Target Date Funds: A Public Service Announcement

Before getting into the main objective of this article, let me briefly explain a Target Date Fund. Investopedia defines a target date fund as “a fund offered by an investment company that seeks to grow assets over a specified period of time for a targeted goal”. The specified period of time is typically the period until the date you “target” for retirement

Target Date Funds: A Public Service Announcement

Before getting into the main objective of this article, let me briefly explain a Target Date Fund. Investopedia defines a target date fund as “a fund offered by an investment company that seeks to grow assets over a specified period of time for a targeted goal”. The specified period of time is typically the period until the date you “target” for retirement or to start withdrawing assets. For this article, I will refer to the target date as the “retirement date” because that is how Target Date Funds are typically used.

Target Date Funds are continuing to grow in popularity as Defined Contribution Plans (i.e. 401(k)’s) become the primary savings vehicle for retirement. Per the Investment Company Institute, as of March 31, 2018, there was $1.1 trillion invested in Target Date Mutual Funds. Defined Contribution Plans made up 67 percent of that total.

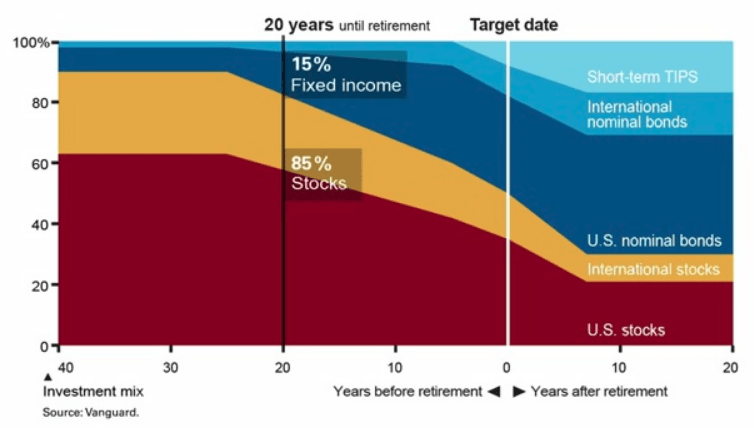

Target Date Funds are often coined as the “set it and forget it” of investments for participants in retirement plans. Target Date Funds that are farther from the retirement date will be invested more aggressively than target date funds closer to the retirement date. Below is a chart showing the “Glide Path” of the Vanguard Target Date Funds. The horizontal access shows how far someone is from retirement and the vertical access shows the percentage of stocks in the investment. In general, more stock means more aggressive. The “40” in the bottom left indicates someone that is 40 years from their retirement date. A common investment strategy in retirement accounts is to be more aggressive when you’re younger and become more conservative as you approach your retirement age. Following this strategy, someone with 40 years until retirement is more aggressive which is why at this point the Glide Path shows an allocation of approximately 90% stocks and 10% fixed income. When the fund is at “0”, this is the retirement date and the fund is more conservative with an allocation of approximately 50% stocks and 50% fixed income. Using a Target Date Fund, a person can become more conservative over time without manually making any changes.

Note: Not every fund family (i.e. Vanguard, American Funds, T. Rowe Price, etc.) has the same strategy on how they manage the investments inside the Target Date Funds, but each of them follows a Glide Path like the one shown below.

The Public Service Announcement

The public service announcement is to remind investors they should take both time horizon and risk tolerance into consideration when creating a portfolio for themselves. The Target Date Fund solution focuses on time horizon but how does it factor in risk tolerance?Target Date Funds combine time horizon and risk tolerance as if they are the same for each investor with the same amount of time before retirement. In other words, each person 30 years from retirement that is using the Target Date strategy as it was intended will have the same stock to bond allocation.This is one of the ways the Target Date Fund solution can fall short as it is likely not possible to truly know somebody’s risk tolerance without knowing them. In my experience, not every investor 30 years from retirement is comfortable with their biggest retirement asset being allocated to 90% stock. For various reasons, some people are more conservative, and the Target Date Fund solution may not be appropriate for their risk tolerance.The “set it and forget it” phrase is often used because Target Date Funds automatically become more conservative for investors as they approach their Target Date. This is a strategy that does work and is appropriate for a lot of investors which is why the strategy is continuing to increase in popularity. The takeaway from this article is to think about your risk tolerance and to be educated on the way Target Date Funds work as it is important to make sure both are in line with each other.For a more information on Target Date Funds please visit https://www.greenbushfinancial.com/target-date-funds-and-their-role-in-the-401k-space/

About Rob……...

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

New York May Deviate From The New 529 Rules

When the new tax rules were implemented on January 1, 2018, a popular college savings vehicle that goes by the name of a “529 plan” received a boost. Prior to the new tax rules, 529 plans could only be used to pay for college. The new tax rules allow account owners to withdraw up to $10,000 per year per child for K – 12 public school, private school,

When the new tax rules were implemented on January 1, 2018, a popular college savings vehicle that goes by the name of a “529 plan” received a boost. Prior to the new tax rules, 529 plans could only be used to pay for college. The new tax rules allow account owners to withdraw up to $10,000 per year per child for K – 12 public school, private school, religious school, or homeschooling expenses. These distributions would be considered “qualified” which means distributions are made tax free.

Initially we expected this new benefit to be a huge tax advantage for our clients that have children that attend private school. They could fully fund a 529 plan up to $10,000 per year, capture a New York State tax deduction for the $10,000 contribution, and then turn around and distribute the $10,000 from the account to make the tuition payment for their kids.

New York May Deviate

States are not required to adhere to the income tax rules set forth by the federal government. In other words, states may choose to adopt the new tax rules set forth by the federal government or they can choose to ignore them. The new tax laws that went into effect in 2018 will impact states differently. More specifically, tax payers in states that have both income taxes and high property taxes, like New York and California, may be adversely affected due to the new $10,000 cap on the ability to fully deduct those expenses on their federal tax return.

As of June 30, 2018, New York has yet to provide guidance as to whether or not they will recognize the K -12 distributions from 529 plans as “qualified”. More than 30 states have already announced that they will adhere to the new federal tax rules. On the opposite side of that coin, California has announced that they will not adhere to the new 529 tax rules and they will tax distribution made for K – 12 expenses. Oregon has gone one step further and will not only tax the distributions but they will also recapture state tax deductions taken for distributions made for K – 12 expenses.

Wait & See

If you live in a state like New York that has yet to provide guidance with regard to the new 529 rules, you end up in this wait and see scenario. There is no way to know which way New York is going to rule on this new federal tax rule. However, if New York follows the path taken by many of the other states that were adversely affected by the new federal tax rules, they may decide to follow suit and choose to ignore the new 529 tax rules adopted by the federal government.

