What is a Bond?

A bond is a form of debt in which an investor serves as the lender. Think of a bond as a type of loan that a company or government would obtain from a bank but in this case the investor is serving as the bank. The issuer of the bond is typically looking to generate cash for a specific use such as general operations, a specific project, and staying current or

What is a Bond?

A bond is a form of debt in which an investor serves as the lender. Think of a bond as a type of loan that a company or government would obtain from a bank but in this case the investor is serving as the bank. The issuer of the bond is typically looking to generate cash for a specific use such as general operations, a specific project, and staying current or paying off other debt.

How do Investors Make Money on a Bond?

Your typical bonds will generate income for investors in one of two ways: periodic interest payments or purchasing the bond at a discount. There are also bonds where a combination of the two are applicable but we will explain each separately.

Interest Payments

There are interest rates associated with the bonds and interest payments are made periodically to the investor (i.e. semi-annual). When the bonds are issued, a promise to pay the interest over the life of the bond as well as the principal when the bond becomes due is made to the investor. For example, a $10,000 bond with a 5% interest rate would pay the investor $500 annually ($250 semi-annually). Typically tax would be due on the interest each year and when the bond comes due, the principal would be paid tax free as a return of cash basis.

Purchasing at a Discount

Another way to earn money on a bond would be to purchase the bond at a discount and at some time in the future get paid the face value of the bond. A simple example would be the purchase of a 10 year, $10,000 bond for a discounted price of $9,000. 10 years from the date of the purchase the investor would receive $10,000 (a $1,000 gain). Typically, the investor would be required to recognize $100 of income per year as “Original Issue Discount” (OID). At the end of the 10 year period, the gain will be recognized and the $10,000 would be paid but only $100, not $1,000, will have to be recognized as income in the final year.

Is There Risk in Bonds?

Investment grade bonds are often used to make a portfolio more conservative and less volatile. If an investor is less risk oriented or approaching retirement/in retirement they would be more likely to have a portfolio with a higher allocation to bonds than a young investor willing to take risk. This is due to the volatility in the stock market and impact a down market has on an account close to or in the distribution phase.

That being said, there are risks associated with bonds.

Interest Rate Risk – in an environment of rising interest rates, the value of a bond held by an investor will decline. If I purchased a 10 year bond two years ago with a 5% interest rate, that bond will lose value if an investor can purchase a bond with the same level of risk at a higher interest rate today. This will make the bond you hold less valuable and therefore will earn less if the bond is sold prior to maturity. If the bond is held to maturity it will earn the stated interest rate and will pay the investor face value but there is an opportunity cost with holding that bond if there are similar bonds available at higher interest rates.

Default Risk – most relevant with high risk bonds, default risk is the risk that the issuer will not be able to pay the face value of the bond. This is the same as someone defaulting on a loan. A bond held by an investor is only as good as the ability of the issuer to pay back the amount promised.

Call Risk – often times there are call features with a bond that will allow the issuer to pay off the bond earlier than the maturity date. In a declining interest rate environment, an issuer may issue new bonds at a lower interest rate and use the profits to pay off other outstanding bonds at higher interest rates. This would negatively impact the investor because if they were receiving 5% from a bond that gets called, they would likely use the proceeds to reinvest in a bond paying a lower rate or accept more risk to earn the same interest rate as the called bond.

Inflation Risk – a high inflation rate environment will negatively impact a bond because it is likely a time of rising interest rates and the purchasing power of the revenue earned on the bond will decline. For example, if an investor purchases a bond with a 3% interest rate but inflation is increasing at 5% the purchasing power of the return on that bond is eroded.

Below is a chart showing the risk spectrum of investing between asset classes and gives a visual on the different classes of bonds and their most susceptible risks.

Types of Bonds

Federal Government

Bonds issued by the federal government are backed by the full faith and credit of the U.S. Government and therefore are often referred to as “risk-free”. There are always risks associated with investing but in this case “risk-free” is referring to the idea that the U.S. Government is not likely to default on a bond and therefore the investor has a high likelihood of being paid the face value of the bond if held to maturity but like any investment there is risk.

There are a number of different federal bonds known as Treasuries and below we will touch on the more common:

Treasuries – Sold via auction in $1,000 increments. An investor will purchase the bond at a price below the face value and be paid the face value when the bond matures. You can bid on these bonds directly through www.treasurydirect.gov, or you can purchase the bonds through a broker or bank.

Treasury Bills – Short term investments sold in $1,000 increments. T-Bills are purchased at a discount with the promise to be paid the face value at maturity. These bonds have a period of less than a year and therefore, in a normal market environment, rates will be less than those of longer term bonds.

Treasury Notes – Sold in $1,000 increments and have terms of 2, 5, and 10 years. Treasury notes are often purchased at a discount and pay interest semi-annually. The 10 year Treasury note is most often used to discuss the U.S. government bond market and analyze the markets take on longer term macroeconomic trends.

Treasury Bonds – Similar to Treasury Notes but have periods of 30 years.

Treasury Inflation-Protected Securities (TIPS) – Sold in 5, 10, and 20 year terms. Not only will TIPS pay periodic interest, the face value of the bond will also increase with inflation each year. The increase in face value will be taxable income each year even though the principal is not paid until maturity. Interest rates on TIPS are usually lower than bonds with like terms because of the inflation protection.

Savings Bonds – There are two types of savings bonds still being issued, Series EE and Series I. The biggest difference between the two is that Series EE bonds have a fixed interest rate while Series I bonds have a fixed interest rate as well as a variable interest rate component. Savings bonds are purchased at a discount and accrue interest monthly. Typically these bonds mature in 20 years but can be cashed early and the cash basis plus accrued interest at the time of sale will be paid to the investor.

Municipal Bonds (Munis) – Bonds issued by states, cities, and local governments to fund specific projects. These bonds are exempt from federal tax and depending on where you live and where the bond was issued they may be tax free at the state level as well. There are two categories of Munis: Government Obligation Bonds and Revenue Bonds. Government Obligation Bonds are secured by the full faith and credit of the issuer’s taxing power (property/income/other). These bonds must be approved by voters. Revenue Bonds are secured by the revenues derived from specific activities the bonds were used to finance. These can be revenues from activities such as tolls, parking garages, or sports arenas.

Agency Bonds – These bonds are issued by government sponsored enterprises such as the Federal Home Loan Mortgage Association (Freddie Mac), the Federal Home Loan Mortgage Association (Fannie Mae), and the Federal Agricultural Mortgage Corporation (Farmer Mac). Agency bonds are used to stimulate activity such as increasing home ownership or agriculture production. Although they are not backed by the full faith and credit of the U.S. Government, they are viewed as less risky than corporate bonds.

Corporate Bonds – These bonds are issued by companies and although viewed as more risky than government bonds, the level of risk depends on the company issuing the bond. Bonds issued by a company like GE or Cisco may be viewed by investors as less of a default risk than a start-up company or company that operates in a volatile industry. The level of risk with the bond is directly related to the interest rate of the bond. Generally, the riskier the bond the higher the interest rate.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.

