Why Did Silicon Valley Bank Fail? The Contagion Risk

This week, Silicon Valley Bank (SVB), the 16th largest bank in the United States, became insolvent in a matter of 48 hours. The bank now sits in the hands of the FDIC which has sent ripples across the financial markets.

This week, Silicon Valley Bank (SVB), the 16th largest bank in the United States, became insolvent in a matter of 48 hours. The bank now sits in the hands of the FDIC which has sent ripples across the financial markets. In this article, I’m going to address:

What caused SVB to fail?

The contagion risk for the banking sector

The business fallout for start-ups

How this could impact Fed policy

FDIC insurance coverage

Silicon Valley Bank

SVB has been in business for 40 years and at the time of the failure, had about $209 Billion in total assets, ranking it as the 16th largest bank in the U.S., so not a small or new bank. But it’s important to acknowledge that this bank was unique when compared to its peers in the banking sector. This bank was known for its concentrated lending to start-up tech companies and venture capital firms.

SVB Isolated Event?

Before we discuss the contagion factors associated with the SVB failure, there are definitely catalysts for this insolvency that were probably specific just to Silicon Valley Bank. Since the bank had such a high concentration of lending practices to start-ups and venture capital firms, that in itself exposed the bank to higher risk when comparing it to traditional bank lending practices. While most major banks in some form or another, lend money to start-up companies, it’s typically not a high percentage of their overall loan portfolio. Over the years, Silicon Valley Bank has become known as the “go-to lender” for start-ups and venture capital firms.

What is a venture capital firm?

Venture capital firms, otherwise known as “VC’s”, are large investment companies that essentially raise money, and then invest that capital primarily and start-up companies. Venture capital firms will sometimes take loans from banks, like SVB, and then invest that money in start-up companies with the hopes of earning a superior rate of return. For example, a venture capital firm could requests a $50 million loan at a 5% interest rate and then invests that money into 5 different start-up companies, with the hopes of earning a return greater than 5% interest rate that they are paying to the bank.

Start-up lending is risky

Lending money to start-up companies generally carries a higher risk than lending money to long-term, cash-stable companies. It’s not uncommon for start-up companies to be producing little to no revenue because they have a promising business idea that has yet to see wide spread adoption. Then add into the mix, the reality that a lot of these start-up companies fail before reaching profitability.

For this reason, if you have a bank, like SVB that has a high concentration of lending activity to start-ups and venture capital firms, they are naturally going to have more risk than a bank that does not engage in concentrated lending activities to this sector of the market.

A Challenging Market Environment For Start-Ups

In 2020 in 2021, the start-up market was booming because there was so much capital injected into the US economy from the Covid stimulus packages issued by the US government. That favorable liquidity environment changed dramatically in 2022 when inflation got out of control, and then the Federal Reserve started quantitative tightening, essentially pulling that cash back out of the economy. This lack of liquidity and higher interest rates put stress on the start-up industry, who depends, mainly on loans and new capital investment to keep operations going. Given this adverse market environment for start-ups, there has been an increase in the number of start-up defaulting on their loans, running out of cash, and going bankrupt. Since SVB’s loan portfolio is heavily concentrated in that start-up sector of the market, they would naturally feel more pain than their peers that have less exposure.

This gives way to the argument that this could in fact just be an unfortunate isolated incident by a bank that overextended its level of risk to a sector of the market that due to monetary tightening by the Fed has gotten crushed over the past year.

However, in the midst of the failure of SVB, another risk has surfaced that could spell trouble for the rest of the banking industry in the coming weeks.

The Contagion Risk

There is some contagion risk associated with what has happened with the failure of SVB which is why I think you saw a rapid drop in the price of other bank stocks, especially small regional banks, over the past two days. The contagion risk centers around, not their loan portfolio, but rather the assets that SVB was holding as reserves that many other banks hold as well, which rendered them unable to meet the withdrawal request of their depositors, and ultimately created a run on the bank.

The Treasury Bond Issue

When banks take in money from depositors, one of the ways that a bank makes money is by taking those deposits that are sitting on the bank’s balance sheet and investing them in “safe” securities which allow the bank to earn interest on that money until their clients request withdrawals. It’s not uncommon for banks to invest that money in low-risk fixed-income investments like U.S. Treasury Bonds which principal and interest payments are backed by U.S. government.

SVB was holding many of these Treasuries and other fixed-income securities when these start-up companies began to default on their loans which then spooked the individuals and companies that still had money on deposit with SVB, worried that the bank might fail, and they started requesting large withdrawals, which then required SVB to begin selling their fixed income assets to raise cash to meet the redemption requests.

Herein lies the problem. While the value of a U.S. Treasury Bond is backed by the U.S. Government, meaning they promise to hand you back the face value of that bond when it matures, the value of that bond can fluctuate in value while it’s waiting to reach maturity. In other words, if you sell the bond before its maturity date, you could lose money.

The enemy of bond prices is rising interest rates because when interest rates go up, bond prices go down. Over the past 12 months, in an effort to fight inflation, the Fed has increased interest rates bigger and faster than it ever has within the past 50 years. So banks, like SVB, that were most likely buying bonds back in 2017, 2018, and 2019 before interest rates skyrocketed, if they were holding longer duration bonds hoping to hold them to maturity, the prices of those bonds are most likely underwater.

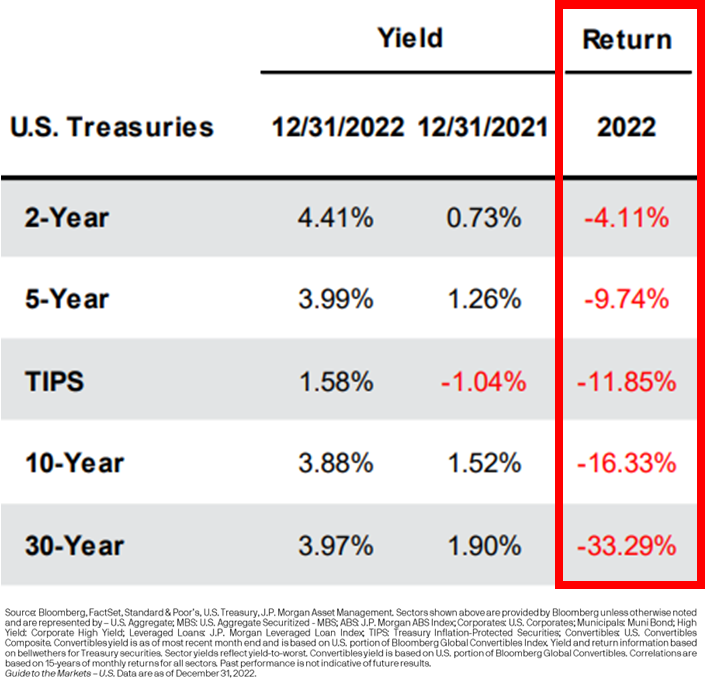

Below is a chart that shows price decline of U.S. Treasury Bonds in 2022 based on the duration of the bonds:

As you can see on the chart, in 2022, the price of a 5 Year US Treasury Bond declined by 9.74% but if you owned a 30 Year U.S. Treasury Bond, the price of that bond declines by 33.29% in 2022. Ouch!!

SVB Forced To Sell Assets At A Bad Time

When a bank needs to raise capital to either make up for loan defaults or because depositors are requesting their cash back, if they do not have enough liquid cash on hand, then they have to begin selling their reserve investments to raise cash. Again, if SVB was buying longer duration bonds back in 2018 and 2019, the intent might have been to hold those bonds until maturity, but the run on their bank forced them to sell those bonds at a loss, so they no longer had the cash to meet the redemption requests.

Will This Problem Spread To Other Banks?

While other banks may not lend as heavily to start-up companies, it is not uncommon at all for banks to purchase Treasuries and other fixed-income securities with their cash reserves. With the economy facing a potential recession in 2023, this has investors asking, what if defaults begin to rise on auto loans, mortgages, and lines of credit during a recession, and then these other banks are forced to liquidate their fixed-income assets at a loss, rendering them unable to meet redemption requests?

