Advanced Tax Strategies For Inherited IRA's

Inherited IRA’s can be tricky. There are a lot of rules surrounding;

Establishment and required minimum distribution (“RMD”) deadlines

Options available to spouse and non-spouse beneficiaries

Strategies for deferring required minimum distributions

Special 60 day rollover rules for inherited IRA’s

Inherited IRA’s can be tricky. There are a lot of rules surrounding;

Establishment and required minimum distribution (“RMD”) deadlines

Options available to spouse and non-spouse beneficiaries

Strategies for deferring required minimum distributions

Special 60 day rollover rules for inherited IRA’s

Establishment Deadline

If the decedent passed away prior to December 31, 2019, as a non-spouse beneficiary you have until December 31st of the year following the decedent’s death to establish an inherited IRA, rollover the balance into that IRA, and begin taking RMD’s based your life expectancy. If you miss that deadline, you are locked into distribution the full balance with a 10 year period.

If the decedent passed away January 1, 2020 or later, with limited exceptions, the inherited IRA rollover option with the stretch option is no longer available to non-spouse beneficiaries.

RMD Deadline - Decedent Passed Away Prior to 12/31/19

If you successfully establish an inherited IRA by the December 31st deadline, if you are non-spouse beneficiary, you will be required to start taking a “required minimum distribution” based on your own life expectancy in the calendar year following the decedent’s date of death.

Here is the most common RMD mistake that is made. The beneficiary forgets to take an RMD from the IRA in the year that the decedent passes away. If someone passes away toward the beginning of the year, there is a high likelihood that they did not take the RMD out of their IRA for that year. They are required to do so and the RMD amount is based on what the decedent was required to take for that calendar year, not based on the life expectancy of the beneficiary. A lot of investment providers miss this and a lot of beneficiaries don’t know to ask this question. The penalty? A lovely 50% excise tax by the IRS on the amount that should have been taken.

Distribution Options Available To A Spouse

If you are the spouse of the decedent you have three distribution options available to you:

Take a cash distribution

Rollover the balance to your own IRA

Rollover the balance to an Inherited IRA

Cash distributions are treated the same whether you are a spouse or non-spouse beneficiary. You incur income tax on the amounts distributed but you do not incur the 10% early withdrawal penalty regardless of age because it’s considered a “death distribution”. For example, if the beneficiary is 50, normally if distributions are taken from a retirement account, they get hit with a 10% early withdrawal penalty for not being over the age of 59½. For death distributions to beneficiaries, that 10% penalty is waived.

#1 Mistake Made By Spouse Beneficiaries

This exemption of the 10% early withdrawal penalty leads me to the number one mistake that we see spouses make when choosing from the three distribution options listed above. The spouse has a distribution option that is not available to non-spouse beneficiaries which is the ability to rollover the balance to their own IRA. While this is typically viewed as the easiest option, in many cases, it is not the most ideal option. If the spouse is under 59½, they rollover the balance to their own IRA, if for whatever reason they need to access the funds in that IRA, they will get hit with income taxes AND the 10% early withdrawal penalty because it’s now considered an “early distribution” from their own IRA.

Myth: Spouse Beneficiaries Have To Take RMD’s From Inherited IRA’s

Most spouse beneficiaries make the mistake of thinking that by rolling over the balance to their own IRA instead of an Inherited IRA they can avoid the annual RMD requirement. However, unlike non-spouse beneficiaries which are required to take taxable distributions each year, if you are the spouse of the decedent you do not have to take RMD’s from the inherited IRA unless your spouse would have been age 70 ½ if they were still alive. Wait…..what?

Let me explain. Let’s say there is a husband age 50 and a wife age 45. The husband passes away and the wife is the sole beneficiary of his retirement accounts. If the wife rolls over the balance to an Inherited IRA, she will avoid taxes and penalties on the distribution, and she will not be required to take RMD’s from the inherited IRA for 20 years, which is the year that their deceased spouse would have turned age 70 ½. This gives the wife access to the IRA if needed prior to age 59 ½ without incurring the 10% penalty.

Wait, It Gets Better......

But wait, since the wife was 5 years young than the husband, wouldn’t she have to start taking RMD’s 5 years sooner than if she just rolled over the balance to her own IRA? If she keeps the balance in the Inherited IRA the answer is “Yes” but here is an IRA secret. At any time, a spouse beneficiary is allowed to rollover the balance in their inherited IRA to their own IRA. So in the example above, the wife in year 19 could rollover the balance in the inherited IRA to her own IRA and avoid having to take RMD’s until she reaches age 70½. The best of both worlds.

Spouse Beneficiary Over Age 59½

If the spouse beneficiary is over the age of 59½ or you know with 100% certainty that the spouse will not need to access the IRA assets prior to age 59 ½ then you can simplify this process and just have them rollover the balance to their own IRA. The 10% early withdrawal penalty will never be an issue.

Non-Spouse Beneficiary Options

As mentioned above, the distribution options available to non-spouse beneficiaries were greatly limited after the passing of the SECURE ACT by Congress on December 19, 2019. For most individuals that inherit retirement accounts after December 31, 2019, they will now be subject to the new "10 Year Rule" which requires non-spouse beneficiary to completely deplete the retirement account 10 years following the year of the decedents death.

For more on the this change and the options available to Non-Spouse beneficiaries in years 2020 and beyond, please read the article below:

60 Day Rollover Mistake

There is a 60 day rollover rule that allows the owner of an IRA to take a distribution from an IRA and if the money is deposited back into the IRA within 60 days, it’s like the distribution never happened. Each taxpayer is allowed one 60 day rollover in a 12 month period. Think of it as a 60 day interest free loan to yourself.

Inherited IRA’s are not eligible for 60 day rollovers. If money is distributed from the Inherited IRA, the rollover back into the IRA will be disallowed, and the individual will have to pay taxes on the amount distributed.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

What Happens To My Pension If The Company Goes Bankrupt?

Given the downward spiral that GE has been in over the past year, we have received the same question over and over again from a number of GE employees and retirees: “If GE goes bankrupt, what happens to my pension?” While it's anyone’s guess what the future holds for GE, this is an important question that any employee with a pension should

Given the downward spiral that GE has been in over the past year, we have received the same question over and over again from a number of GE employees and retirees: “If GE goes bankrupt, what happens to my pension?” While it's anyone’s guess what the future holds for GE, this is an important question that any employee with a pension should know the answer to. While some employees are aware of the PBGC (Pension Benefit Guarantee Corporation) which is an organization that exists to step in and provide pension benefits to employees if the employer becomes insolvent, very few are aware that the PBGC itself may face insolvency within the next ten years. So if the company can’t make the pension payments and the PBGC is out of money, are employees left out in the cold?

Pension shortfall

When a company sponsors a pension plan, they are supposed to make contributions to the plan each year to properly fund the plan to meet the future pension payments that are due to the employees. However, if the company is unable to make those contributions or the underlying investments that the pension plan is invested in underperform, it can lead to shortfalls in the funding.

