The Process of Selling A Business - Pitfalls To Avoid

For business owners, selling the business is often the single most important financial transaction in their lifetime. Since this is such an important event, we created a video series that will guide business owners through the

For business owners, selling the business is often the single most important financial transaction in their lifetime. Since this is such an important event, we created a video series that will guide business owners through the selling process. Dave Wojeski, a partner at Greenbush Financial, has spent years in the merger acquisition space, focusing on business transaction between $5M and $100M in value. Over the course of these 3 videos, Dave will share the following information about the sell side of these business transactions:

Video 1: Valuation & Prepping Your Business For Sale

Knowing when it’s the right time to sell your business

How to determine the value of your business

The returns that buyers typical expect from the acquisition of your business

Prepping your business for sale to command a higher valuation

Video 2: The Process of Selling Your Business

The steps associated with selling your business

Professionals involved in the selling process

Letter of Intent (LOI), Due Diligence, and Purchase Agreement Terms

Special considerations when selling the business to your children

Video 3: Pitfalls To Avoid When Selling Your Business

Common pitfalls to avoid when selling your business

Employment agreements post sale

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Do I Have to Pay Tax When I Sell My House?

When you sell your primary residence, and meet certain requirements, you may be able to exclude all or a portion of your capital gain in the property from taxes. In this article, I am going to cover the $250,000

When you sell your primary residence, and meet certain requirements, you may be able to exclude all or a portion of your capital gain in the property from taxes. In this article, I am going to cover the $250,000 capital gains exclusion for single filers, and the $500,000 capital gains exclusion for married couples filing joint. However, as financial planners, we have also run into some unique situations where clients:

Live in an owner-occupied duplex and rent one half of the property

Have a home office and have been taking depreciation as a tax benefit

Moving into a rental property and made it their primary residence

For homeowners that fall into one of the unique categories, they may face an unexpected tax consequence when the go to sell their property. They may wrongly assume the large capital gains exclusion associated with selling a primary residence will cover gains and depreciation that was taken on the rental portion of the property.

$250,000 / $500,000 Capital Gain Exclusion

When you sell an asset that is appreciated in value, in most cases you must pay tax on the amount of value that that asset has gained since you purchased it. For real estate, if you have held the property for more than 12 months, you typically have to pay long term capital gains tax on the amount of the appreciation. However, for your primary residence, the IRS offers taxpayers some relief if certain requirements are met. These conditions are that:

The home must be considered your primary residence based on IRS rules

You must have occupied the house for at least 2 of the last 5 years

If you meet these requirements, when you go to sell your house the IRS offers the following capital gains exclusion amounts:

Single Filers: $250,000

Married Filing Joint: $500,000

If you are a single tax filer, meet the primary residence requirements, and the gain in your house is not more than $250,000, you will not pay any tax when you sell it. For married couples filing joint, as long as the gain in the property is not more than $500,000, you will not pay any tax when you sell it. Do not mistake the sales price of the house with the amount of the capital gain. If you are married and sell your house for $600,000, that does not necessarily mean that you are going to have to pay tax when you sell it. If you purchased the property 10 years ago for $400,000, and you sell it today for $600,000, you have a $200,000 gain in the property. Since the capital gain exclusion for married couples filing joint is $500,000, you do not have to pay any tax on the gain when you sell your house.

Calculation of Your Cost Basis

When you calculate the gain in your house, you take the sales price of the house, minus the purchase price of the house, minus the cost of any capital improvements that you made to the house while you owned it, minus any commissions that you paid to the realtor. For example, I'm a single filer and I bought a house for $200,000, 10 years later I sell the house for $500,000. when I lived in the house I made $50,000 of capital improvements and when I sold the house I paid the realtor a 5% Commission.

Since the total capital gain is below the $250,000 threshold, I will not pay any tax when I sell the house.

NOTE ABOUT CAPITAL IMPROVEMENTS: You should have documented proof of your capital improvements. Anytime you make major house renovations, you should keep the receipts in case you are ever audited by the IRS and have to justify those capital improvements.

You Can Use The Exemption Multiple Times

This capital gains exception on your primary residence can be used more than once during your lifetime. The only restriction is the exemption can be used only once every two years. For example, let us say you are married and file a joint tax return. You buy your first house for $200,000, and 10 years later sell it for $400,000. In this scenario, you will not pay any tax when you sell your primary residence. Now assume you then take that $200,000 gain and use it as a down payment on your new house and the purchase price of that new house is $400,000, you live in that house for 15 years, and then sell it for $700,000. You will again be able to exclude the full gain in that property when you sell it.

Capital Gains Rule For A Rental That Is Owner Occupied

Here is our first unique situation: It is not uncommon for someone to buy a duplex, live in 1/2 as their primary residence, and rent the other half to a tenant. The question becomes when you go to sell the duplex, how does the capital gains exclusion work since technically it was also your primary residence. This is tricky. In the eyes of the IRS, the duplex is 2 separate properties. The half that you live in is your primary residence, and the half that is rented is actually an investment property. Only the half that you live in as your primary residence is eligible for the primary residence capital gains exclusion. The rented portion of the property is not eligible for the capital gains exclusion.

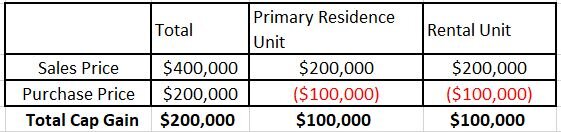

For example, I found a duplex for $200,000, I live in 1/2 as my primary residence and I rent the other half to a tenant. 10 years later I decide to sell the duplex for $400,000. even though I'm a single filer and technically have a $250,000 gain exclusion for my primary residence, that unfortunately will not cover the full gain in the property when I sell it. Here is how I have to allocate the gain between the two units:

The $100,000 gain associated with my principal residence unit is exempt from taxes because it's below the $250,000 exclusion for a single filer. However, the $100,000 capital gain associated with the rental unit, I will have to pay tax on. Since I also owned the house for more than a year, I would pay long-term capital gains rates on the $100,000 which could mean 15% Federal Tax and State Tax. Assuming the State Tax is 5%, I would owe 20% in taxes on the $100,000 gain equaling a $20,000 tax bill.

Recapture of Deprecation

When individuals own rental properties, it is not uncommon for the owner to be taking depreciation on the value of the rental property. Depreciation is a tax strategy which allows you to realize the expense of the property and use those expense to offset income from the property, thus reducing the owner’s tax liability. However, when you sell a property, you have to recapture the depreciation that was previously taken as a tax benefit. Therefore, not only would you potentially have to pay tax on the gain of the rental unit, but you have to factor in that appreciation which is taxed at a different rate than long-term capital gains.

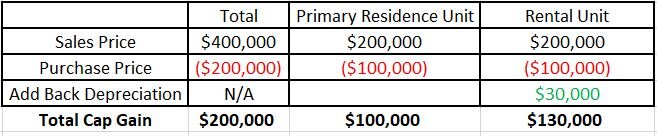

Let us build on the example with the duplex we just discussed. Over the course of the 10 years that I own the property, I took $30,000 worth of depreciation against the property to reduce the tax liability against the rental income I was receiving from the tenant. When I sell the house, the cost basis of my primary residence unit and the rental unit will be different due to the depreciation adjustment. See below:

As you see in the example above, I have a larger gain on the rental unit because I had to add the $30,000 appreciation amount to the gain (or in the accounting terms, it reduced my cost basis by another $30,000). In this situation the $100,000 gain associated with the primary residence unit is 100% excluded from taxes because it is below my $250,000 single filer exemption. However, on the rental unit I will have to pay tax on the $130,000 gain, but the $130,000 is not all taxed at the long-term capital gains rate. The $30,000 in depreciation recapture is taxed at a flat 25% tax rate, whereas the remaining $100,000 and gain is entirely taxed at long-term cap gains rates.

