drafting of a Qualified Domestic Relations Order (QDRO). However, unlike 401(k) and 403(b) plans that usually provide the ex-spouse with distribution options as soon as the QDRO is processed, with pension plans the benefit is typically delayed until the spouse covered by the plan is eligible to begin receiving pension payments. A word of caution, pension plans are tricky. There are a lot more issues to address in a QDRO document compared to a 401(k) plan. 401(k) plans are easy. With a 401(k) plan you have a current balance that can be split immediately. Pension plan are a promise to pay a future benefit and a lot can happen between now and the age that the covered spouse begins to collect pension payments. Pension plans can terminate, be frozen, employers can go bankrupt, or the spouse covered by the retirement plan can continue to work past the retirement date.

I would like to specifically address the final option in the paragraph above. In pension plans, typically the ex-spouse is not entitled to a benefit until the spouse covered by the pension plan is eligible to receive benefits. While the pension plan may state that the employee can retire at 65 and start collecting their pension, that does not mean that they will with 100% certainty. We have seen cases where the ex-husband could have retired at age 65 and started collecting his pension benefit but just to prevent his ex-wife from collecting on his benefit decided to delay retirement which in turn delayed the pension payments to his ex-wife. The ex-wife had included those pension payments in her retirement planning but had to keep working because the ex-husband delayed the benefit. Attorneys will often put language in a QDRO that state that whether the employee retires or not, at a given age, the ex-spouse is entitled to turn on her portion of the pension benefit. The attorneys have to work closely with the TPA of the pension plan to make sure the language in the QDRO is exactly what it need to be to reserve that benefit for the ex-spouse.

IRA (Individual Retirement Accounts)

IRA? are usually the easiest of the three categories to split because they do not require a Qualified Domestic Relations Order to separate the accounts. However, each IRA provider may have different documentation requirements to split the IRA accounts. The account owner should reach out to their investment advisor or the custodian of their IRA accounts to determine what documents are needed to split the account. Sometimes it is as easy as a letter of instruction signed by the owner of the IRA detailing the amount of the split and a copy of the signed divorce agreement. While these accounts are easier to split, make sure the procedures set forth by the IRA custodians are followed otherwise it could result in adverse tax consequences and/or early withdrawal penalties.

About Michael??...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The House Passed The Tax Bill. What's The Next Step?

Last night the house passed the Tax Cut & Jobs Act Bill with ease. Next up is the Senate vote. It’s important to understand the House and the Senate are voting on two different tax reform bills. Below is a chart illustrating the main differences between the House version and the Senate version of the tax reform bill.

Last night the house passed the Tax Cut & Jobs Act Bill with ease. Next up is the Senate vote. It’s important to understand the House and the Senate are voting on two different tax reform bills. Below is a chart illustrating the main differences between the House version and the Senate version of the tax reform bill.

As you can see, there are a number of dramatic differences between the two bills. The easy part was getting the House to approve their version because the Republican Party own 239 of the 435 seats. In other words, they own 55% of the votes.

The Senate Vote

Next, the Senate will put their tax reform bill to a vote. The vote is expected to take place during the week of Thanksgiving. However, in the Senate , which the Republican have the majority, they only have 52 of the 100 seats. In this case, they would need at least 50 “Yes” votes to get the bill approved in the senate. It’s 50, not 51 votes, because in the event of a “tie”, the Vice President gets a vote to break the tie and he is likely to vote “Yes” to keep tax reform moving along.

Reconciliation Process

Once the House and Senate have approved their own separate tax bills, they will then have to begin the reconciliation process of blending the two bills together. This will be the difficult part. The two tax bills are dramatically different so there will be a fair amount of grappling between the House and the Senate committees as to which features stay and which features get tossed out or adjusted as part of the final tax bill. In the end, the final tax reform bill cannot add more than $1.5 Trillion to the national debt over the next 10 years. Otherwise, the bill would need to return to the Senate and would require “60” votes to approve the bill. There is a slim too no chance of that happening.

