Is Inflation Peaking? That’s The Wrong Question…….

While a lot of investors are asking if inflation has peaked, there is a more importnat question they should be asking which will have a bigger impact on our path forward…….

As I write this article on May 11, 2022, the inflation number was just released for April indicating an 8.3% increase in the Consumer Price Index (CPI) which is the primary measure of the inflation rate. The news and market analysts seem to be consumed with the question “has inflation peaked?” Since the April CPI reading was below the March CPI of 8.5%, the answer may very well be “yes”, but I think there is a more important question that analysts and investors should be paying attention to and I would argue that the answer to this question will be more meaningful to the markets. Here it is, looking at all of the drivers of inflation right now, how does the inflation rate get back down to a level that will help the U.S. economy to avoid a recession?

Claiming victory that inflation has peaked could be a very short celebration if the level of inflation REMAINS at an elevated level for longer than the market and the Fed expects.

The Inflation Problem Has Become More Complex

At the end of 2021, it seemed to be the consensus that the primary driver of higher inflation was due to supply chain constraints in a post COVID world. The solution to that problem seemed fairly simple, as the global supply chain heals, there will be more goods to buy, and prices will gradually come down throughout 2022; but that has changed now. It’s not just supply chain issues that are driving inflation any longer, we now have:

Global supply chain issues

Russian / Ukraine conflict

Oil still over $100 per barrel

Tight labor markets

Wage growth

Strong corporate earnings but weaker forecasts

Fed policy

I would also argue that some of the inflation catalysts listed above will have a more significant impact on the rate of inflation than just the COVID supply constraints. In this article I’m going to walk you through the trends that we are seeing in each of these inflation catalysts and how they could impact inflation going forward. We do not believe that the market is doomed to enter a recession at this point but with so many more forces driving inflation higher, monitoring what really matters to the longer term inflation trend should be foremost in the mind of investors as the war against inflation enters the second half of the 2022.

Russia / Ukraine Conflict

Russia’s continued assault on Ukraine has caused a number of supply chain disruptions in itself but none more impactful to the U.S. than the price of oil. The price of oil has been over $100 per barrel for months which is huge driver of inflation since goods need to be transported on planes, ships, trucks, and trains. Oil companies are not in a rush to produce more because they are enjoying lofty profits and they realize that the price of oil could come down quickly if the violence ends in Ukraine. This is why they are hesitant to spend a lot of money to bring more production online because the price of oil could drop down to $80 or below within the next few months. Could oil go higher from here? It could. The Chinese economy has recently been hampered by COVID outbreaks so demand for oil has eased within the last month, but if this changes you could see the price of oil hit new highs on increased demand from China and we are about to enter the summer travel season in the U.S. If oil prices stay above $100 per barrel throughout the summer, it may keep inflation at elevated levels for longer than anticipated.

The Price of Oil

We just went through what’s driving the price of oil higher but if the price of oil drops within the next few months it’s not an automatic victory. If the price of oil is dropping because there is more supply coming online or because there is peace in Ukraine that is excellent, that should reduce inflationary pressures. However, if the price of oil is decreasing because demand is beginning to soften because the consumer is beginning to buy less, that’s not a positive indicator.

More Jobs Than Workers

Currently there are 5.9 million unemployed people in the U.S., and as of March there are 11.5M job openings which puts us at 2 job openings for every 1 person looking for work. If you look at the chart below of the total job openings, it’s easy to see that we are in uncharted territory here:

So, when you have more jobs than people looking for work, what do you think is going to happen to wages? They are going to go up. When you look back in history, one of the largest drivers of big inflationary periods is wage growth. Think about it this way, if the government hands you a stimulus check, you will be able to buy more stuff or pay higher prices for goods and services than you normally would, but this is temporary. Once you have spent that government stimulus money, you can no longer afford to pay higher prices.

If you change jobs, and you receive a $30,000 raise, now you can pay higher prices, not just this year but next year, and the year after that. Wage growth creates “sticky inflation”. It doesn’t just go away when the supply chain recovers or when oil prices retreat. As of April, wage growth has risen 6.4% over the past year, and the last time we saw wage growth over 6% was the 1970’s which not so coincidentally was a period of prolonged hyperinflation.

The only way I can foresee wage growth decreasing is a slow down in the economy which raises the risk of a recession. It’s simple supply and demand. If you have more jobs than people to fill them, companies will have to pay hire wages to attract and keep employees, the companies will most likely pass those higher costs onto the consumer in the form of higher prices, eventually the consumer can no longer afford those higher prices, the economy slows down, and then those excess jobs are eliminated. Not a fun storyline.

Subtle Warning Signs In Corporate Earnings

The tone from the Fed at the beginning of 2022 was that they will be raising rates to slow down inflation, but the economy is strong enough to withstand the rate hikes and we should be able to avoid a recession. The U.S. economy is driven primarily by consumer spending, and the consumer definitely showed up to spend in the first quarter of 2022. However, while many of the companies in the S&P 500 Index exceeded earning expectations, a number of them softened their outlook for the remainder of 2022 due to rising input costs and the impact of higher prices on consumer spending. Knowing that the stock market and bond market are forward looking animals, even though inflation has not taken a huge toll on corporate earnings yet, clouds are beginning to form which investors should pay close attention to.

Tech Stocks Getting Hit

As of May 9th, the S&P 500 Index is down 16% but the Nasdaq is down 26%. When inflation shows up, valuations begin to matter over a company’s growth story because cash becomes king. Here is how I explain it, if inflation is going up at 8% per year, if I ask you if you want me to give you $1 today or $1 a year from now, you would choose $1 today because a year from now, that dollar would have less purchasing power, because inflation is causing the price of everything to go up. It works the same way with stock prices.

The market uses P/E Ratios to determine how expensive stock is which is simply a company’s stock price divided by its earnings per share. If a company’s stock price is $100 and they are expected to earn $100 in profit for each share of stock, the P/E ratio would be 1. But it’s common for stocks to trade at 10, 15, or even 30 times one year of forward earnings. The higher the PE ratio, the more assumed future growth is built into the price of that stock. Some growth companies have very little in terms of net profit because they are spending a lot of money to make their big growth dreams come to life. These growth stocks can sometimes trade at a PE of 50, 100, or higher!!

When inflation hits and investors realize a dollar today is more valuable than a dollar tomorrow, they have to begin to discount those future returns that are built into stock prices. A stock that is trading at 50 times their one year earnings will typically have to drop in price a lot more than a stock that is only trading at 10 times it’s future one year earnings because you have to discount 50 years of earnings instead of 10.

Fed Policy

The last variable in the inflation equation is Fed policy. The Fed has a really tough job right now, reduce inflation without pushing the economy into a recession. When it was just supply chain issues, I think the market had it right by describing it as “the Fed is trying to engineer a soft landing”. With new inflationary forces now entering the equation, I would describe the Feds task as “threading a needle while the needle is moving”.