We also don’t have any guidance as to when NYS will rule on this issue. They may wait until November or December to issue formal guidance. If that happens, 529 account owners looking to take advantage of the new K – 12 distribution rules will have to be on their toes because distributions from 529 accounts have to happen in the same year that the expense is incurred in order to receive the preferentially tax treatment.

Potential investors of 529 plans may get more favorable tax benefits from 529 plans sponsored by their own state. Consult your tax professional for how 529 tax treatments and account fees would apply to your particular situation. To determine which college saving option is right for you, please consult your tax and accounting advisors. Neither APFS nor its affiliates or financial professionals provide tax, legal or accounting advice. Please carefully consider investment objectives, risks, charges, and expenses before investing. For this and other information about municipal fund securities, please obtain an offering statement and read it carefully before you invest. Investments in 529 college savings plans are neither FDIC insured nor guaranteed and may lose value.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Patience Should Reward Investors In 2018

Bottom line, the first half of 2018 was a tough pill to swallow for investors. They had to fight a constant rollercoaster. Volatility was high, returns were low, and the news was dominated with fears of trade wars. This environment has left investors questioning if we are on the eve of the next recession. Well I have good news. While trade wars have driven

Bottom line, the first half of 2018 was a tough pill to swallow for investors. They had to fight a constant rollercoaster. Volatility was high, returns were low, and the news was dominated with fears of trade wars. This environment has left investors questioning if we are on the eve of the next recession. Well I have good news. While trade wars have driven fear into the hearts of investors, during that same time period corporate earnings have been soaring and the U.S. economy has continued its growth path. For these reasons, disciplined investors may have good things waiting for them in the second half of 2018.

Coming Off A Big Year

As of the end of the second quarter, the S&P 500 Index was up 2.6% year to date. So why does 2018 seem like such a disappointment? You have to remember that 2017 was a huge year with the added benefit of very little volatility. It was a straight march up the entire year.

First, let’s compare the performance of the various asset classes in the first half of 2017 versus to first half of 2018. Below are the returns for the various assets classes in the first half of 2017:

Here are those same asset classes in the first half of 2018.

Obviously a huge difference. At this time last year, the S&P 500 Index was already up 9.3% for the year compared to 2.6% in 2018. International and emerging market equities were up over 14% in the first half of 2017. In 2018, those same international stocks were down over 2%. One might guess that bonds would preform better in a year with muted stock returns. Well, one would be wrong because the Barclay’s US Aggregate Bond Index was down 1.6% in the first 6 months of 2018.

Volatility Is Back

Not only has the first half of 2018 been a return drought but the level of volatility in the stock market has also spiked. In the first 6 months of 2017, the S&P 500 Index only had 2 trading days where the stock market moved plus or minus by more than 1% in a day. Guess how many trading days there were in the first half of 2018 where the S&P 500 Index moved up or down by more than 1% in a day.

The answer: 25 Days

That’s a 1,250% increase over 2017. No wonder everyone’s nerves are rattled. So the up 2% YTD in the stock market feels more like a down 10% because a lot has happened in a short period of time. Plus, the only big positive month for the stock market was in January which feels like forever ago.

Recency Bias

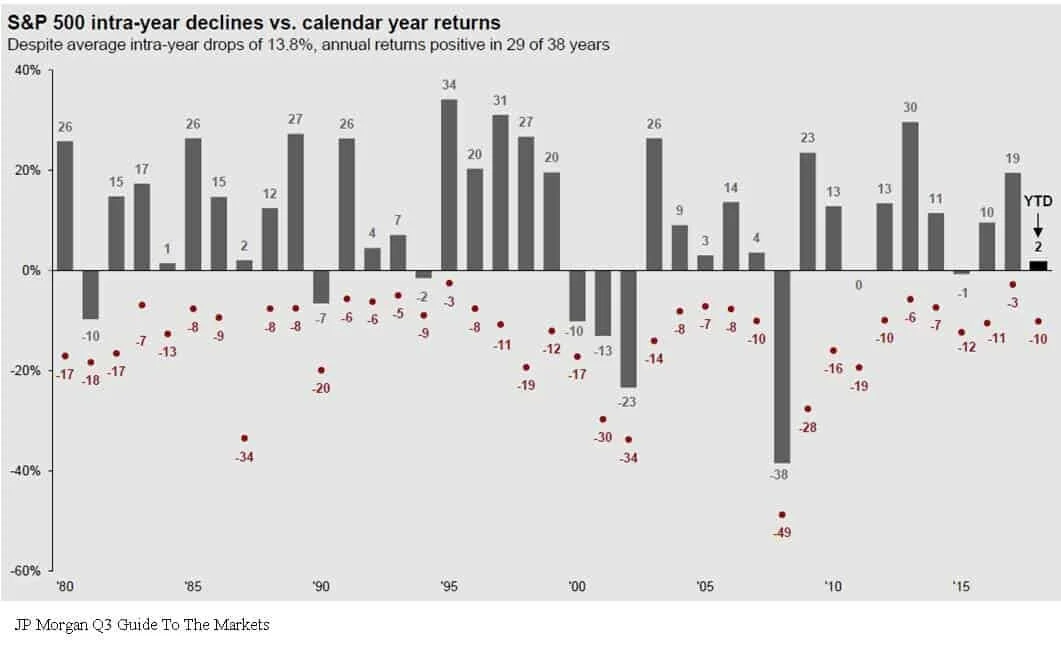

Investors are largely suffering for what we call in the investment industry as “recency bias”. In other words, what happened recently has now become the rule in the minds of investors. Investors are largely using 2017 as their measuring stick for 2018 performance and volatility. While it would seem that the dramatic increase in the level of volatility this year would classify 2018 as an abnormally volatile year, it’s actually 2017 that was the anomaly. Below is a chart that shows the annual return of the S&P 500 Index since 1980. The dots below each annual return are the market corrections that took place as some point during each calendar year.

Based on historical data, it’s “normal” for the market to experience on average a 10% correction at some point during the year. Now look at 2017, the stock market was up 19% for the year but the largest correction during the year was 3%. That’s abnormal. By comparison, even though we are only half way through 2018, we have already experienced a 10% correction and as of June 30th, the S&P 500 Index is up 2% for the year.

