How Much Should I Contribute to Retirement?

A question I’m sure to address during employee retirement presentations is, “How Much Should I be Contributing?”. In this article, I will address some of the variables at play when coming up with your number and provide detail as to why two answers you will find searching the internet are so common.

A question I’m sure to address during employee retirement presentations is, “How Much Should I be Contributing?”. Quick internet search led me to two popular answers.

Whatever you need to contribute to get the match from the employer,

10-15% of your compensation.

As with most questions around financial planning, the answer should really be, “it depends”. We all know it is important to save for retirement, but knowing how much is enough is the real issue and typically there is more work involved than saying 10-15% of your pay.

In this article, I will address some of the variables at play when coming up with your number and provide detail as to why the two answers previously mentioned are so common.

Expenses and Income Replacement

Creating a budget and tracking expenses is usually the best way to estimate what your spending needs will be in retirement. Unfortunately, this is time-consuming and is becoming more difficult considering how easy it is to spend money these days. Automatic payments, subscriptions, payment apps, and credit cards make it easy to purchase but also more difficult to track how much is leaving your bank accounts.

Most financial plans we create start with the client putting together an itemized list of what they believe they spend on certain items like clothes, groceries, vacations, etc. A copy of our expense planner template can be found here. These are usually estimates as most people don’t track expenses in that much detail. Since these are estimates, we will use household income, taxes, and bank/investment accounts as a check to see if expenses appear reasonable.

What do expenses have to do with contributions to your retirement account now? Throughout your career, you receive a paycheck and use those funds to pay for the expenses you have. At some point, you no longer have the paycheck but still have the expenses. Most retirees will have access to social security and others may have a pension, but rarely does that income cover all your expenses. This means that the shortfall often comes from retirement accounts and other savings.

Not taking taxes, inflation, or investment gains into account, if your expenses are $50,000 per year and Social Security income is $25,000 a year, that is a $25,000 shortfall. 20 years of retirement times a $25,000 shortfall means $500,000 you’d need saved to fund retirement. Once we have an estimate of the coveted “What’s My Number?” question, we can create a savings plan to try and achieve that goal.

Cash Flow

As we age, some of the larger expenses we have in life go away. Student loan debt, mortgages, and children are among those expenses that stop at some point in most people’s lives. At the same time, your income is usually higher due to experience and raises throughout your career. As expenses potentially go down and income is higher, there may be cash flow that frees up allowing people to save more for retirement. The ability to save more as we get older means the contribution target amount may also change over time.

Timing of Contributions

Over time, the interest that compounds in retirement accounts often makes up most of the overall balance.

For example, if you contribute $2,000 a year for 30 years into a retirement account, you will end up saving $60,000. If you were able to earn an annual return of 6%, the ending balance after 30 years would be approximately $158,000. $60,000 of contributions and $98,000 of earnings.

The sooner the contributions are in an account, the sooner interest can start compounding. This means, that even though retirement saving is more cash flow friendly as we age, it is still important to start saving early.

Contribute Enough to Receive the Full Employer Match

Knowing the details of your company’s retirement plan is important. Most employers that sponsor a retirement plan make contributions to eligible employees on their behalf. These contributions often come in the form of “Non-Elective” or “Matching”.

Non-Elective – Contributions that will be made to eligible employees whether employees are contributing to the plan or not. These types of contributions are beneficial because if a participant is not able to save for retirement from their own paycheck, the company will still contribute. That being said, the contribution amount made by the employer, on its own, is usually not enough to achieve the level of savings needed for retirement. Adding some personal savings in addition to the employer contribution is recommended.

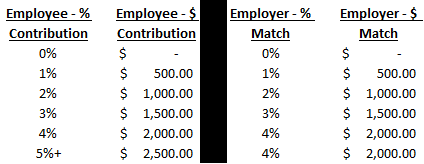

Matching – Employers will contribute on behalf of the employee if the employee is contributing to the plan as well. This means if the employee is contributing $0 to the retirement plan, the company will not contribute. The amount of matching varies by company, so knowing “Match Formula” is important to determine how much to contribute. For example, if the matching formula is “100% of compensation up to 4% of pay”, that means the employer will contribute a dollar-for-dollar match until they contribute 4% of your compensation. Below is an example of an employee making $50,000 with the 4% matching contribution at different contribution rates.

As you can see, this employee could be eligible for a $2,000 contribution from the employer, if they were to save at least 4% of their pay. That is a 100% return on your money that the company is providing.

Any contribution less than 4%, the employee would not be taking advantage of the employer contribution available to them. I’m not a fan of the term “free money”, but that is often the reasoning behind the “Contribute Enough to Receive the Full Employer Match” response.

