STAR Property Tax Credit: Make Sure You Know The New Income Limits

The STAR Credit is a great way to reduce your property taxes in New York. If you are over the age of 65, it gets even better with the Enhanced STAR Credit. But you have to know the income limits associated with the credit otherwise you could unexpectedly lose the credit which could cost you thousands of dollars in additional property taxes. They

The STAR Credit is a great way to reduce your property taxes in New York. If you are over the age of 65, it gets even better with the Enhanced STAR Credit. But you have to know the income limits associated with the credit otherwise you could unexpectedly lose the credit which could cost you thousands of dollars in additional property taxes. They made some big changes to the credit that a lot of homeowners are not aware of. In this article we will review:

The income limits for the STAR Credit

Eligibility requirements for the Enhanced STAR Credit

How much money the STAR credit saves you

The most common mistakes that people make that disqualify them from the credit

The changes that were made to the property tax credit

STAR Property Tax Exemption

Let’s start with the basics. STAR stands for School Tax Relief. It’s a partial exemption from school taxes for your primary residence. There are two different STAR programs:

Basic STAR

Enhanced STAR

You Have To Apply For The Credit

You have to apply for the credit to receive it. It’s not automatic. Also, if you turn 65 this year and you want to further reduce your property taxes, there is a special application process for the Enhanced STAR Credit which requires you to enroll in the annual Income Verification Program (IVP). We will cover this in more detail later on in the article.

How Does The STAR Credit Work

The STAR credit exempts a specified dollar amount from the assessed value of your house prior to the calculation of your school tax bill. Here are the current exemption amounts:

Basic STAR: $30,000

Enhanced STAR: $65,000

The actual dollar amount that you save in school taxes will vary based on where you live in New York State. But if you live in a $300,000 house, you qualify for Basic STAR, and your school taxes before the STAR’s credit are $7,000. It could save you around $700 per year in school taxes. If you qualify for the enhanced STAR, you can more than double that savings number. In a high property tax state like New York, every little bit helps.

Income Limits For The STAR Credit

Here is a table from NYS Department of Taxation and Finance that summarizes the eligibility requirements for the Basic STAR and Enhanced STAR credit:

Requirement #1: It must be your primary residence. The credit does not apply for rental properties or second homes.

Requirement #2: To qualify for the Enhanced STAR, one of the homeowners must be age 65

Requirement #3: The income limitations. We see fewer issues with the Basic STAR since the income limit is $500,000. We see a lot more issues with the Enhanced STAR credit with the income limit at $86,300. Mainly because when you add up social security, pension payments, and required minimum distributions from IRA’s, you have homeowners that flirt with that income limit on a year by year basis. Crossing the income line would drop you back into the Basic STAR program which will most likely result in an unfriendly property tax surprise.

Income Calculation

The eligibility for the 2019 STAR credit is actually based on your income from 2017. You can reference your 2017 federal and state tax returns against the table listed below:

Enhanced STAR Credit

Once you or your spouse turn age 65, you are then eligible to apply for the Enhanced STAR program.

Unlike the basic STAR program, the Enhanced STAR program required homeowners to file renewal applications with their local assessor each year to remain in the program. Under the new rules, new applicants are required to enroll in the Enhanced STAR Income Verification Process.

The application deadline is typically March 1st if you are filing at the county level but it can vary from county to county. You should contact your assessor to verify the application deadline in your area. The good news about enrolling in the Enhance STAR Income Verification Program is you only have to do it once. Once enrolled you will receive the Enhanced STAR credit each year as long as your income is below the required threshold.

Common Mistakes With The Enhanced STAR Credit

Since the income threshold for the Enhanced STAR program is much lower than the Basic STAR program this is where we see homeowners get into trouble. For most retirees, their income is relatively the same from year to year. However, there are frequently one-time events that occur that can push a retiree’s income higher for a given year. Not only do they end up with a large tax bill when they file their taxes but they also find out that they lost the Enhanced STAR Credit for that year. Double ouch!!

Here are the most common income events that retirees have to watch out for:

Capital gains and dividends from taxable investment accounts

Taking larger distributions from IRA’s or pre-tax retirement plans

Age 70 ½ - Required minimum distributions start from IRA’s

Receive an inheritance (some sources can be taxable)

Sell real estate or land other than the primary residence

Surrendering a life insurance policy

Part-time income

The year you turn on social security benefits

If you experience financial events that are expected to increase your taxable income for a given year, you should work closely with you financial advisor or accountant during those years because there may be ways to reduce your income to maintain the Enhanced STAR credit with some advanced planning.

Changes To The STAR Credit

New York made some significant changes to both the Basic STAR and the Enhanced STAR credit that not many homeowners are aware of. The amount of the credit did not change but the methods for applying for and receiving the credit did change.

If you were receiving the Basic STAR credit before and you have not moved since 2016, there is nothing that you have to do. Everything will continue to operate the same. However, if you move or if you are new homeowner, the STAR process will be different. Under the old method, you would simply see a deduction for your STAR credit on your school tax bill. Going forward, when you buy a new house, you will have to pay your full school tax bill, and then New York will mail you a physical check for your STAR credit. In order to receive your check in September, you must register for the Basic STAR program through the state Department of Taxation and Finance by July 1st.

After July 1st, you can still apply for the STAR credit, and the state will provide you with a check, but you may receive the check after September. The same manual check process is applicable with the Enhanced STAR program as well.

If you were receiving the Enhanced STAR and you have not moved, New York is allowing those homeowners to continue to file their renewal applications with their local assessor each year without having to enroll in the new Enhanced STAR Income Verification Program. However, if you move, you will have to enroll in the Income Verification Program in order to remain in the Enhanced STAR Program.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Why Do You Owe More In Taxes This Year?

“I thought there was a tax break. Last year I got a refund. This year, I owe money to the IRS. How did this happen and what do I need to change to fix this?.” As more and more people file their taxes for 2018, the situation described above seems to be the norm instead of the exception to the rule. Taxpayers are realizing that either their tax refund is lower, they owe money for the first time, o

“I thought there was a tax break. Last year I got a refund. This year, I owe money to the IRS. How did this happen and what do I need to change to fix this?”

