The Top 2 Strategies For Paying Off Student Loan Debt

With total student loan debt in the United States approaching $1.4 Trillion dollars, I seem to be having this conversation more and more with clients. There has been a lot of speculation between president obama and student loans, but student loan debt is still piling up. The amount of student loan debt is piling up and it's putting the next generation of

With total student loan debt in the United States approaching $1.4 Trillion dollars, I seem to be having this conversation more and more with clients. There has been a lot of speculation between president obama and student loans, but student loan debt is still piling up. The amount of student loan debt is piling up and it's putting the next generation of our work force at a big disadvantage. While you yourself may not have student loan debt, at some point you may have to counsel a child, grandchild, friend, neighbor, or a co-worker that just can't seem to get ahead because of the financial restrains of their student loan payments. After all, for a child born today, it's projected that the cost for a 4 year degree including room and board will be $215,000 for a State College and $487,000 for a private college. Half a million dollars for a 4 year degree!!

The most common reaction to this is: "There is no way that this can happen. Something will have to change." The reality is, as financial planners, we were saying that exact same thing 10 years ago but we don't say that anymore. Despite the general disbelief that this will happen, the cost of college has continued to rise at a rate of 6% per year over the past 10 years. It's good old supply and demand. If there is a limited supply of colleges and the demand for a college degree keeps going up, the price will continue to go up. As many of us know, a college degree is not necessarily an advantage anymore, it's the baseline. You need it just to get the job interview and that will be even more true for types of jobs that will be available in future years.

No Professional Help

Making matters worse, most individuals that have large student loan debt don't have access to high quality financial planners because they do not have any investible assets since everything is going toward paying down their student loan debt. I wrote this article to give our readers a look into how we as Certified Financial Planners® help our clients to dig out of student loan debt. Unfortunately a lot of the advice that you will find by searching online is either incomplete or wrong. The solution for digging out of student loan debt is not a one size fits all solution and there are trap doors along the way.

Loan Inventory

The first step in the process is to the collect and organize all of the information pertaining to your student loan debt. Create a spreadsheet that lists the following information:

Name of Lender

Type of Loan (Federal or Private)

Name of Loan Servicer

Total Outstanding Loan Balance

Interest Rate

Fixed or Variable Interest Rate

Minimum Monthly Payment

Current Monthly Payment

Estimated Payoff Date

Now, below this information I want you to list January 1 of the current year and the next 10 years. It will look like this:

Total Balance

January 1, 2018

January 1, 2019

January 1, 2020

Each year you will record your total student loan debt below your itemized student loan information. Why? In most cases you are not going to be able to payoff your student loans overnight. It’s going to be a multi-year process. But having this running total will allow you to track your progress. You can even add another column to the right of the “Total Balance” column labelled “Goal”. If your goal is to payoff your student loan debt in five years, set some preliminary balance goals for yourself. When you receive a raise or a bonus at work, a tax refund, or a cash gift from a family member, this will encourage you to apply some or all of those cash windfalls toward your student loan balance to stay on track.

Order of Payoff

The most common advice you will find when researching this topic is “make minimum payments on all of the student loans with the exception of your student loan with the highest interest rate and apply the largest payment you can against that loan”. Mathematically this is the right strategy but we do not necessary recommend this strategy for all of our clients. Here’s why……..

There are two situations that we typically run into with clients:

Situation 1: “I’m drowning in student loan debt and need a lifeline”

Situation 2: “I’m starting to make more money at my job. Should I use some of that extra income to pay down my student loan debt or should I be applying it toward my retirement plan or saving for a house?”

Situation 1: I'm Drowning

As financial planners we are unfortunately running into Situation 1 more frequently. You have young professionals that are graduating from college with a 4 year degree, making $50,000 per year in their first job, but they have $150,000 of student loan debt. So they basically have a mortgage that starts 6 months after they graduate but that mortgage payment comes without a house. For the first few years of their career they are feeling good about their new job, they receive some raises and bonuses here and there, but they still feel like they are struggling every month to meet their expenses. The realization starts to set in the “I’m never going to get ahead because these student loan payments are killing me. I have to do something.”

If you or someone you know is in this category remember these words: “Cash is king”. You will hear this in the business world and it’s true for personal finances as well. As mentioned earlier, from a pure math standpoint, they fastest way to get out of debt is to target the debt with the highest interest rate and go from there. While mathematically that may work, we have found that it is not the best strategy for individuals in this category. If you are in the middle of the ocean, treading water, with the closest island a mile away, why are we having a debate about how fast you can swim to that island? You will never make it. Instead you just need someone to throw you a life preserver.

Life Preserver Strategy

If you are just barely meeting your monthly expense or find yourself falling short each month, you have to stop the bleeding. In these situations, you should be 100% focus on improving your current cash flow not whether you are going to be able to payoff your student loans in 8 years instead of 10 years. In the spreadsheet that you created, organize all of your student loan debt from the largest outstanding loan balance to the smallest. Ignore the interest rate column for the time being. Next, begin making the minimum payments on all of your student loans except for the one with the SMALLEST BALANCE. We need to improve your cash flow which means reducing the number of monthly payments that you have each month. Once the month to month cash flow is no longer an issue then you can graduate to Situation 2 and revisit the debt payoff strategy.

This strategy also builds confidence. If you have a $50,000 loan with a 7% interest rate and two other student loans for $5,000 with an interest rate of 4% while applying more money toward the largest loan balance will save you the most interest long term, it’s going to feel like your climbing Mt. Everest. “Why put an extra $200 toward that $50,000 loan? I’m going to be paying it until I’m 50.” There is no sense of accomplishment. We find that individuals that choose this path will frequently abandon the journey. Instead, if you focus your efforts on the loans with the smaller balances and you are able to pay them off in a year, it feels good. Getting that taste of real progress is powerful. This strategy comes from the book written by Dave Ramsey called the Total Money Makeover. If you have not read the book, read it. If you have a child or grandchild graduating from college, if you were going to give them a check for graduation, buy the book for them and put the check in the book. Tell them that “this check will help you to get a start in your new career but this book is worth the amount of the check multiplied by a thousand”.

Situation 2: Paying Off Your Student Loans Faster

If you are in Situation 2, you are no longer treading water in the middle of the ocean and you made it to the island. The name of this island is “Risk Free Rate Of Return”. Let me explain.

Individuals in this scenario have a good handle on their monthly expenses and they are finding that they now have extra discretionary income. So what’s the best use of that extra income? When you are younger there are probably a number items on your wish list, some of which you may debate looking into title loans near me to obtain. Here are the top four that we see:

Retirement savings

Saving for a house

Paying off student loan debt

Buying a new car

Don't Leave Free Money On The Table

Before applying all of your extra income toward your student loan payments, we ask our clients “what is the employer contribution formula for your employer’s retirement plan?” If it’s a match formula, meaning you have to put money in the plan to get the employer contribution, we will typically recommend that our clients contribute the amount needed to receive the full employer match. Otherwise you are leaving free money on the table.