At the May meeting, the Fed announced, as expected, a 0.50% increase to the Fed funds rate, but during that meeting they also dismissed that a future 0.75% rate hike was on the table. The markets cheered and rose significantly that day hearing that a 0.75% hike was unlikely but then the next day the market lost all of those gains, and continues to add to the losses - worried that the Fed was not raising rates fast enough to keep higher inflation at bay.

It's All About Inflation

While a lot of attention is being given to the Fed and what the Fed might do next, the focus has to come back to not just stopping inflation from going higher but how do they get inflation to decrease fast enough before it derails the consumer. I highlight all of these inflation variables because you could get good news on supply chain improvements and corporate earnings but if oil remains above $100 per barrel and wage growth is still 6%+, it difficult to picture how the year over year change in the inflation rate gets below 4% or 5% before the end of the year.

The consumer is everything. If the consumer has higher wages and the cash reserves to withstand the higher prices while the Fed is working to bring inflation down, it is possible that we could see a rally in the second half of the year. But the long inflation persists, the less likely that relief rally scenario becomes.

This Time It’s Different

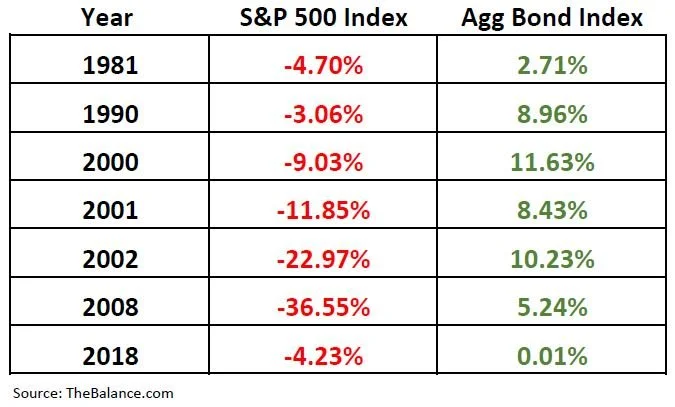

I urge all investors to be careful here. In the investment world you will sometimes hear the phase “this time it’s different” or “we have never been here before” which can add additional stress and anxiety to a market environment that is already scary. I urge caution here because in 2022 there has been a trend that is very different. In most market downturns, when stocks go down, bonds will typically be up, which is one of the benefits of a properly diversified portfolio. When you compare historical returns of the S&P 500 Index versus the Aggregate Bond Index, you will see this pattern:

Unfortunately, as of May 9, 2022, stocks and bonds are both down a significant amount year-to -date:

It feels like we are getting close to a fork in the road. Either we will begin to see meaningful improvement in the inflation rate over the next few months setting both the stock and bond market on a path to recovery in the second half of 2022, or despite the Fed’s best efforts, regardless of whether or not we have seen a peak in inflation, if inflation does not come down a meaningful amount by the fall, the U.S. economy may slip into a mild recession in 2023. Until we know, investors will have to pay very close attention to these monthly indicators that are driving the inflation rate.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Russia & Ukraine: Where Does The Stock Market Go From Here?

Russia’s invasion of Ukraine continues to add uncertainty to global markets. It’s left investors asking the following questions:

Russia’s invasion of Ukraine continues to add uncertainty to global markets. It’s left investors asking the following questions:

What is the most likely outcome of the invasion?

How will this impact the U.S. stock market and global economy?

How high will oil prices go?

Should the U.S. be worried about a Russia cyberattack?

What is China’s role in this conflict?

Will the stock and bond market crash in Russia create a global liquidity event?

Does this change the Fed’s timeline for interest rate hikes?

Do we expect a relief rally or the market selloff to continue?

We will provide you with our answers to these questions in this market update.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Should You Pay Down Debt or Invest Idle Cash?

When you have a large cash reserve, should you take that opportunity to pay down debt or should you invest it? The answer is “it depends”.

It depends on: ….

When you have a large cash reserve, should you take that opportunity to pay down debt or should you invest it? The answer is “it depends”. It depends on:

What is the interest rate on your debt?

What is the funding level of your emergency fund?

Do you have any big one-time expenses planned within the next 12 months?

What is the status of your financial goals? (college savings, retirement, house purchase)

How close are you to retirement?

What type of economic environment are you in?

Understanding the debt secret of the super wealthy

All too often, we see people make the mistake of investing money that they should be using to pay down debt, and this statement is coming from an investment advisor. In this article, I am going to walk you through the conversation that we have with our clients when trying to determine the best use of their idle cash.

What Is The Interest Rate On Your Debt?

Our first question is typically, what is the current interest rate on your debt? As you would expect, the higher the interest rate, the higher the payoff priority. As financial planners, we look at the interest rate on debt as a risk-free rate of return, similar to a return that you might receive on a bank CD or a money market account. If you have a credit card with a balance of $10,000 and the interest rate is 15%, you are paying that credit card company $1,500 in interest each year. If you use your $10,000 in idle cash to payoff you credit card balance, you get to keep that $1,500. We considered it a “risk-free” rate of return because you don’t have to take any risk to obtain it. By paying off the balance, you are guaranteed to not have to pay the credit card company that $1,500 in interest.

If instead you decided to invest that money, you would have to invest in something that earns over a 15% annual rate of return to be ahead of the game. To obtain a 15% rate of return is most likely going to involve taking a high level of risk, meaning you could lose some or all of your $10,000 investment so it’s not an apple to apple comparison because the risk level is different. I will bluntly ask clients: “can you get a bank CD right now that pays you 15%?” When they say “no way”, then I repeat the guidance to pay down the debt because every dollar that you pay toward the debt is receiving a 15% rate of return which you are not paying to the credit card company.

A Tough Decision

A 15% interest rate on debt makes the decision pretty easy but what happens when we are talking about a mortgage that carries a 3% interest rate. Clearly a more difficult decision. Someone who is 40 years old, that has 25 years until retirement might ask, “why would I use my cash to pay down the mortgage with a 3% interest rate when I could be earning 8% per year plus in the stock market over the next 25 years?” The answer can be found in the rest of the variables below.

Emergency Fund

When unexpected events happen in life, it is common for those unexpected events to cost money, which is why we encourage our clients to maintain an emergency fund. Maintaining an adequate cash reserve prevents these unexpected financial events from disrupting your plans for retirement, paying for college, from having to liquidate investments at an inopportune time in the market, or worse to go into debt to pay those expenses. While it is painful to see cash sitting there in a savings account earning minimal interest, it serves the purpose of insulting your overall financial plan from setbacks cause by unplanned events which in turn increases your probability of achieving your financial goals over the long term.

