How Much Should I Budget For Health Care Costs In Retirement?

The number is higher than you think. When you total up the deductibles and premiums for Medicare part A, B, and D, that alone can cost a married couple $7,000 per year. We look at that figure as the baseline number. That $7,000 does not account for the additional costs associated with co-insurance, co-pays, dental costs, or Medigap insurance

The number is higher than you think. When you total up the deductibles and premiums for Medicare part A, B, and D, that alone can cost a married couple $7,000 per year. We look at that figure as the baseline number. That $7,000 does not account for the additional costs associated with co-insurance, co-pays, dental costs, or Medigap insurance premiums which can quickly increase the overall cost to $10,000+ per year.

Tough to believe? Allow me to walk you through the numbers for a married couple.

Medicare Part A: $2,632 Per Year

Part A covers inpatient hospital stays, skilled nursing facility stays, some home health visits, and hospice care. While Part A does not have an annual premium, it does have an annual deductible for each spouse. That deductible for 2017 is $1,316 per person.

Medicare Part B: $3,582

Part B covers physician visits, outpatient services, preventive services, and some home health visits. The standard monthly premium is $134 per person but it could be higher depending on your income level in retirement. There is also a deductible of $183 per year for each spouse.

Medicare Part D: $816

Part D covers outpatient prescription drugs through private plans that contract with Medicare. Enrollment in Part D is voluntary. The benefit helps pay for enrollees’ drug costs after a deductible is met (where applicable), and offers catastrophic coverage for very high drug costs. Part D coverage is actually provided by private health insurance companies. The premium varies based on your income and the types of prescriptions that you are taking. The national average in 2017 for Part D premiums is $34 per person.

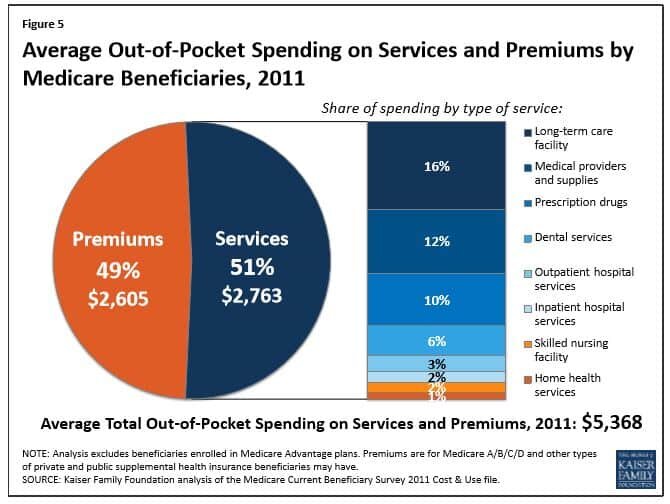

If you total up just these three items, you reach $7,030 in premiums and deductibles for the year. Then you start adding in dental cost, Medigap insurance premiums, co-insurance for Medicare benefits, and it quickly gets a married couple over that $10,000 threshold in health and dental cost each year. Medicare published a report that in 2011, Medicare beneficiaries spent $5,368 out of their own pockets for health care spending, on average. See the table below.

Start Planning Now

Fidelity Investments published a study that found that the average 65 year old will pay $240,000 in out-of-pocket costs for health care during retirement, not including potential long-term-care costs. While that seems like an extreme number, just take the $10,000 that we used above, multiply that by 20 year in retirement, and you get to $200,000 without taking into consideration inflation and other important variable that will add to the overall cost.

Bottom line, you have to make sure you are budgeting for these expenses in retirement. While most individuals focus on paying off the mortgage prior to retirement, very few are aware that the cost of health care in retirement may be equal to or greater than your mortgage payment. When we are create retirement projections for clients we typically included $10,000 to $15,000 in annual expenses to cover health care cost for a married couple and $5,000 – $7,500 for an individual.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Should I Establish A Power of Attorney?

There are three key estate documents that everyone should have: Will, Health Proxy, Power of Attorney, If you have dependents, such as a spouse or children, the statement above graduates from “should have” to “need to

There are three key estate documents that everyone should have:

Will

Health Proxy

Power of Attorney

If you have dependents, such as a spouse or children, the statement above graduates from “should have” to “need to have in place.” The power of attorney document allows someone that you designate to act on your behalf if you are rendered incapacitated such as a car accident, illness, or as you become become more frail later in life.