Why does the IRS tax depreciation recapture at a different rate? They recognize that you use the depreciation to offset income that was originally taxed at ordinary income tax rates, which could be as high as 37% or more. So, they are essentially asking you to pay more tax on the portion of the game assigned to the tax deductions you took while you owned it.

A SPECIAL NOTE ABOUT DEPRECIATION: Depreciation recapture is limited to the lesser of the gain or the depreciation previously taken. For example, if you took $100,000 in depreciation against the property but the gain when you sold the property was only $50,000, when you sell the property you have to pay tax on the $50,000 gain, but it will be at the full 25% depreciation recapture rate. You do not have to pay tax on the full $100,000 depreciation recapture when you sell the property.

Moving Into A Rental Property To Avoid Capital Gains Tax

This is another unique situation that we run into sometimes. Individuals that own rental property that has appreciated in value, or sometimes get the idea that if I move into the property and make it my primary residence for two years, all of the gain in that property will then be sheltered by my primary residence capital gains exclusion. The rule of thumb in these situations is if you have thought of it, the IRS has probably thought of it as well, and has probably put some form of restrictions in place. That is unfortunately true of this strategy as well. In 2009 The IRS created a “qualified vs non-qualified use” test:

Qualified uses the period of time that the house is considered your primary residence. Non-qualified uses the period of time that that house was an investment property. The test applies to ownership periods beginning in 2009, and it ultimately determines that even if you have met all the requirements in making that house your primary residence, when you go to sell it the test will determine how much of the gain exclusion you get to apply when you sell the house.

For example, if you rented out a vacation home for 10 years and then you moved into the house for three years as your primary residence, when you go to sell, the capital gains exclusion is limited to 3/13 of the capital gain the property.

Let's assume I buy a vacation home for $300,000, and rented it out as an investment property for 10 years. I move into the house and make it my primary residence for three, but now have decide to sell it for $700,000. Since I am married and file a joint tax return, it is easy to assume I am eligible for a $500,000 capital gains exclusion on my primary residence. However, in this situation I cannot shelter the full gain because the IRS would apply the qualified use test.

$400,000 Capital Gain x 3/13 = $92,307

When I sell the property and realize the $400,000 gain, I am only able to exclude $92,307 from taxes using the primary residence gain exclusion. The remainder of the gain would be taxed at long term capital gains rate and any depreciation recapture would apply.

Selling Your Primary Residence With A Home Office

For an individual that has been claiming a tax deduction for a home office, a word of caution: If you have taken depreciation over the years for the home office, when you sell the primary residence, you will be eligible for the capital gains exclusion, but you will have to recapture the depreciation that you claimed over the years.

DISCLOSURE: This article does not contain tax advice and is for educational purposes only. For tax advice, please consult your tax professional.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

A CFP® Explains: Wills, Health Proxy, Power of Attorney, & Trusts

When we are constructing financial plans for clients, we inevitably get to the estate planning portion of the plan, and ask them “Do you have updated wills, a health proxy, and a power of attorney in place?

When we are constructing financial plans for clients, we inevitably get to the estate planning portion of the plan, and ask them “Do you have updated wills, a health proxy, and a power of attorney in place?” The most common responses that we receive are:

“I know we should have but we never did”

“I did but it was over 10 years ago”

“I have a will but not a health proxy or a power of attorney”

“I have heard about trusts, should I have one?”

The Will, Health Proxy, and Power of Attorney are the three main estate documents that most people should have. In this article I will review:

How Wills work and items that you should include in your Will

Why you should have a Health Proxy and how they work

Power of Attorney

The probate process

Considering a testamentary trust

Assets that pass outside of the Will

Revocable Trusts & Irrevocable Trusts

Estate planning tips

How much does it cost to establish a will, health proxy, and a power of attorney

Establishing A Will

The most basic estate document that most people are aware of is a written Will. The Will provides specific guidance as to who will receive your assets after you have passed away. The Will also establishes who would be the guardian of your minor children should you pass away prior to your children reaching the age of majority. Without a Will, state laws and the court system that know nothing about you, will decide who receives your assets and who will be the guardian of your minor children; not a situation that most people want.

The Will can be a very simple document. If you are married and have children, the Will may state that if you pass away everything goes to your spouse but if both you and your spouse were to pass away simultaneously, the assets go to the children. For individuals or married couples without children, or for married couples that have been divorced, it’s also critical to have a Will to provide direction as to what will happen to your assets if you were to pass away.

You can engage an estate attorney to complete a simple Will or if your Will is very simple and straightforward, you may elect to use a do-it-yourself option through a platform like Legal Zoom. We typically encourage clients to meet with an estate attorney because when it comes to estate planning many people don’t know what questions to ask to get the right documents and plan in place. If you are married with minor children, and you and your spouse were to pass away leaving all the assets to the kids, with a simple Will, they would have access to their full inheritance at age 18. An 18 year old having access to large sums of money may not be an optimal situation. In those cases, you may want to include a testamentary trust or revocable trust in your estate plan to put some restrictions in place as to how and when your children will have access to their inheritance.

Probate

I'm going pause here for a moment and explain what probate is and the probate process. When someone passes away, all of the assets included in their estate go through what's called a “probate process”. The probate process is a legal process of accounting for all of your assets, debts, and transferring your assets to the beneficiaries of your estate. The person listed in your will as the “executor” is responsible for coordinating the probate process. Depending on the size of the estate, your executor will usually work with an attorney, an accountant, and possibly appraiser, to:

Value the assets in your estate

Work with the courts to process your estate

Pay outstanding expenses or debts

Coordinate the transfer of assets to your beneficiaries

Since the probate process is a legal process involving the courts, the process often takes longer than beneficiaries expect. Individuals will make the incorrect assumption that when you pass away, they just read the will, and your beneficiaries receive the assets within a few days or weeks; unfortunately that's not that case. It’s not uncommon for the probate process to take 6 to 12 months and there are expenses involved with probating an estate. If it’s a complex estate, it could take over a year to complete the probate process.

For these reasons, it’s a common goal with estate planning to find ways to avoid the probate process and pass you assets directly to your beneficiaries. I will explain more about these strategies later on. But circling back to our discussion about the Will, if all you have is a Will, when you pass away, the assets in your estate will pass through this probate process.

Testamentary Trusts

There are a lot of different types of trusts within in estate planning world. One of the most basic and common trusts, especially for individuals with children under that age of 25, is a testamentary trust. A testamentary trust is a trust that is built into your will. With at testamentary trust, you are not establishing a trust today , but rather, if you pass away, a trust is established during the probate process and you can direct assets to the trust. Building a testamentary trust into your Will gives you some control over how the assets are distributed to the beneficiaries after you have passed away.

It's common for individuals or married couples with children under that age of 25, to build these testamentary trusts into their Wills. I will illustrate how these trusts work in the example below.

Example: Jim and Sarah have two children, Rob age 14 and Wendy age 8. Between the value of their house, life insurance policies, and other assets, their estate would total $1.5M. Jim & Sarah realize that if something were to happen to them tomorrow, they would not want their kids to inherit $1.5M when they turn age 18 because they might not go to college, they may try to start a business that fails, buy a Corvette, etc. In their Will they establish a Testamentary Trust that states that if both parents pass away prior to the children turning age 25, all of their assets will flow into a trust, and that Sarah’s brother Harold will serve as the trustee. Harold as the trustee is able to distribute cash from the trust for living expenses, education, health expenses, and other expenses deemed necessary for the well being of the children. The children will receive 1/3 of their inheritance at age 25, 30, and 35.

