Coronavirus RMD Relief: Ability To Waive Mandatory IRA Distributions In 2020

Congress passed the CARES Act in March 2020 which provides individuals with IRA, 401(k), and other employer sponsored retirement accounts, the option to waive their required minimum distribution (RMD) for the 2020 tax year.

Congress passed the CARES Act in March 2020 which provides individuals with IRA, 401(k), and other employer sponsored retirement accounts, the option to waive their required minimum distribution (RMD) for the 2020 tax year. This option is available to both individual over the age of 70½ and non-spouse beneficiaries of inherited IRA’s. In this article we will review:

The new RMD waiver rules

RMD’s for individuals age 70.5

RMD’s for beneficiaries of Inherited IRA’s

What happens if you already took your distribution for 2020?

Options for putting the RMD back into your IRA

Who Qualifies For The RMD Waiver?

Unlike other provisions in the CARES Act that require an individual to demonstrate that they have been impacted by the Coronavirus to gain access, the waiver of 2020 required minimum distributions is available to everyone. If you were age 70½ prior to December 31, 2019 or are the non-spouse beneficiary of an IRA, you are typically required to take a small distribution from your IRA each year, called an “RMD”, and pay tax on those distributions. However, for 2020, if you want to keep that money in your IRA in 2020 and avoid the tax hit associated with taking the distribution, you have the option to do so.

What If You Already Took Your RMD for 2020?

If you already received the RMD amount from your IRA for 2020, you may be able to return it to your IRA, and avoid the tax hit.

If the distribution came from your own personal IRA, not an inherited IRA, you will have two options:

OPTION 1: If the distribution happened within the last 60 days, you can simply return the money to your IRA. For this option, you are utilizing the 60-day rollover rule which allows you to take money out of an IRA, return it within 60 days, and avoid the tax liability. You are only allowed one 60-day rollover every 12 months.

OPTION 2: If the distribution took place more than 60 days ago, you will only be allowed to return it to your IRA if you qualify based on one of the four Coronavirus-Related Distribution criteria:

You, your spouse, or a dependent was diagnosed with the COVID-19

You are unable to work due to lack of childcare resulting from COVID-19

You own a business that has closed or is operating under reduced hours due to COVID-19

You have experienced adverse financial consequences as a result of being quarantined, furloughed, laid off, or having work hours reduced because of COVID-19

If you qualify under one of these items, then you will have 3-years from the date of the distribution to return the money back to your IRA and avoid the tax hit. However, while you have 3-years to return it to the IRA, if you don’t return the money to your IRA prior to December 31, 2020, you will have a tax liability in 2020 for all or a portion of that IRA distribution. It’s only when you actually return the money to your IRA that the tax liability is nullified. If you return it in a future tax year, you would have to go back and amend your 2020 tax return to recapture the taxes that were paid.

Inherited IRA – Non-spouse Beneficiary

However, if you are a non-spouse beneficiary of an IRA, the rules for returning the money to your IRA are different. If you are a non-spouse beneficiary of an IRA and you already received your RMD for 2020, you cannot return that money to your IRA to avoid the tax liability. Why is this? Beneficiaries are not eligible to make rollovers, so that disqualifies them from return the money to the IRA under the rollover rules in the CARES Act.

A Note To Our Greenbush Financial Clients

If you wish to waiver your RMD to 2020 or if have already received your RMD, and wish to process a rollover back into your IRA, 401(k), or employer sponsored plan, please contact us.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Coronavirus Relief: $100K 401(k) Loans & Penalty Free Distributions

With the passing of the CARES Act, Congress made new distribution and loan options available within 401(k) plans, IRA’s, and other types of employer sponsored plans.

With the passing of the CARES Act, Congress made new distribution and loan options available within 401(k) plans, IRA’s, and other types of employer sponsored plans. These new distribution options will provide employees and business owners with access to their retirement accounts with the:

10% early withdrawal penalty waived

Option to spread the income tax liability over a 3-year period

Option to repay the distribution and avoid taxes altogether

401(k) loans up to $100,000 with loan payments deferred for 1 year

Many individuals and small businesses are in a cash crunch. Individuals are waiting for their IRS Stimulus Checks and many small business owners are in the process of applying for the new SBA Disaster Loans and SBA Paycheck Protection Loans. Since no one knows at this point how long it will take the IRS checks to arrive or how long it will take to process these new SBA loans, people are looking for access to cash now to help bridge the gap. The CARES Act opened up options within pre-tax retirement accounts to provide that bridge.

10% Early Withdrawal Penalty Waived

Under the CARES Act, “Coronavirus Related Distributions” up to $100,000 are not subject the 10% early withdrawal penalty for individuals under the age of 59½. The exception will apply to distributions from:

IRA’s

401(K)

403(b)

Simple IRA

SEP IRA

Other types of Employer Sponsored Plans

To qualify for the waiver of the 10% early withdrawal penalty, you must meet one of the following criteria:

You, your spouse, or a dependent was diagnosed with the COVID-19

You are unable to work due to lack of childcare resulting from COVID-19

You own a business that has closed or is operating under reduced hours due to COVID-19

You have experienced adverse financial consequences as a result of being quarantined, furloughed, laid off, or having work hours reduced because of COVID-19

They obviously made the definition very broad and it’s anticipated that a lot of taxpayers will qualify under one of the four criteria listed above. The IRS may also take a similar broad approach in the application of these new qualifying circumstances.

Tax Impact

While the 10% early withdrawal penalty can be waived, in most cases, when you take a distribution from a pre-tax retirement account, you still have to pay income tax on the distribution. That is still true of these Coronavirus Related Distributions but there are options to help either mitigate or completely eliminate the income tax liability associated with taking these distributions from your retirement accounts.

Tax Liability Spread Over 3 Years

Normally when you take a distribution from a pre-tax retirement account, you have to pay income tax on the full amount of the distribution in the year that the distribution takes place.

However, under these new rules, by default, if you take a Coronavirus-Related Distribution from your 401(k), IRA, or other type of employer sponsored plan, the income tax liability will be split evenly between 2020, 2021, and 2022 unless you make a different election. This will help individuals by potentially lowering the income tax liability on these distributions by spreading the income across three separate tax years. However, taxpayers do have the option to voluntarily elect to have the full distribution taxed in 2020. If your income has dropped significantly in 2020, this may be an attractive option instead of deferring that additional income into a tax year where your income has returned to it’s higher level.

1099R Issue

I admittedly have no idea how the tax reporting is going to work for these Coronavirus-Related Distributions. Normally when you take a distribution from a retirement account, the custodian issues you a 1099R Tax Form at the end of the year for the amount of the distribution which is how the IRS cross checks that you reported that income on your tax return. If the default option is to split the distribution evenly between three separate tax years, it would seem logical that the custodians would now have to issue three separate 1099R tax forms for 2020, 2021, and 2022. As of right now, we don’t have any guidance as to how this is going to work.

Repayment Option

There is also a repayment option associated with these Coronavirus Related Distributions, that will provide taxpayers with the option to repay these distributions back into their retirement accounts within a 3-year period and avoid having to pay income tax on these distributions. If individuals elect this option, not only did they avoid the 10% early withdrawal penalty, but they also avoided having to pay tax on the distribution. The distribution essentially becomes an “interest free loan” that you made to yourself using your retirement account.

The 3-year repayment period begins the day after the individual receives the Coronavirus Related Distribution. The repayment is technically treated as a “rollover” similar to the 60 day rollover rule but instead of having only 60 days to process the rollover, taxpayers will have 3 years.

