How Much Should I Contribute to Retirement?

A question I’m sure to address during employee retirement presentations is, “How Much Should I be Contributing?”. In this article, I will address some of the variables at play when coming up with your number and provide detail as to why two answers you will find searching the internet are so common.

A question I’m sure to address during employee retirement presentations is, “How Much Should I be Contributing?”. Quick internet search led me to two popular answers.

Whatever you need to contribute to get the match from the employer,

10-15% of your compensation.

As with most questions around financial planning, the answer should really be, “it depends”. We all know it is important to save for retirement, but knowing how much is enough is the real issue and typically there is more work involved than saying 10-15% of your pay.

In this article, I will address some of the variables at play when coming up with your number and provide detail as to why the two answers previously mentioned are so common.

Expenses and Income Replacement

Creating a budget and tracking expenses is usually the best way to estimate what your spending needs will be in retirement. Unfortunately, this is time-consuming and is becoming more difficult considering how easy it is to spend money these days. Automatic payments, subscriptions, payment apps, and credit cards make it easy to purchase but also more difficult to track how much is leaving your bank accounts.

Most financial plans we create start with the client putting together an itemized list of what they believe they spend on certain items like clothes, groceries, vacations, etc. A copy of our expense planner template can be found here. These are usually estimates as most people don’t track expenses in that much detail. Since these are estimates, we will use household income, taxes, and bank/investment accounts as a check to see if expenses appear reasonable.

What do expenses have to do with contributions to your retirement account now? Throughout your career, you receive a paycheck and use those funds to pay for the expenses you have. At some point, you no longer have the paycheck but still have the expenses. Most retirees will have access to social security and others may have a pension, but rarely does that income cover all your expenses. This means that the shortfall often comes from retirement accounts and other savings.

Not taking taxes, inflation, or investment gains into account, if your expenses are $50,000 per year and Social Security income is $25,000 a year, that is a $25,000 shortfall. 20 years of retirement times a $25,000 shortfall means $500,000 you’d need saved to fund retirement. Once we have an estimate of the coveted “What’s My Number?” question, we can create a savings plan to try and achieve that goal.

Cash Flow

As we age, some of the larger expenses we have in life go away. Student loan debt, mortgages, and children are among those expenses that stop at some point in most people’s lives. At the same time, your income is usually higher due to experience and raises throughout your career. As expenses potentially go down and income is higher, there may be cash flow that frees up allowing people to save more for retirement. The ability to save more as we get older means the contribution target amount may also change over time.

Timing of Contributions

Over time, the interest that compounds in retirement accounts often makes up most of the overall balance.

For example, if you contribute $2,000 a year for 30 years into a retirement account, you will end up saving $60,000. If you were able to earn an annual return of 6%, the ending balance after 30 years would be approximately $158,000. $60,000 of contributions and $98,000 of earnings.

The sooner the contributions are in an account, the sooner interest can start compounding. This means, that even though retirement saving is more cash flow friendly as we age, it is still important to start saving early.

Contribute Enough to Receive the Full Employer Match

Knowing the details of your company’s retirement plan is important. Most employers that sponsor a retirement plan make contributions to eligible employees on their behalf. These contributions often come in the form of “Non-Elective” or “Matching”.

Non-Elective – Contributions that will be made to eligible employees whether employees are contributing to the plan or not. These types of contributions are beneficial because if a participant is not able to save for retirement from their own paycheck, the company will still contribute. That being said, the contribution amount made by the employer, on its own, is usually not enough to achieve the level of savings needed for retirement. Adding some personal savings in addition to the employer contribution is recommended.

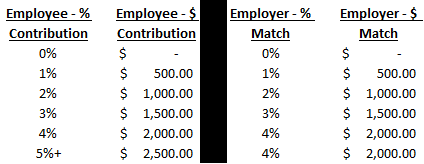

Matching – Employers will contribute on behalf of the employee if the employee is contributing to the plan as well. This means if the employee is contributing $0 to the retirement plan, the company will not contribute. The amount of matching varies by company, so knowing “Match Formula” is important to determine how much to contribute. For example, if the matching formula is “100% of compensation up to 4% of pay”, that means the employer will contribute a dollar-for-dollar match until they contribute 4% of your compensation. Below is an example of an employee making $50,000 with the 4% matching contribution at different contribution rates.

