Federal Disaster Area Penalty-Free IRA & 401(k) Distribution and Loan Options

Individuals who experience a hurricane, flood, wildfire, earthquake, or other type of natural disaster may be eligible to request a Qualified Disaster Recovery Distribution or loan from their 401(k) or IRA to assist financially with the recovery process. The passing of the Secure Act 2.0 opened up new distribution and loan options for individuals whose primary residence is in an area that has been officially declared a “Federal Disaster” area.

Individuals who experience a hurricane, flood, wildfire, earthquake, or other type of natural disaster may be eligible to request a Qualified Disaster Recovery Distribution or loan from their 401(k) or IRA to assist financially with the recovery process. The passing of the Secure Act 2.0 opened up new distribution and loan options for individuals whose primary residence is in an area that has been officially declared a “Federal Disaster” area.

Qualified Disaster Recovery Distributions (QDRD)

In December 2022, the passing of the Secure Act 2.0 made permanent, a distribution option within both 401(K) plans and IRAs, that allows individuals to distribute up to $22,000 from either a 401(k) or IRA, and that distribution is exempt from the 10% early withdrawal penalty. Typically, when an individual is under the age of 59½ and takes a distribution from a 401(K) or IRA, the distribution is subject to both taxes and a 10% early withdrawal penalty.

For an individual, it’s an aggregate of $22,000 between both their 401(k) and IRA accounts, meaning, they can’t distribute $22,000 from their IRA and then another $22,000 from their 401(k), and avoid the 10% penalty on the full $44,000.

If you are married, if each spouse has an IRA and/or 401(k) plan, each spouse would be eligible to process a qualified disaster recovery distribution for the full $22,000 and avoid the 10% penalty on the combined $44,000.

Taxation of Federal Disaster Distributions

Even though these distributions are exempt from the 10% early withdrawal penalty, they are still subject to federal and state income taxes, but the taxpayer has two options:

The taxpayer can elect to include the full amount of the distribution as taxable income in the year that the QDRD takes place; OR

The taxpayer can elect to spread the taxable amount evenly over a 3-year period that begins the year that distribution occurred.

Here is an example of the tax options. Tim is age 40, he lives in Florida, and his area experiences a hurricane. Shortly after the hurricane, the area where Tim’s house is located was officially declared a Federal Disaster Area by FEMA. To help pay for the damage to his primary residence, Tim processes a $12,000 qualified disaster recovery distribution from his Traditional IRA. Tim would not have to pay the 10% early withdrawal penalty due to the QDRD exception, but he would be required to pay federal income tax on the full $12,000. He has the option to either report the full $12,000 on his tax return in the year the distribution took place, or he could elect to spread the $12,000 tax liability over the next 3 years, reporting $4,000 in additional taxable income each year beginning the year that the QDRD took place.

Repayment Option

If an individual completes a disaster recovery distribution from their 401(k) or IRA, they have the option to repay the money to the account within 3 years of the date of the distribution. This allows them to recoup the taxes paid on the distribution by filing an amended tax return(s) for the year or years that the tax liability was reported from the QDRD.

180 Day & Financial Loss Requirement

To make an individual eligible to request a QDRD, not only does their primary residence have to be located within a Federal Disaster area, but they also need to request the QDRD within 180 days of the disaster, and they must have sustained an economic loss on account of the disaster.

QDRD Are Optional Provisions Within 401(k) Plans

If you have a 401(k) plan, a Qualified Disaster Recovery Distribution is an OPTIONAL provision that must be adopted by the plan sponsor of a 401(k) to provide their employees with this distribution option. In other words, your employer is not required to allow these disaster recovery distributions, they have to adopt them. If you live in an area that is declared a federal disaster area and your 401(k) plan does not allow this type of distribution option, you can contact your employer and request that it be added to the plan. Many companies may not be aware that this is a voluntary distribution option that can be added to their plan.

If you have an IRA, as long as you meet the criteria for a QDRD, you are eligible to request this type of distribution.

If you have a 401(k) plan with a former employer and their plan does not allow QDRD, you may be able to rollover the balance in the 401(k) to an IRA, and then request the QDRD from the IRA.

What Changed?

Prior to the passing of Secure Act 2.0, Congress had to authorize these Qualified Disaster Recovery Distributions for each disaster. Section 331 of the Secure Act 2.0 made these QDRDs permanent.

However, one drawback is in the past, these qualified disaster recovery distributions were historically allowed up to $100,000, but the new tax law lowered the maximum QDRD amount to only $22,000.

$100,000 401(k) Loan for Disaster Relief

In addition to the qualified disaster recovery distributions, Secure Act 2.0, also allows plan participants in 401(K) plans to request loans up to the LESSER of $100,000 or 100% of their vested balance in the plan.

Typically, when plan participants request loans from a 401(K) plan, the maximum amount is the LESSER of $50,000 or 50% of their vested balance in the plan. Secure Act 2.0, doubled that amount. The eligibility requirements to receive a disaster recovery 401(k) loan are the same as the eligibility requirements for a Qualified Disaster Recovery Distribution.

In addition to the higher loan limit, plan participants eligible for a 401(K) qualified disaster recovery loan, are also allowed to delay the start date of their loan payments for up to 1 year from the loan processing date. Normally when a 401(K) loan is requested, loan payments begin immediately.

These loans are still subject to the 5-year duration limit, but with the optional 12-month delay in the loan payment start date, the maximum duration of these qualified disaster loans is technically 6 years.

401(K) Loans Are an Optional Provision

Similar to Qualified Disaster Recovery Distributions, 401(k) loans are an optional provision that must be adopted by the plan sponsor of a 401(k) plan. Some plans allow plan participants to take loans while others do not, so the ability to take these disaster recovery loans will vary from plan to plan.

Loans Are Only Available In Qualified Retirement Plans

The $100,000 loan option is only available for Qualified Retirement Plans such as 401(k) and 403(b) plans. IRAs do not provide a loan option. The $22,000 Qualified Disaster Recovery Distribution is the only option for IRAs unless Congress specifically authorizes a higher maximum distribution amount for a specific Federal Disaster, which is within their power to do.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Biden's New SAVE Plan: Lower Student Loan Payments with Forgiveness

With student loan payments set to restart in October 2023, the Biden Administration recently announced a new student loan income-based repayment plan called the SAVE Plan. Not only is the SAVE plan going to significantly lower the required monthly payment for both undergraduate and graduate student loans but there is also a 10-year to 25-year forgiveness period built into the new program. While the new SAVE program is superior in many ways when compared to the current student loan repayment options, it will not be the right fit for everyone.

With student loan payments set to restart in October 2023, the Biden Administration recently announced a new student loan income-based repayment plan called the SAVE Plan. Not only is the SAVE plan going to significantly lower the required monthly payment for both undergraduate and graduate student loans for many borrowers, but there is also a 10-year to 25-year forgiveness period built into the new program. While the new SAVE program is superior in many ways to the current student loan repayment options, it will not be the right fit for everyone. In this article, we will cover:

How does the new SAVE Plan work?

How does the SAVE program compare to other student loan repayment options?

How are the monthly payments calculated under the SAVE program?

What type of loans qualify for the SAVE plan?

How do you apply for the new SAVE plan?

How does loan forgiveness work under the SAVE plan?

Who should avoid enrolling in the SAVE plan?

The new Fresh Start Plan to wipe away defaults and delinquent payments in the past

The SAVE Student Loan Repayment Plan

The SAVE plan is a new Income-Driven Repayment Plan (IDR) for student loans that also contains a loan forgiveness feature. The monthly payments under this program are based on a borrower’s annual income and household size. Once a borrower is enrolled in the SAVE program, any balance remaining on the loan is forgiven after a specified number of years.

