How To Change Your Residency To Another State For Tax Purposes

If you live in an unfriendly tax state such as New York or California, it’s not uncommon for your retirement plans to include a move to a more tax friendly state once your working years are over. Many southern states offer nicer weather, no income taxes, and lower property taxes. According to data from the US Census Bureau, more residents

If you live in an unfriendly tax state such as New York or California, it’s not uncommon for your retirement plans to include a move to a more tax friendly state once your working years are over. Many southern states offer nicer weather, no income taxes, and lower property taxes. According to data from the US Census Bureau, more residents left New York than any other state in the U.S. Between July 2017 and July 2018, New York lost 180,360 residents and gained only 131,726, resulting in a net loss of 48,560 residents. With 10,000 Baby Boomers turning 65 per day over the next few years, those numbers are expected to escalate as retirees continue to leave the state.

When we meet with clients to build their retirement projections, the one thing anchoring many people to their current state despite higher taxes is family. It’s not uncommon for retirees to have children and grandchildren living close by so they greatly favor the “snow bird” routine. They will often downsize their primary residence in New York and then purchase a condo or small house down in Florida so they can head south when the snow starts to fly.

The inevitable question that comes up during those meetings is “Since I have a house in Florida, how do I become a resident of Florida so I can pay less in taxes?” It’s not as easy as most people think. There are very strict rules that define where your state of domicile is for tax purposes. It’s not uncommon for states to initiate tax audit of residents that leave their state to claim domicile in another state and they split time travelling back and forth between the two states. Be aware, the state on the losing end of that equation will often do whatever it can to recoup that lost tax revenue. It’s one of those guilty until proven innocent type scenarios so taxpayers fleeing to more tax favorable states need to be well aware of the rules.

Residency vs Domicile

First, you have to understand the difference between “residency” and “domicile”. It may sound weird but you can actually be considered a “resident” of more than one state in a single tax year without an actual move taking place but for tax purposes each person only has one state of “domicile”.

Domicile is the most important. Think of domicile as your roots. If you owned 50 houses all around the world, for tax purposes, you have to identify via facts and circumstances which house is your home base. Domicile is important because regardless of where you work or earn income around the world, your state of domicile always has the right to tax all of your income regardless of where it was earned.

While each state recognizes that a taxpayer only has one state of domicile, each state has its own definition of who they considered to be a “resident” for tax purposes. If you are considered a resident of a particular state then that state has the right to tax you on any income that was earned in that state. But they are not allowed to tax income earned or received outside of their state like your state of domicile does.

States Set Their Own Residency Rules

To make the process even more fun, each state has their own criteria that defines who they considered to be a resident of their state. For example, in New York and New Jersey, they consider someone to be a resident if they maintain a home in that state for all or most of the year, and they spend at least half the year within the state (184 days). Other states use a 200 day threshold. If you happen to meet the residency requirement of more than one state in a single year, then two different states could consider you a resident and you would have to file a tax return for each state.

Domicile Is The Most Important

Your state of domicile impacts more that just your taxes. Your state of domicile dictates your asset protection rules, family law, estate laws, property tax breaks, etc. From an income tax standpoint, it’s the most powerful classification because they have right to tax your income no matter where it was earned. For example, your domicile state is New York but you worked for a multinational company and you spent a few months working in Ireland, a few months in New Jersey, and most of the year renting a house and working in Florida. You also have a rental property in Virginia and are co-owners of a business based out of Texas. Even though you did not spend a single day physically in New York during the year, they still have the right to tax all of your income that you earned throughout the year.

What Prevents Double Taxation?

So what prevents double taxation where they tax you in the state where the money is earned and then tax you again in your state of domicile? Fortunately, most states provide you with a credit for taxes paid to other states. For example, if my state of domicile is Colorado which has a 4% state income tax and I earned some wages in New York which has a 7% state income tax rate, when I file my state tax return in Colorado, I will not own any additional state taxes on those wages because Colorado provides me with a credit for the 7% tax that I already paid to New York.

It only hurts when you go the other way. Your state of domicile is New York and you earned wage in Colorado during the year. New York will credit you with the 4% in state tax that you paid to Colorado but you will still owe another 3% to New York State since they have the right to tax all of your income as your state of domicile.

Count The Number Of Days

Most people think that if they own two houses, one in New York and one in Florida, as long as they keep a log showing that they lived in Florida for more than half the year that they are free to claim Florida, the more tax favorable state, as their state of domicile. I have some bad news. It’s not that easy. The key in all of this is to take enough steps to prove that your new house is your home base. While the number of days that you spend living in the new house is a key factor, by itself, it’s usually not enough to win an audit.

