Year End Tax Strategies

The end of the year is always a hectic time but taking the time to sit with a tax professional and determine what tax strategies will work best for you may save thousands on your tax bill due April 15th. As the deadline for your taxes starts to get closer, you may be in such a rush to file them on time that you make some mistakes in the process, but

The end of the year is always a hectic time but taking the time to sit with a tax professional and determine what tax strategies will work best for you may save thousands on your tax bill due April 15th. As the deadline for your taxes starts to get closer, you may be in such a rush to file them on time that you make some mistakes in the process, but don't worry, you won't be the only one. If you don't have the relevant tax strategy in place, you are more prone to mistakes. So, the purpose of this article is to discuss some of the most common tax strategies that may apply to you. It may be worth contacting a company that specializes in tax services if you're unsure of how to go about these strategies though. Some of the deadlines for these strategies aren't until tax filing but the majority include an action item that must be done by December 31st to qualify and therefore taking the time before year end is crucial.

Taxable Investment Accounts

Offset some of the realized gains incurred during the year by selling investments in loss positions. Often times dividends received and sales made in a taxable investment account are reinvested. Although the owner of the account never received cash in the transaction, the gain is still realized and therefore taxable. This may cause an issue when the cash is not available to pay the tax bill. By selling investments in a loss position prior to 12/31, you will offset some, if not all, of the gain realized during the year. If possible, sell enough investments in a loss position to take advantage of the maximum $3,000 loss that can be claimed on your tax return.

Note: The IRS recognized this strategy was being abused and implemented the "wash sale" rule. If you sell an investment in a loss position to diminish gains and then repurchase the same investment within 30 days, the IRS does not allow you to claim the loss therefore negating the strategy.

Convert a Traditional IRA to a Roth IRA

If you are in a low income year and will be taxed at a lower tax bracket than projected in the future, it may make sense to convert part of a traditional IRA to a Roth IRA. The current maximum contribution to a Roth IRA in a single year is $5,500 if under 50 and $6,500 if 50 plus. You will pay taxes on the distributions from the traditional but the benefit of a Roth is that all the contributions and earnings accumulated is tax free when distributed as long as the account has been opened for at least 5 years. Roth accounts are typically the last touched during retirement because you want the tax free accumulation as long as possible. Also, Roth accounts can be passed to a beneficiary who can continue accumulating tax free. Roth money is after tax money and therefore the IRS allows you to withdraw contributions tax and penalty free and let the earnings continue to accumulate tax free. If you don't have the cash come tax time to cover the conversion, you can convert the Roth money back to a traditional IRA by tax filing plus extension and the account will be treated as the Roth conversion never took place.

Donate to Charity if you Itemize

If you itemize deductions on your tax return, go through your closet and donate any clothing or household goods that you no longer use. There are helpful tools online that will allow you to value the items donated but be sure you keep record of what was donated and have the charity give you a receipt.

Max Out Your Employer Sponsored Retirement Plan

If you know you will be hit with a big tax bill and want to defer some of the taxes, max out your retirement plan if you haven't already. Employer sponsored plans, such as 401(k)'s, must be funded through payroll by 12/31 and therefore it is important to make this determination early and request your payroll department start upping your contribution for the remaining payroll periods in the year. The maximum for 401(k)'s in 2015 and 2016 is $18,000 if under 50 and $24,000 if 50 plus.

Business Owners – Cut Checks by 12/31

If your company had a great year and the cash is available, use it to pay for expenses you would normally hold off on. This could mean paying state taxes early, paying invoices you usually wait until the end of the payment term, paying monthly expenses like health or general insurance, or buying new office equipment. This might also mean investing in new office furniture such as chairs and desks, or more storage space for all of your paperwork and electronics. Above all, by getting the checks cut by 12/31, you realize the expense in the current year and will decrease your tax bill.

Business Owners – Set Up a Retirement Plan

For owners with no full time employees, a Single(k) plan being put in place by 12/31 will allow you to fund a retirement account up to the 401(k) limits mentioned early. As long as the plan is established by 12/31, the owner will be able to fund the plan any time before tax filing plus extension. If the plan is not established by 12/31, other options like the SEP IRA are available to take money off the table come tax time.With tax laws continuously changing, it is important to consult with your tax professional as there may be strategies available to you that could save you money. Don't procrastinate as some planning before the end of the year may be necessary to take full advantage.