Earnings Are King

Behind the dark clouds of the media headlines and the increased level of volatility this year is the dramatic increase in corporate earnings. Corporate earnings have not only increased but they have leaped forward. Take a look at the chart below:

The market traditionally follows earnings. The earnings per share for the S&P 500 Index in 2017 was 17% which is a strong number historically. In the first quarterly of 2018, the year-over-year earnings per share growth was up 27%. That is a surge in corporate earnings. But you would have no idea looking at the meager 2% YTD return from the stock market this year. Pair that with the fact that the P/E of the S&P 500 is around 16 which is in line with its 20 year historic average. See the chart below:

Even though it has been a long expansion, the market is not “over priced” by historic terms. If the stock market is fairly valued and corporate earnings are accelerating, one could make the case that the stock market has some catching up to do in the second half of the year.

The Chances Of A Recession Are Low

With the yield curve still positively sloped and the Composite Index of Leading Indicator, not only positive, but accelerating, a recession within the next 6 to 12 months seems unlikely. It’s like wandering through a jungle. When you are on the ground, the jungle is intimidating, there are plenty of things to be afraid of, and it’s tough to know which direction you should be walking. As investment advisors it’s our job to climb the tallest tree to get above the jungle to determine which way we should be walking.

In summary, 2018 has been an emotional roller coaster for investors. But making sound investment decision is about putting your emotions and gut feelings aside and looking at the hard economic data when making investment decisions. That data is telling us that we may very well be witnessing the soon to be longest economic expansion since 1900. The U.S. economy is strong, tax reform is boosting corporate earnings, interest rates are rising but are still at benign levels, and consumer sentiment is booming. In the later stages of an economic cycle, higher levels of volatility will be here to stay which will test the patience of investors. But overall the second half of the year could prove to be beneficial for investors that choose to climb the trees.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

We Are Sleep Walking Into The Next Crisis

The U.S. economy is headed down a dangerous path. In our opinion it has nothing to do with the length of the current economic cycle, valuations, interest rates, or trade wars. Instead, it has everything to do with our mounting government deficits. We have been talking about the federal budget deficits for the past ten years but when does that

The U.S. economy is headed down a dangerous path. In our opinion it has nothing to do with the length of the current economic cycle, valuations, interest rates, or trade wars. Instead, it has everything to do with our mounting government deficits. We have been talking about the federal budget deficits for the past ten years but when does that problem really come home to roost?

A Crisis In Plain Sight

An economic crisis is often easier to spot than you think if you are looking in the right places. Most of the time it involves identifying a wide spread trend that has evolved in the financial markets and the economy, shutting out all of the noise, and then applying some common sense. Looking at the tech bubble, people were taking home equity loans to buy tech stocks that they themselves did not understand. During the housing bubble people that were making $40,000 per year were buying homes for $500,000 and banks were giving loans with no verification of income. Both of the last two recessions you could have spotted by paying attention to the trends and applying some common sense.

Government Debt

Looking at the data, we think there is a good chance that the next economic crisis may stem from reaching unsustainable levels of government debt. Up until now we have just been talking about it but my goal with this article is to put where we are now in perspective and why this "talking point" may soon become a reality.

Debt vs GDP

The primary measuring stick that we use to measure the sustainability of the U.S. debt level is the Debt vs GDP ratio. This ratio compares the total debt of the U.S. versus how much the U.S. economy produces in one year. Think of it as an individual. If I told you that someone has $100,000 in credit card debt, your initial reaction may be “wow, that’s a lot of debt”. But then what if I told you that an individual makes $1,000,000 per year in income? That level of debt is probably sustainable for that person since it’s only 10% of their gross earnings, whereas that amount of credit card debt would render someone who makes $50,000 per year bankrupt.

Our total gross federal deficit just eclipsed $21 trillion dollars. That’s Trillion with a “T”. From January through March 2018, GDP in the U.S. was running at an annual rate of $19.965 trillion dollars (Source: The Balance). Based on the 2018 Q1 data our debt vs GDP ratio is approximately 105%. That’s big number.

The Safe Zone

Before I start throwing more percentages at you let's first establish a baseline for what's sustainable and not sustainable from a debt standpoint. Two Harvard professors, Reinhart and Rogoff, conducted a massive study on this exact topic and wrote a whitepaper titled "Growth in a Time of Debt". Their study aimed to answer the question "how much debt is too much for a government to sustain?" They looked at historic data, not just for the U.S. but also for other countries around the world, to determine the correlation between various levels of Debt vs GDP and the corresponding growth or contraction rate of that economy. What they found was that in many cases, once a government's Debt vs GDP ratio exceeded 90%, it was frequently followed by a period of either muted growth or economic contraction. It makes sense. Even though the economy may still be growing, if you are paying more in interest on your debt then you are making, it puts you in a bad place.

Only One Time In History

There has only been one other time in U.S. history that the Debt vs GDP ratio has been as high as it is now and that was during World War II. Back in 1946, the Debt vs GDP ratio hit 119%. The difference between now and then is we are not currently funding a world war. I make that point because wars end and when they end the spending drops off dramatically. Between 1946 and 1952, the Debt vs GDP ratio dropped from 119% to 72%. Our Debt vs GDP ratio bottomed in 1981 at 31%. Since then it has been a straight march up to the levels that were are at now. We are not currently financing a world war and there is not a single expenditure that we can point to that will all of a sudden drop off to help us reduce our debt level.

Spending Too Much

So what is the United States spending the money on? Below is a snapshot of the 2018 federal budget which answers that question. As illustrated by the spending bar on the left, we are estimated to spend $4.1 trillion dollars in 2018. The largest pieces coming from Social Security, Medicare, and Medicaid.

The bar on the right illustrates how the U.S. intends to pay for that $4.1 trillion in spending. At the top of that bar you will see “Borrowing $804 Bn”. That means the Congressional Budget Office estimates that the U.S. will have to borrow an additional $804 billion dollars just to meet the planned spending for 2018. With the introduction of tax reform and the infrastructure spending, the annual spending amount is expected to increase over the next ten years.

Whether you are for or against tax reform, it’s difficult to make the argument that it’s going to “pay for itself in the form of more tax as a result of greater economic growth.” Just run the numbers. If our annual GDP is $19.9 Trillion per year, our 3% GDP growth rate I already factored into the budget numbers, to bridge the $804B shortfall, our GDP growth rate would have to be around 7% per year to prevent further additions to the total government debt. Good luck with that. A 7% GDP growth rate is a generous rate at the beginning of an economic expansion. Given that we are currently in the second longest economic expansion of all time, it’s difficult to make the argument that we are going to see GDP growth rates that are typically associated with the beginning of an expansion period.