That notebook or excel spreadsheet that you used to keep a paper trail of the number of days that you spent at each location, while it may be helpful, the state conducting the audit may just use the extra paper in your notebook to provide you with the long list of information that they are going to need to construct their own timeline. I’m not exaggerating when I say that they will request your credit card statement to see when and where you were spending money, freeway charges, cell phone records with GPS time and date stamps, dentist appointments, and other items that give them a clear picture of where you spent most of your time throughout the year. If you supposedly live in Florida but your dentist, doctors, country club, and newspaper subscriptions are all in New York, it’s going to be very difficult to win that audit. Remember the number of days that you spend in the state is just one factor.

Proving Your State of Domicile

There are a number of action items that you should take if it’s your intent to travel back and forth between two states during the year, and it’s your intent to claim domicile in the more favorable tax state. Here is the list of the action items that you should consider to prove domicile in your state of choice:

Register to vote and physically vote in that state

Register your car and/or boat

Establish gym memberships

Newspapers and magazine subscriptions

Update your estate document to comply with the domicile state laws

Use local doctors and dentists

File your taxes as a resident

Have mail forwarded from your “old house” to your “new house”

Part-time employment in that state

Join country clubs, social clubs, etc.

Host family gatherings in your state of domicile

Change your car insurance

Attend a house of worship in that state

Where your pets are located

Dog Saves Owner $400,000 In Taxes

Probably the most famous court case in this area of the law was the Petition of Gregory Blatt. New York was challenging Mr Blatt’s change of domicile from New York to Texas. While he had taken numerous steps to prove domicile in Texas at the end of the day it was his dog that saved him. The State of New York Division of Tax Appeals in February 2017 ruled that “his change in domicile to Dallas was complete once his dog was moved there”. Mans best friends saved him more than $400,000 in income tax that New York was after him for.

Audit Risk

When we discuss this topic people frequently ask “what are my chances of getting audited?” While some audits are completely random, from the conversations that we have had with accountants in this subject area, it would seem that the more you make, the higher the chances are of getting audited if you change your state of domicile. I guess that makes sense. If your Mr Blatt and you are paying New York State $100,000 per year in income taxes, they are probably going to miss that money when you leave enough to press you on the issue. But if all you have is a NYS pension, social security, and a few small distributions from an IRA, you might have been paying little to no income tax to New York State as it is, so the state has very little to gain by auditing you.

But one of the biggest “no no’s” is changing your state of domicile on January 1st. Yes, it makes your taxes easier because you file your taxes in your old state of domicile for last year and then you get to start fresh with your new state of domicile in the current year without having to file two state tax returns in a single year. However, it’s a beaming red audit flag. Who actually moves on New Year’s Eve? Not many people, so don’t celebrate your move by inviting a state tax audit from your old state of domicile

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Medicaid Spend Down Process In New York

You are most likely reading this article because you had a family member that had a health event and the doctors have informed you that they are not allowed to go back home to their house and will need some form of health assistance going forward. This article was written to help you understand from a high level the steps that you may need to take to

You are most likely reading this article because you had a family member that had a health event and the doctors have informed you that they are not allowed to go back home to their house and will need some form of health assistance going forward. This article was written to help you understand from a high level the steps that you may need to take to get them the care that they need and to get a preview of the Medicaid application process and the spend down process, if that’s the path that needs to be taken.

Everyone is living longer which is a good thing but it creates more complications later in life. It is becoming much more common that people have family members that have a health event in their 80’s or 90’s that renders them unable to continue to live independently. Without advance planning, a lot of the important decisions then have to be made by family and friends so it is important for even younger individuals to understand how the process works because you may be in this situation some day for a loved one.

Do I Have To Apply For Medicaid To Pay For Their Care?

What you will find out very quickly is any type of care whether it's home health care, assisted living, or a nursing home, is very expensive. Very few individuals have the assets and the income to enable them to pay out of pocket for their care without going broke. It's not uncommon for kids or family members to have no idea what mom or dad's income and asset picture looks like. But no one is going to provide you with this information unless you have a power of attorney.

Power of Attorney, Health Proxy, and Will

A power of attorney (“POA”) is a document that allows you to step into a person’s shoes that have been incapacitated. It allows you to get information on their bank accounts, investments, insurance policies, and anything else financially. If you do not have a power of attorney, you need to get one quickly. A lot of financial decisions will most likely need to be made in a very short period of time. You will need to contact an estate attorney to draft the power of attorney. There are some choices that you will have to make when you draft the documents as to what powers the “POA” will have. They can usually be turned around by an attorney in 48 hours if needed.

While you have the estate attorney on the phone, you also will want to make sure that they have a health proxy and a will. The health proxy allows you to make healthy decisions from a family member if they are unable to do so. While it’s difficult to think about, health proxies will typically list out the end of life decisions. For example, a health proxy may state that mom or dad refuses to have a machine breathe for them if they are no longer able to breathe on their own. The questions are tough to answer but it’s very important to have this document in place.

