The Government Is Shut Down. Should You Be Worried?

The senate was not able to pass a temporary spending bill in the late hours of the night so as of Saturday, January 20th the government is officially shut down. But what does that mean? How will it impact you? What will be the impact on the stock market?

The senate was not able to pass a temporary spending bill in the late hours of the night so as of Saturday, January 20th the government is officially shut down. But what does that mean? How will it impact you? What will be the impact on the stock market?

Don’t Let The Media Scare You

The media loves big disruptive events. Why? The news is a "for profit" business. The more viewers they have, the more profits they make. What makes you watch more news? Fear. If the weather forecasts is 80 degrees and sunny, you just go on with your day. Instead, if the weather is predicting “The Largest Winter Blizzard Of The Century”, my guess is you will be glued to the weather channel most of the day trying to figure out when the storm will hit, how many feet of snow is expected to fall, and are schools closing, etc.

You will undoubtedly wake up this morning to headlines about “The Government Shutdown” and all of the horrible things that could happen as a result. In the short term a government shutdown or a “funding gap” is not incredibly disruptive. Many government agencies have residual funding to keep operations going for a period of time. Only portions of the government really “shut down”. The “essential” government services continue to function such as national security and law enforcement. The risk lies in the duration of the government shutdown. If Congress does not pass either a temporary extension or reach a final agreement within a reasonable period of time, some of these government agencies will run out of residual funding and will be forced to halt operations.

The news will target the “what if’s” of the current government shutdown. What if the government stays shut down and social security checks stop? What if the U.S. cannot fund defense spending and we are left defenseless? All of these scenarios would require a very prolonged government shutdown which is unlikely to happen.

How Often Does This Happen?

When I woke up this morning, my first questions was “how often do government shutdowns happen?” Is this an anomaly that I should be worried about or is it a frequent occurrence? The last government shutdown took place on September 30, 2013 and the government stayed shut down for 16 days. Prior to the 2013 shutdown, you have to go back to December 15, 1995. The duration of the 1995 shutdown was 21 days. Making the current government shutdown only the third shutdown between December 15, 1995 – January 20, 2018. Not an anomaly but also not a frequent event.

But let’s look further back. How many times did the U.S. government experience a shutdown between 1976 – 2018? In the past 42 years, the U.S. government has experienced a shutdown 18 times. On average the government shutdowns lasted for about 7 days. This makes me less worried about the current government shutdown given the number of shutdowns that we have overcome in the past.