What is the right level of cash to fund an emergency fund? In most cases, we recommend 4 to 5 months of your living expenses. There is a balance between having adequate cash reserves and holding too much cash. There is an opportunity cost associated with holding too much cash. By holding cash earning less than 1% in interest, you may be giving up the opportunity to earn a higher return on that cash, whether that involves investing it or paying down debt with it.

Here is a common scenario, let’s say someone has $50,000 in cash in their savings account, and 4 months of living expenses is $30,000, that means there is $20,000 in excess cash that could be potentially earning a higher return than it sitting in their bank account. If they are willing to accept some risk, they may be willing to invest that $20,000 in an attempt to generate a higher return on that idle cash, or the cash may be used to fund a college savings account or retirement account which could carry tax benefits as well as advancing one or more of their personal financial goals.

But what if you don’t want to take any risk with that additional $20,000? If you have a mortgage with a 3% interest rate, by applying that $20,000 toward the mortgage, it is technically earning 3% because you are not paying that 3% interest to the bank. Since the interest rate on the mortgage is probably higher than the interest rate you are receiving in your savings account, that cash is working harder for you, and you have the added benefit of paying off your mortgage sooner.

Big One-Time Expenses

Once we have determined the appropriate funding level of a client’s emergency fund and there is excess cash over and above that amount, our next question is “do you have any larger one-time expenses that you foresee over the next 12 months?” For example, you may be planning a kitchen renovation, purchase of a house, or tuition payments for a child. If you will need that excess cash to meet expenses within the next 12 months, you may want to just hold onto the cash. If you use the cash to pay down debt, you won’t have the cash to meet those anticipated expenses in the future, or if you invest the cash, and the value of the investment drops, you may not have time to wait for the investment to recover the lost value before you need to liquidate the investment.

Typically, when we talk about investing, whether it’s in stocks, bonds, mutual funds, or some other type of security, it involves taking more risk than just sitting in cash. The shorter the timeline on the one-time expense, the more risk you take on by investing the cash. Historically, riskier asset classes like stocks behave in more consistent patterns over 10+ year time periods, but it’s impossible to predict how a specific stock or even a bond mutual fund will perform over a specific 3 month period.

Now, if interest rates ever get higher again, and you can find a 6 month or 1 year CD, or money market that pays a decent interest rate, then you may consider allocating some of that short term excess to work in a guaranteed security. Be careful of products liked fixed annuities, even through they may carry an attractive guaranteed interest rate, many annuities have surrender fees if you cash in the annuity prior to a specified number of years.

Status Of Your Various Financial Goals

Our next series of question revolves around assessing the status of a client’s various financial goals:

When do you plan to retire? Are your retirement savings adequate?

Do you have children that will be attending college? Have you started college savings accounts?

You just bought a house. Do you have an adequate amount of term life insurance?

Do you expect to be in a higher tax bracket this year? We may need to find ways to reduce your taxes.

Do you have estate documents in place like wills, health proxies, and a power of attorney?

What are your various financial goals over the next 10 years?

If we find that there is a shortfall in one of these areas, we may advise clients to use their excess cash to shore up a weakness in their overall financial picture. For example, if we meet with a client that has 3 children, ages 8, 5, and 3, and we ask them if they plan to help their children to pay for college, and they say “yes” but they have not yet determined how much financial aid they may receive, how much college is going to cost, and the best type of account to save money in to meet that goal, we will probably run projections for them, discuss how 529 accounts work, and potentially allocate some of their excess cash to fund those accounts.

How Close Are You To Retirement?

One factor that normally weighs heavily on our guidance as to whether someone should use excess cash to pay down debt or invest it is how close they are to retirement. Regardless of the market environment that we are in, we typically encourage our clients to reduce their fixed expenses as much as possible leading up to retirement. But when the stock market is going up by 10%+ and someone has $50,000 left on a mortgage with a 3% interest rate, they will ask me, why would I use my excess cash to pay down debt with a 3% interest rate when I’m earning a lot more keeping it invested in the market?

My response. I have been doing retirement projections for a very long time and when we do these projections, we are making assumptions about:

Annual rates of return on your investments

Inflation rates

Tax rates in the future

The fate of a broken social security system

How long you are going to live?

Probability of a long-term care event

These assumptions are estimated guesses based on historical data but who’s to say they are going to be right. In retirement you don’t have control over the stock market, inflation, or unexpected health events. The only thing you have full control over in retirement is how much you spend. The lower your annual expenses are, the more flexibility you will have within your plan, should one or more of the assumptions in your plan fall short of expectations. There will always be recessions but recessions are a lot more scary when you are retired and drawing money out of your retirement account, while at the same time your accounts may be losing value due to a drop in the stock or bond market. If you have lower expenses, it may allow you to reduce the distributions from your retirement accounts while you are waiting for the market to recover, which could greatly reduce the risk of running out of assets in retirement.

Type of Market Environment

While no one has a crystal ball, there are definitely market environments that we as investment advisors view as more risky than others. When economic data is providing us with mixed signals, there are geopolitical events unfolding that we have no way of predicting the outcome, or we are navigating through a challenging economic environment, it increases the risk level of investing excess cash in an effort to generate a return greater than the interest rate that someone may be paying on an outstanding debt. We definitely take that into account when advising clients whether to invest their cash or to use it to pay down debt.

The Debt Secret of The Super Wealthy

I have recognized a trend as it pertains to high net worth individual and how they invest, which is a concept that can be applied at any level of wealth. Having less debt, can provide individuals with the opportunity to take greater risk, which in turn can lead to a faster and greater accumulation of wealth.

If someone has no debt and they have $90,000 in cash to invest, because they have no debt, they may not need any of that cash to meet their future expense. Assuming they have a high tolerance for risk, they may choose to invest in 3 start-up companies, $30,000 each. Since investing in start-ups is known to be very risky, all three companies could go bankrupt. If 2 companies go bust, but the third company gets acquired by a public company that results in a 10x return on the investment, that $30,000 initial investment grows to $300,000, which subsidizes the losses from the other 2 companies, and still generates a giant return for the investor.

Someone with debt and corresponding higher fixed expenses to service the debt, may find it difficult and even unwise to enter into a similar investment strategy, because if they lose all or a portion of their $90,000 initial investment, it could upend their entire financial picture.

Just an additional note, investors that are successful with these higher risk strategies do not blindly throw money around at high risk investments. They do their homework but having no debt provides them with the opportunity to adopt investment strategies that may be out of reach of the average investor.

In summary, there are situation where it will make sense to invest idle cash in lieu if paying down debt but there are also situations that may not be as obvious, where it makes to pay down debt instead of investing the idle cash. Before just playing the interest rate game, it’s important to weigh all of these factors before making the decision as to the best use of your idle cash.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Will The January Market Selloff Continue?

The markets have experienced an intense selloff in the first three weeks of 2022. As of January 21st, the S&P 500 Index is down over 7% for the month. There are only a few times in the past 10 years that the index has dropped by more the 5% in a single month. That begs the questions, “After those big monthly declines, historically, what happens next?”