Over the next few weeks, this is the exact type of analysis that is probably going to take place at banks across the U.S. banking sector. It’s no longer just a question of “how much does a bank have in reserve assets?” but “What type of assets are being held by the bank and if redemptions increased dramatically would they have the cash to meet those redemption requests?”

The answer may very well be “Yes, there is no reason to panic.” SVB may end up being an isolated incident, not only because they had overexposure to high-risk start-up companies but also because they made poor choices with the fixed-income securities that they purchased with longer durations which compounded the issues when redemptions flooded in and they were forced to sell them at a loss. It’s too early to know for sure so we will have to wait and see.

Change In Fed Policy

This SVB failure could absolutely have an impact on Fed policy. If the Fed realizes that by continuing to push interest rates higher, it could create larger losses in these Treasury cash reserve portfolios at banks across the U.S., a recession shows up, redemptions at banks increase, and then more banks face the same fate as SVB due to the forced selling of those bonds at a loss, it may prompt the Fed to only raise rates by 25bps at the next Fed meeting instead of 50bps.

The reality is we have not seen interest rates rise this fast or by this magnitude within the last 50 years, so the Fed has to be aware that things can begin to break within the U.S. economy that were not intended to break. While getting inflation back down to the 2% - 3% level is the Fed’s primary focus right now, it will be interesting to see if they acknowledge some of these outlier events like SVB failure at the next Fed meeting.

FDIC Insurance

The FDIC has stepped in and taken control of Silicon Valley Bank. Banks have something called FDIC insurance which basically protects an individual’s deposits at a bank up to $250,000 if the bank were to be rendered insolvent. The FDIC saw the run on the bank and basically stepped in to make sure the remainder of the bank’s assets were being preserved as much as possible to meet their $250,000 protection obligation. But there is no protection for individuals and companies that had balances over $250,000 and considering this was a big bank, there are probably a lot of clients of the bank that fall into that category. Not just small companies either. For example, Roku came out on Friday and announced they had approximately $487 Million on deposit with Silicon Valley Bank (Source: CNBC).

The FDIC has issued preliminary guidance that the $250,000 protected amount should be available to depositors for withdrawal but Monday, March 13th, but there has been little to no guidance on what is going to happen to clients of SVB that had balances over $250,000. How much are they going to be able to recoup? When will they have access to that money?

The Business Fallout

Investors are probably going to see a lot of headlines over the next few weeks about businesses not being able to meet payroll or businesses going bankrupt due to SVB failure. Since SVB had a large concentration of start-up companies as clients, this may be more pronounced because many start-ups are not producing enough cash yet to sustain operations. If a company had their business checking account at SVB, depending on the answers from the FDIC as to how much money over the $250,000 they will be able to recoup, and when will they have access to the cash, some of these companies could fold just because they lost access to their cash which is very sad and unfortunate collateral damage from this banking fallout.

Isolated Incident or Contagion?

On the surface, the failure of Silicon Valley Bank may end up being an isolated event that does not spread to the rest of the banking industry but sitting here today, it’s too early to know that for sure. If there are other banks out there that have made similar mistakes by taking on too much duration in their bond portfolio prior to the rapid rise in interest rates, they could potentially face similar redemption problems if the U.S. economy sinks into a recession and defaults and redemption requests start piling up. A lot will depend on the results of these bank asset stress tests, Fed policy, and the direction of the economy over the next 12 months.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

529 to Roth IRA Transfers: A New Backdoor Roth Contribution Strategy Is Born

With the passing of the Secure Act 2.0, starting in 2024, owners of 529 accounts will now have the ability to transfer up to $35,000 from their 529 college savings account directly to a Roth IRA for the beneficiary of the account. While on the surface, this would just seem like a fantastic new option for parents that have money leftover in 529 accounts for their children, it is potentially much more than that. In creating this new rule, the IRS may have inadvertently opened up a new way for high-income earners to move up to $35,000 into a Roth IRA, creating a new “backdoor Roth IRA contribution” strategy for high-income earners and their family members.

With the passing of the Secure Act 2.0, starting in 2024, owners of 529 accounts will now have the ability to transfer up to $35,000 from their 529 college savings account directly to a Roth IRA for the beneficiary of the account. While on the surface, this would just seem like a fantastic new option for parents that have money leftover in 529 accounts for their children, it is potentially much more than that. In creating this new rule, the IRS may have inadvertently opened up a new way for high-income earners to move up to $35,000 into a Roth IRA, creating a new “backdoor Roth IRA contribution” strategy for high-income earners and their family members.

Money Remaining In the 529 Account for Your Children

I will start by explaining this new 529 to Roth IRA transfer provision using the scenario that it was probably intended for; a parent that owns a 529 account for their children, the kids are done with college, and there is still a balance remaining in the 529 account.

The ability to shift money from a 529 account directly to a Roth IRA for your child is a fantastic new distribution option for balances that may be leftover in these accounts after your child or grandchild has completed college. Prior to the passage of the Secure Act 2.0, there were only two options for balances remaining in 529 accounts:

Change the beneficiary on the account to someone else

Process a non-qualified distribution from the account

Both options created potential challenges for the owners of 529 accounts. For the “change the beneficiary option”, what if you only have one child, or what if the remaining balance is in the youngest child’s account? There may not be anyone else to change the beneficiary to.

The second option, processing a “non-qualified distribution” from the 529 account, if there were investment earnings in the account, those investment earnings are subject to taxes and a 10% penalty because they were not used to pay a qualified education expense.

The “Roth Transfer Option” not only gives account owners a third attractive option, but it’s so attractive that planners may begin advising clients to purposefully overfund these 529 accounts with the intention of processing these Roth transfers after the child has completed college.

Requirements for 529 to Roth IRA Transfers

Before I get into explaining the advanced tax and wealth accumulation strategies associated with this new 529 distribution option, like any new tax law, there is a list of rules that you have to follow to be eligible to process these 529 to Roth IRA transfers.

The 15 Year Rule

The first requirement is the 529 account must have been in existence for at least 15 years to be eligible to execute a Roth transfer from the account. The clock starts when you deposit the first dollar into that 529 account. The planning tip here is to fund the 529 as soon as you can after the child is born, if you do, the 529 account will be eligible for Roth IRA transfers by their 15th or 16th birthday.

There is an unanswered question surrounding rollovers between state plans and this 15-year rule. Right now, you are allowed to rollover let’s say a Virginia 529 account into a New York 529 account. The question becomes, since the New York 529 account is a new account, would that end up re-setting the 15-year inception clock?

Contributions Within The Last 5 Years Are Not Eligible

When you go to process a Roth transfer from a 529 account, contributions made to the 529 account within the previous 5 years are not eligible for Roth transfers.

The Beneficiary of the 529 Account and the Owners of the Roth IRA Must Be The Same Person

A third requirement is the beneficiary listed on the 529 account and the owner of the Roth IRA account must be the same person. If your daughter is the beneficiary of the 529 account, she would also need to be the owner of the Roth IRA that is receiving the transfer directly from the 529 account. There is a big question surrounding this requirement that we still need clarification on from the IRS. The question is this: Is the account owner allowed to change the beneficiary on the 529 account without having to re-satisfy a new 15-year account inception requirement?

If they allow beneficiary changes without a new 15-year inception period, with 529 accounts, the account owner can change the beneficiary on these accounts to whomever they want……..including themselves. This would allow a parent to change the beneficiary to themselves on the 529 account and then transfer the balance to their own Roth IRA, which may not be the intent of the new law. We will have to wait for guidance on this.

No Roth IRA Income Limitations

As many people are aware, if you make too much, you are not allowed to contribute to a Roth IRA. For 2023, the ability to make Roth IRA contributions begins to phase out at the following income levels:

Single Filer: $138,000

Married Filer: $218,000

These transfers directly from 529 accounts to the beneficiary’s Roth IRA do not carry the income limitation, so regardless of the income level of the 529 account owner or the beneficiary, there a no maximum income limit that would preclude these 529 to Roth IRA transfers from taking place.