As more and more people file their taxes for 2018, the situation described above seems to be the norm instead of the exception to the rule. Taxpayers are realizing that either their tax refund is lower, they owe money for the first time, or their tax bill is larger than it normally is. While this is a shock to many families and individuals, we saw this issue coming in February of 2018. We even wrote an article at that time titled “Warning To All Employees: Review The Tax Withholding In Your Paycheck Otherwise A Big Tax Bill May Be Waiting For You”.

Below we will highlight some of the catalysts of this issue and provide you with some strategies on how to better prepare for the coming tax year.

New Tax Withholding Tables

When tax reform was passed, the government issued new federal income tax withholding tables to your employer in February which provides them with the amount that they should withhold from your paycheck for tax purposes. Since the federal tax brackets dropped, so did the withholding tables. In February 2018, this seemed like a great thing because most taxpayers saw an increase in their take home pay. However, it simultaneously created a big tax problem for a lot of employees.

Gross Income vs. Taxable Income

There is a difference between your “gross income” and your “taxable income”. If your salary is $80,000 per year, that is your gross income. At tax time, you get to take deductions against your gross income, to reach your total “taxable income” which is a lower amount. Your taxable income is the amount that you actually have to pay taxes on.

For example, you have a married couple, husband has a W2 for $60,000 and his wife has a W2 for $70,000. Their combined gross income is $130,000. Let’s assume they take the standard deduction in 2018 which is a $24,000 deduction. Their total taxable income for 2018 is $106,000.

Impact of Tax Reform

While tax forms did bring lower federal income tax brackets, it also made a lot of changes to the deduction side of the equation. For those of us living in New York, California, and other high tax states, the biggest change was probably the $10,000 cap that they placed on property taxes and state income taxes. The other big change for taxpayers with children was the elimination of the personal exemption deduction which was replaced with a credit. The personal exemption change works for some taxpayers and against others. For more on this topic reference: More Taxpayers Will Qualify For The Child Tax Credit In 2018

For that married couple above that made $130,000 in 2018, under the new tax rules their total taxable income may be $106,000 but if they applied the old tax rules it may have only been $95,000. People are finding out that while the federal tax rates dropped, their total taxable income for the year increased because the higher standard deduction did not make up for all of the itemized deductions that were lost under the new tax rules.

To further aggravate that wound, at the beginning of 2018, the federal government instructed your employer to withhold less federal income tax from your paycheck which put some taxpayers further behind on their withholdings. If you were used to getting a refund when you filed your taxes, technically you may have already received it throughout the year in your paycheck but you just didn’t know it. There are of course taxpayers in the even more difficult camp that were banking on getting a refund only to find out that they actually owe money to the IRS.

How Do You Fix This?

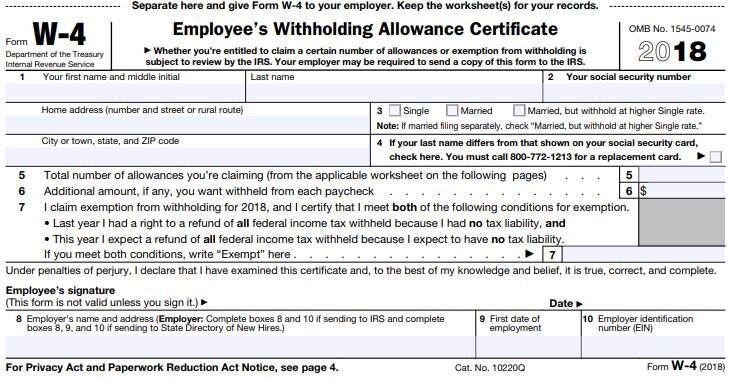

If you unexpectedly owed money to the IRS this year or if you want to restore that refund that you typically receive when you file your taxes, you are going to have to change your tax withholding amount with your employer. You have to request a Form W-4 from your employer. I looks like this……

You can reduce the number of allowances that you are claiming on line 5 or you can instruct your employer to withhold an additional flat dollar amount each pay period on line 6.

There are also other options beside increasing your tax withholdings like increasing your contributions to your 401(k) account or contributing money to a Health Savings Account for your health expenses. These moves may assist you in reducing your taxable income which could lead to a lower tax liability.

Consult With Your Accountant

While I have highlighted the more common catalysts leading to this under withholding issue, there were a lot of changes made to the tax rules so there could have been other factors that led to your higher tax liability this year. Your gross income could have been higher, maybe you took a distribution from an IRA account, or you have realized gains from an investment that you sold during the year. You really have to work with your tax professional to identify what triggered the additional tax liability and determine what action should be taken to reduce your tax liability going forward.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future

How To Change Your Residency To Another State For Tax Purposes

If you live in an unfriendly tax state such as New York or California, it’s not uncommon for your retirement plans to include a move to a more tax friendly state once your working years are over. Many southern states offer nicer weather, no income taxes, and lower property taxes. According to data from the US Census Bureau, more residents

If you live in an unfriendly tax state such as New York or California, it’s not uncommon for your retirement plans to include a move to a more tax friendly state once your working years are over. Many southern states offer nicer weather, no income taxes, and lower property taxes. According to data from the US Census Bureau, more residents left New York than any other state in the U.S. Between July 2017 and July 2018, New York lost 180,360 residents and gained only 131,726, resulting in a net loss of 48,560 residents. With 10,000 Baby Boomers turning 65 per day over the next few years, those numbers are expected to escalate as retirees continue to leave the state.

When we meet with clients to build their retirement projections, the one thing anchoring many people to their current state despite higher taxes is family. It’s not uncommon for retirees to have children and grandchildren living close by so they greatly favor the “snow bird” routine. They will often downsize their primary residence in New York and then purchase a condo or small house down in Florida so they can head south when the snow starts to fly.

The inevitable question that comes up during those meetings is “Since I have a house in Florida, how do I become a resident of Florida so I can pay less in taxes?” It’s not as easy as most people think. There are very strict rules that define where your state of domicile is for tax purposes. It’s not uncommon for states to initiate tax audit of residents that leave their state to claim domicile in another state and they split time travelling back and forth between the two states. Be aware, the state on the losing end of that equation will often do whatever it can to recoup that lost tax revenue. It’s one of those guilty until proven innocent type scenarios so taxpayers fleeing to more tax favorable states need to be well aware of the rules.

