Company Stock In Your 401(k)? Don’t Forget To Elect NUA

If you’re retiring or leaving your job and have company stock in your 401(k), understanding NUA (Net Unrealized Appreciation) could save you thousands in taxes. Many miss this valuable opportunity by rolling everything into an IRA without considering the tax implications. Our latest article breaks down how NUA works, common tax mistakes, and when choosing NUA makes sense. Learn how factors like your age, retirement timeline, and stock performance play a role. Don’t overlook this strategy if your company stock has grown significantly in value—it could make a big difference in your retirement savings.

For employees with company stock as an investment holding within their 401(k) accounts, there is a special distribution rule available that provides significant tax benefits called “NUA”, which stands for Net Unrealized Appreciation. The NUA option becomes available to employees who have either retired or terminated their employment with a company and are in the process of rolling over their 401(k) balances to an IRA. The purpose of this article is to help employees understand:

How does the NUA 401(k) distribution option work?

What are the tax benefits of electing NUA?

The immediate tax event that is triggered with an NUA election

What situations should NUA be elected?

What situations should NUA be AVOIDED?

Special estate tax rules for NUA shares

The Common Rollover Mistake

For employees who have company stock in their 401(k) and do not receive proper guidance, they can easily miss the window to make the NUA election, which can cost them thousands of dollars in additional taxes in their retirement years. When employees leave a company, it’s common for the employee to open a Rollover IRA and process a direct rollover of their entire balance in their 401(k) to their IRA to avoid triggering an immediate tax event as they move their retirement savings away from their former employer.

Example: Tim retires from Company ABC and has a $500,000 balance in that 401(k) plan; $200,000 of the $500,000 is invested in ABC company stock. He sets up a traditional IRA, calls the 401(k) provider, and requests that they process a direct rollover of the full $500,000 balance from his 401K to his IRA. The 401(k) platform processes the rollover, and Tim deposits the $500,000 to his IRA with no taxes being triggered. Then, Tim begins taking distributions from his IRA to supplement his income in retirement. On the surface, everything seems perfectly fine with this scenario. However, Tim may have completely missed a huge tax-saving opportunity by failing to request NUA treatment of his company stock within his 401(k) account.

How Does NUA Work?

When an employee has company stock in their 401(k) account and they go to take a distribution/rollover from their 401(k) after they leave employment with the company, they may be able to elect NUA treatment of the portion of their 401(k) that is invested in company stock. But what does NUA treatment mean? When an employee processes a rollover from their pre-tax 401(k) balance to their Rollover IRA, and then takes distributions from their IRA in the future, they have to pay ordinary income tax on all distributions taken from the IRA account. However, prior to requesting a full rollover of their 401(k) balance to their IRA, an employee with company stock in their 401(k) account can make an NUA election, which allows the appreciation in the stock within the 401(k) account to be taxed at long-term capital gains rates in the future as opposed to ordinary income tax rates which may be higher.

But employees must be aware that by electing NUA, it triggers an immediate tax event for the employee.

Here is how NUA works as an example. Sue has a 401(k) account with Company XYZ. The total balance of Sue’s 401(k) is $800,000, but $400,000 of the $800,000 balance is invested in XYZ company stock that Sue has accumulated over the past 20 years with the company. The cost basis of Sue’s $400,000 in company stock within the 401(k) is $50,000, so over that 20-year period, the company stock has gained $350,000 in value.

When Sue retires, instead of rolling over the full $800,000 balance to her Rollover IRA, she makes an NUA election. The NUA election will send the $400,000 in company stock within her 401(k) account to an after-tax brokerage account in Sue’s name as opposed to a Rollover IRA account. When that happens, Sue has to pay ordinary income tax, not on the full $400,000 value of the stock, but on the $50,000 cost basis amount of the company stock. The $350,000 in “unrealized gain” in the company stock is now sitting in Sue’s brokerage account, and when she sells the stock, she receives long-term capital gain treatment of the $350,000 gain, as opposed to paying ordinary income tax on the $350,000 gain if it was rolled over to her IRA.

But what happens to the rest of Sue’s 401(k) balance that was not invested in company stock? The non-company stock portion of Sue’s 401(k) account can be rolled over to a Rollover IRA and it’s a 100% tax-free event. She just pays ordinary income tax on future distributions from the IRA account.