What happens if I'm in a car accident?

If I have a wife and kids and one day I end up in a car accident and end up in a coma, without a power of attorney in place, not even my wife would be able to access accounts that are solely in my name such as bank accounts, retirement accounts, or creditors. It could put my family in a very difficult situation if my wife is unable to access certain accounts to pay bills or withdraw money to pay for my medical bills while I am recovering. If I establish a Power of Attorney with my wife listed as the POA (Power of Attorney), if I become incapacitated, she can use that document to access all of my accounts as if she were me.

Protecting Against Long Term Care Event

While this a valid example, the Power of Attorney document is more frequently used when elderly individuals experience a long term care event and they are no longer able to manage their finances. The POA gives the designated person the power to make gifts, setup trusts, or implement other wealth preservation strategies to prevent the total depletion of your assets due to the expenses associated with the long term care event.

What happens if you don’t have a power of attorney?

From working with individuals that have been in these situations, it’s ugly. Very ugly. Instead of a trusted person being able to step in and act on your behalf, without a POA your family or friends would need to initiate a guardianship proceeding, wherein the individual is declared incapacitated and a guardian is appointed by the court to manage their financial affairs. The largest drawback of a guardianship proceeding is time and money. It can often times cost more that $15,000 to complete a guardianship processing when taking into account court fees, attorney fees, court evaluations, and bonding fees. In addition and arguably more importantly, you have no control over who the court will decide to appoint as your guardian and that individual will have full control over your finances. You know your family and friends best. Ask yourself this, wouldn’t you prefer to appoint the individual that you trust to carry out your wishes? If the answer is “yes”, then you should strongly consider putting a power of attorney in place.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Small Business Owners: How To Lower The Cost of Health Insurance

As an owner of a small business myself, I’ve had a front row seat to the painful rise of health insurance premiums for our employees over the past decade. Like most of our clients, we evaluate our plan once a year and determine whether or not we should make a change. Everyone knows the game. After running on this hamster wheel for the

As an owner of a small business myself, I’ve had a front row seat to the painful rise of health insurance premiums for our employees over the past decade. Like most of our clients, we evaluate our plan once a year and determine whether or not we should make a change. Everyone knows the game. After running on this hamster wheel for the past decade it led me on a campaign to consult with experts in the health insurance industry to find a better solution for both our firm and for our clients.

The Goal: Find a way to keep the employee health benefits at their current level while at the same time cutting the overall cost to the company. For small business owners reducing the company’s outlay for health insurance costs is a challenge. In many situations, small businesses are the typical small fish in a big pond. As a small fish, they frequently receive less attention from the brokerage community which is more focused on obtaining and maintaining larger plans.

Through our research, we found that there are two key items that can lead to significant cost savings for small businesses. First, understanding how the insurance market operates. Second, understanding the plan design options that exist when restructuring the health insurance benefits for your employees.

Small Fish In A Big Pond

I guess it came as no surprise that there was a positive correlation between the size of the insurance brokerage firm and their focus on the large plan market. Large plans are generally defined as 100+ employees. Smaller employers we found were more likely to obtain insurance through their local chambers of commerce, via a “small business solution teams” within a larger insurance brokerage firm, or they sent their employees directly to the state insurance exchange.

Myth #1: Since I’m a small business, if I get my health insurance plan through the Chamber of Commerce it will be cheaper. I unfortunately discovered that this was not the case in most scenarios. If you are an employer with between 1 – 100 employees you are a “community rated plan”. This means that the premium amount that you pay for a specific plan with a specific provider is the same regardless of whether you have 2 employees or 99 employee because they do not look at your “experience rating” (claims activity) to determine your premium. This also means that it’s the same premium regardless of whether it’s through the Chamber, XYZ Health Insurance Brokers, or John Smith Broker. Most of the brokers have access to the same plans sponsored by the same larger providers in a given geographic region. This was not always the case but the Affordable Care Act really standardized the underwriting process.