Do I Have To Pay Taxes On My Inheritance?

Whenever people come into large sums of money, such as inheritance, the first question is “how much will I be taxed on this money”? Believe it or not, money you receive from an inheritance is likely not taxable income to you.

Whenever people come into large sums of money, such as inheritance, the first question is “how much will I be taxed on this money”? Believe it or not, money you receive from an inheritance is likely not taxable income to you.

Of course there are some caveats to this. If the inherited money is from an estate, there is a chance the money received was already taxed at the estate level. The current federal estate exclusion is $5,430,000 (estate taxes and the exclusion amount varies for states). Therefore, if the estate was large enough, a portion of the inheritance may have been subject to estate tax which is 40% in most cases. That being said, whether the money was or was not taxed at the estate level, you as an individual do not have to pay income taxes on the money.

Although the inheritance itself is not taxable, you may end up paying taxes if there is appreciation after the money is inherited. The type of account and distribution will dictate how the income will be taxed.

Basis Of Inherited Property

Typically, the basis of inherited property is the fair market value of the property on the date of the decedent’s death or the fair market value of the property on the alternate valuation date if the estate uses the alternate valuation date for valuing assets. An estate will choose to value assets on an alternate date subsequent to the date of death if certain assets, such as stocks, have depreciated since the date of death and the estate would pay less tax using the alternate date.

What the fair market value basis means is that if you inherit stock that was originally purchased for $500 and at the date of death has appreciated to $10,000, you will have a “step-up” basis of $10,000. If you turn around and sell the stock for $11,000, you will have a $1,000 gain and if you sell the stock for $9,000, you will have a $1,000 loss.

Inheriting a personal residence also provides for a step-up in basis but the gain or loss may be treated differently. If no one lives in the inherited home after the date of death, it will be treated similar to the stock example above. If you move into the home after death, any subsequent sale at a loss will not be deductible as it will be treated as your personal asset but a gain would have to be recognized and possibly taxed. If you rent the property subsequent to inheritance, it could be treated as a trade or business which would be treated differently for tax purposes.

Inheriting An IRA or Retirement Plan Account

Please read our article “Inherited IRA’s: How Do They Work” for a more detailed explanation of the three different types of distribution options.

When you inherit a retirement account, and you are not the spouse of the decedent, in most cases you will only have one option, fully distribute the account balance 10 years following the year of the decedents death. The SECURE Act that was passed in December 2019 dramatically change the distribution options available to non-spouse beneficiaries. See the article below:

If you are the spouse of the of the decedent, you are able to treat the retirement account as if it was yours and not be forced to take one of the options above. You will have to pay taxes on distributions but you do not have to start withdrawing funds immediately unless there are required minimum distributions needed.

Note: If the inherited account was an after tax account (i.e. Roth), the inheritor must choose one of the options presented above but no tax will be paid on distributions.

Non-Qualified Annuities

Non-qualified annuities are an exception to the step-up in basis rule. The non-spousal inheritor of a non-qualified annuity will have to take either a lump sum or receive payments over a specified time period. If the inheritor chooses a lump sum, the portion that represents the gain (lump sum balance minus decedent’s contributions) will be taxed as ordinary income. If the inheritor chooses a series of payments, distributions will be treated as last in, first out. Last in, first out means that the appreciation will be distributed first and fully taxable until there is only basis left.

If the spouse inherits the annuity, they most likely have the option to treat the annuity contract as if they were the original owner.

This article concentrated on inheritance at a federal level. There is no inheritance tax at a federal level but some states do have an inheritance tax and therefore meeting with a professional is recommended. New York currently does not have an inheritance tax.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.

The Process Of Buying A House

Buying a house can be a fun and exciting experience but it’s also one of the most important financial decisions that you are going to make during your lifetime. This article is designed to help home buyer’s understand:

Buying a house can be a fun and exciting experience but it’s also one of the most important financial decisions that you are going to make during your lifetime. This article is designed to help home buyer’s understand:

The home buying process from start to finish

The parties involved in the process (real estate agent, attorney, bank, etc.)

Common pitfalls to avoid

What to expect when applying for a mortgage

How to calculate the amount of your down payment

Owning Versus Renting

You first have to determine if owning a house is the right financial decision for you. Society wires us to think that owning a house is automatically better than renting but that is not necessarily true in all situations. From a pure dollar and cents standpoint, it may make sense to keep renting given your personal situation. We typically tell clients if there is a fair chance that they may need to sell their house within the next 5 years, in many cases it may make sense to keep renting as opposed to buying a house given all of the upfront costs associated with purchasing a house. It takes a while to recoup closing costs and when you go to sell your house you will most like have to pay your real estate agent 5% - 6% of the selling price.

Determine How Much You Can Afford

Before you even start looking at houses you have to determine two things:

The down payment and closing costs

The amount of the monthly mortgage payment that fits into your budget

There is no point in looking at $300,000 houses if you cannot afford the down payment or the monthly mortgage payment so the initial step involves determining what you can afford.

Calculating Your Closing Costs

Closing costs are in addition to your required “down payment”. First time home buyers often make the mistake of just using the 5% down or 10% down as a rule of thumb for their total upfront cost for buying a house. They often forget about closing costs which can add an additional 2% - 5% of the purchase price of the house to the amount due at closing. Closing costs include:

Discount Points: An up-front fee that you can choose to pay if you want to reduce the interest rate on your loan.

Origination Charge: Fee for processing your mortgage application, pulling credit reports, verifying financial information, and creating the loan

Rate-lock Fee: If you choose to lock in your interest rate beyond a certain period of time

Other Lender Fees: Document preparation fee, processing fee, application fee, and underwriting fees

Appraisal & Inspection Fees: Fees for the lender to inspect and appraise the value of the house

Title Services: Fee charged by the title agent to determine the rightful ownership of the house you are buying and some lenders require title insurance.

Government Recording Charges: Every home buyer must pay these charges for the state and local agencies to record the loans and title documents

Transfer Taxes: Depending on where you live, your state, county or city may charge a tax when the ownership of a home is transferred

Escrow Deposit: At the closing of your home loan, if you decide to escrow or if an escrow is required, there will be an initial deposit in your escrow account to pay for future recurring charges associated with your home, such as property taxes, school taxes, and insurance. You will typically need to pay for the first year of your homeowner’s insurance in full before your home loan closes.

Daily Interest Rate Charge: This charge covers the amount of interest that you will owe on your home loan from the time your loan closes to the first day of your regular mortgage billing cycle.

Flood Insurance: This is a form of hazard insurance that is required by lenders to cover properties in flood zones.

Attorney Fees: Fees typically vary from $300 - $1,000. Most individuals will work with a real estate attorney to review and negotiate the purchase agreement on their behalf. These fees are sometimes paid to the attorney prior to the closing.

As you can see there are a number of fees that you have to be prepared to pay in addition to the down payment required by the lender. Lenders are required by law to give you a “good faith estimate” (GFE) of what the closing costs on your home will be within three days of when you apply for a loan. However, these are just estimates and many of the fees listing on the GFE can legally change by up to 10%, potentially adding thousands of dollars to your final closing cost bill. A day before your closing the lender should provide you with a copy of your HUD-1 settlement statement, which outlines all of the closing fees.