The timing of the repayment is also flexible. You can either repay the distribution as a:

Single lump sum

Partial payments over the course of the 3 year period

Even if you do not repay the full amount of the distribution, any amount that you do repay will avoid income taxation. If you take a Coronavirus Related Distribution, whether you decide to have the distribution split into the three separate tax years or all in 2020, if you repay a portion or all of the distribution within that three year window, you can amend your tax return for the year that the taxes were paid on that distribution, and recoup the income taxes that you paid.

Example: I take a $100,000 distribution from my IRA in April 2020. Since my income is lower in 2020, I elect to have the full distribution taxed to me in 2020, and remit that taxes with my 2020 tax return. The business has a good year in 2021, so in January 2022 I return the full $100,000 to my IRA. I can now amend my 2020 tax return and recapture the income tax that I paid for that $100,000 distribution that qualified as a Coronavirus Related Distribution.

No 20% Withholding Requirement

Normally when you take cash distributions from employee sponsored retirement plans, they are subject to a mandatory 20% federal tax withholding; that requirement has been waived for these Coronavirus Related Distributions up to the $100,000 threshold, so plan participants have access to their full account balance.

Cash Bridge Strategy

Here are some examples as to how individuals and small business owners may be able to use these strategies.

For small business owners that intend to apply for the new SBA Disaster Loan (EIDL) and/or SBA Paycheck Protection Program (PPP), the underwriting process will most likely take a few weeks before the company actually receives the money for the loan. Some businesses need cash sooner than that just to keep the lights on while they are waiting for the SBA money to arrive. A business owner could take a $100,000 from the 401(K) plan, use that money to operate the business, and they have 3 years to return that money to 401(k) plan to avoid having to pay income tax on that distribution. The risk of course, is if the business goes under, then the business owner may not have the cash to repay the loan. In that case, if the owner was under the age of 59½, they avoided the 10% early withdrawal penalty, but would have to pay income tax on the distribution amount.

For individuals and families that are struggling to make ends meet due to the virus containment efforts, they could take a distribution from their retirement account to help subsidize their income while they are waiting for the IRS Stimulus checks to arrive. When they receive the IRS stimulus checks or return to work full time, they can repay the money back into their retirement account prior to the end of the year to avoid the tax liability associated with the distribution for 2020.

401(k) Plan Sponsors

I wanted to issue a special note the plan sponsors of these employer sponsored plans, these Coronavirus Related Distributions are an “optional” feature within the retirement plan. If you want to provide your employees with the opportunity to take these distributions from the plan, you will need to contact your third party administrator, and authorize them to make these distributions. This change will eventually require a plan amendment but companies have until 2022 to amend their plan to allow these Coronavirus Related Distributions to happen now, and the amendment will apply retroactively.

$100,000 Loan Option

The CARES Act also opened up the option to take a $100,000 loan against your 401(k) or 403(b) balance. Normally, the 401(k) maximum loan amount is the lesser of:

50% of your vested balance OR $50,000

The CARES Act includes a provision that will allow plan sponsors to amend their loan program to allow “Coronavirus Related Loans” which increases the maximum loan amount to the lesser of:

100% of your vested balance OR $100,000

To gain access to these higher loan amounts, plan participants have to self attest to the same criteria as the waiver of the 10% early withdrawal penalty. But remember, loans are an optional plan provision within these retirement plans so your plan may or may not allow loans. If the plan sponsors want to allow these high threshold loans, similar to the Coronavirus Related Distributions, they will need to contact their plan administrator authorizing them to do so and process the plan amendment by 2022.

No Loan Payments For 1 Year

Normally when you take a 401(K) loan, the company begins the payroll deductions for your loan payment immediately after you receive the loan. The CARES act will allow plan participants that qualify for these Coronavirus loans to defer loan payments for up to one year. The loan just has to be taken prior to December 31, 2020.

Caution

While the CARES ACT provides some new distribution and loan options for individuals impacted by the Coronavirus, there are always downsides to using money in your retirement account for purposes other than retirement. The short list is:

The money is no longer invested

If the distribution is not returned to the account within 3 years, you will have a tax liability

If you use your retirement account to fund the business and the business fails, you could have to work a lot longer than you anticipated

If you take a big 401(k) loan, even though you don’t have to make loan payments now, a year from the issuance of the loan, you will have big deductions from your paycheck as those loan payments are required to begin.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Coronavirus SBA Loan Forgiveness Program

On March 27, 2020, Congress officially passed the CARES Act which includes the SBA Paycheck Protection Program. This program offers loans to small businesses that can be forgiven if certain conditions are met.

On March 27, 2020, Congress officially passed the CARES Act which includes the SBA Paycheck Protection Program. This program offers loans to small businesses that can be forgiven if certain conditions are met. A special note, this SBA program is separate from the SBA Disaster Loan Program called the Economic Injury Disaster Loan Program.

In this article we will review:

The terms of the Paycheck Protection Program

How the loan amount is calculated

Deferred Payments for 6 to 12 months

How to apply for the loans

The loan forgiveness process

Restrictions on what the loans can be used for

Other loan programs available to small businesses

Paycheck Protection Program

This is a new loan program sponsored by the SBA that was put in place to provide small business owners with access to cash to sustain normal business operations over the course of the next 8 weeks. While these are technically loans, if the guidelines of the program are followed, business owners will:

Never have to make a loan payment

Have the full loan amount forgiven

There are no fees to apply for the loan

Higher and faster approval rates compared to other lending programs

Business Expenses Covered By These Loans

This program is very specific about what the money can be used for. In order to qualify for forgiveness of the loan amount, the loan proceeds have to be used for:

Payroll & commission payments

Mortgage or rent payments

Group health benefits including insurance premiums

Vacation, medical, or sick leave payments

Utility payments

Interest on debt obligations previous to February 15, 2020

More specifically, it’s to cover expenses incurred between February 15, 2020 and June 30, 2020.

Who Qualifies For These SBA Loans?

Most small businesses will be eligible to apply for these loans. Here are the application requirements:

The business has been in operation since February 15, 2020

The business has 500 or less employees

The business has paid salaries, payroll taxes, or Form 1099 non-employee compensation

Ability to demonstrate that your business was economically affected by COVID-19

Sole proprietors, independent contractors, and 501(c)(3) entities are also eligible to apply.

Terms of the Loans

There are a number of unique features about this SBA loan program that will make it very appealing to small business owners:

No fees to apply for the loan

No collateral required

No personal guarantees

Maximum interest rate of 4%

Maximum 10-year amortization

Ability to defer payments for 6 to 12 months (depending on your lender)

No pre-payment penalty

Loan forgiveness if program requirements are met

Loan Forgiveness

There are requirements that have to be met in order for all or a portion of the loan amount to be forgiven by the SBA.

The money has to be spent on qualified expenses (listed above)

The expenses have to be incurred within 8 weeks after the loan is approved

The business has to maintain the same number of employees between Feb 15th and June 30th that it did during same period in 2019 or from January 1, 2020 until February 15, 2020

You cannot reduce employee wages by more than 25% for employee with less than $100K in compensation

Going outside of these requirements will either reduce or eliminate the amount of the loan that is forgiven by the SBA. We are still waiting for clarification on a number of business scenarios concerning employee headcount and wage calculations. The CARES Act was over 800 pages long, but it does seem as of right now, that if you rehire employees that were previously laid off at the beginning of the period, or restore wages that were previously reduced, you will not be penalized as long as you do this by either the end the initial 8 week period or June 30th. We still need clarification as to which deadline will apply.

