New York May Deviate From The New 529 Rules

When the new tax rules were implemented on January 1, 2018, a popular college savings vehicle that goes by the name of a “529 plan” received a boost. Prior to the new tax rules, 529 plans could only be used to pay for college. The new tax rules allow account owners to withdraw up to $10,000 per year per child for K – 12 public school, private school,

When the new tax rules were implemented on January 1, 2018, a popular college savings vehicle that goes by the name of a “529 plan” received a boost. Prior to the new tax rules, 529 plans could only be used to pay for college. The new tax rules allow account owners to withdraw up to $10,000 per year per child for K – 12 public school, private school, religious school, or homeschooling expenses. These distributions would be considered “qualified” which means distributions are made tax free.

Initially we expected this new benefit to be a huge tax advantage for our clients that have children that attend private school. They could fully fund a 529 plan up to $10,000 per year, capture a New York State tax deduction for the $10,000 contribution, and then turn around and distribute the $10,000 from the account to make the tuition payment for their kids.

New York May Deviate

States are not required to adhere to the income tax rules set forth by the federal government. In other words, states may choose to adopt the new tax rules set forth by the federal government or they can choose to ignore them. The new tax laws that went into effect in 2018 will impact states differently. More specifically, tax payers in states that have both income taxes and high property taxes, like New York and California, may be adversely affected due to the new $10,000 cap on the ability to fully deduct those expenses on their federal tax return.

As of June 30, 2018, New York has yet to provide guidance as to whether or not they will recognize the K -12 distributions from 529 plans as “qualified”. More than 30 states have already announced that they will adhere to the new federal tax rules. On the opposite side of that coin, California has announced that they will not adhere to the new 529 tax rules and they will tax distribution made for K – 12 expenses. Oregon has gone one step further and will not only tax the distributions but they will also recapture state tax deductions taken for distributions made for K – 12 expenses.

Wait & See

If you live in a state like New York that has yet to provide guidance with regard to the new 529 rules, you end up in this wait and see scenario. There is no way to know which way New York is going to rule on this new federal tax rule. However, if New York follows the path taken by many of the other states that were adversely affected by the new federal tax rules, they may decide to follow suit and choose to ignore the new 529 tax rules adopted by the federal government.

We also don’t have any guidance as to when NYS will rule on this issue. They may wait until November or December to issue formal guidance. If that happens, 529 account owners looking to take advantage of the new K – 12 distribution rules will have to be on their toes because distributions from 529 accounts have to happen in the same year that the expense is incurred in order to receive the preferentially tax treatment.

Potential investors of 529 plans may get more favorable tax benefits from 529 plans sponsored by their own state. Consult your tax professional for how 529 tax treatments and account fees would apply to your particular situation. To determine which college saving option is right for you, please consult your tax and accounting advisors. Neither APFS nor its affiliates or financial professionals provide tax, legal or accounting advice. Please carefully consider investment objectives, risks, charges, and expenses before investing. For this and other information about municipal fund securities, please obtain an offering statement and read it carefully before you invest. Investments in 529 college savings plans are neither FDIC insured nor guaranteed and may lose value.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Moving Expenses Are No Longer Deductible

If you were planning on moving this year to take a new position with a new company or even a new position within your current employer, the moving process just got a little more expensive. Not only is it expensive, but it can put you under an intense amount of stress as there will be lots of things that you need to have in place before packing up and

If you were planning on moving this year to take a new position with a new company or even a new position within your current employer, the moving process just got a little more expensive. Not only is it expensive, but it can put you under an intense amount of stress as there will be lots of things that you need to have in place before packing up and moving. Even things like how you are going to transport your car over to your new home, can take up a lot of your time, and on top of that, you have to think about how much it's going to cost. Prior to the tax law changes that took effect January 1, 2018, companies would often offer new employees a "relocation package" or "moving expense reimbursements" to help subsidize the cost of making the move. From a tax standpoint, it was great benefit because those reimbursements were not taxable to the employee. Unfortunately that tax benefit has disappeared in 2018 as a result of tax reform.

