2022 Market Outlook

There are trends that are developing in the U.S. economy that we have not seen for decades. As inflation continues to rise at a rapid pace, we have to look back to the 1970’s as a reference point to determine how inflation could impact stocks, bonds, gold, and cash going into 2022. The most common questions that we have received from clients over the past few weeks are:

There are trends that are developing in the U.S. economy that we have not seen for decades. As inflation continues to rise at a rapid pace, we have to look back to the 1970’s as a reference point to determine how inflation could impact stocks, bonds, gold, and cash going into 2022. The most common questions that we have received from clients over the past few weeks are:

Will the stock market rally continue into 2022?

Will higher inflation derail the economy?

How will the market react to the Fed increasing interest rates in 2022?

A lesson from “The Nifty Fifty”

How will the labor shortage and supply chain issues impact the markets in 2022?

I plan to address all of these questions and more as we present our market outlook for 2022.

The Economy Will Continue to Strengthen

It’s our expectation that we will see the U.S. economy gain strength in the first half of 2022. Our economy is based primary on consumer spending and the consumer is charged with cash and ready to spend. The cash has come from record levels of government stimulus in 2020 and 2021, as well as rising wages across many sectors in the U.S. economy. Debt levels are also at historic lows as well. Due to the supply chain constraints, people could not spend the money, therefore they paid down their debt. Per the chart below, debt payments as a percent of U.S. households’ disposable income is at the lowest level in over 40 years.

Talk to any pool company and they will provide you with a clear picture of the pent- up demand. Some pool installers are fully booked through 2022 and are taking deposits for pools for 2023.

Back Orders At Record Levels

Many of the companies that we have spoken with across various industries have back orders at record levels. With back orders, the customer is already committed to buying a product from a company whether it’s a car, roof, gym equipment, etc., but they have yet to take delivery of that product. When the product is delivered, they normally submit full payment, and the company realizes the revenue. From an outlook standpoint, when companies have large back orders, it takes some of the risk off the table because it is not an “if the sales are going to be there to generate revenue” but rather “how quickly can the company deliver the product to their customers”.

Supply Chain Constraints

The answer to the question “how quickly can they deliver?” relies heavily on how fast the global supply chain can get back online going into 2022. People have been slower to return to the workforce than originally expected, which means less people at the ports to unload container ships, less truck drivers to transport the goods from the ports to the stores, and less employees in stores to stock shelves. However, we see a number of new trends that should ease these constraints in 2022:

Individuals needing to return to the workforce after depleting stimulus cash reserves

Employer offering higher wages and sign on bonuses to attract employees

A higher level of vaccination rates in children, easing childcare constraints, and allowing more parents to return to the workforce

I think the economy has largely underestimated the impact of the childcare constraints on the ability for parents to return to the workforce. If your child has a cough, even though a test may reveal that they don't have COVID, they may not be able to return to school for a few days, requiring a parent to take time off from work.

Relief At The Ports

The two main ports in the U.S are the “twin ports” in Los Angeles and Long Beach; 40% of sea freight enters the U.S. through those two ports. Both have been working around the clock to unload ships and they are making significant progress. Mario Cordero, executive director of the Port of Long Beach, stated that in mid- November there were 111 ships off the coast of California waiting to be unloaded and within two weeks that number was reduced to 61 ships. However, it takes time for the goods to get off the ship, loaded onto a truck, and delivered to stores and businesses, but the trend is going in the right direction.

Record Levels of Cash Injection

Over the past 18 months, the U.S. Government has injected more cash into our economy than any other time in history. To put this in perspective, let's compare the dollar amount of the bailout packages during the Great Recession of 2008 / 2009, to the level of cash injection over the past 18 months. In the illustration below on the left side you will see the TARP Program which was the government bailout for the banks and the housing market in 2008 / 2009. On the right, you will see all of the stimulus program that the government rolled out in 2020 / 2021 to battle COVID.

The total cost of TARP was $700 Billion.

Over the past 18 months the government has injected almost $7 Trillion…………TRILLION……into the U.S. economy. That is 10 times the TARP program that was used to rescue the US economy in 2008/2009 when we almost lost the entire U.S. banking system.

To go one more step, below is a chart of the year over year change in the M2 money supply. This allows us to see how much cash is circulating within the U.S. economy compared to the prior year going all the way back to 1980.

Look at that mountain on the righthand side of the chart. We have had recession in the past which has required the government to inject liquidity, which are illustrated by the grey areas in the chart, but nothing to the magnitude of what we have seen over the past 18 months. Just a side note, this chart does not include the recent $1.2 Trillion dollar infrastructure bill that was already passed or the $1.75 Trillion Build Back Better bill that is deck.

A lot of this cash that has been injected into the economy has not been spent yet because due to the supply chain constraints, consumers and business have not been able to spend it. As the supply chain gets back online in 2022 and 2023, consumers and businesses will be able to put this cash to work which should be a boost to the U.S. economy.

Inflation, Inflation, Inflation

The great risk to the economy as we enter 2022 is undoubtedly rising inflation. We have all seen prices rise rapidly for just about everything we buy: groceries, gas, travel, etc. The supply chain issues have made this problem worse because the less goods there are, the more expensive they become. This leads us to the main question which is:

“Will inflation subside once the supply chain gets back online or are these higher levels of inflation that we are seeing now just the beginning?”

This is the question that everyone wants the answer to but it’s too early to tell. The only thing that's going to provide us with the answer is time, so we are going to be watching these trends unfold week by week, month by month, as the data comes in during 2022. In my opinion, there is an equal chance of both scenarios playing out. Scenario one, the supply chain improves throughout 2022, increasing the supply of goods and services, which in turn stabilizes prices, and the risk of hyperinflation begins to fade. Scenario two, either the supply chain does not heal fast enough, or wage growth continues to escalate, causing inflation rates to continue to rise, forcing the Fed’s hand to raise rates more quickly.

You have to remember that inflation only begins to do damage when prices rise to levels that consumers and businesses can no longer afford. Given the historic levels of cash that have been injected into the economy, it’s our expectation that even with prices rising over the next 6 months, that may not curb the consumers ability or desire to purchase those same goods and services at higher prices.

The Fed

The Fed has two main objectives:

Keep the economy at full employment

Keep inflation within its target range of 2% - 3%

As you can see in the chart below, the CPI (Consumer Price Index) which is the Fed’s main measuring stick for inflation has risen well above the Fed’s 3% comfort zone and continues to rise.

In November, it was reported that the year over year change in CPI (inflation) was 6.9%. That’s a big number. In response to these heightened levels of inflation, the Fed has increased its timeline for decreasing the amount of bonds that it is purchasing as well as escalating the timeline for their first interest rate hike. With these changes, the Fed is intentionally tapping the brakes, so the economy does not overheat and give rise to hyperinflation like we saw in the 1970’s. But it's important to understand that every time the Fed raises interest rates, it is working against economic growth because it makes lending more expensive. Less lending normally means less spending.

This change in the Fed stance is not necessarily an end all for the stock market rally. Investors have to remember the Fed is raising rates because the economy is strong which has caused prices to rise. Historically, as long as the Fed is able to raise rates at a measured pace, the economy and the market have time to digest those small increases, and the growth trend can continue. It is when the Fed has to raise rates in large increments in a relatively short period of time, it creates more of an abrupt end to an economic expansion. Think of it this way, if the interest rate on a 30-year mortgage go from 3.25% to 3.50% it’s not going to necessary derail the housing market. But if that 30-year mortgage rate goes from 3.25% to 5% in short period of time, that could cause a huge drop in housing prices because people will no longer be able to afford the mortgage payments to purchase a house at these elevate prices.

