Should I Rollover My Pension To An IRA?

Whether you are about to retire or if you were just notified that your company is terminating their pension plan, making the right decision with regard to your pension plan payout is extremely important. It's important to get this decision right because you only get one shot at it. There are a lot of variables that factor into choosing the right option.

Whether you are about to retire or if you were just notified that your company is terminating their pension plan, making the right decision with regard to your pension plan payout is extremely important. It's important to get this decision right because you only get one shot at it. There are a lot of variables that factor into choosing the right option. While selecting the monthly payment option may be the right choice for your fellow co-worker, it could be the wrong choice for you. Here is a quick list of the items that you should consider before making the decision.

Financial health of the plan sponsor

Your age

Your health

Flexibility

Monthly benefit vs lump sum amount

Inflation

Your overall retirement picture

Financial Health Of The Plan Sponsor

The plan sponsor is the company, organization, union, municipality, state agency, or government entity that is in charge of the pension plan. The financial health of the plan sponsor should weigh heavily on your decision in many cases. After all what good is a monthly pension payment if five years from now the company or entity that sponsors the plan goes bankrupt?

Pension Benefit Guarantee Corporation

But wait……..isn’t there some type of organization that guarantees the pension payments? The answer, there may or may not be. The Pension Benefit Guarantee Corporation (PBGC) is an organization that was established to protect your pension benefit. But PBGC protection only applies if your company participates in the PBGC. Not all pension plans have this protection.

Large companies will typically have PBGC protection. The pension plan is required to pay premiums to the PBGC each year. Those premiums are used to subsidize the cost of bankrupt pension plans if the PBGC has to step in to pay benefits. But it’s very important to understand that even through a pension plan may have PBGC protection that does not mean that 100% of the employee’s pension benefits are protected if the company goes bankrupt.

There is a dollar limited placed on the monthly pension benefit that the PBGC will pay if it has to step in. It’s a sliding scale based on your age and the type of pension benefit that you elected. If your pension payment is greater that the cap, the excess amount is not insured. Here is the PBGC 2021 Maximum Monthly Guarantee Table:

Another important note, if you have not reached age 65, your full pension benefit may not be insured even if it is less than the cap listed in the table.

Again, not all pension plans are afforded this protection by the PBGC. Pension plans offered by states and local government agencies typically do not have PBGC protection.

If you are worried about the financial health of the plan sponsor, that scenario may favor electing the lump sum payment option and then rolling over the funds into your rollover IRA. Once the money is in your IRA, the plan sponsor insolvency risk is eliminated.

Your Age

Your age definitely factors into the decision. If you have 10+ years to retirement and your company decides to terminate their pension plan, it may make sense to rollover your balance in the pension plan into an IRA or your current employer’s 401(k) plan. Primarily because you have the benefit of time on your side and you have full control over the asset allocation of the account.

Pension plans typically maintain a conservative to moderate growth investment object. You will rarely ever find a pension plan that has 80%+ in equity exposure. Why? It’s a pooled account for all of the employees of all ages. Since the assets are required to meet current pension payments, pension plans cannot be subject to high levels of volatility.

If your personal balance in the pension plan is moved into our own IRA, you have the option of selecting an investment objective that matches your personal time horizon to retirement. If you have a long time horizon to retirement, it allows you the freedom to be more aggressive with the investment allocation of the account.

If you are within 5 years to retirement, it does not necessarily mean that selecting the monthly pension payment is the right choice but the decision is less cut and dry. You really have to compare the monthly pension payment versus the return that you would have to achieve in your IRA to replicate that income stream in retirement.

Your Health

Your health is a big factor as well. If you are in poor health, it may favor electing the lump sum option and rolling over the balance into an IRA. Whatever amount is left in your IRA account will be distributed to your beneficiaries. With a straight life pension option, the benefit just stops when you pass away. However, if you are worried about your spouse's spending habits and your spouse is either in good health or is much younger than you, you may want to consider the pension option with a 100% survivor benefit.

Flexibility

While some retirees like the security of a monthly pension payment that will not change for the rest of their life, other retirees prefer to have more flexibility. If you rollover you balance to an IRA, you can decide how much you want to take or not take out of the account in a given year.

Some retirees prefer to spend more in their early years in retirement because that is when their health is the best. Walking around Europe when you are 65 is usually not the same experience as walking around Europe when you are 80. If you want to take $10,000 out of your IRA to take that big trip to Europe or to spend a few months in Florida, it provides you with the flexibility to do so. By making sure that you have sufficient funds in your savings at the time of retirement can help to make things like this possible.

Working Because I Want To

The other category of retirees that tend to favor the IRA rollover option is the "I'm working because I want to" category. It has becoming more common for individuals to retire from their primary career and want to still work doing something else for two or three days a week just to keep their mind fresh. If the income from your part-time employment and your social security are enough to meet your expenses, having a fixed pension payment may just create more taxable income for you when you don't necessarily need it. Rolling over your pension plan to an IRA allows you to defer the receipt of that income until at least age 70½. That is the age that distributions are required from IRA accounts.

Monthly Pension vs Lump Sum

It’s important to determine the rate of return that you would need to achieve in your IRA account to replicate the pension benefit based on your life expectancy. With the monthly pension payment option, you do not have to worry about market fluctuations because the onus is on the plan sponsor to produce the returns necessary to make the pension payments. With the IRA, you or your investment advisor are responsible for producing the investment return in the account.

Example 1: You are 65 and you have the option of either taking a monthly pension payment of $3,000 per month or taking a lump sum in the amount of $500,000. If your life expectancy is age 85, what is the rate of return that you would need to achieve in your IRA to replicate the pension payment?

The answer: 4%

If your IRA account performs better than 4% per year, you are ahead of the game. If your IRA produces a return below 4%, you run the risk of running out of money prior to reaching age 85.

Part of this analysis is to determining whether or not the rate of return threshold is a reasonable rate of return to replicate. If the required rate of return calculation results in a return of 6% or higher, outside of any special circumstances, you may be inclined to select the pension payments and put the responsibility of producing that 6% rate of return each year on the plan sponsor.

Low Interest Rate Environment

A low interest rate environment tends to favor the lump sum option because it lowers the “discount rate” that actuaries can use when they are running the present value calculation. Wait……what?

The actuaries are the mathletes that produce the numbers that you see on your pension statement. They have to determine how much they would have to hand you today in a lump sum payment to equal the amount that you would have received if you elected the monthly pension option.

This is called a “present value” calculation. This amount is not the exact amount that you would have received if you elected the monthly pension payments because they get to assume that they money in the pension plan will earn interest over your life expectancy. For example, if the pension plan is supposed to pay you $10,000 per year for the next 30 years, that would equal $300,000 paid out over that 30 year period. But the present value may only be $140,000 because they get to assume that you will earn interest off of that money over the next 30 years for the amount that is not distributed until a later date.

In lower interest rate environments, the actuaries have to use a lower assume rate of return or a lower “discount rate”. Since they have to assume that you will make less interest on the money in your IRA, they have to provide you with a larger lump sum payment to replicate the monthly pension payments over your life expectancy.