The markets have experienced an intense selloff in the first three weeks of 2022. As of January 21st, the S&P 500 Index is down over 7% for the month. There are only a few times in the past 10 years that the index has dropped by more the 5% in a single month. That begs the questions, “After those big monthly declines, historically, what happens next?” Continued decline? Market recovery? We are going to answer that question in this article

The recent selloff has also been widespread. The selloff in January has negatively impacted stocks, bonds, crypto, while inflation continues to erode the value of cash. It has essentially created a nowhere to hide market environment. As of January 21, 2022, the YTD returns of the major indices are:

S&P 500 Index: -7.7%

Nasdaq: -12.0%

Small Cap 600: -8.5%

Agg (Bonds): -1.7%

Bitcoin: -24.1%

In this article I’m going to cover:

What has caused the selloff?

Do we expect the selloff to continue?

This Has Happened Before

How many times has the S&P 500 index dropped by more than 5% in a month over the past 10 years?

Answer: 4 times

February 2020: -18.92%

November 2018: -5.56%

December 2015: -6.42%

July 2011: -10.40%

Next question: How many times did the S&P 500 Index post a positive return 3 months following the month with the 5%+ loss?

Answer: ALL OF THEM

Mar 2020 – May 2020: 16.7%

Dec 2018 – Feb 2019: 9.5%

Jan 2016 – Mar 2016: 8.6%

Aug 2011 – Oct 2011: 4.0%

Don’t Make The Jump In / Jump Out Mistake

There is no doubt that the big, swift downturns in the markets bring fear, uncertainty, and stress for investors but all too often investors let their emotions get the better of them and the lose sight of the biggest economic trends that are at work. The most common phrase that I hear from investors during these steep declines is:

“Maybe we should just go to cash to stop the losses and then we can buy back into the stock market once the risks have passed.”

The issue becomes: when do you get back in? Following these big temporary sells offs in the market, it is common that the lion share of the gains happened before things feel good again. Investors get back in after the market has already rallied back, meaning they solidified their losses and they are now allocating money back into stocks when they have returned to higher levels.

We accurately forecasted higher levels of volatility in the market in 2022 when we release our 2022 Market Outlook video. It is also our expectation that with inflation rising and the Fed moving interest rates higher, the selloff that we have experienced in January, will not be the only steep selloff that we are faced with this year. Before we get into the longer- term picture, let’s first look at what prompted the January selloff in the markets.

What Caused The Market Selloff in January?

There are a number of factors that we believe has caused this severe selloff in January:

COVID Omicron cases have surged

The Fed’s more hawkish tone

Rising interest rates

Tech sector selloff

COVID investment plays unwinding

Loss of enhanced child tax credit monthly payments

While that looks like a long list, at the risking sounding like a broken record, if you go back to the Market Outlook video that we released in December, all of these were expected. It’s only when unexpected events occur that we then have to shift our strategy for the entire year. Let’s look at each of these items one by one:

COVID Cases Have Peaked

One thing that caught the market by surprise over the past few months is how contagious the Omicron variant was and how many cases there would be. This caused the recovery story to stall as safety measures were put back into place to control the spread of the most recent variant. The good news is it looks like the cases have peaked and are now on the decline. See the chart below:

It's a little tough to see in the chart but the blue line represents the number of confirmed COVID cases. If you look all the way on the righthand side, as of January 20th, they have dropped dramatically. The 7-day moving average has dropped by about 100,000 cases. This trend supports our forecast that the economy will begin opening up again starting in February. We expect the reopening trade story to be part of the market rally coming off of this tough January for the markets.

The Fed’s Hawkish Tone

It's the Fed’s job to keep inflation under control so the economy does not overheat. Inflation has been running at rate of over 6% for the past several months and going into 2022, the Fed telegraphed making 3 rate hikes in 2022. After the Fed’s January meeting, an even more hawkish tone was found in those meeting minutes, suggesting that more than 3 rate hikes could be on the table this year. This caused interest rates to rise rapidly which hurt both stocks and bonds in January.

But let’s take a look at history. The last time the Fed started raising rates was in 2016. Between 2016 and 2018, they hiked the Fed Funds Rate 8 times. During that two-year period, the S&P 500 was up 15.8%. The lesson here is just because the Fed is beginning to raise rates does not necessarily mark the end of the bull market rally.

Rising Interest Rates

Interest rates rose sharply in January which put downward pressure on both stocks and bonds. Investor often have bonds in their portfolio to offer protection when the there are selloffs in the stock market but when interest rates are moving high and the stock market is selling off at the same time, both stocks and bonds tend to move lower together. The yield on the 10 Year Treasury jumped from 1.51% on December 31, 2021 to 1.86% on January 18, 2022. That does not sound like a big increase but in terms of interest rates that is a huge move in 18 days. (In percentage terms, over 23%)

We do expect interest to continue to rise in 2022 but not at the concentrated monthly pace that we saw in January.

Tech Stock Drop

Tech stock took a big hit in January. The Nasdaq is down 12% in the first three weeks of 2022. In the 2022 Market Outlook we talked about tech stock coming under pressure this year in the face of rising interest rate and a lesson from the 1970’s about the “Nifty Fifty”. These tech stocks tend to trade at higher valuations. Interest rates and valuation levels tend to have an inverse relationship meaning if a stock is trading at a higher valuation level (P/E), they tend to be more adversely affected compared to the rest of the market when interest rates move higher.

COVID Investment Plays Unwind

In January, stocks that were considered “stay at home” COVID plays, like streaming, home exercise equipment, and electronic document providers experience large corrections. Here are some of the names that fall into that space and their performance YTD as of January 21, 2022:

Netlfix: -33%

Peloton: -23%

DocuSign: -23%

Now that the United States has reached a level of vaccinations and positive COVID cases that would suggest that we are at or close to herd immunity, there seems to be a higher likelihood that future COVID variants may not cause extreme economic shutdowns that supported the higher valuation level of these “stay at home” investment strategies.

Loss of Child Tax Credit Payments

Since the Build Back Better bill did not pass in December 2021, the $300+ per month that many parents were receiving for the Enhanced Child Tax Credits stopped in January. While those monthly payments to families were only meant to be temporary, it was highly anticipated that they were going to be extended into 2022 with the passing of the Build Back Better bill. Not having that extra money every month could slow down consumer spending in the first quarter of 2022.

Do We Expect The Selloff To Continue?

No one has a crystal ball but I would be very surprised if we do not see a recovery rally in the markets over the next few months. I think people underestimate the amount of money that has been injected into the U.S. economy over the past 18 months. If you total up all of the COVID stimulus packages over the past 18 months, they total $6.9 Trillion dollars. Compare that to the TARP Stimulus package that saved the banks and housing market in the 2008/2009 recession which only totaled $700 Billion. A lot of that stimulus money has yet to be spent due to supply change and labor constraints over the past year.

