New York May Deviate From The New 529 Rules

When the new tax rules were implemented on January 1, 2018, a popular college savings vehicle that goes by the name of a “529 plan” received a boost. Prior to the new tax rules, 529 plans could only be used to pay for college. The new tax rules allow account owners to withdraw up to $10,000 per year per child for K – 12 public school, private school,

When the new tax rules were implemented on January 1, 2018, a popular college savings vehicle that goes by the name of a “529 plan” received a boost. Prior to the new tax rules, 529 plans could only be used to pay for college. The new tax rules allow account owners to withdraw up to $10,000 per year per child for K – 12 public school, private school, religious school, or homeschooling expenses. These distributions would be considered “qualified” which means distributions are made tax free.

Initially we expected this new benefit to be a huge tax advantage for our clients that have children that attend private school. They could fully fund a 529 plan up to $10,000 per year, capture a New York State tax deduction for the $10,000 contribution, and then turn around and distribute the $10,000 from the account to make the tuition payment for their kids.

New York May Deviate

States are not required to adhere to the income tax rules set forth by the federal government. In other words, states may choose to adopt the new tax rules set forth by the federal government or they can choose to ignore them. The new tax laws that went into effect in 2018 will impact states differently. More specifically, tax payers in states that have both income taxes and high property taxes, like New York and California, may be adversely affected due to the new $10,000 cap on the ability to fully deduct those expenses on their federal tax return.

As of June 30, 2018, New York has yet to provide guidance as to whether or not they will recognize the K -12 distributions from 529 plans as “qualified”. More than 30 states have already announced that they will adhere to the new federal tax rules. On the opposite side of that coin, California has announced that they will not adhere to the new 529 tax rules and they will tax distribution made for K – 12 expenses. Oregon has gone one step further and will not only tax the distributions but they will also recapture state tax deductions taken for distributions made for K – 12 expenses.

Wait & See

If you live in a state like New York that has yet to provide guidance with regard to the new 529 rules, you end up in this wait and see scenario. There is no way to know which way New York is going to rule on this new federal tax rule. However, if New York follows the path taken by many of the other states that were adversely affected by the new federal tax rules, they may decide to follow suit and choose to ignore the new 529 tax rules adopted by the federal government.

We also don’t have any guidance as to when NYS will rule on this issue. They may wait until November or December to issue formal guidance. If that happens, 529 account owners looking to take advantage of the new K – 12 distribution rules will have to be on their toes because distributions from 529 accounts have to happen in the same year that the expense is incurred in order to receive the preferentially tax treatment.

Potential investors of 529 plans may get more favorable tax benefits from 529 plans sponsored by their own state. Consult your tax professional for how 529 tax treatments and account fees would apply to your particular situation. To determine which college saving option is right for you, please consult your tax and accounting advisors. Neither APFS nor its affiliates or financial professionals provide tax, legal or accounting advice. Please carefully consider investment objectives, risks, charges, and expenses before investing. For this and other information about municipal fund securities, please obtain an offering statement and read it carefully before you invest. Investments in 529 college savings plans are neither FDIC insured nor guaranteed and may lose value.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Moving Expenses Are No Longer Deductible

If you were planning on moving this year to take a new position with a new company or even a new position within your current employer, the moving process just got a little more expensive. Not only is it expensive, but it can put you under an intense amount of stress as there will be lots of things that you need to have in place before packing up and

If you were planning on moving this year to take a new position with a new company or even a new position within your current employer, the moving process just got a little more expensive. Not only is it expensive, but it can put you under an intense amount of stress as there will be lots of things that you need to have in place before packing up and moving. Even things like how you are going to transport your car over to your new home, can take up a lot of your time, and on top of that, you have to think about how much it's going to cost. Prior to the tax law changes that took effect January 1, 2018, companies would often offer new employees a "relocation package" or "moving expense reimbursements" to help subsidize the cost of making the move. From a tax standpoint, it was great benefit because those reimbursements were not taxable to the employee. Unfortunately that tax benefit has disappeared in 2018 as a result of tax reform.

Taxable To The Employee

Starting in 2018, moving expense reimbursements paid to employee will now represent taxable income. Due to the change in the tax treatment, employees may need to negotiate a higher expense reimbursement rate knowing that any amount paid to them from the company will represent taxable income.

For example, let’s say you plan to move from New York to California and you estimate that your moving expense will be around $5,000. In 2017, your new employer would have had to pay you $5,000 to fully reimburse you for the moving expense. In 2018, assuming you are in the 35% tax bracket, that same employer would need to provide you with $6,750 to fully reimburse you for your moving expenses because you are going to have to pay income tax on the reimbursement amount.

Increased Expense To The Employer

For companies that attract new talent from all over the United States, this will be an added expense for them in 2018. Many companies limit full moving expense reimbursement to executives. Coincidentally, employees at the executive level are usually that highest paid. Higher pay equals higher tax brackets. If you total up the company's moving expense reimbursements paid to key employees in 2017 and then add another 40% to that number to compensate your employees for the tax hit, it could be a good size number.

Eliminated From Miscellaneous Deductions

As an employee, if your employer did not reimburse you for your moving expenses and you had to move at least 50 miles to obtain that position, prior to 2018, you were allowed to deduct those expenses when you filed your taxes and you were not required to itemize to capture the deduction. However, this expense will no longer be deductible even for employees that are not reimbursed by their employer for the move starting in 2018.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Warning To All Employees: Review The Tax Withholding In Your Paycheck Otherwise A Big Tax Bill May Be Waiting For You

As a result of tax reform, the IRS released the new income tax withholding tables in January and your employer probably entered those new withholding amounts into the payroll system in February. It was estimated that about 90% of taxpayers would see an increase in their take home pay once the new withholding tables were implemented.

As a result of tax reform, the IRS released the new income tax withholding tables in January and your employer probably entered those new withholding amounts into the payroll system in February. It was estimated that about 90% of taxpayers would see an increase in their take home pay once the new withholding tables were implemented. While lower tax rates and more money in your paycheck sounds like a good thing, it may come back to bite you when you file your taxes.