Inflation

Inflation can be one of the largest enemies to a monthly pension payment. Inflation, in its simplest form is “the price of everything that you buy today goes up in price over time”. It’s why your grandparents have told you that they remember when a gallon of milk cost a nickel. If you are 65 today and your lock into receiving $2,000 per month for the rest of your life, inflation will erode the spending power of that $2,000 over time.

Historically, inflation increases by about 3% per year. As an example, if your monthly car payment is $400 today, the payment for that same exact car 20 years from now will be $722 per month. Now use this multiplier against everything that you buy each month and it begins to add up quickly.

If you have the money in an IRA, higher inflation typically leads to higher interest rate, which can lead to higher interest rates on bonds. Again, having control over the investment allocation of your IRA account may help you to mitigate the negative impact of inflation compared to a fixed pension payment.

A special note, some pension plans have a cost of living adjustment (“COLA”) built into the pension payment. Having this feature available in your pension plan will help to manage the inflation risk associated with selecting the monthly pension payment option. The plan basically has an inflation measuring stick built into your pension payment. If inflation increases, the plan is allowed to increase the amount of your monthly pension payment to help protect the benefit.

Your Overall Financial Picture

While I have highlighted a number of key variables that you will need to consider before selecting the payout option for your pension benefit, at the end of the day, you have to determine how each option factors into your own personal financial situation. It’s usually wise to run financial projections that identify both the opportunities and risks associated with each payment option.

Don’t be afraid to seek professional help with this decision. They will help you consider what you might need to pay for in the future. Are you going to need money spare for holidays, transportation, even funeral costs should be considered. Where people get into trouble is when they guess or they choose an option based on what most of their co-workers selected. Remember, those co-workers are not going to be there to help you financially if you make the wrong decision.

As an investment advisor, I will also say this, if you meet with a financial planner or investment advisor to assist you with this decision, make sure they are providing you with a non-bias analysis of your options. Depending on how they are compensation, they may have a vested interest in getting you to rollover you pension benefit to an IRA. Even though electing the lump sum payment and rolling the balance over to an IRA may very well be the right decision, they should walk you through a thorough analysis of the month pension payments versus the lump sum rollover option to assist you with your decision.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Moving Expenses Are No Longer Deductible

If you were planning on moving this year to take a new position with a new company or even a new position within your current employer, the moving process just got a little more expensive. Not only is it expensive, but it can put you under an intense amount of stress as there will be lots of things that you need to have in place before packing up and

If you were planning on moving this year to take a new position with a new company or even a new position within your current employer, the moving process just got a little more expensive. Not only is it expensive, but it can put you under an intense amount of stress as there will be lots of things that you need to have in place before packing up and moving. Even things like how you are going to transport your car over to your new home, can take up a lot of your time, and on top of that, you have to think about how much it's going to cost. Prior to the tax law changes that took effect January 1, 2018, companies would often offer new employees a "relocation package" or "moving expense reimbursements" to help subsidize the cost of making the move. From a tax standpoint, it was great benefit because those reimbursements were not taxable to the employee. Unfortunately that tax benefit has disappeared in 2018 as a result of tax reform.

Taxable To The Employee

Starting in 2018, moving expense reimbursements paid to employee will now represent taxable income. Due to the change in the tax treatment, employees may need to negotiate a higher expense reimbursement rate knowing that any amount paid to them from the company will represent taxable income.

For example, let’s say you plan to move from New York to California and you estimate that your moving expense will be around $5,000. In 2017, your new employer would have had to pay you $5,000 to fully reimburse you for the moving expense. In 2018, assuming you are in the 35% tax bracket, that same employer would need to provide you with $6,750 to fully reimburse you for your moving expenses because you are going to have to pay income tax on the reimbursement amount.

Increased Expense To The Employer

For companies that attract new talent from all over the United States, this will be an added expense for them in 2018. Many companies limit full moving expense reimbursement to executives. Coincidentally, employees at the executive level are usually that highest paid. Higher pay equals higher tax brackets. If you total up the company's moving expense reimbursements paid to key employees in 2017 and then add another 40% to that number to compensate your employees for the tax hit, it could be a good size number.

Eliminated From Miscellaneous Deductions

As an employee, if your employer did not reimburse you for your moving expenses and you had to move at least 50 miles to obtain that position, prior to 2018, you were allowed to deduct those expenses when you filed your taxes and you were not required to itemize to capture the deduction. However, this expense will no longer be deductible even for employees that are not reimbursed by their employer for the move starting in 2018.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Spouse Inherited IRA Options

If your spouse passes away and they had either an IRA, 401(k), 403(b), or some other type of employer sponsored retirement account, you will have to determine which distribution option is the right one for you. There are deadlines that you will need to be aware of, different tax implications based on the option that you choose, forms that need to be

If your spouse passes away and they had either an IRA, 401(k), 403(b), or some other type of employer sponsored retirement account, you will have to determine which distribution option is the right one for you. There are deadlines that you will need to be aware of, different tax implications based on the option that you choose, forms that need to be completed, and accounts that may need to be established.

Spouse Distribution Options

As the spouse, if you are listed as primary beneficiary on a retirement account or IRA, you have more options available to you than a non-spouse beneficiary. Non-spouse beneficiaries that inherited retirement accounts after December 31, 2019 are required to fully distribution the account 10 years following the year that the decedent passed away. But as the spouse of the decedent, you have the following options:

Fulling distribute the retirement account with 10 years

Rollover the balance to an inherited IRA

Rollover the balance to your own IRA

To determine which option is the right choice, you will need to take the following factors into consideration:

Your age

The age of your spouse

Will you need to take money from the IRA to supplement your income?

Taxes

Cash Distributions

We will start with the most basic option which is to take a cash distribution directly from your spouse’s retirement account. Be very careful with this option. When you take a cash distribution from a pre-tax retirement account, you will have to pay income tax on the amount that is distributed to you. For example, if your spouse had $50,000 in a 401(k), and you decide to take the full amount out in the form of a lump sum distribution, the full $50,000 will be counted as taxable income to you in the year that the distribution takes place. It’s like receiving a paycheck from your employer for $50,000 with no taxes taken out. When you go to file your taxes the following year, a big tax bill will probably be waiting for you.

In most cases, if you need some or all of the cash from a 401(k) account or an IRA, it usually makes more sense to first rollover the entire balance into an inherited IRA, and then take the cash that you need from there. This strategy gives you more control over the timing of the distributions which may help you to save some money in taxes. If as the spouse, you need the $50,000, but you really need $30,000 now and $20,000 in 6 months, you can rollover the full $50,000 balance to the inherited IRA, take $30,000 from the IRA this year, and take the additional $20,000 on January 2nd the following year so it spreads the tax liability between two tax years.

10% Early Withdrawal Penalty

Typically, if you are under the age of 59½, and you take a distribution from a retirement account, you incur not only taxes but also a 10% early withdrawal penalty on the amount this is distributed from the account. This is not the case when you take a cash distribution, as a beneficiary, directly from the decedents retirement account. You have to report the distribution as taxable income but you do not incur the 10% early withdrawal penalty, regardless of your age.

