Introduction To Medicare

As you approach age 65, there are very important decisions that you will have to make regarding your Medicare coverage. Whether you decide to retire prior to age 65, continue to work past age 65, or have retiree health benefits,

As you approach age 65, there are very important decisions that you will have to make regarding your Medicare coverage. Whether you decide to retire prior to age 65, continue to work past age 65, or have retiree health benefits, you will have to make decisions regarding your Medicare coverage and for many of those decisions you only get one shot at making the right one. The wrong decision can cost you tens of thousands, if not hundreds of thousands of dollars, in retirement via:

Gaps in your coverage leading to unexpected medical bills

Over coverage: Paying too much for insurance that you are not using

Penalties for missing key Medicare enrollment deadlines

The problem is there are a lot of options, deadlines, rules to follow, and with rules there are always exceptions to the rules that you need to be aware of. To make an informed decision you must understand Medicare Part A, Part B, Medicare Supplemental Plans, Medicare Advantage Plans, Part D drug plans, and special exceptions that apply based on the state that you live in.

I urge everyone to read this article whether it’s for you, your parents, grandparents, friends, or other family members. You may be able to help someone that is trying to make these very important healthcare decisions for themselves and it’s very easy to get lost in the Medicare jungle.

Initially my goal was to write a single article to summarize the decisions that retirees face with regard to Medicare. I realized very quickly that the article would end up looking more like a book. So instead I’ve decided to separate the information into series of articles. This first article will provide you with a general overview of Medicare but at the bottom of each article you will find links to other articles that will provide you with more information about Medicare.

With that, let’s go ahead and jump into the first article which will provide you with a broad overview of how Medicare works.

What is Medicare?

Medicare is the government program that provides you with your healthcare benefits after you turn 65. Medicare is run by the Social Security administration, meaning you contact your Social Security office when you have questions or when you apply for benefits.

Original Medicare

While there are a lot of decisions that have to be made about your Medicare benefits, all of the benefits are built on the foundation of Medicare Part A and Medicare Part B. Medicare Part A and Part B together are referred to as “Original Medicare”. You will see the term Original Medicare used a lot when reading about your Medicare options.

Medicare Part A

Medicare Part A covers your inpatient health services such as:

1) Hospitalization

2) Nursing home (Limited)

3) Hospice

4) Home health services (Limited)

As long as you or your spouse worked for at least 10 years, Medicare Part A is provided to you at no cost. During your working years you paid the Medicare tax of 1.45% as part of your payroll taxes. If you or your spouse did not work 10 years or more then you’re still eligible for Medicare Part A but you will have to pay a monthly premium. There are special eligibility rules for individuals that do not meet the 10 year requirement but are either divorced or widowed.

Medicare Part A Is Not Totally “Free”

While there are no monthly premium payments that need to be made for enrolling in Medicare Part A there are deductibles and coinsurance associated with your Part A coverage. While many of us have encountered deductibles, co-pays, and coinsurance through our employer sponsored health insurance plans, I’m going to pause for a moment just to explain three key terms associated with health insurance plans.

Deductible: This is the amount that you have to pay out of pocket before the insurance starts to pay for your healthcare costs. Example, if you have $1,000 deductible, you have to pay $1,000 out-of-pocket before the insurance will start paying anything for the cost of your care.

Co-pays: Co-pays are those small amounts that you have to pay each time a specific service is rendered such as a doctor’s visit or when you pick up a prescription. Example, you may have to pay $25 every time you visit your primary care doctor.

Coinsurance: This is cost sharing between you and the insurance company that’s expressed as either a percentage or a flat dollar amount. Example, if you have a 20% coinsurance for hospital visits, if the hospital bill is $10,000, you pay $2,000 (20%) and the insurance company will pay the remaining $8,000.

Maximum Out Of Pocket: This the maximum dollar amount that you have to pay each year out of pocket before your health care needs are 100% covered by your Medicare or insurance coverage. If your insurance policy has a $5,000 maximum out of pocket, after you have paid $5,000 out of pocket for that calendar year, you will not be expected to pay anything else for the remainder of the year. Monthly premiums and prescription drug costs do not count toward your maximum out of the pocket threshold.

Medicare Part A Has The Following Cost Sharing Structure For 2019:

As you will see in the table above, while you don’t have a monthly premium for Medicare Part A, if you are hospitalized at some point during the year, you would have to first pay $1,364 out of pocket before Medicare starts to pay for your health care costs. In addition, there is a flat dollar amount co-insurance, which is in addition to the deductible, and that amount varies depending on when the health services are performed during the calendar year.

Medicare Part B

Medicare Part B covers your outpatient health services. These include:

1) Doctors visits

2) Lab work

3) Preventative care (flu shots)

4) Ambulance rides

5) Home health care

6) Chiropractic care (limited)

7) Medical equipment

Unlike Medicare Part A, Medicare Part B has a monthly premium that you will need to pay once you enroll. The amount of the monthly premium is based on your adjusted gross income (AGI). The higher your income, the higher the monthly premium. Below is the 2019 Part B premium table.

As you will see on the chart, the minimum monthly premium is $135.50 per month which translates to $1,626 per year. The income threshold in this chart will vary each year.

Medicare 2-Year Lookback At Income

Medicare automatically looks at your AGI from two years prior to determine your AGI for purposes of Part B premium. In the first few years of receiving Medicare, this 2-year lookback can create an issue. If you retire in 2019, they are going to look at your 2017 tax return which probably has a full year worth of income because you were still working full time back in 2017. If you AGI was $200,000 in 2017, they would charge you more than twice the minimum premium for your Part B coverage.

I have good news. There is an easy fix to this problem. You are able to appeal your income to the Social Security Administration due to a “life changing event”. You can ask Social Security to use your most recent income and you typically have to provide proof to Social Security that you retired in 2019. They will sometimes request a letter signed by your former employer verifying your retirement date and a copy of your final paycheck. You will need to file Form SSA-44 (Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event Form)

How Do You Pay Your Monthly Premiums For Part B?

The Medicare Part B premiums are automatically deducted from your monthly Social Security or Railroad Retirement Benefit payments. If you are 65 and have not yet turned on Social Security, Medicare will invoice you quarterly for those premium amounts and you can pay by check.