Is The Loan Forgiveness Amount Taxable?

No. Within this program, the amount that is forgiven is considered a tax-free grant from the U.S. government.

How Is The Amount Of The SBA Loan Calculated?

Since this program was implemented to help businesses support payroll expenses, when you apply for the loan, you will need to submit payroll documentation for the previous 12 months. The calculation for these loans is very simple:

Total payroll expenses for the previous 12 months

DIVIDED by 12 months

MULTIPLIED by 2.5

In the calculation of the total payroll expenses, any employees making more than $100,000, they cap their compensation at $100,000 for purposes of the maximum loan calculation. Also, the amount available in the form this SBA loan is the LESSER of:

2.5 times monthly payroll expenses OR $10 million dollars

Here is a quick example:

Company XYX has 1 owner and 3 employees with the following payroll expenses for the past 12 months:

Owner: $200,000

Employee 1: $90,000

Employee 2: $60,000

Employee 3: $50,000

Since the owner’s salary is capped at $100,000, it will result in the following maximum loan amount:

$300,000 / 12 Months = $25,000

$25,000 x 2.5 = $62,500

If the company is approved for the $62,500 loan, depending on their bank, they may be able to defer making loan payments for 6 months, and as long as the company spends that money within the next 8 weeks on expenses outlined by the SBA program, maintains headcount and employee wages, they will be eligible for full forgiveness of the loan after that 8 week period without pre-payment penalty or a taxable event.

How Do You Apply For These Loans?

For the Paycheck Protection Program, these loans will be issued through banks. When you call your banker you will need to let them know that you are applying for an SBA Paycheck Protection Loan. The SBA serves as a guarantor for these loans so if the borrower meets the SBA criteria, the bank issues the loan, but if the borrower defaults on the loan, the SBA reimburses the bank for those losses.

Choose Your Bank Wisely

Not all banks will be participating in this loan program, so you first have to identify which banks in your area are participating in this SBA Paycheck Protection Program. These loans are going to be in high demand so the banks are most likely going to be overwhelmed with loan applications which could slow down the turnaround time of these loans. It is prudent to reach out to your professional network, like your accountant, investment advisor, or independent commercial broker, to determine which banks have the capacity to get these loans through quickly.

It will be extremely important for business owners to submit all of the proper documentation for the loan on the first attempt. If information is missing from the application or you submit the wrong supporting documentation, it could really slow down the process. The banks receive a fee from the government for every loan that they process so they have a big incentive to focus on the loans that all of the proper documentation so they can approve them quickly.

Start The Process Now

For our clients that we believe meet the criteria for this SBA Loan Program, our top recommendation is to start the process now otherwise you could end up in the back of a very long line. But before you do, you should consult with you accountant, financial advisor, or commercial lender to make sure this is the right program for you. There are multiple programs out there right now to help support small businesses due to the economic crisis caused by the Coronavirus. If you take a loan from one program, it could disqualify you from access to other SBA loans or tax credits that are available that could be more beneficial for your business. Here is our article on the SBA Disaster Loan Program which will be another popular option for businesses impacted by the Coronavirus containment efforts.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Coronavirus SBA Disaster Loan Program

The Coronavirus containment efforts have put a lot of small businesses in a very difficult situation. Some businesses have been forced to shut down altogether, while other businesses are working at a reduced capacity. To help

The Coronavirus containment efforts have put a lot of small businesses in a very difficult situation. Some businesses have been forced to shut down altogether, while other businesses are working at a reduced capacity. To help, Congress recently released billions of dollars to be used by the SBA to fund loans to small businesses. In this article we are going to review:

Loan limits for SBA Disaster Loans

Duration of SBA Disaster Loans

How SBA Disaster Loans differ from traditional SBA Loans

How long does it take to get an SBA loan

The interest rate on SBA loans

Collateral requirements for SBA Disaster Loans

Other lending programs available to small businesses

Quick Overview of SBA Loans

For individuals that are new to SBA Loans just a quick note, the SBA can either lend money directly to businesses or it can require a bank to issue the loans. When the banks issue the loans, the SBA serve as a guarantor for those loan, if the borrower defaults on the loan, the bank gets reimbursed by the SBA for the amount of the default.

There are SBA loans like the “Economic Injury Disaster Loan” that was just made available by Congress that is issued directly from the SBA. It requires a completion of an online application, submission of documentation to the SBA, and then the loan is either approved or denied by the SBA.

SBA Disaster Loan Limits

The SBA Disaster Loan Program provides loans to businesses up to $2 million dollars. Businesses of course, can take loans for less than that amount.

Interest Rate For SBA Disaster Loans

By law, SBA Disaster Loans have to be issued with an interest rate under 4% which is much lower than the interest charged for traditional SBA loans.

Duration of SBA Disaster Loans

The SBA Disaster Loans can be amortized up to a maximum of 30 years. The option to amortize the loan over 30 years provide small businesses with access to capital with lower monthly payments.

Collateral for SBA Disaster Loans

For SBA Disaster Loans, collateral is typically required for loans over $25,000. Due to the unprecedented nature of the Coronavirus crisis, this collateral requirement has been waived. However, a business must pledge collateral to the extent that it is available. The CARES Act also waived the personal guarantee requirement for loans under $200,000.

How Long Does It Take To Get An SBA Loan?

So what’s the turnaround time on an SBA loan? You have to act quickly. Given the high demand for these loans, the banks and SBA are most likely going to be overwhelmed with SBA loan applications. Even though this money has been made available to small businesses, the loans can only be issued as quickly as they can be processed. If you do not start the application now, it may be months before you actually receive the cash for the loan. Unfortunately, some business will not be able to wait that long before closing their doors so it’s important to start the process now.

SBA Disaster Loans between $350,000 and $1M will be considered “SBA Express Loans” and can often be issued within 30 days of the application but the ability to issue the loan within that window will greatly depend on how quickly you can submit the required documents to the bank to complete the underwriting process. The bank or SBA is going to request:

Form P-019: Economic Injury Disaster Loan Supporting Information

IRS Form 4506-T: Request for Transcript of Tax Return

List of all the owners of the business and the percentage of their ownership

Most recent tax return for the business

SBA Form 413: Personal financial statement (for each 20%+ owner of the business)

SBA Form 2202: Schedule of liabilities listing all fixed debts

Personal tax returns for each 20%+ owner

Most recent profit & loss statement and balance sheet for the business

Current YTD profit / loss statement

They may require some additional documentation but these are the most common items.

SBA Disaster Loan Underwriting Process

Getting an SBA loan is not guaranteed by any means. Banks and SBA look at three main items: Cash, Credit, and Collateral. One of the main differences between traditional SBA loans and Disaster SBA loans, is that Disaster Loans have more lax unwriting requirements. While a traditional SBA loans may require all three cash, credit, and collateral to be strong, a disaster loan may only require one of those three items to be in a strong position.

It is very important to apply for the SBA Disaster Loan sooner rather than later based on the cash position of the business. You want to apply for the loan while the cash position of the business is still in decent shape, it increases your chances of being approved. If the business begins taking losses or revenue has stopped entirely, it will be much more difficult to get approved for the SBA Disaster Loan.

Even if your business does not need the money now, it may make sense to apply for the loan, and just keep the cash in the business checking account in case the business needs that capital a few months from now, it’s cheap capital. There are no loan origination fees charged to the borrower to apply for these SBA Disaster Loans and with an interest rate of 3.75%, if the business takes out a loan for $300,000, it’s only costing the business $750 per month in interest expense to have that cash on hand.

