$5,000 Penalty Free Distribution From An IRA or 401(k) After The Birth Of A Child or Adoption

New parents have even more to be excited about in 2020. On December 19, 2019, Congress passed the SECURE Act, which now allows parents to withdraw up to $5,000 out of their IRA’s or 401(k) plans following the birth of their child

New parents have even more to be excited about in 2020. On December 19, 2019, Congress passed the SECURE Act, which now allows parents to withdraw up to $5,000 out of their IRA’s or 401(k) plans following the birth of their child without having to pay the 10% early withdrawal penalty. To take advantage of this new distribution option, parents will need to know:

Effective date of the change

Taxes on the distribution

Deadline to make the withdrawal

Is it $5,000 for each parent or a total per couple?

Do all 401(k) plans allow these types of distributions?

Is it a per child or is it a one-time event?

Can you repay the money to your retirement account at a future date?

How does it apply to adoptions?

This article will provide you with answers to these questions and also provide families with advanced tax strategies to reduce the tax impact of these distributions.

SECURE Act

The SECURE Act was passed in December 2019 and Section 113 of the Act added a new exception to the 10% early withdrawal penalty for taking distributions from retirement accounts called the “Qualified Birth or Adoption Distribution.”

Prior to the SECURE Act, if you were under the age of 59½ and you distributed pre-tax money from an IRA or 401(k) plan, in addition to having to pay ordinary income tax on the amount distributed, you were also hit with a 10% early withdrawal penalty from the IRS. The IRS prior to the SECURE Act did have a list of exceptions to the 10% penalty but having a child or adopting a child was not on that list. Now it is.

How It Works

After the birth of a child, a parent is allowed to distribute up to $5,000 out of either an IRA or a 401(k) plan. Notice the word “after”. You are not allowed to withdraw the money prior to the child being born. New parents have up to 12 months following the date of birth to process the distribution from their retirement accounts and avoid the 10% early withdrawal penalty.

Example: Jim and Sarah have their first child on May 5, 2020. To help with some of the additional costs of a larger family, Jim decides to withdraw $5,000 out of his rollover IRA. Jim’s window to process that distribution is between May 5, 2020 – May 4, 2021.

The Tax Hit

Assuming Jim is 30 years old, he would avoid having to pay the 10% early withdrawal penalty on the $5,000 but that $5,000 still represents taxable income to him in the year that the distribution takes place. If Jim and Sarah live in New York and make a combined income of $100,000, in 2020, that $5,000 would be subject to federal income tax of 22% and state income tax of 6.45%, resulting in a tax liability of $1,423.

Luckily under the current tax laws, there is a $2,000 federal tax credit for dependent children under the age of 17, which would more than offset the total 22% in fed tax liability ($1,100) created by the $5,000 distribution from the IRA. Essentially reducing the tax bill to $323 which is just the state tax portion.

TAX NOTE: While the $2,000 fed tax credit can be used to offset the federal tax liability in this example, if the IRA distribution was not taken, that $2,000 would have reduced Jim & Sarah’s existing tax liability dollar for dollar.

For more info on the “The Child Tax Credit” see our article: More Taxpayers Will Qualify For The Child Tax Credit

$5,000 Per Parent

But it gets better. The $5,000 limit is available to EACH parent meaning if both parents have a pre-tax IRA or 401(k) plan, they can each distribute up to $5,000 from their retirement accounts within 12 months following the birth of their child and avoid the 10% early withdrawal penalty.

ADVANCED TAX STRATEGY: If both parents are planning to distribute the full $5,000 out of their retirement accounts and they are in a medium to high tax bracket, it may make sense to split the two distributions between separate tax years.

Example: Scott and Linda have a child on October 3, 2020 and they both plan to take the full $5,000 out of their IRA accounts. If they are in a 24% federal tax bracket and they process both distributions prior to December 31, 2020, the full $10,000 would be taxable to them in 2020. This would create a $2,400 federal tax liability. Since this amount is over the $2,000 child tax credit, they will have to be prepared to pay the additional $400 federal income tax when they file their taxes since it was not fully offset by the $2,000 tax credit.

In addition, by taking the full $10,000 in the same tax year, Scott and Linda also run the risk of making that income subject to a higher tax rate. If instead, Linda processes her distribution in November 2020 and Scott waits until January 2021 to process his $5,000 IRA distribution, it could result in a lower tax liability and less out of pocket expense come tax time.

Remember, you have 12 months following the date of birth to process the distribution and qualify for the 10% early withdrawal exemption.