As you can see, this employee could be eligible for a $2,000 contribution from the employer, if they were to save at least 4% of their pay. That is a 100% return on your money that the company is providing.

Any contribution less than 4%, the employee would not be taking advantage of the employer contribution available to them. I’m not a fan of the term “free money”, but that is often the reasoning behind the “Contribute Enough to Receive the Full Employer Match” response.

10%-15% of Your Compensation

As said previously, how much you should be contributing to your retirement depends on several factors and can be different for everyone. 10%-15% over a long-term period is often a contribution rate that can provide sufficient retirement savings. Math below…

Assumptions

Age: 25

Retirement Age: 65

Current Income: $30,000

Annual Raises: 2%

Social Security @ 65: $25,000

Annualized Return: 6%

Step 1: Estimate the Target Balance to Accumulate by 65

On average, people will need an estimated 90% of their income for early retirement spending. As we age, spending typically decreases because people are unable to do a lot of the activities we typically spend money on (i.e. travel). For this exercise, we will assume a 65-year-old will need 80% of their income throughout retirement.

Present Salary - $30,000

Future Value After 40 Years of 2% Raises - $65,000

80% of Future Compensation - $52,000

$52,000 – income needed to replace

$25,000 – social security @ 65

$27,000 – amount needed from savings

X 20 – years of retirement (Age 85 - life expectancy)

$540,000 – target balance for retirement account

Step 2: Savings Rate Needed to Achieve $540,000 Target Balance

40 years of a 10% annual savings rate earning 6% interest per year, this person could have an estimated balance of $605,000. $181,000 of contributions and $424,000 of compounded interest.

I hope this has helped provide a basic understanding of how you can determine an appropriate savings rate for yourself. We recommend reaching out to an advisor who can customize your plan based on your personal needs and goals.

About Rob……...

Hi, I’m Rob Mangold, Partner at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Should I Refinance My Mortgage Now?

With all the volatility going on in the market, it seems there is one certainty and that is the word “historical” will continue to be in the headlines. Over the past few months, we’ve seen the Dow Jones Average hit historical highs, the 10-year treasury hit historical lows, and historical daily point movements in the market.

Should I Refinance My Mortgage Now?

With all the volatility going on in the market, it seems there is one certainty and that is the word “historical” will continue to be in the headlines. Over the past few months, we’ve seen the Dow Jones Average hit historical highs, the 10-year treasury hit historical lows, and historical daily point movements in the market. Market volatility will always lead the headlines as it does impact anyone with an investment account. With that in mind, it is important to use these times to reassess your overall financial plan and take advantage of parts of the plan that are in your control.

For a lot of people, their home is their most significant asset and is held for a longer period than any stock or bond they may have. This brings us back to “historical” as mortgage rates continue to drop. Whenever this happens, our clients will call and ask if it makes sense to refinance. In this article, we will help you in making this decision.

3 Important Questions

How much will I be saving annually in interest with a lower rate?

What are the closing costs of refinancing?

How long do I plan on being in the home and how many more years do I have on the mortgage?

If you can answer these questions, then you should have a pretty good idea if it makes sense for you to refinance.

How Much Will I be Saving Annually in Interest with a Lower Rate?

With most financial decisions, dollars matter. So how do you determine how much you will be saving each year with a lower interest rate? Below, I walk through a very basic example, but it will show the possible advantage of the refinance.

One important note with this example is the fact that most loan payments you make will decrease the principal which should decrease the cost of interest. To make this simple, I assume a consistent mortgage balance throughout the year.

Higher Interest Lower Interest

Mortgage Balance: $300,000 Mortgage Balance: $300,000

Interest Rate: 4.5% Interest Rate: 3.5%

Annual Interest: $13,500 Annual Interest: $10,500

By refinancing at the lower rate, the dollar savings in one year was $3,000 in the example when the mortgage balance was $300,000.

Savings over the life of a mortgage at 3.5% compared to 4.5% on a $300,000, 30-year mortgage, should be over $60,000 in interest over that time period if you are making consistent monthly payments.

What are the Closing Costs of Refinancing?

After walking through the exercise above, most people will say “Of course it makes sense to refinance”. Before making the decision, you must consider the cost of refinancing which can vary from person to person and bank to bank. There are several closing costs to consider which could include title insurance, tax stamps, appraisal fee, application fees, etc.