Medicare Part B Deductibles and Coinsurance

In addition to the monthly premiums associated with Part B, as with Part A, there are deductibles and coinsurance associated with Part B coverage. Part B carries:

Annual Deductible: $185

Coinsurance: 20%

Example: In January, your doctor tells you that you need your knee replaced. If the surgery costs $50,000, you would have to pay the first $185 out of pocket, and then you would have to pay an additional $9,963 which is 20% of the remaining amount. Not a favorable situation.

But wait, wouldn’t that be covered under Medicare Part A because it happened at a hospital? Not necessarily because “doctor services” performed in a hospital are typically covered under Medicare Part B.

The Largest Issue with Original Medicare is……..

It unfortunately gets worse. If all you have is Original Medicare (Part A & B), there is no Maximum Out of Pocket Limit. Meaning if you get diagnosed with a rare or terminal disease, and your medical bills for the year are $500,000, you may have to pay out of pocket a large portion of that $500,000.

Also, there is no prescription drug coverage under Original Medicare. So you would have the pay the sticker price of all of your prescription drugs out of pocket with no out of pocket limits.

Medicare Part C, Medicare Part D, and Medicare Supplemental Plans

To help individuals over 65 to manage these large costs associated with Original Medicare, there is:

Medicare Part C – Medicare Advantage Plans

Medicare Part D – Standalone Prescription Drug Plans

Medicare Supplemental Plans (“Medigap plans”)

Who Provides What?

Before I get into what each option provides, let’s first identify who provides what:

Medicare Part A: U.S. Government

Medicare Part B: U.S. Government

Medicare Part C – (Medicare Advantage Plan): Private Insurance Company

Medicare Part D – (Prescription Drug Plan): Private Insurance Company

Medicare Supplemental Plan (“Medigap”): Private Insurance Company

The Most Important Decision

Here is where the road splits. To help retirees manage the cost and coverage gaps not covered by Original Medicare, you have two options:

Select a Medicare Advantage Plan

Select a Medicare Supplemental Plan & Medicare Part D Plan

When it comes to your health care decisions in retirement, this is one of the most important decisions that you are going to make. Depending on what state you live in, you may only have one-shot at this decision. It is so vitally important that you fully understand the pros and cons of each option. Unfortunately, as we will detail in other articles, there is big push by the insurance industry to persuade individuals to select the Medicare Advantage option. Both the private insurance company and the insurance agent selling you the policy get paid a lot more when you select a Medicare Advantage Plan instead of a Medicare Supplemental Plan. While this may be the right choice for some individuals, there are significant risks that individuals need to be aware of before selecting a Medicare Advantage Plan.

Medicare Advantage Plans

VERY IMPORTANT: Medicare Advantage Plans and Medicare Supplemental Plans are NOT the same. Medicare Advantage Plans are NOT “Medigap Plans”.

Medicare Advantage Plans do NOT “supplement” your Original Medicare coverage. Medicare Advantage Plans REPLACE your Medicare coverage. If you sign up for a Medicare Advantage Plan, you are no longer covered by Medicare. Medicare has sold you to the private insurance company.

Medicare Advantage Plans are not necessarily an “enhancement” to your Original Medicare Benefit. They are what the insurance industry considers an “actuarial equivalent”. The term actuarial equivalent benefit is just a fancy way of saying that at a minimum it is “worth the same dollar amount”. Medicare Advantage Plans are required to cover the same procedures that are covered under Medicare Part A & B but not necessarily at the same cost. The actuarial equivalent means when they have a large group of individuals, on average, those people are going to receive the same dollar value of benefit as Original Medicare would have provided. In other words, there are going to be clear winners and losers within the Medicare Advantage Plan structure. You are essentially rolling the dice as to what camp you are going to end up in.

If you enroll in a Medicare Advantage Plan, you will no longer have a Medicare card that you show to your doctors. You will receive an insurance card from the private insurance company. If you have a problem with your healthcare coverage, you do not call Medicare. Medicare is no longer involved.

Why Do People Choose Medicare Advantage Plans?

Here are the top reasons why we see people select Medicare Advantage Plan:

Provide Maximum Out Of Pocket protection

Prescription Drug Coverage

Lower Monthly Premium Compared To Medicare Supplemental Plans

Medicare Supplemental Plans (Medigap)

Now let’s switch gears to Medicare Supplemental Plans, also known as “Medigap Plans”. Unlike Medicare Advantage Plan that replace your Medicare Part A & B coverage, with Medicare Supplement Plans you keep your Original Medicare Coverage and these insurance policies fill in the gaps associated with Medicare Part A & B. So it’s truly an enhancement to your Medicare A & B coverage and not just an actuarial equivalent.

There are different levels of benefits within each of the Medigap plans. Each program is identified with a letter that range from A to N. Here is the chart matrix that shows what each of these programs provides.

For example if you go with plan G which is one of the most popular of the Medigap plans going into 2020, most of the costs associated with Original Medicare are covered by your Supplemental Insurance policy. All you pay is the monthly premium, the $185 Part B deductible, and some small co-pays.

Like Medicare advantage plans, Medicare supplemental plans are provided by private insurance companies. However, what’s different is these plans are standardize. “Standardized” means regardless of what insurance company you select, the health insurance benefits associated with those plans are exactly the same. The only difference is the price that you pay for your monthly premium which is why it makes sense to compare the prices of these plans for each insurance company that offers supplemental plans in your zip code.

VERY IMPORTANT: Not all insurance companies offer Medicare Supplemental Plans. Some just offer Medicare Advantage Plans. So if you end up calling an insurance company directly or meeting directly with an insurance company to discuss your Medicare options, those companies may not even present Medicare Supplemental plans as an option even though that might be the best fit for your personal health insurance needs.

However, even if the insurance company offers Medicare Supplemental plans, you still shop that same plan with other insurance companies. They may tell you “yes we have a Medigap Plan G” but their Medigap Plan G monthly premium may be $100 more per month than another insurance company. Remember, Medicare Supplemental plans are standardized meaning Plan G is the same regardless of which insurance company provides you with your coverage.

Part D – Prescription Drug Plans

If you decide to keep your Original Medicare and add a Medicare Supplemental Plan, you will also have to select a Medicare Part D – Prescription Drug plan to cover the cost of your prescriptions. Unlike Medicare Advantage Plan that have drug coverage bundled into their plans, Medicare Supplemental Plans are medical only, so you need a separate drug plans to cover your prescriptions. It can be beneficial to have a standalone drug plans because you are able to select a plan that favors the prescription drugs that you are taking which could lead to lower out of pocket costs throughout the year. Unlike a Medicare Advantage plan where the prescription drug plan is not customized for you because it’s a take it or leave it bundle.