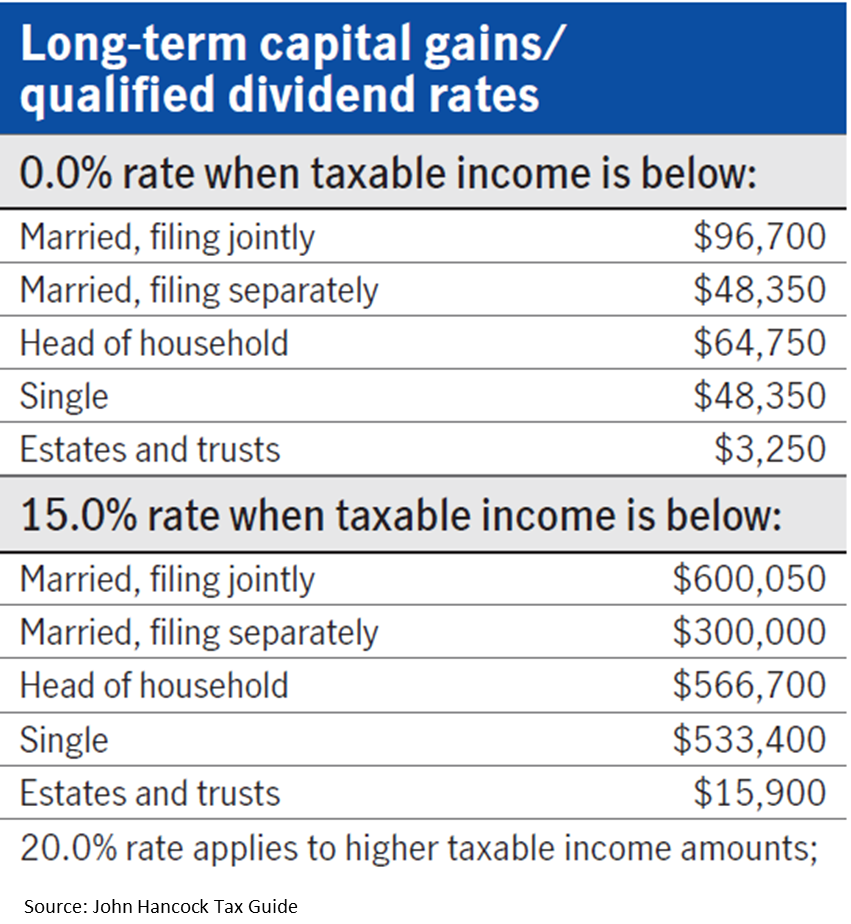

NUA – Long-Term Capital Gains Rates

Depending on Sue’s income level in retirement, her federal long-term capital gains rate may be 0%, 15%, or 20%, which may be lower than if she had realized the IRA distribution at ordinary income tax rates. Here is a quick chart that illustrates the 2025 long-term capital gains rates by filing status and income level:

NUA Triggers A Tax Event

Now let’s go back and review the tax event that was triggered when Sue requested the $400,000 transfer of her company stock from the 401(k) to her brokerage account. Again, when the NUA is processed, she only has to pay ordinary income tax on the cost basis amount of the stock, so in Sue’s case, in the year the NUA distribution takes place, she would have to report an additional $50,000 in taxable income. The tax liability generated could either be paid with her personal cash reserve or she could liquidate some of the company stock in her after-tax brokerage account to pay the taxes.

Timing of the NUA Distribution

There is a tax strategy associated with the timing of requesting the NUA distribution. If someone works for a company until September and then retires, they already have 9 months' worth of income in that tax year. In this case, it may be beneficial to process the rollover from the 401(k) with the NUA to the brokerage account the following tax year, when the individual’s W-2 income is completely off the table, so the taxable cost basis associated with the NUA election is potentially taxed at a lower rate since there is no W2 income the following year.

The Employee’s Age Matters for NUA

Because the cost basis of the company stock is treated like a cash distribution, if an employee takes an NUA distribution before age 55 and has already left the company, the cost basis would be subject to ordinary income tax and the 10% early withdrawal penalty.

NUA – Age 55 Exception To The 10% Early Withdrawal Penalty

Why age 55 and not 59½? Qualified retirement plans (401(k), 403(b), 457(b) plans) have a special exception to the under age 59½ 10% early withdrawal penalty. If you terminate employment with the company AFTER reaching age 55 and you take a cash distribution or NUA directly from the 401(k) plan, the employee is no longer subject to the 10% early withdrawal penalty. But an employee who terminates employment at age 54 and requests the NUA distribution at age 55 would still get hit with the 10% penalty because they did not separate from service AFTER reaching age 55.