The role of your insurance broker is to help you to not only shop the plan once a year but to evaluate the design of your overall health insurance solution. Since small companies usually equal smaller premium dollars for brokers it was not uncommon for us to find that many small business owners just received an email each year from their broker with the new rates, a form to sign to renew, and a “call me with any questions”. Small business owners are usually extremely busy and often times lack the HR staff to really look under the hood of their plan and drive the changes needed to improve the plan from a cost standpoint. The way the insurance brokerage community gets paid is they typically receive a percentage of the annual premiums paid by your company. From talking with individuals in the industry, it’s around 4%. So if a company pays $100,000 per year in premiums for all of their employees, the insurance broker is getting paid $4,000 per year. In return for this compensation the broker is supposed to be advocating for your company. One would hope that for $4,000 per year the broker is at least scheduling a physical meeting with the owner or HR staff to review the plan each year and evaluate the plan design options.

Remember, you are paying your insurance broker to advocate for you and the company. If you do not feel like they are meeting your needs, establishing a new relationship may be the start of your cost savings. There also seemed to be a general theme that bigger is not always better in the insurance brokerage community. If you are a smaller company with under 50 employees, working with smaller brokerage firms may deliver a better overall result.

Plan Design Options

Since the legislation that governs the health insurance industry is in a constant state of flux we found through our research that it is very important to revisit the actual structure of the plan each year. Too many companies have had the same type of plan for 5 years, they have made some small tweaks here and there, but have never taken the time to really evaluate different design options. In other words, you may need to demo the house and start from scratch to uncover true cost savings because the problem may be the actual foundation of the house.

High quality insurance brokers will consult with companies on the actual design of the plan to answer the key question like “what could the company be doing differently other than just comparing the current plan to a similar plan with other insurance providers?” This is a key question that should be asked each year as part of the annual evaluation process.

HRA Accounts

The reason why plan design is so important is that health insurance is not a one size fits all. As the owner of a small business you probably have a general idea as to how frequently and to what extent your employees are accessing their health insurance benefits.

For example, you may have a large concentration of younger employees that rarely utilize their health insurance benefits. In cases like this, a company may choose to change the plan to a high deductible, fund a HRA account for each of the employees, and lower the annual premiums.

HRA stands for “Health Reimbursement Arrangement”. These are IRS approved, 100% employer funded, tax advantage, accounts that reimburses employees for out of pocket medical expenses. For example, let’s say I own a company that has a health insurance plan with no deductible and the company pays $1,000 per month toward the family premium ($12,000 per year). I now replace the plan with a new plan that keeps the coverage the same for the employee, has a $3,000 deductible, and lowers the monthly premium that now only cost the company $800 per month ($9,600 per year). As the employer, I can fund a HRA account for that employee with $3,000 at the beginning of the year which covers the full deductible. If that employee only visits the doctors twice that year and incurs $500 in claims, at the end of the year there will be $2,500 in that HRA account for that employee that the employer can then take back and use for other purposes. The flip side to this example is the employee has a medical event that uses the full $3,000 deductible and the company is now out of pocket $12,600 ($9,600 premiums + $3,000 HRA) instead of $12,000 under the old plan. Think of it as a strategy to “self-insure” up to a given threshold with a stop loss that is covered by the insurance itself. The cost savings with this “semi self-insured” approach could be significant but the company has to conduct a risk / return analysis based on their estimated employee claim rate to determine whether or not it’s a viable option.

This is just one example of the plan design options that are available to companies in an attempt to lower the overall cost of maintaining the plan.

Making The Switch

You are allowed to switch your health insurance provider prior to the plan’s renewal date. However, note that if your current plan has a deductible and your replacement plan also carries a deductible, the employees will not get credit for the deductibles paid under the old plan and will start the new plan at zero. Based on the number of months left in the year and the premium savings it may warrant a “band-aide solution” using HRA, HSA, or Flex Spending Accounts to execute the change prior to the renewal date.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Financial Planning To Do's For A Family

My wife and I just added our first child to the family so this is a topic that has been weighing on my mind over the last 40 weeks. I will share just one non-financial takeaway from the entire experience. The global population may be much lower if men had to go through what women do. That being said, this article is meant to be a guideline for some of the important financial items to consider with children. Worrying about your children will never end and being comfortable with the financial aspects of parenthood may allow you to worry a little less and be able to enjoy the time you have with the

My wife and I just added our first child to the family so this is a topic that has been weighing on my mind over the last 40 weeks. I will share just one non-financial takeaway from the entire experience. The global population may be much lower if men had to go through what women do. That being said, this article is meant to be a guideline for some of the important financial items to consider with children. Worrying about your children will never end and being comfortable with the financial aspects of parenthood may allow you to worry a little less and be able to enjoy the time you have with them.