Calculating Your Down Payment

The amount of your down payment will vary based on the type of loan that you received to purchase your house. The three main types of home loans are:

FHA Loan

Conventional Mortgage

VA Loan (Veterans Affairs)

FHA Loan: FHA stands for Federal Housing Administration. The loans are made by banks but they are guaranteed by the FHA which added additional protection for the lender. FHA loans come with a minimum down payment of 3.5% which make them very popular. With these loans borrowers pay PMI (private mortgage insurance) premiums both upfront and each year until the loan is paid down to a specified level. Loan limits vary by housing type and county. These loans tend to favor low to middle income borrowers who do not have a means to make the traditional 10% - 20% down payment at closing.

Conventional Mortgage: Minimum down payment varies from 5% - 20%. Borrowers that put down less than 20% will have to pay PMI (private mortgage insurance). Conventional mortgages typically require a higher FICO score than FHA loans. These loans tend to favor borrowers with higher credit scores and have enough cash on hand to make a sizable down payment.

VA Loan: VA loans are available only to veterans. The greatest benefit of these loans is they require no down payment and they allow qualified borrowers to purchase a home without the need for mortgage insurance. VA loans also tend to have more flexible and forgiving requirements. The VA charges a mandatory Fund Fee of 2.15% for regular military and 2.40% for Reserve/Guard on purchase loans.Let’s bring it all together in an example. If you anticipate on buying a house for $200,000 and you plan on taking an FHA loan, the amount that you will need to save for the closing will be in the range of $11,000 - $17,000 (3.5% for the down payment and 2% - 5% for the closing costs). This calculation will obviously vary based on the type of loan you plan on taking to purchase your house.

Determine what your monthly mortgage payment

After you have determined how much you need to save to meet the upfront cost of purchasing a house, the next step is to determine the monthly mortgage payment that fits into your budget.

Step 1: Establish your current monthly and annual budget. There is no way to determine what you can afford if you have no idea where you are now from an income and expense standpoint. Tip: Be brutally honest with yourself when listing your expenses. The last thing you want to do is underestimate your expenses, buy a house you cannot afford, and then go through a foreclosure. You will also have to factor in additional expenses into your budget as if you owned the house today such as lawn care, snow removal, appliances, and maintenance expense. As a renter you may not have any of these expenses now but as soon as you own a house, now when something breaks you have to pay to fix it. Homeownership is often times more expensive than most individuals anticipate.

Step 2: Based on your current monthly income and expenses, how much is left over to satisfy a monthly mortgage payment? The general rule is your monthly mortgage payment (including property taxes, PMI, and association fees) should not exceed 32% of your monthly gross income. Tip: Leave some extra room in your budget for life’s unexpected surprises. For example, furnace need to be replaced, dishwasher brakes, spouse loses a job, plumbing issues, etc.

Step 3: Use an online mortgage calculator to determine the loan amount that meets your estimated monthly mortgage payment. Do not forget to take into account property taxes, school taxes, association fees, PMI, and homeowners insurance when reaching your estimated monthly payment.

The parties involved in the home buying process

There are a lot of different professionals that you will interact with during the process of purchasing your house. It’s important to understand who is involved, what their role is in the process, and how they are compensated.

Buyer & Seller: This is pretty self-explanatory. Most buyers and sellers work through realtors and attorneys to complete the real estate transaction so there is typically little or no direct interaction between the buyer and the seller. However, in a “for sale by owner”, the buyer or the buyer’s realtor/attorney will be in direct communication with the seller since there is no real estate agent on the sellers side.

Real Estate Agent (Realtor): Real estate agents are important partners when you are buying a house. They can provide you with helpful information on homes and neighborhoods that isn’t easily accessible to the public. Their knowledge of the home buying process, negotiation skills, and familiarity with the area you want to live in can be very valuable. In most cases, as the buyer, it does not typically cost you anything to use a realtor because they are compensated from the commission paid by the seller of the house.

Real Estate Attorney: Remember, buying a home is a legally binding transaction. A real estate attorney can help you avoid some common pitfalls when purchasing your home. The home buying process eventually results in a formal purchase agreement between the buyer and seller. The purchase agreement is the single most important document in the transaction. Although standard printed forms may be used, a lawyer can explain the forms and make changes and additions to reflect the buyer’s wishes. Examples are:

What are the legal consequences if the closing does not take place?

What happens if the inspection reveals termites, radon, or lead based paint?

Will money be held in escrow from the seller’s proceeds to replace certain items?

How much does a real estate attorney cost? It varies, but expect to pay somewhere in the range of $350 - $1,000. Often times you have to pay the attorney a retainer or pay them in advance of the closing. The amount an attorney charges is usually dependent on the level of services that they are provided to you. Some attorneys may just be preparing the deed while other attorney’s may provide you with a more complete package which can include deed preparation, title examination, purchase agreement review, and lender work. Make sure you fully understand how the attorney’s fee structure works and it often helps to ask your professional network or friends for attorney’s that they have worked with and would recommend.

Bank / Credit Union: Most home buyers need a mortgage to finance the purchase of their house. It is recommended that you contact a few banks and credit unions in your area to compare interest rates, closing costs, and fees associated with the issuance of your mortgage. Similar to selecting a real estate attorney we strongly recommend asking your professional network (accountant, investment advisor) for lenders that they recommend working with. You will have a lot of interaction with the lender throughout the home buying process and working with a lender that makes the underwriting process as smooth as possible will make the overall home buying experience much more enjoyable.

Home Inspector: After your offer has been accepted by the seller you will need to hire a home inspector to visit the house. Your real estate agent will most likely recommend a home inspector to use. The job of the home inspector is to visit the property to make sure there are no issues with the house that may not be apparent to the untrained eye. They look for termite damage, structural issues, mold, condition of the roof, electric, plumbing, drainage, septic, radon levels, etc. A few days after their visit they will provide you with a formal report of their inspection. You typically pay them at the time they conduct the inspection. The cost of a home inspection typically ranges from $250 - $600.

Insurance Broker: You will need to obtain a homeowners insurance policy prior to the closing date. Since you are adding a house to your insurance coverage, often times this is a good opportunity to look at your insurance coverage as a whole because insurance companies will usually offer discounts on “bundling” your insurance coverage. Meaning that a single provider covers your house, cars, and personal umbrella policy. The annual cost of your homeowners insurance will vary greatly depending on the value of your house and where the house is located. For homeowners that have an escrow account associated with their mortgage, the homeowners insurance premium is typically baked into your total monthly mortgage payment , the insurance company issues the invoice directly to the bank, and the bank pays your homeowners insurance directly out of your escrow account.

Timeline: The home buying process from start to finish

Now that we have explained how to determine what you can afford and the parties involved in the home buying process it’s time to put it all together so you know what to expect step by step through the process of purchasing your new home.