You can design these testamentary trusts however you would like. In the Will you would designate who will be the trustee of your trust and the terms of the trust.

IMPORTANT NOTE: Testamentary trusts do not avoid probate like other trusts do. The trust is established as part of the probate process.

Revocable Trusts & Irrevocable Trusts

It's also common for individuals and married couples to consider establishing either a Revocable Trust or Irrevocable Trust as part of their estate planning. These are separate from Testamentary Trusts. Revocable Trusts and Irrevocable Trusts are being established today and assets owned by the trust pass in accordance with the terms set forth in the trust document. There are material differences between these two types of trusts but some primary reasons why people establish these types of trust are to:

Avoid probate

Protecting assets from a long term event

Control how and when assets are distributed beyond the date of death

Reducing the size of the estate

Advanced tax strategies

Assets That Pass Outside of The Will

There are certain assets that pass outside of the Will. Many of these “other assets” pass by “contract”, meaning there are beneficiaries designated on those accounts. A common example of assets that pass by contract are 401(k) accounts, IRA’s, annuities, and life insurance. When you set up those accounts you typically designate beneficiaries for each account and your Will could say something completely different. The assets that pass by contract do not have to go through the probate process unless the beneficiary listed on the account is your estate which is usually not an advantageous election for most individuals.

Transfer On Death Accounts (TOD)

One of the estate planning strategies that we use with clients is instead of holding an individual investment account in the name of the individual, we will register the account as a “transfer on death” (TOD) account. If you have an individual brokerage account and you pass away, the value of that account will have to go through probate. By simply adding the TOD feature to an existing individual brokerage account which lists beneficiaries similar to a 401(K) or IRA account, that account now avoids probate, and passes by contract directly to the beneficiaries.

Depending on the assets that make up your estate, you may be able to setup TOD accounts as opposed to going through the process of setting up trusts but it varies from person to person.

Power of Attorney

Let’s shift gears now over to the Power of Attorney document. A Power of Attorney document is important because it allows someone to step into your shoes and handle your financial affairs, should you become incapacitated. Some common examples are:

Example 1: If you're in a car accident and end up in a coma, for accounts that are held only in your name, such as a checking account, investment account, or credit card, they will only speak to you. Being married does not give your spouse access financially to those accounts while you are still alive but your spouse may need access to them to continue to pay your bills or get access to cash to pay expenses while you're incapacitated. Having a power of attorney document would allow your spouse or trusted individual named as your “agent” to act financially on your behalf.

Example 2: Having a power of attorney in place is key for Long Term Care events. If you have a spouse or parent and they have a stroke, develop dementia, or another health event that renders them unable to handle their personal finances, you could step in as their agent and handle their personal finances. In long term care situations that can often mean paying a nursing home, applying for Medicaid, paying medical bills, or shifting the ownership of assets to protect from a Medicaid spend down.

The Power of Attorney can also be built so your agent is not given that power today but rather it would only be given if a triggering event happened sometime in the future. With this document you really have to name someone you 100% trust. As financial planners, we have seen cases where there is abuse of the Power of Attorney powers and it’s never pretty. It's not uncommon for a power of attorney to allow the agent to make gifts as a planning tool, but that might also include gifts to themselves, so you have to fully trust your agent and the powers that you provide to them.

Health Proxy

The health proxy is usually the least fun estate document to complete but is equally important. In this document you are naming the individual that has the right to make your health decisions for you if you are incapacitated. This document spells out what you want and don’t want to have happen if certain health events occur. While it's not uncommon for individuals to be a little uncomfortable completing this document due to the nature of the questions, it's a lot better to complete it now, versus your family members trying to determine what your wishes would be when a severe health event has already occurred.

The health proxy will list items like:

Would you be willing to be put on life support?

If you could not eat, would you allow them to use a feeding tub

Resuscitation preferences

Willingness to accept blood transfusions

Again, not fun things to think about but by you making these decisions while you are of sound body and mind, it takes away the difficult situation where your family members have to decide in the heat of the moment what you would have wanted. That situation can sometimes tear families apart.

Keep Your Estate Plan Up To Date

All too often, we run into this situation where a client will acknowledge that they have estate documents, but they were established 20 years ago, and they never made any changes. It makes sense to meet with your estate attorney and revisit your estate plan:

Every five years

If you move to a different state

When Congress makes major changes to the estate tax rules

The estate laws vary state by state. If we have clients that are planning to move and they plan to change their state of domicile to another state, we will often encourage them to meet with an estate attorney within that state once the move is complete. Congress has also made a number of changes to the federal estate tax laws over the past few years, with potentially more in the works, and not revisiting the estate plan could end up costing your beneficiaries tens of thousands of dollars in estate taxes that could have been avoided with some advanced planning.

Cost of Estate Documents

The cost of establishing a Will, Health Proxy, Power of Attorney, and Trusts, often varies based on the complexity of your estate plan. A simple Will may cost less than $1,000 to establish through an estate attorney. Establishing all three documents: Will, Health Proxy, and Power of Attorney may cost somewhere between $1,000 - $3,000. While it's not uncommon for individuals to be surprised by the cost of setting up these estate documents, I always urge people to think about the cost of not having those documents in place. The probate process with professionals involved could cost thousands of dollar, your beneficiaries could lose thousands of dollars in taxes that could have been avoided, not to mention the emotional toll on your family trying to figure out what you would have wanted without clear guidance from your estate documents. Revocable Trusts and Irrevocable Trust

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How To Protect Assets From The Nursing Home

When a family member has a health event that requires them to enter a nursing home or need full-time home health care, it can be an extremely stressful financial event for their spouse, children, grandchildren, or caretaker

When a family member has a health event that requires them to enter a nursing home or need full-time home health care, it can be an extremely stressful financial event for their spouse, children, grandchildren, or caretaker. The monthly cost of a nursing home is typically between $10,000 - $15,000 per month and without advanced planning it often requires a family to spend through almost all of their assets before they qualify for Medicaid.

As we all live longer, we become more frail in our 80’s and 90’s, which increases the probability of a long term care event occurring. Many individuals that we meet with have already experienced a long term care event with their parent or grandparents and they have seen first hand the painful process of watching them spend through all of their assets. For couples that are married, it can leave the spouse that is not in need of care in a very difficult financial situation as pensions, social security, and martial assets have to be pledged toward the cost of the care for their spouse. For individuals and widows, the burden is placed on their family or friends to scramble to liquidate assets, access personal financial records, and watch the inheritance for their heirs be depleted in a very short period of time.

I often ask my clients this simple question, “Would you rather your house and assets go to your kids or go to the nursing home?” As you would guess, most people say “my kids”. With enough advanced planning you have that choice and today I’m going to walk you through some of the strategies that we use with our clients to protect assets from long term care events.

Strategies Vary State By State

Since the Medicaid rules vary from state to state, the strategies that I'm presenting in this article can be used by New York State residents. However, if you are resident of another state, this article will still help you to understand asset protection strategies that are commonly used but you should consult with an elder law expert in your state to determine the appropriate application of these strategies.

Long Term Care Insurance

While having a long term care insurance policy in place is ideal because if a long term event occurs it pays out and covers the cost, there are a number of challenges associated with long-term care insurance including:

Insurance companies will rarely issue policies after you reach age 70

If you have any issues within your health history, they may not issue you a policy

The cost of the policies can be expensive

It’s not uncommon for a good long-term care insurance policy to cost an individual between $4,000 and $6,000 per year. The reason why the insurance is more expensive than other types of insurance is there is a high likelihood that if you live past age 65, at some point you will experience a long term care event. Insurance companies don’t like that. Insurance companies like issuing policies for events that have a low probability of occurring, similar to life insurance. In addition, when these long term care policies pay out, they pay out big dollar amounts because the costs are so high. For these reasons, long-term care insurance policies have become more of a luxury item instead of a common solution that is used by individuals and family to protect their assets from a long term care event.