The Nifty Fifty

Looking at that inflation chart that I showed you earlier, it’s been 30 years since the Core CPI index has been over 3%. People that just started investing within the last 30 years have not seen the impact of inflation on stock, bonds, cash, and other asset classes. The last time the U.S. economy experienced higher inflation for a prolonged period of time was the 1970’s. There are a lot of important investment lessons that we learned in the 1970’s but one of them that bears mentioning is the lesson of the “Nifty Fifty”.

The Nifty Fifty was the name given to a group of stocks in the 1970’s that were the darlings of the stock market. Companies like McDonalds, Polaroid, Disney, IBM, Johnson & Johnson were names within the Nifty Fifty. This group of stocks are similar to the FANGs that we have today which include Facebook, Amazon, Netflix, and Google.

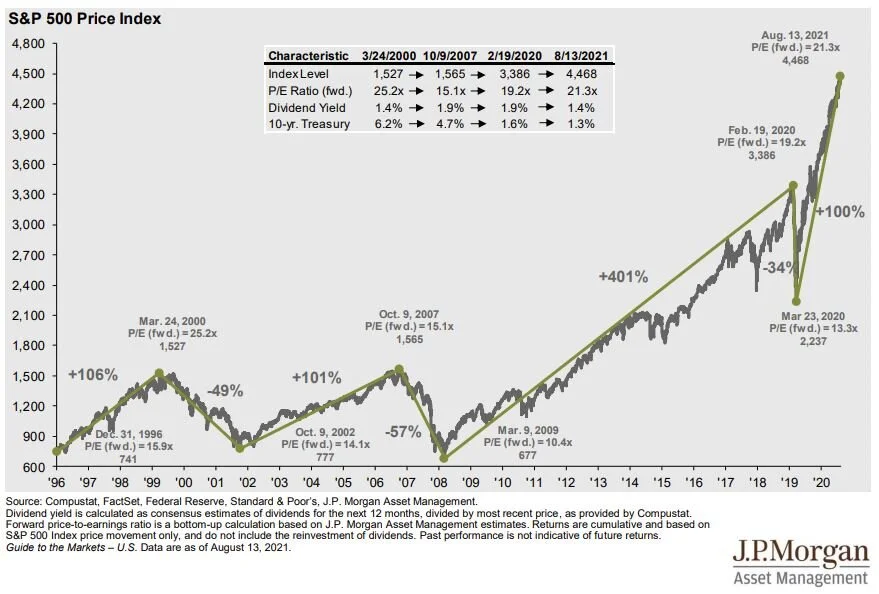

Why the comparison? Coming out of the 1960’s there was prolonged bull market rally, similar to the one we have today, these Nifty Fifty stocks were the growth engines of the market, and as such they traded at very high valuations (P/E ratios) compared to their peers in the stock market. Many of the Nifty Fifty stocks had P/E ratios above 50 times forward earnings. To put that in perspective, right now the S&P 500 Index has a P/E of about 21x forward earnings. When higher inflation shows up, it traditionally has a larger negative impact on stocks that are trading at higher multiples compared to stock that have lower P/E ratios. This is because higher interest rates erode the present value of those future earnings that are baked into the price of those stocks. When higher inflation showed up in the 1970’s, many of stocks in the Nifty Fifty dropped by over 60%. Investors need to remember, when the economy is good and inflation is low, the market tends to care less about valuations. When inflation increase and/or the economy slows down, all of a sudden valuations will begin to matter again to investors.

I’m making this point as a word of caution; the Nifty Fifty and the FANG have a lot of similarities. Even though, at this point, I do not expect a hyper inflationary environment like the 70’s, a rise in inflation may have a similar impact on stocks trading at a higher valuation. Netflix current trades a PE of 55, Amazon (P/E 66), Microsoft (P/E 38). The market looked at the Nifty Fifty similar to how I hear investors talk about the FANG stocks now, “how can they ever go down?” Also from a psychological standpoint, investors often find it difficult to sell holdings that have made them a lot of money, and these FANG stocks have increase in value a lot over the past 10 years. There is also the tax hit that investors incur in taxable accounts when unrealize gains turn into realized gains.

To be clear, this is not a recommendation for investors to go sell of their FANG stocks, it’s about understanding the trends that have played out in history, how those trends may compare to where we are now when assessing risk, opportunity, and the investment decisions that we may face in 2022.

2022 Outlook Summary

Brining all of these variables together, we expect the first half the year to bring with it strong economic growth which should be a favorable environment for risk assets. But…….we don’t anticipate that it will be a smooth ride in 2022 for equity investors. As the Fed implements its anticipated interest rate hikes, there could be a number of selloffs throughout the year that will test the patience of investors. If inflation does not get out of control, those selloffs could be an opportunity for investors to put cash to work, as the market shakes off the scary headline risks and the growth trend continues. We expect the labor shortage and supply chain issues to improve in 2022, which should help to ease some of the inflation fears as prices begin to stabilize in 2022 and potentially drop going into 2023.

The second half of the year will depend largely on the trend of inflation. If inflation runs hotter than expected, it could begin to have an impact on consumer spending as prices rise above what consumers are willing to pay, and it could force the Fed to increase the magnitude or frequency of rate hikes in 2022. Either of those two items could potentially erase or decrease the gains the U.S. stock market may have achieved in the first half of the year.

With higher levels of volatility almost a given for 2022, investor may have to resist the urge to sell out of their stock positions and retreat to bonds or cash knowing that an inflationary environment is an enemy of both high-quality bonds and cash. Overall, investors will have to pay closer attention the economic and inflation data throughout the year to determine if pivots should be made in their investment strategy, especially as we enter the second half of the year.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Why Are Long-Term Care Insurance Premiums Skyrocketing?

Many individuals that have long-term care insurance policies are beginning to receive letters in the mail notifying them that that their insurance premiums are going up by 50%, 70%, or more in some cases. This is after many of the same policyholders have experienced similar size premium increases just a few years ago. In this article I’m going to explain……

Many individuals that have long-term care insurance policies are beginning to receive letters in the mail notifying them that that their insurance premiums are going up by 50%, 70%, or more in some cases. This is after many of the same policyholders have experienced similar size premium increases just a few years ago. In this article I’m going to explain:

Why this is happening

Are these premium increases going to continue?

Options for managing the cost of these policies

If you cancel the policy, alternative solutions for managing the financial risk of a LTC event

Premium Increases & Insolvency

Unfortunately, it’s not just the current premium increases that are presenting LTC policyholders with these difficult decisions. Within the letters, some of these insurance carriers are threatening that if they’re not able to raise premiums by 250% within the next 6 years, that the insurance company may not have enough assets to pay the promised benefit. What good is an insurance policy if there’s no insurance company to pay the benefit? I won’t mention any of the insurance companies by name but here is some of the word for word statements in those letters:

“This represents a 69% rate increase in the premiums for your policy.”

“A.M. Best has downgraded its rating of (NAME OF INSURANCE COMPANY) financial strength to C++ in September 2019, indicating A.M. Best’s view that (NAME OF INSURANE COMPANY) has marginal ability to meet its ongoing insurance obligations.”