The Tax Withholding Guessing Game

Knowing the correct amount to withhold for federal and state income taxes from your paycheck is a bit of a guessing game. Withhold too little throughout the year and when you file your taxes you have a tax bill waiting for you equal to the amount of the shortfall. Withhold too much and you will receive a big tax refund but that also means you gave the government an interest free loan for the year.

There are two items that tell your employer how much to withhold for federal income tax from your paycheck:

Income Tax Withholding Tables

Form W-4

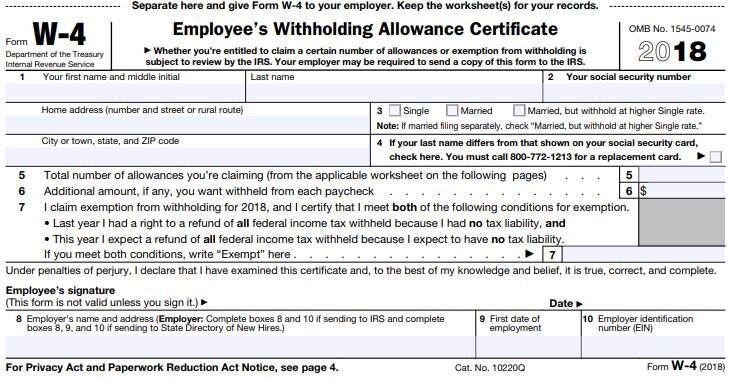

The IRS provides your employer with the Income Tax Withholding Tables. On the other hand, you as the employee, complete the Form W-4 which tells your employer how much to withhold for taxes based on the “number of allowances” that you claim on the form.

What Is A W-4 Form?

The W-4 form is one of the many forms that HR had you complete when you were first hired by the company. Here is what it looks like:

Section 3 of this form tells your employer which withholding table to use:

Single

Married

Married, but withhold at higher Single Rate

Section 5 tells your employer how many "allowances" you are claiming. Allowance is just another word for "dependents". The more allowances your claim, the lower the tax withholding in your paycheck because it assumes that you will have less "taxable income" because in the past you received a deduction for each dependent. This is where the main problem lies. Due to the changes in the tax laws, the tax deduction for personal exemptions was eliminated. This may adversely affect some taxpayers the were claiming a high number of allowances on their W-4 form because even though the number of their dependents did not change, their taxable income may be higher in 2018 because the deduction for personal exemptions no longer exists.

Even though everyone should review their Form W-4 form this year, employees that claimed allowances on their W-4 form are at the highest risk of either under withholding or over withholding taxes from their paychecks in 2018 due to the changes in the tax laws.

How Much Should I Withhold From My Paycheck For Taxes?

So how do you go about calculating that right amount to withhold from your paycheck for taxes to avoid an unfortunate tax surprise when you file your taxes for 2018? There are two methods:

Ask your accountant

Use the online IRS Withholding Calculator

The easiest and most accurate method is to ask your personal accountant when you meet with them to complete your 2017 tax return. Bring them your most recent pay stub and a blank Form W-4. Based on the changes in the tax laws, they can assist you in the proper completion of your W-4 Form based on your estimated tax liability for the year.If you complete your own taxes, I would highly recommend visiting the updated IRS Withholding Calculator. The IRS calculator will ask you a series of questions, such as:

How many dependents you plan to claim in 2018

Are you over the age of 65

The number of children that qualify for the dependent care credit

The number of children that will qualify for the new child tax credit

Estimated gross wages

How much fed income tax has already been withheld year to date

Payroll frequency

At the end of the process it will provide you with your personal results based on the data that you entered. It will provide you with guidance as to how to complete your Form W-4 including the number of allowances to claim and if applicable, the additional amount that you should instruct your employer to withhold from your paycheck for federal income taxes. Additional withholding requests are listed in Section 6 of the Form W-4.

Avoid Disaster

Having this conversation with your accountant and/or using the new IRS Withholding Calculator will help you to avoid a big tax disaster in 2018. Unfortunately, many employees may not learn about this until it's too late. Employees that are used to getting a tax refund may find out in the spring of next year that they owe thousands of dollars to the IRS because the combination of the new tax tables and the changes in the tax law that caused them to inadvertently under withhold federal income taxes throughout the year.

Action Item!!

Take action now. The longer you wait to run this calculation or to have this conversation with your accountant, the larger the adjustment may be to your paycheck. It's easier to make these adjustments now when you have nine months left in the year as opposed to waiting until November.I would strongly recommend that you share this article with your spouse, children in the work force, and co-workers to help them avoid this little known problem. The media will probably not catch wind of this issue until employees start filing their tax returns for 2018 and they find out that there is a tax bill waiting for them.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

No Deduction For Entertainment Expenses In 2019. Ouch!!

There is a little known change that was included in tax reform that will potentially have a big impact on business owners. The new tax laws that went into effect on January 1, 2018 placed stricter limits on the ability to deduct expenses associated with entertainment and business meals. Many of the entertainment expenses that businesses

There is a little known change that was included in tax reform that will potentially have a big impact on business owners. The new tax laws that went into effect on January 1, 2018 placed stricter limits on the ability to deduct expenses associated with entertainment and business meals. Many of the entertainment expenses that businesses were able to deduct in 2017 will no longer we allowed in 2018 and beyond. A big ouch for business owners that spend a lot of money entertaining clients and prospects.

A Quick Breakdown Of The Changes

No Deduction in 2019

Prior to 2018, if the business spent money to take a client out to a baseball game, meet a client for 18 holes of golf, or to host a client event, the business would be able to take a deduction equal to 50% of the total cost associated with the entertainment expense. Starting in 2018, you get ZERO. There is no deduction for those expenses.

The new law specifically states that there is no deduction for:

Any activity generally considered to be entertainment, amusement, or recreation

Membership dues to any club organization for recreation or social purpose

A facility, or portion thereof, used in connection with the above items

This will inevitably cause business owners to ask their accountant: “If I spend the same amount on entertainment expenses in 2018 as I did in 2017, how much are the new tax rules going to cost me tax wise?”

