Should I Refinance My Mortgage Now?

With all the volatility going on in the market, it seems there is one certainty and that is the word “historical” will continue to be in the headlines. Over the past few months, we’ve seen the Dow Jones Average hit historical highs, the 10-year treasury hit historical lows, and historical daily point movements in the market.

Should I Refinance My Mortgage Now?

With all the volatility going on in the market, it seems there is one certainty and that is the word “historical” will continue to be in the headlines. Over the past few months, we’ve seen the Dow Jones Average hit historical highs, the 10-year treasury hit historical lows, and historical daily point movements in the market. Market volatility will always lead the headlines as it does impact anyone with an investment account. With that in mind, it is important to use these times to reassess your overall financial plan and take advantage of parts of the plan that are in your control.

For a lot of people, their home is their most significant asset and is held for a longer period than any stock or bond they may have. This brings us back to “historical” as mortgage rates continue to drop. Whenever this happens, our clients will call and ask if it makes sense to refinance. In this article, we will help you in making this decision.

3 Important Questions

How much will I be saving annually in interest with a lower rate?

What are the closing costs of refinancing?

How long do I plan on being in the home and how many more years do I have on the mortgage?

If you can answer these questions, then you should have a pretty good idea if it makes sense for you to refinance.

How Much Will I be Saving Annually in Interest with a Lower Rate?

With most financial decisions, dollars matter. So how do you determine how much you will be saving each year with a lower interest rate? Below, I walk through a very basic example, but it will show the possible advantage of the refinance.

One important note with this example is the fact that most loan payments you make will decrease the principal which should decrease the cost of interest. To make this simple, I assume a consistent mortgage balance throughout the year.

Higher Interest Lower Interest

Mortgage Balance: $300,000 Mortgage Balance: $300,000

Interest Rate: 4.5% Interest Rate: 3.5%

Annual Interest: $13,500 Annual Interest: $10,500

By refinancing at the lower rate, the dollar savings in one year was $3,000 in the example when the mortgage balance was $300,000.

Savings over the life of a mortgage at 3.5% compared to 4.5% on a $300,000, 30-year mortgage, should be over $60,000 in interest over that time period if you are making consistent monthly payments.

What are the Closing Costs of Refinancing?

After walking through the exercise above, most people will say “Of course it makes sense to refinance”. Before making the decision, you must consider the cost of refinancing which can vary from person to person and bank to bank. There are several closing costs to consider which could include title insurance, tax stamps, appraisal fee, application fees, etc.

If the cost of closing is $5,000, you will have to determine how long it will take you to make that back based on the annual interest savings. Using the example from before, if you save $3,000 in interest each year, it should take you 2 years to breakeven.

One tip we give clients is to start at your current lender. Banks are in competition with other banks and they usually do not want to lose business to a competitor. Knowing the current interest rate environment, a lot of institutions will offer a type of “rapid refinance” for existing customers which may make the process easier but also give you a break on the closing costs if you are staying with them. This should be taken into consideration along with the possibility of getting an even lower interest rate from a different institution which could save you more in the long run even if closing costs are higher.

How Long do I Plan on Being in the Home and How Many More Years do I have on the Mortgage?

This is important since there is a cost to refinancing your mortgage. If it will take you 10 years to “breakeven” between the closing costs and interest you are saving but only plan on being in the house for 5 more years, refinancing may not be the right choice. Also, if you only have a few years left to pay the mortgage you would have to weigh your options.

In summary, taking advantage of these historical low mortgage rates could save you a lot of dollars over the long term but you should consider all the costs associated with it. Taking the time to answer these questions and shop around to make sure you are getting a good deal should be worth the effort.

Public Service Announcement: Like the stock market, it is hard to say anyone has the capability of knowing for sure when interest rates will hit their lows. Make sure you are comfortable with the decision you are making and if you do refinance try not to have buyer’s remorse if the historical lows today turn into new historical lows next year.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

How Much Should I Budget For Health Care Costs In Retirement?

