How Much Should I Contribute to Retirement?

A question I’m sure to address during employee retirement presentations is, “How Much Should I be Contributing?”. In this article, I will address some of the variables at play when coming up with your number and provide detail as to why two answers you will find searching the internet are so common.

A question I’m sure to address during employee retirement presentations is, “How Much Should I be Contributing?”. Quick internet search led me to two popular answers.

Whatever you need to contribute to get the match from the employer,

10-15% of your compensation.

As with most questions around financial planning, the answer should really be, “it depends”. We all know it is important to save for retirement, but knowing how much is enough is the real issue and typically there is more work involved than saying 10-15% of your pay.

In this article, I will address some of the variables at play when coming up with your number and provide detail as to why the two answers previously mentioned are so common.

Expenses and Income Replacement

Creating a budget and tracking expenses is usually the best way to estimate what your spending needs will be in retirement. Unfortunately, this is time-consuming and is becoming more difficult considering how easy it is to spend money these days. Automatic payments, subscriptions, payment apps, and credit cards make it easy to purchase but also more difficult to track how much is leaving your bank accounts.

Most financial plans we create start with the client putting together an itemized list of what they believe they spend on certain items like clothes, groceries, vacations, etc. A copy of our expense planner template can be found here. These are usually estimates as most people don’t track expenses in that much detail. Since these are estimates, we will use household income, taxes, and bank/investment accounts as a check to see if expenses appear reasonable.

What do expenses have to do with contributions to your retirement account now? Throughout your career, you receive a paycheck and use those funds to pay for the expenses you have. At some point, you no longer have the paycheck but still have the expenses. Most retirees will have access to social security and others may have a pension, but rarely does that income cover all your expenses. This means that the shortfall often comes from retirement accounts and other savings.

Not taking taxes, inflation, or investment gains into account, if your expenses are $50,000 per year and Social Security income is $25,000 a year, that is a $25,000 shortfall. 20 years of retirement times a $25,000 shortfall means $500,000 you’d need saved to fund retirement. Once we have an estimate of the coveted “What’s My Number?” question, we can create a savings plan to try and achieve that goal.

Cash Flow

As we age, some of the larger expenses we have in life go away. Student loan debt, mortgages, and children are among those expenses that stop at some point in most people’s lives. At the same time, your income is usually higher due to experience and raises throughout your career. As expenses potentially go down and income is higher, there may be cash flow that frees up allowing people to save more for retirement. The ability to save more as we get older means the contribution target amount may also change over time.

Timing of Contributions

Over time, the interest that compounds in retirement accounts often makes up most of the overall balance.

For example, if you contribute $2,000 a year for 30 years into a retirement account, you will end up saving $60,000. If you were able to earn an annual return of 6%, the ending balance after 30 years would be approximately $158,000. $60,000 of contributions and $98,000 of earnings.

The sooner the contributions are in an account, the sooner interest can start compounding. This means, that even though retirement saving is more cash flow friendly as we age, it is still important to start saving early.

Contribute Enough to Receive the Full Employer Match

Knowing the details of your company’s retirement plan is important. Most employers that sponsor a retirement plan make contributions to eligible employees on their behalf. These contributions often come in the form of “Non-Elective” or “Matching”.

Non-Elective – Contributions that will be made to eligible employees whether employees are contributing to the plan or not. These types of contributions are beneficial because if a participant is not able to save for retirement from their own paycheck, the company will still contribute. That being said, the contribution amount made by the employer, on its own, is usually not enough to achieve the level of savings needed for retirement. Adding some personal savings in addition to the employer contribution is recommended.

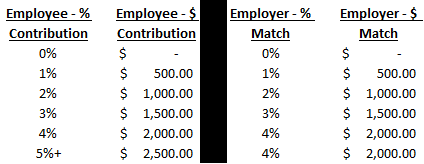

Matching – Employers will contribute on behalf of the employee if the employee is contributing to the plan as well. This means if the employee is contributing $0 to the retirement plan, the company will not contribute. The amount of matching varies by company, so knowing “Match Formula” is important to determine how much to contribute. For example, if the matching formula is “100% of compensation up to 4% of pay”, that means the employer will contribute a dollar-for-dollar match until they contribute 4% of your compensation. Below is an example of an employee making $50,000 with the 4% matching contribution at different contribution rates.

As you can see, this employee could be eligible for a $2,000 contribution from the employer, if they were to save at least 4% of their pay. That is a 100% return on your money that the company is providing.

Any contribution less than 4%, the employee would not be taking advantage of the employer contribution available to them. I’m not a fan of the term “free money”, but that is often the reasoning behind the “Contribute Enough to Receive the Full Employer Match” response.

10%-15% of Your Compensation

As said previously, how much you should be contributing to your retirement depends on several factors and can be different for everyone. 10%-15% over a long-term period is often a contribution rate that can provide sufficient retirement savings. Math below…

Assumptions

Age: 25

Retirement Age: 65

Current Income: $30,000

Annual Raises: 2%

Social Security @ 65: $25,000

Annualized Return: 6%

Step 1: Estimate the Target Balance to Accumulate by 65

On average, people will need an estimated 90% of their income for early retirement spending. As we age, spending typically decreases because people are unable to do a lot of the activities we typically spend money on (i.e. travel). For this exercise, we will assume a 65-year-old will need 80% of their income throughout retirement.

Present Salary - $30,000

Future Value After 40 Years of 2% Raises - $65,000

80% of Future Compensation - $52,000

$52,000 – income needed to replace

$25,000 – social security @ 65

$27,000 – amount needed from savings

X 20 – years of retirement (Age 85 - life expectancy)

$540,000 – target balance for retirement account

Step 2: Savings Rate Needed to Achieve $540,000 Target Balance

40 years of a 10% annual savings rate earning 6% interest per year, this person could have an estimated balance of $605,000. $181,000 of contributions and $424,000 of compounded interest.

I hope this has helped provide a basic understanding of how you can determine an appropriate savings rate for yourself. We recommend reaching out to an advisor who can customize your plan based on your personal needs and goals.

About Rob……...

Hi, I’m Rob Mangold, Partner at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

What Happens When A Minor Child Inherits A Retirement Account?

There are special non spouse beneficiary rules that apply to minor children when they inherit retirement accounts. The individual that is assigned is the custodian of the child, we'll need to assist them in navigating the distribution strategy and tax strategy surrounding they're inherited IRA or 401(k) account. Not being aware of the rules can lead to IRS tax penalties for failure to take requirement minimum distributions from the account each year.

There are special non spouse beneficiary rules that apply to minor children when they inherit retirement accounts. The individual that is assigned as the custodian of the child, will need to assist them in navigating the distribution strategy and tax strategy surrounding their inherited IRA or 401(k) account. Not being aware of the rules can lead to IRS tax penalties for failure to take requirement minimum distributions from the account each year.

Minor Child Rule After December 31, 2019

The IRS changed the rules for minor children as beneficiaries of retirement accounts when they passed the Secure Act in 2019. If the Minor child inherits a retirement account from someone that passes away after December 31, 2019, the minor child is subject to the new non spouse beneficiary rules associated with the new tax law. The new tax law creates a blend of the old “stretch rule” and the new 10-year rule for children that inherit retirement accounts. It also matters who the child inherited the account from - a parent, or someone other than a parent.

Minor Child Inherits Retirement Account From A Parent

If a minor child inherits a retirement account from their parents, and the parent that they inherited the account from passed away after December 31, 2019, the minor child will need to move the 401(k) or IRA into an Inherited IRA before December 31st of the year after their parent passes away, and then begin taking annual Required minimum distributions (RMDs) from the inherited IRA each year until they reach age 21. Once reach age 21, they are then subject to the 10-year rule which requires the minor to fully deplete the account within 10 years of turning age 21.

Age of Majority is 21

Different states have different ages of majority, some 18 and others 21. But the IRS Released clarifying final regulations in July 2024, stating that for purposes of minor children moving from the annual RMD requirement to the 10-year rule would be the age of 21 regardless of state the child lives in and regardless of whether or not the child is student after age 18.

Here is an example, Richard passes away in a car accident in March 2024, the sole beneficiary of his 401k at work is his 10-year-old daughter Kelly. Kelly’s guardian would need to assist her with setting up an inherited IRA before December 31, 2025, and rollover Richard’s 401K balance into that Inherited IRA account. Since Kelly is under the age of 21, she would be required to take annual required minimum distributions from the account which are calculated base hunter age and an IRS life expectancy table beginning 2025. When she receives those annual RMDs for the Inherited IRA, she has to pay income tax on them, but does not incur a 10% early withdrawal penalty for being under the age of 59 1/2 since they are considered death distributes.

Kelly will need to continue to take those RMD's each year until she reaches age 21. At age 21, she is then subject to the new 10-year rule associated with non-spouse beneficiaries which requires her to fully deplete that inherited IRA balance within 10 years of reaching the age 21.

