How Much Money Do I Need To Save To Retire?

This is by far the most popular question that we come across as financial planners. You may have heard some of the "rules of thumb" like “80% of your current take-home pay” or “1 million dollars”. In reality, the answer varies greatly on an individual by individual basis. This article will outline the procedures that we follow as financial planners to help

This is by far the most popular question that we come across as financial planners. You may have heard some of the "rules of thumb" like “80% of your current take-home pay” or “1 million dollars”. In reality, the answer varies greatly on an individual by individual basis. This article will outline the procedures that we follow as financial planners to help individuals answer this very important question.

Step 1: Estimate Your Annual Expenses In Retirement

The first step is to get a ballpark idea of what your annual expenses might look like in retirement. The best place to start is to list your current monthly and annual expenses. Then create a separate column labeled “expenses in retirement”. Whether you are 2 years, 10 years, or 20 years away from retirement the idea is to pretend as if you were retiring tomorrow and determining what your annual expenses might look like. Some of your expenses in retirement will be lower, others may be higher, but most people find that a lot of their current expenses will carry over at the same level into the retirement years. This is because most people have become accustom to a certain standards of living and they intend to maintain that standard of living in retirement. Here are a few important questions that you should ask yourself when forecasting your retirement expenses:

How much should I budget for health insurance?

Will I have a mortgage or debt when I retire?

Do I plan to move when I retire?

Since I will not be working, should I budget additional expenses for vacations and hobbies?

Will I need to keep my life insurance policies after I retire?

Step 2: Adjust Your Retirement Expenses For Inflation

Now that you have a ballpark number of your annual expenses in retirement, you will need to adjust those expenses for inflation. Inflation is just a fancy word for “the price of everything that we buy today will gradually go up in price over time”. If the price of a gallon of milk today is $2 then most likely 20 years from now that same gallon of milk will cost $3.51. A 75% increase!! Historically inflation has grown at a rate of about 3% per year. There are periods of time when the rate of inflation grows faster or slower but on average it grows at 3% per year.

Another way to look at inflation is $20,000 in today’s dollars will not buy the same amount of goods and services 10 years from now because inflation erodes the purchasing power of your $20,000. If I did my annual expense planner and it tells me that I need $50,000 per year in retirement to meet all of my estimated expenses, let’s look at what adjusting that $50,000 for inflation does over different periods of time assuming a 3% rate of inflation:

Today’s Dollars 5 Years From Now 10 Years From Now 20 Years From Now

$50,000 $56,275 $65,238 $87,675

In the above example, if I am retiring in 10 years, and my estimated annual expenses in retirement will be $50,000 in today’s dollars, by the time I retire 10 years from now my annual expenses will increase to $65,238 per year just to stay in the same place that I am in today. Also, inflation does not stop when you retire, it continues into the retirement years. If I am 50 today and plan to live until 90, I have to apply this inflation adjustment for 40 years. It’s clear to see how inflation can have a significant impact on the amount that you may need to withdrawal for your account to meet you estimated expenses at a future date.

Step 3: Gather The Information On Your Current Assets

Once you know your expenses, you now need to gather all of the information on your retirement accounts and pension plans. You should collect the most recent statement for all of your investment accounts (401K, 403B, IRA’s, brokerage accounts, stocks, etc.), pension statements (if applicable), obtain your most recent social security statement, and gather information on the other sources of income and/or assets that may be available when you retire. Such as:

Sale of a business

Downsizing the primary residence

Rental income

Part-time employment

Step 4: Project The Growth Of Your Retirement Assets

There are three main categories to consider when calculating the growth rate of your retirement assets:

Annual contributions

Withdrawals

Investment rate of return

For annual contributions, it’s determining which accounts you plan on making deposits too each year and how much? For most individuals, their employer sponsored retirement plan is the main source of new contributions to their retirement nest egg. If your employer makes regular employer contributions to your retirement plan, you should factor those in as well. For example, if I am contributing 8% of my pay into the plan and my employer is providing me with a 4% matching contributions, I would reasonably assume that I’m adding 12% of my pay to my 401(k) plan each year.

The most popular question that we get in this category is “how much should I be contributing each year to my retirement account with my employer?” We advise employees that they should have a goal of contributing 10% of their pay each year to their retirement accounts. This is an aggregate total between your personal contributions and the employer contributions. Even if you cannot reach that level right now, 10%+ is the target.

Let’s move onto the next category…….withdrawals. Pre-retirement withdrawals from retirement accounts have become much more common in recent years due largely to the rising cost of college education. Parents will take loans from their 401K/403B plans or take early withdrawals from IRA accounts to fulfill the need for additional income during the years that their children are in college. If part of your overall financial plan is to use your retirement accounts to pay for one-time expenses such as college, you will need to factor that into your projections.