Summary

This article was a 30,000 foot view of Medicare Part A, B, C, D, and Medicare Supplemental Plans. There is a lot more to Medicare such as:

Enrollment deadlines for Medicare

How to enroll with Medicare

Comparison of Medicare Advantage & Medicare Supplemental Plans

Special Exceptions for NY & CT residents

Working past age 65

Coordinating Medicare With Retiree Health Benefits

And so many more considerations that will factor into your Medicare decision as you approach age 65 or leave the workforce after age 65.

VERY IMPORTANT: People have different health needs, budgets, and timelines for retirement. Medicare solutions are not a one size fits all solution. The decisions that your co-worker made, friend made, or family member made, may not be the best solution for you. Plus remember, Medicare is complex, and we have found without help, many people do not understand all of the options. I have met with clients that have told me that “they have a supplemental plan” only to find out that they had a Medicare Advantage plan and didn’t know it because they never knew the difference between the two when the policies were issued to them. It makes working with an independent Medicare insurance agent very important.

Please feel free to contact us with your Medicare questions and we would be more than happy to run free quotes for you to help you select the right plan at the right cost.

OTHER ARTICLES ON MEDICARE

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Divorce: The Difference Between Mediation, Collaborative, and Litigation

While making the decision to get a divorce can be difficult, it's equally important to decide which path for the divorce process is the right one for you and your current spouse. There are three options:

While making the decision to get a divorce can be difficult, it's equally important to decide which path for the divorce process is the right one for you and your current spouse. There are three options:

Mediation

Collaborative

Litigation

It important to understand the interworking's of each option before making a decision. For example, "trying" mediation in an attempt to save money could land you directly in a litigation battle without the opportunity to give the collaborative process a shot which may have been the right choice in the first place.

Mediation

In working with our clients, we have seen mediation work for some couples and not for others. For couples that can make mediation work, it is usually the preferred method because it provides a couple with the more control over the timeline of the divorce process, more choices, and it’s usually the least costly of the three options.

Litigation is where each side “lawyers up” and you do battle in court. We have seen litigations that go on for years costing tens of thousands of dollars in legal fees on both sides. What many people don’t realize is only about 5% of all divorce cases end in a judge’s ruling. Instead, approximately 95% of the divorce cases end in a settlement between the two soon to be ex-spouses. So the obvious question is “why should a couple use their martial assets to pay large attorney fees if they can just reach an agreement themselves?”

In conjunction with the mediation process, a couple meets with a mediator with the goal of working out their own agreement with regard to distribution of property / assets / liabilities, retirement assets, taxes, child custody, child support, and spousal maintenance. The mediator serves as a non-bias guide as you work towards an agreement.

You can ask questions like:

“How is child support calculated?”

“What items do we need to consider for the child custody agreement?”

“How do we assign a value to our business?”

“What is the tax impact of splitting the retirement accounts?”

Overcoming Tough Issues

You may find that you are able to reach an amicable agreement on a majority of the items that will be included in your agreement but what happens in the mediation process for the handful of items that you do not agree upon? It's the job of the mediator to help you to work through those tough issues. It may involve the mediator suggesting possible solutions or asking additional questions to obtain more information about the issue. By keeping the lines of communication open and asking additional questions, it can lead to elegant solutions that were not initially identified as an option.

Ground Rules

While it's important to keep the lines of communication open during the mediation process it may be a wise to agree on a set of ground rules for the mediation process. One of those rules may be that you cannot talk about the divorce outside of the formal mediation sessions. Sometime this is where mediation falls apart. Everything seems to be going great but you are working on one or two of those tough issues that's preventing the final settlement agreement, you go home, get into a heated argument without the presence of the mediator to help reign the emotions back in, and the next thing you know the mediation process is dead because the spouses are no longer speaking to each other. Ground rules are an important part of the process.

Control Over The Timeline

One of the big advantages of the mediation process is it gives you a high degree of control over how long the divorce process takes from start to finish. You do not have to wait for replies from the other side's attorney or court dates. The mediation process moves as fast or as slow as you would like it too. The mediation process is often completed in 3 to 10 meetings. According to www.mediate.com the average mediation case settles in 90 days.

Making The Mediation Process Work

Having seen clients go through this process, there are a few key items that need to exist for the mediation process to really work.

The couple must be able to communicate effectively

Both spouses need to feel like they can represent their own interests

Both spouses need to feel comfortable making financial decisions

There is general sense of trust and a willingness to compromise

Communication

If for whatever reason you can't stand the sight of your soon to be ex-spouse, most likely mediation is not going to work. Both spouses need to be able to openly communicate with each other to reach an agreement.

Represent Personal Interests

If one of the spouses feels like that they cannot adequately represent their interests or feel intimidated about speaking openly about what's important to them, the mediation process is probably not the right option. There are a lot of very important decisions being made in a relatively short period of time. It's important for each spouse to be confident that they fully understand the terminology being discussed, the decisions that are being made, and the long term impact of those decisions once the divorce is finalized.

The Non-Financial Spouse

Since one of the important items included in the divorce agreement is the separation of marital assets, if you or your spouse is intimidated by financial terms or finances in general, it can jeopardize the mediation process. However, if this is the case, it's important for the non-financial spouse to establish a trusted relationship with a financial planner that will help them to understand the short and long term impact of the financial decisions that they are making in conjunction with the mediation process. Items like establishing a budget, determining whether or not they can afford to stay in the marital house, retirement projection, paying down debt, the tax impact of child support, alimony payment, and other material items that will impact their overall financial plan post divorce. For the non-financial spouse, if this relationship is not established during the mediation process, it can lead to the downfall in the mediation process because the non-financial spouse may feel like they don't even know the right financial questions to be asking during the mediation process.

Trust & Compromise

Negotiating in good faith and a willingness to compromise are key to making the mediation process work. As soon as one spouse thinks the other spouse is hiding something, it’s game over for the mediation process. It triggers that natural response, if he or she is hiding one thing, what else are they hiding?