IRA Options

Let's move onto the two IRA options that are available to spouse beneficiaries. The spouse has the decide whether to:

Rollover the balance into their own IRA

Rollover the balance into an inherited IRA

By processing a direct rollover to an IRA in either case, the beneficiary is able to avoid immediate taxation on the balance in the account. However, it’s very important to understand the difference between these two options because all too often this is where the surviving spouse makes the wrong decision. In most cases, once this decision is made, it cannot be reversed.

Spouse IRA vs Inherited IRA

There are some big differences comparing the spouse IRA and inherited IRA option.

There is common misunderstanding of the RMD rules when it comes to inherited IRA’s. The spouse often assumes that if they select the inherited IRA option, they will be forced to take a required minimum distribution from the account just like non-spouse beneficiaries had to under the old inherited IRA rules prior to the passing of the SECURE Act in 2019. That is not necessarily true. When the spouses establishes an inherited IRA, a RMD is only required when the deceases spouse would have reached age 70½. This determination is based on the age that your spouse would have been if they were still alive. If they are under that “would be” age, the surviving spouse is not required to take an RMD from the inherited IRA for that tax year.

For example, if you are 39 and your spouse passed away last year at the age of 41, if you establish an inherited IRA, you would not be required to take an RMD from your inherited IRA for 29 years which is when your spouse would have turned age 70½. In the next section, I will explain why this matters.

Surviving Spouse Under The Age of 59½

As the surviving spouse, if you are under that age of 59½, the decision between either establishing an inherited IRA or rolling over the balance into your own IRA is extremely important. Here’s why .

If you rollover the balance to your own IRA and you need to take a distribution from that account prior to reaching age 59½, you will incur both taxes and the 10% early withdrawal penalty on the amount of the distribution.

But wait…….I thought you said the 10% early withdrawal penalty does not apply?

The 10% early withdrawal penalty does not apply for distributions from an “inherited IRA” or for distributions to a beneficiary directly from the decedents retirement account. However, since you moved the balance into your own IRA, you have essentially forfeited the ability to avoid the 10% early withdrawal penalty for distributions taken before age 59½.

The Switch Strategy

There is also a little know “switch strategy” for the surviving spouse. Even if you initially elect to rollover the balance to an inherited IRA to maintain the ability to take penalty free withdrawals prior to age 59½, at any time, you can elect to rollover that inherited IRA balance into your own IRA.

Why would you do this? If there is a big age gap between you and your spouse, you may decide to transition your inherited IRA to your own IRA prior to age 59½. Example, let’s assume the age gap between you and your spouse was 15 years. In the year that you turn age 55, your spouse would have turned age 70½. If the balance remains in the inherited IRA, as the spouse, you would have to take an RMD for that tax year. If you do not need the additional income, you can choose to rollover the balance from your inherited IRA to your own IRA and you will avoid the RMD requirement. However, in doing so, you also lose the ability to take withdrawals from the IRA without the 10% early withdrawal penalty between ages 55 to 59½. Based on your financial situation, you will have to determine whether or not the “switch strategy” makes sense for you.

The Spousal IRA

So when does it make sense to rollover your spouse’s IRA or retirement account into your own IRA? There are two scenarios where this may be the right solution:

The surviving spouse is already age 59½ or older

The surviving spouse is under the age of 59½ but they know with 100% certainty that they will not have to access the IRA assets prior to reaching age 59½

If the surviving spouse is already 59½ or older, they do not have to worry about the 10% early withdrawal penalty.

For the second scenarios, even though this may be a valid reason, it begs the question: “If you are under the age of 59½ and you have the option of changing the inherited IRA to your own IRA at any time, why take the risk?”

As the spouse you can switch from inherited IRA to your own IRA but you are not allowed to switch from your own IRA to an inherited IRA down the road.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Are The New Trade Tariffs Good Or Bad For The Stock Market?

US businesses often imports their manufactured goods from China. This is because the cost of manufacturing products is much lower than in other places so they want to take advantage of this. The government makes money off this relationship by imposing tariffs on certain products coming into the US. President Trump announced on March 8, 2018

US businesses often imports their manufactured goods from China. This is because the cost of manufacturing products is much lower than in other places so they want to take advantage of this. The government makes money off this relationship by imposing tariffs on certain products coming into the US. President Trump announced on March 8, 2018 that the United States will begin imposing a tariff on steel and aluminum imported into the U.S. from countries other than Mexico and Canada. The tariff on steel will be 25% and 10% on aluminum. There are two main questions that we will seek to answer in this article:

What happened the last time the U.S. implemented trade tariffs?

How will the stock market react to the new trade barriers?

What Is A Tariff?

First, let's do a quick recap on what a tariff is. A tariff is a special tax on goods that come into the United States. Tariffs are imposed to make select foreign goods more expensive in an effort to encourage the U.S. consumer to buy more American made goods. For example, if the government puts a 25% tariff on cars that are imported into the U.S., that BMW that was manufactured in Germany and shipped over to the U.S. and sold to you for $70,000 will now cost $87,500 for that same exact car due to the 25% tariff. As a consumer this may cause you not to buy that BMW and instead buy a Corvette that was manufactured in the U.S. and carries a lower price tag.

What Does History Tell Us?

It’s very clear from this chart that the U.S. has not imposed meaningful tariffs since the early 1900’s. Conclusion, it’s going to be very difficult to predict how these tariffs are going to impact the U.S. economy and global trade. Even though we have some historical references, the world is very different today compared to 1930. The “global economy” did not even really exist back then.

As you can see in the chart, the average import trade tariff in 1930 was about 20%. Since 1975, the average trade tariff on imports has been below 5%. More recently, between 2000 and 2016 the average tariff on imports was below 2%.

History Will Not Be A Useful Guide

As an investment manager, when a big financial event takes place, we start to scour through historical data to determine what happened in the past when a similar event took place. While we have had tariffs implemented in the past, many of those tariffs were implemented for reasons other than the ones that are driving the U.S. trade policy today.

Prior to 1914, tariffs were used primarily to generate revenue for the U.S. government. In 1850, tariffs represented 91% of the government’s total revenue mainly because there was no income tax back then. By 1900 that percentage had dropped to 41%. As many of us are well aware, over time, the main source of revenue for the government has shifted to the receipt of income and payroll taxes with tariff revenue only representing about 2% of the government’s total receipts.

During the Industrial Revolution (1760 – 1840), tariffs were used to protect the new U.S. industries that were in their infancy. Without tariffs it would have been very difficult for these new industries that were just starting in the U.S. colonies to compete with the price of goods coming from Europe. Tariffs were used to boost the domestic demand for steel, wool, and other goods that were being produced in the U.S. colonies. These trade policies helped the new industries get off the ground, expand the workforce, and led to a prosperous century of economic growth.

Today, tariffs are being used for a different reason. To protect our mature industries from the risk of extinction as a result of foreign competition. Since the 1950’s, the global economy has evolved and the trade policies of the U.S. have been largely in support of free trade. While this sounds like a positive approach, free trade policies have taken their toll on a number of industries here in the U.S. such as steel, automobiles, and electronics. Foreign countries like China have access to cheap labor and they are able to produce select goods and services at a much lower cost than here in the United States.