It's our expectations that the supply chain, which is already showing improvement, will continue to heal as we move further into 2022, which will give rise to higher levels of consumer spending and in turn, higher corporate earnings.

Inflation will be the greatest risk to the economy in 2022, but if the recovery of the supply chain causes prices to stabilize and consumers have the cash and wages to pay these temporarily higher prices, the bull rally could continue in 2022. But again, it will be choppy. The market could experience numerous corrections similar to what we are experiencing in January that investors may have to hold through, especially as the Fed begins to announce interest rate hikes later this year. We expect patience to be rewarded in 2022.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

2022 Market Outlook

There are trends that are developing in the U.S. economy that we have not seen for decades. As inflation continues to rise at a rapid pace, we have to look back to the 1970’s as a reference point to determine how inflation could impact stocks, bonds, gold, and cash going into 2022. The most common questions that we have received from clients over the past few weeks are:

There are trends that are developing in the U.S. economy that we have not seen for decades. As inflation continues to rise at a rapid pace, we have to look back to the 1970’s as a reference point to determine how inflation could impact stocks, bonds, gold, and cash going into 2022. The most common questions that we have received from clients over the past few weeks are:

Will the stock market rally continue into 2022?

Will higher inflation derail the economy?

How will the market react to the Fed increasing interest rates in 2022?

A lesson from “The Nifty Fifty”

How will the labor shortage and supply chain issues impact the markets in 2022?

I plan to address all of these questions and more as we present our market outlook for 2022.

The Economy Will Continue to Strengthen

It’s our expectation that we will see the U.S. economy gain strength in the first half of 2022. Our economy is based primary on consumer spending and the consumer is charged with cash and ready to spend. The cash has come from record levels of government stimulus in 2020 and 2021, as well as rising wages across many sectors in the U.S. economy. Debt levels are also at historic lows as well. Due to the supply chain constraints, people could not spend the money, therefore they paid down their debt. Per the chart below, debt payments as a percent of U.S. households’ disposable income is at the lowest level in over 40 years.

Talk to any pool company and they will provide you with a clear picture of the pent- up demand. Some pool installers are fully booked through 2022 and are taking deposits for pools for 2023.

Back Orders At Record Levels

Many of the companies that we have spoken with across various industries have back orders at record levels. With back orders, the customer is already committed to buying a product from a company whether it’s a car, roof, gym equipment, etc., but they have yet to take delivery of that product. When the product is delivered, they normally submit full payment, and the company realizes the revenue. From an outlook standpoint, when companies have large back orders, it takes some of the risk off the table because it is not an “if the sales are going to be there to generate revenue” but rather “how quickly can the company deliver the product to their customers”.

Supply Chain Constraints

The answer to the question “how quickly can they deliver?” relies heavily on how fast the global supply chain can get back online going into 2022. People have been slower to return to the workforce than originally expected, which means less people at the ports to unload container ships, less truck drivers to transport the goods from the ports to the stores, and less employees in stores to stock shelves. However, we see a number of new trends that should ease these constraints in 2022:

Individuals needing to return to the workforce after depleting stimulus cash reserves

Employer offering higher wages and sign on bonuses to attract employees

A higher level of vaccination rates in children, easing childcare constraints, and allowing more parents to return to the workforce

I think the economy has largely underestimated the impact of the childcare constraints on the ability for parents to return to the workforce. If your child has a cough, even though a test may reveal that they don't have COVID, they may not be able to return to school for a few days, requiring a parent to take time off from work.

Relief At The Ports

The two main ports in the U.S are the “twin ports” in Los Angeles and Long Beach; 40% of sea freight enters the U.S. through those two ports. Both have been working around the clock to unload ships and they are making significant progress. Mario Cordero, executive director of the Port of Long Beach, stated that in mid- November there were 111 ships off the coast of California waiting to be unloaded and within two weeks that number was reduced to 61 ships. However, it takes time for the goods to get off the ship, loaded onto a truck, and delivered to stores and businesses, but the trend is going in the right direction.

Record Levels of Cash Injection

Over the past 18 months, the U.S. Government has injected more cash into our economy than any other time in history. To put this in perspective, let's compare the dollar amount of the bailout packages during the Great Recession of 2008 / 2009, to the level of cash injection over the past 18 months. In the illustration below on the left side you will see the TARP Program which was the government bailout for the banks and the housing market in 2008 / 2009. On the right, you will see all of the stimulus program that the government rolled out in 2020 / 2021 to battle COVID.

The total cost of TARP was $700 Billion.

Over the past 18 months the government has injected almost $7 Trillion…………TRILLION……into the U.S. economy. That is 10 times the TARP program that was used to rescue the US economy in 2008/2009 when we almost lost the entire U.S. banking system.

To go one more step, below is a chart of the year over year change in the M2 money supply. This allows us to see how much cash is circulating within the U.S. economy compared to the prior year going all the way back to 1980.

Look at that mountain on the righthand side of the chart. We have had recession in the past which has required the government to inject liquidity, which are illustrated by the grey areas in the chart, but nothing to the magnitude of what we have seen over the past 18 months. Just a side note, this chart does not include the recent $1.2 Trillion dollar infrastructure bill that was already passed or the $1.75 Trillion Build Back Better bill that is deck.

A lot of this cash that has been injected into the economy has not been spent yet because due to the supply chain constraints, consumers and business have not been able to spend it. As the supply chain gets back online in 2022 and 2023, consumers and businesses will be able to put this cash to work which should be a boost to the U.S. economy.

Inflation, Inflation, Inflation

The great risk to the economy as we enter 2022 is undoubtedly rising inflation. We have all seen prices rise rapidly for just about everything we buy: groceries, gas, travel, etc. The supply chain issues have made this problem worse because the less goods there are, the more expensive they become. This leads us to the main question which is:

“Will inflation subside once the supply chain gets back online or are these higher levels of inflation that we are seeing now just the beginning?”

This is the question that everyone wants the answer to but it’s too early to tell. The only thing that's going to provide us with the answer is time, so we are going to be watching these trends unfold week by week, month by month, as the data comes in during 2022. In my opinion, there is an equal chance of both scenarios playing out. Scenario one, the supply chain improves throughout 2022, increasing the supply of goods and services, which in turn stabilizes prices, and the risk of hyperinflation begins to fade. Scenario two, either the supply chain does not heal fast enough, or wage growth continues to escalate, causing inflation rates to continue to rise, forcing the Fed’s hand to raise rates more quickly.

You have to remember that inflation only begins to do damage when prices rise to levels that consumers and businesses can no longer afford. Given the historic levels of cash that have been injected into the economy, it’s our expectation that even with prices rising over the next 6 months, that may not curb the consumers ability or desire to purchase those same goods and services at higher prices.