We have seen instances where a company files for bankruptcy and the total dollar amount owed to the pension plan is larger than the total assets of the company. When this happens, the bankruptcy courts may allow the company to terminate the plan and the PBGC is then forced to step in and continue the pension payments to the employees. While this seems like a great system since up until now that system has worked as an effective safety net for these failed pension plans, the PBGC in its most recent annual report is waiving a red flag that it faces insolvency if Congress does not make changes to the laws that govern the premium payments to the PBGC.

What is the PBGC?

The PBGC is a federal agency that was established in 1974 to protect the pension benefits of employees in the private sector should their employer become insolvent. The PBGC does not cover state or government sponsored pension plans. The number of employees that were plan participants in an insolvent pension plan that now receive their pension payments from the PBGC is daunting. According to the 2017 PBGC annual report, the PBGC “currently provides pension payments to 840,000 participants in 4,845 failed single-employer plans and an additional 63,000 participants across 72 multi-employer plans.”

Wait until you hear the dollar amounts associate with those numbers. The PBGC paid out $5.7 Billion dollars in pension payments to the 840,000 participants in the single-employer plans and $141 Million to the 63,000 participants in the multi-employer plans in 2017.

Where Does The PBGC Get The Money To Pay Benefits?

So where does the PBGC get all of the money needed to make billions of dollars in pension payments to these plan participants? You might have guessed “the taxpayers” but for once that’s incorrect. The PBGC’s operations are financed by premiums payments made by companies in the private sector that sponsor pension plans. The PBGC receive no taxpayer dollars. The corporations that sponsor these pension plans pay premiums to the PBGC each year and the premium amounts are set by Congress.

Single-Employer vs Multi-Employer Plans

The PBGC runs two separate insurance programs: “Single-Employer Program” and “Multi-Employer Program”. It’s important to understand the difference between the two. While both programs are designed to protect the pension benefits of the employees, they differ greatly in the level of benefits guaranteed. The assets of the two programs are also kept separate. If one programs starts to fail, the PBGC is not allowed to shift assets over from the other program to save it.

The single-employer program protects plans that are sponsored by single employers. The PBGC steps in when the employer goes bankrupt or can no longer afford to sponsor the plan. The Single-Employer Program is the larger of the two programs. About 75% of the annual pension payments from the PBGC come from this program. Some examples of single-employer companies that the PBGC has had to step into to make pension payments are United Airlines, Lehman Brothers, and Circuit City.

The Multi-Employer program covers pension plans created and funded through collective bargaining agreements between groups of employers, usually in related industries, and a union. These pension plans are most commonly found in construction, transportation, retail food, manufacturing, and services industries. When a plan runs out of money, the PBGC does not step in and takeover the plan like it does for single-employer plans. Instead, it provides “financial assistance” and the guaranteed amounts of that financial assistants are much lower than the guaranteed amounts offered under the single-employer program. For example, in 2017, the PBGC began providing financial assistance to the United Furniture Workers Pension Fund A (UFW Plan), which covers 10,000 participants.

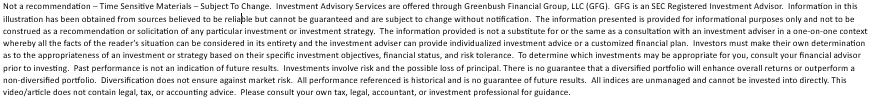

Maximum Guaranteed Amounts

The million dollar question. What is the maximum monthly pension amount that the PBGC will guarantee if the company or organization goes bankrupt? There are maximum dollar amounts for both the single-employer and multi-employer program. The maximum amounts are indexed for inflation each year and are listed on the PBGC website. To illustrate the dramatic difference between the guarantees associated with the pension pensions in a single-employer plan versus a multi-employer plan; here is an example from the PBGC website based on the 2018 rates.

“PBGC’s guarantee for a 65-year-old in a failed single-employer plan can be up to $60,136 annually, while a participant with 30 years of service in a failed multi-employer plan caps out at $12,870 per year. The multi-employer program guarantee for a participant with only 10 years of service caps out at $4,290 per year.”

It’s a dramatic difference.

For the single-employer program the PBGC provides participants with a nice straight forward benefits table based on your age. Below is a sample of the 2018 chart. However, the full chart with all ages can be found on the PBGC website.

Unfortunately, the lower guaranteed amounts for the multi-employer plans are not provided by the PBGC in a nice easy to read table. Instead they provide participant with a formula that is a headache for even a financial planner to sort through. Here is a link to the formula for 2018 on the PBGC website.

PBGC Facing Insolvency In 2025

If the organization guaranteeing your pension plan runs out of money, how much is that guarantee really worth? Not much. If you read the 138 page 2017 annual report issued by the PBGC (which was painful), at least 20 times throughout the report you will read the phase:

“The Multi-employer Program faces very serious challenges and is likely to run out of money by the end of fiscal year 2025.”

They have placed a 50% probability that the multi-employer program runs out of money by 2025 and a 99% probability that it runs out of money by 2036. Not good. The PBGC has urged Congress to take action to fix the problem by raising the premiums charged to sponsors of these multi-employer pension plans. While it seems like a logical move, it’s a double edged sword. While raising the premiums may fix some of the insolvency issues for the PBGC in the short term, the premium increase could push more of the companies that sponsor these plans into bankruptcy.

There is better news for the Single-Employer Program. As of 2017, even though the Single-Employer Program ran a cumulative deficit of $10.9 billion dollars, over the next 10 years, the PBGC is expected to erase that deficit and run a surplus. By comparison the multi-employer program had accumulated a deficit of $65.1 billion dollars by the end of 2017..

Difficult Decision For Employees

While participants in Single-Employer plans may be breathing a little easier after reading this article, if the next recession results in a number of large companies defaulting on their pension obligations, the financial health of the PBGC could change quickly without help from Congress. Employees are faced with a one-time difficult decision when they retire. Option one, take the pension payments and hope that the company and PBGC are still around long enough to honor the pension payments. Or option two, elect the lump sum, and rollover then present value of your pension benefit to your IRA while the company still has the money. The right answer will vary on a case by case basis but the projected insolvency of the PBGC’s Multi-employer Program makes that decision even more difficult for employees.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

After A Divorce, Who Gets To File As Head of Household For Their Taxes?

There are often issues with money and taxes when a couple separates, or even when an ex-divorcee gets married again but this is one of most common tax questions that we receive when a married couple with children are in the process of getting divorced.

There are often issues with money and taxes when a couple separates, or even when an ex-divorcee gets married again but this is one of most common tax questions that we receive when a married couple with children are in the process of getting divorced.

With regards to divorces and taxes though, there are five different tax filing types:

Single

Married Filing Joint

Married Filing Separately

Head of Household

Qualifying widow(er) with dependent child

There are a number of advantages for the spouse that is able to use the Head of Household (“HOH”) filing status after the divorce is finalized. They include:

Lower tax brackets

A higher standard deduction

The possibility of qualifying for more tax credits and deductions

Joint Custody

When parents are awarded joint custody, you would think that there is some flexibility as to who is allowed to file as HOH or at a minimum that the spouses can alternate who files as HOH each year. In a divorce, even with a joint custody arrangement, there is typically one custodial parent. The custodial parent is the parent that the children spend the greatest number of days during the year.In simple terms, it literally comes down to counting the number of days during the calendar year that the children spends with each parent. The parent that spends the most days with the children during the year is the custodial parent and has the right to file as Head of Household, to claim the children as a dependent, claim the child tax credits, and the dependent child care credit.

