New Rules For Non Spouse Beneficiaries Of Retirement Accounts Starting In 2020

The SECURE Act was signed into law on December 19, 2019 and with it comes some very important changes to the options that are available to non-spouse beneficiaries of IRA’s, 401(k), 403(b), and other types of retirement accounts

The SECURE Act was signed into law on December 19, 2019 and with it comes some very important changes to the options that are available to non-spouse beneficiaries of IRA’s, 401(k), 403(b), and other types of retirement accounts starting in 2020. Unfortunately, with the passing of this law, Congress took away one of the most valuable distribution options available to non-spouse beneficiaries called the “stretch” provision. Non-spouse beneficiaries would utilize this distribution option to avoid the tax hit associated with having to take big distributions from pre-tax retirement accounts in a single tax year. This article will cover:

The old inherited IRA rules vs. the new inherited IRA rules

The new “10 Year Rule”

Who is grandfathered in under the old inherited IRA rules?

Impact of the new rules on minor children beneficiaries

Tax traps awaiting non spouse beneficiaries of retirement accounts

The “Stretch” Option Is Gone

The SECURE Act’s elimination of the stretch provision will have a big impact on non-spouse beneficiaries. Prior to January 1, 2020, non-spouse beneficiaries that inherited retirement accounts had the option to either:

Take a full distribution of the retirement account within 5 years

Rollover the balance to an inherited IRA and stretch the distributions from the retirement account over their lifetime. Also known as the “stretch option”.

Since any money distributed from a pre-tax retirement account is taxable income to the beneficiary, many non-spouse beneficiaries would choose the stretch option to avoid the big tax hit associated with taking larger distributions from a retirement account in a single year. Under the old rules, if you did not move the money to an inherited IRA by December 31st of the year following the decedent’s death, you were forced to take out the full account balance within a 5 year period.

On the flip side, the stretch option allowed these beneficiaries to move the retirement account balance from the decedent’s retirement account into their own inherited IRA tax and penalty free. The non-spouse beneficiary was then only required to take small distributions each year from the account called a RMD (“required minimum distribution”) but was allowed to keep the retirement account intact and continuing to accumulate tax deferred over their lifetime. A huge benefit!

The New 10 Year Rule

For non-spouse beneficiaries, the stretch option was replaced with the “10 Year Rule” which states that the balance in the inherited retirement account needs to be fully distributed by the end of the 10th year following the decedent’s date of death. The loss of the stretch option will be problematic for non-spouse beneficiaries that inherit sizable retirement accounts because they will be forced to take larger distributions exposing those pre-tax distributions to higher tax rates.

No RMD Requirement Under The 10 Year Rule

Even though the stretch option has been lost, beneficiaries will have some flexibility as to the timing of when distributions will take place from their inherited IRA. Unlike the stretch provision that required the non-spouse beneficiary to start taking the RMD’s the year following the decedent’s date of death, there are no RMD requirements associated with the new 10 year rule. Meaning in extreme cases, the beneficiary could choose not to take any distributions from the retirement account for 9 years and then in year 10 distribute the full account balance.

Now, unless you love paying taxes, very few people would elect to distribute a large pre-tax retirement account balance in a single tax year but the new rules give you a decade to coordinate a distribution strategy that will help you to manage your tax liability under the new rules.

Tax Traps For Non-Spouse Beneficiaries

These new inherited IRA distribution rules are going to require pro-active tax and financial planning for the beneficiaries of these retirement accounts. I’m lumping financial planning into that mix because taking distributions from pre-tax retirement accounts increases your taxable income which could cause the following things to happen:

Reduce the amount of college financial aid that your child is receiving

Increase the amount of your social security that is considered taxable income

Loss of property tax credits such as the Enhanced STAR Program

Increase your Medicare Part B and Part D premiums the following year

You may phase out of certain tax credits or deductions that you were previously receiving

Eliminate your ability to contribute to a Roth IRA

Loss of Medicaid or Special Needs benefits

Ordinary income and capital gains taxed at a higher rate

You really have to plan out the next 10 years and determine from a tax and financial planning standpoint what is the most advantageous way to distribute the full balance of the inherited IRA to minimize the tax hit and avoid triggering an unexpected financial consequence associated with having additional income during that 10 year period.

Who Is Grandfathered In?

If you are the non-spouse beneficiary of a retirement account and the decedent passed away prior to January 1, 2020, you are grandfathered in under the old inherited IRA rules. Meaning you are still able to utilize the stretch provision. Here are a few examples:

Example 1: If you had a parent pass away in 2018 and in 2019 you rolled over their IRA into your own inherited IRA, you are not subject to the new 10 year rule. You are allowed to stretch the IRA distributions over your lifetime in the form of those RMD’s.

Example 2: On December 15, 2019, you father passed away and you are listed as the beneficiary on his 401(k) account. Since he passed away prior to January 1, 2020, you would still have the option of setting up an Inherited IRA prior to December 31, 2020 and then stretching the distributions over your lifetime.

Example 3: On February 3, 2020, your uncle passes away and you are listed as a beneficiary on his Rollover IRA. Since he passed away after January 1, 2020, you would be required to distribute the full IRA balance prior to December 31, 2030.

You are also grandfathered in under the old rules if:

The beneficiary is the spouse

Disabled beneficiaries

Chronically Ill beneficiaries

Individuals who are NOT more than 10 years younger than the decendent

Certain minor children (see below)

Even beyond 2020, the beneficiaries listed above will still have the option to rollover the balance into their own inherited IRA and then stretch the required minimum distributions over their lifetime.

Minor Children As Beneficiaries

The rules are slightly different if the beneficiary is the child of the decedent AND they are still a minor. I purposely capitalized the word “and”. Within the new law is a “Special Rule for Minor Children” section that states if the beneficiary is a child of the decedent but has not reached the age of majority, then the child will be able to take age-based RMD’s from the inherited IRA but only until they reach the age of majority. Once they are no longer a minor, they are required to distribute the remainder of the retirement account balance within 10 years.

Example: A mother and father pass away in a car accident and the beneficiaries listed on their retirement accounts are their two children, Jacob age 10, and Sarah age 8. Jacob and Sarah would be able to move the balances from their parent’s retirements accounts into an inherited IRA and then just take small required minimum distributions from the account based on their life expectancy until they reach age 18. In their state of New York, age 18 is the age of majority. The entire inherited IRA would then need to be fully distributed to them before the end of the calendar year of their 28th birthday.

This exception only applies if they are a child of the decedent. If a minor child inherits a retirement account from a non-parent, such as a grandparent, then they are immediately subject to the 10 year rule.

Note: the age of majority varies by state.

Plans Not Impacted Until January 1, 2022

The replacement of the stretch option with the new 10 Year Rule will impact most non-spouse beneficiaries in 2020. There are a few exceptions to that effective date:

403(b) & 457 plans sponsored by state and local governments, including Thrift Savings Plans sponsored by the Federal Government will not lose the stretch option until January 1, 2022

Plans maintained pursuant to a collective bargaining agreement also do not lose the stretch option until January 1, 2022

Advanced Planning

Under the old inherited IRA rules there was less urgency for immediate tax planning because the non-spouse beneficiaries just had to move the money into an inherited IRA the year after the decedent passed away and in most cases the RMD's were relatively small resulting in a minimal tax impact. For non-spouse beneficiaries that inherit a retirement account after January 1, 2020, it will be so important to have a tax plan and financial plan in place as soon as possible otherwise you could lose a lot of your inheritance to higher taxes or other negative consequences associated with having more income during those distribution years.