The amount of that employer contribution represents a risk free rate of return. Meaning, unlike the investing in the stock market, you do not have to take any risk to receive that return on your money. If your company guarantees a 100% match on the first 5% of pay contribution out of your paycheck into the plan, your money is guaranteed to double up to 5% of your pay. Where else are you going to get a 100% risk free rate of return on your money?

Start With The Highest Interest Rate

Now that you have extra income each month you can begin to pick and choose how you apply it. You should list all of you student loans from the highest interest rate to the lowest. If it’s close between two interest rates but one is a fixed interest rate and the other is a variable interest rate, it’s typically better to pay down the variable interest rate loan first if interest rates are expected to move higher. Apply the minimum payment amount to all of your student loan payments and apply as much as you can toward the loan with the HIGHEST INTEREST RATE. Once the loan with the highest interest rate is paid off, you will move on to the next one.

Again, by applying more money toward your student loans, those additional payments represent a risk free rate of return equal to the interest rate that is being charges on each loan. For example, if the highest interest rate on one of your student loans is 7%, every additional dollar that you are apply toward paying off that loan you are receiving a 7% rate of return on because you are not paying that amount to the lender.

Here is a rebuttal question that we sometimes get: “But wouldn’t it be better to put it in the stock market and earn a higher rate of return?” However, that’s not an apple to apples comparison. The 7% rate of return that you are receiving by paying down that student loan balance is guaranteed because it represents interest that would have been paid to the lender that you are now keeping. By contrast, even though the stock market may average an 8% annualized rate of return over a 10 year period, you have to take risk to obtain that 8% rate of return. A 7% risk free rate of return is the equivalent of being able to buy a CD at a bank with a 7% interest rate guaranteed by the FDIC which does not exist right now.

But Can't I Deduct The Interest On My Student Loans?

It depends on how much you make. In 2018, if you are single, the deduction for student loan interest begins to phaseout at $70,000 of AGI and you completely lose the deduction once your AGI is above $85,000. If you are married filing a joint tax return, the deduction begins to phaseout at $140,000 of AGI and it’s completely gone once your AGI hits $170,000.

Also the deduction is limited to $2,500.

However, even if you can deduct the interest on your student loan, the tax benefit is probably not as big as you think. Let me explain via an example. Take the following fact set:

Tax Filing Status: Single

Adjusted Gross Income (AGI): $50,000

Outstanding Student Loan Balance: $60,000

Interest Rate: 7% ($4,200 Per Year)

First, you are limited to deducting $2,500 of the $4,200 in student loan interest that you paid to the lender. At $50,000 of AGI your top federal tax bracket in 2018 is 22%. So that $2,500 equals $550 in actual tax savings ($2,500 x 22% = $550). If you want to get technical, taking the tax deduction into account, your after tax interest rate on your student loan debt is really 6.08% instead of 7%. Can you get a CD from a bank right now with a 6% interest rate? No. From both a debt reduction standpoint and a rate of return standpoint, it probably makes sense to pay down that loan more aggressively.

Striking A Balance

When you are younger, you typically have a lot of financial goals such as saving for retirement, paying off debt, saving for the down payment on your first house, starting a family, college savings for you kids, etc. While I'm sure you would like to take all of your extra income and really start aggressively reducing your student loans you have to determine what the right balance is between all of your financial goals. If you receive a $5,000 bonus from work, you may allocate $3,000 of that toward your student loan debt and deposit $2,000 in your savings account for the eventual down payment on your first house. We also recommend speaking a loan authority company to see what can be done to help you reach your goal. One example being to create that "goal" column in your student loan spreadsheet will help you to keep that balance and eventually lead to the payoff of all of your student loans.

Forgiveness Scheme

Although they are not very common and only a few people can qualify for one of these schemes, they will provide great help. A student loan forgiveness scheme can help a student pay off their loan over an extended period of time, a shorter period of time, reduce the amount they owe, or entirely pay off the loan for them. However, like I have already mentioned, this is based upon whether they qualify or not.I hope this has been of some assistance and i have provided you with some helpful advice on how to prepare for and manage your student loan.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Much Will The Value Of Your House Drop Under The New Tax Law?

It's not a secret to anyone at this point that the new tax bill is going to inflict some pain on the U.S. housing market in 2018. The questions that most homeowners and real estate investors are asking is: "How much are home prices likely to decrease within the next year due to the tax changes?" The new $10,000 limitation on SALT deductions, the lower

It's not a secret to anyone at this point that the new tax bill is going to inflict some pain on the U.S. housing market in 2018. The questions that most homeowners and real estate investors are asking is: "How much are home prices likely to decrease within the next year due to the tax changes?" The new $10,000 limitation on SALT deductions, the lower deduction cap mortgages interest, and the higher standard deduction are all lining up to take a bite out of real estate prices. The size of the bite will largely depend on where you live and the value of your house.

3 Bites That Will Hurt

The Trump tax reform made three significant changes to the tax laws that will impact housing prices:

Capped state and local tax ("SALT") deductions at $10,000 (includes property taxes)

Lowered the deduction cap on the first $750,000 of a mortgage

Doubled the standard deduction

The New Standard Deduction

There is a reason why I'm starting this analysis with the doubling of the standard deduction in 2018. For many households in the U.S., the doubling of the standard deduction will make the cap on the SALT deductions irrelevant. Let me explain. Below is a comparison of the standard deduction limits in 2017 versus 2018:

In 2018, a married couple filing a joint tax return would need over $24,000 in itemized deductions to justify not taking the standard deduction and calling it a day. For a married couple, both W-2 employees, $7,000 in property taxes, $9,000 in state income taxes, if those are their only itemized deductions, then it will most likely makes sense for them to take the $24,000 standard deduction. So the $10,000 cap on property taxes and state income taxes becomes irrelevant because it’s an itemized deduction. This will be a big change for many U.S. households. In 2017, that same family may have itemized because their property and state taxes exceeded the $12,700 standard deduction threshold.

For taxpayers age 65 and older, the new tax law kept the additional standard deduction amounts: $1,250 for single filers and $2,500 for married filing joint which are over and above the normal limits.

$10,000 Cap On State & Local Taxes

Starting in 2018, taxpayers are limited to a $10,000 deduction for a combination of their property taxes, school taxes, and state & local income tax. For states that have both high property taxes and high income taxes like New York, New Jersey, and California, homeowners will most likely be looking at a larger decrease in the value of their homes versus states like Florida that have lower property taxes and no state income taxes. The houses with the higher dollar value may experience a larger drop in price.

If you live in a $200,000 house, the property / school taxes are $5,000, and you decided to sell your house, the family looking to buy your house may already be planning on taking the $24,000 standard deduction at that income level, so the new tax cap would not really decrease the “value” of the house to the potential buyer.