The number is higher than you think. When you total up the deductibles and premiums for Medicare part A, B, and D, that alone can cost a married couple $7,000 per year. We look at that figure as the baseline number. That $7,000 does not account for the additional costs associated with co-insurance, co-pays, dental costs, or Medigap insurance

The number is higher than you think. When you total up the deductibles and premiums for Medicare part A, B, and D, that alone can cost a married couple $7,000 per year. We look at that figure as the baseline number. That $7,000 does not account for the additional costs associated with co-insurance, co-pays, dental costs, or Medigap insurance premiums which can quickly increase the overall cost to $10,000+ per year.

Tough to believe? Allow me to walk you through the numbers for a married couple.

Medicare Part A: $2,632 Per Year

Part A covers inpatient hospital stays, skilled nursing facility stays, some home health visits, and hospice care. While Part A does not have an annual premium, it does have an annual deductible for each spouse. That deductible for 2017 is $1,316 per person.

Medicare Part B: $3,582

Part B covers physician visits, outpatient services, preventive services, and some home health visits. The standard monthly premium is $134 per person but it could be higher depending on your income level in retirement. There is also a deductible of $183 per year for each spouse.

Medicare Part D: $816

Part D covers outpatient prescription drugs through private plans that contract with Medicare. Enrollment in Part D is voluntary. The benefit helps pay for enrollees’ drug costs after a deductible is met (where applicable), and offers catastrophic coverage for very high drug costs. Part D coverage is actually provided by private health insurance companies. The premium varies based on your income and the types of prescriptions that you are taking. The national average in 2017 for Part D premiums is $34 per person.

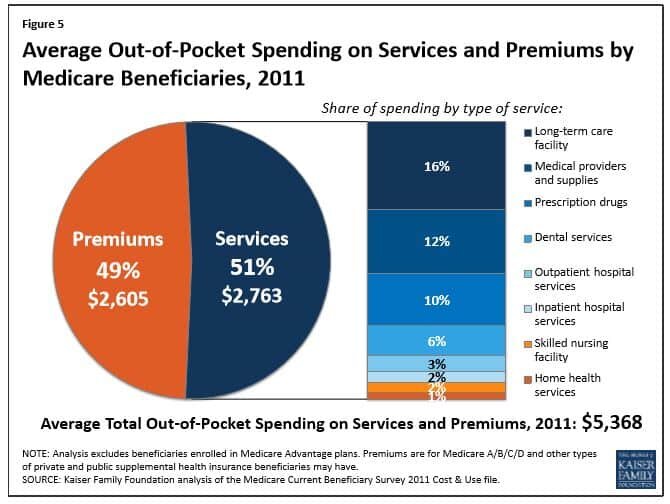

If you total up just these three items, you reach $7,030 in premiums and deductibles for the year. Then you start adding in dental cost, Medigap insurance premiums, co-insurance for Medicare benefits, and it quickly gets a married couple over that $10,000 threshold in health and dental cost each year. Medicare published a report that in 2011, Medicare beneficiaries spent $5,368 out of their own pockets for health care spending, on average. See the table below.

Start Planning Now

Fidelity Investments published a study that found that the average 65 year old will pay $240,000 in out-of-pocket costs for health care during retirement, not including potential long-term-care costs. While that seems like an extreme number, just take the $10,000 that we used above, multiply that by 20 year in retirement, and you get to $200,000 without taking into consideration inflation and other important variable that will add to the overall cost.

Bottom line, you have to make sure you are budgeting for these expenses in retirement. While most individuals focus on paying off the mortgage prior to retirement, very few are aware that the cost of health care in retirement may be equal to or greater than your mortgage payment. When we are create retirement projections for clients we typically included $10,000 to $15,000 in annual expenses to cover health care cost for a married couple and $5,000 – $7,500 for an individual.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.