Taxable To The Employee

Starting in 2018, moving expense reimbursements paid to employee will now represent taxable income. Due to the change in the tax treatment, employees may need to negotiate a higher expense reimbursement rate knowing that any amount paid to them from the company will represent taxable income.

For example, let’s say you plan to move from New York to California and you estimate that your moving expense will be around $5,000. In 2017, your new employer would have had to pay you $5,000 to fully reimburse you for the moving expense. In 2018, assuming you are in the 35% tax bracket, that same employer would need to provide you with $6,750 to fully reimburse you for your moving expenses because you are going to have to pay income tax on the reimbursement amount.

Increased Expense To The Employer

For companies that attract new talent from all over the United States, this will be an added expense for them in 2018. Many companies limit full moving expense reimbursement to executives. Coincidentally, employees at the executive level are usually that highest paid. Higher pay equals higher tax brackets. If you total up the company's moving expense reimbursements paid to key employees in 2017 and then add another 40% to that number to compensate your employees for the tax hit, it could be a good size number.

Eliminated From Miscellaneous Deductions

As an employee, if your employer did not reimburse you for your moving expenses and you had to move at least 50 miles to obtain that position, prior to 2018, you were allowed to deduct those expenses when you filed your taxes and you were not required to itemize to capture the deduction. However, this expense will no longer be deductible even for employees that are not reimbursed by their employer for the move starting in 2018.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Warning To All Employees: Review The Tax Withholding In Your Paycheck Otherwise A Big Tax Bill May Be Waiting For You

As a result of tax reform, the IRS released the new income tax withholding tables in January and your employer probably entered those new withholding amounts into the payroll system in February. It was estimated that about 90% of taxpayers would see an increase in their take home pay once the new withholding tables were implemented.

As a result of tax reform, the IRS released the new income tax withholding tables in January and your employer probably entered those new withholding amounts into the payroll system in February. It was estimated that about 90% of taxpayers would see an increase in their take home pay once the new withholding tables were implemented. While lower tax rates and more money in your paycheck sounds like a good thing, it may come back to bite you when you file your taxes.

The Tax Withholding Guessing Game

Knowing the correct amount to withhold for federal and state income taxes from your paycheck is a bit of a guessing game. Withhold too little throughout the year and when you file your taxes you have a tax bill waiting for you equal to the amount of the shortfall. Withhold too much and you will receive a big tax refund but that also means you gave the government an interest free loan for the year.

There are two items that tell your employer how much to withhold for federal income tax from your paycheck:

Income Tax Withholding Tables

Form W-4

The IRS provides your employer with the Income Tax Withholding Tables. On the other hand, you as the employee, complete the Form W-4 which tells your employer how much to withhold for taxes based on the “number of allowances” that you claim on the form.

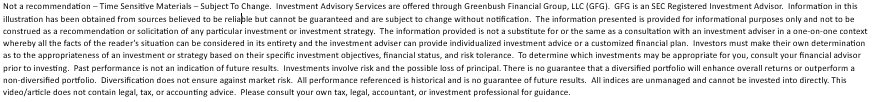

What Is A W-4 Form?

The W-4 form is one of the many forms that HR had you complete when you were first hired by the company. Here is what it looks like:

Section 3 of this form tells your employer which withholding table to use:

Single

Married

Married, but withhold at higher Single Rate

Section 5 tells your employer how many "allowances" you are claiming. Allowance is just another word for "dependents". The more allowances your claim, the lower the tax withholding in your paycheck because it assumes that you will have less "taxable income" because in the past you received a deduction for each dependent. This is where the main problem lies. Due to the changes in the tax laws, the tax deduction for personal exemptions was eliminated. This may adversely affect some taxpayers the were claiming a high number of allowances on their W-4 form because even though the number of their dependents did not change, their taxable income may be higher in 2018 because the deduction for personal exemptions no longer exists.

Even though everyone should review their Form W-4 form this year, employees that claimed allowances on their W-4 form are at the highest risk of either under withholding or over withholding taxes from their paychecks in 2018 due to the changes in the tax laws.