The third variable to consider when determining the growth of your assets is the assumed annual rate of return on your investments. There are many items to consider when determining a reasonable annual rate of return for your accounts. Some of those considerations include:

Time horizon to retirement

Allocation of your portfolio (stocks vs bonds)

Concentrated holdings (10%+ of your portfolio allocated to a single investment)

Accumulation phase versus distribution phase

The answer to the question: “what rate of return should I expect from my retirement accounts?”, can really only be determine on a case by case basis. Using an unreasonable rate of return assumption can create a significant disconnect between your retirement projections versus what is likely to actually occur within your investment accounts. Be careful with this step.

Step 5: Factor In Taxes

Don’t forget about the lovely IRS. All assets are not treated equally from a tax standpoint. For most individuals, the majority of their retirement savings will be in pre-tax retirement vehicles such as 401(k), 403(b), and Traditional IRA’s. That means when you take distributions from those accounts, you will realize earned income, and have to pay tax. For example, if you have $400,000 in your 401K account and you are in the 25% tax bracket, $100,000 of that $400,000 will be lost to taxes as withdrawals are made from the account.

If you have after tax investment accounts, it’s possible that you may owe little to no taxes on withdrawals. However, if there are unrealized investment gains built up in your after tax investment accounts then you may owe capital gains tax when liquidating positons.

Also note, you may have to pay taxes on a portion of your social security benefit. The amount of your social security benefit that is taxable varies based on your level of income.

Step 6: Spend Down Your Assets

In the final step, you should run long term projections to illustrate the spend down of your assets in retirement. Here are the steps:Example

Start with your annual after tax expense number $60,000

Subtract social security less taxes: ($20,000)

Subtract pension payments less taxes (if applicable): ($10,000)

Annual Expenses Net SS and Pensions: $30,000

In the example above, this individual would need an additional $30,000 after-tax to meet their anticipated annual expenses in Year 1 of retirement. I stress “after-tax” because if all of the retirement assets are in a pre-tax retirement account then they would need to gross up their distributions for taxes to get to the $30,000 after tax. If it is assumed that $40,000 has to be withdrawn from an IRA each year, the 3% inflation rate is applied to the annual expenses, and the life expectancy of this individual is 20 years from the date that they retire, this individual would need to withdrawal $1,074,814 out of their retirement accounts over the next 20 years to meet their income needs.

Step 7: Identify Multiple Solutions

There are often times multiple roads to reach a destination and the same is true when planning for retirement. If you find that you assets are falling short of the amount that is needed to sustain your expenses in retirement, you should work with a knowledgeable financial planner to identify alternative solutions. It may help you to answer questions like:

If I decided to work part-time in retirement how much would I have to earn?

If I downsize my primary residence in retirement how does this impact the overall picture?

If I can’t retire at age 63, what age can I comfortably retire at?

What are the pros and cons of taking social security benefits prior to normal retirement age

I also encourage clients to spend time looking at their annual expenses. If you find that your are cutting it close on income versus expenses in retirement, it's usually easier to cut expenses than it is to create more income in the retirement year.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

First Time Homebuyer Tips

Buying your first home is one of life’s milestones that everyone should have the opportunity to experience if they choose. Owning a home gives you a feeling of accomplishment and as you make payments a portion is going to your personal net worth rather than a landlord. The process is exciting but one surefire piece of information that I wish I

Buying your first home is one of life’s milestones that everyone should have the opportunity to experience if they choose. Owning a home gives you a feeling of accomplishment and as you make payments a portion is going to your personal net worth rather than a landlord. The process is exciting but one surefire piece of information that I wish I knew when buying my first home is that you will come across surprises. Whether it be a delay in closing, an issue with financing, or closing costs being higher than expected, it is important to know that you can do all the preparation possible and still be hit in the face with some setbacks.

This article will not only touch on some of the important considerations when buying your first home but will give examples of possible setbacks and how to avoid them.

Know Your Number

The most important piece of information to have when purchasing your home is how much you can spend. The purchase of your home should not be the only goal to consider. All of your other financial objectives such as paying off debt (i.e. college and unsecured) and saving for retirement must be taken into consideration. Also, it is recommended you have an emergency fund in place that would cover at least 4 months of your fixed expenses in case something happens with your job or some other event occurs. Knowing your number does not only include what you can afford today but how much you can afford monthly moving forward. If your monthly cash flow becomes dangerously low or negative with the addition of a mortgage payment (including mortgage/property taxes/homeowners), the house may be too expensive.

NOTE: Just because you are preapproved for a certain amount does not mean you need to spend that amount.

Choose An Agent You Trust

You will be spending a lot of time with your agent so choose them wisely. It should be someone you get along with and someone you can trust will look out for your best interests. If your agent just cares about receiving a commission, they may push you to purchase a home before looking at all of your options or buying a home you can’t afford. Remember, you are the client and therefore should be treated as such.

NOTE: Just because you never physically cut a check to your real estate agent doesn’t mean you aren’t paying them. In a typical transaction the seller will pay the commissions. An agreed upon percentage will come out of the sales proceeds and go to both real estate agents (the buyer’s and the seller’s) and therefore the cost is built into the price you pay.