Replacing The REPAYE Plan

The SAVE Plan will be replacing the current REPAYE plan, but the terms associated with the SAVE plan are enhanced. Any borrowers previously enrolled in the REPAYE plan will automatically be transitioned to the SAVE plan.

What Types of Loans Are Eligible?

Only federal student loans are eligible for the SAVE plan. Private student loans and Parent PLUS loans are not eligible for this repayment option. Both federal undergraduate and graduate student loans are eligible for the SAVE plan, but the monthly payment calculation and forgiveness terms differ depending on whether the borrower has undergraduate loans, graduate loans, or both.

SAVE Plan Monthly Payment Calculation

There are several income-driven repayment plans currently available to borrowers, but those plans typically require the borrower to commit 10% to 20% of their discretionary income toward their student loan payments each year. The new SAVE plan will only require individuals with undergraduate loans to commit 5% of their discretionary income toward their student loan payments each year. As mentioned above, individuals currently enrolled in the REPAYE plan, which requires a 10% of income payment, will automatically be transitioned to the SAVE plan, which could lower their monthly payment amount.

Definition of Income

The SAVE program limits the borrower to only having to pay 5% of their household discretionary income toward their undergraduate loan balance each year. While that seems pretty straightforward, there are a few terms that we need to define here. First, it’s 5% of household income, meaning if you are married and file a joint tax return, you must use your combined income when applying for the SAVE plan. If there are two incomes, that could naturally raise the amount you pay each month toward your student loans.

However, if a borrower is married but chooses to file their tax return, married filing separately instead of married filing jointly, then only the spouse applying for the SAVE plan has to report their income. While at first this might seem like a no-brainer, I would urge extreme caution before electing to file your tax return married filing separately. While this tactic could lower the required monthly payments for your student loan and potentially increase the forgiveness amount at the end, electing to file as married filing separately could dramatically increase your overall tax liability depending on the income level between the two spouses. It creates a situation where you could win on the student loan side but lose on the tax side. For this reason, I strongly encourage married couples to consult with their tax advisor before completing the SAVE plan application.

If you are a single filer, there is nothing to worry about; it’s just your income.

We also have to define the term discretionary income. Discretionary income usually means your total income minus all your living expenses like rent, groceries, utilities, etc. But that is not how it’s defined for purposes of the SAVE plan, which makes sense because everyone has different living expenses. For purposes of the 5% SAVE plan calculation, your discretionary income is the difference between your adjusted gross income (AGI) and 225% of the U.S. Department of Health and Human Services Poverty Guideline based on your family size.

For 2023, here are the Federal Poverty Levels based on family size:

Individuals: $14,580

Family of 2: $19,720

Family of 3: $24,860

Family of 4: $30,000

The list continues as the size of the family increases, and these amounts change each year. Let’s look at an easy example:

Sarah is a single tax filer

She has $80,000 in undergraduate federal student loans

Her adjusted gross income (AGI) is $40,000

Here is how her student loan payment would be calculated under the SAVE Plan.

Adjusted Gross Income: $40,000

Minus 225% of Individual Household Poverty Rate: $32,805 ($14,580 x 225%)

Equals: $7,195

Multiply by 5%: $359.75

So Sarah would only have to pay $359.75 for the YEAR (about $30 per month) toward her student loan under the new SAVE plan.

Some Borrowers Will Pay $0

No payments will be required under the SAVE plan for borrowers with an adjusted gross income below 225% of the Federal Poverty Level. In the example above, if Sarah’s AGI was only $30,000, since her $30,000 in income is below 225% of the Federal Poverty threshold of $32,805, she would not be required to make any monthly student loan payment under the SAVE plan until her income rises above the 225% threshold.

Size of the Household

As you can see above, it’s not just the annual income amount that determines how much a borrower will pay under the SAVE plan but also how many individuals there are within that person's household. More specifically, they ask for individuals who qualify as your “dependents.” If Sarah is a single filer with 2 roommates, she cannot claim those roommates as household members for the SAVE repayment plan. The SAVE application specifically asks for the following:

How many children, including unborn children, are in your family and receive more than half of their support from you?

How many other people, excluding your spouse and children, live with you and receive more than half of their support for you?

Studentaid.gov has the following illustration posted on their website to give borrowers a rough estimate of what the monthly payment student loan payment will be based on varying levels of income and family size:

The 5% Payment Will Take Effect July 2024

You will notice something odd in the illustration above. When I presented the example with Sarah, her AGI was $40,000 for a household of 1, which resulted in an estimated monthly payment of $30 but the chart above says $60 per month. Why? Under the current REPAYE plan which the SAVE plan is replacing, the payment amount is 10% of discretionary income. The lower 5% of discretionary income amount associated with the new SAVE plan is not expected to be phased in until July 2024. This means that borrowers who enroll in the SAVE plan now, while their payment may still be lower than that standard 10-year repayment plan, they will have to pay 10% of their discretionary income toward their student loans until they reach July 2024 when the new 5% rule becomes effective.

Going Into Effect in 2023

There are three components of the SAVE Plan that are going into effect in 2023, some of which we have yet to address in this article.

The larger income shield. Most of the current income-based student loan repayment plans only shield the borrower’s AGI up to 100% to 150% of the Federal Poverty Level compared to the new SAVE plan’s 225%. Under the SAVE plan, the 225% shield is in effect for 2023 reducing the amount of the borrower’s AGI subject to the current 10% repayment allowance. Also, more borrowers will be completely relieved of making payments when they restart in October because the income protection threshold is higher under the SAVE Plan.

The treatment of unpaid interest: We have not covered this yet but we will later on, the treatment of unpaid interest and the compounding of the interest for loans covered by the SAVE plan will be much more favorable for borrowers. This feature goes into effect in 2023.

Married Filing Separately: Married couples who choose to file their tax return married filing separately will no longer be required to include their spouse’s income in their monthly payment calculation under the SAVE plan.

Graduate Loans

The more favorable 5% income repayment amount that takes effect in July 2024 is only available for undergraduate loans under the SAVE plan. Individuals with graduate loans are eligible to enroll in the SAVE program but the minimum payment amount is based on 10% of discretionary income instead of 5%.

For borrowers that have both undergraduate and graduate student loans, they will take a weighted average between their undergraduate loans at 5% and graduate loans at 10% to reach the percent of discretionary income that will be required under the SAVE payment plan. Example: If you have $20,000 in undergraduate loans and $60,000 in graduate loans, you have $80,000 in student loans in total: 25% are undergraduate and 75% are graduate.

5% x 25% = 1.25%

10% x 75% = 7.50%

Average Weighted: 8.75%

This borrower would have to commit 8.75% of their discretionary income toward their SAVE student loan repayment plan.

SAVE Plan Loan Forgiveness

There is also a loan forgiveness component associated with the new SAVE Plan. Once you have made payments on your student loan for a specified number of years, any remaining balance is forgiven. The timeline to forgiveness under the SAVE plan can range from 10 years to 25 years. The original principal balance of your student loan or loans is what determines your forgiveness timeline.

Beginning in July 2024, borrowers who had original student loan balances of $12,000 or less, may be required to make monthly payments in accordance with the income-based payment plan, but after 10 years, any remaining loan balance is completely forgiven.

For each $1,000 in original student loan debt over the $12,000 threshold, they add one year to the borrower's forgiveness timeline up to the maximum of 20 years for undergraduate debt and 25 years for graduate debt. For example, Sue has a student loan with a current balance of $ 8,000 but the original principal balance of the loan was $14,000. Since Sue is $2,000 over the $12,000 threshold, her forgiveness timeline will be 12 years. If Sue continues to make income-based payments under the SAVE plan, any remaining balance after year 12 is completely forgiven.

Payments Made In The Past Count Toward Forgiveness

A big question for borrowers, for years that you had already made student loan payments, do those years count toward your SAVE plan forgiveness timeline? Good news, the answer is “Yes” and it gets better. You also receive credit for the specific periods of deferment and forbearance which will count toward the forgiveness timeline.