How Much Should I Withhold From My Paycheck For Taxes?

So how do you go about calculating that right amount to withhold from your paycheck for taxes to avoid an unfortunate tax surprise when you file your taxes for 2018? There are two methods:

Ask your accountant

Use the online IRS Withholding Calculator

The easiest and most accurate method is to ask your personal accountant when you meet with them to complete your 2017 tax return. Bring them your most recent pay stub and a blank Form W-4. Based on the changes in the tax laws, they can assist you in the proper completion of your W-4 Form based on your estimated tax liability for the year.If you complete your own taxes, I would highly recommend visiting the updated IRS Withholding Calculator. The IRS calculator will ask you a series of questions, such as:

How many dependents you plan to claim in 2018

Are you over the age of 65

The number of children that qualify for the dependent care credit

The number of children that will qualify for the new child tax credit

Estimated gross wages

How much fed income tax has already been withheld year to date

Payroll frequency

At the end of the process it will provide you with your personal results based on the data that you entered. It will provide you with guidance as to how to complete your Form W-4 including the number of allowances to claim and if applicable, the additional amount that you should instruct your employer to withhold from your paycheck for federal income taxes. Additional withholding requests are listed in Section 6 of the Form W-4.

Avoid Disaster

Having this conversation with your accountant and/or using the new IRS Withholding Calculator will help you to avoid a big tax disaster in 2018. Unfortunately, many employees may not learn about this until it's too late. Employees that are used to getting a tax refund may find out in the spring of next year that they owe thousands of dollars to the IRS because the combination of the new tax tables and the changes in the tax law that caused them to inadvertently under withhold federal income taxes throughout the year.

Action Item!!

Take action now. The longer you wait to run this calculation or to have this conversation with your accountant, the larger the adjustment may be to your paycheck. It's easier to make these adjustments now when you have nine months left in the year as opposed to waiting until November.I would strongly recommend that you share this article with your spouse, children in the work force, and co-workers to help them avoid this little known problem. The media will probably not catch wind of this issue until employees start filing their tax returns for 2018 and they find out that there is a tax bill waiting for them.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Big Changes For 401(k) Hardship Distributions

While it probably seems odd that there is a connection between the government passing a budget and your 401(k) plan, this year there was. On February 9, 2018, the Bipartisan Budget Act of 2018 was passed into law which ended the government shutdown by raising the debt ceiling for the next two years. However, also buried in the new law were

While it probably seems odd that there is a connection between the government passing a budget and your 401(k) plan, this year there was. On February 9, 2018, the Bipartisan Budget Act of 2018 was passed into law which ended the government shutdown by raising the debt ceiling for the next two years. However, also buried in the new law were changes to rules that govern hardship distributions in 401(k) plans.

What Is A Hardship Distribution?

A hardship distribution is an optional distribution feature within a 401(k) plan. In other words, your 401(k) plan may or may not allow them. To answer that question, you will have to reference the plan’s Summary Plan Description (SPD) which should be readily available to plan participants.

If your plan allows hardship distributions, they are one of the few in-service distribution options available to employees that are still working for the company. There are traditional in-service distributions which allow employees to take all or a portion of their account balance after reaching the age 59½. By contrast, hardship distributions are for employees that have experienced a “financial hardship”, are still employed by the company, and they are typically under the age of 59½.

Meeting The "Hardship" Requirement

First, you have to determine if your financial need qualifies as a "hardship". They typically include:

Unreimbursed medical expenses for you, your spouse, or dependents

Purchase of an employee's principal residence

Payment of college tuition and relative education costs such as room and board for the next 12 months for you, your spouse, dependents, or children who are no longer dependents.

