How To Change Your Residency To Another State For Tax Purposes

If you live in an unfriendly tax state such as New York or California, it’s not uncommon for your retirement plans to include a move to a more tax friendly state once your working years are over. Many southern states offer nicer weather, no income taxes, and lower property taxes. According to data from the US Census Bureau, more residents

If you live in an unfriendly tax state such as New York or California, it’s not uncommon for your retirement plans to include a move to a more tax friendly state once your working years are over. Many southern states offer nicer weather, no income taxes, and lower property taxes. According to data from the US Census Bureau, more residents left New York than any other state in the U.S. Between July 2017 and July 2018, New York lost 180,360 residents and gained only 131,726, resulting in a net loss of 48,560 residents. With 10,000 Baby Boomers turning 65 per day over the next few years, those numbers are expected to escalate as retirees continue to leave the state.

When we meet with clients to build their retirement projections, the one thing anchoring many people to their current state despite higher taxes is family. It’s not uncommon for retirees to have children and grandchildren living close by so they greatly favor the “snow bird” routine. They will often downsize their primary residence in New York and then purchase a condo or small house down in Florida so they can head south when the snow starts to fly.

The inevitable question that comes up during those meetings is “Since I have a house in Florida, how do I become a resident of Florida so I can pay less in taxes?” It’s not as easy as most people think. There are very strict rules that define where your state of domicile is for tax purposes. It’s not uncommon for states to initiate tax audit of residents that leave their state to claim domicile in another state and they split time travelling back and forth between the two states. Be aware, the state on the losing end of that equation will often do whatever it can to recoup that lost tax revenue. It’s one of those guilty until proven innocent type scenarios so taxpayers fleeing to more tax favorable states need to be well aware of the rules.

Residency vs Domicile

First, you have to understand the difference between “residency” and “domicile”. It may sound weird but you can actually be considered a “resident” of more than one state in a single tax year without an actual move taking place but for tax purposes each person only has one state of “domicile”.

Domicile is the most important. Think of domicile as your roots. If you owned 50 houses all around the world, for tax purposes, you have to identify via facts and circumstances which house is your home base. Domicile is important because regardless of where you work or earn income around the world, your state of domicile always has the right to tax all of your income regardless of where it was earned.

While each state recognizes that a taxpayer only has one state of domicile, each state has its own definition of who they considered to be a “resident” for tax purposes. If you are considered a resident of a particular state then that state has the right to tax you on any income that was earned in that state. But they are not allowed to tax income earned or received outside of their state like your state of domicile does.

States Set Their Own Residency Rules

To make the process even more fun, each state has their own criteria that defines who they considered to be a resident of their state. For example, in New York and New Jersey, they consider someone to be a resident if they maintain a home in that state for all or most of the year, and they spend at least half the year within the state (184 days). Other states use a 200 day threshold. If you happen to meet the residency requirement of more than one state in a single year, then two different states could consider you a resident and you would have to file a tax return for each state.

Domicile Is The Most Important

Your state of domicile impacts more that just your taxes. Your state of domicile dictates your asset protection rules, family law, estate laws, property tax breaks, etc. From an income tax standpoint, it’s the most powerful classification because they have right to tax your income no matter where it was earned. For example, your domicile state is New York but you worked for a multinational company and you spent a few months working in Ireland, a few months in New Jersey, and most of the year renting a house and working in Florida. You also have a rental property in Virginia and are co-owners of a business based out of Texas. Even though you did not spend a single day physically in New York during the year, they still have the right to tax all of your income that you earned throughout the year.

What Prevents Double Taxation?

So what prevents double taxation where they tax you in the state where the money is earned and then tax you again in your state of domicile? Fortunately, most states provide you with a credit for taxes paid to other states. For example, if my state of domicile is Colorado which has a 4% state income tax and I earned some wages in New York which has a 7% state income tax rate, when I file my state tax return in Colorado, I will not own any additional state taxes on those wages because Colorado provides me with a credit for the 7% tax that I already paid to New York.

It only hurts when you go the other way. Your state of domicile is New York and you earned wage in Colorado during the year. New York will credit you with the 4% in state tax that you paid to Colorado but you will still owe another 3% to New York State since they have the right to tax all of your income as your state of domicile.

Count The Number Of Days

Most people think that if they own two houses, one in New York and one in Florida, as long as they keep a log showing that they lived in Florida for more than half the year that they are free to claim Florida, the more tax favorable state, as their state of domicile. I have some bad news. It’s not that easy. The key in all of this is to take enough steps to prove that your new house is your home base. While the number of days that you spend living in the new house is a key factor, by itself, it’s usually not enough to win an audit.

That notebook or excel spreadsheet that you used to keep a paper trail of the number of days that you spent at each location, while it may be helpful, the state conducting the audit may just use the extra paper in your notebook to provide you with the long list of information that they are going to need to construct their own timeline. I’m not exaggerating when I say that they will request your credit card statement to see when and where you were spending money, freeway charges, cell phone records with GPS time and date stamps, dentist appointments, and other items that give them a clear picture of where you spent most of your time throughout the year. If you supposedly live in Florida but your dentist, doctors, country club, and newspaper subscriptions are all in New York, it’s going to be very difficult to win that audit. Remember the number of days that you spend in the state is just one factor.

Proving Your State of Domicile

There are a number of action items that you should take if it’s your intent to travel back and forth between two states during the year, and it’s your intent to claim domicile in the more favorable tax state. Here is the list of the action items that you should consider to prove domicile in your state of choice:

Register to vote and physically vote in that state

Register your car and/or boat

Establish gym memberships

Newspapers and magazine subscriptions

Update your estate document to comply with the domicile state laws

Use local doctors and dentists

File your taxes as a resident

Have mail forwarded from your “old house” to your “new house”

Part-time employment in that state

Join country clubs, social clubs, etc.

Host family gatherings in your state of domicile

Change your car insurance

Attend a house of worship in that state

Where your pets are located

Dog Saves Owner $400,000 In Taxes

Probably the most famous court case in this area of the law was the Petition of Gregory Blatt. New York was challenging Mr Blatt’s change of domicile from New York to Texas. While he had taken numerous steps to prove domicile in Texas at the end of the day it was his dog that saved him. The State of New York Division of Tax Appeals in February 2017 ruled that “his change in domicile to Dallas was complete once his dog was moved there”. Mans best friends saved him more than $400,000 in income tax that New York was after him for.

Audit Risk

When we discuss this topic people frequently ask “what are my chances of getting audited?” While some audits are completely random, from the conversations that we have had with accountants in this subject area, it would seem that the more you make, the higher the chances are of getting audited if you change your state of domicile. I guess that makes sense. If your Mr Blatt and you are paying New York State $100,000 per year in income taxes, they are probably going to miss that money when you leave enough to press you on the issue. But if all you have is a NYS pension, social security, and a few small distributions from an IRA, you might have been paying little to no income tax to New York State as it is, so the state has very little to gain by auditing you.

But one of the biggest “no no’s” is changing your state of domicile on January 1st. Yes, it makes your taxes easier because you file your taxes in your old state of domicile for last year and then you get to start fresh with your new state of domicile in the current year without having to file two state tax returns in a single year. However, it’s a beaming red audit flag. Who actually moves on New Year’s Eve? Not many people, so don’t celebrate your move by inviting a state tax audit from your old state of domicile

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Should You Put Your House In A Trust?

