When Do Higher Interest Rates Become Harmful To The Stock Market?

On Friday, the jobs report came out and it was a strong report. The consensus was expecting 180,000 new jobs in January and the actual number released on Friday ended up being 200,000. So why did the markets drop? The answer: wage growth. The jobs report not only contains how many new employees were hired but it also includes the amount

On Friday, the jobs report came out and it was a strong report. The consensus was expecting 180,000 new jobs in January and the actual number released on Friday ended up being 200,000. So why did the markets drop? The answer: wage growth. The jobs report not only contains how many new employees were hired but it also includes the amount that wages for the current workforce either increased or decreased on a year over year basis. The report on Friday indicated that wages went up by 2.9% year over year. That is the strongest wage growth number since 2009.

Double Edged Sword

Wage growth is a double edged sword. On the positive side, when wages are going up, people have more money in their paychecks which allows them to spend more and consumer spending makes up 70% of our GDP in the United States. I'm actually surprised the market did not see this coming. The whole premise behind tax reform was "if we give U.S. corporations a tax break, they will use that money to hire more employees and increase wages." The big question people had with the tax reform was "would the trickle down of the dollars saved by the corporations eventually make it to the employees pockets?" Many corporations in January, as a result of tax reform, announced employee bonuses and increases to the minimum wage paid within their organizations. The wage growth number on Friday would seem to imply that this is happening. So again, I'm actually surprised that the market was not ready for this and while the market reacted negatively I see this more as a positive long term trend, instead of a negative one. If instead the U.S. corporations decided not to give the bonuses or increase wages for employees and just use the money from the tax reform savings to increase dividends or share buybacks, then you probably would have seen only a moderate increase in the wage growth number. But that also would imply that there would be no "trickle down" effect to the middle class.

The Downside

This all sounds really positive but what is the downside to wage growth? While wage growth is good for employees, it's bad for corporate earnings. If I was paying Employee A $50,000 in 2017 but now I'm paying them $55,000 per year in 2018, assuming the output of that employee did not change, the expenses to the company just went up by $5,000 per year. Now multiply that over thousands of employees. It's a simple fact that higher expenses without higher output equals lower profits.

Wage Growth = Inflation

There is another downside to wage growth. Wage growth is the single largest contributor to inflation. Inflation is what we use to measure the increase in the price of goods and services in the U.S.. Why are these two measurements so closely related? If your salary just increased by $300 per month, when you go to the grocery store to buy milk, you may not notice that the price of milk went up by $0.15 over last week because you are making more in your paycheck. That is inflation. The price of everything starts going up because, in general, consumers have more take home pay and it gives the sellers of goods and services more pricing power. Visa versa, when the economy is in a recession, people are losing their jobs, and wages are decreasing. If you sell cars and you decided to raise the price of the cars that you sell, that may cause the consumer to not buy from you and look for a lower priced alternative. Companies have less pricing power when the economy is contracting and you typically have "deflation" not inflation.

When Does Inflation Become Harmful?

Some inflation is good. It means the economy is doing well. A rapid increase in inflation is bad because it forces the Fed to use monetary policy to slow down the economy so it does not over heat. The Fed uses the Federal Funds Rate as their primary tool to keep inflation in check. When inflation starts heating up, the Fed will often raise the Fed Funds Rate to increase the cost of lending which in turn reduces the demand for lending. It’s like tapping the brakes in your car to make sure you do not accelerate too quickly and then go flying off the road.

If some inflation is good but too much inflation is bad, the question is at what point do higher interest rates really jeopardize economic growth? The chart below provides us with guidance as to what has happened in the past when interest rates were on the rise.

The chart compares every 2 year period in the stock market versus the level of the 10-Year Treasury yield between 1963 – 2017. For example, one dot would represent the time period 1963 – 1964. Another dot would represent 1964 – 1965 and so on. If the dot is above the “0.0” line, that means that there was a “positive correlation” between stock prices going up and the interest rate on the 10-Year Treasury yield going up during that same time period. Worded another way, when the dot is above the line that means the stock market was going up while interest rates were also increasing. In general, the dots above the line are good, when they are below the line, that’s bad.

Right now the 10-Year Treasury Bond is at 2.85% which is the red line on the chart. What we can conclude from this is going all the way back to 1963, at this data point, there has never been a two year period where interest rates were rising and stock prices were falling. Could it be different this time? It could, but it’s a low probability if we use historical data as our guide. History would suggest that we do not run into trouble until the yield on the 10-Year Treasury Bond gets above 4%. Once the yield on our 10-Year Treasury Bond reaches that level and interest rates are rising, historically the correlation between rising interest rates and stock prices turns negative. Meaning interest rates are going up but stock prices are going down.