Tax Reform by Christmas

President Trump wants the bill on his desk to sign into law before Christmas. While it seems likely that the Senate will pass their tax bill next week, the battle will take place in the reconciliation process that will begin immediately after that vote. It’s a tall order to fill given that there are only six weeks left in the year and how different the two bills are in their current form. However, don’t underestimate how badly the Republican party wants to put a run on the scoreboard before the end of the year. If they get tax reform through in the last week of the year, it’s an understatement to say that it will be an intense final week of December for year-end tax planning. Stay tuned for more………

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Do Trusts Expire?

Do trusts have an expiration date after the death of the grantor? For most states, the answer is “Yes”. New York is one of those states that have adopted “The Rule Against Perpetuities” which requires all of the assets to be distributed from the trust by a specified date.

Do trusts have an expiration date after the death of the grantor? For most states, the answer is “Yes”. New York is one of those states that have adopted “The Rule Against Perpetuities” which requires all of the assets to be distributed from the trust by a specified date.

The Rule Against Perpetuities

For most states, the trust assets have to be distributed no later than the “lifetime of those then living plus 21 years.” In other words, the trust asset must be distributed 21 years after the death of the youngest beneficiary listed in the trust document. For example, if I setup a trust with my children listed as beneficiaries, after my passing the trust assets would have to be distributed no later than 21 years following the death of my youngest child.

Per Stirpes Beneficiaries

Some trust documents have the children listed as beneficiaries “per stirpes”. This mean that if a child is no longer alive their share of the trust passes to their heirs. In many cases their children. If the beneficiaries are listed in the trust document as per stirpes beneficiaries then you may be able to make the argument that the “youngest beneficiary” is really the grandchildren not the children which will allow the trust to retain the assets for a longer period of time. Typically trusts do not allow the perpetuity rule to extend beyond their grandchildren.

Consult An Estate Attorney

Trust can be tricky and the language in a trust document is not always black and white, so it’s highly recommended that you consult with an estate attorney that is familiar with the estate laws for you state of residence and can review the terms of the trust document.DISCLOSURE: The information listed above is not legal advice. For legal advice, please consult your attorney.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Divorce: Make Sure You Address The College Savings Accounts

The most common types of college savings accounts are 529 accounts, UGMA, and UTMA accounts. When getting divorce it’s very important to understand who the actual owner is of these accounts and who has legal rights to access the money in those accounts. Not addressing these accounts in the divorce agreement can lead to dire consequences

The most common types of college savings accounts are 529 accounts, UGMA, and UTMA accounts. When getting divorce it’s very important to understand who the actual owner is of these accounts and who has legal rights to access the money in those accounts. Not addressing these accounts in the divorce agreement can lead to dire consequences for your children if your ex-spouse drains the college savings accounts for their own personal expenses.

UGMA or UTMA Accounts

The owner of these types of accounts is the child. However, since a child is a minor there is a custodian assigned to the account, typically a parent, that oversees the assets until the child reaches age 21. The custodian has control over when withdraws are made as long as it could be proven that the withdrawals being made a directly benefiting the child. This can include school clothes, buying them a car at age 16, or buying them a computer. It’s important to understand that withdraws can be made for purposes other than paying for college which might be what the account was intended for. You typically want to have your attorney include language in the divorce agreement that addresses what these account can and can not be used for. Once the child reaches the age of majority, age 21, the custodian is removed, and the child has full control over the account.

529 accounts

When it comes to divorce, pay close attention to 529 accounts. Unlike a UGMA or UTMA accounts that are required to be used for the benefit of the child, a 529 account does not have this requirement. The owner of the account has complete control over the 529 account even though the child is listed as the beneficiary. We have seen instances where a couple gets divorced and they wrongly assume that the 529 account owned by one of the spouses has to be used for college. As soon as the divorce is finalized, the ex-spouse that owns the account then drains the 529 account and uses the cash in the account to pay legal fees or other personal expenses. If the divorce agreement did not speak to the use of the 529 account, there’s very little you can do since it’s technically considered an asset of the parent.

Divorce agreements can address these college saving accounts in a number of way. For example, it could state that the full balance has to be used for college before out-of-pocket expenses are incurred by either parent. It could state a fixed dollar amount that has to be withdrawn out of the 529 account each year with any additional expenses being split between the parents. There is no single correct way to address the withdraw strategies for these college savings accounts. It is really dependent on the financial circumstances of you and your ex spouse and the plan for paying for college for your children.