This Shutdown Could Be Longer

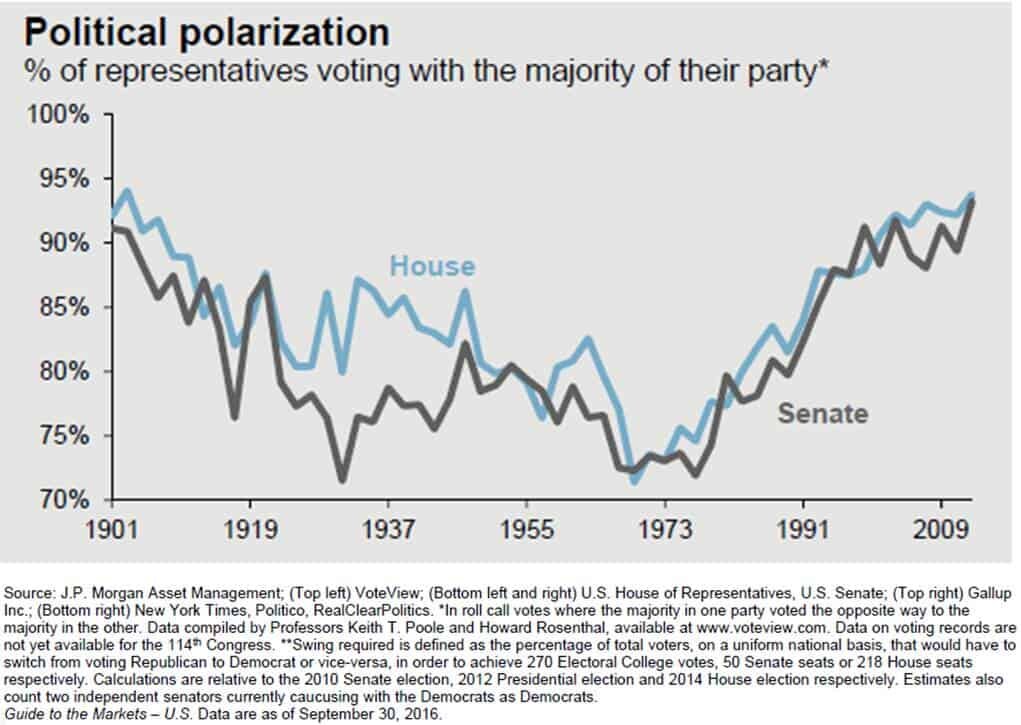

The only thing that worries me a little is the potential duration of the current government shutdown. I would not consider two data points to be a new “trend” but it is hard to ignore that the last two government shutdowns that occurred in 1995 and 2013 were much longer than the 7 day historical average. However, this could be the start of a new trend given how polarized Congress has become. It’s a clear trend that over the past 40 years fewer members of the Senate and House are willing to cross party lines during a vote. See the chart below: Back in 1973, only 73% of the members of Congress voted with the majority of their political party. It would seem rational to assume that during that time period members of Congress were more willing to step across the aisle for the greater good of the American people. Now, approximately 95% of the members of both the House and Senate vote with their own camp. This creates deadlock situations that take longer to resolve as the “blame game” takes center stage.

Impact On The Stock Market

In most cases, injecting uncertainty in our economy is never good for the stock market. However, given the fact that U.S. corporations are still riding the high of tax reform, if the government shutdown is resolved within the next two weeks it may have little or no impact on the markets.

If it were not for the recent passage of tax reform, my guess is this government shutdown may have been completely avoided. Not choosing a side here but just acknowledging the Democratic Party was delivered a blow with passage of tax reform in December. Since the spending bill requires 60 votes to pass in the Senate, it will require support from the Democrats. This situation provides the Democratic party with a golden opportunity to negotiate terms to help make up for some the lost ground from the passage of the Republican led tax bill. This challenging political environment could lengthen the duration of the government shutdown. However, it’s also important to remember that neither party benefits from a government shutdown, especially in a midterm election year.

Over the next two weeks, I would recommend that investors take all the media hype with a grain of salt. However, if a permanent or temporary spending bill is not passed within the next two weeks, it could result in increased volatility and downward pressure on the stock market as government agencies run out of cash reserves and begin to put workers on furlough. At this point, we are really in a “wait and see” environment.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The House Passed The Tax Bill. What's The Next Step?

Last night the house passed the Tax Cut & Jobs Act Bill with ease. Next up is the Senate vote. It’s important to understand the House and the Senate are voting on two different tax reform bills. Below is a chart illustrating the main differences between the House version and the Senate version of the tax reform bill.

Last night the house passed the Tax Cut & Jobs Act Bill with ease. Next up is the Senate vote. It’s important to understand the House and the Senate are voting on two different tax reform bills. Below is a chart illustrating the main differences between the House version and the Senate version of the tax reform bill.

As you can see, there are a number of dramatic differences between the two bills. The easy part was getting the House to approve their version because the Republican Party own 239 of the 435 seats. In other words, they own 55% of the votes.

The Senate Vote

Next, the Senate will put their tax reform bill to a vote. The vote is expected to take place during the week of Thanksgiving. However, in the Senate , which the Republican have the majority, they only have 52 of the 100 seats. In this case, they would need at least 50 “Yes” votes to get the bill approved in the senate. It’s 50, not 51 votes, because in the event of a “tie”, the Vice President gets a vote to break the tie and he is likely to vote “Yes” to keep tax reform moving along.

Reconciliation Process

Once the House and Senate have approved their own separate tax bills, they will then have to begin the reconciliation process of blending the two bills together. This will be the difficult part. The two tax bills are dramatically different so there will be a fair amount of grappling between the House and the Senate committees as to which features stay and which features get tossed out or adjusted as part of the final tax bill. In the end, the final tax reform bill cannot add more than $1.5 Trillion to the national debt over the next 10 years. Otherwise, the bill would need to return to the Senate and would require “60” votes to approve the bill. There is a slim too no chance of that happening.

Tax Reform by Christmas

President Trump wants the bill on his desk to sign into law before Christmas. While it seems likely that the Senate will pass their tax bill next week, the battle will take place in the reconciliation process that will begin immediately after that vote. It’s a tall order to fill given that there are only six weeks left in the year and how different the two bills are in their current form. However, don’t underestimate how badly the Republican party wants to put a run on the scoreboard before the end of the year. If they get tax reform through in the last week of the year, it’s an understatement to say that it will be an intense final week of December for year-end tax planning. Stay tuned for more………

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.