The IRA Owner Must Have Earned Income

With exception of the Roth IRA income phaseout rules, the rest of the Roth RIA rules still apply when determining whether or not a 529 to Roth IRA transfer is allowed in a given tax year. First, the beneficiary of the 529 (also the owner of the Roth IRA) needs to have earned income in the year that the transfer takes place to be eligible to process a transfer from the 529 to their Roth IRA.

Annual 529 to Roth IRA Transfer Limits

The amount that can be transferred from the 529 to the Roth IRA is also limited each year by the regular Roth IRA annual contribution limits. For 2023, an individual under the age of 50, is allowed to make a Roth IRA contribution of up to $6,500. That is the most that can be moved from the 529 account to Roth IRA in a single tax year. But in addition to this hard dollar limit, you have to also take into account any other Roth IRA contributions that were made to the IRA owner’s account and the IRA owners earned income for that tax year.

The annual contribution limit to a Roth IRA for 2023 is actually the LESSER of:

$6,500; or

100% of the earned income of the account owner

Assuming the IRA contribution limits stay the same in 2024, if a child only has $3,000 in income, the maximum amount that could be transferred from the 529 to the Roth IRA in 2024 is $3,000.

If the child made a contribution of their own to the Roth IRA, that would also count against the amount that is available for the 529 to Roth IRA transfer. For example, the child makes $10,000 in earned income, making them eligible for the full $6,500 Roth IRA contribution, but if the child contributes $2,000 to their Roth IRA throughout the year, the maximum 529 to Roth IRA transfer would be $4,500 ($6,500 - $2,000 = $4,500)

The IRA limits could be the same or potentially higher in 2024 when this 529 to Roth IRA transfer option goes into effect.

$35,000 Limiting Maximum Per Beneficiary

The maximum lifetime amount that can be transferred from a 529 to a Roth IRA is $35,000 for each beneficiary. Given the annual contribution limits that we just covered, you would not be allowed to just transfer $35,000 from the 529 to the Roth IRA all in one shot. The $35,000 lifetime limit would be reached after making multiple years of transfers from the 529 to the Roth IRA over a number of tax years.

Advanced 529 Planning Strategies Using Roth Transfers

Now I’m going to cover some of the advanced tax and wealth accumulation strategies that may be able to be executed under this 529 Roth Transfer provision. Disclosure, writing this in February 2023, we are still waiting on guidance from the IRS on what they may or may not have intended with this new 529 to Roth transfer option that becomes available starting in 2024, so their guidance could either reinforce that these strategies can be used or limit the use of these advanced strategies. Time will tell.

Super Funding A Roth IRA For Your Child

While 529 accounts have traditionally been used to save exclusively for future college expenses for your children or grandchild, they just become much more than that. Parents and grandparents can now fund these accounts when a child is young with the pure intention of NOT using the funds for college but rather creating a supercharged Roth IRA as soon as that child begins earning income in their teenage years and into their 20s.

This is best illustrated in an example. You have a granddaughter that is born in 2023, you open a 529 account for her and fund it with $15,000. By the time your granddaughter has reached age 18, let’s assume through wise investment decisions, the account has tripled to $45,000. Between ages 18 and 21, she works a summer job making $8,000 in earned income each year and then gets a job after graduating college making $80,000 per year. Assuming she made no contributions to a Roth IRA over the years, you would be able to make transfers between her 529 account and her Roth IRA up to the annual contribution limit until the total transfers reached the $35,000 lifetime maximum.

If that $35,000 lifetime maximum is reached when she turns age 24, assuming she also makes wise investment decisions and earns 8% per year on her Roth IRA until she reaches age 60, at age 60 she would have $620,000 in that Roth IRA account that could be withdrawal ALL TAX-FREE.

Now multiply that $620,000 across EACH of your children or grandchildren, and it becomes a truly fantastic way to build tax-free wealth for the next generation.

529 Backdoor Roth Contribution Strategy

A fun fact, there are no age limits on either the owner or beneficiary of a 529 account. At the age of 40, I could open a 529 account, be the owner and the beneficiary of the account, fund the account with $15,000, wait the 15 years, and then when I turn age 55, begin processing transfers directly from the 529 to my Roth IRA up to the maximum annual IRA limit each year until I reach my $35,000 lifetime limit.

I really don’t care that the money has to sit in the 529 for 15 years because 529 accumulate tax deferred anyways, and by the time I hit age 59.5, making me eligible for tax-free withdrawal of the earnings, I will have already moved most of the balance over to my Roth IRA. Oh and remember, even if you make too much to contribute directly to a Roth IRA, the income limits do not apply to these 529 to Roth IRA direct transfers.

The IRS may have inadvertently created a new “Backdoor Roth IRA Contribution” strategy for high-income earners.

Now there may be some limitations that can come into play with the age of the individual executing this strategy, it’s really less about their age, and more about whether or not they will have earned income 15 years from now when the 529 to Roth IRA transfer window opens. If you are 65, fund a 529, and then at age 80 want to begin these 529 to Roth IRA transfers, if you have no earned income, you can process these 529 to Roth IRA transfers because you are limited by the regular IRA annual contribution limits that require you to have earned income to process the transfers.

Advantage Over Traditional Backdoor Roth Conversions

For individuals that have a solid understanding of how the traditional “Backdoor Roth IRA Contribution” strategy works, the new 529 to Roth IRA transfer strategy potentially contains additional advantages over and above the traditional backdoor Roth strategy. These movements from the 529 to Roth IRA are not considered “conversions”, they are considered direct transfers. Why is that important? Under the traditional Backdoor Roth Contribution strategy the taxpayer is making a non-deductible contribution to a traditional IRA and then processes a conversion to a Roth IRA.

One of the IRS rules during this conversion process is the “aggregation rule”. When a Roth conversion is processed, the taxpayer has to aggregate all of their pre-tax IRA balance together in determining how much of the conversion is taxable, so if the taxpayer has other pre-tax IRAs, it came sometimes derail the backdoor Roth contribution strategy. If they instead use the 529 to Roth IRA direct transfer processes, since as of right now it is not technically a “conversion”, the aggregate rule is avoided.

The second big advantage is with the 529 to Roth IRA transfer strategy, the Roth IRA is potentially being funded with “untaxed earnings” as opposed to after-tax dollar. Again, in the traditional Backdoor Roth Strategy, the taxpayer is using after-tax money to make a nondeductible contribution to a Traditional IRA and then converting those dollars to a Roth IRA. If instead the taxpayer funds a 529 with $15,000 in after-tax dollars, but during the 15-year holding, The account grows the $35,000, they are then able to begin direct transfers from the 529 to the Roth IRA when $20,000 of that account balance represents earnings that were never taxed. Pretty cool!!

State Tax Deduction Clawbacks?

There are some states, like New York, that offer tax deductions for contributions to 529 accounts up to annual limits. When the federal government changes the rules for 529 accounts, the states do not always follow suit. For example, when the federal government changed the tax laws allowing account owners to distribute up to $10,000 per year for K – 12 qualified expenses from 529 accounts, some states, like New York, did not follow suit, and did not recognize the new “qualified expenses”. Thus, if someone in New York distributed $10,000 from a 529 for K – 12 expenses, while they would not have to pay federal tax on the distribution, New York viewed it as a “non-qualified distribution”, not only making the earnings subject to state taxes but also requiring a clawback of any state tax deduction that was taken on the contribution amounts.

The question becomes will the states recognize these 529 to Roth IRA transfers as “qualified distributions,” or will they be subject to taxes and deduction clawbacks at the state level? Time will tell.

Waiting for Guidance From The IRS

This new 529 to Roth IRA transfer option that starts in 2024 has the potential to be a tremendous tax-free wealth accumulation strategy for not just children but for individuals of all ages. However, as I mentioned multiple times in the article, we have to wait for formal guidance from the IRS to determine which of these advanced wealth accumulation strategies will be allowed from tax years 2024 and beyond.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Top 10 Things To Know About Filing A Tax Extension

Are you considering filing for a tax extension? It can be a great way to give yourself more time to organize your financial documents and ensure that the information on your return is accurate. But before you file the extension, here are a few things you should know.