Impact On Sales Professionals

If you are in sales and big part of your job is entertaining prospects in hopes of winning their business, if your company can no longer deduct those expenses, are you going to find out at some point this year that the company is going to dramatic limit the resources available to entertain clients? If they end up limiting these resources, how are you supposed to hit your sales numbers and how does that change the landscape of how you solicit clients?

Impact On The Entertainment Industry

This has to be bad news for golf courses, casinos, theaters, and sports arena. As the business owner, if you were paying $15,000 per year for your membership to the local country club and you justified spending that amount because you knew that you could take a tax deduction for $7,500, now what? Now that you can’t deduct any of it, you may decide to cancel your membership or seek out a cheaper alternative.

Impact On Charitable Organizations

How do most charities raise money? Events. As you may have noticed in the chart, in 2017 tickets to a qualified charitable event were 100% deductible. In 2018, it goes from 100% deductible to Zero!! It’s bad enough that the regular entertainment expenses went from 50% to zero but going from 100% to zero hurts so much more. Also charitable events usually have high price tags because they have to cover the cost of event and raise money for the charity. In 2018, it will be interesting to see how charitable organizations get over this hurdle. It may have to disclose right on the registration form for the event that the ticket cost is $500 but $200 of that amount is the cost of the event (non-deductible) and $300 is the charitable contribution.

Exceptions To The New Rules

There are some unique exceptions to the new rules. Many business owners will not find any help within these exceptions but here they are:

Entertainment, amusement, and recreation expenses you treat as compensation to your employees in their wages (In other words, the cost ends up in your employee’s W2)

Expenses for recreation, social, or similar activities, including facilities, primarily for employees, and it can’t be highly compensation employees (“HCE”). In 2018 an HCE employee is an employee that makes more than $120,000 or is a 5%+ owners of the company.

Expenses for entertainment goods, services, and facilities that you sell to customers

What’s The Deal With Meals?

Prior to 2018, employers could deduct 50% of expenses for business-related meals while traveling. Also meals provided to an employee for the convenience of the employer on the employer’s business premises were 100% deductible by the employer and tax-free to the recipient employee.

Starting in 2018, meal expenses incurred while traveling on business remain 50% deductible to the business. However, meals provided via an on-premises cafeteria or otherwise on the employers premise for the convenience of the employer will now be limited to a 50% deduction.

There is also a large debate going on between tax professional as to which meals or drinks may fall into the “entertainment” category and will lose their deduction entirely.

Impact On Business

This is just one of the many “small changes” that was made to the new tax laws that will have a big impact on many businesses. It may very well change the way that businesses spend money to attract new clients. This in turn will most likely lead to unintended negative consequences for organizations that operate in the entertainment, catering, and charitable sectors of the U.S. economy.

Disclosure: For education purposes only. Please seek tax advice from your tax professional

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Marriage Penalty: Past and Present

Whether you're currently married or not, the new tax legislation may impact how the "Marriage Penalty" affects you. Never heard of such a thing? Let's take a look at a simple example and show how it may be different under the new tax regulation.

The Marriage Penalty: Past and Present

Whether you're currently married or not, the new tax legislation may impact how the "Marriage Penalty" affects you. Never heard of such a thing? Let's take a look at a simple example and show how it may be different under the new tax regulation.

The Past (kind of)

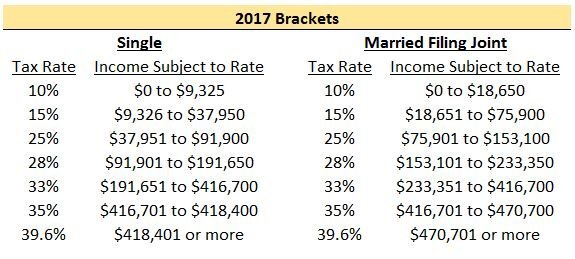

I say "kind of" because most people still have to file their 2017 tax return. Here is the 2017 tax table for Single Filers and Married Filing Joint Filers:

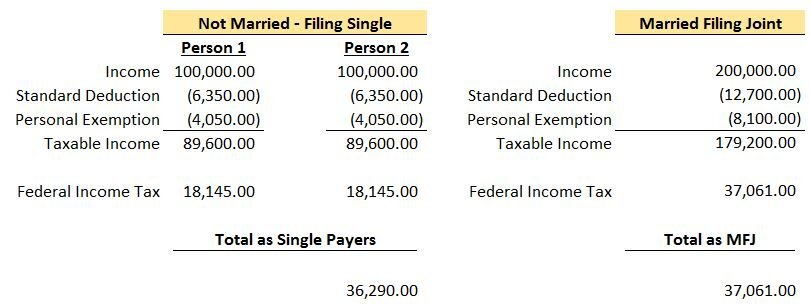

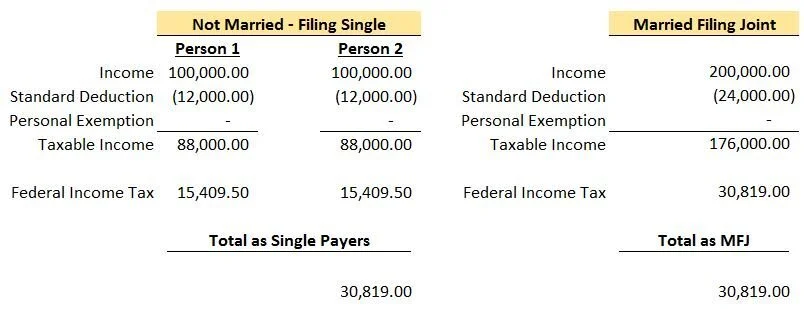

A reasonable person would think that the income subject to tax would simply double if you went from filing Single to Married Filing Joint. As you can see, this isn't the case once you are in the 25%+ tax bracket and it can mean big dollars! Let's take a look at a simple example where each person makes the same amount of money. We will also assume they will be taking the standard deduction in 2017.

Note: To calculate the “Federal Income Tax” amount above, you can use the IRS tables here 2017 1040 Tax Table Instructions. All of your income is not taxed at your top rate. For example, if your top income falls in the 25% tax bracket, as a single payer you will only pay 25% on income from $37,951 to $91,900. Everything below that range will be taxed at either 10% or 15%.