Reaching an agreement requires comprise especially on the difficult issues. If either spouse going into the mediation process is unwilling to give up any ground, it will make the mediation process difficult if not impossible. Married couples pursing a divorce have to remember that same amount of income and assets that were previously supporting a single household are now being used to support two separate households. It typically costs more to support two households instead of one. Two mortgages, two sets of clothes for the kids, two cable bills, etc. Both sides typically have to adjust their standard of living after the divorce is finalized.

Collaborative Divorce

If mediation is not a good fit for you, instead of just defaulting to the litigation option, an option that is growing rapidly in popularity is Collaborative Divorce.

Unlike mediation where it’s just you, your spouse, and a mediator, in the collaborative setting each spouse retains their own attorney to represent them at the table.

The goal of the attorneys in the collaborative setting is the same as the mediator, to reach an amicable agreement between you and your spouse. In fact, the attorneys will typically sign an agreement that if the collaborative process fails and you are unable to reach an agreement, those same attorneys are excluded from representing you in a litigation case. In other words, no matter how much you like your attorney, you would have to find a different attorney if you end up in court. This is an important aspect of the collaborative process because everyone is driving toward a settlement agreement. In divorce cases, people worry that their spouse’s attorney will try to “stir the pot” and get their spouse worked up about certain issues. If the collaborate process fails, both attorneys are out of the picture.

More Support

Having your own attorney sitting next to you and negotiating on your behalf is what many people need to feel comfortable that nothing is being missed and the right decisions are being made on their behalf. If negotiations get too intense during a collaborative session you can take a break, regroup, and seek counsel from your attorney.

Who Is Involved?

In most collaborative divorce cases there are anywhere from 4 to 7 people sitting at the table:

You

Your Attorney

Your Spouse

Your Spouse's Attorney

A Coach or Mediator

Child Specialist

Financial Specialist

The coach or mediators serves as a neutral. They coordinate the meetings, ask questions to help facilitate the negotiations, and help set and enforce the ground rules for the collaborative process. A child specialist can be involved in specific meetings to coordinate the child custody agreement or a financial specialist can be called in to assist in equitable distribution of the martial assets.

What Does It Cost?

Collaborate Divorce is not cheap. You have attorneys involved, a coach, and possibly specialists to help reach an agreement. However, the collaborative process provides you with more control compared to litigation. It provides you with more control over the duration of the divorce process and control over the terms of your agreement. Similar to mediation, the pace of the collaborative process is set by the parties involved. You do not have to wait for court dates. We have seen some collaborative cases reach an agreement faster than a mediation case because the attorneys were there to help push the process along.

It also provides you with more control over the terms of your agreement because you are not tied to “what the law says”. You can create solutions that work for you, work for your spouse, but are outside the boundaries of case law. Also you are not tied to decisions that are handed down by a judge that does not know you or your kids.

In many cases, collaborative ends up being less expensive than full litigation because the duration of the divorce process tends to be shorter since everyone is driving toward a settlement. But given the number of professionals involved in the process, it’s typically more expensive than mediation.

Litigation

Litigation is what most of us think of when we hear the word “divorce”. You go out and find the best attorney that is going to make your soon to be ex-spouse pay!!! Sometimes litigation is unavoidable. As mentioned earlier, if you can’t stand the sight of your ex-spouse sitting across the table from you, then most likely mediation and collaborative are not going to work.

Litigation is usually the most expensive route to go. Attorneys bill by the hour and when you have court dates, your attorney will usually begin their bill rates as soon as they leave the office. Also they have to spend time replying to motions from your spouse’s attorney, preparing for court, and calling experts to testify in court. All too often, an attorney can look at the assets and income of a couple that is getting divorced and they can ballpark the amount of the child support, alimony, and an approximate asset split based on past settlement agreement. The couple then proceeds to spend months and sometimes years in court arguing about this, that, and other thing just to end up in the same spot but with less assets because both sides had to pay their attorneys $20,000+ in legal fees. It’s for this reason that the collaborative divorce process is gaining traction.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Do I Make Too Much To Qualify For Financial Aid?

If you have children that are college-bound at some point you will begin the painful process of calculating how much college will cost for both you and them. However, you might be less worried about the financial aspects of your child going to college after viewing some of the Bloomsburg student apartments for rent on the market at the moment.

If you have children that are college-bound at some point you will begin the painful process of calculating how much college will cost for both you and them. However, you might be less worried about the financial aspects of your child going to college after viewing some of the Bloomsburg student apartments for rent on the market at the moment. Anyway, I have heard the statement, "well they will just have to take loans" but what parents don't realize is loans are a form of financial aid. Loans are not a given. Whether your children plan to attend a public college or private college, both have formulas to determine how much a family is expected to pay out of pocket before you even reach any "financial aid" which includes loans.

College Costs Are Increasing By 6.5% Per Year

The rise in the cost of college has outpaced the inflation rate of most other household costs over the past three decades.

To put this in perspective, if you have a 3 year old child and the cost of tuition / room & board for a state school is currently $25,000 by the time that child turns 17, the cost for one year of tuition / room & board will be $60,372. Multiply that by 4 years for a bachelor's degree: $241,488. Ouch!!! Which leads you to the next question, how much of that $60,372 per year will I have to pay out of pocket?

FAFSA vs CSS Profile Form

Public schools and private school have a different calculation for how much “aid” you qualify for. Public or state schools go by the FAFSA standards. Private schools use the “CSS Profile” form. The FAFSA form is fairly straight forward and is applied universally for state colleges. However, private schools are not required to follow the FAFSA financial aid guidelines which is why they have the separate CSS Profile form. By comparison the CSS profile form requests more financial information.

For example, for couples that are divorced, the FAFSA form only takes into consideration the income and assets of the parent that the child lives with for more than six months out of the year. This excludes the income and assets of the parent that the child does not live with for the majority of the year which could have a positive impact on the financial aid calculation. However, the CSS profile form, for children with divorced parents, requests and takes into consideration the income and assets of both parents regardless of their marital status.