On the flip side, if you own a $600,000 house, your property/school taxes are $18,000, and you are looking to sell your house, the new $10,000 cap will most likely have a negative impact on the value of your house. As you might assume, the individuals and families with the higher incomes that could afford to purchase a $600,000 house will naturally be the homeowners that will continue to itemize their deduction in 2018. So owning that $600K house in 2018 comes at an additional annual cost to the buyer because they lose $8,000 in property tax deductions. For individuals and families in the top federal tax bracket (37%), the cost to live in that house just went up by $3,120 per year. I have personally already had two clients call me that just purchased a house in 2017 with property taxes above the $10,000 cap and they said “I might not have purchased this big of a house if I knew I was not going to be able to deduct all of the property taxes”.

$750,000 Deduction Cap On Mortgages

Prior to 2018, taxpayers could only deduct interest on the first $1,000,000 of a mortgage. For all new mortgages, beginning in 2018, the cap was reduced from $1,000,000 to $750,000. The new tax law grandfathered the $1M cap for mortgages that were already in existence prior to December 31, 2017. Obviously this change will only impact very high income earning individuals and families living in houses valued at $1M+ but it still may have a negative impact on the prices of those big houses. I say "may" because if you can afford a $3M condo in Manhattan, you may not care that you lost a $7,500 tax deduction.

It Depends Where You Live

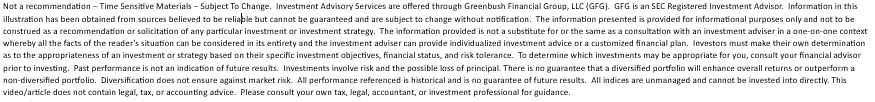

Given these changes to tax law, it seems likely that the states with higher property taxes and higher home values will be the most vulnerable to price adjustments. Below is a map, from Zillow and Credit Suisse, showing the median home price by state:

Let's also locate the states that have a high concentration of mortgages over $500,000. As mentioned above, this may put price pressure on homeowners trying to sell houses above the new $750,000 mortgage interest deduction threshold:

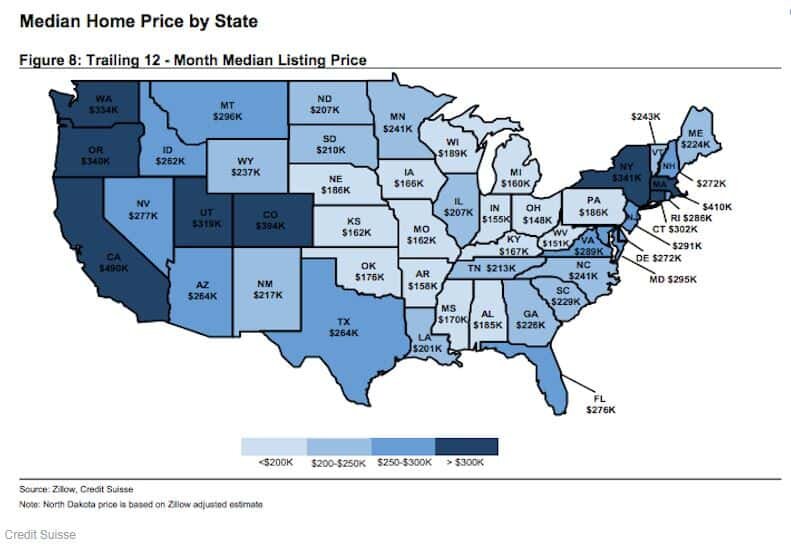

And the "Non-Winners" are New York, California, and New Jersey. Moody's published a list of the 25 counties that are expect to lose the largest percentage of value. Note, that only six of those counties are located outside of New York or New Jersey:

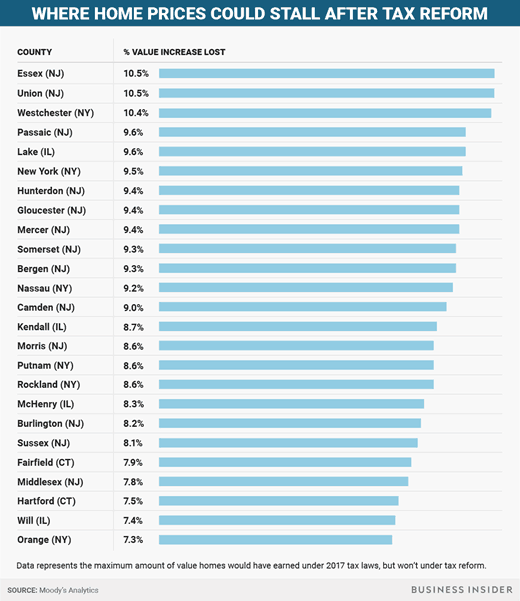

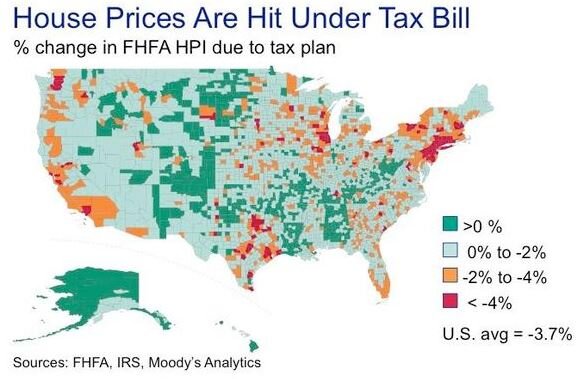

To bring it all together, Moody's and FHFA published the illustration below showing the percentage change in the Federal Housing Finance Agency – House Price Index as a result of the new tax bill:

It's safe to assume that geographically, the negative impact that the new tax rules will have on the U.S. house market will occur in concentrated pockets as opposed to a widespread reduction in housing prices across the country.

Do Not Move To Alaska Just Yet!!

Before you show the chart above to your family at dinner tonight with a “Go Alaska” hat on, I urge you to read on. (Disclosure, I have nothing against Alaska. I was born in Fairbanks, Alaska) If you live in one of the “red spots” on the heat map above or in one of the counties in the list of “where home prices could stall after tax reform”, the charts above do not necessarily mean that at the end of 2018 your house is going to be worth 5% less than it was at the beginning of 2018. Moody’s has done the comparison of the tax bill passing versus no tax bill. If prior to the tax bill being passed it was estimated in 2018 that homes in your area were going to increase in value by 5% and the heat map above shows a 4% drop as a result of tax reform, then that means instead the value of your home growing by 5% it may only grow by 1%.

As with any forecast, it’s anyone’s guess at this point how the math will actually work itself out but in general I think it will be more positive than the consensus expects.

House Values Under $250,000 – Status Quo

Given the changes to the tax law, if you live in a house that is valued under $250,000, regardless of where you live, the downward pressure on the price of your house as a result of tax reform should be minimal. Why? Most buyers in this range will most likely be electing the standard deduction anyways so the new $10,000 cap on SALT deductions should have little to no impact. This should even be true for states that have high property taxes because the homeowners would need over $24,000 in itemized deductions before the $10,000 cap would potentially hurt them tax wise.

