Inherited IRA's: How Do They Work?

An Inherited IRA is a retirement account that is left to a beneficiary after the owner’s death. It is important to have a general knowledge of how Inherited IRA’s work because a minor error in how the account is set up could lead to major tax consequences.

An Inherited IRA is a retirement account that is left to a beneficiary after the owner’s death. It is important to have a general knowledge of how Inherited IRA’s work because a minor error in how the account is set up could lead to major tax consequences.

Before going into the different kinds of Inherited IRA’s, if you are the sole beneficiary of your spouse’s IRA, you are able to transfer the assets to your own existing IRA or to a new IRA through what is called a “Spousal Transfer”. This account is not treated as an Inherited IRA and therefore is subject to all the rules a Traditional IRA would be subject to as if it was always held in your name. If the spouse needs to have access to the money before age 59 ½, it would probably make sense to set up an Inherited IRA because this would give the spouse options to access the money without incurring a 10% early withdrawal penalty.

Withdrawal Rules for Spouse & Non-Spouse Beneficiaries

The SECURE Act that passed in December 2019 dramatically changed the distribution options that are available to non-spouse beneficiaries. If you are spousal beneficiary please reference the following article:

10 Year Method

All the assets must be distributed by the 10th year after the year in which the account holder died. This option may make sense compared to the Lump Sum option explained next to spread out the tax liability over a longer period.

Lump Sum Distribution

You may take a lump sum distribution when the account is inherited. It is recommended that you consult your tax preparer to discuss the tax consequences of this method since you may move up into a different tax bracket.

Additional Takeaways

If the decedent was required to take a distribution in the year of death, it is important to determine whether or not the decedent took the distribution. If the decedent was required to take a RMD but did not do so in the year they passed, the inheritor must take the distribution based on the life expectancy of the decedent or the distribution will be subject to a 50% penalty. Distributions going forward will be based on the life expectancy of the inheritor.

It is important to be sure a beneficiary form is completed for the Inherited IRA. If there is no beneficiary and the account goes to an estate then the inheritor will have limited choices on which distribution method to choose among other tax consequences.

You are only able to combine Inherited IRA’s if they were inherited from the same individual. If you have multiple Inherited IRA’s from different individuals, you cannot commingle the assets because of the distributions that must be taken.

There is no 60 day rule with Inherited IRA’s like there is with other Traditional IRA’s. The 60 day rule allows someone to withdraw money from an IRA and as long as it’s replenished within 60 days there is no tax consequence. This is not available with Inherited IRA’s, all non-Roth distributions are taxable.

The charts below are from insurancenewsnet.com publication titled “Extended IRA Quick Reference Guide” give another look at the details of Inherited IRA’s.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.

What is the 60 Day Rule and How Should it be Used?

The 60 day rule refers to the length of time an individual has to deposit money back into a retirement account that was previously withdrawn without incurring a taxable event. There are a number of reasons someone would withdraw money from an account whether it be to pay a large tax bill, obtain cash for an unexpected expense, or to rollover the

The 60 day rule refers to the length of time an individual has to deposit money back into a retirement account that was previously withdrawn without incurring a taxable event. There are a number of reasons someone would withdraw money from an account whether it be to pay a large tax bill, obtain cash for an unexpected expense, or to rollover the balance into another retirement account.

There are multiple ways to rollover a balance from one retirement account to another so we will begin by explaining the more common ways to rollover a balance where the 60 day rule won't come into play.

Direct Rollover

A direct rollover is a transfer from a retirement plan to another retirement plan or IRA where the custodian of your current plan makes payment directly to your new account. This can be in the form of a check made payable to the new account custodian or a direct wire transfer. This method will avoid taxes and penalties because the account owner never had access to the cash during the transfer.

Trustee to Trustee Transfer

Similar to the direct rollover, a trustee to trustee transfer moves money from one IRA to another IRA without the account owner ever having access to the cash and therefore avoiding taxes and penalties.

The direct rollover and trustee to trustee transfer methods both avoid taxes and penalties as cash is never available to the owner and therefore the 60 day rule does not come into effect. In any case where the account owner has access to the cash, the money will have to be redeposited into another retirement account within 60 days or the owner will be taxed on any pre-tax dollars and possibly penalized if the owner is under the age of 59 ½.

The 60 day rule is one of the only ways an owner has access to money in a retirement account without paying taxes or penalties on the distribution. An individual can take advantage of this if they are in need of immediate cash for something like an unexpected expense. The distribution is essentially an interest free loan from your retirement account for 60 days. If the money is not available within the 60 days to redeposit, taxes and possible penalties will be assessed on the distribution.

IRS: One 60 Day Rollover in 12 Month Rule

The IRS recognized that individuals were taking advantage of this rule by taking multiple distributions in a single year and therefore increasing the time period. Beginning after January 1, 2015, the IRS changed the law to state that only one rollover can be made from one IRA to another IRA within a 12 month period. This rule does not apply to the following:

rollovers from traditional IRAs to Roth IRAs (conversions)

trustee-to-trustee transfers to another IRA

IRA-to-plan rollovers

plan-to-IRA rollovers

plan-to-plan rollovers

It shows the one rollover in a 12 month period rule was meant to limit the abuse of the 60 day rule because direct rollovers and trustee to trustee transfers are excluded.