So if you don’t have a long-term care insurance policy, what can you do to protect your assets from a long-term event?

Establish A Medicaid Trust

If an individual does not have a long term care insurance policy to help protect against the cost of a long term care event, the next strategy to consider is setting up a Medicaid Trust to own their non-retirement assets. Non-retirement assets can include a house, investment account, stocks, non-qualified annuities, permanent life insurance policies, and other assets not held within a Traditional IRA or other type of pre-tax retirement account. This is how the strategy works:

Establish a Medicaid Trust

Transfer assets from the individual’s name into the name of the trust

Assets are held in the trust for at least 5 years

The individual experiences a long term care event requiring them to enter a nursing home

Since the trust has owned the assets for more than 5 years, they are no longer countable assets, the individual can automatically qualify for Medicaid as long as their assets outside of the trust are below the asset allowance threshold; Medicaid pays the nursing home for their care, and the trust assets are preserved for the spouse and their heirs.

Medicaid 5 Year Look Back Period

In New York, Medicaid has a 5 year look back period. The 5 year look back period was put into place to prevent individuals from gifting away all of their assets right before or after they experience a long term care event in an effort to qualify for Medicaid. In 2020, New York requires residents to spend down all of their countable assets until they are below the $15,750 asset allowance threshold. Once below that level, the individual qualifies for Medicaid, and Medicaid will pay the nursing home costs. When an individual submits a Medicaid application, they request 5 years worth of financial records. If that individual gave any asset away within the last five years, whether it’s to a person or a trust, those asset will be brought back in as “countable assets” required to be spent down before the individual will qualify for Medicaid.

Example: Jim is 88 years old and has $100,000 in his savings account. His health is beginning to deteriorate and he gifts $90,000 to his kids in an effort to reduce his assets to qualify for Medicaid. Two years later Jim has a stroke requiring him to enter a nursing home, and only has $10,000 in his savings account. When he applies for Medicaid, they will request 5 years worth of his bank records and discover that he gifted $90,000 away to his kids two years ago. That $90,000 is a countable asset subject to spend down even though he no longer has it. But it gets worse, his kids spent the $90,000, so they are unable to return the $90,000 to Jim. Jim is not eligible for Medicaid and there is no cash available to pay for his care.

Medicaid Trust Strategy

For the Medicaid Trust strategy to work, the assets have to be put into the trust 5 years prior to submission of the Medicaid application. Once the assets are owned by the trust for more than 5 years, regardless of the dollar value in the trust, it’s no longer a countable asset, and the individual can automatically qualify for Medicaid.

Example: At age 84, Jim sets up an Medicaid trust, and moves $90,000 of his $100,000 in cash into the trust. At age 90, Jim has a stroke requiring him to enter a nursing home, but now since the assets were in the trust for more than 5 years, he is no longer required to spend down the $90,000, and he qualifies for Medicaid. That $90,000 is now reserved for his kids who are the beneficiaries of the trust.

Establishing a trust instead of gifting assets away to family members can help to preserve those assets against the situation where the individual does not make it past the 5 year look back period and the money gifted has already been spent by the beneficiaries.

How Do Medicaid Trusts Work?

Medicaid trusts are considered “irrevocable trusts” which means when you move assets into the trust you technically do not own them anymore. By setting up a trust, you are essentially establishing an entity, with it’s own Tax ID, to own your assets. The thought of giving away assets often scares individuals away for setting up these trusts but it shouldn’t. Estate attorneys often include language in the trust documents to offer some flexibility. Before I go into some examples, I first want to define some trust terms:

Grantor: The grantor is the person that currently owns the assets and is now gifting it (or transferring it) into their trust. If for example, you are doing this planning for your parents, they would be the “grantors” of the trust.

Trustee: The trustee is the individual or individual(s) that are responsible for managing the assets owned by the trust. This is typically not the grantor. The reason being is if you gift your assets to a trust but you still have full control of it, the question arises, have you really given it away? In most cases, the grantor will designate one or more of their children as trustees. The trustees are responsible for carrying out the terms of the trust

Beneficiaries: The beneficiaries of the trust are the individuals that are entitled to receive the assets typically after the grantor or grantors have passed away. It’s common for the beneficiaries of the trust to be the same as the beneficiaries listed in a person’s will.

Access to Income

When you gift assets to a Medicaid trust, you technically no longer have access to the principle, but grantors still have access to any “income” generated by the trust assets. This is most easily explained as an example.

Mark & Sarah have traditional IRA’s, their primary residence, and an investment account with a value of $200,000. They do not anticipate needing to access the $200,000 to supplement their income and want to protect that asset from a long term care event so they know that their kids will inherit it. They establish a Medicaid trust with their two children designated a co-trustees and they move the ownership of the house and the $200,000 investment account into the name of the trust. If the holdings in the $200,000 investment account are producing dividend and interest income, Mark & Sarah are allowed to receive that income each year because they always have access to the income generated by the trust, they just can’t access the principal portion of the trust assets.

Revoke Part Of The Trust

Estate attorneys may also build in a feature which allows the trustees to “revoke“ all or a portion of the trust assets. Let’s build on the Mark & Sarah example above:

Mark and Sarah gift their house and the $200,000 investment account to their Medicaid trust but two years later Sarah incurs an unforeseen medical event and they need access to $50,000. Since the trustee was given the power to revoke all or a portion of the trust asset, the trustee works with the estate attorney to revoke $50,000 of the trust assets in the investment account and send it to the grantors (Mark & Sarah). The $150,000 remaining in the investment account continues to work toward that 5 year look back period, and Mark & Sarah have the money they need for the medical expenses.

Gifts To The Beneficiaries

An alternative solution to the same scenario listed above is that the trustees can be given the power to gift assets to the beneficiaries while the grantors are still alive. Essentially the trustees, who are often also the beneficiaries of the trust, gift themselves assets from the trust, and then turn around and gift those assets back to the grantors. In the Mark & Sarah example above, instead of revoking part of the trust assets, their children, who are the trustees, gift $50,000 to themselves, and then turn around and gift $50,000 to their parents (Mark & Sarah) to pay their medical bills. But with gifting powers, you really have to trust the individuals that are serving as trustees of your Medicaid trust because they cannot be required to gift the money back to the grantor.

Putting Your House In The Trust

It's common for individuals to think: “Well all I have is my house, I don’t have any investment accounts, so there is no point in setting up a trust because my house is always protected.” That's incorrect. If you own your house and you experience a long term care event:

Your primary residence is not a countable assets for Medicaid eligibility and you can qualify for Medicaid while still owning your house

Medicaid cannot force you to sell your house while you or your spouse are still alive and then spend down those assets for your care

However, and this is super important, even though your primary residence is not a countable asset and they can't force you to sell it while you or your spouse are still alive, Medicaid can put a LIEN against your house for the amount that they pay the nursing home for your care. So when you or your spouse pass away, the value of your house is included in your estate, Medicaid will force the estate to sell the house and they will recapture the amount that they paid for your care.

Example: Linda’s husband Tim passed away three years ago and she is the surviving spouse. Her only asset is the primary residence that she lives in worth $250,000 with no mortgage. Linda has a stroke and is required to enter a nursing home. Because she has no other assets besides her primary residence, she qualifies for Medicaid, and Medicaid pays for the cost of her care at the nursing home. Linda passes away 2 year later. During that two year period in the nursing home, Medicaid paid $260,000 for her care. Linda's children, who were expecting to inherit the house when she passed away, now find out that Medicaid has a lien against the house for $260,000; meaning when they sell the house, the full $250,000 goes directly to Medicaid, and the kids receive nothing.