When you say the word “trust” many people think that trusts are only used by the uber rich to protect their millions of dollars but that is very far from the truth. Yes, extremely wealthy families do use trusts to reduce the size of their estate but there are also a lot of very good reasons why it makes sense for an average individual or family to establish

When you say the word “trust” many people think that trusts are only used by the uber rich to protect their millions of dollars but that is very far from the truth. Yes, extremely wealthy families do use trusts to reduce the size of their estate but there are also a lot of very good reasons why it makes sense for an average individual or family to establish a trust. The two main reasons being the avoidance of probate and to protect assets from a long-term care event. This article will walk you through:

How trusts work

The difference between a Revocable Trust and an Irrevocable Trust

The benefits of putting your house in a trust

How to establish a trust

What are the tax considerations

What Is A Trust?

When you establish a trust, you are basically creating a fictitious person that is going to own your assets. Depending on the type of trust that you establish, the trust may even have it's own social security number that is called a “tax ID number”. Here is an example. Mark and Sarah Williams, like most married couples, own their primary residence in joint name. They decide to establish the “Williams Family Trust”. Once the trust is established, they change the name on the deed of their house from Mark and Sarah to the Williams Family Trust.

Revocable Trust vs. Irrevocable Trust

Before I get into the benefits of establishing a trust for your house, you first have to understand the difference between a “Revocable Trust” and an “Irrevocable Trust”. As the name suggests, a revocable trust, you can revoke at any time. In other words, you as the owner, can take that asset back. You never really “give it away”. Revocable trusts do not have a separate tax identification number. They are established in the social security number of the owner. A revocable trust is sometime referred to as a “living trust”.

With an Irrevocable Trust, once you have transferred the ownership of the house to the trust, it’s irrevocable, meaning you are never supposed to be able to take it back. The trust will own that house for the rest of your life. Now that sounds super restrictive but there are a lot of strategies that estate attorneys use to ease those restrictions and I will cover some of those strategies later on in this article.

In both cases, in trust language, the owner that gave property to the trust is called the “grantor”. I just want you to be familiar with that term when it is used throughout this article.

So why would someone use an Irrevocable Trust instead of a Revocable Trust? The answer is, it depends on which benefits you are trying to access by placing your house in a trust.

The Benefits Of A Revocable Trust Owning Your House

People transfer the ownership of their house to a revocable trust for the following reasons:

Avoid probate

They have children under the age of 25

They want maximum flexibility

Avoid Probate

From our experience, this is the number one reason why people put their house in a revocable trust. Trust assets avoid probate. If you have ever had a family member pass away and you were the executor of their estate, you know how much of a headache the probate process is. Not to mention costly.

Let’s go back to our example with Mark & Sarah Williams. They own their house joint and they have a will that lists their two children as 50/50 beneficiaries on all of their assets.

When the first spouse passes away, there is no issue because the house is owned joint, and the ownership automatically passes to the surviving spouse. However, when the surviving spouse passes away, the house is part of the surviving spouse’s estate that will be subject to the probate process. You typically try to avoid probate because the probate process:

Is a costly process

It delays the receipt of the asset by your beneficiaries

Makes the value of your estate accessible to the public

The costs come in the form of attorney fees, accountant fees, executor commissions, and appraisal fees which are necessary to probate the estate. The delays come from the fact that it’s a court driven process. You have to obtain court issued letters of testamentary to even start the process and the courts have to approve the final filing of the estate. It’s not uncommon for the probate process to take 6 months or longer from start to finish.

If your house is owned by a revocable trust, you skip the whole probate process. Upon the passing of the second spouse, the house is transferred from the name of the trust into the name of the trust beneficiaries. You save the cost of probate and your beneficiaries have immediate access to the house.

The Difference Between A Trust and A Will

I’ll stop for a second because this is usually where I get the question, “So if I have a trust, do I need a will?” The answer is yes, you need both. Anything owned by your trust will go immediately to the beneficiaries of the trust but any assets not owned by the trust will pass to your beneficiaries via the will. Trusts can own real estate, checking accounts, life insurance policies, and other assets. But there are some assets like cars and personal belongings that are usually held outside of a trust that will pass to your beneficiaries via the will. But in most cases, people have the same beneficiaries listed in the will and the trust.

Children Under The Age of 25

For parents with children under the age of 25, revocable trusts are used to prevent the children from coming into their full inheritance at a very young age. If you just have a will, both parents pass away when your child is 18, and they come into a sizable inheritance between your life insurance, retirement accounts, and the house, they may not make the best financial decisions. What if they decide to not go to college because they inherited a million dollar but then they spend through all of the money within 5 years? As financial planners we have unfortunately seen this happen. It’s ugly.

A revocable trust can put restrictions in place to prevent this from happening. There might be language in the trust that states they receive 1/3 of their inheritance at age 25, 1/3 at age 30, 1/3 at age 35. But in the meantime, the trustee can authorize distributions for living expenses, education, health expenses, etc. The options are limitless and these documents are customized to meet your personal preferences.

Maximum Flexibility

The revocable trust offers the grantor the most flexibility because they are not giving away the asset. It’s still part of your estate, it’s just not subject to probate. At any time, the owners can take the asset back, change the trustee, change beneficiaries of the trust, and change the features of the trust.

The Benefits Of An Irrevocable Trust

Let’s shift gears to the irrevocable trust. The benefits of establishing an irrevocable trust include:

Avoid probate

They have children under that age of 25

Protect assets from a long-term care event

Reduce the size of an estate

As you will see, the top two are the same as the revocable trust. Irrevocable trust assets avoid probate and are a way of controlling how assets are distributed after you pass away. However, you will see two additional benefit listed that were not associated with a revocable trust. Let’s look at the long-term care event protection benefit.

Protect Assets From A Long-Term Care Event

When individuals use an irrevocable trust to protect assets from a long-term care event, it’s sometimes called a “Medicaid Trust”. If you have ever had the personal experience of a loved one needing any type of long-term care whether via home health aids, assisted living, or a nursing home, you know how expensive that care costs. According to the NYS Health Department, the average daily cost of a nursing home is $371 per day in the northeastern region. That’s $135,360 per year.

For an individual that needs this type of care, they are required to spend down all of their assets until they hit a very low threshold, and then Medicaid starts picking up the tab from there. Now the IRS is smart. They are not going to allow you to hit a long term care event and then transfer all of your assets to a family member or a trust to qualify for Medicaid. There is a 5 year look back period which says any assets that you have gifted away within the last 5 years, whether to an individual or a trust, is back on the table for purposes of the spend down before you qualify for Medicaid. This is why they call these trusts a Medicaid Trust.

Medicaid Will Put A Lien Against The House

Now, your primary resident is not an asset subject to the Medicaid spend down. If your only asset is your house and you have spent down all of your other assets that are not in an IRA or qualified retirement plan, you can qualify for Medicaid immediately. So why put the house in an irrevocable trust then? While Medicaid cannot make you sell your primary residence or count it as an asset for the spend down, Medicaid will put a lien against your estate for the amount they pay for your care. So when you pass away, your house does not go to your children or heirs, Medicaid assumes ownership, and will sell it to recoup the cash that they paid out for your care. Not a great outcome. Most people would prefer that the value of their house go to their kids instead of Medicaid.