$10,000 Grant

The CARES Act includes an emergency grant in the amount of $10,000 to any small business or nonprofit that applies for the Economic Injury Disaster Program. When the business owner applies for this SBA Disaster loan, they can request for the grant amount to be advanced within 3 days of submitting the loan application. There are restrictions as to what the grant money can be used for such as payroll, paying a mortgage or rent, and other expenses specifically outlines by the EIDL.

Other Business Loan Programs

As a result of the Coronavirus stimulus package, there are a number of other lending programs available to small businesses besides the SBA Disaster Loan Program. Some individual states have developed their own lending programs to give small businesses access to interest free loans quickly. There is also the new Paycheck Protection Loan Program associated with the CARES Act that was recently passed, these loans have a loan forgiveness feature associated with them if certain terms are met. The terms of these other loan programs may end up being more favorable than the SBA Disaster Loan Program but it will have to be assessed on a case by case basis.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

IRS Stimulus Checks To Individuals: Eligibility & Timing

The U.S. Senate recently passed the CARES Act which was put in place to help stabilize the economy in the wake of the Coronavirus containment efforts. One of the key items in the bill are the stimulus checks that the IRS will issue to

The U.S. Senate recently passed the CARES Act which was put in place to help stabilize the economy in the wake of the Coronavirus containment efforts. One of the key items in the bill are the stimulus checks that the IRS will issue to individuals and their children. In this article we will review:

The amount of the IRS checks

What makes you eligible to receive a check

Income Limitations & Phaseouts

When To Expect The Payment

Direct Deposit vs Physical Check

Unanswered Questions That Need Clarification

IRS Checks To Individuals

The government plans to immediately begin issuing checks directly to individual taxpayers. Individuals that qualify will be eligible to receive a check for $1,200 plus $500 for each child.

Example: A household that has 2 parents and 3 children may be eligible to receive a payment from the IRS in the amount of $3,900.

Parent 1: $1,200

Parent 2: $1,200

Child 1: $500

Child 2: $500

Child 3: $500

Are You Eligible To Receive A Check From The IRS?

Whether or not you receive a check from the IRS will be depend on your taxable income for either 2019 or 2018.

Single Filer: Less than $75,000

Married Filing Joint: Less Than $150,000

There is a phaseout of the payments between:

Single Filer: $75,000 – $99,000

Married Filing Joint: $150,000 – $198,000

Once above the income limits for a single filer of $99,000 and the joint filer of $198,000, you will not be eligible to receive a check.

If you already filed your taxes for 2019, the IRS will look at your 2019 tax return. If you have not filed your taxes for 2019, then the IRS will look at your income on your 2018 tax return. If you did not file a tax return for either year, then the IRS will look at your wages that were reported to social security in those tax years.

What If You Have Less Income In 2020?

But what happens if you were over those income limits for 2018 and 2019 but because of the Coronavirus, your income will be lower in 2020 making you eligible for the payments? You will not receive a check like everyone else but you will be able to capture the payments as a tax credit when you file your 2020 tax return. The payments from the IRS are really “tax credits” that the government is sending to individuals in advance of the filing of their 2020 tax return. Instead of making individuals wait to file their 2020 tax return, the IRS is sending the money to these individuals now.

Second scenario, what if your income was lower in 2018 and 2019 qualifying you for the IRS check but in 2020 your income will be above the threshold. Answer, we don’t know. As of right now there does not seem to be language in the bill saying that they’re going to recapture the credit when you file your 2020 tax return but this is one of those items that will need to be addressed by the IRS after the fact.

How Long Will It Take To Get The IRS Check?

This is the biggest question mark right now. It seems like the IRS is going to direct deposit these payments to your checking account for anyone that has ACH instructions on file with the IRS. If you have ever received a refund or made tax payments directly from your checking account, this would apply to you. However, what if someone no longer has that bank account? We are not sure how that is going to work. The direct deposits may happen sometime in April.

If the IRS does not have bank account instructions on file, they will have to cut physical checks. The last time Congress issued checks to people as part of a stimulus package was 2008 and it took 2 months for those checks to arrive. If this follows a similar path, individual taxpayers might not receive these IRS checks until May but this is another item that still needs to be addressed by the IRS.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Coronavirus Battle Will Be Won Or Lost By April 30th

These are unprecedented times. Over the past few weeks we have spent countless hours researching past epidemics, listening to medical experts, economists, market analysts, hedge fund managers, and local business owners. Of all the

These are unprecedented times. Over the past few weeks we have spent countless hours researching past epidemics, listening to medical experts, economists, market analysts, hedge fund managers, and local business owners. Of all the things we’ve learned up to this point, one thing seems very clear to us, we should know by April 30th whether the U.S. economy is setting itself up for a quick recovery or a prolonged recession.

Why April 30th? Confirmed cases of the Coronavirus are going to spike in the upcoming weeks as test results come back. As we charge toward the peak of the infection rate, we will begin to see whether the inflection rate is accelerating or leveling out. All of this is driven by the effectiveness of the containment efforts that are being put in place now. But will it be enough and when will investors know which path the economy is on?

In addition, we are beginning to see some abnormal behavior from certain asset classes within the financial markets as stimulus packages and rate cuts are put to work by countries around the globe. In this article, we will present those trends and help investors prepare for what could be next for the financial markets.

A Race Against Time

The US economy is in a race against time. While every day the headlines are filled with breaking news about bailout packages, interest rate cuts, infection rates, and the stock market dropping by over 1000 points a day, at the risk of over oversimplifying it, there are really only 3 things that matter:

Containing the virus as soon as possible

Keeping businesses solvent during the shutdown

Providing individuals with financial assistance to pay their bills

These items are listed in the order of priority and I'm going to explain why.

#1: Containment

If the US government is not able to slow the infection rate by the end of April, it’s going to be difficult for many businesses to sustain operations without layoffs. While layoffs have already begun in industries directly impacted by the Coronavirus containment efforts such as restaurants, airlines, and hotels, this trend would most likely spread into the broader economy and make a quick recovery less likely.

The ideal scenario is the containment efforts prove effective and by the end of April the rate of infection decreases or levels out, fear subsides in the market knowing that progress is being made, and people resume travelling, restaurants reopen, and global spending and trade return to “pre-Corona” levels. In this scenario, the losses that we have seen in the U.S. stock market could rebound quickly in the second half of the year.

In addition, if there is swift recovery, the U.S. consumer and businesses now have access to lower interest rates, oil prices not seen since 2002, and an economy that would most likely resume it’s steady growth trend.

Error On The Side Of More

As we have seen in prior economic crises, problems become much larger when the government does not act fast enough or with enough firepower to manage the threat; that is especially true of the current situation. Understanding that time is everything in this situation, the government should be erroring on the side of more swift and restrictive measures to contain the virus. Rolling out containment efforts in pieces as we have seen over the past two weeks, in my opinion, creates more risk to achieving a positive outcome and from speaking with business owners over the past few days, it creates more disruption. If you are a business that is still allowed to operate in this environment but every day new restrictions are passed down in pieces, valuable time has to be taken to digest those rules, determine how it impacts the business, and then communicate the new restrictions to the employees. I have heard some business owners say “it would actually be better for us if they just shut everything down for two weeks”.

Erroring on the side of “more” will hurt the stock market and the economy in the short term but I think it will give us a better chance of avoiding a prolonged recession. But we will just have to wait to see how effective the current containment efforts are over the course of the next few weeks.