If Linda had put the house into a Medicaid trust 5 years prior to her stroke, she would have immediately qualified for Medicaid, but Medicaid would not be entitled to put a lien against her primary residence. When she passes away, since the house is owned by the trust, there is no probate, and her children receive the full value of the house.

Again, the way I phrase this to my clients is, would you rather your kids inherit your house or would you rather it go to the nursing home? With some advance planning you have a choice.

The Cost of Setting Up A Trust

The other factor that has scared some people away from setting up a Medicaid trust is the setup cost. It’s not uncommon for an estate attorney to charge between $3,000 - $8,000 to setup a Medicaid trust. But in the example that we just looked at above with Linda, you are spending $5,000 today to setup a trust, that is going to potentially protect an asset worth $250,000.

The next objection, “well what if I spend the money setting up the trust and I don’t make it past the 5 year look back period?” If that’s the case, the $5,000 that you spent on setting up the trust is just $5,000 less that nursing home is going to receive for your care. To qualify for Medicaid, you have to spend down your assets below the $15,750 threshold so if you have countable assets above that amount, you would have lost the money to nursing home anyway.

Countable Assets

I have mentioned the term “countable assets” a few times throughout this article; countable assets are the assets that are subject to that Medicaid spend down. Instead of going through the long list of assets that are countable it's easier to explain which assets are NOT countable. The value of your primary residence is not a countable asset even though it's subject to the lien. Pre-tax retirement accounts such as Traditional IRA’s and 401(k) plans are not countable assets. Pre-paid funeral expenses up to a specific dollar threshold are also not a countable asset. Outside of those three assets, almost everything else is a countable asset.

Retirement Accounts

As I just mentioned above, pre-tax retirement accounts are not subject to the Medicaid spend down, however, Medicaid does require you to take required minimum distributions (RMD’s) from those pre-tax retirement accounts each year and contribute those directly to the cost of your care. Notice that I keep saying “pre-tax”, that’s because Roth IRA’s are countable assets subject to spend down. If you have $100,000 in a Roth IRA, Medicaid will require you to spend down that account until you reach the $15,750 in total countable assets qualifying you for Medicaid.

Pensions & Social Security

You can use Medicaid trusts to protect assets but they cannot be used to protect “income”. Monthly pension payments and Social Security income are subject to the Medicaid income threshold. For individuals that are single or widowed, your income has to below $875 per month in 2020 to qualify for Community Medicaid and below $50 per month for Chronic Care Medicaid. If an individual is receiving social security, pensions, or other income sources above that threshold, all of that income automatically goes toward their care.

If you are married and your spouse is the one that has entered the nursing home, you are considered the “community spouse”. As the community spouse you are allowed to keep $3,216 per month in income.

Example: Rob and Tracey are married, Rob just entered the nursing home, but Tracey is still living in their primary residence. Their monthly income is as follows:

Rob Social Security: $2,000

Tracy Social Security: $2,000

Rob Pension: $3,000

Total Monthly Income: $7,000

Of the $7,000 in total monthly income that Tracey is used to receiving, once Rob qualifies for Medicaid, she will only be receiving $3,216 per month. The rest of the monthly income would go toward Rob’s care at the nursing home.

Community Spouse Asset Allowance

If you are married and your spouse has a long term care event requiring them to go into a nursing home and you plan to apply for Medicaid, you as the community spouse are allowed to keep countable assets up to the greater of:

$74,820; or

One-half of the couple’s total combined assets up to $128,640 (in 2020)

Take Action

Unless you have a long term care insurance policy or enough assets set aside to offset the financial risk of a long term care event occurring in the future, setting up a Medicaid trust may make sense. But I also want to provide you with a quick list of considerations when establishing a Medicaid trust:

You should only transfer assets to the trust that you know you are not going to need to supplement your income in retirement.

Step up in basis: By establishing a Medicaid trust as opposed to gifting assets directly to individuals, the estate attorney can include language that will allow the assets of the trust to receive a step up in basis when the grantor passes away which can mitigate a huge tax hit for the beneficiaries.

For these strategies to work it takes advanced planning so start the process now. Each asset that is transferred into the trust has its own 5 year look back period. The sooner you get the assets transferred into the trust, the sooner that clock starts.

If you are doing this planning for a parent, grandparent, or other family member, it's important to consult with professionals that are familiar with the elder law and Medicaid rules for the state that the individual resides in. These rules, limits, and trust strategies vary from state to state.

Contact Us For Help If you are a New York resident doing this type of planning for yourself or for a family member that is a resident of New York, please feel free to reach out to us with questions. We can help you to better understand how to protect assets from a long term care events and connect you with an estate attorney that can assist you with the establishment of Medicaid trust if the trust route is the most appropriate strategy for asset protection. Disclosure: This article is for educational purposes only. It does not contain legal, Medicaid, or tax advice. You should consult with a professional for advice tailored to your personal financial situation.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Which Stock Market Index Is Better To Track? The Dow or S&P 500 Index

Today, I’m going explain the difference between the Dow Jones Industrial Average (“The Dow”) and the S&P 500 Index. While both indexes are meant to be an accurate representation of the performance of the US

Today, I’m going explain the difference between the Dow Jones Industrial Average (“The Dow”) and the S&P 500 Index. While both indexes are meant to be an accurate representation of the performance of the US stock market, it’s important to understand the difference between the two.

Why is it important? This year, 2020, is a perfect example why. As I write this article on August 21, 2020, the Dow Jones industrial average is DOWN -2.80% for the year. Meanwhile, the S&P 500 index is UP 4.79% for the year. If both indexes are supposed to be accurate representations of the performance of the stock market, why is one down 2% and the other up 4%?

Special disclosure: I will be mentioning individual companies in this article to help educate you on this topic. These are not recommendations to buy, sell, or hold any of the companies mentioned.

30 companies versus 500 companies

Neither of these indexes are comprised of all of the publicly traded companies in the U.S. stock market. The sponsors of these indexes have hand selected the companies that they have chosen to represent the index. The Dow Index is only made up of 30 companies. The S&P 500 index, as the name suggests, is comprised of 500 companies.

It’s easy for the S&P 500 to win the argument that 500 companies is probably a better representation of the overall stock market versus just the 30 companies that have been hand picked to represent the Dow.