Please feel free to contact us if you have any questions on the new inherited IRA rules. We would also be more than happy to share with you some of the advanced tax strategies that we will be using with our clients to help them to minimize the tax impact of the new 10 year rule.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Understanding FAFSA & How To Qualify For More College Financial Aid

As the cost of college continues to rise, so does the financial stress that it puts on families trying to determine the optimal solution to pay for college. It’s never been more important for parents and family members of these students

As the cost of college continues to rise, so does the financial stress that it puts on families trying to determine the optimal solution to pay for college. It’s never been more important for parents and family members of these students to understand:

How is college financial aid calculated?

Are there ways to increase the amount of financial aid you can receive?

What are the income and asset thresholds where financial aid evaporates?

Understanding the FAFSA 2 Year Lookback Rule

The difference between financial aid at public colleges vs private colleges

In this article we will provide you with guidance on these topics as well as introduce strategies that we as financial planners use with our clients to help them qualify for more financial aid.

How is college financial aid calculated?

Too often we see families jump to the incorrect assumption that “I make too much to qualify for financial aid.” Depending on what your asset and income picture looks like there may be strategies that will allow you to shift assets around during the financial aid determination years to qualify for need based financial aid. But you first need to understand how need based financial aid is calculated.

The Department of Education has a formula to calculate your “Expected Family Contribution” (EFC). The Expected Family Contribution is the amount that a family is expected to pay out of pocket each year before financial aid is awarded. Here is the general formula for financial aid:

It’s pretty simple and straight forward. Cost of the college, minus the EFC, equals the amount of your financial aid award. Now let’s breakdown how the EFC is calculated

Expected Family Contribution (EFC) Calculation

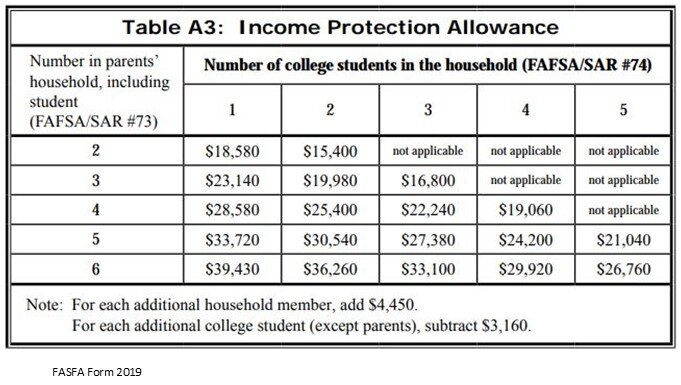

Both the parent’s income and assets, as well as the student’s income and assets come into play when calculating a family’s EFC. But they are weighted differently in the formula. Let’s look at the parent’s income and assets first.

Parent’s Income & Assets

Parents Income: The parent’s income is one of the largest factors in the EFC calculation. The percentage of the parents income that counts toward the EFC calculation is expressed as a range between 22% - 47% because it depends on a number of factors such as household size and the number of children that you have attending college at the same time.

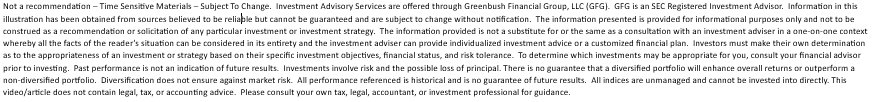

However, there is an “Income Protection Allowance” that allows parents to shelter a portion of their income from the formula based on the household size and the number of children attending college. See that chart below for the 2019-2020 FAFSA form:

Parents Assets: Any assets owned by the parents of the student are multiplied by 5.64% and that amount counts towards the EFC. Here are a few assets that are specifically EXCLUDED from this calculation:

Retirement Accounts: 401(k), 403(b), IRA’s, SEP, Simple

Pensions

Primary Residence

Family controlled business (less than 100 employees and 51%+ ownership by parents)

On the opposite side of that coin, here is a list of some assets that are specifically INCLUDED in the calculation:

Balance in 529 accounts

Real estate other than the primary residence

Even if held in an LLC – Reported separately from “business assets”

Non-retirement investment accounts, savings account, CD’s

Trusts where the student is a beneficiary of the trust (even if not entitled to distributions yet)

Business interest (less than 51% family owned by parents or more than 100 employees)

Similar to the Income Allowance Table, there is also a Parents’ Asset Protection Allowance Table that allows them to shelter a portion of their countable assets from the EFC formula. See the table below for the 2019-2020 school year.

Student’s Income & Assets

Now let’s switch gears over to the student side of the EFC formula. The income and the assets of the student are weighted differently than the parent’s income and assets. Here is the student side of the EFC formula:

As you can clearly see, income and assets in the student’s name compared to the parent name will dramatically increase the Expected Family Contribution and in turn decrease the amount of financial aid awarded. It is because of this, that as a general rule, if you think your asset and income picture may qualify you for financial aid, do not put assets in the name of your child. The most common error that we see people make are assets in an UGMA or UTMA account. Even though parents control those accounts, they are technically considered an asset of the child. If there is $30,000 sitting in an UTMA account for the student, they are automatically losing around $6,000 EACH YEAR in financial aid. Multiply that by 4 years of college, it ends up costing the family $24,000 out of pocket that otherwise could have been covered by financial aid.

EFC Formula Illustration

If we put all of the pieces together, here is an illustration of the full EFC Formula:

Grandparent Owned 529 Plans For The Student

As you will see in the EFC formula above, assets owned by the grandparents with the student listed as the beneficiary, like 529 accounts, are not counted at all toward the EFC calculation. This can be a very valuable college savings strategy for families since the parent owned 529 accounts count toward the Expected Family Contribution. However, there are some pitfalls and common mistakes that we have seen people make with regard to grandparent owned 529 accounts. See the article below for more information specific to this topic:

Article: Common Mistakes With Grandparent Owned 529 Accounts

Financial Aid Chart

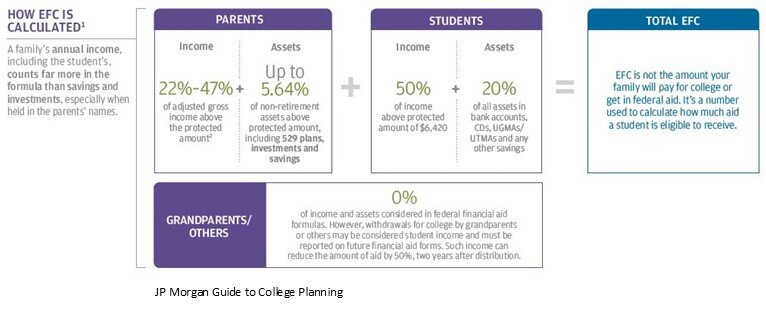

Our friends over at JP Morgan were kind enough to put a summary chart together for this EFC calculation which allows families to get a ballpark idea of what their Expected Family Contribution might be without getting out a calculator. The chart below is based on the following assumptions:

Two parent household

2 Children: One attending college and the other still at home

The child attending college has no assets or income

The oldest parent is age 49

Using the chart above, if the parents combined income is $150,000 and they have $100,000 in countable assets, the Expected Family Contribution would be $33,737 for that school year. What does that mean? If the student is attending a state college and the tuition with room and board is $26,000, since the EFC is greater than the total cost of college for that year, that family would receive no financial aid. However, if that student applies to a private school and the CSS Profile form results in approximately that same EFC of $33,737 but the private school costs $60,000 per year, then the family may receive need based financial aid or a grant from the private school equaling $26,263 per year.