Form 8332

At any time after the divorce, the custodial parent has the ability to file Form 8332 with their tax return which allows the noncustodial parent to claim one or any number of the children as a dependent on their own tax return. However, even if the custodial party files Form 8332 with their return allowing their ex-spouse to claim one or more of the children as dependents for that tax year, they still retain the right to file under the Head of Household filing status. The Head of Household filing status cannot be transferred to the noncustodial parent via Form 8332.

Both Parents Claim HOH

There are a few rare cases where it could be possible for both parents to file as Head of Household in the same tax year. For example, if there are two children, one child spends 51% of the year with one parent, and the second child spends 51% of the year with the other parent, both parents may be able to file as Head of Household in the same tax year. If you feel like you and your ex-spouse qualify for this exception, you will need to keep very careful records of where the children spend their days and nights throughout the year.

You should keep a “child custody log” because there is a good chance that both parents filing as HOH post-divorce will trigger an audit by the IRS. But there is nothing guaranteeing that a child custody log by itself will satisfy the IRS in the event of an audit. The IRS could request additional information to determine that the 51% time requirement was met by each parent.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Should I Rollover My Pension To An IRA?

Whether you are about to retire or if you were just notified that your company is terminating their pension plan, making the right decision with regard to your pension plan payout is extremely important. It's important to get this decision right because you only get one shot at it. There are a lot of variables that factor into choosing the right option.

Whether you are about to retire or if you were just notified that your company is terminating their pension plan, making the right decision with regard to your pension plan payout is extremely important. It's important to get this decision right because you only get one shot at it. There are a lot of variables that factor into choosing the right option. While selecting the monthly payment option may be the right choice for your fellow co-worker, it could be the wrong choice for you. Here is a quick list of the items that you should consider before making the decision.

Financial health of the plan sponsor

Your age

Your health

Flexibility

Monthly benefit vs lump sum amount

Inflation

Your overall retirement picture

Financial Health Of The Plan Sponsor

The plan sponsor is the company, organization, union, municipality, state agency, or government entity that is in charge of the pension plan. The financial health of the plan sponsor should weigh heavily on your decision in many cases. After all what good is a monthly pension payment if five years from now the company or entity that sponsors the plan goes bankrupt?

Pension Benefit Guarantee Corporation

But wait……..isn’t there some type of organization that guarantees the pension payments? The answer, there may or may not be. The Pension Benefit Guarantee Corporation (PBGC) is an organization that was established to protect your pension benefit. But PBGC protection only applies if your company participates in the PBGC. Not all pension plans have this protection.

Large companies will typically have PBGC protection. The pension plan is required to pay premiums to the PBGC each year. Those premiums are used to subsidize the cost of bankrupt pension plans if the PBGC has to step in to pay benefits. But it’s very important to understand that even through a pension plan may have PBGC protection that does not mean that 100% of the employee’s pension benefits are protected if the company goes bankrupt.

There is a dollar limited placed on the monthly pension benefit that the PBGC will pay if it has to step in. It’s a sliding scale based on your age and the type of pension benefit that you elected. If your pension payment is greater that the cap, the excess amount is not insured. Here is the PBGC 2021 Maximum Monthly Guarantee Table:

Another important note, if you have not reached age 65, your full pension benefit may not be insured even if it is less than the cap listed in the table.

Again, not all pension plans are afforded this protection by the PBGC. Pension plans offered by states and local government agencies typically do not have PBGC protection.

If you are worried about the financial health of the plan sponsor, that scenario may favor electing the lump sum payment option and then rolling over the funds into your rollover IRA. Once the money is in your IRA, the plan sponsor insolvency risk is eliminated.

Your Age

Your age definitely factors into the decision. If you have 10+ years to retirement and your company decides to terminate their pension plan, it may make sense to rollover your balance in the pension plan into an IRA or your current employer’s 401(k) plan. Primarily because you have the benefit of time on your side and you have full control over the asset allocation of the account.

Pension plans typically maintain a conservative to moderate growth investment object. You will rarely ever find a pension plan that has 80%+ in equity exposure. Why? It’s a pooled account for all of the employees of all ages. Since the assets are required to meet current pension payments, pension plans cannot be subject to high levels of volatility.

If your personal balance in the pension plan is moved into our own IRA, you have the option of selecting an investment objective that matches your personal time horizon to retirement. If you have a long time horizon to retirement, it allows you the freedom to be more aggressive with the investment allocation of the account.

If you are within 5 years to retirement, it does not necessarily mean that selecting the monthly pension payment is the right choice but the decision is less cut and dry. You really have to compare the monthly pension payment versus the return that you would have to achieve in your IRA to replicate that income stream in retirement.

Your Health

Your health is a big factor as well. If you are in poor health, it may favor electing the lump sum option and rolling over the balance into an IRA. Whatever amount is left in your IRA account will be distributed to your beneficiaries. With a straight life pension option, the benefit just stops when you pass away. However, if you are worried about your spouse's spending habits and your spouse is either in good health or is much younger than you, you may want to consider the pension option with a 100% survivor benefit.

Flexibility

While some retirees like the security of a monthly pension payment that will not change for the rest of their life, other retirees prefer to have more flexibility. If you rollover you balance to an IRA, you can decide how much you want to take or not take out of the account in a given year.

Some retirees prefer to spend more in their early years in retirement because that is when their health is the best. Walking around Europe when you are 65 is usually not the same experience as walking around Europe when you are 80. If you want to take $10,000 out of your IRA to take that big trip to Europe or to spend a few months in Florida, it provides you with the flexibility to do so. By making sure that you have sufficient funds in your savings at the time of retirement can help to make things like this possible.

Working Because I Want To

The other category of retirees that tend to favor the IRA rollover option is the "I'm working because I want to" category. It has becoming more common for individuals to retire from their primary career and want to still work doing something else for two or three days a week just to keep their mind fresh. If the income from your part-time employment and your social security are enough to meet your expenses, having a fixed pension payment may just create more taxable income for you when you don't necessarily need it. Rolling over your pension plan to an IRA allows you to defer the receipt of that income until at least age 70½. That is the age that distributions are required from IRA accounts.

Monthly Pension vs Lump Sum

It’s important to determine the rate of return that you would need to achieve in your IRA account to replicate the pension benefit based on your life expectancy. With the monthly pension payment option, you do not have to worry about market fluctuations because the onus is on the plan sponsor to produce the returns necessary to make the pension payments. With the IRA, you or your investment advisor are responsible for producing the investment return in the account.

Example 1: You are 65 and you have the option of either taking a monthly pension payment of $3,000 per month or taking a lump sum in the amount of $500,000. If your life expectancy is age 85, what is the rate of return that you would need to achieve in your IRA to replicate the pension payment?