What can be Rolled Over?

Most of the time the entire balance in a retirement account can be rolled over to another account unless the balance includes an amount of money that is required to be withdrawn. Examples include required minimum distributions and contributions in excess of limits (plus earnings on the excess contributions). For retirement plans, in addition to RMD's and excess contributions, any loans outstanding at the time of rollover or hardship distributions taken during the year will be subject to taxes and possible penalties.

Are Taxes Assessed at the Time of Distribution?

Distribution from an IRA: Typically, a tax is not assessed on a distribution from an IRA unless the account owner elects to have taxes withheld. A distribution from a pre-tax IRA account is typically subject to a 10% early withdrawal penalty if taken before 59 ½.

Distribution from Retirement Plan: Any distribution taken from a retirement plan where cash is made available to the owner is subject to a minimum 20% federal withholding. For example, if you request a $10,000 distribution, you will receive $8,000 and $2,000 will go to the government. There is no option to opt out of this withholding even if you intend to rollover the balance within 60 days. For this reason, a direct rollover would be a way to avoid the 20% withholding.

It is important to understand if you intend to rollover a distribution from a retirement account that the entire amount of the distribution must be redeposited within 60 days to avoid taxes and penalties even if taxes were already withheld. Using the previous example, if you take a $10,000 distribution from a retirement account and have the 20% withheld for taxes you must redeposit $10,000 within 60 days even though you only received $8,000 in cash. This scenario may appear that you are losing $2,000 but when you complete your taxes the $10,000 distribution will not be taxable as long as the full amount was redeposited within 60 days. When you file your taxes, the $2,000 will be included in the federal taxes withheld which is how the money is recouped.

How is the Rollover Reported to the Government?

Any time you wish to utilize the 60 day rule, it is important you keep documentation. Any distribution from a retirement account will generate a 1099-R form that must be reported as income on your tax return. Also, the 1099-R will show any taxes withheld from the distribution. You will receive a 1099-R even if a direct rollover or trustee to trustee transfer was done. The way the distribution is coded determines how the IRS treats it for tax purposes. If the distribution is coded as a direct rollover or trustee to trustee transfer, the distribution will not be treated as taxable income. If the distribution gave you access to cash, the 1099-R will be coded in a way that treats the distribution as a taxable event. If you redeposited the amount into another retirement account within 60 days, it is important you notify your tax preparer and bring documentation showing the deposit was made timely. The tax preparer should then treat the distribution as a non-taxable event.

About Rob.........

Hi, I'm Rob Mangold. I'm the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.

How Much Life Insurance Do I Need?

Do you even need life insurance? If you have dependants to protect and you do not have enough savings, you will most likely need life insurance. But the question is how much should I have? Well, your home will be one of your biggest assets, and in some cases the money that it makes from its sale when you have passed away is a significant inheritance

Do you even need life insurance? If you have dependants to protect and you do not have enough savings, you will most likely need life insurance. But the question is how much should I have? Well, your home will be one of your biggest assets, and in some cases the money that it makes from its sale when you have passed away is a significant inheritance for your children.

If you do not have dependents or you have enough savings to cover the current and future expenses for your dependents there really is no need for life insurance. Life insurance sales professional can be very aggressive with their sales tactics and sometime they mask their services as "financial planning" but all of their solutions lead to you buying an expensive whole life insurance policy.

Remember, life insurance is simply a transfer of risk. When you are younger, have a family, a mortgage, and are just starting to accumulate assets, the amount of life insurance coverage is usually at its greatest. But as your children grow up, they finish college, you pay your mortgage, you have no debt, and you have accumulated a good amount in retirement savings, your need to transfer that risk diminishes because you have essentially become self-insured. Just because you had a $1M dollar life insurance policy issued 10 years ago does not mean that is the amount you need now.

Which kind of insurance should you get?

It's our opinion that for most individuals term insurance makes the most sense. Insurance agents are always very eager to sell whole life, variable life, and universal life policies. Why? They pay big commissions!! When you compare a $1M 30 year term policy and a $1M Whole Life policy side by side, often times the annual premium for whole life insurance is 10 times that amount of the term insurance policy. Insurance agents will tout that the whole life policy has cash value, you can take loans, and that it's a tax deferred savings vehicle. But often time when you compare that to: "If I just bought the cheaper term insurance and did something else with the money I would have spent on the more expensive whole life policy such as additional pre-tax retirement savings, college savings for the kids, paying down the mortgage, or setting up an investment management account, at the end of the day I'm in a much better spot financially."

How much life insurance do you need?

The most common rule of thumb that I hear is "10 times my annual salary". Please throw that out the window. The amount of insurance you need varies greatly from individual to individual. The calculation to reach the answer is fairly straight forward. Below is the approach we take with our clients:

How much debt do you have? This includes mortgages, car loans, personal loans, credit cards, etc. Your total debt amount is your starting point.

What are your annual expenses? Just create a quick list of your monthly expenses, they do not have to be exact, and our recommendation is to estimate on the high side just to be safe. Then multiply your monthly expense by 12 months to reach your "annual after tax expenses".