Residency vs Domicile

First, you have to understand the difference between “residency” and “domicile”. It may sound weird but you can actually be considered a “resident” of more than one state in a single tax year without an actual move taking place but for tax purposes each person only has one state of “domicile”.

Domicile is the most important. Think of domicile as your roots. If you owned 50 houses all around the world, for tax purposes, you have to identify via facts and circumstances which house is your home base. Domicile is important because regardless of where you work or earn income around the world, your state of domicile always has the right to tax all of your income regardless of where it was earned.

While each state recognizes that a taxpayer only has one state of domicile, each state has its own definition of who they considered to be a “resident” for tax purposes. If you are considered a resident of a particular state then that state has the right to tax you on any income that was earned in that state. But they are not allowed to tax income earned or received outside of their state like your state of domicile does.

States Set Their Own Residency Rules

To make the process even more fun, each state has their own criteria that defines who they considered to be a resident of their state. For example, in New York and New Jersey, they consider someone to be a resident if they maintain a home in that state for all or most of the year, and they spend at least half the year within the state (184 days). Other states use a 200 day threshold. If you happen to meet the residency requirement of more than one state in a single year, then two different states could consider you a resident and you would have to file a tax return for each state.

Domicile Is The Most Important

Your state of domicile impacts more that just your taxes. Your state of domicile dictates your asset protection rules, family law, estate laws, property tax breaks, etc. From an income tax standpoint, it’s the most powerful classification because they have right to tax your income no matter where it was earned. For example, your domicile state is New York but you worked for a multinational company and you spent a few months working in Ireland, a few months in New Jersey, and most of the year renting a house and working in Florida. You also have a rental property in Virginia and are co-owners of a business based out of Texas. Even though you did not spend a single day physically in New York during the year, they still have the right to tax all of your income that you earned throughout the year.

What Prevents Double Taxation?

So what prevents double taxation where they tax you in the state where the money is earned and then tax you again in your state of domicile? Fortunately, most states provide you with a credit for taxes paid to other states. For example, if my state of domicile is Colorado which has a 4% state income tax and I earned some wages in New York which has a 7% state income tax rate, when I file my state tax return in Colorado, I will not own any additional state taxes on those wages because Colorado provides me with a credit for the 7% tax that I already paid to New York.

It only hurts when you go the other way. Your state of domicile is New York and you earned wage in Colorado during the year. New York will credit you with the 4% in state tax that you paid to Colorado but you will still owe another 3% to New York State since they have the right to tax all of your income as your state of domicile.

Count The Number Of Days

Most people think that if they own two houses, one in New York and one in Florida, as long as they keep a log showing that they lived in Florida for more than half the year that they are free to claim Florida, the more tax favorable state, as their state of domicile. I have some bad news. It’s not that easy. The key in all of this is to take enough steps to prove that your new house is your home base. While the number of days that you spend living in the new house is a key factor, by itself, it’s usually not enough to win an audit.

That notebook or excel spreadsheet that you used to keep a paper trail of the number of days that you spent at each location, while it may be helpful, the state conducting the audit may just use the extra paper in your notebook to provide you with the long list of information that they are going to need to construct their own timeline. I’m not exaggerating when I say that they will request your credit card statement to see when and where you were spending money, freeway charges, cell phone records with GPS time and date stamps, dentist appointments, and other items that give them a clear picture of where you spent most of your time throughout the year. If you supposedly live in Florida but your dentist, doctors, country club, and newspaper subscriptions are all in New York, it’s going to be very difficult to win that audit. Remember the number of days that you spend in the state is just one factor.

Proving Your State of Domicile

There are a number of action items that you should take if it’s your intent to travel back and forth between two states during the year, and it’s your intent to claim domicile in the more favorable tax state. Here is the list of the action items that you should consider to prove domicile in your state of choice:

Register to vote and physically vote in that state

Register your car and/or boat

Establish gym memberships

Newspapers and magazine subscriptions

Update your estate document to comply with the domicile state laws

Use local doctors and dentists

File your taxes as a resident

Have mail forwarded from your “old house” to your “new house”

Part-time employment in that state

Join country clubs, social clubs, etc.

Host family gatherings in your state of domicile

Change your car insurance

Attend a house of worship in that state

Where your pets are located

Dog Saves Owner $400,000 In Taxes

Probably the most famous court case in this area of the law was the Petition of Gregory Blatt. New York was challenging Mr Blatt’s change of domicile from New York to Texas. While he had taken numerous steps to prove domicile in Texas at the end of the day it was his dog that saved him. The State of New York Division of Tax Appeals in February 2017 ruled that “his change in domicile to Dallas was complete once his dog was moved there”. Mans best friends saved him more than $400,000 in income tax that New York was after him for.

Audit Risk

When we discuss this topic people frequently ask “what are my chances of getting audited?” While some audits are completely random, from the conversations that we have had with accountants in this subject area, it would seem that the more you make, the higher the chances are of getting audited if you change your state of domicile. I guess that makes sense. If your Mr Blatt and you are paying New York State $100,000 per year in income taxes, they are probably going to miss that money when you leave enough to press you on the issue. But if all you have is a NYS pension, social security, and a few small distributions from an IRA, you might have been paying little to no income tax to New York State as it is, so the state has very little to gain by auditing you.

But one of the biggest “no no’s” is changing your state of domicile on January 1st. Yes, it makes your taxes easier because you file your taxes in your old state of domicile for last year and then you get to start fresh with your new state of domicile in the current year without having to file two state tax returns in a single year. However, it’s a beaming red audit flag. Who actually moves on New Year’s Eve? Not many people, so don’t celebrate your move by inviting a state tax audit from your old state of domicile

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Accountant Put The Owner’s Kids On Payroll And Bomb Shelled The 401(k) Plan

The higher $12,000 standard deduction for single filers has produced an incentive in some cases for business owners to put their kids on the payroll in an effort to shift income out of the owner’s high tax bracket into the children’s lower tax bracket. However, there was a non-Wojeski accountant that advised his clients not only to put his kids on the

Big Issue

The higher $12,000 standard deduction for single filers has produced an incentive in some cases for business owners to put their kids on the payroll in an effort to shift income out of the owner’s high tax bracket into the children’s lower tax bracket. However, there was a non-Wojeski accountant that advised his clients not only to put his kids on the payroll but also to have their children put all of that W2 compensation in the company’s 401(k) plan as a Roth deferral.