As you can see, because of the change in filing status, this couple owed a total of $771 more to the federal government. This is the “Marriage Penalty”. Typically as incomes rise, the dollar amount of the penalty becomes larger. For this couple, their top tax bracket went from 25% each when filing single to 28% filing joint.

The Present

Here is the 2018 tax table in the new tax legislation for Single Filers and Married Filing Joint Filers:

Upon review, you can see that the top income brackets are not doubled for Married Filing Joint. At 37%, a single person filing would reach the top rate at $500,001 while married filing joint would reach at $600,001. That being said, the “Marriage Penalty” appears to kick in at higher income levels compared to the past and therefore should impact less people. The income bracket for Married Filing Joint is doubled up until $400,000 of combined income compared to just $75,901 under the 2017 brackets.

Let’s take a look at the same couple in the example above.

Due to the income brackets doubling from single to married filing joint for this couple, the “Marriage Penalty” they would have incurred in 2017 appears to go away. In this example, they would also pay less in federal taxes in both situations. This article is more focused on the impact on the “Marriage Penalty” but having a lower tax bill is always a plus.

Standard vs. Itemized Deductions

The tax brackets aren’t the only penalty. Another common tax increase people see when going from single to married filing joint are the deductions they lose. If I’m single and own a home, it is likely I will itemized because the sum of my property taxes, mortgage interest, and state income taxes exceed the standard deduction amount. Assume the couple in the example above is still not married but Person 1 owns a home and rather than taking the standard deduction, Person 1 itemizes for an amount of $15,000. For 2017, their total deductions will be $21,350 ($15,000 Person 1 plus $6,350 Person 2) and for 2018, their total deductions will be $27,000 ($15,000 Person 1 plus $12,000 Person 2).

Now they get married and have to choose whether to itemize or take the standard deduction.

2017: Assuming they live together in the same house, in 2017 they would still itemize because they have deductions of $15,000 for Person 1 and some additional items that Person 2 would bring to the table (i.e. their state income taxes). Say their total itemized deductions are $18,000 when married filing joint. They would still itemize because $18,000 is more than the Married Filing Joint standard deduction of $12,700. But now compare the $18,000 to the $21,350 they got filing single. They lose out on $3,350 of deductions. Usually, less deductions equals more taxes.

2018: Assuming they live together in the same house, in 2018 they would no longer itemize. Assuming their total itemized deductions are still $18,000, that is less than the $24,000 standard deduction they can take when married filing joint. $24,000 standard deduction in 2018 is still less than the $27,000 they got filing separately by $3,000. Again, less deductions usually means more taxes. The “Marriage Penalty” lives on!

A lot of people will still lose out on deductions in 2018 but the “Marriage Penalty” will hit less people because of the increase in the standard deduction. If Person 1 has itemized deductions of $10,000 in 2017, they would itemize if they filed single and possibly take the standard deduction of $12,700 filing joint. In 2018 however, Person 1 would take the standard deduction both as a single tax payer ($12,000) and married filing joint ($24,000) which takes away the “Marriage Penalty” related to the deduction.

The Why?

Why do tax brackets work this way? Like most taxes, I assume the idea was to generate more income for the government. Some may also argue that typical couples don't make the same salaries which seems like an archaic point of view.Was it all fixed with the new tax legislation? It doesn't appear so but it does look like less people will be struck by Cupid's Marriage Penalty.

About Rob.........

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally , professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, pleas feel free to join in on the discussion or contact me directly.

More Taxpayers Will Qualify For The Child Tax Credit

There is great news for parents in the middle to upper income tax brackets in 2018. The new tax law dramatically increased the income phaseout threshold for claiming the child tax credit. In 2017, parents were eligible for a $1,000 tax credit for each child under the age of 17 as long as their adjusted gross income (“AGI”) was below $75,000 for single

There is great news for parents in the middle to upper income tax brackets in 2018. The new tax law dramatically increased the income phaseout threshold for claiming the child tax credit. In 2017, parents were eligible for a $1,000 tax credit for each child under the age of 17 as long as their adjusted gross income (“AGI”) was below $75,000 for single filers and $110,000 for married couples filing a joint return. If your AGI was above those amounts, the $1,000 credit was reduced by $50 for every $1,000 of income above those thresholds. In other words, the child tax credit completely phased out for a single filer with an AGI greater than $95,000 and for a married couple with an AGI greater than $130,000.

Note: If you are not sure what the amount of your AGI is, it’s the bottom line on the first page of your tax return (Form 1040).

New Phaseout Thresholds In 2018+

Starting in 2018, the new phaseout thresholds for the Child Tax Credit begin at the following AGI levels:

Single Filer: $200,000

Married Filing Joint: $400,000

If your AGI falls below these thresholds, you are eligible for the full Child Tax Credit. For taxpayers with an AGI amount that exceeds these thresholds, the phaseout calculation is the same as 2017. The credit is reduced by $50 for every $1,000 in income over the AGI threshold.

Wait......It Gets Better

Not only will more families qualify for the child tax credit in 2018 but the amount of the credit was doubled. The new tax law increased the credit from $1,000 to $2,000 for each child under the age of 17.

In 2017, a married couple, with three children, with an AGI of $200,000, would have received nothing for the child tax credit. In 2018, that same family will receive a $6,000 tax credit. That’s huge!! Remember, “tax credits” are more valuable than “tax deductions”. Tax credits reduce your tax liability dollar for dollar whereas tax deductions just reduce the amount of your income subject to taxation.

Tax Reform Giveth & Taketh Away

While the change to the tax credit is good news for most families with children, the elimination of personal exemptions starting in 2018 is not.

In 2017, taxpayers were able to take a tax deduction equal to $4,050 for each dependent (including themselves) in addition to the standard deduction. For example, a married couple with 3 children and $200,000 in income, would have been eligible received the following tax deductions:

Standard Deduction: $12,700

Husband: $4,050

Wife: $4,050

Child 1: $4,050

Child 2: $4,050

Child 3: $4,050

Total Deductions $32,950

Child Tax Credit: $0

This may lead you to the following question: “Does the $6,000 child tax credit that this family is now eligible to receive in 2018 make up for the loss of $20,250 ($4,050 x 5) in personal exemptions?”