It makes sense. Even though interest rates are moving up right now, they are still at historically low levels. So lending is still “cheap” by historical standards which will continue to fuel growth in the economy.

A Gradual Rise In Interest Rates

Most fixed income managers that we speak with are expecting a gradual rise in interest rates throughout 2018. While we expect interest rates to move higher throughout the year due to an increase in wage growth as a result of a tighter labor market, in our opinion, it’s a stretch to make the case that the yield on the 10-year Treasury will be at 4% by the end of the year.

If the U.S. was the only country in the world, I would feel differently. Our economy is continuing to grow, wages are increasing, the labor markets are tight which requires companies to pay more for good employees, and all of these factors would warrant a dramatic increase in the rate of inflation. But we are not the only country in the world and the interest rate environment in the U.S. is impacted by global rates.

The chart below illustrates the yield on a 10 year government bonds for the U.S., Japan, Germany, UK, Italy, Spain, and total “Global Ex-U.S.”.

On December 31, 2017 the yield on a 10-Year Government Bond in the U.S. was 2.71%. The yield on a 10-Year government bond in Germany was only 0.46%. So, if you bought a 10-Year Government Bond from Germany, they are going to hand you back a measly 0.46% in interest each year for the next 10 years.

Why is this important? The argument can be made that while the changes in the Fed Funds Rate may have a meaningful impact on short-term rates, it may have less of an impact on intermediate to longer term interest rates. When the U.S. government needs more money to spend they conduct “treasury auctions”. The government announces that on a specified date that they are going to be selling “30 million worth of 10-year treasury bonds at a 2.8% rate”. As long as there is enough demand to sell all of the bonds at the 2.8% rate, the auction is a success. If there is not enough demand, then they may have to increase the interest rate from 2.8% to 3% to sell all $30 million worth of the bonds. While the U.S. 10-Year Treasury Bond only had a yield of 2.71%, it’s a lot higher than the other trusted government lenders around the world. As you can see in the chart above, the average 10-year government bond yield excluding the U.S. is 1.03%. This keeps the demand for U.S. debt high without the need to dramatically increase the interest rate on new government debt issuance to attract buyers of the debt.

As for the trend in global interest rates, you will see in the chart that from September 30, 2017 to December 31, 2017, global 10-year government bond yields ex-U.S. decreased from 1.05% to 1.03%. While we are in the monetary tightening cycle in the U.S., there is still monetary easing happening around the world as a whole which should prevent our 10-year treasury yields from spiking over the next 12 months.

Impact on Investment Portfolios

The media will continue to pounce on this story about “the risk of rising interest rates and inflation” throughout 2018 but it’s important to keep it in context. If tax reform works the way that it’s supposed to, wage growth should continue but we may not see the positive impact of increased consumer spending due to the wage growth until corporate earnings are released for the first and second quarter of 2018. We just have to wait to see how the strength of consumer spending nets out against the pressure on corporate earnings from higher wages.

However, investors should be looking at the fixed income portion of their portfolio to make sure there is the right mix of bonds if inflation is expected to rise throughout the year. Bond duration and credit quality will play an important role in your fixed income portfolio in 2018.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How To Teach Your Kids About Investing

As kids enter their teenage years, as a parent, you begin to teach them more advanced life lessons that they will hopefully carry with them into adulthood. One of the life lessons that many parents teach their children early on is the value of saving money. By their teenage years many children have built up a small savings account from birthday gifts,

As kids enter their teenage years, as a parent, you begin to teach them more advanced life lessons that they will hopefully carry with them into adulthood. One of the life lessons that many parents teach their children early on is the value of saving money. By their teenage years many children have built up a small savings account from birthday gifts, holidays, and their part-time jobs. As parents you have most likely realized the benefit of compounding interest through working with a financial advisor, contributing to a 401(k) plan, or depositing money to a college savings account. As financial planners, we often get the question: “What is the best way to teach your children about the value of investing and compounding interest? "

The #1 rule.......

We have been down this road many times with our clients and their children. Here is the number one rule: Make it an engaging experience for your kids. Investments can be a very dull topic to talk about and it can be painfully dull from a child’s point of view. All they know is the $1,000 that was in their savings account is now with their parent’s investment guy.