At first look it would seem to be a dynamite tax strategy but this strategy blew up when the company got their year end discrimination testing back for the 401(k) plan and all of the executives, including the owner, were forced to distribute their pre-tax deferrals from the plan due to failed discrimination testing. It created a huge unexpected tax liability for the owners and all of the executives completely defeating the tax benefit of putting the kids on payroll. Not good!!

Why This Happened

If your client sponsors a 401(k) plan and they are not a “safe harbor plan”, then each year the plan is subject to “discrimination testing”. This discrimination testing is to ensure that the owners and “highly compensated employees” are not getting an unfair level of benefits in the 401(k) plan compared to the rest of the employees. They look at what each employee contributes to the plan as a percent of their total compensation for the year. For example, if you make $3,000 in employee deferrals and your W2 comp for the year is $60,000, your deferral percentage is 5%.

They run this calculation for each employee and then they separate the employees into two groups: “Highly Compensated Employees” (HCE) and “Non-Highly Compensation Employees” (NHCE). A highly compensated employee is any employee that in 2019:

is a 5% or more owner, or

Makes $125,000 or more in compensation

They put the employees in their two groups and take an average of each group. In most cases, the HCE’s average cannot be more than 2% higher than the NHCE average. If it is, then the HCE’s get pre-tax money kicked back to them out of the 401(k) plan that they have to pay tax on. It really ticks off the HCE’s when this happens because it’s an unexpected tax bill.

Little Known Attribution Rule

ATTRIBUTION RULE: Event though a child of an owner may not be a 5%+ owner or make more than $125,000 in compensation, they are automatically considered an HCE because they are related to the owner of the business. So in the case that I referred above, the accountant had the client pay the child $12,000 and defer $12,000 into the 401(k) plan as a Roth deferral making their deferral percentage 100% of compensation. That brought the average for the HCE way way up and caused the plan fail testing.

To make matters worse, when 401(k) refunds happen to the HCE’s they do not go back to the person that deferred the highest PERCENTAGE of pay, they go to the person that deferred the largest DOLLAR AMOUNT which was the owner and the other HCE’s that deferred over $18,000 in the plan each.

How To Avoid This Mistake

Before advising a client to put their children on payroll and having them defer that money into the 401(k) plan, ask them these questions:

Does your company sponsor a 401(k) plan?

If yes, is your plan a “safe harbor 401(k) plan?

If the company sponsors a 401(k) plan AND it’s a safe harbor plan, you are in the clear with using this strategy because there is no discrimination testing for the employee deferrals.

If the company sponsors a 401(k) plan AND it’s NOT a safe harbor plan, STOP!! The client should either consult with the TPA (third party administrator) of their 401(k) plan to determine how their kids deferring into the plan will impact testing or put the kids on payroll but make sure they don’t contribute to the plan.

Side note, if the company sponsors a Simple IRA, you don’t have to worry about this issue because Simple IRA’s do not have discrimination testing. The children can defer into the retirement plan without causing any issues for the rest of the HCE’s.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

New York May Deviate From The New 529 Rules

When the new tax rules were implemented on January 1, 2018, a popular college savings vehicle that goes by the name of a “529 plan” received a boost. Prior to the new tax rules, 529 plans could only be used to pay for college. The new tax rules allow account owners to withdraw up to $10,000 per year per child for K – 12 public school, private school,

When the new tax rules were implemented on January 1, 2018, a popular college savings vehicle that goes by the name of a “529 plan” received a boost. Prior to the new tax rules, 529 plans could only be used to pay for college. The new tax rules allow account owners to withdraw up to $10,000 per year per child for K – 12 public school, private school, religious school, or homeschooling expenses. These distributions would be considered “qualified” which means distributions are made tax free.

Initially we expected this new benefit to be a huge tax advantage for our clients that have children that attend private school. They could fully fund a 529 plan up to $10,000 per year, capture a New York State tax deduction for the $10,000 contribution, and then turn around and distribute the $10,000 from the account to make the tuition payment for their kids.

New York May Deviate

States are not required to adhere to the income tax rules set forth by the federal government. In other words, states may choose to adopt the new tax rules set forth by the federal government or they can choose to ignore them. The new tax laws that went into effect in 2018 will impact states differently. More specifically, tax payers in states that have both income taxes and high property taxes, like New York and California, may be adversely affected due to the new $10,000 cap on the ability to fully deduct those expenses on their federal tax return.

As of June 30, 2018, New York has yet to provide guidance as to whether or not they will recognize the K -12 distributions from 529 plans as “qualified”. More than 30 states have already announced that they will adhere to the new federal tax rules. On the opposite side of that coin, California has announced that they will not adhere to the new 529 tax rules and they will tax distribution made for K – 12 expenses. Oregon has gone one step further and will not only tax the distributions but they will also recapture state tax deductions taken for distributions made for K – 12 expenses.

Wait & See

If you live in a state like New York that has yet to provide guidance with regard to the new 529 rules, you end up in this wait and see scenario. There is no way to know which way New York is going to rule on this new federal tax rule. However, if New York follows the path taken by many of the other states that were adversely affected by the new federal tax rules, they may decide to follow suit and choose to ignore the new 529 tax rules adopted by the federal government.

We also don’t have any guidance as to when NYS will rule on this issue. They may wait until November or December to issue formal guidance. If that happens, 529 account owners looking to take advantage of the new K – 12 distribution rules will have to be on their toes because distributions from 529 accounts have to happen in the same year that the expense is incurred in order to receive the preferentially tax treatment.