Home Care, Assisted Living, or Nursing Home

Prior to the health event, mom or dad may have been living by themselves at their house. Now the doctor is telling them that because of the damage done by the stroke, that they will not release them from the hospital until other arrangements are made for their care. There are three options to receive care:

Receiving care in the home via home care by health aids

Assisted living facility

Nursing home facility

People that cannot pay for 100% of their care and that do not have a long term care insurance policy, typically have to spend down their personal assets and then apply for Medicaid. Now that is said, let's jump right into what is protected and not protected as far as income and assets for Medicaid.

Different Rules For Different States

Each state has different eligibility and spends down rules when it comes to Medicaid. For purposes of this article, we will assume that the person needing the care is a resident of New York. If you live in a different state, the process will be similar but the actual amounts and the definition of "protected" assets may be different. It's usually best to work with a Medicaid planner, estate attorney, or local social services office that is located within your state/county to obtain the rules for your family member that needs care.

The Medicaid Rules In New York

There are different limits based on whether the family member needing care is married and their spouse is still alive or if they are single or widowed. In general, if a couple is married and one spouse needs care, more assets and income will be able to be protected and they will be able to qualify for Medicaid because they recognize that income and assets have to be available to support the spouse that does not need the care. But for purposes of this article, we will assume that mom passed away and dad now needs care.

Asset Limit

In 2018, to qualify for Medicaid, an individual is only allowed to keep $15,150 in assets. The next question I get is "what counts toward that number?" It's actually easier to explain what DOES NOT count toward that number. The only assets that do not count toward that threshold are as follows:

Primary Residence

1 Vehicle

Pre-Tax Retirement Accounts (if older than age 70½) - (However Required Minimum Distribution goes toward care)

Irrevocable Trust (Funded at least 5 years ago)

Pre-paid burial expenses

That's it. If dad has $50,000 in his checking account, $20,000 in a Roth IRA, and a RV, the RV will need to be sold and he will need to spend down the Roth IRA and the checking account until the balance reaches $15,150 in order to apply for Medicaid.

Primary Residence

Very important, while the primary residence is a protected asset for purposes of the Medicaid application, Medicaid will place a lien against dad’s estate for the money that they paid on his behalf. Meaning when he passes away, the kids do not automatically get the house. Medicaid will be first in line after the house is sold waiting to get paid. The amount depends on how much Medicaid paid out. If dad lives in a house that is worth $200,000 and Medicaid during his lifetime paid out $120,000 for his care, when the house sells, Medicaid will get $120,000 and the beneficiaries of the estate will only get the remaining $80,000.

When kids hear this they typically get upset because mom and dad worked their whole life to payoff the mortgage and maintain the house and now they are going to lose it to Medicaid. Is there anything that can be done to protect it? If the house was not put into a Medicaid Trust 5 years before needing to qualify for Medicaid then no, there is nothing that can be done. That’s why advanced planning is so important.

If dad worked with an estate attorney to establish a Medicaid trust 5 years ago, the attorney could have changed the ownership of the house to the trust, once dad makes it by 5 years without a health event, it’s no longer a countable asset for Medicaid and Medicaid cannot place a lien against the house. The question I usually ask our clients is “do you want Medicaid to get your house or do you want your kids to have it?” Most people say their kids but if advanced planning was not completed, you lose this options.

No Gifts To Kids

So what if you change the name on the house to the kids? It's considered a "gift". All gifts made within the last five years are a countable assets. It's called the "5 year look back period". When you apply for Medicaid for dad you have to provide them with a ton of information including 5 years of all statements for bank accounts and investment accounts. Also you have to provide them with copies of all checks written over the past 5 years that were in excess of $1,000. Medicaid is making sure that you did not "give" all of dad's assets away last minute so he could qualify for Medicaid and avoid the spend down.

Income Limits

We have talked about assets but what about income? It's not uncommon for a parent to be receiving a pension and/or social security. They are only allowed to keep $842 per month in 2018. The rest of their income will be applied toward their care. This can create some tough decisions if dad has to go to assisted living or a nursing home and the family has to maintain the house and meet his financial needs on $842 per month. Again, Medicaid it trying to recoup as much as it can to pay for dad's care.

Medicaid Pooled Trust

There are ways to protect income above the $842 threshold through the use of a Medicaid Pooled Trust. Unlike the Medical Irrevocable Trust to protect assets that needs to be established 5 years prior, these trusts can be establish now to protect more income. They work like a special checking account that can only be used to pay bills in dad's name. You can never withdraw cash out of the accounts. As long as dad is considered "disabled" by the social security administration or NYS he may qualify to setup this trust. There are not-for-profit entities that administer this income trust. Basically his income from social security and pension would be deposited to this trust account and then when bills show up for utilities, property taxes, car payment, etc, you submit the bill to the organization that is administering the trust and they pay the bill on behalf of that individual.

