Potential Consequences of Taking IRA Distributions to Pay Off Debt

Once there is no longer a paycheck, retirees will typically meet expenses with a combination of social security, withdrawals from retirement accounts, annuities, and pensions. Social security, pensions, and annuities are usually fixed amounts, while withdrawals from retirement accounts could fluctuate based on need. This flexibility presents

Potential Consequences of Taking IRA Distributions to Pay Off Debt

Once there is no longer a paycheck, retirees will typically meet expenses with a combination of social security, withdrawals from retirement accounts, annuities, and pensions. Social security, pensions, and annuities are usually fixed amounts, while withdrawals from retirement accounts could fluctuate based on need. This flexibility presents opportunities to use retirement savings to pay off debt; but before doing so, it is important to consider the possible consequences.

Clients often come to us saying they have some amount left on a mortgage and they would feel great if they could just pay it off. Lower monthly bills and less debt when living on a fixed income is certainly good, both from a financial and psychological point of view, but taking large distributions from retirement accounts just to pay off debt may lead to tax consequences that can make you worse off financially.

Below are three items I typically consider before making a recommendation for clients. Every retiree is different so consulting with a professional such as a financial planner or accountant is recommended if you’d like further guidance.

Impact on State Income and Property Taxes

Depending on what state you are in, withdrawals from IRA’s could be taxed very differently. It is important to know how they are taxed in your state before making any big decision like this. For example, New York State allows for tax free withdrawals of IRA accounts up to a maximum of $20,000 per recipient receiving the funds. Once the $20,000 limit is met in a certain year, any distribution you take above that will be taxed.

If someone normally pulls $15,000 a year from a retirement account to meet expenses and then wanted to pull another $50,000 to pay off a mortgage, they have created $45,000 of additional taxable income to New York State. This is typically not a good thing, especially if in the future you never have to pull more than $20,000 in a year, as you would have never paid New York State taxes on the distributions.

Note: Another item to consider regarding states is the impact on property taxes. For example, New York State offers an “Enhanced STAR” credit if you are over the age of 65, but it is dependent on income. Here is an article that discusses this in more detail STAR Property Tax Credit: Make Sure You Know The New Income Limits.

What Tax Bracket Are You in at the Federal Level?

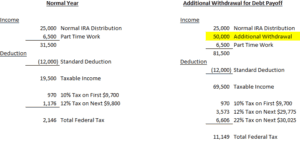

Federal income taxes are determined using a “Progressive Tax” calculation. For example, if you are filing single, the first $9,700 of taxable income you have is taxed at a lower rate than any income you earn above that. Below are charts of the 2019 tax tables so you can review the different tax rates at certain income levels for single and married filing joint ( Source: Nerd Wallet ).

There isn’t much of a difference between the first two brackets of 10% and 12%, but the next jump is to 22%. This means that, if you are filing single, you are paying the government 10% more on any additional taxable income from $39,475 – $84,200. Below is a basic example of how taking a large distribution from the IRA could impact your federal tax liability.

How Will it Impact the Amount of Social Security You Pay Tax on?

This is usually the most complicated to calculate. Here is a link to the 2018 instructions and worksheets for calculating how much of your Social Security benefit will be taxed ( IRS Publication 915 ). Basically, by showing more income, you may have to pay tax on more of your Social Security benefit. Below is a chart put together with information from the IRS to show how much of your benefit may be taxed.

To calculate “Combined Income”, you take your Adjusted Gross Income + Nontaxable Interest + Half of your Social Security benefit. For the purpose of this discussion, remember that any amount you withdraw from your IRA is counted in your Combined Income and therefore could make more of your social security benefit subject to tax.

Peace of mind is key and usually having less bills or debt can provide that, but it is important to look at the cost you are paying for it. There are times that this strategy could make sense, but if you have questions about a personal situation please consult with a professional to put together the correct strategy.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Can I Open A Roth IRA For My Child?

Parents always want their children to succeed financially so they do everything they can to set them up for a good future. One of the options for parents is to set up a Roth IRA and we have a lot of parents that ask us if they are allowed to establish one on behalf of their son or daughter. You can, as long as they have earned income. This can be a

Parents will often ask us: “What type of account can I setup for my kids that will help them to get a head start financially in life"?”. One of the most powerful wealth building tools that you can setup for your children is a Roth IRA because all of accumulation between now and when they withdrawal it in retirement will be all tax free. If your child has $10,000 in their Roth IRA today, assuming they never make another deposit to the account, and it earns 8% per year, 40 years from now the account balance would be $217,000.

Contribution Limits

The maximum contribution that an individual under that age of 50 can make to a Roth IRA in 2022 is the LESSER of:

$6,000

100% of earned income

For most children between the age of 15 and 21, their Roth IRA contributions tend to be capped by the amount of their earned income. The most common sources of earned income for young adults within this age range are:

Part-time employment

Summer jobs

Paid internships

Wages from parent owned company

If they add up all of their W-2's at the end of the year and they total $3,000, the maximum contribution that you can make to their Roth IRA for that tax year is $3,000.