Use Your Agent As An Asset

Your agent is likely much more knowledgeable about home buying than you so use that knowledge to your benefit. The agent should be able to help you value homes and determine whether the house is fairly priced. Ask them as many questions as possible throughout the entire process.

On The Fence

If you are on the fence whether or not to buy a home then take your time. If you may relocate because of your job or family don’t jump into purchasing a home. It is not worth paying the closing costs and going through the hassle of home buying if you may move in the near future. We typically use the “5 Year Rule” when making the determination. If you don’t see yourself being in the house for at least 5 years you should consider whether or not you will get your money back when you sell.

Compare Lenders

The banking industry is extremely competitive and it is worth shopping around for the best offer when choosing a mortgage provider. If you aren’t comfortable with numbers, don’t be afraid to ask for help. A difference of 0.10% on a 30 year mortgage could be the difference of thousands of dollars wasted on interest.

Don’t Cheap Out On Homeowners

Don’t choose your homeowners policy based on price. Of course price is one of the considerations but it is not the only one. Make sure your policy is the most comprehensive you can comfortably afford as the cost of increased premiums is likely much less than the cost of coming out of pocket for something not covered. Remember, insurance companies, like banks, are in a competitive industry so shop around.

Down Payment

Most lenders require a 20% down payment of the home value to avoid paying additional costs. This means if the value of the home is $200,000, you will have to pay $40,000 out of pocket! Most lenders offer Federal Housing Administration (FHA) loans that allow you to put down as little as 3.5%. If you choose this type of loan you also have to purchase Private Mortgage Insurance (PMI). This will be a cost added to your mortgage payment until the value of your home is adequate enough to remove the PMI. It is important to factor this in as a cost similar to interest because a 5% interest rate could quickly look like 6-7% if you have to pay PMI.

Closing And Other Additional Costs

There are a lot of out of pocket costs to consider when purchasing a home. Examples of these costs are listed below. An important piece of knowing your number is to consider all the costs that may come up during the process.

Loan Origination Fee

Attorney Fees

Property Taxes

Home Owners Insurance

Appraisal Fee

Inspection Fee

Title Insurance

Recording Fee

Government Recording Charges

Credit Report Fee

Flood Determination Fee

How To Help Avoid Certain Complications

Situation: I bought a house at the top of my budget that I thought was move in ready but needs repairs.

Recommendation: Choose an inspector that has a great reputation and knows the location. There may be issues that are common to the area that one inspector may be more likely to identify. Also, bring a contractor or someone of similar background for a walk through. Repairs can be extremely costly and if you purchased a home at the top end of your budget you may not be able to afford certain fixes. It should be known that all issues cannot be foreseen but taking the necessary steps to diminish these situations will not hurt. Don’t purchase a home that will bankrupt you if repairs need to be done.

Situation: I bought a home I can’t fill.

Recommendation: Closing costs and repairs won’t be the only out of pocket expenses. Complete a summary of items you think you may need to buy after the purchase. This may include furniture, appliances, décor, and fixtures. In these situations it is always better to overestimate.

Situation: My lease is up in a month and I would like to purchase a home.

Recommendation: Purchasing a home is something that requires time and planning. The home will likely be the largest purchase you’ve ever made (depending on the college you choose) so it is not something to rush. If you are thinking of moving after your lease is up or when you relocate jobs, start planning as soon as possible. Feeling forced into purchasing something as important as a home will likely lead to regrets.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.

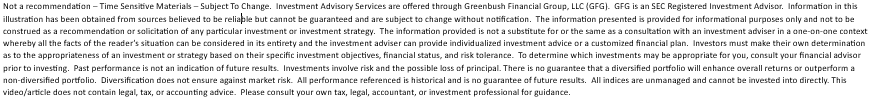

Stock Options 101: ISO, NQSO, and Restricted Stock

If you are reading this article, your company has probably granted you stock options. Stock options give you the potential share in the growth of your company’s value without any financial risk to you until you exercise the options and buy shares of your company’s stock.

If you are reading this article, your company has probably granted you stock options. Stock options give you the potential share in the growth of your company’s value without any financial risk to you until you exercise the options and buy shares of your company’s stock.

Stock options give you the right to purchase a specific number of shares of the company’s stock at a fixed price. There is typically a vesting schedule attached to option grants that specify when you have the right to exercise your stock options. Companies can offer employees:

Incentive Stock Options (“ISO”)

Nonqualified Stock Options (“NQSO”)

Restricted Stock

It is very important to understand how these different types of options and grants are taxed otherwise it could lead to unfortunate tax surprises down the road.

Non-Qualified Stock Options (NQSO)

A non-qualified stock option (NQSO) is a type of stock option that does not qualify for special favorable tax treatment under the US Internal Revenue Code. Thus the word nonqualified applies to the tax treatment (not to eligibility or any other consideration). NQSOs are the most common form of stock option and may be granted to employees, officers, directors, contractors, and consultants.