Step 1: Get prequalified for a mortgage. You may think you can qualify for a $250,000 mortgage but you really do not know until you actually apply. In the preapproval process you will provide some information to the bank that will be issuing your mortgage such as tax returns, statements showing investment and savings accounts, and they will usually run a credit report. The more intense financial due diligence happens after an offer has been accepted on your house and they are actually preparing to provide you with the loan.

Step 2: Begin looking at houses. Most individuals at this point will hire a real estate agent to help them find and look at houses.

Step 3: Make an offer. Once you find the house that you want, you will have your real estate agent present the seller with your offer. This is where the negotiation process begins. If the seller is listing the house for $200,000, you can make an offer for whatever amount you choose. Once an offer is presented to the seller, three things can happen:

The seller can accept it

The seller can reject it

The seller will counter offer

Your real estate agent can really help you in this process to determine what may be a reasonable offer. It is usually dependent upon how long the house has been on the market, where is the property located, is there a situation that requires selling the house quickly, and what have other similar houses sold for in the area. After making the offer you will typically receive a response within 48 hours. The seller will sometimes give their real estate agent a range saying that they will accept less than the asking price but only to a specific threshold. In most situations the buyer and the seller meet somewhere in the middle. If the house is listed for $200K, the buyer may put in an offer for $180K and after some back and forth they eventually meet somewhere around $190K. But that is not always the case. If there are multiple offers on the house you could end up in a “bidding war”. Offers are “blind bids” meaning that you and your real estate agent have no way of knowing what other people are offering the seller for the house. Buyers are essentially making their “best guess” that their offer will win. You may make an offer for full price only for another buyer to come in two hours later and offer $10,000 over their asking price. You really have to lean on your real estate agent to give you some guidance based on their knowledge of the market.

Step 4: Offer accepted……now what? Typically, purchase offers are contingent on a home inspection of the property. Your real estate agent will usually help you arrange to have a home inspection conducted within a few days of your offer being accepted. There are usually contingencies in your offer agreement that provides you with the chance to renegotiate your offer or withdraw it without penalty if the inspection reveals significant material damage. If the inspector discovers issues with the house you will have to make the decision if you want to ask the seller to fix the issue prior to the closing date. Prior to the close you will have a walk-through of the house, which gives you a chance to confirm that any agreed-upon repairs have been made.

Step 5: Apply for a mortgage. Now that your offer has been accepted the mortgage underwriting process will kick into high gear. The bank will assign you a “loan officer” or “mortgage broker” to serve as the direct contact at the bank throughout the mortgage approval process. You will provide them with the information on the house that you intend to purchase, they will send you the mortgage application with all of financial documents that they will need to formally approve you for the mortgage. The bank will also arrange for an appraiser to visit the house and provide an independent estimate of the value of the house. After all if they are giving you a loan for $200,000, they want to make sure that house is worth at least $200,000 in case you were to stop paying the mortgage then essentially the bank would own the house and have to sell it. You will receive a “commitment letter” from your bank once your mortgage has been formally approved.

You will need to show the bank documentation of the account that is currently holding the cash that will be used for your down payment and closing costs. If someone gifts you money to buy your house, the person that made the gift will most likely have to sign a letter stating that it was an outright gift and not a loan.

Step 5½ : You will simultaneous engage a real estate attorney to begin working with at this time. Your attorney will review the purchase agreement, initiate a title search and review the results, begin prepping the deed, and communicate directly with the seller’s attorney if changes or additions need to be made to the purchasing agreement.

Step 6: Set a closing date. The closing date is the date that you will sign a huge pile of papers and the house officially becomes yours. There is typically an “estimated closing date” set in the purchase agreement but a firm date needs to be set by the buyer, seller, attorneys, and the bank. The seller’s real estate agent, the buyer’s real estate agent, your mortgage broker, and the attorneys on both sides will typically communicate with each other to establish the closing date. A special note……..a lot can happen during a real estate transaction that can delay the closing date. Issues can arise on the seller’s side or the mortgage process could take longer than expected. In other words, even though you have a “final closing date” be prepared for the closing date to change. If you are renting right now and have a lease, if your closing date is May 1st it’s usually recommended that you have your current lease run until May 30th or June 30th in case the closing date gets pushed back. Real estate transactions have a lot of moving parts and a lot of unexpected things that are out of your control can happen.

Step 7: Contact your insurance broker to establish a homeowner’s policy. Your bank will require you to have homeowners insurance on the property. You must pay for the policy and have it at closing. You are free to select your own insurance carrier but the lender will typically require the insurance company issuing the policy to be a specific rating or higher.

Your insurance broker may also help you with your title insurance policy. Many lenders will require you to have a title insurance policy at closing. As part of the home buying process a title search should be conducted which results in a report that shows who owns the property and if there are any liens against the property. Title insurance protects you and the lender up to the full value of the property if fraud, a lien, or faulty title is discovered after your closing.

Step 8: The day BEFORE the closing. It is recommended that you send a reminder email to your real estate agent, attorney, and mortgage broker to confirm that everything is a “go” for the closing the next day. You and your real estate agent should make a final inspection of the property within 24 hours prior to the closing. In many cases, the lender will make a similar inspection before closing. The bank that is issuing you the loan should also be able to provide you with a copy of your HUD-1, which is a long, one page document that details all of the financial activity associated with the purchase of your house. You should review this document with your mortgage broker and/or attorney prior to the closing to make sure everything is accurate.

You will also need to confirm with your attorney/mortgage broker the amount of the certified check that you will need to bring to the closing. A certified check is a special type of check issued by a bank that guarantees that the funds to back that check are guaranteed by the bank issuing the check.

Step 9: The date of your closing. You made it!!!!!! Today is the day your new house officially becomes yours. There are two primary things that you need to bring with you to the closing:

Certified check

Homeowners policy and proof of payment

The actual closing is conducted by a “closing agent” who may be an employee of the lender or title company, or it may be an attorney representing you or the lender. The lender and seller, or their representatives, and the real estate agents may or may not be at the actual closing. It is not unusual for the parties to the transaction to complete their roles without ever meeting face to face.

For the most part, your role at closing is to review and sign the numerous documents associated with a mortgage loan. The closing agent should explain the nature and purpose of each one and give you and your attorney an opportunity to check them before signing.

At the conclusion of the meeting you receive the keys to the house and you are officially a new homeowner.

Step 10: Begin making your monthly mortgage payments. One of the top questions that we get is “What is an escrow account?” You will hear that term a lot when you are going through the mortgage process. Think of an escrow account as a separate savings account that is attached to your mortgage. When you make a monthly mortgage payment, it is made up of a few components:

Principal & Interest Payments: Amount applied against your actual loan

PMI (if applicable): Mortgage insurance

Escrow: Cash reserve to pay taxes and homeowners insurance

If my monthly mortgage payment is $2,000, only $1,100 of that amount may actually be applied against the loan. The other $900 may be used to pay my monthly PMI and the remainder is deposited to my escrow account.