There is a lot of information to take into consideration when putting together a financial plan and the larger your family the more pieces to the puzzle. It is important to set goals and celebrate them when they are met. Everything cannot be done in a day, a week, or a month, so creating a task list to knock off one by one is usually an effective approach. Using relatives, friends, and professionals as resources is important to know what should be on that list for topics you aren’t familiar with.

Create a Budget

It may seem tedious but this is one of the most important pieces of a family’s financial plan. You don’t have to track every dollar coming in and out but having a detailed breakdown on where your money is being spent is necessary in putting together a plan. This simple Expense Planner can serve as a guideline in starting your budget. If you don’t have an accurate idea of where your money is being spent then you can’t know where you can cut back or afford to spend more if needed. Also, the budget is a great topic during a romantic dinner.

You will always want to have 4-6 months expenses saved up and accessible in case a job is lost or someone becomes disabled and cannot work. Having an accurate budget will help you determine how much money you should have liquid.

Insurance

You want to be sure you are sufficiently covered if anything ever happened. One terrible event could leave your family in a situation that may have been avoidable. Insurance is also something you want to take care of as soon as possible so you know the coverage is there if needed.

Health Insurance

Research the policies that are available to you and determine which option may be the most appropriate in your situation. It is important to know the medical needs of your family when making this decision.

Turning one spouse’s single coverage into family coverage is one of the more common ways people obtain coverage for a family. Insurance companies will usually only allow changes to policies through open enrollment or when a “qualifying event” occurs. Having a child is usually a qualifying event but this may only allow the child to be added to one’s coverage, not the spouse. If that is the case, the spouse will want to make sure they have their own coverage until they can be added to the family plan.

It is important to use the resources available to you and consult with your health insurance provider on the ins and outs. If neither spouse has coverage through work, the exchange can be a resource for information and an option to obtain coverage (https://www.healthcare.gov/).

Life Insurance

The majority of people will obtain Term Life Insurance as it is a cost effective way to cover the needs of your family. Life insurance policies have an extensive underwriting process so the sooner you start the sooner you will be covered if anything ever happened. How Much Life Insurance Do I Need?, is an article that may help answer the question regarding the amount of life insurance sufficient for you.

Disability Insurance

The probability of using disability insurance is likely more than that of life insurance. Like life insurance, there is usually a long underwriting process to obtain coverage. Disability insurance is important as it will provide income for your family if you were unable to work. Below are some terms that may be helpful when inquiring about these policies.

Own Occupation – means that insurance will turn on if you are unable to perform YOUR occupation. “Any Occupation” is usually cheaper but means that insurance will only turn on if you can prove you can’t do ANY job.

60% Monthly Income – this represents the amount of the benefit. In this example, you will receive 60% of your current income. It is likely not taxable so the net pay to you may be similar to your paycheck. You can obtain more or less but 60% monthly income is a common benefit amount.

90 Day Elimination Period – this means the benefit won’t start until 90 days of being disabled. This period can usually be longer or shorter.

Cost of Living or Inflation Rider – means the benefit amount will increase after a certain time period or as your salary increases.

Wills, POA’s, Health Proxies

These are important documents to have in place to avoid putting the weight of making difficult decisions on your loved ones. There are generic templates that will suffice for most people but it is starting the process that is usually the most difficult. “What Is The Process Of Setting Up A Will?, is an article that may help you start.

College Savings

The cost of higher education is increasing at a rapid rate and has become a financial burden on a lot of parents looking to pick up the tab for their kids. 529 accounts are a great way to start saving early. There are state tax benefits to parents in some states (including NYS) and if the money is spent on tuition, books, or room and board, the gain from the investments is tax free. Roth IRA’s are another investment vehicle that can be used for college but for someone to contribute to a Roth IRA they must have earned income. Therefore, a newborn wouldn’t be able to open a Roth IRA. Since the gain in 529’s is tax free if used for college, the earlier the dollars go into the account the longer they have to potentially earn income from the market.

529’s can also be opened by anyone, not just the parents. So if the child has a grandparent that likes buying savings bonds or a relative that keeps purchasing clothes the child will wear once, maybe have them contribute to a 529. The contribution would then be eligible for the tax deduction to the contributor if available in the state.

Below is a chart of the increasing college costs along with links to information on college planning.

About Rob……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.