For example, Jeff graduated from college in 2017, he has an original loan balance of $20,000 and made payments on his student loans in 2017, 2018, 2019, and then did not make any student loan payments 2020 – 2023 due to the COVID relief. Jeff enrolls in the SAVE repayment plan. Since his original loan balance was $8,000 over the $12,000 10-year threshold, his timeline to forgiveness is 18 years. However, because Jeff started making student loan payments in 2017 and he also receives credit for the years of deferred payments under the COVID relief, he is credited with 7 years toward his 18-year forgiveness timeline. After Jeff has made another 11 years' worth of income-based student loan payments under the SAVE program, any remaining loan balance will be forgiven.

Forgiveness May Trigger A Taxable Event

If you are forgiven all or a portion of your student loan balance, you may have to pay taxes on the amount of the loan forgiveness. It states right on the SAVE plan application that “forgiveness may be taxable”. As of 2023, forgiven loan balances are a tax-free event but that rule sunsets in 2025. With the SAVE plans having a 10-year to 25-year forgiveness period, who knows what the tax rules will be when those remaining loan balances become eligible for forgiveness.

Borrowers Who Consolidate Multiple Loans

It’s not uncommon for college graduates to have 3 or more federal student loans outstanding at the same time because they will typically take multiple student loans over their college tenure and then at some point consolidate all of their loans together. When borrowers consolidate all of their loans into one under the SAVE plan, they receive a credit for a weighted average of payments that count toward forgiveness based upon the principal balance of loans being consolidated.

That’s the technical way of saying if you consolidate two of your student loans into one and the first loan that you consolidated began repayment 9 years ago and had a $1,000 original balance but then you consolidated it with a second loan with an original balance of $8,000 that you just started making payments on last year, if you qualify for 10-year forgiveness under the SAVE plan, the full loan balance will not be forgiven next year which would be the 10th year since you started making payments on the $1,000 loan. They are going to weigh the balance of each loan and how long you have been making payments on each loan to determine how much credit you receive toward your forgiveness timeline once enrolled in the SAVE plan.

Does Interest Accumulate In The SAVE Plan?

A concern will often arise with these income-based repayment plans that if your income is low enough and it does not require you to make a payment or if the payment is very small, does the interest on the student loan continue to accumulate which in turn continues to increase the amount that you own on your student loan?

Under the new SAVE plan, the answer is “No”. The SAVE plan cancels unpaid interest. For example, if under the SAVE plan your monthly payment is $150 but the monthly interest on your loan is $225, instead of the $75 being added to your loan balance, the $75 in unpaid interest is canceled by the Education Department. This new feature associated with the SAVE plan will prevent outstanding loan balances from ballooning due to unpaid compounding interest.

Loan Defaults and Delinquent Borrowers (Fresh Start Program)

The Department of Education is giving all student loan borrowers a fresh start under what is specifically called the Fresh Start Program. For all borrowers that either fell into default prior to the COVID payment pause or have delinquent student loan payments on their credit history, all student loan borrowers are allowed to enroll in the new Fresh Start program which brings everyone current regardless of what their student loan payment history was prior to the COVID payment pause.

But action needs to be taken prior to September 2024 to qualify for this Fresh Start. This does not happen automatically. I have been told that you will need to contact either the Education Department’s Default Resolution Group or your student loan service provider and ask to be enrolled in the Fresh Start Program. Once in the Fresh Start Program, the loan default and/or late payments are also permanently removed from your credit report.

How Do You Enroll In The SAVE Plan?

To enroll in the SAVE plan, you can visit the StudentAid.gov website. You will be able to apply for the SAVE program, get an estimate of what your monthly payment amount will be, and ask any questions that you have about the SAVE program. You can also call 1-800-433-3243. There is also a printable PDF of the SAVE application that you can download from the website.

SAVE is one of many “Income-Driven Repayment” (IDR) plans that are available to borrowers. Fortunately, on the first page of the SAVE application, you can check a box that says, “I want the income-driven repayment plan with the lowest monthly payment.” For many borrowers, this will be the new SAVE plan, but if one of the other IDR programs like IBR, PAYE, or ICR offers a lower monthly payment, you will be enrolled in that Income-Driven Repayment Plan.

The SAVE Plan Is Not For Everyone

While there are no income limitations that restrict borrowers from enrolling in the SAVE Plan, this plan will not be the right fit for everyone. It will take careful consideration on the part of each borrower to determine if they should enroll in the SAVE plan, continue with the standard 10-year repayment plan, or select a different Income-Driven Repayment option. Right on the SAVE application, it states that there is no cap on that amount of the monthly payment and “your payments may exceed what you would have paid under the 10-year standard repayment plan”.

Everyone’s situation will be different depending on your annual income amount, the size of your outstanding loan balance, the type of loans that you have, the size of your household, tax filing status, how long you have already been paying on your loans, and what you can afford to pay each month toward your student loans.

In general, for higher-income earners with small to medium-sized loan balances, the SAVE program may not make sense because the payments under the SAVE program are based solely on your income and household size rather than your loan balance.

The Monthly Payment Amounts Change Each Year

Since the SAVE Plan is an income-driven repayment plan, your required monthly payment amount can vary each year as your income level and household size change. If you were making $30,000 as a single filer in 2024, you might not be required to make any payments, but if you change jobs and begin earning $80,000 per year, your payments could increase dramatically under these Income-Driven Repayment plans.

In the past, these income-driven repayment plans have been a headache to maintain because you had to go through the manual process of recertifying your income each year, but there is good news on this front. The SAVE plan will give borrowers the option to give the Department of Education access to the IRS database to pull their income from their tax return automatically each year to avoid the manual process of recertifying their income each year. Section 5A of the SAVE application is titled “Authorization to Retrieve Federal Tax Information From the IRS”, so you can elect this when you enroll in the SAVE plan.

You Are Not Locked Into The SAVE Plan

Once you are enrolled in the SAVE plan, you are not locked into it. At any time, you may change to any other student loan repayment plan for which you are eligible, so if your circumstances change in the future, you could enroll in a different repayment option that better meets your financial situation.

Student Loan Repayment Strategy

As borrowers, it's very tempting to quickly select the student loan repayment program that offers the lowest monthly payment amount, but that may not be the best long-term financial solution. As I mentioned before, the standard repayment schedule for student loans is fixed payments over 10 years. With the SAFE plan potentially lowering the monthly payment amounts and stretching the loan out over a longer duration, borrowers could end up paying more over the life of that loan. In addition, for borrowers aiming for forgiveness, it isn’t easy to know what your income may be 5+ years from now.

While interest does not compound in the SAVE program, if your payments are only being applied toward the interest portion of your loans, the principal amount of the loan is not decreasing, which could cause you to pay more over that 20 to 25-year period than you would have just keeping the standard payment schedule a paying off your loan in 10 years. While forgiveness may be waiting for you after 20 years, it could trigger a taxable event, making the forgiveness target even less attractive.

The SAVE program is positive because it may give some borrowers much-needed relief as student loan payments restart and for borrowers just graduating from college. However, for borrowers who enroll in the SAVE program, it may make financial sense to ignore the forgiveness aspect of the program and pay more than just the minimum monthly payment to pay off the loans faster. Debt-free living is a wonderful thing.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Starting in 2024, 401(k) Plan Will Be Required to Cover Part-time Employees

In the past, companies have been allowed to limit access to their 401(k) plan to just full-time employees but that is about to change starting in 2024. With the passing of the Secure Act, beginning in 2024, companies that sponsor 401(K) plans will be required to allow part-time employees to participate in their qualified retirement plans.

In the past, companies have been allowed to limit access to their 401(k) plan to just full-time employees but that is about to change starting in 2024. With the passing of the Secure Act, beginning in 2024, companies that sponsor 401(K) plans will be required to allow part-time employees to participate in their qualified retirement plans.