The Fed

The Fed has two main objectives:

Keep the economy at full employment

Keep inflation within its target range of 2% - 3%

As you can see in the chart below, the CPI (Consumer Price Index) which is the Fed’s main measuring stick for inflation has risen well above the Fed’s 3% comfort zone and continues to rise.

In November, it was reported that the year over year change in CPI (inflation) was 6.9%. That’s a big number. In response to these heightened levels of inflation, the Fed has increased its timeline for decreasing the amount of bonds that it is purchasing as well as escalating the timeline for their first interest rate hike. With these changes, the Fed is intentionally tapping the brakes, so the economy does not overheat and give rise to hyperinflation like we saw in the 1970’s. But it's important to understand that every time the Fed raises interest rates, it is working against economic growth because it makes lending more expensive. Less lending normally means less spending.

This change in the Fed stance is not necessarily an end all for the stock market rally. Investors have to remember the Fed is raising rates because the economy is strong which has caused prices to rise. Historically, as long as the Fed is able to raise rates at a measured pace, the economy and the market have time to digest those small increases, and the growth trend can continue. It is when the Fed has to raise rates in large increments in a relatively short period of time, it creates more of an abrupt end to an economic expansion. Think of it this way, if the interest rate on a 30-year mortgage go from 3.25% to 3.50% it’s not going to necessary derail the housing market. But if that 30-year mortgage rate goes from 3.25% to 5% in short period of time, that could cause a huge drop in housing prices because people will no longer be able to afford the mortgage payments to purchase a house at these elevate prices.

The Nifty Fifty

Looking at that inflation chart that I showed you earlier, it’s been 30 years since the Core CPI index has been over 3%. People that just started investing within the last 30 years have not seen the impact of inflation on stock, bonds, cash, and other asset classes. The last time the U.S. economy experienced higher inflation for a prolonged period of time was the 1970’s. There are a lot of important investment lessons that we learned in the 1970’s but one of them that bears mentioning is the lesson of the “Nifty Fifty”.

The Nifty Fifty was the name given to a group of stocks in the 1970’s that were the darlings of the stock market. Companies like McDonalds, Polaroid, Disney, IBM, Johnson & Johnson were names within the Nifty Fifty. This group of stocks are similar to the FANGs that we have today which include Facebook, Amazon, Netflix, and Google.

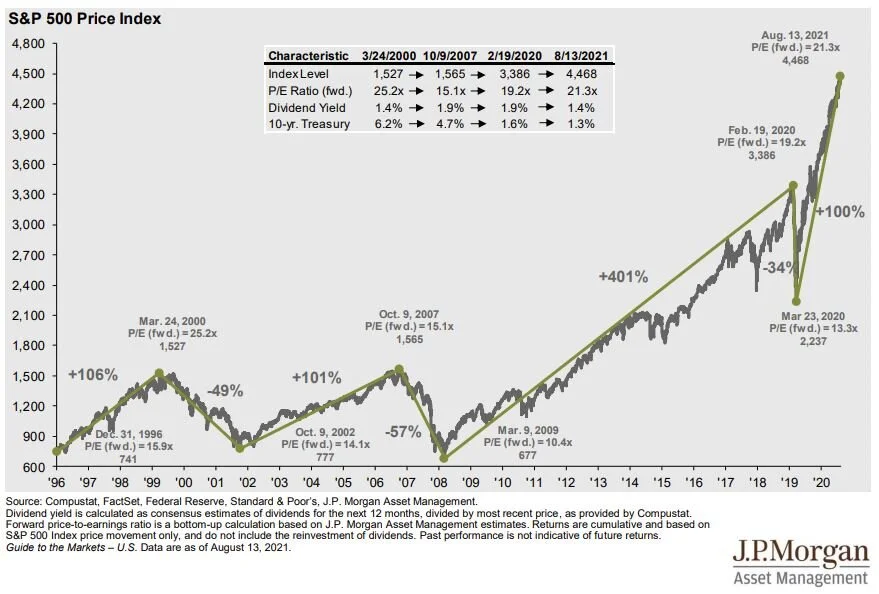

Why the comparison? Coming out of the 1960’s there was prolonged bull market rally, similar to the one we have today, these Nifty Fifty stocks were the growth engines of the market, and as such they traded at very high valuations (P/E ratios) compared to their peers in the stock market. Many of the Nifty Fifty stocks had P/E ratios above 50 times forward earnings. To put that in perspective, right now the S&P 500 Index has a P/E of about 21x forward earnings. When higher inflation shows up, it traditionally has a larger negative impact on stocks that are trading at higher multiples compared to stock that have lower P/E ratios. This is because higher interest rates erode the present value of those future earnings that are baked into the price of those stocks. When higher inflation showed up in the 1970’s, many of stocks in the Nifty Fifty dropped by over 60%. Investors need to remember, when the economy is good and inflation is low, the market tends to care less about valuations. When inflation increase and/or the economy slows down, all of a sudden valuations will begin to matter again to investors.

I’m making this point as a word of caution; the Nifty Fifty and the FANG have a lot of similarities. Even though, at this point, I do not expect a hyper inflationary environment like the 70’s, a rise in inflation may have a similar impact on stocks trading at a higher valuation. Netflix current trades a PE of 55, Amazon (P/E 66), Microsoft (P/E 38). The market looked at the Nifty Fifty similar to how I hear investors talk about the FANG stocks now, “how can they ever go down?” Also from a psychological standpoint, investors often find it difficult to sell holdings that have made them a lot of money, and these FANG stocks have increase in value a lot over the past 10 years. There is also the tax hit that investors incur in taxable accounts when unrealize gains turn into realized gains.

To be clear, this is not a recommendation for investors to go sell of their FANG stocks, it’s about understanding the trends that have played out in history, how those trends may compare to where we are now when assessing risk, opportunity, and the investment decisions that we may face in 2022.

2022 Outlook Summary

Brining all of these variables together, we expect the first half the year to bring with it strong economic growth which should be a favorable environment for risk assets. But…….we don’t anticipate that it will be a smooth ride in 2022 for equity investors. As the Fed implements its anticipated interest rate hikes, there could be a number of selloffs throughout the year that will test the patience of investors. If inflation does not get out of control, those selloffs could be an opportunity for investors to put cash to work, as the market shakes off the scary headline risks and the growth trend continues. We expect the labor shortage and supply chain issues to improve in 2022, which should help to ease some of the inflation fears as prices begin to stabilize in 2022 and potentially drop going into 2023.

The second half of the year will depend largely on the trend of inflation. If inflation runs hotter than expected, it could begin to have an impact on consumer spending as prices rise above what consumers are willing to pay, and it could force the Fed to increase the magnitude or frequency of rate hikes in 2022. Either of those two items could potentially erase or decrease the gains the U.S. stock market may have achieved in the first half of the year.