Public Colleges vs. Private Colleges

It’s important to point out that FAFSA and the EFC calculation primarily applies to students that plan on attending a Community College, State College, or certain Private Colleges. Since Private Colleges do not receive federal financial aid they do not have to adhere to the EFC calculation that is used by FAFSA. Private college can choose to use to FAFSA criteria but many of the private colleges will require students to complete both the FAFSA form and the CSS Profile Form.

Here are a few examples of how the financial reporting deviates:

If the parents have a 100% family owned business, they would not have to list that as an asset on the FAFSA application but they would have to list the business as an assets on the CSS Profile form.

The equity in your primary residence is not counted as an asset for FAFSA but it is listed as an asset on the CSS Profile Form.

For parents that are divorced. FAFSA only looks at the assets and income of the custodial parent. The CSS Profile Form captures the assets and income of both the custodial and non-custodial parent.

Because of the deviations between the FAFSA application and the CSS Profile Form, we have seen situations where a student received no need based financial aid when applying to a $50,000 per year private school but they received financial aid for attending a state school even though the annual cost to attend the state school was half the cost of the private school.

Top 10 Ways To Increase College Financial Aid

Here is a quick list of the top strategies that we use to help families to qualify for more financial aid.

Disclosure: There are details associated with each strategy listed below that need to be executed correctly in order for the strategy to have a positive impact on the EFC calculation. Not all strategies will work depending on the financial circumstances of each household and where the child plans to attend college. Contact us for details.

Get assets out of the name of the student

Grandparent owned 529 accounts

Use countable assets of the parents to pay down debt

Move UTGMA & UGMA accounts to 529 UGMA or 529 UTMA accounts

Increase contributions to retirement accounts

Minimize distributions from retirement accounts

Minimize capital gain and dividend income

Accelerate necessary expenses

Use home equity line of credit instead of home equity loan

Families that own small businesses have a lot of advanced planning options

FAFSA – 2 Year Lookback

It’s important to understand the FAFSA application process because you have know when they take the snapshot of your income and assets for the EFC calculation in order to have a shot at increasing the financial aid that you may be able to qualify for.

FAFSA looks back 2 years to determine what your income will be for the upcoming school year. For example, if your child is going to be a freshman in college in the fall of 2020, you will report your 2018 income on the FAFSA application. This is important because you have to start putting some of these strategies into place in the spring of your child’s sophomore year in high school otherwise you could miss out on planning opportunities for their freshman year in college.

If your child is already a junior or senior in high school and you are just reading this article now, there is still an opportunity to implement some of the strategies listed above. Income has a 2 year lookback but assets are reported as of the day of the application. Also the FAFSA application is completed each year that your child is attending college, so even though you may have missed income reduction strategies for their freshman year, at some point the 2 year lookback will influence the financial aid picture during the four years of their undergraduate degree.

IMPORTANT NOTE: Income has a 2-year lookback

Asset balances are determined on the day that you submit the FAFSA Application

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Introduction To Medicare

As you approach age 65, there are very important decisions that you will have to make regarding your Medicare coverage. Whether you decide to retire prior to age 65, continue to work past age 65, or have retiree health benefits,

As you approach age 65, there are very important decisions that you will have to make regarding your Medicare coverage. Whether you decide to retire prior to age 65, continue to work past age 65, or have retiree health benefits, you will have to make decisions regarding your Medicare coverage and for many of those decisions you only get one shot at making the right one. The wrong decision can cost you tens of thousands, if not hundreds of thousands of dollars, in retirement via:

Gaps in your coverage leading to unexpected medical bills

Over coverage: Paying too much for insurance that you are not using

Penalties for missing key Medicare enrollment deadlines

The problem is there are a lot of options, deadlines, rules to follow, and with rules there are always exceptions to the rules that you need to be aware of. To make an informed decision you must understand Medicare Part A, Part B, Medicare Supplemental Plans, Medicare Advantage Plans, Part D drug plans, and special exceptions that apply based on the state that you live in.

I urge everyone to read this article whether it’s for you, your parents, grandparents, friends, or other family members. You may be able to help someone that is trying to make these very important healthcare decisions for themselves and it’s very easy to get lost in the Medicare jungle.

Initially my goal was to write a single article to summarize the decisions that retirees face with regard to Medicare. I realized very quickly that the article would end up looking more like a book. So instead I’ve decided to separate the information into series of articles. This first article will provide you with a general overview of Medicare but at the bottom of each article you will find links to other articles that will provide you with more information about Medicare.

With that, let’s go ahead and jump into the first article which will provide you with a broad overview of how Medicare works.

What is Medicare?

Medicare is the government program that provides you with your healthcare benefits after you turn 65. Medicare is run by the Social Security administration, meaning you contact your Social Security office when you have questions or when you apply for benefits.

Original Medicare

While there are a lot of decisions that have to be made about your Medicare benefits, all of the benefits are built on the foundation of Medicare Part A and Medicare Part B. Medicare Part A and Part B together are referred to as “Original Medicare”. You will see the term Original Medicare used a lot when reading about your Medicare options.

Medicare Part A

Medicare Part A covers your inpatient health services such as:

1) Hospitalization

2) Nursing home (Limited)

3) Hospice

4) Home health services (Limited)

As long as you or your spouse worked for at least 10 years, Medicare Part A is provided to you at no cost. During your working years you paid the Medicare tax of 1.45% as part of your payroll taxes. If you or your spouse did not work 10 years or more then you’re still eligible for Medicare Part A but you will have to pay a monthly premium. There are special eligibility rules for individuals that do not meet the 10 year requirement but are either divorced or widowed.

Medicare Part A Is Not Totally “Free”

While there are no monthly premium payments that need to be made for enrolling in Medicare Part A there are deductibles and coinsurance associated with your Part A coverage. While many of us have encountered deductibles, co-pays, and coinsurance through our employer sponsored health insurance plans, I’m going to pause for a moment just to explain three key terms associated with health insurance plans.

Deductible: This is the amount that you have to pay out of pocket before the insurance starts to pay for your healthcare costs. Example, if you have $1,000 deductible, you have to pay $1,000 out-of-pocket before the insurance will start paying anything for the cost of your care.

Co-pays: Co-pays are those small amounts that you have to pay each time a specific service is rendered such as a doctor’s visit or when you pick up a prescription. Example, you may have to pay $25 every time you visit your primary care doctor.

Coinsurance: This is cost sharing between you and the insurance company that’s expressed as either a percentage or a flat dollar amount. Example, if you have a 20% coinsurance for hospital visits, if the hospital bill is $10,000, you pay $2,000 (20%) and the insurance company will pay the remaining $8,000.

Maximum Out Of Pocket: This the maximum dollar amount that you have to pay each year out of pocket before your health care needs are 100% covered by your Medicare or insurance coverage. If your insurance policy has a $5,000 maximum out of pocket, after you have paid $5,000 out of pocket for that calendar year, you will not be expected to pay anything else for the remainder of the year. Monthly premiums and prescription drug costs do not count toward your maximum out of the pocket threshold.

Medicare Part A Has The Following Cost Sharing Structure For 2019:

As you will see in the table above, while you don’t have a monthly premium for Medicare Part A, if you are hospitalized at some point during the year, you would have to first pay $1,364 out of pocket before Medicare starts to pay for your health care costs. In addition, there is a flat dollar amount co-insurance, which is in addition to the deductible, and that amount varies depending on when the health services are performed during the calendar year.