There are a number of myths out there about filing a tax extension beyond the April 15th deadline. Many taxpayers incorrectly assume that there are penalties involved or it increases their chances of being audited by the IRS. In reality, filing for an extension can be a great way to give yourself more time to organize your financial documents, identify tax strategies to implement, and ensure that the information on your return is accurate. But before you file the extension, here are a few things you should know.......

1: You must file your extension by April 15th

To apply for an extension, you must file the appropriate paperwork by the April 15th filing deadline. However, filing for an extension does not extend the due date for payment of any taxes owed.

2: What is the extension deadline?

The tax extension filing due date for individual returns is October 15th in most years, but this can vary by a day or two each year, depending on what day of the week the tax deadline or extension deadline falls on. If they fall on a Saturday, Sunday, or Holiday, the IRS will typically move the date to the next business date.

3: How do you file an extension?

You or your accountant can file your extension electronically. This is the quickest and easiest way to file an extension. If you prefer to file your extension by mail, you can do so by filling out Form 4868 and sending it to the IRS.

4: What if you owe taxes?

If you owe taxes, it’s important to remember that filing for an extension does not extend the due date for payment. At least 90% of the tax owed for the year must be paid with the extension. Any remaining balance can be paid by the extended due date, although it will be subject to interest (not penalties). If you do not pay at least 90% of the balance owed, then you will be subject to interest and late payment penalties until the tax is paid.

If you pay your taxes after April 15th but before October 15th, you may be subject to a "failure to pay" penalty. This penalty is typically 0.5% of the tax owed for each month that the taxes remain unpaid, up to a maximum of 25%.

If you pay your taxes after October 15th, the “failure to pay” penalty increases to 1% per month, up to a maximum of 25%. In addition, you may also be subject to a "failure to file" penalty of 5% per month, up to a maximum of 25%.

If you can't pay the taxes due by the April 15th deadline and don't file an extension, you may be subject to both the “failure to pay” and “failure to file” penalties. This can add up to a substantial amount, so it's important to file an extension if you can't pay your taxes by the April 15th due date.

5: What if you are due a refund?

It will not take longer for the IRS to process your refund, however since your return will be submitted at a later date, your refund will be received later than if the return was submitted by April 15th.

6: Are You More Likely To Get Audited By The IRS?

No, there is absolutely no correlation between the filing of an extension and audit risk. However, filing an incomplete or incorrect tax return which necessitates the filing of an amended tax return, can increase your audit risk.

7: Do You Have To Give A Reason To File An Extension?

When you file for an extension, you don’t have to give a reason for why you need the extra time. The IRS will accept your extension request without question.

8: Do You Still Have To Make Estimated Tax Payments?

If you make estimated tax payments each year, filing an extension for the previous tax year, does not extend the due date of making your estimated tax payment for the current tax year on April 15th, June 15th, September 15th, and January 15th.

The penalty for not making estimated tax payments is 4.5% of the unpaid taxes for each quarter that the taxes remain unpaid.

9: IRA Contribution Deadline

Even if you file an extension, IRA contributions must still be made by the April 15th tax deadline.

10: Extra Time To Make Contributions to Employer-Sponsored Retirement Plans

While putting your tax return on extension does not extend the IRA contribution deadline, it does extend the deadline for self-employed individuals making contributions to their employer-sponsored retirement plans, which are not due until a tax filing deadline plus extension. This would include contributions to Simple IRAs, SEP IRAs, Solo(k), Cash Balance Plans, and employer contributions to 401(K) plans.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

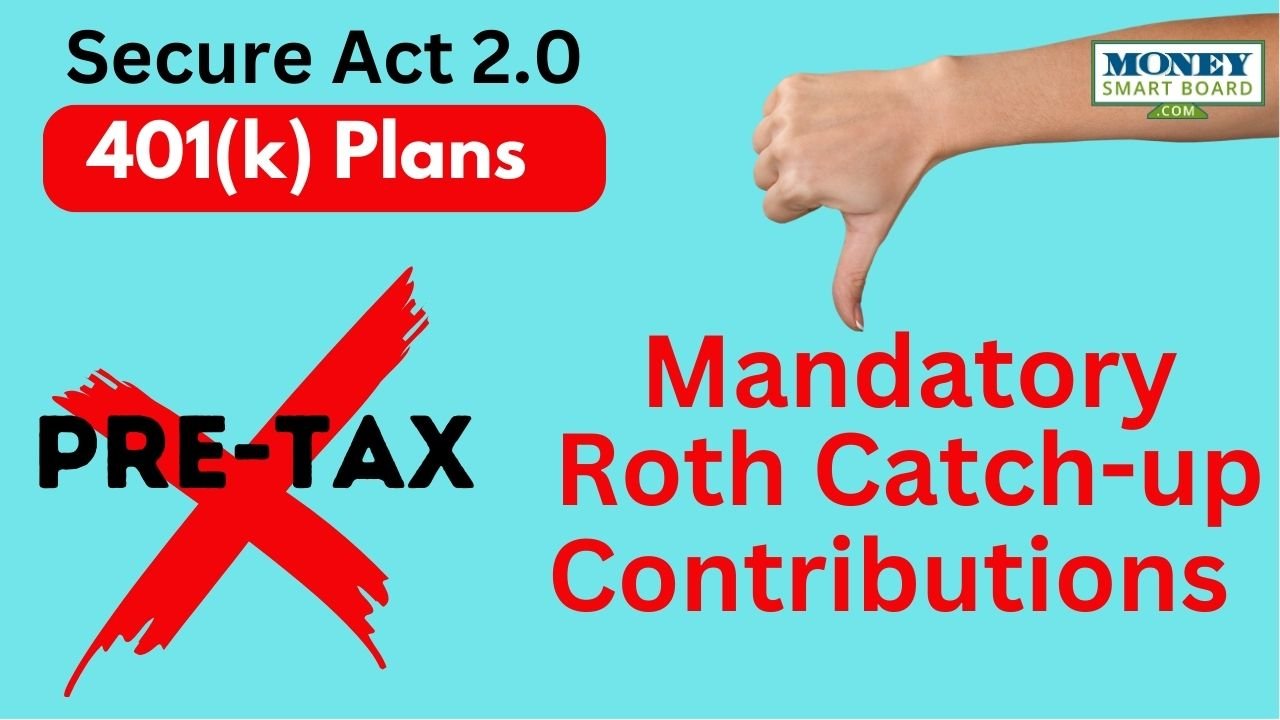

Mandatory Roth Catch-up Contributions for High Wage Earners - Secure Act 2.0

Starting in 2026, individuals that make over $145,000 in wages will no longer be able to make pre-tax catch-up contributions to their employer-sponsored retirement plan. Instead, they will be forced to make catch-up contributions in Roth dollars which means that they will no longer receive a tax deduction for those contributions.

Starting in 2026, individuals that make over $145,000 in wages will no longer be able to make pre-tax catch-up contributions to their employer-sponsored retirement plan. Instead, they will be forced to make catch-up contributions in Roth dollars which means that they will no longer receive a tax deduction for those contributions.

This, unfortunately, was not the only change that the IRS made to the catch-up contribution rules with the passing of the Secure Act 2.0 on December 23, 2022. Other changes will take effect in 2025 to further complicate what historically has been a very simple and straightforward component of saving for retirement.

Even though this change will not take effect until 2026, your wage for 2025 may determine whether or not you will qualify to make pre-tax catch-up contributions in the 2026 tax year. In addition, high wage earners may implement tax strategies in 2025, knowing that they are going to lose this sizable tax deduction in the 2024 tax year.