Apply Common Sense

Here’s where we apply common sense to the debt situation. Excluding the financing of a world war, the United State is currently at a level of debt that has never been obtained in history. Like running a business, there are only two ways to dig yourself out of debt. Cut spending or increase revenue. While tax reform may increase revenue in the form of economic growth, it does not seem likely that the U.S. economy is at this stage in the economic cycle and be able to obtain the GDP growth rate needed to prevent a further increase in the government deficits.

A cut in spending, in its simplest form, means that something has to be taken away. No one wants to hear that. The Republican and Democratic parties seem so deeply entrenched in their own camps that it will make it difficult, if not impossible, for any type of spending reform to take place before we are on the eve of what would seem to be a collision course with the debt wall. Over the past two decades, the easy solution has been to “just borrow more” which makes the landing even harder when we get there.

Answering the “when” question is probably the most difficult. We are clearly beyond what history has revered as the “comfort zone” when to comes to our Debt vs GDP ratio. However, the combination of the economic boost from tax reform and infrastructure spending in the U.S., the accelerating economic expansion that is happening outside of the U.S., and the low global interest rate environment, could continue to support growth rates even at these elevated levels of government debt.

Debt is tricky. There are times when it can be smart accept the debt, and times where it isn’t helpful. As we know from the not too distant past, it has the ability to sustain growth for an unnaturally long period of time but when the music stops it gets ugly very quickly. I’m not yelling that the sky is falling and everyone needs to go to cash tomorrow. But now is a good time to evaluate where you are risk wise within your portfolio and begin having the discussion with your investment advisor as to what an exit plan may look like if the U.S. debt levels become unsustainable and it triggers a recession within the next five years.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

The Medicaid Spend Down Process In New York

You are most likely reading this article because you had a family member that had a health event and the doctors have informed you that they are not allowed to go back home to their house and will need some form of health assistance going forward. This article was written to help you understand from a high level the steps that you may need to take to

You are most likely reading this article because you had a family member that had a health event and the doctors have informed you that they are not allowed to go back home to their house and will need some form of health assistance going forward. This article was written to help you understand from a high level the steps that you may need to take to get them the care that they need and to get a preview of the Medicaid application process and the spend down process, if that’s the path that needs to be taken.

Everyone is living longer which is a good thing but it creates more complications later in life. It is becoming much more common that people have family members that have a health event in their 80’s or 90’s that renders them unable to continue to live independently. Without advance planning, a lot of the important decisions then have to be made by family and friends so it is important for even younger individuals to understand how the process works because you may be in this situation some day for a loved one.

Do I Have To Apply For Medicaid To Pay For Their Care?

What you will find out very quickly is any type of care whether it's home health care, assisted living, or a nursing home, is very expensive. Very few individuals have the assets and the income to enable them to pay out of pocket for their care without going broke. It's not uncommon for kids or family members to have no idea what mom or dad's income and asset picture looks like. But no one is going to provide you with this information unless you have a power of attorney.

Power of Attorney, Health Proxy, and Will

A power of attorney (“POA”) is a document that allows you to step into a person’s shoes that have been incapacitated. It allows you to get information on their bank accounts, investments, insurance policies, and anything else financially. If you do not have a power of attorney, you need to get one quickly. A lot of financial decisions will most likely need to be made in a very short period of time. You will need to contact an estate attorney to draft the power of attorney. There are some choices that you will have to make when you draft the documents as to what powers the “POA” will have. They can usually be turned around by an attorney in 48 hours if needed.

While you have the estate attorney on the phone, you also will want to make sure that they have a health proxy and a will. The health proxy allows you to make healthy decisions from a family member if they are unable to do so. While it’s difficult to think about, health proxies will typically list out the end of life decisions. For example, a health proxy may state that mom or dad refuses to have a machine breathe for them if they are no longer able to breathe on their own. The questions are tough to answer but it’s very important to have this document in place.

Home Care, Assisted Living, or Nursing Home

Prior to the health event, mom or dad may have been living by themselves at their house. Now the doctor is telling them that because of the damage done by the stroke, that they will not release them from the hospital until other arrangements are made for their care. There are three options to receive care:

Receiving care in the home via home care by health aids

Assisted living facility

Nursing home facility

People that cannot pay for 100% of their care and that do not have a long term care insurance policy, typically have to spend down their personal assets and then apply for Medicaid. Now that is said, let's jump right into what is protected and not protected as far as income and assets for Medicaid.

Different Rules For Different States

Each state has different eligibility and spends down rules when it comes to Medicaid. For purposes of this article, we will assume that the person needing the care is a resident of New York. If you live in a different state, the process will be similar but the actual amounts and the definition of "protected" assets may be different. It's usually best to work with a Medicaid planner, estate attorney, or local social services office that is located within your state/county to obtain the rules for your family member that needs care.

The Medicaid Rules In New York

There are different limits based on whether the family member needing care is married and their spouse is still alive or if they are single or widowed. In general, if a couple is married and one spouse needs care, more assets and income will be able to be protected and they will be able to qualify for Medicaid because they recognize that income and assets have to be available to support the spouse that does not need the care. But for purposes of this article, we will assume that mom passed away and dad now needs care.

Asset Limit

In 2018, to qualify for Medicaid, an individual is only allowed to keep $15,150 in assets. The next question I get is "what counts toward that number?" It's actually easier to explain what DOES NOT count toward that number. The only assets that do not count toward that threshold are as follows:

Primary Residence

1 Vehicle

Pre-Tax Retirement Accounts (if older than age 70½) - (However Required Minimum Distribution goes toward care)

Irrevocable Trust (Funded at least 5 years ago)

Pre-paid burial expenses

That's it. If dad has $50,000 in his checking account, $20,000 in a Roth IRA, and a RV, the RV will need to be sold and he will need to spend down the Roth IRA and the checking account until the balance reaches $15,150 in order to apply for Medicaid.

Primary Residence

Very important, while the primary residence is a protected asset for purposes of the Medicaid application, Medicaid will place a lien against dad’s estate for the money that they paid on his behalf. Meaning when he passes away, the kids do not automatically get the house. Medicaid will be first in line after the house is sold waiting to get paid. The amount depends on how much Medicaid paid out. If dad lives in a house that is worth $200,000 and Medicaid during his lifetime paid out $120,000 for his care, when the house sells, Medicaid will get $120,000 and the beneficiaries of the estate will only get the remaining $80,000.