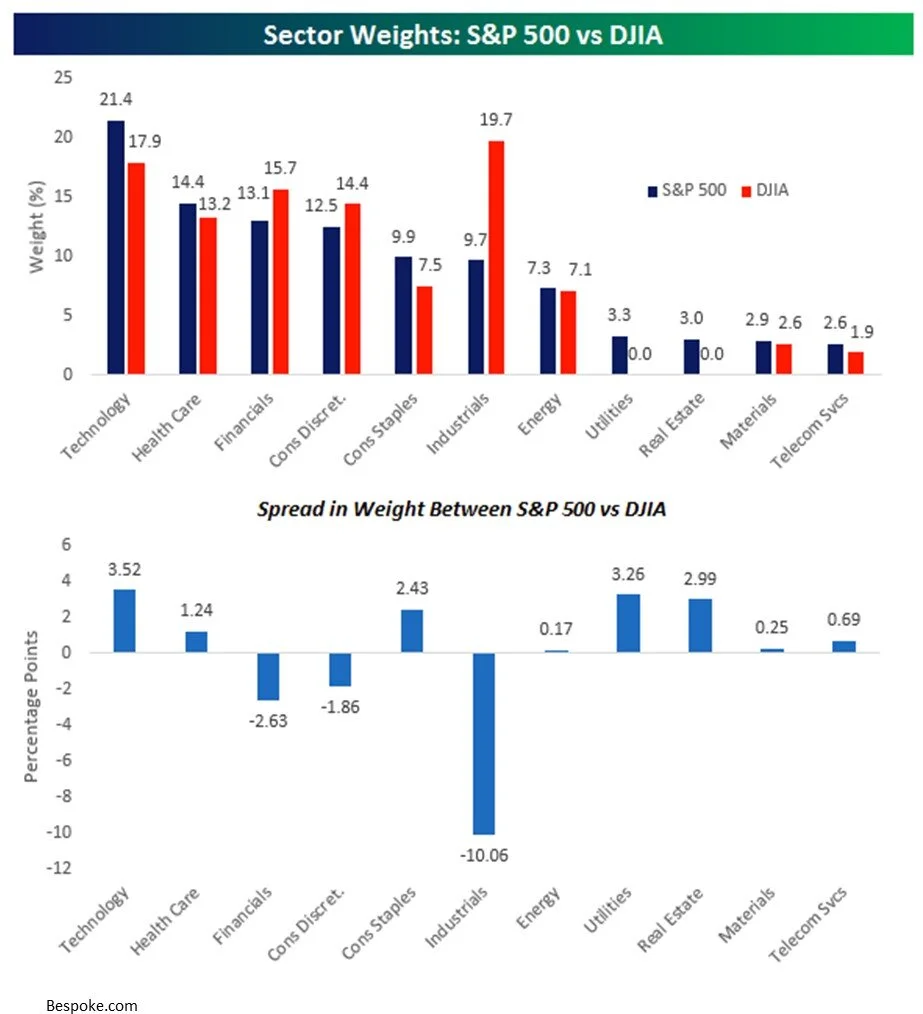

Market sectors

Sector concentration also has a big impact on the performance of these indexes. Stocks are categorized into “sectors” which groups publicly traded companies together by industry. Banks are in the “financial sector”, oil companies are in the “energy sector”, and so on. Since the Dow and the S&P 500 Index have different companies in them, they also have different sector weightings. Below are charts that compare the sector weights in the S&P 500 Index and the DJIA (Dow Jones Industrial Average). The second chart provides a summary of the difference in the sector weightings. 30 companies

The largest two differences in the sector weightings between the S&P 500 Index and the Dow are Industrials and Technology. The S&P 500 Index has a higher concentration of technology stocks (Examples: Apple, Google, Amazon) and a lower concentration of Industrial Stocks (Examples: GE, Catepillar, 3M). So when tech stocks have a good year, all other things being equal, the return of the S&P 500 Index will most likely be higher than the Dow. This explains some of the deviation in the YTD return between the S&P 500 Index and the Dow Index because the technology sector is up 26% YTD while the industrial sector is down 5% YTD.

Price Weighted vs Market Cap Weighted

This is probably the most important difference between the two indexes.

The Dow Index is “Price Weighted”

The S&P 500 Index is “Market Cap Weighted”

Before I jump into the comparison, you first have to understand the pieces that make up these terms.

Stock Price

A company’s stock price is meaningless as a standalone data point. If all you told me was that Company A has a stock price of $25 and Company B has a stock price of $400, I have no idea which company is bigger, which company has performed better, or which company is cheaper to buy. The only thing that stock price tells you is the estimated value of the company divided by the number of shares outstanding.

Let me explain this in an example. I have two separate companies: Jim’s Construction Inc. worth $2M and Albany Software Inc worth $1M. Both companies decide to go public. When a company “goes public”, the ownership of the company moves from the handful of individual private owners to whoever owns the shares of the stock being issued. The company that is going public decides how many shares of stock that it wants to issue. In this example let’s say Albany Software only wants to offer 1,000 shares of stock but Jim’s Construction wants to issue 200,000 shares of stock. Remember, stock price is determined by the value of the company divided by the number of shares issued:

When these two companies go public, Jim’s Construction will have a stock price of $10 per share and Albany Software will have stock price of $1,000 per share. If I showed a group of amateur investors just the stock price of each company and asked them:

Which company is bigger?

Which company is more expensive to buy today?

Which company would you have liked to own 5 years ago?

Most people would answer Albany Software with a stock price of $1,000 per share. When the truth is Jim’s Construction is actually twice the size of Albany Software, both stocks are priced at their fair market value so one is not necessarily more expensive than the other, and assuming these companies went public 5 years ago, there is no way to know which stock has performed better. Maybe 5 years ago Jim’s Construction was trading at $2 per share resulting in a 400% gain versus Albany Software that was trading at $800 per share 5 years ago, only representing a 25% gain.

Market Cap

A company’s “market cap” is just another way of determining the total value of the company. Market cap is calculated by multiplying the number of shares outstanding by the current stock price. If you wanted to compare the size of Apple vs Google:

Apple Stock Price $473 x 4.2 Billion Shares = $2.02 Trillion market cap

Google Stock Price $1,581 x 676 Million Shares = $1.07 Trillion market cap

Again, even through Apple has a much lower stock price than Google, the total value of Apple is twice that of Google.

The Most Important Difference Between S&P & Dow

With that investment lesson under our belts, we are now ready to go full circle back so I can explain why the Dow Index being “Price Weighted” and the S&P 500 Index being “Market Cap Weighted” is so important.

The Dow Jones Index is Price Weighted

Remember the Dow Index is only made up of 30 stocks. When you hear on the news that the Dow Index went up 300 points today or was down 700 points yesterday, the sponsors of the Dow are running a price weighted calculation of the 30 companies within the index. The calculation is simple, it’s just the price per share of each stock divided by a common divisor (historically the number of stocks in the index).

The problem with this calculation, as we discussed above, is that it completely ignores the size or “market cap” of the company. If Apple and Joe’s Construction Inc. both have a share price of $400 per share, should they really be weighted equally in the index? I would argue no, but in the Dow Jones Index they would be weighted equally in index.

The S&P 500 Index is Market Cap Weighted

The S&P 500 Index on the other hand is market cap weighted. The index is made up of the 500 largest U.S. publicly traded companies. Within the index, the larger companies have a bigger impact on performance of the index because each company’s weight in the S&P Index is calculated by taking the market cap of the company divided by the total market cap of all 500 companies in the index.

Since the S&P 500 Index has a larger number of companies and ranks the companies by size within the index, I would argue that the S&P 500 Index is the more appropriate index to track for purposes of determining the true performance of the U.S. stock market.

Tips for Tracking The Indexes

The media likes to report on the Dow because the price movement numbers are bigger and it grabs attention. If both the Dow and the S&P 500 drop by 2% in a single day, that equates to a 554 point drop in the Dow and a 67 point drop in the S&P 500 Index. What grabs more attention?

“Market drops by 554 point!!” or “Market drops by 67 points”

But it’s not uncommon, for all of the reasons that we discussed, for the day-to-day performance of the Dow and S&P 500 Index to be different. One or two companies can have a large impact on the Dow Index and push it up or down for the day which is less likely within the S&P 500 Index because there are 500 companies within the index all moving in their various directions.

I also encourage you to track “percentages” and not “point” movements. The Dow falling by 500 points sounds horrible but you have to remember that the Dow index is currently at 27,739, so a 500 point move only represents a 1.8% change. Back in 2010, when the Dow Index was at 10,000, a 500 point drop was more meaningful because it represented a 5% drop in the index. Just something to keep in mind with both the Dow and the S&P 500 Index at these higher levels.

Remember: Track the S&P 500 Index not the Dow and measure the daily movements in percentages not points. 30 stocks

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

How Much Life Insurance Should You Have? Top 8 Factors

When we are assisting clients in building their personal financial plan, inevitably one of the most frequent questions that comes up is: “How much life insurance should I have?”