Home Care Limitation

Most individuals want to return to their home and have the care provided at their house via home health aids. This may or may not be an option. It all depends on the level of care needed. If Medicaid will be paying for dad's care, you will need to call the social services office in the county that he lives in. They will send an "assessor" to his house to determine if the living conditions are adequate for home care and they will also determine the level of care that is needed. In general, if the estimated cost of home care is expected to be at least 90% of what it would cost for care at a facility, Medicaid will not pay for home care and will require them to go to an assisted living or nursing home facility.Home health aids typically range in price from $15 - $30 per hour. Assume it cost $25 per hour, if dad needs care 8 hours a day, 7 days a week that would cost $6,083 per month. If you need a nurse or registered nurse to administer medication at the home, you are looking at $40+ per hour for those services.

Steps From Start To Finish

We have covered a lot of ground and this is just a general overview. But here is a general list of the steps that need to be taken assuming dad had a health event and you need to apply for Medicaid on his behalf:

Contact an estate attorney to establish a power of attorney and requirement for Medicaid application

Using the POA, begin collecting financial information for the Medicaid process

Contact the county social services office to request an assessment to determine if home care will be an option if it's in question

If a spend down is required to qualify for Medicaid, work with estate attorney to develop spend down strategy

If monthly income is above threshold, determine if a Medicaid pooled trust is an option

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Much Will The Value Of Your House Drop Under The New Tax Law?

It's not a secret to anyone at this point that the new tax bill is going to inflict some pain on the U.S. housing market in 2018. The questions that most homeowners and real estate investors are asking is: "How much are home prices likely to decrease within the next year due to the tax changes?" The new $10,000 limitation on SALT deductions, the lower

It's not a secret to anyone at this point that the new tax bill is going to inflict some pain on the U.S. housing market in 2018. The questions that most homeowners and real estate investors are asking is: "How much are home prices likely to decrease within the next year due to the tax changes?" The new $10,000 limitation on SALT deductions, the lower deduction cap mortgages interest, and the higher standard deduction are all lining up to take a bite out of real estate prices. The size of the bite will largely depend on where you live and the value of your house.

3 Bites That Will Hurt

The Trump tax reform made three significant changes to the tax laws that will impact housing prices:

Capped state and local tax ("SALT") deductions at $10,000 (includes property taxes)

Lowered the deduction cap on the first $750,000 of a mortgage

Doubled the standard deduction

The New Standard Deduction

There is a reason why I'm starting this analysis with the doubling of the standard deduction in 2018. For many households in the U.S., the doubling of the standard deduction will make the cap on the SALT deductions irrelevant. Let me explain. Below is a comparison of the standard deduction limits in 2017 versus 2018:

In 2018, a married couple filing a joint tax return would need over $24,000 in itemized deductions to justify not taking the standard deduction and calling it a day. For a married couple, both W-2 employees, $7,000 in property taxes, $9,000 in state income taxes, if those are their only itemized deductions, then it will most likely makes sense for them to take the $24,000 standard deduction. So the $10,000 cap on property taxes and state income taxes becomes irrelevant because it’s an itemized deduction. This will be a big change for many U.S. households. In 2017, that same family may have itemized because their property and state taxes exceeded the $12,700 standard deduction threshold.

For taxpayers age 65 and older, the new tax law kept the additional standard deduction amounts: $1,250 for single filers and $2,500 for married filing joint which are over and above the normal limits.

$10,000 Cap On State & Local Taxes

Starting in 2018, taxpayers are limited to a $10,000 deduction for a combination of their property taxes, school taxes, and state & local income tax. For states that have both high property taxes and high income taxes like New York, New Jersey, and California, homeowners will most likely be looking at a larger decrease in the value of their homes versus states like Florida that have lower property taxes and no state income taxes. The houses with the higher dollar value may experience a larger drop in price.

If you live in a $200,000 house, the property / school taxes are $5,000, and you decided to sell your house, the family looking to buy your house may already be planning on taking the $24,000 standard deduction at that income level, so the new tax cap would not really decrease the “value” of the house to the potential buyer.

On the flip side, if you own a $600,000 house, your property/school taxes are $18,000, and you are looking to sell your house, the new $10,000 cap will most likely have a negative impact on the value of your house. As you might assume, the individuals and families with the higher incomes that could afford to purchase a $600,000 house will naturally be the homeowners that will continue to itemize their deduction in 2018. So owning that $600K house in 2018 comes at an additional annual cost to the buyer because they lose $8,000 in property tax deductions. For individuals and families in the top federal tax bracket (37%), the cost to live in that house just went up by $3,120 per year. I have personally already had two clients call me that just purchased a house in 2017 with property taxes above the $10,000 cap and they said “I might not have purchased this big of a house if I knew I was not going to be able to deduct all of the property taxes”.