How much monthly income do you have to replace? If you are married, we have to look at the income of each spouse. If your monthly expenses are $50,000 per year and the husband earns $30,000 and the wife earns $80,000, we are going to need more insurance on the wife because we have to replace $80,000 per year in income if she were to pass away unexpectedly. Married couples make the mistake of getting the same face value of insurance just because. Look at it from an income replacement standpoint. If you are a single parent or provider, you will just look at the amount of income that is needed to meet the anticipated monthly expenses for your dependents.

Factor in long term savings goals and expenses. Examples of this are the college cost for your children and the annual retirement savings for the surviving spouse.

Example:

Husband: Age 40: Annual Income $70,000

Wife: Age 41: Annual Income $70,000

Children: Age 13 & 10

Total Outstanding Debt with Mortgage: $250,000

Total Annual After Tax Expenses: $90,000

Savings & Investment Accounts: $100,000

Remember there is not a single correct way to calculate your insurance need. This example is meant to help you through the thought process. Let's look at an insurance policy for the husband. We first look at what the duration of the term insurance policy should be. Our top two questions are "when will the mortgage be paid off?" and "when will the kids be done with college?" These are the two most common large expenses that we are insuring against. In this example let's assume they have 20 years left on their mortgage so at a minimum we will be looking at a 20 year term policy since the youngest child will done with their 4 year degree within the next 12 years. So a 20 year term covers both.

Here is how we would calculate the amount. Start with the total amount of debt: $250,000. That is our base amount. Then we need to look at college expense for the kids. Assume $20K per year for each child for a 4 year degree: $160,000. Next we look at how much annual income we need to replace on the husband's life to meet their monthly expense. In this example it will be close to all of it but let's reduce it to $60K per year. It is determined that they will need their current level of income until the mortgage is paid in full so $60,000 x 20 Years = $1,200,000. When you add all of these up they will need a 20 year term policy with a death benefit of $1,610,000. But we also have to take into account that they already have $100,000 in savings and their levels of debt should decrease with each year as time progresses. In this scenario we would most likely recommend a 20 Year Term Policy with a $1.5M death benefit on the husband's life.

The calculation for his wife in this scenario would be similar since they have the same level of income.

About Michael.........

Hi, I'm Michael Ruger. I'm the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Paying Down Debt: What is the Best Strategy?

Living with debt is not easy. It can be a constant burden and easily disrupt day-to-day life. Having debt will also ruin your credit score too. The worse your credit score gets, the less likely you will be accepted for any type of loan. One of the fastest ways to get rid of your debt is to pay your debt off in the correct order.

Living with debt is not easy. It can be a constant burden and easily disrupt day-to-day life. Having debt will also ruin your credit score too. The worse your credit score gets, the less likely you will be accepted for any type of loan. One of the fastest ways to get rid of your debt is to pay your debt off in the correct order.

STEP 1: Create a list of all your current debts

The first step is understanding what you owe. To start, make a master list of all your monthly credit card and loan statements. For each bill, include:

The creditor's name

The total amount you owe on that bill

The minimum required monthly payment

The interest rate (also known as APR)

The payment due date

STEP 2: List all of your monthly expenses

Add up all your monthly expenses: rent, car, food, utilities, health insurance and the minimum payments on your debts; as well as regular spending on things such as entertainment and clothing. Subtract that figure from your monthly after-tax income. The remaining amount is what you could put toward debt repayment each month-though it may make sense for you to save some.

STEP 3: Call your lenders

Call your lenders and explain your situation. They may be willing to lower your interest rate temporarily or waive late fees. You may also be able to lower your interest rate by transferring some high-interest credit card debt onto a new credit card with a lower rate (though that's not a long-term solution).

STEP 4: Payoff high interest rate or small balances first

You can start with the bill carrying the highest interest, or the one with the smallest balance. Prioritizing the highest-rate debt can save you more money: You pay off your most expensive debt sooner. Paying off the smallest debt can eliminate a bill faster, providing a motivating boost. Whichever you choose, make sure to pay at least the minimum on all your debts.

Pay the monthly minimum on each debt. The exception: your target bill. Put more money toward this one to pay it down faster. Once you pay off that bill, choose another to pay down aggressively. Your monthly debt repayment total shouldn't change, even when you eliminate bills. This way you gain momentum as you go, putting more and more money toward each remaining bill.

STEP 5: Get creative

You can use your annual tax refund or holiday bonus to pay down debt. Look for small ways to save money every day, such as riding your bike to work, or eating in instead of dining out. Another way to make a dent quickly is to sell unused or unnecessary belongings-maybe downgrading your car to a more affordable model with lower monthly payments.

STEP 6: Break the cycle

As you start to escape debt, it can be tempting to reward yourself by splurging on a new smartphone or an expensive dinner but just a few purchases can erase all your hard work. Instead, buy things with cash or your debit card, and think long and hard before taking on any new debt.

Read this book

If you want to live a debt free life, I strongly recommend you read the book "Total Money Makeover" by Dave Ramsey. Ramsey's book really paves the way to get out of debt and stay out of debt.

About Michael.........