When kids hear this they typically get upset because mom and dad worked their whole life to payoff the mortgage and maintain the house and now they are going to lose it to Medicaid. Is there anything that can be done to protect it? If the house was not put into a Medicaid Trust 5 years before needing to qualify for Medicaid then no, there is nothing that can be done. That’s why advanced planning is so important.

If dad worked with an estate attorney to establish a Medicaid trust 5 years ago, the attorney could have changed the ownership of the house to the trust, once dad makes it by 5 years without a health event, it’s no longer a countable asset for Medicaid and Medicaid cannot place a lien against the house. The question I usually ask our clients is “do you want Medicaid to get your house or do you want your kids to have it?” Most people say their kids but if advanced planning was not completed, you lose this options.

No Gifts To Kids

So what if you change the name on the house to the kids? It's considered a "gift". All gifts made within the last five years are a countable assets. It's called the "5 year look back period". When you apply for Medicaid for dad you have to provide them with a ton of information including 5 years of all statements for bank accounts and investment accounts. Also you have to provide them with copies of all checks written over the past 5 years that were in excess of $1,000. Medicaid is making sure that you did not "give" all of dad's assets away last minute so he could qualify for Medicaid and avoid the spend down.

Income Limits

We have talked about assets but what about income? It's not uncommon for a parent to be receiving a pension and/or social security. They are only allowed to keep $842 per month in 2018. The rest of their income will be applied toward their care. This can create some tough decisions if dad has to go to assisted living or a nursing home and the family has to maintain the house and meet his financial needs on $842 per month. Again, Medicaid it trying to recoup as much as it can to pay for dad's care.

Medicaid Pooled Trust

There are ways to protect income above the $842 threshold through the use of a Medicaid Pooled Trust. Unlike the Medical Irrevocable Trust to protect assets that needs to be established 5 years prior, these trusts can be establish now to protect more income. They work like a special checking account that can only be used to pay bills in dad's name. You can never withdraw cash out of the accounts. As long as dad is considered "disabled" by the social security administration or NYS he may qualify to setup this trust. There are not-for-profit entities that administer this income trust. Basically his income from social security and pension would be deposited to this trust account and then when bills show up for utilities, property taxes, car payment, etc, you submit the bill to the organization that is administering the trust and they pay the bill on behalf of that individual.

Home Care Limitation

Most individuals want to return to their home and have the care provided at their house via home health aids. This may or may not be an option. It all depends on the level of care needed. If Medicaid will be paying for dad's care, you will need to call the social services office in the county that he lives in. They will send an "assessor" to his house to determine if the living conditions are adequate for home care and they will also determine the level of care that is needed. In general, if the estimated cost of home care is expected to be at least 90% of what it would cost for care at a facility, Medicaid will not pay for home care and will require them to go to an assisted living or nursing home facility.Home health aids typically range in price from $15 - $30 per hour. Assume it cost $25 per hour, if dad needs care 8 hours a day, 7 days a week that would cost $6,083 per month. If you need a nurse or registered nurse to administer medication at the home, you are looking at $40+ per hour for those services.

Steps From Start To Finish

We have covered a lot of ground and this is just a general overview. But here is a general list of the steps that need to be taken assuming dad had a health event and you need to apply for Medicaid on his behalf:

Contact an estate attorney to establish a power of attorney and requirement for Medicaid application

Using the POA, begin collecting financial information for the Medicaid process

Contact the county social services office to request an assessment to determine if home care will be an option if it's in question

If a spend down is required to qualify for Medicaid, work with estate attorney to develop spend down strategy

If monthly income is above threshold, determine if a Medicaid pooled trust is an option

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Beware of the 5 Year Rule for Your Roth Assets

Being able to save money in a Roth account, whether in a company retirement plan or an IRA, has great benefits. You invest money and when you use it during retirement you don't pay taxes on your distributions. But is that always the case? The answer is no. There is an IRS rule that you must take note of known as the "5 Year Rule". There are a number

Beware of the 5 Year Rule for Your Roth Assets

Being able to save money in a Roth account, whether in a company retirement plan or an IRA, has great benefits. You invest money and when you use it during retirement you don't pay taxes on your distributions. But is that always the case? The answer is no. There is an IRS rule that you must take note of known as the "5 Year Rule". There are a number of scenarios where this rule could impact you and rather than getting too much into the weeds, this post is meant to serve as a public service announcement so you are aware it exists.

Advantages of a Roth

As previously mentioned, the benefit of Roth assets is that the account grows tax deferred and if the distributions are "qualified" you don't have to pay taxes. This is compared to a Traditional IRA/401(k) where the full distribution is taxed at ordinary income tax rates and regular investment accounts where you pay taxes on dividends/interest each year and capital gains taxes when you sell holdings. A quick example of Roth vs. Traditional below:

Roth Traditional

Original Investment $ 10,000.00 $ 10,000.00

Earnings $ 10,000.00 $ 10,000.00

Total Account Balance $ 20,000.00 $ 20,000.00

Taxes (Assume 25%) $ - $ 5,000.00

Account Value at Distribution $ 20,000.00 $ 15,000.00

This all seems great, and it is, but there are benefits of both Roth and Traditional (Pre-Tax) accounts so don’t think you have to start moving everything to Roth now. This article gives more detail on the two different types of accounts and may help you decide which is best for you Traditional vs. Roth IRA’s: Differences, Pros, and Cons.

Qualified Disbursements

Note the “occurs at least five years after the year of the employee’s first designated Roth contribution”. This is the “5 Year Rule”. The other qualifications are the same for Traditional IRA’s, but the “5 Year Rule” is special for Roth money. Not always good to be special.

It seems pretty straight forward and in most cases it is. Open a Roth IRA, let it grow at least 5 years, and as long as I’m 59.5 my distributions are qualified. Someone who has Roth money in a 401(k) or other employer sponsored plan may think it is just as easy. That isn’t always the case. Typically, an employee retires, and they roll their retirement savings into a Traditional or a Roth IRA. Say I worked at the company for 10 years, and I now retire and want to use all the savings I’ve created for myself throughout the years. I can start taking qualified distributions from my Roth IRA because I started contributing 10 years ago, correct? Wrong! The time you we’re contributing to the Roth 401(k) is not transferred to the new Roth IRA. If you took distributions directly from the 401(k) and we’re at least 59.5 they would be qualified. In most cases however, people don’t start using their 401(k) money until retirement and most plans only allow for lump sum distributions once you are no longer with the company.

So what do you do?