$5,000 For Each Child

This 10% early withdrawal exemption is available for each child that is born. It does not have a lifetime limit.

Example: Building on the Scott and Linda example above, they have their first child October 2020, and both of them process a $5,000 distribution from their IRA’s avoiding the 10% penalty. They then have their second child in November 2021. Both Scott and Linda would be eligible to withdraw another $5,000 each out of their IRA or 401(k) within 12 months after the birth of their second child and again avoid having to pay the 10% early withdrawal penalty.

IRS Audit

One question that we have received is “Do I need to keep track of what I spend the money on in case I’m ever audited by the IRS?” The short answer is “No”. The new law does not require you to keep track of what the money was spent on. The birth of your child is the “qualifying event” which makes you eligible to distribute the $5,000 penalty free.

Not All 401(k) Plans Will Allow These Distributions

Starting in 2020, this 10% early withdrawal exception will apply to all pre-tax IRA accounts but it does not automatically apply to all 401(k), 403(b), or other types of qualified employer sponsored retirement plans.

While the SECURE Act “allows” these penalty free distributions to be made, companies can decide whether or not they want to provide this special distribution option to their employees. For employers that have existing 401(k) or 403(b) plans, if they want to allow these penalty free distributions to employees after the birth of a child, they will need to contact their third-party administrator and request that the plan be amended.

For companies that intend to add this distribution option to their plan, they may need to be patient with the timeline for the change. 401(k) providers will most likely need to update their distribution forms, tax codes on their 1099R forms, and update their recordkeeping system to accommodate this new type of distribution.

Ability To Repay The Distribution

The new law also offers parents the option to repay the amounts to their retirement account that were distributed due to a qualified birth or adoption. The repayment of the amounts previously distributed from the IRA or 401(k) would be in addition to the annual contribution limits. There is not a lot of clarity at this point as to how these “repayments” will work so we will have to wait for future guidance from the IRS on this feature.

Adoptions

The 10% early withdrawal exception also applies to adoptions. An individual is allowed to take a distribution from their retirement account up to $5,000 for any children under the age of 18 that is adopted. Similar to the timing rules of the birth of a child, the distribution must take place AFTER the adoption is finalized, but within 12 months following that date. Any money distributed from retirement accounts prior to the adoption date will be subject to the 10% penalty for individuals under the age of 59½.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Understanding FAFSA & How To Qualify For More College Financial Aid

As the cost of college continues to rise, so does the financial stress that it puts on families trying to determine the optimal solution to pay for college. It’s never been more important for parents and family members of these students

As the cost of college continues to rise, so does the financial stress that it puts on families trying to determine the optimal solution to pay for college. It’s never been more important for parents and family members of these students to understand:

How is college financial aid calculated?

Are there ways to increase the amount of financial aid you can receive?

What are the income and asset thresholds where financial aid evaporates?

Understanding the FAFSA 2 Year Lookback Rule

The difference between financial aid at public colleges vs private colleges

In this article we will provide you with guidance on these topics as well as introduce strategies that we as financial planners use with our clients to help them qualify for more financial aid.

How is college financial aid calculated?

Too often we see families jump to the incorrect assumption that “I make too much to qualify for financial aid.” Depending on what your asset and income picture looks like there may be strategies that will allow you to shift assets around during the financial aid determination years to qualify for need based financial aid. But you first need to understand how need based financial aid is calculated.

The Department of Education has a formula to calculate your “Expected Family Contribution” (EFC). The Expected Family Contribution is the amount that a family is expected to pay out of pocket each year before financial aid is awarded. Here is the general formula for financial aid:

It’s pretty simple and straight forward. Cost of the college, minus the EFC, equals the amount of your financial aid award. Now let’s breakdown how the EFC is calculated

Expected Family Contribution (EFC) Calculation

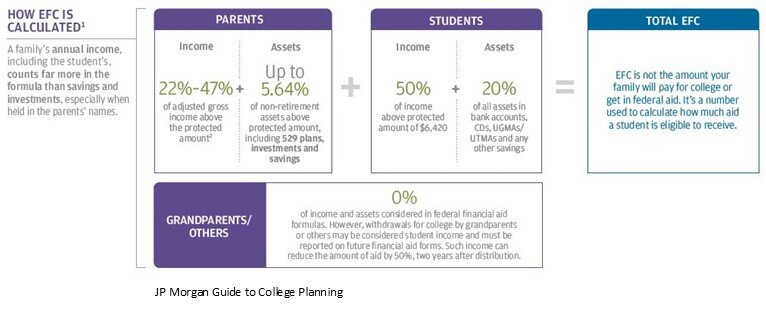

Both the parent’s income and assets, as well as the student’s income and assets come into play when calculating a family’s EFC. But they are weighted differently in the formula. Let’s look at the parent’s income and assets first.