Hi, I'm Michael Ruger. I'm the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Simple IRA vs. 401(k) - Which one is right for your company?

There are a lot of options available to small companies when establishing an employer sponsored retirement plan. For companies that have employees in addition to the owners of the company, the question is do they establish a 401(k) plan or a Simple IRA?The right fit for your company depends on:

There are a lot of options available to small companies when establishing an employer sponsored retirement plan. For companies that have employees in addition to the owners of the company, the question is do they establish a 401(k) plan or a Simple IRA?The right fit for your company depends on:

What are the company's primary goals for establishing the plan?

How much the owner(s) plan to contribute to the plan?

How many employees does the company have?

Do you want to restrict the plan to only full time employees?

The cost of maintaining each plan?

Does the company intend to make an employer contribution to the plan?

Diversity of the investment menu

Below is a chart that contains a quick comparison of some of the main features of each type of plan:

For many small companies it often makes sense to start with a Simple IRA plan and then transition to a 401K plan as the company grows or when the owner intends to start accessing the upper deferral limits offered by the 401(k) plan.

Simple IRA's are relatively easy to setup and the administrative fees to maintain these plans are typically lower in comparison to 401(k) plans. Most Simple IRA providers will only charge $10 - $30 to custody the accounts.

By comparison, 401(k) plans are ERISA covered plans which require a TPA Firm (third party administrator) to maintain the plan documents, conduct year end plan testing, and file the 5500 each year. The TPA fees vary based on the provider and the number of employees eligible to participate in the plan. A ballpark range is $1,500 - $2,500 for companies with under 50 employees.

However, the additional TPA fees associated with establishing a 401(k) plan may be justified if:

The owners intend to max out their employee deferrals

The owners are approaching retirement and need to make big contributions

The company wants to maintain flexibility with the employer contribution

The company would like to make Roth contributions, loans, or rollovers available

WARNING: Most investment providers are "one trick ponies". They will talk about 401(k) plans and not present other options because they either do not have a thorough understand of how Simple IRA plans work or they are only able to offer 401(k) plans. Before establishing a retirement plan it is important to work with a firm that presents both options, helps you to understand the difference between the two types of plans, and assist you in evaluating which plan would best meet your company's goals and objectives.

About Michael.........

Hi, I'm Michael Ruger. I'm the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Comparing Different Types of Employer Sponsored Retirement Plans

Employer sponsored retirement plans are typically the single most valuable tool for business owner when attempting to:

Reduce their current tax liability

Attract and retain employees

Accumulate wealth for retirement

But with all of the different types of plans to choose from which one is the right one for your business? Most business owners are familiar with how 401(k) plans work but that might not be the right fit given variables such as:

Employer sponsored retirement plans are typically the single most valuable tool for business owner when attempting to:

Reduce their current tax liability

Attract and retain employees

Accumulate wealth for retirement

But with all of the different types of plans to choose from which one is the right one for your business? Most business owners are familiar with how 401(k) plans work but that might not be the right fit given variables such as:

# of Employees

Cash flows of the business

Goals of the business owner

There are four main stream employer sponsored retirement plans that business owners have to choose from:

SEP IRA

Single(k) Plan

Simple IRA

401(k) Plan

Since there are a lot of differences between these four types of plans we have included a comparison chart at the conclusion of this newsletter but we will touch on the highlights of each type of plan.

SEP IRA PLAN

This is the only employer sponsored retirement plan that can be setup after 12/31 for the previous tax year. So when you are sitting with your accountant in the spring and they deliver the bad news that you are going to have a big tax liability for the previous tax year, you can establish a SEP IRA up until your tax filing deadline plus extension, fund it, and take a deduction for that year.

However, if the company has employees that meet the plan’s eligibility requirement, these plans become very expensive very quickly if the owner(s) want to make contributions to their own accounts. The reason being, these plans are 100% employer funded which means there are no employee contributions allowed and the employer contribution is uniform for all plan participants. For example, if the owner contributes 15% of their income to the SEP IRA, they have to make an employer contribution equal to 15% of compensation for each employee that has met the plans eligibility requirement. If the 5305-SEP Form, which serves as the plan document, is setup correctly a company can keep new employees out of the plan for up to 3 years but often times it is either not setup correctly or the employer cannot find the document.

Single(k) Plan or “Solo(k)”

These plans are for owner only entities. As soon as you have an employee that works more than 1000 hours in a 12 month period, you cannot sponsor a Single(k) plan.

The plans are often times the most advantageous for self-employed individuals that have no employees and want to have access to higher pre-tax contribution levels. For all intensive purposes it is a 401(k) plan, same contributions limits, ERISA protected, they allow loans and Roth contributions, etc. However, they can be sponsored at a much lower cost than traditional 401(k) plans because there are no non-owner employees. So there is no year-end testing, it’s typically a boiler plate plan document, and the administration costs to establish and maintain these plans are typically under $400 per year compared to traditional 401(k) plans which may cost $1,500+ per year to administer.

The beauty of these plans is the “employee contribution” of the plan which gives it an advantage over SEP IRA plans. With SEP IRA plans you are limited to contributes up to 25% of your income. So if you make $24,000 in self-employment income you are limited to a $6,000 pre-tax contribution.