You pay taxes on these options at the time of exercise. For tax purposes, the exercise spread is compensation income and is therefore reported on your IRS Form W-2 for the calendar year of exercise.

Example: Your stock options have an exercise price of $30 per share. You exercise them when the price of your company stock is $100 per share. You have a $70 spread ($100 – 30) and thus $70 per share is included in your W2 as ordinary income.

Your company will withhold taxes—income tax, Social Security, and Medicare—when you exercise the options.

When you sell the shares, whether immediately or after a holding period, your proceeds are taxed under the rules for capital gains and losses. You report the stock sale on Form 8949 and Schedule D of your IRS Form 1040 tax return.

Incentive Stock Options (ISO)………..

Incentive stock options (ISOs) qualify for special tax treatment under the Internal Revenue Code and are not subject to Social Security, Medicare, or withholding taxes. However, to qualify they must meet rigid criteria under the tax code. ISOs can be granted only to employees, not to consultants or contractors. There is a $100,000 limit on the aggregate grant value of ISOs that may first become exercisable (i.e. vest) in any calendar year. Also, for an employee to retain the special ISO tax benefits after leaving the company, the ISOs must be exercised within three months after the date of termination.

After you exercise these options, if you hold the acquired shares for at least two years from the date of grant and one year from the date of exercise, you incur favorable long-term capital gains tax (rather than ordinary income tax) on all appreciation over the exercise price. However, the paper gains on shares acquired from ISOs and held beyond the calendar year of exercise can subject you to the alternative minimum tax (AMT). This can be problematic if you are hit with the AMT on theoretical gains but the company's stock price then plummets, leaving you with a big tax bill on income that has evaporated.

Very Important: If you have been granted ISOs, it’s important to understand how the alternative minimum tax can affect you prior to exercising your stock options.

Restricted Stock……………….

Your company may no longer be granting you stock options, or may be granting fewer than before. Instead, you may be receiving restricted stock. While these grants don't give you the same potentially life-altering, wealth-building upside as stock options, they do have additional benefits compared to ISO’s and NQSO’s.

The value of stock options, such as ISO’s and NQSO’s, depend on how much (or whether) your company's stock price rises above the price on the grant date. By contrast, restricted stock has value at vesting even if the stock price has not moved or even dropped since grant.

Depending on your attitude toward risk and your experience with swings in your company's stock price, the certainty of your restricted stock's value can be appealing. By contrast, stock options (ISO & NQSO) have great upside potential but can be "underwater" (i.e. having a market price lower than the exercise price). This is why restricted stock is often granted to a newly hired executive. It may be awarded as a hiring bonus or to make up for compensation and benefits, including in-the-money options and nonqualified retirement benefits, forfeited by leaving a prior employer.

Of course, the very essence of restricted stock is that you must remain employed until the shares vest to receive its value. While you may have between 30 and 90 days to exercise stock options after voluntary termination, unvested grants of restricted stock are often forfeited immediately. Thus, it is an extremely effective “golden handcuff” to keep you at your company.

Fewer Decisions

Unlike a stock option, which requires you to decide when to exercise and what exercise method to use, restricted stock involves fewer decisions. When you receive the shares at vesting—which can be based simply on the passage of time or the achievement of performance goals—you may have a choice of tax-withholding methods (e.g. cash, sell shares for taxes), or your company may automatically withhold enough vested shares to cover the tax withholding. Restricted stock is considered "supplemental" wages, following the same tax rules and W-2 reporting that apply to grants of nonqualified stock options.

Tax Decisions

The most meaningful decision with restricted stock grants is whether to make a Section 83(b) election to be taxed on the value of the shares at grant instead of at vesting. Whether to make this election, named after the section of the Internal Revenue Code that authorizes it, is up to you. (It is not available for Restricted Stock Units (RSUs), which are not "property" within the meaning of Internal Revenue Code Section 83)

If a valid 83(b) election is made within 30 days from the date of grant, you will recognize as of that date ordinary income based on the value of the stock at grant instead of recognizing income at vesting. As a result, any appreciation in the stock price above the grant date value is taxed at capital gains rates when you sell the stock after vesting.

While this can appear to provide an advantage, you face significant disadvantages should the stock never vest and you forfeit it because of job loss or other reasons. You cannot recover the taxes you paid on the forfeited stock. For this reason, and the earlier payment date of required taxes on the grant date value, you usually do better by not making the election. However, this election does provide one of the few opportunities for compensation to be taxed at capital gains rates. In addition, if you work for a startup pre-IPO company, it can be very attractive for stock received as compensation when the stock has a very small current value and is subject to a substantial risk of forfeiture. Here, the downside risk is relatively small.

Dividends

Unlike stock options, which rarely carry dividend equivalent rights, restricted stock typically entitles you to receive dividends when they are paid to shareholders.