Open a Roth IRA outside of the plan with a small balance well before you plan to use the money. If I fund a Roth IRA with $100, 10 years from now I retire and roll my Roth 401(k) into that Roth IRA, I have satisfied the 5 year rule because I opened that Roth IRA account 10 years ago. The clock starts on the date the Roth IRA was opened, not the date the assets are transferred in.

About Rob.........

Hi, I’m Rob Mangold. I’m the Chief Operating Officer at Greenbush Financial Group and a contributor to the Money Smart Board blog. We created the blog to provide strategies that will help our readers personally, professionally, and financially. Our blog is meant to be a resource. If there are questions that you need answered, please feel free to join in on the discussion or contact me directly.

Does "Sell In May And Go Away" Really Work?

There is a well-known trading strategy that goes by the name of "Sell In May And Go Away". The strategy involves liquidating all of your stock holdings in May and then re-establishing your stock positions in November. The basic premise of this strategy is when you reference performance data from the stock market for the past 100 years, two of

There is a well-known trading strategy that goes by the name of "Sell In May And Go Away". The strategy involves liquidating all of your stock holdings in May and then re-establishing your stock positions in November. The basic premise of this strategy is when you reference performance data from the stock market for the past 100 years, two of the three worse months typically occur between May and October. But does it really work?

Losing Strategy

While there are years that we can point to that the "Sell In May" strategy would have worked, it would have been a losing strategy for the past 4 out of 5 years.

The only year that strategy would have worked within the last five years was in 2015 and you avoid a minuscule 1% loss. On the flip side, you missed a huge 11.6% gain in 2017. If you implemented this strategy every year for the past 5 years, it would have cost you 22.4% in investment returns. Not good.

Looking Back Further

Instead of looking back just 5 years, let’s look back 10 years from 2008 to 2017. The “Sell In May” strategy would have only worked 4 out of 10 times. So it would have been the losing strategy 60% of the time. Again, not good.

So why do you hear so much about it? Looking at the market data, even though it has not been a reliable source as to whether or not the stock market will be up or down during the May to October months, the return data of the Dow Jones Industrial Average suggests historically that the largest returns are found during the November through April months.

A perfect example is 2010. In 2010, the Dow Jones Industrial Average produced a return of 1% between May – October. However, the Dow Jones produced a 15.2% rate of return in 2010 between November and April. Implementing the “Sell In May” strategy would have cost you 1% in return since you were not invested during the summer months but you still captured the lion share of the return from the stock market for the year.

Also, when the economy is in a recession, May through October typically contains the months that produce the largest losses for the Dow. During the 2008 recession, the Dow was down 27.3% between May and October but it was only down 12.4% between November and April. Likewise, during the 2001 recession, the Dow was down 15.5% between May and October but it was actually positive 9.6% between November and April.

Measure of Magnitude Not Direction

The further you dig into the data, the more it seems that the "Sell In May" strategy is a more accurate measure of "magnitude" instead of direction. Let's compare the May to October vs. the November to April return data of the Dow Jones Industrial Average 2008 – 2015 from Stock Almanac.

Looking at this time period, the losses were either less severe or the gains were greater between the November and April time frame 6 out of 8 years or 75% of the time. Compared with only 3 out of the 8 years where the direction of the returns were different when comparing those two time frames or 37.5% of the time.

Recession vs. Expansion

I think there are a number of takeaways from looking at this data. One might conclude that when U.S. economy is in a period of expansion, the "Sell In May" strategy has less than a coin flip chance of creating a more favorable investment return. However, when the economy is in a recession, the historical data may also suggest that more weight be given to the strategy since May through October in the past two recessions has contained the largest drops in the stock market.With all of that said, timing the market is very difficult and many investment professionals even label it as foolish. In general, long term investors are often better served by selecting an asset allocation that is appropriate for their risk tolerance and time horizon and staying the course.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

College Students: The Top 2 Action Items To Get Ahead

The job market for college students is more competitive than it has ever been in the past. Why? Because companies continue to leverage technology to do more with less people. So what separates the college students that have multiple job offers prior to graduation from the college grads that struggle to find their first career?As an investment advisor,

The job market for college students is more competitive than it has ever been in the past. Why? Because companies continue to leverage technology to do more with less people. So what separates the college students that have multiple job offers prior to graduation from the college grads that struggle to find their first career?As an investment advisor, most of our clients are business owners or executives. They are the folks that hold the keys to the positions that are available at their respective companies. Throughout our daily interaction with these clients we receive continuous feedback about:

Their young rockstar employee that is rising quickly through the ranks

The troubles that they are having finding the right people

The skills and personality traits that they are looking for in their next round of hires

If your child is either in college or about to enter college, what advice can you give them to put them at the top of the most wanted list of these high growth companies?

Intern, Intern, Intern

The college degree gets you the interview. Your work experience is what lands you the job. If it comes down to two candidates for a position, both interview well, both have the right personality for the job, good GPA’s, etc, if one candidate has completed an internship and other has not, the candidate with the work experience is going to be highly favored. There are a number of reasons for this.

First, the goal of the company is to get you up and running as soon as possible. If you have real life work experience, the employer will most likely assume that you will be up and running more quickly than a new employee that has no work experience. You probably already know the lingo of the industry, you may be familiar with the software that the company uses, you know who the competitors are in the industry, etc.

Second, there is more to talk about in the interview. While it’s pleasant to talk about your personal interests, the research that you have completed on the company, general knowledge of the industry, and your college experience. Instead, if you are able to talk about a project that you worked on during a college internship that is relevant to the positon that you are applying for, the conversation and the lasting impression that you will have during your interview will be elevated to a level that is head and shoulders above most of the other job candidates that will follow the typically question and answer session.

College students should get involved with as many internships and work studies as they can while they are attending college. Also, don’t’ wait until your senior year in college to obtain an internship. Internships serve another purpose besides giving you the advantage in a job interview. They can also tell you what you don’t want to do. You put yourself in a tough spot if you spend four years in college to obtain an accounting degree, only to find out after obtaining your first job that you don’t like being an accountant. It happens more often than you would think. We all have to do all we can in order to reach our career goal. It’s better to find that out in your freshman or sophomore year of college so you have the opportunity to change majors if needed.

Internships also help to narrow down your options. You may be interested in obtaining a degree in business but business is a very broad industry with a lot of different paths. Are you interested in marketing, finance, sales, accounting, management, operations, data analytics, manufacturing, or investment banking? Even if you are not 100% certain which path is the right one for you, make a choice. It will either reinforce your decision or it will allow you to scratch it off the list. Both are equally important.