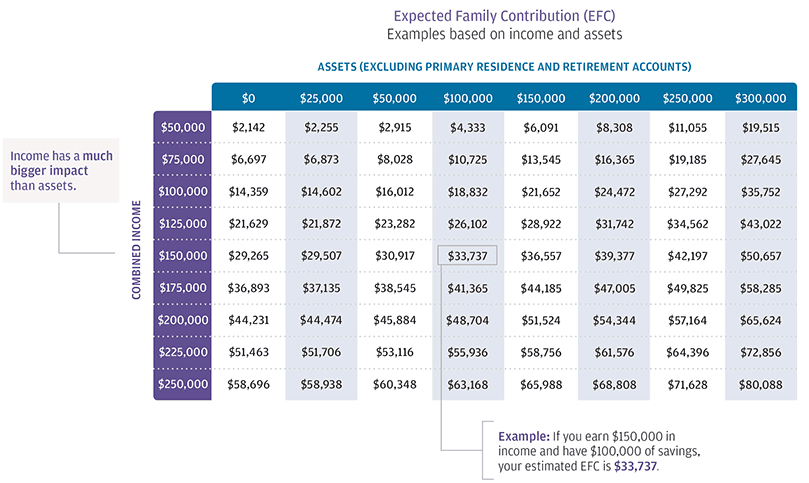

Expected Family Contribution

Both the FAFSA and CSS Profile form result in an "Expected Family Contribution" (EFC). That is the amount the family is expected to pay out of pocket for their child's college expense before the financial aid package begins. Below is a EFC award chart based on the following criteria:

FAFSA Criteria

2 Parent Household

1 Child Attending College

1 Child At Home

State of Residence: NY

Oldest Parent: 49 year old

As you can see in the chart, income has the largest impact on the amount of financial aid. If a married couple has $150,000 in AGI but has no assets, their EFC is already $29,265. For example, if tuition / room and board is $25,000 for SUNY Albany that means they would receive no financial aid.

Student Loans Are A Form Of Financial Aid

Most parents don't realize the federal student loans are considered "financial aid". While "grant" money is truly "free money" from the government to pay for college, federal loans make up about 32% of the financial aid packages for the 2016 – 2017 school year. See the chart below:

Start Planning Now

The cost of college is increasing and the amount of financial aid is declining. According to The College Board, between 2010 – 2016, federal financial aid declined by 25% while tuition and fees increased by 13% at four-year public colleges and 12% at private colleges. This unfortunate trend now requires parents to start running estimated EFC calculation when their children are still in elementary school so there is a plan for paying for the college costs not covered by financial aid.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Tax Reform: At What Cost?

The Republicans are in a tough situation. There is a tremendous amount of pressure on them to get tax reform done by the end of the year. This type of pressure can have ugly side effects. It’s similar to the Hail Mary play at the end of a football game. Everyone, including the quarterback, has their eyes fixed on the end zone but nobody realizes that no

The Republicans are in a tough situation. There is a tremendous amount of pressure on them to get tax reform done by the end of the year. This type of pressure can have ugly side effects. It’s similar to the Hail Mary play at the end of a football game. Everyone, including the quarterback, has their eyes fixed on the end zone but nobody realizes that no one is covering one of the defensive lineman and he’s just waiting for the ball to be hiked. The game ends without the ball leaving the quarterback’s hands.

The Big Play

Tax reform is the big play. If it works, it could lead to an extension of the current economic rally and more. I’m a supporter of tax reform for the purpose of accelerating job growth both now and in the future. It’s not just about U.S. companies keeping jobs in the U.S. That has been the game for the past two decades. The new game is about attracting foreign companies to set up shop in the U.S. and then hire U.S. workers to run their plants, companies, subsidiaries, etc. Right now we have the highest corporate tax rate in the world which has not only prevented foreign companies from coming here but it has also caused U.S. companies to move jobs outside of the United States. If everyone wants more pie, you have to focus on making the pie bigger, otherwise we are all just going to sit around and fight over who’s piece is bigger.

Easier Said Than Done

How do we make the pie bigger? We have to lower the corporate tax rate which will entice foreign companies to come here to produce the goods and services that they are already selling in the U.S. Which is easy to do if the government has a big piggy bank of money to help offset the tax revenue that will be lost in the short term from these tax cuts. But we don’t.

$1.5 Trillion In Debt Approved

Tax reform made some headway in mid-October when the Senate passed the budget. Within that budget was a provision that would allow the national debt to increase by approximately $1.5 trillion dollars to help offset the short-term revenue loss cause by tax reform. While $1.5 trillion sounds like a lot of money, and don’t get me wrong, it is, let’s put that number in context with some of the proposals that are baked into the proposed tax reform.

Pass-Through Entities

One of the provisions in the proposed tax reform is that income from “pass-through” businesses would be taxed at a flat rate of 25%.

A little background on pass-through business income: sole proprietorships, S corporations, limited liability companies (LLCs), and partnerships are known as pass-through businesses. These entities are called pass-throughs, because the profits of these firms are passed directly through the business to the owners and are taxed on the owners’ individual income tax returns.

How many businesses in the U.S. are pass-through entities? The Tax Foundation states on its website that pass-through entities “make up the vast majority of businesses and more than 60 percent of net business income in America. In addition, pass-through businesses account for more than half of the private sector workforce and 37 percent of total private sector payroll.”

At a conference in D.C., the American Society of Pension Professionals and Actuaries (ASPPA), estimated that the “pass through 25% flat tax rate” will cost the government $6 trillion - $7 trillion in tax revenue. That is a far cry from the $1.5 trillion that was approved in the budget and remember that is just one of the many proposed tax cuts in the tax reform package.

Are Democrats Needed To Pass Tax Reform?

Since $1.5 trillion was approved in the budget by the senate, if the proposed tax reform is able to prove that it will add $1.5 trillion or less to the national debt, the Republicans can get tax reform passed through a “reconciliation package” which does not require any Democrats to step across the aisle. If the tax reform forecasts exceed that $1.5 trillion threshold, then they would need support from a handful of Democrats to get the tax reformed passed which is unlikely.

Revenue Hunting

To stay below that $1.5 trillion threshold, the Republicans are “revenue hunting”. For example, if the proposed tax reform package is expected to cost $5 trillion, they would need to find $3.5 trillion in new sources of tax revenue to get the net cost below the $1.5 trillion debt limit.

State & Local Tax Deductions – Gone?

One for those new revenue sources that is included in the tax reform is taking away the ability to deduct state and local income taxes. This provision has created a divide among Republicans. Since many southern states do not have state income tax, many Republicans representing southern states support this provision. Visa versa, Republicans representing states from the northeast are generally opposed to this provision since many of their states have high state and local incomes taxes. There are other provisions within the proposed tax reform that create the same “it depends on where you live” battle ground within the Republican party.