If you transfer the ownership of the house to an Irrevocable Trust, you can live in the house for the rest of your life, and as long as the house has been in the trust for more than 5 years, it’s not a spend down asset for Medicaid and Medicaid cannot place a lien against your house for the money that they pay out for your care.

So if you are age 65 or older or have parents that are 65 or older, in many cases it makes sense for that individual to setup an irrevocable trust, transfer the ownership of the house to the trust, and start the 5 year clock for the Medicaid look back period. Once you have satisfied the 5 year period, you are free and clear.

Frequently Asked Question

When I meet with clients about this, there are usually a number of other questions that come up when we talk about placing the house in a trust. Here are the most common:

If my house is in a trust, do I still qualify for the STAR and Enhanced STAR property tax exemption?

ANSWER: Yes

If my house is gifted to a trust, do my beneficiaries still receive a step-up in basis when they inherit the asset?

ANSWER: As long as the estate attorney put the appropriate language in your trust document, the house will receive a step up in basis at your death.

What if I want to sell my house down the road but it’s owned by the trust?

ANSWER: It depends on what type of trust owns your house and the language in your trust document. When you sell your primary residence, as a single tax filer you do not have pay tax on the first $250,000 of capital gain in the property. For married filers, the number is $500,000. Example, married couple bought their house in 1980 for $40,000, it’s now worth $400,000, which equals $360,000 in appreciation or gain in value. When they sell their house, they do not pay any tax on the gain because it’s below the $500,000 exclusion.

If a revocable trust owns your house, you retain these tax exclusions because you technically still own the house. If an irrevocable trust owns your house, depending on the type of irrevocable trust you establish and the language in your trust document, you may or may not be able to utilize these exclusions.

Many of the irrevocable trust that we see drafted by estate attorneys that exist for the purpose of avoiding probate and protecting asset from Medicaid are considered grantor trusts. The estate attorney will often put language in the document that protects the assets from Medicaid but allows the grantor to capture the primary residence capital gains exclusion if they sell their house at some point in the future. But this is not always the case. If you establish a irrevocable trust for your primary residence, it’s important to have this discussion with your estate attorney to make sure this specific item is addressed in your trust document.

Now, here is the most common mistake that we see people make when they sell their house that is owned by their irrevocable trust. You put your primary residence in an irrevocable trust six years ago so you are now free and clear on the five year look back period. You decided to sell your current house and buy another house or sell your house and put the cash in the bank. At the closing the buyers make the check payable to you instead of your trust. You deposit the check to your checking account and then move it into the trust account or issue the check to purchase your next house. Guess what? The 5 year clock just restarted. The money can never leave the trust. If your intention is to sell one house and by another house, at the closing they should make the check payable to your trust, and the trust buys your next house.

Does the trust need to file a tax return?

ANSWER: Only irrevocable trusts have to file tax returns because revocable trusts are built under the social security number of the grantor. However, if the only asset that the irrevocable trust owns is your primary residence, the trust would not have any income, so there would not be a need to file a tax return for the trust each year.

Are irrevocable trusts 100% irrevocable?

ANSWER: There are tricks that estate attorneys use to get around the irrevocable restriction of these trusts. For example, the trust could make a gift to the beneficiaries of the trust and then the beneficiaries turn around and gift the money back to the grantor of the trust. Grantors can also retain the right to change who the trustees are, the beneficiaries, and they can revoke the trust. Bottom line, if you really need to get to the money, there are usually ways to do it.

How To Establish A Trust

You will need to retain an estate attorney to draft and execute your trust document. For a simple revocable or irrevocable trust, it may cost anywhere from $2,000 – $5,000. Before people get scared away by this cost, I remind them that if their house is subject to probate their estate may have to pay attorney fees, accountant fees, appraisal fees, and executor commissions which can easily total more than that.

In the case of a long-term care event, I just ask clients the question “Do you want your kids to inherit your house that you worked hard for or do you want Medicaid to take it if a long-term care event occurs down the road?” Most people reply, “I want my kids to have it.” Putting the house in an irrevocable trust for 5 years assures that they will.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Advanced Tax Strategies For Inherited IRA's

Inherited IRA’s can be tricky. There are a lot of rules surrounding;

Establishment and required minimum distribution (“RMD”) deadlines

Options available to spouse and non-spouse beneficiaries

Strategies for deferring required minimum distributions

Special 60 day rollover rules for inherited IRA’s

Inherited IRA’s can be tricky. There are a lot of rules surrounding;

Establishment and required minimum distribution (“RMD”) deadlines

Options available to spouse and non-spouse beneficiaries

Strategies for deferring required minimum distributions

Special 60 day rollover rules for inherited IRA’s

Establishment Deadline

If the decedent passed away prior to December 31, 2019, as a non-spouse beneficiary you have until December 31st of the year following the decedent’s death to establish an inherited IRA, rollover the balance into that IRA, and begin taking RMD’s based your life expectancy. If you miss that deadline, you are locked into distribution the full balance with a 10 year period.

If the decedent passed away January 1, 2020 or later, with limited exceptions, the inherited IRA rollover option with the stretch option is no longer available to non-spouse beneficiaries.

RMD Deadline - Decedent Passed Away Prior to 12/31/19

If you successfully establish an inherited IRA by the December 31st deadline, if you are non-spouse beneficiary, you will be required to start taking a “required minimum distribution” based on your own life expectancy in the calendar year following the decedent’s date of death.

Here is the most common RMD mistake that is made. The beneficiary forgets to take an RMD from the IRA in the year that the decedent passes away. If someone passes away toward the beginning of the year, there is a high likelihood that they did not take the RMD out of their IRA for that year. They are required to do so and the RMD amount is based on what the decedent was required to take for that calendar year, not based on the life expectancy of the beneficiary. A lot of investment providers miss this and a lot of beneficiaries don’t know to ask this question. The penalty? A lovely 50% excise tax by the IRS on the amount that should have been taken.

Distribution Options Available To A Spouse

If you are the spouse of the decedent you have three distribution options available to you:

Take a cash distribution

Rollover the balance to your own IRA

Rollover the balance to an Inherited IRA

Cash distributions are treated the same whether you are a spouse or non-spouse beneficiary. You incur income tax on the amounts distributed but you do not incur the 10% early withdrawal penalty regardless of age because it’s considered a “death distribution”. For example, if the beneficiary is 50, normally if distributions are taken from a retirement account, they get hit with a 10% early withdrawal penalty for not being over the age of 59½. For death distributions to beneficiaries, that 10% penalty is waived.

#1 Mistake Made By Spouse Beneficiaries

This exemption of the 10% early withdrawal penalty leads me to the number one mistake that we see spouses make when choosing from the three distribution options listed above. The spouse has a distribution option that is not available to non-spouse beneficiaries which is the ability to rollover the balance to their own IRA. While this is typically viewed as the easiest option, in many cases, it is not the most ideal option. If the spouse is under 59½, they rollover the balance to their own IRA, if for whatever reason they need to access the funds in that IRA, they will get hit with income taxes AND the 10% early withdrawal penalty because it’s now considered an “early distribution” from their own IRA.