With 529 accounts there is also the additional issue of “what if the child decides not to go to college?” The divorce agreement should address what happens to that 529 account. Is the account balance move to a younger sibling? Is the balance distributed to the child at a certain age? Or will the assets be distributed 50-50 between the two parents?

Is for these reason that you should make sure that your divorce agreement includes specific language that applies to the use of the college savings account for your children

For more information on college savings account, click on the hyperlink below:

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Common Mistakes With Grandparent Owned 529 Accounts

529 college savings accounts owned by the grandparents can be in a valuable benefit for a college bound grandchild. Since the accounts are owned by the grandparents it does not show up anywhere for financial aid purposes which allows the student to qualify for more financial aid. However, even though 529 account owned by the grandparents are

529 Accounts

529 college savings accounts owned by the grandparents can be in a valuable benefit for a college bound grandchild. Since the accounts are owned by the grandparents it does not show up anywhere for financial aid purposes which allows the student to qualify for more financial aid. However, even though 529 account owned by the grandparents are not considered an asset when applying for financial aid, distributions from 529 accounts on behalf of the beneficiary are considered income of the account beneficiary in the year that the disbursement occurs from 529 account.

For example, assume the grandchild receives $20,000 in financial aid in their freshman year but there is still a $10,000 balance due to attend college. The grandparents distribute $10,000 from the 529 account that they own for the benefit of the grandchild. When the parents apply for the financial aid package in the student’s Junior year, they $10,000 529 disbursement that took place in the freshman year will need to be reports as income of the student on the FASFA application. That could completely destroy their financial aid package since 50% of the student’s income counts against the financial aid package.

Remember, the FASFA application now looks back two years instead of one for income purposes. To avoid this situation, the grandparents should not distribute any money from the grandchild’s 529 account until the spring semester of their sophomore year.

Don’t setup UGMA or UTMA accounts

UGMA a stands for Uniform Gift to Minors Act. UTMA stands for Uniform Transfer to Minors Act. Different names but the accounts work in a similar fashion.

If there is a chance that the student may qualify for financial support from either a public or private institution, these accounts can significantly reduce the financial award. The types of accounts are considered an asset of the child not the grandparent. When an asset is titled in the child’s name, approximately 20% of the account balance will count against their financial aid package. For this reason, it is often more beneficial to establish a 529 account which is considered an asset of the grandparent and can be invisible for financial aid purposes.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

M&A Activity: Make Sure You Address The Seller’s 401(k) Plan

Buying a company is an exciting experience. However, many companies during a merger or acquisition fail to address the issues surrounding the seller’s retirement plan which can come back to haunt the buyer in a big way. I completely understand why this happens. Purchase price, valuations, tax issues, terms, holdbacks, and new employment

Buying a company is an exciting experience. However, many companies during a merger or acquisition fail to address the issues surrounding the seller’s retirement plan which can come back to haunt the buyer in a big way. I completely understand why this happens. Purchase price, valuations, tax issues, terms, holdbacks, and new employment agreements tend to dominate the conversations throughout the business transaction. But lurking in the dark, below these main areas of focus, lives the seller’s 401(k) plan. Welcome to the land of unintended consequences where unexpected liabilities, big dollar outlays, and transition issues live.

Asset Sale or Stock Sale

Whether the transaction is a stock sale or asset sale will greatly influence the series of decisions that the buyer will need to make regarding the seller’s 401(k) plan. In an asset sale, it is common that employees of the seller’s company are terminated from employment and subsequently “rehired” by the buyer’s company. With asset sales, as part of the purchase agreement, the seller will often times be required to terminate their retirement plan prior to the closing date.

Terminating the seller’s plan prior to the closing date has a few advantages from both the buyer’s standpoint and from the standpoint of the seller’s employees. Here are the advantages for the buyer:

Advantage 1: The Seller Is Responsible For Terminating Their Plan

From the buyer’s standpoint, it’s much easier and cost effective to have the seller terminate their own plan. The seller is the point of contact at the third party administration firm, they are listed as the trustee, they are the signer for the final 5500, and they typically have a good personal relationship with their service providers. Once the transaction is complete, it can be a headache for the buyer to track down the authorized signers on the seller’s plan to get all of the contact information changed over and allows the buyer’s firm to file the final 5500.