Tax Strategy For Inherited IRAs for Minors

The guardians of the minor child will need to assist them with the tax strategy associated with taking distributions from their inherited IRA account since any money withdrawn from these accounts is considered taxable income to the child. While the IRS requires the minor child to take a small distribution each year to satisfy the annual RMD requirement, they are allowed to take any amount they would like out of the inherited IRA which creates a tax planning opportunity since most children have very little taxable income, and are in very low tax brackets.

In some cases, due to the standard deduction awarded to all taxpayers, the child, for example, may be able to take out $12,000 a year, and pay no federal tax on those distributions since they have no income, and the standard deduction covers the full amount of the distribution from the inherited IRA account. In those cases, it may be prudent for the child to distribute more than just the requested minimum distribution amount each year, otherwise when they are aged 21, they may have income from employment and then these inherited IRA distributions that are required within that 10 year period would be taxable to them at that time at potentially a higher rate.

FAFSA Warning

Another factor to consider one taking distributions from a minor’s inherited IRA is the impact on their college financial aid if they are college bound after high school. Distributions from these inherited IRA accounts are considered income of the child which is the most punitive category within the college financial aid award formula. A child’s income, over a specific threshold, counts approximately 50% against any college financial aid that could potentially be awarded. So, if a child processes a distribution from their inherited IRA for $20,000, while it might be a good tax move, if that child would have qualified for need based college financial aid, they may have just lost $10,000 in aid due to that IRA distribution during a determination year.

When a FAFSA application is completed for a child, the determined year for income purposes of the financial aid award looks back 2 years, so there is a lot of advanced planning by the guardian of the child that needs to take place to make sure larger inherited IRA distributions do not adversely affect the FAFSA award.

Example: If the child will be entering college in the fall of 2025, the FAFSA calculations looks at their income from 2023 to determine how much college financial aid they qualify for.

Traditional IRA vs Roth IRA

It does matter whether the child inherits a Traditional IRA or a Roth IRA. The RMD rule and the 10-year rule are the same, but the taxation of the distributions from the IRA to the child are different. If the child has an Inherited Traditional IRA, the guardian has to be more careful about making distributions to the minor child because all distributions are considered taxable income. If the child has an Inherited Roth IRA, by nature of the Roth IRA rules the distributions are not taxable to the minor child. However, Roth IRA's are extremely valuable because all the accumulation within the inherited Roth IRA are tax free upon withdrawal, so typically the strategy is to keep the account intact as long as possible so the child receives as much tax free appreciation as possible at the end of the 10 years.

Minor Child 10-Year Rule

Once the child reaches age 21, the rules change to the 10-year rule which requires the child to deplete any remaining balance in the inherited IRA within 10 years of turning age 21. The child has full discretion on the amounts that they wish to withdraw from their inherited IRA each year.

Minor Child Inherits A Retirement Account From A Non-Parent

If a minor child inherits a retirement account from someone other than their parents, the inherited IRA rules are different. The child is no longer allowed to take RMD’s from the inherited IRA each year until age 21, and then switch to the 10 year rule. If the child inherits a retirement account from someone other than their parent, they are treated the same as any other non-spouse beneficiary, and are immediately subject to the 10 year rule. They may or may not be required to take RMDs each year IN ADDITION to being required to deplete the account within 10 years, but that depends on what the age of the decedent was when they passed.

When the decedent passed away, if they had already reached their Required Beginning Date for RMDs, then the minor child would be required to continue to take annual RMD’s from the inherited IRA in addition to the 10-year rule starting immediately. If the decedent has yet to reach the required beginning date for RMDs, then the minor child is just subject to the 10-year rule.

In either situation, a minor child immediately subject to the 10-year rule requires detailed tax planning to avoid adverse and toxic consequences of poor distribution planning to avoid the loss of college financial aid due to the taxable income assigned to the child associated with those distributions from the inherited IRA.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

What Happens When You Inherit an Already Inherited IRA?

When you are the successor beneficiary of an Inherited IRA the rules are very complex.

When someone passes away and they have a retirement account, if there are non-spouse beneficiaries listed on the account, they will typically rollover the balance in the inherited retirement account to either an Inherited Traditional IRA or Inherited Roth IRA. But what happens when the original beneficiary passes away and there is still a balance remaining in that inherited IRA account? The answer is that a successor beneficiary inherits the account, and then the distribution rules become complex very quickly.

Beneficiary of an Inherited IRA (Successor Beneficiaries)

As a beneficiary of an inherited IRA, it's important to understand that the options available to you for taking distributions for the account will be determined by the distribution options that were available to the original beneficiary of the retirement account that you inherited it from, which vary from beneficiary to beneficiary.

Non-spouse Inherited IRA Rule

The IRS changed the rules for non-spouse beneficiaries back in 2019 with the passing of the Secure Act, which put original non-spouse beneficiaries in two camps: beneficiaries that inherited a retirement account from someone that passed away prior to January 1, 2020, and beneficiaries that inherited retirement accounts some someone that passed January 1, 2020 or later.

We have a whole article dedicated to these new non-spouse beneficiary rules that can be found on our website but for now I will move forward with the cliff notes version.

Stretch Rule vs 10-Year Rule Beneficiaries

As the beneficiary of an inherited IRA, you must be able to answer two questions:

Was the original beneficiary subject to the “RMD stretch rule” or “10-year rule”?

If that beneficiary was required to take an RMD in the year they passed, did they already distribute the full amount?

Original Beneficiary was the Spouse

A common situation is that a child has two parents - the first parent passes away, and the balance in those retirement accounts are then inherited by the surviving spouse and moved into the surviving spouse’s own retirement accounts. A spouse of an original owner of a retirement account has special rules available to them which allow them to roll their deceased spouse’s retirement accounts into their own retirement accounts and treat them as their own. When their children inherited the remaining balance in the retirement accounts from the second to parent, they are considered non spouse beneficiaries and are most likely subject to the new 10-year distribution rule unless they qualify for an exception.

Non-spouse Beneficiary 10-Year Rule

If the original beneficiary of the Inherited IRA received that account from someone that passed away after December 31, 2019 and they are a non-spouse beneficiary, they are most likely subject to the new 10-Year Rule which requires the original beneficiary to fully deplete that retirement within 10 year of the year following the original decedent’s death.

Example: Sue, the original owner of a Traditional IRA passes away in 2022, and her daughter Katie is the sole beneficiary of her IRA. Since Katie is a non-spouse beneficiary, she would be required to fully deplete the IRA by 2032, 10 years following the year after that Sue passed away.

But what happens if Katie, the original beneficiary of that inherited IRA passes away in 2026, and she is only 4 years into the 10-year depletion cycle? In this example, when Katie set up her inherited IRA, she named her two children Scott & Mara as 50/50 beneficiary on her inherited IRA account. Scott and Mara would move their respective 50% balance into their own inherited IRA account but as beneficiaries of an already inherited IRA, the 10-year rule does not reset. Scott & Mara would be bound to the same 10-year depletion date that Katie was subject to so Scott & Mara would have to deplete the Inherited IRA (2 times inherited) by 2032 which was Katie’s original 10-year depletion date.

10-Year Rule: The basic rule is if the original beneficiary of the inherited IRA was subject to the 10-year rule, as the new beneficiary of that existing inherited IRA, you get whatever time is remaining in that original 10-year period to fully deplete that Inherited IRA. It does not matter whether the inherited IRA that you inherited was a Traditional IRA or a Roth IRA, the same rules apply.

Original Beneficiary was a “Stretch Rule” beneficiary or the Spouse

For original non-spouse beneficiaries that inherited the retirement account from an account owner that passed away before January 1st, 2020, they have access to what is called the Stretch Rule. Those non-spouse beneficiaries are allowed to move the original owners balance of the retirement account to their own inherited IRA and they are not required to deplete the account in 10 years.

Instead, those non-spouse beneficiaries are only required to take an annual RMD (required minimum distribution) each year, which are small distributions from the Inherited IRA each year, but they could effectively stretch the existence of that inherited account over their lifetime. But it’s also important to note, that some non-spouse beneficiaries that inherited a retirement account from someone who passes on or after January 1, 2020, may have qualified for a stretch rule exception which are as follows:

Surviving spouse

Person less than 10 years younger than the decedent

Minor children

Disabled person

Chronically ill person

Some See-Through Trusts benefitting someone on this exception list

If the original beneficiary of the inherited IRA was eligible for the stretch rule, and you inherited that inherited IRA from that individual, you would NOT be eligible for the Stretch Rule, you would be subject to the 10-year rule, but you would have a full 10-years after the owner of that inherited IRA passes away to fully deplete the balance in that inherited IRA that you inherited.

When we are talking about beneficiaries of an already inherited IRA, it does not matter whether you were their spouse or non-spouse because the spouse exceptions only apply to the spouse of the original decedent.