Payment necessary to prevent eviction of you from your home, or foreclosure on the mortgage of your primary residence

For funeral expenses

Certain expenses for the repair of damage to the employee's principal residence

Second, there are rules that govern how much you can take out of the plan in the form of a hardship distribution and restrictions that are put in place after the hardship distribution is taken. Below is a list of the rules under the current law:

The withdrawal must not exceed the amount needed by you

You must first obtain all other distribution and loan options available in the plan

You cannot contribute to the 401(k) plan for six months following the withdrawal

Growth and investment gains are not eligible for distribution from specific sources

Changes To The Rules Starting In 2019

Plan sponsors need to be aware that starting in 2019 some of the rules surrounding hardship distributions are going to change in conjunction with the passing of the Budget Act of 2018. The reasons for taking a hardship distribution did not change. However, there were changes made to the rules associated with taking a hardship distribution starting in 2019. More specifically, of the four rules listed above, only one will remain.

No More "6 Month Rule"

The Bipartisan Budget Act of 2018 eliminated the rule that prevents employees from making 401(k) contributions until 6 months after the date the hardship distribution was issued. The purpose of the 6 month wait was to deter employees from taking a hardship distribution. In addition, for employees that had to take a hardship it was a silent way of implying that “if things are bad enough financially that you have to take a distribution from your retirement account, you probably should not be making contributions to your 401(k) plan for the next few months.”

However, for employees that are covered by a 401(k) plan that offers an employer matching contribution, not being able to defer in the plan for 6 months also meant no employer matching contribution during that 6 month probationary period. Starting in 2019, employees will no longer have to worry about that limitation.

Loan First Rule Eliminated

Under the current 401(k) rules, if loans are available in the 401(k) plan, the plan participant was required to take the maximum loan amount before qualifying for a hardship distribution. That is no longer a requirement under the new law.

We are actually happy to see this requirement go away. It never really made sense to us. If you have an employee, who’s primary residence is going into foreclosure, why would you make them take a loan which then requires loan payments to be made via deductions from their paycheck? Doesn’t that put them in a worse financial position? Most of the time when a plan participant qualifies for a hardship, they need the money as soon as possible and having to go through the loan process first can delay the receipt of the money needed to remedy their financial hardship.

Earnings Are Now On The Table

Under the current 401(k) rules, if an employee requests a hardship distribution, the portion of their elective deferral source attributed to investment earnings was not eligible for withdrawal. Effective 2019, that rule has also changed. Both contributions and earnings will be eligible for a hardship withdrawal.

Still A Last Resort

We often refer to hardship distributions as the “option of last resort”. This is due to the taxes and penalties that are incurred in conjunction with hardship distributions. Unlike a 401(k) loan which does not trigger immediate taxation, hardship distributions are a taxable event. To make matters worse, if you are under the age of 59½, you are also subject to the 10% early withdrawal penalty.

For example, if you are under the age of 59½ and you take a $20,000 hardship distribution to make the down payment on a house, you will incur taxes and the 10% penalty on the $20,000 withdrawal. Let’s assume you are in the 24% federal tax bracket and 7% state tax bracket. That $20,000 distribution just cost you $8,200 in taxes.

Gross Distribution: $20,000

Fed Tax (24%): ($4,800)

State Tax (7%): ($1,400)

10% Penalty: ($2,000)

Net Amount: $11,800

There is also an opportunity cost for taking that money out of your retirement account. For example, let’s assume you are 30 years old and plan to retire at age 65. If you assume an 8% annual rate of return on your 401(K) investment that $20,000 really cost you $295,707. That’s what the $20,000 would have been worth, 35 years from now, compounded at 8% per year.

Plan Amendment Required

These changes to the hardship distribution rule will not be automatic. The plan sponsor of the 401(k) will need to amend the plan document to adopt these new rules otherwise the old hardship distribution rules will still apply. We recommend that companies reach out to their 401(k) providers to determine whether or not amending the plan to adopt the new hardship distribution rules makes sense for the company and your employees.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

More Taxpayers Will Qualify For The Child Tax Credit

There is great news for parents in the middle to upper income tax brackets in 2018. The new tax law dramatically increased the income phaseout threshold for claiming the child tax credit. In 2017, parents were eligible for a $1,000 tax credit for each child under the age of 17 as long as their adjusted gross income (“AGI”) was below $75,000 for single

There is great news for parents in the middle to upper income tax brackets in 2018. The new tax law dramatically increased the income phaseout threshold for claiming the child tax credit. In 2017, parents were eligible for a $1,000 tax credit for each child under the age of 17 as long as their adjusted gross income (“AGI”) was below $75,000 for single filers and $110,000 for married couples filing a joint return. If your AGI was above those amounts, the $1,000 credit was reduced by $50 for every $1,000 of income above those thresholds. In other words, the child tax credit completely phased out for a single filer with an AGI greater than $95,000 and for a married couple with an AGI greater than $130,000.