The seller’s “good relationship” with their service providers is key. The seller has to call these companies and let them know that they are losing the plan since the plan is terminating. There are a lot of steps that need to be completed by those 401(k) service providers after the closing date of the transaction. If they are dealing with the seller, their “client”, they may be more helpful and accommodating in working through the termination process even though they losing the business. If they get a random call for the “new contact” for the plan, you risk getting put at the bottom of the pile

Part of the termination process involves getting all of the participant balances out of the plan. This includes terminated employees of the seller’s company that may be difficult for the buyer to get in contact with. It’s typically easier for the seller to coordinate the distribution efforts for the terminated plan.

Advantage 2: The Buyer Does Not Inherit Liability Issues From The Seller’s Plan

This is typically the main reason why the buyer will require the seller to terminate their plan prior to the closing date. Employer sponsored retirement plans have a lot of moving parts. If you take over a seller’s 401(k) plan to make the transition “easier”, you run the risk of inheriting all of the compliance issues associated with their plan. Maybe they forgot to file a 5500 a few years ago, maybe their TPA made a mistake on their year-end testing last year, or maybe they neglected to issues a required notice to their employees knowing that they were going to be selling the company that year. By having the seller terminate their plan prior to the closing date, the buyer can better protect themselves from unexpected liabilities that could arise down the road from the seller’s 401(k) plan.

Now, let’s transition the conversation over to the advantages for the seller’s employees.

Advantage 1: Distribution Options

A common goal of the successor company is to make the transition for the seller’s employees as positive as possible right out of the gate. Remember this rule: “People like options”. Having the seller terminate their retirement plan prior to the closing date of the transactions gives their employees some options. A plan termination is a “distributable event” meaning the employees have control over what they would like to do with their balance in the seller’s 401(k) plan. This is also true for the employees that are “rehired” by the buyer. The employees have the option to:

Rollover their 401(k) balance in the buyer’s plan (if eligible)

Rollover their 401(k) balance into a rollover IRA

Take a cash distribution

Some combination of options 1, 2, and 3

The employees retain the power of choice.

If instead of terminating the seller’s plan, what happens if the buyer decides to “merge” the seller’s plan in their 401(k) plan? With plan mergers, the employees lose all of the distribution options listed above. Since there was not a plan termination, the employees are forced to move their balances into the buyer’s plan.

Advantage 2: Credit For Service With The Seller’s Company

In many acquisitions, again to keep the new employees happy, the buyer will allow the incoming employee to use their years of service with the seller’s company toward the eligibility requirements in the buyer’s plan. This prevents the seller’s employees from coming in and having to satisfy the plan’s eligibility requirements as if they were a new employee without any prior service. If the plan is terminated prior to the closing date of the transaction, the buyer can allow this by making an amendment to their 401(k) plan.

If the plan terminates after the closing date of the transaction, the plan technically belonged to the buyer when the plan terminated. There is an ERISA rule, called the “successor plan rule”, that states when an employee is covered by a 401(k) plan and the plan terminates, that employee cannot be covered by another 401(k) plan sponsored by the same employer for a period of 12 months following the date of the plan termination. If it was the buyer’s intent to allow the seller’s employees to use their years of service with the selling company for purposes of satisfy the eligibility requirement in the buyer’s plan, you now have a big issue. Those employees are excluded from participating in the buyer’s plan for a year. This situation can be a speed bump for building rapport with the seller’s employees.

Loan Issue

If a company allows 401(k) loans and the plan terminates, it puts the employee in a very bad situation. If the employee is unable to come up with the cash to payoff their outstanding loan balance in full, they get taxed and possibly penalized on their outstanding loan balance in the plan.