10%-15% of Your Compensation

As said previously, how much you should be contributing to your retirement depends on several factors and can be different for everyone. 10%-15% over a long-term period is often a contribution rate that can provide sufficient retirement savings. Math below…

Assumptions

Age: 25

Retirement Age: 65

Current Income: $30,000

Annual Raises: 2%

Social Security @ 65: $25,000

Annualized Return: 6%

Step 1: Estimate the Target Balance to Accumulate by 65

On average, people will need an estimated 90% of their income for early retirement spending. As we age, spending typically decreases because people are unable to do a lot of the activities we typically spend money on (i.e. travel). For this exercise, we will assume a 65-year-old will need 80% of their income throughout retirement.

Present Salary - $30,000

Future Value After 40 Years of 2% Raises - $65,000

80% of Future Compensation - $52,000

$52,000 – income needed to replace

$25,000 – social security @ 65

$27,000 – amount needed from savings

X 20 – years of retirement (Age 85 - life expectancy)

$540,000 – target balance for retirement account

Step 2: Savings Rate Needed to Achieve $540,000 Target Balance

40 years of a 10% annual savings rate earning 6% interest per year, this person could have an estimated balance of $605,000. $181,000 of contributions and $424,000 of compounded interest.

I hope this has helped provide a basic understanding of how you can determine an appropriate savings rate for yourself. We recommend reaching out to an advisor who can customize your plan based on your personal needs and goals.

About Rob……...

Hi, I’m Rob Mangold, Partner at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Percentage of Pay vs Flat Dollar Amount

Enrolling in a company retirement plan is usually the first step employees take to join the plan and it is important that the enrollment process be straight forward. There should also be a contact, i.e. an advisor (wink wink), who can guide the employees through the process if needed. Even with the most efficient enrollment process, there is a lot of

Retirement Contributions - Percentage of Pay vs Flat Dollar Amount

Enrolling in a company retirement plan is usually the first step employees take to join the plan and it is important that the enrollment process be straight forward. There should also be a contact, i.e. an advisor (wink wink), who can guide the employees through the process if needed. Even with the most efficient enrollment process, there is a lot of information employees must provide. Along with basic personal information, employees will typically select investments, determine how much they’d like to contribute, and document who their beneficiaries will be. This post will focus on one part of the contribution decision and hopefully make it easier when you are determining the appropriate way for you to save.

A common question you see on the investment commercials is “What’s Your Number”? Essentially asking how much do you need to save to meet your retirement goals. This post isn’t going to try and answer that. The purpose of this post is to help you decide whether contributing a flat dollar amount or a percentage of your compensation is the better way for you to save.

As we look at each method, it may seem like I favor the percentage of compensation because that is what I use for my personal retirement account but that doesn’t mean it is the answer for everyone. Using either method can get you to “Your Number” but there are some important considerations when making the choice for yourself.

Will You Increase Your Contribution As Your Salary Increases?

For most employees, as you start to earn more throughout your working career, you should probably save more as well. Not only will you have more money coming in to save but people typically start spending more as their income rises. It is difficult to change spending habits during retirement even if you do not have a paycheck anymore. Therefore, to have a similar quality of life during retirement as when you were working, the amount you are saving should increase.

By contributing a flat dollar, the only way to increase the amount you are saving is if you make the effort to change your deferral amount. If you do a percentage of compensation, the amount you save should automatically go up as you start to earn more without you having to do anything.

Below is an example of two people earning the same amount of money throughout their working career but one person keeps the same percentage of pay contribution and the other keeps the same flat dollar contribution. The percentage of pay person contributes 5% per year and starts at $1,500 at 25. The flat dollar person saves $2,000 per year starting at 25.

The percentage of pay person has almost $50,000 more in their account which may result in them being able to retire a full year or two earlier.

A lot of participants, especially those new to retirement plans, will choose the flat dollar amount because they know how much they are going to be contributing each pay period and how that will impact them financially. That may be useful in the beginning but may harm someone over the long term if changes aren’t made to the amount they are contributing. If you take the gross amount of your paycheck and multiply that amount by the percent you are thinking about contributing, that will give you close to, if not the exact, amount you will be contributing to the plan. You may also be able to request your payroll department to run a quick projection to show the net impact on your paycheck.

There are a lot of factors to take into consideration to determine how much you need to be saving to meet your retirement goals. Simply setting a percentage of pay and keeping it the same your entire working career may not get you all the way to your goal but it can at least help you save more.

Are You Maxing Out?

The IRS sets limits on how much you can contribute to retirement accounts each year and for most people who max out it is based on a dollar limit. For 2024, the most a person under the age of 50 can defer into a 401(k) plan is $23,000. If you plan to max out, the fixed dollar contribution may be easier to determine what you should contribute. If you are paid weekly, you would contribute approximately $442.31 per pay period throughout the year. If the IRS increases the limit in future years, you would increase the dollar amount each pay period accordingly.