$750,000 Deduction Cap On Mortgages

Prior to 2018, taxpayers could only deduct interest on the first $1,000,000 of a mortgage. For all new mortgages, beginning in 2018, the cap was reduced from $1,000,000 to $750,000. The new tax law grandfathered the $1M cap for mortgages that were already in existence prior to December 31, 2017. Obviously this change will only impact very high income earning individuals and families living in houses valued at $1M+ but it still may have a negative impact on the prices of those big houses. I say "may" because if you can afford a $3M condo in Manhattan, you may not care that you lost a $7,500 tax deduction.

It Depends Where You Live

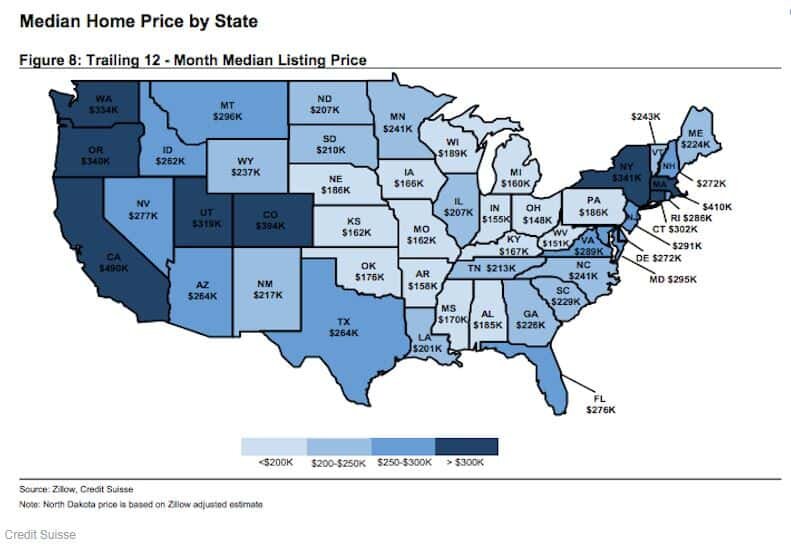

Given these changes to tax law, it seems likely that the states with higher property taxes and higher home values will be the most vulnerable to price adjustments. Below is a map, from Zillow and Credit Suisse, showing the median home price by state:

Let's also locate the states that have a high concentration of mortgages over $500,000. As mentioned above, this may put price pressure on homeowners trying to sell houses above the new $750,000 mortgage interest deduction threshold:

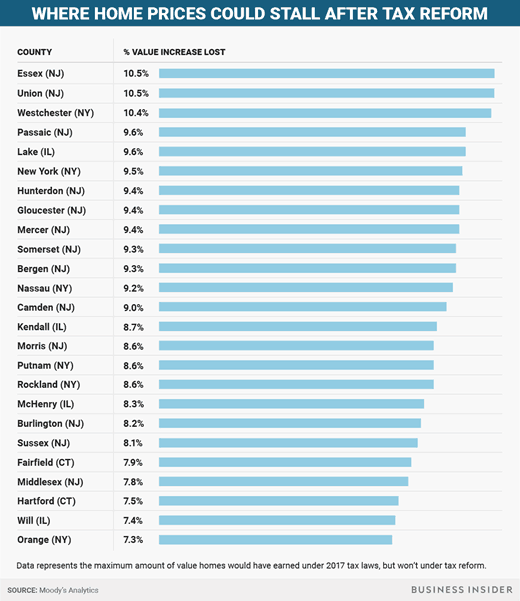

And the "Non-Winners" are New York, California, and New Jersey. Moody's published a list of the 25 counties that are expect to lose the largest percentage of value. Note, that only six of those counties are located outside of New York or New Jersey:

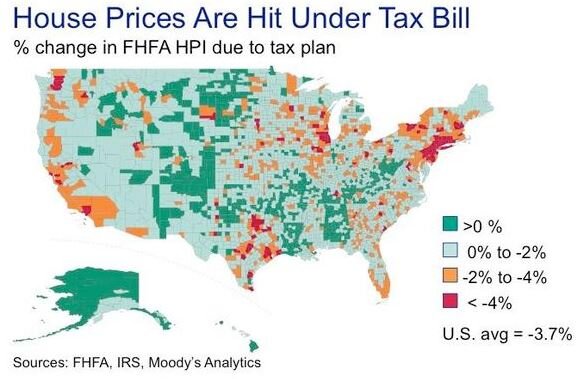

To bring it all together, Moody's and FHFA published the illustration below showing the percentage change in the Federal Housing Finance Agency – House Price Index as a result of the new tax bill:

It's safe to assume that geographically, the negative impact that the new tax rules will have on the U.S. house market will occur in concentrated pockets as opposed to a widespread reduction in housing prices across the country.

Do Not Move To Alaska Just Yet!!