The answer: 4%

If your IRA account performs better than 4% per year, you are ahead of the game. If your IRA produces a return below 4%, you run the risk of running out of money prior to reaching age 85.

Part of this analysis is to determining whether or not the rate of return threshold is a reasonable rate of return to replicate. If the required rate of return calculation results in a return of 6% or higher, outside of any special circumstances, you may be inclined to select the pension payments and put the responsibility of producing that 6% rate of return each year on the plan sponsor.

Low Interest Rate Environment

A low interest rate environment tends to favor the lump sum option because it lowers the “discount rate” that actuaries can use when they are running the present value calculation. Wait……what?

The actuaries are the mathletes that produce the numbers that you see on your pension statement. They have to determine how much they would have to hand you today in a lump sum payment to equal the amount that you would have received if you elected the monthly pension option.

This is called a “present value” calculation. This amount is not the exact amount that you would have received if you elected the monthly pension payments because they get to assume that they money in the pension plan will earn interest over your life expectancy. For example, if the pension plan is supposed to pay you $10,000 per year for the next 30 years, that would equal $300,000 paid out over that 30 year period. But the present value may only be $140,000 because they get to assume that you will earn interest off of that money over the next 30 years for the amount that is not distributed until a later date.

In lower interest rate environments, the actuaries have to use a lower assume rate of return or a lower “discount rate”. Since they have to assume that you will make less interest on the money in your IRA, they have to provide you with a larger lump sum payment to replicate the monthly pension payments over your life expectancy.

Inflation

Inflation can be one of the largest enemies to a monthly pension payment. Inflation, in its simplest form is “the price of everything that you buy today goes up in price over time”. It’s why your grandparents have told you that they remember when a gallon of milk cost a nickel. If you are 65 today and your lock into receiving $2,000 per month for the rest of your life, inflation will erode the spending power of that $2,000 over time.

Historically, inflation increases by about 3% per year. As an example, if your monthly car payment is $400 today, the payment for that same exact car 20 years from now will be $722 per month. Now use this multiplier against everything that you buy each month and it begins to add up quickly.

If you have the money in an IRA, higher inflation typically leads to higher interest rate, which can lead to higher interest rates on bonds. Again, having control over the investment allocation of your IRA account may help you to mitigate the negative impact of inflation compared to a fixed pension payment.

A special note, some pension plans have a cost of living adjustment (“COLA”) built into the pension payment. Having this feature available in your pension plan will help to manage the inflation risk associated with selecting the monthly pension payment option. The plan basically has an inflation measuring stick built into your pension payment. If inflation increases, the plan is allowed to increase the amount of your monthly pension payment to help protect the benefit.

Your Overall Financial Picture

While I have highlighted a number of key variables that you will need to consider before selecting the payout option for your pension benefit, at the end of the day, you have to determine how each option factors into your own personal financial situation. It’s usually wise to run financial projections that identify both the opportunities and risks associated with each payment option.

Don’t be afraid to seek professional help with this decision. They will help you consider what you might need to pay for in the future. Are you going to need money spare for holidays, transportation, even funeral costs should be considered. Where people get into trouble is when they guess or they choose an option based on what most of their co-workers selected. Remember, those co-workers are not going to be there to help you financially if you make the wrong decision.

As an investment advisor, I will also say this, if you meet with a financial planner or investment advisor to assist you with this decision, make sure they are providing you with a non-bias analysis of your options. Depending on how they are compensation, they may have a vested interest in getting you to rollover you pension benefit to an IRA. Even though electing the lump sum payment and rolling the balance over to an IRA may very well be the right decision, they should walk you through a thorough analysis of the month pension payments versus the lump sum rollover option to assist you with your decision.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Spouse Inherited IRA Options

If your spouse passes away and they had either an IRA, 401(k), 403(b), or some other type of employer sponsored retirement account, you will have to determine which distribution option is the right one for you. There are deadlines that you will need to be aware of, different tax implications based on the option that you choose, forms that need to be

If your spouse passes away and they had either an IRA, 401(k), 403(b), or some other type of employer sponsored retirement account, you will have to determine which distribution option is the right one for you. There are deadlines that you will need to be aware of, different tax implications based on the option that you choose, forms that need to be completed, and accounts that may need to be established.

Spouse Distribution Options

As the spouse, if you are listed as primary beneficiary on a retirement account or IRA, you have more options available to you than a non-spouse beneficiary. Non-spouse beneficiaries that inherited retirement accounts after December 31, 2019 are required to fully distribution the account 10 years following the year that the decedent passed away. But as the spouse of the decedent, you have the following options:

Fulling distribute the retirement account with 10 years

Rollover the balance to an inherited IRA

Rollover the balance to your own IRA

To determine which option is the right choice, you will need to take the following factors into consideration:

Your age

The age of your spouse

Will you need to take money from the IRA to supplement your income?

Taxes

Cash Distributions

We will start with the most basic option which is to take a cash distribution directly from your spouse’s retirement account. Be very careful with this option. When you take a cash distribution from a pre-tax retirement account, you will have to pay income tax on the amount that is distributed to you. For example, if your spouse had $50,000 in a 401(k), and you decide to take the full amount out in the form of a lump sum distribution, the full $50,000 will be counted as taxable income to you in the year that the distribution takes place. It’s like receiving a paycheck from your employer for $50,000 with no taxes taken out. When you go to file your taxes the following year, a big tax bill will probably be waiting for you.

In most cases, if you need some or all of the cash from a 401(k) account or an IRA, it usually makes more sense to first rollover the entire balance into an inherited IRA, and then take the cash that you need from there. This strategy gives you more control over the timing of the distributions which may help you to save some money in taxes. If as the spouse, you need the $50,000, but you really need $30,000 now and $20,000 in 6 months, you can rollover the full $50,000 balance to the inherited IRA, take $30,000 from the IRA this year, and take the additional $20,000 on January 2nd the following year so it spreads the tax liability between two tax years.

10% Early Withdrawal Penalty

Typically, if you are under the age of 59½, and you take a distribution from a retirement account, you incur not only taxes but also a 10% early withdrawal penalty on the amount this is distributed from the account. This is not the case when you take a cash distribution, as a beneficiary, directly from the decedents retirement account. You have to report the distribution as taxable income but you do not incur the 10% early withdrawal penalty, regardless of your age.

IRA Options

Let's move onto the two IRA options that are available to spouse beneficiaries. The spouse has the decide whether to:

Rollover the balance into their own IRA

Rollover the balance into an inherited IRA

By processing a direct rollover to an IRA in either case, the beneficiary is able to avoid immediate taxation on the balance in the account. However, it’s very important to understand the difference between these two options because all too often this is where the surviving spouse makes the wrong decision. In most cases, once this decision is made, it cannot be reversed.

Spouse IRA vs Inherited IRA

There are some big differences comparing the spouse IRA and inherited IRA option.

There is common misunderstanding of the RMD rules when it comes to inherited IRA’s. The spouse often assumes that if they select the inherited IRA option, they will be forced to take a required minimum distribution from the account just like non-spouse beneficiaries had to under the old inherited IRA rules prior to the passing of the SECURE Act in 2019. That is not necessarily true. When the spouses establishes an inherited IRA, a RMD is only required when the deceases spouse would have reached age 70½. This determination is based on the age that your spouse would have been if they were still alive. If they are under that “would be” age, the surviving spouse is not required to take an RMD from the inherited IRA for that tax year.