It’s very important for companies to make note of this now because many companies will need to start going through their employee census data to identify the part-time employees that will become eligible for the 401(K) plan on January 1, 2024. Failure to properly notify these part-time employees of their eligibility to participate in the plan could result in plan compliance failures, DOL penalties, and it could require the company to make a mandatory employer contribution to those employees for the missed deferral opportunity.

Full-time Employee Restriction

Prior to the passing of the Secure Act 1.0 in December 2019, 401(K) plans were allowed to limit participation in plans to employees that had completed 1 year of service which is commonly defined as 12 months of employment AND 1,000 hours worked within that 12-month period. The 1 year wait with the 1,000 hours requirement allowed companies to keep part-time employees who work less than 1,000 hours from participating in the company’s 401(k) plan.

Secure Act 1.0

When Congress passed Secure Act 1.0 in December 2019, it included a new provision that requires 401(K) plans to cover part-time employees who have completed three consecutive years of service and worked 500 or more hours during each of those years to participate in the plan starting in 2024. For purposes of the 3 consecutive years and 500 hours requirement, companies are only required to track employee service back to January 1, 2021, any services prior to that date, can be disregarded for purposes of this new part-time employee coverage requirement.

Example: John works for Company ABC which sponsors a 401(k) plan. The plan restricts eligibility to 1 year and 1,000 hours. John has been working part-time for Company ABC since March 2020 and he worked the following hours in 2021, 2022, and 2023:

2021 Hours Worked: 560

2022 Hours Worked: 791

2023 Hours Worked: 625

Since John had never worked more than 1,000 hours in a 12-month period, he was never eligible to participate in the ABC 401(k) plan. However, under the new Secure Act 1.0 rules, ABC would be required to allow John to participate in the plan starting January 1, 2024, because he works for three consecutive years with more than 500 hours.

Excluded Employees

The new part-time employee coverage requirement does not apply to employees covered by a collective bargaining agreement or nonresident aliens. 401(K) plans are still allowed to exclude those employees regardless of hours worked.

Employee Deferrals Only

For the part-time employees that meet the 3 consecutive years and 500+ hours of service each year, while the new rules require them to be offered the opportunity to participate in the 401(k) plan, it only requires plans to make them eligible to participate in the employee deferral portion of the plan. It does not require them to be eligible for EMPLOYER contributions. For part-time employees who become eligible to participate under these new rules, they are allowed to put their own money into the plan, but the company is not required to provide them with an employer matching, employer non-elective, profit sharing, or safe harbor contributions until that employee has met the plan’s full eligibility requirements.

In the example we looked at previously with John, John would be allowed to voluntarily make employee contributions from his paycheck but if the company sponsors an employer matching contribution that requires employees to work 1 year and 1,000 hours to be eligible, John would not be eligible to receive the employer matching contribution even though he is eligible to make employee contributions to the plan.

Secure Act 2.0

Up until now, we have covered the new part-time employee coverage requirements under Secure Act 1.0. However, in December 2022, Congress passed Secure Act 2.0, which changed the part-time employee coverage requirements beginning January 1, 2025. The main change that Secure Act 2.0 made is it reduced the 3 Consecutive Years down to 2 Consecutive Years starting in 2025. Both still require 500 or more hours each year but now a part-time employee will only need to complete 2 consecutive years of 500 or more hours instead of 3 beginning in 2025.

Also in 2025, under Secure Act 2.0, for purposes of assessing the 2 consecutive years with 500 or more hours, companies only have to look at service dating back to January 1, 2023, employment before that date is excluded from this part-time employee coverage exception.

2024 & 2025 Summary

Starting in 2024, employers will need to look back as far as January 1, 2021, and identify part-time employees who worked at least 3 consecutive years with 500 or more hours worked in each of those three years.

Starting in 2025, employers will need to look at both definitions of part-time employees. The Secure Act 1.0, three consecutive years of 500 hours or more going back to January 1, 2021, and separately, the Secure Act 2.0, 2 consecutive years of 500 hours or more going back to January 1, 2023. An employee could technically become eligible under either definition.

Penalties For Not Notifying Part-time Employees of Eligibility

Companies should take this new part-time employee eligibility rule very seriously. Failure to properly notify part-time employees of their eligibility to make employee deferrals to the 401(K) plan could result in a plan compliance failure and the assessment of Department of Labor penalties. The DOL conducts random audits of 401(K) plans and one of the primary pieces of information that they typically request during an audit is for the employer to provide a full employee census file and be able to prove that they properly notified each eligible employee of their ability to participate in the company’s 401(K) plan.

In addition to fines for not properly notifying these new part-time employees of their ability to participate in the plan, the DOL could require the company to make a “QNEC” (Qualified Non-Elective Contribution) on behalf of those part-time employees which is a pure EMPLOYER contribution. Even though these part-time employees might not be eligible for other employer contributions in the plan, this QNEC funded by the employer is to make up for the missed employee deferral opportunity. The DOL is basically saying that since the company did not properly notify the employee of their ability to make contributions out of their paycheck, now the company has to fund those contributions on their behalf. They could assign the QNEC amount equal to the average percentage of compensation amount deferred by the rest of the employees covered by the plan which could be a very costly mistake for an employer.

Why The Rule Change?

There are two primary drivers that led to the adoption of this new 401(k) part-time employee coverage requirement. First, acknowledging a change in the U.S. labor force, where instead of employees working one full-time job, more employees are working multiple part-time jobs. By working multiple part-time jobs with different employers, while that employee may work more than 1000 hours a year, they may never become eligible to participate in any of their employer’s 401(K) plans because they were not considered full-time with any single employer.

This brings us to the second driver of this new rule, which is increasing access for more employees to an employer-based retirement-saving solution. Given the increase in life expectancy, there is a retirement savings shortfall issue within the U.S., and giving employees easier access to employer-based solutions may encourage more employees to save more for retirement.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

2023 RMDs Waived for Non-spouse Beneficiaries Subject To The 10-Year Rule

There has been a lot of confusion surrounding the required minimum distribution (RMD) rules for non-spouse, beneficiaries that inherited IRAs and 401(k) accounts subject to the new 10 Year Rule. This has left many non-spouse beneficiaries questioning whether or not they are required to take an RMD from their inherited retirement account prior to December 31, 2023. Here is the timeline of events leading up to that answer

There has been a lot of confusion surrounding the required minimum distribution (RMD) rules for non-spouse beneficiaries who inherited IRAs and 401(k) accounts subject to the new 10-Year Rule. This has left many non-spouse beneficiaries questioning whether or not they are required to take an RMD from their inherited retirement account prior to December 31, 2023. Here is the timeline of events leading up to that answer:

December 2019: Secure Act 1.0

In December 2019, Congress passed the Secure Act 1.0 into law, which contained a major shift in the distribution options for non-spouse beneficiaries of retirement accounts. Prior to the passing of Secure Act 1.0, non-spouse beneficiaries were allowed to move these inherited retirement accounts into an inherited IRA in their name, and then take small, annual distributions over their lifetime. This was referred to as the “stretch option” since beneficiaries could keep the retirement account intact and stretch those small required minimum distributions over their lifetime.

Secure Act 1.0 eliminated the stretch option for non-spouse beneficiaries who inherited retirement accounts for anyone who passed away after December 31, 2019. The stretch option was replaced with a much less favorable 10-year distribution rule. This new 10-year rule required non-spouse beneficiaries to fully deplete the inherited retirement account 10 years following the original account owner’s death. However, it was originally interpreted as an extension of the existing 5-year rule, which would not require the non-spouse beneficiary to take annual RMD, but rather, the account balance just had to be fully distributed by the end of that 10-year period.