When your property taxes and school taxes are due, the county that you live in will typically send those tax bills directly to the bank holding your mortgage and then the bank in turn pays those bills out of your escrow account. The bank will typically mail the homeowners a receipt that the tax bill has been paid. It’s basically a forced monthly savings account for your anticipated tax bills. The same thing is true for your homeowner insurance premium payments. The bank that is holding your mortgage forecasts how much your taxes and homeowner insurance is going to be for the next 12 months and then builds those amounts into your monthly mortgage payments. The bank does not want you to lose your house because you were unable to pay your property or school taxes. The property and school tax bills show up once a year and depending on where you live those bills can be for thousands of dollars.

If there is additional money left in your escrow account after the taxes and homeowner insurance has been paid, the bank is usually required to send a portion of that additional cash reserve to the homeowner in the form of a check. Those are fun checks to get in the mail.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Much Money Do I Need To Save To Retire?

This is by far the most popular question that we come across as financial planners. You may have heard some of the "rules of thumb" like “80% of your current take-home pay” or “1 million dollars”. In reality, the answer varies greatly on an individual by individual basis. This article will outline the procedures that we follow as financial planners to help

This is by far the most popular question that we come across as financial planners. You may have heard some of the "rules of thumb" like “80% of your current take-home pay” or “1 million dollars”. In reality, the answer varies greatly on an individual by individual basis. This article will outline the procedures that we follow as financial planners to help individuals answer this very important question.

Step 1: Estimate Your Annual Expenses In Retirement

The first step is to get a ballpark idea of what your annual expenses might look like in retirement. The best place to start is to list your current monthly and annual expenses. Then create a separate column labeled “expenses in retirement”. Whether you are 2 years, 10 years, or 20 years away from retirement the idea is to pretend as if you were retiring tomorrow and determining what your annual expenses might look like. Some of your expenses in retirement will be lower, others may be higher, but most people find that a lot of their current expenses will carry over at the same level into the retirement years. This is because most people have become accustom to a certain standards of living and they intend to maintain that standard of living in retirement. Here are a few important questions that you should ask yourself when forecasting your retirement expenses:

How much should I budget for health insurance?

Will I have a mortgage or debt when I retire?

Do I plan to move when I retire?

Since I will not be working, should I budget additional expenses for vacations and hobbies?

Will I need to keep my life insurance policies after I retire?

Step 2: Adjust Your Retirement Expenses For Inflation

Now that you have a ballpark number of your annual expenses in retirement, you will need to adjust those expenses for inflation. Inflation is just a fancy word for “the price of everything that we buy today will gradually go up in price over time”. If the price of a gallon of milk today is $2 then most likely 20 years from now that same gallon of milk will cost $3.51. A 75% increase!! Historically inflation has grown at a rate of about 3% per year. There are periods of time when the rate of inflation grows faster or slower but on average it grows at 3% per year.

Another way to look at inflation is $20,000 in today’s dollars will not buy the same amount of goods and services 10 years from now because inflation erodes the purchasing power of your $20,000. If I did my annual expense planner and it tells me that I need $50,000 per year in retirement to meet all of my estimated expenses, let’s look at what adjusting that $50,000 for inflation does over different periods of time assuming a 3% rate of inflation:

Today’s Dollars 5 Years From Now 10 Years From Now 20 Years From Now

$50,000 $56,275 $65,238 $87,675

In the above example, if I am retiring in 10 years, and my estimated annual expenses in retirement will be $50,000 in today’s dollars, by the time I retire 10 years from now my annual expenses will increase to $65,238 per year just to stay in the same place that I am in today. Also, inflation does not stop when you retire, it continues into the retirement years. If I am 50 today and plan to live until 90, I have to apply this inflation adjustment for 40 years. It’s clear to see how inflation can have a significant impact on the amount that you may need to withdrawal for your account to meet you estimated expenses at a future date.

Step 3: Gather The Information On Your Current Assets

Once you know your expenses, you now need to gather all of the information on your retirement accounts and pension plans. You should collect the most recent statement for all of your investment accounts (401K, 403B, IRA’s, brokerage accounts, stocks, etc.), pension statements (if applicable), obtain your most recent social security statement, and gather information on the other sources of income and/or assets that may be available when you retire. Such as:

Sale of a business

Downsizing the primary residence

Rental income

Part-time employment

Step 4: Project The Growth Of Your Retirement Assets

There are three main categories to consider when calculating the growth rate of your retirement assets:

Annual contributions

Withdrawals

Investment rate of return

For annual contributions, it’s determining which accounts you plan on making deposits too each year and how much? For most individuals, their employer sponsored retirement plan is the main source of new contributions to their retirement nest egg. If your employer makes regular employer contributions to your retirement plan, you should factor those in as well. For example, if I am contributing 8% of my pay into the plan and my employer is providing me with a 4% matching contributions, I would reasonably assume that I’m adding 12% of my pay to my 401(k) plan each year.

The most popular question that we get in this category is “how much should I be contributing each year to my retirement account with my employer?” We advise employees that they should have a goal of contributing 10% of their pay each year to their retirement accounts. This is an aggregate total between your personal contributions and the employer contributions. Even if you cannot reach that level right now, 10%+ is the target.

Let’s move onto the next category…….withdrawals. Pre-retirement withdrawals from retirement accounts have become much more common in recent years due largely to the rising cost of college education. Parents will take loans from their 401K/403B plans or take early withdrawals from IRA accounts to fulfill the need for additional income during the years that their children are in college. If part of your overall financial plan is to use your retirement accounts to pay for one-time expenses such as college, you will need to factor that into your projections.

The third variable to consider when determining the growth of your assets is the assumed annual rate of return on your investments. There are many items to consider when determining a reasonable annual rate of return for your accounts. Some of those considerations include:

Time horizon to retirement

Allocation of your portfolio (stocks vs bonds)

Concentrated holdings (10%+ of your portfolio allocated to a single investment)

Accumulation phase versus distribution phase

The answer to the question: “what rate of return should I expect from my retirement accounts?”, can really only be determine on a case by case basis. Using an unreasonable rate of return assumption can create a significant disconnect between your retirement projections versus what is likely to actually occur within your investment accounts. Be careful with this step.

Step 5: Factor In Taxes

Don’t forget about the lovely IRS. All assets are not treated equally from a tax standpoint. For most individuals, the majority of their retirement savings will be in pre-tax retirement vehicles such as 401(k), 403(b), and Traditional IRA’s. That means when you take distributions from those accounts, you will realize earned income, and have to pay tax. For example, if you have $400,000 in your 401K account and you are in the 25% tax bracket, $100,000 of that $400,000 will be lost to taxes as withdrawals are made from the account.

If you have after tax investment accounts, it’s possible that you may owe little to no taxes on withdrawals. However, if there are unrealized investment gains built up in your after tax investment accounts then you may owe capital gains tax when liquidating positons.

Also note, you may have to pay taxes on a portion of your social security benefit. The amount of your social security benefit that is taxable varies based on your level of income.