“Please be aware that as of 06/06/21 over the next 3-6 years we are planning to seek additional rate increases of up to 250% for lifetime benefits”

This creates a very difficult decision for the policyholder to either:

Keep the policy and pay the higher premiums

Cancel the policy

Make adjustments to the current policy to make it more affordable in the short-term

These Policies Are Not Cheap

In most cases, these long-term care insurance premiums were not cheap to begin with. Prior to these premium increases, it was not uncommon for a robust policy in New York to cost between $2,500-$4,000 per year, per person. LTC policies tend to carry a higher cost because they have a higher probability of paying out when compared to other types of insurance policies. For example, with life insurance, they expect you to pay your premiums, you live a long happy life, and the insurance policy never pays out. Compare this to the risk of a long-term event, where in 2021 HealthView Services produced a study that stated:

“An Average healthy 65-year-old couple living to their projected actuarial longevity has a 75% chance that one partner will require a significant level of long term care. There is a 25% probability that both partners will need long-term care” (source: Think Advisor)

Couple that with the fact that long-term care expenses are very high and insurance companies have to charge more in premiums to balance the dollars in versus dollars out.

With these premium increases now in play, some retired couples are faced with a situation where they previously may have been paying $5,000 per year for both policies and they find out their premiums are going up by 70%, increasing that annual cost to $8,500 per year.

Affordability Issue

So what happens when a retired couple, on a fixed amount of income, gets one of these letters, and realizes they can’t afford the premium increase. They essentially have two options:

Cancel the policy

Make amendments to the policy (if the insurance company allows)

Let’s start off by looking at the amendment option. Many insurance companies, in exchange for a lower premium increase, may allow you to reduce the benefits offered by the policy to make it more affordable. You may have options like

Extending the elimination period

Reducing inflation riders

Reducing the daily benefit

Reducing the maximum lifetime benefit

Reducing home care options

These are just some of the adjustments that could be made, but remember, you are taking what you have now, and watering it down to make it more affordable. Caution, at some point you have to ask yourself:

“If I reduce the benefits of this policy, will it provide me enough coverage to meet my financial needs should I have a long-term event?”

If the answer is “No”, then you may have to look more closely at the option of canceling the policy. But what happens if you cancel the policy and you are now exposed to the financial risk of a long-term care event? Answer, you will have to identify another financial strategy to manage that risk. Two of the most common that we have implemented for clients are

Self-insuring

Setting up Medicaid trusts

Self-Insuring Alternative

The way this solution works is you are essentially setting money aside for yourself, acting as your own insurance company, should a long-term care event arise later in life, you will have money set aside to pay those expenses. If you were previously paying an insurance company $4,000 per year for your LTC policy, then cancel the policy, you would set up a separate investment account where you continue to deposit the amount of the premium payments that you were previously making each year so there will be a pool of assets to draw from should a long-term event arise.

But, you have to run projections to determine how much money is estimated to be in those accounts at future ages to make sure it is sufficient to cover enough of those costs that it won’t put you in a tough financial situation later on. There is an upside benefit to this strategy that if you never have a long-term care event, there are assets sitting there that your beneficiaries could inherit. If instead that money was going toward long-term care insurance premiums and there’s not a long-term care event, all that money has essentially been wasted. However, this strategy does take more planning because your self-insurance strategy may be not cover the same dollar for dollar amount that your LTC policy would have covered if a long-term care event arises.

Medicaid trust

Understanding how Medicaid trusts works is a whole article in itself and we have a video dedicated just to this topic. But the general idea behind the strategy is this, if you have a long-term event and you do not have a LTC insurance policy, you essentially have to spend through all of your countable assets to pay for your care. Note, the annual costs of assisted living or a nursing home is often $100,000+ per year. For those that do not have assets, Medicaid will often pay for the cost of assisted-living or nursing home care. By setting up a trust and placing your assets in a trust ahead of time, if those assets are owned by the trust for a specific number of years, if there is a long-term care event, you do not have to spend those assets down, and Medicaid picks up the tab for your care. Like I said, there’s a lot more detail regarding the strategy and if you’d like to know more watch this video:

Medicaid Trust Video: https://www.youtube.com/watch?v=iBVQtrGiUso

Future Premium Increases

You also have to include in your analysis the risk of future premium increases which seem likely. These letters from the insurance companies themselves state that they may have to increase premiums by a lot more just to stay in business. So it’s not just evaluating the current premium increase in these situations but also considering what decisions you could face within the next 5 – 10 years if the premiums double again. This variable can definitely influence the decisions that you are making now.

Why Are These Premium Increases Happening?

This is a 20 year problem in the making. For decades insurance companies have miscalculated how long people were going to live and the rising cost of long-term care. Since they weren’t charging enough at the onset of these policies, they have not collected enough in insurance premiums to cover the insurance claims that are now being filed by policyholders. Thus, the policyholders that currently have policies are now being required to pay more to make up for those underwriting mistakes.

The second issue is that there is less competition in the long term care insurance market. Insurance companies in general do not want to issue policies in a sector of the market where the probability of a payout is high and the dollar amount of the payout is also high; they want to operate in sectors of the market where the probability of a payout is low so they get to just keep your premium payments. Many insurance companies have completely exited the Long Term Care Insurance market. For example, in New York state, there are only two insurance companies remaining that are issuing traditional long-term care policies. Less competition, higher prices.

The third issue is due to the dramatic rise in the annual premium amounts, they have become less affordable for new policyholders. Many retirees can’t afford to pay $4,000+ per year for each spouse’s LTC policy so the issuance of new policies is dropping; that again, saddles the current policy holders with the premium increases.

A Difficult Decision

For all of these reasons, if you are currently a holder of a LTC insurance policy, instead of just blindly paying the higher premiums, it really makes sense to evaluate your options with the anticipation that the premiums may continue to increase in the future. For those that decide to amend their policy to reduce the cost, you really have to evaluate if the policy covers enough going forward to make it worth continuing on with the policy. I strongly recommend seeking professional help with this decision. Professionals in the industry can help you evaluate your options because these decisions can be irreversible and the right solution will vary individual by individual.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Much Does Your Car Insurance Increase When You Add A Teenager To Your Policy?

How much will the cost of your car insurance increase once you add a teenager to your policy. Here are a few strategies for reducing the cost……

You have probably heard the phrase “kids are expensive“. That phrase takes on a whole new meaning when you find out how much your car insurance is going to increase when you add your teenage child to your policy. In this article I’m going to share with you:

How much you can expect your car insurance premiums to increase when a teenager is added

What does the insurance company look at when determining the premium?

Are car insurance premiums higher for males or females?

Ways to reduce the cost

How much does the cost go up if they get into a car accident?

When your child turns 18, should you move them to their own policy?

Coverage mistakes

Ruger Personal Note: I have an 18 year old daughter that we added to our auto policy about a year ago. The two main things that I have learned so far are:

The cost increase was higher than I expected

New drivers hit stuff with their cars

By the time my oldest daughter was 18, she had already hit a deer, a post, and my car which was parked in our driveway. Yea, that last one was a rough day because I had to fix both cars. I’m writing this article because there are strategies that you can implement to reduce the cost of the insurance for your children and it’s also important to understand the liability that you take on by having a new driver on your policy.

How Much Does Your Car Insurance Increase?

The million dollar question: How much is your car insurance premium going to increase once you add your child to the policy?

Like so many other things in life, there is not a 100% straight answer because it depends on a number of variables such as:

Credit Score of the parents

Driving record of the parents

Will they have their own car or sharing a car with their parents?

What type of car will they be driving?

What state do you live in?

Coverage limits of the policy

The Insurance company issuing the policy

But let me give you a base case scenario to work with before we get into discussing all of the variables that factor into the premium calculation. In this example we have:

A 16 year old driver that is being added to their parent’s auto policy

Parents have a good credit score

Parents both have good driving records

Your child will have their own 2016 Honda Civic to drive

The annual INCREASE in your auto insurance premium may be between $1,000 - $1,500. This is more of a best case scenario. If the parents have poor credit scores or poor driving records, the premium could increase by $3,000+ per year in some cases. To get a better idea of where you might fall within this wide spectrum, let’s look at the variables that influence the cost of auto insurance when a new driver is added.