Example: John inherited a Traditional IRA from his father who passed away in 2018. John was a non-spouse beneficiary, but since his father passed before 2020, he was eligible for the stretch provision which allowed John to roll over the Traditional IRA to an inherited IRA in his name and he was only required to take annual RMD’s each year but was not required to deplete the account in 10 years. John passes in 2025, his daughter Sarah is the beneficiary of the Inherited IRA, since Sarah inherited the inherited IRA from John who passes after December 31, 2019, Sarah would be required to deplete the balance in John’s inherited IRA by 2035, 10-year following the year after John passes.

RMD of Beneficiaries of Inherited IRAs

Now we have to move on to the second question that beneficiaries of Inherited IRAs need to ask, which is “does the successor beneficiary of an inherited IRA need to take annual RMD’s from the account each year?” The answer is “it depends”.

It’s common for beneficiaries of Inherited IRAs to be subject to both the 10-year rule and be required to take annual required minimum distributions from the account. Whether or not the beneficiary needs to take an RMD will depend on the whether or not the original beneficiary of the account was required to take RMDs. The basic rule is if the current owner of the Inherited IRA was required to take annual RMD’s from the account, you as the beneficiary of the Inherited will be required to continue to take RMD’s from the account. The IRS has a rule that once an owner of an IRA or Inherited IRA has started taking RMDs, they cannot be stopped.

If the answer is “Yes:”, the person that you inherited the Inherited IRA from was already taking RMD’s from the Inherited IRA account, then you as the beneficiary of that inherited IRA would be subject to whatever time is left in the 10-year rule, and you would also be required to take RMDs from the account each year.

Don’t Forget To Take The Decedent’s RMD

RMD’s are usually required to begin the year after an individual passes away which is true of Inherited IRAs but as the beneficiary of an retirement account, where the decedent was required to take an RMD for that year, you have to ask the question: did they satisfy their RMD requirement before they passed away.

If the answer is “yes”, no action is required in the year that they passed away unless they were in year 10 year of the depletion cycle.

If the answer is “no”, then you as the beneficiary of that existing Inherited IRA are required to take the undistributed RMD amount from that inherited IRA in the year that the decedent passed away.

Example: Kelly inherits an Inherited IRA from her mother Linda. Linda originally inherited the IRA from her father when he passed in 2022. At the time that her father passed, he was 80, which made him subject to RMDs. When Linda inherited the account from her father, since he was subject to RMDs, Linda was subject to the 10-year rule and annual RMDs. Linda passed in 2024, her daughter Kelly inherits her Inherited IRA, and Kelly would be required to fully deplete the inherited IRA by 2032 (Linda original 10 year rule date), she would be required to take annual RMD’s from the account because Linda was receiving RMDs, and if Linda did not receive her full RMD in 2024 when she passed, Kelly would have to distribute any amount that Linda would have been required to take in the year that she passes.

A lot of rules, but all very important to avoid the IRS penalties that await the taxpayers that fail to take the proper RMD amount or fail to adhere to the new 10-year rule.

Summary of 3 Successor IRA Questions

When you are the beneficiary of an inherited IRA, you must be able to answer the following questions:

Was the person that you inherited the inherited IRA from subject to the 10-year rule?

Was the person that you inherited the Inherited IRA from required to take annual RMDs?

Did the decedent take their RMD before they passed?

What was the age of the decedent when that passed?

The last question is important because there are potential situations where someone is the original beneficiary of an Inherited IRA subject to the 10-year rule, based on the age of the original owner when they passed and the age when the original beneficiary when they inherited the IRA may not make them subject to the annual RMD requirement. However, if the original beneficiary passes away after their “Required Beginning Date” for RMDs, the beneficiary of that inherited IRA may be subject to an annual RMD requirements even though the original beneficiary was not.

The IRS has unfortunately made the rules very complex for beneficiaries of an Inherited IRA account, so I would strongly recommend consulting with a professional to make sure you fully understand the rules.

General Rules Successor IRA Rules

If you are a successor beneficiary:

If the owner on the inherited IRA was subject to the stretch rule, you as the successor beneficiary are now subject to the 10-year rule

If the owner of the Inherited IRA was subject to the 10-year rule, you have whatever time is remaining within that original 10 year window to deplete the account balance.

Whether or not you have to take an RMD in the year they pass and in future years, is more complex, seek help from a professional.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Beneficiaries May Need To Take An RMD From A Decedent’s IRA In The Year They Pass Away

A common mistake that beneficiaries of retirement accounts make when they inherit either a Traditional IRA or 401(k) account is not knowing that if the decedent was required to take an RMD (required minimum distribution) for the year but did not distribute the full amount before they passed, the beneficiaries are then required to withdrawal that amount from the retirement account prior to December 31st of the year they passed away. Not taking the RMDs prior to December 31st could trigger IRS penalties unless an exception applies.

A common mistake that beneficiaries of retirement accounts make when they inherit either a Traditional IRA or 401(k) account is not knowing that if the decedent was required to take an RMD (required minimum distribution) for the year but did not distribute the full amount before they passed, the beneficiaries are then required to withdrawal that amount from the retirement account prior to December 31st of the year they passed away. Not taking the RMDs prior to December 31st could trigger IRS penalties unless an exception applies.

The RMD Requirement for the Decedent

Once you reach a specific age, the IRS requires taxpayers to begin taking mandatory annual distributions from their pre-tax retirement account each year. These mandatory annual distributions are called RMDs or required minimum distributions. The age at which an individual is required to begin taking RMDs is also referred to as the “Required Beginning Date” (RBD). The Required Beginning Date is based on your date of birth:

Born 1950 or earlier: Age 72

Born 1951 – 1959: Age 73

Born 1960 or later: Age 75

Example: If Jim was born in 1951 and turns age 73 this year, and Jim has a Traditional IRA with a $500,000 balance, in 2024, Jim would be required to withdraw $18,867 from his IRA as his annual RMD and pay tax on the distribution.

Undistributed RMD Amount When Someone Passes Away

It’s a common situation for an individual who has reached their Required Beginning Date for RMDs to pass away prior to distributing the required amount from their IRA account for that calendar year.

Example: Jen is age 81; she passed away in February 2024 with a $300,000 balance in her Traditional IRA. Her RMD amount for 2024 would be $15,463. If Jen only distributed $3,000 from her IRA prior to passing away in February, the beneficiary or beneficiaries of Jen’s IRA would be required to withdraw the remaining amount of her RMD, $12,463, prior to December 31, 2024, otherwise the beneficiaries will be faced with a 10% to 25% excise tax on the amount of the RMD that was not withdrawn prior to December 31st.

A Single Beneficiary

If there is only one beneficiary that is inheriting the entire account balance, the process is easy: determine the remaining amount of the decedent’s RMD, and then process the remaining RMD amount from the IRA account prior to December 31st of the year that they passed away.

Multiple Beneficiaries

When there are multiple beneficiaries of a pre-tax retirement account, the IRS recently released new regulations clarifying a question that has been in existence for a very long time.

The question has been, “If there are multiple beneficiaries of a retirement account, does EACH beneficiary need to distribute an equal share of the decedent’s remaining RMD amount OR do they collectively just have to make sure the remaining RMD amount was distributed but it does not have to be in equal shares?”

I’ll show you why this matters in an example:

Susan passed away before taking her $20,000 RMD for the year. She has a $200,000 balance in her Traditional IRA, and her two kids, Scott and Wanda, are both 50% primary beneficiaries on her account. The kids set up separate inherited IRAs and transfer their $100,000 shares into their respective accounts. Scott intends to take a $50,000 distribution from his Inherited IRA, pay the tax, and buy a boat, but Wanda, who is a high-income earner, wants to avoid taking taxable distributions from her Inherited IRA until after she retires.

Since Scott took enough out of his Inherited IRA to cover Susan’s full $20,000 undistributed RMD in the year she passed, is Wanda relieved of having to take an RMD from her account in the year that Susan passed, or does she still need to distribute her $10,000 share of the $20,000 RMD?

The new IRS regulations state that the decedent’s undistributed RMD amount is allowed to be satisfied by “any beneficiary” in the year that they pass away. Meaning the RMD does not have to be distributed in equal amounts to each beneficiary, as long as the total remaining RMD amount is distributed by one or more of the beneficiaries of the decedent.

In the example above, if Scott processed $50,000 from his inherited IRA in the year that Susan passed, Wanda would not be required to take a distribution from her inherited IRA that year because Susan’s $20,000 remaining RMD amount is deemed to be fulfilled.

A Decedent With Multiple IRAs

It’s not uncommon for an individual to have more than one Traditional IRA account when they pass away. The question becomes if they have multiple IRAs and each of those IRAs has an undistributed RMD amount at the time the decedent passes away, can the beneficiaries total up all of the undistributed RMD amounts and take the full amount from one single IRA account OR do they have to take the undistributed RMD amount from each IRA account?

The answer is “it depends”. It depends on whether the beneficiaries are the same or different for each of their IRA accounts.