Step 6: Spend Down Your Assets

In the final step, you should run long term projections to illustrate the spend down of your assets in retirement. Here are the steps:Example

Start with your annual after tax expense number $60,000

Subtract social security less taxes: ($20,000)

Subtract pension payments less taxes (if applicable): ($10,000)

Annual Expenses Net SS and Pensions: $30,000

In the example above, this individual would need an additional $30,000 after-tax to meet their anticipated annual expenses in Year 1 of retirement. I stress “after-tax” because if all of the retirement assets are in a pre-tax retirement account then they would need to gross up their distributions for taxes to get to the $30,000 after tax. If it is assumed that $40,000 has to be withdrawn from an IRA each year, the 3% inflation rate is applied to the annual expenses, and the life expectancy of this individual is 20 years from the date that they retire, this individual would need to withdrawal $1,074,814 out of their retirement accounts over the next 20 years to meet their income needs.

Step 7: Identify Multiple Solutions

There are often times multiple roads to reach a destination and the same is true when planning for retirement. If you find that you assets are falling short of the amount that is needed to sustain your expenses in retirement, you should work with a knowledgeable financial planner to identify alternative solutions. It may help you to answer questions like:

If I decided to work part-time in retirement how much would I have to earn?

If I downsize my primary residence in retirement how does this impact the overall picture?

If I can’t retire at age 63, what age can I comfortably retire at?

What are the pros and cons of taking social security benefits prior to normal retirement age

I also encourage clients to spend time looking at their annual expenses. If you find that your are cutting it close on income versus expenses in retirement, it's usually easier to cut expenses than it is to create more income in the retirement year.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

First Time Homebuyer Tips

Buying your first home is one of life’s milestones that everyone should have the opportunity to experience if they choose. Owning a home gives you a feeling of accomplishment and as you make payments a portion is going to your personal net worth rather than a landlord. The process is exciting but one surefire piece of information that I wish I

Buying your first home is one of life’s milestones that everyone should have the opportunity to experience if they choose. Owning a home gives you a feeling of accomplishment and as you make payments a portion is going to your personal net worth rather than a landlord. The process is exciting but one surefire piece of information that I wish I knew when buying my first home is that you will come across surprises. Whether it be a delay in closing, an issue with financing, or closing costs being higher than expected, it is important to know that you can do all the preparation possible and still be hit in the face with some setbacks.

This article will not only touch on some of the important considerations when buying your first home but will give examples of possible setbacks and how to avoid them.

Know Your Number

The most important piece of information to have when purchasing your home is how much you can spend. The purchase of your home should not be the only goal to consider. All of your other financial objectives such as paying off debt (i.e. college and unsecured) and saving for retirement must be taken into consideration. Also, it is recommended you have an emergency fund in place that would cover at least 4 months of your fixed expenses in case something happens with your job or some other event occurs. Knowing your number does not only include what you can afford today but how much you can afford monthly moving forward. If your monthly cash flow becomes dangerously low or negative with the addition of a mortgage payment (including mortgage/property taxes/homeowners), the house may be too expensive.

NOTE: Just because you are preapproved for a certain amount does not mean you need to spend that amount.

Choose An Agent You Trust

You will be spending a lot of time with your agent so choose them wisely. It should be someone you get along with and someone you can trust will look out for your best interests. If your agent just cares about receiving a commission, they may push you to purchase a home before looking at all of your options or buying a home you can’t afford. Remember, you are the client and therefore should be treated as such.

NOTE: Just because you never physically cut a check to your real estate agent doesn’t mean you aren’t paying them. In a typical transaction the seller will pay the commissions. An agreed upon percentage will come out of the sales proceeds and go to both real estate agents (the buyer’s and the seller’s) and therefore the cost is built into the price you pay.

Use Your Agent As An Asset

Your agent is likely much more knowledgeable about home buying than you so use that knowledge to your benefit. The agent should be able to help you value homes and determine whether the house is fairly priced. Ask them as many questions as possible throughout the entire process.

On The Fence

If you are on the fence whether or not to buy a home then take your time. If you may relocate because of your job or family don’t jump into purchasing a home. It is not worth paying the closing costs and going through the hassle of home buying if you may move in the near future. We typically use the “5 Year Rule” when making the determination. If you don’t see yourself being in the house for at least 5 years you should consider whether or not you will get your money back when you sell.

Compare Lenders

The banking industry is extremely competitive and it is worth shopping around for the best offer when choosing a mortgage provider. If you aren’t comfortable with numbers, don’t be afraid to ask for help. A difference of 0.10% on a 30 year mortgage could be the difference of thousands of dollars wasted on interest.

Don’t Cheap Out On Homeowners

Don’t choose your homeowners policy based on price. Of course price is one of the considerations but it is not the only one. Make sure your policy is the most comprehensive you can comfortably afford as the cost of increased premiums is likely much less than the cost of coming out of pocket for something not covered. Remember, insurance companies, like banks, are in a competitive industry so shop around.

Down Payment

Most lenders require a 20% down payment of the home value to avoid paying additional costs. This means if the value of the home is $200,000, you will have to pay $40,000 out of pocket! Most lenders offer Federal Housing Administration (FHA) loans that allow you to put down as little as 3.5%. If you choose this type of loan you also have to purchase Private Mortgage Insurance (PMI). This will be a cost added to your mortgage payment until the value of your home is adequate enough to remove the PMI. It is important to factor this in as a cost similar to interest because a 5% interest rate could quickly look like 6-7% if you have to pay PMI.

Closing And Other Additional Costs

There are a lot of out of pocket costs to consider when purchasing a home. Examples of these costs are listed below. An important piece of knowing your number is to consider all the costs that may come up during the process.

Loan Origination Fee

Attorney Fees

Property Taxes

Home Owners Insurance

Appraisal Fee

Inspection Fee

Title Insurance

Recording Fee

Government Recording Charges

Credit Report Fee

Flood Determination Fee

How To Help Avoid Certain Complications

Situation: I bought a house at the top of my budget that I thought was move in ready but needs repairs.

Recommendation: Choose an inspector that has a great reputation and knows the location. There may be issues that are common to the area that one inspector may be more likely to identify. Also, bring a contractor or someone of similar background for a walk through. Repairs can be extremely costly and if you purchased a home at the top end of your budget you may not be able to afford certain fixes. It should be known that all issues cannot be foreseen but taking the necessary steps to diminish these situations will not hurt. Don’t purchase a home that will bankrupt you if repairs need to be done.

Situation: I bought a home I can’t fill.

Recommendation: Closing costs and repairs won’t be the only out of pocket expenses. Complete a summary of items you think you may need to buy after the purchase. This may include furniture, appliances, décor, and fixtures. In these situations it is always better to overestimate.

Situation: My lease is up in a month and I would like to purchase a home.

Recommendation: Purchasing a home is something that requires time and planning. The home will likely be the largest purchase you’ve ever made (depending on the college you choose) so it is not something to rush. If you are thinking of moving after your lease is up or when you relocate jobs, start planning as soon as possible. Feeling forced into purchasing something as important as a home will likely lead to regrets.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.

Stock Options 101: ISO, NQSO, and Restricted Stock

If you are reading this article, your company has probably granted you stock options. Stock options give you the potential share in the growth of your company’s value without any financial risk to you until you exercise the options and buy shares of your company’s stock.