For example, if you are 39 and your spouse passed away last year at the age of 41, if you establish an inherited IRA, you would not be required to take an RMD from your inherited IRA for 29 years which is when your spouse would have turned age 70½. In the next section, I will explain why this matters.

Surviving Spouse Under The Age of 59½

As the surviving spouse, if you are under that age of 59½, the decision between either establishing an inherited IRA or rolling over the balance into your own IRA is extremely important. Here’s why .

If you rollover the balance to your own IRA and you need to take a distribution from that account prior to reaching age 59½, you will incur both taxes and the 10% early withdrawal penalty on the amount of the distribution.

But wait…….I thought you said the 10% early withdrawal penalty does not apply?

The 10% early withdrawal penalty does not apply for distributions from an “inherited IRA” or for distributions to a beneficiary directly from the decedents retirement account. However, since you moved the balance into your own IRA, you have essentially forfeited the ability to avoid the 10% early withdrawal penalty for distributions taken before age 59½.

The Switch Strategy

There is also a little know “switch strategy” for the surviving spouse. Even if you initially elect to rollover the balance to an inherited IRA to maintain the ability to take penalty free withdrawals prior to age 59½, at any time, you can elect to rollover that inherited IRA balance into your own IRA.

Why would you do this? If there is a big age gap between you and your spouse, you may decide to transition your inherited IRA to your own IRA prior to age 59½. Example, let’s assume the age gap between you and your spouse was 15 years. In the year that you turn age 55, your spouse would have turned age 70½. If the balance remains in the inherited IRA, as the spouse, you would have to take an RMD for that tax year. If you do not need the additional income, you can choose to rollover the balance from your inherited IRA to your own IRA and you will avoid the RMD requirement. However, in doing so, you also lose the ability to take withdrawals from the IRA without the 10% early withdrawal penalty between ages 55 to 59½. Based on your financial situation, you will have to determine whether or not the “switch strategy” makes sense for you.

The Spousal IRA

So when does it make sense to rollover your spouse’s IRA or retirement account into your own IRA? There are two scenarios where this may be the right solution:

The surviving spouse is already age 59½ or older

The surviving spouse is under the age of 59½ but they know with 100% certainty that they will not have to access the IRA assets prior to reaching age 59½

If the surviving spouse is already 59½ or older, they do not have to worry about the 10% early withdrawal penalty.

For the second scenarios, even though this may be a valid reason, it begs the question: “If you are under the age of 59½ and you have the option of changing the inherited IRA to your own IRA at any time, why take the risk?”

As the spouse you can switch from inherited IRA to your own IRA but you are not allowed to switch from your own IRA to an inherited IRA down the road.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Divorce: The Difference Between Mediation, Collaborative, and Litigation

While making the decision to get a divorce can be difficult, it's equally important to decide which path for the divorce process is the right one for you and your current spouse. There are three options:

While making the decision to get a divorce can be difficult, it's equally important to decide which path for the divorce process is the right one for you and your current spouse. There are three options:

Mediation

Collaborative

Litigation

It important to understand the interworking's of each option before making a decision. For example, "trying" mediation in an attempt to save money could land you directly in a litigation battle without the opportunity to give the collaborative process a shot which may have been the right choice in the first place.

Mediation

In working with our clients, we have seen mediation work for some couples and not for others. For couples that can make mediation work, it is usually the preferred method because it provides a couple with the more control over the timeline of the divorce process, more choices, and it’s usually the least costly of the three options.

Litigation is where each side “lawyers up” and you do battle in court. We have seen litigations that go on for years costing tens of thousands of dollars in legal fees on both sides. What many people don’t realize is only about 5% of all divorce cases end in a judge’s ruling. Instead, approximately 95% of the divorce cases end in a settlement between the two soon to be ex-spouses. So the obvious question is “why should a couple use their martial assets to pay large attorney fees if they can just reach an agreement themselves?”

In conjunction with the mediation process, a couple meets with a mediator with the goal of working out their own agreement with regard to distribution of property / assets / liabilities, retirement assets, taxes, child custody, child support, and spousal maintenance. The mediator serves as a non-bias guide as you work towards an agreement.

You can ask questions like:

“How is child support calculated?”

“What items do we need to consider for the child custody agreement?”

“How do we assign a value to our business?”

“What is the tax impact of splitting the retirement accounts?”

Overcoming Tough Issues

You may find that you are able to reach an amicable agreement on a majority of the items that will be included in your agreement but what happens in the mediation process for the handful of items that you do not agree upon? It's the job of the mediator to help you to work through those tough issues. It may involve the mediator suggesting possible solutions or asking additional questions to obtain more information about the issue. By keeping the lines of communication open and asking additional questions, it can lead to elegant solutions that were not initially identified as an option.

Ground Rules

While it's important to keep the lines of communication open during the mediation process it may be a wise to agree on a set of ground rules for the mediation process. One of those rules may be that you cannot talk about the divorce outside of the formal mediation sessions. Sometime this is where mediation falls apart. Everything seems to be going great but you are working on one or two of those tough issues that's preventing the final settlement agreement, you go home, get into a heated argument without the presence of the mediator to help reign the emotions back in, and the next thing you know the mediation process is dead because the spouses are no longer speaking to each other. Ground rules are an important part of the process.

Control Over The Timeline

One of the big advantages of the mediation process is it gives you a high degree of control over how long the divorce process takes from start to finish. You do not have to wait for replies from the other side's attorney or court dates. The mediation process moves as fast or as slow as you would like it too. The mediation process is often completed in 3 to 10 meetings. According to www.mediate.com the average mediation case settles in 90 days.

Making The Mediation Process Work

Having seen clients go through this process, there are a few key items that need to exist for the mediation process to really work.

The couple must be able to communicate effectively

Both spouses need to feel like they can represent their own interests

Both spouses need to feel comfortable making financial decisions

There is general sense of trust and a willingness to compromise

Communication

If for whatever reason you can't stand the sight of your soon to be ex-spouse, most likely mediation is not going to work. Both spouses need to be able to openly communicate with each other to reach an agreement.

Represent Personal Interests

If one of the spouses feels like that they cannot adequately represent their interests or feel intimidated about speaking openly about what's important to them, the mediation process is probably not the right option. There are a lot of very important decisions being made in a relatively short period of time. It's important for each spouse to be confident that they fully understand the terminology being discussed, the decisions that are being made, and the long term impact of those decisions once the divorce is finalized.

The Non-Financial Spouse

Since one of the important items included in the divorce agreement is the separation of marital assets, if you or your spouse is intimidated by financial terms or finances in general, it can jeopardize the mediation process. However, if this is the case, it's important for the non-financial spouse to establish a trusted relationship with a financial planner that will help them to understand the short and long term impact of the financial decisions that they are making in conjunction with the mediation process. Items like establishing a budget, determining whether or not they can afford to stay in the marital house, retirement projection, paying down debt, the tax impact of child support, alimony payment, and other material items that will impact their overall financial plan post divorce. For the non-financial spouse, if this relationship is not established during the mediation process, it can lead to the downfall in the mediation process because the non-financial spouse may feel like they don't even know the right financial questions to be asking during the mediation process.