Multiple IRAs – Same Beneficiaries

If the decedent has multiple IRAs but the beneficiaries are exactly the same as all of their IRAs, then the beneficiaries are allowed to aggregate the undistributed RMD amounts together and distribute that amount from any IRA or IRAs that they choose before the end of the year.

Multiple IRAs – Different Beneficiaries

However, in the instance that the decedent has multiple IRAs but has different beneficiaries listed amongst the different IRA accounts, then the decedent’s undistributed RMD amount needs to be taken from each IRA account.

Privacy Issue with Multiple Beneficiaries

I have been a financial planner long enough to know that not all family members get along after someone passes away. If the decedent had an undistributed RMD amount in the year that they passed and the beneficiaries are not openly sharing their plans regarding how much they plan to withdraw out of their inherited IRA in the year the decedent passed away, it may be impossible to coordinate the disproportionate distributions between the multiple beneficiaries defaulting the beneficiary to taking their equal share of the undistributed RMD amount.

IRS Penalty For Missing RMD

If the beneficiaries fail to distribute the decedent’s remaining RMD amount before December 31st of the year that they pass away, then the IRS will assess a 25% penalty against the amount that was not timely distributed from the IRA account.

Special Note: The IRS penalty is reduced to 10% if corrected in a timely fashion.

Automatic Waiver of the RMD Penalty

The final regulations released by the IRS in 2024 granted a very favorable automatic waiver of the missed RMD penalty that did not exist prior to July 2024. The automatic waiver originally stemmed from the common scenario that if the decedent passed away in December and had not yet satisfied their RMD amount for the year, it was often difficult for the beneficiaries to work with the custodians of the IRA to get those distributions processed prior to December 31st. However, the IRS, being oddly gracious, now provides beneficiaries with an automatic waiver of the missed RMD penalty, specifically for undistributed RMD amounts for a decedent, up until December 31st of the year AFTER the decedent’s death to satisfy the RMD requirement.

When Is No RMD Required?

I have gone through numerous scenarios without stating the obvious. If the decedent either died before their Required Beginning Date for RMDs or if they died AFTER their Required Beginning Date but distributed their full RMD amount prior to passing away, the beneficiaries are not required to distribute anything from the decedent’s IRA prior to December 31st in the year that they passed away.

Also, if the Decedent had a Roth IRA, Roth IRAs do not have an RMD requirement, so the beneficiaries of the Roth IRA would not be required to take an RMD prior to December 31st in the year the decedent passes away.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Final Rules For Non-spouse Beneficiary Inherited IRAs Has Been Released: The 10-Year Rule, Annual RMD Requirement, Tax Strategies, New 401(k) Roth Rules, and More…….

In July 2024, the IRS released its long-awaited final regulations clarifying the annual RMD (required minimum distribution) rules for non-spouse beneficiaries of retirement accounts that are subject to the new 10-year rule. But like most IRS regulations, it’s anything but simple and straightforward.

In July 2024, the IRS released its long-awaited final regulations clarifying the annual RMD (required minimum distribution) rules for non-spouse beneficiaries of retirement accounts that are subject to the new 10-year rule. But like most IRS regulations, it’s anything but simple and straightforward. The short answer is for non-spouse beneficiaries that are subject to the 10-year rule; some beneficiaries will be required to begin taking annual RMDs starting in 2025 while others will not. In this article, we will review:

The RMD requirement for non-spouse beneficiaries

RMD start date

IRS penalty relief for missed RMDs

Are one-time distributions required for missed RMDs 2020 - 2024?

Different RMD rules for Traditional IRAs versus Roth IRAs

Different RMD rules for Roth 401(k) versus Roth IRAs

Common RMD mistake for stretch rule beneficiaries

In addition to covering the topics above related to the new RMD rules, we want this article to be a “one-stop shop” for non-spouse beneficiaries to understand how these non-spouse inherited IRAs work from start to finish, so we will start this article by covering:

How Inherited IRA work for non-spouse beneficiaries

Rules for a decedent that pass either before or after 2019

The new 10-year Rule

Beneficiaries that are granted an exception to the new 10-year rule

Required minimum distributions (RMDs)

Taxation of distributions from inherited IRAs

Tax strategies and Pitfalls associated with Inherited IRA accounts

Special rules for minor children with Inherited IRAs

(If you are reading this just for the new RMD rules, you can skip to the second half of the article)

Non-spouse Beneficiaries of Retirement Accounts

When you inherit a retirement account, there are different options available to you depending on whether you are a “spouse beneficiary” or a “non-spouse beneficiary”. In this article, we are going to be focusing on the options available to a non-spouse beneficiary.

Non-spouse Beneficiary Rules Prior to 2020

In 2019, the SECURE Act 1.0 was passed, which greatly limited the inherited IRA options that were available to non-spouse beneficiaries of IRAs, 401(k)’s, and other types of employer-sponsored retirement plans. Under the old rules, if someone passed away prior to January 1, 2020, you as a non-spouse beneficiary, were allowed to move the balance of that IRA into an inherited IRA in your name, avoid any immediate tax implications, and you only had to take small distributions each year called RMDs (required minimum distributions) based on IRS life expectancy table. This was called the “stretch rule” which allowed a non-spouse beneficiary to stretch the distributions over their lifetime.

If you wanted to take more out of the account, you could, since it’s an inherited IRA, even if you were under the age of 59 ½, you avoided the 10% early withdrawal penalty and either had to pay income tax on a pre-tax retirement account or avoided tax altogether on Roth inherited IRA accounts. These beneficiaries had a lot of flexibility with this option with minimal emergency tax planning needed.

For individuals in this camp who inherited a retirement account from someone who passed away prior to January 1, 2020, the good news is you are grandfathered in under the old rules, and none of the changes that we are going to cover in this article apply to you. You still have access to the stretch provision.

Non-spouse Beneficiary of Decedent That Passed After December 31, 2019

SECURE Act 1.0, which passed in 2019, took away the “stretch option” for most non-spouse beneficiaries and replaced it with a much more restrictive “10-Year Rule,” which requires a non-spouse beneficiary to fully deplete the account balance of that inherited retirement account within 10 years start the year after the decedent passed away. If you inherited a retirement account from someone who passed away AFTER December 31, 2019, and you are non-spouse beneficiaries, you are subject to the new 10-Year Rule UNLESS you meet one of the exceptions. Non-spouse beneficiaries that qualify for an exception to the 10-year rule are referred to as “Eligible Designated Beneficiaries” in the new tax regulations if you choose to read the 260 pages that were just released by the IRS.

Here is the list of beneficiaries that are exempt from the new 10-year rule and still have the stretch option available to them:

Surviving spouse

Person less than 10 years younger than the decedent

Minor children

Disabled person

Chronically ill person

Some See-Through Trusts benefitting someone on this exception list

Non-Spouse Beneficiary Not More Than 10 Years Younger Than The Decedent

I wanted to highlight this exception because it’s the most common exception to the 10-rule for non-spouse beneficiaries that we see amongst our clients. If you are a non-spouse beneficiary of a retirement account from someone that was not more than 10 years younger than you like a sibling or a cousin, the new 10-year distribution rule does not apply to you. You are allowed to roll over the balance to your own inherited IRA and stretch annual RMDs over your lifetime.

Example: Tim passes away at the age of 55 and his sister Susan age 58 is the 100% primary beneficiary of his Traditional IRA account, since Susan is a non-spouse beneficiary, she normally would be subject to the 10-year rule requiring her to fully distribute and pay tax on Tim’s IRA balance within a 10 year period. However, since Tim was less than 10 years younger than Susan, she qualifies for the exception to the 10-year rule. She can rollover Tim’s IRA balance into an Inherited IRA in her name, and she would only be required to take small required minimum distributions each year starting the year after Tim passed away.

Minor Children As Beneficiary of Retirement Accounts

The minor child exception is a little tricker. If a minor child is the beneficiary of a retirement account, and they inherited the retirement account from their parents, they are only required to take those small annual RMDs until they reach age 21, but then as soon as they turn 21, they switch over to the 10-Year Rule. If they inherited the retirement account from someone other than their parent, then the 10-year period begins the year after the decedent passes away like the rest of the non-spouse beneficiaries.

Example: Josh is age 12 and his mother unexpectedly passes away and Josh is listed as the primary beneficiary on his mother’s 401(K) account at work. Josh, as a non-spouse beneficiary, would not immediately be subject to the 10-year rule, but instead, he would be temporarily allowed to use the stretch provision; he would be required to take annual RMDs each year from the retirement account until he reaches age 21. Once Josh reaches age 21, he will then be subject to the 10-year rule, and he will be required to fully distribute the retirement account 10 years following when he turns age 21.

Age of Majority: Normally the “age of majority” is defined by the state that the minor lives in. For some states, it’s age 18, and in other states, it’s age 21. The new IRS regulations addressed this issue and stated that regardless of the age of majority for the state that the minor lives in and regardless of whether or not the child is a student past the age of 18, the age of majority for purposes of triggering the 10-year rule for non-spouse beneficiaries will be age 21.