Before you show the chart above to your family at dinner tonight with a “Go Alaska” hat on, I urge you to read on. (Disclosure, I have nothing against Alaska. I was born in Fairbanks, Alaska) If you live in one of the “red spots” on the heat map above or in one of the counties in the list of “where home prices could stall after tax reform”, the charts above do not necessarily mean that at the end of 2018 your house is going to be worth 5% less than it was at the beginning of 2018. Moody’s has done the comparison of the tax bill passing versus no tax bill. If prior to the tax bill being passed it was estimated in 2018 that homes in your area were going to increase in value by 5% and the heat map above shows a 4% drop as a result of tax reform, then that means instead the value of your home growing by 5% it may only grow by 1%.

As with any forecast, it’s anyone’s guess at this point how the math will actually work itself out but in general I think it will be more positive than the consensus expects.

House Values Under $250,000 – Status Quo

Given the changes to the tax law, if you live in a house that is valued under $250,000, regardless of where you live, the downward pressure on the price of your house as a result of tax reform should be minimal. Why? Most buyers in this range will most likely be electing the standard deduction anyways so the new $10,000 cap on SALT deductions should have little to no impact. This should even be true for states that have high property taxes because the homeowners would need over $24,000 in itemized deductions before the $10,000 cap would potentially hurt them tax wise.

The Sandwich: House Values $250,000 - $750,000

The homeowners at the highest risk of a reduction in the value of their house are located in what I call “The Sandwich”. They have a house that is valued somewhere between $250,000 – $750,000 and they live in a high property tax state. While Congress touts that the doubling of the standard deduction is a “fix all” for all of the tax deductions that have been taken away, it’s unfortunately not. There are a number of individuals and families that are in the income range customarily associated with buying a $250K – $750K house that may actually pay more in taxes under the new rules.

Taxpayers in this group are also moving from their “starter house” in their first “big house”. Unlike the super wealthy that may care less about paying an extra $5,000 in taxes per year, for an upper middle class family that has kids, that is saving for college, and contributing to 401(k) plans, the loss of that tax benefit may mean they can’t take a family vacation if they buy that bigger house. Less buyers in the market for houses in this “Sandwich” range translates to lower prices.

How much lower? Probably nothing dramatic in the short term because the U.S. economy is doing so well. When the economy is growing, people feel secure in their jobs, wages are going up, workers are getting bonuses, and that provides them with the additional income needed to make that larger mortgage payment and pay a little more in taxes.

My concern would be for someone that is planning to purchase a house and then sell within the next 5 years. If the economy goes into a recession, people start losing their jobs, and the U.S. consumer starts look for more ways to stretch their dollars, the homeowners that stretched themselves to buy the bigger house based on the big bonus that they received when the economy was humming are at a big risk of losing their house. In addition, there may be fewer buyers in the market because families may not want to waste money on property taxes that they can’t deduct.

The Millionaire Club: House Values $750,000+

It would seem that houses in the $750,000+ range have the most lose to for two reasons. First, homeowners in this category pay the highest property taxes and they are typically not electing the standard deduction at this income level. Second, home buyers at this price point would also be negatively impacted by the lower $750,000 cap on the mortgage interest deduction.

But I doubt this will be the case. Why? There is only so much lake front property. If you make over $5M per year and you fall in love with a lake house in upstate New York that has a $1.5M price tag, while you could try to find a similar lake house in a more tax friendly state, if you make $5M per year, what’s another $15,000 in expenses for buy your first choice.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Procedures For Splitting Retirement Accounts In A Divorce

If you are going through a divorce and you or your spouse have retirement accounts, the processes for splitting the retirement accounts will vary depending on what type of retirement accounts are involved.

If you are going through a divorce and you or your spouse have retirement accounts, the processes for splitting the retirement accounts will vary depending on what type of retirement accounts are involved.

401(k) & 403(b) Plan

The first category of retirement plans are called ?employer sponsored qualified plans?. This category includes 401(k) plans, 403(b) plans, 457 plans, and profit sharing plans. Once you and your spouse have agreed upon the split amount of the retirement plans, one of the attorneys will draft Domestic Relations Order, otherwise known as a QDRO. This document provides instruction to the plans TPA (third party administrator) as to how and when to split the retirement assets between the ex-spouses. Here is the procedures from start to finish:

One attorney drafts the Domestic Relations Order (?DRO?)

The attorney for the other spouse reviews and approved the DRO

The spouse covered by the retirement plan submits it to the TPA for review

The TPA will review the document and respond with changes that need to be made (if any)

Attorneys submit the DRO to the judge for signing

Once the judge has signed the DRO, its now considered a Qualified Domestic Relations Order (QDRO)

The spouse covered by the retirement plan submits the QDRO to the plans TPA for processing

The TPA splits the retirement account and will often issues distribution forms to the ex-spouse not covered by the plan detailing the distribution options

Step number four is very important. Before the DRO is submitting to the judge for signing, make sure that the TPA, that oversees the plan being split, has had a chance to review the document. Each plan is different and some plans require unique language to be included in the DRO before the retirement account can be split. If the attorneys skip this step, we have seen cases where they go through the entire process, pay the court fees to have the judge sign the QDRO, they submit the QDRO for processing with the TPA, and then the TPA firm rejects the QDRO because it is missing information. The process has to start all over again, wasting time and money.