Myth: Spouse Beneficiaries Have To Take RMD’s From Inherited IRA’s

Most spouse beneficiaries make the mistake of thinking that by rolling over the balance to their own IRA instead of an Inherited IRA they can avoid the annual RMD requirement. However, unlike non-spouse beneficiaries which are required to take taxable distributions each year, if you are the spouse of the decedent you do not have to take RMD’s from the inherited IRA unless your spouse would have been age 70 ½ if they were still alive. Wait…..what?

Let me explain. Let’s say there is a husband age 50 and a wife age 45. The husband passes away and the wife is the sole beneficiary of his retirement accounts. If the wife rolls over the balance to an Inherited IRA, she will avoid taxes and penalties on the distribution, and she will not be required to take RMD’s from the inherited IRA for 20 years, which is the year that their deceased spouse would have turned age 70 ½. This gives the wife access to the IRA if needed prior to age 59 ½ without incurring the 10% penalty.

Wait, It Gets Better......

But wait, since the wife was 5 years young than the husband, wouldn’t she have to start taking RMD’s 5 years sooner than if she just rolled over the balance to her own IRA? If she keeps the balance in the Inherited IRA the answer is “Yes” but here is an IRA secret. At any time, a spouse beneficiary is allowed to rollover the balance in their inherited IRA to their own IRA. So in the example above, the wife in year 19 could rollover the balance in the inherited IRA to her own IRA and avoid having to take RMD’s until she reaches age 70½. The best of both worlds.

Spouse Beneficiary Over Age 59½

If the spouse beneficiary is over the age of 59½ or you know with 100% certainty that the spouse will not need to access the IRA assets prior to age 59 ½ then you can simplify this process and just have them rollover the balance to their own IRA. The 10% early withdrawal penalty will never be an issue.

Non-Spouse Beneficiary Options

As mentioned above, the distribution options available to non-spouse beneficiaries were greatly limited after the passing of the SECURE ACT by Congress on December 19, 2019. For most individuals that inherit retirement accounts after December 31, 2019, they will now be subject to the new "10 Year Rule" which requires non-spouse beneficiary to completely deplete the retirement account 10 years following the year of the decedents death.

For more on the this change and the options available to Non-Spouse beneficiaries in years 2020 and beyond, please read the article below:

60 Day Rollover Mistake

There is a 60 day rollover rule that allows the owner of an IRA to take a distribution from an IRA and if the money is deposited back into the IRA within 60 days, it’s like the distribution never happened. Each taxpayer is allowed one 60 day rollover in a 12 month period. Think of it as a 60 day interest free loan to yourself.

Inherited IRA’s are not eligible for 60 day rollovers. If money is distributed from the Inherited IRA, the rollover back into the IRA will be disallowed, and the individual will have to pay taxes on the amount distributed.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Accountant Put The Owner’s Kids On Payroll And Bomb Shelled The 401(k) Plan

The higher $12,000 standard deduction for single filers has produced an incentive in some cases for business owners to put their kids on the payroll in an effort to shift income out of the owner’s high tax bracket into the children’s lower tax bracket. However, there was a non-Wojeski accountant that advised his clients not only to put his kids on the

Big Issue

The higher $12,000 standard deduction for single filers has produced an incentive in some cases for business owners to put their kids on the payroll in an effort to shift income out of the owner’s high tax bracket into the children’s lower tax bracket. However, there was a non-Wojeski accountant that advised his clients not only to put his kids on the payroll but also to have their children put all of that W2 compensation in the company’s 401(k) plan as a Roth deferral.

At first look it would seem to be a dynamite tax strategy but this strategy blew up when the company got their year end discrimination testing back for the 401(k) plan and all of the executives, including the owner, were forced to distribute their pre-tax deferrals from the plan due to failed discrimination testing. It created a huge unexpected tax liability for the owners and all of the executives completely defeating the tax benefit of putting the kids on payroll. Not good!!

Why This Happened

If your client sponsors a 401(k) plan and they are not a “safe harbor plan”, then each year the plan is subject to “discrimination testing”. This discrimination testing is to ensure that the owners and “highly compensated employees” are not getting an unfair level of benefits in the 401(k) plan compared to the rest of the employees. They look at what each employee contributes to the plan as a percent of their total compensation for the year. For example, if you make $3,000 in employee deferrals and your W2 comp for the year is $60,000, your deferral percentage is 5%.

They run this calculation for each employee and then they separate the employees into two groups: “Highly Compensated Employees” (HCE) and “Non-Highly Compensation Employees” (NHCE). A highly compensated employee is any employee that in 2019:

is a 5% or more owner, or

Makes $125,000 or more in compensation

They put the employees in their two groups and take an average of each group. In most cases, the HCE’s average cannot be more than 2% higher than the NHCE average. If it is, then the HCE’s get pre-tax money kicked back to them out of the 401(k) plan that they have to pay tax on. It really ticks off the HCE’s when this happens because it’s an unexpected tax bill.

Little Known Attribution Rule

ATTRIBUTION RULE: Event though a child of an owner may not be a 5%+ owner or make more than $125,000 in compensation, they are automatically considered an HCE because they are related to the owner of the business. So in the case that I referred above, the accountant had the client pay the child $12,000 and defer $12,000 into the 401(k) plan as a Roth deferral making their deferral percentage 100% of compensation. That brought the average for the HCE way way up and caused the plan fail testing.

To make matters worse, when 401(k) refunds happen to the HCE’s they do not go back to the person that deferred the highest PERCENTAGE of pay, they go to the person that deferred the largest DOLLAR AMOUNT which was the owner and the other HCE’s that deferred over $18,000 in the plan each.

How To Avoid This Mistake

Before advising a client to put their children on payroll and having them defer that money into the 401(k) plan, ask them these questions:

Does your company sponsor a 401(k) plan?

If yes, is your plan a “safe harbor 401(k) plan?

If the company sponsors a 401(k) plan AND it’s a safe harbor plan, you are in the clear with using this strategy because there is no discrimination testing for the employee deferrals.

If the company sponsors a 401(k) plan AND it’s NOT a safe harbor plan, STOP!! The client should either consult with the TPA (third party administrator) of their 401(k) plan to determine how their kids deferring into the plan will impact testing or put the kids on payroll but make sure they don’t contribute to the plan.

Side note, if the company sponsors a Simple IRA, you don’t have to worry about this issue because Simple IRA’s do not have discrimination testing. The children can defer into the retirement plan without causing any issues for the rest of the HCE’s.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Percentage of Pay vs Flat Dollar Amount

Enrolling in a company retirement plan is usually the first step employees take to join the plan and it is important that the enrollment process be straight forward. There should also be a contact, i.e. an advisor (wink wink), who can guide the employees through the process if needed. Even with the most efficient enrollment process, there is a lot of

Retirement Contributions - Percentage of Pay vs Flat Dollar Amount

Enrolling in a company retirement plan is usually the first step employees take to join the plan and it is important that the enrollment process be straight forward. There should also be a contact, i.e. an advisor (wink wink), who can guide the employees through the process if needed. Even with the most efficient enrollment process, there is a lot of information employees must provide. Along with basic personal information, employees will typically select investments, determine how much they’d like to contribute, and document who their beneficiaries will be. This post will focus on one part of the contribution decision and hopefully make it easier when you are determining the appropriate way for you to save.