Note: If you are not sure what the amount of your AGI is, it’s the bottom line on the first page of your tax return (Form 1040).

New Phaseout Thresholds In 2018+

Starting in 2018, the new phaseout thresholds for the Child Tax Credit begin at the following AGI levels:

Single Filer: $200,000

Married Filing Joint: $400,000

If your AGI falls below these thresholds, you are eligible for the full Child Tax Credit. For taxpayers with an AGI amount that exceeds these thresholds, the phaseout calculation is the same as 2017. The credit is reduced by $50 for every $1,000 in income over the AGI threshold.

Wait......It Gets Better

Not only will more families qualify for the child tax credit in 2018 but the amount of the credit was doubled. The new tax law increased the credit from $1,000 to $2,000 for each child under the age of 17.

In 2017, a married couple, with three children, with an AGI of $200,000, would have received nothing for the child tax credit. In 2018, that same family will receive a $6,000 tax credit. That’s huge!! Remember, “tax credits” are more valuable than “tax deductions”. Tax credits reduce your tax liability dollar for dollar whereas tax deductions just reduce the amount of your income subject to taxation.

Tax Reform Giveth & Taketh Away

While the change to the tax credit is good news for most families with children, the elimination of personal exemptions starting in 2018 is not.

In 2017, taxpayers were able to take a tax deduction equal to $4,050 for each dependent (including themselves) in addition to the standard deduction. For example, a married couple with 3 children and $200,000 in income, would have been eligible received the following tax deductions:

Standard Deduction: $12,700

Husband: $4,050

Wife: $4,050

Child 1: $4,050

Child 2: $4,050

Child 3: $4,050

Total Deductions $32,950

Child Tax Credit: $0

This may lead you to the following question: “Does the $6,000 child tax credit that this family is now eligible to receive in 2018 make up for the loss of $20,250 ($4,050 x 5) in personal exemptions?”

By itself? No. But you have to also take into consideration that the standard deduction is doubling in 2018. For that same family, in 2018, they will have the following deductions and tax credits:

Standard Deduction: $24,000

Personal Exemptions: $0

Total Deductions: $24,000

Child Tax Credit: $6,000

Even though $24,000 plus $6,000 is not greater than $32,950, remember that credits are worth more than tax deductions. In 2017, a married couple, with $200,000 in income, put the top portion of their income subject to the 28% tax bracket. Thus, $32,950 in tax deductions equaled a $9,226 reduction in their tax bill ($32,950 x 28%).

In 2018, due to the changes in the tax brackets, instead of their top tax bracket being 28%, it’s now 24%. The $24,000 standard deduction reduces their tax bill by $5,760 ($24,000 x 24%) but now they also have a $6,000 tax credit with reduces their remaining tax bill dollar for dollar, resulting in a total tax savings of $11,760. Taxes saved over last year: $2,534. Not a bad deal.

For many families, the new tax brackets combined with the doubling of the standard deduction and the doubling of the child tax credit with higher phaseout thresholds, should offset the loss of the personal exemptions in 2018.

This information is for educational purposes only. Please consult your accountant for personal tax advice.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Much Will Your Paycheck Increase In 2018?

U.S taxpayers have a big reason to celebrate this week. By the end of February, you should see your paycheck increase. The government released the new payroll withholding tables this week which will lower the amount of taxes withheld from your paycheck and increase your take home pay. Naturally the next question is "How much will my paycheck go

U.S taxpayers have a big reason to celebrate this week. By the end of February, you should see your paycheck increase. The government released the new payroll withholding tables this week which will lower the amount of taxes withheld from your paycheck and increase your take home pay. Naturally the next question is "How much will my paycheck go up?" Out of curiously, I spent my Saturday morning comparing the 2017 tax tables to the new 2018 tax tables to answer that question. Yes, this is what nerds do on their weekends.