Potential investors of 529 plans may get more favorable tax benefits from 529 plans sponsored by their own state. Consult your tax professional for how 529 tax treatments and account fees would apply to your particular situation. To determine which college saving option is right for you, please consult your tax and accounting advisors. Neither APFS nor its affiliates or financial professionals provide tax, legal or accounting advice. Please carefully consider investment objectives, risks, charges, and expenses before investing. For this and other information about municipal fund securities, please obtain an offering statement and read it carefully before you invest. Investments in 529 college savings plans are neither FDIC insured nor guaranteed and may lose value.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Moving Expenses Are No Longer Deductible

If you were planning on moving this year to take a new position with a new company or even a new position within your current employer, the moving process just got a little more expensive. Not only is it expensive, but it can put you under an intense amount of stress as there will be lots of things that you need to have in place before packing up and

If you were planning on moving this year to take a new position with a new company or even a new position within your current employer, the moving process just got a little more expensive. Not only is it expensive, but it can put you under an intense amount of stress as there will be lots of things that you need to have in place before packing up and moving. Even things like how you are going to transport your car over to your new home, can take up a lot of your time, and on top of that, you have to think about how much it's going to cost. Prior to the tax law changes that took effect January 1, 2018, companies would often offer new employees a "relocation package" or "moving expense reimbursements" to help subsidize the cost of making the move. From a tax standpoint, it was great benefit because those reimbursements were not taxable to the employee. Unfortunately that tax benefit has disappeared in 2018 as a result of tax reform.

Taxable To The Employee

Starting in 2018, moving expense reimbursements paid to employee will now represent taxable income. Due to the change in the tax treatment, employees may need to negotiate a higher expense reimbursement rate knowing that any amount paid to them from the company will represent taxable income.

For example, let’s say you plan to move from New York to California and you estimate that your moving expense will be around $5,000. In 2017, your new employer would have had to pay you $5,000 to fully reimburse you for the moving expense. In 2018, assuming you are in the 35% tax bracket, that same employer would need to provide you with $6,750 to fully reimburse you for your moving expenses because you are going to have to pay income tax on the reimbursement amount.

Increased Expense To The Employer

For companies that attract new talent from all over the United States, this will be an added expense for them in 2018. Many companies limit full moving expense reimbursement to executives. Coincidentally, employees at the executive level are usually that highest paid. Higher pay equals higher tax brackets. If you total up the company's moving expense reimbursements paid to key employees in 2017 and then add another 40% to that number to compensate your employees for the tax hit, it could be a good size number.

Eliminated From Miscellaneous Deductions

As an employee, if your employer did not reimburse you for your moving expenses and you had to move at least 50 miles to obtain that position, prior to 2018, you were allowed to deduct those expenses when you filed your taxes and you were not required to itemize to capture the deduction. However, this expense will no longer be deductible even for employees that are not reimbursed by their employer for the move starting in 2018.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Warning To All Employees: Review The Tax Withholding In Your Paycheck Otherwise A Big Tax Bill May Be Waiting For You

As a result of tax reform, the IRS released the new income tax withholding tables in January and your employer probably entered those new withholding amounts into the payroll system in February. It was estimated that about 90% of taxpayers would see an increase in their take home pay once the new withholding tables were implemented.

As a result of tax reform, the IRS released the new income tax withholding tables in January and your employer probably entered those new withholding amounts into the payroll system in February. It was estimated that about 90% of taxpayers would see an increase in their take home pay once the new withholding tables were implemented. While lower tax rates and more money in your paycheck sounds like a good thing, it may come back to bite you when you file your taxes.

The Tax Withholding Guessing Game

Knowing the correct amount to withhold for federal and state income taxes from your paycheck is a bit of a guessing game. Withhold too little throughout the year and when you file your taxes you have a tax bill waiting for you equal to the amount of the shortfall. Withhold too much and you will receive a big tax refund but that also means you gave the government an interest free loan for the year.

There are two items that tell your employer how much to withhold for federal income tax from your paycheck:

Income Tax Withholding Tables

Form W-4

The IRS provides your employer with the Income Tax Withholding Tables. On the other hand, you as the employee, complete the Form W-4 which tells your employer how much to withhold for taxes based on the “number of allowances” that you claim on the form.

What Is A W-4 Form?

The W-4 form is one of the many forms that HR had you complete when you were first hired by the company. Here is what it looks like:

Section 3 of this form tells your employer which withholding table to use:

Single

Married

Married, but withhold at higher Single Rate

Section 5 tells your employer how many "allowances" you are claiming. Allowance is just another word for "dependents". The more allowances your claim, the lower the tax withholding in your paycheck because it assumes that you will have less "taxable income" because in the past you received a deduction for each dependent. This is where the main problem lies. Due to the changes in the tax laws, the tax deduction for personal exemptions was eliminated. This may adversely affect some taxpayers the were claiming a high number of allowances on their W-4 form because even though the number of their dependents did not change, their taxable income may be higher in 2018 because the deduction for personal exemptions no longer exists.

Even though everyone should review their Form W-4 form this year, employees that claimed allowances on their W-4 form are at the highest risk of either under withholding or over withholding taxes from their paychecks in 2018 due to the changes in the tax laws.

How Much Should I Withhold From My Paycheck For Taxes?

So how do you go about calculating that right amount to withhold from your paycheck for taxes to avoid an unfortunate tax surprise when you file your taxes for 2018? There are two methods:

Ask your accountant

Use the online IRS Withholding Calculator

The easiest and most accurate method is to ask your personal accountant when you meet with them to complete your 2017 tax return. Bring them your most recent pay stub and a blank Form W-4. Based on the changes in the tax laws, they can assist you in the proper completion of your W-4 Form based on your estimated tax liability for the year.If you complete your own taxes, I would highly recommend visiting the updated IRS Withholding Calculator. The IRS calculator will ask you a series of questions, such as:

How many dependents you plan to claim in 2018

Are you over the age of 65

The number of children that qualify for the dependent care credit

The number of children that will qualify for the new child tax credit

Estimated gross wages

How much fed income tax has already been withheld year to date

Payroll frequency

At the end of the process it will provide you with your personal results based on the data that you entered. It will provide you with guidance as to how to complete your Form W-4 including the number of allowances to claim and if applicable, the additional amount that you should instruct your employer to withhold from your paycheck for federal income taxes. Additional withholding requests are listed in Section 6 of the Form W-4.