The Sandwich: House Values $250,000 - $750,000

The homeowners at the highest risk of a reduction in the value of their house are located in what I call “The Sandwich”. They have a house that is valued somewhere between $250,000 – $750,000 and they live in a high property tax state. While Congress touts that the doubling of the standard deduction is a “fix all” for all of the tax deductions that have been taken away, it’s unfortunately not. There are a number of individuals and families that are in the income range customarily associated with buying a $250K – $750K house that may actually pay more in taxes under the new rules.

Taxpayers in this group are also moving from their “starter house” in their first “big house”. Unlike the super wealthy that may care less about paying an extra $5,000 in taxes per year, for an upper middle class family that has kids, that is saving for college, and contributing to 401(k) plans, the loss of that tax benefit may mean they can’t take a family vacation if they buy that bigger house. Less buyers in the market for houses in this “Sandwich” range translates to lower prices.

How much lower? Probably nothing dramatic in the short term because the U.S. economy is doing so well. When the economy is growing, people feel secure in their jobs, wages are going up, workers are getting bonuses, and that provides them with the additional income needed to make that larger mortgage payment and pay a little more in taxes.

My concern would be for someone that is planning to purchase a house and then sell within the next 5 years. If the economy goes into a recession, people start losing their jobs, and the U.S. consumer starts look for more ways to stretch their dollars, the homeowners that stretched themselves to buy the bigger house based on the big bonus that they received when the economy was humming are at a big risk of losing their house. In addition, there may be fewer buyers in the market because families may not want to waste money on property taxes that they can’t deduct.

The Millionaire Club: House Values $750,000+

It would seem that houses in the $750,000+ range have the most lose to for two reasons. First, homeowners in this category pay the highest property taxes and they are typically not electing the standard deduction at this income level. Second, home buyers at this price point would also be negatively impacted by the lower $750,000 cap on the mortgage interest deduction.

But I doubt this will be the case. Why? There is only so much lake front property. If you make over $5M per year and you fall in love with a lake house in upstate New York that has a $1.5M price tag, while you could try to find a similar lake house in a more tax friendly state, if you make $5M per year, what’s another $15,000 in expenses for buy your first choice.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Will Home Equity Loan Interest Be Deductible In 2019+?

The answer............it depends. It depends on what you used or are going to use the home equity loan for. Up until the end of 2017, borrowers could deduct interest on home equity loans or homes equity lines of credit up to $100,000. Unfortunately, many homeowners will lose this deduction under the new tax law that takes effect January 1, 2018.

The answer............it depends. It depends on what you used or are going to use the home equity loan for. Up until the end of 2017, borrowers could deduct interest on home equity loans or homes equity lines of credit up to $100,000. Unfortunately, many homeowners will lose this deduction under the new tax law that takes effect January 1, 2018.

Old Rules

Taxpayers used to be able to take a home equity loan or tap into a home equity line of credit, spend the money on whatever they wanted (pool, college tuition, boat, debt consolidation) and the interest on the loan was tax deductible. For borrowers in higher tax brackets this was a huge advantage. For a taxpayer in the 39% fed tax bracket, if the interest rate on the home equity loan was 3%, their after tax interest rate was really 1.83%. This provided taxpayers with easy access to cheap money.

The Rules Are Changing In 2018

To help pay for the new tax cuts, Congress had to find ways to bridge the funding gap. In other words, in order for some new tax toys to be given, other tax toys needed to be taken away. One of those toys that landed in the donation box was the ability to deduct the interest on home equity loans and home equity lines of credit. But all may not be lost. The tax law splits "qualified residence interest" into two categories:

Acquisition Indebtedness

Home Equity Indebtedness

Whether or not your home equity loan or HELOC is considered acquisition indebtedness or home equity indebtedness may ultimately determine whether or not the interest on that loan will continue to be deductible in 2018 and future years under the new tax rules. I say "may" because we need additional guidance form the IRS as to how the language in the tax bill will be applied in the real world. As of right now you have some tax professionals stating that all interest from homes equity sources will be disallowed beginning in 2018 and other tax professionals taking the position that home equity loans from acquisition indebtedness will continue to be eligible for the tax deduction in 2018. For the purpose of this article, we will assume that the IRS will continue to allow the deduction of interest on home equity loans and HELOCs associated with acquisition indebtedness.

Acquisition Indebtedness

Acquisition indebtedness is defined as “indebtedness that is secured by the residence and that is incurred in acquiring, constructing, or substantially improving any qualified residence of the taxpayer”. It seems likely, under this definition, if you took out a home equity loan to build an addition on your house, that would be classified as a “substantial improvement” and you would be able to continue to deduct the interest on that home equity loan in 2018. Where we need help from the IRS is further clarification on the definition of “substantial improvement”. Is it any project associated with the house that arguably increases the value of the property?

More good news, this ability to deduct interest on home equity loans and HELOCs for debt that qualifies as “acquisition indebtedness” is not just for loans that were already issued prior to December 31, 2017 but also for new loans.

Home Equity Indebtedness

Home equity indebtedness is debt incurred and secured by the residence that is used for items that do not qualify as "acquisition indebtedness". Basically everything else. So beginning in 2018, interest on home equity loans and HELOC's classified as "home equity indebtedness" will not be tax deductible.

No Grandfathering

Unfortunately for taxpayers that already have home equity loans and HELOCs outstanding, the Trump tax reform did not grandfather the deduction of interest for existing loans. For example, if you took a home equity loan in 2016 for $20,000 and there is still a $10,000 balance on the loan, you will be able to deduct the interest that you paid in 2017 but beginning in 2018, the deduction will be lost if it does not qualify as "acquisition indebtedness".

Partial Deduction

An important follow-up question that I have received from clients is: “what if I took a home equity loan for $50,000, I used $30,000 to renovate my kitchen, but I used $20,000 as a tuition payment for my daughter? Do I lose the deduction on the full outstanding balance of the loan because it was not used 100% for substantial improvements to the house? Great question. Again, we need more clarification on this topic from the IRS but it would seem that you would be allowed to take a deduction of the interest for the portion of the loan that qualifies as “acquisition indebtedness” but you would not be able to deduct the interest attributed to the “non-acquisition or home equity indebtedness”.

Time out……how do you even go about calculating that if it’s all one loan? Even if I can calculate it, how is the IRS going to know what portion of the interest is attributed to the kitchen project and which portion is attributed to the tuition payment? More great questions and we don’t have answers to them right now. These are the types of issues that arise when you rush major tax reform through Congress and then you make it effective immediately. There is a laundry list of unanswered questions and we just have to wait for clarification on from the IRS.

Itemized Deduction

An important note about the deduction of interest on a home equity loan or HELOC, it's an itemized deduction. You have to itemize in order to capture the tax benefit. Since the new tax rules eliminated or limited many of the itemized deductions available to taxpayers and increased the standard deduction to $12,000 for single filers and $24,000 for married filing joint, many taxpayers who previously itemized will elect the standard deduction for the first time in 2018. In other word, regardless of whether or not the IRS allows the deduction for home equity loan interest assigned to acquisition indebtedness, very few taxpayers will reap the benefits of that tax deduction because your itemized deductions would need to exceed the standard deduction thresholds before you would elect to itemize.