The Calculation

Like most financial calculations, it's long and boring. I will provide you with the cliff notes version. The government provides your company with tax withholding tables that they enter into the payroll system. It tells your employer how much to withhold in fed taxes from each pay check. The three main variables in the calculation are:

Payroll frequency (weekly, bi-weekly, etc)

The number of withholding allowances that you claim

The amount of your pay

Single Filers or Head of Household

If you are a single or head of household tax filer, I ran the following calculations based on a bi-weekly payroll schedule and an employee claiming one withholding allowance. The table below illustrates how much your annual take home pay may increase under the new tax withholding tables at various salary levels.

Based on this analysis, it looks like a single filer’s paycheck will increase between 2% – 3% as soon as the new withholding tables are entered into the payroll system. If you want to know how much your bi-weekly pay will increase, just take the annual numbers listed above and divide them by 26 pay periods. If the payroll frequency at your company is something other than bi-weekly or you claim more than one withholding allowance, your percentage increase in take home pay will deviate from the table listed above.

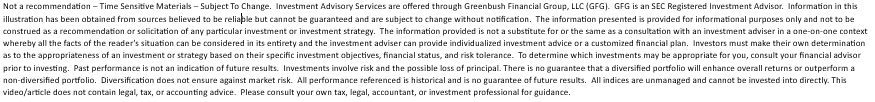

Married Couples Filing Joint

For employees that are married and file a joint tax return, below is the calculations based on a bi-weekly payroll schedule and two withholding allowances. The table below illustrates how much your annual take home pay may increase under the new tax withholding tables at various salary levels.

Even though I added an additional withholding allowance in the calculation for the married employee, I was surprised that the “range” of the percentage increase in the take home pay for a married employee was noticeably wider than a single tax filer. As you will see in the table above, the increase in take home pay for an employee in this category range from 1.5% – 3.1%.

Another interesting observation, in the single filer table, the percentage increase in take home pay actually diminished as the employee’s annual compensation increased. In contrast, for the married employee, the percentage increase in annual take home pay gradually increased as the employee’s annual salary increased. Conclusion…..get married in 2018? Nothing says love like new withholding tables.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Tax Reform Could Lead To A Spike In The Divorce Rate In 2018

The Tax Cut & Jobs Act that was recently passed has already caused taxpayers to accelerate certain financial decisions as we transition from the current tax laws to the new tax laws over the course of the next two years.

The Tax Cut & Jobs Act that was recently passed has already caused taxpayers to accelerate certain financial decisions as we transition from the current tax laws to the new tax laws over the course of the next two years.

Current Tax Law: Alimony Is Tax Deductible

Under the current tax law, alimony payments are taxable income to the ex-spouse receiving the payments and they are tax deductible to the ex-spouse making the payments. When alimony is awarded pursuant to a divorce, it’s typically because there was a disparity in the level of income between the two spouses during the marriage. The ex-spouse paying the alimony, in most cases, is the higher income earning spouse both before and after the divorce finalized.

Let’s look at this in a real life example. Jim and Sarah have decided to get a divorce. Jim makes $300,000 per year and Sarah is a homemaker with $0 income. Pursuant to the divorce agreement, Jim will be required to pay Sarah $50,000 per year for 5 years. Jim will be able to deduct the $50,000 each year against his taxable income and Sarah will claim the $50,000 as taxable income on her tax return. Based on the 2018 Individual Tax Brackets, the top end of Jim’s income is in the 35% tax bracket. Thus, paying $50,000 in alimony really results in an “after-tax” expense to Jim of $32,500.