When we are assisting clients in building their personal financial plan, inevitably one of the most frequent questions that comes up is: “How much life insurance should I have?” It's an important question to ask because if something unexpected were to ever happen to you or your spouse, it could put your family in a very difficult financial situation. To help mitigate this risk, people buy life insurance to guard against this type of unfortunate event but it’s important to know how much life insurance protection you should have. If you have too little, the coverage might not be enough to meet your family’s financial needs. If you have too much, you might be wasting money on insurance that you don’t need.

In this article we're going to go over the top 8 variables that factor into how much life insurance you should have, as well as, what type of insurance might make sense for you.

#1: Amount of Debt

First, you should tally up the total value of all of your outstanding debt.

Mortgage

Student Loans

HELOC

Credit Cards

Car Loans

Any other debt…………..

If you have dependents and something were to happen to you, the goal is to minimize the future annual expenses for your family. If you are married and you are used to having two incomes in the household to pay the mortgage, student loans, and car loans, if one spouse passes away, the family loses that income stream and it could be very difficult to meet the monthly payment on the debt with only one income. The life insurance would payout at the death of the insured spouse and those proceeds can be used to wipe out all of the debt which in turn reduces the monthly expense burden on the family.

#2: Income Level of Each Spouse

If you are married, the income level of each spouse will factor into how much life insurance each spouse should have. If spouse 1 makes $200K per year and spouse 2 makes $40K per year, typically you will need more insurance on spouse 1 than spouse 2. If Spouse 1 passes away, over the next 5 years, that’s $1 million in income that would need to potentially be replaced ($200K x 5 Years). However, if spouse 2 passes away, there would only need to be $200K to cover the next 5 years of income ($40K x 5 years).

A common mistake that married couples make is they blindly go in and purchase two insurance policies with the same death benefit without taking the different income levels into account. For possibly the same combined premium amount, in many but not all cases, couples can be better served by shifting more of the insurance coverage to the spouse with the higher income.

#3: Future College Expenses

If you have children and you expect those children to attend college, if you do not expect to receive large amounts of need based financial aid, it's important to factor in future college expenses into the amount of the insurance coverage. If you have 3 children and you planned on paying for their first 4 years of college, assuming college tuition with room and board is $25,000 per year, that’s $100,000 per child, multiplied by 3, for a grand total of $300,000 in anticipated college costs.

#4: Household Expenses

Everyone has a different lifestyle. One couple that has a combined income of $300,000 may need $250,000 to support household expenses if one of the spouses were to pass away. But another couple making the same $300,000 per year may only need $150,000 per year in income to support the household if one of the spouses passes away. You have to determine how your annual expenses would be impacted based on the untimely death of each spouse.

#5: Outside Savings

The amount of wealth that you have already accumulated absolutely factors into the amount of insurance that you may need. For example, if you sold your business and have $2 million in cash and non-retirement investment accounts, you may essentially be self-insured, meaning if something happened to you, you have accumulated enough savings to meet all of your family’s future financial needs without the need for additional insurance coverage.

However, if you and your spouse are both below the age of 50, have 2 children, and all of your wealth is tied up in 401(k)’s or retirement accounts, if you or your spouse were to pass away, the surviving spouse would have to withdrawal that money from the retirement accounts to meet expenses and pay tax on those distributions. So that $200,000 in their 401(K) may only be $150,000 after the taxes are paid but it depending on your tax bracket. By comparison, personal life insurance policies that you pay for out of pocket, the insurance proceeds are received tax free when paid to your beneficiaries.

So it’s not just a question of how much you have accumulated but also how accessible are those assets to your beneficiaries if they need to use those assets to supplement their income.

#6: Retirement Savings

You also have to consider the impact of an untimely death of a spouse on your retirement projections. If you or your spouse are covered by an employer sponsored retirement plan, like a 401(k) or 403(b), your retirement projections probably have you both making those regular annual contributions up until your retirement date. If one spouse passes away, those retirement contributions that were supposed to be there, no longer will be, which could force the surviving spouse to work longer than they wanted too.

You have to pay close attention to individuals that have pensions. Some pensions require the employee to turn on their pension benefit to reserve the survivor benefit for their spouse. If the employee passes away prior to their pension start date, the generous pension benefit which the family was depending on could be replaced by a much lower lump sum death benefit. In addition, retirees that elect a pension benefit with no survivor benefits to their spouse will sometimes use life insurance to cover the risk that they pass away and the pension stops within the early years of retirement.

#7: Adult Children with Disabilities

For families that have adult children with disabilities, it's not uncommon for the parents to be providing some form of continued financial support for their disabled child for the duration of their adulthood. If the parents were to pass away, the concern is that there has to be enough assets inherited by the child to provide them with support for the remainder of their life. Parents will often set up a Special Needs Trust to serve as the beneficiary of these life insurance policies so if the policies do payout it does not jeopardize the Social Security, Medicaid, Medicare or other government assistance that the disabled child may be receiving.

#8: Estate Plan

For some clients, it’s part of their estate plan that no matter what happens they want to know that $500,000 will go to each child, their favorite charity, to a trust for their grandchildren, or for clients with larger estates to pay the anticipated estate tax. To guarantee that those amounts will be available to meet their estate wishes, individuals can purchase permanent life insurance that will payout at the death of the insured.

Case Study

Let's run through a simple example given the following fact set:

Spouse 1 Income: $200,000 (Age 30)

Spouse 2 Income; $50,000 (Age 31)

Children: Susan Age 4 and Rebecca Age 2

Mortgage: $250,000

Student Loans: $20,000

The couple above has the college savings goal to pay for the first 4 years of the kid’s college expenses which is anticipated to be $25,000 per year.

Total Debt: $270,000

Total Estimated Future College Expense: $200,000 ($25K per year for each child)

From an income replacement standpoint, we would be looking to provide this family with a minimum of 5 years of income replacement. For the coverage on Spouse 1 that would be:

$200K Annual Income x 5 Years = $1M

Total Debt and College Costs = $470K

Total Insurance Coverage on Spouse 1: $1.5M (round up)

For the coverage on Spouse 2 that calculation would be: $50K Annual Income x 5 Years = $250KTotal Debt & College Costs = $470KTotal Insurance Coverage on Spouse 2 = $750K (round up)

How Much Does Insurance Cost?

In general, term insurance is cheap and permanent insurance is more expensive. For 90% of the individuals that we work with for their financial plan, term insurance typically makes the most sense. To give you an idea, a $1M 30 Year Term policy with William Penn Insurance Company, for an individual with the following fact set:

Age 30

Gender: Male

Resident of New York

Non-Smoker

Preferred Health Class

The monthly premium would only be $70.46 per month as of July 2020.

New York Residents: We Can Help

Michael Ruger & Rob Mangold are independent insurance agents which means we are not tied to a single insurance company. If you are a resident of New York, we can consult with you, help you to determine the amount of insurance that you need, evaluate you current life insurance coverage, and run free quotes for you across the major life insurance carriers in NY to determine the most appropriate carrier for your insurance policy. Contact Us

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The New PPP Loan Forgiveness Application & Early Submission

It just keeps getting better for small business owners. On June 17, 2020, the SBA released the updated PPP Forgiveness Application. In addition to making the forgiveness application easier to complete, the new application

It just keeps getting better for small business owners. On June 17, 2020, the SBA released the updated PPP Forgiveness Application. In addition to making the forgiveness application easier to complete, the new application also provided additional guidance on a number of questions that arose when the SBA extended the forgiveness period to 24 weeks.

But it gets better. On June 22nd, the SBA issued additional guidance allowing borrowers to apply for forgiveness prior to the end of the 8 week or 24 week covered period if the borrowers had already spent their full PPP loan amount.