2022: The IRS Adds RMDs to the 10-Year Rule

In February 2022, the Treasury Department issued proposed regulations changing the interpretation of the 10-year rule. In the proposed regulations the IRS clarified that RMDs would be required for select non-spouse beneficiaries subject to the 10-year rule, depending on the decedent’s age when they passed away. Making some non-spouse beneficiaries subject to the 10-year rule with no RMDs and others subject to the 10-year rule with annual RMDs.

Why the change? The IRS has a rule within the current tax law that states that once required minimum distributions have begun for an owner of a retirement account the account must be depleted, at least as rapidly as a decedent would have, if they were still alive. The 10-year rule with no RMD requirement would then violate that current tax law because an account owner could be 80 years old, subject to annual RMDs, then they pass away, their non-spouse beneficiary inherits the account, and the beneficiary could voluntarily decide not to take any RMDs, and fully deplete the account in year 10 in accordance with the new 10-year rule. So, technically, stopping the RMDs would be a violation of the current tax law despite the account having to be fully depleted within 10 years.

In the proposed guidance, the IRS clarified, that if the account owner had already reached their “Required Beginning Date” (RBD) for required minimum distributions (RMD) while they were still alive, if a non-spouse beneficiary, inherits that retirement account, they would be subject to both the 10-year rule and the annual RMD requirement.

However, if the original owner of the IRA or 401k passes away prior to their Required Beginning Date for RMDs since the RMDs never began if a non-spouse beneficiary inherits the account, they would still be required to deplete the account within 10 years but would not be required to take annual RMDs from the account.

Let’s look at some examples. Jim is age 80 and has $400,000 in a traditional IRA, and his son Jason is the 100% primary beneficiary of the account. Jim passed away in May 2023. Since Jason is a non-spouse beneficiary, he would be subject to the 10-year rule, meaning he would have to fully deplete the account by year 10 following the year of Jim’s death. Since Jim was age 80, he would have already reached his RMD start date, requiring him to take an RMD each year while he was still alive, this in turn would then require Jason to continue those annual RMDs during that 10-year period. Jason’s first RMD from the inherited IRA account would need to be taken in 2024 which is the year following Jim’s death.

Now, let’s keep everything the same except for Jim’s age when he passes away. In this example, Jim passes away at age 63, which is prior to his RMD required beginning date. Now Jason inherits the IRA, he is still subject to the 10-year rule, but he is no longer required to take RMDs during that 10-year period since Jim had not reached his RMD required beginning date at the time that he passed.

As you can see in these examples, the determination as to whether or not a non-spouse beneficiary is subject to the mandatory RMD requirement during the 10-year period is the age of the decedent when they pass away.

No Final IRS Regs Until 2024

The scenario that I just described is in the proposed regulations from the IRS but “proposed regulations” do not become law until the IRS issues final regulations. This is why we advised our clients to wait for the IRS to issue final regulations before applying this new RMD requirement to inherited retirement accounts subject to the 10-year rule.

The IRS initially said they anticipated issuing final regulations in the first half of 2023. Not only did that not happen, but they officially came out on July 14, 2023, and stated that they would not issue final regulations until at least 2024, which means non-spouse beneficiaries of retirement accounts subject to the 10-year rule will not face a penalty for not taking an RMD for 2023, regardless of when the decedent passed away.

Heading into 2024 we will once again have to wait and see if the IRS comes forward with the final regulations to implement the new RMDs rules outlined in their proposed regs.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Requesting FICA Tax Refunds For W2 Employees With Multiple Employers

If you are a W2 employee who makes over $160,200 per year and you have multiple employers or you switched jobs during the year, or you have both a W2 job and a self-employment gig, your employer(s) may be withholding too much FICA tax from your wages and you may be due a refund of those FICA tax overpayments. Requesting a FICA tax refund requires action on your part and an understanding of how the FICA tax is calculated.

If you are a W2 employee who makes over $160,200 per year and you have multiple employers or you switched jobs during the year, or you have both a W2 job and a self-employment gig, your employer(s) may be withholding too much FICA tax from your wages and you may be due a refund of those FICA tax overpayments. Requesting a FICA tax refund requires action on your part and an understanding of how the FICA tax is calculated.

How is FICA Tax Calculated

If you are a W2 employee, you will see a FICA deduction on your paychecks, which stands for Federal Insurance Contributions Act. The FICA tax is the funding vehicle for the Medicare and Social Security programs in the U.S. The 7.65% FICA tax consists of 6.2% for Social Security and 1.45% for Medicare, but the 6.2% allocated to Social Security has a cap, which means the government only assesses the 6.2% tax up to a specified wage limit each year. That wage limit is called the “taxable wage base,” and for 2023, the taxable wage base is $160,200. Any income up to the $160,200 taxable wage base is assessed the full 7.65% FICA tax, and any amounts over the taxable wage base are just assessed the 1.45% for Medicare since the Medicare tax does not have a cap.

Note: The IRS taxable wage base usually increases each year.

Employees with Multiple Employers During The Same Tax Year

For employees who work for more than one company during the year and whose total wages are over the $160,200 taxable wage base, this can cause an over-withholding of FICA tax from their wages.

Example: Sue is a doctor employed by XYZ Hospital and earns $150,000 between January and August, then Sue accepts a new position with ABC Hospital and earns $100,000 between September and December. Both XYZ Hospital and ABC Hospital will withhold the full 7.65% in FICA tax from Sue’s paycheck because she was below the taxable wage base of $160,200 with each employer. But Sue is only required to pay the 6.2% Social Security portion of the FICA tax up to $160,200 in wages, so she has too much paid into FICA for the year.

XYZ Hospital SS 6.2% x $150,000 = $9,300

ABC Hospital SS 6.2% x $100,000 = $6,200

Total SS FICA Actually Withheld: $15,500

Annual Limit: SS 6.2% x Taxable Wage Base $160,200 = $9,932

Sue’s FICA tax was over-withheld by $5,568 for the year. So, how does she get that money back from the IRS?

Requesting a FICA Tax Refund (Multiple Employers)

A refund of the excess FICA tax does not automatically occur. In the example above, if Sue identifies the FICA over withholding prior to filing her taxes for the year, she can recapture the excess withholding when she prepares her tax return (1040) for that tax year. The excess FICA withholding is applied as if it were excess federal income tax withholding.

If Sue does not identify the FICA excess withholding until after she has filed her taxes for the year, she could file IRS Form 843 to recover the excess FICA withholding. Thankfully, it’s a very easy tax form to complete. Timing-wise, it may take the IRS 3 to 4 months to review and process your FICA tax refund.

Requesting A FICA Tax Refund (Single Employer)

The FICA tax refund process is slightly different for individuals who have only one employer. Payroll mistakes will sometimes happen, causing an employer to over-withhold FICA taxes from an employee’s wages. In these cases, the IRS requires you first to try to resolve the FICA excess withholding with your employer before submitting Form 843. If resolving the FICA excess withholding is unsuccessful with your employer, you can file Form 843.

Self-Employed FICA Tax Refund

For individuals who have both a W2 job and are also self-employed they can also experience these FICA overpayment situations. Self-employed individuals pay both the employee portion of the FICA 7.65% and the employer portion of FICA 7.65%, for a total of 15.3% on their self-employment income up to the taxable wage base.

For self-employed individuals who are either sole proprietors or partners in a partnership or LLC, they typically do not have wages, so there is no direct FICA withholding as there is with W2 employees. Self-employed individuals make estimated tax payments four times a year to cover both their estimated FICA and income tax liability. If these individuals end up in a FICA overpayment situation due to W2 wages outside of their self-employment income, the overpayment can be applied toward their tax liability for the year or result in a refund from their self-employment income. They typically do not need to file IRS Form 843.