$50,000 x 35% = $17,500 (fed tax savings)

$50,000 – $17,500 = $32,500 (after tax expense to Jim)

Sarah will claim that $50,000 in alimony payments as income and let’s assume that the alimony payments are her only income for the year. Next year, as a single filer, Sarah will receive a standard deduction of $12,000, and the remainder of the $38,000 will be taxed at a blend of her 10% & 12% tax rate. As a result, Sarah will only pay about $4,400 in taxes on the $50,000 in alimony income.

To sum it all up, if the $50,000 is taxed to Sarah, approximately $4,400 will be paid to the IRS in taxes and she nets $45,600 in after tax income. However, if Jim was not able to deduct the alimony payments and had to pay tax on that $50,000, he would first have to pay the $17,500 in taxes to the IRS, and then he would hand Sarah a check for $32,500 after tax. Sarah is worse off because she received less after tax income. Jim would ultimately be worse off because he would need to part with more pre-tax income to create the same after tax benefit for Sarah. The IRS is the only one that wins.

Gaming The System

Since divorce agreements, in most states, are not required to adhere to predefined calculations for splitting assets, alimony payments, and in some cases child support, the tax game can be played when there is a high income earning spouse and alimony payments in the mix. In exchange for fewer assets or less child support, some divorce agreements have purposefully shifted more to alimony. The ex-spouse with the big income gets a bigger tax deduction and the ex-spouse receiving the alimony payment is able to take full advantage of their lower tax brackets and maximize their after tax income.

Alimony Is No Longer Deductible

To stop the tax game, included in the new tax bill was a provision that specifically states that alimony payments will no longer be deductible by the payor, nor reportable as income by the recipient, for divorce agreements signed after December 31, 2018.

The good news is this will not impact the ability to deduct alimony payments for divorce agreements that are currently in place. The bad news is for divorce agreements signed after December 31, 2018, the high income earner will no longer be able to deduct the alimony payments. That eliminates the tax arbitrage that has been used in the past to make the pie larger for both spouses. In general, if you shrink the size of the asset and income pie, it leaves more to fight about because each spouse is trying to preserve their standard of living as much as possible post-divorce.

For couples that have been sitting on the fence about getting divorced, this could be the catalyst to start the process in 2018 to make sure they have a signed agreement prior to December 31, 2018.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Should You Prepay Your Property Taxes?

If you live in New York or any other state with "higher" property taxes you should determine whether or not it makes sense to pay your 2018 property taxes prior to December 31, 2017. Why? Tax reform will be capping your state and local tax deductions at $10,000 beginning in 2018. Don't forget though, that it's important to make sure you keep on

If you live in New York or any other state with "higher" property taxes you should determine whether or not it makes sense to pay your 2018 property taxes prior to December 31, 2017. Why? Tax reform will be capping your state and local tax deductions at $10,000 beginning in 2018. Don't forget though, that it's important to make sure you keep on top of your taxes, as you don't want to cause an issue further down the line.

To prevent taxpayers from navigating around the $10,000 deduction cap that will take effect in 2018, Congress wrote right into the tax bill that taxpayers will not be able to prepay their 2018 state income taxes and take the tax deduction in 2017. However, they left the door open for prepaying your 2018 property taxes in 2017 and taking the deduction in 2017 before the cap goes into effect.

Should you do this? The answer depends on your expected income for the 2017 tax year.

Alternative Minimum Tax

Before you rush down to your town office in the last week of December to prepay your 2018 taxes, if you think your income level in 2017 is going to make you subject to AMT, I will save you the trip. Alternative Minimum Tax (AMT) is a special tax calculation that was implemented back in 1969 to make sure the "wealthy" pay their fair share of taxes. The AMT calculation allows fewer deductions and exemptions than the standard tax system. Taxpayers have to calculate their taxes the "normal way" and then calculate their taxes under the AMT method. Whichever method generates the higher tax liability is the one that you pay.

The problem with AMT is over time they did not index the exemption level adequately for wage inflation since its inception in 1969. Again it was supposed to stop the wealthy from taking advantage of tax deductions. In 2017, the exemptions amounts for AMT are as follows:

Single Filer: $54,300

Married Filing Joint: $84,500

Not exactly what many of us would considered wealthy. It gets better, that exemption begins to phase out at the following levels in 2017 making more of your income subject to the special AMT calculation.