About Rob.........

Hi, I'm Rob Mangold. I'm the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.

How Much Life Insurance Do I Need?

Do you even need life insurance? If you have dependants to protect and you do not have enough savings, you will most likely need life insurance. But the question is how much should I have? Well, your home will be one of your biggest assets, and in some cases the money that it makes from its sale when you have passed away is a significant inheritance

Do you even need life insurance? If you have dependants to protect and you do not have enough savings, you will most likely need life insurance. But the question is how much should I have? Well, your home will be one of your biggest assets, and in some cases the money that it makes from its sale when you have passed away is a significant inheritance for your children.

If you do not have dependents or you have enough savings to cover the current and future expenses for your dependents there really is no need for life insurance. Life insurance sales professional can be very aggressive with their sales tactics and sometime they mask their services as "financial planning" but all of their solutions lead to you buying an expensive whole life insurance policy.

Remember, life insurance is simply a transfer of risk. When you are younger, have a family, a mortgage, and are just starting to accumulate assets, the amount of life insurance coverage is usually at its greatest. But as your children grow up, they finish college, you pay your mortgage, you have no debt, and you have accumulated a good amount in retirement savings, your need to transfer that risk diminishes because you have essentially become self-insured. Just because you had a $1M dollar life insurance policy issued 10 years ago does not mean that is the amount you need now.

Which kind of insurance should you get?

It's our opinion that for most individuals term insurance makes the most sense. Insurance agents are always very eager to sell whole life, variable life, and universal life policies. Why? They pay big commissions!! When you compare a $1M 30 year term policy and a $1M Whole Life policy side by side, often times the annual premium for whole life insurance is 10 times that amount of the term insurance policy. Insurance agents will tout that the whole life policy has cash value, you can take loans, and that it's a tax deferred savings vehicle. But often time when you compare that to: "If I just bought the cheaper term insurance and did something else with the money I would have spent on the more expensive whole life policy such as additional pre-tax retirement savings, college savings for the kids, paying down the mortgage, or setting up an investment management account, at the end of the day I'm in a much better spot financially."

How much life insurance do you need?

The most common rule of thumb that I hear is "10 times my annual salary". Please throw that out the window. The amount of insurance you need varies greatly from individual to individual. The calculation to reach the answer is fairly straight forward. Below is the approach we take with our clients:

How much debt do you have? This includes mortgages, car loans, personal loans, credit cards, etc. Your total debt amount is your starting point.

What are your annual expenses? Just create a quick list of your monthly expenses, they do not have to be exact, and our recommendation is to estimate on the high side just to be safe. Then multiply your monthly expense by 12 months to reach your "annual after tax expenses".

How much monthly income do you have to replace? If you are married, we have to look at the income of each spouse. If your monthly expenses are $50,000 per year and the husband earns $30,000 and the wife earns $80,000, we are going to need more insurance on the wife because we have to replace $80,000 per year in income if she were to pass away unexpectedly. Married couples make the mistake of getting the same face value of insurance just because. Look at it from an income replacement standpoint. If you are a single parent or provider, you will just look at the amount of income that is needed to meet the anticipated monthly expenses for your dependents.

Factor in long term savings goals and expenses. Examples of this are the college cost for your children and the annual retirement savings for the surviving spouse.

Example:

Husband: Age 40: Annual Income $70,000

Wife: Age 41: Annual Income $70,000

Children: Age 13 & 10

Total Outstanding Debt with Mortgage: $250,000

Total Annual After Tax Expenses: $90,000

Savings & Investment Accounts: $100,000

Remember there is not a single correct way to calculate your insurance need. This example is meant to help you through the thought process. Let's look at an insurance policy for the husband. We first look at what the duration of the term insurance policy should be. Our top two questions are "when will the mortgage be paid off?" and "when will the kids be done with college?" These are the two most common large expenses that we are insuring against. In this example let's assume they have 20 years left on their mortgage so at a minimum we will be looking at a 20 year term policy since the youngest child will done with their 4 year degree within the next 12 years. So a 20 year term covers both.