Credit Score of the Parent

I was surprised to learn that the credit score of the parents is one of the largest factors that many insurance companies use to determine the amount of the premium increase. They have apparently identified a trend that parents that are financially responsible tend to have children that are less likely to get in car accidents. Even though this will not be true for all families, insurance companies have accumulated a lot of data over a long period to reach these conclusions.

This brings us to our first strategy for reducing the cost of the car insurance for your children. If the parents are able to improve their credit score before adding the child to their auto policy, it could reduce the premium increase. There are many ways to do accomplish this but it is beyond the scope of this article. However, here is a good article from Nerd Wallet that can help.

The Parents Driving Record

This one is pretty self-explanatory. If the parents have a lot of marks on their driving records such as multiple accidents or speeding tickets, it could make the premium increase higher when you go to add your child to the policy. Again, the insurance company must have made a connection between the driving behavior of the parents and the driving behavior of their children.

Are car insurance premiums higher for males or females?

The answer to this one is “it depends on what insurance company you go with”. Some insurance companies do charge more depending on whether you are adding a son or a daughter to your policy, others do not. How do you know which insurance companies are gender bias? You can either ask the insurance company directly if it influences the premium or you engage the services of an independent insurance agency that knows the underwriting criteria of each insurance company.

Will The New Driver Have Their Own Car?

Another big factor in the insurance cost will be what vehicle your teenager will be driving. If you are adding a new driver to your policy and adding an additional car to your policy as well, the premium increase will obviously be larger than if you are just adding a new driver who will be driving the current cars listed on your policy. In the Honda Civic example above, adding the car and the new driver increased the annual premium by $1,000 - $1,500. If you are adding the new driver to your current policy but they will be co-driving a car with you, the premium may only increase a few hundred dollars but it depends on the value of the cars that you drive.

A Driver Assigned To Each Car

I asked about a work around here. Let’s say there are 2 parents and 1 child. If you add a third car to your policy for the new driver, most insurance carriers do not allow you to say that two of the cars belong to Parent A, the third car to Parent B, and the child shares each of the three cars. If there are 3 cars and 3 drivers covered by the policy, the insurance company typically wants to assign a “primary driver” to each vehicle listed on the policy.

NOTE: Be careful when you add new drivers to your policy. Make sure you provide them with clear direction as to who the primary driver is for each vehicle. If you buy your child a car and you drive a more expensive car than your child, you don’t want the insurance company assigning your child as the primary driver to your car which could result in a larger increase in the annual premium. It’s worth taking the time to review your auto policy after any changes have been made.

Not telling the insurance company about the new driver

Unfortunately, some families may decide not to tell their insurance company about the new driver in the family. Not a good idea. This opens you up to a whole host of liability issues. While car insurance does “follow the car”, meaning whoever is driving your car will most likely be covered in some fashion by your auto policy, however, if there is a claim and the insurance company finds out that you intentionally did not add the new driver to your policy, they may pay the claim, but they may also drop your coverage after that.

Ways To Reduce The Cost

There are a number of ways that you may be able to reduce the cost of the insurance for your teenager:

Defensive Driving Course

Good Student Discount

Student Away from Home Discount

Removing collision coverage on an older car

Notice I did not mention anything about Drivers Education. I was surprised to find out that in New York, more insurance carriers no longer offer a discount for the child completing a Drivers Ed course. Some carriers offer the “Good Student Discount” which provides a small discount for students that maintain over a certain GPA. The “Student Away From Home” discount is for children that go away to college, they are not allowed to bring their cars, but they will be driving when they come home for breaks. With this discount, the insurance company is recognizing that they will be driving less in that situation. Having your child complete a defensive driving course can decrease the premium and many of these courses are now available online.

Removing collision coverage on an older car can also reduce the cost of the coverage. If your child is driving a car that is worth $5,000 and you feel like you are in a position financially to replace that car if you needed to, then you may elect to waive collision coverage on the car which can lower the premium. For vehicles of higher value, this is a larger risk, and if there is a car loan against the car, most lenders will require you to maintain collision coverage until the loan is paid off.

Moving Your Child To Their Own Car Insurance Policy

One of the questions I asked the insurance agent was:

“When does it make sense for the child to obtain their own car insurance policy as opposed to being covered under their parent’s policy?”

The general rule of thumb is if your children are still living at home, in many cases it will make sense, from a cost standpoint, to keep them covered under your policy. If you want your child to be responsible for the car insurance payment, you can just charge them for their share of the coverage.

One of the largest discounts that most insurance carriers offer is a “multi vehicle discount” while could reduce the annual cost of the car insurance by around 25% for some carriers. So, let’s say that the Honda Civic for your child costs $1,000 per year under your policy, if your child goes and obtains their own insurance policy, they will lose the multi car discount that you are receiving under your policy, and it could increase their cost by 25%.

Also, remember that I mentioned before that the parents credit score can be a big factor in determining the amount of the auto premium for their child’s coverage. Most young adults have little to no credit history so if they go to obtain their own insurance policy, it could increase the cost. Previously, they may have been benefiting from their parent’s strong credit scores and driving history which leads me to my next planning tip. At some point, your child will leave home, and they will obtain their own car insurance policy. As a parent, you can help them but encourage them to begin establishing some credit history early on so when they go to obtain their first car insurance policy, they have a good credit score, and it could reduce that annual expense.

How Much Does The Cost Increase If They Get Into A Car Accident?

I’ll go back to my original point that “new drivers hit stuff”. There is a high likelihood that the new driver in your family is going to hit a mailbox, a garbage can backing out of the driveway, another car, or one of their friends could hit their car in a high school parking lot. When these life events happen, the question becomes, how much are your car insurance premiums going to increase? Does $1,000 go to $3,000 per year? The answer unfortunately is it depends on what happened. The size of the insurance claim can influence the amount of the premium increase.

With any damage to a vehicle, you have three options:

Don’t fix it

Pay to fix it out of pocket

Submit an insurance claim and fix it

The first question to answer in this analysis is “what is your deductible?” It’s common for car insurance policies to have deductibles which means when you submit a claim, you must pay a certain amount out of pocket before the insurance company picks up the rest; a $500 deductible is common. So, if your child hits something, does some minor damage, and the total cost to fix it is $600, if your deductible is already $500, submitting an insurance claim will only pay $100, and you run the risk of your annual insurance premiums increasing. It may be better to just pay the $600 out of pocket instead of submitting the insurance claim.

If there is more significant damage like $3,000+, it may make sense to just submit the claim, pay the deductible, and let the insurance company pay for the rest. My friend that is in the insurance industry will remind people, “This is why you have insurance….use it.”

It’s a more difficult decision when the dollar amount of the fix is somewhere in the middle of these examples. If the car has $1,000 of damage but you have a $500 deductible, what should you do? This is where having an independent insurance broker can help. You can call your broker, explain the situation, and they may be able to provide you with an estimate of how much your insurance premium will increase each year if you submit the claim, then you can make an informed decision based on that information.

Know Your Coverage

All car insurance policies are not the same!! While, of course, everyone wants their car insurance premium as low as possible, do not make the mistake of just blindly running to the lowest cost option. Lower cost can mean lower coverage. The day that your child gets into a car accident is going to be a very bad day. That day will get even worse if your child hits a $75,000 Tesla and you find out that your auto policy only covers $25,000 of property damage so you are on the hook for the other $50,000!!! Make sure you are not being sold a watered-down car insurance policy that will open you up to gaps in coverage. You may have saved $400 per year on the insurance premium but when an accident happens, you could be out of pocket $10,000+.