Trust & Compromise

Negotiating in good faith and a willingness to compromise are key to making the mediation process work. As soon as one spouse thinks the other spouse is hiding something, it’s game over for the mediation process. It triggers that natural response, if he or she is hiding one thing, what else are they hiding?

Reaching an agreement requires comprise especially on the difficult issues. If either spouse going into the mediation process is unwilling to give up any ground, it will make the mediation process difficult if not impossible. Married couples pursing a divorce have to remember that same amount of income and assets that were previously supporting a single household are now being used to support two separate households. It typically costs more to support two households instead of one. Two mortgages, two sets of clothes for the kids, two cable bills, etc. Both sides typically have to adjust their standard of living after the divorce is finalized.

Collaborative Divorce

If mediation is not a good fit for you, instead of just defaulting to the litigation option, an option that is growing rapidly in popularity is Collaborative Divorce.

Unlike mediation where it’s just you, your spouse, and a mediator, in the collaborative setting each spouse retains their own attorney to represent them at the table.

The goal of the attorneys in the collaborative setting is the same as the mediator, to reach an amicable agreement between you and your spouse. In fact, the attorneys will typically sign an agreement that if the collaborative process fails and you are unable to reach an agreement, those same attorneys are excluded from representing you in a litigation case. In other words, no matter how much you like your attorney, you would have to find a different attorney if you end up in court. This is an important aspect of the collaborative process because everyone is driving toward a settlement agreement. In divorce cases, people worry that their spouse’s attorney will try to “stir the pot” and get their spouse worked up about certain issues. If the collaborate process fails, both attorneys are out of the picture.

More Support

Having your own attorney sitting next to you and negotiating on your behalf is what many people need to feel comfortable that nothing is being missed and the right decisions are being made on their behalf. If negotiations get too intense during a collaborative session you can take a break, regroup, and seek counsel from your attorney.

Who Is Involved?

In most collaborative divorce cases there are anywhere from 4 to 7 people sitting at the table:

You

Your Attorney

Your Spouse

Your Spouse's Attorney

A Coach or Mediator

Child Specialist

Financial Specialist

The coach or mediators serves as a neutral. They coordinate the meetings, ask questions to help facilitate the negotiations, and help set and enforce the ground rules for the collaborative process. A child specialist can be involved in specific meetings to coordinate the child custody agreement or a financial specialist can be called in to assist in equitable distribution of the martial assets.

What Does It Cost?

Collaborate Divorce is not cheap. You have attorneys involved, a coach, and possibly specialists to help reach an agreement. However, the collaborative process provides you with more control compared to litigation. It provides you with more control over the duration of the divorce process and control over the terms of your agreement. Similar to mediation, the pace of the collaborative process is set by the parties involved. You do not have to wait for court dates. We have seen some collaborative cases reach an agreement faster than a mediation case because the attorneys were there to help push the process along.

It also provides you with more control over the terms of your agreement because you are not tied to “what the law says”. You can create solutions that work for you, work for your spouse, but are outside the boundaries of case law. Also you are not tied to decisions that are handed down by a judge that does not know you or your kids.

In many cases, collaborative ends up being less expensive than full litigation because the duration of the divorce process tends to be shorter since everyone is driving toward a settlement. But given the number of professionals involved in the process, it’s typically more expensive than mediation.

Litigation

Litigation is what most of us think of when we hear the word “divorce”. You go out and find the best attorney that is going to make your soon to be ex-spouse pay!!! Sometimes litigation is unavoidable. As mentioned earlier, if you can’t stand the sight of your ex-spouse sitting across the table from you, then most likely mediation and collaborative are not going to work.

Litigation is usually the most expensive route to go. Attorneys bill by the hour and when you have court dates, your attorney will usually begin their bill rates as soon as they leave the office. Also they have to spend time replying to motions from your spouse’s attorney, preparing for court, and calling experts to testify in court. All too often, an attorney can look at the assets and income of a couple that is getting divorced and they can ballpark the amount of the child support, alimony, and an approximate asset split based on past settlement agreement. The couple then proceeds to spend months and sometimes years in court arguing about this, that, and other thing just to end up in the same spot but with less assets because both sides had to pay their attorneys $20,000+ in legal fees. It’s for this reason that the collaborative divorce process is gaining traction.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Procedures For Splitting Retirement Accounts In A Divorce

If you are going through a divorce and you or your spouse have retirement accounts, the processes for splitting the retirement accounts will vary depending on what type of retirement accounts are involved.

If you are going through a divorce and you or your spouse have retirement accounts, the processes for splitting the retirement accounts will vary depending on what type of retirement accounts are involved.

401(k) & 403(b) Plan

The first category of retirement plans are called ?employer sponsored qualified plans?. This category includes 401(k) plans, 403(b) plans, 457 plans, and profit sharing plans. Once you and your spouse have agreed upon the split amount of the retirement plans, one of the attorneys will draft Domestic Relations Order, otherwise known as a QDRO. This document provides instruction to the plans TPA (third party administrator) as to how and when to split the retirement assets between the ex-spouses. Here is the procedures from start to finish:

One attorney drafts the Domestic Relations Order (?DRO?)

The attorney for the other spouse reviews and approved the DRO

The spouse covered by the retirement plan submits it to the TPA for review

The TPA will review the document and respond with changes that need to be made (if any)

Attorneys submit the DRO to the judge for signing

Once the judge has signed the DRO, its now considered a Qualified Domestic Relations Order (QDRO)

The spouse covered by the retirement plan submits the QDRO to the plans TPA for processing

The TPA splits the retirement account and will often issues distribution forms to the ex-spouse not covered by the plan detailing the distribution options

Step number four is very important. Before the DRO is submitting to the judge for signing, make sure that the TPA, that oversees the plan being split, has had a chance to review the document. Each plan is different and some plans require unique language to be included in the DRO before the retirement account can be split. If the attorneys skip this step, we have seen cases where they go through the entire process, pay the court fees to have the judge sign the QDRO, they submit the QDRO for processing with the TPA, and then the TPA firm rejects the QDRO because it is missing information. The process has to start all over again, wasting time and money.

Pension Plans

Like employer sponsored retirement plans, pension plans are split through the drafting of a Qualified Domestic Relations Order (QDRO). However, unlike 401(k) and 403(b) plans that usually provide the ex-spouse with distribution options as soon as the QDRO is processed, with pension plans the benefit is typically delayed until the spouse covered by the plan is eligible to begin receiving pension payments. A word of caution, pension plans are tricky. There are a lot more issues to address in a QDRO document compared to a 401(k) plan. 401(k) plans are easy. With a 401(k) plan you have a current balance that can be split immediately. Pension plan are a promise to pay a future benefit and a lot can happen between now and the age that the covered spouse begins to collect pension payments. Pension plans can terminate, be frozen, employers can go bankrupt, or the spouse covered by the retirement plan can continue to work past the retirement date.