Note: S-Corp owners do have W2 wages

Requesting A Reduction In FICA Withholding

For employees that are in this two-employer situation, and they know they are going to have W2 wages over the taxable wage base, in a perfect world, they would be allowed to submit a request to one of their employers to either reduce or eliminate the social security portion of their FICA withholding to avoid the over withholding during the tax year. However, this is not allowed. Each employer is responsible for withholding the full 7.65% in FICA tax from the employee’s pay up to the taxable wage base, and this approach makes sense because each individual employer has no way of knowing what you earned in W2 wages at your other employers during the year.

3-Year Status of Limitations

If you are reading this article now, but you realize you have had excess FICA withholding for the past few years without requesting a refund, the IRS allows you to go back 3 years to request a refund of those excess FICA withholdings. Anything over 3 years back and you are out of luck, the U.S. government thanks you for your additional donations to Social Security and Medicare trusts.

The Employer Does Not Get A Refund

FICA tax is paid by both the employee and the employer:

Employee Social Security: 6.2%

Employer Social Security: 6.2%

Employee Medicare: 1.45%

Employer Medicare: 1.45%

Total FICA EE & ER: 15.3%

So if the employee works for 2 different companies, they have combined wages over the $160,200 taxable wage base, making them eligible for a FICA refund for the 6.2% of social security tax on wages paid over the wage base, does the EMPLOYER also get a refund for those excess FICA withholdings?

The answer, unfortunately, is “No”.

If an employee works for 10 different companies and makes $100,000 in W2 wages with each company, each of those 10 employers would withhold the full FICA tax from that employee’s $100,000 in W2 wages, but since the employee had $1,000,000 in combined wages, they would be due a $52,067 refund in FICA wages ($1M - $160,200 x 6.2%). However, the government keeps that full 6.2% that was paid in by each of the 10 employers with no refund due to any of the companies.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Fewer 401(k) Plans Will Require A 5500 Audit Starting in 2023

401(K) plans with over 100 eligible plan participants are considered “large plans” in the eyes of DOL and require an audit to be completed each year with the filing of their 5500. These audits can be costly, often ranging from $8,000 - $30,000 per year.

Starting in 2023, there is very good news for an estimated 20,000 401(k) plans that were previously subject to the 5500 audit requirement. Due to a recent change in the way that the DOL counts the number of plan participants for purposes of assessing a large plan filer status, many plans that were previously subject to a 401(k) audit, will no longer require a 5500 audit for plan year 2023 and beyond.

401(K) plans with over 100 eligible plan participants are considered “large plans” in the eyes of DOL and require an audit to be completed each year with the filing of their 5500. These audits can be costly, often ranging from $8,000 - $30,000 per year.

Starting in 2023, there is very good news for an estimated 20,000 401(k) plans that were previously subject to the 5500 audit requirement. Due to a recent change in the way that the DOL counts the number of plan participants for purposes of assessing a large plan filer status, many plans that were previously subject to a 401(k) audit, will no longer require a 5500 audit for plan year 2023 and beyond.

401(K) 5500 Audit Requirement

A little background first on the audit rule: if a company sponsors a 401K plan and they have 100 or more participants at the beginning of the year, that plan is now considered a “large plan”, and the plan is required to submit an audit report with their annual 5500 filings.

For plans that are just above the 100 plan participant threshold, the DOL provides some relief in the “80 – 120 rule”, which basically states that if the plan was a “small plan” filer in the previous year, the plan can remain a small plan filer until the plan participant count reaches 121.

Old Plan Participant Count Method

Not all employees count toward the 100 or 121 audit threshold. Under the old rules, the company only had to count employees who were:

Eligible to participate in the plan; and

Terminated employees with a balance still in the plan

But under the older rules, ALL plan-eligible employees had to be counted whether or not they had a balance in the plan. For example, if a landscaping company had:

150 employees

95 employees are eligible to participate in the plan

Of the 95 eligible employees, 27 employees have balances in the 401(K) plan

35 terminated employees with a balance still in the plan

Under the 2022 audit rules, this plan would be subject to the 5500 audit requirement because they had 95 eligible plan participants PLUS 35 terminated employees with balances, bringing the plan participant audit count to 130, making them a “large plan” filer. A local accounting firm might charge $10,000 for the plan audit each year.

New Plan Participant Count Method

Starting in 2023, the way that the DOL counts plan participants to determine “large plan” filer status changed. Now, instead of counting all eligible plan participants whether or not they have a balance in the plan, starting in 2023, the DOL will only count:

Eligible employees that HAVE A BALANCE in the plan

Terminated employees with balances still in the plan

Looking at the same landscaping company in the previous example:

150 employees

95 employees are eligible to participate in the plan

Of the 95 eligible employees, 27 employees have balances in the 401(K) plan

35 terminated employees still have balances in the plan

Under the new DOL rules, this 401(K) plan would no longer require a 5500 audit because they only have to count the 27 eligible employees WITH BALANCES in the plan and the 35 terminated employees with balances, bringing the total employee audit count to 62. The plan would be allowed to file as a “small plan” starting in 2023 and would no longer have to incur the $10,000 cost for the 5500 audit each year.

20,000 Fewer 401(k) Plans Requiring An Audit

The DOL expects this change to eliminate the 5500 audit required for approximately 20,000 401(k) plans. The primary purpose of this change is to encourage more companies that do not already offer a 401(k) plan to their employees to adopt one and to lower the annual cost for many companies that would otherwise be subject to a 5500 audit requirement.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

So Where Is The Recession?

Toward the end of 2022 and for the first half of this year, many economics and market analysts were warning investors of a recession starting within the first 6 months of 2023. Despite those widespread warnings, the S&P 500 Index is up 16% YTD as of July 3, 2023, notching one of the strongest 6-month starts to a year in history. So why have so many people been wrong about their prediction and off by so much?

Toward the end of 2022 and for the first half of this year, many economists and market analysts were warning investors of a recession starting within the first 6 months of 2023. Despite those widespread warnings, the S&P 500 Index is up 16% YTD as of July 3, 2023, notching one of the strongest 6-month starts to a year in history. So why have so many people been wrong about their prediction and off by so much?

The primary reason is that the U.S. economy and the U.S. stock market are telling us two different stories. The U.S. stock market seems to be telling the story that the worst is behind us, inflation is coming down, and we are at the beginning of a renewed economic growth cycle fueled by the new A.I. technology. But the U.S. economy is telling a very different story. The economic data suggests that the economy is slowing down quickly, higher interest rates are taking their toll on bank lending, the consumer, commercial real estate, and many of the economic indicators that have successfully forecasted a recession in the past are not only flashing red but have become progressively more negative over the past 6 months despite the rally in the stock market.

So are the economists that predicted a recession this year wrong or just early? In this article, we will review both sides of the argument to determine where the stock market may be heading in the second half of 2023.

The Bull Case

Let’s start off by looking at the bull case making the argument that the worst is behind us and the stock market will continue to rally from here.

Strong Labor Markets

The bulls will point to the strength of the U.S. labor market. Due to the shortage of workers in the labor market, companies are still desperate to find employees to hire, and even companies that have experienced a slowdown within the last 6 months are reluctant to layoff employees for fear that they will not be able to hire them back if either a recession is avoided or if it’s just a mild recession.

I agree that the labor market environment is different than previous market cycles, as a business owner myself, I cannot remember the last time it was this difficult to find qualified employees to hire. From the research that we have completed, the main catalyst of this issue stems from a demographic issue within the U.S. labor force. It’s the simple fact that there are a lot more people in the U.S. ages 50 to 70 than there are people ages 20 – 40. You have people retiring in droves, dropping out of the workforce, and there are just not enough people to replace them.

The bulls are making the case that because of this labor shortage, the unemployment rate will remain low, the consumer will retain their spending power, and a recession will be avoided.