Parent’s Income & Assets

Parents Income: The parent’s income is one of the largest factors in the EFC calculation. The percentage of the parents income that counts toward the EFC calculation is expressed as a range between 22% - 47% because it depends on a number of factors such as household size and the number of children that you have attending college at the same time.

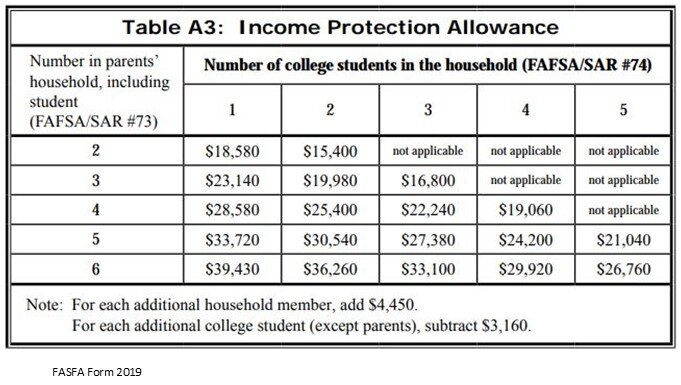

However, there is an “Income Protection Allowance” that allows parents to shelter a portion of their income from the formula based on the household size and the number of children attending college. See that chart below for the 2019-2020 FAFSA form:

Parents Assets: Any assets owned by the parents of the student are multiplied by 5.64% and that amount counts towards the EFC. Here are a few assets that are specifically EXCLUDED from this calculation:

Retirement Accounts: 401(k), 403(b), IRA’s, SEP, Simple

Pensions

Primary Residence

Family controlled business (less than 100 employees and 51%+ ownership by parents)

On the opposite side of that coin, here is a list of some assets that are specifically INCLUDED in the calculation:

Balance in 529 accounts

Real estate other than the primary residence

Even if held in an LLC – Reported separately from “business assets”

Non-retirement investment accounts, savings account, CD’s

Trusts where the student is a beneficiary of the trust (even if not entitled to distributions yet)

Business interest (less than 51% family owned by parents or more than 100 employees)

Similar to the Income Allowance Table, there is also a Parents’ Asset Protection Allowance Table that allows them to shelter a portion of their countable assets from the EFC formula. See the table below for the 2019-2020 school year.

Student’s Income & Assets

Now let’s switch gears over to the student side of the EFC formula. The income and the assets of the student are weighted differently than the parent’s income and assets. Here is the student side of the EFC formula:

As you can clearly see, income and assets in the student’s name compared to the parent name will dramatically increase the Expected Family Contribution and in turn decrease the amount of financial aid awarded. It is because of this, that as a general rule, if you think your asset and income picture may qualify you for financial aid, do not put assets in the name of your child. The most common error that we see people make are assets in an UGMA or UTMA account. Even though parents control those accounts, they are technically considered an asset of the child. If there is $30,000 sitting in an UTMA account for the student, they are automatically losing around $6,000 EACH YEAR in financial aid. Multiply that by 4 years of college, it ends up costing the family $24,000 out of pocket that otherwise could have been covered by financial aid.

EFC Formula Illustration

If we put all of the pieces together, here is an illustration of the full EFC Formula:

Grandparent Owned 529 Plans For The Student

As you will see in the EFC formula above, assets owned by the grandparents with the student listed as the beneficiary, like 529 accounts, are not counted at all toward the EFC calculation. This can be a very valuable college savings strategy for families since the parent owned 529 accounts count toward the Expected Family Contribution. However, there are some pitfalls and common mistakes that we have seen people make with regard to grandparent owned 529 accounts. See the article below for more information specific to this topic:

Article: Common Mistakes With Grandparent Owned 529 Accounts

Financial Aid Chart

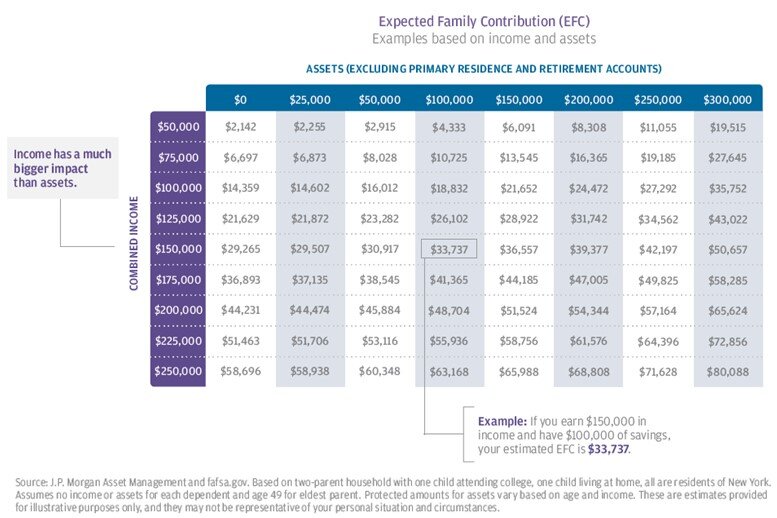

Our friends over at JP Morgan were kind enough to put a summary chart together for this EFC calculation which allows families to get a ballpark idea of what their Expected Family Contribution might be without getting out a calculator. The chart below is based on the following assumptions:

Two parent household

2 Children: One attending college and the other still at home

The child attending college has no assets or income

The oldest parent is age 49

Using the chart above, if the parents combined income is $150,000 and they have $100,000 in countable assets, the Expected Family Contribution would be $33,737 for that school year. What does that mean? If the student is attending a state college and the tuition with room and board is $26,000, since the EFC is greater than the total cost of college for that year, that family would receive no financial aid. However, if that student applies to a private school and the CSS Profile form results in approximately that same EFC of $33,737 but the private school costs $60,000 per year, then the family may receive need based financial aid or a grant from the private school equaling $26,263 per year.

Public Colleges vs. Private Colleges

It’s important to point out that FAFSA and the EFC calculation primarily applies to students that plan on attending a Community College, State College, or certain Private Colleges. Since Private Colleges do not receive federal financial aid they do not have to adhere to the EFC calculation that is used by FAFSA. Private college can choose to use to FAFSA criteria but many of the private colleges will require students to complete both the FAFSA form and the CSS Profile Form.

Here are a few examples of how the financial reporting deviates:

If the parents have a 100% family owned business, they would not have to list that as an asset on the FAFSA application but they would have to list the business as an assets on the CSS Profile form.

The equity in your primary residence is not counted as an asset for FAFSA but it is listed as an asset on the CSS Profile Form.

For parents that are divorced. FAFSA only looks at the assets and income of the custodial parent. The CSS Profile Form captures the assets and income of both the custodial and non-custodial parent.

Because of the deviations between the FAFSA application and the CSS Profile Form, we have seen situations where a student received no need based financial aid when applying to a $50,000 per year private school but they received financial aid for attending a state school even though the annual cost to attend the state school was half the cost of the private school.

Top 10 Ways To Increase College Financial Aid

Here is a quick list of the top strategies that we use to help families to qualify for more financial aid.

Disclosure: There are details associated with each strategy listed below that need to be executed correctly in order for the strategy to have a positive impact on the EFC calculation. Not all strategies will work depending on the financial circumstances of each household and where the child plans to attend college. Contact us for details.

Get assets out of the name of the student

Grandparent owned 529 accounts

Use countable assets of the parents to pay down debt

Move UTGMA & UGMA accounts to 529 UGMA or 529 UTMA accounts

Increase contributions to retirement accounts

Minimize distributions from retirement accounts

Minimize capital gain and dividend income

Accelerate necessary expenses

Use home equity line of credit instead of home equity loan

Families that own small businesses have a lot of advanced planning options

FAFSA – 2 Year Lookback

It’s important to understand the FAFSA application process because you have know when they take the snapshot of your income and assets for the EFC calculation in order to have a shot at increasing the financial aid that you may be able to qualify for.

FAFSA looks back 2 years to determine what your income will be for the upcoming school year. For example, if your child is going to be a freshman in college in the fall of 2020, you will report your 2018 income on the FAFSA application. This is important because you have to start putting some of these strategies into place in the spring of your child’s sophomore year in high school otherwise you could miss out on planning opportunities for their freshman year in college.

If your child is already a junior or senior in high school and you are just reading this article now, there is still an opportunity to implement some of the strategies listed above. Income has a 2 year lookback but assets are reported as of the day of the application. Also the FAFSA application is completed each year that your child is attending college, so even though you may have missed income reduction strategies for their freshman year, at some point the 2 year lookback will influence the financial aid picture during the four years of their undergraduate degree.

IMPORTANT NOTE: Income has a 2-year lookback

Asset balances are determined on the day that you submit the FAFSA Application

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Do Trusts Expire?