Medicare Part B

Medicare Part B covers your outpatient health services. These include:

1) Doctors visits

2) Lab work

3) Preventative care (flu shots)

4) Ambulance rides

5) Home health care

6) Chiropractic care (limited)

7) Medical equipment

Unlike Medicare Part A, Medicare Part B has a monthly premium that you will need to pay once you enroll. The amount of the monthly premium is based on your adjusted gross income (AGI). The higher your income, the higher the monthly premium. Below is the 2019 Part B premium table.

As you will see on the chart, the minimum monthly premium is $135.50 per month which translates to $1,626 per year. The income threshold in this chart will vary each year.

Medicare 2-Year Lookback At Income

Medicare automatically looks at your AGI from two years prior to determine your AGI for purposes of Part B premium. In the first few years of receiving Medicare, this 2-year lookback can create an issue. If you retire in 2019, they are going to look at your 2017 tax return which probably has a full year worth of income because you were still working full time back in 2017. If you AGI was $200,000 in 2017, they would charge you more than twice the minimum premium for your Part B coverage.

I have good news. There is an easy fix to this problem. You are able to appeal your income to the Social Security Administration due to a “life changing event”. You can ask Social Security to use your most recent income and you typically have to provide proof to Social Security that you retired in 2019. They will sometimes request a letter signed by your former employer verifying your retirement date and a copy of your final paycheck. You will need to file Form SSA-44 (Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event Form)

How Do You Pay Your Monthly Premiums For Part B?

The Medicare Part B premiums are automatically deducted from your monthly Social Security or Railroad Retirement Benefit payments. If you are 65 and have not yet turned on Social Security, Medicare will invoice you quarterly for those premium amounts and you can pay by check.

Medicare Part B Deductibles and Coinsurance

In addition to the monthly premiums associated with Part B, as with Part A, there are deductibles and coinsurance associated with Part B coverage. Part B carries:

Annual Deductible: $185

Coinsurance: 20%

Example: In January, your doctor tells you that you need your knee replaced. If the surgery costs $50,000, you would have to pay the first $185 out of pocket, and then you would have to pay an additional $9,963 which is 20% of the remaining amount. Not a favorable situation.

But wait, wouldn’t that be covered under Medicare Part A because it happened at a hospital? Not necessarily because “doctor services” performed in a hospital are typically covered under Medicare Part B.

The Largest Issue with Original Medicare is……..

It unfortunately gets worse. If all you have is Original Medicare (Part A & B), there is no Maximum Out of Pocket Limit. Meaning if you get diagnosed with a rare or terminal disease, and your medical bills for the year are $500,000, you may have to pay out of pocket a large portion of that $500,000.

Also, there is no prescription drug coverage under Original Medicare. So you would have the pay the sticker price of all of your prescription drugs out of pocket with no out of pocket limits.

Medicare Part C, Medicare Part D, and Medicare Supplemental Plans

To help individuals over 65 to manage these large costs associated with Original Medicare, there is:

Medicare Part C – Medicare Advantage Plans

Medicare Part D – Standalone Prescription Drug Plans

Medicare Supplemental Plans (“Medigap plans”)

Who Provides What?

Before I get into what each option provides, let’s first identify who provides what:

Medicare Part A: U.S. Government

Medicare Part B: U.S. Government

Medicare Part C – (Medicare Advantage Plan): Private Insurance Company

Medicare Part D – (Prescription Drug Plan): Private Insurance Company

Medicare Supplemental Plan (“Medigap”): Private Insurance Company

The Most Important Decision

Here is where the road splits. To help retirees manage the cost and coverage gaps not covered by Original Medicare, you have two options:

Select a Medicare Advantage Plan

Select a Medicare Supplemental Plan & Medicare Part D Plan

When it comes to your health care decisions in retirement, this is one of the most important decisions that you are going to make. Depending on what state you live in, you may only have one-shot at this decision. It is so vitally important that you fully understand the pros and cons of each option. Unfortunately, as we will detail in other articles, there is big push by the insurance industry to persuade individuals to select the Medicare Advantage option. Both the private insurance company and the insurance agent selling you the policy get paid a lot more when you select a Medicare Advantage Plan instead of a Medicare Supplemental Plan. While this may be the right choice for some individuals, there are significant risks that individuals need to be aware of before selecting a Medicare Advantage Plan.

Medicare Advantage Plans

VERY IMPORTANT: Medicare Advantage Plans and Medicare Supplemental Plans are NOT the same. Medicare Advantage Plans are NOT “Medigap Plans”.

Medicare Advantage Plans do NOT “supplement” your Original Medicare coverage. Medicare Advantage Plans REPLACE your Medicare coverage. If you sign up for a Medicare Advantage Plan, you are no longer covered by Medicare. Medicare has sold you to the private insurance company.

Medicare Advantage Plans are not necessarily an “enhancement” to your Original Medicare Benefit. They are what the insurance industry considers an “actuarial equivalent”. The term actuarial equivalent benefit is just a fancy way of saying that at a minimum it is “worth the same dollar amount”. Medicare Advantage Plans are required to cover the same procedures that are covered under Medicare Part A & B but not necessarily at the same cost. The actuarial equivalent means when they have a large group of individuals, on average, those people are going to receive the same dollar value of benefit as Original Medicare would have provided. In other words, there are going to be clear winners and losers within the Medicare Advantage Plan structure. You are essentially rolling the dice as to what camp you are going to end up in.

If you enroll in a Medicare Advantage Plan, you will no longer have a Medicare card that you show to your doctors. You will receive an insurance card from the private insurance company. If you have a problem with your healthcare coverage, you do not call Medicare. Medicare is no longer involved.

Why Do People Choose Medicare Advantage Plans?

Here are the top reasons why we see people select Medicare Advantage Plan:

Provide Maximum Out Of Pocket protection

Prescription Drug Coverage

Lower Monthly Premium Compared To Medicare Supplemental Plans

Medicare Supplemental Plans (Medigap)

Now let’s switch gears to Medicare Supplemental Plans, also known as “Medigap Plans”. Unlike Medicare Advantage Plan that replace your Medicare Part A & B coverage, with Medicare Supplement Plans you keep your Original Medicare Coverage and these insurance policies fill in the gaps associated with Medicare Part A & B. So it’s truly an enhancement to your Medicare A & B coverage and not just an actuarial equivalent.

There are different levels of benefits within each of the Medigap plans. Each program is identified with a letter that range from A to N. Here is the chart matrix that shows what each of these programs provides.

For example if you go with plan G which is one of the most popular of the Medigap plans going into 2020, most of the costs associated with Original Medicare are covered by your Supplemental Insurance policy. All you pay is the monthly premium, the $185 Part B deductible, and some small co-pays.

Like Medicare advantage plans, Medicare supplemental plans are provided by private insurance companies. However, what’s different is these plans are standardize. “Standardized” means regardless of what insurance company you select, the health insurance benefits associated with those plans are exactly the same. The only difference is the price that you pay for your monthly premium which is why it makes sense to compare the prices of these plans for each insurance company that offers supplemental plans in your zip code.

VERY IMPORTANT: Not all insurance companies offer Medicare Supplemental Plans. Some just offer Medicare Advantage Plans. So if you end up calling an insurance company directly or meeting directly with an insurance company to discuss your Medicare options, those companies may not even present Medicare Supplemental plans as an option even though that might be the best fit for your personal health insurance needs.

However, even if the insurance company offers Medicare Supplemental plans, you still shop that same plan with other insurance companies. They may tell you “yes we have a Medigap Plan G” but their Medigap Plan G monthly premium may be $100 more per month than another insurance company. Remember, Medicare Supplemental plans are standardized meaning Plan G is the same regardless of which insurance company provides you with your coverage.