If you are reading this article, your company has probably granted you stock options. Stock options give you the potential share in the growth of your company’s value without any financial risk to you until you exercise the options and buy shares of your company’s stock.

Stock options give you the right to purchase a specific number of shares of the company’s stock at a fixed price. There is typically a vesting schedule attached to option grants that specify when you have the right to exercise your stock options. Companies can offer employees:

Incentive Stock Options (“ISO”)

Nonqualified Stock Options (“NQSO”)

Restricted Stock

It is very important to understand how these different types of options and grants are taxed otherwise it could lead to unfortunate tax surprises down the road.

Non-Qualified Stock Options (NQSO)

A non-qualified stock option (NQSO) is a type of stock option that does not qualify for special favorable tax treatment under the US Internal Revenue Code. Thus the word nonqualified applies to the tax treatment (not to eligibility or any other consideration). NQSOs are the most common form of stock option and may be granted to employees, officers, directors, contractors, and consultants.

You pay taxes on these options at the time of exercise. For tax purposes, the exercise spread is compensation income and is therefore reported on your IRS Form W-2 for the calendar year of exercise.

Example: Your stock options have an exercise price of $30 per share. You exercise them when the price of your company stock is $100 per share. You have a $70 spread ($100 – 30) and thus $70 per share is included in your W2 as ordinary income.

Your company will withhold taxes—income tax, Social Security, and Medicare—when you exercise the options.

When you sell the shares, whether immediately or after a holding period, your proceeds are taxed under the rules for capital gains and losses. You report the stock sale on Form 8949 and Schedule D of your IRS Form 1040 tax return.

Incentive Stock Options (ISO)………..

Incentive stock options (ISOs) qualify for special tax treatment under the Internal Revenue Code and are not subject to Social Security, Medicare, or withholding taxes. However, to qualify they must meet rigid criteria under the tax code. ISOs can be granted only to employees, not to consultants or contractors. There is a $100,000 limit on the aggregate grant value of ISOs that may first become exercisable (i.e. vest) in any calendar year. Also, for an employee to retain the special ISO tax benefits after leaving the company, the ISOs must be exercised within three months after the date of termination.

After you exercise these options, if you hold the acquired shares for at least two years from the date of grant and one year from the date of exercise, you incur favorable long-term capital gains tax (rather than ordinary income tax) on all appreciation over the exercise price. However, the paper gains on shares acquired from ISOs and held beyond the calendar year of exercise can subject you to the alternative minimum tax (AMT). This can be problematic if you are hit with the AMT on theoretical gains but the company's stock price then plummets, leaving you with a big tax bill on income that has evaporated.

Very Important: If you have been granted ISOs, it’s important to understand how the alternative minimum tax can affect you prior to exercising your stock options.

Restricted Stock……………….

Your company may no longer be granting you stock options, or may be granting fewer than before. Instead, you may be receiving restricted stock. While these grants don't give you the same potentially life-altering, wealth-building upside as stock options, they do have additional benefits compared to ISO’s and NQSO’s.

The value of stock options, such as ISO’s and NQSO’s, depend on how much (or whether) your company's stock price rises above the price on the grant date. By contrast, restricted stock has value at vesting even if the stock price has not moved or even dropped since grant.

Depending on your attitude toward risk and your experience with swings in your company's stock price, the certainty of your restricted stock's value can be appealing. By contrast, stock options (ISO & NQSO) have great upside potential but can be "underwater" (i.e. having a market price lower than the exercise price). This is why restricted stock is often granted to a newly hired executive. It may be awarded as a hiring bonus or to make up for compensation and benefits, including in-the-money options and nonqualified retirement benefits, forfeited by leaving a prior employer.

Of course, the very essence of restricted stock is that you must remain employed until the shares vest to receive its value. While you may have between 30 and 90 days to exercise stock options after voluntary termination, unvested grants of restricted stock are often forfeited immediately. Thus, it is an extremely effective “golden handcuff” to keep you at your company.

Fewer Decisions

Unlike a stock option, which requires you to decide when to exercise and what exercise method to use, restricted stock involves fewer decisions. When you receive the shares at vesting—which can be based simply on the passage of time or the achievement of performance goals—you may have a choice of tax-withholding methods (e.g. cash, sell shares for taxes), or your company may automatically withhold enough vested shares to cover the tax withholding. Restricted stock is considered "supplemental" wages, following the same tax rules and W-2 reporting that apply to grants of nonqualified stock options.

Tax Decisions

The most meaningful decision with restricted stock grants is whether to make a Section 83(b) election to be taxed on the value of the shares at grant instead of at vesting. Whether to make this election, named after the section of the Internal Revenue Code that authorizes it, is up to you. (It is not available for Restricted Stock Units (RSUs), which are not "property" within the meaning of Internal Revenue Code Section 83)

If a valid 83(b) election is made within 30 days from the date of grant, you will recognize as of that date ordinary income based on the value of the stock at grant instead of recognizing income at vesting. As a result, any appreciation in the stock price above the grant date value is taxed at capital gains rates when you sell the stock after vesting.

While this can appear to provide an advantage, you face significant disadvantages should the stock never vest and you forfeit it because of job loss or other reasons. You cannot recover the taxes you paid on the forfeited stock. For this reason, and the earlier payment date of required taxes on the grant date value, you usually do better by not making the election. However, this election does provide one of the few opportunities for compensation to be taxed at capital gains rates. In addition, if you work for a startup pre-IPO company, it can be very attractive for stock received as compensation when the stock has a very small current value and is subject to a substantial risk of forfeiture. Here, the downside risk is relatively small.

Dividends

Unlike stock options, which rarely carry dividend equivalent rights, restricted stock typically entitles you to receive dividends when they are paid to shareholders.

However, unlike actual dividends, the dividends on restricted stock are reported on your W-2 as wages (unless you made a Section 83(b) election at grant) and are not eligible for the lower tax rate on qualified dividends until after vesting.

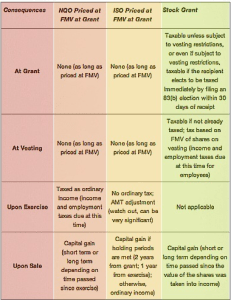

Comparison Chart

Disclosure: The information listed above is for educational purposes only. Greenbush Financial Group, LLC does not provide tax advice. For tax advice, please consult your accountant.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Is Child Support & Alimony Calculated In New York?

For purposes of child support, either parent can be named the custodial parent by a Court. For the purposes of this article we will assume that the mother is the custodial parent and will be receiving the child support and alimony payments. However, fathers who have custody can also use this as a guide.

For purposes of child support, either parent can be named the custodial parent by a Court. For the purposes of this article we will assume that the mother is the custodial parent and will be receiving the child support and alimony payments. However, fathers who have custody can also use this as a guide.

How do I apply for child support?

Usually, you ask for child support in Family Court in the county where you and the child live. You can also go for child support in the county where the father lives. You are not required to have a lawyer to apply for child support but it is recommended that you consult with a divorce attorney prior to filing for support.

How is the dollar amount of child support calculated?