Pension Plans

Like employer sponsored retirement plans, pension plans are split through the drafting of a Qualified Domestic Relations Order (QDRO). However, unlike 401(k) and 403(b) plans that usually provide the ex-spouse with distribution options as soon as the QDRO is processed, with pension plans the benefit is typically delayed until the spouse covered by the plan is eligible to begin receiving pension payments. A word of caution, pension plans are tricky. There are a lot more issues to address in a QDRO document compared to a 401(k) plan. 401(k) plans are easy. With a 401(k) plan you have a current balance that can be split immediately. Pension plan are a promise to pay a future benefit and a lot can happen between now and the age that the covered spouse begins to collect pension payments. Pension plans can terminate, be frozen, employers can go bankrupt, or the spouse covered by the retirement plan can continue to work past the retirement date.

I would like to specifically address the final option in the paragraph above. In pension plans, typically the ex-spouse is not entitled to a benefit until the spouse covered by the pension plan is eligible to receive benefits. While the pension plan may state that the employee can retire at 65 and start collecting their pension, that does not mean that they will with 100% certainty. We have seen cases where the ex-husband could have retired at age 65 and started collecting his pension benefit but just to prevent his ex-wife from collecting on his benefit decided to delay retirement which in turn delayed the pension payments to his ex-wife. The ex-wife had included those pension payments in her retirement planning but had to keep working because the ex-husband delayed the benefit. Attorneys will often put language in a QDRO that state that whether the employee retires or not, at a given age, the ex-spouse is entitled to turn on her portion of the pension benefit. The attorneys have to work closely with the TPA of the pension plan to make sure the language in the QDRO is exactly what it need to be to reserve that benefit for the ex-spouse.

IRA (Individual Retirement Accounts)

IRA? are usually the easiest of the three categories to split because they do not require a Qualified Domestic Relations Order to separate the accounts. However, each IRA provider may have different documentation requirements to split the IRA accounts. The account owner should reach out to their investment advisor or the custodian of their IRA accounts to determine what documents are needed to split the account. Sometimes it is as easy as a letter of instruction signed by the owner of the IRA detailing the amount of the split and a copy of the signed divorce agreement. While these accounts are easier to split, make sure the procedures set forth by the IRA custodians are followed otherwise it could result in adverse tax consequences and/or early withdrawal penalties.

About Michael??...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Do Trusts Expire?

Do trusts have an expiration date after the death of the grantor? For most states, the answer is “Yes”. New York is one of those states that have adopted “The Rule Against Perpetuities” which requires all of the assets to be distributed from the trust by a specified date.

Do trusts have an expiration date after the death of the grantor? For most states, the answer is “Yes”. New York is one of those states that have adopted “The Rule Against Perpetuities” which requires all of the assets to be distributed from the trust by a specified date.

The Rule Against Perpetuities

For most states, the trust assets have to be distributed no later than the “lifetime of those then living plus 21 years.” In other words, the trust asset must be distributed 21 years after the death of the youngest beneficiary listed in the trust document. For example, if I setup a trust with my children listed as beneficiaries, after my passing the trust assets would have to be distributed no later than 21 years following the death of my youngest child.

Per Stirpes Beneficiaries

Some trust documents have the children listed as beneficiaries “per stirpes”. This mean that if a child is no longer alive their share of the trust passes to their heirs. In many cases their children. If the beneficiaries are listed in the trust document as per stirpes beneficiaries then you may be able to make the argument that the “youngest beneficiary” is really the grandchildren not the children which will allow the trust to retain the assets for a longer period of time. Typically trusts do not allow the perpetuity rule to extend beyond their grandchildren.

Consult An Estate Attorney

Trust can be tricky and the language in a trust document is not always black and white, so it’s highly recommended that you consult with an estate attorney that is familiar with the estate laws for you state of residence and can review the terms of the trust document.DISCLOSURE: The information listed above is not legal advice. For legal advice, please consult your attorney.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Lower Your Tax Bill By Directing Your Mandatory IRA Distributions To Charity

When you turn 70 1/2, you will have the option to process Qualified Charitable Distributions (QCD) which are distirbution from your pre-tax IRA directly to a chiartable organizaiton. Even though the SECURE Act in 2019 changed the RMD start age from 70 1/2 to age 72, your are still eligible to make these QCDs beginning the calendar year that you

When you turn 70 1/2, you will have the option to process Qualified Charitable Distributions (QCD) which are distribution from your pre-tax IRA directly to a chartable organization. Even though the SECURE Act in 2019 changed the RMD start age from 70 1/2 to age 72, your are still eligible to make these QCDs beginning the calendar year that you turn age 70 1/2. At age 72, you must begin taking required minimum distributions (RMD) from your pre-tax IRA’s and unless you are still working, your employer sponsored retirement plans as well. The IRS forces you to take these distributions whether you need them or not. Why is that? They want to begin collecting income taxes on your tax deferred retirement assets.