Avoid Disaster

Having this conversation with your accountant and/or using the new IRS Withholding Calculator will help you to avoid a big tax disaster in 2018. Unfortunately, many employees may not learn about this until it's too late. Employees that are used to getting a tax refund may find out in the spring of next year that they owe thousands of dollars to the IRS because the combination of the new tax tables and the changes in the tax law that caused them to inadvertently under withhold federal income taxes throughout the year.

Action Item!!

Take action now. The longer you wait to run this calculation or to have this conversation with your accountant, the larger the adjustment may be to your paycheck. It's easier to make these adjustments now when you have nine months left in the year as opposed to waiting until November.I would strongly recommend that you share this article with your spouse, children in the work force, and co-workers to help them avoid this little known problem. The media will probably not catch wind of this issue until employees start filing their tax returns for 2018 and they find out that there is a tax bill waiting for them.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

No Deduction For Entertainment Expenses In 2019. Ouch!!

There is a little known change that was included in tax reform that will potentially have a big impact on business owners. The new tax laws that went into effect on January 1, 2018 placed stricter limits on the ability to deduct expenses associated with entertainment and business meals. Many of the entertainment expenses that businesses

There is a little known change that was included in tax reform that will potentially have a big impact on business owners. The new tax laws that went into effect on January 1, 2018 placed stricter limits on the ability to deduct expenses associated with entertainment and business meals. Many of the entertainment expenses that businesses were able to deduct in 2017 will no longer we allowed in 2018 and beyond. A big ouch for business owners that spend a lot of money entertaining clients and prospects.

A Quick Breakdown Of The Changes

No Deduction in 2019

Prior to 2018, if the business spent money to take a client out to a baseball game, meet a client for 18 holes of golf, or to host a client event, the business would be able to take a deduction equal to 50% of the total cost associated with the entertainment expense. Starting in 2018, you get ZERO. There is no deduction for those expenses.

The new law specifically states that there is no deduction for:

Any activity generally considered to be entertainment, amusement, or recreation

Membership dues to any club organization for recreation or social purpose

A facility, or portion thereof, used in connection with the above items

This will inevitably cause business owners to ask their accountant: “If I spend the same amount on entertainment expenses in 2018 as I did in 2017, how much are the new tax rules going to cost me tax wise?”

Impact On Sales Professionals

If you are in sales and big part of your job is entertaining prospects in hopes of winning their business, if your company can no longer deduct those expenses, are you going to find out at some point this year that the company is going to dramatic limit the resources available to entertain clients? If they end up limiting these resources, how are you supposed to hit your sales numbers and how does that change the landscape of how you solicit clients?

Impact On The Entertainment Industry

This has to be bad news for golf courses, casinos, theaters, and sports arena. As the business owner, if you were paying $15,000 per year for your membership to the local country club and you justified spending that amount because you knew that you could take a tax deduction for $7,500, now what? Now that you can’t deduct any of it, you may decide to cancel your membership or seek out a cheaper alternative.

Impact On Charitable Organizations

How do most charities raise money? Events. As you may have noticed in the chart, in 2017 tickets to a qualified charitable event were 100% deductible. In 2018, it goes from 100% deductible to Zero!! It’s bad enough that the regular entertainment expenses went from 50% to zero but going from 100% to zero hurts so much more. Also charitable events usually have high price tags because they have to cover the cost of event and raise money for the charity. In 2018, it will be interesting to see how charitable organizations get over this hurdle. It may have to disclose right on the registration form for the event that the ticket cost is $500 but $200 of that amount is the cost of the event (non-deductible) and $300 is the charitable contribution.

Exceptions To The New Rules

There are some unique exceptions to the new rules. Many business owners will not find any help within these exceptions but here they are:

Entertainment, amusement, and recreation expenses you treat as compensation to your employees in their wages (In other words, the cost ends up in your employee’s W2)

Expenses for recreation, social, or similar activities, including facilities, primarily for employees, and it can’t be highly compensation employees (“HCE”). In 2018 an HCE employee is an employee that makes more than $120,000 or is a 5%+ owners of the company.

Expenses for entertainment goods, services, and facilities that you sell to customers

What’s The Deal With Meals?

Prior to 2018, employers could deduct 50% of expenses for business-related meals while traveling. Also meals provided to an employee for the convenience of the employer on the employer’s business premises were 100% deductible by the employer and tax-free to the recipient employee.

Starting in 2018, meal expenses incurred while traveling on business remain 50% deductible to the business. However, meals provided via an on-premises cafeteria or otherwise on the employers premise for the convenience of the employer will now be limited to a 50% deduction.

There is also a large debate going on between tax professional as to which meals or drinks may fall into the “entertainment” category and will lose their deduction entirely.

Impact On Business

This is just one of the many “small changes” that was made to the new tax laws that will have a big impact on many businesses. It may very well change the way that businesses spend money to attract new clients. This in turn will most likely lead to unintended negative consequences for organizations that operate in the entertainment, catering, and charitable sectors of the U.S. economy.

Disclosure: For education purposes only. Please seek tax advice from your tax professional

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

More Taxpayers Will Qualify For The Child Tax Credit

There is great news for parents in the middle to upper income tax brackets in 2018. The new tax law dramatically increased the income phaseout threshold for claiming the child tax credit. In 2017, parents were eligible for a $1,000 tax credit for each child under the age of 17 as long as their adjusted gross income (“AGI”) was below $75,000 for single

There is great news for parents in the middle to upper income tax brackets in 2018. The new tax law dramatically increased the income phaseout threshold for claiming the child tax credit. In 2017, parents were eligible for a $1,000 tax credit for each child under the age of 17 as long as their adjusted gross income (“AGI”) was below $75,000 for single filers and $110,000 for married couples filing a joint return. If your AGI was above those amounts, the $1,000 credit was reduced by $50 for every $1,000 of income above those thresholds. In other words, the child tax credit completely phased out for a single filer with an AGI greater than $95,000 and for a married couple with an AGI greater than $130,000.

Note: If you are not sure what the amount of your AGI is, it’s the bottom line on the first page of your tax return (Form 1040).