While this a good thing for the U.S. consumer because you can purchase a big screen TV made in China for a lot less than that same TV made in the U.S., there are negative side effects. First and foremost are the U.S. jobs that are lost when a company decides that it can produce the same product for a lot less over in China. We have seen this trend play out over the past 20 or 30 years. Tariffs can help protect some of those U.S. jobs because it makes products purchased from foreign manufactures more expensive and it increases the demand for U.S. goods. The downside to that is the consumer may be asked to pay more for those same products since at the end of the day it costs more to produce those products in the U.S.

In the announcement of the steel and aluminum tariffs yesterday, the White House also acknowledged the national security risk of certain industries facing extinction in the United States. Below is a chart of production of steel in the U.S. from 1970 – 2016.

As you can see in the chart, our economy has grown dramatically over this time period but we are producing half the amount of steel in the U.S. that we were 47 years ago. If everything stayed the same, this reduction in the U.S. production of steel would probably continue. It begs the question, what happens 50 years from now if there is a global conflict and we are unable to build tanks, jets, and ships because we import 100% of our steel from China and they decide to shut off the supply? There are definitely certain industries that we will always need to protect here in the U.S. even though they may be “cheaper” to buy somewhere else.

There is also monopoly risk. Once we have to import 100% of a particular good or service, those producers have 100% pricing power over us. While I would be less concerned over TV’s and electronics, I would be more concerned over items like cars, foods, building materials, and other items that many of us consider a necessity to our everyday lives.

Free or Fair?

While we have had “free” trade policies over the past few decades, have they been “fair”? Elon Musk, the CEO of Tesla, recently highlighted that “China isn’t playing fair in the car trade with the U.S.” He goes on to point out that China puts a 25% import tariff on American cars sold to China but the U.S. only has a 2.5% import tariff on cars that are manufactured in China and sold in the U.S.

In response to this, Trump mentioned in his speech that the U.S. will be pursuing “reciprocal” or “mirror” trade policies. Meaning, if a country puts a 25% tariff on U.S. goods imported into their country, the U.S. would put a 25% tariff on those same goods that are imported from their country into the U.S.

Trade Wars

While the reciprocal trade policies seem fair on the surface and it also makes sense to protect industries that are vital to our national security, the greatest risk of transitioning from a “free trade” policy to “protectionism” policy is trade wars. We just put a 25% tariff on all of the steel that is imported from China, how is China going to respond to that? Remember, the U.S. is part of a global economy and trade is important. How important? When you look at the gross revenue of all of the companies that make up the S&P 500 Index, over 50% of their revenue now comes from outside the U.S. If all of a sudden, foreign countries start putting tariffs on U.S. goods sold aboard, that could have a big negative impact on the corporate earnings of our big multinational corporations in the United States. In addition, when you listen to the quarterly earnings calls from companies like Apple, Nike, Pepsi, and Ford, the future growth of those companies are relying heavily on their ability to sell their products to the growing consumer base in the emerging market. Countries like China, India, Russia, and Brazil.

I go back to my initial point, that history will not be a great guide for us here. We have not used tariffs in a very long period of time and the reason why we are using tariffs now is different than it was in the past. Plus the world has changed. There is no clear way to know at this point if these new tariffs are going to help or hurt the U.S. economy over the next year because a lot depends on how these foreign countries respond to the United States moving away from the long standing era of free trade.

Canada & Mexico Exempt

The White House announced yesterday that Canada and Mexico would be exempt from the new tariffs. Why? This is my guess and it's only guess, the U.S. is currently in the process of negotiating the NAFTA terms with Canada and Mexico. NAFTA stands for the North American Free Trade Agreement. Trump has made it clear that if we cannot obtain favorable trade terms, the U.S. will exit the NAFTA agreement. The U.S. may use the recent tariff announcement as a negotiation tool in the talks with Canada and Mexico on NAFTA. "Listen, we gave you an exemption but if you don't give us favorable trade terms, all deals are off."

Coin Flip

While tax reform seems like a clear win for U.S. corporations, only history will tell us whether or not these new trade policies will help or harm the U.S. economy. If we are able to protect more U.S. jobs, protect industries vital to the growth and protection of the U.S., and negotiate better trade deals with our trading partners, we may look back and realize this was the right move at the right time.On the flip side of the coin, if trade wars break out that could lead to a decrease in the demand for U.S. goods around the globe that may cause the U.S. to lose more jobs than it is trying to protect. As a result, that could put downward pressure on corporate earnings and in turn send stock prices lower in the U.S. Only time will tell.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Warning To All Employees: Review The Tax Withholding In Your Paycheck Otherwise A Big Tax Bill May Be Waiting For You

As a result of tax reform, the IRS released the new income tax withholding tables in January and your employer probably entered those new withholding amounts into the payroll system in February. It was estimated that about 90% of taxpayers would see an increase in their take home pay once the new withholding tables were implemented.

As a result of tax reform, the IRS released the new income tax withholding tables in January and your employer probably entered those new withholding amounts into the payroll system in February. It was estimated that about 90% of taxpayers would see an increase in their take home pay once the new withholding tables were implemented. While lower tax rates and more money in your paycheck sounds like a good thing, it may come back to bite you when you file your taxes.

The Tax Withholding Guessing Game

Knowing the correct amount to withhold for federal and state income taxes from your paycheck is a bit of a guessing game. Withhold too little throughout the year and when you file your taxes you have a tax bill waiting for you equal to the amount of the shortfall. Withhold too much and you will receive a big tax refund but that also means you gave the government an interest free loan for the year.

There are two items that tell your employer how much to withhold for federal income tax from your paycheck:

Income Tax Withholding Tables

Form W-4

The IRS provides your employer with the Income Tax Withholding Tables. On the other hand, you as the employee, complete the Form W-4 which tells your employer how much to withhold for taxes based on the “number of allowances” that you claim on the form.

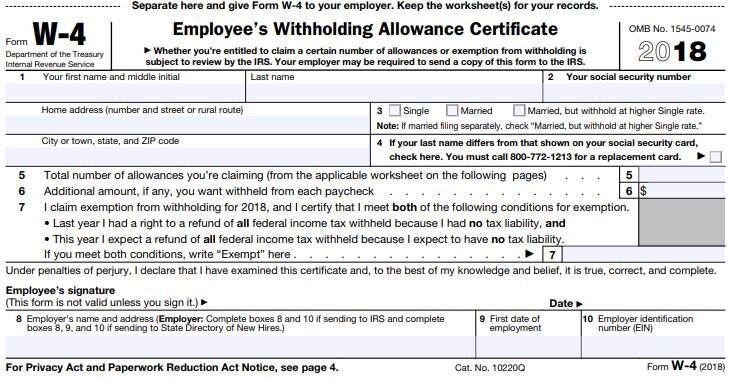

What Is A W-4 Form?

The W-4 form is one of the many forms that HR had you complete when you were first hired by the company. Here is what it looks like:

Section 3 of this form tells your employer which withholding table to use:

Single

Married

Married, but withhold at higher Single Rate

Section 5 tells your employer how many "allowances" you are claiming. Allowance is just another word for "dependents". The more allowances your claim, the lower the tax withholding in your paycheck because it assumes that you will have less "taxable income" because in the past you received a deduction for each dependent. This is where the main problem lies. Due to the changes in the tax laws, the tax deduction for personal exemptions was eliminated. This may adversely affect some taxpayers the were claiming a high number of allowances on their W-4 form because even though the number of their dependents did not change, their taxable income may be higher in 2018 because the deduction for personal exemptions no longer exists.