Roth IRA's for Minors

If you child is under the age of 18, you can still establish a Roth IRA for them. However, it will be considered a "custodial IRA". Since minors cannot enter into contracts, you as the parent serve as the custodian to their account. You will need to sign all of the forms to setup the account and select the investment allocation for the IRA. It's important to understand that even though you are listed as a custodian on the account, all contributions made to the account belong 100% to the child. Once the child turns age 18, they have full control over the account.

Age 18+

If the child is age 18 or older, they will be required to sign the forms to setup the Roth IRA and it's usually a good opportunity to introduce them to the investing world. We encourage our clients to bring their children to the meeting to establish the account so they can learn about investing, stocks, bonds, the benefits of compounded interest, and the stock market in general. It's a great learning experience.

Contribution Deadline & Tax Filing

The deadline to make a Roth IRA contribution is April 15th following the end of the calendar year. We often get the question: "Does my child need to file a tax return to make a Roth IRA contribution?" The answer is "no". If their taxable income is below the threshold that would otherwise require them to file a tax return, they are not required to file a tax return just because a Roth IRA was funded in their name.

Distribution Options

While many of parents establish Roth IRA’s for their children to give them a head start on saving for retirement, these accounts can be used to support other financial goals as well. Roth contributions are made with after tax dollars. The main benefit of having a Roth IRA is if withdrawals are made after the account has been established for 5 years and the IRA owner has obtained age 59½, there is no tax paid on the investment earnings distributed from the account.

If you distribute the investment earnings from a Roth IRA before reaching age 59½, the account owner has to pay income tax and a 10% early withdrawal penalty on the amount distributed. However, income taxes and penalties only apply to the “earnings” portion of the account. The contributions, since they were made with after tax dollar, can be withdrawal from the Roth IRA at any time without having to pay income taxes or penalties.

Example: I deposit $5,000 to my daughters Roth IRA and four years from now the account balance is $9,000. My daughter wants to buy a house but is having trouble coming up with the money for the down payment. She can withdrawal $5,000 out of her Roth IRA without having to pay taxes or penalties since that amount represents the after tax contributions that were made to the account. The $4,000 that represents the earnings portion of the account can remain in the account and continue to accumulate tax-free. Not only did I provide my daughter with a head start on her retirement savings but I was also able to help her with the purchase of her first house.

We have seen clients use this flexible withdrawal strategy to help their children pay for their wedding, pay for college, pay off student loans, and to purchase their first house.

Not Limited To Just Your Children

This wealth accumulate strategy is not limited to just your children. We have had grandparents fund Roth IRA's for their grandchildren and aunts fund Roth IRA's for their nephews. They do not have to be listed as a dependent on your tax return to establish a custodial IRA. If you are funded a Roth IRA for a minor or a college student that is not your child, you may have to obtain the total amount of wages on their W-2 form from their parents or the student because the contribution could be capped based on what they made for the year.

Business Owners

Sometime we see business owners put their kids on payroll for the sole purpose of providing them with enough income to make the $6,000 contribution to their Roth IRA. Also, the child is usually in a lower tax bracket than their parents, so the wages earned by the child are typically taxed at a lower tax rate. A special note with this strategy, you have to be able to justify the wages being paid to your kids if the IRS or DOL comes knocking at your door.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

M&A Activity: Make Sure You Address The Seller’s 401(k) Plan

Buying a company is an exciting experience. However, many companies during a merger or acquisition fail to address the issues surrounding the seller’s retirement plan which can come back to haunt the buyer in a big way. I completely understand why this happens. Purchase price, valuations, tax issues, terms, holdbacks, and new employment

Buying a company is an exciting experience. However, many companies during a merger or acquisition fail to address the issues surrounding the seller’s retirement plan which can come back to haunt the buyer in a big way. I completely understand why this happens. Purchase price, valuations, tax issues, terms, holdbacks, and new employment agreements tend to dominate the conversations throughout the business transaction. But lurking in the dark, below these main areas of focus, lives the seller’s 401(k) plan. Welcome to the land of unintended consequences where unexpected liabilities, big dollar outlays, and transition issues live.

Asset Sale or Stock Sale

Whether the transaction is a stock sale or asset sale will greatly influence the series of decisions that the buyer will need to make regarding the seller’s 401(k) plan. In an asset sale, it is common that employees of the seller’s company are terminated from employment and subsequently “rehired” by the buyer’s company. With asset sales, as part of the purchase agreement, the seller will often times be required to terminate their retirement plan prior to the closing date.