A common question you see on the investment commercials is “What’s Your Number”? Essentially asking how much do you need to save to meet your retirement goals. This post isn’t going to try and answer that. The purpose of this post is to help you decide whether contributing a flat dollar amount or a percentage of your compensation is the better way for you to save.

As we look at each method, it may seem like I favor the percentage of compensation because that is what I use for my personal retirement account but that doesn’t mean it is the answer for everyone. Using either method can get you to “Your Number” but there are some important considerations when making the choice for yourself.

Will You Increase Your Contribution As Your Salary Increases?

For most employees, as you start to earn more throughout your working career, you should probably save more as well. Not only will you have more money coming in to save but people typically start spending more as their income rises. It is difficult to change spending habits during retirement even if you do not have a paycheck anymore. Therefore, to have a similar quality of life during retirement as when you were working, the amount you are saving should increase.

By contributing a flat dollar, the only way to increase the amount you are saving is if you make the effort to change your deferral amount. If you do a percentage of compensation, the amount you save should automatically go up as you start to earn more without you having to do anything.

Below is an example of two people earning the same amount of money throughout their working career but one person keeps the same percentage of pay contribution and the other keeps the same flat dollar contribution. The percentage of pay person contributes 5% per year and starts at $1,500 at 25. The flat dollar person saves $2,000 per year starting at 25.

The percentage of pay person has almost $50,000 more in their account which may result in them being able to retire a full year or two earlier.

A lot of participants, especially those new to retirement plans, will choose the flat dollar amount because they know how much they are going to be contributing each pay period and how that will impact them financially. That may be useful in the beginning but may harm someone over the long term if changes aren’t made to the amount they are contributing. If you take the gross amount of your paycheck and multiply that amount by the percent you are thinking about contributing, that will give you close to, if not the exact, amount you will be contributing to the plan. You may also be able to request your payroll department to run a quick projection to show the net impact on your paycheck.

There are a lot of factors to take into consideration to determine how much you need to be saving to meet your retirement goals. Simply setting a percentage of pay and keeping it the same your entire working career may not get you all the way to your goal but it can at least help you save more.

Are You Maxing Out?

The IRS sets limits on how much you can contribute to retirement accounts each year and for most people who max out it is based on a dollar limit. For 2024, the most a person under the age of 50 can defer into a 401(k) plan is $23,000. If you plan to max out, the fixed dollar contribution may be easier to determine what you should contribute. If you are paid weekly, you would contribute approximately $442.31 per pay period throughout the year. If the IRS increases the limit in future years, you would increase the dollar amount each pay period accordingly.

Company Match

A company match as it relates to retirement plans is when the company will contribute an amount to your retirement account as long as you are eligible and are contributing. The formula on how the match is calculated can be very different from plan to plan but it is typically calculated based on a dollar amount or a percentage of pay. The first “hurdle” to get over with a company match involved is to put in at least enough money out of your paycheck to receive the full match from the company. Below is an example of a dollar match and a percent of pay match to show how it relates to calculating how much you should contribute.

Dollar for Dollar Match Example

The company will match 100% of the first $1,000 you contribute to your plan. This means you will want to contribute at least $1,000 in the year to receive the full match from the company. Whether you prefer contributing a flat dollar amount or percentage of compensation, below is how you calculate what you should contribute per pay period.

Flat Dollar – if you are paid weekly, you will want to contribute at least $19.23 ($1,000 / 52 weeks = $19.23). Double that amount to $38.46 if you are paid bi-weekly.

Percentage of Pay – if you make $30,000 a year, you will want to contribute at least 3.33% ($1,000 / $30,000).

Percentage of Compensation Match Example

The company will match 100% of every dollar up to 3% of your compensation.

Flat Dollar – if you make $30,000 a year and are paid weekly, you will want to contribute at least $17.31 ($30,000 x 3% = $900 / 52 weeks = $17.31). Double that amount to $34.62 if you are paid bi-weekly.

Percentage of Pay – no matter how much you make, you will want to contribute at least 3%.

If the match is based on a percentage of pay, not only is it easier to determine what you should contribute by doing a percent of pay yourself, you also do not have to make changes to your contribution amount if your salary increases. If the match is up to 3% and you are contributing at least 3% as a percentage of pay, you know you should receive the full match no matter what your salary is.

If you do a flat dollar amount to get the 3% the first year, when your salary increases you will no longer be contributing 3%. For example, if I set up my contributions to contribute $900 a year, at a salary of $30,000 I am contributing 3% of my compensation (900 / 30,000) but at a salary of $35,000 I am only contributing 2.6% (900 / 35,000) and therefore not receiving the full match.

Note: Even though in these examples you are receiving the full match, it doesn’t mean it is always enough to meet your retirement goals, it is just a start.

In summary, either the flat dollar or percentage of pay can be effective in getting you to your retirement goal but knowing what that goal is and what you should be saving to get there is key.

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Navigating Student Loan Repayment Programs

I had the fortunate / unfortunate experience of attending a seminar on the various repayment programs available to young professionals and the parents of these young professionals with student loan debt. I can summarize it in three words: “What a mess!!” As a financial planner, we are seeing firsthand the impact of the mounting student loan debt

I had the fortunate / unfortunate experience of attending a seminar on the various repayment programs available to young professionals and the parents of these young professionals with student loan debt. I can summarize it in three words: “What a mess!!” As a financial planner, we are seeing firsthand the impact of the mounting student loan debt epidemic. Only a few years ago, we would have a handful of young professional reach out to us throughout the year looking for guidance on the best strategy for managing their student loan debt. Within the last year we are now having these conversations on a weekly basis with not only young professionals but the parents of those young professional that have taken on debt to help their kids through college. It would lead us to believe that we may be getting close to a tipping point with the mounting student loan debt in the U.S.

While you may not have student loans yourself, my guess is over next few years you will have a friend, child, nephew, niece, employee, or co-working that comes to you looking for guidance as to how to manage their student loan debt. Why you? Because there are so many repayment programs that have surfaced over the past 10 years and there is very little guidance out there as to how to qualify for those programs, how the programs work, and whether or not it’s a good financial move. So individuals struggling with student loan debt will be looking for guidance from people that have been down this road before. This article is not meant to make you an expert on these programs but is rather meant to provide you with an understanding of the various options that are available to individuals seeking help with managing the student loan debt.

Student Loan Delinquency Rate: 25%

While the $1.5 Trillion dollars in outstanding student loan debt is a big enough issue by itself, the more alarming issue is the rapid rise in the number of loans that are either in delinquency or default. That statistic is 25%. So 1 in every 4 outstanding student loans is either behind in payments or is in default. Even more interesting is we are seeing a concentration of delinquencies in certain states. See the chart below:

Repayment Program Options

Congress in an effort to assist individuals with the repayment of their student loan debt has come out with a long list of repayment programs over the past 10 years. Upfront disclosure, navigating all of the different programs is a nightmare. There is a long list of questions that come up like:

Does a “balanced based” or “income based” repayment plan make the most sense?

What type of loan do you have now?

It is a federal or private loan?

When did you take the loan?

Who do you currently work for?

What is current interest rate on your loan?

What is your income?

Are you married?