Even though everyone should review their Form W-4 form this year, employees that claimed allowances on their W-4 form are at the highest risk of either under withholding or over withholding taxes from their paychecks in 2018 due to the changes in the tax laws.

How Much Should I Withhold From My Paycheck For Taxes?

So how do you go about calculating that right amount to withhold from your paycheck for taxes to avoid an unfortunate tax surprise when you file your taxes for 2018? There are two methods:

Ask your accountant

Use the online IRS Withholding Calculator

The easiest and most accurate method is to ask your personal accountant when you meet with them to complete your 2017 tax return. Bring them your most recent pay stub and a blank Form W-4. Based on the changes in the tax laws, they can assist you in the proper completion of your W-4 Form based on your estimated tax liability for the year.If you complete your own taxes, I would highly recommend visiting the updated IRS Withholding Calculator. The IRS calculator will ask you a series of questions, such as:

How many dependents you plan to claim in 2018

Are you over the age of 65

The number of children that qualify for the dependent care credit

The number of children that will qualify for the new child tax credit

Estimated gross wages

How much fed income tax has already been withheld year to date

Payroll frequency

At the end of the process it will provide you with your personal results based on the data that you entered. It will provide you with guidance as to how to complete your Form W-4 including the number of allowances to claim and if applicable, the additional amount that you should instruct your employer to withhold from your paycheck for federal income taxes. Additional withholding requests are listed in Section 6 of the Form W-4.

Avoid Disaster

Having this conversation with your accountant and/or using the new IRS Withholding Calculator will help you to avoid a big tax disaster in 2018. Unfortunately, many employees may not learn about this until it's too late. Employees that are used to getting a tax refund may find out in the spring of next year that they owe thousands of dollars to the IRS because the combination of the new tax tables and the changes in the tax law that caused them to inadvertently under withhold federal income taxes throughout the year.

Action Item!!

Take action now. The longer you wait to run this calculation or to have this conversation with your accountant, the larger the adjustment may be to your paycheck. It's easier to make these adjustments now when you have nine months left in the year as opposed to waiting until November.I would strongly recommend that you share this article with your spouse, children in the work force, and co-workers to help them avoid this little known problem. The media will probably not catch wind of this issue until employees start filing their tax returns for 2018 and they find out that there is a tax bill waiting for them.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Big Changes For 401(k) Hardship Distributions

While it probably seems odd that there is a connection between the government passing a budget and your 401(k) plan, this year there was. On February 9, 2018, the Bipartisan Budget Act of 2018 was passed into law which ended the government shutdown by raising the debt ceiling for the next two years. However, also buried in the new law were

While it probably seems odd that there is a connection between the government passing a budget and your 401(k) plan, this year there was. On February 9, 2018, the Bipartisan Budget Act of 2018 was passed into law which ended the government shutdown by raising the debt ceiling for the next two years. However, also buried in the new law were changes to rules that govern hardship distributions in 401(k) plans.

What Is A Hardship Distribution?

A hardship distribution is an optional distribution feature within a 401(k) plan. In other words, your 401(k) plan may or may not allow them. To answer that question, you will have to reference the plan’s Summary Plan Description (SPD) which should be readily available to plan participants.

If your plan allows hardship distributions, they are one of the few in-service distribution options available to employees that are still working for the company. There are traditional in-service distributions which allow employees to take all or a portion of their account balance after reaching the age 59½. By contrast, hardship distributions are for employees that have experienced a “financial hardship”, are still employed by the company, and they are typically under the age of 59½.

Meeting The "Hardship" Requirement

First, you have to determine if your financial need qualifies as a "hardship". They typically include:

Unreimbursed medical expenses for you, your spouse, or dependents

Purchase of an employee's principal residence

Payment of college tuition and relative education costs such as room and board for the next 12 months for you, your spouse, dependents, or children who are no longer dependents.

Payment necessary to prevent eviction of you from your home, or foreclosure on the mortgage of your primary residence

For funeral expenses

Certain expenses for the repair of damage to the employee's principal residence

Second, there are rules that govern how much you can take out of the plan in the form of a hardship distribution and restrictions that are put in place after the hardship distribution is taken. Below is a list of the rules under the current law:

The withdrawal must not exceed the amount needed by you

You must first obtain all other distribution and loan options available in the plan

You cannot contribute to the 401(k) plan for six months following the withdrawal

Growth and investment gains are not eligible for distribution from specific sources

Changes To The Rules Starting In 2019

Plan sponsors need to be aware that starting in 2019 some of the rules surrounding hardship distributions are going to change in conjunction with the passing of the Budget Act of 2018. The reasons for taking a hardship distribution did not change. However, there were changes made to the rules associated with taking a hardship distribution starting in 2019. More specifically, of the four rules listed above, only one will remain.

No More "6 Month Rule"

The Bipartisan Budget Act of 2018 eliminated the rule that prevents employees from making 401(k) contributions until 6 months after the date the hardship distribution was issued. The purpose of the 6 month wait was to deter employees from taking a hardship distribution. In addition, for employees that had to take a hardship it was a silent way of implying that “if things are bad enough financially that you have to take a distribution from your retirement account, you probably should not be making contributions to your 401(k) plan for the next few months.”

However, for employees that are covered by a 401(k) plan that offers an employer matching contribution, not being able to defer in the plan for 6 months also meant no employer matching contribution during that 6 month probationary period. Starting in 2019, employees will no longer have to worry about that limitation.

Loan First Rule Eliminated

Under the current 401(k) rules, if loans are available in the 401(k) plan, the plan participant was required to take the maximum loan amount before qualifying for a hardship distribution. That is no longer a requirement under the new law.

We are actually happy to see this requirement go away. It never really made sense to us. If you have an employee, who’s primary residence is going into foreclosure, why would you make them take a loan which then requires loan payments to be made via deductions from their paycheck? Doesn’t that put them in a worse financial position? Most of the time when a plan participant qualifies for a hardship, they need the money as soon as possible and having to go through the loan process first can delay the receipt of the money needed to remedy their financial hardship.

Earnings Are Now On The Table

Under the current 401(k) rules, if an employee requests a hardship distribution, the portion of their elective deferral source attributed to investment earnings was not eligible for withdrawal. Effective 2019, that rule has also changed. Both contributions and earnings will be eligible for a hardship withdrawal.

Still A Last Resort

We often refer to hardship distributions as the “option of last resort”. This is due to the taxes and penalties that are incurred in conjunction with hardship distributions. Unlike a 401(k) loan which does not trigger immediate taxation, hardship distributions are a taxable event. To make matters worse, if you are under the age of 59½, you are also subject to the 10% early withdrawal penalty.

For example, if you are under the age of 59½ and you take a $20,000 hardship distribution to make the down payment on a house, you will incur taxes and the 10% penalty on the $20,000 withdrawal. Let’s assume you are in the 24% federal tax bracket and 7% state tax bracket. That $20,000 distribution just cost you $8,200 in taxes.