Read These Books

There is common trait among business owners and executives. They typically have a thirst for knowledge which usually means that they are avid readers. One of the greatest challenges that young employees have is being able to relate to how the owner of the business thinks, what motivates them, and how they view the world. In general, business owners tend to admire or at least acknowledge the risk taking behaviors and achievements of some of the standout CEO’s of their time. Steve Jobs, Elon Musk, Bill Gates, Warren Buffet, Jeff Bezos, and the list goes on.

It’s not uncommon for a business owner to borrow personality traits or business strategies from some of these highly regarded CEO’s and incorporated them into their own business. If during an interview you happen to bring up that you admire how Elon Musk has the ability to identify solutions to problems in industries where it was previously deemed impossible like PayPal and SpaceX. There is a good chance that the business owner or executive that is interviewing you has either read Elon’s book or is aware of his achievements and it brings that conversation to next level.

In addition, the person interviewing you will most likely assume that if you are interested in reading those types of books than you probably have that entrepreneur mindset which is rare and valuable. It’s very difficult to teach someone how to think like an entrepreneur. Showing that you possess that trait can easily excite a potential employer.

Here are the top three books that I would recommend reading:

Delivering Happiness by Tony Hsieh (CEO of Zappos)

Elon Musk by Ashlee Vance (CEO of Tesla)

The Virgin Way by Richard Branson (CEO of Virgin Group)

Each of these CEO's have different leadership styles, come from different industries, have different backgrounds, and provide different takeaways for the reader. There is a tremendous amount of knowledge to be gain from reading these books and all of these books are written in a way that makes it difficult to put them down once you have started reading them.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Don't Let Taxes Dictate Your Investment Decisions

Everyone hates to pay more in taxes. But this is something that has to be done. Sometimes taxes can often lead investors to make foolish investment decisions. The stock market bottomed in March 2009 and since then we have experienced the second-longest bull market rally of all time. This type of market environment typically creates a

Everyone hates to pay more in taxes. But this is something that has to be done. Sometimes taxes can often lead investors to make foolish investment decisions. The stock market bottomed in March 2009 and since then we have experienced the second-longest bull market rally of all time. This type of market environment typically creates a stockpile of unrealized gains in the equity portion of your portfolio. When you go to sell one of your investment holdings that has appreciated in value over the past few years there may be a big tax bill waiting for you. But when is it the right time to ignore the tax hit and execute the trade?

Do The Math

What sounds worse? Writing a check to the government for $10,000 in taxes or experiencing a 3% loss in your investment accounts? Most people would answer paying taxes. After all, who wants to write a check to the government for $10,000 after you have already paid your fair share of taxes throughout the year. It’s this exact situation that gets investors in a lot of trouble when the stock market turns or when that concentrated stock position takes a nosedive.

Before making this decision make sure you do the math. If you have $500,000 in your taxable investment account and the account value drops by 3%, your account just lost $15,000. It would have been better to sell the holding, pay the $10,000 in taxes, and you would still be ahead by $5,000. Before making the decision not to sell for tax reasons, make sure you run this calculation.

Gains Are Good

While most of us run from paying taxes like the plague, remember gains are good. It means that you made money on the investment. At some point you are going to have to pay tax on that gain unless your purposefully waiting for the investment to lose value or if you plan to die with that holding in your estate.

If you put $100,000 in an aggressive investment a year ago and it’s now worth $200,000, if you sell it all today, you will have to pay long term cap gains tax and possibly state tax on the $100,000 realized gain. But remember, what goes up by 100% can also go down by 100%. To avoid the tax bill, you make the decision to just sit on the investment and 3 months from now the economy goes into a recession. The value of that investment drops to $125,000 and you sell it before things get worse. While you successfully decreased your tax liability, the tax hit would have been a lot better than saying goodbye to $75,000.

As financial planners we are always looking for ways to reduce the tax bill for our clients but sometimes paying taxes is unavoidable. The more you make, the more you pay in taxes. In most tax years, investors try to use investment losses to help offset some of the realized taxable gains. However, since most assets classes have appreciated in value over the last few years, investors may be challenges to find investment losses in their accounts.

Capital Gains Tax

A quick recap of capital gains tax rates. There are long-term and short-term capital gains. They apply to investments that are held in non-retirement account. IRA’s, 401(k), and 403(b) plans are all tax deferred vehicles so you do not have worry about realizing capital gains tax when you sell a holding within those types of accounts.

In a taxable brokerage account, if you buy an investment and sell it in less than 12 months, if it made money, you realize a short-term capital gain. Short-term gains do not receive preferential tax treatment. You pay tax at the ordinary income tax rates.

However, if you buy an investment and hold it for more than a year before selling it, the gain is taxed at the preferential long-term capital gain rates. At the federal level, there are three flat rates: 0%, 15%, and 20%. At the state level, it varies based on what state you live in. If you live in New York, where we are headquartered, long-term capital gains do not have preferential tax treatment for state income tax purposes. They are taxed as ordinary income. While other states like Alaska, Florida, and Texas assess no taxes at the state level on capital gains.

The tax rate that you pay on your long-term capital gains at the federal level depends on your AGI for that particular tax year. Here are the thresholds for 2021:

A special note for investors that fall in the 20% category, in addition to being taxed at the higher rate, there is also a 3.8% Medicare surtax that is tacked onto the 20% rate. So the top long-term capital gains rate for high income earners is really 23.8%, not 20%.

Don't Forget About The Flat Rate

Investors forget that long-term capital gains are taxed for the most part at a flat rate. If your AGI is $200,000 and you are considering selling an investment that would cause you to incur a $100,000 long-term capital gain, it may not matter from a tax standpoint whether you sell it all this year or if you split the gain between two different tax years. You are still taxed at that flat 15% federal tax rate on the full amount of the gain regardless of when you sell it.There are of course exceptions to this rule. Here is a list of some of the exceptions that you need to aware of:

Your AGI limit for the year

The impact of the long-term capital gain on your AGI

College financial aid

Social security taxation

Health insurance through the exchange

First exception is the one-time income event that pushes your income dramatically higher for the year. This could be a big bonus, a good year for the company that you own, or you sell an investment property. In these cases you have to mindful of the federal capital gains tax thresholds. If it’s toward the end of the year and you are thinking about selling an investment that has a good size unrealized gain built up into it, it may be prudent to sell enough to keep yourself out of the top long-term capital gains bracket and then sell the rest in January when you enter the new tax year. That move could save you 8.8% in taxes on the realized gains. The 23.8% to tax rate minus the 15% median rate. If you are at the beginning or in the middle of a tax year trying to make this decision, the decision is more difficult. You will have to weigh the risk of the investment losing value before you flip into a new tax year versus paying a slightly higher tax rate on the gain.