Example: Jill takes a $30,000 loan from her 401(k) plan in May 2017. In August 2017, her company Tough Love Inc., announces that it has sold the company to a private equity firm and it will be immediately terminating the plan. Jill is 40 years old and has a $28,000 outstanding loan balance in the plan. When the plan terminates, the loan will be processed as an early distribution, not eligible for rollover, and she will have to pay income tax and the 10% early withdrawal penalty on the $28,000 outstanding loan balance. Ouch!!!

From the seller’s standpoint, to soften the tax hit, we have seen companies provide employees with a severance package or final bonus to offset some of the tax hit from the loan distribution.

From the buyer’s standpoint, you can amend the plan to allow employees of the seller’s company to rollover their outstanding 401(k) loan balance into your plan. While this seems like a great option, proceed with extreme caution. These “loan rollovers” get complicated very quickly. There is usually a window of time where the employee’s money is moving over from seller’s 401(k) plan over to the buyer’s 401(k) plan, and during that time period a loan payment may be missed. This now becomes a compliance issue for the buyer’s plan because you have to work with the employee to make up those missed loan payments. Otherwise the loan could go into default.

Example, Jill has her outstanding loan and the buyer amends the plan to allow the direct rollover of outstanding loan balances in the seller’s plan. Payroll stopped from the seller’s company in August, so no loan payments have been made, but the seller’s 401(k) provider did not process the direct rollover until December. When the loan balance rolls over, if the loan is not “current” as of the quarter end, the buyer’s plan will need to default her loan.

Our advice, handle this outstanding 401(k) loan issue with care. It can have a large negative impact on the employees. If an employee owes $10,000 to the IRS in taxes and penalties due to a forced loan distribution, they may bring that stress to work with them.

Stock Sale

In a stock sale, the employees do not terminate and then get rehired like in an asset sale. It’s a “transfer of ownership” as opposed to “a sale followed by a purchase”. In an asset sale, employees go to sleep one night employed by Company A and then wake up the next morning employed by Company B. In a stock sale, employees go to sleep employed by Company A, they wake up in the morning still employed by Company A, but ownership of Company A has been transferred to someone else.

With a stock sale, the seller’s plan typically merges into the buyer’s plan, assuming there is enough ownership to make them a “controlled group”. If there are multiple buyers, the buyers should consult with the TPA of their retirement plans or an ERISA attorney to determine if a controlled group will exist after the transaction is completed. If there is not enough common ownership to constitute a “controlled group”, the buyer can decide whether to continue to maintain the seller’s 401(k) plan as a standalone plan or create a multiple employer plan. The basic definition of a “controlled group” is an entity or group of individuals that own 80% or more of another company.

Stock Sales: Do Your Due Diligence!!!

In a stock sale, since the buyer will either be merging the seller’s plan into their own or continuing to maintain the seller’s plan as a standalone, you are inheriting any and all compliance issues associated with that plan. The seller’s issues become the buyer’s issues the day of the closing. The buyer should have an ERISA attorney that performs a detailed information request and due diligence on the seller’s 401(k) plan prior the closing date.

Seller Uses A PEO

Last issue. If the selling company uses a Professional Employer Organization (PEO) for their 401(k) services and the transaction is going to be a stock sale, make sure you get all of the information that you need to complete a mid-year valuation or the merged 5500 for the year PRIOR to the closing date. We have found that it’s very difficult to get information from PEO firms after the acquisition has been completed.

The Transition Rule

There is some relief provided by ERISA for mergers and acquisitions. If a control group exists, you have until the end of the year following the year of the acquisition to test the plans together. This is called the “transition rule”. However, if the buyer makes “significant” changes to the seller’s plan during the transition period, that may void the ability to delay combined testing. Unfortunately, there is not clear guidance as to what is considered a “significant change” so the buyer should consult with their TPA firm or ERISA attorney before making any changes to their own plan or the seller’s plan that could impact the rights, benefits, or features available to the plan participants.

Horror Stories

There are so many real life horror stories out there involving companies that go through the acquisition process without conducting the proper due diligence and transition planning with regard to the seller’s retirement plan. It never ends well!! As the buyer, it’s worth the time and the money to make sure your team of advisors have adequately addressed any issues surrounding the seller’s retirement plan prior to the closing date.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Much Should I Budget For Health Care Costs In Retirement?