Here is how we would calculate the amount. Start with the total amount of debt: $250,000. That is our base amount. Then we need to look at college expense for the kids. Assume $20K per year for each child for a 4 year degree: $160,000. Next we look at how much annual income we need to replace on the husband's life to meet their monthly expense. In this example it will be close to all of it but let's reduce it to $60K per year. It is determined that they will need their current level of income until the mortgage is paid in full so $60,000 x 20 Years = $1,200,000. When you add all of these up they will need a 20 year term policy with a death benefit of $1,610,000. But we also have to take into account that they already have $100,000 in savings and their levels of debt should decrease with each year as time progresses. In this scenario we would most likely recommend a 20 Year Term Policy with a $1.5M death benefit on the husband's life.

The calculation for his wife in this scenario would be similar since they have the same level of income.

About Michael.........

Hi, I'm Michael Ruger. I'm the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Paying Down Debt: What is the Best Strategy?

Living with debt is not easy. It can be a constant burden and easily disrupt day-to-day life. Having debt will also ruin your credit score too. The worse your credit score gets, the less likely you will be accepted for any type of loan. One of the fastest ways to get rid of your debt is to pay your debt off in the correct order.

Living with debt is not easy. It can be a constant burden and easily disrupt day-to-day life. Having debt will also ruin your credit score too. The worse your credit score gets, the less likely you will be accepted for any type of loan. One of the fastest ways to get rid of your debt is to pay your debt off in the correct order.

STEP 1: Create a list of all your current debts

The first step is understanding what you owe. To start, make a master list of all your monthly credit card and loan statements. For each bill, include:

The creditor's name

The total amount you owe on that bill

The minimum required monthly payment

The interest rate (also known as APR)

The payment due date

STEP 2: List all of your monthly expenses

Add up all your monthly expenses: rent, car, food, utilities, health insurance and the minimum payments on your debts; as well as regular spending on things such as entertainment and clothing. Subtract that figure from your monthly after-tax income. The remaining amount is what you could put toward debt repayment each month-though it may make sense for you to save some.

STEP 3: Call your lenders

Call your lenders and explain your situation. They may be willing to lower your interest rate temporarily or waive late fees. You may also be able to lower your interest rate by transferring some high-interest credit card debt onto a new credit card with a lower rate (though that's not a long-term solution).

STEP 4: Payoff high interest rate or small balances first

You can start with the bill carrying the highest interest, or the one with the smallest balance. Prioritizing the highest-rate debt can save you more money: You pay off your most expensive debt sooner. Paying off the smallest debt can eliminate a bill faster, providing a motivating boost. Whichever you choose, make sure to pay at least the minimum on all your debts.

Pay the monthly minimum on each debt. The exception: your target bill. Put more money toward this one to pay it down faster. Once you pay off that bill, choose another to pay down aggressively. Your monthly debt repayment total shouldn't change, even when you eliminate bills. This way you gain momentum as you go, putting more and more money toward each remaining bill.

STEP 5: Get creative

You can use your annual tax refund or holiday bonus to pay down debt. Look for small ways to save money every day, such as riding your bike to work, or eating in instead of dining out. Another way to make a dent quickly is to sell unused or unnecessary belongings-maybe downgrading your car to a more affordable model with lower monthly payments.

STEP 6: Break the cycle

As you start to escape debt, it can be tempting to reward yourself by splurging on a new smartphone or an expensive dinner but just a few purchases can erase all your hard work. Instead, buy things with cash or your debit card, and think long and hard before taking on any new debt.

Read this book

If you want to live a debt free life, I strongly recommend you read the book "Total Money Makeover" by Dave Ramsey. Ramsey's book really paves the way to get out of debt and stay out of debt.

About Michael.........

Hi, I'm Michael Ruger. I'm the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

What is the Process for Setting Up a Will?

Creating a will is often a task that everyone knows they should do but it gets put on the back burner. Creating a will is one of the most critical things you can do for your loved ones. Putting your wishes on paper helps your heirs avoid unnecessary hassles, and you gain the peace of mind knowing that a life's worth of possessions will end up in the right

Creating a will is often a task that everyone knows they should do but it gets put on the back burner. Creating a will is one of the most critical things you can do for your loved ones. Putting your wishes on paper helps your heirs avoid unnecessary hassles, and you gain the peace of mind knowing that a life's worth of possessions will end up in the right hands. But before for you do, it helps to know the overall process of setting up a will to save you time and money.