With higher levels of volatility almost a given for 2022, investor may have to resist the urge to sell out of their stock positions and retreat to bonds or cash knowing that an inflationary environment is an enemy of both high-quality bonds and cash. Overall, investors will have to pay closer attention the economic and inflation data throughout the year to determine if pivots should be made in their investment strategy, especially as we enter the second half of the year.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

What Caused The Market To Sell Off In September?

What Caused The Market To Sell Off In September?

The stock market experienced a fairly significant drop in the month of September. In September, the S&P 500 Index dropped 4.8% which represents the sharpest monthly decline since March 2020. I wanted to take some time today to evaluate:

· What caused the market drop?

· Do we think this sell off is going to continue?

· Have the recent market events caused us to change our investment strategy?

September Is Historically A Bad Month

Looking back at history, September is historically the worse performing month for the stock market. Since 1928, the S&P 500 Index has averaged a 1% loss in September (WTOP News). Most investors have probably forgotten that in September 2020, the market experienced a 10% correction, but rallied significantly in the 4th quarter.

The good news is the 4th quarter is historically the strongest quarter for the S&P 500. Since 1945, the stock market has averaged a 3.8% return in the final three months of the year (S&P Global).

The earned income penalty ONLY applies to taxpayers that turn on their Social Security prior to their normal retirement age. Once you have reached your normal retirement age, this penalty does not apply.

Delta Variant

The emergence of the Delta Variant slowed economic activity in September. People cancelled travel plans, some individuals avoided restaurants and public events, employees were out sick or quarantined, and it delayed some companies from returning 100% to an office setting. However, we view this as a temporary risk as vaccination rates continue to increase, booster shots are distributed, and the death rates associated with the virus continue to stay at well below 2020 levels.

China Real Estate Risk

Unexpected risks surfaced in the Chinese real estate market during September. China's second largest property developer Evergrande Group had accumulated $300 billion in debt and was beginning to miss payments on its outstanding bonds. This spread fears that a default could cause issues other places around the globe. Those risks subsided as the month progressed and the company began to liquidate assets to meet its debt payments.

Rising Inflation

In September we received the CPI index report for August that showed a 5.3% increase in year over year inflation which was consistent with the higher inflation trend that we had seen earlier in the year. In our opinion, inflation has persisted at these higher levels due to:

· Big increase in the money supply

· Shortage of supply of good and services

· Rising wages as companies try to bring employees back into the workforce

The risk here is if the rate of inflation continues to increase then the Fed may be forced to respond by raising interest rates which could slow down the economy. While we acknowledge this as a risk, the Fed does not seem to be in a hurry to raise rates and recently announced plans to pare back their bond purchases before they begin raising the Fed Funds Rate. Fed Chairman Powell has called the recent inflation trend “transitory” due to a bottleneck in the supply chain as company rush to produce more computer chips, construction materials, and fill labor shortages to meet consumer demand. Once people return to work and the supply chain gets back on line, the higher levels of inflation that we are seeing could subside.

Rising Rates Hit Tech Stocks

Interest rates rose throughout the month of September which caused mortgage rates to move higher, but more recently there has been an inverse relationship between interest rates and tech stocks. As interest rates rise, tech stocks tend to fall. We attribute this largely to the higher valuations that these tech stocks trade at. As interest rates rise, it becomes more difficult to justify the multiples that these tech stocks are trading at. It is also important to acknowledge that these tech companies have become so large that the tech sector now represents about 30% of the S&P 500 Index (JP Morgan Guide to the Markets).

Risk of a Government Shutdown

Toward the end of the month, the news headlines were filled with the risk of the government shutdown which has been a reoccurring issue for the U.S. government for the past 20 years. This was nothing new, but it just added more uncertainty to the pile of negative headlines that plagued the markets in September. It was announced on September 30th that Congress had approved a temporary funding bill to extend the deadline to December 3rd.

Expectation Going Forward

Even though the Stock Market faced a pile of bad news in September, our internal investment thesis at our firm has not changed. Our expectation is that:

· The economy will continue to gain strength in coming quarters

· There is a tremendous amount of liquidity still in the system from the stimulus packages that has yet to be spent

· People will begin to return to work to produce more goods and services

· Those additional goods and services will then ease the current supply chain bottleneck

· Interest rates will move higher but they still remain at historically low levels

· The risk of the delta variant will diminish increasing the demand for travel

We will continue to monitor the economy, financial markets, and will release more articles in the future as the economic conditions continue to evolve in the coming months.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Beware of Annuities

I’ll come right out and say “I’m not a fan of annuities”. They tend to carry:

1) Higher internal fees

2) Surrender charges that prevent investors from getting out of them

3) “Guarantees” that are inferior to alternative investment solutions

Unfortunately, annuities pay Financial Professionals a lot of money, which is why it is not uncommon for Investment Advisors to present them as a primary solution. For example, some annuities pay Investment Professionals 5% - 8% of the amount invested, so if you invest $200,000 in the annuity, the advisor gets paid $10,000 to $16,000 as soon as you deposit the money to the annuity. Compared to an Investment Advisor that may be charging you 1% per year to manage your portfolio, it will take them 5 to 8 years to earn that same amount.

To be fair, there are a few situations where I think annuities make sense, and I will share those with you in this article. In general, however, I think investors should be very cautious when they are presented with an annuity as a primary investment solution, and I will explain why.

Fixed Annuities & Variable Annuities

There are two different types of annuities. Fixed annuities and variable annuities. Within those categories, there are a lot of different flavors, such as indexed annuities, guaranteed income benefits, non-qualified, qualified, etc. Annuities are often issued by banks, investment firms, insurance companies, employer sponsored plan providers, or directly to the consumer. It is important to understand that not all annuities are the same and they can vary greatly from provider to provider. The points that I will be making in this article are my personal option based on my 20 years of experience in the investment industry.

Annuities Have High Fees

My biggest issue with annuities in general is the higher internal costs associated with them. When you read the fine print, annuities can carry:

· Commissions

· Contract fees

· Mortality expenses

· Surrender fees

· Rider fees

· Mutual fund expense ratios

· Penalties for surrender prior to age 59½

When you total all of those annual fees, it can sometimes be between 2% - 4% PER YEAR. The obvious questions is, “How is your money supposed to grow if the insurance company is assessing fees of 2% - 4% per year?”

Sub-Par Guarantees

The counter argument to this is that the insurance company is offering you “guarantees” in exchange for these higher fees. During the annuity presentation, the broker might say “if you invest in this annuity, you are guaranteed not to lose any money. It can only make money”. Who wouldn’t want that? But the gains in these annuities are often either capped each year, or get chipped away by the large internal fees associated with the annuity contract. So, even though you may not “lose money”, you may not be making as much as you could in a different investment solution.