By itself? No. But you have to also take into consideration that the standard deduction is doubling in 2018. For that same family, in 2018, they will have the following deductions and tax credits:

Standard Deduction: $24,000

Personal Exemptions: $0

Total Deductions: $24,000

Child Tax Credit: $6,000

Even though $24,000 plus $6,000 is not greater than $32,950, remember that credits are worth more than tax deductions. In 2017, a married couple, with $200,000 in income, put the top portion of their income subject to the 28% tax bracket. Thus, $32,950 in tax deductions equaled a $9,226 reduction in their tax bill ($32,950 x 28%).

In 2018, due to the changes in the tax brackets, instead of their top tax bracket being 28%, it’s now 24%. The $24,000 standard deduction reduces their tax bill by $5,760 ($24,000 x 24%) but now they also have a $6,000 tax credit with reduces their remaining tax bill dollar for dollar, resulting in a total tax savings of $11,760. Taxes saved over last year: $2,534. Not a bad deal.

For many families, the new tax brackets combined with the doubling of the standard deduction and the doubling of the child tax credit with higher phaseout thresholds, should offset the loss of the personal exemptions in 2018.

This information is for educational purposes only. Please consult your accountant for personal tax advice.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Business Owners: Strategies To Reduce Your Taxable Income To Qualify For The New 20% Qualified Business Income Deduction

Now that small business owners have the 20% deduction available for their pass-through income in 2018, as a business owner, you will need to begin to position your business to take full advantage of the new tax deduction. However, the Qualified Business Income ("QBI") deduction has taxable income thresholds. Once the owner's personal taxable

Now that small business owners have the 20% deduction available for their pass-through income in 2018, as a business owner, you will need to begin to position your business to take full advantage of the new tax deduction. However, the Qualified Business Income ("QBI") deduction has taxable income thresholds. Once the owner's personal taxable income begins to exceed specific dollar amounts, the 20% deduction with either phase out or it will trigger an alternative calculation that could lower the deduction.

First: Understand The 20% Deduction

If you are not already familiar with how the new 20% deduction works, I encourage you to read our article:"How Pass-Through Income Will Be Taxes In 2018 For Small Business Owners"If you are already familiar with how the Qualified Business Income deduction works, please continue reading.

The Taxable Income Thresholds

Regardless of whether you are considered a “services business” or “non-services business” under the new tax law, you will need to be aware of the following income thresholds:

Individual: $157,500

Married: $315,000

These threshold amounts are based on the “total taxable income” listed on the tax return of the business owner. Not “AGI” and not just the pass-through income from the business. Total taxable income. For example, if I make $100,000 in net profit from my business and my wife makes $400,000 in W-2 income, our total taxable income on our married filing joint tax return is going to be way over the $315,000 threshold. So do we completely lose the 20% deduction on the $100,000 in pass-through income from the business? Maybe not!!

The Safe Zone

For many business owners, to maximize the new 20% deduction, they will do everything that they can to keep their total taxable income below the thresholds. This is what I call the “safe zone”. If you keep your total taxable income below these thresholds, you will be allowed to take your total qualified business income, multiply it by 20%, and you’re done. Once you get above these thresholds, the 20% deduction will either begin to phase out or it will trigger the alternative 50% of W-2 income calculation which may reduce the deduction. The phase out ranges are listed below:

Inidividuals: $157,500 to $207,500

Married: $315,000 to $415,000

As you get closer to the top of the range the deduction begins to completely phase out for “services businesses” and for “non-services business” the “lesser of 20% of QBI or 50% of wages paid to employees” is fully phased in.

What Reduces "Total Taxable Income"?

There are four main tools that business owners can use to reduce their total taxable income:

Standard Deduction or Itemized Deductions

Self-Employment Tax

Retirement Plan Contributions

Timing Expenses

Standard & Itemized Deductions

Since tax reform eliminated many of the popular tax deductions that business owners have traditionally used to reduce their taxable income, for the first time in 2018, a larger percentage of business owners will elect taking the standard deduction instead of itemizing. You do not need to itemize to capture the 20% deduction for your qualified business income. This will allow business owners to take the higher standard deduction and still capture the 20% deduction on their pass-through income. Whether you take the standard deduction or continue to itemize, those deductions will reduce your taxable income for purposes of the QBI income thresholds.

Example: You are a business owner, you are married, and your only source of income is $335,000 from your single member LLC. At first look, it would seem that your total income is above the $315,000 threshold and you are subject to the phase out calculation. However, if you elect the standard deduction for a married couple filing joint, that will reduce your $335,000 in gross income by the $24,000 standard deduction which brings your total taxable income down to $311,000. Landing you below the threshold and making you eligible for the full 20% deduction on your qualified business income.

The point of this exercise is for business owners to understand that if your gross income is close to the beginning of the phase out threshold, somewhere within the phase out range, or even above the phase out range, there may be some relief in the form of the standard deduction or your itemized deductions.

Self-Employment Tax

Depending on how your business is incorporated, you may be able to deduct half of the self-employment tax that you pay on your pass-through income. Sole proprietors, LLCs, and partnership would be eligible for this deduction. Owners of S-corps receive W2 wages to satisfy the reasonable compensation requirement and receive pass-through income that is not subject to self-employment tax. So this deduction is not available for S-corps.

The self-employment tax deduction is an “above the line” deduction which means that you do not need to itemize to capture the deduction. The deduction is listed on the first page of your 1040 and it reduces your AGI.

Example: You are a partner at a law firm, not married, the entity is taxed as a partnership, and your gross income is $200,000. Like the previous example, it looks like your income is way over the $157,500 threshold for a single tax filer. But you have yet to factor in your tax deductions. For simplicity, let’s assume you take the standard deduction:

Total Pass-Through Income: $200,000

Less Standard Deduction: ($12,000)

Less 50% Self-Employ Tax: ($15,000) $200,000 x 7.5% = $15,000

Total Taxable Income: $173,000

While you total taxable income did not get you below the $157,500 threshold, you are now only mid-way through the phase out range so you will capture a portion of the 20% deduction on your pass-through income.