Two more points to make about knowing your coverage:

No one ever gets up in the morning and says “I’m going to get into a car accident today”

New drivers hit stuff

Thank You to HMS Agency

I want to send out a special thank you to Steve Mather, a partner at HMS Agency, for helping me collect the information that I needed to write this article. As a financial planner, I enjoy helping people to save money, but I know very little about the inner workings of car insurance which is why I rely on experts like Steve and his team.

This information is for educational purposes only. For information specific to your insurance needs, please contact a licensed insurance agent.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Should You Make Pre-tax or Roth 401(k) Contributions?

When you become eligible to participate in your employer’s 401(k), 403(b), or 457 plan, you will have to decide what type of contributions that you want to make to the plan.

When you become eligible to participate in your employer’s 401(k), 403(b), or 457 plan, you will have to decide what type of contributions that you want to make to the plan. Most employer sponsored retirement plans now offer employees the option to make either Pre-tax or Roth contributions. A number of factors come into play when deciding what source is the right one for you including:

Age

Income level

Marital status

Income need in retirement

Withdrawal plan in retirement

Abnormal income years

You have to consider all of these factors before making the decision to contribute either pre-tax or Roth to your retirement plan.

Pre-tax vs Roth Contributions

First, let’s start off by identifying the differences between pre-tax and Roth contributions. It’s pretty simple and straight forward. With pre-tax contributions, the strategy is “don’t tax me on it now, tax me on it later”. The contributions are deducted from your gross pay, they deduct FICA tax, but they do not withhold federal or state tax which in doing so, you are essentially lowering the amount of your income that is subject to federal and state income tax in that calendar year. The full amount is deposited into your 401K, the balance accumulates tax deferred, and then when you retire, and pull money out, that is when you pay tax on it. The tax strategy here is taking income off the table when you are working and in a higher tax bracket, and then paying tax on that money after you are retired, your paychecks have stopped, and you are hopefully in a lower tax bracket.

With Roth contributions, the strategy is “pay tax on it now, don’t pay tax on it later”. When your contributions are deducted from your pay, they withhold FICA, as well as Federal and State income tax, but when you withdraw the money in retirement, you don’t have to pay tax on any of it INCLUDING all of the earnings.

Age

Your age and your time horizon to retirement are a big factor to consider when trying to decide between pre-tax or Roth contributions. In general, the younger you are and the longer your time horizon to retirement, the more it tends to favor Roth contributions because you have more years to build the earning in the account which will eventually be withdrawn tax-free. In contrast, if you’re within 10 years to retirement, you have a relatively short period of time before withdrawals will begin from the account, making pre-tax contributions may make the most sense.

When you end up in one of those mid time horizon ranges like 10 to 20 years to retirement, the other factors that we’re going to discuss have a greater weight in arriving at your decision to do pre-tax or Roth.

Income level

Your level of income also has a big impact on whether pre-tax or Roth makes sense. In general, the higher your level of income, the more it tends to favor pre-tax contributions. In contrast, lower to medium levels of income, can favor Roth contributions. Remember pre-tax is “don’t tax me on it now, tax me on it later”, and the strategy is you are assuming that you are in a higher tax bracket now during your earning years then you will be in retirement when you don’t have a paycheck. By contrast, a 22 year old, that has accepted their first job, will most likely be at the lowest level of income over their working career, and have the expectation that their earnings will grow overtime. This situation would favor making Roth contributions because you are paying tax on the contributions while you are still in a low tax bracket and then later on when your income rises, you can switch over to pre-tax.

Marital status

Your marital status matters because if you’re married and you file a joint tax return, you have to consider not just your income but your spouse’s income. If you make $30,000 a year, that might lead you to think that Roth is a good option, but if your spouse makes $200,000 a year, your combined income on your joint tax return is $230,000 which puts you in a higher tax bracket. Assuming you’re not going to need $230,000 per year to live off of in retirement, pre-tax contributions may be more appropriate because you want the tax deduction now.

A change in your marital status can also influence the type of contributions that you’re making to the plan. If you are a single filer making $50,000 a year, you may have been making Roth contributions but then you get married and your spouse makes $100,000 a year, since your income will now be combined for tax filing purposes, it may make sense for you to change your elections to pre-tax contributions.

These changes can also take place when one spouse retires and the other is still working. Prior to the one spouse retiring, both were earning income, and both were making pre-tax contributions. Once one of the spouses retires the income level drops, the spouse that is still working may want to switch to Roth contributions given their much lower tax rate.

Withdrawal plan in retirement

You also have to look ahead to your retirement years and estimate what your income picture might look like. If you anticipate that you will need the same level in retirement that you have now, even though you might have a shorter time horizon to retirement, it may favor making Roth contributions because your tax rate is not anticipated to drop in the retirement years. So why not pay tax on the contributions now and then receive the earnings on the account tax-free, as opposed to making pre-tax contributions and having to pay tax on all of it. The benefit associated with pre-tax contributions assumes that you’re in a higher tax rate now and when you withdraw the money you will be in a lower tax bracket.

Some individuals accumulate balances in their 401(k) accounts but they also have pensions. As they get closer to retirement, they realize between their pension and Social Security, they will not need to make withdrawals from their 401(k) account to supplement their income. In many of those cases, we can assume a much longer time horizon for those accounts which may begin to favor Roth contributions. Also, if those accounts are going to continue to accumulate and eventually be inherited by their children, from a tax standpoint, it’s more beneficial for children to inherit a Roth account versus a pre-tax retirement account because they have to pay tax on all of the money in a pre-tax retirement account as some point.

Abnormal income years

It’s not uncommon during your working years to have some abnormal income years where your income ends up being either significantly higher or significantly lower than it normally is. In these abnormal years it often makes sense to change your pre-tax or Roth approach. If you are a business owner, you typically make $300,000 per year, but the business has a bad year, and you’re only going to make $50,000 this year, instead of making your usual pre-tax contributions, it may make sense to contribute Roth that year. If you are a W-2 employee, and the company that you work for is having a really good year, and you expect to receive a big bonus at the end of the year, if you’re contributing Roth it may make sense to switch to pre-tax anticipating that your income will be much higher for the tax year.

Another exception can happen in the year that you retire. Some companies will issue bonuses or paid out built up sick time or vacation time which can count as taxable income. In those years it may make sense to make larger pre-tax contributions because the income in that final year may be much higher than normal.

Frequently Asked Questions About Roth Contributions

When we are educating 401K plan participants on this topic, there are a few frequently asked questions that we receive:

Do all retirement plans allow Roth contributions?

ANSWER: No, Roth contributions are a voluntary contribution source that a company has to elect to offer to its employees. We are seeing a lot more plans that offer this benefit but not all plans do.

Can you contribute both Pre-Tax and Roth at the same time to the plan?

ANSWER: Yes, if your plan allows Roth contributions you are normally able to contribute both pre-tax and Roth to the plan simultaneously. However, the annual deferral limits are aggregated for purposes of all employee elective deferrals. For example, in 2024, the maximum employee deferral limits are as follows:

Under the age of 50: $23,000

Age 50+: $30,500

You can contribute all pre-tax, all Roth, or any combination of the two but those amounts are aggregated together for purposes of assessing the annual dollar limits.

Do you have to set up a separate account for your Roth contributions to the 401K?