With so much that has happened since the Paycheck Protection Program was first launched. Here is a quick recap of the events leading up to the release of the new PPP Forgiveness Application and the new guidance:

March 27, 2020: Congress passed the CARES Act which created the PPP Loan Program

April 2020: The SBA opens the window for companies to access the PPP Loans

May 15, 2020: The SBA released the first version of the PPP Loan Forgiveness Application

June 5, 2020: Congress passed the PPP Flexibility Act

Extended Covered Period to 24 Weeks

Reduced payroll cost requirement from 75% to 60%

Extended rehire safe harbor from June 30th to December 31st

June 17, 2020: SBA releases the updated PPP Forgiveness Application

June 22, 2020: SBA allows companies to apply for forgiveness prior to the end of the covered period

In this article we are going to address:

How to complete the new PPP Forgiveness Application

The EZ Forgiveness Application vs the Long Form PPP Forgiveness Application

Which companies are eligible to submit the PPP EZ Forgiveness Application

The new max comp limits of $20,833 and $46,154

Ability to apply for forgiveness prior to the end of the covered period

PPP EZ Forgiveness Application – Form 3508EZ

Instead of releasing just one forgiveness application, the SBA actually released two separate PPP Forgiveness applications:

PPP Loan Forgiveness EZ - Form 3508EZ

PPP Loan Forgiveness Revised – Form 3508

The good news is both applications are much shorter than the initial 12 page Forgiveness Application that was released on May 15th, but making it even better, we now also have an EZ application which will make the Paycheck Protection Program Forgiveness Application process even easier for many companies. The EZ application is only 3 pages long. giving companies access to a shorter forgiveness application made sense to us because the PPP loan amount was calculated based on 10 weeks of payroll and with the extension of the covered period to 24 weeks, companies now have 24 weeks of payroll to cover a loan amount based on 10 weeks. The result, most companies will most likely be able to reach the full PPP forgiveness amount on Payroll Costs alone without having to take into account rent, utilities, and other qualified expenses.

Who Is Eligible To Use The PPP EZ Forgiveness Application?

Companies will only be able to utilize the PPP EZ Forgiveness Application if they satisfy one of the following three criteria. I will give you the short and sweet version first followed by the long technical version of the criteria. Short and sweet:

You have no employees (Sole Proprietors or Owner Only Entities)

You did not reduce employee HEADCOUNT (FTE’s) and did not reduce WAGES by more than 25% for employees making less than $100,000 in 2019 during the covered period compared to January 1, 2020 – March 31, 2020

You did not reduce employee WAGES by more than 25% for employees making less than $100,000 in 2019 but you reduced the number of FTE’s during the covered period. However, the reduction in FTE’s was because CDC, OSHA, or other government agencies limited the capacity that the business could operate at during the covered period.

Here is the long technical version of the three criteria:

The borrower is a self-employed individual, independent contractor, or sole proprietor who had no employees at the time of the PPP loan application and did not include any employee salaries in the computation of the average monthly payroll in the PPP Application Form (SBA Form 2483).

The borrower did not reduce annual salary or hourly wages of any employee by more than 25% during the covered period compared to January 1, 2020 and March 31, 2020 AND The borrower did not reduce the number of employees or the average paid hours of employees between January 1, 2020 and the end of the covered period.

The borrower did not reduce annual salary or hourly wages of any employee by more than 25% during the covered period compared to January 1, 2020 – March 31, 2020 AND the borrower was unable to operate during the covered period at the same level of business activity as before February 15, 2020, due to compliance with requirements established or guidelines issued between March 1, 2020 and December 31, 2020 by the Secretary of Health, CDC, or OSHA, related to the maintenance of standards of sanitation, social distancing, or any other work or customer safety requirement related to COVID-19.

Again, you just have to be able to satisfy ONE of the three criteria listed above. You do not need to satisfy all three.

Reduction In Wages of Employees

Per the criteria mentioned above, if you reduced wages by more than 25% during the covered period for employees that made under $100,000 in 2019, you would not be able to complete the PPP EZ Application.

At first look this seems pretty self-explanatory but it’s really not. If you just read that statement for what it is, it would lead you to look at just your year-end payroll report for 2019, determine who had an annual compensation of $100,000 or less, and then you would look to see if any of those employees had wage reductions of greater than 25% during the covered period.

However, the way the guidance was written, it would imply that the $100,000 annualized compensation applies on a per pay period basis, meaning if in ANY pay period in 2019, you paid an employee higher than a $100,000 annualized wage, that employee would not be subject to the wage reduction calculation. It’s best to illustrate this in an example.

Let’s say Jim is one of your employees and in 2019 you paid Jim a total of $80,000. His $80,000 in compensation included $75,000 in base pay plus his $5,000 annual bonus that was paid to him in the final pay period in December. Your payroll is run on a biweekly basis meaning for purposes of assessing the $100,000 annual compensation limit, any employee that received more than $3,846.15 in any bi-weekly pay period in 2019, would not be subject to the wage reduction calculation. Since in Jim’s last paycheck of 2019, he received his regular bi-weekly wage of $2,884.15 plus his annual bonus of $5,000, his final paycheck in December was for $7,884.15. Thus Jim is excluded from the wage reduction calculation and can be ignored for purposes of assessing whether or not you are eligible to complete the PPP EZ Forgiveness Application even though his total compensation for 2019 was under $100,000.

Whether or not it was the SBA’s intention to assess the $100,000 limit in this manner, we cannot be 100% certain, but as of today, that’s how it reads.

Now that we have all of that fun stuff out of the way, let’s get to completing the PPP Forgiveness EZ Application. For the purpose of this article we are focusing on the EZ application because given the new 24 week covered period, the new safe harbor exceptions, and the ability to submit the application early, we expect that a lot of companies will qualify to submit the EZ Forgiveness application.

How To Complete the PPP Loan Forgiveness EZ Application

Here is what the first page of the PPP Loan Forgiveness Application Form 3508EZ looks like:

There are no worksheets that need to be completed!! It’s just this page and a second page that has a bunch of lines that Borrower has to initial certifying that they followed all of the rules associated with the PPP Loan Program.

Top Section: The top section of the form is just general information on your company, your PPP loan, and your payroll schedule.

Covered Period: If your PPP loan was issued prior to June 5th, you have the option to either select the 8 week covered period or 24 week covered period. The covered period beings on the date that you received the PPP loan. One might ask, why would anyone choose the 8 week covered period? There are actually a few reasons.

Reason 1: The company has already spent all of the PPP loan money within the 8 week period.

Reason 2: By electing the 24 week covered period, it also potentially creates a 24 week covered period for the FTE (full time equivalent employee) calculation and the 25% wage reduction calculation. But the guidance that we just received from the SBA on June 22nd which allows companies to file the forgiveness application prior to the end of the covered period could change this. The SBA issued guidance allowing companies to file the forgiveness application early but they did clarify what happens if the company receives full forgiveness but then reduces wages or FTE’s prior the end of the full 24 week covered period. We are flying blind right now until we get more guidance from the SBA on this.

For companies that have not spent 100% of their PPP loan amount, it think this new guidance creates a wait and see approach, as to whether the company should select the 8 week covered period or select the 24 week covered period with the ability to apply for forgiveness early.

For companies that have been able to spend 80% to 90% of their PPP loan during the 8 week covered period, that were planning on reducing employees or wages after the covered period was complete, depending on the guidance that the SBA issues, it may be advantageous for those companies to stick with the 8 week period, as opposed to being subject to the 24 week covered period calculations that could reduce the forgiveness amount.

The only other downside to selecting the 8 week period is the compensation limit for each owner and each employee is capped at a lower level compared to the 24 week covered period. We will cover this when we get to the Payroll Cost portion of the forgiveness application.

What is the “End Date” of your Covered Period?