Company Match

A company match as it relates to retirement plans is when the company will contribute an amount to your retirement account as long as you are eligible and are contributing. The formula on how the match is calculated can be very different from plan to plan but it is typically calculated based on a dollar amount or a percentage of pay. The first “hurdle” to get over with a company match involved is to put in at least enough money out of your paycheck to receive the full match from the company. Below is an example of a dollar match and a percent of pay match to show how it relates to calculating how much you should contribute.

Dollar for Dollar Match Example

The company will match 100% of the first $1,000 you contribute to your plan. This means you will want to contribute at least $1,000 in the year to receive the full match from the company. Whether you prefer contributing a flat dollar amount or percentage of compensation, below is how you calculate what you should contribute per pay period.

Flat Dollar – if you are paid weekly, you will want to contribute at least $19.23 ($1,000 / 52 weeks = $19.23). Double that amount to $38.46 if you are paid bi-weekly.

Percentage of Pay – if you make $30,000 a year, you will want to contribute at least 3.33% ($1,000 / $30,000).

Percentage of Compensation Match Example

The company will match 100% of every dollar up to 3% of your compensation.

Flat Dollar – if you make $30,000 a year and are paid weekly, you will want to contribute at least $17.31 ($30,000 x 3% = $900 / 52 weeks = $17.31). Double that amount to $34.62 if you are paid bi-weekly.

Percentage of Pay – no matter how much you make, you will want to contribute at least 3%.

If the match is based on a percentage of pay, not only is it easier to determine what you should contribute by doing a percent of pay yourself, you also do not have to make changes to your contribution amount if your salary increases. If the match is up to 3% and you are contributing at least 3% as a percentage of pay, you know you should receive the full match no matter what your salary is.

If you do a flat dollar amount to get the 3% the first year, when your salary increases you will no longer be contributing 3%. For example, if I set up my contributions to contribute $900 a year, at a salary of $30,000 I am contributing 3% of my compensation (900 / 30,000) but at a salary of $35,000 I am only contributing 2.6% (900 / 35,000) and therefore not receiving the full match.

Note: Even though in these examples you are receiving the full match, it doesn’t mean it is always enough to meet your retirement goals, it is just a start.

In summary, either the flat dollar or percentage of pay can be effective in getting you to your retirement goal but knowing what that goal is and what you should be saving to get there is key.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

A New Year: Should I Make Changes To My Retirement Account?

A simple and easy answer to this question would be…..Maybe? Not only would that answer make this article extremely short, it wouldn’t explain some important items that participants should take into consideration when making decisions about their retirement plan.Every time the calendar adds a year we get a sense of reset. A lot of the same tasks on the

A simple and easy answer to this question would be…..Maybe? Not only would that answer make this article extremely short, it wouldn’t explain some important items that participants should take into consideration when making decisions about their retirement plan.Every time the calendar adds a year we get a sense of reset. A lot of the same tasks on the to do list get added each January and hopefully this article helps you focus on matters to consider regarding your retirement plan.

Should I Consult With The Advisor On My Plan?

At our firm we make an effort to meet with participants at least annually. Saving in company retirement plans is about longevity so many times the individual meetings are brief and no allocation changes are made. Even if this is the result, an overview of your account, at least annually, is a good way to keep retirement savings fresh in your mind and add a sense of comfort that you’re investing appropriately based on your time horizon and risk tolerance.

These individual meetings are also a good time to discuss other financial questions you may have. Your retirement plan is only a piece of your financial plan and we encourage participants to use the resources available to them. Often times these meetings start off as a simple account overview but turn into lengthy conversations about various financial decisions the participant has been weighing.

How Much Should I Be Contributing This Year?

This answer is not the same for everyone because, among other things, people have different retirement goals, financial situations, and time horizon. That being said, if the company has a match component in their plan, the first milestone would be to contribute enough to receive the most the company is willing to give you. For example, if the company will match 100% of your contributions up to 3% of pay, any amount you contribute less than 3% will leave you missing out on retirement savings the company is willing to provide you.

Again, the amount that should be saved is dependent on the individual but saving anywhere from 10% to 15% of your compensation is a good benchmark. In the previous example, if the company will match 3%, that means you would have to contribute 7% to achieve the lower end of that benchmark. This may seem like a difficult task so starting at an amount you are comfortable with and working your way to your ultimate goal is important.

Should You Be Making Allocation Changes?

The initial allocation you choose for your retirement account is important. Selecting the appropriate portfolio from the start based on your risk tolerance and time until retirement can satisfy your investment needs for a number of years. The chart below shows that over longer periods of time historical annual returns tend to be less volatile.

When you have over 10 years until retirement, reviewing the account at least annually is important as there are a number of reasons you would want to change your allocation. Lifestyle changes, different retirement goals, or specific investment performance to name a few. Participants tend to lose out on investment return when they try to time the market and are forced to sell low and buy high. This chart shows that even though there may be volatility in the short term, as long as you have time and an appropriate allocation from the start, you should see returns that will help you achieve your retirement goals.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.