ANSWER: No. The Roth contributions that you make out of your paycheck to the plan are just tracked as a separate source within the 401K plan. They have to do this because when it comes to withdrawing the money, they have to know how much of your account balance is pre-tax and what amount is Roth. Typically, on your statements, you will see your total balance, and then it breaks it down by money type within your account.

What happens when I retire and I have Roth money in my 401K account?

ANSWER: For those that contribute Roth to their accounts, it's common for them to have both pre-tax and Roth money in their account when they retire. The pre-tax money could be from employee deferrals that you made or from the employer contributions. When you retire, you can set up both a rollover IRA and a Roth IRA to receive the rollover balance from each source.

SPECIAL NOTE: The Roth source has a special 5 year holding rule. To be able to withdraw the earnings from the Roth source tax free, you have to be over the age of 59 ½ AND the Roth source has to have been in existence for at least 5 years. Here is the problem, that five-year holding clock does not transfer over from a Roth 401(k) to a Roth IRA. If you did not have a Roth IRA a prior to the rollover, you would have to re satisfy the five-year holding period within the Roth IRA before making withdraws. We normally advise clients in this situation that they should set up a Roth IRA with $1 five years prior to retirement to start that five-year clock within the Roth IRA so by the time they rollover the Roth 401(k) balance they are free and clear of the 5 year holding period requirement. (Assuming their income allows them to make a Roth IRA contribution during that $1 year)

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Cash Balance Plans: $100K to $300K in Pre-tax Contributions

DB/DC combo plans can allow business owners to contribute $100,000 to $300,000 pre-tax EACH YEAR which can save them tens of thousands of dollars in taxes.

A Cash Balance Plan for small business owners can be one the best ways to shelter large amounts of income from taxation each year. Most small business owners are familiar with 401(K) plans, SEP IRA’s, Solo(k) Plans, and Simple IRA’s, but these “DB/DC Combo” plans bring the tax savings for business owners to a whole new level. DB/DC combo plans can allow business owners to contribute $100,000 to $300,000 pre-tax EACH YEAR which can save them tens of thousands of dollars in taxes. In this article I’m going to walk you through:

How cash balance plans and DB/DC combo plans work

Which companies are the best fit for these plans

How the contribution amount is calculated each year

Why an actuary is involved

How long should these plans be in place for?

The cost of maintaining these plans

How they differ from 401(k) plans, SEP IRA, Solo(k), and Simple IRA plans

The Right Type of Company

When we put one of these DB/DC combo plans in place for a client, most of the time, the company has the following characteristics:

Less than 20 full time employees

The business is producing consistent cash flow

Business owners are making $300K or more per year

Business owner is looking for a way to dramatically reduce their tax liability

Company already sponsors either a 401(k), Solo(k), Simple IRA, or SEP IRA

What Is A Cash Balance Plan?

This special plan design involves running a 401(k) plan and Cash Balance Plan side by side. 401(K) plans, SEP IRAs, and Simple IRAs are considered a “defined contribution plans”. As the name suggests, a defined contribution plan defines the maximum hard dollar amount that you can contribute to the plan each year. The calculation is based on the current, here and now benefit. For 2021, the maximum annual contribution limits for a 401(k) plan is either $58,000 or $64,500 depending on your age.

A Cash Balance Plan is considered a “defined benefit plan”; think a pension plan. Define benefit plans define the benefit that will be available to you at some future date and the contribution that is required today is a calculation based on the dollar amount needed to meet that future benefit. They have caps but the caps are much higher than defined contribution plans and they vary based on the age and compensation of the business owner. Also, even though they are pension plans, they typically payout the benefit as a lump sum pre-tax amount that can be rolled over to either an IRA or other type of qualified plan.

As mentioned earlier, these Combo plans can provide annual pre-tax contribution in excess of $300,000 per year for some business owners. Now that is the maximum but you do not have to design your plan to be based on the maximum contribution. Some small business owners would prefer to just contribute $100,000 - $150,000 pre-tax per year if that was available, and these combo plans can be designed to meet those contribution levels.

Employee Demographic

Employee demographic play a huge role as to whether or not these plans work for a given company. Similar to 401(K) plans, cash balance plans are subject to nondiscrimination testing year which requires the company to make an employer contribution to eligible employees based on amounts that are contributed to the owner’s accounts. But it’s not as big of a jump in contribution level to the employees that many business owners expect. It's not uncommon a company to already be sponsoring a company retirement plan which is providing the employees with an employer contribution equal to 3% to 5% of the employees annual compensation. Many of these DB/DC combo plans only require a 7.5% total contribution to pass testing. Thus, making an additional 2.5% of compensation contributions to the employees can open up $100,000 - $250,000 in additional pre-tax contributions for the business owner. In many cases, the tax savings for the business owner more than pays for the additional contribution to the employee so everyone wins. The employee get more and the business owner gets a boat load of tax savings.

The age and annual compensation of the owner versus the employees also has a large impact. In general, this plan design works the best for businesses where the average age of the employees is much lower than the age of the business owner, and the business owner’s compensation is much higher than that of the average employee. These plans are very common for dentists, doctors, lawyers, consultants, and any other small business that fits this owner vs employee demographic.

If you have no employees or it’s an owner only entity, even better. You just graduated to the higher contribution level without additional contributions to employees.

Reminder: You only have to count full time employees. ERISA defines full time employees as being employed for at least 1 year and working over 1,000 hours during that one year period. If you have employees working less than 1,000 hours a year, they may never become eligible for the plan.

The 3 Year Rule

When you adopt a Cash Balance Plan, you typically have to keep the plan in place for at least 3 years. The IRS does not want you to have one great year, contribute $300,000 pre-tax, and then terminate the plan the next year. Unlike 401(k) plans, cash balance plans have minimum funding requirements each year which is why businesses have to have more predictable revenue streams for this plan design to makes sense.

However, you can build in fail safe into the plan design to help protect against bad years in the business. Since no business owner knows what is going to happen over the next three years, we can build into the plan design a “lesser of” statement which calculates the contribution for the business owner based on the “lesser of the ERISA max comp limit for the year or the owners comp for that tax year.” If the business owner makes $500,000, they would use the ERISA comp limit of $290,000 for 2021. If it’s a horrible year and the business owner only makes $50,000 that year, the required contribution would be based on that lower compensation level, reducing the required contribution for that year.

After 3 years, the company has the option to voluntarily terminate the cash balance plan, and the business owner can rollover his or her balance into the 401(k) plan or rollover IRA.

Contributions Are Due Tax Filing Deadline Plus Extension

The company is not required to fund these plans until tax filing deadline plus extension. If the business is a 12/31 fiscal year end and you adopt the plan in November, you would not be required to fund the contribution until either September 15th or October 15th of the following year depend on how your business is incorporated.

Assumed Rates of Return

Unlike a 401(k) plan where each employee has their own account that they have control over, Cash Balance Plans are pooled investment account, because the company is responsible for producing the rate of return in the account that meets or beats the actuarial assumptions. The annual rate of return target for the cash balance plan can sometimes be tied to a treasury bond yield, flat rate, or other metric used by the actuary within the ERISA guidelines. If the plan assets underperform the assumed rate of return, it could increase the required contribution for that year. Vice versa, if the plan assets outperform the assumed rate, it can decrease the required contribution for the year. The additional risk taken on by the company has to be considered when selecting the appropriate asset allocation for the cash balance account.

Annual Plan Fees

Since cash balance plans are defined benefit plans, you will need an actuary to calculate the required minimum contribution each year. Since most of these plans are DC/DB combo plans, the 401(K) plan and the Cash Balance Plan need to be tested together for purposes of passing year end testing. A full 401(k) may carry $1,000 - $3,000 in annual administration cost each year depending on your platform, whereas running both a 401(K) and Cash Balance Plan may increase those administration costs to $4,000 - $7,000 depending again on the platform and the number of employees.