Non-Spouse Beneficiary Subject To The 10-Year Rule

If you are a non-spouse beneficiary who inherited a retirement account from someone who passed away AFTER December 31, 2019, and you DO NOT qualify for one of the exceptions previously listed, then you are subject to the new “10-Year Rule”. The 10-Year Rule requires a non-spouse beneficiary to fully deplete the inherited retirement account balance no later than 10 years following the year after the decedent passes away.

The 10-Year Rule Applies to Both Pre-Tax and Roth Retirement Accounts

Regardless of whether you inherited a pre-tax retirement account like a Traditional IRA, SEP IRA, or 401(k) account or a Roth retirement account like a Roth IRA or Roth 401(k), the 10-year rule applies.

Example: Sarah’s father just passed away in February 2024, and she was the 100% primary beneficiary of his Traditional IRA account with a balance of $300,000. Sarah is age 60. Sarah, as a non-spouse beneficiary, would be subject to the 10-year rule and would be required to fully distribute and pay tax on the full $300,000 before December 31, 2034, which is 10 years following the year after her father passed away.

The RMD Mystery

When the 10-Year Rule first came into being in 2020, it was assumed that this 10-year rule was an extension of the previous “5-year rule”, which only required the beneficiary to deplete the account balance within 5 years but there was no annual RMDs requirement during that 5-year period. The IRS just simply eliminated the “stretch option” and extended the 5-year rule to a 10-year rule.

But then, two after the IRS passed SECURE Act 1.0 with this new 10-year rule, the IRS came out with new proposed regulations that basically said, “Whoops, I know we wrote it that way, but that’s not what we meant.”

In the proposed regulations that the IRS released in February 2022, the IRS clarified that what they meant to say was that certain non-spouse beneficiaries that are subject to the new 10-year rule would ALSO be required to take annual RMDs during that 10-year period. This was not welcome news for many non-spouse beneficiaries, and it created a lot of confusion since a few years had already gone by since the new 10-year rule was signed into law.

The New RMD Rules for Inherited IRA for Non-spouse Beneficiaries

The finalized IRS regulations that were just released in July 2024 made their stance official. Whether or not a non-spouse beneficiary will be subject to BOTH the 10-Year Rule and annual RMDs will be dependent on two factors:

The age of the decedent when they passed away

The type of retirement account that the beneficiary inherited (Pre-tax or Roth)

RMD Requirement Based on Age of Decedent

If you are the original owner of a retirement account (Traditional IRA, 401(k), etc.), once you reach a specific age, the IRS requires you to start taking small distributions from that pre-tax account each year, which are called required minimum distributions (RMDs).

The age at which you are required to begin taking RMDs is called your Required Beginning Date (“RBD”), not to be confused with the “RMD”. There are too many acronyms in the finance world “The IRS wants you to take your RMD by your RBD ASAP so they can collect their TAX.”

The date at which RMDs are required to begin varies based on your date of birth:

Born 1950 or earlier: Age 72

Born 1951 – 1959: Age 73

Born 1960 or later: Age 75

Someone that is born in 1956 would be required to start taking RMDs from their pre-tax retirement accounts at age 73. Why is this relevant to non-spouse beneficiaries? Because whether or not the decedent died before or after their Required Beginning Date for RMDs will determine whether or not you, as the non-spouse beneficiary, are required to take annual RMDs during the 10-Year Rule period.

The Decedent Passes Away Prior to Their RMD Required Beginning Date

If the decedent passed away prior to their Required Beginning Date, then you, as the non-spouse beneficiary, are subject to the 10-Year Rule, but you ARE NOT REQUIRED to take annual RMDs during the 10-year period. You simply have to deplete the account balance prior to the end of the 10 years.

Example: Brad’s father passes away at age 68 and Brad is the 100% beneficiary of his Traditional IRA. Brad’s father was born in 1956, making his RMD start at age 73. Since Brad’s father passed away prior to reaching age 73 (RBD), Brad would be subject to the 10-year rule but would not be required to take annual RMDs during that 10-year period.

The Decedent Passes Away After Their RMD Required Beginning Date

If the decedent passes away AFTER their Required Beginning Date for RMDs, then the non-spouse beneficiary is subject to BOTH the 10-year rule AND is required to take annual RMDs during that 10-year period.

Example: Dave’s father passed away at age 80, and he had been taking RMDs for many years since he was beyond his Required Beginning Date. When Dave inherits his father’s Traditional IRA, he will not only be subject to the 10-year rule as a non-spouse beneficiary, but he will also be required to distribute annual RMDs every year from the Inherited IRA account since his father had already begun receiving RMDs for his account.

RMDs Not Required Until 2025

Since the IRS just released the final regulation in July 2024, for non-spouse beneficiaries that are subject to both the 10-Year Rule and annual RMDs, RMDs are not required to begin until 2025.

Good news: For non-spouse beneficiaries subject to the 10-year rule, the IRS has waived all penalties for the “missed RMDs” between 2020 and 2024, and they are not requiring these non-spouse beneficiaries to “make up” for missed RMDs for years leading up to 2025. The RMDs will be calculated in 2025 like everything has been working smoothly since Day 1.

No Reset of the 10-Year Depletion Timeline

It’s important to note that even though the IRS took 4 years to clarify the RMD rules associated with the new 10-year rule, it does not reset the 10-year clock for the depletion of the inherited retirement account.

Example: Jessica’s uncle passed away in 2020 at the age of 82. Jessica, as a non-spouse beneficiary, would be subject to the 10-year rule requiring her to fully deplete the Traditional IRA by December 31, 2030. Since her uncle was past his Required Beginning Date for RMDs, Jessica would be required to take annual RMD in the years 2025 – 2030. (Note that the 2021 – 2024 RMDs were waived due to the IRS delay). Even though her first RMD will not be until 2025, she is still required to deplete the Traditional IRA account by December 31, 2030.

Annual RMD Rules

Many of these examples incorporate the delay in annual RMDs due to the delay in the IRS regulations being released. However, if someone passes away in 2024 and has a non-spouse beneficiary listed on their pre-tax retirement account, the 10-year timeline and the first annual RMD calendar would begin in 2025, which is the year following the decedent’s date of death.

The first RMD is required to be taken by a non-spouse beneficiary by December 31st of the year following the decedent's death.

Inherited Roth IRAs – No RMD Requirement

You will notice in most of my examples that I specifically use a “Traditional IRA” or “Pre-tax Retirement Account.” That is because only pre-tax retirement accounts have the RMD requirement. If you are the original owner of a Roth IRA, Roth IRAs do not require you to take an RMD regardless of your age. So, under the new rules, if you inherit a Roth IRA, since the decedent would not have been required to take an RMD from a Roth IRA at any age, they never had a “Required Beginning Date”. This makes the non-spouse beneficiary subject to the 10-year rule, but no annual RMDs would be required from an inherited Roth IRA.

Note: If you inherit a Roth IRA and you are eligible for the stretch options, annual RMDs are then required from you Inherited Roth IRA account.

Roth 401(k)s Are Different

While typically, Roth IRAs and Roth 401(k)s have the same rules, the IRS included a weird rule for Roth 401(k)s in the final regulations regarding the RMD requirement. If you inherit a 401(k) plan, it’s possible that there are both Pre-tax and Roth monies within that same account since most 401(k) plans allow plan participants to make either pre-tax deferrals or Roth deferrals to the plan.

Normally I would have thought if a 401(k) account contains both Pre-tax and Roth dollars, as a non-spouse beneficiary, you would have the 10-year rule for the full account balance, but you could ignore the RMD requirement for the Roth dollars, but the annual RMDs on the pre-tax portion of the account would depend on whether or not the decedent passed away before or after their Required Beginning Date for RMDs. Assuming this, I would have been correct for the pre-tax portion of the 401(k) account but potentially wrong about no annual RMDs for the Roth portion of the 401(k) account.

The final regulations state that if the 401(k) account contains ONLY Roth dollars, no pre-tax dollars within the account, then a non-spouse beneficiary is subject to the 10-year rule but DOES NOT have to take annual RMDs during that 10-year period.

However, if the 401(k) account contains both Roth and any other type of pre-tax source, like employee pre-tax deferrals, employer match, and employer profit sharing, which is much more common for 401(k) plans, then the ENTIRE BALANCE in the 401(k) plan, INCLUDING THE ROTH SOURCE, is subject to the annual RMD requirement during the 10-year period. Yuck!!!

This new rule will encourage individuals who have a Roth source within their employer-sponsored retirement plans to roll over their Roth monies within the plan to a Roth IRA before they pass away. By removing that Roth source from the employer-sponsored retirement plans and moving it into a Roth IRA, now when the non-spouse beneficiary inherits the Roth IRA, they are allowed to accumulate those Roth dollars longer within the 10-year period since they are not required to take annual RMDs from a Roth IRA account.