Gross Distribution: $20,000

Fed Tax (24%): ($4,800)

State Tax (7%): ($1,400)

10% Penalty: ($2,000)

Net Amount: $11,800

There is also an opportunity cost for taking that money out of your retirement account. For example, let’s assume you are 30 years old and plan to retire at age 65. If you assume an 8% annual rate of return on your 401(K) investment that $20,000 really cost you $295,707. That’s what the $20,000 would have been worth, 35 years from now, compounded at 8% per year.

Plan Amendment Required

These changes to the hardship distribution rule will not be automatic. The plan sponsor of the 401(k) will need to amend the plan document to adopt these new rules otherwise the old hardship distribution rules will still apply. We recommend that companies reach out to their 401(k) providers to determine whether or not amending the plan to adopt the new hardship distribution rules makes sense for the company and your employees.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

403(b) Lawsuits Continue To Spread To More Colleges

In the last 3 years, the number of lawsuits filed against colleges for excessive fees and compliance issues related to their 403(b) plans has increased exponentially. Here is a list of just some of the colleges that have had lawsuit brought against them by their 403(b) plan participants:

In the last 3 years, the number of lawsuits filed against colleges for excessive fees and compliance issues related to their 403(b) plans has increased exponentially. Here is a list of just some of the colleges that have had lawsuit brought against them by their 403(b) plan participants:

Yale

NYU

Duke

John Hopkins

MIT

Columbia

Emory

Cornell

Vanderbilt

Northeastern

USC

The fiduciary landscape has completely changed for organizations, like colleges, that sponsor ERISA 403(b) plans. In 2009, new regulations were passed that brought 403(b) plans up to the compliance standards historically found in the 401(k) market. Instead of slowly phasing in the new regulations, the 403(b) market basically went from zero to 60 mph in a blink of an eye. While some of the basic elements of the new rules were taken care of by the current service providers such as the required written plan documents, contract exchange provisions, and new participant disclosures, we have found that colleges, due to a lack of understanding of what is required to fulfill their fiduciary role to the plan, have fallen very short of putting the policies and procedures in place to protect the college from liabilities that can arise from the 403(b) plan.

Top Violations

Based on the lawsuits that have been filled against the various colleges, here is a list of the most common claims that have been included in these lawsuits:

Excessive fees

Fees associated with multiple recordkeepers

Too many investment options

Improper mutual fund share class

Variable annuity products

Excessive Fees

This is by far number one on the list. As you look at these lawsuits, most of them include a claim that the university breached their fiduciary duty under ERISA by allowing excessive fees to be charged to plan participants.

Here is the most common situation that we see when consulting with colleges that leads to this issue. A college had been with the same 403(b) provider for 60 years. Without naming names, they assume that their 403(b) plan has reasonable fees because all of the other colleges that they know of also use this same provider. So their fees must be reasonable right? Wrong!!

If you are member of the committee that oversees that 403(b) plan at your college, how do you answer this question? How do you know that the fees for your plan are reasonable? Can you show documented proof that you made a reasonable effort to determine whether or not the plan fees are reasonable versus other 403(b) providers?

The only way to answer this question is by going through an RFP process. For colleges that we consult with we typically recommend that they put an RFP out every 3 to 5 years. That is really the only way to be able to adequately answer the question: “Are the plan fees reasonable?” Now if you go through the RFP process and you find that another reputable provider is less expensive than your current provider, you are not required to change to that less expensive provider. However, from a fiduciary standpoint, you should acknowledge at the end of the RFP process that there were lower fee alternatives but the current provider was selected because of reasons X, Y, and Z. Document, document, document!!

Investment Fees / Underperformance / Investment Options

Liability is arising in these 403(b) plans due to

Revenue sharing fees buried in the mutual fund expense rations

Underperformance of the plan investments versus the benchmark / peer group

Too many investment options

Investment options concentrated all in one fund family

Restrictions associate with the plan investment

Investment Policy Statement violations or No IPS

Failure to document quarterly and annual investment reviews

Here is the issue. Typically members of these committees that oversee the 403(b) plan are not investment experts and you need to basically be an investment expert to understand mutual fund share classes, investment revenue sharing, peer group comparisons, asset classes represented within the fund menu, etc. To fill the void, colleges are beginning to hire investment firms to serve as third party consultants to the 403(b) committee. In most cases these firms charge a flat dollar fee to:

Prepare quarterly investment reports

Investment benchmarking

Draft a custom Investment Policy Statement

Coordinate the RFP process

Negotiation plan fees with the current provider

Conduct quarterly and annual reviews with the 403(b) committee

Compliance guidance

Multiple Recordkeepers

While multiple recordkeepers is becoming more common for college 403(b) plans, it requires additional due diligence on the part of the college to verify that it’s in the best interest of the plan participants. Multiple recordkeepers means that your 403(b) plan assets are split between two or more custodians. For example, a college may use both TIAA CREF and Principal for their 403(b) platform. Why two recordkeepers? Most of the older 403(b) accounts are setup as individual annuity contracts. As such, if the college decides to charge their 403(b) provider, unlike the 401(k) industry where all of the plan assets automatically move over to the new platform, each plan participant is required to voluntarily sign forms to move their account balance from the old 403(b) provider to the new 403(b) provider. It’s almost impossible to get all of the employee to make the switch so you end up with two separate recordkeepers.

Why does this create additional liability for the college? Even through the limitation set forth by these individual annuity contracts is out of the control of the college, by splitting the plan assets into two pieces you may be limiting the economies of scale of the total plan assets. In most cases the asset based fees for a 403(b) plan decreases as the plan assets become larger with that 403(b) provider. By splitting the assets between two 403(b) platforms, you are now creating two smaller plans which could result in larger all-in fees for the plan participants.

Now, it may very well be in the best interest of the plan participants to have two separate platforms but the college has to make sure that they have the appropriate documentation to verify that this due diligence is being conducts. This usually happens as a result of an RFP process. Here is an example. A college has been using the same 403(b) provider for the last 50 years but to satisfy their fiduciary obligation to the plan they going through the RFP process to verify that their plan fees are reasonable. Going into the RFP process they had no intention of change provides but as a result of the RFP process they realize that there are other 403(b) providers that offer better technology, more support for the plan sponsor, and lower fees than their current platform. While they are handcuffed by the individual contracts in the current 403(b) plan, they still have control over where the future contributions of the plan will be allocated so they decide that it’s in both the plan participants and the college’s best interest to direct the future contributions to the new 403(b) platform.

Too Many Investment Options

More is not always better in the retirement plan world. The 403(b) oversite committee, as a fiduciary, is responsible for selecting the investments that will be offered in accordance with the plan’s investment menu. Some colleges unfortunately take that approach that if we offer 80+ different mutual funds for the investment that should “cover all of their bases” since plan participants have access to every asset class, mutual fund family, and ten different small cap funds. The plaintiffs in these 403(b) lawsuits alleged that many of the plan’s investment options were duplicates, performed poorly, and featured high fees that are inappropriate for large 403(b) plans.

To make matters worse, if you have 80+ mutual funds on your 403(b) investment menu, you have to conduct regular and on-going due diligence on all 80+ mutual funds in your plan to make sure that they still meet the investment criteria set out in the plan’s IPS. If you have mutual funds in your plan that fall outside of the IPS criteria and those issues have not been addressed and/or documented, if a lawsuit is brought against the college it will be very difficult to defend that the college was fulfilling its fiduciary obligation to the investment menu.