Will This Crush The Home Equity Loan Market?

My friends in the banking industry have already started to ask me, “what impact do you think the new tax rules will have on the home equity loan market as a whole?” It obviously doesn’t help but at the same time I don’t think it will deter most homeowners from accessing home equity indebtedness. Why? Even without the deduction, home equity will likely remain one of the cheapest ways to borrow money. Typically the interest rate on home equity loans and HELOCs are lower because the loan is secured by the value of your house. Personal loans, which typically have no collateral, are a larger risk to the lender, so they charge a higher interest rate for those loans.

Also, for most families in the United States, the primary residence is their largest asset. A middle class family may not have access to a $50,000 unsecured personal loan but if they have been paying down their mortgage for the past 15 years, they may have $100,000 in equity in their house. With the cost of college going up and financial aid going down, for many families, accessing home equity via a loan or a line of credit may be the only viable option to help bridge the college funding gap.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Tax Reform Could Lead To A Spike In The Divorce Rate In 2018

The Tax Cut & Jobs Act that was recently passed has already caused taxpayers to accelerate certain financial decisions as we transition from the current tax laws to the new tax laws over the course of the next two years.

The Tax Cut & Jobs Act that was recently passed has already caused taxpayers to accelerate certain financial decisions as we transition from the current tax laws to the new tax laws over the course of the next two years.

Current Tax Law: Alimony Is Tax Deductible

Under the current tax law, alimony payments are taxable income to the ex-spouse receiving the payments and they are tax deductible to the ex-spouse making the payments. When alimony is awarded pursuant to a divorce, it’s typically because there was a disparity in the level of income between the two spouses during the marriage. The ex-spouse paying the alimony, in most cases, is the higher income earning spouse both before and after the divorce finalized.

Let’s look at this in a real life example. Jim and Sarah have decided to get a divorce. Jim makes $300,000 per year and Sarah is a homemaker with $0 income. Pursuant to the divorce agreement, Jim will be required to pay Sarah $50,000 per year for 5 years. Jim will be able to deduct the $50,000 each year against his taxable income and Sarah will claim the $50,000 as taxable income on her tax return. Based on the 2018 Individual Tax Brackets, the top end of Jim’s income is in the 35% tax bracket. Thus, paying $50,000 in alimony really results in an “after-tax” expense to Jim of $32,500.

$50,000 x 35% = $17,500 (fed tax savings)

$50,000 – $17,500 = $32,500 (after tax expense to Jim)

Sarah will claim that $50,000 in alimony payments as income and let’s assume that the alimony payments are her only income for the year. Next year, as a single filer, Sarah will receive a standard deduction of $12,000, and the remainder of the $38,000 will be taxed at a blend of her 10% & 12% tax rate. As a result, Sarah will only pay about $4,400 in taxes on the $50,000 in alimony income.

To sum it all up, if the $50,000 is taxed to Sarah, approximately $4,400 will be paid to the IRS in taxes and she nets $45,600 in after tax income. However, if Jim was not able to deduct the alimony payments and had to pay tax on that $50,000, he would first have to pay the $17,500 in taxes to the IRS, and then he would hand Sarah a check for $32,500 after tax. Sarah is worse off because she received less after tax income. Jim would ultimately be worse off because he would need to part with more pre-tax income to create the same after tax benefit for Sarah. The IRS is the only one that wins.

Gaming The System

Since divorce agreements, in most states, are not required to adhere to predefined calculations for splitting assets, alimony payments, and in some cases child support, the tax game can be played when there is a high income earning spouse and alimony payments in the mix. In exchange for fewer assets or less child support, some divorce agreements have purposefully shifted more to alimony. The ex-spouse with the big income gets a bigger tax deduction and the ex-spouse receiving the alimony payment is able to take full advantage of their lower tax brackets and maximize their after tax income.

Alimony Is No Longer Deductible

To stop the tax game, included in the new tax bill was a provision that specifically states that alimony payments will no longer be deductible by the payor, nor reportable as income by the recipient, for divorce agreements signed after December 31, 2018.

The good news is this will not impact the ability to deduct alimony payments for divorce agreements that are currently in place. The bad news is for divorce agreements signed after December 31, 2018, the high income earner will no longer be able to deduct the alimony payments. That eliminates the tax arbitrage that has been used in the past to make the pie larger for both spouses. In general, if you shrink the size of the asset and income pie, it leaves more to fight about because each spouse is trying to preserve their standard of living as much as possible post-divorce.

For couples that have been sitting on the fence about getting divorced, this could be the catalyst to start the process in 2018 to make sure they have a signed agreement prior to December 31, 2018.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Should You Prepay Your Property Taxes?

If you live in New York or any other state with "higher" property taxes you should determine whether or not it makes sense to pay your 2018 property taxes prior to December 31, 2017. Why? Tax reform will be capping your state and local tax deductions at $10,000 beginning in 2018. Don't forget though, that it's important to make sure you keep on

If you live in New York or any other state with "higher" property taxes you should determine whether or not it makes sense to pay your 2018 property taxes prior to December 31, 2017. Why? Tax reform will be capping your state and local tax deductions at $10,000 beginning in 2018. Don't forget though, that it's important to make sure you keep on top of your taxes, as you don't want to cause an issue further down the line.

To prevent taxpayers from navigating around the $10,000 deduction cap that will take effect in 2018, Congress wrote right into the tax bill that taxpayers will not be able to prepay their 2018 state income taxes and take the tax deduction in 2017. However, they left the door open for prepaying your 2018 property taxes in 2017 and taking the deduction in 2017 before the cap goes into effect.

Should you do this? The answer depends on your expected income for the 2017 tax year.

Alternative Minimum Tax

Before you rush down to your town office in the last week of December to prepay your 2018 taxes, if you think your income level in 2017 is going to make you subject to AMT, I will save you the trip. Alternative Minimum Tax (AMT) is a special tax calculation that was implemented back in 1969 to make sure the "wealthy" pay their fair share of taxes. The AMT calculation allows fewer deductions and exemptions than the standard tax system. Taxpayers have to calculate their taxes the "normal way" and then calculate their taxes under the AMT method. Whichever method generates the higher tax liability is the one that you pay.

The problem with AMT is over time they did not index the exemption level adequately for wage inflation since its inception in 1969. Again it was supposed to stop the wealthy from taking advantage of tax deductions. In 2017, the exemptions amounts for AMT are as follows:

Single Filer: $54,300

Married Filing Joint: $84,500

Not exactly what many of us would considered wealthy. It gets better, that exemption begins to phase out at the following levels in 2017 making more of your income subject to the special AMT calculation.