Retirement Plans – "The Golden Goose"

Retirement plans will be the undisputed Golden Goose for purposes of reducing your taxable income for purposes of the qualified business income deduction. Take the example that we just went through with the attorney in the previous section. Now, let’s assume that same attorney maxes out their pre-tax employee deferrals in the company’s 401(k) plan. The limit in 2018 for employees under the age of 50 is $18,500.

Total Pass-Through Income: $200,000

Less Standard Deduction: ($12,000)

Less 50% Self-Employ Tax: ($15,000)

Pre-Tax 401(k) Contribution: ($18,500)

Total Taxable Income: $154,500

Jackpot!! That attorney has now reduced their taxable income below the $157,500 QBI threshold and they will be eligible to take the full 20% deduction against their pass-through income.

Retirement plan contributions are going to be looked at in a new light starting in 2018. Not only are you reducing your tax liability by shelter your income from taxation but now, under the new rules, you are simultaneously increasing your QBI deduction amount.

When tax reform was in the making there were rumors that Congress may drastically reduce the contribution limits to retirement plans. Thankfully this did not happen. Long live the goose!!

Start Planning Now

Knowing that this Golden Goose exists, business owners will need to ask themselves the following questions:

How much should I plan on contributing to my retirement accounts this year?

Is the company sponsoring the right type of retirement plan?

Should we be making changes to the plan design of our 401(k) plan?

How much will the employer contribution amount to the employees increase if we try to max out the pre-tax contributions for the owners?

Business owners are going to need to engage investment firms and TPA firms that specialize in employer sponsored retirement plan. Up until now, sponsoring a Simple IRA, SEP IRA, or 401(K), as a way to defer some income from taxation has worked but tax reform will require a deeper dive into your retirement plan. The golden question:

“Is the type of retirement plan that I’m currently sponsoring through my company the right plan that will allow me to maximize my tax deductions under the new tax laws taking into account contribution limits, admin fees, and employer contributions to the employees.”

If you are not familiar with all of the different retirement plans that are available for small businesses, please read our article “Comparing Different Types Of Employer Sponsored Plans”.

DB / DC Combo Plans Take Center Stage

While DB/DC Combo plans have been around for a number of years, you will start to hear more about them beginning in 2018. A DB/DC Combo plan is a combination of a Defined Benefit Plan (Pension Plan) and a Defined Contribution Plan (401k Plan). While pension plans are usually only associated with state and government employers or large companies, small companies are eligible to sponsor pension plans as well. Why is this important? These plans will allow small business owners that have total taxable income well over the QBI thresholds to still qualify for the 20% deduction.

While defined contribution plans limit an owner’s aggregate pre-tax contribution to $55,000 per year in 2018 ($61,000 for owners age 50+), DB/DC Combo plans allow business owners to make annual pre-tax contributions ranging from $60,000 – $300,000 per year. Yes, per year!!

Example: A married business owner makes $600,000 per year and has less than 5 full time employees. Depending on their age, that business owner may be able to implement a DB/DC Combo plan prior to December 31, 2018, make a pre-tax contribution to the plan of $300,000, and reduce their total taxable income below the $315,000 QBI threshold.

Key items to make these plans work:

You need to have the cash to make the larger contributions each year

These DB/DC plan needs to stay in existence for at least 3 years

This plan design usually works for smaller employers (less than 10 employees)

Shelter Your Spouse's W-2 Income

It's not uncommon for a business owner to have a spouse that earns W-2 wages from employment outside of the family business. Remember, the QBI thresholds are based on total taxable income on the joint tax return. If you think you are going to be close to the phase out threshold, you may want to encourage your spouse to start putting as much as they possibly can pre-tax into their employer's retirement plan. Unlike self-employment income, W-2 income is what it is. Whatever the number is on the W-2 form at the end of the year is what you have to report as income. By contrast, business owners can increase expenses in a given year, delay bonuses into the next tax year, and deploy other income/expense maneuvers to play with the amount of taxable income that they are showing for a given tax year.

Timing Expenses

One of the last tools that small business owners can use to reduce their taxable income is escalating expense. Now, it would be foolish for businesses to just start spending money for the sole purpose of reducing income. However, if you are a dental practice and you were planning on purchasing some new equipment in 2018 and purchasing a software system in 2019, depending on where your total taxable income falls, you may have a tax incentive to purchase both the equipment and the software system all in 2018. As you get toward the end of the tax year, it might be worth making that extra call to your accountant, before spending money on those big ticket items. The timing of those purchases could have big impact on your QBI deduction amount.

Disclosure: The information in this article is for educational purposes. For tax advice, please consult your tax advisor.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Will Home Equity Loan Interest Be Deductible In 2019+?

The answer............it depends. It depends on what you used or are going to use the home equity loan for. Up until the end of 2017, borrowers could deduct interest on home equity loans or homes equity lines of credit up to $100,000. Unfortunately, many homeowners will lose this deduction under the new tax law that takes effect January 1, 2018.

The answer............it depends. It depends on what you used or are going to use the home equity loan for. Up until the end of 2017, borrowers could deduct interest on home equity loans or homes equity lines of credit up to $100,000. Unfortunately, many homeowners will lose this deduction under the new tax law that takes effect January 1, 2018.

Old Rules

Taxpayers used to be able to take a home equity loan or tap into a home equity line of credit, spend the money on whatever they wanted (pool, college tuition, boat, debt consolidation) and the interest on the loan was tax deductible. For borrowers in higher tax brackets this was a huge advantage. For a taxpayer in the 39% fed tax bracket, if the interest rate on the home equity loan was 3%, their after tax interest rate was really 1.83%. This provided taxpayers with easy access to cheap money.