Do trusts have an expiration date after the death of the grantor? For most states, the answer is “Yes”. New York is one of those states that have adopted “The Rule Against Perpetuities” which requires all of the assets to be distributed from the trust by a specified date.

Do trusts have an expiration date after the death of the grantor? For most states, the answer is “Yes”. New York is one of those states that have adopted “The Rule Against Perpetuities” which requires all of the assets to be distributed from the trust by a specified date.

The Rule Against Perpetuities

For most states, the trust assets have to be distributed no later than the “lifetime of those then living plus 21 years.” In other words, the trust asset must be distributed 21 years after the death of the youngest beneficiary listed in the trust document. For example, if I setup a trust with my children listed as beneficiaries, after my passing the trust assets would have to be distributed no later than 21 years following the death of my youngest child.

Per Stirpes Beneficiaries

Some trust documents have the children listed as beneficiaries “per stirpes”. This mean that if a child is no longer alive their share of the trust passes to their heirs. In many cases their children. If the beneficiaries are listed in the trust document as per stirpes beneficiaries then you may be able to make the argument that the “youngest beneficiary” is really the grandchildren not the children which will allow the trust to retain the assets for a longer period of time. Typically trusts do not allow the perpetuity rule to extend beyond their grandchildren.

Consult An Estate Attorney

Trust can be tricky and the language in a trust document is not always black and white, so it’s highly recommended that you consult with an estate attorney that is familiar with the estate laws for you state of residence and can review the terms of the trust document.DISCLOSURE: The information listed above is not legal advice. For legal advice, please consult your attorney.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Do Inherited IRA's Work For Non-Spouse Beneficiaries?

The SECURE Act was signed into law on December 19, 2019 which completely changed the distribution options that are available to non-spouse beneficiaries. One of the major changes was the elimination of the “stretch provision” which previously allowed non-spouse beneficiaries to rollover the balance into their own inherited IRA and then take small

The SECURE Act was signed into law on December 19, 2019 which completely changed the distribution options that are available to non-spouse beneficiaries. One of the major changes was the elimination of the “stretch provision” which previously allowed non-spouse beneficiaries to rollover the balance into their own inherited IRA and then take small required minimum distributions over their lifetime.

That popular option was replaced with the new 10 Year Rule which will apply to most non-spouse beneficiaries that inherit IRA’s and other types of retirements account after December 31, 2019.

New Rules For Non-Spouse Beneficiaries Years 2020+

The article and Youtube video listed below will provide you with information on:

New distribution options available to non-spouse beneficiaries

The new 10 Year Rule

Beneficiaries that are grandfathered in under the old rules

SECURE Act changes

Old rules vs New rules

New tax strategies for non-spouse beneficiaries

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Does A Simple IRA Plan Work?

Not every company with employees should have a 401(k) plan. In many cases, a Simple IRA plan may be the best fit for a small business. These plans carry the following benefits

Not every company with employees should have a 401(k) plan. In many cases, a Simple IRA plan may be the best fit for a small business. These plans carry the following benefits

No TPA fees

Easy to setup & operate

Employee attraction and retention tool

Pre-tax contributions for the owners to lower their tax liability

Your company

To be eligible to sponsor a Simple IRA, your company must have less than 100 employees. The contribution limits to these plans are about half that of a 401(k) plan but it still may be the right fit for you company. Here are some of the most common statements that we hear from the owners of the business that would lead you to considering a Simple IRA plan over a 401(k) plan:

"I want to put a retirement plans in place for my employees that has very low fees and is easy to operate."

"We are a start-up, we don't have a lot of money to contribute to the plan as the owners, but we want to put a plan in place to attract and retain employees."

"I plan on contributing $15,000 per year to the plan, even if I sponsored a plan that allowed me to contribute more I wouldn't because I'm socking all of the profits back into the business"

"I have a SEP IRA now but I just hired my first employee. I need to setup a different type of plan since SEP IRA's are 100% employer funded"

Establishment Deadline

The deadline to establish a Simple IRA plan is October 1st. Once you have cross over that date, you would have to wait until the following calendar year to set the plan.

Eligibility

The eligibility requirements for a Simple IRA are different than a SEP IRA or 401(k) plans. Unlike these other plan "1 Year of Service" = $5,000 of compensation earned in a calendar year. If you want to only cover "full-time" employees with your retirement plan, you may need to consider a 401(k) plan which has the 1 year and 1000 hours requirement to obtain a year of service. The most restrictive "wait time" that you can put into place is 2 years. Meaning an employee must obtain 2 years of service before they are eligible to start contributing to the plan. You can also be more lenient that 2 years, such as immediate entry or a 1-year wait, but 2 years is the most restrictive it can be.