To piggyback on the first exception, you have to remember that long term capital gains increase your AGI. If you make $300,000 and you realize a $200,000 long term capital gain on an investment, it’s going to bump you up into the highest federal long term capital gains tax rate.

College financial aid can be a big exception. If you have a child in college or a child that will be going to college within the next two years, and you expect to receive some type of financial aid based on income, be very careful about when you realize capital gains in your investment portfolio. The parent’s investment income can count against a student’s financial aid package. Also, FASFA looks back two years for purposes of determining your financial aid package so conducing this tax versus risk analysis requires some advanced planning.

For those receiving social security benefit, capital gains can impact how much of your social security benefit is subject to taxation.

For individuals that receive their health insurance through a state exchange platform (Obamacare) and qualify for income subsidies, the capital gains income could decrease the amount of the subsidy that you are receive for that year. Be careful.

Don't Make The This Mistake

Bottom line, nothing is ever simple. I wish I could say that in all instances you should completely ignore the tax ramifications and make the right investment decision. In the real world, it’s about determining the balance between the two. It’s about doing the math to better under the tax hit versus the downside risk of continuing to hold a security to avoid paying taxes.

While the current economic expansion may still have further to go, we are probably closer to the end than we are the beginning of the current economic expansion. When the expansion ends, investors are going to be tempted to hold onto certain investments within their portfolio longer than they should because they don’t want to take the tax hit. Don’t make this mistake. If you have a stock holding within your portfolio and it drops significantly in value, you may not have the time horizon needed to wait for that investment to bounce back. Or you may have the opportunity to preserve principal during the next market downturn and buy back that same investment at lower level.

In general, it’s good time for investors to revisit their investment portfolios from a risk standpoint. You may be faced with some difficult investment decisions within the next few years. Remember, selling an investment that has lost money is ten times easier than selling one of your “big winners”. Do the math, don’t get emotionally attached to any particular investment, and be prepared to make investment changes to your investment portfolios as we enter the later stages of this economic cycle.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Can I Open A Roth IRA For My Child?

Parents always want their children to succeed financially so they do everything they can to set them up for a good future. One of the options for parents is to set up a Roth IRA and we have a lot of parents that ask us if they are allowed to establish one on behalf of their son or daughter. You can, as long as they have earned income. This can be a

Parents will often ask us: “What type of account can I setup for my kids that will help them to get a head start financially in life"?”. One of the most powerful wealth building tools that you can setup for your children is a Roth IRA because all of accumulation between now and when they withdrawal it in retirement will be all tax free. If your child has $10,000 in their Roth IRA today, assuming they never make another deposit to the account, and it earns 8% per year, 40 years from now the account balance would be $217,000.

Contribution Limits

The maximum contribution that an individual under that age of 50 can make to a Roth IRA in 2022 is the LESSER of:

$6,000

100% of earned income

For most children between the age of 15 and 21, their Roth IRA contributions tend to be capped by the amount of their earned income. The most common sources of earned income for young adults within this age range are:

Part-time employment

Summer jobs

Paid internships

Wages from parent owned company

If they add up all of their W-2's at the end of the year and they total $3,000, the maximum contribution that you can make to their Roth IRA for that tax year is $3,000.

Roth IRA's for Minors

If you child is under the age of 18, you can still establish a Roth IRA for them. However, it will be considered a "custodial IRA". Since minors cannot enter into contracts, you as the parent serve as the custodian to their account. You will need to sign all of the forms to setup the account and select the investment allocation for the IRA. It's important to understand that even though you are listed as a custodian on the account, all contributions made to the account belong 100% to the child. Once the child turns age 18, they have full control over the account.

Age 18+

If the child is age 18 or older, they will be required to sign the forms to setup the Roth IRA and it's usually a good opportunity to introduce them to the investing world. We encourage our clients to bring their children to the meeting to establish the account so they can learn about investing, stocks, bonds, the benefits of compounded interest, and the stock market in general. It's a great learning experience.

Contribution Deadline & Tax Filing

The deadline to make a Roth IRA contribution is April 15th following the end of the calendar year. We often get the question: "Does my child need to file a tax return to make a Roth IRA contribution?" The answer is "no". If their taxable income is below the threshold that would otherwise require them to file a tax return, they are not required to file a tax return just because a Roth IRA was funded in their name.

Distribution Options

While many of parents establish Roth IRA’s for their children to give them a head start on saving for retirement, these accounts can be used to support other financial goals as well. Roth contributions are made with after tax dollars. The main benefit of having a Roth IRA is if withdrawals are made after the account has been established for 5 years and the IRA owner has obtained age 59½, there is no tax paid on the investment earnings distributed from the account.

If you distribute the investment earnings from a Roth IRA before reaching age 59½, the account owner has to pay income tax and a 10% early withdrawal penalty on the amount distributed. However, income taxes and penalties only apply to the “earnings” portion of the account. The contributions, since they were made with after tax dollar, can be withdrawal from the Roth IRA at any time without having to pay income taxes or penalties.

Example: I deposit $5,000 to my daughters Roth IRA and four years from now the account balance is $9,000. My daughter wants to buy a house but is having trouble coming up with the money for the down payment. She can withdrawal $5,000 out of her Roth IRA without having to pay taxes or penalties since that amount represents the after tax contributions that were made to the account. The $4,000 that represents the earnings portion of the account can remain in the account and continue to accumulate tax-free. Not only did I provide my daughter with a head start on her retirement savings but I was also able to help her with the purchase of her first house.

We have seen clients use this flexible withdrawal strategy to help their children pay for their wedding, pay for college, pay off student loans, and to purchase their first house.

Not Limited To Just Your Children

This wealth accumulate strategy is not limited to just your children. We have had grandparents fund Roth IRA's for their grandchildren and aunts fund Roth IRA's for their nephews. They do not have to be listed as a dependent on your tax return to establish a custodial IRA. If you are funded a Roth IRA for a minor or a college student that is not your child, you may have to obtain the total amount of wages on their W-2 form from their parents or the student because the contribution could be capped based on what they made for the year.

Business Owners

Sometime we see business owners put their kids on payroll for the sole purpose of providing them with enough income to make the $6,000 contribution to their Roth IRA. Also, the child is usually in a lower tax bracket than their parents, so the wages earned by the child are typically taxed at a lower tax rate. A special note with this strategy, you have to be able to justify the wages being paid to your kids if the IRS or DOL comes knocking at your door.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.