Potential Consequences of Taking IRA Distributions to Pay Off Debt

Once there is no longer a paycheck, retirees will typically meet expenses with a combination of social security, withdrawals from retirement accounts, annuities, and pensions. Social security, pensions, and annuities are usually fixed amounts, while withdrawals from retirement accounts could fluctuate based on need. This flexibility presents

Potential Consequences of Taking IRA Distributions to Pay Off Debt

Once there is no longer a paycheck, retirees will typically meet expenses with a combination of social security, withdrawals from retirement accounts, annuities, and pensions. Social security, pensions, and annuities are usually fixed amounts, while withdrawals from retirement accounts could fluctuate based on need. This flexibility presents opportunities to use retirement savings to pay off debt; but before doing so, it is important to consider the possible consequences.

Clients often come to us saying they have some amount left on a mortgage and they would feel great if they could just pay it off. Lower monthly bills and less debt when living on a fixed income is certainly good, both from a financial and psychological point of view, but taking large distributions from retirement accounts just to pay off debt may lead to tax consequences that can make you worse off financially.

Below are three items I typically consider before making a recommendation for clients. Every retiree is different so consulting with a professional such as a financial planner or accountant is recommended if you’d like further guidance.

Impact on State Income and Property Taxes

Depending on what state you are in, withdrawals from IRA’s could be taxed very differently. It is important to know how they are taxed in your state before making any big decision like this. For example, New York State allows for tax free withdrawals of IRA accounts up to a maximum of $20,000 per recipient receiving the funds. Once the $20,000 limit is met in a certain year, any distribution you take above that will be taxed.

If someone normally pulls $15,000 a year from a retirement account to meet expenses and then wanted to pull another $50,000 to pay off a mortgage, they have created $45,000 of additional taxable income to New York State. This is typically not a good thing, especially if in the future you never have to pull more than $20,000 in a year, as you would have never paid New York State taxes on the distributions.

Note: Another item to consider regarding states is the impact on property taxes. For example, New York State offers an “Enhanced STAR” credit if you are over the age of 65, but it is dependent on income. Here is an article that discusses this in more detail STAR Property Tax Credit: Make Sure You Know The New Income Limits.

What Tax Bracket Are You in at the Federal Level?

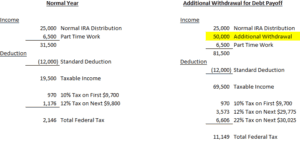

Federal income taxes are determined using a “Progressive Tax” calculation. For example, if you are filing single, the first $9,700 of taxable income you have is taxed at a lower rate than any income you earn above that. Below are charts of the 2019 tax tables so you can review the different tax rates at certain income levels for single and married filing joint ( Source: Nerd Wallet ).

There isn’t much of a difference between the first two brackets of 10% and 12%, but the next jump is to 22%. This means that, if you are filing single, you are paying the government 10% more on any additional taxable income from $39,475 – $84,200. Below is a basic example of how taking a large distribution from the IRA could impact your federal tax liability.

How Will it Impact the Amount of Social Security You Pay Tax on?

This is usually the most complicated to calculate. Here is a link to the 2018 instructions and worksheets for calculating how much of your Social Security benefit will be taxed ( IRS Publication 915 ). Basically, by showing more income, you may have to pay tax on more of your Social Security benefit. Below is a chart put together with information from the IRS to show how much of your benefit may be taxed.

To calculate “Combined Income”, you take your Adjusted Gross Income + Nontaxable Interest + Half of your Social Security benefit. For the purpose of this discussion, remember that any amount you withdraw from your IRA is counted in your Combined Income and therefore could make more of your social security benefit subject to tax.

Peace of mind is key and usually having less bills or debt can provide that, but it is important to look at the cost you are paying for it. There are times that this strategy could make sense, but if you have questions about a personal situation please consult with a professional to put together the correct strategy.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Warning To All Employees: Review The Tax Withholding In Your Paycheck Otherwise A Big Tax Bill May Be Waiting For You

As a result of tax reform, the IRS released the new income tax withholding tables in January and your employer probably entered those new withholding amounts into the payroll system in February. It was estimated that about 90% of taxpayers would see an increase in their take home pay once the new withholding tables were implemented.

As a result of tax reform, the IRS released the new income tax withholding tables in January and your employer probably entered those new withholding amounts into the payroll system in February. It was estimated that about 90% of taxpayers would see an increase in their take home pay once the new withholding tables were implemented. While lower tax rates and more money in your paycheck sounds like a good thing, it may come back to bite you when you file your taxes.

The Tax Withholding Guessing Game

Knowing the correct amount to withhold for federal and state income taxes from your paycheck is a bit of a guessing game. Withhold too little throughout the year and when you file your taxes you have a tax bill waiting for you equal to the amount of the shortfall. Withhold too much and you will receive a big tax refund but that also means you gave the government an interest free loan for the year.

There are two items that tell your employer how much to withhold for federal income tax from your paycheck:

Income Tax Withholding Tables

Form W-4

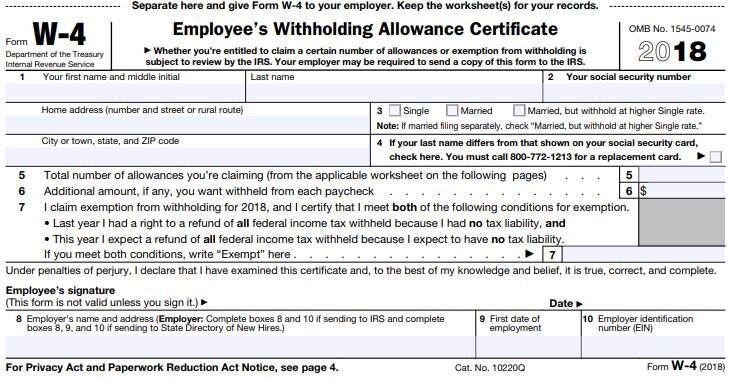

The IRS provides your employer with the Income Tax Withholding Tables. On the other hand, you as the employee, complete the Form W-4 which tells your employer how much to withhold for taxes based on the “number of allowances” that you claim on the form.