Ignoring the life lessons for a moment, the primary investment vehicle for brokerage accounts with balances under $50,000 is typically a mutual fund. But let’s pause for a moment. We have a dual objective here. We of course want our children to make as much money as possible in their investment account but we also want to simultaneously teach them life long lessons about investing.

The issue with young investors

Explaining how a mutual fund operates can be a complex concept for a first time investor because you have all of these companies in one investment, expense ratios, different types of funds, and different fund families. It’s not exciting, it’s intimidating.

Consider this approach. Ask the child what their hobbies are? Do they have a cell phone? Have them take their cell phone out during the meeting and ask them how often they use it during the day and how many of their friends have cell phones. Then ask them, if you received $20 every time someone in this area bought a cell phone would you have a lot of money? Then explain that this scenario is very similar to owning stock in a cell phone company. The more they sell the more money the company makes. As a “shareholder” you own a piece of that company and you receive a piece of the profits if the company grows. If your child plays sports, do they wear a lot of Nike or Under Armour? Explain investing to them in a way that they can relate it to their everyday life. Now you have their attention because you attached the investment idea to something they love.

A word of caution....

If they are investing in stocks it is also important for them to understand the concept of risk. Not every investment goes up and you could start with $1,000 and end the year with $500, so they need to understand risk and time horizon.

While it’s not prudent in most scenarios to invest 100% of a portfolio in one stock, there may be some middle ground. Instead of investing their entire $1,000 in a mutual fund, consider investing $500 – $700 in a mutual fund but let them pick one to three stocks to hold in the account. It may make sense to have them review those stock picks with your investment advisor for two reasons. One, you want them to have a good experience out of the gates and that investment advisor can provide them with their option of their stock picks. Second, the investment advisor can tell them more about the companies that they have selected to further engage them.

Don't forget the last step......

Download an app on their smartphone so they can track the investments that they selected. You may be surprise how often they check the performance of their stock holdings and how they begin to pay attention to news and articles applicable to the companies that they own.At that point you have engaged them and as they hopefully see their investment holdings appreciate in value they will become even more excited about saving money in their investment account and making their next stock pick. In addition, they also learn valuable investment lessons early on like when one of their stocks loses value. How do they decide whether to sell it or continue to hold it? It’s a great system that teaches them about investing, decision making, risk, and the value of compounding investment returns.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Target Date Mutual Funds and Their Role in the 401(k) Space

A target date mutual fund is a fund in the hybrid category that automatically resets the asset mix of stocks, bonds and cash equivalents in its portfolio according to a selected time frame that is appropriate for a particular investor. In simpler terms, an investor can purchase a target date fund based on their anticipated retirement date and the fund will

In recent years, a growing trend in the 401(k) space has been the use of target date mutual funds.

Target Date Mutual Funds

A target date mutual fund is a fund in the hybrid category that automatically resets the asset mix of stocks, bonds and cash equivalents in its portfolio according to a selected time frame that is appropriate for a particular investor. In simpler terms, an investor can purchase a target date fund based on their anticipated retirement date and the fund will automatically become more conservative as the investor approaches retirement.

This is often times a suitable investment for the average investor or participant in a 401(k) plan that would not typically make allocation adjustments on their own. During the financial crisis of 2008 and 2009, many investors approaching retirement were overexposed to the stock market and lost half of their savings with no time to make it back before retirement. This is where the benefit of a well-managed target date fund would have been useful as investors who needed an allocation change as they approached retirement would have got it. Emphasis on the well-managed.

At year end 2013, there was approximately $595.5 billion dollars invested in target date mutual funds, up from approximately $111.9 billion in 2006 based on a study conducted by Morningstar. With so much money being placed in these funds, it is important to know how they work and what to look for when choosing the correct fund for your risk tolerance and time horizon.

As mentioned previously, the allocation of assets within a target date fund will automatically rebalance throughout the life of the investment to focus more on income. With that being said, how does the rebalancing happen and how often does the rebalancing take place? The rebalancing takes place automatically when fund managers of that target date fund determine the allocation in the fund no longer meets its intentions. It is argued that most target date mutual funds do not rebalance nearly enough as some can be as long as 4-5 years.