Terminating the seller’s plan prior to the closing date has a few advantages from both the buyer’s standpoint and from the standpoint of the seller’s employees. Here are the advantages for the buyer:

Advantage 1: The Seller Is Responsible For Terminating Their Plan

From the buyer’s standpoint, it’s much easier and cost effective to have the seller terminate their own plan. The seller is the point of contact at the third party administration firm, they are listed as the trustee, they are the signer for the final 5500, and they typically have a good personal relationship with their service providers. Once the transaction is complete, it can be a headache for the buyer to track down the authorized signers on the seller’s plan to get all of the contact information changed over and allows the buyer’s firm to file the final 5500.

The seller’s “good relationship” with their service providers is key. The seller has to call these companies and let them know that they are losing the plan since the plan is terminating. There are a lot of steps that need to be completed by those 401(k) service providers after the closing date of the transaction. If they are dealing with the seller, their “client”, they may be more helpful and accommodating in working through the termination process even though they losing the business. If they get a random call for the “new contact” for the plan, you risk getting put at the bottom of the pile

Part of the termination process involves getting all of the participant balances out of the plan. This includes terminated employees of the seller’s company that may be difficult for the buyer to get in contact with. It’s typically easier for the seller to coordinate the distribution efforts for the terminated plan.

Advantage 2: The Buyer Does Not Inherit Liability Issues From The Seller’s Plan

This is typically the main reason why the buyer will require the seller to terminate their plan prior to the closing date. Employer sponsored retirement plans have a lot of moving parts. If you take over a seller’s 401(k) plan to make the transition “easier”, you run the risk of inheriting all of the compliance issues associated with their plan. Maybe they forgot to file a 5500 a few years ago, maybe their TPA made a mistake on their year-end testing last year, or maybe they neglected to issues a required notice to their employees knowing that they were going to be selling the company that year. By having the seller terminate their plan prior to the closing date, the buyer can better protect themselves from unexpected liabilities that could arise down the road from the seller’s 401(k) plan.

Now, let’s transition the conversation over to the advantages for the seller’s employees.

Advantage 1: Distribution Options

A common goal of the successor company is to make the transition for the seller’s employees as positive as possible right out of the gate. Remember this rule: “People like options”. Having the seller terminate their retirement plan prior to the closing date of the transactions gives their employees some options. A plan termination is a “distributable event” meaning the employees have control over what they would like to do with their balance in the seller’s 401(k) plan. This is also true for the employees that are “rehired” by the buyer. The employees have the option to:

Rollover their 401(k) balance in the buyer’s plan (if eligible)

Rollover their 401(k) balance into a rollover IRA

Take a cash distribution

Some combination of options 1, 2, and 3

The employees retain the power of choice.

If instead of terminating the seller’s plan, what happens if the buyer decides to “merge” the seller’s plan in their 401(k) plan? With plan mergers, the employees lose all of the distribution options listed above. Since there was not a plan termination, the employees are forced to move their balances into the buyer’s plan.

Advantage 2: Credit For Service With The Seller’s Company

In many acquisitions, again to keep the new employees happy, the buyer will allow the incoming employee to use their years of service with the seller’s company toward the eligibility requirements in the buyer’s plan. This prevents the seller’s employees from coming in and having to satisfy the plan’s eligibility requirements as if they were a new employee without any prior service. If the plan is terminated prior to the closing date of the transaction, the buyer can allow this by making an amendment to their 401(k) plan.

If the plan terminates after the closing date of the transaction, the plan technically belonged to the buyer when the plan terminated. There is an ERISA rule, called the “successor plan rule”, that states when an employee is covered by a 401(k) plan and the plan terminates, that employee cannot be covered by another 401(k) plan sponsored by the same employer for a period of 12 months following the date of the plan termination. If it was the buyer’s intent to allow the seller’s employees to use their years of service with the selling company for purposes of satisfy the eligibility requirement in the buyer’s plan, you now have a big issue. Those employees are excluded from participating in the buyer’s plan for a year. This situation can be a speed bump for building rapport with the seller’s employees.

Loan Issue

If a company allows 401(k) loans and the plan terminates, it puts the employee in a very bad situation. If the employee is unable to come up with the cash to payoff their outstanding loan balance in full, they get taxed and possibly penalized on their outstanding loan balance in the plan.

Example: Jill takes a $30,000 loan from her 401(k) plan in May 2017. In August 2017, her company Tough Love Inc., announces that it has sold the company to a private equity firm and it will be immediately terminating the plan. Jill is 40 years old and has a $28,000 outstanding loan balance in the plan. When the plan terminates, the loan will be processed as an early distribution, not eligible for rollover, and she will have to pay income tax and the 10% early withdrawal penalty on the $28,000 outstanding loan balance. Ouch!!!

From the seller’s standpoint, to soften the tax hit, we have seen companies provide employees with a severance package or final bonus to offset some of the tax hit from the loan distribution.