Single Filers: $120,700

Married Filing Joint: $160,900

Why am I going into so much detail amount AMT? Remember, AMT adds back deductions that were previously allowed under the standard calculation. One of those add backs is property taxes. So if your AMT tax liability exceeds your tax liability calculated with the standard formula, there is no point in prepaying your 2018 property taxes because you won't be able to deduct them anyways. Those deductions get added back in as part of the AMT calculation.

Contact Your Accountant

The AMT calculation is complex. If you are not able to accurately estimate whether or not your AMT tax liability will be greater than the standard calculation, you should contact your accountant for guidance.

Those Not Subject To AMT

If you are not subject to AMT and you plan to itemize in 2017, it probably does makes sense to prepay your property taxes for 2018 by December 29, 2017. Otherwise you are just going to lose the deduction in 2018 because it will most likely be more advantageous at that income level to just take the larger standard deduction that will be available in 2018. You end up with the best of both worlds. You get to deduct your 2018 property taxes in 2017 which reduces your income and then capture the large standard deduction in 2018,

How Do You Prepay Your Property Taxes?

So how do you pay your property taxes early? It's most likely going to require your checkbook and a trip to your town office, First, call your town office to make sure the 2018 property tax invoices are available. Once you know that they are available, you should drive down to your town office prior to December 29, 2017 and pay the tax bill.

If you escrow taxes, which many homeowners do, there is a good chance that your mortgage company will not receive your property tax bill in time to issue a check from your escrow account prior to December 29th. For this reason, you should call your mortgage services company and determine what they need to prove that you paid your 2018 property taxes with a personal check. This will hopefully prevent them from issuing a check out of your escrow account for the property taxes that you already paid with your personal check for 2018.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The House Passed The Tax Bill. What's The Next Step?

Last night the house passed the Tax Cut & Jobs Act Bill with ease. Next up is the Senate vote. It’s important to understand the House and the Senate are voting on two different tax reform bills. Below is a chart illustrating the main differences between the House version and the Senate version of the tax reform bill.

Last night the house passed the Tax Cut & Jobs Act Bill with ease. Next up is the Senate vote. It’s important to understand the House and the Senate are voting on two different tax reform bills. Below is a chart illustrating the main differences between the House version and the Senate version of the tax reform bill.

As you can see, there are a number of dramatic differences between the two bills. The easy part was getting the House to approve their version because the Republican Party own 239 of the 435 seats. In other words, they own 55% of the votes.

The Senate Vote

Next, the Senate will put their tax reform bill to a vote. The vote is expected to take place during the week of Thanksgiving. However, in the Senate , which the Republican have the majority, they only have 52 of the 100 seats. In this case, they would need at least 50 “Yes” votes to get the bill approved in the senate. It’s 50, not 51 votes, because in the event of a “tie”, the Vice President gets a vote to break the tie and he is likely to vote “Yes” to keep tax reform moving along.

Reconciliation Process

Once the House and Senate have approved their own separate tax bills, they will then have to begin the reconciliation process of blending the two bills together. This will be the difficult part. The two tax bills are dramatically different so there will be a fair amount of grappling between the House and the Senate committees as to which features stay and which features get tossed out or adjusted as part of the final tax bill. In the end, the final tax reform bill cannot add more than $1.5 Trillion to the national debt over the next 10 years. Otherwise, the bill would need to return to the Senate and would require “60” votes to approve the bill. There is a slim too no chance of that happening.

Tax Reform by Christmas

President Trump wants the bill on his desk to sign into law before Christmas. While it seems likely that the Senate will pass their tax bill next week, the battle will take place in the reconciliation process that will begin immediately after that vote. It’s a tall order to fill given that there are only six weeks left in the year and how different the two bills are in their current form. However, don’t underestimate how badly the Republican party wants to put a run on the scoreboard before the end of the year. If they get tax reform through in the last week of the year, it’s an understatement to say that it will be an intense final week of December for year-end tax planning. Stay tuned for more………

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.