#2: Keeping Businesses Solvent

The second priority is keeping businesses solvent during the economic slowdown. Most businesses can survive disruptions that last 30 to 60 days if they are given access to cheap capital. It's for this reason that the Fed has rapidly dropped interest rates to almost zero and has pumped billions of dollars of liquidity into the system to encourage banks to lend. The U.S. government is also working on stimulus packages that would provide direct capital injection for industries most adversely effected by the containment efforts. What we are experiencing now is the first “all stop” global economic shutdown that we have ever seen. The government is trying to minimize the number of companies that go insolvent between now in the containment of the virus. At this point, it seems like the U.S. is doing an adequate job of opening up the cash floodgates for the companies here in the U.S.

#3: Financial Assistance For Individuals

The third priority is providing financial assistance for individuals that have been laid off so they can continue meet their basic needs while this containment process runs its course. There are discussions happening right now about the U.S. government sending everyone a check for $1,000, programs for deferring student loan payments, and encouraging financial institutions to create special programs for individuals that have been negatively impacted by the economic slowdown. But I placed this lower on the priority list than business solvency because most people can survive being laid off for a month or two with some financial assistance from the government, but if the current environment turns into a prolonged recession, they lose their job, and are unable to find work over the next 6 to 12 months, that it a much dire situation. It’s vitally important for the U.S. to preserve jobs during this containment period.

Abnormal Activity

When there are unprecedented events that occur in the markets, they bring with them abnormal behaviors within financial markets that tend to surprise investors. During the recent market selloff there are two unexpected events that have occurred:

The pace of the market selloff

Recent losses in the bond market

During the recent selloff, the U.S. stock market set a record when it lost over 20% if its value in just 16 days. By comparison, below is a chart of the other 20% declines in the stock market and the number of days it took for the 20% drop to happen.

To us, this speaks to the fear and uncertainty surrounding the events that are currently unfolding in the markets. In addition, the average daily price movement of the S&P 500 Index over the past 2 weeks has been 5% per day. That’s a crazy amount of volatility.

Turning to the bond market, a surprising trend has unfolded over the past week. Typically, when the stock market is selling off, interest rates go down, and bond prices go up. This allows bonds to appreciate in value and offset some of the losses from the stock side of the portfolio. While this was the trend for the first two weeks of the sell off, that trend recently reversed. The stock market was selling off and interest rates where rising. This created an environment where both stocks and bonds were losing value at the same time. Not an ideal market environment for a diversified portfolio. On March 17th, the yield on the 10 year treasury bond went from 0.72% to 1.08% which is a big move for a bond yield in a single day, especially considering that the stock market was down that day.

Why did that happen? We can point to a few reasons. First, the bond market is anticipating a $1 trillion dollar stimulus package to be released by Congress. When the government wants to spend $1 trillion dollars, it does so by issuing bonds which is debt. The demand for bonds, especially of this magnitude, are not in high demand because governments around the world are also spending money to stimulate their own economy. To entice people to buy our bonds, they have to offer them at a higher interest rate.

Along those same lines, countries that hold our bonds have been selling them to raise cash to fund their own stimulus packages. As demand for U.S. bonds decreases, the interest rate goes up and the price of the bonds goes down. Will this trend continue? Interest rates could move slightly higher in the short-term but the Fed has the ability to step in and start buying U.S. bonds if it wants to lower interest rates. In addition, the flight to safety trade will most likely continue in upcoming weeks as the uncertainty surrounding the containment efforts persists which will also create additional demand for U.S. Treasuries.

What To Expect

As we sit here on March 19th, it’s tough to handicap which outcome is more likely: a quick bounce back or a prolonged recession. However, the upcoming few weeks are going to be key at providing us with evidence on the success or failure of the containment efforts. Investors need to be ready to make changes to their investment portfolios over the upcoming months as the likely outcome begins to surface. The current market environment has the makings to either be one of the greatest investment opportunities of all time or just the beginning of a prolonged slowdown in the U.S. economy. Emotions will temp investors to make irrational investment decisions but it’s important to keep the relevant economic and financial market data in focus. Stay safe, stay healthy, and we welcome any questions that you have regarding the current market environment.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Market Selloff: Time To Buy, Sell, or Hold?

Over the past month, the stock market has dropped by 20%. Largely due to the economic impact of the Coronavirus. As the feeling of panic continues to increase here in the U.S., our clients are asking:

Over the past month, the stock market has dropped by 20%. Largely due to the economic impact of the Coronavirus. As the feeling of panic continues to increase here in the U.S., our clients are asking:

Should we be buying stocks at these lower levels?

Is it going to get worse before it gets better?

How quickly do you think the market will bounce back after the virus is contained?

Having managed money for clients through the Tech Bubble, The Great Recession of 2008/2009, and countless market selloffs, while the circumstances are always different from crisis to crisis, there are patterns that seem to be consistent within each market selloff. Being able to identify those patterns is key in determining what the next move should be within your investment portfolio and I’m going to share those with you today.

DISCLOSURE: Throughout this article I will be using examples of industries and companies. These are not recommendations to buy or sell a particular stock. Please consult your investment professional for advice.

Is The Market Oversold?

When there is a market selloff, one of the key questions we’re trying to answer is: “Has the stock market overreacted to the risks that are being presented?” In answering this question, I think the key thing that investors forget is that a company’s stock price represents more than just one year of its earnings. When investors buy a stock it’s typically because they expect that company to grow over the course of multiple years and yield a generous return. Unexpected events like the Coronavirus without question impact those projections but it’s not uncommon for the market to overreact because it’s focused on what’s going to happen to that company’s revenue in the short term.

A good example of this are the airlines in the United States. Due to the Coronavirus companies have canceled conferences, people have canceled vacations, and sporting events have been postponed or are now being played without spectators. That is a direct hit to the airlines in the U.S. because prior to the Coronavirus they had projected a specific amount of revenue to be generated during 2020 based on all that activity. But here comes the key question. Many of the airline stocks in the U.S. have dropped by more than 50% in the past 60 days. If investors believe that the Coronavirus will eventually be contained in the coming months, are those airlines really only worth half of what they were 60 days ago?

Buffett’s Words of Wisdom

I hesitate to use Warren Buffett’s famous quote because it’s used with such frequency but it’s proven to be a valuable investment practice during times of uncertainty: “Be fearful when others are greedy and greedy when others are fearful.” While it’s easy to say, it’s very difficult to execute effectively. Buying low and selling high goes against every human emotion. It often means stepping into the most unloved names, at what would seem to be the worst time, and owning that decision. Right now those investments seem to be the airlines, hotels, cruiselines, oil companies, and other industries directly tied to travel and tourism.

This same concept also applies to the decision to “hold” or not sell your equity holdings when the market is in a panic. Even though no one likes to see their investment accounts lose value, if you were positioned appropriately prior to the start the Coronavirus pandemic, in my professional opinion, you should not be making any adjustments to your portfolio given the recent market events. If however, you were allocated too aggressively based on your own personal risk tolerance or time horizon, you have a much more difficult decision to make.

Short Term vs Long Term Risks

Market selloffs are typically triggered by two types of risks: short term risks and long term risks. Being able to identify which risk the market is facing should greatly influence the decisions that you are making within your investment portfolio.

I’m going to use the airlines again as an example. In my personal option, the Coronavirus represents a short-term risk to the airline industry. In an effort to contain the virus, conferences have been cancelled, companies have told their employees not to travel, people have canceled vacations, etc. But you have to ask yourself this question: “what’s likely to happen once the virus is contained?” Conferences may be rescheduled, business travel resumes, and people map out a new plan for their vacation. There is arguably pent up demand being created right now that the airlines will benefit from once the virus is contained.