Part D – Prescription Drug Plans

If you decide to keep your Original Medicare and add a Medicare Supplemental Plan, you will also have to select a Medicare Part D – Prescription Drug plan to cover the cost of your prescriptions. Unlike Medicare Advantage Plan that have drug coverage bundled into their plans, Medicare Supplemental Plans are medical only, so you need a separate drug plans to cover your prescriptions. It can be beneficial to have a standalone drug plans because you are able to select a plan that favors the prescription drugs that you are taking which could lead to lower out of pocket costs throughout the year. Unlike a Medicare Advantage plan where the prescription drug plan is not customized for you because it’s a take it or leave it bundle.

Summary

This article was a 30,000 foot view of Medicare Part A, B, C, D, and Medicare Supplemental Plans. There is a lot more to Medicare such as:

Enrollment deadlines for Medicare

How to enroll with Medicare

Comparison of Medicare Advantage & Medicare Supplemental Plans

Special Exceptions for NY & CT residents

Working past age 65

Coordinating Medicare With Retiree Health Benefits

And so many more considerations that will factor into your Medicare decision as you approach age 65 or leave the workforce after age 65.

VERY IMPORTANT: People have different health needs, budgets, and timelines for retirement. Medicare solutions are not a one size fits all solution. The decisions that your co-worker made, friend made, or family member made, may not be the best solution for you. Plus remember, Medicare is complex, and we have found without help, many people do not understand all of the options. I have met with clients that have told me that “they have a supplemental plan” only to find out that they had a Medicare Advantage plan and didn’t know it because they never knew the difference between the two when the policies were issued to them. It makes working with an independent Medicare insurance agent very important.

Please feel free to contact us with your Medicare questions and we would be more than happy to run free quotes for you to help you select the right plan at the right cost.

OTHER ARTICLES ON MEDICARE

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Manufacturing Is Contracting: Another Economic Indicator Flashes Red

Yet another important economic indicator rolled over this week which has triggered a sell-off in the U.S. equity markets. Each month the Institute of Supply Management (“ISM”) issues two reports: Manufacturing ISM ReportNon-

Yet another important economic indicator rolled over this week which has triggered a sell-off in the U.S. equity markets. Each month the Institute of Supply Management (“ISM”) issues two reports:

Manufacturing ISM Report

Non-Manufacturing ISM Report

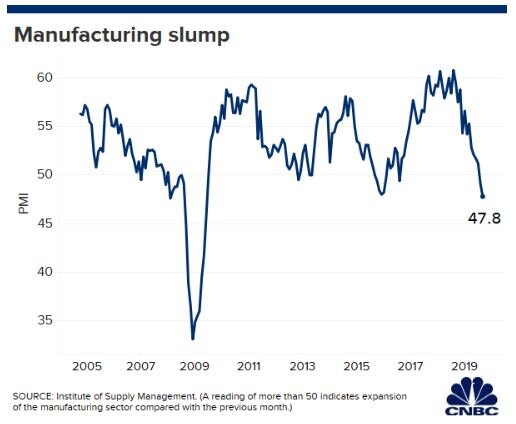

A reading above 50 indicates an expansion and a reading below 50 indicates a contraction. The Manufacturing ISM Report was released on Tuesday and it showed a reading of 47.8 for September indicating that manufacturing in the U.S. is beginning to contract. Not only was it the first contraction of the index within the last few years but the index reached a level not seen since 2009. In this article we will cover:

Why the ISM Index is important

Historically what happens to the stock market after the reading goes below 50?

What caused the unexpected drop in the ISM index?

Manufacturing trends around the globe and how they could impact the U.S. stock market

Why The ISM Index Is Important

The ISM Manufacturing Index tells us how healthy the manufacturing sector of the U.S. economy is. This index is also referred to as the Purchasing Managers Index (PMI) and I will explain why. The ISM issues a monthly survey to more than 300 manufacturing companies. The purchasing managers at these big manufactures are on the front line when it comes to getting a read on the pulse of business conditions. The survey includes questions on the trends in new orders, production, inventories, employment, supply chain, and backlog orders. The ISM assigns weightings to each metric, aggregates all of the responses together, and it results in the data point that signals either an expansion or a contraction.

If most of the manufactures in the U.S. have a ton of new orders, inventories are low, and they are looking to hire more people, that would most likely produce a reading above 50, implying that the outlook is positive for the U.S. economy as these big manufactures ramp up production to meet the increase in demand for their products.

On the other hand, if these surveys show a drop off in new orders, inventories are rising, or hiring has dropped off, that would most likely produce a reading below 50, implying that manufacturing and in turn the U.S. economy is slowing down. Analysts will use the ISM index to get a read on what corporate earnings might look like at the end of the quarter. If the index is dropping during the quarter, this could be foreshadowing a shortfall in corporate earnings for the quarter which the stock market will not find out about until after the quarter end.

Here is a historic snapshot of the ISM’s Manufactures Index:

As you will see in the chart, manufacturing has been slowing over the course of the past year but up until September, it was still expanding at a moderate pace. For September, economists had broadly expected a reading of 50.4 but the ISM report produced a result of 47.8 signaling a contraction for the first time since 2016.

What Does This Mean For The Stock Market?

So in the past, when the ISM Index has gone below 50, what happened to the stock market? To answer that question, let’s start by looking at a chart that shows the correlation between the ISM Index and the S&P 500 Index:

The dark blue line is the ISM index and the light blue line is the S&P 500 Index. Looking at this data, I would highlight the following points:

The ISM Index and the S&P 500 Index seem to move in lockstep. While the ISM might give you a preview of what quarterly earnings might look like, it does not give you a big forward looking preview of bad things to come. By the time the ISM index starts dropping, the stock market is already dropping with it.

We need more data. There have been a few times that the index has gone below 50 within the last 20 years and it has not been followed by a recession. Look at 2016 for example. The ISM index dropped below 50, but if you trimmed your equity positions at that point, you missed the big rally from January 2017 through September 2019. We need more data because historically multiple back to back months of readings below have signaled a recession.

If the index hits 45 or lower within the next few months, watch out below!!

What Caused The Most Recent Drop In The ISM Manufactures Index?

When it comes to unexpected market events, there is usually a wide mote of differing opinions. But it seems like the most recent drop could be attributed to a continued weakening of spending by U.S. businesses. While the U.S. consumer seems to still be strong and spending money, spending by businesses on big ticket items has tapered off over the past few months.

As you will see in the chart above, durable goods orders have dropped over the past two months which is the main barometer for business spending. When businesses are uncertain about the future, they tend to not spend money and business owners have no lack of things to be worried about going into 2020. The growth rate of the U.S. economy has been slowing, uncertainty surrounding global trade continues, and 2020 is an election year. One or more of these uncertainties may need to resolve themselves before businesses are willing to resume spending.

Global Manufacturing Trends

While manufacturing in the U.S. just started contracting in September, the picture is a little darker when we look at the manufacturing trends in other parts of the world. Below is a heat map that shows the PMI Index for countries all around the world. Here is how you read it:

Green is good. Manufacturing is expanding

Yellow is neutral: Manufacturing is flat

Red is bad: Manufacturing is contracting

If you look at 2017 and 2018, there was a lot of green all around the world indicating that manufacturing was expanding around the globe. As we have progressed further into 2019, you are beginning to see more yellow and in some areas of the world there is red indicating contraction. Look at Germany in particular. There has been big change in the economic conditions in Europe and the global economy is very interconnected. The weakness that started in Europe seems to be spreading to other places throughout the globe.