With a Single(k) plan, for 2016, I can contribute $18,000 per year (another $6,000 if I’m over 50) up to 100% of my self-employment income and in addition to that amount I can make an employer contribution up to 25% of my income. In the previous example, if you make $24,000 in self-employment income, you would be able to make a salary deferral contribution of $18,000 and an employer contribution of $6,000, effectively wiping out all of your taxable income for that tax year.

Simple IRA

Simple IRA’s are the JV version of 401(k) plans. Smaller companies that have 1 – 30 employees that are looking to start a retirement plan will often times start with implementing a Simple IRA plan and eventually graduate to a 401(k) plan as the company grows. The primary advantage of Simple IRA Plans over 401(k) Plans is the cost. Simple IRA’s do not require a TPA firm since they are self-administered by the employer and they do not require annual 5500 filings so the cost to setup and maintain the plan is usually much less than a 401(k) plan.

What causes companies to choose a 401(k) plan over a Simple IRA plan?

Owners want access to higher pre-tax contribution limits

They want to limit to the plan to just full time employees

The company wants flexibility with regard to the employer contribution

The company wants a vesting schedule tied to the employer contributions

The company wants to expand the investment menu beyond just a single fund family

401(k) Plans

These are probably the most well recognized employer sponsored plans since at one time or another each of us has worked for a company that has sponsored this type of plan. So we will not spend a lot of time going over the ins and outs of these types of plan. These plans offer a lot of flexibility with regard to the plan features and the plan design.

We will issue a special note about the 401(k) market. For small business with 1 -50 employees, you have a lot of options regarding which type of plan you should sponsor but it’s our personal experience that most investment advisors only have a strong understanding of 401(k) plans so they push 401(k) plans as the answer for everyone because it’s what they know and it’s what they are comfortable talking about. When establishing a retirement plan for your company, make sure you consult with an advisor that has a working knowledge of all these different types of retirement plans and can clearly articulate the pros and cons of each type of plan. This will assist you in establishing the right type of plan for your company.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How to Create a Business Plan

Starting your own business can be an exciting and rewarding experience. It can offer numerous advantages such as being your own boss, setting your own schedule and making a living doing something you enjoy. But, becoming a successful entrepreneur requires thorough planning, creativity, and hard work. After making the decision to start your

Starting your own business can be an exciting and rewarding experience. It can offer numerous advantages such as being your own boss, setting your own schedule and making a living doing something you enjoy. But, becoming a successful entrepreneur requires thorough planning, creativity, and hard work. After making the decision to start your own business, you'll need to be realistic about the sort of goals and targets you want to achieve at first. Businesses need targets though, so be sure to set some. Meeting targets does usually indicate business growth and success, so that's why they are so important. As with any business though, it all starts with a solid plan...

Learn from those before you

Before you make the leap to start your own business, make sure you talk or work for the person that you want to be 5 years from now. Working in the industry before taking your leap of faith will most likely increase your success rate. On the surface some businesses seem simple and straight forward. No business ever is. You have to figure out how the successful companies in that industry currently make money, what are their margins, who are the customers, who are the competitors, and more importantly what are the missteps that you should avoid when building you own business.

You must be able to answer these questions

Why am I starting a business?

What kind of business do I want?

Who is my ideal customer?

What products or services will my business provide?

Am I prepared to spend the time and money needed to get my business started?

What differentiates my business idea and the products or services I will provide from others in the market?

Where will my business be located?

How many employees will I need?

What types of suppliers do I need?

How much money do I need to get started?

Will I need to get a loan?

How soon will it take before my products or services are available?

How long do I have until I start making a profit?

Who is my competition?

How will I price my product compared to my competition?

How will I set up the legal structure of my business?

What taxes do I need to pay?

What kind of insurance do I need?

How will I manage my business?

How will I advertise my business?

Do not spend a dime until you can clearly answer all of these questions otherwise you are leaving your fate to chance.

Write your business plan

Your business plan is your roadmap to success. Business plans typically forecast out 3 to 5 years. Any shorter than that and you will have no idea where you are going with the business. Any longer than that is irrelevant because you may need to make material adjustments to your plan within the first 3 years as obstacles present themselves and as the competitive landscape changes along the way. Here are the key elements that you will want include in your business plan:

Executive Summary: Your executive summary is a snapshot of your business plan as a whole and touches on your company profile and goals. Read these tips about what to include.

Company Description: Your company description provides information on what you do, what differentiates your business from others, and the markets your business serves.

Market Analysis: Before launching your business, it is essential for you to research your business industry, market and competitors.

Organization & Management: Every business is structured differently. Find out the best organization and management structure for your business.

Service or Product Line: What do you sell? How does it benefit your customers? What is the product lifecycle? Get tips on how to tell the story about your product or service.

Marketing & Sales: How do you plan to market your business? What is your sales strategy? Read more about how to include this information in your plan.Funding Request: If you are seeking funding for your business, find out about the necessary information you should include in your plan.

Financial Projections: If you need funding, providing financial projections to back up your request is critical. Find out what information you need to include in your financial projections for your small business.