Because it’s such an ugly process navigating through these programs and more and more borrowers are having trouble managing their student loan debt, specialists are starting to emerge that know these programs and can help individuals to identify which programs is right for them. Student loan debt management has become its own animal within the financial planning industry.

Understanding The Grace Period

Before we jump into the programs, I want to address a situation that we see a lot of young professional getting caught in. Most students are aware of the 6 month grace period associated with student loan payment plans. The grace period is the 6 month period following graduation from college that no student loan payments are due. It gives graduates an opportunity to find a job before their student loan payments begin. What many borrowers do not realize is the “grace period’ is a one-time benefit. Meaning if you graduate with a 4 year degree, use your grace period, but then decide to go back for a master degree, you can often times put your federal student loans in a “deferred status” while you are obtaining your master degree but as soon as you graduate, there is no 6 month grace period. Those student loan payments begin the day after you graduate because you already used your 6 month grace period after your undergraduate degree. This can put students behind the eight ball right out of the gates.

What Type Of Loan Do You Have?

The first step is you have to determine what type of student loan you have. There are two categories: Federal and Private. The federal loans are student loans either issued or guaranteed by the federal government and they come in three flavors: Direct, FFEL, and Perkins. Private loans are student loans issued by private institutions such as a bank or a credit union.

If you are not sure what type of student loan you have you should visit www.nslds.ed.gov. If you have any type of federal loan it will be listed on that website. You will need to establish a login and it requires a FSA ID which is different than your Federal PIN. If your student loan is not listed on that website, then it’s a private loan and it should be listed on your credit report.

In general, if you have a private loan, you have very few repayment options. If you have federal loans, there are a number of options available to you for repayment.

Parties To The Loan

There are four main parties involved with student loans:

The Lender

The Guarantor

The Servicer

The Collection Agency

The lender is the entity that originates the loan. If you have a “direct loan”, the lender is the Department of Education. If you have FFEL loan, the lender is a commercial bank but the federal government serves as the “Guarantor”, essentially guaranteeing that financial institutions that the loan will be repaid.

Most individuals with student loan debt or Plus loans will probably be more familiar with the name of the loan “Servicer”. The loan servicer is a contractor to the bank or federal government, and their job is to handle the day-to-day operations of the loan. The names of these servicer’s include: Navient, Nelnet, Great Lakes, AES, MOHELA, HESC, OSLA, and a few others.

A collection agency is a third party vendor that is hired to track down payments for loans that are in default.

Balance-Based Repayment Plans

These programs are your traditional loan repayment programs. If you have a federal student loan, after graduate, your loan will need to be repaid over one of the following time periods: 10 years, 25 years, or 30 years with limitations. The payment can either be structure as a fixed dollar amount that does not change for the life of the loan or a “graduated payment plan” in which the payments are lower at the beginning and gradually get larger.

While it may be tempting to select the “graduated payment plan” because it gives you more breathing room early on in your career, we often caution students against this. A lot can happened during your working career. What happens when 10 years from now you get unexpectedly laid off and are out of work for a period of time? Those graduated loan payments may be very high at that point making your financial hardship even more difficult.

Private loan may not offer a graduated payment option. Since private student loans are not regulated by any government agency they get to set all of the terms and conditions of the loans that they offer.

From all of the information that we have absorbed, if you can afford to enroll in a balanced based repayment plan, that is usually the most advantageous option from the standpoint of paying the least interest during the duration of the loan.

Income-Driven Repayment Program

All of the other loan repayment programs fall underneath the “income based payment” category, where your income level determines the amount of your monthly student loan payment within a given year. To qualify for the income based plans, your student loans have to be federal loans. Private loans do not have access to these programs. Many of these programs have a “loan forgiveness” element baked into the program. Meaning, if you make a specified number of payments or payments for a specified number of years, any remaining balance on the student loan is wiped out. For individuals that are struggling with their student loan payments, these programs can offer more affordable options even for larger student loan balances. Also, the income based payment plans are typically a better long-term solution than “deferments” or “forbearance”.

Here is the list of Income-Driven Repayment Programs:

Income-Contingent Repayment (ICR)

Income-Based Repayment (IBR)

Pay-As-You-Earn (PAYE)

Revised Pay-As-You-Earn (REPAYE)

Each of these programs has a different income formula and a different set of prerequisites for the type of loans that qualify for each program but I will do a quick highlight of each program. If you think there is a program that may fit your circumstances I encourage you to visit https://studentaid.ed.gov/sa/

We have found that borrowers have to do a lot of their own homework when it comes to determining the right program for their personal financial situation. The loan servicers, which you would hope have the information to steer you in the right direction, up until now, have not been the best resource for individuals with student loan debt or parent plus loans. Hence, the rise in the number of specialists in the private sector now serving as fee based consultants.

Income-Contingent Repayment (ICR)

This program is for Direct Loans only. The formula is based on 20% of an individual’s “discretionary income” which is the difference between AGI and 100% of federal poverty level. For a single person household, the 2018 federal poverty level is $12,140 and it changes each year. The formula will result in a required monthly payment based on this data. Once approved you have to renew this program every 12 months. Part of the renewal process in providing your most up to date income data which could change the loan payment amount for the next year of the loan repayment. After a 25-years repayment term, the remaining balance is forgiven but depending on the tax law at the time of forgiveness, the forgiven amount may be taxable. The ICR program is typically the least favorable of the four options because the income formula usually results in the largest monthly payment.

However, this program is one of the few programs that allows Parent PLUS borrowers but they must first consolidate their federal loans via the federal loan consolidation program.

Income-Based Repayment (IBR)

This program is typically more favorable than the ICR program because a lower amount of income is counted toward the required payment. Both Direct and FFEL loans are allowed but Parent Plus Loans are not. The formula takes into account 15% of “discretionary income” which is the difference between AGI and 150% of the federal poverty level. If married it does look at your joint income unless you file separately. Like the ICR program, the loan is forgiven after 25 years and the forgiveness amount may be taxable income.

Pay-As-You-Earn (PAYE)

This plan is typically the most favorable plan for those that qualify. This program is for Direct Loans only. The formula only takes into account 10% of AGI. The forgiveness period is shortened to 20 years. The one drawback is this program is limited to “newer borrowers”. To qualify you cannot have had a federal outstanding loan as of October 1, 2007 and it’s only available for federal student loans issued after October 1, 2011. Joint income is takes into account for married borrowers unless you file taxes separately.

Revised Pay-As-You-Earn (REPAYE)

Same as PAYE but it eliminates the “new borrower” restriction. The formula takes into account 10% of AGI. The only difference is for married borrowers, it takes into account joint income regardless of how you file your taxes. So filing separately does not help. The 20 year forgiveness is the same at PAYE but there is a 25 year forgiveness if the borrow took out ay graduate loans.

Loan Forgiveness Programs

There are programs that are designed specifically for forgive the remaining balance of the loan after a specific number of payment or number of years based on a set criteria which qualifies an individual for these programs. Individuals have to be very careful with “loan forgiveness programs”. While it seems like a homerun having your student loan debt erase, when these individuals go to file their taxes they may find out that the loan forgiveness amount is considered taxable income in the tax year that the loan is forgiven. With this unexpected tax hit, the celebration can be short lived. But not all of the loan forgiveness programs trigger taxation. Here are the three loan forgiveness programs:

Public Service Loan Forgiveness

Teacher Loan Forgiveness

Perkins Loan Forgiveness

Following the same format as above, I will provide you with a quick summary on each of these loan forgiveness programs with links to more information on each one.