The cost basis associated with the NUA distribution is treated the same as a regular cash distribution from a 401(k) plan.

When Electing NUA Makes Sense

There are certain situations where making the NUA election makes sense, and there are situations where it should be avoided. We will start off by reviewing the common situations where electing NUA makes sense in lieu of rolling over the entire balance to an IRA.

Large Unrealized Gain In The Company Stock

In order for the NUA election to make sense, there typically has to be a large unrealized gain built up in the company stock within the 401(k) plan. Said another way, the company stock has to have performed well within the 401(k) account. If the value of the company stock in an employee's 401(k) account is $200,000 and the cost basis is $170,000, if that employee elects an NUA and then transfers the $200,000 in stock to their brokerage account, it’s going to trigger a $170,000 immediate tax event and only $30,000 would receive long-term capital gains treatment. In this case, it’s probably not worth the tax hit.

In the example with Sue, she only had to pay ordinary income tax on $50,000 of the $400,000 in company stock, so the NUA would make more sense in her situation because she is shifting $350,000 to long-term capital gains treatment.

Ordinary Income Tax vs Long Term Capital Gains Rates

For NUA to make sense, it’s a race between what tax rate someone would pay if the money were distributed from a Rollover IRA and distributed at ordinary income tax rates versus the long-term capital gains tax rate if NUA is elected. Under current tax law, the federal tax rate jumps from 12% to 22% at $96,950 for a joint tax filer. On the surface it would seem that someone with under $96,950 in income might be better off rolling over the balance to an IRA and paying ordinary income tax rates at 12% instead of the long-term capital gains rate of 15%. However, if you look at the long-term capital gains tax rates in the table earlier in the article, if in 2025 a joint filer has income below $96,700, the long-term capital gains rate is 0%, and a 0% tax rate always wins.

Time Horizon Matters

An employee's time horizon to retirement also factors into the NUA decision. If an employee leaves a company at age 40, not only would they have to pay taxes and the 10% penalty on the cost basis of the NUA distribution, but by moving the company stock to a taxable brokerage account, they are losing the tax deferred accumulation benefit associated with the Rollover IRA for the next 19+ years. Since the brokerage account is a taxable account, the owner of the account has to pay taxes every year on dividends, interest, and realized gains produced by the brokerage account. If the company stock is liquidated and the full 401(k) balance is rolled over to an IRA, all of the investment income avoids immediate taxation and continues to accumulate within the IRA account. For taxpayers in higher tax brackets, this may have its advantages.

There are a lot of factors in the NUA decision, but in general, the shorter the timeline to when distributions will begin from retirement savings, the more it favors NUA; the longer the time horizon to retirement, the less it favors NUA over the benefits of continued tax deferred accumulation in a Rollover IRA account.

Reduce Future RMDs

For individuals who have a majority of their assets in pre-tax retirement accounts, like 401(k) and IRA accounts, and are fortunate enough to not need to take large distributions from those accounts in retirement because they have other sources of income, eventually when those individuals reach RMD age (73 or 75), the IRS is going to force them to start taking large taxable distributions out of their pre-tax retirement accounts.

For an individual in this situation, electing NUA can be an attractive option. Instead of their full 401(k) balance ending up in a Rollover IRA with a future RMD requirement, the company stock is sent to a brokerage account that does not require RMDs.

Estate Planning – No Step-Up In Cost Basis for NUA

Here is a little-known estate planning fact about NUA elections. Normally, when you have unrealized gains in a brokerage account and the owner of the account passes away, the beneficiaries of the estate receive a step-up in cost basis, which eliminates the taxable gain if the beneficiaries were to sell the stock. For individuals that elect NUA from a 401(k) account, there is a special rule that states if shares are deposited into a brokerage account as a result of an NUA election, the remaining portion of the NUA will be considered “income with respect of the decedent”, meaning the beneficiaries of the estate will have to pay long-term capital gains when they eventually sell those shares.

I’m not sure how this is tracked because when you move shares into a brokerage account that has NUA, if the shares continue to appreciate in value, and shares are bought and sold throughout the decedent’s lifetime, how do you determine which portion of the remaining unrealized gain was from the NUA election and which portion represents unrealized gains post NUA? A wonderful question for your tax professional if you end up in this situation.