Your Competitive Advantage: What makes your business unique? Determining this could help you stand out from the crowd and give you advantages over your competitors.

Appendix: An appendix is optional, but a useful place to include information such as resumes, permits and leases. Find additional information you should include in your appendix.

Surround yourself with a great team of advisors.

Most business should have an accountant to ensure your books are correct and that all of the money your business is involved with is accounted for. You will collaborate with an attorney. You will also need a financial advisor. they will provide you with advice on where you can spend more money, what do you need to keep back or whether you need to reduce the money your spending on marketing for example. These professionals will help you to get your business established and help you with the key decisions that need to be made when you are establishing a business for the first time.

How should I incorporate?

What business expenses can I deduct?

How much cash do I need to sustain my business on a monthly basis?

It is likely that many of these professionals will be working with a client in your industry so they can provide you with real world guidance on the pros and cons of the decisions that you have to make.

Rule #1: Make sure you trust and like who you are working with. Do not just select a firm because they have a big name or because your friend uses them. You are going to be busy building your business so you will rely heavily on your team of professional advisors to make sure from a legal, tax, and financial standpoint that you are maximizing your resources.

About Michael.........

Hi, I'm Michael Ruger. I'm the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Target Date Mutual Funds and Their Role in the 401(k) Space

A target date mutual fund is a fund in the hybrid category that automatically resets the asset mix of stocks, bonds and cash equivalents in its portfolio according to a selected time frame that is appropriate for a particular investor. In simpler terms, an investor can purchase a target date fund based on their anticipated retirement date and the fund will

In recent years, a growing trend in the 401(k) space has been the use of target date mutual funds.

Target Date Mutual Funds

A target date mutual fund is a fund in the hybrid category that automatically resets the asset mix of stocks, bonds and cash equivalents in its portfolio according to a selected time frame that is appropriate for a particular investor. In simpler terms, an investor can purchase a target date fund based on their anticipated retirement date and the fund will automatically become more conservative as the investor approaches retirement.

This is often times a suitable investment for the average investor or participant in a 401(k) plan that would not typically make allocation adjustments on their own. During the financial crisis of 2008 and 2009, many investors approaching retirement were overexposed to the stock market and lost half of their savings with no time to make it back before retirement. This is where the benefit of a well-managed target date fund would have been useful as investors who needed an allocation change as they approached retirement would have got it. Emphasis on the well-managed.

At year end 2013, there was approximately $595.5 billion dollars invested in target date mutual funds, up from approximately $111.9 billion in 2006 based on a study conducted by Morningstar. With so much money being placed in these funds, it is important to know how they work and what to look for when choosing the correct fund for your risk tolerance and time horizon.

As mentioned previously, the allocation of assets within a target date fund will automatically rebalance throughout the life of the investment to focus more on income. With that being said, how does the rebalancing happen and how often does the rebalancing take place? The rebalancing takes place automatically when fund managers of that target date fund determine the allocation in the fund no longer meets its intentions. It is argued that most target date mutual funds do not rebalance nearly enough as some can be as long as 4-5 years.

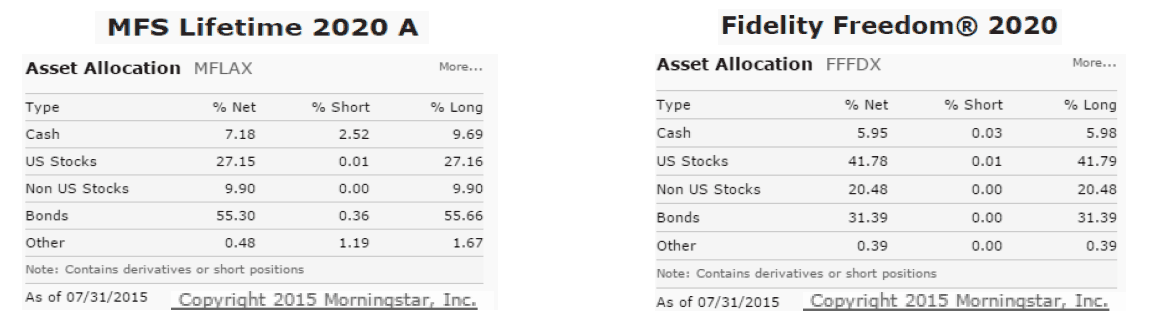

It is important to know that the date of a target date fund is the date the investor plans to retire and is not the date in which the fund is at its most conservative allocation. Fund families operate their target date mutual funds very differently. For example, one fund family may have a 2020 fund that is 30% stocks and 70% bonds compared to another more aggressive fund family that is allocated 60% stocks and 40% bonds in their 2020 target date fund.

There are arguments for both allocations. Since an investor is at their retirement age, they should typically be more conservative. On the other hand, just because the investor hit their retirement age they may not be taking distributions from the account for another 5-10 years, and therefore could possibly achieve more growth.

A target date fund can be a suitable investment option for investors who would like a hands off approach in their 401(k), but participants must be aware that there is still due diligence necessary throughout the life of the investment. Below is a chart showing the results of a study conducted by Morningstar in 2010. It shows the allocation of target date mutual funds for different fund families during the financial crisis of 2008 and 2009. These target date mutual funds were meant for investors retiring in 2010 and therefore should have been allocated in a way that would not over expose them to a significant decline in the market two years from retirement.