However, unlike actual dividends, the dividends on restricted stock are reported on your W-2 as wages (unless you made a Section 83(b) election at grant) and are not eligible for the lower tax rate on qualified dividends until after vesting.

Comparison Chart

Disclosure: The information listed above is for educational purposes only. Greenbush Financial Group, LLC does not provide tax advice. For tax advice, please consult your accountant.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Is Child Support & Alimony Calculated In New York?

For purposes of child support, either parent can be named the custodial parent by a Court. For the purposes of this article we will assume that the mother is the custodial parent and will be receiving the child support and alimony payments. However, fathers who have custody can also use this as a guide.

For purposes of child support, either parent can be named the custodial parent by a Court. For the purposes of this article we will assume that the mother is the custodial parent and will be receiving the child support and alimony payments. However, fathers who have custody can also use this as a guide.

How do I apply for child support?

Usually, you ask for child support in Family Court in the county where you and the child live. You can also go for child support in the county where the father lives. You are not required to have a lawyer to apply for child support but it is recommended that you consult with a divorce attorney prior to filing for support.

How is the dollar amount of child support calculated?

The Child Support Standard Act (CSSA) is the law in NYS and tells the amount of child support the father must pay. The CSSA applies to parental income up to a maximum of $181,000 (2021 limit) and the Court can apply it to income in excess of $148,000 based on certain factors. Examples of these factors are: the financial ability of the father, the lifestyle the child would have enjoyed if the parents stayed living together, and any special needs the child may have. The maximum can be adjusted periodically by the New York State legislature. The amount you get depends on what the father’s income is, what your income is, how many children you have together, and what your children’s basic needs are

The Support Magistrate will look at the information in your financial disclosure affidavit and the father’s financial disclosure affidavit, if he supplies one. The Support Magistrate might also ask you and the father to answer questions. And you and he might be asked to give the Support Magistrate other evidence of your income and expenses, such as a paystub or a W-2 statement.

Both parents’ incomes are used to figure out how much child support the father has to pay because both parents have to support their children.

This is how it is calculated:

Deduct (subtract) these things from each parent’s income:

spousal maintenance paid to a former husband or wife by court order

child support paid to other children by court order

public assistance and supplemental security income (SSI)

city taxes

social security and Medicare taxes (FICA)

Combine (add) the incomes of both parents after making those deductions, and multiply the total you get by the correct percentage:

17% for one child

25% for two children

29% for three children

31% for four children

Not less than 35% for five children or more

Divide the figure you get between both parents according to both your incomes (on a “pro rata” basis). This means that if the father earns twice as much as you, he must pay twice as much child support.

The father may also have to pay additional amounts for:

child care, if you are working or going to school.

medical care not covered by insurance

the child’s educational expenses

The parent who has health insurance must also (if reasonable) continue providing health insurance for your children. The cost of providing health insurance will be shared between yourself and the father, in proportion to your respective incomes. If neither of you has health insurance, the court will order the custodial parent (the parent with the greatest amount of custody) to apply for the state’s child health insurance plan.

When do child support payments stop?

Child support payments typically end when the child reaches age 21 or becomes emancipated. Emancipation means a child is living separately and independently from a parent, or is self –supporting. Some things that show that a child is emancipated are:

Child has completed 4 years of college education

Child has gotten married

Child is living away from home (except for living at school or college)

Child has gone into the military

Child is 17 years old and working full-time (except for summer vacation jobs)

Child willingly and fro no good reason has ended the relationship with both parents

In New York, alimony is referred to in three different ways: as alimony, spousal support, and maintenance. “Temporary maintenance” is an order that one spouse must financially support the other while the divorce is being finalized. Once the divorce is finalized, the temporary maintenance stops and the judge decides whether permanent alimony is appropriate.

How is the amount of alimony payments determined?

Unlike child support payments there really are no set guidelines for the amount and duration of alimony payments. To decide whether spousal support is appropriate, the judge will look at the needs of the spouse asking for support and whether the other spouse has the financial ability to provide financial help. For example, if your income is lower than your spouse’s but you are able to support yourself, you may not be entitled to alimony. The court will also look at other factors when making a decision about support:

the length of the marriage

each spouse’s age and health status

each spouse’s present and future earning capacity

the need of one spouse to incur education or training expenses

whether the spouse seeking maintenance is able to become self-supporting

whether caring for children inhibited one spouse’s earning capacity

equitable distribution of marital property, and

the contributions that one spouse has made as a homemaker in order to help enhance the other spouse’s earning capacity.