Note: The pre-tax sources within a 401(k) works the same way as inheriting a Traditional IRA. A non-spouse beneficiary would be subject to the 10-year rule and may or may not have to take RMDs during the 10-year period depending on whether or not the decedent dies before or after their Required Beginning Date for RMDs.

Non-Spouse Beneficiaries Eligible For The Stretch Rule Only Had An RMD Waiver for 2020

In 2020, part of the COVID relief packages was the ability to waive taking an RMD during that calendar year. I have run into a few cases where non-spouse beneficiaries that were grandfathered in under the “stretch rules” requiring them to take an annual RMD each year, are getting confused with the delay in the RMD requirement for non-spouse beneficiaries that are subject to the new 10-year rule after December 2019. The delay in the annual RMDs until 2025 for non-spouse beneficiaries ONLY applies to individuals subject to the 10-year rule. If you inherited a retirement account from someone who passed away prior to 2020 or you qualify for one of the exceptions to the 10-Year Rule as a non-spouse beneficiary, you are grandfathered in under the old “Stretch Rule,” which requires the owner of that Inherited IRA to take annual RMD’s from that account each year starting in the calendar year following the decedent’s date of death.

In summary, if you are a stretch rule non-spouse beneficiary, the only year you were allowed to skip your RMD was 2020 per the COVID relief; you should have restarted your annual RMDs in 2021 and taken an RMD for 2021, 2022, and 2023, and subsequent years. If you missed this, the good news is the Secure Act 2.0 also lowered the IRS penalty amount for missed RMDs, from 50% to 25% and even lower to 10% if timely corrected.

Non-Spouse Inherited IRA Tax Strategies

We will be writing a separate article that contains all of the advanced tax strategies that we implement for clients who are non-spouse beneficiaries subject to the 10-year rule since there are a number of them, but here is some of the standard guidance that we provide to our clients.

If you inherit a Roth IRA, that is an ideal situation because even though you are subject to the 10-year rule as a non-spouse beneficiary, all of the accumulation in an Inherited Roth IRA can be withdrawn tax-free.

Example: John inherits a $200,000 Roth IRA from his mother in 2024. John, as a non-spouse beneficiary, will be subject to the 10-year rule, so the account has to be depleted by 2034, but he is not required to take annual RMDs because it’s a Roth IRA account. If John invests the $200,000 wisely and receives an 8% annual rate of return, at the end of 10-year the $200,000 has grown to $431,785 within that Inherited Roth IRA, and the full balance will be distributed to him ALL TAX-FREE.

For this reason, we have a lot more clients processing Roth Conversions in retirement to push more of their net worth from the pre-tax bucket over to the Roth bucket, which is much more favorable for non-spouse beneficiaries when they inherit the account.

For clients that inherit larger pre-tax retirement accounts that are subject to the 10-year rule, we have to develop a detailed tax plan for the next 10 years since we know all of that money will need to be distributed and taxed within the next 10 years, which could cause the money to be taxed at a higher tax rate, increased Medicare premiums, lower financial aid awards for parents with kids in college, have their social security taxed at a higher rate, lose tax deductions, or other negative consequences for showing too much income in a single year.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

A Market Selloff Triggered By A Fed Policy Error

The Fed made a significant policy error last week by deciding not to cut the Fed Funds rate and the stock market is now responding to that error via the selloff we have seen over the past week. Unfortunately, this policy error is nothing new. Throughout history, the Fed typically waits too long to begin reducing interest rates after inflation has already abated and they seem to be on that path again.

The Fed made a significant policy error last week by deciding not to cut the Fed Funds rate and the stock market is now responding to that error via the selloff we have seen over the past week. Unfortunately, this policy error is nothing new. Throughout history, the Fed typically waits too long to begin reducing interest rates after inflation has already abated and they seem to be on that path again.

The Fed’s primary objective is to create an economic environment with full employment and inflation in a range of 2% to 3%. The Fed's primary tool to achieve these objectives is the use of the Fed Funds rate, which has a dramatic impact on interest rates within the economy. When the economy runs too hot, the Fed raises interest rates to slow it down. When the economy begins to contract, the Fed lowers interest rates and makes lending more attractive to get the economy going again.

Think of the economy like a campfire; the Fed is the campfire attendant, and they have three tools at their disposal:

Logs

Gasoline

Garden hose

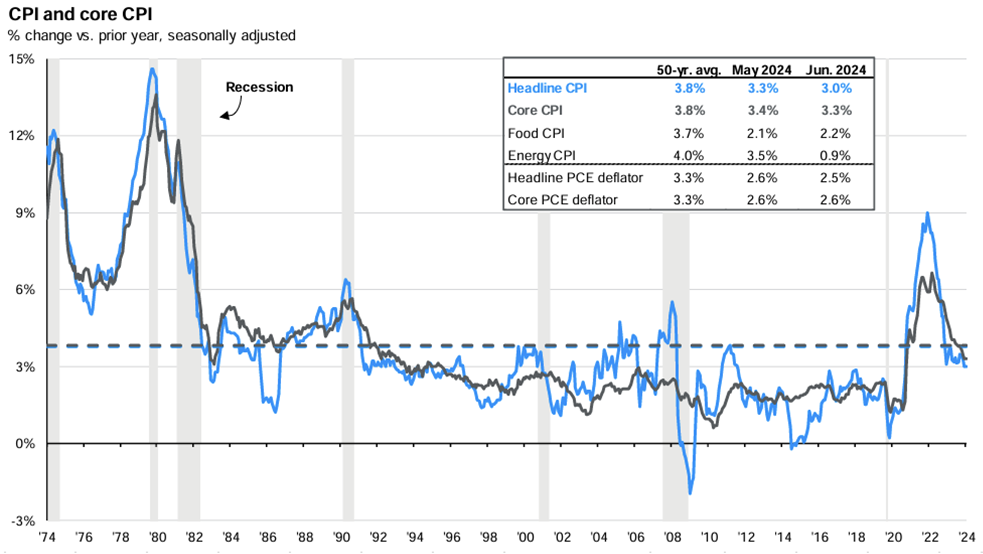

When the economy is growing rapidly, the fire can get too big and risks getting out of control. When that happens, the Fed can use the garden hose (raising interest rates) to dampen the blaze. Over the past 18 months, the Fed has raised rates to reduce inflation from the peak rate of 9% to the current rate of 3%.

Their use of the hose has also caused the labor market to soften which can be seen in the reduction in the rate of non-farm payroll gains:

It can also be seen in the recent rise in the unemployment rate (grey line) and the steady decline in wage growth (blue line):

While the Fed has successfully tamed the inflation blaze, it now runs a new risk: the fire going out completely, which results in the economy slipping into a recession.

As the fire dies down, the Fed's job is to add logs to the fire via interest rate cuts to keep the fire from going out completely.

Last Wednesday (July 31, 2024), the fire was at a level that it needed a log, but the Fed decided not to add one, and the stock market responded accordingly. The Fed does not meet again until September 17th, which is almost seven weeks away. They now run the risk that the fire gets too low before reaching that September meeting.

But there is also another risk that the market is digesting: if the fire does get too low or goes out before the September 17th meeting; for anyone that has ever used too much water on a fire, it can take a while to rebuild the fire. Meaning, if the Fed does wait until the September meeting to reduce interest rates by 0.25% - 0.50%, it historically takes 4 to 6 months before that decrease in interest rates has a positive impact on the economy, and that 4 to 6 month wait is usually ugly for the equity markets knowing that help is on the way but it’s not here yet.

If the recent market selloff escalates, I think there is a good chance that the Fed may need to step in before the September 17th meeting and announce a rate cut to calm the markets. While it may be viewed as an act of desperation to keep the economy from slipping into a recession, in my opinion, it’s something that should have already happened. It’s only logical that if inflation is in a safe range and trending downward, and labor markets are showing the same trend line of softening which they are, a 0.25% rate cut, at a minimum, is warranted given the fact that the rate cut will not have its positive impact for another 4 – 6 months.

Unfortunately, throughout history, the Fed has been late to both sides of the game. They typically wait too long to raise rates, which gave us the 9% inflation in 2022, and they historically wait too long to cut rates, which is why there has historically been turbulence from the equity market on the backside of Fed rate hike cycles.

If the Fed either steps in before the September 17th meeting to lower rates or if the economy can stabilize between now and the September meeting for a potentially larger rate cut from the Fed, markets may stabilize in the coming week, however, investors also have to be ready for an escalation of the current selloff and increased levels of volatility as the markets try to maneuver through the late-innings of the Fed’s tightening cycle. Otherwise, the economy could slip into a mild recession that so many economists were predicting in 2023 that never happened, and then the Fed will be forced to use gasoline on the fire via a series of rapid large rate cuts and/or direct injection of liquidity (bond buying).