What is a will?

A will is simply a legal document in which you, the testator, declare who will manage your estate after you die. Your estate can consist of big, expensive things such as a vacation home but also small items that might hold sentimental value such as photographs. The person named in the will to manage your estate is called the executor because he or she executes your stated wishes. Sometimes though, people get confused by this and aren't too sure what the meaning of an executor.

A will can also serve to declare who you wish to become the guardian for any minor children or dependents, and who you want to receive specific items that you own - Aunt Sally gets the silver, Cousin Billy the bone china, and so on. Someone designated to receive any of your property is called a "beneficiary."

Some types of property, including certain insurance policies and retirement accounts, generally aren't covered by wills. You should've listed beneficiaries when you took out the policies or opened the accounts. Check if you can't remember, and make sure you keep beneficiaries up to date, since what you have on file when you die should dictate who receives those assets.

What happens if I die without a will?

If you die without a valid will, you'll become what's called intestate. That usually means your estate will be settled based on the laws of your state that outline who inherits what. Probate is the legal process of transferring the property of a deceased person to the rightful heirs.

Since no executor was named, a judge appoints an administrator to serve in that capacity. An administrator also will be named if a will is deemed to be invalid. All wills must meet certain standards such as being witnessed to be legally valid. Again, requirements vary from state to state.

An administrator will most likely be a stranger to you and your family, and he or she will be bound by the letter of the probate laws of your state. As such, an administrator may make decisions that wouldn't necessarily agree with your wishes or those of your heirs.

Do I need an attorney to prepare my will?

No, you aren't required to hire a lawyer to prepare your will, though an experienced attorney can provide useful advice on estate-planning strategies such as establishing testamentary, revocable, and irrevocable trusts. But as long as your will meets the legal requirements of your state, it's valid whether a lawyer drafted it or you wrote it yourself on the back of a napkin.

Do-it-yourself will kits are widely available online which are of course better than nothing but we usually recommend that our clients at least have an attorney review their will and make sure the specifications in their will match their wishes.

Should my spouse and I have a joint will or separate wills?

Estate planners almost universally advise against joint wills, and some states don't even recognize them. Odds are you and your spouse won't die at the same time, and there's probably property that's not jointly held. That's why separate wills make better sense, even though your will and your spouse's will might end up looking remarkably similar.

In particular, separate wills allow for each spouse to address issues such as ex-spouses and children from previous relationships. Ditto for property that was obtained during a previous marriage. Be very clear about who gets what. Probate laws generally favor the current spouse.

Who should I name as my executor?

You can name your spouse, an adult child, or another trusted friend or relative as your executor. If your affairs are complicated, it might make more sense to name an attorney or someone with legal and financial expertise. You can also name joint executors, such as your spouse or partner and your attorney.

One of the most important things your will can do is empower your executor to pay your bills and deal with debt collectors. Make sure the wording of your will allows for this, and also gives your executor leeway to take care of any related issues that aren't specifically outlined in your will.

How do I leave specific items to specific heirs?

If you wish to leave certain personal property to certain heirs, indicate as much in your will. In addition, you can create a separate document called a letter of instruction that you should keep with your will.

A letter of instruction, which isn't legally binding in some states, can be written more informally than a will and can go into detail about which items go to whom. You can also include specifics about any number of things that will help your executor settle your estate including account numbers, passwords and even burial instructions.

Another option is to leave everything to one trusted person who knows your wishes for distributing your personal items. This, of course, is risky because you're relying on this person to honor your intentions without fail. Consider carefully.

Who has the right to contest my will?

Contesting a will refers to challenging the legal validity of all or part of the document. A beneficiary who feels slighted by the terms of a will might choose to contest it. Depending on which state you live in, so too might a spouse, ex-spouse or child who believes your stated wishes go against local probate laws.

A will can be contested for any number of other reasons: it wasn't properly witnessed; you weren't competent when you signed it; or it's the result of coercion or fraud. It's usually up to a probate judge to settle the dispute. The key to successfully contesting a will is finding legitimate legal fault with it. A clearly drafted and validly executed will is the best defense.

About Michael.........