ISM Non-Manufacturing Index

Now, you could make the argument that the U.S. is a services economy and it does not rely heavily on manufacturing, so how much does this contraction in manufacturing really matter? Well, if we switch gears to the ISM Non-Manufacturing Index which surveys the services sector of the US economy, the September report just came out with a reading of 52.6 compared to the 55.3 that the market was expecting. This is also down sharply from the 56.4 reported for August.

While the services sector of the U.S. economy is not contracting yet, it seems like the numbers may be headed in that direction.

What Investors Should Expect

There are pluses and minuses to this new ISM data. The contraction of the ISM Manufactures Index and the deceleration of the growth rate of the ISM Non-Manufactures Index in September is just another set of key economic indicators that are now flashing red. Implying that we may be yet another step closer to the arrival of the next recession in the U.S. economy.

The only small positive that can be taken away from this data is that the Fed now has the weak economic data that it needs to begin aggressively reducing interest rates in the U.S. which could boost stock prices in the short term. But investors have to be ready for the rollercoaster ride that the stock market may be headed towards as these two forces collide in the upcoming months.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

4 Things That Elite Millennials Do To Fast Track Their Careers

As a young professional, your most valuable asset is your career. While you can watch endless videos on the benefits of making Roth IRA contributions or owning real estate, at the end of the day if you're making $400,000 instead of

As a young professional, your most valuable asset is your career. While you can watch endless videos on the benefits of making Roth IRA contributions or owning real estate, at the end of the day if you're making $400,000 instead of $70,000 before reaching the age of 40, you will have the opportunity to build real wealth faster.

As the owner of an investment firm, I have had the opportunity to work with a lot of very success Millennials that have either successfully grown a business or have climbed the corporate ladder much faster than their peers. Even though these elite young professionals all have different backgrounds, personalities, and skill sets, I have noticed that there are 4 things that make them similar and I’m going to share them with you today.

They Take Risks Early & Often

Think about the last time you left a job; whether it was to take a job with a different company, start your own business, or take a new position within your current company, you probably spent days or maybe weeks in mental turmoil asking yourself questions like:

“Am I making the right decision?”

“What if I get to this new company and the position is not what they say it’s going to be?”

“Should I risk going out on my own and starting a company?”

We have all been there, and it’s awful. All you can think about is, “What if this does not work out the way I expect?”. What I have noticed with this group of successful millennials is that they are able to recognize the uncertainty in those situations, but still choose to jump forward without ever looking back. They are like cats in the way that no matter where they land down the road, the one thing they feel certain about is that they will land on their feet.

This is not just something that they do once or twice, but rather multiple times throughout their working careers. In general, the young professionals that really surge forward are the ones that take risks early on in their careers. Starting a business or making a big career change when you are 25 with no mortgage and no family to support is typically easier to manage then taking that same risk when you have a mortgage and/or family to support. We have seen young professionals start businesses and in year two or three the business nearly goes under, but they somehow held on, pushed forward, and they turned it into a wildly successful business. There is no perfect age to take these leaps, but it’s just acknowledging that without a lot of advanced planning it becomes much more difficult to take these risks as your personal expenses grow.

Sense Of Purpose

When you talk with this group of successful Millennials, they all have a very strong sense of purposes. Now, sense of purpose does not necessarily mean that they have life all figured out. Many of the professionals in this elite group will jokingly admit that they have no idea what the future holds for them, however, they can tell you at length what they love about their career and their explanation will often sound very different than if you were to ask their coworkers what they love about their job.

Example, we have a client that provides custom software to companies and they have rising star on their team. Looking at this employee’s resume and position within the company you would say “Ok, typical software developer, coder, very techy, etc.” However, this employee has taken it upon himself to post videos to social media everyday as he builds robot armies, provides free strategies for solving problems using custom software, and he has amassed a huge following of tech fans wanting more.

This was not something that his supervisor asked him to do or a task that is at all part of his job description. Nope, he is sincerely passionate about helping companies to solve everyday problems using custom software and he puts it all out there for the world to see. Such a clear sense of purposes that has allowed him to turn something ordinary into something extraordinary. The tip here: figure out what you love and try to incorporate it into your career.

They Say “No”

This is kind of an odd one, but I have noticed this trait to be common among successful younger business owners and executives. They know when to say “No” to an opportunity. For most professionals, the power of “No” comes later on in their careers after they have seen enough opportunities turn into complete train wrecks. Most younger professionals do not have 30 years of battle tested experience in an effort to execute their growth plans, they dine at what I call “the buffet of opportunity”.

When you start a company or lead a team of executives, usually the main goal is to grow the company as fast as possible, so when you are presented with 3 growth ideas, you may decide to chase 2 or all 3 in an effort to grow the company. Sometimes that’s ok, but what I have seen these successful Millennials recognize is that by committing all of their resources toward what they feel is the single best opportunity they are able to either succeed or fail FASTER. A concept that was identified by Elon Musk of Tesla.

I was able to identify this trait through the actions of one of our clients. A young business owner that had a company in the energy sector and the company had been experiencing double digit growth for a number of years. Since they had cash and they were looking for ways to grow the company, instead of just selling their product and then hiring third party contractors for the install, they decided that they could produce additional revenue by handling the installation themselves.

Two years after that decision was made, I was having breakfast with the owner of the company and he said that decision almost bankrupted the company. While they were very good at producing their product, they were horrible at running construction teams and managing the liability associated with the installation process. He said, “I should have just said no and stuck to what we were good at.”

That experience made me aware of the Power of No being used by other young business owners and executives. We have had clients that have said “No” to:

A large new client because it would tie the fate of their company to that client

Joint working relationship with other companies

Providing services related too but not associated with their core business

New investors in the company

Selling the company

All of these decisions are tough decisions to make, but I have noticed that our most successful young professionals are not afraid to look opportunity in the eye and say “not today”.

The L-Factor

An executive from Yahoo named Tim Sanders wrote a book a number of years ago called The Likeability Factor. The main idea of the book is people choose who they like and they tend to buy from them, hire them, and purposefully spend more time with them. It may not be a surprise that many of the successful young professionals that we see growing businesses and sprinting up the corporate ladder have what Tim Sanders calls a high “L-Factor”.

Think of the clients and co-workers that show up at your office door and you know it’s going to be a fun and engaging conversation. Those are the high L-factor people in our lives. It’s been shown that those High L-factor executives tend to survive layoffs time after time because even though their actual position may be getting eliminated, the powers that be sometimes find a place for that person to land for no other reason than they liked them and wanted to keep them with the company.

While I’m sure all of us can think of someone that is in a position of power that has an L-factor of zero, there are far many more business owners and executives that have made it to where they are today because they are likeable.

I feel like I could give you endless examples of instances where I have seen likeability play out in favor of successful young professionals, but I think everyone understands the general idea. The one thing that I will point out though that is also in Tim’s book is that any level, you have the ability to raise your L-Factor. Likeability is a skill like listening, negotiating, or public speaking. It comes very natural to some people, but others have to work at it.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

What Is An Inverted Yield Curve?

Today, August 14, 2019, the main part of the yield curveinverted. This is an important event because an inverted yield curve hashistorically been a very good predictor of a coming recession. In this articlewe will review

Today, August 14, 2019, the main part of the yield curveinverted. This is an important event because an inverted yield curve hashistorically been a very good predictor of a coming recession. In this articlewe will review

What the yield curve is

What it means when the yield curve inverts

Historical data showing why it’s been a goodpredictor of recessions

What it means for investors today

Understanding the Yield Curve

The yield curve is an economic indicator that originates from the bond market. It’s basically a chart that shows the yield of government bonds at different durations. For example, the yield on a two-year treasury note versus a 10 year government bond. In a healthy economic environment, the curve is positively sloped as is illustrated by the chart below.