While these plans can carry a higher cost, you have to weigh it against the tax savings that the business owner is realizing by having the DC/DB combo plan in place. If they are able to contribute an additional $200,000 over just their 401(K), that could save them $80,000 in taxes. Many business owners in the top tax bracket are willing to pay an additional $3,000 in admin fees to save $80,000 in taxes.

Run Projections

As a business owner, you have to weigh the additional costs of sponsoring the plan against the amount of your tax savings. For the right company, these combo plans can be fantastic but it’s not a set it and forget it type plan design. As the employee demographics within the company change over the years it can impact this cost benefit analysis. We have seen cases where hiring just one employee has thrown off the whole plan design a year later.

If you would like to learn more about this plan design or would like us to run a projection for your company, feel free to reach out to us for a complementary consult.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

What Caused The Market To Sell Off In September?

What Caused The Market To Sell Off In September?

The stock market experienced a fairly significant drop in the month of September. In September, the S&P 500 Index dropped 4.8% which represents the sharpest monthly decline since March 2020. I wanted to take some time today to evaluate:

· What caused the market drop?

· Do we think this sell off is going to continue?

· Have the recent market events caused us to change our investment strategy?

September Is Historically A Bad Month

Looking back at history, September is historically the worse performing month for the stock market. Since 1928, the S&P 500 Index has averaged a 1% loss in September (WTOP News). Most investors have probably forgotten that in September 2020, the market experienced a 10% correction, but rallied significantly in the 4th quarter.

The good news is the 4th quarter is historically the strongest quarter for the S&P 500. Since 1945, the stock market has averaged a 3.8% return in the final three months of the year (S&P Global).

The earned income penalty ONLY applies to taxpayers that turn on their Social Security prior to their normal retirement age. Once you have reached your normal retirement age, this penalty does not apply.

Delta Variant

The emergence of the Delta Variant slowed economic activity in September. People cancelled travel plans, some individuals avoided restaurants and public events, employees were out sick or quarantined, and it delayed some companies from returning 100% to an office setting. However, we view this as a temporary risk as vaccination rates continue to increase, booster shots are distributed, and the death rates associated with the virus continue to stay at well below 2020 levels.

China Real Estate Risk

Unexpected risks surfaced in the Chinese real estate market during September. China's second largest property developer Evergrande Group had accumulated $300 billion in debt and was beginning to miss payments on its outstanding bonds. This spread fears that a default could cause issues other places around the globe. Those risks subsided as the month progressed and the company began to liquidate assets to meet its debt payments.

Rising Inflation

In September we received the CPI index report for August that showed a 5.3% increase in year over year inflation which was consistent with the higher inflation trend that we had seen earlier in the year. In our opinion, inflation has persisted at these higher levels due to:

· Big increase in the money supply

· Shortage of supply of good and services

· Rising wages as companies try to bring employees back into the workforce

The risk here is if the rate of inflation continues to increase then the Fed may be forced to respond by raising interest rates which could slow down the economy. While we acknowledge this as a risk, the Fed does not seem to be in a hurry to raise rates and recently announced plans to pare back their bond purchases before they begin raising the Fed Funds Rate. Fed Chairman Powell has called the recent inflation trend “transitory” due to a bottleneck in the supply chain as company rush to produce more computer chips, construction materials, and fill labor shortages to meet consumer demand. Once people return to work and the supply chain gets back on line, the higher levels of inflation that we are seeing could subside.

Rising Rates Hit Tech Stocks

Interest rates rose throughout the month of September which caused mortgage rates to move higher, but more recently there has been an inverse relationship between interest rates and tech stocks. As interest rates rise, tech stocks tend to fall. We attribute this largely to the higher valuations that these tech stocks trade at. As interest rates rise, it becomes more difficult to justify the multiples that these tech stocks are trading at. It is also important to acknowledge that these tech companies have become so large that the tech sector now represents about 30% of the S&P 500 Index (JP Morgan Guide to the Markets).

Risk of a Government Shutdown

Toward the end of the month, the news headlines were filled with the risk of the government shutdown which has been a reoccurring issue for the U.S. government for the past 20 years. This was nothing new, but it just added more uncertainty to the pile of negative headlines that plagued the markets in September. It was announced on September 30th that Congress had approved a temporary funding bill to extend the deadline to December 3rd.

Expectation Going Forward

Even though the Stock Market faced a pile of bad news in September, our internal investment thesis at our firm has not changed. Our expectation is that:

· The economy will continue to gain strength in coming quarters

· There is a tremendous amount of liquidity still in the system from the stimulus packages that has yet to be spent

· People will begin to return to work to produce more goods and services

· Those additional goods and services will then ease the current supply chain bottleneck

· Interest rates will move higher but they still remain at historically low levels

· The risk of the delta variant will diminish increasing the demand for travel

We will continue to monitor the economy, financial markets, and will release more articles in the future as the economic conditions continue to evolve in the coming months.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Do You Have To Pay Tax On Your Social Security Benefits?

I have some unfortunate news. If you look at your most recent paycheck, you are going to see a guy by the name of “FICA” subtracting money from your take-home pay. Part of that FICA tax is sent to the Social Security system, which entitles you to receive Social Security payments when you retire. The unfortunate news is that, even though it was a tax that you paid while you were working, when you go to receive your payments from Social Security, most retirees will have to pay some form of Income Tax on it. So, it’s a tax you pay on a tax? Pretty much!

In this article, I will be covering:

· The percent of your Social Security benefit that will be taxable

· The tax rate that you pay on your Social Security benefits

· The Social Security earned income penalty

· State income tax exceptions

· Withholding taxes from your Social Security payments

What percent of your Social Security benefit is taxable?

First, let’s start off with how much of your Social Security will be considered taxable income. It ranges from 0% to 85% of the amount received. Where you fall in that range will depend on the amount of income that you have each year. Here is the table for 2021:

But, here’s the kicker. 50% of your Social Security benefit that you receive counts towards the income numbers that are listed in the table above to arrive at your “combined Income” amount. Here is the formula:

Adjusted Gross Income (AGI) + nontaxable interest + 50% of your SS Benefit = Combined Income

If you are a single tax filer, and you are receiving $30,000 in Social Security benefits, you are already starting at a combined income level of $15,000 before you add in any of your other income from employment, pensions, pre-tax distributions from retirement accounts, investment income, or rental income.

As you will see in the table, if your combined income for a single filer is below $25,000, or a joint filer below $32,000, you will not have to pay any tax on your Social Security benefit. Taxpayers above those thresholds will have to pay some form of tax on their Social Security benefits. But, I have a small amount of good news: no one has to pay tax on 100% of their benefit, because the highest percentage is 85%. Therefore, everyone at a minimum receives 15% of their benefit tax free.

NOTE: The IRS does not index the combined income amounts in the table above for inflation, meaning that even though an individual’s Social Security and wages tends to increase over time, the dollar amounts listed in the table stay the same from year to year. This has caused more and more taxpayers to have to pay tax on a larger portion of their Social Security benefit over time.