Effective Date Delayed Until 2026

Originally when the Secure Act 2.0 was passed, the Mandatory 401(K) Roth Catch-up was schedule to become effective in 2024. However, in August 2023, the IRS released a formal notice delaying the effective date until 2026. This was most likely a result of 401(k) service providers reaching out to the IRS requesting for the delay so the IRS has more time to provide much need additional guidance on this new rule as well as time for the 401(k) service providers to update their systems to comply with the new rules.

Before Secure Act 2.0

Before the Secure Act 2.0 was passed, the concept of making catch-up contributions to your employer-sponsored retirement account was very easy. If you were age 50 or older at any time during that tax year, you were able to contribute the maximum employee deferral amount for the year PLUS an additional catch-up contribution. For 2023, the annual contribution limits for the various types of employer-sponsored retirement plans that have employee deferrals are as follows:

401(k) / 403(b)

EE Deferral Limit: $22,500

Catch-up Limit: $7,500

Total $30,000

Simple IRA

EE Deferral Limit: $15,500

Catch-up Limit: $3,500

Total $19,000

You had the option to contribute the full amount, all Pre-tax, all Roth, or any combination of the two. It was more common for individuals to make their catch-up contributions with pre-tax dollars because normally, taxpayers are in their highest income earning years right before they retire, and they typically prefer to take that income off the table now and pay tax in it in retirement when their income is lower and subject to lower tax rates.

Mandatory Roth Catch-Up Contributions

Beginning in 2026, the catch-up contribution game is going to completely change for high wage earners. Starting in 2026, if you are age 50 or older, and you made more than $145,000 in WAGES in the PREVIOUS tax year with the SAME employer, you would be forced to make your catch-up contributions in ROTH dollars to your QUALIFIED retirement plan. I purposefully all capped a number of the words in that sentence, and I will now explain why.

Employees that have “Wages”

This catch-up contribution restriction only applies to individuals that have WAGES over $145,000 in the previous calendar year. Wages meaning W2. Since many self-employed individuals do not have “wages” (partners or sole proprietors) it would appear that they are not subject to this restriction and will be allowed to continue making pre-tax catch-up contribution regardless of their income.

On the surface, this probably seems unfair because you could have a W2 employee that makes $200,000 and they are forced to make their catch-up contribution to the Roth source but then you have a sole proprietor that also makes $200,000 but they can continue to make their catch-up contributions all pre-tax. Why would the IRS allow this?

The $145,000 income threshold is based on the individual’s wages in the PREVIOUS calendar year and it’s not uncommon for self-employed individuals to have no idea what their net income will be until their tax return is complete, which might not be until September or October of the following year.

Wages in the Previous Tax Year

For taxpayers that have wages, they will have to look back at their W2 from the previous calendar year to determine whether or not they will be eligible to make their catch-up contribution in pre-tax dollars for the current calendar year.

For example, it’s January 2026, Tim is 52 years old, and his W2 wages with his current employer were $160,000 in 2025. Since Jim’s wages were over the $145,000 threshold in 2025, if he wants to make the catch-up contribution to his retirement account in 2026, he would be forced to make those catch-up contributions to the Roth source in the plan so he would not receive a tax deduction for those contributions.

Wages With The Same Employer

When the Secure Act 2.0 mentions the $145,000 wage limit, it refers to wages in the previous calendar year from the “employer sponsoring the plan”. So it’s not based on your W2 income with any employer but rather your current employer. If you made $180,000 in W2 income in 2025 from XYZ Inc. but then you decide to switch jobs to ABC Inc. in 2026, since you did not have any wages from ABC Inc. in 2026, there are no wages with your current employer to assess the $145,000 threshold which would make you eligible to make your catch-up contributions all in pre-tax dollars to ABC Inc. 401(K) plan for 2026 even though your W2 wages with XYZ Inc. were over the $145,000 limit in 2025.

This would also be true for someone that is hired mid-year with a new employer. For example, Sarah is 54 and was hired by Software Inc. on July 1, 2026, with an annual salary of $180,000. Since Sarah had no wages from Software Inc. in 2025, she would be eligible to make her catch-up contribution all in pre-tax dollars. But it gets better for Sarah, she will also be able to make a pre-tax catch-up contribution in 2026 too. For the 2026 plan year, they look back at Sarah’s 2024 W2 to determine whether or not here wages were over the $145,000 threshold, since she only works for half of the year, her total wages were $90,000, which is below the $145,000 threshold.

If Sarah continues to work for Software Inc. into 2027, that would be the first year that she would be forced to make her catch-up contribution to the Roth source because she would have had a full year of wages in 2026, equaling $180,000.

$145,000 Wage Limit Indexed for Inflation

There is language in the new tax bill to index the $145,000 wage threshold for inflation meaning after 2024, it will most likely increase that wage threshold by small amount each year. So while I use the $145,000 in many of the examples, the wage threshold may be higher by the time we reach the 2026 effective date.

The Plan Must Allow Roth Contributions

Not all 401(k) plans allow employees to make Roth contributions to their plan. Roth deferrals are an optional feature that an employer can choose to either offer or not offer to their employees. However, with this new mandatory Roth catch-up rule for high wage earners, if the plan includes employees that are eligible to make catch-up contributions and who earned over $145,000 in the previous year, if the plan does not allow Roth contributions, it does not just block the high wage earning employees from making catch-up contributions, it blocks ALL employees in the plan from making catch-up contributions regardless of whether an employee made over or under the $145,000 wage threshold in the previous year.

Based on this restriction, I’m assuming you will see a lot of employer-sponsored qualified retirement plans that currently do not allow Roth contributions to amend their plans to allow these types of contributions starting in 2026 so all of the employees age 50 and older do not get shut out of making catch-up contributions.

Simple IRA Plans: No Mandatory Roth Catch-up

Good news for Simple IRA Plans, this new Roth Catch-up Restriction for high wage earners only applies to “qualified plans” (401(k), 403(b), and 457(b) plans), and Simple IRAs are not considered “qualified plans.” So employees that are covered by Simple IRA plans can make as much as they want in wages, and they will still be eligible to make catch-up contributions to their Simple IRA, all pre-tax.

That’s a big win for Simple IRA plans starting in 2026, on top of the fact that the Secure Act 2.0 will also allow employees covered by Simple IRA plans to make Roth Employee Deferrals beginning in 2025. Prior to the Secure Act 2.0, only pre-tax deferrals were allowed to be made to Simple IRA accounts.

Roth Contributions

A quick reminder on how Roth contributions work in retirement plans. Roth contributions are made with AFTER-TAX dollars, meaning you pay income tax on those contributions now, but all the investment returns made within the Roth source are withdrawn tax-free in retirement, as long as you are over the age of 59½, and the contributions have been in your retirement account for at least 5 years.

For example, you make a $7,000 Roth catch-up contribution today, over the next 10 years, let’s assume that $7,000 grows to $15,000, after reaching age 59½, you can withdraw the full $15,000 tax-free. This is different from traditional pre-tax contributions, where you take a tax deduction now for the $7,000, but then when you withdraw the $15,000 in retirement, you pay tax on ALL of it.

It’s So Complex Now

One of the most common questions that I receive is, “What is the maximum amount that I can contribute to my employer-sponsored plan?”

Prior to Secure Act 2.0, there were 3 questions to arrive at the answer:

What type of plan are you covered by?

How old are you?

What is your compensation for this year?

Starting in 2024, I will have to ask the following questions:

What type of plan are you covered by?

If it’s a qualified plan, do they allow Roth catch-up contributions?

How old are you?

Are you a W2 employee or self-employed?

Did you work for the same employer last year?

If yes, what were your total W2 wages last year?

What is your compensation/wage for this year? (max 100% of comp EE deferral rule limit)

While this list has become noticeably longer, in 2025, the Secure Act 2.0 will add additional complexity and questions to this list when the “Additional Catch-up Contributions for Ages 60 - 63” go into effect. We will cover that fun in another article.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Secure Act 2.0: Roth Simple IRA Contributions Beginning in 2023

With the passage of the Secure Act 2.0, for the first time ever, starting in 2023, taxpayers will be allowed to make ROTH contributions to Simple IRAs. Prior to 2023, only pre-tax contributions were allowed to be made to Simple IRA plans.