In a positively sloped yield curve, longer-term bonds have higher yields. Here’s a hypothetical example using CDs. Let’s say you go into that bank and you are trying to decide between buying a 1 year CD or a 5 year CD. In most cases you would naturally expect the 5 year CD to give you a higher level of interest because the bank is locking up your money for 5 years instead of 1 year. If a 1 year CD gives you 1% interest, you might expect a five-year CD to give you 3% interest in a bond market that has a positively sloped yield curve, because the further you go out in duration, the higher the current yield.

However, sticking to our hypothetical example using CD's, there are periods of time when you go into the bank and the 1 year CD has a higher interest rate than a 5 year CD. That would make you ask the obvious question, “Why would anyone to buy a 5 year CD at a lower interest-rate than a 1 year CD? You get a higher investment return on your money for the next year and you get your money back faster?”.

The answer is as such, in the bond market, investors willsometimes buy bonds for a longer duration at a lower current yield because theyexpect a recession to come. When arecession hits, typically the Federal Reserve will start lowering interestrates to help stimulate the economy. When that happens, interest ratestypically drop. Anticipating this drop in interest rates, bond investors are willingto buy bonds today that lock up their money for a longer period of time with alower yield because they expect interest rates to drop in the near future.

So, let’s use the hypothetical CD example again. You go into the bank and the 1 year CD rate is 3% and the 5 year CD rate is 2.5%. In an inverted yield curve situation, investors are buying those 5 year CD’s even though they have a lower interest-rate, because when the recession hits and the Fed starts lowering interest rates when that 1 year CD matures a year from now, the new rate on CD’s may be a 1 year CD at 1% and 1.5% on a 5 year CD. So from an investment standpoint today, it’s a better move to lock in your 2.5% interest rate for 5 years even though the yield is lower than the 1 year CD today. You can see in this example why an inverted yield curve is such a bearish signal for the markets.

Below is an illustration of an inverted yield curve:

It’s a Very Good Predicator of Recessions

When you look at the historical data, it shows how frequently an inverted yield curve has preceded a coming recession. Below is a chart that shows the spread between a 2 year government bond and a 10 year government bond. The yield curve is positively sloped when the blue line is above the dark black line. When the blue line falls below the dark black line, that means that the yield curve is inverted. The grey areas in the chart indicate recessions.

Today, the main part of the yield curve which means the 2year vs the 10 year bonds inverted. However, it’s important to point out that earlier in 2019, the yield onthe 10 year treasury bond dropped below the yield on the 3 month treasury note,so technically this is the second time the yield curve is inverted in 2019.

What Does That Mean for Investors?

If we use history as our guide, the inverted yield curve is a caution light for investors. Historically, the main question people ask next is, “How long after the yield curve inverts does the recession usually begin?”. Here is the chart:

As you can see, the problem with using this data to build an estimates timeline until the next recession is the variance in the data. Even though, in the past 5 recessions, the “average” period of time between the inversion of the yield curve and the subsequent recession was about 12 months, in 2 out of the 5 recessions, the inversion happened within 2 months of the beginning of the next recession. Timing the markets is very difficult and as we get into the later innings of this long economic expansion, the risks begin to mount. For this reason, it very important for investors to revisit their exposure to risk asset to make sure they are properly diversified.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Should I Payoff My Mortgage Early?

As a financial planner, clients will frequently ask me the following question, “Should I apply extra money toward my mortgage and pay it off early?”. The answer depends on several factors such as:

As a financial planner, clients will frequently ask me the following question, “Should I apply extra money toward my mortgage and pay it off early?”. The answer depends on several factors such as:

The status of your other financial goals

Interest rate

How long you plan to live in the house

How close you are to retirement

The rate of return for other available investment options

Status of your other financial goals

Before you start applying additional payments toward your mortgage, you should first conduct an assessment of the status of your various financial goals.

For clients that have children, we usually start with the following questions:

“What are your plans for paying for college for your kids? Are the college savings accounts appropriately funded?”

The cost of college keeps rising which requires more advanced planning on behalf of parents that have children that are college bound, but before committing more money toward the mortgage, you should have an idea as to what your financial aid package might look like, so you have a ballpark idea of what you will have to pay out of pocket each year for college.

If you have an extra $5,000 sitting in your savings account, you can either apply that toward the mortgage, which is a one-time benefit, or you can put that money into a college 529 account when your child is 5 years old, and let it accumulate for 13 the next years. Assuming you get a 6% rate of return within that 529 account, you will be able to withdrawal $10,665 all tax free when it comes time to pay for college.

Here is the list of other questions that we typically ask clients before we give them the green light to escalate the payments on their mortgage:

Is there enough money in your retirement accounts to fulfill your plans for retirement?

Do you have any other debt? Student loan debt, credit card debt, HELOC?

How many months of living expense have you put aside in an emergency fund?

Are there any big one-time expenses coming up?

Do you have the appropriate amount of life insurance?

Do you foresee any career changes in the near future?

If there are financial shortfalls in some of these other areas, it may be better to shore up some of the weaknesses in your overall financial plan before applying additional cash toward the mortgage.

What is the interest rate on your mortgage?

The interest rate that the bank or credit union is charging you on your mortgage has a significant weight in the decision as to whether or not you should pay off your mortgage early. We tell clients that you should look at the interest rate on debt as a “risk free rate of return”. If you have a mortgage with a 4% interest rate and you have $5,000 in cash sitting in your savings account, by applying that $5,000 toward your mortgage you are technically earning a 4% rate of return on that money because you are not paying it to the bank. The reason it is “risk free” is because you would have paid that money to the bank otherwise.

It’s important to understand the risk-free concept of paying off debt. Clients will sometimes ask me “Why would I put more money toward my mortgage with an interest rate of 4% when I can invest it in the stock market and get an 8% rate of return?”

My answer is, “It’s not an apple to apple comparison because you are comparing two different risk classes.” You have to take risk in the stock market to obtain that possible 8% rate of return, as compared to applying the money toward your mortgage which is guaranteed because you are guaranteed to not pay the bank that interest. It would be more appropriate to compare the interest rate on your mortgage to a CD rate at a bank, or the interest rate for a money market account.

After this exchange, the client will frequently comment, “Well, I can’t get 4% in a CD at a bank these days”. In those cases, if they have idle cash, it may be advantageous to apply the cash toward the mortgage instead of letting it sit in their savings account or a CD with a lower interest rate.

Interest rate below 5%

When the interest rate on your mortgage is below 5%, it makes the decision more difficult. Depending on the interest rate environment, there may be lower risk investments other than stocks that could earn a higher rate of return compared to the interest rate on your mortgage. You may also have some long term financial goal like retirement that allows you to comfortably take more risk and assume a higher long term annualized rate of return in those higher risk asset classes. When you have a lower interest rate on your mortgage, applying additional cash toward the mortgage may still be the prudent decision, but it requires more analysis.

Interest rate above 5%

When we see the interest rates on a mortgage above 5% the decision to pay off the mortgage early gets easier. Based on the examples that we have already covered, if the interest rate on your mortgage is 6%, by applying more cash toward the mortgage you are earning a risk-free rate of return of 6%, that’s a pretty good risk-free rate of return in most market environments. For our readers that had mortgages in the early 80’s, they saw mortgage rates north of 15%. That’s a nice risk-free rate of return, but hopefully we never see the interest rate on mortgages that high ever again.

How long do you plan to live in the house?