Obamacare

One of the main reasons why the Trump administration pushed so hard for the Repeal and Replace of Obamacare was “revenue hunting”. They needed the tax savings from the repeal and replace of Obamacare to carrry over to fill the hole that will be created by the proposed tax reform. Since that did not happen, they are now looking high and low for other revenue sources.

Retirement Accounts At Risk?

If the Republicans fail to get tax reform through they run the risk of losing face with their supporters since they have yet to get any of the major reforms through that they campaigned on. Tax reform was supposed to be a layup, not a Hail Mary and this is where the hazard lies. Republicans, out of the desperation to get tax reform through, may start making cuts where they shouldn’t. There are rumors that the Republican Party may consider making cuts to the 401(k) contribution limits and employers sponsored retirement plan. Even though Trump tweeted on October 23, 2017 that he would not touch 401(k)’s as part of tax reform, they are running out of the options for other places that they can find new sources of tax revenue. If it comes down to the 1 yard line and they have the make the decision between making deep cuts to 401(k) plans or passing the tax reform, retirement plans may end up being the sacrificial lamb. There are other consequences that retirement plans may face if the proposed tax reform is passed but it’s too broad to get into in this article. We will write a separate article on that topic.

Tax Reform May Be Delayed

Given all the variables in the mix, passing tax reform before December 31st is starting to look like a tall order to fill. If the Republicans are looking for new sources of revenue, they should probably look for sources that are uniform across state lines otherwise they risk splintering the Republican Party like we saw during the attempt to Repeal and Replace Obamacare. We are encouraging everyone to pay attention to the details buried in the tax reform. While I support tax reform to secure the country’s place in the world both now and in the future, if provisions that make up the tax reform are rushed just to get something done, we run the risk of repeating the short lived glory that tax reform saw during the Reagan Era. They passed sweeping tax cuts, the deficits spiked, and they were forced to raise tax rates a few years later.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Can I Negotiate A Car Lease Buyout?

The short answer is "yes", but the approach that you take will most likely determine whether or not you are successful at purchasing your vehicle for a lower price than the amount listed in the lease agreement. When you lease a car, the lease agreement typically includes an amount that you can purchase the car for at the end of the lease. That amount is

The short answer is "yes", but the approach that you take will most likely determine whether or not you are successful at purchasing your vehicle for a lower price than the amount listed in the lease agreement. When you lease a car, the lease agreement typically includes an amount that you can purchase the car for at the end of the lease. That amount is essentially a guess by the bank that is providing the financing for the lease as to what the future value of your vehicle will be at the end of the lease.

Lease Buyout Calculation

Step number one in the negotiation process is to determine what your vehicle is worth. Did the bank guess right or wrong? If the purchase amount in your lease agreement is $25,000 but you find that the vehicle, based on current market conditions, is only worth $18,000, you probably have room to negotiate the purchase price of your vehicle but you have to do your homework. Compare your vehicle's purchase price to the retail value of local auto dealers. If you can show the bank that there is a local auto dealer trying to sell the exact make and model of your leased car with similar mileage, the bank will be more likely to accept a lower purchase price realizing that they guessed wrong.

Deal Directly With The Bank

You may have noticed that I continue to reference the "bank" in the negotiation process and not the "dealer". This is intentional. Some leasing banks allow dealers to increase the cost of the lease buyout to make a profit. Dealers can also charge document fees, which are taxable in most states. It may also be advantageous to line up your own financing for the lease purchase amount before entering into the negotiation process. If the dealer arranges the financing for you, it can sometimes increase your interest rate to make more money on the purchase. By dealing directly with the leasing bank you can cut out these additional costs.

You Make The Offering Price

Start by making an offer to the leasing bank based on your market research. Also make sure you contact the leasing bank well in advance of the lease "turn-in date". The bank may not be able to provide you with an immediate response to your offer so give yourself plenty of time for the negotiation process to work.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog. I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Fiduciary Rule: Exposing Your 401(K) Advisor’s Secrets

It’s here. On June 9, 2017, the long awaited Fiduciary Rule for 401(k) plans will arrive. What secrets does your 401(k) advisor have?

It’s here. On June 9, 2017, the long awaited Fiduciary Rule for 401(k) plans will arrive. The wirehouse and broker-dealer community within the investment industry has fought this new rule every step of the way. Why? Because their secrets are about to be exposed. Fee gouging in these 401(k) plans has spiraled out of control and it has gone on for way too long. While the Fiduciary Rule was designed to better protect plan participants within these employer sponsored retirement plans, the response from the broker-dealer community, in an effort to protect themselves, may actually drive the fees in 401(k) plans higher than they are now.

If your company sponsors an employer sponsored retirement plan and your investment advisor is a broker with one of the main stream wirehouse or broker dealers then they may be approaching you within the next few months regarding a “platform change” for your 401(k) plan. Best advice, start asking questions before you sign anything!! The brokerage community is going to try to gift wrap this change and present this as a value added service to their current 401(k) clients when the reality is this change is being forced onto the brokerage community and they are at great risk at losing their 401(k) clients to independent registered investment advisory firms that have served as co-fiduciaries to their plans along.

The Fiduciary Rule requires all investment advisors that handle 401(k) plans to act in the best interest of their clients. Up until now may brokers were not held to this standard. As long as they delivered the appropriate disclosure documents to the client, the regulations did not require them to act in their client’s best interest. Crazy right? Well that’s all about to change and the response of the brokerage community will shock you.

I will preface this article by stating that there have been a variety of responses by the broker-dealer community to this new regulation. While we cannot reasonably gather information on every broker-dealers response to the Fiduciary Rule, this article will provide information on how many of the brokerage firms are responding to the new legislation given our independent research.

SECRET #1:

Many of the brokerage dealers are restricting what 401(k) platforms their brokers can use. If the broker currently has 401(k) clients that maintain a plan with a 401(k) platform outside of their new “approved list”, they are forcing them to move the plan to a pre-approved platform or the broker will be required to resign as the advisor to the plan. Even though your current 401(k) platform may be better than the new proposed platform, the broker may attempt to move your plan so they can keep the plan assets. How is this remotely in your employee’s best interest? But it’s happening. We have been told that some of these 401(k) providers end up on the “pre-approve list” because they are willing to share fees with the broker dealer. If you don’t share fees, you don’t make the list. Really ugly stuff!!