I would like to specifically address the final option in the paragraph above. In pension plans, typically the ex-spouse is not entitled to a benefit until the spouse covered by the pension plan is eligible to receive benefits. While the pension plan may state that the employee can retire at 65 and start collecting their pension, that does not mean that they will with 100% certainty. We have seen cases where the ex-husband could have retired at age 65 and started collecting his pension benefit but just to prevent his ex-wife from collecting on his benefit decided to delay retirement which in turn delayed the pension payments to his ex-wife. The ex-wife had included those pension payments in her retirement planning but had to keep working because the ex-husband delayed the benefit. Attorneys will often put language in a QDRO that state that whether the employee retires or not, at a given age, the ex-spouse is entitled to turn on her portion of the pension benefit. The attorneys have to work closely with the TPA of the pension plan to make sure the language in the QDRO is exactly what it need to be to reserve that benefit for the ex-spouse.

IRA (Individual Retirement Accounts)

IRA? are usually the easiest of the three categories to split because they do not require a Qualified Domestic Relations Order to separate the accounts. However, each IRA provider may have different documentation requirements to split the IRA accounts. The account owner should reach out to their investment advisor or the custodian of their IRA accounts to determine what documents are needed to split the account. Sometimes it is as easy as a letter of instruction signed by the owner of the IRA detailing the amount of the split and a copy of the signed divorce agreement. While these accounts are easier to split, make sure the procedures set forth by the IRA custodians are followed otherwise it could result in adverse tax consequences and/or early withdrawal penalties.

About Michael??...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

M&A Activity: Make Sure You Address The Seller’s 401(k) Plan

Buying a company is an exciting experience. However, many companies during a merger or acquisition fail to address the issues surrounding the seller’s retirement plan which can come back to haunt the buyer in a big way. I completely understand why this happens. Purchase price, valuations, tax issues, terms, holdbacks, and new employment

Buying a company is an exciting experience. However, many companies during a merger or acquisition fail to address the issues surrounding the seller’s retirement plan which can come back to haunt the buyer in a big way. I completely understand why this happens. Purchase price, valuations, tax issues, terms, holdbacks, and new employment agreements tend to dominate the conversations throughout the business transaction. But lurking in the dark, below these main areas of focus, lives the seller’s 401(k) plan. Welcome to the land of unintended consequences where unexpected liabilities, big dollar outlays, and transition issues live.

Asset Sale or Stock Sale

Whether the transaction is a stock sale or asset sale will greatly influence the series of decisions that the buyer will need to make regarding the seller’s 401(k) plan. In an asset sale, it is common that employees of the seller’s company are terminated from employment and subsequently “rehired” by the buyer’s company. With asset sales, as part of the purchase agreement, the seller will often times be required to terminate their retirement plan prior to the closing date.

Terminating the seller’s plan prior to the closing date has a few advantages from both the buyer’s standpoint and from the standpoint of the seller’s employees. Here are the advantages for the buyer:

Advantage 1: The Seller Is Responsible For Terminating Their Plan

From the buyer’s standpoint, it’s much easier and cost effective to have the seller terminate their own plan. The seller is the point of contact at the third party administration firm, they are listed as the trustee, they are the signer for the final 5500, and they typically have a good personal relationship with their service providers. Once the transaction is complete, it can be a headache for the buyer to track down the authorized signers on the seller’s plan to get all of the contact information changed over and allows the buyer’s firm to file the final 5500.

The seller’s “good relationship” with their service providers is key. The seller has to call these companies and let them know that they are losing the plan since the plan is terminating. There are a lot of steps that need to be completed by those 401(k) service providers after the closing date of the transaction. If they are dealing with the seller, their “client”, they may be more helpful and accommodating in working through the termination process even though they losing the business. If they get a random call for the “new contact” for the plan, you risk getting put at the bottom of the pile

Part of the termination process involves getting all of the participant balances out of the plan. This includes terminated employees of the seller’s company that may be difficult for the buyer to get in contact with. It’s typically easier for the seller to coordinate the distribution efforts for the terminated plan.

Advantage 2: The Buyer Does Not Inherit Liability Issues From The Seller’s Plan

This is typically the main reason why the buyer will require the seller to terminate their plan prior to the closing date. Employer sponsored retirement plans have a lot of moving parts. If you take over a seller’s 401(k) plan to make the transition “easier”, you run the risk of inheriting all of the compliance issues associated with their plan. Maybe they forgot to file a 5500 a few years ago, maybe their TPA made a mistake on their year-end testing last year, or maybe they neglected to issues a required notice to their employees knowing that they were going to be selling the company that year. By having the seller terminate their plan prior to the closing date, the buyer can better protect themselves from unexpected liabilities that could arise down the road from the seller’s 401(k) plan.

Now, let’s transition the conversation over to the advantages for the seller’s employees.

Advantage 1: Distribution Options

A common goal of the successor company is to make the transition for the seller’s employees as positive as possible right out of the gate. Remember this rule: “People like options”. Having the seller terminate their retirement plan prior to the closing date of the transactions gives their employees some options. A plan termination is a “distributable event” meaning the employees have control over what they would like to do with their balance in the seller’s 401(k) plan. This is also true for the employees that are “rehired” by the buyer. The employees have the option to:

Rollover their 401(k) balance in the buyer’s plan (if eligible)

Rollover their 401(k) balance into a rollover IRA

Take a cash distribution

Some combination of options 1, 2, and 3

The employees retain the power of choice.

If instead of terminating the seller’s plan, what happens if the buyer decides to “merge” the seller’s plan in their 401(k) plan? With plan mergers, the employees lose all of the distribution options listed above. Since there was not a plan termination, the employees are forced to move their balances into the buyer’s plan.

Advantage 2: Credit For Service With The Seller’s Company

In many acquisitions, again to keep the new employees happy, the buyer will allow the incoming employee to use their years of service with the seller’s company toward the eligibility requirements in the buyer’s plan. This prevents the seller’s employees from coming in and having to satisfy the plan’s eligibility requirements as if they were a new employee without any prior service. If the plan is terminated prior to the closing date of the transaction, the buyer can allow this by making an amendment to their 401(k) plan.

If the plan terminates after the closing date of the transaction, the plan technically belonged to the buyer when the plan terminated. There is an ERISA rule, called the “successor plan rule”, that states when an employee is covered by a 401(k) plan and the plan terminates, that employee cannot be covered by another 401(k) plan sponsored by the same employer for a period of 12 months following the date of the plan termination. If it was the buyer’s intent to allow the seller’s employees to use their years of service with the selling company for purposes of satisfy the eligibility requirement in the buyer’s plan, you now have a big issue. Those employees are excluded from participating in the buyer’s plan for a year. This situation can be a speed bump for building rapport with the seller’s employees.

Loan Issue

If a company allows 401(k) loans and the plan terminates, it puts the employee in a very bad situation. If the employee is unable to come up with the cash to payoff their outstanding loan balance in full, they get taxed and possibly penalized on their outstanding loan balance in the plan.