If the cost of closing is $5,000, you will have to determine how long it will take you to make that back based on the annual interest savings. Using the example from before, if you save $3,000 in interest each year, it should take you 2 years to breakeven.

One tip we give clients is to start at your current lender. Banks are in competition with other banks and they usually do not want to lose business to a competitor. Knowing the current interest rate environment, a lot of institutions will offer a type of “rapid refinance” for existing customers which may make the process easier but also give you a break on the closing costs if you are staying with them. This should be taken into consideration along with the possibility of getting an even lower interest rate from a different institution which could save you more in the long run even if closing costs are higher.

How Long do I Plan on Being in the Home and How Many More Years do I have on the Mortgage?

This is important since there is a cost to refinancing your mortgage. If it will take you 10 years to “breakeven” between the closing costs and interest you are saving but only plan on being in the house for 5 more years, refinancing may not be the right choice. Also, if you only have a few years left to pay the mortgage you would have to weigh your options.

In summary, taking advantage of these historical low mortgage rates could save you a lot of dollars over the long term but you should consider all the costs associated with it. Taking the time to answer these questions and shop around to make sure you are getting a good deal should be worth the effort.

Public Service Announcement: Like the stock market, it is hard to say anyone has the capability of knowing for sure when interest rates will hit their lows. Make sure you are comfortable with the decision you are making and if you do refinance try not to have buyer’s remorse if the historical lows today turn into new historical lows next year.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Can I Negotiate A Car Lease Buyout?

The short answer is "yes", but the approach that you take will most likely determine whether or not you are successful at purchasing your vehicle for a lower price than the amount listed in the lease agreement. When you lease a car, the lease agreement typically includes an amount that you can purchase the car for at the end of the lease. That amount is

The short answer is "yes", but the approach that you take will most likely determine whether or not you are successful at purchasing your vehicle for a lower price than the amount listed in the lease agreement. When you lease a car, the lease agreement typically includes an amount that you can purchase the car for at the end of the lease. That amount is essentially a guess by the bank that is providing the financing for the lease as to what the future value of your vehicle will be at the end of the lease.

Lease Buyout Calculation

Step number one in the negotiation process is to determine what your vehicle is worth. Did the bank guess right or wrong? If the purchase amount in your lease agreement is $25,000 but you find that the vehicle, based on current market conditions, is only worth $18,000, you probably have room to negotiate the purchase price of your vehicle but you have to do your homework. Compare your vehicle's purchase price to the retail value of local auto dealers. If you can show the bank that there is a local auto dealer trying to sell the exact make and model of your leased car with similar mileage, the bank will be more likely to accept a lower purchase price realizing that they guessed wrong.

Deal Directly With The Bank

You may have noticed that I continue to reference the "bank" in the negotiation process and not the "dealer". This is intentional. Some leasing banks allow dealers to increase the cost of the lease buyout to make a profit. Dealers can also charge document fees, which are taxable in most states. It may also be advantageous to line up your own financing for the lease purchase amount before entering into the negotiation process. If the dealer arranges the financing for you, it can sometimes increase your interest rate to make more money on the purchase. By dealing directly with the leasing bank you can cut out these additional costs.

You Make The Offering Price

Start by making an offer to the leasing bank based on your market research. Also make sure you contact the leasing bank well in advance of the lease "turn-in date". The bank may not be able to provide you with an immediate response to your offer so give yourself plenty of time for the negotiation process to work.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog. I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Where Are We In The Market Cycle?

Before you can determine where you are going, you first have to know where you are now. Seems like a simple concept. A similar approach is taken when we are developing the investment strategy for our client portfolios. The question more specifically that we are trying to answer is “where are we at in the market cycle?” Is there more upside

Before you can determine where you are going, you first have to know where you are now. Seems like a simple concept. A similar approach is taken when we are developing the investment strategy for our client portfolios. The question more specifically that we are trying to answer is “where are we at in the market cycle?” Is there more upside to the market? Is there a downturn coming? No one knows for sure and there is no single market indicator that has proven to be an accurate predicator of future market trends. Instead, we have to collect data on multiple macroeconomic indicators and attempt to plot where we are in the current market cycle. Here is a snapshot of where we are at now:

The length of the current bull market is starting to worry some investors. Living through the tech bubble and the 2008 recession, those were healthy reminders that markets do not always go up. We are currently in the 87th month of the expansion which is the 4th longest on record. Since 1900, the average economic expansion has lasted 46 months. This leaves many investors questioning, “is the bull market rally about to end?” We are actually less concerned about the “duration” of the expansion. We prefer to look at the “magnitude” of the expansion. This recovery has been different. In most economic recoveries the market grows rapidly following a recession. If you look at the magnitude of this expansion that started in the 4th quarter of 2007 versus previous expansions, it has been lackluster at best. See the chart on the next page. This may lead investors to conclude that there is more to the current economic expansion.

Next up, employment. Over the past 50 years, the unemployment rate has averaged 6.2%. We are currently sitting at an unemployment rate of 5.0%. Based on that number it may be reasonable to conclude that we are close to full employment. Once you get close to full employment you begin to lose that surge in growth that the economy receives from adding 250,000+ jobs per month. It may also imply that we are getting closer to the end of this market cycle.

Now let’s look at the valuation levels in the stock market. In other words, in general are the stocks in the S&P 500 Index cheap to buy, fairly valued, or expensive to buy at this point? We measure this by the forward price to earning ratio (P/E) of the S&P 500 index. The average P/E of the S&P 500 over the last 25 years is 15.9. Back in 2008, the P/E of the S&P 500 was around 9.0. From a valuation standpoint, back in 2008, stocks were very cheap to buy. When stocks are cheap, investors tend to hold them regardless of what’s happening in the global economy with the hopes that they will at least become “fairly valued” at some point in the future. Right now the P/E Ratio of the S&P 500 Index is about 16.8 which is above the 15.9 historic average. This may indicate that stock are starting to become “expensive” from a valuation standpoint and investors may be tempted to sell positions during periods of volatility.

Even though stocks may be perceived as “overvalued” that does not necessarily mean they are not going to become more overvalued from here. In fact, often times after long bull rallies “the plane will overshoot the runway”. However, it does typically mean that big gains are harder to come by since a large amount of the future earnings expectations of the S&P 500 companies are already baked into the stock price. It leaves the door open for more quarterly earning disappointments which could rise to higher levels of volatility in the markets.

The most popular question of the year goes to: “Trump or Hillary? And how will the outcome impact the stock market?” I try not to get too deep in the weeds of politics mainly because history has shown us that there is no clear evidence whether the economy fares better under a Republican president or a Democratic president. However, here is the key point. Markets do not like uncertainty and one of the candidates that is running (I will let you guess which one) represents a tremendous amount of uncertainty regarding the actions that they may take if elected president of the United States. Still, under these circumstances, it is very difficult to develop a sound investment strategy centered around political outcomes that may or may not happen. We really have to “wait and see” in this case.

Let’s travel over the Atlantic. Brexit was a shock to the stock market over the summer but the long term ramifications of the United Kingdom’s exit from the European Union is yet to be known. The exit process will most likely take a number of years as the EU and the UK negotiate terms. In our view, this does not pose an immediate threat to the global economy but it will represent an ongoing element of uncertainty as the EU continues to restart sustainable economic growth in the region.

The chart below is one of the most important illustrations that allows us to gauge the overall level of risk that exists in the global economy. When a country wants to jump start its economy it will often lower the reserve rate (similar to our Fed Funds Rate) in an effort to encourage lending. An increase in borrowing hopefully leads to an increase in consumer spending and economic growth. Unfortunately, countries around the globed have taken this concept to an extreme level and have implemented “negative rates”. If you buy a 10 year government bond in Germany or Japan, you are guaranteed to lose money over that 10 year period. If you have a checking account at a bank in Japan, instead of receiving interest from the bank, the bank may charge you a fee to hold onto your own money. Crazy right? It’s happening. In fact, 33% of the countries around the world have a negative yield on their 10 year government bond. See the chart below. When you look around the globe 71% of the countries have a 10 year government bond yield below 1%. The U.S. 10 Year Treasury sits just above that at 1.7%.

So, what does that mean for the global economy? Basically, countries around the world are starving for economic growth and everyone is trying to jump start their economy at the same time. Possible outcomes? On the positive side, the stage is set for growth. There is “cheap money” and favorable interest rates at levels that we have never seen before in history. Meaning a little growth could go a long ways.