Inflation is Dropping Fast

The main risk to the economy over the past 18 months has been the rapid rise in inflation. The bulls will highlight that not only has the inflation dropped but it has dropped quickly. Inflation peaked in June 2022 at around 9% and as of May 2023, the inflation rate has dropped all of the way down to 4% with the Fed’s target at 2% - 3%. The inflation battle is close to being won. As a result of the rapid drop in inflation, the Fed made the decision to pause as opposed to raising the Fed Fund Rate at their last meeting, which is also welcomed news for bullish investors since avoiding additional interest rate hikes and shifting the discussion to Fed Fund rate cuts could eliminate some of the risks of a Fed-induced recession.

The Market Has Already Priced In The Recession

Some bulls will argue that the stock market has already priced in a mild recession which is the reason why the S&P 500 Index was down 19% in 2022, so even if we end up in a recession, the October 2022 market lows will not be retested. Also, since the market was down in 2022, historically it’s a rare occurrence that the market is down two years in a row.

The Bear Case

Now let’s shift gears over to the bear case that would argue that while a recession has not surfaced yet, there are numerous economic indicators that would suggest that there is a very high probability that the U.S. economy will enter a recession within the next 12 months. Full disclosure, we are in this camp and we have been in this camp since December 2021. Admittedly, I am surprised at the “magnitude” of the rally this year but not necessarily surprised at the rally itself.

Bear Market Rallies Are Common

Rarely does the stock market fire a warning shot and then proceed to enter a recession. Historically, it is more common that the stock market experiences what we call a “false rally”, right before the stock market wakes up to the fact that the economy is headed for a recession, followed by a steep selloff but there is always a bull market case that exists that investors want to believe.

The last real recession that we had was the 2008 housing crisis and while investors remember how painful that recession was for their investment accounts, they typically don’t remember what was happening prior to the recession beginning. Leading into the 2008/2009 recession, the S&P 500 Index had rallied 12%, the housing market issues were beginning to surface, but there was still a strong case for a soft landing as the Fed paused interest rate hikes, and began decreasing the Fed Funds Rate at the beginning of 2008, but as we know today the Great Recession occurred anyways.

The Fed Has Never Delivered A Soft Landing

While there is talk of a soft landing with no recession, if you look back in history, anytime the Fed has had to reduce the inflation rate by more than 2%, the Fed rate hike cycle has been followed by a recession every single time. As I mentioned above, the inflation rate peaked at 9% and their target is 2% - 3% so they have to bring down the inflation rate by much more than 2%. If they pull off a soft landing with no recession, it would be the first time that has ever happened.

The Market Bottom

For the bulls that argue that the market is expecting a mild recession and has already priced that in, that would also be the first time that has ever happened. If you look back at the past 9 recessions, how many times in the past 9 recessions did the market bottom PRIOR to the recession beginning? Answer: Zero. In each of the past 9 recessions, the market bottomed at some point during the recession but not before it.

Also, the historical P/E ratio of the S&P 500 Index is a 17. P/E ratios are a wildly used metric to determine whether an investment or index is undervalued, fairly valued, or overvalued. As I write this article on July 3, 2023, the forward P/E of the S&P 500 Index is 22 so the stock market is already arguably overvalued or as others might describe it as “priced to perfection”. So not only is the stock market priced for no recession, it’s priced for significant earnings growth from the companies that are represented within the S&P 500 Index.

A Rally Fueled by 6 Tech Companies

The S&P 500 Index, the stock market, is comprised of 500 of the largest publicly traded companies in the U.S. The S&P Index is a “cap-weighted index” which means the larger the company, the larger the impact on the direction of the index. Why does this matter? In 2023, many of the big tech companies in the U.S. have rallied substantially on the back of the artificial intelligence boom.

As of June 2, 2023, the S&P 500 Index was up 11.4% YTD, and at that time Nvidia one of the top ten largest companies in the S&P 500 was up 171%, Amazon up 49%, Google up 41%. If instead you ignored the size of the companies in the S&P 500 Index and gave equal weight to each of the 500 companies that make up the stock index, the S&P 500 Index would have only been up 1.2% YTD as of June 2, 2023. So this has not been what we consider a broad rally where most of the companies are moving higher. (Data Source for this section: Reuters)

Why is this important? In a truly sustainable growth environment, we tend to see a broad market rally where a large number of companies within the index see a meaningful amount of appreciation and just doesn’t seem to be the case with the stock market rally this year.

2 Predictors of Coming Recessions

There are two economic indicators that have historically been very good at predicting recessions; the yield curve and the Leading Economic Indicators Index. Both started the year flashing red warning signals and despite the stock market rally so far this year, both indicators have moved even more negative within the first 6 months of 2023.

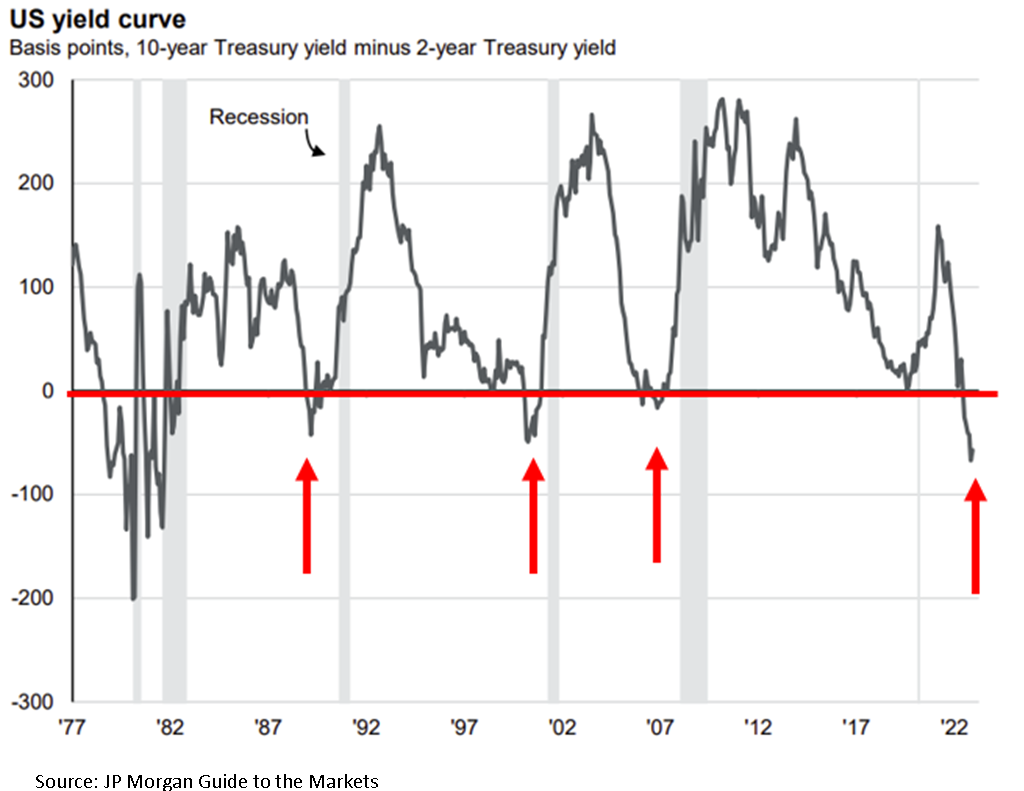

Inverted Yield Curve

The yield curve right now is inverted which historically is a very accurate predictor of a coming recession. Below is a chart of the yield curve going back to 1977, anytime the grey line moved below the red line in the chart, the yield curve is inverted. As you can see, each time the yield curve inverts it’s followed by a recession which are the grey shaded areas within the graph. On the far right side of the chart is where we are now, heavily inverted. If we don’t get a recession within the next 12 months, it would be the first time ever that the yield curve was this inverted and a recession did not occur.

The duration of the inversion is also something to take note of. As of July 2, 2023 the yield curve has been inverted for 159 trading days, since 1962 the longest streak that the yield curve was inverted was 209 trading days ending May 2008 (the beginning of the Great Recession). If the current yield curve stays inverted until mid-September, which is likely, it will break that record.