Hi, I'm Michael Ruger. I'm the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Need to Know College Savings Strategies

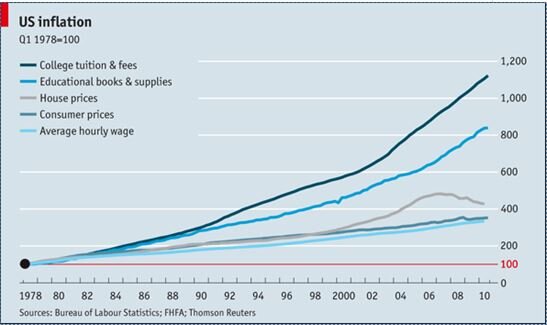

Our newsletter this quarter is dedicated to helping families plan for what has become a life-altering cost of paying for college. But do not fear, there are simple things you can do to boost your children's college fund. It is not news to anyone that over the past 30 years, the cost of college tuition and room & board at all levels has spun out of control.

Our newsletter this quarter is dedicated to helping families plan for what has become a life-altering cost of paying for college. But do not fear, there are simple things you can do to boost your children's college fund. It is not news to anyone that over the past 30 years, the cost of college tuition and room & board at all levels has spun out of control. The year over year increase in the cost of tuition and fees since 1978 to date has far outpaced any reasonable rate of inflation, and demands a new look at college savings strategies. In the chart below, you will see the increase in the price of college tuition and fee versus other comparable expenses over the past 30 years. Its mind blowing!!

Fund A 529 Account*

As far as college savings strategies go, there are very few options that beat 529 accounts as a savings vehicle for college. In these accounts you make after tax contribution to the account and when the amounts are withdrawn, as long as those withdrawals are attributed to a qualified college expenses, the earnings generated by the account are tax free. Depending on the state you live in you may be eligible to receive a state tax deduction for contribution up to specified dollar amount. In New York, single filers receive a NYS tax deduction up to $5,000 and married filing joint $10,000.

Also for financial aid purposes these account are looked at very favorably in the EFC (Expected Family Contribution) calculation. They are looked at by FASFA as an asset of the "parent" not the asset of the "child". There are many contribution and withdrawal strategies associated with these accounts that can produce big tax benefits for individuals accumulating savings for themselves or their children.

Roth IRAs Are Not Just For Retirement

When clients have the dual goal of saving for retirement and saving for college, the Roth IRA is often times a great option. Even if you make too much to contribute directly to a Roth, you can implement a "non-deductible IRA to Roth IRA conversion strategy" that will allow you to still get money into a Roth IRA.

Contributions to Roth IRAs are made with after tax dollars but unlike a traditional IRA if you hold a Roth IRA for at least 5 years and make withdrawals after age 59 1/2 you pay no tax on the earnings.

Here is one college savings strategy technique: You are allowed at any time and at any age to withdrawal the contribution portion of your account balance from a Roth IRA tax and penalty free. For example, if I contribute $5,000 to a Roth IRA and 5 years later it is worth $10,000, I can contact my IRA provider and request that they distribute just my basis ($5,000) and leave the earnings in the account to continue to accumulate tax free. You can then use that basis distribution to fund college expenses but the earnings in the Roth IRA continue to accumulate tax free.

Maximize Your Financial Aid

There are strategies that can be implemented leading up to the filing of the FASFA form that can increase that amount of financial aid that you receive. When you apply for financial aid, FASFA has a complex EFC calculation that takes a snapshot of your assets and income to determine how much financial aid you will qualify for. There are ways to shift assets and shelter income from this calculation that can save individuals and families thousands of dollars when it come to paying for college. Here are a few of the strategies that can help to improve a EFC calculation:

Save money in the parents or grandparents name, not the childs name

Pay off consumer debt, such as credit cards and auto loans

Spend down the students asset and income first

Accelerate necessary expenses (such as computer purchase) to reduce cash

Minimize capital gains

Maximize your contributions to a retirement plan

Do not withdrawal money from a retirement plan to pay for college

Ask grandparents to wait to give grandchildren money until after college

Trust funds are generally ineffective at sheltering money from EFC

Prepay your mortgage

Contribute to 529 plans owned by the parent or grandparent

Choose the date to submit the FASFA carefully

About Michael...

Hi, Im Michael Ruger. Im the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.