SECRET #2:

Because these wirehouses and broker-dealers know that their brokers are not “experts” in 401(k) plans, many of the brokerage firms are requiring their 401(k) plans to add a third-party fiduciary service which usually results in higher plan fees. The question to ask is “if you were so concerned about our fiduciary liability why did you wait until now to present this third party fiduciary service?” They are doing this to protect themselves, not the client. Also, many of these third party fiduciary services could standardize the investment menu and take the control of the investment menu away from the broker. Which begs the question, what are you paying the broker for?

SECRET #3:

Some broker-dealers are responding to the Fiduciary Rule by forcing their brokers to move all their 401(k) plans to a “fee based platform” versus a commission based platform. The plan participants may have paid commissions on investments when they were purchased within their 401(k) account and now could be forced out of those investments and locked into a fee based fee structure after they already paid a commission on their balance. This situation will be common for 401(k) plans that are comprised primarily of self-directed brokerage accounts. Make sure you ask the advisor about the impact of the fee structure change and any deferred sales charges that may be imposed due to the platform change.

SECRET #4:

The plan fees are often times buried. The 401(k) industry has gotten very good at hiding fees. They talk in percentages and basis points but rarely talk in hard dollars. One percent does not sound like a lot but if you have a $2 million dollar 401(k) plan that equals $20,000 in fees coming out of the plans assets every year. Most of the fees are buried in the mutual fund expense ratios and you basically have to be an investment expert to figure out how much you are paying. This has continued to go on because very rarely do companies write a check for their 401(k) fees. Most plans debit plan assets for their plan fees but the fees are real.

With all of these changes taking place, now is the perfect time to take a good hard look at your company’s employer sponsored retirement plan. If your current investment advisor approaches you with a recommended “platform change” that is a red flag. Start asking a lot of questions and it may be a good time to put your plan out to bid to see if you can negotiate a better overall solution for you and your employees.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Planning for Long Term Care

The number of conversations that we are having with our clients about planning for long term care is increasing exponentially. Whether it’s planning for their parents, planning for themselves, or planning for a relative, our clients are largely initiating these conversations as a result of their own personal experiences.

The number of conversations that we are having with our clients about planning for long term care is increasing exponentially. Whether it’s planning for their parents, planning for themselves, or planning for a relative, our clients are largely initiating these conversations as a result of their own personal experiences.

The baby-boomer generation is the first generation that on a large scale is seeing the ugly aftermath of not having a plan in place to address a long term care event because they are now caring for their aging parents that are in their 80’s and 90’s. Advances in healthcare have allowed us to live longer but the longer we live the more frail we become later in life.

Our clients typically present the following scenario to us: “I have been taking care of my parents for the past three years and we just had to move my dad into the nursing home. What an awful process. How can I make sure that my kids don’t have to go through that same awful experience when I’m my parents age?”

“Planning for long term care is not just about money…….it’s about having a plan”

If there are no plans, your kids or family members are now responsible for trying to figure out “what mom or dad would have wanted”. Now tough decisions need to be made that can poison a relationship between siblings or family members.

Some individuals never create a plan because it involves tough personal decisions. We have to face the reality that at some point in our lives we are going to get older and later in life we may reach a threshold that we may need help from someone else to care for ourselves or our spouse. It’s a tough reality to face but not facing this reality will most likely result in the worst possible outcome if it happens.

Ask yourself this question: “You worked hard all of your life to buy a house, accumulate assets in retirement accounts, etc. If there are assets left over upon your death, would you prefer that those assets go to your kids or to the nursing home?” With some advance planning, you can make sure that your assets are preserved for your heirs.

The most common reason that causes individuals to avoid putting a plan in place is: “I have heard that long term care insurance is too expensive.” I have good news. First, there are other ways to plan for the cost of a long term care event besides using long term care insurance. Second, there are ways to significantly reduce the cost of these policies if designed correctly.

The most common solution is to buy a long term care insurance policy. The way these policies work is if you can no longer perform certain daily functions, the policy pays a set daily benefit. Now a big mistake many people make is when they hear “long term care” they think “nursing home”. In reality, about 80% of long term care is provided right in the home via home health aids and nurses. Most LTC policies cover both types of care. Buying a LTC policy is one of the most effective ways to address this risk but it’s not the only one.

Why does long term care insurance cost more than term life insurance or disability insurance? The answer, most insurance policies insure you against risks that have a low probability of happening but has a high financial impact. Similar to a life insurance policy. There is a very low probability that a 25 year old will die before the age of 60. However, the risk of long term care has a high probability of happening and a high financial impact. According to a study conducted by the U.S Department of Human Health and Services, “more than 70% of Americans over the age of 65 will need long-term care services at some point in their lives”. Meaning, there is a high probability that at some point that insurance policy is going to pay out and the dollars are large. The average daily rate of a nursing home in upstate New York is around $325 per day ($118,625 per year). The cost of home health care ranges greatly but is probably around half that amount.

So what are some of the alternatives besides using long term care insurance? The strategy here is to protect your assets from Medicaid. If you have a long term care event you will be required to spend down all of your assets until you reach the Medicaid asset allowance threshold (approx. $13,000 in assets) before Medicaid will start picking up the tab for your care. Often times we will advise clients to use trusts or gifting strategies to assist them in protecting their assets but this has to be done well in advance of the long term care event. Medicaid has a 5 year look back period which looks at your full 5 year financial history which includes tax returns, bank statements, retirement accounts, etc, to determine if any assets were “given away” within the last 5 years that would need to come back on the table before Medicaid will begin picking up the cost of an individuals long term care costs. A big myth is that Medicare covers the cost of long term care. False, Medicare only covers 100 days following a hospitalization. There are a lot of ins and outs associated with buildings a plan to address the risk of long term care outside of using insurance so it is strongly advised that individuals work with professionals that are well versed in this subject matter when drafting a plan.

An option that is rising in popularity is “semi self-insuring”. Instead of buying a long term care policy that has a $325 per day benefit, an individual can obtain a policy that covers $200 per day. This can dramatically reduce the cost of the LTC policy because it represents less financial risk to the insurance company. You have essentially self insured for a portion of that future risk. The policy will still payout $73,000 per year and the individual will be on the line for $45,625 out of pocket. Versus not having a policy at all and the individual is out of pocket $118,000 in a single year to cover that $325 per day cost.