Types of Contributions

Like a 401(k) plan, Simple IRA have both employee deferral contributions and employer contributions.

Employee Deferrals

Eligible employees are allowed to make pre-tax contributions to their Simple IRA accounts. The contribution limits are less than a traditional 401(k). Below is a tale comparing the 2021 contribution limits of a Simple IRA vs a 401(k) Plan:

There are not Roth deferrals allows in Simple IRA plans.

Employer Contributions

Unlike other employer sponsored retirement plans, employer contributions are mandatory each year to a Simple IRA plan. The company must choose between two pre-set employer contribution formulas:

2% Non-elective

3$ Matching contribution

With the 2% non-elective contribution, the company must contribute 2% of each eligible employee’s compensation to the plan whether they contribute to the plan or not.

For the 3% matching contribution, it’s a dollar for dollar match up to 3% of compensation that they employee contributes to the plan. The match formula is more popular than the 2% non-elective contribution because the company only must contribute if the employee contributes.

Special 1% Rule

With the employer matching contribution there is also a special rule. In 2 out of any 5 consecutive years, the company can lower the employer match to as low as 1% of pay. We will often see start-up company's take advantage of this rule by putting a 1% employer match in place for the first 2 years of the plan to minimize costs and then they are committed to making the 3% match for years 3, 4, and 5.

100% Vesting

All employer contributions to Simple IRA plans are 100% vested. The company is not allowed to attach a "vesting schedule" to the contributions.

Important Compliance Requirements

Make sure you have a 5304 Simple Form in your files for each year you sponsor the Simple IRA plan. If you are audited by the IRS or DOL, they will ask for these forms. You need to distribute this form to all of your employee each year between Nov 1st and Dec 1st for the upcoming plan year. The documents notifies your employees that:

A retirement plan exists

Plan eligibility requirement

Employer contribution formula

Who they submit their deferral elections to within the company

If you do not have this form on file, the IRS will assume that you have immediate eligibility for your Simple IRA plan, meaning that all of your employees are due employer contributions since day one of employment. Even employee that used to work for you and have since terminated employment. It’s an ugly situation.

Make sure the company is timely when submitting the employee deferrals to the Simple IRA plan. Since you are withholding money from employees pay for the salary deferrals the IRS want you to send that money to their Simple IRA accounts “as soon as administratively feasible”. The suggested time phrase is within a week of the deduction in payroll. But you must be consistent with the timing of your remittances to your Simple IRA plan. If you typically submit contributions to your Simple IRA provider 5 days after a payroll run but one week you randomly submit it 2 days after the payroll run, 2 days just became the rule and all of the other deferral remittances are “late”. The company will be assessed penalties for all of the late deferral remittances. So be consistent.

Cannot Terminate Mid-Year

Unlike other retirement plans, you cannot terminate a Simple IRA plan mid-year. Simple IRA plan termination are most common when a company started with a Simple IRA, has grown in employee head count, and now wishes to put a 401(k) plan in place. You must wait until after December 31st to terminate the Simple IRA plan and implement the new 401(k) plan.

Special 2 Year Rule

If you replace your Simple IRA with a 401(k) plan, the balances in the Simple IRA can usually be rolled over into the new 401(k) if the employee elects to do so. However, be very careful of the special Simple IRA 2 Year Distribution Rule. If you process any type of distribution from a Simple IRA, within a two-year period of the employee depositing their first dollar to the account, and the employee is under 59½, they are hit with a 25% IRS penalty. THIS ALSO APPLIES TO DIRECT ROLLOVERS. Normally when you process a direct rollover from one retirement plan to another, no taxes or penalties are assessed. That is not the case in Simple IRA plan so be care of this rule. If you decide to switch from a Simple IRA to a 401(k), make sure you run a list of all the employees that maintain a balance in the Simple IRA plan to determine which employees are subject to the 2-year withdrawal restriction.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Does A SEP IRA Work?

SEP stands for “Simplified Employee Pension”. The SEP IRA is one of the most common employer sponsored retirement plans used by sole proprietors and small businesses.

What is a SEP?

SEP stands for “Simplified Employee Pension”. The SEP IRA is one of the most common employer sponsored retirement plans used by sole proprietors and small businesses.