Back when 9/11 happened, I viewed that risk as a longer term risk for the airlines because people could choose to permanently change their behavior and choose not to fly for a very long time based on that event. In the 2008 financial crisis, the banks had a long road ahead of them as they executed plans to dig out of their leveraged positions. Problems of this nature usually require more time to fix which is why these longer term risks can justify a move from stocks into bonds.

Winners and Losers

Even with short term risk diversification is key. Just because a risk is a short term risk does not necessarily mean all companies are going to survive it. There is a risk to all companies that are impacted by market events that they run out of cash before the tide turns back to the upside. If you are an investor looking to buy into airlines at these lower levels, it's typically prudent to buy multiple companies in smaller increments, as opposed to establishing a large position in a single airline. Again, just an example, if you decide to buy stock in American Airlines, Delta, Southwest, and United Airlines, the risk of buying low is one of the four may run out of money before the virus is contained and they are forced with filing bankruptcy without a bailout from the government. If you put all of your money into one airline, you are taking on a lot more risk.

Buyer’s Remorse

One of the lessons I’ve learned from buying during a market selloff is you need to keep your long-term perspective. Meaning when you purchase a stock that has dropped significantly, there are forces acting on that company that could cause it to drop by more. You have to be comfortable with that reality and you have to possess the time horizon to weather the storm in the likely case that it could get worse before it gets better.

It’s all too common that investors purchase a stock thinking that since it’s already dropped 30%+ that it can’t possibly go any lower, only to watch it drop by another 30% and then feel pressured to sell it thinking they made a mistake. I call this “buyer’s remorse”. When you play the role of an opportunistic investor, it may take months or years for the benefit to be realized. Investing for a “quick pop” is a fool’s game, especially with the Coronavirus situation. No one knows how long it’s going to take to contain the virus, how badly Q1 and Q2 revenue will be hurt for companies, or will it end up causing a recession. Making the decision to buy stock at lower levels is usually based on the investment thesis that the stock market is overreacting to a relatively short term event and those companies getting hit the hardest will recover over time.

How Much Time Will It Take For the Market To Recover?

No one knows the answer to this question because we have never really been in this situation before. We have been through other epidemics in the past such as SARS, MERS, Swine Flu, and Ebola, but nothing that spread as quickly or as broadly around the globe as the Coronavirus. Since China was ground zero for the virus, the good news is we are already seeing significant progress being made at containing the virus.

As you can see via the blue line in the chart, at the beginning of February China was reporting thousands of new cases every day, but since the beginning of March the line flattens out, meaning the number new people getting infected is tapering off. If the United States follows a similar trajectory, we may see the rate of infection rise significantly in the upcoming days only to see the numbers taper off a month or two from now.

I would argue that we have an added advantage over China and Europe in that we had more time to prepare, we know more about the spread of the virus, and how to contain it. I think the lesson that we learned from Europe was you have to be aggressive in your containment efforts which is why you are seeing the extreme measures that the U.S. is taking to contain the spread of the virus. Those extreme containment efforts hurt the market more in the short term but will hopefully result in less damage to the economy over the longer term.

It’s really a race against time. The longer it takes to contain the virus, the longer it takes for people to get back to work, the longer it takes for people to feel safe traveling again, which results in more companies being put at risk of running out of capital waiting for the recovery to arrive. This is the reason why the Fed is aggressively dropping interest rates right now. Dropping interest rates does absolutely nothing to contain the virus or make people feel safe about traveling but it provides companies that are struggling due to the loss of revenue with access to low interest rate debt to bridge the gap.

A Recession Is Very Possible

A recession is defined as two consecutive quarters of negative GDP growth. With the global slowdown that has taken place in 2020, the U.S. economy may post a negative GDP number for the first quarter. Since it takes a while to bring global supply chains back online and for consumers to return to their normal spending behaviors, it's possible that the U.S. economy could also post a negative GDP number for the second quarter as well. By definition, that puts the U.S. economy in a recession. But it may end up being a very brief recession as the Coronavirus reaches containment, global supply chains come back online, pent up demand for goods and services is fulfilled, and U.S. households and businesses have the dual benefit of having access to lower oil prices and lower interest rates.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Should I Refinance My Mortgage Now?

With all the volatility going on in the market, it seems there is one certainty and that is the word “historical” will continue to be in the headlines. Over the past few months, we’ve seen the Dow Jones Average hit historical highs, the 10-year treasury hit historical lows, and historical daily point movements in the market.

Should I Refinance My Mortgage Now?

With all the volatility going on in the market, it seems there is one certainty and that is the word “historical” will continue to be in the headlines. Over the past few months, we’ve seen the Dow Jones Average hit historical highs, the 10-year treasury hit historical lows, and historical daily point movements in the market. Market volatility will always lead the headlines as it does impact anyone with an investment account. With that in mind, it is important to use these times to reassess your overall financial plan and take advantage of parts of the plan that are in your control.

For a lot of people, their home is their most significant asset and is held for a longer period than any stock or bond they may have. This brings us back to “historical” as mortgage rates continue to drop. Whenever this happens, our clients will call and ask if it makes sense to refinance. In this article, we will help you in making this decision.

3 Important Questions

How much will I be saving annually in interest with a lower rate?

What are the closing costs of refinancing?

How long do I plan on being in the home and how many more years do I have on the mortgage?

If you can answer these questions, then you should have a pretty good idea if it makes sense for you to refinance.

How Much Will I be Saving Annually in Interest with a Lower Rate?

With most financial decisions, dollars matter. So how do you determine how much you will be saving each year with a lower interest rate? Below, I walk through a very basic example, but it will show the possible advantage of the refinance.

One important note with this example is the fact that most loan payments you make will decrease the principal which should decrease the cost of interest. To make this simple, I assume a consistent mortgage balance throughout the year.

Higher Interest Lower Interest

Mortgage Balance: $300,000 Mortgage Balance: $300,000

Interest Rate: 4.5% Interest Rate: 3.5%

Annual Interest: $13,500 Annual Interest: $10,500

By refinancing at the lower rate, the dollar savings in one year was $3,000 in the example when the mortgage balance was $300,000.

Savings over the life of a mortgage at 3.5% compared to 4.5% on a $300,000, 30-year mortgage, should be over $60,000 in interest over that time period if you are making consistent monthly payments.

What are the Closing Costs of Refinancing?

After walking through the exercise above, most people will say “Of course it makes sense to refinance”. Before making the decision, you must consider the cost of refinancing which can vary from person to person and bank to bank. There are several closing costs to consider which could include title insurance, tax stamps, appraisal fee, application fees, etc.

If the cost of closing is $5,000, you will have to determine how long it will take you to make that back based on the annual interest savings. Using the example from before, if you save $3,000 in interest each year, it should take you 2 years to breakeven.

One tip we give clients is to start at your current lender. Banks are in competition with other banks and they usually do not want to lose business to a competitor. Knowing the current interest rate environment, a lot of institutions will offer a type of “rapid refinance” for existing customers which may make the process easier but also give you a break on the closing costs if you are staying with them. This should be taken into consideration along with the possibility of getting an even lower interest rate from a different institution which could save you more in the long run even if closing costs are higher.

How Long do I Plan on Being in the Home and How Many More Years do I have on the Mortgage?