With the passage of the Secure Act 2.0, for the first time ever, starting in 2023, taxpayers will be allowed to make ROTH contributions to Simple IRAs. Prior to 2023, only pre-tax contributions were allowed to be made to Simple IRA plans.

Roth Simple IRAs

So what happens when an employee walks in on January 3, 2023, and asks to start making Roth contributions to their Simple IRA? While the Secure Act 2.0 allows it, the actual ability to make Roth contributions to Simple IRAs may take more time for the following reasons:

The custodians that provide Simple IRA accounts to employees may need more time to create updated client agreements to include Roth language

Employers may need to decide if they want to allow Roth contributions to their plans and educate their employees on the new options

Employers will need to communicate to their payroll providers that there will be a new deduction source in payroll for these Roth contributions

Employees may need time to consult with their financial advisor, accountant, or plan representative to determine whether they should be making Roth or Pre-tax Contributions to their Simple IRA.

Mandatory or Optional?

Now that the law has passed, if a company sponsors a Simple IRA plan, are they required to offer the Roth contribution option to their employees? It’s not clear. If the Simple IRA Roth option follows the same path as its 401(k) counterpart, then it would be a voluntary election made by the employer to either allow or not allow Roth contributions to the plan.

For companies that sponsor Simple IRA plans, each year, the company is required to distribute Form 5304-Simple to the employees. This form provides employees with information on the following:

Eligibility requirements

Employer contributions

Vesting

Withdrawals and Rollovers

The IRS will most likely have to create an updated Form 5304-Simple for 2023, which includes the new Roth language. If the Roth election is voluntary, then the 5304-Simple form would most likely include a new section where the company that sponsors the plan would select “yes” or “no” to Roth employee deferrals. We will update this article once the answer is known.

Separate Simple IRA Roth Accounts?

Another big question that we have is whether or not employees that elect the Roth Simple IRA contributions will need to set up a separate account to receive them.

In the 401(k) world, plans have recordkeepers that track the various sources of contributions and the investment earnings associated with each source so the Pre-Tax and Roth contributions can be made to the same account. In the past, Simple IRAs have not required recordkeepers because the Simple IRA account consists of all pre-tax dollars.

Going forward, employees that elect to begin making Roth contributions to their Simple IRA, they may have to set up two separate accounts, one for their Roth balance and the other for their Pre-tax balance. Otherwise, the plans would need some form of recordkeeping services to keep track of the two separate sources of money within an employee’s Simple IRA account.

Simple IRA Contribution Limits

For 2023, the annual contribution limit for employee deferrals to a Simple IRA is the LESSER of:

100% of compensation; or

Under Age 50: $15,500

Age 50+: $19,000

These dollar limits are aggregate for all Pre-tax and Roth deferrals; in other words, you can’t contribute $15,500 in pre-tax deferrals and then an additional $15,500 in Roth deferrals. Similar to 401(k) plans, employees will most likely be able to contribute any combination of Pre-Tax and Roth deferrals up to the annual limit. For example, an employee under age 50 may be able to contribute $10,000 in pre-tax deferrals and $5,500 in Roth deferral to reach the $15,500 limit.

Employer Roth Contribution Option

The Secure Act 2.0 also included a provision that allows companies to give their employees the option to receive their EMPLOYER contributions in either Pre-tax or Roth dollars. However, this Roth employer contribution option is only available in “qualified retirement plans” such as 401(k), 403(b), and 457(b) plans. Since a Simple IRA is not a qualified plan, this Roth employer contribution option is not available.

Employee Attraction and Retention

After reading all of this, your first thought might be, what a mess, why would a company voluntarily offer this if it’s such a headache? The answer: employee attraction and retention. Most companies have the same problem right now, finding and retaining high-quality employees. If you can offer a benefit to your employees that your competitors do not, it could mean the difference between a new employee accepting or rejecting your offer.

The Secure Act 2.0 introduced a long list of new features and changes to employer-sponsored retirement plans. These changes are being implemented in phases over the next few years, with some other big changes starting in 2024. The introduction of Roth to Simple IRA plans just happens to be the first of many. Companies that take the time to understand these new options and evaluate whether or not they would add value to their employee benefits package will have a competitive advantage when it comes to attracting and retaining employees.

Other Secure Act 2.0 Articles:

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Secure Act 2.0: RMD Start Age Pushed Back to 73 Starting in 2023

On December 23, 2022, Congress passed the Secure Act 2.0, which moved the required minimum distribution (RMD) age from the current age of 72 out to age 73 starting in 2023. They also went one step further and included in the new law bill an automatic increase in the RMD beginning in 2033, extending the RMD start age to 75.

On December 23, 2022, Congress passed the Secure Act 2.0, which moved the required minimum distribution (RMD) age from the current age of 72 out to age 73 starting in 2023. They also went one step further and included in the new law bill an automatic increase in the RMD beginning in 2033, extending the RMD start age to 75.

This is the second time within the past 3 years that Congress has changed the start date for required minimum distributions from IRAs and employer-sponsored retirement plans. Here is the history and the future timeline of the RMD start dates:

1986 – 2019: Age 70½

2020 – 2022: Age 72

2023 – 2032: Age 73

2033+: Age 75

You can also determine your RMD start age based on your birth year:

1950 or Earlier: RMD starts at age 72

1951 – 1959: RMD starts at age 73

1960 or later: RMD starts at age 75

What Is An RMD?

An RMD is a required minimum distribution. Once you hit a certain age, the IRS requires you to start taking a distribution each year from your various retirement accounts (IRA, 401(K), 403(b), Simple IRA, etc.) because they want you to begin paying tax on a portion of your tax-deferred assets whether you need them or not.

What If You Turned Age 72 In 2022?

If you turned age 72 anytime in 2022, the new Secure Act 2.0 does not change the fact that you would have been required to take an RMD for 2022. This is true even if you decided to delay your first RMD until April 1, 2023, for the 2022 tax year.

If you are turning 72 in 2023, under the old rules, you would have been required to take an RMD for 2023; under the new rules, you will not have to take your first RMD until 2024, when you turn age 73.

Planning Opportunities

By pushing the RMD start date from age 72 out to 73, and eventually to 75 in 2033, it creates more tax planning opportunities for individuals that do need to take distributions out of their IRAs to supplement this income. Since these distributions from your retirement account represent taxable income, by delaying that mandatory income could allow individuals the opportunity to process larger Roth conversions during the retirement years, which can be an excellent tax and wealth-building strategy.

Delaying your RMD can also provide you with the following benefits:

Reduce the amount of your Medicare premiums

Reduce the percentage of your social security benefit that is taxed

Make you eligible for tax credits or deductions that you would have phased out of

Potentially allow you to realize a 0% tax rate on long-term capital gains

Continue to keep your pre-tax retirement dollars invested and growing

Additional Secure Act 2.0 Articles

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

2023 Market Outlook: A New Problem Emerges

While the markets are still very focused on the battle with inflation, a new problem is going to emerge in 2023 that is going to take it’s place. The markets have experienced a relief rally in November and December but we expect the rally to fade quickly going into 2023.

While the markets are still very focused on the battle with inflation, a new problem is going to emerge in 2023 that is going to take its place. The markets have experienced a relief rally in November and December, but we expect the rally to fade quickly going into 2023.

Inflation Trend and Fed Policy

I’m writing this article on December 15, 2022, and this week, we received the inflation reading for November and the Fed’s 0.50% interest rate hike. Headline CPI, the primary measure of inflation, dropped from 7.7% in October to 7.1% in November which is a meaningful decline, most likely signaling that peak inflation is behind us. So why such a grim outlook for 2023? One word……History. If you look at the historical trends of meaningful economic indicators and compare them to what the data is telling us now, the message to us is it will be nothing short of a Christmas miracle for the U.S. economy to avoid a recession in 2023.