Special Establishment Deadline

SEP are one of the few retirement plans that can be established after December 31st which make them a powerful tax tool. For example, it’s March, you are meeting with your accountant and they deliver the bad news that you have a big tax bill that is due. You can setup the SEP IRA any time to your tax filing date PLUS extension, fund it, and capture the tax deduction.

Easy to Setup & Low Plan Fees

The other advantage of SEP IRA’s is they are easy to setup and you do not have a third-party administrator to run the plan, so the costs are a lot lower than a traditional 401(k) plans. These plans can typically be setup with 24 hours.

Contributions limits

SEP IRA contributions are expressed as a percentage of compensation. The maximum contribution is either 20% of the owners “net earned income” or 25% of the owners W2 wages. It all depends on how your business is incorporated. You have the option to contribution any amount less than the maximum contribution.

100% Employer Funded

SEP IRA plans are 100% employer funded meaning there is no employee deferral piece. Which makes them expense plans to sponsor for a company that eligible employees because the employer contribution is uniform for all employees. Meaning if the owner contributes 20% of their compensation to the plan for themselves they must also make a contribution equal to 20% of compensation for each eligible employee. Typically, once employees begin becoming eligible for the plan, a company will terminate the SEP IRA and replace it with either a Simple IRA or 401(k) plans.

Employee Eligibility Requirements

An employee earns a “year of service” for each calendar year that they earn $500 in compensation. You can see how easy it is to earn a “year of service” in these types of plans. This is where a lot of companies make an error because they only look at their “full time employees” as eligible. The good news for business owners is you can keep employees out of the plan for 3 years and then they become eligible in the 4th year of employment. For example, I am a sole proprietor and I hire my first employee, if my plan document is written correctly, I can keep that employee out of the SEP IRA for 3 years and then they will not be eligible for the employer contribution until the 4th year of employment.

Read This……..Very Important…..

There is a plan document called a 5305 SEP form that is required to sponsor a SEP IRA plan. This form can be printed off the IRS website or is sometimes provide by the investment platform for your plan. Remember, SEP IRA plans are “self-administered” meaning that you as the business owner are responsible for keeping the plan in compliance. Do cannot always rely on your investment advisor or accountant to help you with your SEP IRA plan. You should have a 5305 SEP for in your employer files for each year you have sponsored the plan. This form does not get filed with the IRS or DOL but rather is just kept in your employer files in the case of an audit. You are required to give this form to all employees of the company each year. It’s a way of notifying your employees that the plan exists and it lists the eligibility requirements.

Compliance Issues

The main compliance issues to watch out for with these plan is not having that 5305 SEP Form for each year the plan has been sponsored, not accurately identifying eligible employees, and miscalculating your “net earned income” for the max SEP IRA contribution.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Do Single(k) Plans Work?

A Single(k) plan is an employer sponsored retirement plan for owner only entities, meaning you have no full-time employees. These owner only entities get the benefits of having a full fledge 401(k) plan without the large administrative costs associated with traditional 401(k) plans.

What is a Single(k) Plan?

A Single(k) plan is an employer sponsored retirement plan for owner only entities, meaning you have no full-time employees. These owner only entities get the benefits of having a full fledge 401(k) plan without the large administrative costs associated with traditional 401(k) plans.

What is the definition of a “full-time” employee?

Often times a small company will have some part-time staff. It does not matter whether you consider them “part-time”, the definition of full-time employee is defined by the IRS as working 1000 hours in a 12 month period. If you have a “full-time” employee you would not be eligible to sponsor a Single(k) plan.

Types of Contributions

There are two types of contributions to these plans. Employee deferral contributions and employer profit sharing contributions. The employee deferral piece works like a 401(k) plan. If you are under the age of 50 you can contribute $19,500, in 2021, in employee deferrals. If you are 50 or older, you get the $6,500 catch up contribution so you can contribute $24,000 in employee deferrals.

The reason why these plans are a little different than other employer sponsored plans is the employee deferral piece allows you to put 100% of your compensation into these plans up to those dollar thresholds.

In addition to the employee deferrals, you can also contribute 20% of your net earned income in the form of a profit-sharing contribution. For example, if you make $100,000 in net earned income from self-employment and you are over 50, you could contribute $24,000 in employee deferrals and then you could contribute an additional $20,000 in form of a profit sharing contribution. Making your total pre-tax contribution $44,000.

Establishment Deadline

You have to establish these plans by December 31st. In most cases that plan does not have to be funded by 12/31 but you have to have the plan document signed by 12/31. You normally have until tax filing deadline plus extension to fund the plan.