The number is higher than you think. When you total up the deductibles and premiums for Medicare part A, B, and D, that alone can cost a married couple $7,000 per year. We look at that figure as the baseline number. That $7,000 does not account for the additional costs associated with co-insurance, co-pays, dental costs, or Medigap insurance

The number is higher than you think. When you total up the deductibles and premiums for Medicare part A, B, and D, that alone can cost a married couple $7,000 per year. We look at that figure as the baseline number. That $7,000 does not account for the additional costs associated with co-insurance, co-pays, dental costs, or Medigap insurance premiums which can quickly increase the overall cost to $10,000+ per year.

Tough to believe? Allow me to walk you through the numbers for a married couple.

Medicare Part A: $2,632 Per Year

Part A covers inpatient hospital stays, skilled nursing facility stays, some home health visits, and hospice care. While Part A does not have an annual premium, it does have an annual deductible for each spouse. That deductible for 2017 is $1,316 per person.

Medicare Part B: $3,582

Part B covers physician visits, outpatient services, preventive services, and some home health visits. The standard monthly premium is $134 per person but it could be higher depending on your income level in retirement. There is also a deductible of $183 per year for each spouse.

Medicare Part D: $816

Part D covers outpatient prescription drugs through private plans that contract with Medicare. Enrollment in Part D is voluntary. The benefit helps pay for enrollees’ drug costs after a deductible is met (where applicable), and offers catastrophic coverage for very high drug costs. Part D coverage is actually provided by private health insurance companies. The premium varies based on your income and the types of prescriptions that you are taking. The national average in 2017 for Part D premiums is $34 per person.

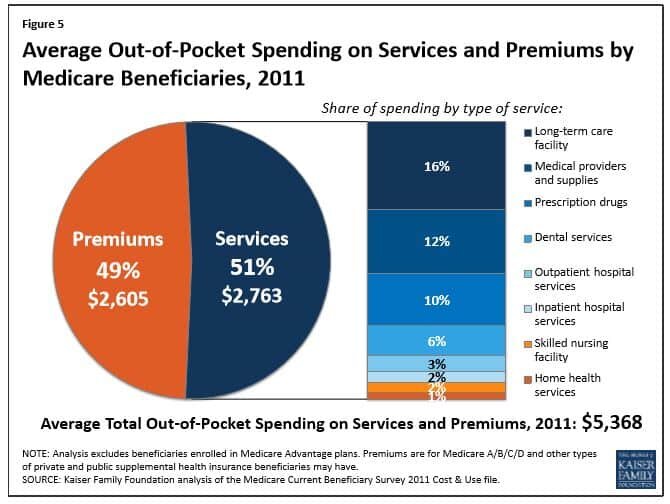

If you total up just these three items, you reach $7,030 in premiums and deductibles for the year. Then you start adding in dental cost, Medigap insurance premiums, co-insurance for Medicare benefits, and it quickly gets a married couple over that $10,000 threshold in health and dental cost each year. Medicare published a report that in 2011, Medicare beneficiaries spent $5,368 out of their own pockets for health care spending, on average. See the table below.

Start Planning Now

Fidelity Investments published a study that found that the average 65 year old will pay $240,000 in out-of-pocket costs for health care during retirement, not including potential long-term-care costs. While that seems like an extreme number, just take the $10,000 that we used above, multiply that by 20 year in retirement, and you get to $200,000 without taking into consideration inflation and other important variable that will add to the overall cost.

Bottom line, you have to make sure you are budgeting for these expenses in retirement. While most individuals focus on paying off the mortgage prior to retirement, very few are aware that the cost of health care in retirement may be equal to or greater than your mortgage payment. When we are create retirement projections for clients we typically included $10,000 to $15,000 in annual expenses to cover health care cost for a married couple and $5,000 – $7,500 for an individual.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Tax Reform: Your Company May Voluntarily Terminate Your Retirement Plan

Make no mistake, your company retirement plan is at risk if the proposed tax reform is passed. But wait…..didn’t Trump tweet on October 23, 2017 that “there will be NO change to your 401(k)”? He did tweet that, however, while the tax reform might not directly alter the contribution limits to employer sponsored retirement plans, the new tax rates

Make no mistake, your company retirement plan is at risk if the proposed tax reform is passed. But wait…..didn’t Trump tweet on October 23, 2017 that “there will be NO change to your 401(k)”? He did tweet that, however, while the tax reform might not directly alter the contribution limits to employer sponsored retirement plans, the new tax rates will produce a “disincentive” for companies to sponsor and make employer contributions to their plans.