This is important since there is a cost to refinancing your mortgage. If it will take you 10 years to “breakeven” between the closing costs and interest you are saving but only plan on being in the house for 5 more years, refinancing may not be the right choice. Also, if you only have a few years left to pay the mortgage you would have to weigh your options.

In summary, taking advantage of these historical low mortgage rates could save you a lot of dollars over the long term but you should consider all the costs associated with it. Taking the time to answer these questions and shop around to make sure you are getting a good deal should be worth the effort.

Public Service Announcement: Like the stock market, it is hard to say anyone has the capability of knowing for sure when interest rates will hit their lows. Make sure you are comfortable with the decision you are making and if you do refinance try not to have buyer’s remorse if the historical lows today turn into new historical lows next year.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Coronavirus vs. SARS: Buying Opportunity?

As fears of the Coronavirus continue to spread, this week was the largest drop in the stock market since the 2008 / 2009 financial crisis. On Thursday, February 27, 2020, the Dow Jones Index dropped by 1,191 points, making it the

As fears of the Coronavirus continue to spread, this week was the largest drop in the stock market since the 2008 / 2009 financial crisis. On Thursday, February 27, 2020, the Dow Jones Index dropped by 1,191 points, making it the largest single day point drop in the history of the index. As the selling has intensified into the week, clients are asking us what we expect in the upcoming weeks. Should they be buying the dip? Do we expect a further selloff from here?

Like most major market events, we have to look back in history to find similar events that allow us to model how the markets might behave from here. This week, we have conducted extensive research into virus outbreaks that have happened in the past such as SARS, MERS, Zika, and Swine Flu, in an effort to better understand possible outcomes to the Coronavirus epidemic. In this article, I’m going to share with you:

Coronavirus vs SARS / Zika / other epidemics

What makes the Coronavirus different than other epidemics in the past

Why has this selloff been so fast & fierce

Disruptions to the global supply chain

Performance of the stock market following the end of epidemics in the past

Will the Fed lower rates to help the market

When does this become a buying opportunity for investors

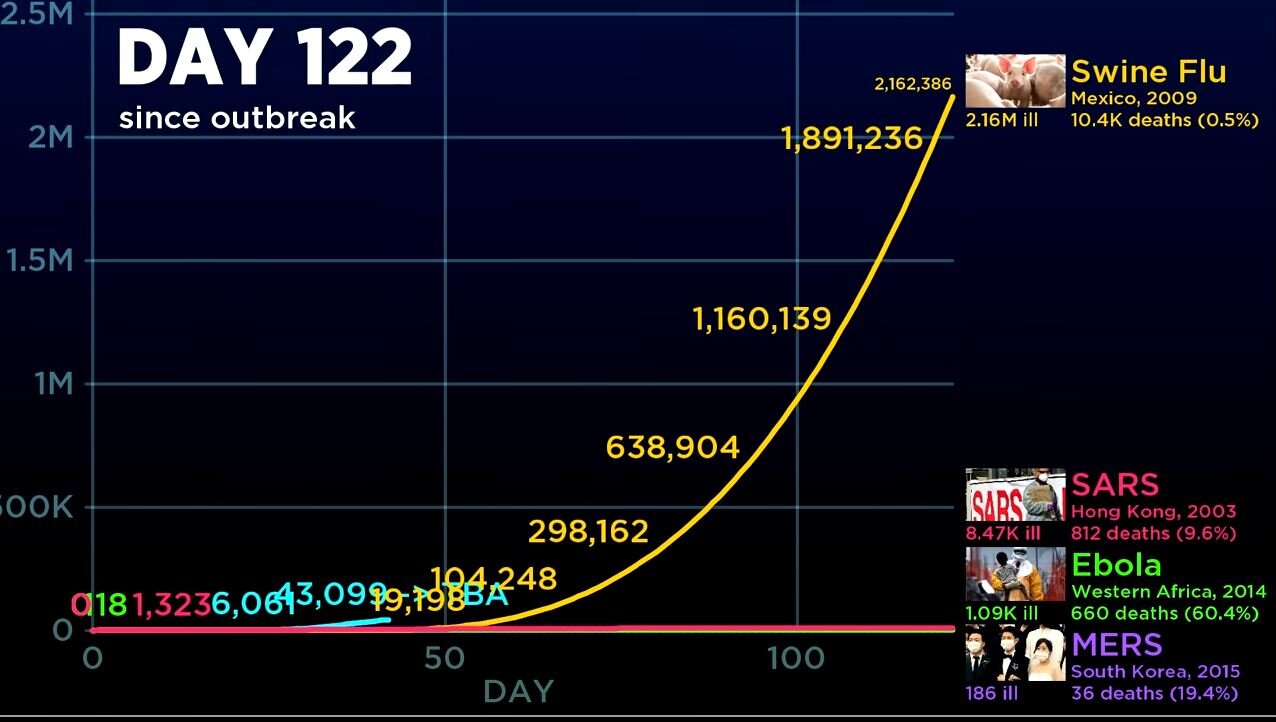

Coronavirus vs SARS

We spent an extensive amount of time comparing Coronvavirus to SARS, and other epidemics in the past. Without a doubt, the Coronavirus is very different than many of the epidemics that we have seen in the past which is making financial modeling very difficult. When we compare the Coronavirus to SARS and other outbreaks, the rate at which the Coronavirus has spread in the first 30 days is unprecedented. Here are a few time lapse charts that compares the infection rate of the Coronavirus to SARS, Ebola, MERS, and Swine Flu.

When you compare SARS to the Coronavirus at Day 19, SARS was much worse out of the gates. By Day 19, SARS had infected 1,490 people and 53 people had died, making the death rate 3.6%. By comparison, at Day 19, Coronavirus had only infected 123 people in China, and resulted in 2 deaths. Making the death rate 1.6%.

However, only 7 days later, at Day 26, the story completely changed:

By Day 26, the number of confirmed cases of Coronavirus rocketed higher, outpacing that of SARS in the early 2000’s. In addition, the death toll for the Coronavirus jumped to 79 people.

But then it continued to get worse. By Day 43, the chart says it all:

By day 43, the number of confirmed cases of the Coronavirus jumped to 43,099 compared to just 3,860 confirmed cases of the SARS virus during that same time period. The death toll for the Coronavirus had risen to over 1,000 people compared to 217 from SARS during that same time period. This chart highlights the main issue with the Coronavirus. It’s spreading faster than government’s are able to control compared to most epidemics in the past.

Now, I say “most” because when we started gathering the data, there is a chart that looks similar to the Coronravirus outbreak. If I move these charts forward to Day 122, this is what happened with the Swine Flu in Mexico in 2009.

The Swine Flu was relatively mute for the first 50 days, but after day 50, the chart looks very similar to the fast spread of the Coronavirus. By Day 122, 2.1M people had been infected with the Swine Flu and over 10,000 people had died.

So why didn’t you hear more about the Swine flu when it was happening? The death rate of the Swing Flu was only 0.5%. Compare this to the current 2.1% estimated death rate of the Coronavirus, which is not as high as the SARS death rate of 4.9%, but it is significantly higher than the Swine Flu. Here is a chart comparing the death rate of SARS, Coronavirus, and MERS:

Another important note, the Swine Flu was fairly wide spread as well. See the chart below from the World Health Organization on the Swine Flu:

However, given how fast the Coronavirus is spreading in it’s early stage, it could end up having a larger global footprint than the Swine Flu if they are unable to contain it soon.