If you plan to sell your house within the next 5 years, applying additional payments toward the mortgage has a positive financial impact, but it’s typically not as strong as when you compare it to someone that has 20 years left on mortgage and they plan to be living in the house for the next 20+ years.

It’s a lesson in compounding interest. Example, you have the following mortgage:

Outstanding balance: $200,000

Interest rate: 4%

Years left on the mortgage: 20 Years

You have $20,000 sitting in your savings account that you are considering applying toward the mortgage. If you plan to sell the house a year from now, applying $20,000 toward the mortgage would save you $800 in interest.

If you plan to stay in the house for the full 20 years, applying the $20,000 toward your mortgage today would save you $9,086 in interest over the remaining life of the mortgage.

Should I payoff my mortgage before I retire?

When we are helping clients prepare for retirement, we remind them that with all of the unknowns that the future holds, the one thing that you have 100% control over both now and in the future are your annual expenses. You don’t have control over market returns, inflation, tax rates, etc, so the goal is to give you the most flexibility in retirement and minimize your expenses. It not uncommon for the mortgage to be your largest monthly expense.

It is for this reason that retirement serves as kind of a wild card in this rate of return analysis. During the accumulation years, you may be assuming an 8% rate of return on your retirement account because you had an overweight to stocks in your portfolio. Now that you are transitioning over to the distribution phase, it’s common for investors to decrease the risk level in their retirement accounts, which is often accompanied by a lower assumed rate of return over longer time periods. It makes that gap between the interest rate on your mortgage and the assumed rate on your investment accounts smaller, thus giving more weight to escalating the payoff of the mortgage.

Additionally, no mortgage means less money coming out of your retirement accounts each year, which helps investors manage the risk of outliving their retirement savings.

While we like our clients to retire with as little debt as possible, there are scenarios that arise where it does make sense to have a mortgage in retirement. Both of these scenarios stem from the situation where 100% of the client’s assets are tied up in pre-tax retirement accounts.

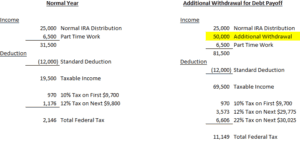

If they have $50,000 left on the mortgage and they are about to retire, we typically would not advise them to distribute $50,000 from their retirement account to pay off the mortgage because they will take a big income tax hit by realizing all of that additional taxable income in a single tax year. In these cases, it may make sense to continue to make the regular monthly mortgage payments until the mortgage is paid in full.

In a similar situation when clients want to buy a second house in retirement, but most of their money is tied up in pre-tax retirement, instead of incurring a big tax hit by taking a large distribution from their retirement accounts, it may make sense for them to just take the mortgage and make regular monthly payments. This strategy spreads the distributions from the retirement accounts over multiple tax years which could more than offset the interest that you are paying to the bank over the life of the loan. In addition, the money in your retirement accounts is allowed to accumulate tax deferred for a longer period of time.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Understanding Required Minimum Distributions & Advanced Tax Strategies For RMD's

A required minimum distribution (RMD) is the amount that the IRS requires you to take out of your retirement account each year when you hit a certain age or when you inherit a retirement account from someone else. It’s important to plan tax-wise for these distributions because they can substantially increase your tax liability in a given year;

Understanding Required Minimum Distributions & Advanced Tax Strategies For RMD’s

A required minimum distribution (RMD) is the amount that the IRS requires you to take out of your retirement account each year when you hit a certain age or when you inherit a retirement account from someone else. It’s important to plan tax-wise for these distributions because they can substantially increase your tax liability in a given year; consequentially, not distributing the correct amount from your retirement accounts will invite huge tax penalties from the IRS. Luckily, there are advanced tax strategies that can be implemented to help reduce the tax impact of these distributions, as well as special situations that exempt you from having to take an RMD.

Age 72

LAW CHANGE: There were changes to the RMD age when the SECURE Act was passed into law on December 19, 2019. Prior to the law change, you were required to start taking RMD’s in the calendar year that you turned age 70 1/2. For anyone turning age 70 1/2 after December 31, 2019, their RMD start age is now delayed to age 72.

The most common form of required minimum distribution is age 72. In the calendar year that you turn 72, you are required to take your first distribution from your pretax retirement accounts.

The IRS has a special table called the “Uniform Lifetime Table”. There is one column for your age and another column titled “distribution period”. The way the table works is you find your age and then identify what your distribution period is. Below is the calculation step by step:

1) Determine your December 31 balance in your pre-tax retirement accounts for the previous year end

2) Find the distribution period on the IRS uniform lifetime table

3) Take your 12/31 balance and divide that by the distribution period

4) The previous step will result in the amount that you are required to take out of your retirement account by 12/31 of that year

Example: If you turn age 72 in March of 2023, you would be required to take your first RMD in that calednar year unless you elect the April 1st delay in the first year. After you find your age on the IRS uniform lifetime table, next to it you will see a distribution period of 25.6. The balance in your traditional IRA account on December 31, 2018 was $400,000, so your RMD would be calculated as follows:

$400,000 / 25.6 = $15,625

Your required minimum distribution amount for the 2023 tax year is $15,625. The first RMD will represent about 3.9% of the account balance, and that percentage will increase by a small amount each year.

RMD Deadline

There are very important dates that you need to be aware of once you reach age 72. In most years, you have to make your required minimum distribution prior to December 31 of that tax year. However, there is an exception for the year that you turn age 72. In the year that you turn 72, you have the option of taking your first RMD either prior to December 31 or April 1 of the following year. The April 1 exception only applies to the year that you turn 72. Every year after that first year, you are required to take your distribution by December 31st.

Delay to April 1st

So why would someone want to delay their first required minimum distribution to April 1? Since the distribution results in additional taxable income, it’s about determining which tax year is more favorable to realize the additional income.

For example, you may have worked for part of the year that you turned age 72 so you’re showing earned income for the year. If you take the distribution from your IRA prior to 12/31 that represents more income that you have to pay tax on which is stacked up on top of your earned income. It may be better from a tax standpoint to take the distribution in the following January because the amount distributed from your retirement account will be taxed in a year when you have less income.

Very important rule:

If you decide to delay your first required minimum distribution past 12/31, you will be required to take two RMD‘s in that following year.

Example: I retire from my company in September 2023 and I also turned 72 that same year. If I elect to take my first RMD on February 1, 2024, prior to the April 1 deadline, I will then be required to take a second distribution from my IRA prior to December 31, 2024.

If you are already retired in the year that you turn age 72 and your income level is going to be relatively the same between the current year and the following year, it often makes sense to take your first RMD prior to December 31st, so are not required to take two RMD‘s the following year which can subject those distributions to a higher tax rate and create other negative tax events.

IRS Penalty

If you fail to distribute the required amount by the given deadline, the IRS will be kind enough to assess a 50% penalty on the amount that you should have taken for your required minimum distribution. If you were required to take a $14,000 distribution and you failed to do so by the applicable deadline, the IRS will hit you with a $7,000 penalty. If you make the distribution, but the amount is not sufficient enough to meet the required minimum distribution amount, they will assess the 50% penalty on the shortfall instead. Bottom line, don’t miss the deadline.

Exceptions If You Are Still Working

There is an exception to the 72 RMD rule. If your only retirement asset is an employer sponsored retirement plan, such as a 401(k), 403(b), or 457, as long as you are still working for that employer, you are not required to take an RMD from that retirement account until after you have terminated from employment regardless of your age.

Example: You are age 73 and your only retirement asset is a 401(k) account with your current employer with a $100,000 balance, you will not be required to take an RMD from your 401(k) account in that year even though you are over the age of 72.