Be The Insurance Company

At a high level, this is how insurance companies work. They sell you an annuity, then the insurance company turns around and invests your money, and hands you back a lower rate of return, often in the form of “guarantees”. That is how they stay in business. So, my question is “Why wouldn’t you just keep your money, invest it like the insurance would have, and you keep all of the gains”?

The answer: Fear. Most investments involve some level of risk, meaning you could lose money. Annuity presentations prey on this fear. They will usually show financial illustrations from recessions, such as when the market went down 30%, but the annuity lost no value. For retirees, this can be very appealing, because the working years are over and now they just have their life savings to last them for the rest of their lives.

But like other successful investors, insurance companies rely on the historical returns of the stock market, which suggest that over longer periods of time (10+ year) the stock market tends to appreciate in value. See the charge of the S&P 500 Index below. Even with the pull backs and recessions, the value of the stock market has historically moved higher.

Annuity Surrender Fees Lock You In

The insurance company knows they are going to have your money for a long period of time because most annuities carry “surrender fees”. Most surrender schedules last 5 – 10 YEARS!! This means if you change your mind and want out of the annuity before the surrender period is up, the annuity company hits you with big fees. So, before you write the check to fund the annuity, make sure it’s 100% the right decision.

Do Not Invest an IRA In An Annuity

This situation always baffles me. We will come across investors that have an IRA invested in an annuity. Annuities by themselves have the advantage of being “tax deferred vehicles” meaning you do not pay taxes on the gains accumulated in the annuity until you make a withdrawal. You pay money to the insurance company to have that benefit since annuities are insurance products.

An IRA by itself is also a tax deferred account. You can choose to invest your IRA in whatever you want – cash, stocks, bonds, mutual funds, or an annuity. So, here is my question: since an IRA is already tax deferred vehicle, why would you pay extra fees to an annuity company to invest it in a tax deferred annuity? It makes no sense to me.

The answer, again, is usually fear. An individual retires, they meet with an investment advisor that recommends that they rollover their 401(k) into an IRA, and uses the fear of losing money in the market to convince them to move their full 401(k) into an annuity product. I completely understand the fear of losing money in retirement, and for some individuals it may make sense to put a portion of their retirement assets into something like an annuity that offers some guarantees. But in my experience, it rarely makes sense to invest the majority of your retirement assets in an annuity.

Guaranteed Minimum Income Benefits

Another sparkling gem associated with annuities that is often appealing to retirees are annuities that carry a GMIB, or “Guaranteed Minimum Income Benefit”. These annuities are usually designed to go up by a “guaranteed” 5% - 8% per year, and then at a set age will pay you a set monthly amount for the rest of your life. Now that sounds wonderful, but here is the catch that I want you to be aware of. For most annuity companies, the value of your annuity associated with the “guaranteed increases” only matters if you annuitize the contract with that insurance company. After 10 years, if instead you decided to surrender the annuity, you typically do not receive those big, guaranteed increases, but instead get the actual value of the underlying investments less the big fees. This is why there is often more than one “balance” illustrated on your annuity statement.

Here is the catch of the GMIB – when you go to turn it on, the annuity company decides what that fictitious GMIB balance will equal in the form of a monthly benefit for the rest of your life. Also, with some annuities, they cap the guaranteed increase after a set number of years. In general, what I have found is annuities that were issued with GMIB prior to 2008 tend to be fairly generous, because that was before the 2008/2009 recession. After 2008, the guarantees associated with these GMIB’s became less advantageous.

When Do Annuities Make Sense

I have given you the long list of reason why I am not a fan of annuities but there are a few situations where I think annuities can make sense:

1) Overspending protection

2) CD’s vs Fixed Annuity

Overspending Protection

When people retire, for the first time in their lives, they often have access to their 401(K), 403(b), or other retirement account. Having a large dollar amount sitting in accounts that you have full access to can sometimes be a temptation to overspend, make renovation to your house, go on big vacations, etc. But when you retire, when the money is gone, it is gone. For individuals that do not trust themselves to not spend through the money, turning that lump sum of money into a guaranteed money payment for the rest of their lives may be beneficial. In these cases, it may make sense for an individual to purchase an annuity with their retirement dollars, because it lowers the risk of them running out of money in retirement.

CD’s vs Fixed Annuities

For individuals that have a large cash reserve, and do not want to take any risk, sometimes annuity companies will offer attractive fixed annuity rates. For example, your bank may offer a 2 year CD at a 2%, but there may be an insurance company that will offer you a fixed annuity at a rate of 3.5% per year for 7 years. The obvious benefit is a higher interest rate each year. The downside is usually that the annuity carries surrender fees if you break the annuity before the maturity date. But if you don’t see any need to access the cash before the end of the surrender period, it may be worth collecting the higher interest rate.

Final Advice

Selecting the right investment vehicle is a very important decision. Before selecting an investment solution, it often makes sense to meet with a few different firms to listen to the approach of each advisor to determine which is the most appropriate for your financial situation. If you go into one of these meetings and an annuity is the only solution that is present, I would be very cautious about moving forward with that solution before you have vetted other options.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Roth Conversions In Retirement

Roth conversions in retirement are becoming a very popular tax strategy. It can help you to realize income at a lower tax rate, reduce your RMD’s, accumulate assets tax free, and pass Roth money onto your beneficiaries. However, there are pros and cons that you need to be aware of, because processing a Roth conversion involves showing more taxable income in a given year. Without proper tax planning, it could lead to unintended financial consequences such as:

· Social Security taxed at a higher rate

· Higher Medicare premiums

· Assets lost to a long term care event

· Higher taxes on long term capital gains

· Losing tax deductions and credits

· Higher property taxes

· Unexpected big tax liability

In this video, Michael Ruger will walk you through some of the strategies that he uses with his clients when implementing Roth Conversions. This can be a very effective wealth building strategy when used correctly.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Impact of Inflation on Stocks, Bonds, and Cash

The inflation fears are rising in the market and we are releasing this video to help you to better understand how inflation works and the impact that is has on stock, bonds, and cash.

The inflation fears are rising in the market and we are releasing this video to help you to better understand how inflation works and the impact that is has on stock, bonds, and cash. In this video we will go over:

· How inflation works

· Recent inflation trends that are spooking the markets

· Do we have to worry about hyperinflation like in the 80’s

· How stocks perform in inflationary environments

· The risk to bonds in inflationary environments

· How cash melts due to inflation

· The Feds reaction to inflation

· Inflation conspiracy theories that are building momentum

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The GameStop Surge: 5 Investment Lessons

In this video, we will be explaining what is driving the price surge in GameStop, AMC, and other companies in the markets. More importantly there are 5 very important investment lessons that investors can learn from the recent GameStop anomaly that we will present in the video.

In this video, we will be explaining what is driving the price surge in GameStop, AMC, and other companies in the markets. More importantly there are 5 very important investment lessons that investors can learn from the recent GameStop anomaly that we will present in the video.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.