The court will also look to see whether the acts of one spouse have inhibited or continue to inhibit the other spouse’s earning capacity or ability to obtain employment. The most common example of this would be domestic violence. If one spouse’s abuse of the other affected that abused spouse’s ability to maintain or to get a job, the court might consider those actions in making its order. Disclosure: The information listed above is for educational purposes only. Greenbush Financial Group, LLC does not provide legal advice. For legal advice, please consult your attorney.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How To Prepare Financially For A Divorce

Divorce can stain finances as well as emotions. Both parties are trying to determine financially what life is going to look like after the divorce is finalized. It is also more common than not that in a marriage one of the spouses assumes the role of paying the bills and managing the family's finances. In this arrangement the "non-financial spouse" is now

Divorce can stain finances as well as emotions. Both parties are trying to determine financially what life is going to look like after the divorce is finalized. It is also more common than not that in a marriage one of the spouses assumes the role of paying the bills and managing the family's finances. In this arrangement the "non-financial spouse" is now forced very quickly into the role of understanding their total financial picture.

How much income do they need to meet their living expenses?

Where are all of the marital assets located?

How much debt do they have?

How much should they expect to receive or pay in child support / alimony?

Who is responsible for paying the bills while the divorce process is ongoing?

Step 1: Establish a team of professionals........

Since so many important financial decisions are being made in such a short window of time, we strongly recommend that each spouse surround themselves with a team of professionals that they like and trust. That team of professionals usually consists of an attorney /mediator, accountant, therapist, and a financial planner. Even though the divorce process can be stressful and sometimes scary, surrounding yourself with a knowledgeable team of advisors will help you to better understand your current situation, the options available to you, and to help you better prepare for life after the divorce is final.

Step 2: Identify your assets and debts.............

You need to fully understand your current financial situation before you can begin to plan for your income and expenses going forward. First, make a list of all of your assets, their values, where they are located, and how they are owned (jointly or separately). This can usually be accomplished by gathering statements on all of your accounts.

You will also need a list of all of your debts, the name of each creditor, outstanding balances, monthly payments, interest rates, and how each debt is owned (jointly or separately). This information can typically be obtained by requesting a credit report for both you and your spouse.

Step 3: Create a new budget...............

Before you can figure out how much income/support you will need going forward you need to know what your estimated monthly expenses are going to be once the divorce is finalized. We recommend listing all of your monthly expenses and list separately large one-time expenses that are expected to be incurred in the future such as college expense for the kids or a down payment on a house. Once you know your estimated monthly expenses you can work with your financial professionals to determine how much income/support you will need each month to meet those expenses taking into account taxes, inflation, and an assumed rate of return on your assets. Please feel free to utilize our GFG Expense Planner which is located in the Resource section of our newsroom.

Step 4: Develop financial projections............

Remember, the financial decisions that you are making now during the divorce process will most likely have a dramatic impact on what your financial future will look like. Not all assets are treated equally. Some assets are taxable while others are not. Likewise, you may have access to certain assets now to meet current expense while others assets may not be available until retirement.

The goal of these financial projections is to determine what your financial future may look like next year, 3 years, 10 years, and 20 years from now given the financial decisions that are being made today. There are a lot of variables that need to be considered when creating these projections such as assumed rates of return on current assets, annual contribution amounts, taxes, social security, inflation, and debt. We strongly recommend that individuals work with financial planners that specialize in divorce planning to develop these projections.

Having formal income and expense projections in place will also allow you determine how changes to what is being offered during the negotiation process will impact your financial future.

Step 5: Crossing emotional and financial decisions

It is not uncommon for individuals to have an emotional attachment to a specific marital asset. The two most commons assets that we see that fall into this category are the primary residence and pensions.

We see many situations where one spouse has a strong emotional attachment to the house and they become completely focused on doing whatever it takes to "keep the house". But there are certain circumstances where from a financial standpoint that keeping the house is just not a viable financial option. Couples can underestimate the financial impact of divorce. While married, a couple's total income was being used to maintain a single household. Now that same level of income will need to be used to maintain two separate households which usually comes at a greater overall cost. If projections can be produced early on in the divorce process showing that keeping the current house is just not a viable option, it may remove that addition stress of fighting over an asset that cannot be financially maintain by either spouse.

Disclosure: The information listed above is for educational purposes only. Greenbush Financial Group, LLC does not provide legal advice. For legal advice, please consult your attorney.

About Michael.........

Hi, I'm Michael Ruger. I'm the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Sample Business Plan

The business plan for a startup business provides entrepreneurs with a guide in creating a business plan and items to consider when starting a new business.

Sample Business Plan

The business plan for a startup business provides entrepreneurs with a guide in creating a business plan and items to consider when starting a new business.

Click on the PDF link in the green box below.

Expense Planner

The expense planner is used to determine your annual after tax expenses both now and in retirement.

Financial Planning Questionnaire

The financial planning questionnaire is used to gather information in the initial phase of the financial planning process with Greenbush Financial Group.