Loans & Roth Deferrals

Single(k) plans provide all of the benefits to the owner of a full 401(k) plan at a fraction of the cost. You can set up the plan to allow 401(k) loan and Roth deferral contributions.

SEP IRA vs Single(k) Plans

A lot of small business owners find themselves in a position where they are trying to decide between setting up a SEP IRA or a Single(k) plan. One of the big factors, that is often times the deciding factor, is how much the owner intends to contribute to the plan. The SEP IRA limits the business owner to just the 20% of net earned income. Whereas the Single(k) plan allows the 20% of net earned income plus the employee deferral contribution amount. However, if 20% of your net earned income would satisfy your target amount then the SEP IRA may be the right choice.

Advanced Strategy Using A Single(k) Plan

Here is a great tax strategy if you have one spouse that is the primary breadwinner bringing in most of the income and the other has self-employment income for a side business. If the spouse with the self-employment income is over the age of 50 and makes $20,000 in net earned income, they could set up a Single(k) Plan and defer the full $20,000 into their Single(k) plan as employee deferrals. If they had a SEP IRA, the max contribution would have been $4,000.

A huge tax savings for a married couple that is looking to lower their tax liability.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.

Required Minimum Distribution Tax Strategies

If you are turning age 72 this year, this article is for you. You will most likely have to start taking required minimum distributions from your retirement accounts. This article will outline:

If you are turning age 72 this year, this article is for you. You will most likely have to start taking required minimum distributions from your retirement accounts. This article will outline:

Deadlines to take your RMD

Tax implications

Strategies to reduce your tax bill

How is my RMD calculated?

The IRS has a tax table that determines the amount that you have to take out of your retirement accounts each year. To determine your RMD amount you will need to obtain the December 31st balance in your retirement accounts, find your age on the IRS RMD tax table, and divide your 12/31 balance by the number listed next to your age in the tax table.

Exceptions to the RMD requirement........

There are two exceptions. First, Roth IRA’s do not require RMD’s. Second, if you are still working, you maintain a balance in your current employer’s retirement plan, and you are not a 5%+ owner of the company, you do not need to take an RMD from that particular retirement account until you terminate employment with the company. Which leads us to the first tax strategy. If you are age 72 or older and you are still working, you can typically rollover your traditional IRA’s and former employer 401(k)/403(b) accounts into your current employers retirement plan. By doing so, you avoid the requirement to take RMD’s from those retirement accounts outside of your current employers retirement plan and you avoid having to pay taxes on those required minimum distributions. If you are 5%+ owner of the company, you are out of luck. The IRS will still require you to take the RMD from your retirement account even though you are still “employed” by the company.

Deadlines

In the year that you turn 72, if you do not meet one of the exceptions listed above, you will have a very important decision to make. You have the option to take the RMD by 12/31 of that year or wait until the beginning of the following tax year. For your first RMD, the deadline to take the RMD is April 1st of the year following the year that you turn age 72. For example, if you turn 72 on June 2017, you will not be required to take your first RMD until April 1, 2018. If you worked full time from January 2017 – June 2017, it may make sense for you to delay your first RMD until January 2018 because your income will most likely be higher in 2017 because you worked for half of the year. When you take a RMD, like any other distribution from a pre-tax retirement account, it increases the amount of your taxable income for the year. From a pure tax standpoint it usually makes snese to realize income from retirement accounts in years that you are in a lower tax bracket.

SPECIAL NOTE: If you decided to delay your first RMD until after December 31st, you will be required to take two RMD’s in that year. One prior to April 1st and the second before Decemeber 31st. The April 1st rule only applies to your first RMD. You should consult with your accountant to determine the best RMD strategy given your personal income tax situation. For all tax years following the year that you turn age 72, the RMD deadline is December 31st.

VERY IMPORTANT: Do not miss your RMD deadline. The IRS hits you with a lovely 50% excise tax if you fail to take your RMD by the deadline. If you were due a $4,000 RMD and you miss the deadline, the IRS is going to levy a $2,000 excise tax against you.

Contributions to charity to avoid taxes

Another helpful tax strategy, if you make contributions to a charity, a church, or not-for-profit organization, you have the option with IRA’s to direct all or a portion of your RMD directly to these organization. In doing so, you satisfy your RMD but avoid having to pay income tax on the distribution from the IRA. The number one rule here, the distribution must go directly from your IRA account to the not-for-profit organization. At no point during this transaction can the owner of the IRA take possession of cash from the RMD otherwise the full amount will be taxable to the owner of the IRA. Typically the custodian of your IRA will have to issue and mail a third party check directly to the not-for-profit organization.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.