Some retirees find themselves in the fortunate situation of not needing this additional income so the RMD’s just create additional tax liability. If you are charitably inclined and would prefer to avoid the additional tax liability, you can make a charitable contribution directly from your IRA and avoid all or a portion of the tax liability generated by the required minimum distribution requirement.

It Does Not Work For 401(k)’s

You can only make “qualified charitable contributions” from an IRA. This option is not available for 401(k), 403(b), and other qualified retirement plans. If you wish to execute this strategy, you would have to process a direct rollover of your FULL 401(k) balance to a rollover IRA and then process the distribution from your IRA to charity.

The reason why I emphases the word “full” for your 401(k) rollover is due to the IRS “aggregation rule”. Assuming that you no longer work for the company that sponsors your 401(k) account, you are age 72 or older, and you have both a 401(k) account and a separate IRA account, you will need to take an RMD from both the 401(k) account and the IRA separately. The IRS allows you to aggregate your IRA’s together for purposes of taking RMD’s. If you have 10 separate IRA’s, you can total up the required distribution amounts for each IRA, and then take that amount from a single IRA account. The IRS does not allow you to aggregate 401(k) accounts for purposes of satisfying your RMD requirement. Thus, if it’s your intention to completely avoid taxes on your RMD requirement, you will have to make sure all of your retirement accounts have been moved into an IRA.

Contributions Must Be Made Directly To Charity

Another important rule. At no point can the IRA distribution ever hit your checking account. To complete the qualified charitable contribution, the money must go directly from your IRA to the charity or not-for-profit organization. Typically this is completed by issuing a “third party check” from your IRA. You provide your IRA provider with payment instructions for the check and the mailing address of the charitable organization. If at any point during this process you take receipt of the distribution from your IRA, the full amount will be taxable to you and the qualified charitable contribution will be void.

Tax Lesson

For many retirees, their income is lower in the retirement years and they have less itemized deductions since the kids are out of the house and the mortgage is paid off. Given this set of circumstances, it may make sense to change from itemizing to taking the standard deduction when preparing your taxes. Charitable contributions are an itemized deduction. Thus, if you take the standard deduction for your taxes, you no longer receive the tax benefit of your contributions to charity. By making IRA distributions directly to a charity, you are able to take the standard deduction but still capture the tax benefit of making a charitable contribution because you avoid tax on an IRA distribution that otherwise would have been taxable income to you.

Example: Church Offering

Instead of putting cash or personal checks in the offering each Sunday, you may consider directing all or a portion of your required minimum distribution from your IRA directly to the church or religious organization. Usually having a conversation with your church or religious organization about your new “offering structure” helps to ease the awkward feeling of passing the offering basket without making a contribution each week.

Example: Annual Contributions To Charity

In this example, let’s assume that each year I typically issue a personal check of $2,000 to my favorite charity, Big Brother Big Sisters, a not-for-profit organization. I’m turning 70½ this year and my accountant tells me that it would be more beneficial to take the standard deduction instead of itemizing. My RMD for the year is $5,000. I can contact my IRA provider, have them issuing a check directly to the charity for $2,000 and issue me a check for the remaining $3,000. I will only have to pay taxes on the $3,000 that I received as opposed to the full $5,000. I win, the charity wins, and the IRS kind of loses. I’m ok with that situation.

Don’t Accept Anything From The Charity In Return

This is a very important rule. Sometimes when you make a charitable contribution, as a sign of gratitude, the charity will send you a coffee mug, gift basket, etc. When this happens, you will typically get a letter from the charity confirming your contribution but the amount listed in the letter will be slightly lower than the actual dollar amount contributed. The charity will often reduce the contribution by the amount of the gift that was given. If this happens, the total amount of the charitable contribution fails the “qualified charitable contribution” requirement and you will be taxed on the full amount. Plus, you already gave the money to charity so you have spend the funds that you could use to pay the taxes. Not good

Limits

While this will not be an issue for many of us, there is a $100,000 per person limit for these qualified charitable contributions from IRA’s.

Summary

While there are a number of rules to follow when making these qualified charitable contributions from IRA’s, it can be a great strategy that allows retirees to continue contributing to their favorite charities, religious organizations, and/or not-for-profit organizations, while reducing their overall tax liability.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.