On the negative side, these central banks around the global are pretty much out of ammunition. They have fired every arrow that they have at this point to prevent their economy from contracting. If they cannot get their economy to grow and begin to normalize rates in the near future, when they get hit by the next recession they will have nothing to combat it with. It’s like the fire department showing up to a house fire with no water in the truck. The U.S. is not immune to this situation. Everyone wants the Fed to either not raise rates or raise rates slowly for the fear of the negative impact that it may have on the stock market or the value of the dollar. But would you rather take a little pain now or wait for the next recession to hit and have no way to stop the economy from contracting? It seems like a risky game.

When we look at all of these economic factors as a whole it suggests to us that the U.S. economy is continuing to grow but at a slower pace than a year ago. The data leads us to believe that we may be entering the later stages of the recent bull market rally and that now is a prudent time to revisit the level of exposure to risk assets in our client portfolios. At this point we are more concerned about entering a period of long term stagnation as opposed to a recession. With the rate of economic growth slowing here in the U.S. and the rich valuations already baked into the stock market, we could be entering a period of muted returns from both the stock and bond market. It is important that investors establish a realistic view of where we are in the economic cycle and adjust their return expectations accordingly.

As always, please feel free to contact me if you’d like to discuss your portfolio or our outlook for the economy.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

What is a Bond?

A bond is a form of debt in which an investor serves as the lender. Think of a bond as a type of loan that a company or government would obtain from a bank but in this case the investor is serving as the bank. The issuer of the bond is typically looking to generate cash for a specific use such as general operations, a specific project, and staying current or

What is a Bond?

A bond is a form of debt in which an investor serves as the lender. Think of a bond as a type of loan that a company or government would obtain from a bank but in this case the investor is serving as the bank. The issuer of the bond is typically looking to generate cash for a specific use such as general operations, a specific project, and staying current or paying off other debt.

How do Investors Make Money on a Bond?

Your typical bonds will generate income for investors in one of two ways: periodic interest payments or purchasing the bond at a discount. There are also bonds where a combination of the two are applicable but we will explain each separately.

Interest Payments

There are interest rates associated with the bonds and interest payments are made periodically to the investor (i.e. semi-annual). When the bonds are issued, a promise to pay the interest over the life of the bond as well as the principal when the bond becomes due is made to the investor. For example, a $10,000 bond with a 5% interest rate would pay the investor $500 annually ($250 semi-annually). Typically tax would be due on the interest each year and when the bond comes due, the principal would be paid tax free as a return of cash basis.

Purchasing at a Discount

Another way to earn money on a bond would be to purchase the bond at a discount and at some time in the future get paid the face value of the bond. A simple example would be the purchase of a 10 year, $10,000 bond for a discounted price of $9,000. 10 years from the date of the purchase the investor would receive $10,000 (a $1,000 gain). Typically, the investor would be required to recognize $100 of income per year as “Original Issue Discount” (OID). At the end of the 10 year period, the gain will be recognized and the $10,000 would be paid but only $100, not $1,000, will have to be recognized as income in the final year.

Is There Risk in Bonds?

Investment grade bonds are often used to make a portfolio more conservative and less volatile. If an investor is less risk oriented or approaching retirement/in retirement they would be more likely to have a portfolio with a higher allocation to bonds than a young investor willing to take risk. This is due to the volatility in the stock market and impact a down market has on an account close to or in the distribution phase.

That being said, there are risks associated with bonds.

Interest Rate Risk – in an environment of rising interest rates, the value of a bond held by an investor will decline. If I purchased a 10 year bond two years ago with a 5% interest rate, that bond will lose value if an investor can purchase a bond with the same level of risk at a higher interest rate today. This will make the bond you hold less valuable and therefore will earn less if the bond is sold prior to maturity. If the bond is held to maturity it will earn the stated interest rate and will pay the investor face value but there is an opportunity cost with holding that bond if there are similar bonds available at higher interest rates.

Default Risk – most relevant with high risk bonds, default risk is the risk that the issuer will not be able to pay the face value of the bond. This is the same as someone defaulting on a loan. A bond held by an investor is only as good as the ability of the issuer to pay back the amount promised.