Single Filers: $120,700

Married Filing Joint: $160,900

Why am I going into so much detail amount AMT? Remember, AMT adds back deductions that were previously allowed under the standard calculation. One of those add backs is property taxes. So if your AMT tax liability exceeds your tax liability calculated with the standard formula, there is no point in prepaying your 2018 property taxes because you won't be able to deduct them anyways. Those deductions get added back in as part of the AMT calculation.

Contact Your Accountant

The AMT calculation is complex. If you are not able to accurately estimate whether or not your AMT tax liability will be greater than the standard calculation, you should contact your accountant for guidance.

Those Not Subject To AMT

If you are not subject to AMT and you plan to itemize in 2017, it probably does makes sense to prepay your property taxes for 2018 by December 29, 2017. Otherwise you are just going to lose the deduction in 2018 because it will most likely be more advantageous at that income level to just take the larger standard deduction that will be available in 2018. You end up with the best of both worlds. You get to deduct your 2018 property taxes in 2017 which reduces your income and then capture the large standard deduction in 2018,

How Do You Prepay Your Property Taxes?

So how do you pay your property taxes early? It's most likely going to require your checkbook and a trip to your town office, First, call your town office to make sure the 2018 property tax invoices are available. Once you know that they are available, you should drive down to your town office prior to December 29, 2017 and pay the tax bill.

If you escrow taxes, which many homeowners do, there is a good chance that your mortgage company will not receive your property tax bill in time to issue a check from your escrow account prior to December 29th. For this reason, you should call your mortgage services company and determine what they need to prove that you paid your 2018 property taxes with a personal check. This will hopefully prevent them from issuing a check out of your escrow account for the property taxes that you already paid with your personal check for 2018.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

A Lesson From Bitcoin

I'm not writing this article to predict whether Bitcoin is going to $0 or $50,000. I have no idea whether it's going to go up or down from here. But I have had countless conversations with clients and friends over the past few weeks which starts like this "What do you think about Bitcoin?"My response is, before you make any type of investment, you should

I'm not writing this article to predict whether Bitcoin is going to $0 or $50,000. I have no idea whether it's going to go up or down from here. But I have had countless conversations with clients and friends over the past few weeks which starts like this "What do you think about Bitcoin?"

My response is, before you make any type of investment, you should be able to answer the following questions. If you can't answer these questions with confidence, you probably should not be investing in it.

"Explain It To Me In 30 Seconds"

Investing is as much of an art as it is a science which is why you can ask three different investment advisors about the same investment and get three different answers. While the full analysis of an investment can be complex and require a thorough understanding of markets, equity analysis, and financial reports, seasoned veterans have mastered their craft and have a way of simplifying the process. One of the lessons that I learned from my mentor and that I continue to apply to selecting investments today is "If you can't explain it to me in less than 30 seconds, I don't want to have anything to do with it."Before investing in anything, you should:

Develop an investment thesis

Identify the risks

Identify competitors

Know at what price to sell at

Let's look at each of these items and how they apply to the Bitcoin situation.

Develop an investment thesis

An investment thesis answers the question, why are you committing money to that particular investment? When buying a stock, you try to identify companies that have strong management, good cash flow, a promising new product or service, expanding market share, and a competitive advantage with the expectation that the company will outperform a given benchmark.

“Because I think it will go up” is not an investment thesis. You have to include in your investment thesis items that can be measured. If for example, I decide to invest in a cell phone company because they are expected to expand into China, India, and increase their market share over the next 3 years by 50%. I have identified a clear and measurable reason why I have chosen to invest in that company.

Bitcoin poses a challenge in this sense. When you invest in a company, you are essentially investing in the future cash flow that is expected to be produced by that company. Which is why the price to earnings ratio is often used to determine if a company is “reasonably priced”. Bitcoin is a currency that does not produce future cash flow so what metrics can you build into an investment thesis that will allow you to measure your expected outcome? I have yet to hear a good answer to that question. An “expert” making a prediction that Bitcoin is going to $30,000 is not a great metric to use. Remember, price appreciation is a by product of the improvement of the underlying financial drivers of an investment. If you can’t identify what those financial drivers are, price is irrelevant.

Identify the risks

Before making any investment, you should be able to take out a sheet of paper and list of the risks to your investment thesis. If you don’t know the risks, how do you know when to get out of that investment? In my cell phone company example, I bought that stock because I expected that company to gain 50% of the cell phone market share in China & India over the next 3 years. What are the risks to that investment thesis?

Currency risk: The value of the U.S. dollar increases versus the local currency decreasing profits

Execution risk: They do not successfully execute their strategy. It takes 5 years instead of 3.

Political risk: The Chinese government assumes ownership of the company

Market risk: The global economy goes into a recession

Competitor risk: Another reputable cell phone company enters that market

Management risk: The current CEO leaves the company and the new CEO takes the company in a different direction

Cash flow risk: The company takes on too much debt trying to expand and has to scale back

While everyone goes into a new investment with the hopes and dreams that it is the next Apple, you have to be able to identify what could send your great investment tumbling to the ground.

Can you list all of the risks associated with Bitcoin? It could go to zero but that’s true of any investment. With many new technologies, services, currencies, and medical devices, you have too unfortunately accept the fact that all of the risks associated with that investment are probably not known. It does not necessarily mean it’s a bad investment since most breakthrough technology and products are met with resistance and then uniformly accepted by the masses down the road. But it does imply that the investment comes with a much higher level of risk because a greater number of unknowns exists and you have to be able to live with the fact that it has just as much of a chance of going up by 100% as it does going to zero. While this line of thinking may not completely deter you from making a particular investment, it will hopefully influence the amount that you decide to commit to riskier investments.

Identify Competitors

When identifying competitors, my first question is usually "how large are the barriers to entry into are particular product or market?" The larger the barriers to entry, the longer it takes competitors to catch up to the market leaders. It would seem in the case of Bitcoin, that the barriers to entry for cryptocurrencies are fairly low. I'm already starting to hear the buzz at holiday parties about "ICO's" which stands for Initial Coin Offering. If I were looking to invest in Bitcoin, I would be asking the questions:

Who are the other main stream cryptocurrencies?

Do they have a competitive advantage over Bitcoin?

What would entice someone to switch from Bitcoin to another cryptocurrency?

How large is the cyptocurrency market?

Will regulations eventually come into play and create barriers to entry?

How many people that invested in Bitcoin do you think can answer these questions? My guess is not many. That in itself is risky.