As you can see, the equity (stock) allocation varies greatly between fund families and the over exposure led to significant declines in investors accounts. Too many people had their retirement account nearly halved two years from retirement which is devastating for an individuals quality of life.

There are definitely pitfalls to target date mutual funds but they can be appropriate in the right circumstances. It is important that investors are educated on what target date mutual funds are and more importantly what they are not. Here are a few takeaways that may help you determine which, if any, target date fund is appropriate for you.

Determine Your Risk Tolerance First

The first questions an investment advisor will typically have for a client are: “What is your time horizon?” and “What is your risk tolerance?”. Since target date mutual funds allocate assets for a group of investors based on a date in the future, the only piece that is somewhat satisfied is time horizon. Just because a group of investors have the same time horizon does not mean they should be invested the same way. Fund managers cannot allocate funds in a way that satisfies both questions without knowing the risk tolerance for each individual investor. That means, the risk tolerance piece relies on you. Two 45 year old investors may be 20 years from retirement and have completely different portfolio allocations due to their risk tolerance. One may be more aggressive and tolerant of stock market fluctuations while the other may be conservative and less willing to risk their savings. Even though each investor has the same time horizon, the appropriate portfolio for each would vary greatly. It is important to know your risk tolerance and apply that knowledge to the appropriate target date fund.

Research the Different Target Date Fund Options

As shown in the chart on the previous page, the asset allocation for a target date fund for one fund family could be drastically different when compared to the same target date fund for another fund family. This can be confusing for investors which is why it is important to research the fund and the current allocation before investing. The charts below show the asset allocation of two 2020 target date mutual funds from different families.

Both target date mutual funds are the same in terms of retirement date but drastically different in exposure to the stock market. The MFS 2020 fund with approximately 63% allocated to bonds/cash and 37% to stocks is a much more conservative portfolio than the Fidelity 2020, which is approximately 37% bonds/cash and 63% stocks. An investor with 5 years to retirement could have very different objectives with their retirement account and therefore each fund may be appropriate as a 2020 fund. An over exposure to the stock market for someone retiring in 5 years could be devastating as shown in 2008/2009 which is why it is important for each individual to determine their time horizon, risk tolerance, and investment objectives when selecting the correct target date fund for their portfolio.

Difference Between Target Date and Active Management

Although target date mutual funds are often referred to as “set it and forget it”, there are a number of factors that must be taken into consideration. Most target date mutual funds are typically managed exclusively on time horizon. Fund managers traditionally do not make significant allocation adjustments to these types of funds based on changing market conditions which can leave investors exposed to big drops in the stock market as they approach retirement. Investors within 10 years to retirement should work closely with their investment advisor to make sure they have the right mix of stocks and bonds in their portfolio.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.

The Shift from Defined Benefit to Defined Contribution Plans

As defined benefit plans continue to become a thing of the past and workers realize they will not have a pension (and possibly Social Security) to rely on during retirement, it is important to be educated on the investments and opportunities available in employer sponsored defined contribution plans. This newsletter will briefly discuss the

As defined benefit plans continue to become a thing of the past and workers realize they will not have a pension (and possibly Social Security) to rely on during retirement, it is important to be educated on the investments and opportunities available in employer sponsored defined contribution plans. This newsletter will briefly discuss the difference between defined benefit plans and defined contribution plans, why the dramatic shift from one to the other, and why it is important to be educated on retirement and the investment options available.

Defined Benefit Plans

Defined benefit plans (commonly referred to as pension plans) are promises made by an organization to pay a specific amount, usually monthly, to an employee during retirement. These amounts are calculated based on a number of factors including an employees earnings history, service, and age. Since the organization is responsible for funding these plans during an employee’s retirement, investment returns are the concern of the organization, not the employee.

Defined Contribution Plans

Rather than an employer guaranteeing a benefit during retirement as is the case with defined benefit plans, the employee (and often times the employer) will make contributions to a defined contribution plan which accumulates over time and is drawn upon by the employee during retirement. One of the most common forms of defined contribution plans available to workers is the 401(k) plan. Since the guarantee of a monthly benefit during retirement is not there in a 401(k) plan, whatever is accumulated from employee/employer contributions and investment returns over the years is what will be available to the employee throughout retirement. In other words, this is the amount that must last throughout retirement.

Why the shift to 401(k)s and other defined contribution plans?

Defined benefit plans were set up to reward employees with consistent income during retirement since they are no longer earning. This is a great benefit to employees if available but these plans are becoming obsolete. As baby boomers continue to retire and live longer than previous generations, defined benefit plans are becoming too expensive to fund.

It is extremely difficult for companies (and municipalities) to turn a profit when they continue paying employees twenty years after their last day. Think of a defined benefit plan like you would a bad contract in baseball. Let me use one of the most scrutinized contracts in baseball history as an example. The Mets contract with Bobby Bonilla.