Call Risk – often times there are call features with a bond that will allow the issuer to pay off the bond earlier than the maturity date. In a declining interest rate environment, an issuer may issue new bonds at a lower interest rate and use the profits to pay off other outstanding bonds at higher interest rates. This would negatively impact the investor because if they were receiving 5% from a bond that gets called, they would likely use the proceeds to reinvest in a bond paying a lower rate or accept more risk to earn the same interest rate as the called bond.

Inflation Risk – a high inflation rate environment will negatively impact a bond because it is likely a time of rising interest rates and the purchasing power of the revenue earned on the bond will decline. For example, if an investor purchases a bond with a 3% interest rate but inflation is increasing at 5% the purchasing power of the return on that bond is eroded.

Below is a chart showing the risk spectrum of investing between asset classes and gives a visual on the different classes of bonds and their most susceptible risks.

Types of Bonds

Federal Government

Bonds issued by the federal government are backed by the full faith and credit of the U.S. Government and therefore are often referred to as “risk-free”. There are always risks associated with investing but in this case “risk-free” is referring to the idea that the U.S. Government is not likely to default on a bond and therefore the investor has a high likelihood of being paid the face value of the bond if held to maturity but like any investment there is risk.

There are a number of different federal bonds known as Treasuries and below we will touch on the more common:

Treasuries – Sold via auction in $1,000 increments. An investor will purchase the bond at a price below the face value and be paid the face value when the bond matures. You can bid on these bonds directly through www.treasurydirect.gov, or you can purchase the bonds through a broker or bank.

Treasury Bills – Short term investments sold in $1,000 increments. T-Bills are purchased at a discount with the promise to be paid the face value at maturity. These bonds have a period of less than a year and therefore, in a normal market environment, rates will be less than those of longer term bonds.

Treasury Notes – Sold in $1,000 increments and have terms of 2, 5, and 10 years. Treasury notes are often purchased at a discount and pay interest semi-annually. The 10 year Treasury note is most often used to discuss the U.S. government bond market and analyze the markets take on longer term macroeconomic trends.

Treasury Bonds – Similar to Treasury Notes but have periods of 30 years.

Treasury Inflation-Protected Securities (TIPS) – Sold in 5, 10, and 20 year terms. Not only will TIPS pay periodic interest, the face value of the bond will also increase with inflation each year. The increase in face value will be taxable income each year even though the principal is not paid until maturity. Interest rates on TIPS are usually lower than bonds with like terms because of the inflation protection.

Savings Bonds – There are two types of savings bonds still being issued, Series EE and Series I. The biggest difference between the two is that Series EE bonds have a fixed interest rate while Series I bonds have a fixed interest rate as well as a variable interest rate component. Savings bonds are purchased at a discount and accrue interest monthly. Typically these bonds mature in 20 years but can be cashed early and the cash basis plus accrued interest at the time of sale will be paid to the investor.

Municipal Bonds (Munis) – Bonds issued by states, cities, and local governments to fund specific projects. These bonds are exempt from federal tax and depending on where you live and where the bond was issued they may be tax free at the state level as well. There are two categories of Munis: Government Obligation Bonds and Revenue Bonds. Government Obligation Bonds are secured by the full faith and credit of the issuer’s taxing power (property/income/other). These bonds must be approved by voters. Revenue Bonds are secured by the revenues derived from specific activities the bonds were used to finance. These can be revenues from activities such as tolls, parking garages, or sports arenas.

Agency Bonds – These bonds are issued by government sponsored enterprises such as the Federal Home Loan Mortgage Association (Freddie Mac), the Federal Home Loan Mortgage Association (Fannie Mae), and the Federal Agricultural Mortgage Corporation (Farmer Mac). Agency bonds are used to stimulate activity such as increasing home ownership or agriculture production. Although they are not backed by the full faith and credit of the U.S. Government, they are viewed as less risky than corporate bonds.

Corporate Bonds – These bonds are issued by companies and although viewed as more risky than government bonds, the level of risk depends on the company issuing the bond. Bonds issued by a company like GE or Cisco may be viewed by investors as less of a default risk than a start-up company or company that operates in a volatile industry. The level of risk with the bond is directly related to the interest rate of the bond. Generally, the riskier the bond the higher the interest rate.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.