Leading Economic Indicators Index (LEI Index)

The Leading Economic Indicators index is the second very accurate predictor of a coming recession because as the name suggests the index is comprised of forward-looking economic data including but not limited to manufacturing hours works, building permits, yield curve, consumer confidence, and weekly unemployment claims. The yield curve is a warning from the bond market and the LEI index is a warning from the U.S. economy.

In the chart below, when the blue drops below the red line (where the red arrows are) the LEI index has turned negative, indicating that the forward-looking economic indicators in the U.S. economy are slowing down. The light grey areas are the recessions. As you can see in the chart, shortly after the LEI index goes negative, historically a recession appears shortly after. If you look at where are now on the righthand side of the chart, not only are we negative on the LEI, but we have never been this negative without already being in a recession. Again, if we don’t get a recession within the next 12 months, it would be the first time ever that this indicator did not accurately predict a recession at its current level.

“Well…..This Time It’s Different”

A common phrase that you will hear from the bulls right now is “well…..this time is different” followed by a list of all the reasons why the yield curve, LEI index, and other indicators that are flashing red are no longer a creditable predictor of a coming recession. After being in the investment industry for over 20 years and experiencing the tech bubble bust, housing crisis, Eurozone crisis, and Covid, from my experience, it’s rarely different which is why these predictors of recessions have been so accurate over time. Yes, the market environment is not exactly the same in each time period, sometimes there is a house crisis, other times an energy crisis, or maybe a pandemic, but the impact that monetary policy and fiscal policy have on the economy tend to remain constant over longer periods of time.

Market Timing

It’s very difficult to time the market. I would love to be able to know exactly when the market was peaking and bottoming in each market cycle but the stock market itself throws off so many false readings that become traps for investors. While we rely more heavily on the economic indicators because they have a better track record of predicting market outcomes over the long term, the timing is never spot on but what I have learned over time is that if you are able to sidestep the recessions, and avoid the big 25%+ downturns in an investment portfolio, it often leads to greater outperformance over the long term. Remember, mathematically, if your portfolio drops by 50%, you have to earn a 100% rate of return to get back to breakeven. But it takes discipline to watch these market rallies happen and not feel like you are missing out.

The Consumer’s Uphill Battle

Consumer spending is the number one driver of the U.S. economy and the consumer is going to face multiple headwinds in the second half of 2023. First, student loan payments are set to restart in October. Due to the Covid relief, many individuals with student loans have not been required to make a payment for the past three years and the $10,000 student loan debt cancellation that many people were banking on was recently struck down by the Supreme Court.

Second, while inflation has dropped, the interest rates on mortgages, car loans, and credit cards have not. The inflation rate dropped from 9% in June 2022 to 4% in May 2023 but the 30-year fixed mortgage rate peaked in November at around 7% and as of July 2023 still remains around 6.8%, virtually unchanged, so not a lot of relief for individuals that are trying to buy a house.

This is largely attributed to the third headwind for consumers which is that banks are tightening their lending practices. The banks see the same charts of the economy that we do and when the economy begins slowing down banks begin to tighten their lending standards making it more difficult for consumers and businesses to obtain loans. Even though the stock market has rallied in 2023, banks have continued to tighten their lending standards over the past 6 months and with more limited access to credit, that could put pressure on the economy in the second half of 2023.

Consumer spending has been stronger than expected in 2023 which has helped fuel the stock market rally this year but we can see in the data that a lot of this spending has been done using credit cards and default rates on credit cards and auto loans are rising quickly. So now many consumers have not only spent through their savings but by the end of the year they could have large credit card payments, car payments, higher mortgage/rent payments, and student loan payments.

Reasons for Recession Delay

With all of these clear headwinds for the market, why has the recession not begun yet as so many economists had forecasted at the beginning of 2023? In my opinion, the primary reason for the delay is that it typically takes 9 to 12 months for each Fed rate hike to impact the economy. When the Fed is raising rates, they are intentionally trying to slow down the economy to curb inflation. The Fed just paused for the first time in June 2023 but all of the rate hikes that were implemented in the first half of 2023 have yet to work their way into the economy. This is why you see yet another very consist historically pattern with the Fed Funds Rate. A pattern that I call the “Fed Table Top”. Here is a chart showing the last three Fed rate hike cycles going back to 2000:

You will see the same pattern over time, the Fed raises interest rates to fight inflation which are the moves higher in the chart, they pause at the top of their rate hike cycle which is the “Table Top”, and then a recession appears as a result of their tightening cycle, and they begin dropping interest rates. Once the Fed has reached its pause status or “table top”, some of those pauses last over a year, while other pauses only last a few months. The pause makes sense because again it takes time for all of those rate hikes to impact the economy so it’s never just a straight up and then a straight down in interest rates.

So then that raises the question, how long will this pause be? Honestly, I have no idea, and this is the tricky part again about timing but the pattern has repeated itself time and time again. However, as you can also see in the Fed chart above when you compare the current Fed rate hike cycle to those of the previous 3 cycles, the Fed just raised rates by more than the previous three cycles in a much shorter period of time, that would lead me to believe that this Fed Table Top could be shorter because the 9-month lag of the interest rate hikes on the economy will happen at a greater magnitude compared to the Fed rating rates at 0.25% - 0.50% per meeting as they did in the previous two Fed rate hike cycles.

Bulls or the Bears?

Only time will tell if the economic patterns of the past will remain true and a recession will emerge within the next 12 months or if this time it is truly different, and a recession will be avoided. For investors that have chosen the path of the bull, they will have to remain on their toes, because historically when the turn comes, it comes fast, and with very little warning.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Big FAFSA Calculation & Application Changes Starting in 2023

Parents that are used to completing the FAFSA application for their children are in for a few big surprises starting in 2023. Not only is the FAFSA application being completely revamped but the FAFSA calculation itself is being changed which could result in substantially lower financial aid awards for many college-bound students.

Parents that are used to completing the FAFSA application for their children are in for a few big surprises starting in 2023. Not only is the FAFSA application being completely revamped but the FAFSA calculation itself is being changed which could result in substantially lower financial aid awards for many college-bound students.

FAFSA Application Delayed Until December 1st

In 2023, the FAFSA application will not become available for completion until December 1st. Normally the FAFSA application becomes available for completion on October 1st of each year but due to the changes that are being made to the application, software updates, and staff training, they have delayed the release of the FAFSA application for the 2024 – 2025 school year to December 1, 2023. This will reduce the window to time that parents have to submit the FAFSA application in 2023 so advanced preparation is advised.

A Simplified FAFSA Application

Completing the FAFSA application can be a very frustrating process; tons of questions, unclear wording as to what information FAFSA is actually asking parents to report, and you have to spend a lot of time collecting all of your personal financial documents that are needed to enter the information on the FAFSA application.

Fortunately, in 2020, Congress passed the FAFSA Simplification Act which will greatly simplify the FAFSA application in 2023 and years going forward. The old FAFSA application contained 108 questions, the new FAFSA application is only expected to contain 36 questions. In addition to cutting the questions in half, the wording of many of the questions will be amended to make it easier to understand how to report your financial assets. Two very welcome changes to the application.

EFC (Expected Family Contribution) Calculation Removed

In the past, completing the FAFSA application has resulted in an Expected Family Contribution (EFC) amount which is meant to provide a ballpark amount that a family may have to pay out of pocket before need-based financial aid is awarded to a student. The term EFC can be misleading because it’s not necessarily the hard dollar amount that parents will be required to pay out of pocket but rather it’s the family’s financial need relative to other applicants.

To remove this confusion, EFC will now be replaced by SAI (Student Aid Index), so now after parents complete the FAFSA application, it will result in an SAI amount.