Example: Jill takes a $30,000 loan from her 401(k) plan in May 2017. In August 2017, her company Tough Love Inc., announces that it has sold the company to a private equity firm and it will be immediately terminating the plan. Jill is 40 years old and has a $28,000 outstanding loan balance in the plan. When the plan terminates, the loan will be processed as an early distribution, not eligible for rollover, and she will have to pay income tax and the 10% early withdrawal penalty on the $28,000 outstanding loan balance. Ouch!!!

From the seller’s standpoint, to soften the tax hit, we have seen companies provide employees with a severance package or final bonus to offset some of the tax hit from the loan distribution.

From the buyer’s standpoint, you can amend the plan to allow employees of the seller’s company to rollover their outstanding 401(k) loan balance into your plan. While this seems like a great option, proceed with extreme caution. These “loan rollovers” get complicated very quickly. There is usually a window of time where the employee’s money is moving over from seller’s 401(k) plan over to the buyer’s 401(k) plan, and during that time period a loan payment may be missed. This now becomes a compliance issue for the buyer’s plan because you have to work with the employee to make up those missed loan payments. Otherwise the loan could go into default.

Example, Jill has her outstanding loan and the buyer amends the plan to allow the direct rollover of outstanding loan balances in the seller’s plan. Payroll stopped from the seller’s company in August, so no loan payments have been made, but the seller’s 401(k) provider did not process the direct rollover until December. When the loan balance rolls over, if the loan is not “current” as of the quarter end, the buyer’s plan will need to default her loan.

Our advice, handle this outstanding 401(k) loan issue with care. It can have a large negative impact on the employees. If an employee owes $10,000 to the IRS in taxes and penalties due to a forced loan distribution, they may bring that stress to work with them.

Stock Sale

In a stock sale, the employees do not terminate and then get rehired like in an asset sale. It’s a “transfer of ownership” as opposed to “a sale followed by a purchase”. In an asset sale, employees go to sleep one night employed by Company A and then wake up the next morning employed by Company B. In a stock sale, employees go to sleep employed by Company A, they wake up in the morning still employed by Company A, but ownership of Company A has been transferred to someone else.

With a stock sale, the seller’s plan typically merges into the buyer’s plan, assuming there is enough ownership to make them a “controlled group”. If there are multiple buyers, the buyers should consult with the TPA of their retirement plans or an ERISA attorney to determine if a controlled group will exist after the transaction is completed. If there is not enough common ownership to constitute a “controlled group”, the buyer can decide whether to continue to maintain the seller’s 401(k) plan as a standalone plan or create a multiple employer plan. The basic definition of a “controlled group” is an entity or group of individuals that own 80% or more of another company.

Stock Sales: Do Your Due Diligence!!!

In a stock sale, since the buyer will either be merging the seller’s plan into their own or continuing to maintain the seller’s plan as a standalone, you are inheriting any and all compliance issues associated with that plan. The seller’s issues become the buyer’s issues the day of the closing. The buyer should have an ERISA attorney that performs a detailed information request and due diligence on the seller’s 401(k) plan prior the closing date.

Seller Uses A PEO

Last issue. If the selling company uses a Professional Employer Organization (PEO) for their 401(k) services and the transaction is going to be a stock sale, make sure you get all of the information that you need to complete a mid-year valuation or the merged 5500 for the year PRIOR to the closing date. We have found that it’s very difficult to get information from PEO firms after the acquisition has been completed.

The Transition Rule

There is some relief provided by ERISA for mergers and acquisitions. If a control group exists, you have until the end of the year following the year of the acquisition to test the plans together. This is called the “transition rule”. However, if the buyer makes “significant” changes to the seller’s plan during the transition period, that may void the ability to delay combined testing. Unfortunately, there is not clear guidance as to what is considered a “significant change” so the buyer should consult with their TPA firm or ERISA attorney before making any changes to their own plan or the seller’s plan that could impact the rights, benefits, or features available to the plan participants.

Horror Stories

There are so many real life horror stories out there involving companies that go through the acquisition process without conducting the proper due diligence and transition planning with regard to the seller’s retirement plan. It never ends well!! As the buyer, it’s worth the time and the money to make sure your team of advisors have adequately addressed any issues surrounding the seller’s retirement plan prior to the closing date.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Do Inherited IRA's Work For Non-Spouse Beneficiaries?

The SECURE Act was signed into law on December 19, 2019 which completely changed the distribution options that are available to non-spouse beneficiaries. One of the major changes was the elimination of the “stretch provision” which previously allowed non-spouse beneficiaries to rollover the balance into their own inherited IRA and then take small

The SECURE Act was signed into law on December 19, 2019 which completely changed the distribution options that are available to non-spouse beneficiaries. One of the major changes was the elimination of the “stretch provision” which previously allowed non-spouse beneficiaries to rollover the balance into their own inherited IRA and then take small required minimum distributions over their lifetime.

That popular option was replaced with the new 10 Year Rule which will apply to most non-spouse beneficiaries that inherit IRA’s and other types of retirements account after December 31, 2019.

New Rules For Non-Spouse Beneficiaries Years 2020+

The article and Youtube video listed below will provide you with information on:

New distribution options available to non-spouse beneficiaries

The new 10 Year Rule

Beneficiaries that are grandfathered in under the old rules

SECURE Act changes

Old rules vs New rules

New tax strategies for non-spouse beneficiaries

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

5 Options For Money Left Over In College 529 Plans

If your child graduates from college and you are fortunate enough to still have a balance in their 529 college savings account, what are your options for the remaining balance? There are basically 5 options for the money left over in college 529 plans.

If your child graduates from college and you are fortunate enough to still have a balance in their 529 college savings account, what are your options for the remaining balance? There are basically 5 options for the money left over in college 529 plans.

Advanced degree for child

If after the completion of an undergraduate degree, your child plans to continue on to earn a master's degree, law school, or medical school, you can use the remaining balance toward their advanced degree.

Transfer the balance to another child

If you have another child that is currently in college or a younger child that will be attending college at some point, you can change the beneficiary on that account to one of your other children. There is no limit on the number of 529 accounts that can be assigned to a single beneficiary.

Take the cash

When you make withdrawals from 529 accounts for reasons that are not classified as a "qualified education expenses", the earnings portion of the distribution is subject to income taxation and a 10% penalty. Again, only the earnings are subject to taxation and the penalty, your cost basis in the account is not. For example, if my child finishes college and there is $5,000 remaining in their 529 account, I can call the 529 provider and ask them what my cost basis is in the account. If they tell me my cost basis is $4,000 that means that the income taxation and 10% penalty will only apply to $1,000. The rest of the account is withdrawn tax and penalty free.

Reserve the account for a future grandchild

Once your child graduates from college, you can change the beneficiary on the account to yourself. By doing so the account will continue to grow and once your first grandchild is born, you can change the beneficiary on that account over to the grandchild.

Reserve the account for yourself or spouse

If you think it's possible that at some point in the future you or your wife may go back to school for a different degree or advanced degree, you assign yourself as the beneficiary of the account and then use the account balance to pay for that future degree.

About Michael.........