New Phaseout Thresholds In 2018+

Starting in 2018, the new phaseout thresholds for the Child Tax Credit begin at the following AGI levels:

Single Filer: $200,000

Married Filing Joint: $400,000

If your AGI falls below these thresholds, you are eligible for the full Child Tax Credit. For taxpayers with an AGI amount that exceeds these thresholds, the phaseout calculation is the same as 2017. The credit is reduced by $50 for every $1,000 in income over the AGI threshold.

Wait......It Gets Better

Not only will more families qualify for the child tax credit in 2018 but the amount of the credit was doubled. The new tax law increased the credit from $1,000 to $2,000 for each child under the age of 17.

In 2017, a married couple, with three children, with an AGI of $200,000, would have received nothing for the child tax credit. In 2018, that same family will receive a $6,000 tax credit. That’s huge!! Remember, “tax credits” are more valuable than “tax deductions”. Tax credits reduce your tax liability dollar for dollar whereas tax deductions just reduce the amount of your income subject to taxation.

Tax Reform Giveth & Taketh Away

While the change to the tax credit is good news for most families with children, the elimination of personal exemptions starting in 2018 is not.

In 2017, taxpayers were able to take a tax deduction equal to $4,050 for each dependent (including themselves) in addition to the standard deduction. For example, a married couple with 3 children and $200,000 in income, would have been eligible received the following tax deductions:

Standard Deduction: $12,700

Husband: $4,050

Wife: $4,050

Child 1: $4,050

Child 2: $4,050

Child 3: $4,050

Total Deductions $32,950

Child Tax Credit: $0

This may lead you to the following question: “Does the $6,000 child tax credit that this family is now eligible to receive in 2018 make up for the loss of $20,250 ($4,050 x 5) in personal exemptions?”

By itself? No. But you have to also take into consideration that the standard deduction is doubling in 2018. For that same family, in 2018, they will have the following deductions and tax credits:

Standard Deduction: $24,000

Personal Exemptions: $0

Total Deductions: $24,000

Child Tax Credit: $6,000

Even though $24,000 plus $6,000 is not greater than $32,950, remember that credits are worth more than tax deductions. In 2017, a married couple, with $200,000 in income, put the top portion of their income subject to the 28% tax bracket. Thus, $32,950 in tax deductions equaled a $9,226 reduction in their tax bill ($32,950 x 28%).

In 2018, due to the changes in the tax brackets, instead of their top tax bracket being 28%, it’s now 24%. The $24,000 standard deduction reduces their tax bill by $5,760 ($24,000 x 24%) but now they also have a $6,000 tax credit with reduces their remaining tax bill dollar for dollar, resulting in a total tax savings of $11,760. Taxes saved over last year: $2,534. Not a bad deal.

For many families, the new tax brackets combined with the doubling of the standard deduction and the doubling of the child tax credit with higher phaseout thresholds, should offset the loss of the personal exemptions in 2018.

This information is for educational purposes only. Please consult your accountant for personal tax advice.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Business Owners: Strategies To Reduce Your Taxable Income To Qualify For The New 20% Qualified Business Income Deduction

Now that small business owners have the 20% deduction available for their pass-through income in 2018, as a business owner, you will need to begin to position your business to take full advantage of the new tax deduction. However, the Qualified Business Income ("QBI") deduction has taxable income thresholds. Once the owner's personal taxable

Now that small business owners have the 20% deduction available for their pass-through income in 2018, as a business owner, you will need to begin to position your business to take full advantage of the new tax deduction. However, the Qualified Business Income ("QBI") deduction has taxable income thresholds. Once the owner's personal taxable income begins to exceed specific dollar amounts, the 20% deduction with either phase out or it will trigger an alternative calculation that could lower the deduction.

First: Understand The 20% Deduction

If you are not already familiar with how the new 20% deduction works, I encourage you to read our article:"How Pass-Through Income Will Be Taxes In 2018 For Small Business Owners"If you are already familiar with how the Qualified Business Income deduction works, please continue reading.

The Taxable Income Thresholds

Regardless of whether you are considered a “services business” or “non-services business” under the new tax law, you will need to be aware of the following income thresholds:

Individual: $157,500

Married: $315,000

These threshold amounts are based on the “total taxable income” listed on the tax return of the business owner. Not “AGI” and not just the pass-through income from the business. Total taxable income. For example, if I make $100,000 in net profit from my business and my wife makes $400,000 in W-2 income, our total taxable income on our married filing joint tax return is going to be way over the $315,000 threshold. So do we completely lose the 20% deduction on the $100,000 in pass-through income from the business? Maybe not!!

The Safe Zone

For many business owners, to maximize the new 20% deduction, they will do everything that they can to keep their total taxable income below the thresholds. This is what I call the “safe zone”. If you keep your total taxable income below these thresholds, you will be allowed to take your total qualified business income, multiply it by 20%, and you’re done. Once you get above these thresholds, the 20% deduction will either begin to phase out or it will trigger the alternative 50% of W-2 income calculation which may reduce the deduction. The phase out ranges are listed below:

Inidividuals: $157,500 to $207,500

Married: $315,000 to $415,000

As you get closer to the top of the range the deduction begins to completely phase out for “services businesses” and for “non-services business” the “lesser of 20% of QBI or 50% of wages paid to employees” is fully phased in.

What Reduces "Total Taxable Income"?

There are four main tools that business owners can use to reduce their total taxable income:

Standard Deduction or Itemized Deductions

Self-Employment Tax

Retirement Plan Contributions

Timing Expenses

Standard & Itemized Deductions

Since tax reform eliminated many of the popular tax deductions that business owners have traditionally used to reduce their taxable income, for the first time in 2018, a larger percentage of business owners will elect taking the standard deduction instead of itemizing. You do not need to itemize to capture the 20% deduction for your qualified business income. This will allow business owners to take the higher standard deduction and still capture the 20% deduction on their pass-through income. Whether you take the standard deduction or continue to itemize, those deductions will reduce your taxable income for purposes of the QBI income thresholds.

Example: You are a business owner, you are married, and your only source of income is $335,000 from your single member LLC. At first look, it would seem that your total income is above the $315,000 threshold and you are subject to the phase out calculation. However, if you elect the standard deduction for a married couple filing joint, that will reduce your $335,000 in gross income by the $24,000 standard deduction which brings your total taxable income down to $311,000. Landing you below the threshold and making you eligible for the full 20% deduction on your qualified business income.