Public Service Loan Forgiveness

This program is only for Direct Loans. To qualify for this loan forgiveness program, you must be a full-time employee for a “public service employer”. This could be a government agency, municipality, hospital, school, or even a 501(C)(3) not-for-profit. You must be enrolled in one of the federal repayment plans either balanced-based or income driven. Once you have made 120 payments AFTER October 1, 2007, the remaining balance is forgiven. Also the 120 payments do not have to be consecutive. The good news with this program is the forgiven amount is not taxable income. To enroll in the plan you have to submit the Public Service Loan Forgiveness Employment Certification Form to US Department of Education. See this link for more info: https://studentaid.ed.gov/sa/repay-loans/forgiveness-cancellation/public-service

Teacher Loan Forgiveness

This program is for Federal Stafford loans issued after 1998. You have to teach full-time for five consecutive years in a “low-income” school or educational services agency to qualify for this program. The loan forgiveness amount is capped at either $5,000 or $17,000 based on the subject area that you teach. https://studentaid.ed.gov/sa/repay-loans/forgiveness-cancellation/teacher#how-much

As special note, even though teachers may also be considered “Public Service” employees, you cannot make progress toward the Teacher Loan Forgiveness Program and the Public Service Loan Forgiveness Program at the same time.

To apply for this program, you must submit the Teacher Loan Forgiveness Application to your loan servicer.

Perkins Loan Forgiveness

As the name suggests, this program is only available for Federal Perkins Loans. Also, it’s only available to certain specific full-time professions. You can find the list by clicking on this link: https://studentaid.ed.gov/sa/repay-loans/forgiveness-cancellation/perkins

The Perkins forgiveness program can provide up to 100% forgiveness in 5 years with NO PAYMENTS REQUIRED. To apply for this program you have complete an application through the school, if they are the lender, or your loan servicer.

Be Careful Consolidating Student Loans

Young professionals have to be very careful when consolidating student loan debt. One of the biggest mistakes that we see borrows without the proper due diligence consolidate their federal student loans with a private institution to take advantage of a lower interest rate. Is some cases it may be the right move but as soon as this happen you are shut out of any options that would have been available to you if you still had federal student loans. Before you go from a federal loan to a private loan, make sure you properly weigh all of your options.

If you already have private loans and you want to consolidate the loans with a different lender to lower interest rate or obtain more favorable repayment term, there is typically less hazard in doing so.

You are allowed to consolidate federal loans within the federal system but it does not save you any interest. They simply take the weighted average of all the current interest rate on your federal loans to reach the interest rate on your new consolidated federal student loan.

Defaulting On A Student Loan

Defaulting on any type of loan is less than ideal but student loans are a little worse than most loans. Even if you claim bankruptcy, there are very few cases where student loan debt gets discharged in a bankruptcy filing. For private loans, not only does it damage your credit rating but the lender can sue you in state court. Federal loans are not any better. Defaulting on a federal loan will damage your credit score but the federal government can go one step further than private lenders to collect the unpaid debt. They have the power to garnish your wages if you default on a federal loan.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

What Happens To My Pension If The Company Goes Bankrupt?

Given the downward spiral that GE has been in over the past year, we have received the same question over and over again from a number of GE employees and retirees: “If GE goes bankrupt, what happens to my pension?” While it's anyone’s guess what the future holds for GE, this is an important question that any employee with a pension should

Given the downward spiral that GE has been in over the past year, we have received the same question over and over again from a number of GE employees and retirees: “If GE goes bankrupt, what happens to my pension?” While it's anyone’s guess what the future holds for GE, this is an important question that any employee with a pension should know the answer to. While some employees are aware of the PBGC (Pension Benefit Guarantee Corporation) which is an organization that exists to step in and provide pension benefits to employees if the employer becomes insolvent, very few are aware that the PBGC itself may face insolvency within the next ten years. So if the company can’t make the pension payments and the PBGC is out of money, are employees left out in the cold?

Pension shortfall

When a company sponsors a pension plan, they are supposed to make contributions to the plan each year to properly fund the plan to meet the future pension payments that are due to the employees. However, if the company is unable to make those contributions or the underlying investments that the pension plan is invested in underperform, it can lead to shortfalls in the funding.

We have seen instances where a company files for bankruptcy and the total dollar amount owed to the pension plan is larger than the total assets of the company. When this happens, the bankruptcy courts may allow the company to terminate the plan and the PBGC is then forced to step in and continue the pension payments to the employees. While this seems like a great system since up until now that system has worked as an effective safety net for these failed pension plans, the PBGC in its most recent annual report is waiving a red flag that it faces insolvency if Congress does not make changes to the laws that govern the premium payments to the PBGC.

What is the PBGC?

The PBGC is a federal agency that was established in 1974 to protect the pension benefits of employees in the private sector should their employer become insolvent. The PBGC does not cover state or government sponsored pension plans. The number of employees that were plan participants in an insolvent pension plan that now receive their pension payments from the PBGC is daunting. According to the 2017 PBGC annual report, the PBGC “currently provides pension payments to 840,000 participants in 4,845 failed single-employer plans and an additional 63,000 participants across 72 multi-employer plans.”

Wait until you hear the dollar amounts associate with those numbers. The PBGC paid out $5.7 Billion dollars in pension payments to the 840,000 participants in the single-employer plans and $141 Million to the 63,000 participants in the multi-employer plans in 2017.

Where Does The PBGC Get The Money To Pay Benefits?

So where does the PBGC get all of the money needed to make billions of dollars in pension payments to these plan participants? You might have guessed “the taxpayers” but for once that’s incorrect. The PBGC’s operations are financed by premiums payments made by companies in the private sector that sponsor pension plans. The PBGC receive no taxpayer dollars. The corporations that sponsor these pension plans pay premiums to the PBGC each year and the premium amounts are set by Congress.

Single-Employer vs Multi-Employer Plans

The PBGC runs two separate insurance programs: “Single-Employer Program” and “Multi-Employer Program”. It’s important to understand the difference between the two. While both programs are designed to protect the pension benefits of the employees, they differ greatly in the level of benefits guaranteed. The assets of the two programs are also kept separate. If one programs starts to fail, the PBGC is not allowed to shift assets over from the other program to save it.

The single-employer program protects plans that are sponsored by single employers. The PBGC steps in when the employer goes bankrupt or can no longer afford to sponsor the plan. The Single-Employer Program is the larger of the two programs. About 75% of the annual pension payments from the PBGC come from this program. Some examples of single-employer companies that the PBGC has had to step into to make pension payments are United Airlines, Lehman Brothers, and Circuit City.

The Multi-Employer program covers pension plans created and funded through collective bargaining agreements between groups of employers, usually in related industries, and a union. These pension plans are most commonly found in construction, transportation, retail food, manufacturing, and services industries. When a plan runs out of money, the PBGC does not step in and takeover the plan like it does for single-employer plans. Instead, it provides “financial assistance” and the guaranteed amounts of that financial assistants are much lower than the guaranteed amounts offered under the single-employer program. For example, in 2017, the PBGC began providing financial assistance to the United Furniture Workers Pension Fund A (UFW Plan), which covers 10,000 participants.