As you can see there are a number of different options when it come to planning for long term care. It’s about understanding your options and determining which solution is right for your personal financial situation.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Small Business Owners: How To Lower The Cost of Health Insurance

As an owner of a small business myself, I’ve had a front row seat to the painful rise of health insurance premiums for our employees over the past decade. Like most of our clients, we evaluate our plan once a year and determine whether or not we should make a change. Everyone knows the game. After running on this hamster wheel for the

As an owner of a small business myself, I’ve had a front row seat to the painful rise of health insurance premiums for our employees over the past decade. Like most of our clients, we evaluate our plan once a year and determine whether or not we should make a change. Everyone knows the game. After running on this hamster wheel for the past decade it led me on a campaign to consult with experts in the health insurance industry to find a better solution for both our firm and for our clients.

The Goal: Find a way to keep the employee health benefits at their current level while at the same time cutting the overall cost to the company. For small business owners reducing the company’s outlay for health insurance costs is a challenge. In many situations, small businesses are the typical small fish in a big pond. As a small fish, they frequently receive less attention from the brokerage community which is more focused on obtaining and maintaining larger plans.

Through our research, we found that there are two key items that can lead to significant cost savings for small businesses. First, understanding how the insurance market operates. Second, understanding the plan design options that exist when restructuring the health insurance benefits for your employees.

Small Fish In A Big Pond

I guess it came as no surprise that there was a positive correlation between the size of the insurance brokerage firm and their focus on the large plan market. Large plans are generally defined as 100+ employees. Smaller employers we found were more likely to obtain insurance through their local chambers of commerce, via a “small business solution teams” within a larger insurance brokerage firm, or they sent their employees directly to the state insurance exchange.

Myth #1: Since I’m a small business, if I get my health insurance plan through the Chamber of Commerce it will be cheaper. I unfortunately discovered that this was not the case in most scenarios. If you are an employer with between 1 – 100 employees you are a “community rated plan”. This means that the premium amount that you pay for a specific plan with a specific provider is the same regardless of whether you have 2 employees or 99 employee because they do not look at your “experience rating” (claims activity) to determine your premium. This also means that it’s the same premium regardless of whether it’s through the Chamber, XYZ Health Insurance Brokers, or John Smith Broker. Most of the brokers have access to the same plans sponsored by the same larger providers in a given geographic region. This was not always the case but the Affordable Care Act really standardized the underwriting process.

The role of your insurance broker is to help you to not only shop the plan once a year but to evaluate the design of your overall health insurance solution. Since small companies usually equal smaller premium dollars for brokers it was not uncommon for us to find that many small business owners just received an email each year from their broker with the new rates, a form to sign to renew, and a “call me with any questions”. Small business owners are usually extremely busy and often times lack the HR staff to really look under the hood of their plan and drive the changes needed to improve the plan from a cost standpoint. The way the insurance brokerage community gets paid is they typically receive a percentage of the annual premiums paid by your company. From talking with individuals in the industry, it’s around 4%. So if a company pays $100,000 per year in premiums for all of their employees, the insurance broker is getting paid $4,000 per year. In return for this compensation the broker is supposed to be advocating for your company. One would hope that for $4,000 per year the broker is at least scheduling a physical meeting with the owner or HR staff to review the plan each year and evaluate the plan design options.

Remember, you are paying your insurance broker to advocate for you and the company. If you do not feel like they are meeting your needs, establishing a new relationship may be the start of your cost savings. There also seemed to be a general theme that bigger is not always better in the insurance brokerage community. If you are a smaller company with under 50 employees, working with smaller brokerage firms may deliver a better overall result.

Plan Design Options

Since the legislation that governs the health insurance industry is in a constant state of flux we found through our research that it is very important to revisit the actual structure of the plan each year. Too many companies have had the same type of plan for 5 years, they have made some small tweaks here and there, but have never taken the time to really evaluate different design options. In other words, you may need to demo the house and start from scratch to uncover true cost savings because the problem may be the actual foundation of the house.

High quality insurance brokers will consult with companies on the actual design of the plan to answer the key question like “what could the company be doing differently other than just comparing the current plan to a similar plan with other insurance providers?” This is a key question that should be asked each year as part of the annual evaluation process.

HRA Accounts

The reason why plan design is so important is that health insurance is not a one size fits all. As the owner of a small business you probably have a general idea as to how frequently and to what extent your employees are accessing their health insurance benefits.

For example, you may have a large concentration of younger employees that rarely utilize their health insurance benefits. In cases like this, a company may choose to change the plan to a high deductible, fund a HRA account for each of the employees, and lower the annual premiums.

HRA stands for “Health Reimbursement Arrangement”. These are IRS approved, 100% employer funded, tax advantage, accounts that reimburses employees for out of pocket medical expenses. For example, let’s say I own a company that has a health insurance plan with no deductible and the company pays $1,000 per month toward the family premium ($12,000 per year). I now replace the plan with a new plan that keeps the coverage the same for the employee, has a $3,000 deductible, and lowers the monthly premium that now only cost the company $800 per month ($9,600 per year). As the employer, I can fund a HRA account for that employee with $3,000 at the beginning of the year which covers the full deductible. If that employee only visits the doctors twice that year and incurs $500 in claims, at the end of the year there will be $2,500 in that HRA account for that employee that the employer can then take back and use for other purposes. The flip side to this example is the employee has a medical event that uses the full $3,000 deductible and the company is now out of pocket $12,600 ($9,600 premiums + $3,000 HRA) instead of $12,000 under the old plan. Think of it as a strategy to “self-insure” up to a given threshold with a stop loss that is covered by the insurance itself. The cost savings with this “semi self-insured” approach could be significant but the company has to conduct a risk / return analysis based on their estimated employee claim rate to determine whether or not it’s a viable option.

This is just one example of the plan design options that are available to companies in an attempt to lower the overall cost of maintaining the plan.

Making The Switch

You are allowed to switch your health insurance provider prior to the plan’s renewal date. However, note that if your current plan has a deductible and your replacement plan also carries a deductible, the employees will not get credit for the deductibles paid under the old plan and will start the new plan at zero. Based on the number of months left in the year and the premium savings it may warrant a “band-aide solution” using HRA, HSA, or Flex Spending Accounts to execute the change prior to the renewal date.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.