The last time Bonilla had an at bat for the Mets was in 1999, yet in 2015 he received a check for $1.19 million dollars. That amount is more than 17 of the current 25 players will make in 2015. Not the best business model when you are paying that kind of money to a player that hasn’t filled a seat (generated income for a company) in 15 years. The payment is guaranteed to Bonilla through 2035, which can be compared to a worker retiring at 55 and receiving a guaranteed payment for life.

For the reasons that seem obvious now, the past 30 years has seen a dramatic shift from defined benefit plans to defined contribution plans.

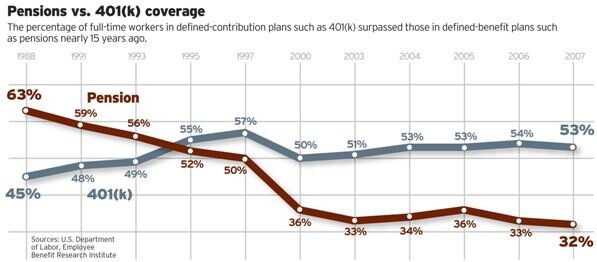

This chart illustrates the shift noted above. The breakeven point is shown around 1990 with no signs of the trend reversing.

As of June 30, 2014, 401(k) plans held an estimated $4.4 trillion in assets which is compared to $2.2 trillion in 2004.

Savings and Investment Performance

So, with less retirees having a pension plan to rely on for consistent income throughout retirement, how well are people preparing for retirement? The USA Today released an article in March 2015 titled “For millions, 401(k) plans have fallen short”, which describes the lack of retirement savings and inability for the majority of retirees to maintain their current lifestyle during retirement. The article references a report issued by the Employee Benefit Research Institute that stated the median amount in 401(k) savings accounts is $18,433. The median is higher for older employees as Vanguard 401(k) accounts for savers age 55 to 64 was $76,381 in 2013.

The Social Security website calculates life expectancy and determined that a man reaching age 65 today is expected to live until 84.3 years old (86.6 years old for women). That being said, an employee expecting to retire at age 65 with less than $100,000 in retirement savings has to live off that and social security for 20 plus years. The shift in retirement has led to many retirees not enjoying the retirement they had once planned.

As mentioned earlier, the migration from defined benefit plans to defined contribution plans has led to employees being responsible for managing their retirement. It is apparent that the savings rate for the average employee has not been sufficient to fund retirement, so now let us look at how employees are performing compared to major asset classes.

Contributions are only one part of a 401(k) balance with the other being interest earned. The chart above shows how the average investor has performed compared to different asset classes over the past 20 years. The 2.5% earned by the average investor was only .1% higher than inflation. This essentially means that in real dollars the average investor did not have any earnings during this period.

We typically look at the S&P 500 when determining how the stock market is performing which was up 9.9% over the same period. The other highlighted bar in the graph shows a portfolio with 60% in stocks and 40% in bonds, which is more of a conservative allocation but still saw an increase of 8.7%. When participating in a 401(k) for 20, 30, or 40 years, the majority of the balance when approaching retirement is not the contributions made but the interest that has compounded over an extended period of time. Losing 6-8% annually has a dramatic impact on an account, especially over a 20 year period.

This chart shows the impact of lost earnings over 40 years. In the example, the investor makes an initial investment of $10,000 earning 0%, 2%, 5%, and 8% annually with no additional contributions. Two quick takeaways are the interest that compounds at 5% and 8% are much more than the initial investment and after 20 years the difference between 5% and 8% is almost double.

Taking Control Of Your 401(k)

As defined contribution plans continue to takeover as the main income vehicle for retirees, how can employees benefit and take advantage of the available resources from these plans?

Start contributing as soon as possible - As shown earlier, the interest that compounds in a retirement account makes up the majority of the balance when invested for an extended period of time. The sooner you can start contributing the longer the account has to grow and the need to play catch-up as you approach retirement may be avoided. Also, you will be less reliable on the dollars being contributed as you are not used to the income each pay period.

Take advantage of the employer match - If your employer is generous enough to offer a match, take advantage of it. For example, you make $50,000 a year and your employer matches up to 3% of your compensation. This means that you can contribute $1,500 of pre-tax money and automatically double your investment. That is a 100% return just for participating in the plan.

Use the available resources - If your plan has a financial advisor, sit down with him or her and discuss your retirement goals and how to invest your contributions. The reason the average investor performs so poorly compared to the indexes is because they try to time the market and when they pull out they are reluctant to get back in. Discuss your time horizon and risk tolerance with your advisor and let them allocate your investments in a way that makes sense.

It is important to be educated, and historically, investors do not benefit over longer periods if they try to beat the market. JP Morgan put out a study that showed an investor who missed the 10 best days in the stock market from 1994-2014 earned a little more than half of an investor who was fully invested during the same period. If you have a long time horizon, it is important to hold through the ups and downs as historically the stock market goes up over long periods. For most investors, 10-15 years from retirement is when participants should start reassessing their allocation and determine if it is still the appropriate position for them.

Final Thoughts

As money continues to pour into defined contribution plans, it is important that the public be educated on what this means for retirement. Now more than ever it is up to employees to take responsibility for their retirement and save enough to last as defined benefit plans become obsolete and Social Security needs an overhaul that no one will touch.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.