Year End Tax Strategies

The end of the year is always a hectic time but taking the time to sit with a tax professional and determine what tax strategies will work best for you may save thousands on your tax bill due April 15th. As the deadline for your taxes starts to get closer, you may be in such a rush to file them on time that you make some mistakes in the process, but

The end of the year is always a hectic time but taking the time to sit with a tax professional and determine what tax strategies will work best for you may save thousands on your tax bill due April 15th. As the deadline for your taxes starts to get closer, you may be in such a rush to file them on time that you make some mistakes in the process, but don't worry, you won't be the only one. If you don't have the relevant tax strategy in place, you are more prone to mistakes. So, the purpose of this article is to discuss some of the most common tax strategies that may apply to you. It may be worth contacting a company that specializes in tax services if you're unsure of how to go about these strategies though. Some of the deadlines for these strategies aren't until tax filing but the majority include an action item that must be done by December 31st to qualify and therefore taking the time before year end is crucial.

Taxable Investment Accounts

Offset some of the realized gains incurred during the year by selling investments in loss positions. Often times dividends received and sales made in a taxable investment account are reinvested. Although the owner of the account never received cash in the transaction, the gain is still realized and therefore taxable. This may cause an issue when the cash is not available to pay the tax bill. By selling investments in a loss position prior to 12/31, you will offset some, if not all, of the gain realized during the year. If possible, sell enough investments in a loss position to take advantage of the maximum $3,000 loss that can be claimed on your tax return.

Note: The IRS recognized this strategy was being abused and implemented the "wash sale" rule. If you sell an investment in a loss position to diminish gains and then repurchase the same investment within 30 days, the IRS does not allow you to claim the loss therefore negating the strategy.

Convert a Traditional IRA to a Roth IRA

If you are in a low income year and will be taxed at a lower tax bracket than projected in the future, it may make sense to convert part of a traditional IRA to a Roth IRA. The current maximum contribution to a Roth IRA in a single year is $5,500 if under 50 and $6,500 if 50 plus. You will pay taxes on the distributions from the traditional but the benefit of a Roth is that all the contributions and earnings accumulated is tax free when distributed as long as the account has been opened for at least 5 years. Roth accounts are typically the last touched during retirement because you want the tax free accumulation as long as possible. Also, Roth accounts can be passed to a beneficiary who can continue accumulating tax free. Roth money is after tax money and therefore the IRS allows you to withdraw contributions tax and penalty free and let the earnings continue to accumulate tax free. If you don't have the cash come tax time to cover the conversion, you can convert the Roth money back to a traditional IRA by tax filing plus extension and the account will be treated as the Roth conversion never took place.

Donate to Charity if you Itemize

If you itemize deductions on your tax return, go through your closet and donate any clothing or household goods that you no longer use. There are helpful tools online that will allow you to value the items donated but be sure you keep record of what was donated and have the charity give you a receipt.

Max Out Your Employer Sponsored Retirement Plan

If you know you will be hit with a big tax bill and want to defer some of the taxes, max out your retirement plan if you haven't already. Employer sponsored plans, such as 401(k)'s, must be funded through payroll by 12/31 and therefore it is important to make this determination early and request your payroll department start upping your contribution for the remaining payroll periods in the year. The maximum for 401(k)'s in 2015 and 2016 is $18,000 if under 50 and $24,000 if 50 plus.

Business Owners – Cut Checks by 12/31

If your company had a great year and the cash is available, use it to pay for expenses you would normally hold off on. This could mean paying state taxes early, paying invoices you usually wait until the end of the payment term, paying monthly expenses like health or general insurance, or buying new office equipment. This might also mean investing in new office furniture such as chairs and desks, or more storage space for all of your paperwork and electronics. Above all, by getting the checks cut by 12/31, you realize the expense in the current year and will decrease your tax bill.

Business Owners – Set Up a Retirement Plan

For owners with no full time employees, a Single(k) plan being put in place by 12/31 will allow you to fund a retirement account up to the 401(k) limits mentioned early. As long as the plan is established by 12/31, the owner will be able to fund the plan any time before tax filing plus extension. If the plan is not established by 12/31, other options like the SEP IRA are available to take money off the table come tax time.With tax laws continuously changing, it is important to consult with your tax professional as there may be strategies available to you that could save you money. Don't procrastinate as some planning before the end of the year may be necessary to take full advantage.

About Rob.........

Hi, I'm Rob Mangold. I'm the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.

Understanding Investment Tax Forms

Making a wide variety of investments is a wise move as it means if one market drops, not all of your investments will be affected. If you've only invested in stocks or real estate then it would be a good idea to diversify. Take a look at this review and see if Bitcoin is something you want to invest in. The whole point of investing is to make a profit from your

Types of Investment Income

Making a wide variety of investments is a wise move as it means if one market drops, not all of your investments will be affected. If you've only invested in stocks or real estate then it would be a good idea to diversify. Take a look at this review and see if Bitcoin is something you want to invest in. The whole point of investing is to make a profit from your investments so you want to give yourself as much of a chance of success as possible. Income from investments can be divided into four main categories;

Interest – Interest income is paid on bonds and other types of fixed-income securities such as fixed annuities. Interest is always taxable as ordinary income unless it is paid inside an IRA or qualified plan or annuity contract. Municipal bond interest is also tax free and interest from treasury securities is exempt from taxation at the state and local levels.