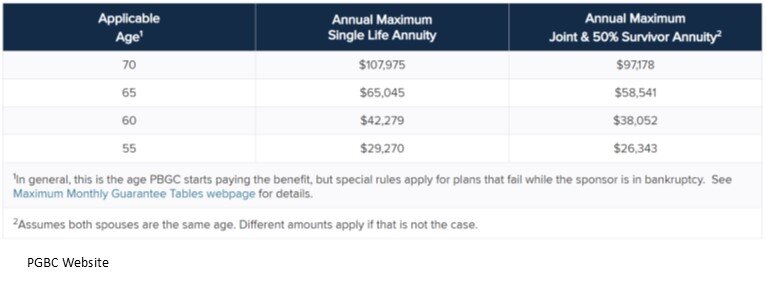

Maximum Guaranteed Amounts

The million dollar question. What is the maximum monthly pension amount that the PBGC will guarantee if the company or organization goes bankrupt? There are maximum dollar amounts for both the single-employer and multi-employer program. The maximum amounts are indexed for inflation each year and are listed on the PBGC website. To illustrate the dramatic difference between the guarantees associated with the pension pensions in a single-employer plan versus a multi-employer plan; here is an example from the PBGC website based on the 2018 rates.

“PBGC’s guarantee for a 65-year-old in a failed single-employer plan can be up to $60,136 annually, while a participant with 30 years of service in a failed multi-employer plan caps out at $12,870 per year. The multi-employer program guarantee for a participant with only 10 years of service caps out at $4,290 per year.”

It’s a dramatic difference.

For the single-employer program the PBGC provides participants with a nice straight forward benefits table based on your age. Below is a sample of the 2018 chart. However, the full chart with all ages can be found on the PBGC website.

Unfortunately, the lower guaranteed amounts for the multi-employer plans are not provided by the PBGC in a nice easy to read table. Instead they provide participant with a formula that is a headache for even a financial planner to sort through. Here is a link to the formula for 2018 on the PBGC website.

PBGC Facing Insolvency In 2025

If the organization guaranteeing your pension plan runs out of money, how much is that guarantee really worth? Not much. If you read the 138 page 2017 annual report issued by the PBGC (which was painful), at least 20 times throughout the report you will read the phase:

“The Multi-employer Program faces very serious challenges and is likely to run out of money by the end of fiscal year 2025.”

They have placed a 50% probability that the multi-employer program runs out of money by 2025 and a 99% probability that it runs out of money by 2036. Not good. The PBGC has urged Congress to take action to fix the problem by raising the premiums charged to sponsors of these multi-employer pension plans. While it seems like a logical move, it’s a double edged sword. While raising the premiums may fix some of the insolvency issues for the PBGC in the short term, the premium increase could push more of the companies that sponsor these plans into bankruptcy.

There is better news for the Single-Employer Program. As of 2017, even though the Single-Employer Program ran a cumulative deficit of $10.9 billion dollars, over the next 10 years, the PBGC is expected to erase that deficit and run a surplus. By comparison the multi-employer program had accumulated a deficit of $65.1 billion dollars by the end of 2017..

Difficult Decision For Employees

While participants in Single-Employer plans may be breathing a little easier after reading this article, if the next recession results in a number of large companies defaulting on their pension obligations, the financial health of the PBGC could change quickly without help from Congress. Employees are faced with a one-time difficult decision when they retire. Option one, take the pension payments and hope that the company and PBGC are still around long enough to honor the pension payments. Or option two, elect the lump sum, and rollover then present value of your pension benefit to your IRA while the company still has the money. The right answer will vary on a case by case basis but the projected insolvency of the PBGC’s Multi-employer Program makes that decision even more difficult for employees.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Volatility, Market Timing, and Long-Term Investing

For many savers, the objective of a retirement account is to accumulate assets while you are working and use those assets to pay for your expenses during retirement. While you are in the accumulation phase, assets are usually invested and hopefully earn a sufficient rate of return to meet your retirement goal. For the majority,

Volatility, Market Timing, and Long-Term Investing

For many savers, the objective of a retirement account is to accumulate assets while you are working and use those assets to pay for your expenses during retirement. While you are in the accumulation phase, assets are usually invested and hopefully earn a sufficient rate of return to meet your retirement goal. For the majority, these accounts are long-term investments and there are certain investing ideas that should be taken into consideration when managing portfolios. This article will discuss volatility, market timing and their role in long-term retirement accounts.

“Market timing is the act of moving in and out of the market or switching between asset classes based on using predictive methods such as technical indicators or economic data” (Investopedia). In other words, trying to sell investments when they are near their highest and buy investments when they are near their lowest. It is difficult, some argue impossible, to time the market successfully enough to generate higher returns. Especially over longer periods. That being said, by reallocating portfolios and not experiencing the full loss during market downturns, investors could see higher returns. When managing portfolios over longer periods, this should be done without the emotion of day to day volatility but by analyzing greater economic trends.

So far, the stock market in 2018 has been volatile; particularly when compared to 2017. Below are charts of the S&P 500 from 1/1/2018 – 10/21/2018 and the same period for 2017.

Source: Yahoo Finance. Information has been obtained from sources believed to be reliable and are subject to change without notification.

Based on the two charts above, one could conclude the majority of investors would prefer 2017 100% of the time. In reality, the market averages a correction of over 10% each year and there are years the market goes up and there are years the market goes down. Currently, the volatility in the market has a lot of investors on edge, but when comparing 2018 to the market historically, one could argue this year is more typical than a year like 2017 where the market had very little to no volatility.

Another note from the charts above are the red and green bars on the bottom of each year. The red represent down days in the market and the green represent up days. You can see that even though there is more volatility in 2018 compared to 2017 when the market just kept climbing, both years have a mixture of down days and up days.

A lot of investors become emotional when the market is volatile but even in the midst of volatility and downturns, there are days the market is up. The chart below shows what happens to long-term portfolio performance if investors miss the best days in the market during that period.

Source: JP Morgan. Information has been obtained from sources believed to be reliable and are subject to change without notification.

Two main takeaways from the illustration above are; 1) missing the best days over a period in the market could have a significant impact on a portfolios performance, and 2) some of the best days in the market over the period analyzed came shortly after the worst days. This means that if people reacted on the worst days and took their money from the market then they likely missed some of the best days.

Market timing is difficult over long periods of time and making drastic moves in asset allocation because of emotional reactions to volatility isn’t always the best strategy for long-term investing. Investors should align their portfolios taking both risk tolerance and time horizon into consideration and make sure the portfolio is updated as each of these change multiple times over longer periods.

When risk tolerance or time horizon do not change, most investors should focus on macro-economic trends rather than daily/weekly/monthly volatility of the market. Not experiencing the full weight of stock market declines could generate higher returns and if data shows the economy may be slowing, it could be a good time to take some “chips off the table”. That being said, looking at past down markets, some of the best days occur shortly after the worst days and staying invested enough to keep in line with your risk tolerance and time horizon could be the best strategy.

It is difficult to take the emotion out of investing when the money is meant to fund your future needs so speaking with your financial consultant to review your situation may be beneficial.

About Rob……...