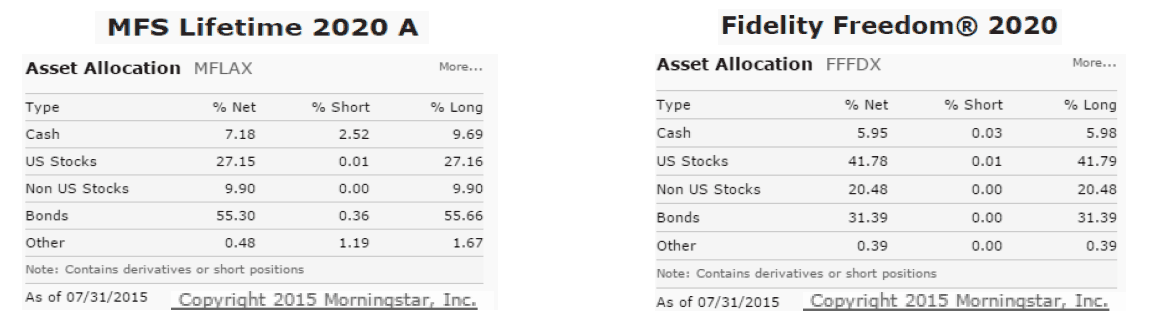

It is important to know that the date of a target date fund is the date the investor plans to retire and is not the date in which the fund is at its most conservative allocation. Fund families operate their target date mutual funds very differently. For example, one fund family may have a 2020 fund that is 30% stocks and 70% bonds compared to another more aggressive fund family that is allocated 60% stocks and 40% bonds in their 2020 target date fund.

There are arguments for both allocations. Since an investor is at their retirement age, they should typically be more conservative. On the other hand, just because the investor hit their retirement age they may not be taking distributions from the account for another 5-10 years, and therefore could possibly achieve more growth.

A target date fund can be a suitable investment option for investors who would like a hands off approach in their 401(k), but participants must be aware that there is still due diligence necessary throughout the life of the investment. Below is a chart showing the results of a study conducted by Morningstar in 2010. It shows the allocation of target date mutual funds for different fund families during the financial crisis of 2008 and 2009. These target date mutual funds were meant for investors retiring in 2010 and therefore should have been allocated in a way that would not over expose them to a significant decline in the market two years from retirement.

As you can see, the equity (stock) allocation varies greatly between fund families and the over exposure led to significant declines in investors accounts. Too many people had their retirement account nearly halved two years from retirement which is devastating for an individuals quality of life.

There are definitely pitfalls to target date mutual funds but they can be appropriate in the right circumstances. It is important that investors are educated on what target date mutual funds are and more importantly what they are not. Here are a few takeaways that may help you determine which, if any, target date fund is appropriate for you.

Determine Your Risk Tolerance First

The first questions an investment advisor will typically have for a client are: “What is your time horizon?” and “What is your risk tolerance?”. Since target date mutual funds allocate assets for a group of investors based on a date in the future, the only piece that is somewhat satisfied is time horizon. Just because a group of investors have the same time horizon does not mean they should be invested the same way. Fund managers cannot allocate funds in a way that satisfies both questions without knowing the risk tolerance for each individual investor. That means, the risk tolerance piece relies on you. Two 45 year old investors may be 20 years from retirement and have completely different portfolio allocations due to their risk tolerance. One may be more aggressive and tolerant of stock market fluctuations while the other may be conservative and less willing to risk their savings. Even though each investor has the same time horizon, the appropriate portfolio for each would vary greatly. It is important to know your risk tolerance and apply that knowledge to the appropriate target date fund.

Research the Different Target Date Fund Options

As shown in the chart on the previous page, the asset allocation for a target date fund for one fund family could be drastically different when compared to the same target date fund for another fund family. This can be confusing for investors which is why it is important to research the fund and the current allocation before investing. The charts below show the asset allocation of two 2020 target date mutual funds from different families.

Both target date mutual funds are the same in terms of retirement date but drastically different in exposure to the stock market. The MFS 2020 fund with approximately 63% allocated to bonds/cash and 37% to stocks is a much more conservative portfolio than the Fidelity 2020, which is approximately 37% bonds/cash and 63% stocks. An investor with 5 years to retirement could have very different objectives with their retirement account and therefore each fund may be appropriate as a 2020 fund. An over exposure to the stock market for someone retiring in 5 years could be devastating as shown in 2008/2009 which is why it is important for each individual to determine their time horizon, risk tolerance, and investment objectives when selecting the correct target date fund for their portfolio.

Difference Between Target Date and Active Management

Although target date mutual funds are often referred to as “set it and forget it”, there are a number of factors that must be taken into consideration. Most target date mutual funds are typically managed exclusively on time horizon. Fund managers traditionally do not make significant allocation adjustments to these types of funds based on changing market conditions which can leave investors exposed to big drops in the stock market as they approach retirement. Investors within 10 years to retirement should work closely with their investment advisor to make sure they have the right mix of stocks and bonds in their portfolio.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.