The Child Support Standard Act (CSSA) is the law in NYS and tells the amount of child support the father must pay. The CSSA applies to parental income up to a maximum of $181,000 (2021 limit) and the Court can apply it to income in excess of $148,000 based on certain factors. Examples of these factors are: the financial ability of the father, the lifestyle the child would have enjoyed if the parents stayed living together, and any special needs the child may have. The maximum can be adjusted periodically by the New York State legislature. The amount you get depends on what the father’s income is, what your income is, how many children you have together, and what your children’s basic needs are

The Support Magistrate will look at the information in your financial disclosure affidavit and the father’s financial disclosure affidavit, if he supplies one. The Support Magistrate might also ask you and the father to answer questions. And you and he might be asked to give the Support Magistrate other evidence of your income and expenses, such as a paystub or a W-2 statement.

Both parents’ incomes are used to figure out how much child support the father has to pay because both parents have to support their children.

This is how it is calculated:

Deduct (subtract) these things from each parent’s income:

spousal maintenance paid to a former husband or wife by court order

child support paid to other children by court order

public assistance and supplemental security income (SSI)

city taxes

social security and Medicare taxes (FICA)

Combine (add) the incomes of both parents after making those deductions, and multiply the total you get by the correct percentage:

17% for one child

25% for two children

29% for three children

31% for four children

Not less than 35% for five children or more

Divide the figure you get between both parents according to both your incomes (on a “pro rata” basis). This means that if the father earns twice as much as you, he must pay twice as much child support.

The father may also have to pay additional amounts for:

child care, if you are working or going to school.

medical care not covered by insurance

the child’s educational expenses

The parent who has health insurance must also (if reasonable) continue providing health insurance for your children. The cost of providing health insurance will be shared between yourself and the father, in proportion to your respective incomes. If neither of you has health insurance, the court will order the custodial parent (the parent with the greatest amount of custody) to apply for the state’s child health insurance plan.

When do child support payments stop?

Child support payments typically end when the child reaches age 21 or becomes emancipated. Emancipation means a child is living separately and independently from a parent, or is self –supporting. Some things that show that a child is emancipated are:

Child has completed 4 years of college education

Child has gotten married

Child is living away from home (except for living at school or college)

Child has gone into the military

Child is 17 years old and working full-time (except for summer vacation jobs)

Child willingly and fro no good reason has ended the relationship with both parents

In New York, alimony is referred to in three different ways: as alimony, spousal support, and maintenance. “Temporary maintenance” is an order that one spouse must financially support the other while the divorce is being finalized. Once the divorce is finalized, the temporary maintenance stops and the judge decides whether permanent alimony is appropriate.

How is the amount of alimony payments determined?

Unlike child support payments there really are no set guidelines for the amount and duration of alimony payments. To decide whether spousal support is appropriate, the judge will look at the needs of the spouse asking for support and whether the other spouse has the financial ability to provide financial help. For example, if your income is lower than your spouse’s but you are able to support yourself, you may not be entitled to alimony. The court will also look at other factors when making a decision about support:

the length of the marriage

each spouse’s age and health status

each spouse’s present and future earning capacity

the need of one spouse to incur education or training expenses

whether the spouse seeking maintenance is able to become self-supporting

whether caring for children inhibited one spouse’s earning capacity

equitable distribution of marital property, and

the contributions that one spouse has made as a homemaker in order to help enhance the other spouse’s earning capacity.

The court will also look to see whether the acts of one spouse have inhibited or continue to inhibit the other spouse’s earning capacity or ability to obtain employment. The most common example of this would be domestic violence. If one spouse’s abuse of the other affected that abused spouse’s ability to maintain or to get a job, the court might consider those actions in making its order. Disclosure: The information listed above is for educational purposes only. Greenbush Financial Group, LLC does not provide legal advice. For legal advice, please consult your attorney.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How To Prepare Financially For A Divorce

Divorce can stain finances as well as emotions. Both parties are trying to determine financially what life is going to look like after the divorce is finalized. It is also more common than not that in a marriage one of the spouses assumes the role of paying the bills and managing the family's finances. In this arrangement the "non-financial spouse" is now

Divorce can stain finances as well as emotions. Both parties are trying to determine financially what life is going to look like after the divorce is finalized. It is also more common than not that in a marriage one of the spouses assumes the role of paying the bills and managing the family's finances. In this arrangement the "non-financial spouse" is now forced very quickly into the role of understanding their total financial picture.

How much income do they need to meet their living expenses?

Where are all of the marital assets located?

How much debt do they have?

How much should they expect to receive or pay in child support / alimony?

Who is responsible for paying the bills while the divorce process is ongoing?

Step 1: Establish a team of professionals........

Since so many important financial decisions are being made in such a short window of time, we strongly recommend that each spouse surround themselves with a team of professionals that they like and trust. That team of professionals usually consists of an attorney /mediator, accountant, therapist, and a financial planner. Even though the divorce process can be stressful and sometimes scary, surrounding yourself with a knowledgeable team of advisors will help you to better understand your current situation, the options available to you, and to help you better prepare for life after the divorce is final.

Step 2: Identify your assets and debts.............

You need to fully understand your current financial situation before you can begin to plan for your income and expenses going forward. First, make a list of all of your assets, their values, where they are located, and how they are owned (jointly or separately). This can usually be accomplished by gathering statements on all of your accounts.

You will also need a list of all of your debts, the name of each creditor, outstanding balances, monthly payments, interest rates, and how each debt is owned (jointly or separately). This information can typically be obtained by requesting a credit report for both you and your spouse.

Step 3: Create a new budget...............

Before you can figure out how much income/support you will need going forward you need to know what your estimated monthly expenses are going to be once the divorce is finalized. We recommend listing all of your monthly expenses and list separately large one-time expenses that are expected to be incurred in the future such as college expense for the kids or a down payment on a house. Once you know your estimated monthly expenses you can work with your financial professionals to determine how much income/support you will need each month to meet those expenses taking into account taxes, inflation, and an assumed rate of return on your assets. Please feel free to utilize our GFG Expense Planner which is located in the Resource section of our newsroom.

Step 4: Develop financial projections............

Remember, the financial decisions that you are making now during the divorce process will most likely have a dramatic impact on what your financial future will look like. Not all assets are treated equally. Some assets are taxable while others are not. Likewise, you may have access to certain assets now to meet current expense while others assets may not be available until retirement.

The goal of these financial projections is to determine what your financial future may look like next year, 3 years, 10 years, and 20 years from now given the financial decisions that are being made today. There are a lot of variables that need to be considered when creating these projections such as assumed rates of return on current assets, annual contribution amounts, taxes, social security, inflation, and debt. We strongly recommend that individuals work with financial planners that specialize in divorce planning to develop these projections.

Having formal income and expense projections in place will also allow you determine how changes to what is being offered during the negotiation process will impact your financial future.

Step 5: Crossing emotional and financial decisions

It is not uncommon for individuals to have an emotional attachment to a specific marital asset. The two most commons assets that we see that fall into this category are the primary residence and pensions.