Key Takeaway From The Comparison

Our key takeaway from this comparison is that Coronavirus has spread more quickly in the early stages compared to past epidemics which represents a larger risk to the markets than in the past. Due to the pace of the spread, it’s difficult to put an estimated timeline together for containment. When we look at the comparison of Coronavirus to the Swine Flu, it shows that there could be further downside risks to the markets if the spread of the virus follows a similar glide path.

Coronavirus Disruption To The Market

We issued an article earlier this week explaining the business impact of the Coronavirus.

Article: Coronavirus & The Market Selloff

I just want to quickly summarize again what’s causing the market selloff from a business standpoint. As the Coronavirus continues to spread to other regions, it forces governments to restrict the movements of its people in an effort to contain the spread of the virus. This means transportation is shut down, events are canceled where there would have been large gatherings of people, and employees are not going to work. Also, when people are afraid, they don’t go out to eat, and they don’t go shopping. All of these things have a direct impact on the revenue of the companies that make up the stock market. When these companies entered 2020, there was no expectation that their manufacturing operations could be completely shut down due to a global health epidemic. The stock market right now is trying to determine how much it needs to discount the prices of these companies based on the revenue that’s being lost.

The longer the epidemic continues, the longer it takes people to get back to work, the longer it takes people to resume their normal spending habits, and the more damage it does to the markets.

The China Impact

When comparing SARS to the Coronavirus it’s also important to acknowledge the growth in the size of China’s economy between 2003 and 2020. When the SARS outbreak happened in 2003, China’s economy only represented 8.7% of global GDP. As of 2019, China’s economy now equals 19% of total global GDP. Since the Coronavirus has been the most wide spread in China, It will have a much larger impact on the markets around the globe compared to the SARS outbreak when China was a much smaller player in the global economy.

Valuations in the U.S. Stock Market

In our opinion, one of the other big factors that has fueled the magnitude of the selloff here in the U.S., is the simple fact that going into 2020, the stock market was overvalued already by historic terms. As of December 31, 2019, the P/E ratio of the S&P 500 was 18. The 25 year historical average P/E for the S&P 500 Index is 16. This essentially means that stocks were expensive going into the beginning of the year. When stocks are already arguably overvalued, and a negative event happens, the prices have to drop by more realizing that those companies are not going to produce the earnings growth for the upcoming year that was already baked into the stock price.

Fed Lowering Rates

There is talk now of the Fed coming to the markets aid and lowering interest rates throughout the year. Going into 2020, it was the market’s expectation that the Fed was going to remain on hold for 2020. In my opinion, the rate cuts are probably warranted at this point, given the unexpected slowdown to the global economy as a result of the Coronavirus. But I would also warn that the Fed lowering interest rates is not in itself going to heal the markets. Giving companies access to cheaper capital is not going to make people feel safer about traveling around the globe and it’s not going to help manufacturers resume operations if their employees can’t get to the factory due to travel restrictions.

However, giving companies access to cheaper capital will allow them to better weather the storm while the governments around the world work on a containment plan. Without that access to cheap capital, you could see companies going under because it took revenue too long to ramp back up.

Global Supply Chain

Investors should not underestimate the damage that has been done to the global supply change and how long it takes to get the supply chain back up and running again. A good example are car manufacturers. They do not typically keep large inventories of parts, and if those parts are not being made, they’re not being shipped, meaning they can’t build the cars, so they can’t sell the cars, and revenue drops.

Within the electronics industry, a lot of the products are made up of hundreds if not thousands of components, and the product does not work without all of those components. If there is one computer chip that is made in Korea, and the manufacturing of those chips has been halted, then the end product cannot be built and shipped. The examples go on and on but when you think of manufacturing around the globe being brought offline, it’s not like a light switch where you can go and simply turn it back on. It takes a while for it to get back up and running again. So while investors might think the Coronavirus could just impact Q1 revenue, it’s more likely that it will impact revenue beyond just the first quarter.

When Do You Buy The Dip?

I have received a lot of calls from clients asking if they should begin buying stocks at these lower levels with the anticipation of a bounce back. When we look at other epidemics in the past, there has been a sizable rally in the stock market 6 to 12 months after the epidemic has ended. The chart below shows each epidemic and the subsequent 6 month and 12 month return of the S&P 500 after the epidemic ended. On average, the stock market rose 20% a year following the end of the epidemic which is why investors are eager to buy into the selloff.

In my personal opinion, at some point, the Coronavirus will be contained and it will create an opportunity for investors. There is pent up demand being accumulated now that will need to be filled after the virus is contained. Individuals will most likely reschedule vacations and travel plans once they feel it’s safe to travel around the globe, and the Fed, via lower rates, will have given companies access to even cheaper capital to grow. But as I write this article on February 28th, I caution investors. When you look at the data that we’ve collected, there could definitely be more downside to the selloff if they are unable to contain the spread of the Coronavirus within the next few weeks. The market right now is just trying to guess how much damage has been done with no real solid guidance as to whether it’s guessing right or wrong.

It may be prudent to wait for evidence that progress is being made on the containment efforts of the virus before buying back into the market. For long term investors, it’s important to understand that while the Coronavirus will undoubtedly have an impact on the revenue of companies in 2020, in the past, epidemics have rarely changed the fate of solid companies over the long term.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Coronavirus & The Market Selloff

Today was a wild ride for the stock market. The Dow Jones posted a loss of 1,031 points on February 24, 2020 as fears of the continued spread of the Coronavirus sparked a selloff in the stock market. Over the past 24 hours, we've

Today was a wild ride for the stock market. The Dow Jones posted a loss of 1,031 points on February 24, 2020 as fears of the continued spread of the Coronavirus sparked a selloff in the stock market. Over the past 24 hours, we've received the following questions from clients that I want to address in this article:

Why is the market selling off on this news?

Do you think the selloff will continue?

Should you be moving money out of stocks into bonds?

Why Is Market Selling Off On This News?

You have to remember that the stock market is made up of individual companies. Each company’s stock price is just an educated guess by investors as to how much those companies are going to make in profits over the next 3 months, 1 year, 5 years, and beyond. Unexpected events like the Coronavirus create large deviations between those educated guesses and actual results.

In the case of the Coronavirus, it’s disrupting the revenue stream of many companies that produce and sell goods across the globe. For example, Nike receives 17% of its revenue from China, and the company has temporarily closed more than half of its stores in China. The stores that remain open are operating on abbreviated hours. If the stores are not open, then they can’t sell Nike shoes and apparel, which will most likely cause Nike’s Q1 revenue to be lower than expected. That in turn could cause the stock price to drop once the Q1 earnings report is released later this year.

But it’s not just Nike. The S&P 500 Index is made up of a lot of companies that sell goods in China and other locations around the world: Apple, Yum Brands, McDonalds, Proctor & Gamble, and the list goes on. Beyond just retail, you have airlines, hotels, and casinos that are being negatively impacted as people cancel travel plans and vacations. The point I’m trying to make is there are real business reasons why the stock market is reacting the way it is, it’s not just displaced fear.

All of these companies are trying to figure out right now what the impact will be to their revenue. The next question then becomes, how much are these companies going to miss by?

Do You Think the Selloff Will Continue?

That leads us into the next questions which is “do you think the selloff will continue?” Historically, contagious disease outbreaks have been quickly contained, such as the SARS outbreak in the early 2000’s. The amount of damage to the markets seems to be highly correlated to the amount of time it takes to contain the outbreak. The longer it takes to contain the outbreak, the longer it takes people to return to work and to return to their normal spending habits. The news broke this morning that there are new confirmed cases of the Coronavirus in Italy and South Korea which makes investors question whether or not the threat has been contained.