Improper Mutual Fund Share Classes

To piggyback on this issue, what many plan sponsors don’t realize is that by selecting a more limited menu of mutual funds it can lower the overall plan fees. Mutual funds have different share classes and some share classes require a minimum initial investment to gain asset to that share class. For example you may have Mutual Fund A retail share class with a 0.80% internal expense ratio but there is also a Mutual Fund A institutional share class with a 0.30% internal expense ratio. However, the institutional share class requires an initial investment of $100,000 to gain access. If Mutual Fund A is a U.S. Large Cap Stock Fund and your plan offers 10 other U.S. Large Cap Stock Funds, your plan may not meet the institutional share requirement because the assets are spread between 10 different mutual funds within the same asset class. If instead, the committee decided that it was prudent to offer just Mutual Fund A to represent the U.S. Large Cap Stock holding on the investment menu, the plan may be able to meet that $100,000 minimum initial investment and gain access to the lower cost institutional share class.

Variable Annuity Products

While variable annuity products have historically been a common investment option for 403(b) plans, they typically charge fees that are higher than the fees that are charged by most standard mutual funds. In addition, variable annuities can place distribution restrictions on select investment investments which may not be in the plan participants best interest.

The most common issue we come across is with the TIAA Traditional investment. While TIAA touts the investment for its 3% guarantee, we have found that very few plan participants are aware that there is a 10 year distribution restriction associated with that investment. When you go to remove money from the TIAA Traditional fund, TIAA will inform you that you can only move 1/10th of your balance out of that investment each year over the course of the next ten years. You can see how this could be a problem for a plan participant that may have 100% of their balance in the TIAA Traditional investment as they approach retirement. Their intention may have been to retire at age 65 and rollover the balance to their own personal IRA. If they have money in the TIAA Traditional investment that is no longer an option. They would be limited to process a rollover equal to 1/10th of their balance in the TIAA Tradition investment between the age of 65 and 74. Only after age 74 would they completely free from this TIAA withdrawal restriction.

Consider Hiring A Consultant

While this may sound self-serving, colleges are really going to need help with the initial and on-going due diligence associate with keeping their 403(b) plan in compliance. For a reasonable cost, colleges should be able to engage an investment firm that specialized in this type of work to serve as a third party consultant for the 403(b) investment committee. Just make sure the fee is reasonable. The consulting fee should be expressed as a flat dollar amount fee, not an asset based fee, because they are fulfilling that role as a “consultant”, not the “investment advisor” to the 403(b) plan assets.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Top 2 Strategies For Paying Off Student Loan Debt

With total student loan debt in the United States approaching $1.4 Trillion dollars, I seem to be having this conversation more and more with clients. There has been a lot of speculation between president obama and student loans, but student loan debt is still piling up. The amount of student loan debt is piling up and it's putting the next generation of

With total student loan debt in the United States approaching $1.4 Trillion dollars, I seem to be having this conversation more and more with clients. There has been a lot of speculation between president obama and student loans, but student loan debt is still piling up. The amount of student loan debt is piling up and it's putting the next generation of our work force at a big disadvantage. While you yourself may not have student loan debt, at some point you may have to counsel a child, grandchild, friend, neighbor, or a co-worker that just can't seem to get ahead because of the financial restrains of their student loan payments. After all, for a child born today, it's projected that the cost for a 4 year degree including room and board will be $215,000 for a State College and $487,000 for a private college. Half a million dollars for a 4 year degree!!

The most common reaction to this is: "There is no way that this can happen. Something will have to change." The reality is, as financial planners, we were saying that exact same thing 10 years ago but we don't say that anymore. Despite the general disbelief that this will happen, the cost of college has continued to rise at a rate of 6% per year over the past 10 years. It's good old supply and demand. If there is a limited supply of colleges and the demand for a college degree keeps going up, the price will continue to go up. As many of us know, a college degree is not necessarily an advantage anymore, it's the baseline. You need it just to get the job interview and that will be even more true for types of jobs that will be available in future years.

No Professional Help

Making matters worse, most individuals that have large student loan debt don't have access to high quality financial planners because they do not have any investible assets since everything is going toward paying down their student loan debt. I wrote this article to give our readers a look into how we as Certified Financial Planners® help our clients to dig out of student loan debt. Unfortunately a lot of the advice that you will find by searching online is either incomplete or wrong. The solution for digging out of student loan debt is not a one size fits all solution and there are trap doors along the way.

Loan Inventory

The first step in the process is to the collect and organize all of the information pertaining to your student loan debt. Create a spreadsheet that lists the following information:

Name of Lender

Type of Loan (Federal or Private)

Name of Loan Servicer

Total Outstanding Loan Balance

Interest Rate

Fixed or Variable Interest Rate

Minimum Monthly Payment

Current Monthly Payment

Estimated Payoff Date

Now, below this information I want you to list January 1 of the current year and the next 10 years. It will look like this:

Total Balance

January 1, 2018

January 1, 2019

January 1, 2020

Each year you will record your total student loan debt below your itemized student loan information. Why? In most cases you are not going to be able to payoff your student loans overnight. It’s going to be a multi-year process. But having this running total will allow you to track your progress. You can even add another column to the right of the “Total Balance” column labelled “Goal”. If your goal is to payoff your student loan debt in five years, set some preliminary balance goals for yourself. When you receive a raise or a bonus at work, a tax refund, or a cash gift from a family member, this will encourage you to apply some or all of those cash windfalls toward your student loan balance to stay on track.

Order of Payoff

The most common advice you will find when researching this topic is “make minimum payments on all of the student loans with the exception of your student loan with the highest interest rate and apply the largest payment you can against that loan”. Mathematically this is the right strategy but we do not necessary recommend this strategy for all of our clients. Here’s why……..

There are two situations that we typically run into with clients:

Situation 1: “I’m drowning in student loan debt and need a lifeline”

Situation 2: “I’m starting to make more money at my job. Should I use some of that extra income to pay down my student loan debt or should I be applying it toward my retirement plan or saving for a house?”

Situation 1: I'm Drowning

As financial planners we are unfortunately running into Situation 1 more frequently. You have young professionals that are graduating from college with a 4 year degree, making $50,000 per year in their first job, but they have $150,000 of student loan debt. So they basically have a mortgage that starts 6 months after they graduate but that mortgage payment comes without a house. For the first few years of their career they are feeling good about their new job, they receive some raises and bonuses here and there, but they still feel like they are struggling every month to meet their expenses. The realization starts to set in the “I’m never going to get ahead because these student loan payments are killing me. I have to do something.”

If you or someone you know is in this category remember these words: “Cash is king”. You will hear this in the business world and it’s true for personal finances as well. As mentioned earlier, from a pure math standpoint, they fastest way to get out of debt is to target the debt with the highest interest rate and go from there. While mathematically that may work, we have found that it is not the best strategy for individuals in this category. If you are in the middle of the ocean, treading water, with the closest island a mile away, why are we having a debate about how fast you can swim to that island? You will never make it. Instead you just need someone to throw you a life preserver.