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

2024 Market Outlook: Investors Are In For A Few Surprises

Investors have to be ready for many surprises in 2024. While the US economy was able to escape a recession in 2023, if anything, it has increased the chances of either a recession or a market pullback in the first half of 2024.

Investors have to be ready for many surprises in 2024. While the US economy was able to escape a recession in 2023, if anything, it has increased the chances of either a recession or a market pullback in the first half of 2024. While many investors remember how bad the Great Recession was back in 2008 and 2009, very few remember what the market conditions were like prior to the recession beginning. As an investment firm, we archive a lot of that data, so we reference it at any time to determine where the market may be headed today, and the historical data is alarming.

Rewind the clock to January 2008

In January 2008, the US economy was already in a recession, but it had not officially been declared yet that's because a recession, by textbook definition, is two consecutive quarters of negative GDP, but you don't get the quarterly GDP readings until after each calendar quarter end, so while the recession in the US officially began December 2007, investors didn't realize recession had been declared until mid-way through 2008. So what were the forecasts for the S&P 500 in January 2008?

The broker-dealer that we were with at the time was forecasting in January 2008 that the S&P 500 Index would be up 16% in 2008. We now know that 2008 was the first year of the Great Recession, and the S&P 500 ended up posting a loss of 36% for the year. Many investors don't realize that historically, the consensus is very bad at predicting a coming recession because they failed to recognize the patterns in the economy and monetary policy that tend to be very good predictors of recessions. Investors are often more worried about missing out on the next 20% rally in the markets, which is why they get caught when the market begins its steep sell-off.

What were some of these economists looking at in January 2008 that made them so wrong? Towards the end of 2007, we had already begun to see the cracks within the US housing market, the economy had already started to slow, but in September 2007, the Federal Reserve began to lower interest rates which stock forecasters saw as a bullish signal that the monetary stimulus of lower interest rates would mean growth for the stock market in 2008. This echoes much of the same rhetoric that I heard in the fourth quarter of 2023 as the Fed decided to go on pause and then built in rate cuts to their 2024 forecast.

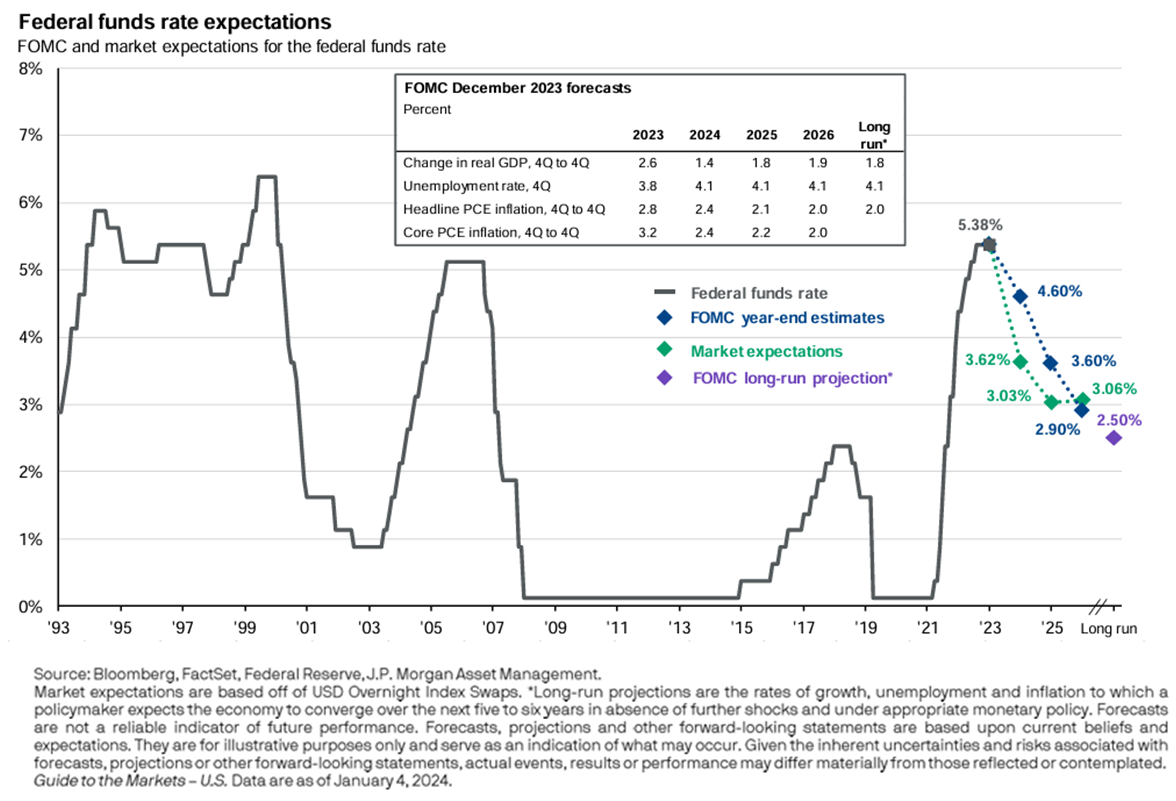

If you look back at history, there's a pattern between the US economy and the Fed funds rate, and it's fairly consistent over time. Here is a chart of the Fed funds rate going back to 1993. You will see the same pattern in the chart, The Fed raises rates to fight inflation, they pause (which is the tabletop portion at each of the mountain peaks), and then rates drop rapidly when the economy slows by too much, and the economy enters a recession. The Fed is historically very bad at delivering soft landings, which is a reduction in inflation without a recession.

Why is that? I think largely it's because we have the largest economy in the world, so picture a battleship in a bathtub, it takes a long time to turn, and because it's so large, once you've begun the turn you can't just stop the turn on a dime, so our turns tend to overshoot their mark, creating prolonged bull market rallies past what the consensus expects, but also an inability to stop the economy from slowing too much in an effort to fight inflation before it dips into a recession.

Here is the pattern

This chart shows our current rate hike cycle as well as the five rate hike cycles before us. For the five rate hike cycles preceding our current cycle, four of the five resulted in a recession. But that means one of the five created a soft landing, which one was it?

The 1994/1995 rate hike cycle was one of the very few soft landings that the Fed has engineered in history, so could that be done again? What was different about the mid-90s compared to the other four rate hike cycles that led us into a recession?

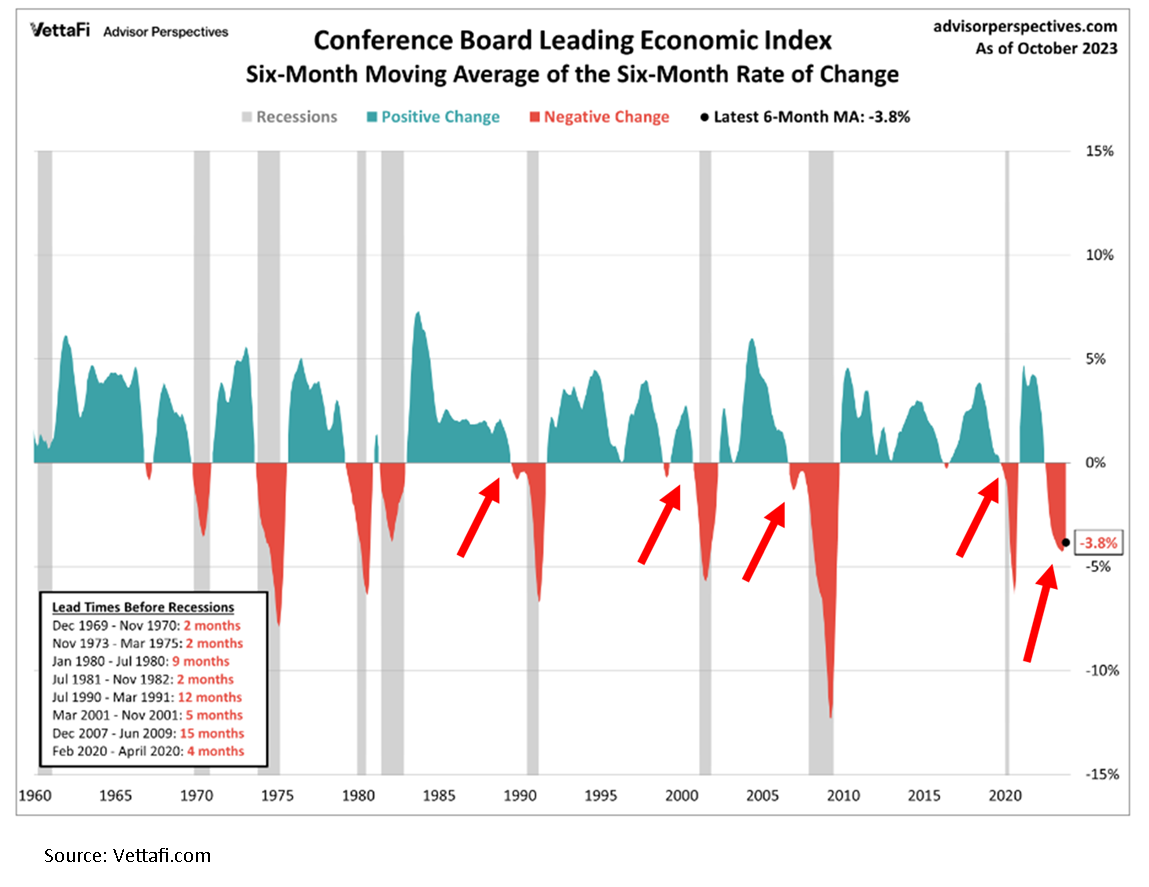

Leading Economic Index

The leading economic index is comprised of multiple economic indicators such as manufacturing hours worked, consumer sediment, building permits, and more. Its parts are considered by many to be forward-looking measurements of economic activity, which is why it's called the leading index. Below is a historical chart of the LEI index going back to 1960. The way you read the chart, when it's blue the leading indicators in aggregate are positive, when it's red, the leading indicators in aggregate are contracting.