Tax Rate on Social Security Benefits

Your Social Security benefits are taxed as ordinary income. There are no special tax rates for Social Security like capital gains rates for investment income. Social Security is taxed at the federal level but may or may not be taxed at the state level. Currently there are 37 states in the U.S. that do not tax Social Security benefits. There are 4 states that tax it at the same level as the federal government and there are 13 states that partially tax the benefit. Here is table:

Withholding Taxes From Your Social Security Benefit

For taxpayers that know that will have to pay tax on their Social Security benefit, it is usually a good idea to have Social Security withholding taxes taken directly from your Social Security payments. Otherwise, you will have to issue checks for estimated tax payments throughout the year which can be a headache. They only provide you with four federal tax withholding options:

· 7%

· 10%

· 12%

· 22%

These percentages are applied to the full amount of your Social Security benefit, not to just the 50% or 85% that is taxable. Just something to consider when selecting your withholding elections.

To make a withholding election, you have to complete Form W-4V (Voluntary Withholding Request). Once you have completed the form, which only has 7 lines, you can mail it or drop it off at the closest Social Security Administration office.

Social Security Earned Income Penalty

If you elect to turn on your Social Security benefit prior to your Normal Retirement Age (NRA) AND you plan to keep working, you have to be aware of the Social Security earned income penalty. Your Normal Retirement Age is the age that you are entitled to receive your full Social Security benefit, and it’s based on your date of birth.

The earned income penalty ONLY applies to taxpayers that turn on their Social Security prior to their normal retirement age. Once you have reached your normal retirement age, this penalty does not apply.

Basically, the IRS limits how much you are allowed to make each year if you elect to turn on your Social Security early. If you earn over those amounts, you may have to pay all or a portion of the Social Security benefit back to the government. In the Chart below “FRA” stands for “Fully retirement age”, which is the same as “Normal Retirement Age” (NRA). Also note that for married couples, the earned income numbers below apply to your personal earnings, and do not take into consideration your spouse’s income.

INCOME UNDER $18,960: If you earned income is below $18,960, no penalty, you get to keep your full social security benefit

INCOME OVER $18,960: You lose $1 of your social security benefit for every $2 you earn over the threshold. Example:

· You turn on your social security at age 63

· Your social security benefit is $20,000 per year

· You make $40,000 per year in wages

Since you made $40,000 in wages, you are $21,040 over the $18,960 limit:

$21,040 x 50% ($1 reduction for every $2 earned) = $10,520 penalty.

The following year, your $20,000 Social Security benefit would be reduced by $10,520 for the assessment of the earned income penalty. Ouch!!

As a general rule of thumb, if you plan on working prior to your Social Security normal retirement age, and your wages will be in excess of the $18,960 limit, it usually make sense to wait to turn on your Social Security benefit until your wages are below the threshold or you reach normal retirement age.

NOTE: You will see in the middle row of the table “In the calendar year FRA is reached”. In the year that you reach your full retirement age for social security the wage threshold his higher and the penalty is lower (a $1 penalty for every $3 over the threshold).

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

College Savings Account Options

There are a lot of different types of accounts that you can use to save for college. But, certain accounts have advantages over others such as:

· Tax deductions for contributions

· Tax free accumulation and withdrawal

· The impact on college financial aid

· Who has control over the account

· Accumulation rate

The types of college savings account that I will be covering in this article are:

· 529 accounts

· Coverdell accounts (also know as ESA’s)

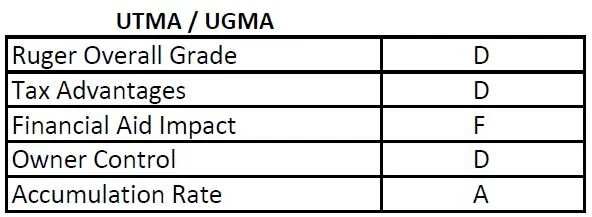

· UTMA / UGMA accounts

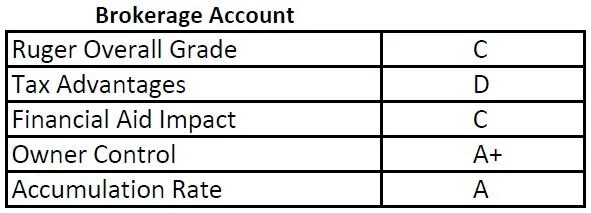

· Brokerage Accounts

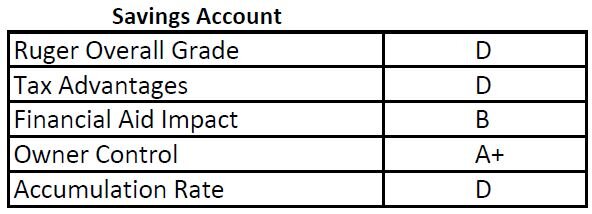

· Savings Accounts

To make it easy to compare and contrast each option, I will have a grading table at the beginning of each section that will provide you with some general information on each type of account, as well as my overall grade on the effectiveness of each college saving option.

529 Plans

I’ll start with my favorite which are 529 College Savings Plan accounts. As a Financial Planner, I tend to favor 529 accounts as primary college savings vehicles due to the tax advantages associated with them. Many states offer state income tax deductions for contributions up to specific dollar amounts, so there is an immediate tax benefit. For example, New York provides a state tax deduction for up to $5,000 for single filers, and $10,000 for joint filers for contributions to NYS 529 accounts year. There is no income limitation for contributing to these accounts.

NOTE: Every now and then I come across individuals that have 529 accounts outside of their home state and they could be missing out on state tax deductions.

However, the bigger tax benefit is that fact that all of the investment returns generated by these accounts can be withdrawn tax free, as long as they are used for a qualified college expense. For example, if you deposit $5K into a 529 account when your child is 2 years old, and it grows to $15,000 by the time they go to college, and you use the account to pay qualified expenses, you do not pay tax on any of the $15,000 that is withdrawn. That is huge!! With many of the other college savings options like UTMA or brokerage accounts, you have to pay tax on the gains.

There is also a control advantage, in that the parent, grandparent, or whoever establishes the accounts has full control as to when and how much is distributed from the account. This is unlike UTMA / UGMA accounts, where once the child reaches a certain age, the child can do whatever they want with the account without the account owner’s consent.

A 529 account does count against the financial aid calculation, but it is a minimal impact in most cases. Since these accounts are typically owned by the parents, in the FAFSA formula, 5.6% of the balance would count against the financial aid reward. So, if you have a $50,000 balance in a 529 account, it would only set you back $2,800 per year in financial aid.

I gave these account an “A” for an accumulation rating because they have a lot of investment option available, and account owners can be as aggressive or conservative as they would like with these accounts. Many states also offer “age based portfolios” where the account is allocated based on the age of the child, and when the will turn 18. These portfolios automatically become more conservative as they get closer to the college start date.

The contributions limits to these accounts are also very high. Lifetime contributions can total $400,000 or more (depending on your state) per beneficiary.

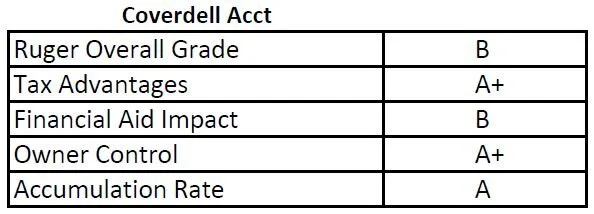

Coverdell Accounts (Education Savings Accounts)

Coverdell accounts have some of the benefits associated with 529 accounts, but there are contribution and income restrictions associated with these types of accounts. First, as of 2021, only taxpayers with adjusted gross income below $110,000 for single filers and $220,000 for joint filers are eligible to contribute to Coverdell accounts.

The other main limiting factor is the contribution limits. You are limited to a $2,000 maximum contribution each year until the beneficiary’s 18th birthday. Given the rising cost of college, it is difficult to accumulate enough in these accounts to reach the college savings goals for many families. Similar to 529 accounts, these accounts are counted as an asset of the parents for purposes of financial aid.