What Are Pre-Tax Contributions Worth?

Remember, the main incentive of making contributions to employer sponsored retirement plans is moving income that would have been taxed now at a higher tax rate into the retirement years, when for most individuals, their income will be lower and that income will be taxed at a lower rate. If you have a business owner or executive that is paying 45% in taxes on the upper end of the income, there is a large incentive for that business owner to sponsor a retirement plan. They can take that income off of the table now and then realize that income in retirement at a lower rate.

This situation also benefits the employees of these companies. Due to non-discrimination rules, if the owner or executives are receiving contributions from the company to their retirement accounts, the company is required to make employer contributions to the rest of the employees to pass testing. This is why safe harbor plans have become so popular in the 401(k) market.

But what happens if the tax reform is passed and the business owners tax rate drops from 45% to 25%? You would have to make the case that when the business owner retires 5+ years from now that their tax rate will be below 25%. That is a very difficult case to make.

An Incentive NOT To Contribute To Retirement Plans

This creates an incentive for business owners NOT to contribution to employer sponsored retirement plans. Just doing the simple math, it would make sense for the business owner to stop contributing to their company sponsored retirement plan, pay tax on the income at a lower rate, and then accumulate those assets in a taxable account. When they withdraw the money from that taxable account in retirement, they will realize most of that income as long term capital gains which are more favorable than ordinary income tax rates.

If the owner is not contributing to the plan, here are the questions they are going to ask themselves:

Why am I paying to sponsor this plan for the company if I’m not using it?

Why make an employer contribution to the plan if I don’t have to?

This does not just impact 401(k) plans. This impacts all employer sponsored retirement plans: Simple IRA’s, SEP IRA’s, Solo(k) Plans, Pension Plans, 457 Plans, etc.

Where Does That Leave Employees?

For these reasons, as soon as tax reform is passed, in a very short time period, you will most likely see companies terminate their retirement plans or at a minimum, lower or stop the employer contributions to the plan. That leaves the employees in a boat, in the middle of the ocean, without a paddle. Without a 401(k) plan, how are employees expected to save enough to retire? They would be forced to use IRA’s which have much lower contribution limits and IRA’s don’t have employer contributions.

Employees all over the United States will become the unintended victim of tax reform. While the tax reform may not specifically place limitations on 401(k) plans, I’m sure they are aware that just by lowering the corporate tax rate from 35% to 20% and allowing all pass through business income to be taxes at a flat 25% tax rate, the pre-tax contributions to retirement plans will automatically go down dramatically by creating an environment that deters high income earners from deferring income into retirement plans. This is a complete bomb in the making for the middle class.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Lower Your Tax Bill By Directing Your Mandatory IRA Distributions To Charity

When you turn 70 1/2, you will have the option to process Qualified Charitable Distributions (QCD) which are distirbution from your pre-tax IRA directly to a chiartable organizaiton. Even though the SECURE Act in 2019 changed the RMD start age from 70 1/2 to age 72, your are still eligible to make these QCDs beginning the calendar year that you

When you turn 70 1/2, you will have the option to process Qualified Charitable Distributions (QCD) which are distribution from your pre-tax IRA directly to a chartable organization. Even though the SECURE Act in 2019 changed the RMD start age from 70 1/2 to age 72, your are still eligible to make these QCDs beginning the calendar year that you turn age 70 1/2. At age 72, you must begin taking required minimum distributions (RMD) from your pre-tax IRA’s and unless you are still working, your employer sponsored retirement plans as well. The IRS forces you to take these distributions whether you need them or not. Why is that? They want to begin collecting income taxes on your tax deferred retirement assets.