Knowing At What Price To Sell

Of all the investment criteria that I have listed so far, I think this one is the most problematic when it comes to Bitcoin. When making any investment, you have to be able to answer the question: “Based on all of the information that I have today, at what price should I sell it at?” If I own a rental property and it’s fair market value is $250,000 and I collect $15,000 per year in rent, if someone offered me $300,000 to buy my rental property should I sell it? To answer that question, I would map out all of the income that I expect to receive from that property over my lifetime and apply a reasonable appreciation rate of the property value itself. It’s a similar process in evaluating a stock. You are looking at the annual earnings of the company and what you expect those earnings to be in the future. Both of these examples, like most investments, generate future cash flow and have reasonable appreciation rates that can be applied. With Bitcoin, as I mentioned earlier, there is no future cash flow. It’s value right now is being set based on what the next person is willing to buy it for. If one day people wake up and decide I don’t want to buy your Bitcoin or provide you with any good or services in exchange for your Bitcoin, there is nothing there. There are no earnings, there are no products, there are no services, there are no brick and mortar buildings, it’s vapor. With traditional currency, like the U.S. dollar, you have the taxing power and the assets of the United States government confirming that the dollar bill in your hand is worth something

So if I decide to buy Bitcoin today at $14,000 per coin, at what dollar amount should I sell it because it has become overvalued? I have no idea how anyone answers that question at this point. That’s problematic because if I start to make money, the difficult decision is “when do I get out?” When investing, it’s very easy to sell investments that have lost money. It’s emotionally much more difficult to sell your winners. So again, if I buy Bitcoin today and it goes to $30,000, do I sell it? Does it keep going to $50,000? I have absolutely nothing to based that on and that’s a problem.

Remember The Tulips

The single most important take away from this articles is "make sure you understand what you are investing in". If you can't explain it in less than 30 seconds, you probably should not be investing in it. Specific to Bitcoin, I use the saying, history does not repeat itself but it does rhyme. Some of the rhyming took place in the 1600's in the form of the Tulip bubble. In the Netherlands, during the Tulip mania, the cost of a tulip equaled to the cost of a house. Don't believe it? Just take a stroll down history lane. Here's the article: Tulip Mania

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Do I Make Too Much To Qualify For Financial Aid?

If you have children that are college-bound at some point you will begin the painful process of calculating how much college will cost for both you and them. However, you might be less worried about the financial aspects of your child going to college after viewing some of the Bloomsburg student apartments for rent on the market at the moment.

If you have children that are college-bound at some point you will begin the painful process of calculating how much college will cost for both you and them. However, you might be less worried about the financial aspects of your child going to college after viewing some of the Bloomsburg student apartments for rent on the market at the moment. Anyway, I have heard the statement, "well they will just have to take loans" but what parents don't realize is loans are a form of financial aid. Loans are not a given. Whether your children plan to attend a public college or private college, both have formulas to determine how much a family is expected to pay out of pocket before you even reach any "financial aid" which includes loans.

College Costs Are Increasing By 6.5% Per Year

The rise in the cost of college has outpaced the inflation rate of most other household costs over the past three decades.

To put this in perspective, if you have a 3 year old child and the cost of tuition / room & board for a state school is currently $25,000 by the time that child turns 17, the cost for one year of tuition / room & board will be $60,372. Multiply that by 4 years for a bachelor's degree: $241,488. Ouch!!! Which leads you to the next question, how much of that $60,372 per year will I have to pay out of pocket?

FAFSA vs CSS Profile Form

Public schools and private school have a different calculation for how much “aid” you qualify for. Public or state schools go by the FAFSA standards. Private schools use the “CSS Profile” form. The FAFSA form is fairly straight forward and is applied universally for state colleges. However, private schools are not required to follow the FAFSA financial aid guidelines which is why they have the separate CSS Profile form. By comparison the CSS profile form requests more financial information.

For example, for couples that are divorced, the FAFSA form only takes into consideration the income and assets of the parent that the child lives with for more than six months out of the year. This excludes the income and assets of the parent that the child does not live with for the majority of the year which could have a positive impact on the financial aid calculation. However, the CSS profile form, for children with divorced parents, requests and takes into consideration the income and assets of both parents regardless of their marital status.

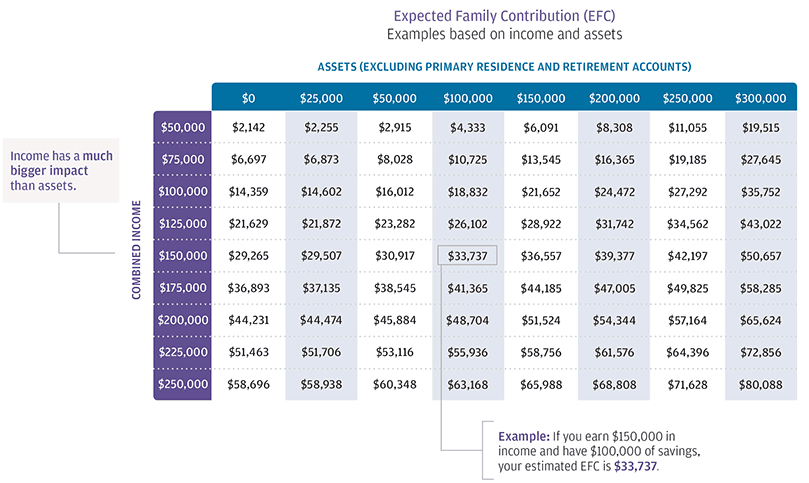

Expected Family Contribution

Both the FAFSA and CSS Profile form result in an "Expected Family Contribution" (EFC). That is the amount the family is expected to pay out of pocket for their child's college expense before the financial aid package begins. Below is a EFC award chart based on the following criteria:

FAFSA Criteria

2 Parent Household

1 Child Attending College

1 Child At Home

State of Residence: NY

Oldest Parent: 49 year old

As you can see in the chart, income has the largest impact on the amount of financial aid. If a married couple has $150,000 in AGI but has no assets, their EFC is already $29,265. For example, if tuition / room and board is $25,000 for SUNY Albany that means they would receive no financial aid.

Student Loans Are A Form Of Financial Aid

Most parents don't realize the federal student loans are considered "financial aid". While "grant" money is truly "free money" from the government to pay for college, federal loans make up about 32% of the financial aid packages for the 2016 – 2017 school year. See the chart below:

Start Planning Now

The cost of college is increasing and the amount of financial aid is declining. According to The College Board, between 2010 – 2016, federal financial aid declined by 25% while tuition and fees increased by 13% at four-year public colleges and 12% at private colleges. This unfortunate trend now requires parents to start running estimated EFC calculation when their children are still in elementary school so there is a plan for paying for the college costs not covered by financial aid.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Procedures For Splitting Retirement Accounts In A Divorce

If you are going through a divorce and you or your spouse have retirement accounts, the processes for splitting the retirement accounts will vary depending on what type of retirement accounts are involved.

If you are going through a divorce and you or your spouse have retirement accounts, the processes for splitting the retirement accounts will vary depending on what type of retirement accounts are involved.

401(k) & 403(b) Plan

The first category of retirement plans are called ?employer sponsored qualified plans?. This category includes 401(k) plans, 403(b) plans, 457 plans, and profit sharing plans. Once you and your spouse have agreed upon the split amount of the retirement plans, one of the attorneys will draft Domestic Relations Order, otherwise known as a QDRO. This document provides instruction to the plans TPA (third party administrator) as to how and when to split the retirement assets between the ex-spouses. Here is the procedures from start to finish:

One attorney drafts the Domestic Relations Order (?DRO?)