From the buyer’s standpoint, you can amend the plan to allow employees of the seller’s company to rollover their outstanding 401(k) loan balance into your plan. While this seems like a great option, proceed with extreme caution. These “loan rollovers” get complicated very quickly. There is usually a window of time where the employee’s money is moving over from seller’s 401(k) plan over to the buyer’s 401(k) plan, and during that time period a loan payment may be missed. This now becomes a compliance issue for the buyer’s plan because you have to work with the employee to make up those missed loan payments. Otherwise the loan could go into default.

Example, Jill has her outstanding loan and the buyer amends the plan to allow the direct rollover of outstanding loan balances in the seller’s plan. Payroll stopped from the seller’s company in August, so no loan payments have been made, but the seller’s 401(k) provider did not process the direct rollover until December. When the loan balance rolls over, if the loan is not “current” as of the quarter end, the buyer’s plan will need to default her loan.

Our advice, handle this outstanding 401(k) loan issue with care. It can have a large negative impact on the employees. If an employee owes $10,000 to the IRS in taxes and penalties due to a forced loan distribution, they may bring that stress to work with them.

Stock Sale

In a stock sale, the employees do not terminate and then get rehired like in an asset sale. It’s a “transfer of ownership” as opposed to “a sale followed by a purchase”. In an asset sale, employees go to sleep one night employed by Company A and then wake up the next morning employed by Company B. In a stock sale, employees go to sleep employed by Company A, they wake up in the morning still employed by Company A, but ownership of Company A has been transferred to someone else.

With a stock sale, the seller’s plan typically merges into the buyer’s plan, assuming there is enough ownership to make them a “controlled group”. If there are multiple buyers, the buyers should consult with the TPA of their retirement plans or an ERISA attorney to determine if a controlled group will exist after the transaction is completed. If there is not enough common ownership to constitute a “controlled group”, the buyer can decide whether to continue to maintain the seller’s 401(k) plan as a standalone plan or create a multiple employer plan. The basic definition of a “controlled group” is an entity or group of individuals that own 80% or more of another company.

Stock Sales: Do Your Due Diligence!!!

In a stock sale, since the buyer will either be merging the seller’s plan into their own or continuing to maintain the seller’s plan as a standalone, you are inheriting any and all compliance issues associated with that plan. The seller’s issues become the buyer’s issues the day of the closing. The buyer should have an ERISA attorney that performs a detailed information request and due diligence on the seller’s 401(k) plan prior the closing date.

Seller Uses A PEO

Last issue. If the selling company uses a Professional Employer Organization (PEO) for their 401(k) services and the transaction is going to be a stock sale, make sure you get all of the information that you need to complete a mid-year valuation or the merged 5500 for the year PRIOR to the closing date. We have found that it’s very difficult to get information from PEO firms after the acquisition has been completed.

The Transition Rule

There is some relief provided by ERISA for mergers and acquisitions. If a control group exists, you have until the end of the year following the year of the acquisition to test the plans together. This is called the “transition rule”. However, if the buyer makes “significant” changes to the seller’s plan during the transition period, that may void the ability to delay combined testing. Unfortunately, there is not clear guidance as to what is considered a “significant change” so the buyer should consult with their TPA firm or ERISA attorney before making any changes to their own plan or the seller’s plan that could impact the rights, benefits, or features available to the plan participants.

Horror Stories

There are so many real life horror stories out there involving companies that go through the acquisition process without conducting the proper due diligence and transition planning with regard to the seller’s retirement plan. It never ends well!! As the buyer, it’s worth the time and the money to make sure your team of advisors have adequately addressed any issues surrounding the seller’s retirement plan prior to the closing date.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Do Inherited IRA's Work For Non-Spouse Beneficiaries?

The SECURE Act was signed into law on December 19, 2019 which completely changed the distribution options that are available to non-spouse beneficiaries. One of the major changes was the elimination of the “stretch provision” which previously allowed non-spouse beneficiaries to rollover the balance into their own inherited IRA and then take small

The SECURE Act was signed into law on December 19, 2019 which completely changed the distribution options that are available to non-spouse beneficiaries. One of the major changes was the elimination of the “stretch provision” which previously allowed non-spouse beneficiaries to rollover the balance into their own inherited IRA and then take small required minimum distributions over their lifetime.

That popular option was replaced with the new 10 Year Rule which will apply to most non-spouse beneficiaries that inherit IRA’s and other types of retirements account after December 31, 2019.

New Rules For Non-Spouse Beneficiaries Years 2020+

The article and Youtube video listed below will provide you with information on:

New distribution options available to non-spouse beneficiaries

The new 10 Year Rule

Beneficiaries that are grandfathered in under the old rules

SECURE Act changes

Old rules vs New rules

New tax strategies for non-spouse beneficiaries

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.