The Inflation Battle Will Begin at 5%

While it's encouraging to see the inflation rate dropping, the true battle will begin once the year-over-year inflation rate measured by headline CPI reaches the 5% - 6% range. Inflation most likely peaked in June 2022 at 9% and dropped to 7.1% in November, but remember, the Fed’s target range for inflation is 2% - 3%, so we still have at least another 4% to go.

RECESSION RISK #1: If you look back through U.S. history, the Fed has never successfully reduced the inflation rate by more than 2% WITHOUT causing a recession. We have already dropped by 2%, and we still have another 4% to go.

I expect the next 3 months to show meaningful drops in the inflation rate and would not be surprised if we are in a 5% - 6% range by March or April, largely because supply chains have healed, the economy is slowing, the price of oil has come down substantially, and the job market is beginning to soften. But once we get down to the 5% - 6% range, we could see slow progress, which could end the party for investors that are stilling in the bull rally camp.

The Wage Growth Battle

We expect progress to be halted because of the shortage of supply of workers in the labor force, which will keep wages persistently higher, allowing the US consumer to keep paying higher prices for goods and services, which will leave us with higher interest rates for longer. Every time Powell has spoken over the past few months (the head of the Federal Reserve), he expresses his concerns that wages remain far too high. The solution is simple but ugly. The Fed needs to continue to apply pressure on the economy until the unemployment rate begins to rise which will bring wage growth level down to a level that will allow them to reach their 2% - 3% target inflation range.

Companies Are Reluctant To Let Go of Employees

Since one of the major issues plaguing US businesses is trying to find employees, companies will be more reluctant to let go of employee with the fear that they will need them once the economy begins to recover. This situation could create an abrupt spike and the unemployment rate when companies are finally forced to give in all at once to the reality that they will need to shed employees due to the slowing economy.

Rising Unemployment

Another lesson from history, if you look back at the past 9 recessions, how many times did the stock market bottom BEFORE the recession began? Answer: ZERO. So, if you think the bottom is already in the stock market but you also believe that there is a high probability that the U.S. economy will enter a recession in 2023, you are on the wrong side of history.

When we look back at the past 9 recessions, there is a common trend. As you would expect, when the economy begins to contract, people lose their jobs, which causes the unemployment rate to rise. In all of the past 9 recessions, the stock market did not bottom until AFTER the unemployment rate began to rise. If you think there is a high probability that the unemployment rate will rise in 2023, which is what the Fed is targeting to bring down wage growth, then we most likely have not seen the market bottom in this bear market cycle.

JP Morgan has a great chart summarizing this point across the past 9 recessions. While it looks like a lot is going on in this illustration, each chart shows one of the past 9 recessions.

The Purple Line = Unemployment Rate

The Black Straight Line = Where the stock market bottomed

The Gray Area = The recession

In each of the charts below, observe how the purple line begin to rise and then the solid black line follows in each chart. That would support the trend that the bottom in the stock market historically happens after the unemployment rate begin it’s climb which has not happened yet.

A New Problem Will Emerge

While the markets have been super focused on inflation in 2022, a new problem is going to surface in 2023. The economy is going to trade its inflation problem for the reality of a weakening U.S. consumer.

The Fed will be successful at slowing down the economy via their rate hikes, which will eventually lead to job losses, weakness in the housing market, a slowdown in consumer spending on goods and travel, and less capital spending. Those forces should be enough to deliver the two quarters of negative GDP growth in 2023, which would coincide with a recession.

The Fed Will Have Its Hands Tied

Normally, when the economy begins to contract, the Fed will step in and begin lowering interest rates to restart economic growth. However, if the inflation rate, while moving lower, is still between 4% and 5% when the economic slowdown hits, the Fed will not be able to come to the economy’s aid with fear that premature reductions in the fed funds rate could reignite inflation which is exactly what happened in the 1970s.

The recession itself will eventually bring inflation down to the Feds 2% inflation target, but while it’s happening, it’s going to feel like you are watching a train wreck in slow motion, but you can’t do anything about it. Not a great environment for the stock market.

Length of the recession

The next question I receive is, do we expect a mild recession or severe recession? I’ll be completely honest, it’s impossible to know. A lot will depend on the timing of when the economy begins to contract and where the rate of inflation is. The longer it takes inflation to get down to the 2% range while the economy contracts, the longer and more severe the recession will be. This absolutely could end up being a mild recession but there’s no way to know that sitting here in December 2022, looking at all of the challenges that lie ahead for the markets in 2023.

An Opportunity For Bonds

Due to the rising interest rates in 2022, the bond market has had one of the worst years in history. Below is a chart showing the annual returns of the aggregate bond index going back to 1970.

We have never seen a year where bonds are down 11% in a single year. It’s our expectation that this trend will reverse course in 2023. When interest rates stop rising, the Fed pauses and eventually begins lowering rates, that should be a positive environment for fixed-income returns. Where bonds failed to give investors any type of safety net in 2022, I think that safety net will return in 2023. We are already beginning to see evidence of interest rates moving lower, with the 10-year US Treasury yields moving from 4.2% down to the current rate of 3.5% over the past 45 days.

Warnings From The Inverted Yield Curve

While a number of the economic indicators that we watching are flashing red going into 2023, there are very few that tell the story better than the inverted yield curve. Without getting into all the technical details about what an inverted yield curve is, the simple version of this explanation is, it's basically the bond market telling the stock market that trouble is on the horizon. Historically, when the yield curve inverts, The US economy enters a recession within the next 6 to 18 months. See below, a chart of the yield curve going back to 1970.

Each of the red arrows is where the yield curve inverts. The gray areas on the chart are the recessions. You can see very quickly how consistent the yield curve inversion has been at predicting recessions over time. If you look on the far right-hand side of the chart, that red arrow is where we are now, heavily inverted. So if you believe that we are not going to get a recession within the next 6 to 18 months, you are sitting heavily on the wrong side of history and have adopted a “this time it's different” mentality which can be dangerous. History tends to repeat itself more times than people like to admit.

Proactive investment decisions

Going into 2023, I think it's very important to be realistic about your expectations for the equity markets, given the headwinds that we face. This market environment is going to require very proactive investment decisions and constant monitoring of the economic data as we receive it throughout the year. A mild recession is entirely possible. If we end up in a mild recession, inflation drops down into the Feds comfort range due to the contracting economy, and the Fed can begin lowering rates before the end of 2023, that could put a bottom in the stock market, and the next bull market rally could emerge. But it's just too early to know that sitting here in December 2022 with a lot of headwinds facing the market.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Turn on Social Security at 62 and Your Minor Children Can Collect The Dependent Benefit

Not many people realize that if you are age 62 or older and have children under the age of 18, your children are eligible to receive social security payments based on your earnings history, and it’s big money. However, social security does not advertise this little know benefit, so you have to know how to apply, the rules, and tax implications.

Not many people realize that if you are age 62 or older and have children under the age of 18, your children are eligible to receive social security payments based on your earnings history, and it’s big money. However, social security does not advertise this little know benefit, so you have to know how to apply, the rules, and tax implications. In this article, I will walk you through the following:

The age limit for your children to be eligible to receive SS benefits

The amount of the payments to your kids

The family maximum benefit calculation

How the benefits are taxed to your children

How to apply for the social security dependent benefits

Pitfall: You may have to give the money back to social security…..

Eligibility Requirements for Dependent Benefits

Three requirements make your children eligible to receive social security payments based on your earnings history:

You have to be age 62 or older

You must have turned on your social security benefit payments

Your child must be unmarried and meet one of the following eligibility requirements:

Under the age of 18

Between the ages of 18 and 19 and a full-time student K – 12

Age 18 or older with a disability that began before age 22

How Much Does Your Child Receive?

If you are 62 or older, you have turned on your social security benefits, and your child meets the criteria above, your child would be eligible to receive 50% of your Full Retirement Age (FRA) Social Security Benefit EVERY YEAR, until they reach age 18. This can sometimes change a parent’s decision to turn on their social security benefit at age 62 instead of waiting until their Full Retirement Age of 67 (for individuals born in 1960 or later). But it gets better because the 50% of your FRA social security benefit is for EACH child.