The point of this exercise is for business owners to understand that if your gross income is close to the beginning of the phase out threshold, somewhere within the phase out range, or even above the phase out range, there may be some relief in the form of the standard deduction or your itemized deductions.

Self-Employment Tax

Depending on how your business is incorporated, you may be able to deduct half of the self-employment tax that you pay on your pass-through income. Sole proprietors, LLCs, and partnership would be eligible for this deduction. Owners of S-corps receive W2 wages to satisfy the reasonable compensation requirement and receive pass-through income that is not subject to self-employment tax. So this deduction is not available for S-corps.

The self-employment tax deduction is an “above the line” deduction which means that you do not need to itemize to capture the deduction. The deduction is listed on the first page of your 1040 and it reduces your AGI.

Example: You are a partner at a law firm, not married, the entity is taxed as a partnership, and your gross income is $200,000. Like the previous example, it looks like your income is way over the $157,500 threshold for a single tax filer. But you have yet to factor in your tax deductions. For simplicity, let’s assume you take the standard deduction:

Total Pass-Through Income: $200,000

Less Standard Deduction: ($12,000)

Less 50% Self-Employ Tax: ($15,000) $200,000 x 7.5% = $15,000

Total Taxable Income: $173,000

While you total taxable income did not get you below the $157,500 threshold, you are now only mid-way through the phase out range so you will capture a portion of the 20% deduction on your pass-through income.

Retirement Plans – "The Golden Goose"

Retirement plans will be the undisputed Golden Goose for purposes of reducing your taxable income for purposes of the qualified business income deduction. Take the example that we just went through with the attorney in the previous section. Now, let’s assume that same attorney maxes out their pre-tax employee deferrals in the company’s 401(k) plan. The limit in 2018 for employees under the age of 50 is $18,500.

Total Pass-Through Income: $200,000

Less Standard Deduction: ($12,000)

Less 50% Self-Employ Tax: ($15,000)

Pre-Tax 401(k) Contribution: ($18,500)

Total Taxable Income: $154,500

Jackpot!! That attorney has now reduced their taxable income below the $157,500 QBI threshold and they will be eligible to take the full 20% deduction against their pass-through income.

Retirement plan contributions are going to be looked at in a new light starting in 2018. Not only are you reducing your tax liability by shelter your income from taxation but now, under the new rules, you are simultaneously increasing your QBI deduction amount.

When tax reform was in the making there were rumors that Congress may drastically reduce the contribution limits to retirement plans. Thankfully this did not happen. Long live the goose!!

Start Planning Now

Knowing that this Golden Goose exists, business owners will need to ask themselves the following questions:

How much should I plan on contributing to my retirement accounts this year?

Is the company sponsoring the right type of retirement plan?

Should we be making changes to the plan design of our 401(k) plan?

How much will the employer contribution amount to the employees increase if we try to max out the pre-tax contributions for the owners?

Business owners are going to need to engage investment firms and TPA firms that specialize in employer sponsored retirement plan. Up until now, sponsoring a Simple IRA, SEP IRA, or 401(K), as a way to defer some income from taxation has worked but tax reform will require a deeper dive into your retirement plan. The golden question:

“Is the type of retirement plan that I’m currently sponsoring through my company the right plan that will allow me to maximize my tax deductions under the new tax laws taking into account contribution limits, admin fees, and employer contributions to the employees.”

If you are not familiar with all of the different retirement plans that are available for small businesses, please read our article “Comparing Different Types Of Employer Sponsored Plans”.

DB / DC Combo Plans Take Center Stage

While DB/DC Combo plans have been around for a number of years, you will start to hear more about them beginning in 2018. A DB/DC Combo plan is a combination of a Defined Benefit Plan (Pension Plan) and a Defined Contribution Plan (401k Plan). While pension plans are usually only associated with state and government employers or large companies, small companies are eligible to sponsor pension plans as well. Why is this important? These plans will allow small business owners that have total taxable income well over the QBI thresholds to still qualify for the 20% deduction.

While defined contribution plans limit an owner’s aggregate pre-tax contribution to $55,000 per year in 2018 ($61,000 for owners age 50+), DB/DC Combo plans allow business owners to make annual pre-tax contributions ranging from $60,000 – $300,000 per year. Yes, per year!!

Example: A married business owner makes $600,000 per year and has less than 5 full time employees. Depending on their age, that business owner may be able to implement a DB/DC Combo plan prior to December 31, 2018, make a pre-tax contribution to the plan of $300,000, and reduce their total taxable income below the $315,000 QBI threshold.

Key items to make these plans work:

You need to have the cash to make the larger contributions each year

These DB/DC plan needs to stay in existence for at least 3 years

This plan design usually works for smaller employers (less than 10 employees)

Shelter Your Spouse's W-2 Income

It's not uncommon for a business owner to have a spouse that earns W-2 wages from employment outside of the family business. Remember, the QBI thresholds are based on total taxable income on the joint tax return. If you think you are going to be close to the phase out threshold, you may want to encourage your spouse to start putting as much as they possibly can pre-tax into their employer's retirement plan. Unlike self-employment income, W-2 income is what it is. Whatever the number is on the W-2 form at the end of the year is what you have to report as income. By contrast, business owners can increase expenses in a given year, delay bonuses into the next tax year, and deploy other income/expense maneuvers to play with the amount of taxable income that they are showing for a given tax year.

Timing Expenses

One of the last tools that small business owners can use to reduce their taxable income is escalating expense. Now, it would be foolish for businesses to just start spending money for the sole purpose of reducing income. However, if you are a dental practice and you were planning on purchasing some new equipment in 2018 and purchasing a software system in 2019, depending on where your total taxable income falls, you may have a tax incentive to purchase both the equipment and the software system all in 2018. As you get toward the end of the tax year, it might be worth making that extra call to your accountant, before spending money on those big ticket items. The timing of those purchases could have big impact on your QBI deduction amount.

Disclosure: The information in this article is for educational purposes. For tax advice, please consult your tax advisor.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.