The attorney for the other spouse reviews and approved the DRO

The spouse covered by the retirement plan submits it to the TPA for review

The TPA will review the document and respond with changes that need to be made (if any)

Attorneys submit the DRO to the judge for signing

Once the judge has signed the DRO, its now considered a Qualified Domestic Relations Order (QDRO)

The spouse covered by the retirement plan submits the QDRO to the plans TPA for processing

The TPA splits the retirement account and will often issues distribution forms to the ex-spouse not covered by the plan detailing the distribution options

Step number four is very important. Before the DRO is submitting to the judge for signing, make sure that the TPA, that oversees the plan being split, has had a chance to review the document. Each plan is different and some plans require unique language to be included in the DRO before the retirement account can be split. If the attorneys skip this step, we have seen cases where they go through the entire process, pay the court fees to have the judge sign the QDRO, they submit the QDRO for processing with the TPA, and then the TPA firm rejects the QDRO because it is missing information. The process has to start all over again, wasting time and money.

Pension Plans

Like employer sponsored retirement plans, pension plans are split through the drafting of a Qualified Domestic Relations Order (QDRO). However, unlike 401(k) and 403(b) plans that usually provide the ex-spouse with distribution options as soon as the QDRO is processed, with pension plans the benefit is typically delayed until the spouse covered by the plan is eligible to begin receiving pension payments. A word of caution, pension plans are tricky. There are a lot more issues to address in a QDRO document compared to a 401(k) plan. 401(k) plans are easy. With a 401(k) plan you have a current balance that can be split immediately. Pension plan are a promise to pay a future benefit and a lot can happen between now and the age that the covered spouse begins to collect pension payments. Pension plans can terminate, be frozen, employers can go bankrupt, or the spouse covered by the retirement plan can continue to work past the retirement date.

I would like to specifically address the final option in the paragraph above. In pension plans, typically the ex-spouse is not entitled to a benefit until the spouse covered by the pension plan is eligible to receive benefits. While the pension plan may state that the employee can retire at 65 and start collecting their pension, that does not mean that they will with 100% certainty. We have seen cases where the ex-husband could have retired at age 65 and started collecting his pension benefit but just to prevent his ex-wife from collecting on his benefit decided to delay retirement which in turn delayed the pension payments to his ex-wife. The ex-wife had included those pension payments in her retirement planning but had to keep working because the ex-husband delayed the benefit. Attorneys will often put language in a QDRO that state that whether the employee retires or not, at a given age, the ex-spouse is entitled to turn on her portion of the pension benefit. The attorneys have to work closely with the TPA of the pension plan to make sure the language in the QDRO is exactly what it need to be to reserve that benefit for the ex-spouse.

IRA (Individual Retirement Accounts)

IRA? are usually the easiest of the three categories to split because they do not require a Qualified Domestic Relations Order to separate the accounts. However, each IRA provider may have different documentation requirements to split the IRA accounts. The account owner should reach out to their investment advisor or the custodian of their IRA accounts to determine what documents are needed to split the account. Sometimes it is as easy as a letter of instruction signed by the owner of the IRA detailing the amount of the split and a copy of the signed divorce agreement. While these accounts are easier to split, make sure the procedures set forth by the IRA custodians are followed otherwise it could result in adverse tax consequences and/or early withdrawal penalties.

About Michael??...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Do Trusts Expire?

Do trusts have an expiration date after the death of the grantor? For most states, the answer is “Yes”. New York is one of those states that have adopted “The Rule Against Perpetuities” which requires all of the assets to be distributed from the trust by a specified date.

Do trusts have an expiration date after the death of the grantor? For most states, the answer is “Yes”. New York is one of those states that have adopted “The Rule Against Perpetuities” which requires all of the assets to be distributed from the trust by a specified date.

The Rule Against Perpetuities

For most states, the trust assets have to be distributed no later than the “lifetime of those then living plus 21 years.” In other words, the trust asset must be distributed 21 years after the death of the youngest beneficiary listed in the trust document. For example, if I setup a trust with my children listed as beneficiaries, after my passing the trust assets would have to be distributed no later than 21 years following the death of my youngest child.

Per Stirpes Beneficiaries

Some trust documents have the children listed as beneficiaries “per stirpes”. This mean that if a child is no longer alive their share of the trust passes to their heirs. In many cases their children. If the beneficiaries are listed in the trust document as per stirpes beneficiaries then you may be able to make the argument that the “youngest beneficiary” is really the grandchildren not the children which will allow the trust to retain the assets for a longer period of time. Typically trusts do not allow the perpetuity rule to extend beyond their grandchildren.

Consult An Estate Attorney

Trust can be tricky and the language in a trust document is not always black and white, so it’s highly recommended that you consult with an estate attorney that is familiar with the estate laws for you state of residence and can review the terms of the trust document.DISCLOSURE: The information listed above is not legal advice. For legal advice, please consult your attorney.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Common Mistakes With Grandparent Owned 529 Accounts

529 college savings accounts owned by the grandparents can be in a valuable benefit for a college bound grandchild. Since the accounts are owned by the grandparents it does not show up anywhere for financial aid purposes which allows the student to qualify for more financial aid. However, even though 529 account owned by the grandparents are

529 Accounts

529 college savings accounts owned by the grandparents can be in a valuable benefit for a college bound grandchild. Since the accounts are owned by the grandparents it does not show up anywhere for financial aid purposes which allows the student to qualify for more financial aid. However, even though 529 account owned by the grandparents are not considered an asset when applying for financial aid, distributions from 529 accounts on behalf of the beneficiary are considered income of the account beneficiary in the year that the disbursement occurs from 529 account.

For example, assume the grandchild receives $20,000 in financial aid in their freshman year but there is still a $10,000 balance due to attend college. The grandparents distribute $10,000 from the 529 account that they own for the benefit of the grandchild. When the parents apply for the financial aid package in the student’s Junior year, they $10,000 529 disbursement that took place in the freshman year will need to be reports as income of the student on the FASFA application. That could completely destroy their financial aid package since 50% of the student’s income counts against the financial aid package.

Remember, the FASFA application now looks back two years instead of one for income purposes. To avoid this situation, the grandparents should not distribute any money from the grandchild’s 529 account until the spring semester of their sophomore year.

Don’t setup UGMA or UTMA accounts

UGMA a stands for Uniform Gift to Minors Act. UTMA stands for Uniform Transfer to Minors Act. Different names but the accounts work in a similar fashion.

If there is a chance that the student may qualify for financial support from either a public or private institution, these accounts can significantly reduce the financial award. The types of accounts are considered an asset of the child not the grandparent. When an asset is titled in the child’s name, approximately 20% of the account balance will count against their financial aid package. For this reason, it is often more beneficial to establish a 529 account which is considered an asset of the grandparent and can be invisible for financial aid purposes.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.