If you look at the four rate hike cycles that led to a recession, the leading indicators index was contracting in all four prior to the recession beginning, serving as a warning sign. But if you look at 1995 in the chart, the leading indicators index never contracted, which means the Fed was able to bring down inflation without slowing the economy.

But on the far right-hand side of the chart, look at where we are now. Not only has the leading indicators index contracted similar to the four rate hike cycles that caused the recession, but it's contracted at a level so deep that we've never been at this level without already being in a recession. If we avoid a recession over the next 12 months, it will be the first time that the LEI index has been this low without a recession preceding it.

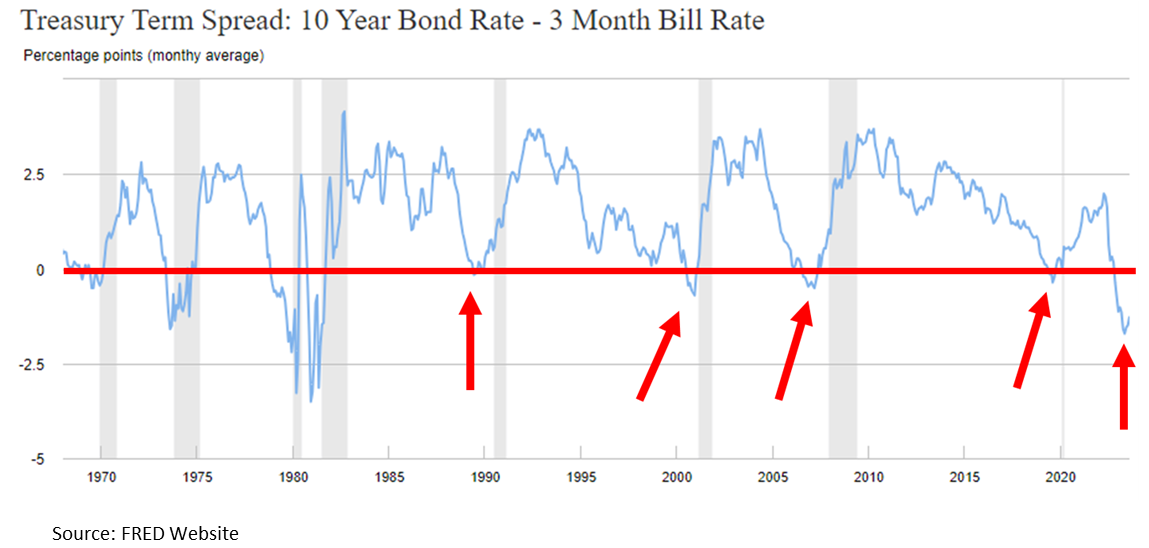

Inverted yield curve

There is a technical indicator in the bond market called the yield curve, which tracks both short-term and long-term interest rates. Without getting into the technical details of how it works, when the yield curve inverts, which means short-term interest rates are higher than long-term interest rates, historically, it's a bearish signal, and it increases the likelihood of a recession occurring. In the past, an inverted yield curve has been a very good predictor of a coming recession. See the chart below.

Anytime The blue line drops below the red line the yield curve is inverted, the gray bars on the chart are the recessions, so when all of the previous 5 recessions the yield curve gave us an advance warning before the recession actually occurred. On the far right-hand side of the chart, that is where we are now, not just slightly inverted, but far more heavily inverted than the previous four recessions. Similar to the leading indicators index historical behavior, if we were to avoid a recession in the next 12 months, that would be the exception to the rule.

Returning to our original question of why was the 1994/1995 soft landing different, notice on the inverted yield curve chart during 1995, the yield curve never inverted, making it much different than the situation we're in now.

Magnitude and pace of rate hikes

After going through this exercise and understanding the patterns of the leading indicators index as well as the yield curve, let's return to our first chart, which showed the six rate hike cycles, including the one we're in now.

The gold line is the rate hike cycle that we're in now, the others are the five previous rate hike cycles. Again four of those five caused the recession, and the reason why the gold line on the chart is higher than the rest the Fed raised rates higher and faster than they had in the previous five rate hike cycles which begs the question, if the catalyst that caused the recessions is stronger, wouldn't the occurance of a recession be more likely?

Said another way, think of the Fed as a bully that likes to push kids at school, the kids represent the US economy, and the force that the bully uses to push the kids is measured by the magnitude of the interest rate increase. There are six kids standing in the hallway as the bully approaches, the first four he pushes with half of his strength, and the kids fall over on the floor, the fifth child gets nudged but does not fall over, but the bully is now running full speed at the sixth child and we're trying to figure out how it's going to end.

With history as a guide, I have a difficult time envisioning a situation where that sixth student remains on their feet.

No Recession

So what if we're wrong? What if, by some miracle, in the face of all these historic trends, the US economy avoids a recession? I would then add that while it is, of course, possible that we could avoid a recession because it's happened before, that does not necessarily mean we are going avoid a 10% plus market correction at some point in 2024 because the stock market looks to be priced for perfection. You can see this in the future earnings expectations for the S&P 500. Blue bars on the chart are the earnings expectations going into 2024 that are already baked into the S&P 500 stock prices.

It seems that not only is the consensus expecting no recession, but they are also expecting significant earnings growth. Again, with the leading economic indicators being so negative right now and the Fed not expected to lower rates until mid-2024, how do the companies in the S&P 500 meet those aggressive earnings expectations when it seems like the consumer is softening? I completely understand that the stock market is a forward-looking animal, but it seems more likely that we're repeating the mistakes of the past because the stock market can only go so far without the economy and the stock market is already way ahead even as we head into 2024. That was the most puzzling aspect of 2023, the stock market continued to rally throughout all of 2023, while the U.S. economy continued to slow throughout 2023.

The Consumer Is Not As Strong As They Seem

I continue to hear the phrase, “consumer spending remains strong”, and I agree that the consumer has been more resilient that even I expected in 2023. However, much of that spending is being done on credit. Take a look at how much credit card debt has risen in the U.S. post COVID, quickly breaking through over $1 Trillon dollars.

Not only has the level of credit card debt risen to record levels but the interest rates being charged on that debt is significantly higher than it was just a year ago, resulting in less discretionary income for consumers with credit card debt.

Buffet & Munger

Many people know the famous investor Warren Buffet and his famous quote: “Be fearful when others are greedy, and be greedy when others are fearful.” But many people don’t know that Warren had a fellow billionaire partner in Berkshire Hathaway named Charlie Munger. Charlie just passed away in 2023 at the age of 99, and Charlie had a famous quote of his own:

“The world is full of foolish gamblers, and they will not do as well as the patient investors.”

Living in a world of FOMO (Fear Of Missing Out), patience is probably the most difficult investment discipline to master, but I personally have found it to be the most rewarding discipline during my 20+ year career in the investment industry. The year 2024 may be lining up to be another history lesson as FOMO investors fail to recognize the historical pattern between interest rates and the economy dating back 50 years but time will tell.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Federal Disaster Area Penalty-Free IRA & 401(k) Distribution and Loan Options

Individuals who experience a hurricane, flood, wildfire, earthquake, or other type of natural disaster may be eligible to request a Qualified Disaster Recovery Distribution or loan from their 401(k) or IRA to assist financially with the recovery process. The passing of the Secure Act 2.0 opened up new distribution and loan options for individuals whose primary residence is in an area that has been officially declared a “Federal Disaster” area.

Individuals who experience a hurricane, flood, wildfire, earthquake, or other type of natural disaster may be eligible to request a Qualified Disaster Recovery Distribution or loan from their 401(k) or IRA to assist financially with the recovery process. The passing of the Secure Act 2.0 opened up new distribution and loan options for individuals whose primary residence is in an area that has been officially declared a “Federal Disaster” area.

Qualified Disaster Recovery Distributions (QDRD)