Life Preserver Strategy

If you are just barely meeting your monthly expense or find yourself falling short each month, you have to stop the bleeding. In these situations, you should be 100% focus on improving your current cash flow not whether you are going to be able to payoff your student loans in 8 years instead of 10 years. In the spreadsheet that you created, organize all of your student loan debt from the largest outstanding loan balance to the smallest. Ignore the interest rate column for the time being. Next, begin making the minimum payments on all of your student loans except for the one with the SMALLEST BALANCE. We need to improve your cash flow which means reducing the number of monthly payments that you have each month. Once the month to month cash flow is no longer an issue then you can graduate to Situation 2 and revisit the debt payoff strategy.

This strategy also builds confidence. If you have a $50,000 loan with a 7% interest rate and two other student loans for $5,000 with an interest rate of 4% while applying more money toward the largest loan balance will save you the most interest long term, it’s going to feel like your climbing Mt. Everest. “Why put an extra $200 toward that $50,000 loan? I’m going to be paying it until I’m 50.” There is no sense of accomplishment. We find that individuals that choose this path will frequently abandon the journey. Instead, if you focus your efforts on the loans with the smaller balances and you are able to pay them off in a year, it feels good. Getting that taste of real progress is powerful. This strategy comes from the book written by Dave Ramsey called the Total Money Makeover. If you have not read the book, read it. If you have a child or grandchild graduating from college, if you were going to give them a check for graduation, buy the book for them and put the check in the book. Tell them that “this check will help you to get a start in your new career but this book is worth the amount of the check multiplied by a thousand”.

Situation 2: Paying Off Your Student Loans Faster

If you are in Situation 2, you are no longer treading water in the middle of the ocean and you made it to the island. The name of this island is “Risk Free Rate Of Return”. Let me explain.

Individuals in this scenario have a good handle on their monthly expenses and they are finding that they now have extra discretionary income. So what’s the best use of that extra income? When you are younger there are probably a number items on your wish list, some of which you may debate looking into title loans near me to obtain. Here are the top four that we see:

Retirement savings

Saving for a house

Paying off student loan debt

Buying a new car

Don't Leave Free Money On The Table

Before applying all of your extra income toward your student loan payments, we ask our clients “what is the employer contribution formula for your employer’s retirement plan?” If it’s a match formula, meaning you have to put money in the plan to get the employer contribution, we will typically recommend that our clients contribute the amount needed to receive the full employer match. Otherwise you are leaving free money on the table.

The amount of that employer contribution represents a risk free rate of return. Meaning, unlike the investing in the stock market, you do not have to take any risk to receive that return on your money. If your company guarantees a 100% match on the first 5% of pay contribution out of your paycheck into the plan, your money is guaranteed to double up to 5% of your pay. Where else are you going to get a 100% risk free rate of return on your money?

Start With The Highest Interest Rate

Now that you have extra income each month you can begin to pick and choose how you apply it. You should list all of you student loans from the highest interest rate to the lowest. If it’s close between two interest rates but one is a fixed interest rate and the other is a variable interest rate, it’s typically better to pay down the variable interest rate loan first if interest rates are expected to move higher. Apply the minimum payment amount to all of your student loan payments and apply as much as you can toward the loan with the HIGHEST INTEREST RATE. Once the loan with the highest interest rate is paid off, you will move on to the next one.

Again, by applying more money toward your student loans, those additional payments represent a risk free rate of return equal to the interest rate that is being charges on each loan. For example, if the highest interest rate on one of your student loans is 7%, every additional dollar that you are apply toward paying off that loan you are receiving a 7% rate of return on because you are not paying that amount to the lender.

Here is a rebuttal question that we sometimes get: “But wouldn’t it be better to put it in the stock market and earn a higher rate of return?” However, that’s not an apple to apples comparison. The 7% rate of return that you are receiving by paying down that student loan balance is guaranteed because it represents interest that would have been paid to the lender that you are now keeping. By contrast, even though the stock market may average an 8% annualized rate of return over a 10 year period, you have to take risk to obtain that 8% rate of return. A 7% risk free rate of return is the equivalent of being able to buy a CD at a bank with a 7% interest rate guaranteed by the FDIC which does not exist right now.

But Can't I Deduct The Interest On My Student Loans?

It depends on how much you make. In 2018, if you are single, the deduction for student loan interest begins to phaseout at $70,000 of AGI and you completely lose the deduction once your AGI is above $85,000. If you are married filing a joint tax return, the deduction begins to phaseout at $140,000 of AGI and it’s completely gone once your AGI hits $170,000.

Also the deduction is limited to $2,500.

However, even if you can deduct the interest on your student loan, the tax benefit is probably not as big as you think. Let me explain via an example. Take the following fact set:

Tax Filing Status: Single

Adjusted Gross Income (AGI): $50,000

Outstanding Student Loan Balance: $60,000

Interest Rate: 7% ($4,200 Per Year)

First, you are limited to deducting $2,500 of the $4,200 in student loan interest that you paid to the lender. At $50,000 of AGI your top federal tax bracket in 2018 is 22%. So that $2,500 equals $550 in actual tax savings ($2,500 x 22% = $550). If you want to get technical, taking the tax deduction into account, your after tax interest rate on your student loan debt is really 6.08% instead of 7%. Can you get a CD from a bank right now with a 6% interest rate? No. From both a debt reduction standpoint and a rate of return standpoint, it probably makes sense to pay down that loan more aggressively.

Striking A Balance

When you are younger, you typically have a lot of financial goals such as saving for retirement, paying off debt, saving for the down payment on your first house, starting a family, college savings for you kids, etc. While I'm sure you would like to take all of your extra income and really start aggressively reducing your student loans you have to determine what the right balance is between all of your financial goals. If you receive a $5,000 bonus from work, you may allocate $3,000 of that toward your student loan debt and deposit $2,000 in your savings account for the eventual down payment on your first house. We also recommend speaking a loan authority company to see what can be done to help you reach your goal. One example being to create that "goal" column in your student loan spreadsheet will help you to keep that balance and eventually lead to the payoff of all of your student loans.

Forgiveness Scheme

Although they are not very common and only a few people can qualify for one of these schemes, they will provide great help. A student loan forgiveness scheme can help a student pay off their loan over an extended period of time, a shorter period of time, reduce the amount they owe, or entirely pay off the loan for them. However, like I have already mentioned, this is based upon whether they qualify or not.I hope this has been of some assistance and i have provided you with some helpful advice on how to prepare for and manage your student loan.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

No Deduction For Entertainment Expenses In 2019. Ouch!!

There is a little known change that was included in tax reform that will potentially have a big impact on business owners. The new tax laws that went into effect on January 1, 2018 placed stricter limits on the ability to deduct expenses associated with entertainment and business meals. Many of the entertainment expenses that businesses

There is a little known change that was included in tax reform that will potentially have a big impact on business owners. The new tax laws that went into effect on January 1, 2018 placed stricter limits on the ability to deduct expenses associated with entertainment and business meals. Many of the entertainment expenses that businesses were able to deduct in 2017 will no longer we allowed in 2018 and beyond. A big ouch for business owners that spend a lot of money entertaining clients and prospects.

A Quick Breakdown Of The Changes

No Deduction in 2019