When To Avoid NUA

As part of the analysis above, I highlighted a number of situations where an NUA election might not make sense, but a quick hit list is:

Company stock has not performed well in 401(k) account – high cost basis

High tax rate assessed on the cost basis amount during the year of NUA election

Employee under age 55 or 59½, potentially triggering early withdrawal penalty

Long time horizon to retirement (loss of tax deferred accumulation)

Ordinary tax rate lower or similar to long-term capital gains rate

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Hidden Tax Traps in Retirement Most People Miss

Many retirees are caught off guard by unexpected tax hits from required minimum distributions (RMDs), Social Security, and even Medicare premiums. In this article, we break down the most common retirement tax traps — and how smart planning can help you avoid them.

Most people think retirement is the end of tax planning. But nothing could be further from the truth. There are several tax traps that retirees encounter, which range from:

How RMDs create tax surprises

How Social Security is taxed

How Medicare Premiums (IRMAA) are affected by income

A lack of tax-specific distribution planning

We will be covering each of these tax traps in this article to assist retirees in avoiding these costly mistakes in the retirement years.

RMD Tax Surprises

Once you reach a specific age, the IRS requires individuals to begin taking mandatory distributions from their pre-tax retirement accounts, called RMDs (required minimum distributions). Distributions from pre-tax retirement accounts represent taxable income to the retiree, which requires advanced planning to ensure that that income is not realized at an unnecessarily high tax rate.

All too often, Retirees will make the mistake of putting off distributions from their pre-tax retirement accounts until RMDs are required to begin, which allows the pretax accounts to accumulate and become larger during retirement, which in turn requires larger distributions once the RMD start age is reached.

Here is a common example: Tim and Sue retire from New York State at age 55 and both have pensions that are more than enough to meet their current expenses. Both of them also have retirement accounts through NYS, totaling $500,000. Assuming Tim and Sue start taking their required minimum distributions (RMDs) at age 75, and since Tim and Sue do not need to take withdrawals from their retirement account to supplement their income, those retirement accounts could grow to over $1,000,000. This sounds like a good thing, but it creates a potential tax problem. By age 75, they’ll both be receiving their pensions and have turned on Social Security, which under current tax law is 85% taxable at the federal level. On top of that, they’ll need to take a required minimum distribution of $37,735 which stacks up on top of all their other income sources.

This additional income from age 75 and beyond could:

Be subject to higher tax rates

Trigger higher Medicare Premiums

Cause them to phase out of certain tax deductions or credits

In hindsight, it may have been more prudent for Tim & Sue to begin taking distributions from their retirement accounts each year beginning the year after they retired, to avoid many of these unforeseen tax consequences 20 years after they retired.

How Is Social Security Taxed?

I start this section by saying, based on current law, because the Trump administration has on its agenda to make social security tax-free at the Federal level. At the time of this article, social security is potentially subject to taxation at the federal level for individuals based on their income. A handful of states also tax social security benefits.

Here is a quick summary of the proportion of social security benefits subject to taxation at the Federal level in 2025:

0% Taxable: Combined income for single filers below $25,000 and joint filers below $32,000.

50% Taxable: Combined income for single filers between $25,000 - $34,000 and joint filers between $32,000 - $44,000

85% Taxable: Combined income for single filers above $34,000 and joint filers above $44,000.

One-time events that occur in retirement could dramatically impact the amount of a retiree's social security benefit, subject to taxation. For example, a retiree might sell a stock at a gain in a brokerage account, surrender an insurance policy, earn part-time income, or take a distribution from a pre-tax retirement account. Any one of these events could inadvertently trigger a larger tax liability associated with the amount of an individual’s social security that is subject to taxation at the Federal level.

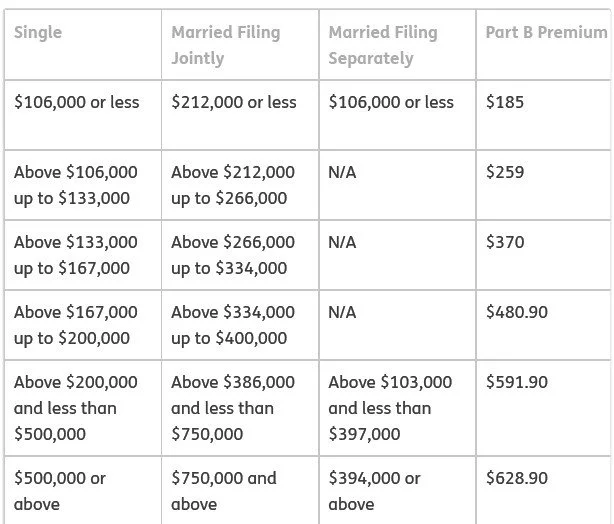

Medicare Premiums Are Income-Based

When you turn age 65, many retirees discover for the first time that there is a cost associated with enrolling in Medicare, primarily in the form of the Medicare Part B premiums that are deducted directly from a retiree's monthly social security benefit. The tax trap is that if a retiree shows too much income in a given year, it can cause their Medicare premium to increase for 2 years in the future.