What Is A W-4 Form?

The W-4 form is one of the many forms that HR had you complete when you were first hired by the company. Here is what it looks like:

Section 3 of this form tells your employer which withholding table to use:

Single

Married

Married, but withhold at higher Single Rate

Section 5 tells your employer how many "allowances" you are claiming. Allowance is just another word for "dependents". The more allowances your claim, the lower the tax withholding in your paycheck because it assumes that you will have less "taxable income" because in the past you received a deduction for each dependent. This is where the main problem lies. Due to the changes in the tax laws, the tax deduction for personal exemptions was eliminated. This may adversely affect some taxpayers the were claiming a high number of allowances on their W-4 form because even though the number of their dependents did not change, their taxable income may be higher in 2018 because the deduction for personal exemptions no longer exists.

Even though everyone should review their Form W-4 form this year, employees that claimed allowances on their W-4 form are at the highest risk of either under withholding or over withholding taxes from their paychecks in 2018 due to the changes in the tax laws.

How Much Should I Withhold From My Paycheck For Taxes?

So how do you go about calculating that right amount to withhold from your paycheck for taxes to avoid an unfortunate tax surprise when you file your taxes for 2018? There are two methods:

Ask your accountant

Use the online IRS Withholding Calculator

The easiest and most accurate method is to ask your personal accountant when you meet with them to complete your 2017 tax return. Bring them your most recent pay stub and a blank Form W-4. Based on the changes in the tax laws, they can assist you in the proper completion of your W-4 Form based on your estimated tax liability for the year.If you complete your own taxes, I would highly recommend visiting the updated IRS Withholding Calculator. The IRS calculator will ask you a series of questions, such as:

How many dependents you plan to claim in 2018

Are you over the age of 65

The number of children that qualify for the dependent care credit

The number of children that will qualify for the new child tax credit

Estimated gross wages

How much fed income tax has already been withheld year to date

Payroll frequency

At the end of the process it will provide you with your personal results based on the data that you entered. It will provide you with guidance as to how to complete your Form W-4 including the number of allowances to claim and if applicable, the additional amount that you should instruct your employer to withhold from your paycheck for federal income taxes. Additional withholding requests are listed in Section 6 of the Form W-4.

Avoid Disaster

Having this conversation with your accountant and/or using the new IRS Withholding Calculator will help you to avoid a big tax disaster in 2018. Unfortunately, many employees may not learn about this until it's too late. Employees that are used to getting a tax refund may find out in the spring of next year that they owe thousands of dollars to the IRS because the combination of the new tax tables and the changes in the tax law that caused them to inadvertently under withhold federal income taxes throughout the year.

Action Item!!

Take action now. The longer you wait to run this calculation or to have this conversation with your accountant, the larger the adjustment may be to your paycheck. It's easier to make these adjustments now when you have nine months left in the year as opposed to waiting until November.I would strongly recommend that you share this article with your spouse, children in the work force, and co-workers to help them avoid this little known problem. The media will probably not catch wind of this issue until employees start filing their tax returns for 2018 and they find out that there is a tax bill waiting for them.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Who Pays The Tax On A Cash Gift?

This question comes up a lot when a parent makes a cash gift to a child or when a grandparent gifts to a grandchild. When you make a cash gift to someone else, who pays the tax on that gift? The short answer is “typically no one does”. Each individual has a federal “lifetime gift tax exclusion” of $5,400,000 which means that I would have to give

This question comes up a lot when a parent makes a cash gift to a child or when a grandparent gifts to a grandchild. When you make a cash gift to someone else, who pays the tax on that gift? The short answer is “typically no one does”. Each individual has a federal “lifetime gift tax exclusion” of $5,400,000 which means that I would have to give away $5.4 million dollars before I would owe “gift tax” on a gift. For married couples, they each have a $5.4 million dollar exclusion so they would have to gift away $10.8M before they would owe any gift tax. When a gift is made, the person making the gift does not pay tax and the person receiving the gift does not pay tax below those lifetime thresholds.

“But I thought you could only gift $15,000 per year per person?” The $15,000 per year amount is the IRS “gift exclusion amount” not the “limit”. You can gift $15,000 per year to any number of people and it will not count toward your $5.4M lifetime exclusion amount. A married couple can gift $30,000 per year to any one person and it will not count toward their $10.8M lifetime exclusion. If you do not plan on making gifts above your lifetime threshold amount you do not have to worry about anyone paying taxes on your cash gifts.

Let’s look at an example. I’m married and I decide to gift $20,000 to each of my three children. When I make that gift of $60,000 ($20K x 3) I do not owe tax on that gift and my kids do not owe tax on the gift. Also, that $60,000 does not count toward my lifetime exclusion amount because it’s under the $28K annual exclusion for a married couple to each child.

In the next example, I’m single and I gift $1,000,000 my neighbor. I do not owe tax on that gift and my neighbor does not owe any tax on the gift because it is below my $5.4M threshold. However, since I made a gift to one person in excess of my $15,000 annual exclusion, I do have to file a gift tax return when I file my taxes that year acknowledging that I made a gift $985,000 in excess of my annual exclusion. This is how the IRS tracks the gift amounts that count against my $5.4M lifetime exclusion.

Important note: This article speaks to the federal tax liability on gifts. If you live in a state that has state income tax, your state’s gift tax exclusion limits may vary from the federal limits.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.