For example, Jim is retired, age 62, and he has one child under age 18, Josh, who is age 12. If he turns on his social security benefit at age 62, he would receive $1,200 per month, but if he waits until his FRA of 67, he would receive $1,700 per month. Even though Jim would receive a lower social security benefit at age 62, if he turns on his benefit at age 62, Jim and his child Josh would receive the following monthly payments from social security:

Jim: $1,200 ($14,400 per year)

Josh: $850 ($10,200 per year)

Even though Jim receives a reduced SS benefit by turning on his benefit at age 62, the 50% dependent child benefit is still calculated based on Jim’s Full Retirement Age benefit of $1,700. Josh will be eligible to continue to receive monthly payments from social security until the month of his 18th birthday. That’s a lot of money that could go towards college savings, buying a car, or a down payment on their first house.

The Family Maximum Benefit Limit

If you have 10 children, I have bad news; social security imposes a “family maximum benefit limit” for all dependents eligible to collect on your earnings history. The family benefits are limited to 150% to 188% of the parent’s full retirement age benefit.

I’ll explain this via an example. Let’s assume everything is the same as in the previous example with Jim, but now Jim has four children, all under 18. Let’s also assume that Jim’s Family maximum benefit is 150% of his FRA benefit, which would equal a maximum family benefit of $2,550 per month ($1,700 x 150%). We now have the following:

Jim: $1,200

Child 1: $850

Child 2: $850

Child 3: $850

Child 4: $850

If you total up the monthly social security benefits paid to Jim and his children, it equals $4,600, which is $2,050 over the $2,550 family maximum benefit limit.

Always Use Your FRA Benefit In The Family Max Calculation

Here is another important rule to note when calculating the family maximum benefit, regardless of when your file for your social security benefits, age 62, 64, 67, or 70, you always use your Full Retirement Age benefit when calculating the Family Maximum Benefit amount. In the example above, Jim filed for social security benefits early at age 62. Instead of using Jim’s age $1,200 social security benefit to calculate the remaining amount available for his children, Jim has to use his FRA benefit of $1,700 in the formula before determining how much his children are eligible to receive.

Social security would reduce the children’s benefits by an equal amount until their total benefit is reduced to the family maximum limit.

These are the steps:

Jim Max Family Benefit = $1,700 (FRA) x 150% = $2,550

$2,550 (Family Max) - $1,700 (Jim FRA) = $850

Divide $850 by Jim’s 4 eligible children = $212.50 for each child

This results in the following social security benefits paid to Jim and his 4 children:

Jim: $1,200

Child 1: $212.50

Child 2: $212.50

Child 3: $212.50

Child 4: $212.50

A note about ex-spouses, if someone was married for more than 10 years, then got divorced, the ex-spouse may still be entitled to the 50% spousal benefit, but that does not factor into the family maximum calculation, nor is it reduced for any family maximum benefit overages.

Social Security Taxation

Social security payments received by your children are considered taxable income, but that does not necessarily mean that they will owe any tax on the amounts received. Let me explain, your child’s income has to be above a specific threshold before they owe any federal taxes on the social security benefits they receive.

You have to add up all of their regular taxable income and tax-exempt income and then add 50% of the social security benefits that they received. If your child has no other income besides the social security benefits, it’s just 50% of the social security benefits that were paid to them. If that total is below $25,000, they do not have to pay any federal tax on their social security benefit. If it’s above that amount, then a portion of the social security benefits received will be taxable at the federal level.

States have different rules when it comes to taking social security benefits. Most states do not tax social security benefits, but there are about 13 states that assess state taxes on social security benefits in one form or another, but our state New York, is thankfully not one of them.

You Can Still Claim Your Child As A Dependent On Your Tax Return

More good news, even though your child is showing income via the social security payment, you can still claim them as a dependent on your tax return as long as they continue to meet the dependent criteria.

How To Apply For Social Security Dependent Benefits

You cannot apply for your child’s dependent benefits online; you have to apply by calling the Social Security Administration at 800-772-1213 or scheduling an appointment at your local Social Security office.

Be Care of This Pitfall

There is one pitfall to the social security payment received by your child or children, it’s not a pitfall about the money received, but the issue revolves around the titling of the account that the social security benefits are deposited into when they are received on behalf of the child.

The premise behind social security providing these benefits to the minor children of retirees is that if someone retires at age 62 and still has minor children as dependents, they may need additional income to support the household expenses. Whether that is true or not does not prevent you from taking advantage of these dependent payments to your children, but it does raise the issue of the “conserved benefits” letter that many people receive once the child turns age 18.

You may receive a letter from social security once your child is 18 instructing you to return any of the social security dependent payments received on your child’s behalf and saved. So wait, if you save this money for our child to pay for college, you have to hand it back to social security, but if you spend it, you get to keep it? On the surface, the answer is “yes,” but it all depends on who is listed as the account owner that the social security payments are deposited into on behalf of your child.

If the parent is listed as an owner or joint owner of the account, you are expected to return the saved or “conserved” payment to the Social Security Administration. However, if the account that the social security payments are deposited into is owned 100% by your child, you do not have to return the saved money to social security.

Then I will get the question, “Well, what type of account can you set up for a 12-year-old that they own 100%?” Some banks will allow you to set up savings accounts in the name of a child at age 14, UTMA accounts can be set up at any age, and they are considered accounts owned 100% by the child even though a parent is listed as a custodian.

Watch out for the 529 account pitfall. For parents that want to use these Social Security payments to help subsidize college savings, they will sometimes set up a 529 account and deposit the payments into that account to take advantage of the tax benefits. Even though these 529 accounts are set up with the child listed as the beneficiary, they are often considered assets of the parents because the parent has control over the distributions from the account. However, you can set up 529 accounts as UTMA 529, which avoids this issue since the child is now technically the owner and has complete control over the assets at the age of majority.

FAFSA Considerations

Be aware that if your child is college bound and you expect to qualify for need-based financial aid, assets owned by the child count against the FAFSA calculation. The way the calculation works is that about 20% of any assets owned by the child count against the need-based financial aid that is awarded. There is no way around this issue, but it’s not the end of the world because that means 80% of the balance does not count against the FAFSA calculation and it was free money from Social Security that can be used to pay for college.

Social Security Filing Strategy

If you are age 62 or older and have minor children, it may very well make sense to file for Social Security early, even though it may permanently reduce your Social Security benefit once you factor in the Social Security payments that will be made to your children as dependents. But, you have to make sure you understand how Social Security is taxed, the Security earned income penalty, the impact of Social Security survivor benefits for your spouse, and many other factors before making this decision.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Self-Employment Income In Retirement? Use a Solo(k) Plan To Build Wealth

It’s becoming more common for retirees to take on small self-employment gigs in retirement to generate some additional income and to stay mentally active and engaged. But, it should not be overlooked that this is a tremendous wealth-building opportunity if you know the right strategies. There are many, but in this article, we will focus on the “Solo(k) strategy

Self-Employment Income In Retirement? Use a Solo(k) Plan To Build Wealth

It’s becoming more common for retirees to take on small self-employment gigs in retirement to generate some additional income and to stay mentally active and engaged. But, it should not be overlooked that this is a tremendous wealth-building opportunity if you know the right strategies. There are many, but in this article, we will focus on the “Solo(k) strategy.”

What Is A Solo(K)

A Solo(k) plan is an employer-sponsored retirement plan that is only allowed to be sponsored by owner-only entities. It works just like a 401(k) plan through a company but without the high costs or administrative hassles. The owner of the business is allowed to make both employee deferrals and employer contributions to the plan.

Solo(k) Deferral Limits

For 2023, a business owner is allowed to contribute employee deferrals up to a maximum of the LESSER of:

100% of compensation; or

$30,000 (Assuming the business owner is age 50+)

Pre-tax vs. Roth Deferrals