Medicare looks back at your income from two years prior to determine the amount of your Medicare Part B premium in the current year. Here is the Medicare Part B premium table for 2025:

As you can see from the table, as income rises, so does the monthly premium charged by Medicare. There are no additional benefits, the retiree just has to pay more for their Medicare coverage.

This is where those higher RMDs can come back to haunt retirees once they reach the RMD start age. They might be ok between ages 65 – 75, but once they hit age 75 and must start taking RMDs from their pre-tax retirement accounts, those pre-tax RMD’s can sometimes push retirees over the Medicare based premium income threshold, and then they end up paying higher premiums to Medicare for the rest of their lives that could have been avoided.

Lack of Retirement Distribution Planning

All these tax traps surface due to a lack of proper distribution planning as an individual enters retirement. It’s incredibly important for retirees to look at their entire asset picture leading up to retirement, determine the income level that is needed to cover expenses in their retirement year, and then construct a long-term distribution plan that allows them to minimize their tax liability over the remainder of their life expectancy. This may include:

Processing sizable distributions from pre-tax accounts early in the retirement years

Processing Roth conversions

Delaying to file for social security

Developing a tax plan for surrendering permanent life insurance policies

Evaluating pension and annuity elections

A tax plan for realizing gains in taxable investment accounts

Forecasting RMDs at age 73 or 75

Developing a robust distribution plan leading up to retirement can potentially save retirees thousands of dollars in taxes over the long run and avoid many of the pitfalls and tax traps that we reviewed in the article today.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Trump Has The Stock Market and Fed Cornered

The stock market selloff continues amid the escalation of the trade wars between the US and 180 other countries. It’s left investors asking the questions:

Where is the bottom?

Are we headed for a recession?

Unfortunately, the answers are largely rooted in the decisions that President Trump makes in the coming days and weeks. There have been talks about the Fed decreasing rate, tax reform getting passed sooner, negotiations beginning with 50 of the 180 countries that we placed tariff on, but in this article we are going to explain why all of these solutions may be too little too late when it comes to the overall negative impact that tariff are currently having on the US economy.

The stock market selloff continues amid the escalation of the trade wars between the U.S. and 180 other countries, and it’s left investors asking the questions:

Where is the bottom?

Are we headed for a recession?

Unfortunately, the answers are largely rooted in the decisions that President Trump makes in the coming days and weeks. There have been talks about the Fed decreasing rates, tax reform getting passed sooner, and negotiations beginning with 50 of the 180 countries that we placed tariffs on. In this article, we are going to explain why all of these solutions may be too little too late when it comes to the overall negative impact that tariffs are currently having on the U.S economy.

Trump Holds All of the Cards

In our opinion, the only way out of this market selloff is a policy pivot by the Trump administration on the latest round of tariffs - which could be announced ant any moment. Markets would likely respond very positively to any sign of relief. This could come in the form of a “pause” in the assessments of the tariffs for a specific number of days to provide time for negotiations to take place, or the Trump administration could reverse course, either walking back or reducing the tariff amounts that are currently being assessed.

Notice that I didn’t add to the list that “tariffs are either eliminated or reduced by successfully negotiating with 180 countries on which tariffs have been placed.” While this would typically be an option, we do not believe that the Trump administration has the manpower to successfully negotiate with 180 countries simultaneously in a way that would reduce or eliminate the tariffs before they negatively impact the global economy.

The magnitude of the tariff is a real problem, and we believe this to be one of the big missteps by the Trump administration in trade negotiations. The reciprocal tariffs are not based on the tariffs that are being levied against U.S. goods being imported by other countries, but rather a formula by the Trump administration that’s based on the trade deficit between the U.S. and these various countries, which is not prudently resolved through the assessment of tariffs.