The Rules Are Changing In 2018

To help pay for the new tax cuts, Congress had to find ways to bridge the funding gap. In other words, in order for some new tax toys to be given, other tax toys needed to be taken away. One of those toys that landed in the donation box was the ability to deduct the interest on home equity loans and home equity lines of credit. But all may not be lost. The tax law splits "qualified residence interest" into two categories:

Acquisition Indebtedness

Home Equity Indebtedness

Whether or not your home equity loan or HELOC is considered acquisition indebtedness or home equity indebtedness may ultimately determine whether or not the interest on that loan will continue to be deductible in 2018 and future years under the new tax rules. I say "may" because we need additional guidance form the IRS as to how the language in the tax bill will be applied in the real world. As of right now you have some tax professionals stating that all interest from homes equity sources will be disallowed beginning in 2018 and other tax professionals taking the position that home equity loans from acquisition indebtedness will continue to be eligible for the tax deduction in 2018. For the purpose of this article, we will assume that the IRS will continue to allow the deduction of interest on home equity loans and HELOCs associated with acquisition indebtedness.

Acquisition Indebtedness

Acquisition indebtedness is defined as “indebtedness that is secured by the residence and that is incurred in acquiring, constructing, or substantially improving any qualified residence of the taxpayer”. It seems likely, under this definition, if you took out a home equity loan to build an addition on your house, that would be classified as a “substantial improvement” and you would be able to continue to deduct the interest on that home equity loan in 2018. Where we need help from the IRS is further clarification on the definition of “substantial improvement”. Is it any project associated with the house that arguably increases the value of the property?

More good news, this ability to deduct interest on home equity loans and HELOCs for debt that qualifies as “acquisition indebtedness” is not just for loans that were already issued prior to December 31, 2017 but also for new loans.

Home Equity Indebtedness

Home equity indebtedness is debt incurred and secured by the residence that is used for items that do not qualify as "acquisition indebtedness". Basically everything else. So beginning in 2018, interest on home equity loans and HELOC's classified as "home equity indebtedness" will not be tax deductible.

No Grandfathering

Unfortunately for taxpayers that already have home equity loans and HELOCs outstanding, the Trump tax reform did not grandfather the deduction of interest for existing loans. For example, if you took a home equity loan in 2016 for $20,000 and there is still a $10,000 balance on the loan, you will be able to deduct the interest that you paid in 2017 but beginning in 2018, the deduction will be lost if it does not qualify as "acquisition indebtedness".

Partial Deduction

An important follow-up question that I have received from clients is: “what if I took a home equity loan for $50,000, I used $30,000 to renovate my kitchen, but I used $20,000 as a tuition payment for my daughter? Do I lose the deduction on the full outstanding balance of the loan because it was not used 100% for substantial improvements to the house? Great question. Again, we need more clarification on this topic from the IRS but it would seem that you would be allowed to take a deduction of the interest for the portion of the loan that qualifies as “acquisition indebtedness” but you would not be able to deduct the interest attributed to the “non-acquisition or home equity indebtedness”.

Time out……how do you even go about calculating that if it’s all one loan? Even if I can calculate it, how is the IRS going to know what portion of the interest is attributed to the kitchen project and which portion is attributed to the tuition payment? More great questions and we don’t have answers to them right now. These are the types of issues that arise when you rush major tax reform through Congress and then you make it effective immediately. There is a laundry list of unanswered questions and we just have to wait for clarification on from the IRS.

Itemized Deduction

An important note about the deduction of interest on a home equity loan or HELOC, it's an itemized deduction. You have to itemize in order to capture the tax benefit. Since the new tax rules eliminated or limited many of the itemized deductions available to taxpayers and increased the standard deduction to $12,000 for single filers and $24,000 for married filing joint, many taxpayers who previously itemized will elect the standard deduction for the first time in 2018. In other word, regardless of whether or not the IRS allows the deduction for home equity loan interest assigned to acquisition indebtedness, very few taxpayers will reap the benefits of that tax deduction because your itemized deductions would need to exceed the standard deduction thresholds before you would elect to itemize.

Will This Crush The Home Equity Loan Market?

My friends in the banking industry have already started to ask me, “what impact do you think the new tax rules will have on the home equity loan market as a whole?” It obviously doesn’t help but at the same time I don’t think it will deter most homeowners from accessing home equity indebtedness. Why? Even without the deduction, home equity will likely remain one of the cheapest ways to borrow money. Typically the interest rate on home equity loans and HELOCs are lower because the loan is secured by the value of your house. Personal loans, which typically have no collateral, are a larger risk to the lender, so they charge a higher interest rate for those loans.

Also, for most families in the United States, the primary residence is their largest asset. A middle class family may not have access to a $50,000 unsecured personal loan but if they have been paying down their mortgage for the past 15 years, they may have $100,000 in equity in their house. With the cost of college going up and financial aid going down, for many families, accessing home equity via a loan or a line of credit may be the only viable option to help bridge the college funding gap.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Tax Reform Could Lead To A Spike In The Divorce Rate In 2018

The Tax Cut & Jobs Act that was recently passed has already caused taxpayers to accelerate certain financial decisions as we transition from the current tax laws to the new tax laws over the course of the next two years.

The Tax Cut & Jobs Act that was recently passed has already caused taxpayers to accelerate certain financial decisions as we transition from the current tax laws to the new tax laws over the course of the next two years.

Current Tax Law: Alimony Is Tax Deductible

Under the current tax law, alimony payments are taxable income to the ex-spouse receiving the payments and they are tax deductible to the ex-spouse making the payments. When alimony is awarded pursuant to a divorce, it’s typically because there was a disparity in the level of income between the two spouses during the marriage. The ex-spouse paying the alimony, in most cases, is the higher income earning spouse both before and after the divorce finalized.

Let’s look at this in a real life example. Jim and Sarah have decided to get a divorce. Jim makes $300,000 per year and Sarah is a homemaker with $0 income. Pursuant to the divorce agreement, Jim will be required to pay Sarah $50,000 per year for 5 years. Jim will be able to deduct the $50,000 each year against his taxable income and Sarah will claim the $50,000 as taxable income on her tax return. Based on the 2018 Individual Tax Brackets, the top end of Jim’s income is in the 35% tax bracket. Thus, paying $50,000 in alimony really results in an “after-tax” expense to Jim of $32,500.