Dividends – These represent a portion of a company's current profits that it passes on to shareholders. Dividends can be taxed as ordinary income, or they may qualify for lower capital gains treatment in some cases if they are coded as "qualified" dividends.

Capital Gains – This represents the amount of profit realized when an investment is sold at a higher price than that for which it was bought. Long-term gains are realized for investments held for at least a year and a day before they were sold, and are taxed at a lower rate than ordinary income. Short-term gains are taxed as ordinary income.

Retirement and Annuity Distributions – Although distributions from retirement plans are not technically a form of investment income, they are listed here because IRA and retirement plan owners can only access the gains from their investments in these accounts by taking distributions. Normal distributions are always taxed as ordinary income.

Tax Forms

Each income type listed above is broken out on a corresponding 1099 form issued by the broker or issuer of the income generated. Every form includes the name, address and tax ID number of the issuing entity. These forms are listed as follows:1099-INT – Breaks out the interest paid to the investor. This form is issued for anyone who owns bonds, CDs or mutual funds that invested in fixed income securities or cash or has an interest-bearing bank or brokerage account.

Box 1 shows total taxable interest paid

Box 2 shows the amount of early withdrawal penalty, if any

Box 3 shows the amount of U.S. Treasury security interest paid

Box 4 shows the amount of tax withheld

Box 5 shows investment expenses

Box 6 shows foreign tax paid

Box 7 shows the foreign payor

Box 8 shows tax-exempt interest

Box 9 shows interest from special private activity bonds

Box 10 shows the CUSIP number for tax-free bond interest

Boxes 11-13 show state ID information and withholding

1099-DIV – This breaks down the total amount of dividends paid to an investor. It is issued to holders of any common stock, preferred stock, or mutual fund that invests in them. However, it is not issued to owners of cash value life insurance policies, as those dividends are merely a return of premium.

Box 1a shows total ordinary dividends

Box 1b shows total qualified dividends

Boxes 2a-d break down capital gains from mutual funds, REITs and collectibles

Box 3 shows nondividend distributions

Box 4 shows federal tax withheld

Box 5 shows investment expenses

Boxes 6 and 7 show foreign tax paid and the foreign payor

Boxes 8 and 9 show cash and noncash liquidation distributions

Box 10 shows private interest dividends

Box 11 shows specified private activity bond interest dividends

Boxes 12-14 show state ID information and withholding

1099-B – This form breaks down the amount of capital gain or loss that the investor realized for that tax year. It is issued to everyone who bought or sold publicly traded securities at a gain or loss. Many brokerage firms issue additional statements that break down the loss or gain for each trade and then quantify them into net long- and/or short-term gains and losses for the year.

Box 1a shows the date of sale or exchange

Box 1b shows the date of acquisition

Box 1c shows whether it is a long- or short-term gain or loss

Box 1d shows the ticker symbol of the security

Box 1e shows the quantity sold

Box 2a shows the gross proceeds reported to the IRS both before and after commission and expenses

Box 2b shows a checkbox if loss not allowed due to amount shown in box 2a

Box 3 shows cost or other basis

Box 4 shows federal tax withheld

Box 5 shows any amount of wash sale loss that was disallowed

Box 6 has checkboxes for noncovered securities and for sales where the basis in box 3 was reported to the IRS

Box 7 shows income from bartering

Box 8 is for a description of the security if needed

Boxes 9-12 break down realized and unrealized gains and losses from derivatives contracts

Boxes 13-15 show state ID information and withholding

1099-R – This form is issued to everyone who receives distributions from IRAs, qualified retirement plans or annuity contracts that are not housed inside a tax-deferred account or plan.

Box 1 shows the gross distribution amount

Box 2a shows the amount of taxable distribution

Box 2b has checkboxes for taxable amount not determined and total distribution

Box 3 shows amount of capital gain included in box 2a

Box 4 shows federal tax withheld

Box 5 shows employee/Roth contributions

Box 6 shows net unrealized appreciation in employer securities

Box 7 shows the distribution code that determines how the distribution is taxed

Box 8 shows the value of any annuity contract included in the distribution

Box 9a shows the value of distribution percentage that belongs to the recipient

Box 9b shows the amount of the employee's investment for annuity distributions where the exclusion ratio must be computed

If Box 10 is filled, refer to instructions on Form 5329

Box 11 shows the year the recipient first made a Roth contribution of any kind

Boxes 12-17 show state and local ID information and withholding

1099 MISC – Although most of this form pertains to earned income, it is also used to report royalty income (box 1) and working interest income (box 7) in oil and gas leases.Form 5498 – The receiving custodian of a qualified plan rollover or IRA transfer issues this to the account holder as proof that the transfer was not a taxable event and should not be counted as a distribution.

About Michael.........

Hi, I'm Michael Ruger. I'm the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.