For example, let's say that Japan assesses a 5% tariff against U.S. imports. Since the U.S. imports more from Japan than Japan imports from the U.S., this results in a trade deficit between the two countries. The Trump administration has decided not to levy a reciprocal tariff based on the 5% actual tariff levied against U.S. goods but rather is assessing a much larger tariff based on the amount of the trading deficit between the U.S. and Japan. However, this might not be the root cause of the trade imbalance. Another example: let's say the U.S. consumer prefers buying Japanese electronics, but there aren’t naturally many things that Japan buys or needs from the U.S. This would cause exports from Japan to exceed imports from the U.S., which is being driven largely by consumer demand, not tariffs. However, the Trump administration is now assessing sizable tariffs against Japan to try to reduce the trade deficit. In effect, this approach either forces Japan to buy more goods from the U.S. or for the U.S. consumer to buy less goods imported from Japan - even those products are preferred for their quality over alternatives from other countries.

In a way, the Trump administration is trying to use a hammer to fix a problem that requires a screwdriver. In addition, it was recently pointed out on an analyst call that since the United States spends more than it makes, we are naturally going to run deficits with other countries because we're purchasing more than we produce as a country. If we are concerned with the U.S. trade deficits, and although tariffs may be a contributing factor, the lion’s share of the problem may be the U.S. just outspending what we produce each year.

Tariffs are Paralyzing the Global Economy

While we have seen the tariffs being implemented this week, just the threat of tariffs has a paralyzing impact on both the U.S. and global economy. Since there is so much at stake in the negotiation of these tariffs, it causes companies to put off purchasing decisions, hiring decisions, new construction, and encourages companies to sit on their cash, not knowing which direction the economy will go from here.

Not only do we need a pause, delay, or elimination of the tariff to stave off a recession, but it needs to happen within a reasonable period of time, because the reduction in spending by consumers and businesses during this wait-and-see approach is already reducing the GDP in Q2, which could push the QDP negative in Q2 and potentially Q3. Two consecutive quarters of negative GDP is a recession.

Delay In Building New Factories

While the Trump administration's main goal with the trade negotiations is to bring more manufacturing back to the United States, these are multibillion-dollar decisions for these publicly traded companies. For example, it’s estimated that if Apple were to move forward with building a new multi-billion facility in the U.S., it might take them 10 years to build it. The catalyst for building it in the first place would be to avoid having to pay the tariffs on iPhones that are being imported from China. But if you're Apple, do you commit to spending billions to build a new factory in the US when in 4 years there could be a change in the administration in Washington and then the tariffs could be removed, making it no longer prudent to produce hardware in the United States? These are the decisions that these big multinational companies face before pulling the trigger on bringing manufacturing back to the United States.

Labor Shortage

Another reasonable question to ask is if all these manufacturing jobs come back to the United States, do we have enough workers to hire in the U.S. to run those factories? The unemployment rate in the U.S. is 4.2%, which is well below the 6% historical trend. With the Trump administration greatly limiting immigration into the U.S., it’s difficult to pinpoint where all these additional workers would come from within the U.S.

The Fed is Stuck

The Fed is stuck between a rock and a hard place. Normally, when there is weakness in the U.S. economy, the Fed will step in and begin lowering interest rates. However, tariffs are inflationary, so if the Fed begins reducing rates to help the economy while prices are moving higher because of the tariffs, it could result in another round of hyperinflation like we saw coming out of COVID. This may cause the Fed to stay on pause, meaning the markets may not receive any immediate help from the Fed in the near future.

Tax Reform

There is also the argument to be made that weakening the U.S. economy may allow larger tax cuts to be passed with the anticipation of the Trump tax cuts that are currently working their way through Congress. While this may very well be true, again, it’s a timing issue. Tax reform is a slow-moving animal, and even in the best-case scenario, we may not see the tax reform passed until August 2025 or later, but by then the U.S. economy could already be in a recession if the tariff issues are not resolved.

Waiting For the Recovery

The economy is truly balancing on the edge of a knife right now. An announcement at any moment from the Trump administration indicating a pause or reduction of the tariff could make the last few weeks just a bad dream. But it’s not just that relief happens, but that the U.S. economy likely needs to receive that relief soon to avoid too much damage from happening due to the economic paralysis in the interim. There are very few moments in history where so much is riding on policy coming out of Washington that it becomes difficult to predict which path the U.S. economy will follow in coming weeks and months. This is truly a situation where investors will have to assess the data each day and what the developing trends in the economic data are to determine whether or not changes should be made to their asset allocation.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.