$50,000 x 35% = $17,500 (fed tax savings)

$50,000 – $17,500 = $32,500 (after tax expense to Jim)

Sarah will claim that $50,000 in alimony payments as income and let’s assume that the alimony payments are her only income for the year. Next year, as a single filer, Sarah will receive a standard deduction of $12,000, and the remainder of the $38,000 will be taxed at a blend of her 10% & 12% tax rate. As a result, Sarah will only pay about $4,400 in taxes on the $50,000 in alimony income.

To sum it all up, if the $50,000 is taxed to Sarah, approximately $4,400 will be paid to the IRS in taxes and she nets $45,600 in after tax income. However, if Jim was not able to deduct the alimony payments and had to pay tax on that $50,000, he would first have to pay the $17,500 in taxes to the IRS, and then he would hand Sarah a check for $32,500 after tax. Sarah is worse off because she received less after tax income. Jim would ultimately be worse off because he would need to part with more pre-tax income to create the same after tax benefit for Sarah. The IRS is the only one that wins.

Gaming The System

Since divorce agreements, in most states, are not required to adhere to predefined calculations for splitting assets, alimony payments, and in some cases child support, the tax game can be played when there is a high income earning spouse and alimony payments in the mix. In exchange for fewer assets or less child support, some divorce agreements have purposefully shifted more to alimony. The ex-spouse with the big income gets a bigger tax deduction and the ex-spouse receiving the alimony payment is able to take full advantage of their lower tax brackets and maximize their after tax income.

Alimony Is No Longer Deductible

To stop the tax game, included in the new tax bill was a provision that specifically states that alimony payments will no longer be deductible by the payor, nor reportable as income by the recipient, for divorce agreements signed after December 31, 2018.

The good news is this will not impact the ability to deduct alimony payments for divorce agreements that are currently in place. The bad news is for divorce agreements signed after December 31, 2018, the high income earner will no longer be able to deduct the alimony payments. That eliminates the tax arbitrage that has been used in the past to make the pie larger for both spouses. In general, if you shrink the size of the asset and income pie, it leaves more to fight about because each spouse is trying to preserve their standard of living as much as possible post-divorce.

For couples that have been sitting on the fence about getting divorced, this could be the catalyst to start the process in 2018 to make sure they have a signed agreement prior to December 31, 2018.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Should You Prepay Your Property Taxes?

If you live in New York or any other state with "higher" property taxes you should determine whether or not it makes sense to pay your 2018 property taxes prior to December 31, 2017. Why? Tax reform will be capping your state and local tax deductions at $10,000 beginning in 2018. Don't forget though, that it's important to make sure you keep on

If you live in New York or any other state with "higher" property taxes you should determine whether or not it makes sense to pay your 2018 property taxes prior to December 31, 2017. Why? Tax reform will be capping your state and local tax deductions at $10,000 beginning in 2018. Don't forget though, that it's important to make sure you keep on top of your taxes, as you don't want to cause an issue further down the line.

To prevent taxpayers from navigating around the $10,000 deduction cap that will take effect in 2018, Congress wrote right into the tax bill that taxpayers will not be able to prepay their 2018 state income taxes and take the tax deduction in 2017. However, they left the door open for prepaying your 2018 property taxes in 2017 and taking the deduction in 2017 before the cap goes into effect.

Should you do this? The answer depends on your expected income for the 2017 tax year.

Alternative Minimum Tax

Before you rush down to your town office in the last week of December to prepay your 2018 taxes, if you think your income level in 2017 is going to make you subject to AMT, I will save you the trip. Alternative Minimum Tax (AMT) is a special tax calculation that was implemented back in 1969 to make sure the "wealthy" pay their fair share of taxes. The AMT calculation allows fewer deductions and exemptions than the standard tax system. Taxpayers have to calculate their taxes the "normal way" and then calculate their taxes under the AMT method. Whichever method generates the higher tax liability is the one that you pay.

The problem with AMT is over time they did not index the exemption level adequately for wage inflation since its inception in 1969. Again it was supposed to stop the wealthy from taking advantage of tax deductions. In 2017, the exemptions amounts for AMT are as follows:

Single Filer: $54,300

Married Filing Joint: $84,500

Not exactly what many of us would considered wealthy. It gets better, that exemption begins to phase out at the following levels in 2017 making more of your income subject to the special AMT calculation.

Single Filers: $120,700

Married Filing Joint: $160,900

Why am I going into so much detail amount AMT? Remember, AMT adds back deductions that were previously allowed under the standard calculation. One of those add backs is property taxes. So if your AMT tax liability exceeds your tax liability calculated with the standard formula, there is no point in prepaying your 2018 property taxes because you won't be able to deduct them anyways. Those deductions get added back in as part of the AMT calculation.

Contact Your Accountant

The AMT calculation is complex. If you are not able to accurately estimate whether or not your AMT tax liability will be greater than the standard calculation, you should contact your accountant for guidance.

Those Not Subject To AMT

If you are not subject to AMT and you plan to itemize in 2017, it probably does makes sense to prepay your property taxes for 2018 by December 29, 2017. Otherwise you are just going to lose the deduction in 2018 because it will most likely be more advantageous at that income level to just take the larger standard deduction that will be available in 2018. You end up with the best of both worlds. You get to deduct your 2018 property taxes in 2017 which reduces your income and then capture the large standard deduction in 2018,

How Do You Prepay Your Property Taxes?

So how do you pay your property taxes early? It's most likely going to require your checkbook and a trip to your town office, First, call your town office to make sure the 2018 property tax invoices are available. Once you know that they are available, you should drive down to your town office prior to December 29, 2017 and pay the tax bill.

If you escrow taxes, which many homeowners do, there is a good chance that your mortgage company will not receive your property tax bill in time to issue a check from your escrow account prior to December 29th. For this reason, you should call your mortgage services company and determine what they need to prove that you paid your 2018 property taxes with a personal check. This will hopefully prevent them from issuing a check out of your escrow account for the property taxes that you already paid with your personal check for 2018.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.