Some retirees find themselves in the fortunate situation of not needing this additional income so the RMD’s just create additional tax liability. If you are charitably inclined and would prefer to avoid the additional tax liability, you can make a charitable contribution directly from your IRA and avoid all or a portion of the tax liability generated by the required minimum distribution requirement.

It Does Not Work For 401(k)’s

You can only make “qualified charitable contributions” from an IRA. This option is not available for 401(k), 403(b), and other qualified retirement plans. If you wish to execute this strategy, you would have to process a direct rollover of your FULL 401(k) balance to a rollover IRA and then process the distribution from your IRA to charity.

The reason why I emphases the word “full” for your 401(k) rollover is due to the IRS “aggregation rule”. Assuming that you no longer work for the company that sponsors your 401(k) account, you are age 72 or older, and you have both a 401(k) account and a separate IRA account, you will need to take an RMD from both the 401(k) account and the IRA separately. The IRS allows you to aggregate your IRA’s together for purposes of taking RMD’s. If you have 10 separate IRA’s, you can total up the required distribution amounts for each IRA, and then take that amount from a single IRA account. The IRS does not allow you to aggregate 401(k) accounts for purposes of satisfying your RMD requirement. Thus, if it’s your intention to completely avoid taxes on your RMD requirement, you will have to make sure all of your retirement accounts have been moved into an IRA.

Contributions Must Be Made Directly To Charity

Another important rule. At no point can the IRA distribution ever hit your checking account. To complete the qualified charitable contribution, the money must go directly from your IRA to the charity or not-for-profit organization. Typically this is completed by issuing a “third party check” from your IRA. You provide your IRA provider with payment instructions for the check and the mailing address of the charitable organization. If at any point during this process you take receipt of the distribution from your IRA, the full amount will be taxable to you and the qualified charitable contribution will be void.

Tax Lesson

For many retirees, their income is lower in the retirement years and they have less itemized deductions since the kids are out of the house and the mortgage is paid off. Given this set of circumstances, it may make sense to change from itemizing to taking the standard deduction when preparing your taxes. Charitable contributions are an itemized deduction. Thus, if you take the standard deduction for your taxes, you no longer receive the tax benefit of your contributions to charity. By making IRA distributions directly to a charity, you are able to take the standard deduction but still capture the tax benefit of making a charitable contribution because you avoid tax on an IRA distribution that otherwise would have been taxable income to you.

Example: Church Offering

Instead of putting cash or personal checks in the offering each Sunday, you may consider directing all or a portion of your required minimum distribution from your IRA directly to the church or religious organization. Usually having a conversation with your church or religious organization about your new “offering structure” helps to ease the awkward feeling of passing the offering basket without making a contribution each week.

Example: Annual Contributions To Charity

In this example, let’s assume that each year I typically issue a personal check of $2,000 to my favorite charity, Big Brother Big Sisters, a not-for-profit organization. I’m turning 70½ this year and my accountant tells me that it would be more beneficial to take the standard deduction instead of itemizing. My RMD for the year is $5,000. I can contact my IRA provider, have them issuing a check directly to the charity for $2,000 and issue me a check for the remaining $3,000. I will only have to pay taxes on the $3,000 that I received as opposed to the full $5,000. I win, the charity wins, and the IRS kind of loses. I’m ok with that situation.

Don’t Accept Anything From The Charity In Return

This is a very important rule. Sometimes when you make a charitable contribution, as a sign of gratitude, the charity will send you a coffee mug, gift basket, etc. When this happens, you will typically get a letter from the charity confirming your contribution but the amount listed in the letter will be slightly lower than the actual dollar amount contributed. The charity will often reduce the contribution by the amount of the gift that was given. If this happens, the total amount of the charitable contribution fails the “qualified charitable contribution” requirement and you will be taxed on the full amount. Plus, you already gave the money to charity so you have spend the funds that you could use to pay the taxes. Not good

Limits

While this will not be an issue for many of us, there is a $100,000 per person limit for these qualified charitable contributions from IRA’s.

Summary

While there are a number of rules to follow when making these qualified charitable contributions from IRA’s, it can be a great strategy that allows retirees to continue contributing to their favorite charities, religious organizations, and/or not-for-profit organizations, while reducing their overall tax liability.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.